The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC response to the IAASB exposure draft on conforming amendments to IAASB International Standards a

4 December 2019

Dear willie,

Exposure Draft - Conforming Amendments to the IAASB International Standards as a Result of the Revised IESBA Code

The Financial Reporting Council (FRC) welcomes the opportunity to comment on this exposure draft. As the UK's Competent Authority for Audit, our mandate includes: the setting of auditing, assurance and ethical standards; inspection of public interest entity audits and enforcement action against auditors. We also oversee the accountancy profession in regulation of its members and take public interest misconduct cases where conduct falls below expected standards (e.g. where practitioners fail to comply with the fundamental principles and requirements set out in the Code of Ethics). The FRC also is responsible for setting the UK Corporate Governance Code and its associated guidance.

Although IAASB and IESBA are independent Boards they both fall under the umbrella of IFAC. Members of IFAC are required to demonstrate a commitment to compliance with IAASB's standards and the IESBA Code. It is, therefore, essential that the Boards should liaise and avoid inconsistencies between their requirements and guidance. Accordingly, we support such liaison and efforts to address inconsistencies, including the proposals in this exposure draft.

We are, however, concerned that there are still some significant inconsistencies that this exposure draft does not address. We identified some of these to IESBA in our responses to its consultations during the development of the revised IESBA Code. They include:

- Use of 'may' and 'might'. The term 'may' is used, and defined in IESBA's Glossary, to "denote permission to take a particular action in certain circumstances, including as an exception to a requirement". The term 'might' is used, and defined in IESBA's Glossary, to "denote the possibility of a matter arising, an event occurring or a course of action being taken". We agree that this reflects some common language usage of those terms. However, this use of 'may' in IESBA's Code is inconsistent with its use in ISAs where it does not denote "permission" but rather actions auditors might take. It would be helpful if IESBA and IAASB could be consistent in their use of terminology.

- Inconsistencies in defined terms. For example, IAASB does not define "audit team" for the purpose of International Standards on Auditing (ISAS) but both IAASB and IESBA include "engagement team" as a defined term. The significant difference between the definitions of audit team and engagement team, and the fact that audit team is not an IAASB defined term, is unhelpful and risks inconsistent application of the terms, particularly by auditors who may be focussed on the definition of engagement team for the purpose of the ISAs.

There are also some terms used by both Boards but for which the definitions are not completely consistent. These include 'assurance engagement', 'financial statements', 'firm', and 'non-compliance [with laws and regulations]'. IAASB and IESBA should be able to work together to develop a single Glossary. It would not matter if some terms in such a Glossary were used only by one Board, what is more important is that common terms have only one definition.

We strongly encourage IAASB and IESBA to work together to seek to eliminate all inconsistencies.

Responses to IAASB's Specific Consultation Questions

- Whether respondents believe the proposed limited amendments are sufficient to resolve actual or perceived inconsistencies between the IAASB's International Standards and the changes made by IESBA in issuing the revised IESBA Code.

As explained above, there are still some inconsistencies between IAASB's International Standards and the IESBA Code that need to be addressed.

With regard to this exposure draft, we agree that most of the proposed changes address other inconsistencies between IAASB's International Standards and the changes made by IESBA in issuing the revised IESBA Code. However, there are a small number of proposed changes that we do not agree with. These are set out in the Attachment to this letter. The reasons for our disagreement include changes simply not being necessary, some changes where clearer wording could be used, and some where there is an unjustified change to the purpose of the text in the IAASB standard and/or extant text that remains relevant has been deleted.

- Whether respondents believe that the proposed effective date of approximately 90 days after the approval of the due process by the Public Interest Oversight Board is appropriate.

The proposed changes do not introduce substantive changes to the requirements of IAASB's International Standards and, accordingly, a relatively short implementation period is acceptable. However, some jurisdictions will need to expose the changes for their national standards and as a result may need to have a later effective date than that set by IAASB.

If you have any questions on our response, or wish to discuss any of our observations in more detail please contact me on [email protected] or +44-20-7492-2323.

