The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Key Facts and Trends in the Accountancy Profession 2019

Financial Reporting Council

Key Facts and Trends in the Accountancy Profession

The FRC's mission is to promote transparency and integrity in business. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The content in this publication is provided for general information purposes only. Although the FRC endeavors to ensure the accuracy of the information provided by the accountancy firms and bodies in preparing this publication, the FRC has not performed a detailed review of information supplied. Accordingly, the FRC accepts no responsibility for any reliance others may place upon the information herein and it shall not be liable for any loss or damage arising from the use of the information contained within this publication nor from any action or decision taken as a result of using such information.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2019 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number

- Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

- Foreword

- Section One – Main Highlights

- Section Two – Members and Students of the Accountancy Bodies

- Registered Members and Students in UK and ROI

- Registered Members and Students Worldwide

- Analysis of Members and Students of the Seven Accountancy Bodies

- Students who became Members

- Sectoral Employment of Members and Students Worldwide

- Gender of Members and Students Worldwide

- Members and Students Worldwide

- Diversity and Inclusion

- UK and ROI vs Rest of the World

- Section Three – Resource Information of the Accountancy Bodies

- Section Four – Oversight of Audit Regulation

- Section Five – Audit Firms

- Section Six – Data Tables of the Charts (Total Figures and Percentages)

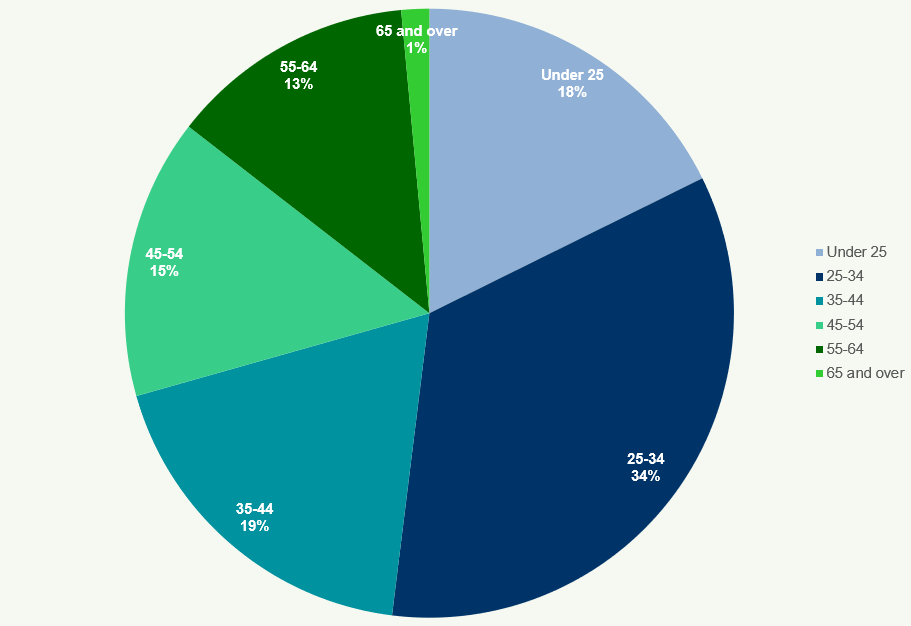

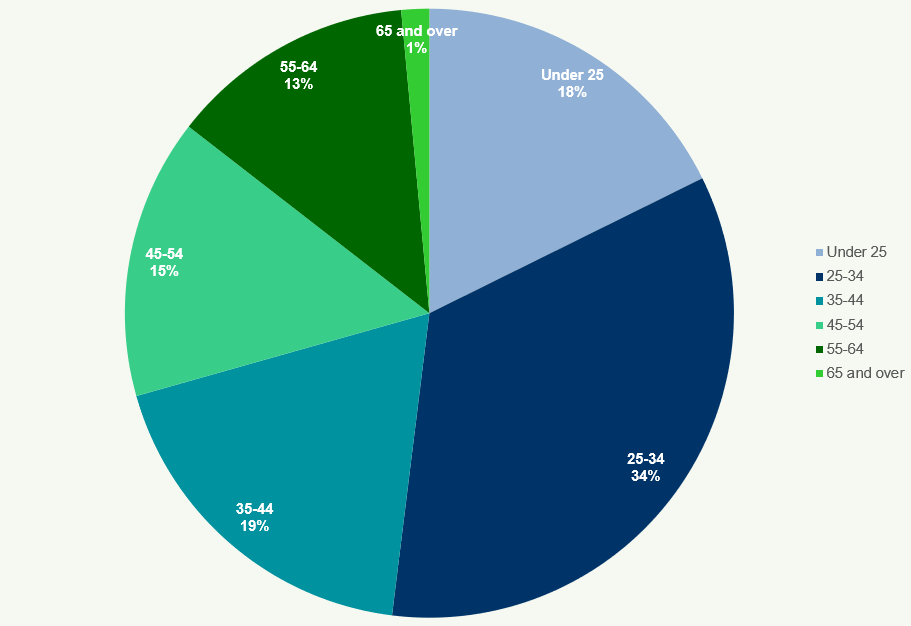

- Age of Managers at PIE Audit Firms 2018

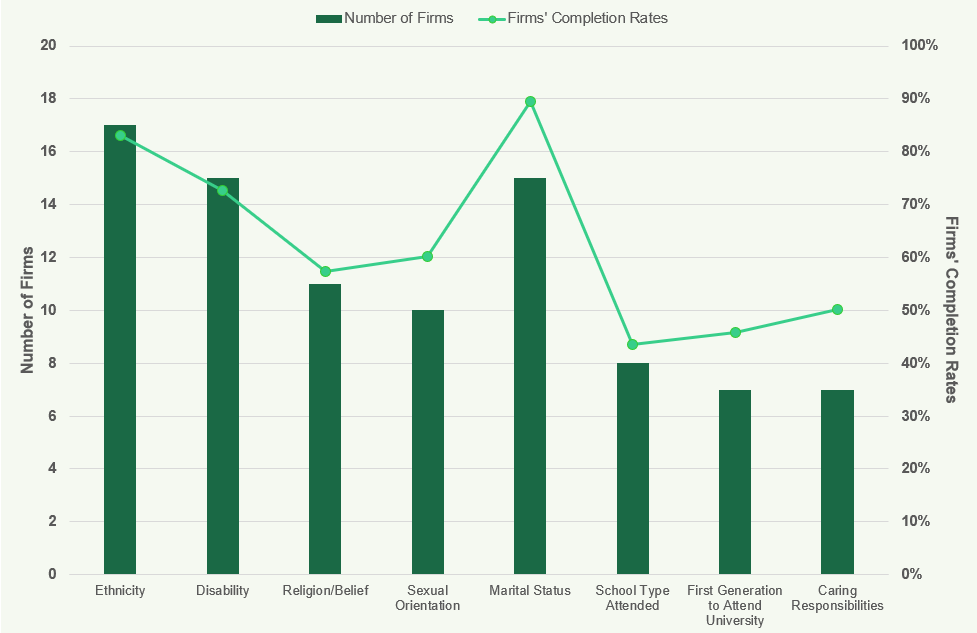

- Diversity Data Completion Rates

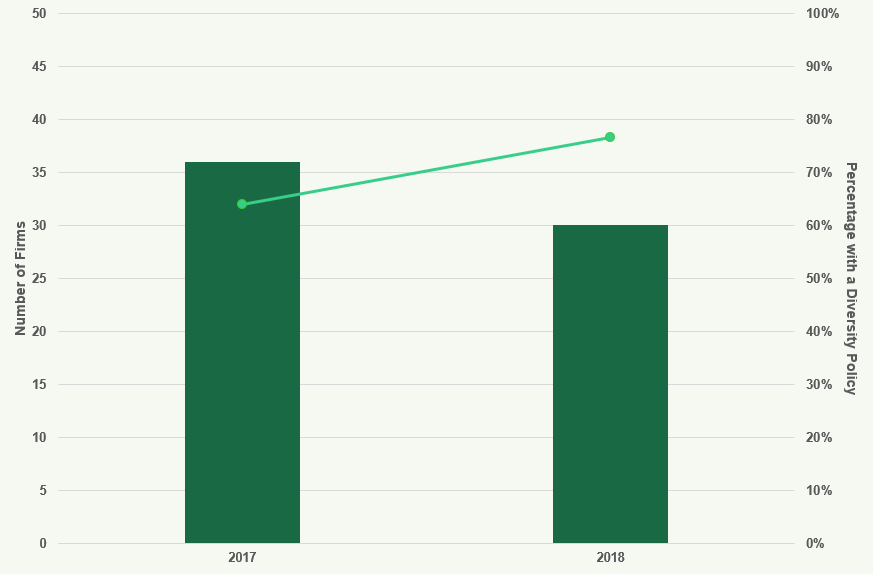

- Diversity Policies

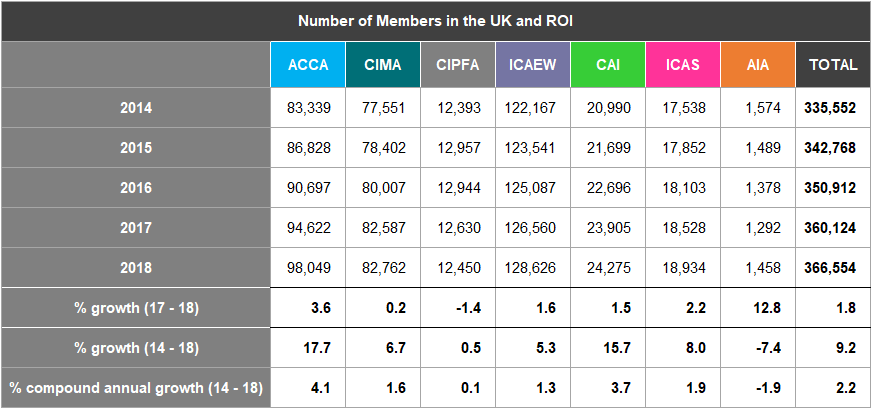

- Table A14: Members in UK and ROI 2014-2018

- Table A16: Members Worldwide 2014-2018

- Table A18: Members by Employment Sector Worldwide 2018

- Table A20: Female Members Worldwide 2014-2018

- Table A22: Members by Age Worldwide 2014

- Table A24: Students by Age Worldwide 2014

- Table A26: Students by Geographical Region Worldwide 2018

- Table A30: Fee Income (£m) 2014-2018

- Table A33: Audit Fee Income Growth Rates 2016-17 and 2017-18

- Section Seven – Glossary

- Footnotes

- Diversity Information on Members and Students under the Public Sector Equality Duty

- Location of Students

- Profile of Students Worldwide of the Accountancy Bodies

- Graduate Entrants to Training

- The Association of Accounting Technicians (AAT)

- Age Distribution of Members and Students

- Resource Information

- Section Three – Resource Information on the Accountancy Bodies

- Section Four – Oversight of Audit Regulation

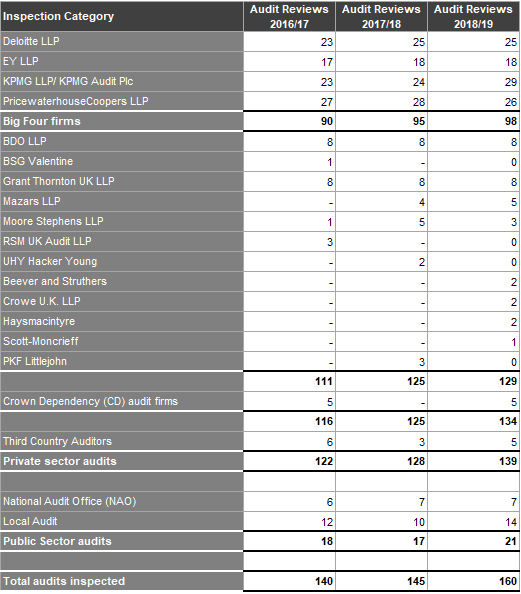

- Monitoring of Registered Audit Firms by the FRC's Audit Quality Review Team

- Monitoring of Registered Audit Firms by RSBs

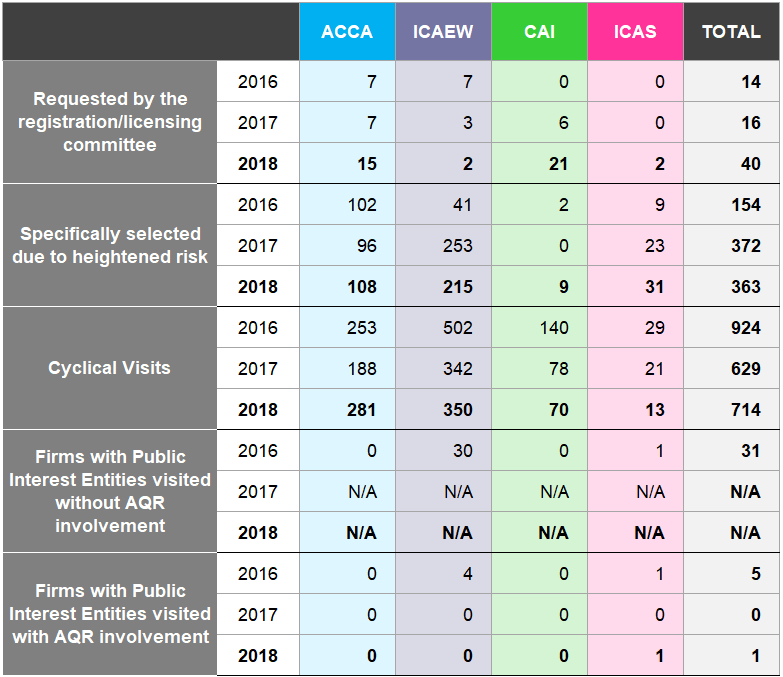

- Reasons for Monitoring Visits to Registered Audit Firms by RSBs

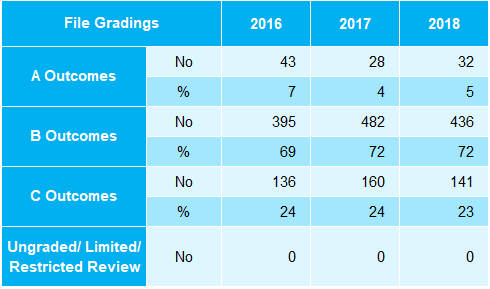

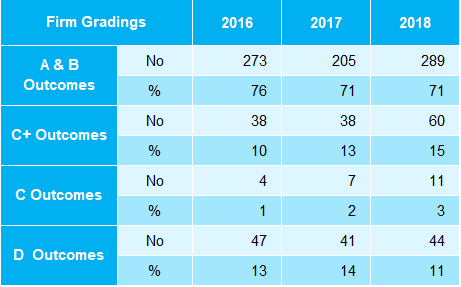

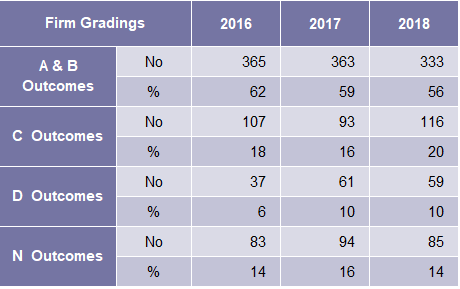

- Gradings of Monitoring Visits to Registered Audit Firms by RSBs

- Complaints about Auditors

- Recognised Qualifying Bodies (RQBs)

- Approved Training Offices

- Section Five – Audit Firms

- Growth of Fee Income

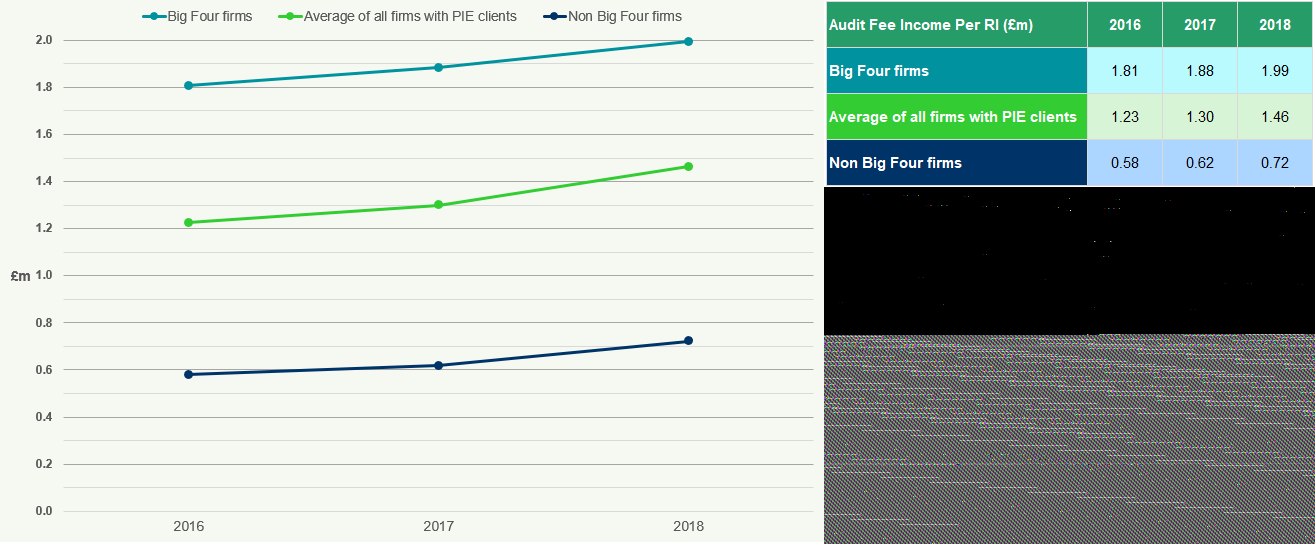

- Audit Fee Income per Responsible Individual (RI)

