The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Preparers Levy 2023-24 – FCA contact details

The Financial Reporting Council (FRC) serves the public interest by setting high standards of corporate governance and stewardship, corporate reporting, auditing and actuarial work, and by holding to account those responsible for delivering them. The FRC's powers come primarily from the Companies Act 2006 (CA 2006).

The FRC sets the UK Corporate Governance Code and UK Stewardship Code, UK accounting standards (UK GAAP) and actuarial standards; promotes the quality of corporate reporting; sets auditing standards and ethical standards for auditors; monitors and enforces audit quality; and operates independent enforcement arrangements for accountants and actuaries.

The FRC seeks to ensure that the provision of financial information by public and large private companies complies with relevant reporting requirements. It reviews the strategic reports, directors' reports and accounts of UK public and large private companies for compliance with the law. It keeps under review interim reports of all listed issuers and annual reports of certain other non-corporate listed entities.

The FRC carries out these responsibilities on behalf of the Secretary of State in relation to annual accounts and other documents falling within its remit. It has delegated its responsibilities to the Supervision Committee, which is a sub-committee of the FRC Board.

The Department for Business and Trade (DBT) has consulted on proposals to establish a new statutory regulator, the Audit, Governance and Reporting Authority (ARGA). The FRC is in transition to becoming ARGA. In March 2023 the FRC published its 3-Year Plan 2023-26, which is on the FRC website at www.frc.org.uk.

FRC Preparers Levy

By agreement with DBT and HM Treasury, the FRC is funded partly through a levy on the following organisations that are subject to, or have regard to, FRC regulatory requirements in preparing their accounts:

- Companies listed on the London Stock Exchange, and UK AIM and AQUIS Market group companies with an equity share listing.

- Large private entities with a turnover of £500m or more. Subsidiaries of UK listed companies with a turnover of £500m or more are invoiced on the same invoice as their parent company.

- Standard Global Depository Receipt companies ('GDRs').

- Government Departments and other public sector organisations that publish accounts.

The FRC preparers levy also funds the UK Endorsement Board (UKEB) which was set up by the Government as an independent body, to endorse and adopt International Financial Reporting Standards for use in the UK and to lead the UK's participation in and contribution to the development of a single set of international accounting standards. It is accountable to the Secretary of State for its statutory functions and to the FRC in respect of its governance and due process.

The FRC's responsibilities are currently funded on a non-statutory basis. Should this voluntary approach prove unsustainable, the FRC may request that the Secretary of State make regulations for the FRC to levy its funding on a statutory basis under Section 17 of the Companies (Audit, Investigations and Community Enterprise) Act 2004.

With the agreement of HM Treasury and DBT, the FRC collects the UK contribution to the International Accounting Standards Board (IASB) alongside the preparers' levy.

Calculation of the Preparers Levy

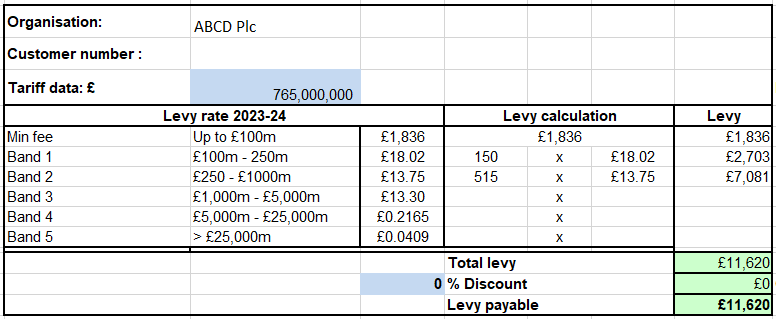

The 2023/24 levy is made up of a minimum levy of £1,836.00 and further amounts for companies above a certain threshold, with the rate per £m declining in five levy size bands. Companies with a Standard listing receive a 20% discount. AIM and AQUIS market group companies and large private entities receive a 50% discount. An example of the levy calculation is as follows:

The levies requested from listed entities are calculated on the basis of their market capitalisation on 30 September 2022. For large private entities, the FRC calculates the levy based on the turnover disclosed in the latest annual report available at Companies House on 30 September 2022. For large private subsidiaries within a group, the FRC applies the levy to the total turnover of all those subsidiaries with a turnover of more than £500m and invoices the ultimate domestic parent for the levy based on that total. This has the effect of reducing the levy that would otherwise be requested.

Purchase orders

A number of organisations provide the FRC with a Purchase Order (PO) number to facilitate the payment process. In general, the PO number has been provided by the individual or team responsible for preparing the organisation's annual report and accounts.

Contact Us

If you have received your invoice from the FCA and you have a query, please contact the FCA contact centre on 0300 500 597 or [email protected]

If you have a policy related question on the levy, please email the FRC on [email protected].

Financial Reporting Council

June 2023