Yours sincerely.

Mark Babington Acting Director, UK Auditing Standards and Competition

Attachment

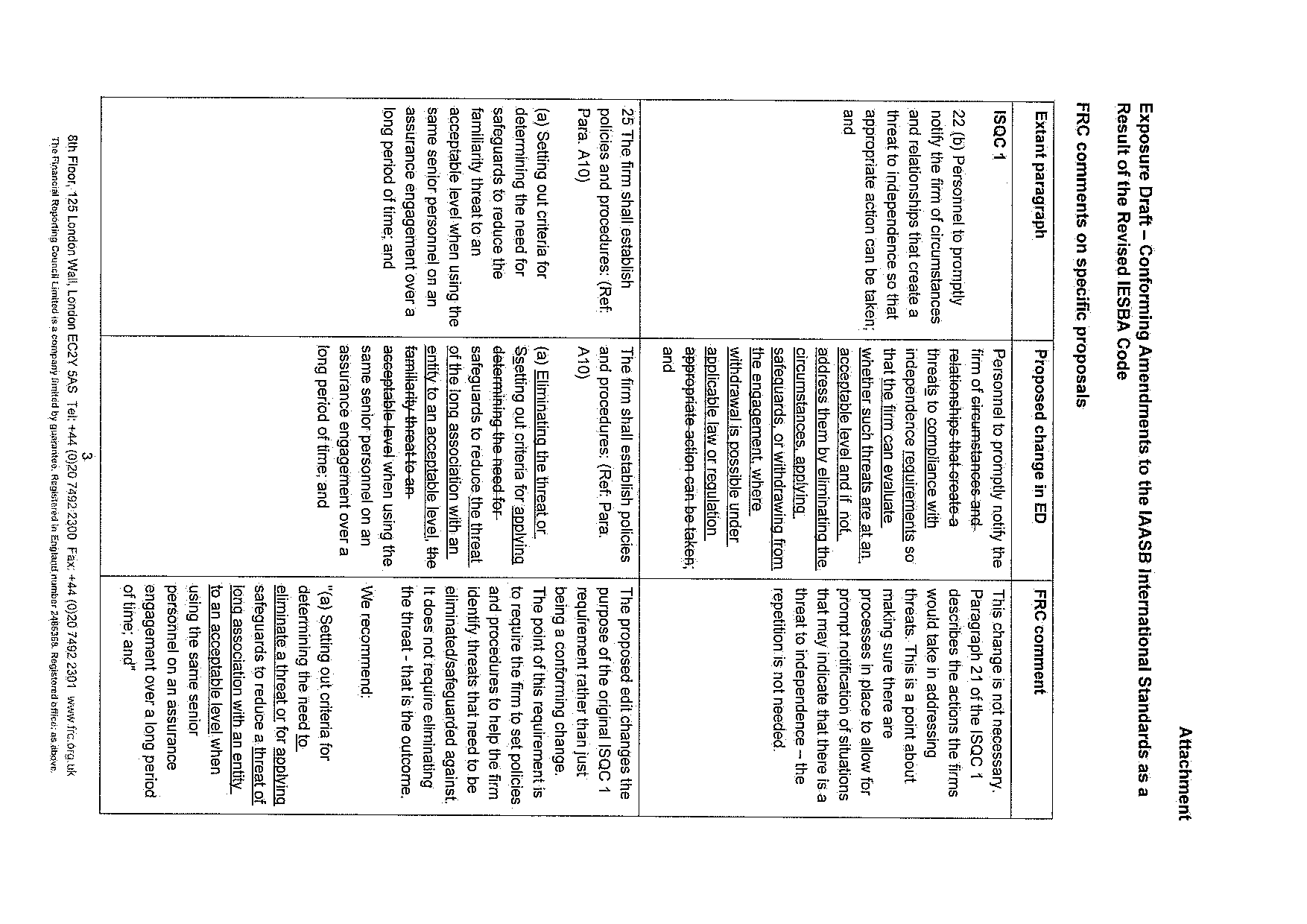

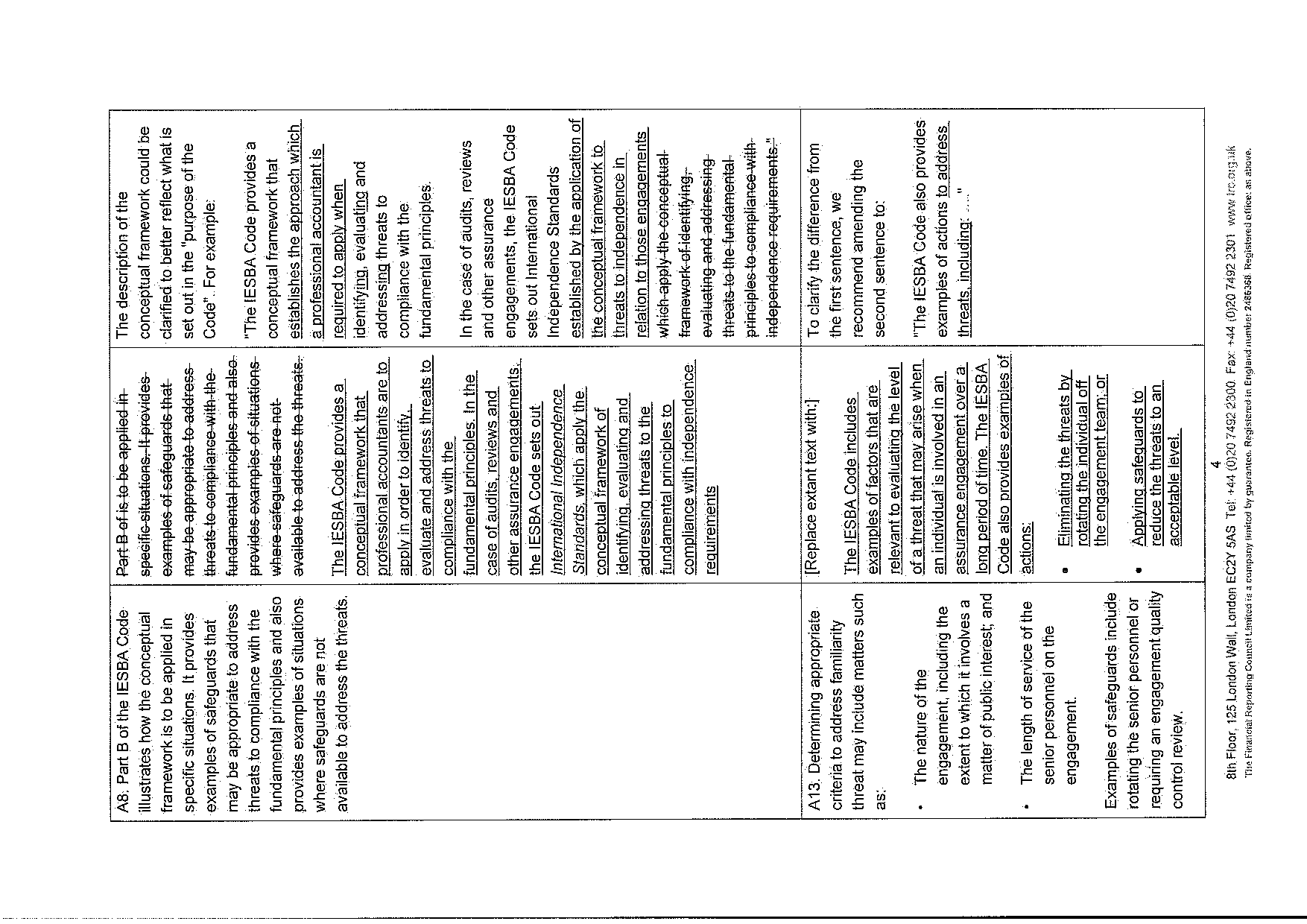