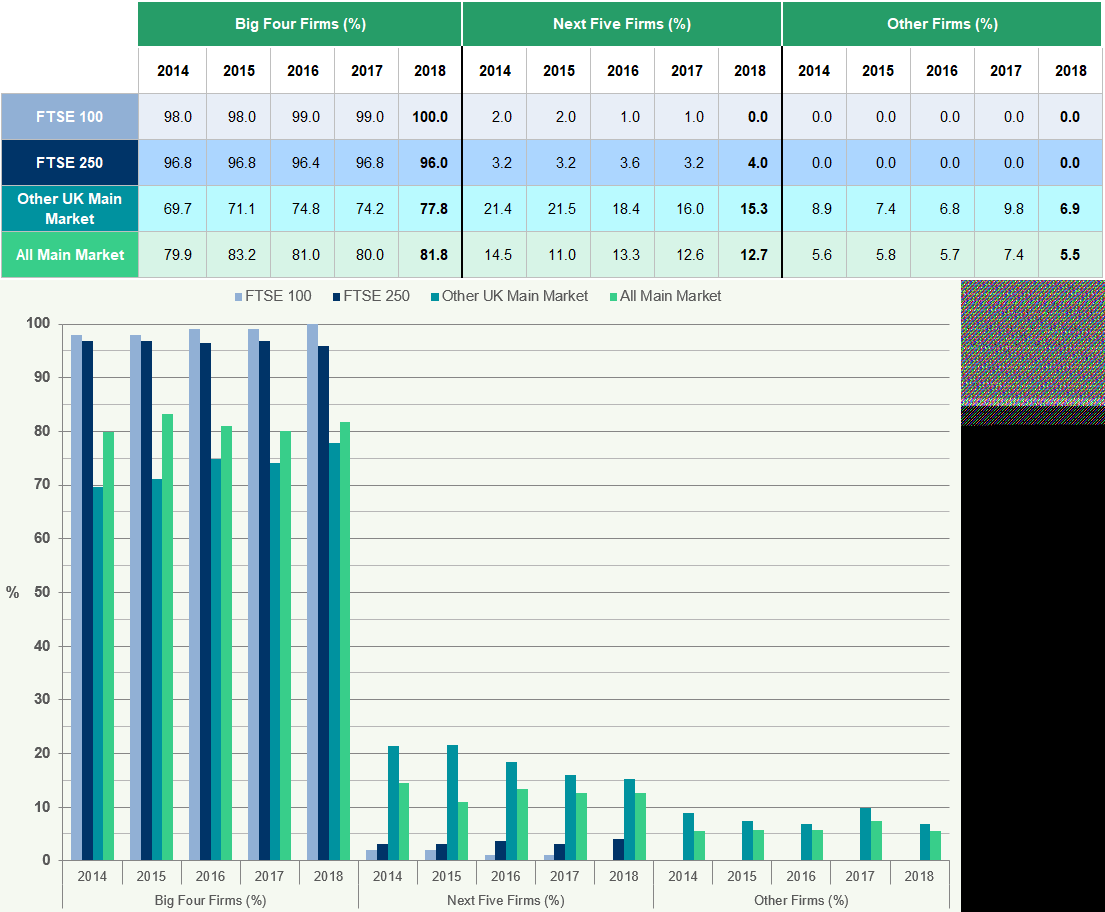

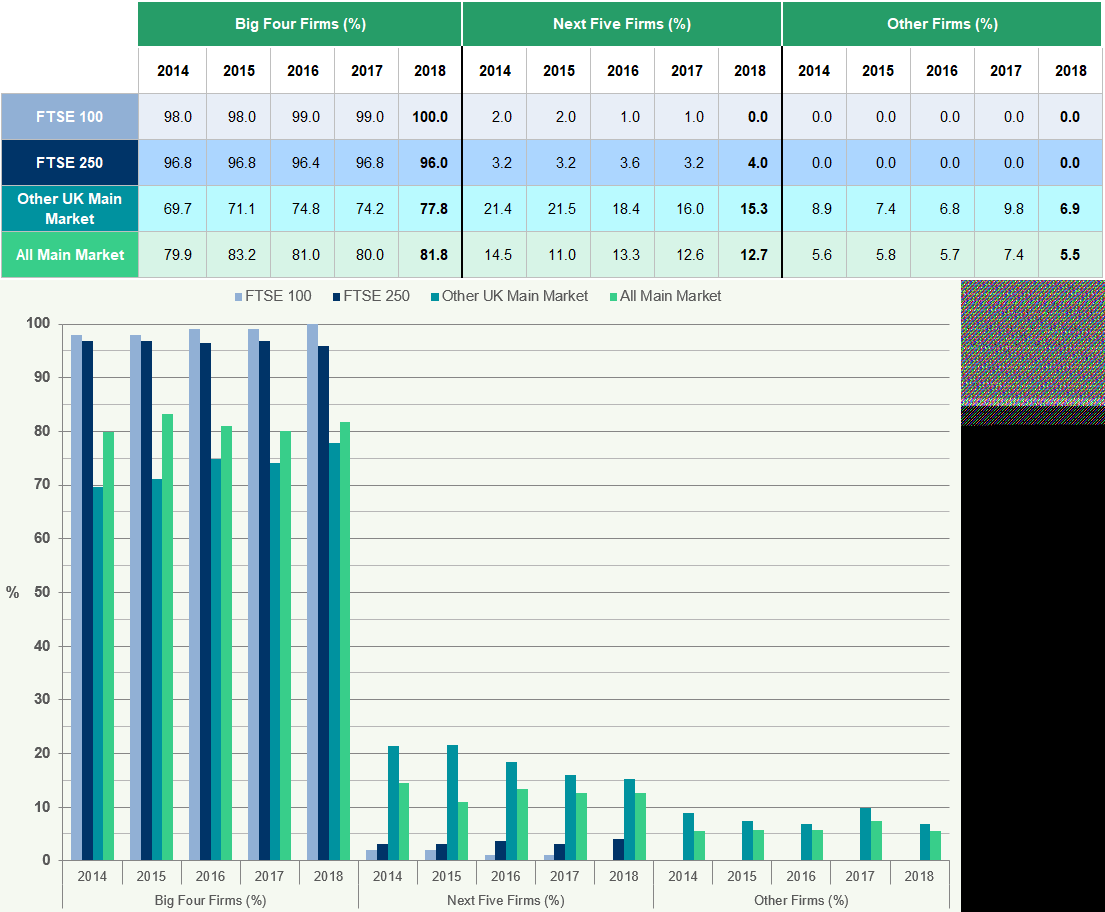

- Concentration of Listed Companies' Audits

- Concentration of Listed Companies' Audits

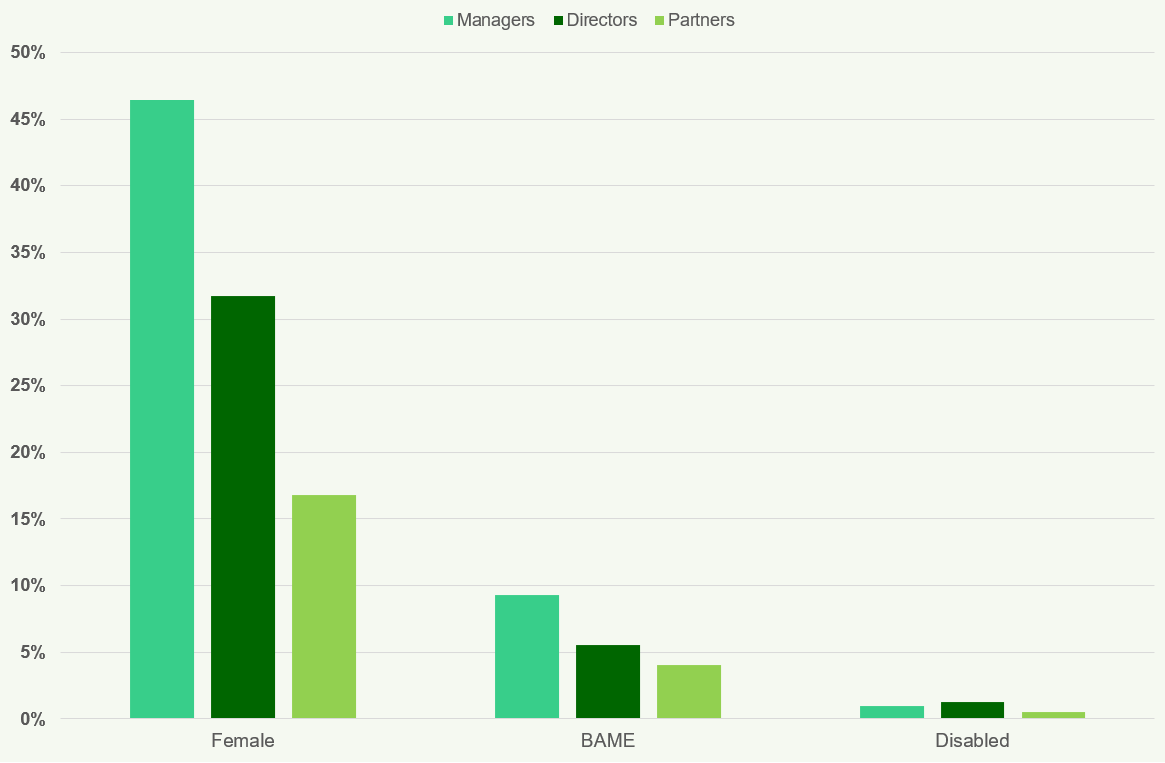

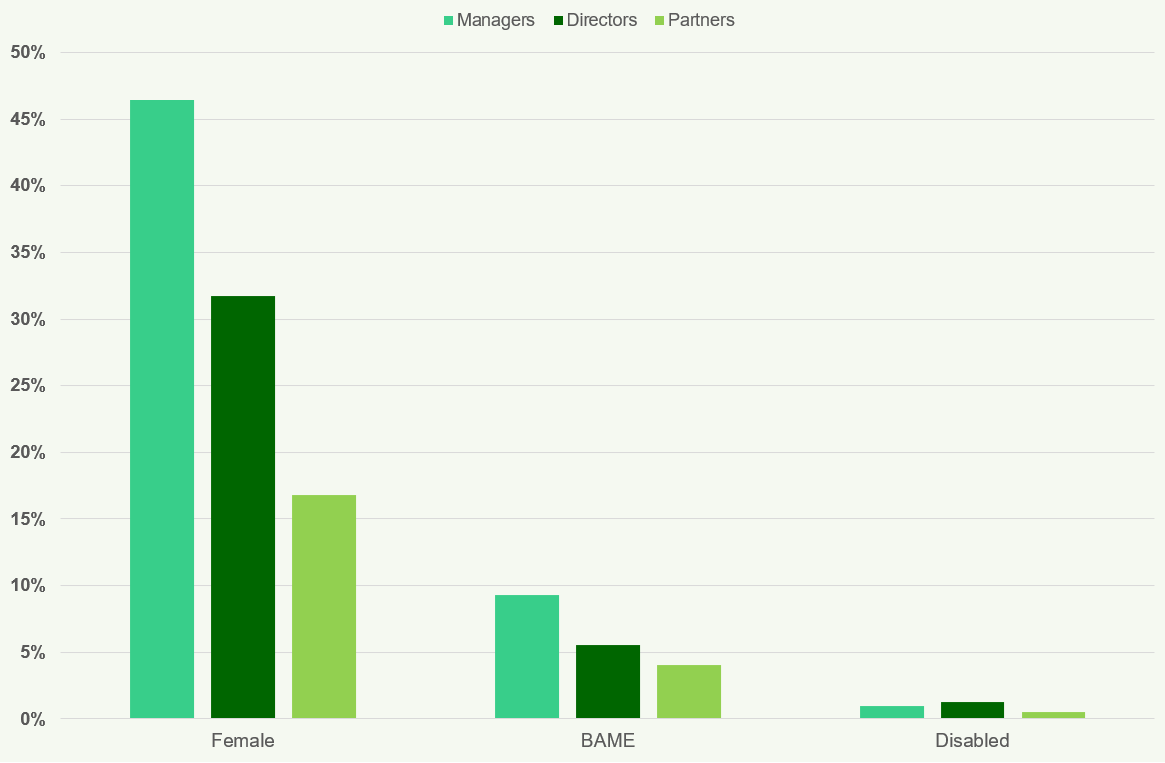

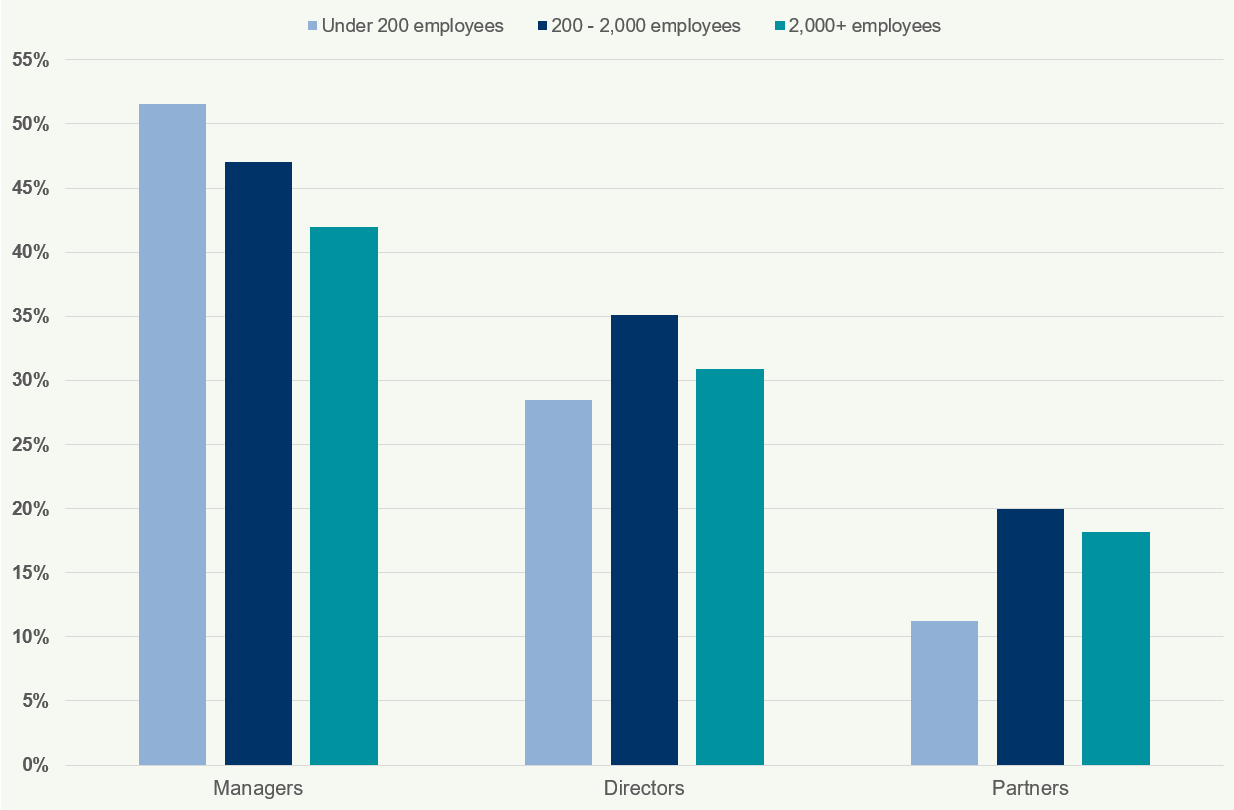

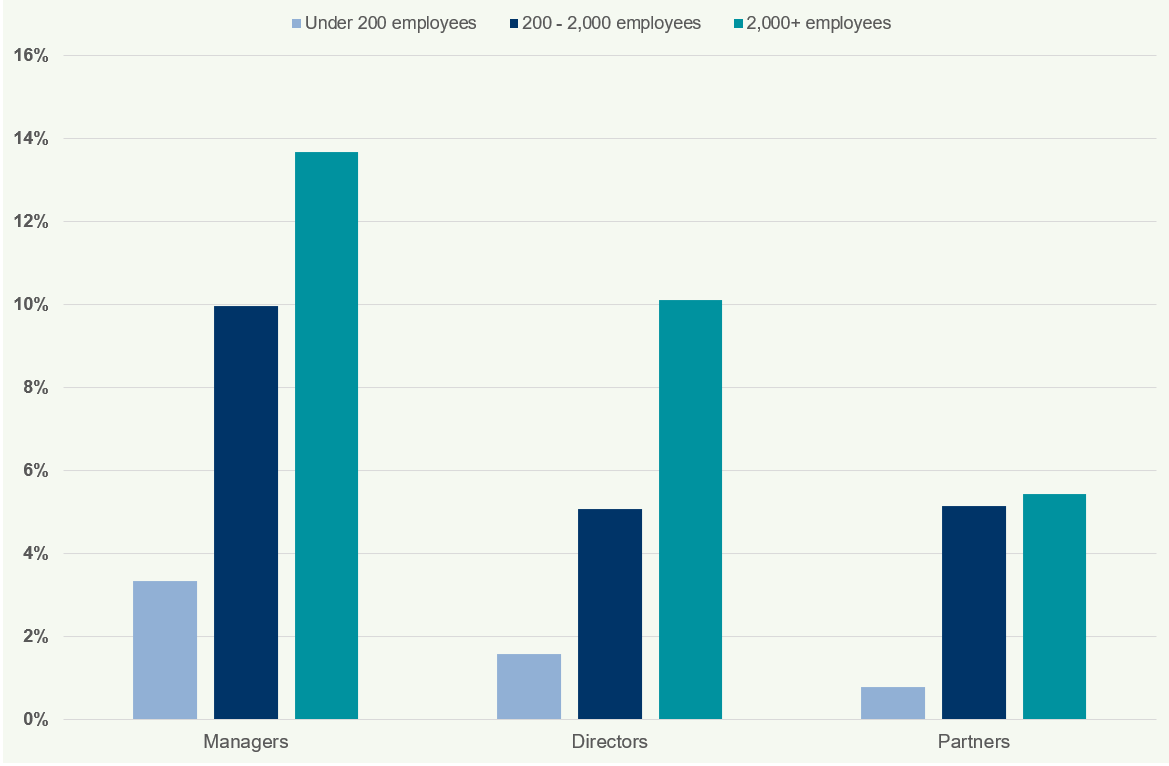

- Diversity at PIE Audit Firms' Senior Management

- Age of Workforce at the Audit Firms

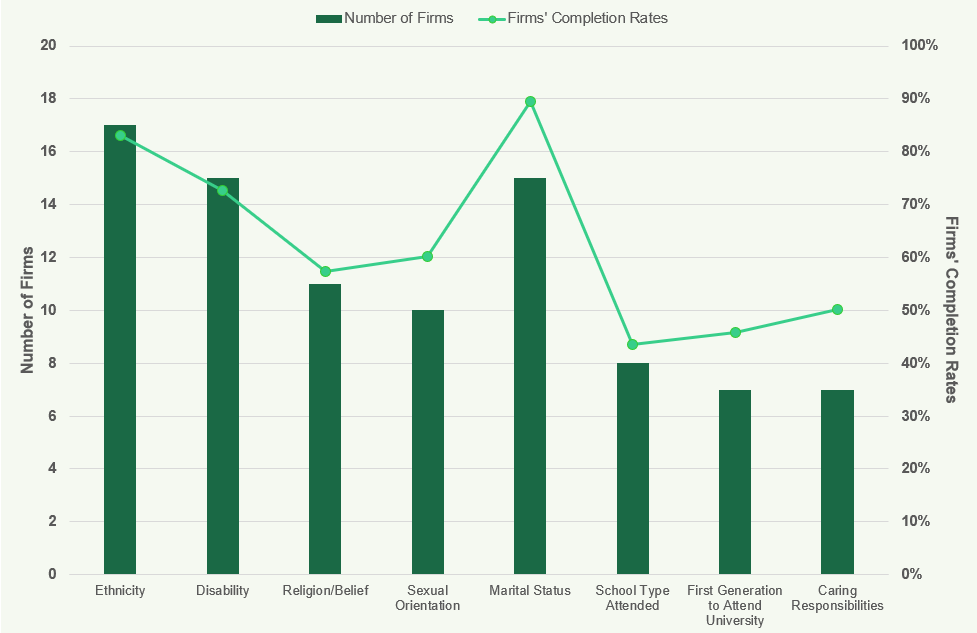

- Diversity Information Collected by the PIE Audit Firms (Workforce)

- Section Six – Data Tables of the Charts (Total Figures and Percentages)

- Section Seven – Glossary

Foreword

This is the seventeenth edition of ‘Key Facts and Trends in the Accountancy Profession'.

This publication provides statistical information and trends on the members and students in the accountancy profession. Information is obtained from the following accountancy bodies: the six UK Chartered Accountancy bodies1, the Association of International Accountants (AIA) (“the accountancy bodies") and the Association of Accounting Technicians (AAT) (“all bodies"). In the sections below, the tables on members show data for the UK and the Republic of Ireland (ROI) combined and worldwide data. We include the UK and ROI figures together, partly because members and firms are entitled to practise in both jurisdictions and partly because in some cases it is difficult for all bodies to separate the data. The Irish Auditing and Accounting Supervisory Authority (IAASA) publishes information relating specifically to the ROI accountancy bodies, which can be found at http://www.iaasa.ie.

Where appropriate we highlight significant trends and explain possible limitations of the data; however, it is important to note that we do not check the accuracy of the information provided. Where there are notable trends in the data, we follow this up with all bodies and firms to verify that they are content with the information they provided, but we do not include commentary on the possible reasons for any particular trends. We stress that it is often difficult to make comparisons between the different accountancy bodies, or between the audit firms that audit public interest entities (PIEs2), given the differences in the way data is classified and because of different regulatory arrangements.

Diversity at all bodies and audit firms continues to be high on the FRC's agenda. In 2019, the FRC was recognised as a public body. We are required to have due regard to the Public Sector Equality Duty (PSED) which was introduced by the Equality Act 2010 (the Act). The FRC must therefore consider the following objectives in its oversight of all bodies:

- Eliminate unlawful discrimination, harassment, victimisation and any other conduct prohibited by the Act;

- Advance equality of opportunity between people who share a protected characteristic3 and people who do not share it; and

- Foster good relations between people who share protected characteristics and people who do not share it.

Further information can be found in the Diversity sections of this publication.

As always, we are grateful to those that took the time to complete our questionnaire on how we can continue to improve this publication, viewable here: http://www.smartsurvey.co.uk/s/EYRS5/

Section One – Main Highlights

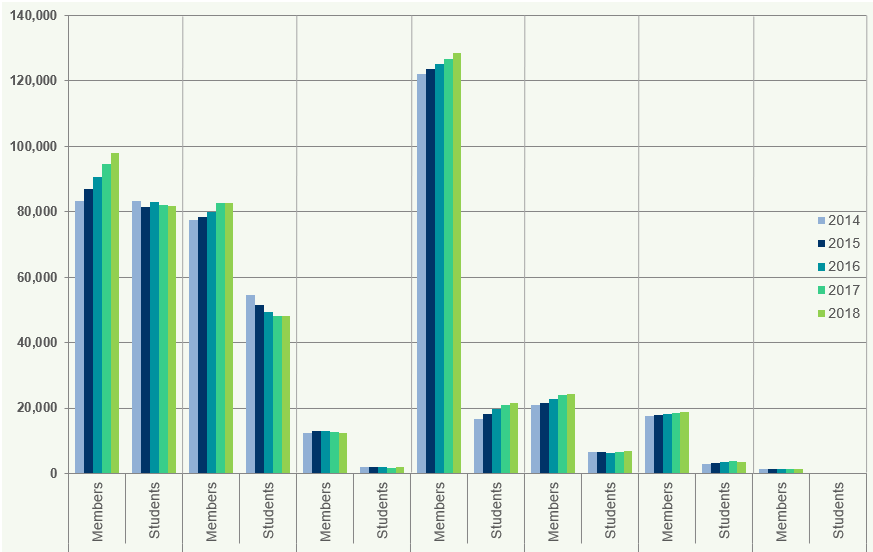

The Accountancy Bodies 2014 to 2018

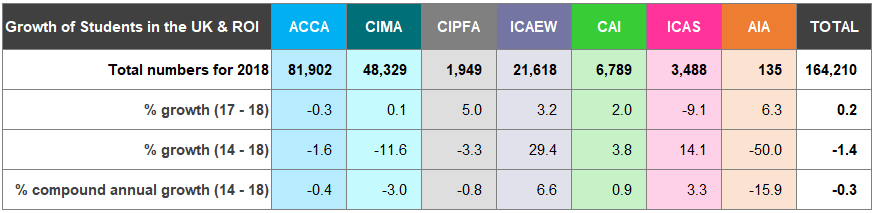

Membership of the accountancy bodies continues to grow. The seven bodies in this report have over 365,000 members in the UK and ROI and almost 550,000 members worldwide. The compound annual growth rate from 2014 to 2018 is 2.2% in the UK and ROI and 3.1% worldwide (Figures 1 and 2).

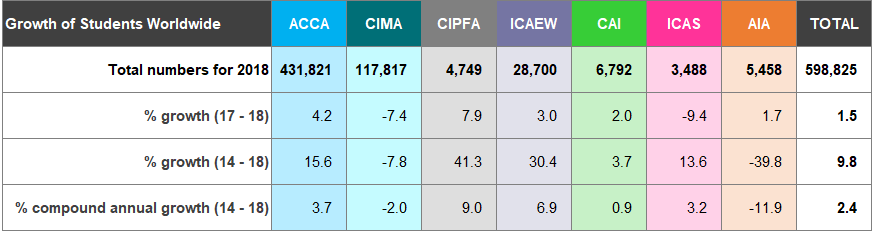

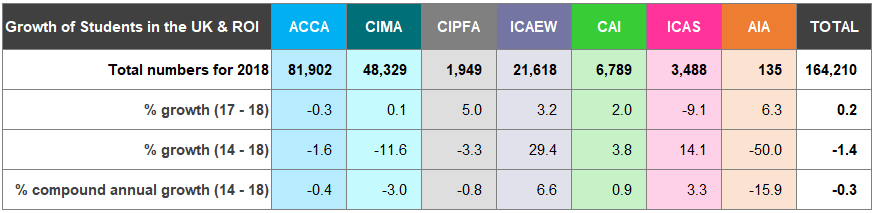

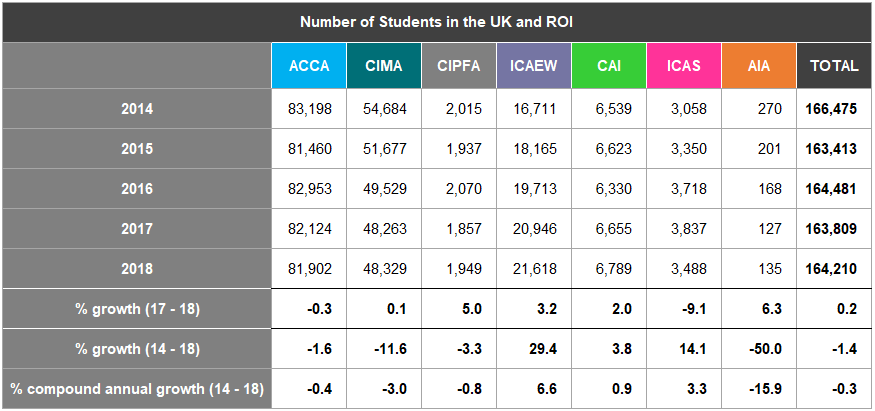

There are over 164,000 students in the UK and ROI and nearly 600,000 worldwide. Student numbers in the UK and ROI increased by 0.2% and by 1.5% worldwide from 2017 to 2018.

There was a decline in the compound annual growth rate for UK and ROI students between 2014 and 2018 (-0.3%) but there was a 2.4% increase worldwide over the same period. Only AIA (-11.9%) and CIMA (-2.0%) experienced a decline in its compound annual growth worldwide 2014-2018 figures (Figures 1 and 2).

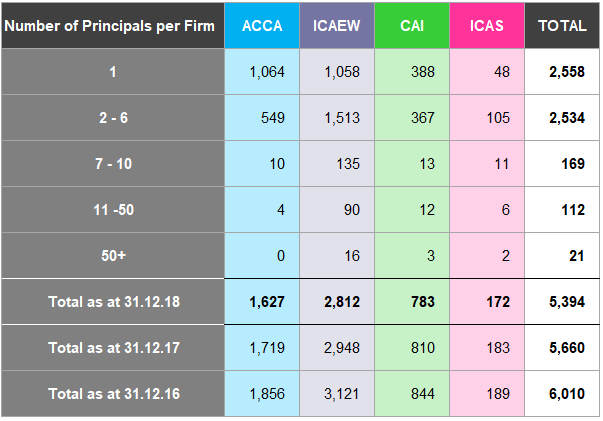

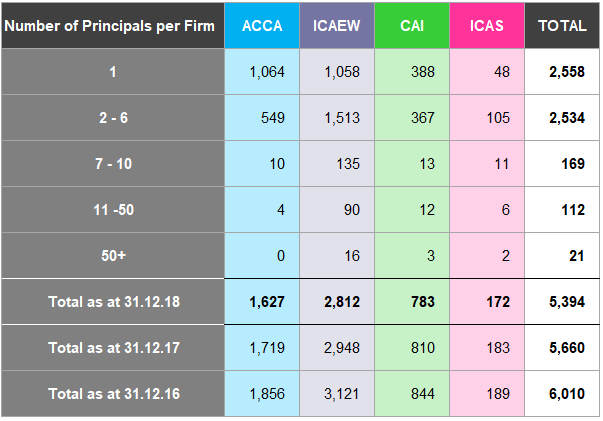

The number of audit firms registered with the Recognised Supervisory Bodies (RSB) continues to decline. The total number of registered audit firms was 5,394 as at 31 December 2018, compared to 5,660 and 6,010 registered firms as at 31 December 2017 and 2016 respectively (Figure 21).

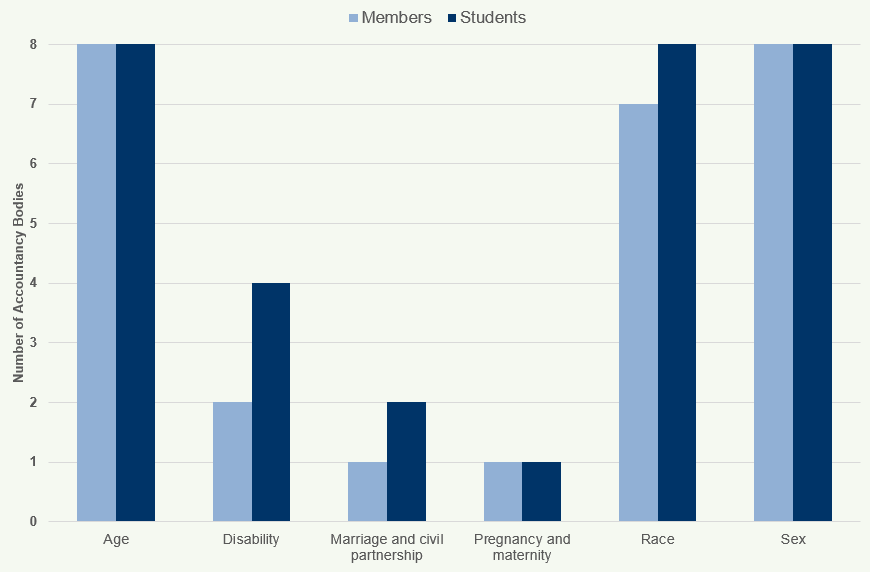

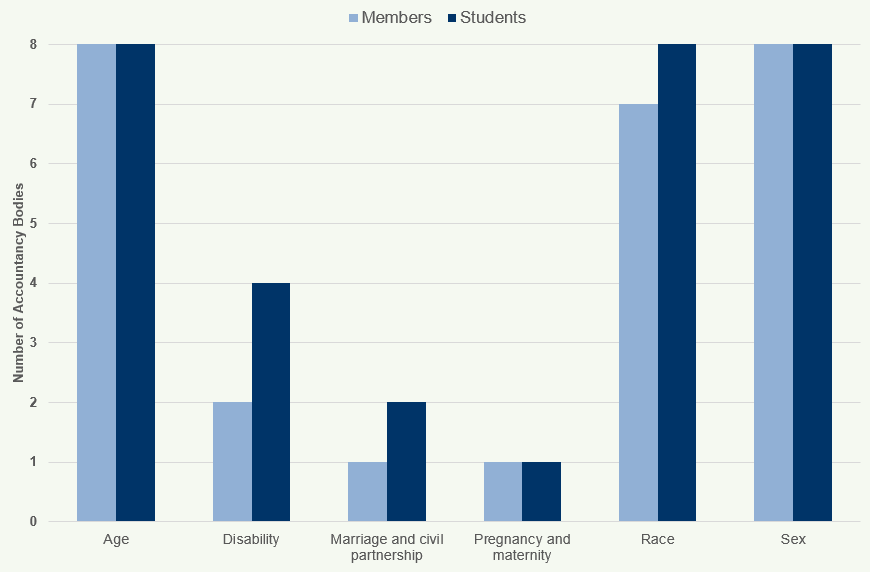

The Public Sector Equality Duty applies to the FRC and any successor body and we are accordingly reporting on the profession's diversity in greater detail. This year we asked all bodies whether they collect data on the nine protected characteristics of their members and students and of their workforce.

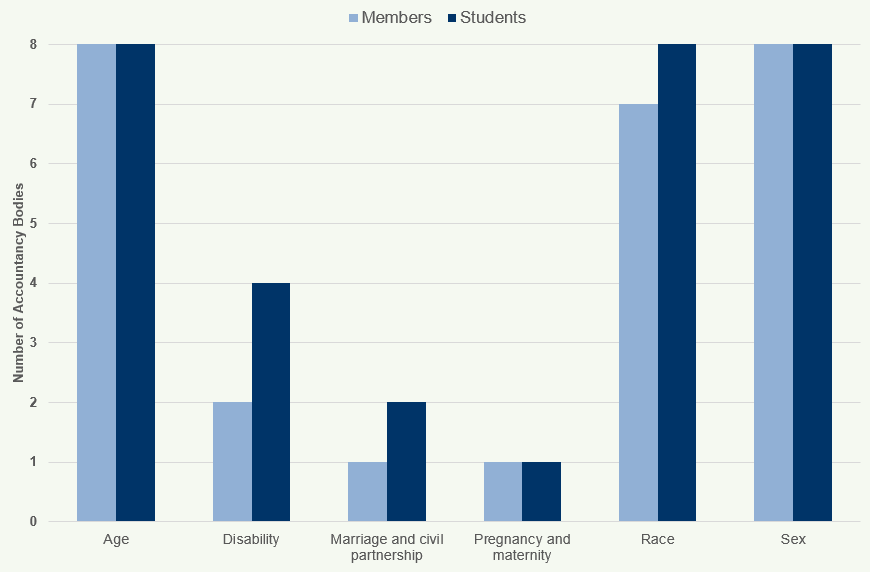

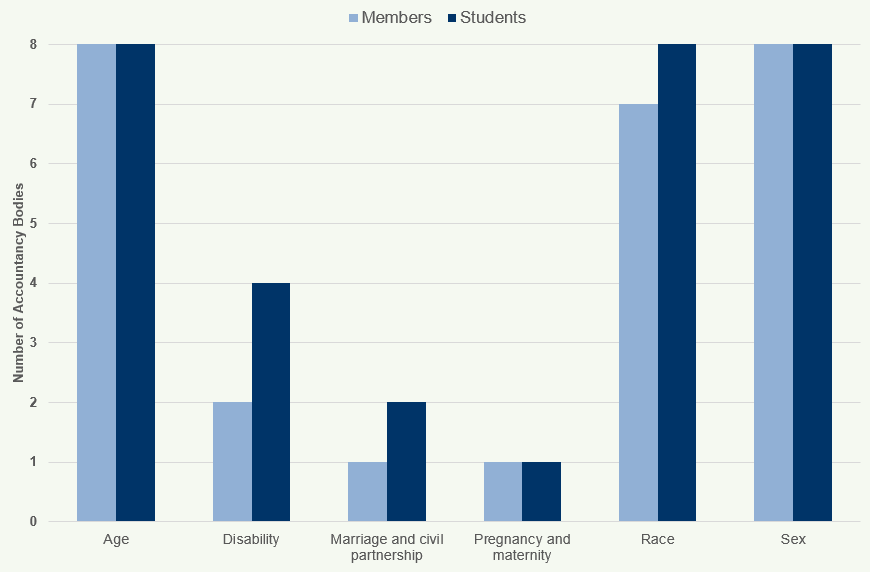

Figure 9 shows that a high percentage of accountancy bodies collect data on age, race and gender of their members and students. Four of the bodies collect disability data of their students; however, only two of the bodies collect this data of its members. Figure 20 shows that there has been an increase in the number of bodies that collect diversity data of their workforce in respect of age, gender, race/ ethnicity, disability, religion or belief and sexual orientation. All the bodies now have diversity policies/ statements in place.

Think Ahead ACCA CIPFA The Chartered Institute of Public Finance & Accountancy ICAS: AIA THE ASSOCIATION OF INTERNATIONAL ACCOUNTANTS CIMA Chartered Institute of Management Accountants ICAEW aat CHARTERED ACCOUNTANTS IRELAND

4 To be an RSB, the body must satisfy the recognition criteria as set out in Schedule 10 of the Companies Act 2006. Individuals and audit firms that wish to be appointed as a statutory auditor in the UK must be registered with an RSB. There are four RSBs: ACCA, ICAEW, CAI and ICAS.

The Audit Firms 2017/18

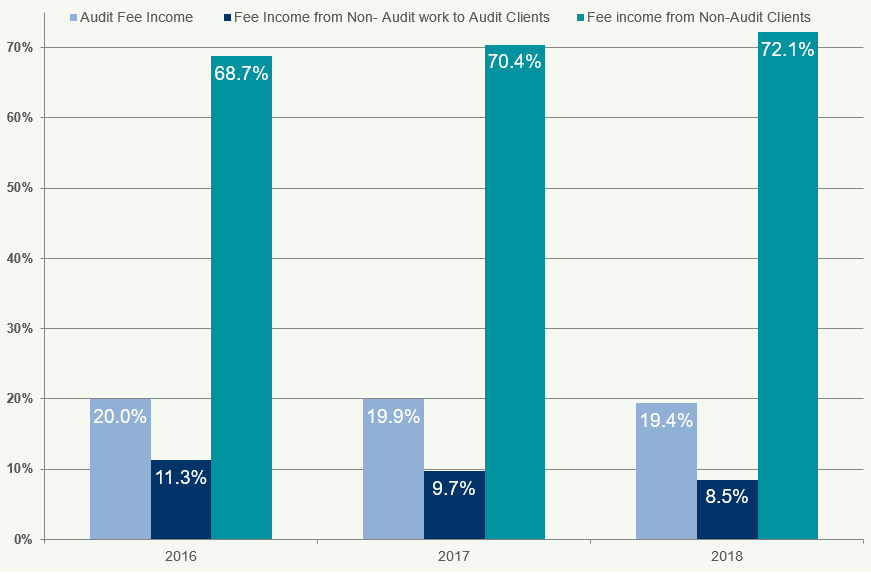

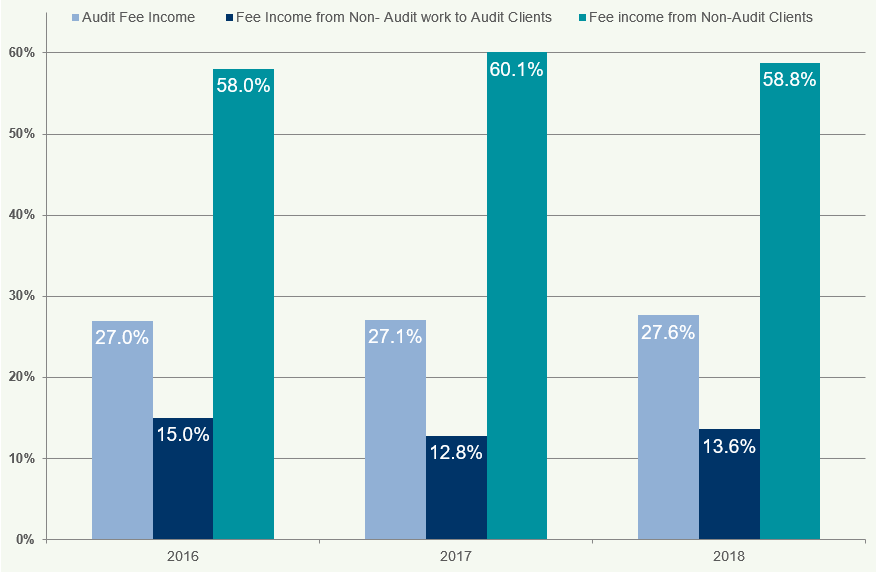

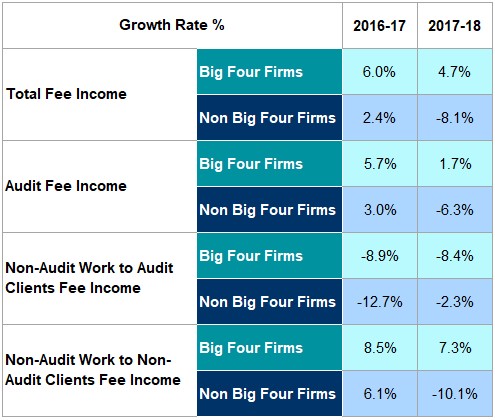

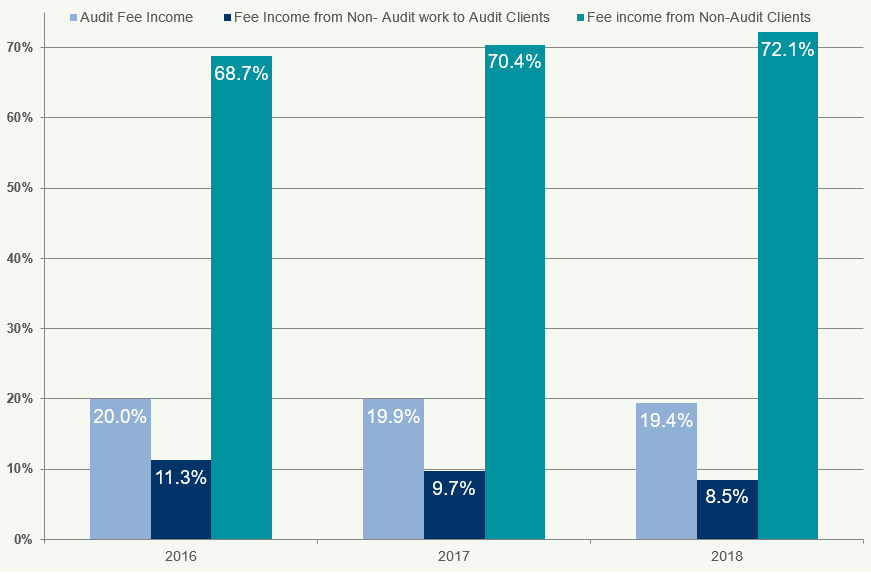

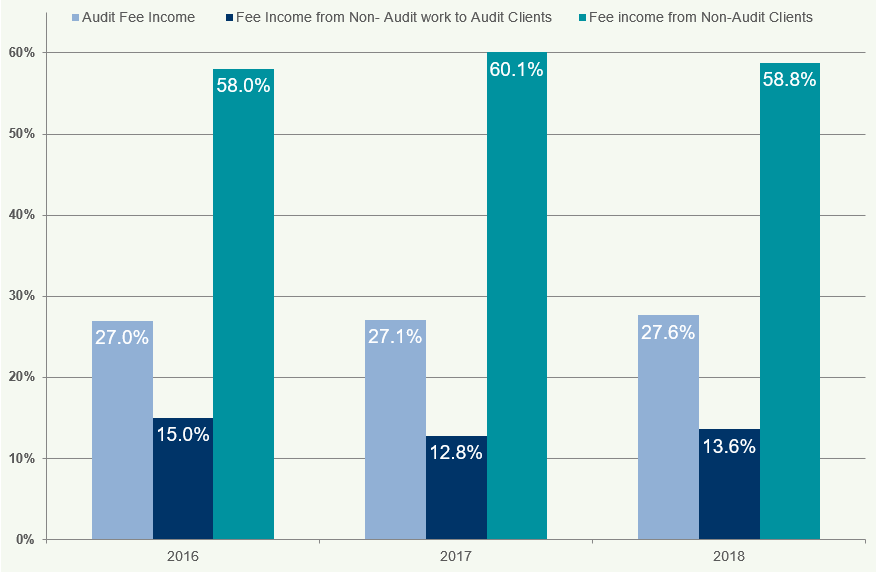

Figure 33 shows the fee income for audit and non-audit services for 30 of the audit firms with Public Interest Entity (PIE) clients for 2018-year ends. Firms are listed in order of fee income from audit, rather than total fee income. Six PIE audit firms chose not to participate in the publication (all data is provided on a voluntary basis to the FRC).