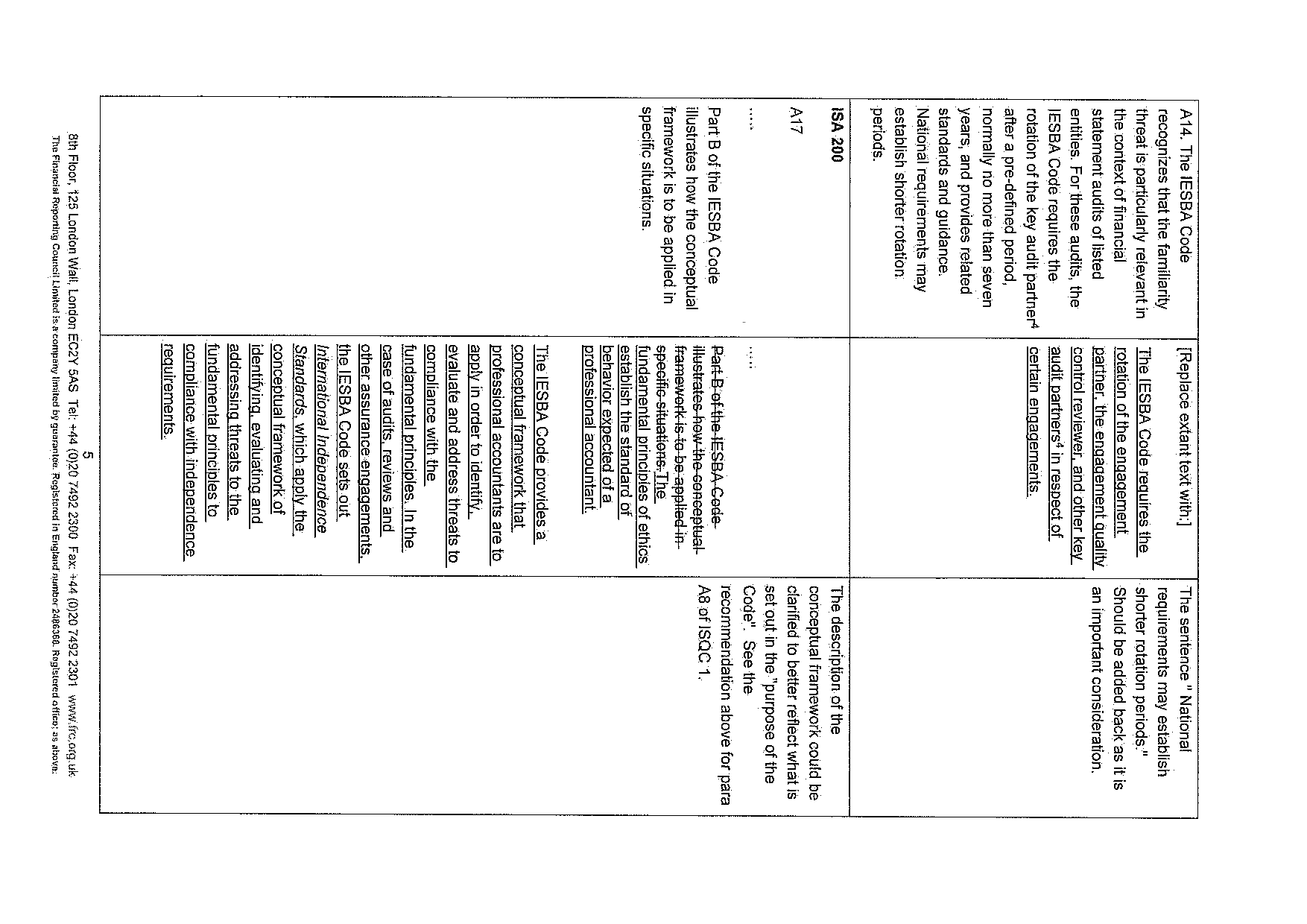

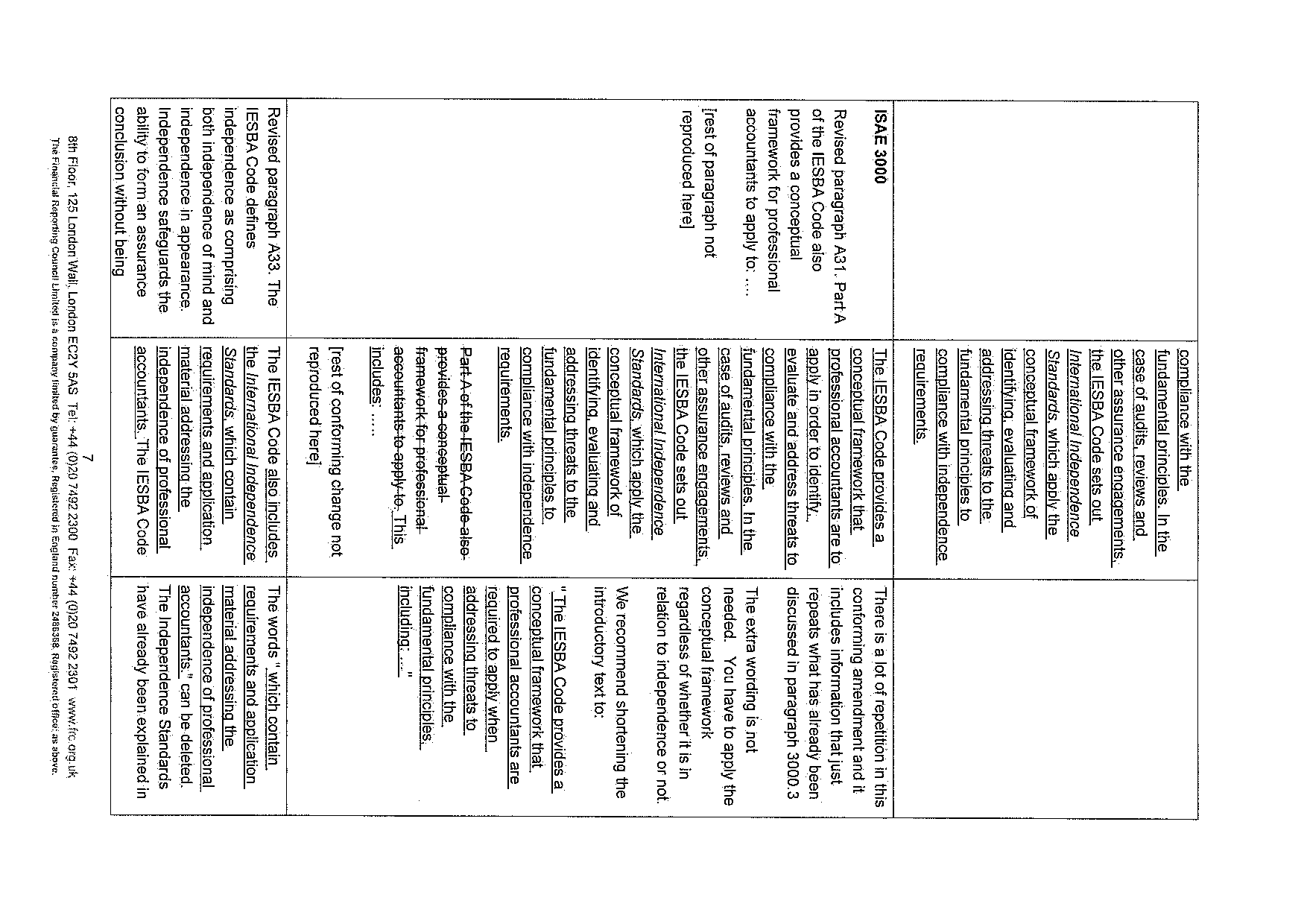