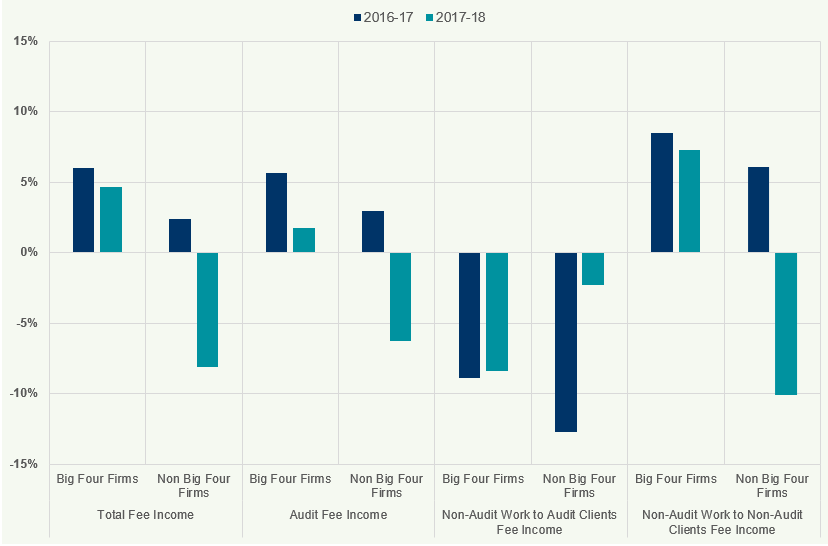

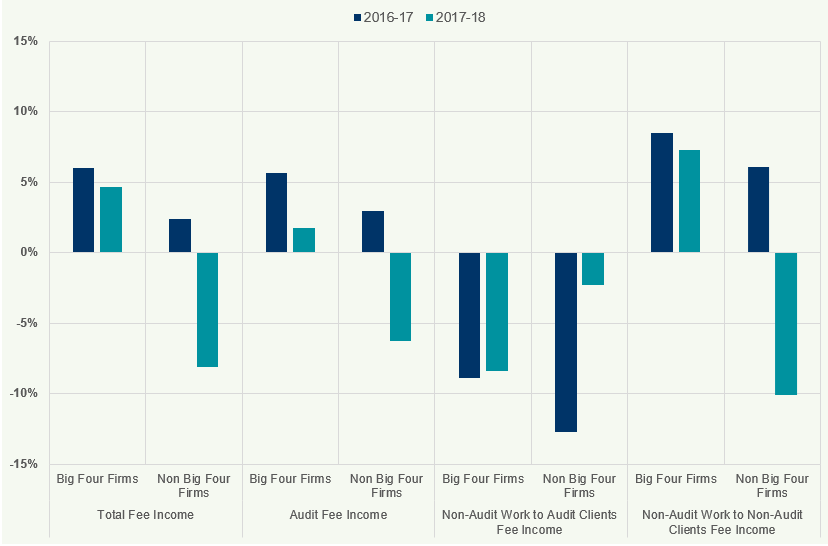

The Big Four firms continued to see an increase (4.7%) in their “total fee income"; however, the rate of growth has fallen compared to 2016/17. Firms outside the Big Four saw a decline in their total fee income (-8.1%) compared to a 2.4% increase in 2016/17 (Figure 36).

Fees for non-audit work to audit clients for Big Four and non-Big Four firms experienced a decline by 8.4% and 2.3% respectively from 2017 to 2018 (Figure 36). Audit fee income for Big Four firms increased by 1.7% from 2017 to 2018 compared to 5.7% from 2016 to

- Audit fee income for audit firms outside the Big Four decreased by 6.3% from 2017 to 2018 compared to a 3.0% increase from 2016 to 2017 (Figure 36).

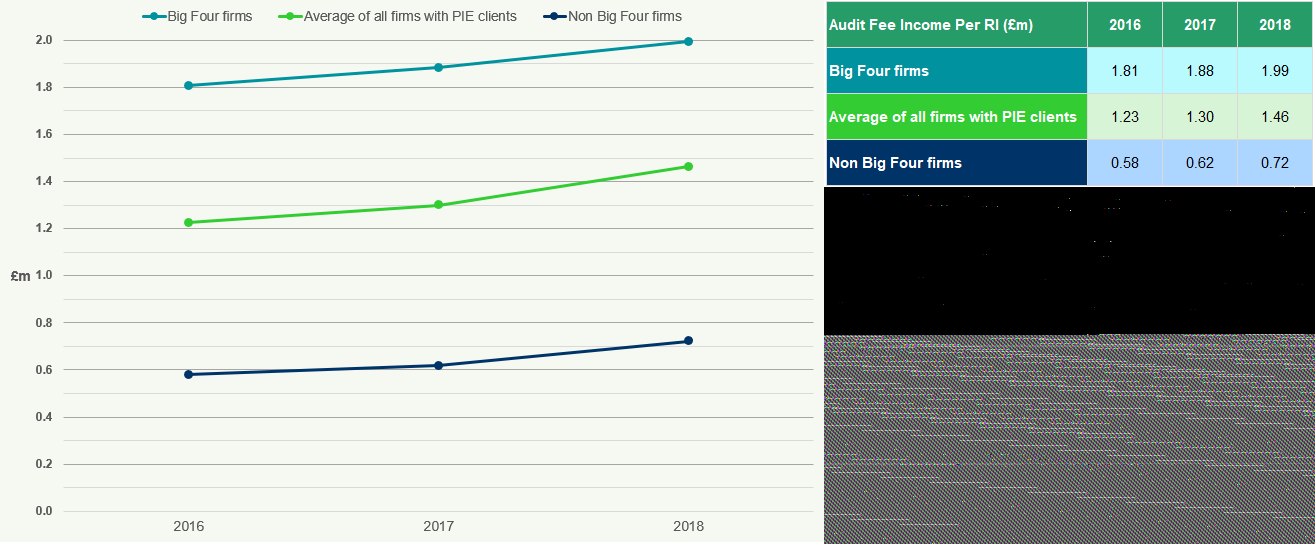

The average audit fee income per Statutory Auditor/ Responsible Individual (RI) for 2018 for all firms with PIE clients was £1.46m, an increase of £0.16m from 2017 (Figure 37).

For the year ended 31 December 2018, 100% of FTSE 100 companies were audited by the Big Four accountancy firms (Figure 39).

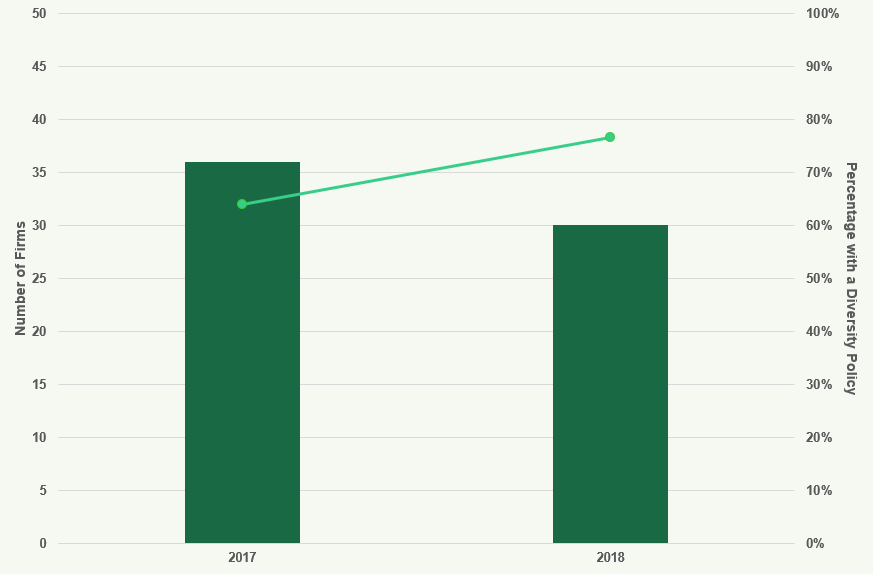

In respect of Diversity at audit firms, this year we have focused on senior management highlighting the percentage of females; black, asian and minority ethnic (BAME); and disabled individuals at each of the 24 PIE audit firms that disclosed this data (Figures 40 to 43). We extended our request to the PIE audit firms asking whether they collect information on the following diversity indicators of their workforce: age, ethnicity, disability, religion/belief, sexual orientation, marital status, school type attended, first generation to attend university and caring responsibilities. The data and the staff completion rates on each indicator are set out in Figure

- The firms were also asked whether they have any diversity policies in place (Figure 46).

Section Two – Members and Students of the Accountancy Bodies

Registered Members and Students in UK and ROI

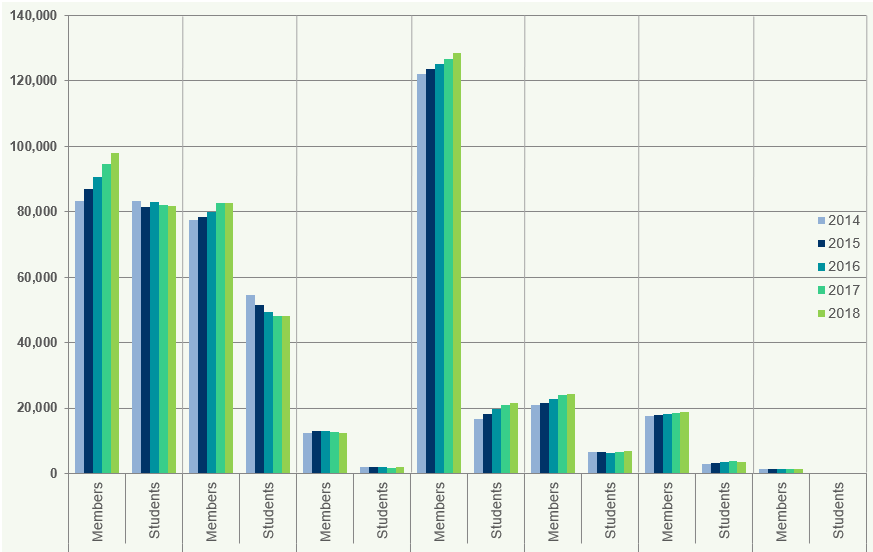

Figure 1 shows growth rates and the number of members and students in the UK and ROI, as at 31 December for the five years to 31 December 2018.

Figure 1: Members and Students in the UK and ROI

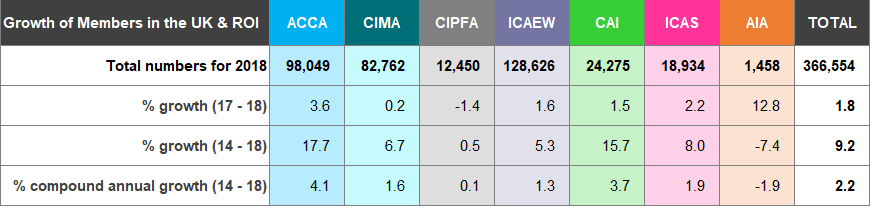

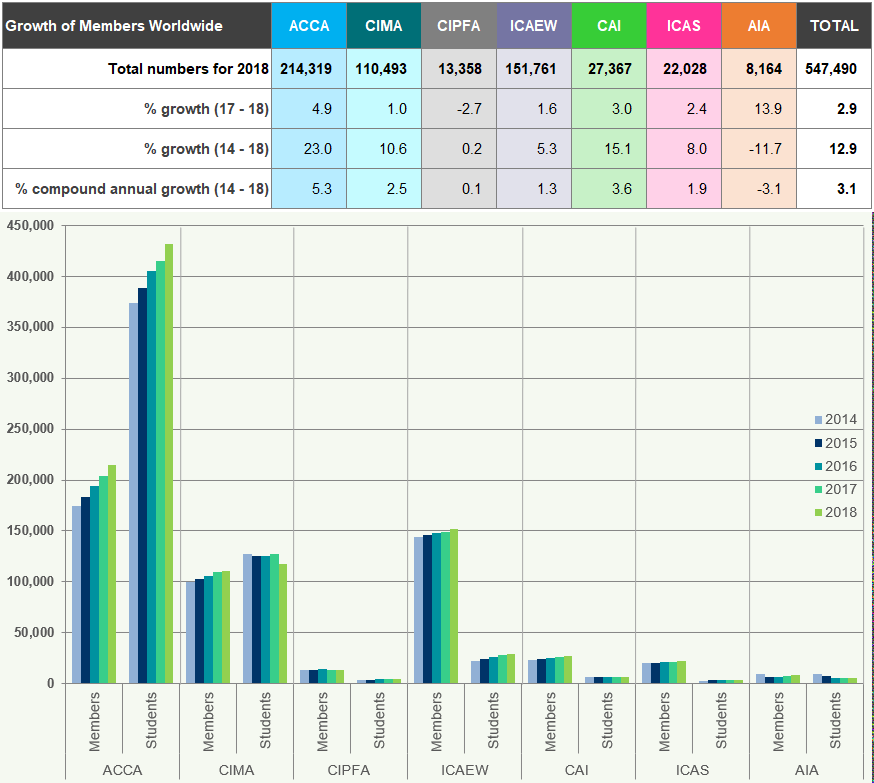

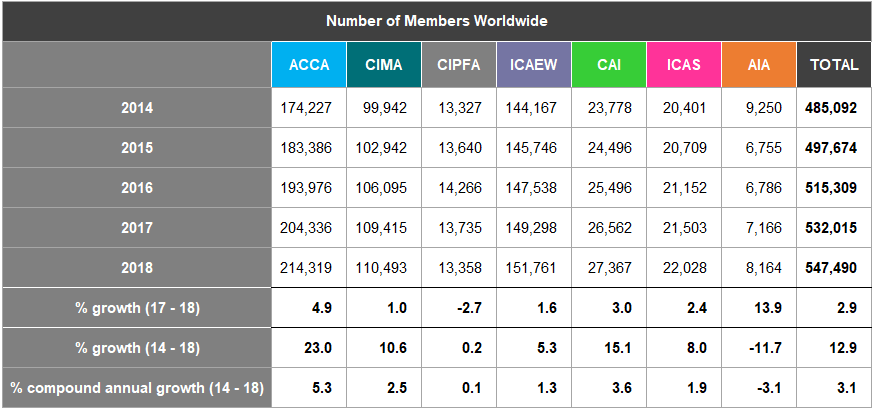

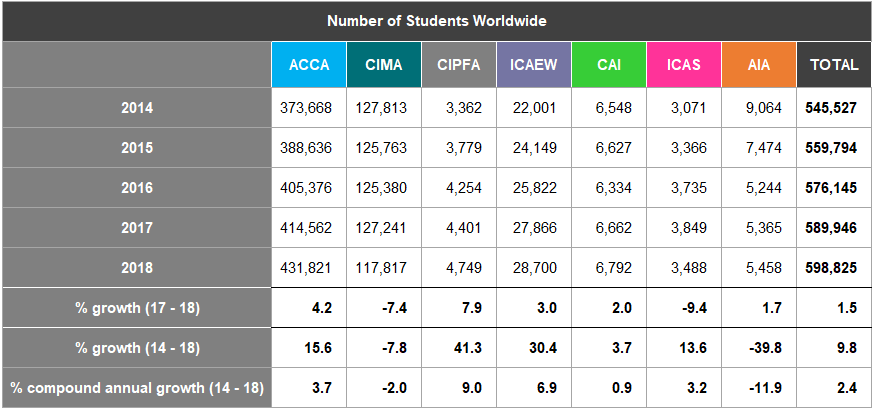

Registered Members and Students Worldwide

Figure 2 shows growth rates and the number of worldwide5 members and students, as at 31 December for the five years to 31 December 2018.

Figure 2: Members and Students Worldwide

5 The location of members and students is based on the registered address supplied to the accountancy bodies and may be either the place of employment or the place of residence.

Analysis of Members and Students of the Seven Accountancy Bodies

The total number of members of the seven accountancy bodies in the UK and ROI has continued to grow steadily at a compound annual growth rate of 2.2% for the period 2014 to

-

Total membership rose by 1.8% from 2017 to 2018 compared with 2.6% from 2016 to 2017 (Figure 1). Growth rates of membership vary considerably at each of the individual accountancy bodies in the UK and ROI. ICAEW continues to have the largest number of members in this jurisdiction; however, ACCA showed the strongest growth at a compound annual rate of 4.1% between 2014 and

-

Only AIA has seen a decline in membership over this period. The total number of students in the UK and ROI has increased by 0.2% from 2017 to 2018 compared with a decrease of 0.4% between 2016 and

-

ACCA and ICAS have seen a decrease in student numbers between 2017 and 2018 at -0.3% and -9.1% respectively.

The worldwide membership of the accountancy bodies has grown by 2.9% from 2017 to 2018 and at a compound annual growth of 3.1% for the period 2014 to 2018 (Figure 2).

Overall, worldwide student numbers increased by 1.5% from 2017 to 2018 with a compound annual growth of 2.4% between 2014 and 2018.

Qualifications differ across the recognised qualifying bodies (see page 37). Over 70% of the total worldwide student membership are training with ACCA for its qualification.

6 The statistics for AAT are shown separately on pages 17 and 18.

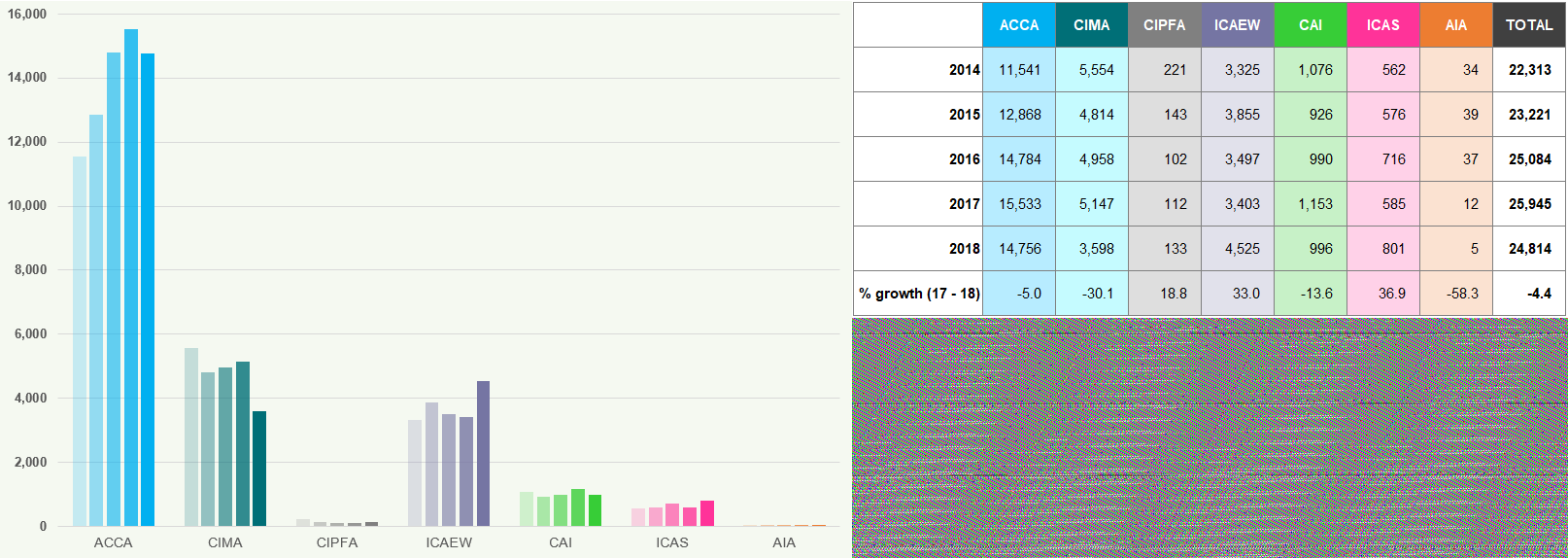

Students who became Members

Figure 3 shows the number of worldwide students who became members, as at 31 December for each of the years 2014 to 2018.

Figure 3: Students to Members Worldwide 2014 to 2018

ACCA, CIMA, CAI and AIA have all seen a decline in the number of students becoming members in 2018 compared to

ACCA, CIMA, CAI and AIA have all seen a decline in the number of students becoming members in 2018 compared to

- Overall, the total number of students who became members worldwide decreased from 2017 to 2018 by -4.4%. In 2016/17 there was an increase of 3.4%.

Prior to 2017, CAI reported only on the number of students who became members in ROI. The 2017 and 2018 figures show the number of students to members worldwide.

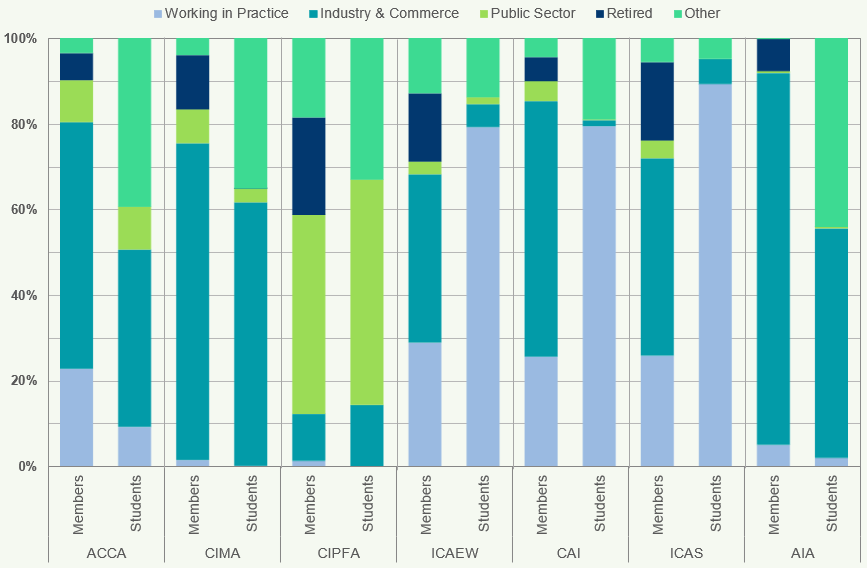

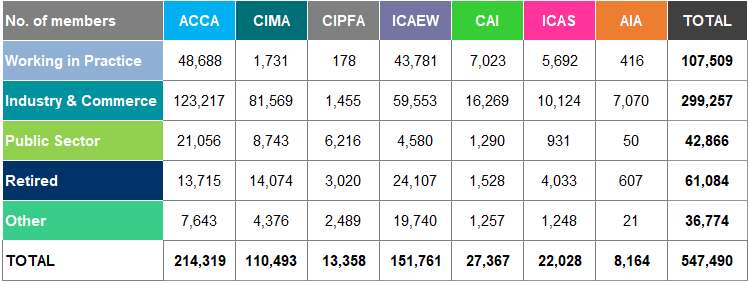

Sectoral Employment of Members and Students Worldwide

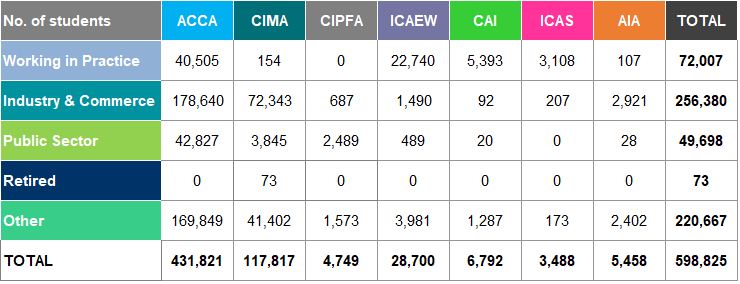

Figure 4 shows the percentages of members and students worldwide of each of the seven accountancy bodies, according to their sectoral employment7 as at 31 December 2018.

Figure 4: Sectoral Employment Worldwide 2018

The Industry and Commerce sector employs the highest percentage of members (55%) and students (43%) across the accountancy bodies. CIMA's and AIA's members in this sector make up 74% and 87% respectively of their population.

Over three quarters of students at ICAEW, CAI and ICAS are in practice (i.e. working at an accountancy firm). In contrast 2% or less of CIMA, CIPFA and AIA students are employed in practice.

Overall, 12% of students are employed in practice and 8% in public sector.

7 (i) "Other category" for members includes those who are unemployed, taking a career break, undertaking full time study, on maternity leave and any member who are unclassified, for example having not provided the information. In the case of CAI all such members are included in their most recent employment where available. The ICAEW includes members working within the charity sector under "Public Sector". For ICAS, the figure for Industry and Commerce includes students working in the public sector. (ii) "Other" for students includes those that are not employed, employed in other sectors, those in full time education, independent students for whom no information on their employment is available and those individuals that have passed their final exams and are entitled to membership but have not yet been admitted.

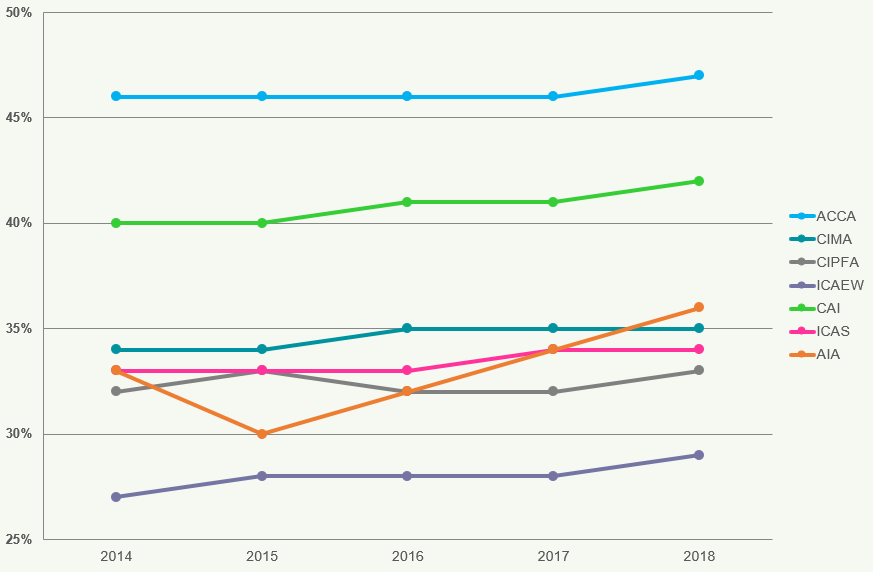

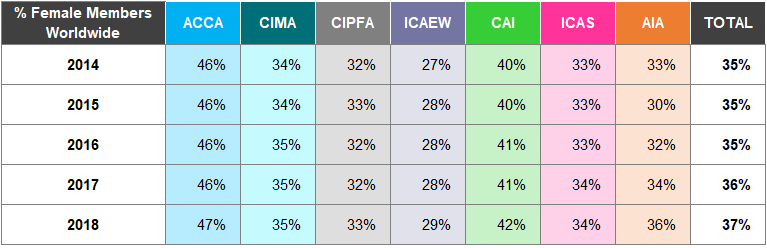

Gender of Members and Students Worldwide

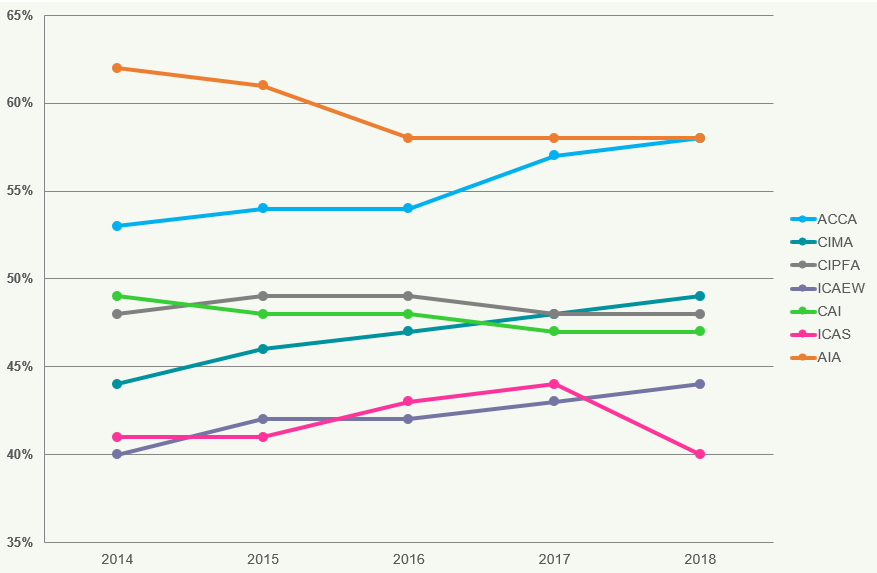

Figures 5 and 6 show the percentage of female members and students worldwide respectively, as at 31 December for each of the years 2014 to 2018.

Figure 5: Female Members Worldwide 2014 to 2018

The average percentage of female members has increased from 35% in 2014 to 37% in 2018.

Since 2014, all of the accountancy bodies have increased their percentage of female members worldwide, with AIA experiencing the largest increase of 3% in this period. ACCA continue to have the highest female percentage (members) of all the accountancy bodies since we began collating this information.

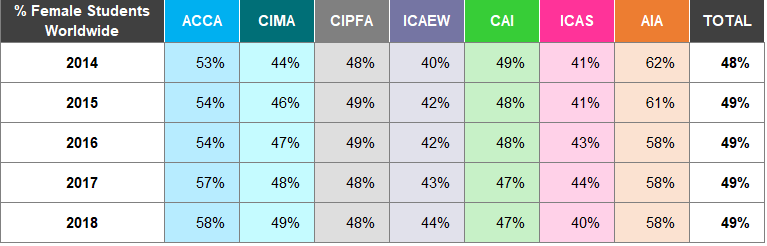

Figure 6: Female Students Worldwide 2014 to 2018

The overall percentage of female students (49%) is greater than the overall percentage of female members (37%).

ACCA and AIA have the largest percentage of female students in 2018, both 58%.

For 2017 and 2018, CAI and ICAS figures refer only to the proportion of females in the student intake, not of the total student population.

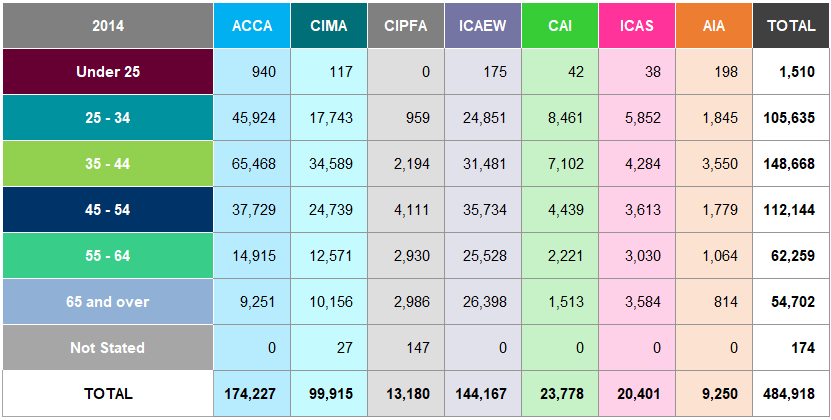

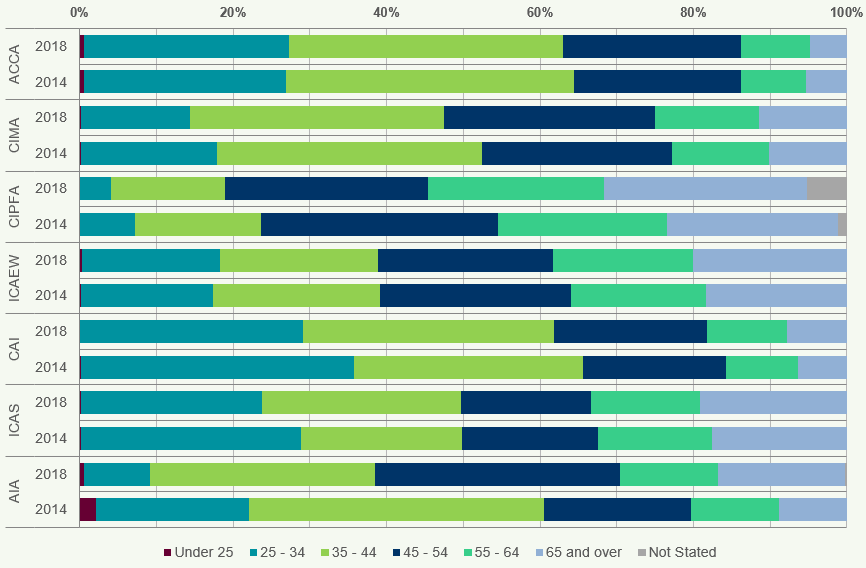

Members and Students Worldwide

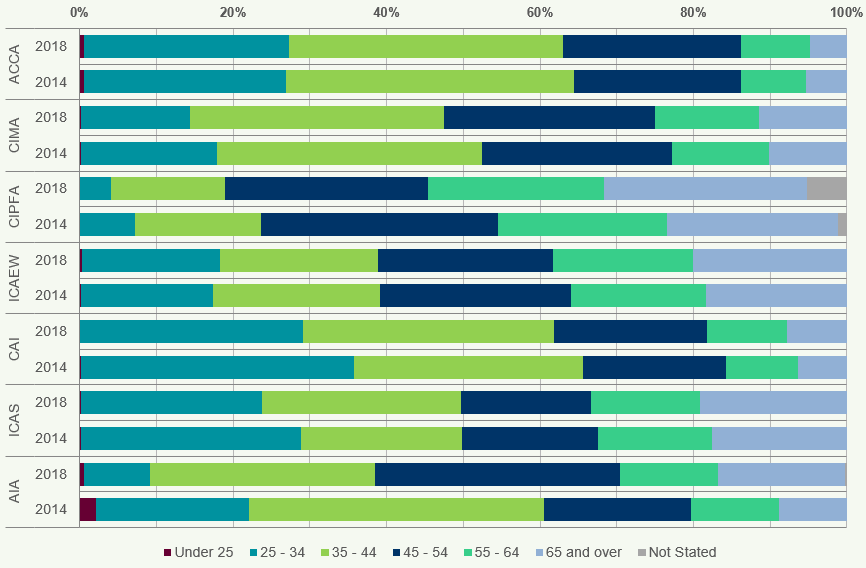

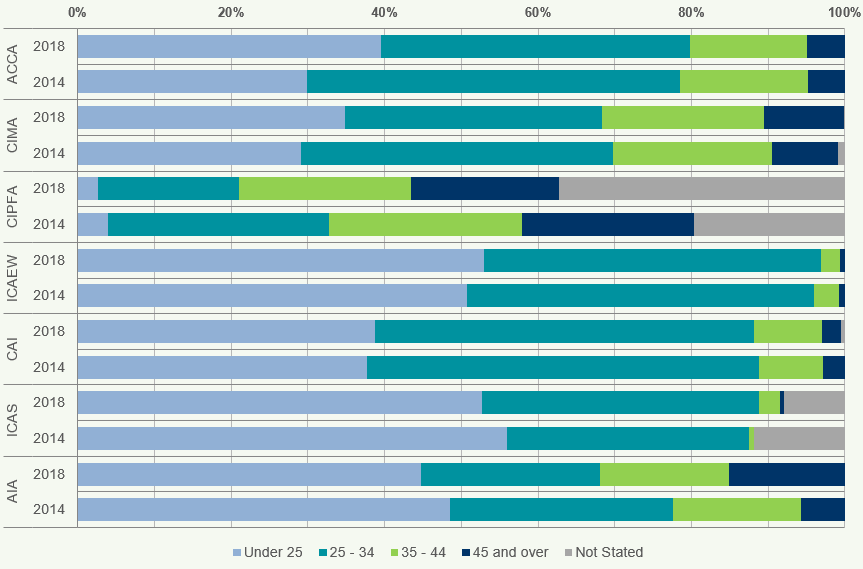

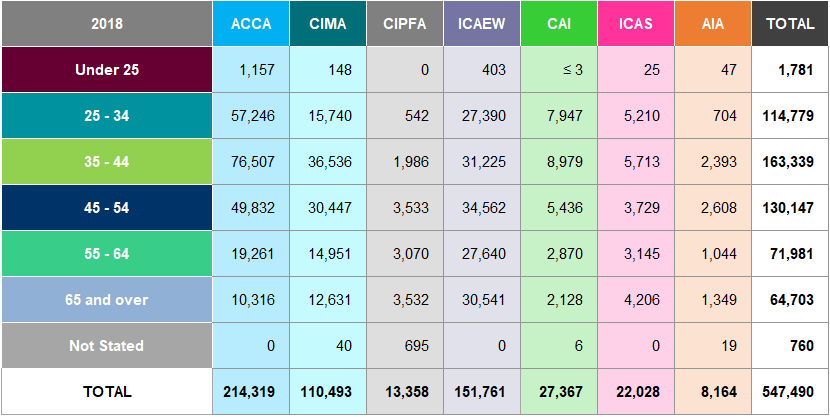

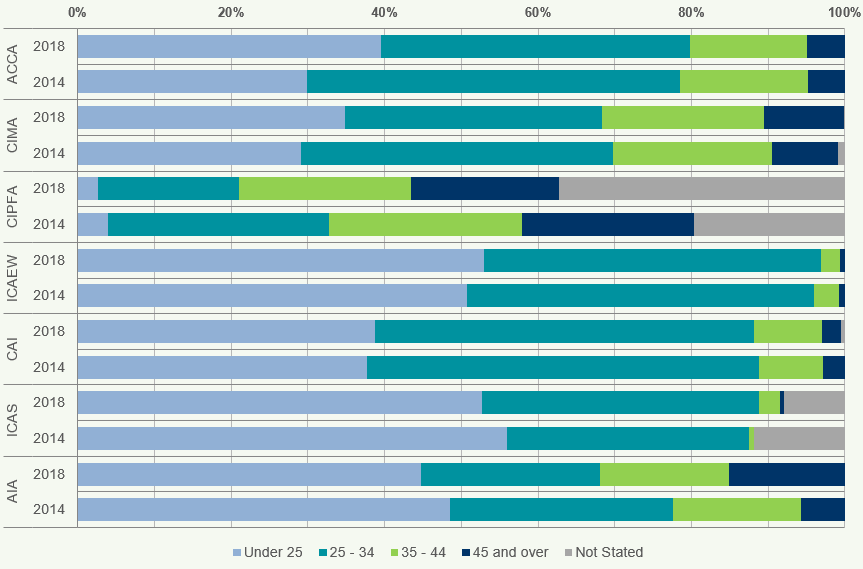

Figures 7 and 8 compare the age distribution of members and students, as at 31 December 2014 and 2018.

Figure 7: Age of Members Worldwide 2014 and 2018

There are significant differences in the age profiles of worldwide members of the seven accountancy bodies in

There are significant differences in the age profiles of worldwide members of the seven accountancy bodies in

- ACCA and CAI have the highest proportion of members aged under 35, 28% and 29% respectively, whilst CIPFA have the largest percentage of members aged 55 and over at 49%.

Most members are aged between 35 to 44 for 2018, accounting for 30% of the total population.

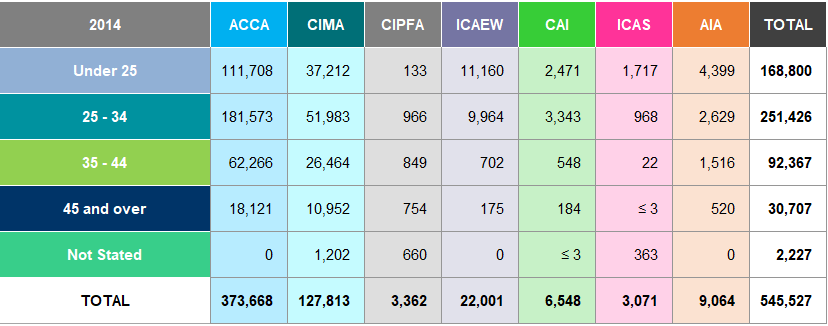

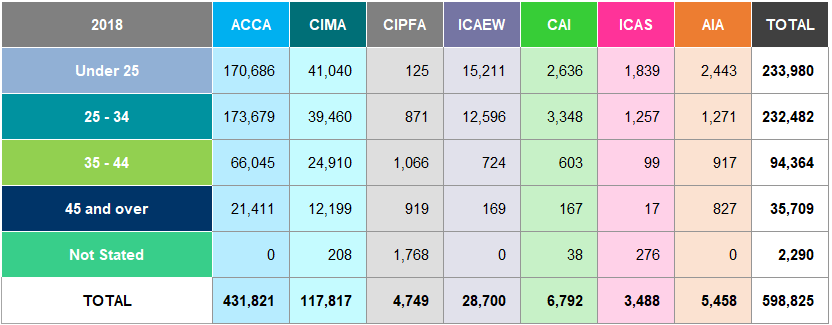

Figure 8: Age of Students Worldwide 2014 and 2018

There are significant differences in the age profiles of worldwide students of the seven accountancy bodies in

There are significant differences in the age profiles of worldwide students of the seven accountancy bodies in

- ACCA and AIA have the highest proportion of students aged under 25, 30% and 31% respectively, whilst CIPFA has the largest percentage of students aged 45 and over at 55%.

Most students are aged between 25 to 34 for 2018, accounting for 35% of the total population.

Diversity and Inclusion

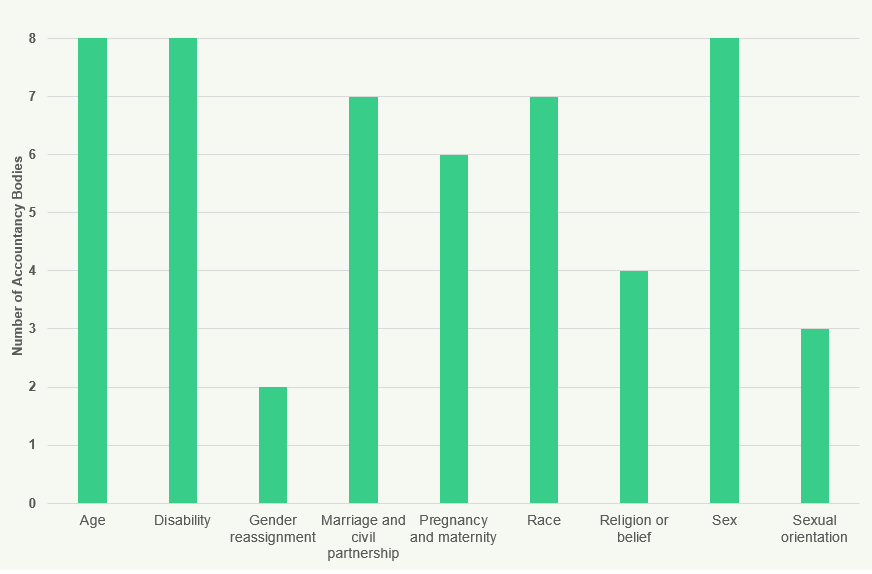

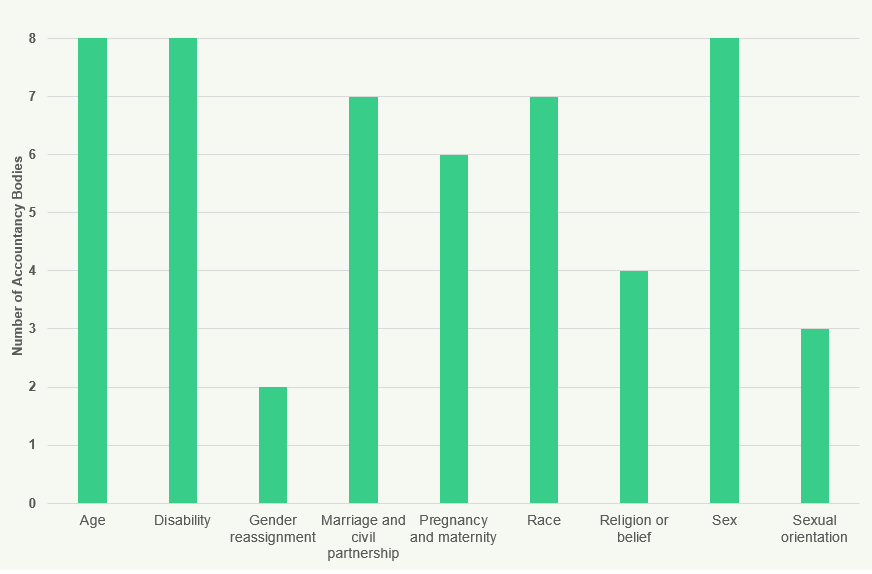

Figures 9 and 10 illustrate diversity statistics of the accountancy bodies. Figure 9 illustrates the percentage of accountancy bodies that collect data across nine protected characteristics (age, disability, gender reassignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, sex and sexual orientation).