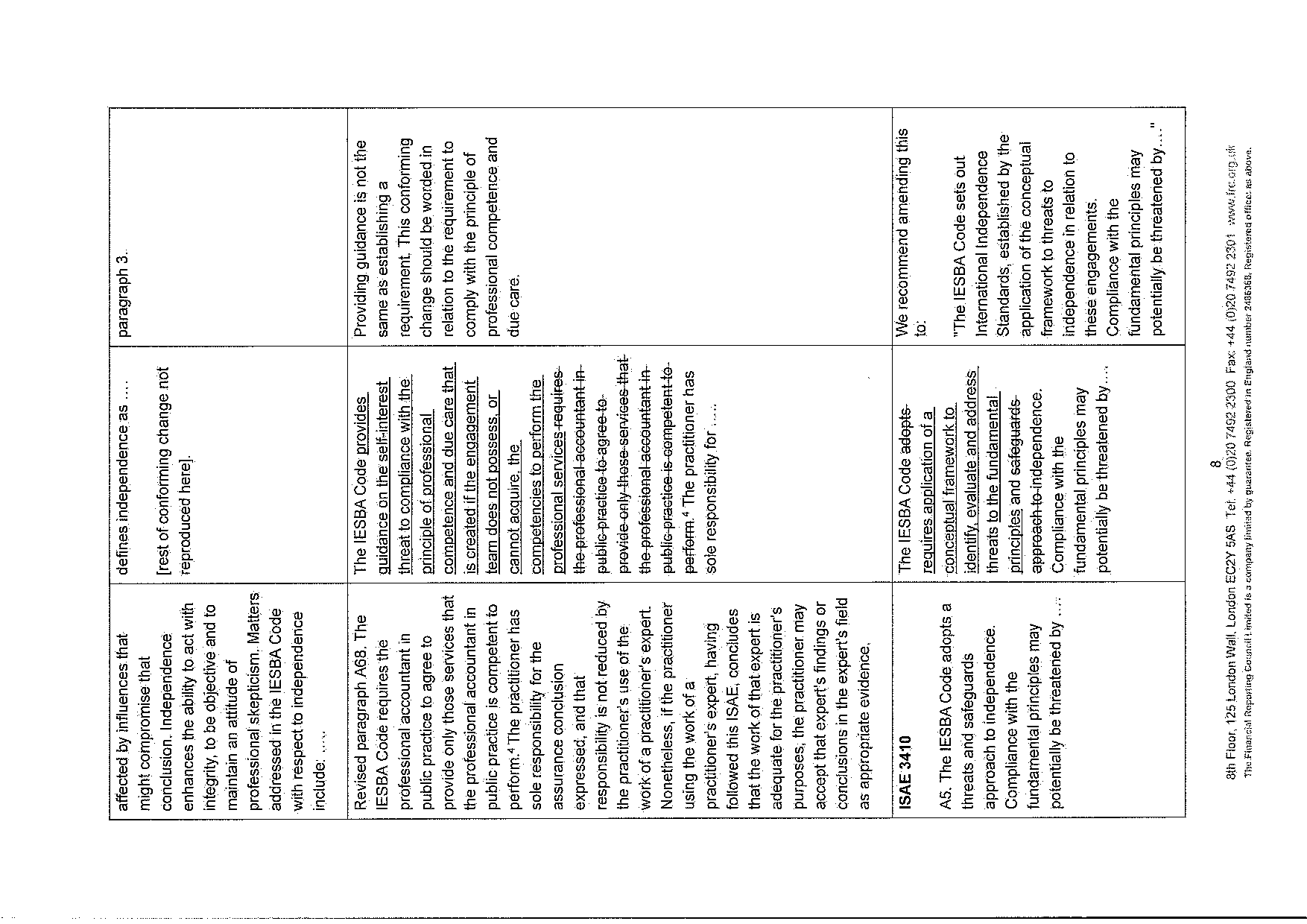

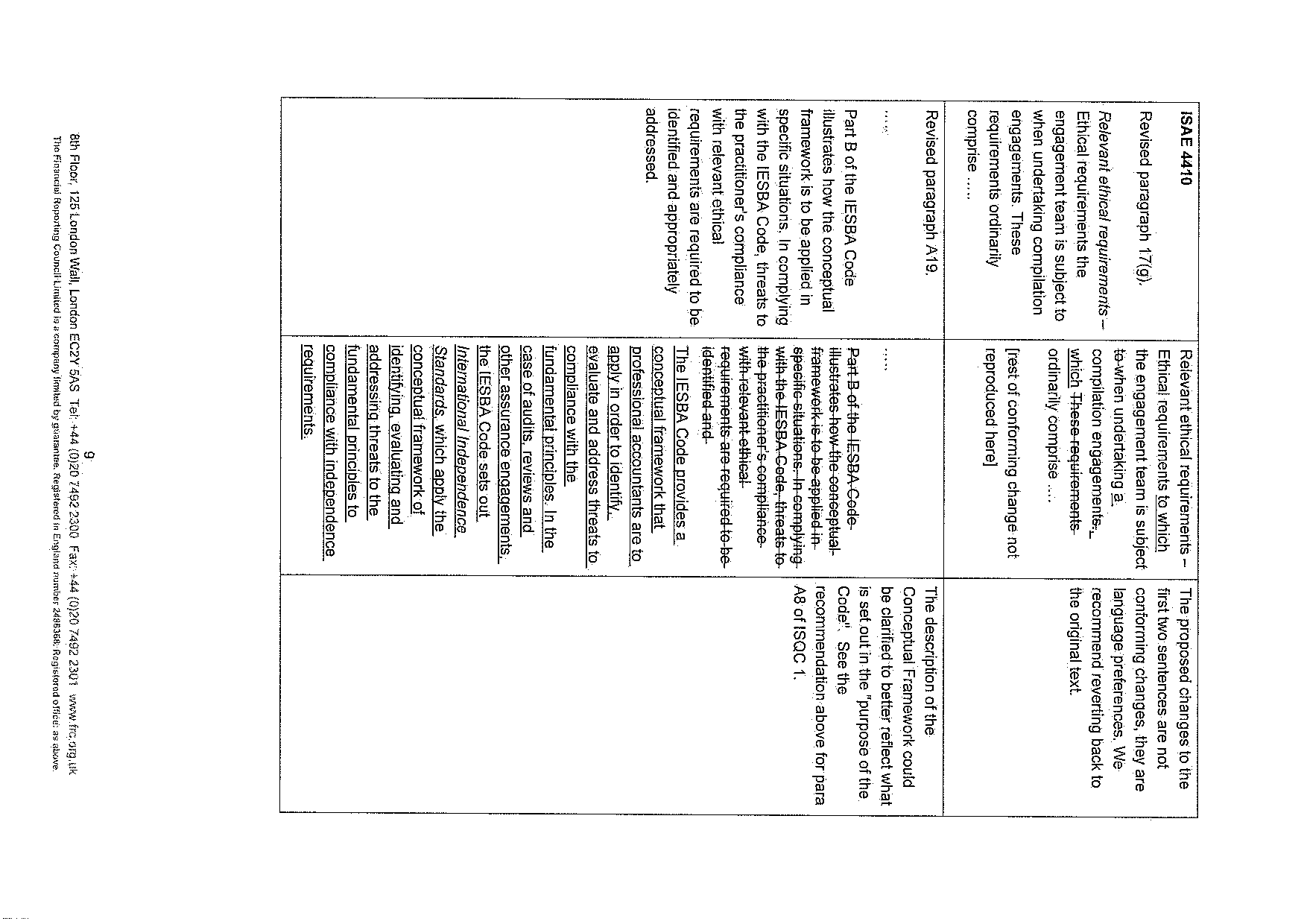

FRC comments on specific proposals

8th Floor, 125 London Wall, London EC2Y 5AS Tel: +44 (0)20 7492 2300 Fax: +44 (0)20 7492 2301 www.frc.org.uk The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered office: as above.