Figure 9: Diversity Data Collection by Accountancy Bodies (Members and Students) 2018

A high percentage of accountancy bodies collect data on age, race and gender of their members and students. Four of the bodies collect disability data of their students; however, only two of the bodies collect this data of its members.

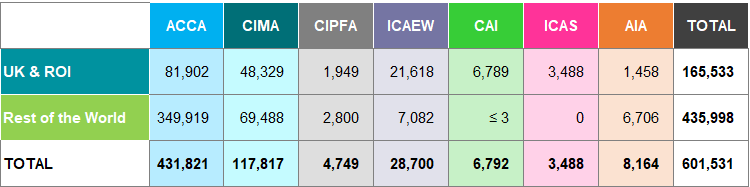

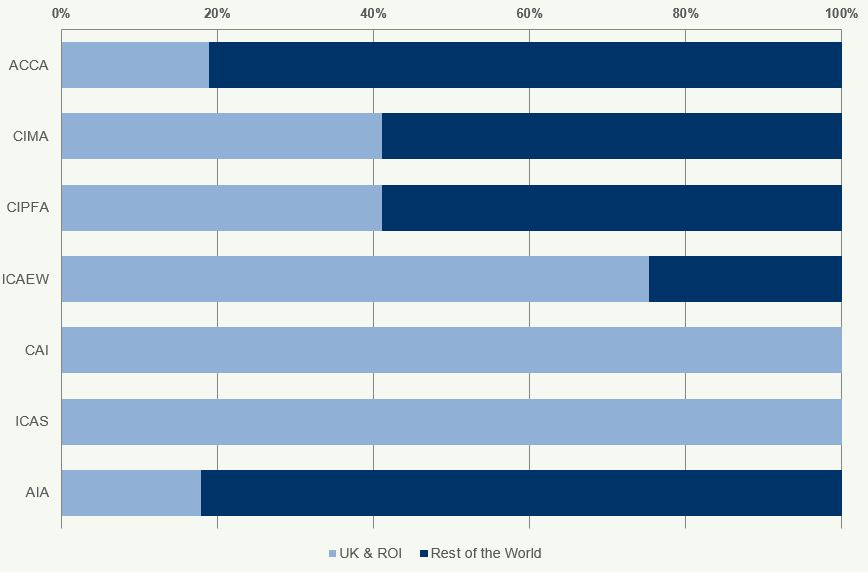

UK and ROI vs Rest of the World

Figure 10 illustrates the percentage of members and students in the UK & ROI as opposed to the rest of the world.

Figure 10: Percentage of Members and Students in UK & ROI as Opposed to Rest of the World 2018

Around two-thirds of the members of ICAEW, CAI and ICAS are based in the UK & ROI (80%, 79% and 75% respectively). ACCA has the lowest percentage of members based in the UK & ROI (46%).

In the case of students, the percentages vary across the bodies. More than 75% of ICAEW, CAI and ICAS students are based in the UK & ROI (86%, 86% and 82% respectively), whilst for ACCA and CIMA, the percentages are around 19% and 41% respectively.

Section Three – Resource Information of the Accountancy Bodies

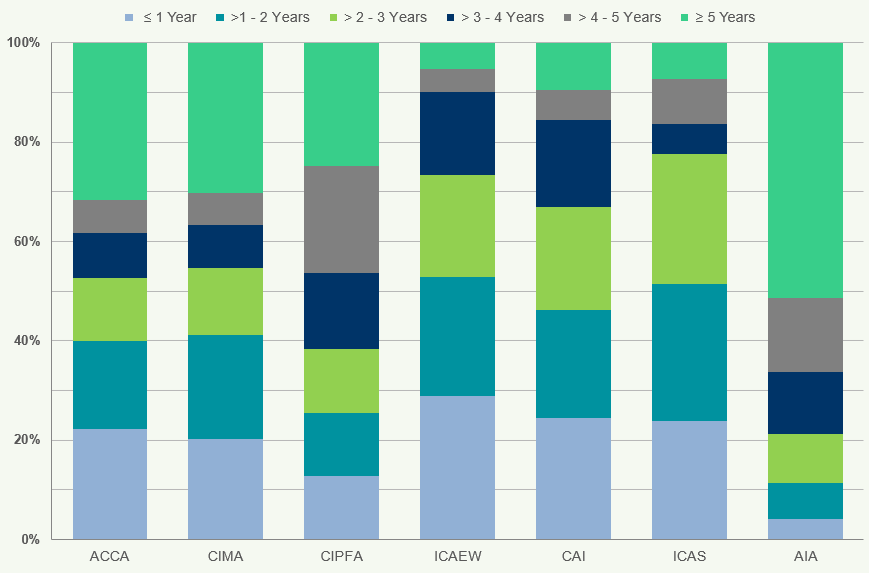

Years of Experience

Figure 12 illustrates the distribution of members by years of experience.

Figure 12: Percentage of Members by Years of Experience Worldwide 2018

In 2018, the average percentage of members with 0-5 years of experience was 18%. This compares to 19% in

In 2018, the average percentage of members with 0-5 years of experience was 18%. This compares to 19% in

- CAI has the highest percentage (35%) of members with 0-5 years of experience whilst AIA has the lowest (6%). For CIPFA, members with more than 20 years of experience account for 61% of their total members.

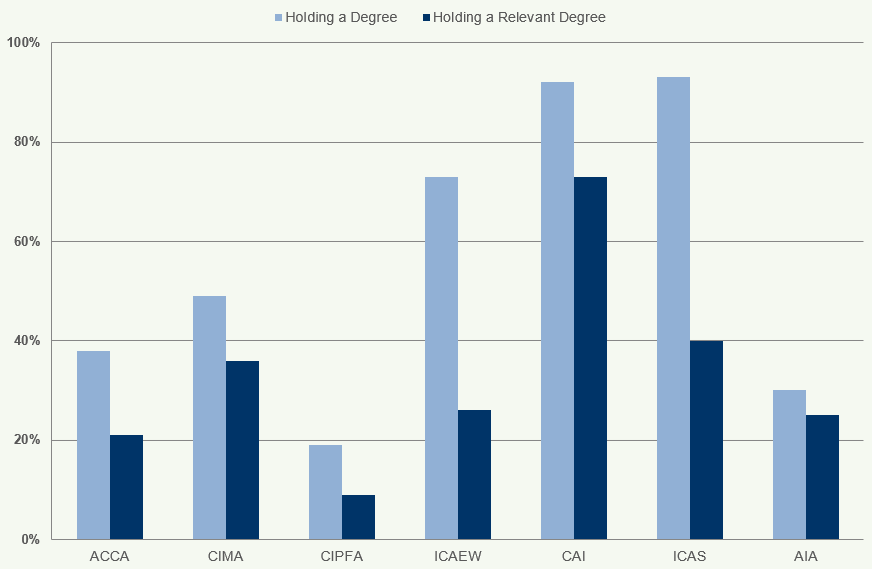

Education and Qualifications

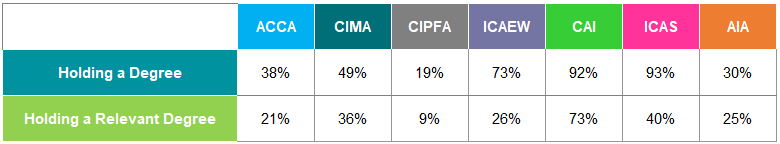

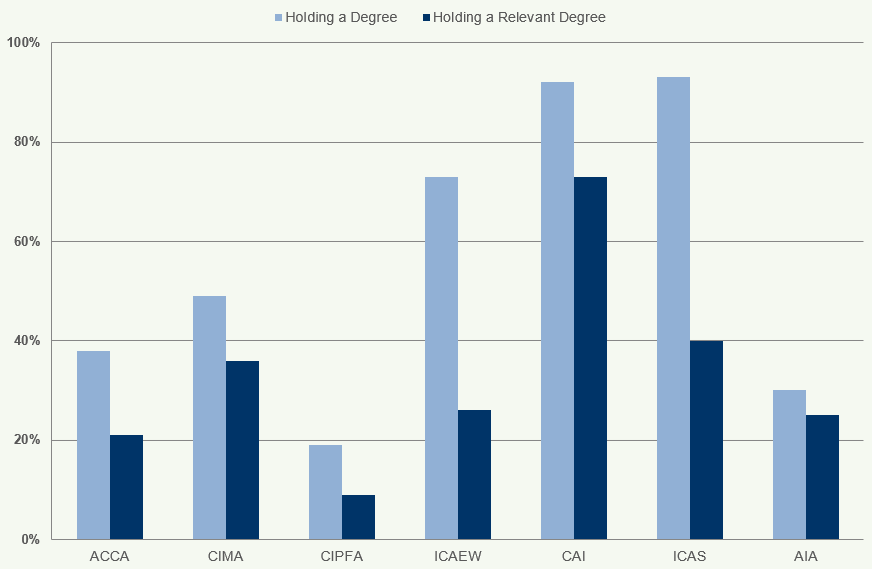

Figure 13 shows the percentage of students with degrees compared to relevant degrees.

Figure 13: Percentage of Students with a Degree and a Relevant Degree Worldwide 2018

Almost all students have a degree in CIPFA, ICAEW, CAI and ICAS. In comparison, for ACCA and CIMA, 48% and 53% of students respectively hold a degree.

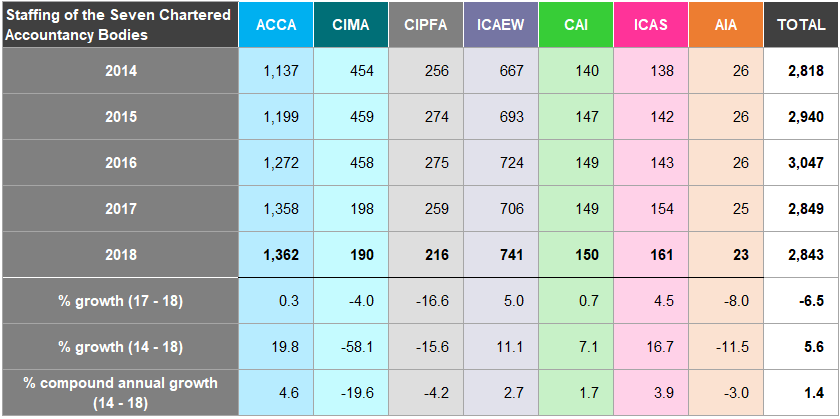

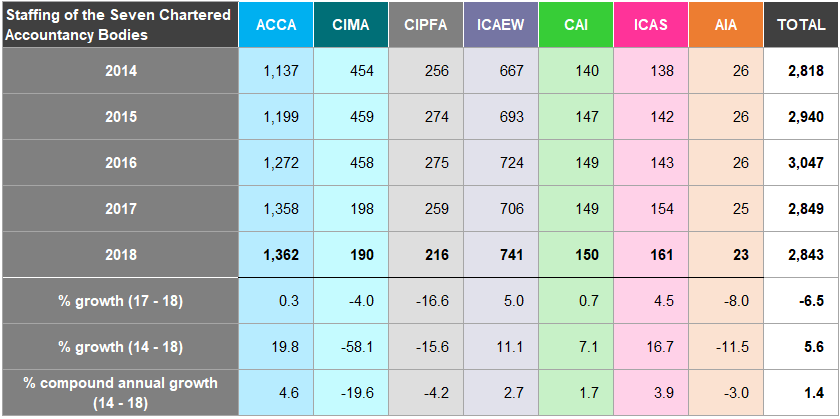

Staffing Levels

Figure 14 illustrates the number of staff employed by the accountancy bodies.

Figure 14: Staffing Levels 2014-2018

The total number of staff employed by the seven accountancy bodies has increased by 11.2% between 2014 and 2018.

Age Profile

Figure 15 compares the age profile of members with that of students.

Figure 15: Percentage of Members and Students by Age Group Worldwide 2018

Most members are in the age ranges 35-44 and 45-54, whilst most students are in the 25-34 age range.

Table A2: Total Student Numbers 2018 and % Growth 2014-2018 for Accounting Organisations in the UK & ROI

Fee Income

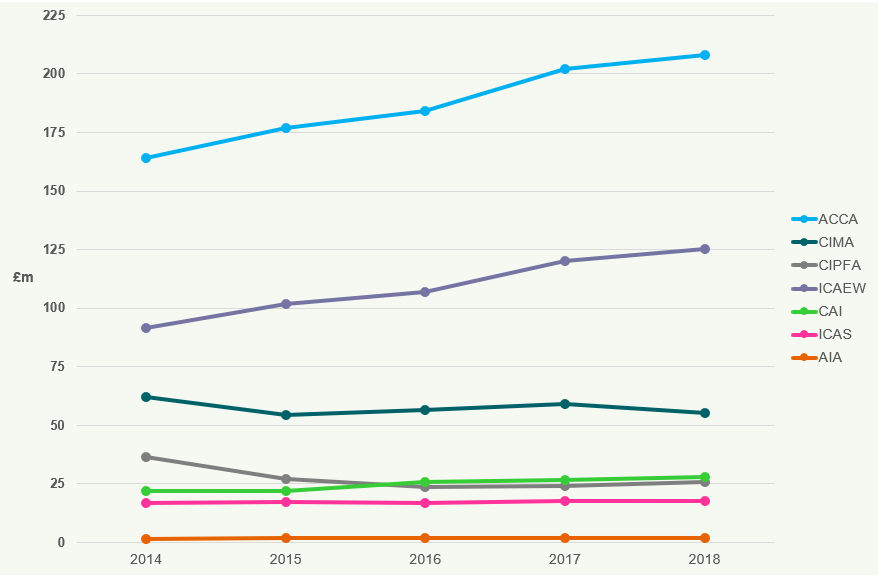

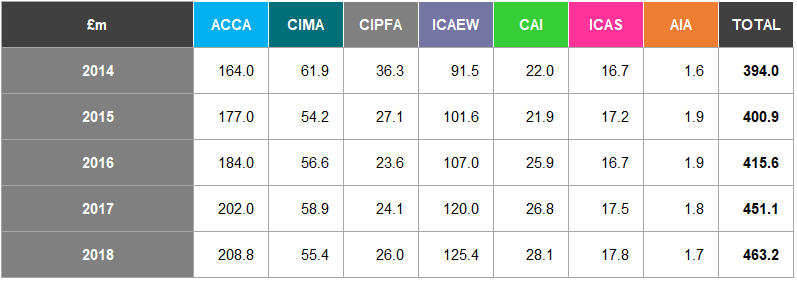

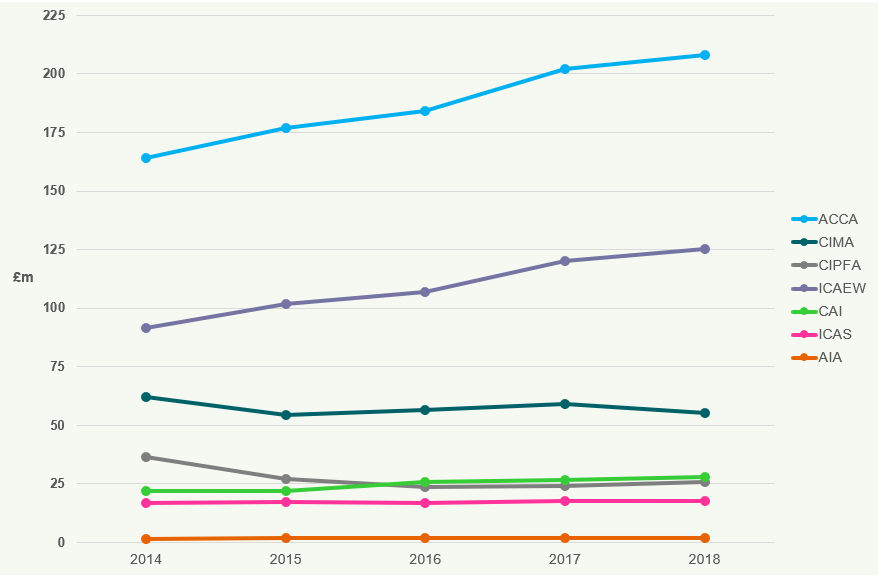

Figure 16 shows the fee income of the seven accountancy bodies for the years 2014 to 2018.

Figure 16: Fee Income (£m) 2014-2018

The total fee income of the seven accountancy bodies has increased by 20.0% from 2014 to

The total fee income of the seven accountancy bodies has increased by 20.0% from 2014 to

- ACCA's fee income increased by 29.5% over the same period, whilst AIA's fee income decreased by 13.9%.

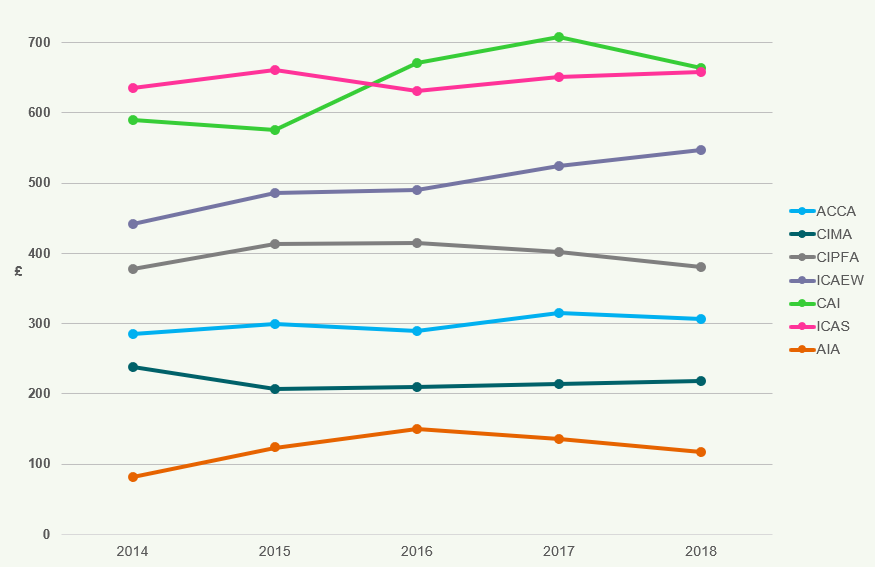

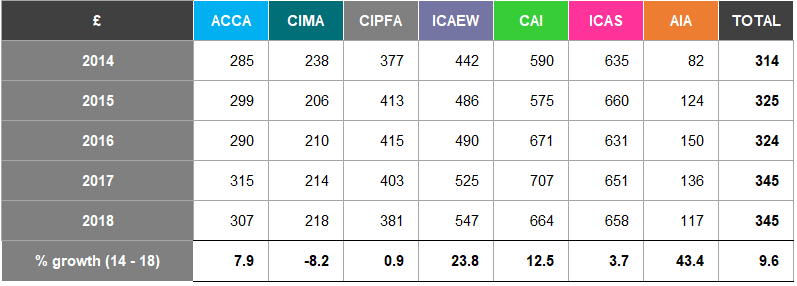

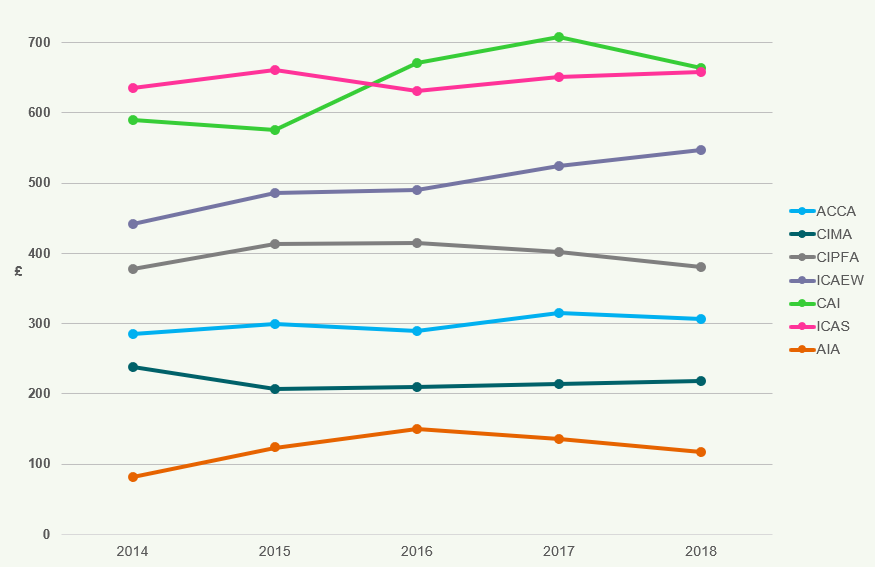

Average Fees

Figure 17 illustrates the average fees charged by accountancy bodies.

Figure 17: Average Fees (£) 2014-2018

The average fees charged by all bodies has increased by 7.0% from 2014 to 2018, with CIPFA and ICAEW having the largest increase (16.2% and 13.0% respectively). The average fees of CIMA and AIA have decreased by 0.5% and 8.9% respectively.

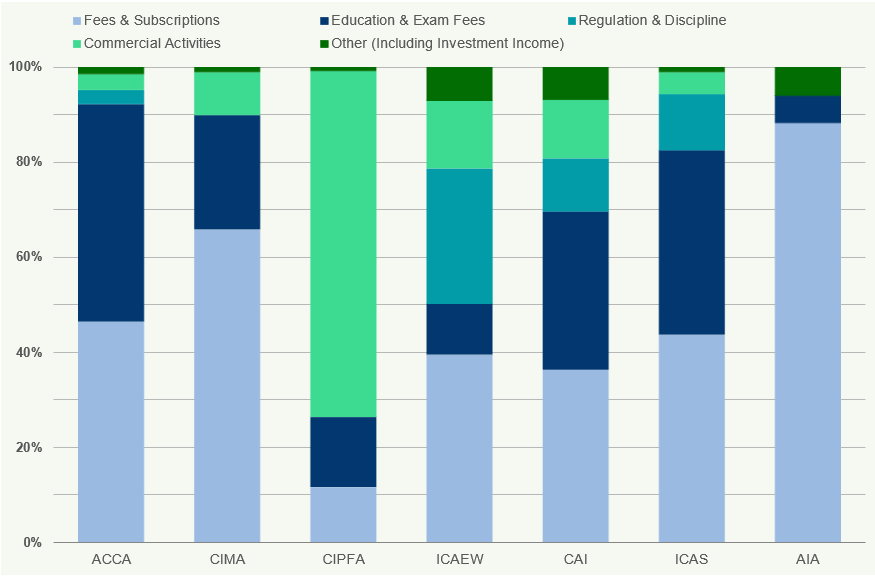

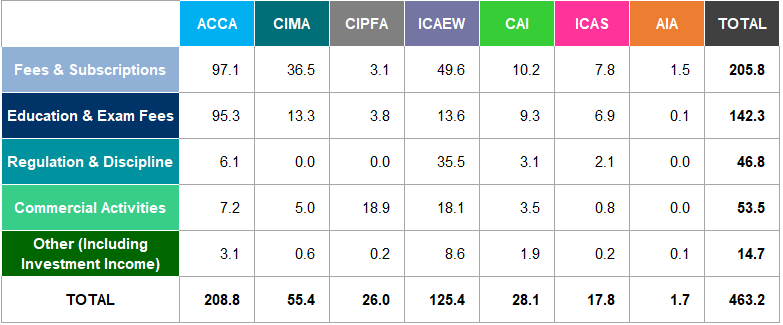

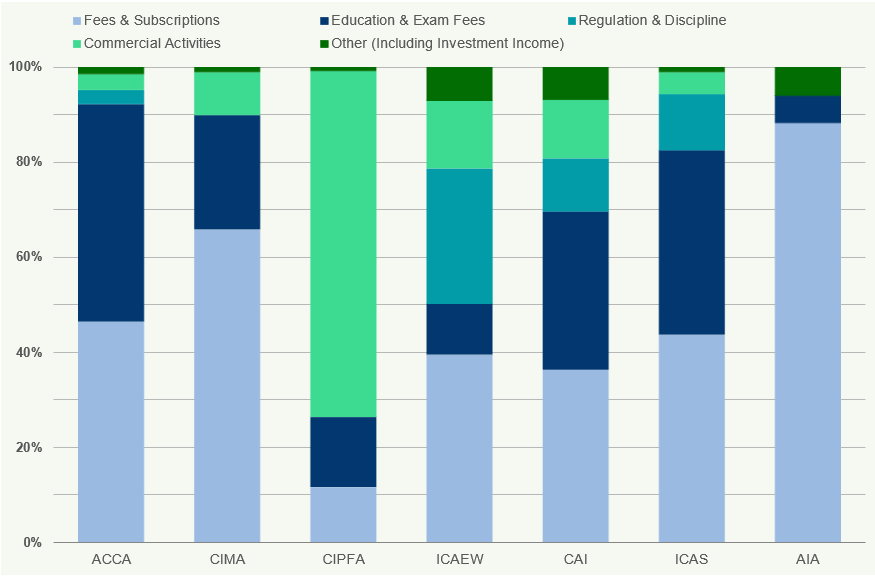

Breakdown of Income

Figure 18 illustrates the breakdown of income sources for the accountancy bodies.

Figure 18: Percentage Breakdown of Income Sources 2018

Most of the income of accountancy bodies is from Fees & Subscriptions and Education, which account for 58% and 23% respectively of their total income. CIPFA and ICAEW have the highest percentage of income from Fees & Subscriptions (79% and 72% respectively), whilst ACCA and CIMA have the highest percentage of income from Education (35% and 36% respectively).

Section Four – Oversight of Audit Regulation

Staffing

Figure 19 illustrates the number of staff employed by the Recognised Supervisory Bodies (RSBs) in their audit regulation departments.

Figure 19: Staffing Levels in Audit Regulation Departments of RSBs 2014-2018

The total number of staff employed in the audit regulation departments of the RSBs has increased by 7.8% between 2014 and

The total number of staff employed in the audit regulation departments of the RSBs has increased by 7.8% between 2014 and

- ICAEW and ACCA account for 89% of the staff employed by RSBs.

Diversity and Inclusion

Figure 20 illustrates the number of RSBs that collect diversity data in respect of their workforce.

Figure 20: Diversity Data Collection by RSBs (Workforce) 2018

All RSBs collect diversity data on age, gender, race/ethnicity, and disability. The number of RSBs that collect data on religion or belief and sexual orientation has increased from 2 in 2017 to 3 in 2018.

Regulation and Oversight

This section provides information about the regulation and oversight of audit firms and audit work.

Audit Firms

Table A11 illustrates the total number of principals per firm for 2016-2018 in the UK & ROI.

Table A11: Total Number of Principals per Firm in UK and ROI, 2016-2018

The number of firms with 10 or more principals has decreased from 56 in 2016 to 48 in

The number of firms with 10 or more principals has decreased from 56 in 2016 to 48 in

- The number of sole practitioner firms has decreased by 13.9% over the same period.

Enforcement

Table A12 illustrates enforcement outcomes.

Table A12: Enforcement Outcomes 2016-2018

The number of new applications decreased by 13.2% from 2016 to 2018, whilst the number of applications surrendered increased by 7.1%.

Audit Reviews

Table A13 illustrates the number of audit reviews conducted.

Table A13: Number of Audit Reviews 2016/17-2018/19

The number of audit reviews has increased by 8.7% from 2016/17 to 2018/19. The Big Four firms account for 38% of all audit reviews.

Review of Audit Work

Figure 22 illustrates the number and percentage of firms subject to reviews.

Figure 22: Number and Percentage of Firms Subject to Reviews 2016-2018

The number of firms subject to reviews has decreased by 9.3% from 2016 to

The number of firms subject to reviews has decreased by 9.3% from 2016 to

- CAI has seen the largest decrease (20.9%), whilst ACCA has seen an increase of 7.1%.

Selection of Audit Firms for Review

Table A14 illustrates the inspection categories.

Table A14: Inspection Categories 2016-2018

Cyclical visits account for 61% of all inspection categories, followed by committee requests (23%).

Review Outcomes

The outcomes of audit reviews are categorised as file gradings and firm gradings.

File Gradings

File gradings are categorised into A, B, C outcomes, and ungraded.

Table A4: File Gradings by Outcome 2016-2018

The percentage of files with an A outcome has increased from 42% in 2016 to 48% in

The percentage of files with an A outcome has increased from 42% in 2016 to 48% in

- The percentage of files with a C outcome has decreased from 16% in 2016 to 12% in 2018.

Table A5: Firm Gradings by Outcome 2016-2018

The percentage of firms with an A&B outcome has increased from 73% in 2016 to 77% in

The percentage of firms with an A&B outcome has increased from 73% in 2016 to 77% in

- The percentage of firms with a D outcome has decreased from 4% in 2016 to 2% in 2018.

Firm Gradings

Firm gradings are categorised into A&B, C, D, N outcomes.

Table A6: Firm Gradings by Outcome 2016-2018

The percentage of firms with an A&B outcome has increased from 69% in 2016 to 74% in

The percentage of firms with an A&B outcome has increased from 69% in 2016 to 74% in

- The percentage of firms with a D outcome has decreased from 5% in 2016 to 3% in 2018.

Table A7: File Gradings Outcomes 2016-2018

The percentage of files with an A outcome has increased from 40% in 2016 to 45% in

The percentage of files with an A outcome has increased from 40% in 2016 to 45% in

- The percentage of files with a C outcome has decreased from 18% in 2016 to 14% in 2018.

File Gradings for the Big Four Firms

Table A8 and Table A9 illustrate the file gradings for the Big Four firms.

Table A8: Firm Gradings by Outcome 2016-2018 (Big Four)

All Big Four firms received A&B outcomes for their firm gradings in 2018.

Table A9: File Gradings Outcomes 2016-2018 (Big Four)

The percentage of files with an A outcome has increased from 61% in 2016 to 65% in

The percentage of files with an A outcome has increased from 61% in 2016 to 65% in

- The percentage of files with a C outcome has decreased from 7% in 2016 to 5% in 2018.

Firm Gradings for the Big Four Firms

Table A10 illustrates firm gradings outcomes for the Big Four firms.

Table A10: Firm and File Gradings 2016-2018 (Big Four)

All Big Four firms received A&B outcomes for their firm gradings in

All Big Four firms received A&B outcomes for their firm gradings in

- The percentage of files with an A outcome has increased from 61% in 2016 to 65% in 2018.

Section Five – Audit Firms

Complaints and Disciplinary

Table A11 illustrates complaint and case metrics for the RSBs.

Table A11: Complaint and Case Metrics for RSBs 2016-2018

The number of new complaints has decreased by 13.9% from 2016 to

The number of new complaints has decreased by 13.9% from 2016 to

- The number of cases closed has increased by 10.1% over the same period.

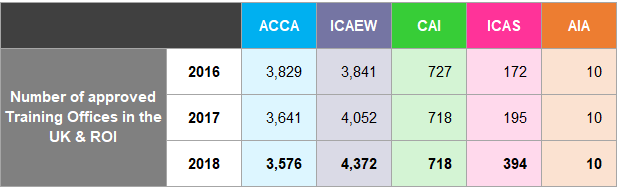

Auditing Qualification

Table A12 illustrates student and member audit qualification statistics.

Table A12: Student and Member Audit Qualification Statistics 2016-2018

The number of students with an audit qualification has decreased by 1.1% from 2016 to 2018, whilst the number of members with an audit qualification has increased by 0.8%.

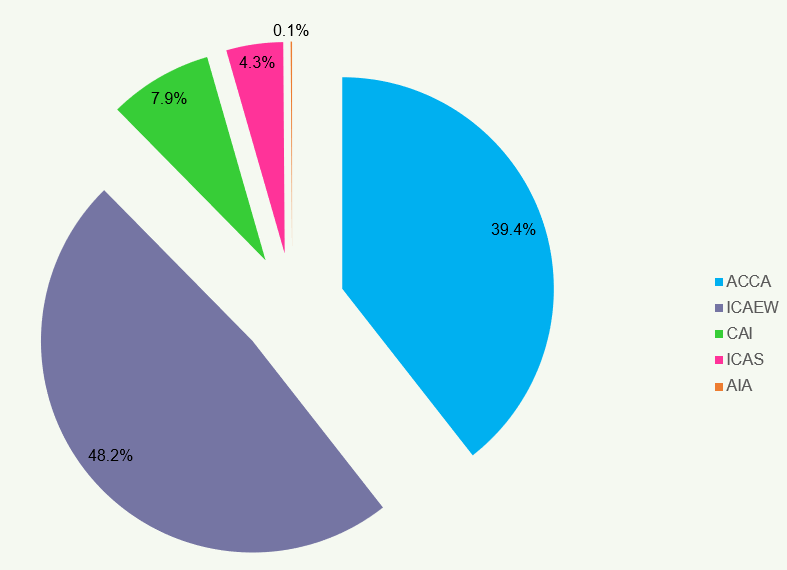

Approved Training Offices

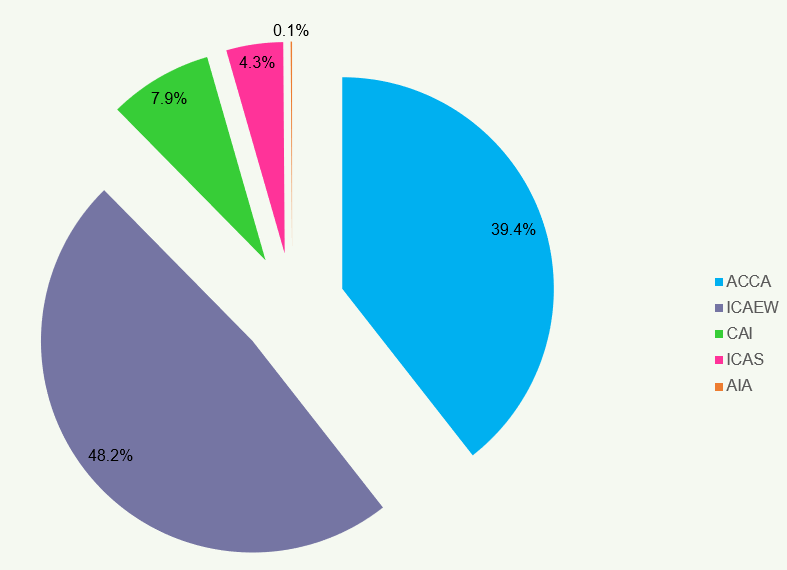

Figure 23 illustrates the percentage breakdown across professional bodies. Table A13 shows the number of approved training offices.

Figure 23: Percentage Breakdown Across Professional Bodies 2018

ICAEW accounts for the largest percentage (48.2%) of approved training offices, followed by ACCA (39.4%).

Table A13: Number of Approved Training Offices in the UK & ROI 2016-2018

The number of approved training offices has decreased by 9.9% from 2016 to

The number of approved training offices has decreased by 9.9% from 2016 to

- ICAEW has seen the largest decrease (12.1%), whilst AIA has seen an increase of 3.8%.

Diversity Data at Audit Firms

This section focuses on diversity at audit firms, specifically for senior management positions (Managers, Directors, and Partners).

Figure 24: Percentage of Managers (Big Four Firms) 2018 This chart shows the percentage of managers that are Female, BAME, and Disabled for each of the Big Four firms in

- Across all Big Four firms, female managers range from 44% to 46%, BAME managers from 15% to 20%, and disabled managers from 0% to 1%.

Figure 25: Percentage of Directors (Big Four Firms) 2018 This chart illustrates the percentage of directors who are Female, BAME, and Disabled for each of the Big Four firms in

- Female directors are between 27% and 30%, BAME directors range from 6% to 10%, and disabled directors are between 0% and 1%.

Figure 26: Percentage of Partners (Big Four Firms) 2018 This chart displays the percentage of partners that are Female, BAME, and Disabled for each of the Big Four firms in

- Female partners range from 18% to 21%, BAME partners from 4% to 7%, and disabled partners are between 0% and 1%.

Fee Income of Audit Firms

Figure 27 illustrates the percentage breakdown of income sources for audit firms.

Figure 27: Percentage Breakdown of Audit Fee Income 2016-2018

Audit fee income accounts for 60% of total income, followed by non-audit work to audit clients (25%) and non-audit work to non-audit clients (15%). The percentage of audit fee income has remained relatively stable from 2016 to 2018.

Non-Audit Services to Audit Clients

Figure 28 illustrates the fee income from non-audit services to audit clients for Big Four and non-Big Four firms.

Figure 28: Fee Income from Non-Audit Services to Audit Clients 2016-2018

Fees for non-audit work to audit clients for Big Four firms decreased by 8.4% from 2017 to 2018, whilst for non-Big Four firms it decreased by 2.3%.

Non-Audit Work to Non-Audit Clients

Figure 29 illustrates the fee income from non-audit work to non-audit clients for Big Four and non-Big Four firms.

Figure 29: Fee Income from Non-Audit Work to Non-Audit Clients 2016-2018

Fees for non-audit work to non-audit clients for Big Four firms increased by 1.9% from 2017 to 2018, whilst for non-Big Four firms it decreased by 0.8%.

Audit Fee Income Per Responsible Individual (RI)

Figure 30 illustrates the audit fee income per RI for different firm types.

Figure 30: Audit Fee Income Per RI 2016-2018

The average audit fee income per RI for all firms with PIE clients increased by 10.9% from 2017 to

The average audit fee income per RI for all firms with PIE clients increased by 10.9% from 2017 to

- For Big Four firms, it increased by 11.8%, and for non-Big Four firms by 7.1%.

Market Share of FTSE 350 Audit Firms

This section provides information about the market share of FTSE 350 audit firms.

Figure 31: Percentage Market Share for UK FTSE 100 Companies 2014-2018 This chart illustrates the percentage market share of audit firms for UK FTSE 100 companies from 2014 to

- The Big Four firms consistently audit 100% of FTSE 100 companies throughout this period.

Figure 32: Percentage Market Share for UK FTSE 250 Companies 2014-2018 This chart illustrates the percentage market share of audit firms for UK FTSE 250 companies from 2014 to

- The Big Four firms consistently audit over 95% of FTSE 250 companies, with a slight decrease in 2018 compared to previous years. Mid-tier firms audit a small but increasing percentage.

Figure 33: Percentage Market Share for FTSE 350 Companies by Size of Firm 2014-2018

The Big Four firms audit 98% of FTSE 350 companies in 2018, a slight decrease from 99% in

The Big Four firms audit 98% of FTSE 350 companies in 2018, a slight decrease from 99% in

- Mid-tier firms have seen a slight increase in their market share.

Figure 34: Percentage of Managers by Diversity Characteristic (All PIE Firms) 2018

This chart shows the average percentage of female managers (42%), BAME managers (17%), and disabled managers (0.6%) across all PIE audit firms in 2018.

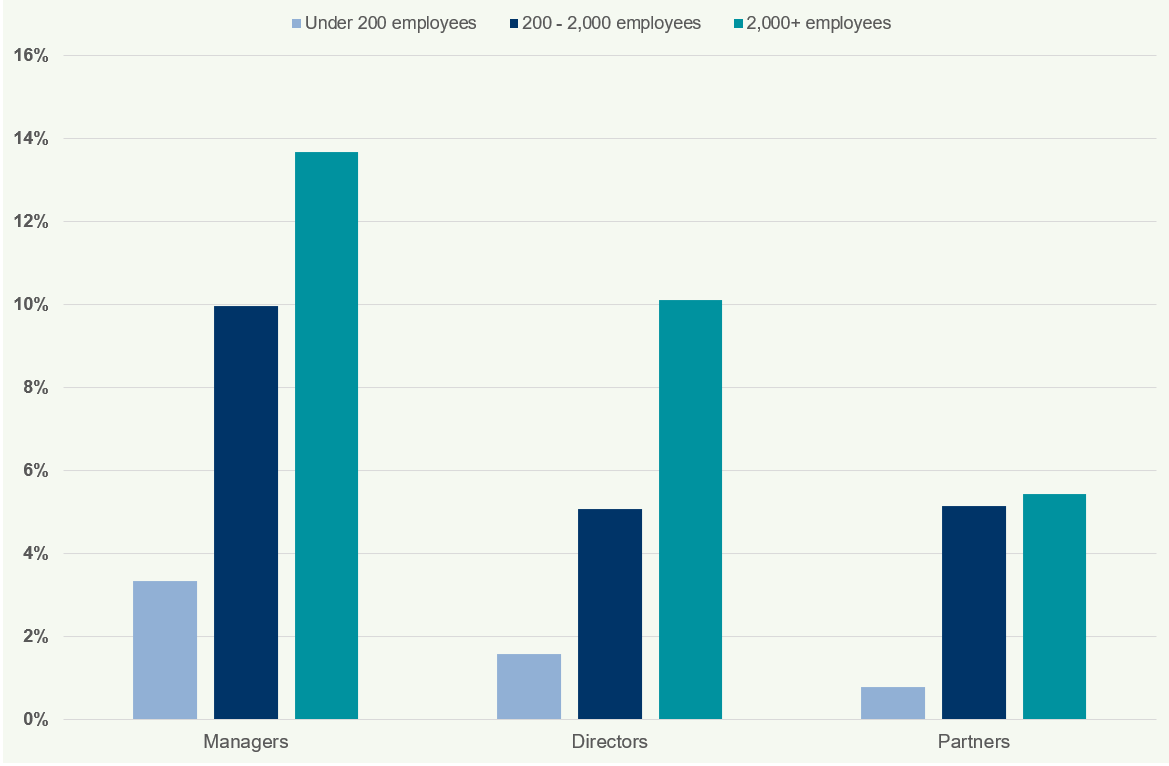

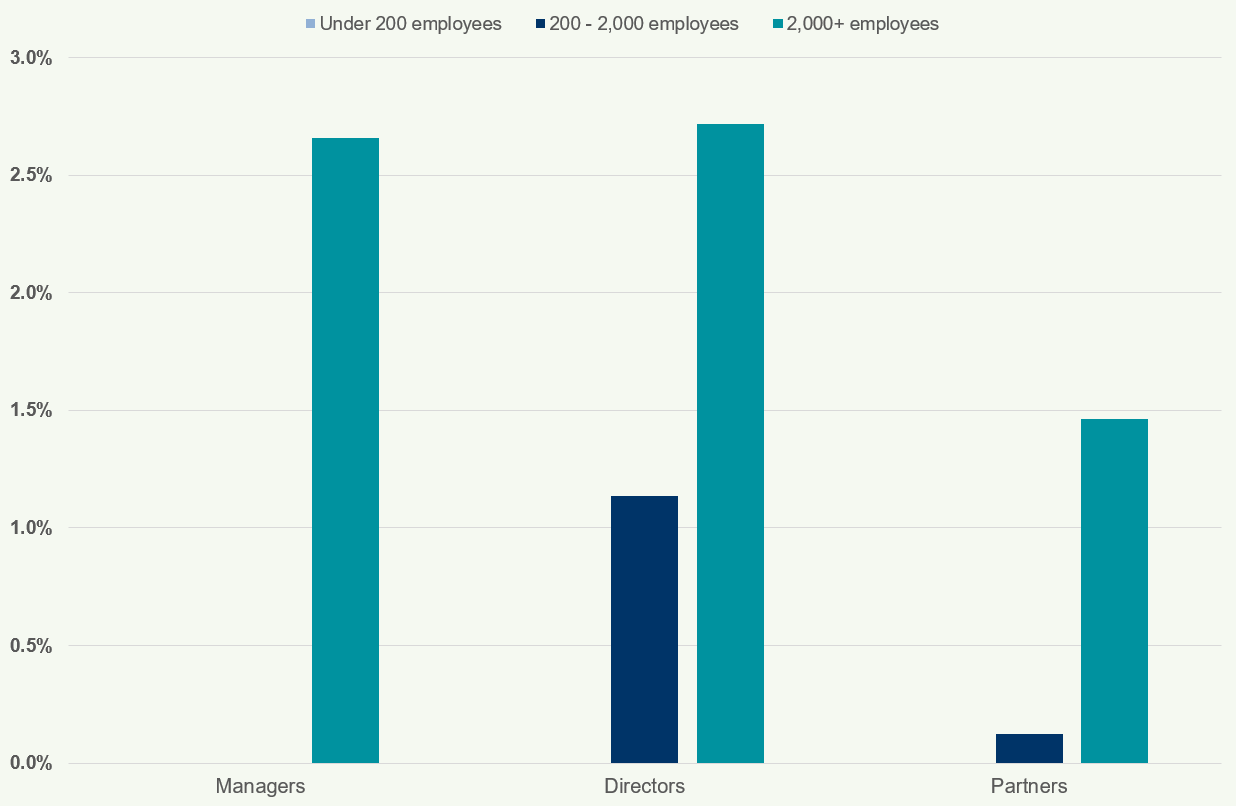

Figure 35: Percentage of Managers by Size of Firm 2018

This chart shows the percentage of managers who are Female, BAME, and Disabled, categorised by firm size. For all firm sizes, the percentage of female managers is consistently higher than BAME and disabled managers.

Figure 36: Percentage of Directors by Size of Firm 2018

This chart shows the percentage of directors who are Female, BAME, and Disabled, categorised by firm size. The percentages for female directors are higher than BAME and disabled directors across all firm sizes, but generally lower than manager percentages.

Figure 37: Percentage of Partners by Size of Firm 2018

This chart illustrates the percentage of partners who are Female, BAME, and Disabled, categorised by firm size. The percentages for all diversity characteristics are lowest at the partner level compared to managers and directors.

Section Six – Data Tables of the Charts (Total Figures and Percentages)

Age of Managers at PIE Audit Firms 2018

Figure 38: Age of Managers at PIE Audit Firms 2018

This chart shows the age distribution of managers at PIE audit firms in

This chart shows the age distribution of managers at PIE audit firms in

- The majority of managers are aged between 35-44 (40%) and 25-34 (30%).

Diversity Data Completion Rates

Figure 39: Diversity Data Completion Rates 2018

This chart displays the number of firms and their completion rates for diversity data across categories such as age, gender, race/ethnicity, and disability. Completion rates are highest for gender and age.

Diversity Policies

Figure 40: Diversity Policies 2017 and 2018

This chart shows the number of firms and the percentage of firms with a diversity policy in 2017 and

This chart shows the number of firms and the percentage of firms with a diversity policy in 2017 and

- All firms had a diversity policy in place in 2018.

Table A14: Members in UK and ROI 2014-2018

Table A15: Students in UK and ROI 2014-2018

Table A16: Members Worldwide 2014-2018

Table A17: Students Worldwide 2014-2018

Table A18: Members by Employment Sector Worldwide 2018

Table A19: Students by Employment Sector Worldwide 2018

Table A20: Female Members Worldwide 2014-2018

Table A21: Female Students Worldwide 2014-2018

Table A22: Members by Age Worldwide 2014

Table A23: Members by Age Worldwide 2018

Table A24: Students by Age Worldwide 2014

Table A25: Students by Age Worldwide 2018

Table A26: Students by Geographical Region Worldwide 2018

Table A27: Members by Years Qualified Worldwide 2018

Table A28: Percentage of Students with a Degree and a Relevant Degree Worldwide 2018

Table A29: Members and Students by Age Group Worldwide 2018

Table A30: Fee Income (£m) 2014-2018

Table A31: Average Fees (£) 2014-2018

Table A32: Fee Income Breakdown by Category 2018

Table A33: Audit Fee Income Growth Rates 2016-17 and 2017-18

Section Seven – Glossary

Accountancy Bodies The six UK Chartered Accountancy bodies: Association of Chartered Certified Accountants (ACCA), Institute of Chartered Accountants in Ireland (ICAI/CAI), Chartered Institute of Public Finance and Accountancy (CIPFA), Chartered Institute of Management Accountants (CIMA), Institute of Chartered Accountants in England and Wales (ICAEW) and Institute of Chartered Accountants of Scotland (ICAS); and the Association of International Accountants (AIA).

All bodies The accountancy bodies and the Association of Accounting Technicians (AAT).

Big Four firms The four largest audit firms: Deloitte, EY, KPMG and PwC.

BAME Black, Asian and Minority Ethnic.

Compound Annual Growth Rate (CAGR) The mean annual growth rate of an investment over a specified period longer than one year.

Financial Reporting Council (FRC) The UK’s independent regulator responsible for promoting good corporate governance and reporting.

FTSE 100 A share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation.

FTSE 250 A share index of the 250 largest companies by market capitalisation which are not in the FTSE 100.

FTSE 350 The collective term for the companies in the FTSE 100 and FTSE 250 indices.

PIE Public Interest Entities, as defined in the Statutory Auditors and Third Country Auditors Regulations (SATCAR) 2016. These are entities governed by the law of a member state whose secure transferable securities (equity and debt) are admitted to trading on a regulated market in the EEA; and credit institutions and insurance undertakings.

Recognised Supervisory Body (RSB) A body that is recognised under Schedule 10 of the Companies Act 2006 to register and supervise statutory auditors in the UK.

Responsible Individual (RI) An individual responsible for signing audit reports on behalf of an audit firm.

UK and ROI United Kingdom and Republic of Ireland.

Footnotes

There are significant differences in the age profiles of worldwide members of the seven accountancy bodies in

- ACCA and CAI have the highest proportion of members aged under 35, 28% and 29% respectively, whilst CIPFA have the largest percentage of members aged 55 and over at 49%.

Most members are aged between 35 to 44 for 2018, accounting for 30% of the total population.

In 2018, 39% of students from the seven accountancy bodies were under the age of 25 compared with 31% in 2014. ICAEW, CAI and ICAS have the highest percentage of students aged 34 or under at 97%, 88% and 89% respectively in

- In comparison, CIPFA have the largest proportion of students aged 35 and over at 42%.

Diversity Information on Members and Students under the Public Sector Equality Duty

We asked all bodies, whether they collect data on the protected characteristics recognised under the Equality Act

- Figure 9 shows the number of professional bodies that collect these characteristics on their respective members and students.

Six of the nine protected characteristics asked of all bodies are currently being used to record members' and students' data. The other three indicators (Religion/Belief, Sexual Orientation and Gender reassignment) are not currently being recorded.

Two of the bodies that collate information on Race stated that they capture data for both the ethnicity and nationality of their members and students.

Location of Students

Figure 10 shows the location4 (UK and ROI, and the rest of the world) of students of the accountancy bodies as at 31 December 2018.

81% of ACCA and 82% of AIA students are based outside the UK and ROI. In contrast, ICAS and CAI have a low percentage of students based outside of the UK and ROI.

28% of all students from the accountancy bodies study in the UK and ROI.

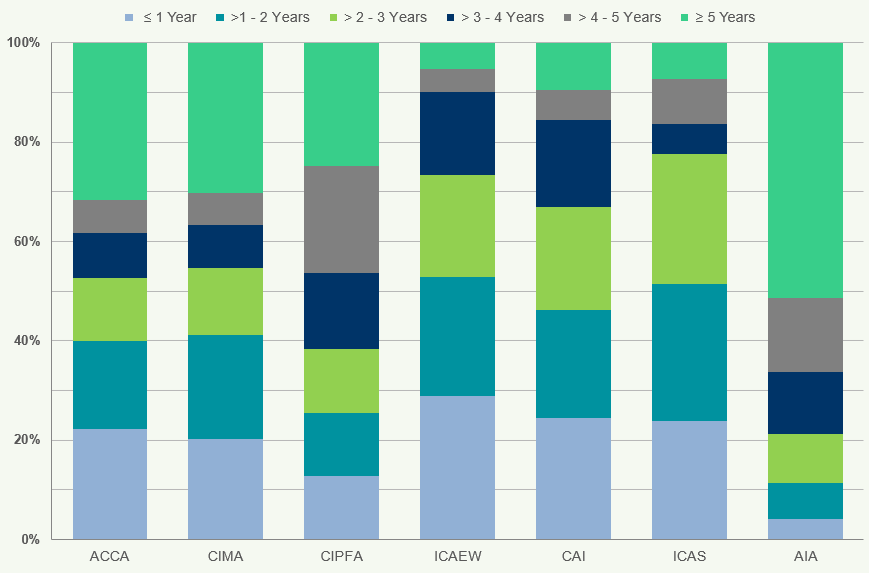

Profile of Students Worldwide of the Accountancy Bodies

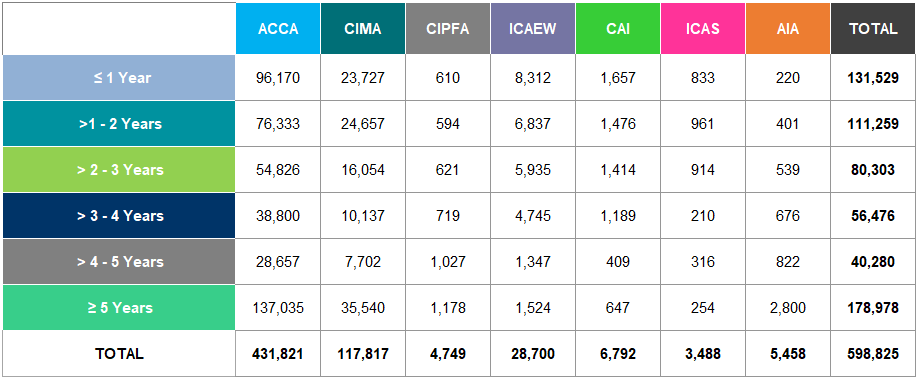

Figure 11 sets out on a worldwide basis the length of time5 that individuals have been registered as students with these accountancy bodies.

A high percentage of ICAEW, CAI and ICAS students complete their training in 4 years or less, with 10%, 16% and 16% respectively of their students being registered for more than 4 years as at 31 December 2018.

Graduate Entrants to Training

Figure 12 shows the percentages of students worldwide of each accountancy body who, at the time of registration as students, were (i) graduates of any discipline and, of those, (ii) graduates who held a "relevant degree"6.

The accountancy bodies do not require entrants to hold a university degree and offer a range of entry routes.

Comparisons of the percentage of students holding “relevant degrees” are difficult to assess because the accountancy bodies use different definitions of a “relevant degree".

ACCA, ICAEW, CAI, ICAS, CIPFA and CIMA also have apprenticeship schemes intended for non-graduates/ school leavers as an entry route into the accountancy profession.

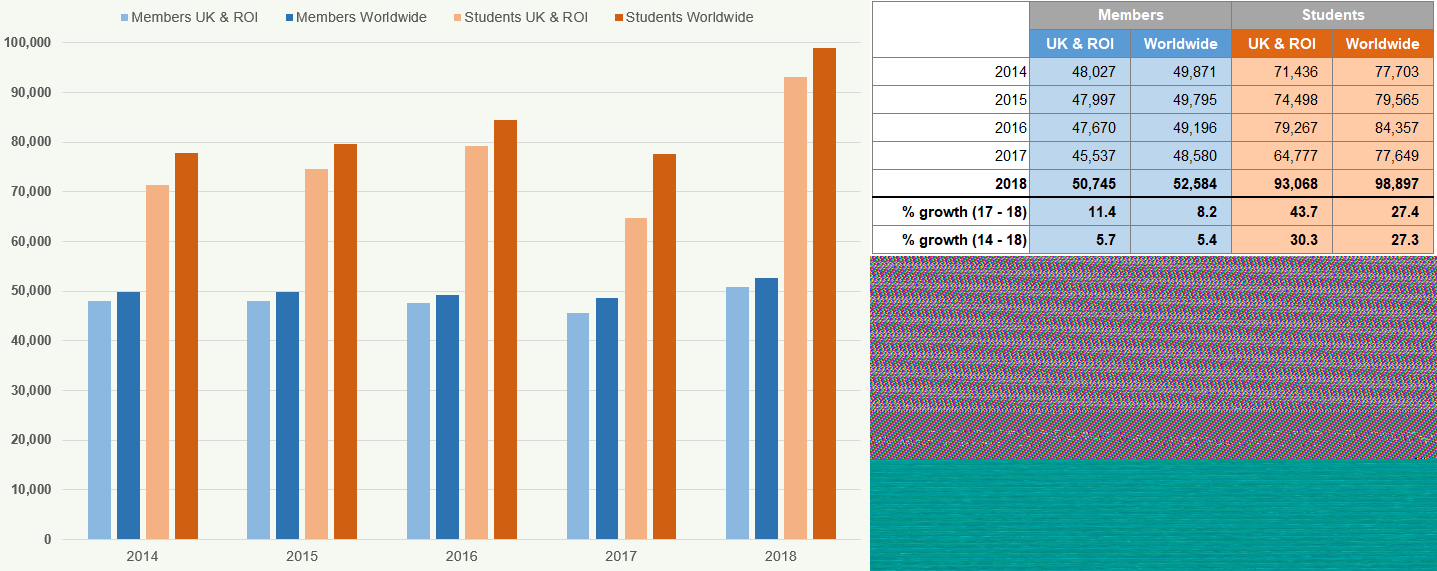

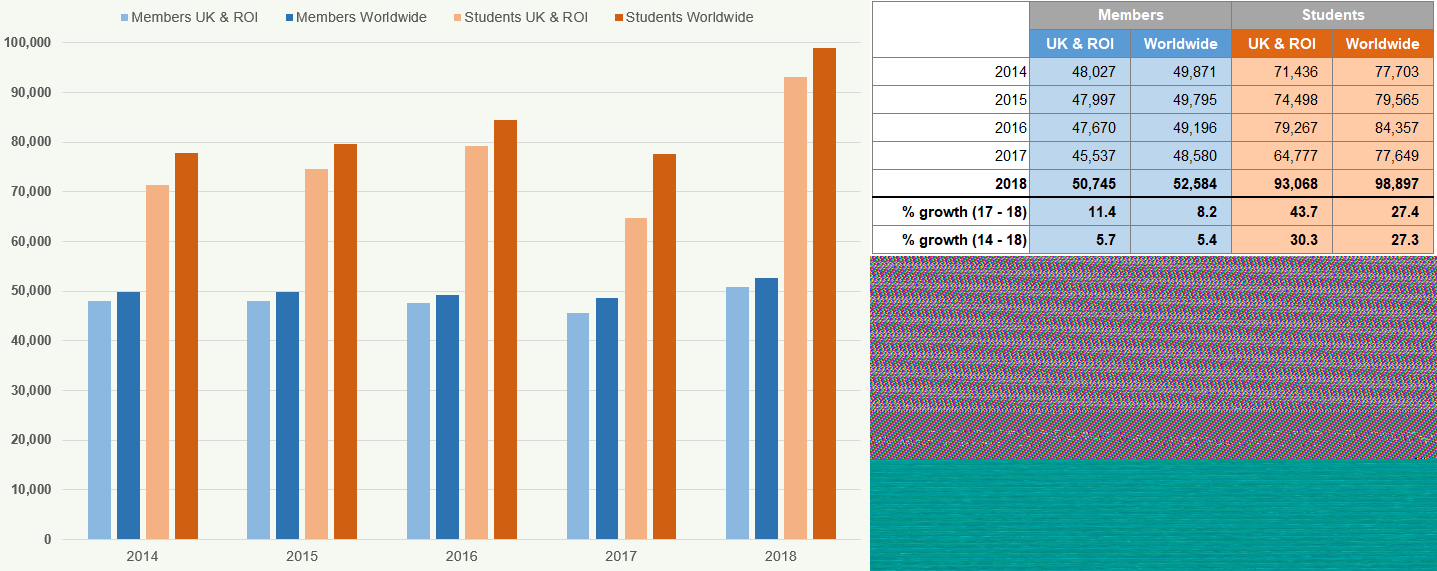

The Association of Accounting Technicians (AAT)

Members and Students in the UK and ROI and Worldwide

AAT is used as an entry level qualification by some of the chartered accountancy bodies included in this publication. Figure 13 shows the number of AAT members and students and percentage growth rate from 2014 to 2018.

| Members | Students | |||

|---|---|---|---|---|

| UK & ROI | Worldwide | UK & ROI | Worldwide | |

| 2014 | 48,027 | 49,871 | 71,436 | 77,703 |

| 2015 | 47,997 | 49,795 | 74,498 | 79,565 |

| 2016 | 47,670 | 49,196 | 79,267 | 84,357 |

| 2017 | 45,537 | 48,580 | 64,777 | 77,649 |

| 2018 | 50,745 | 52,584 | 93,068 | 98,897 |

| % growth (17-18) | 11.4 | 8.2 | 43.7 | 27.4 |

| % growth (14-18) | 5.7 | 5.4 | 30.3 | 27.3 |

The number of members in the UK and ROI and worldwide both rose by 11.4% and 8.2% between 2017 and 2018 respectively, due to the 2018 figures now including affiliate members.

The number of students also increased by 43.7% in the UK and ROI and by 27.4% worldwide as the 2018 figures now includes the number of students undertaking AAT's short qualification.

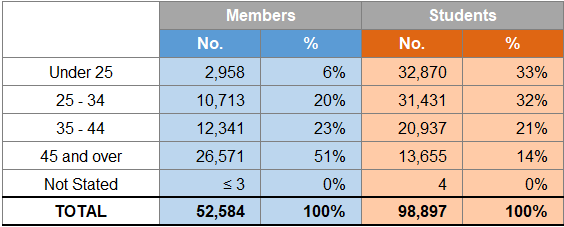

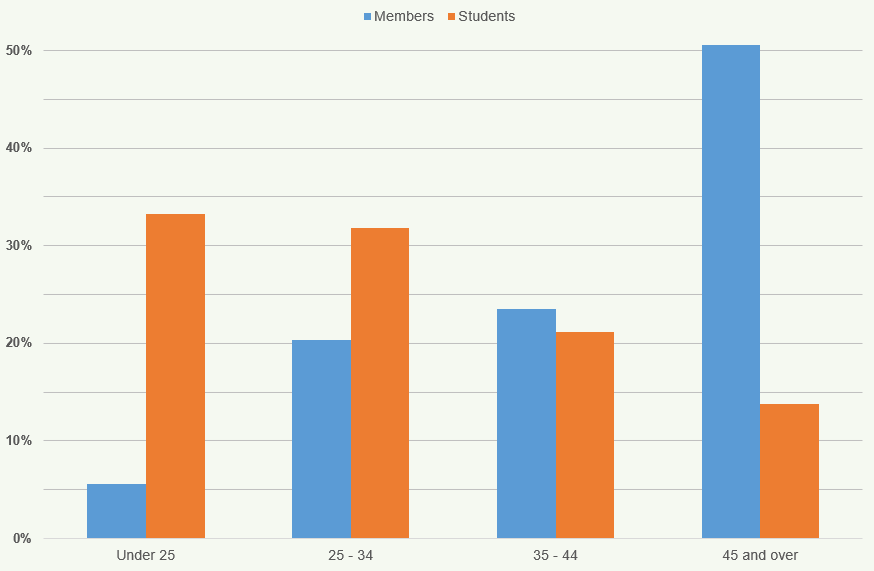

Age Distribution of Members and Students

Figure 14 indicates the age distribution of members and students for 2018.

The highest percentage of members (51%) are aged 45 and over while the highest percentage of students (33%) are under the age of 25.

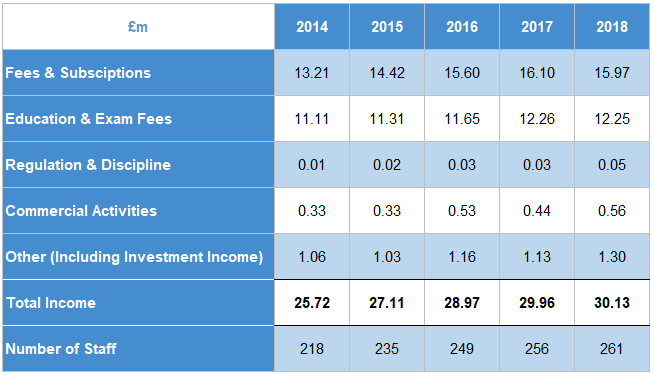

Resource Information

| £m | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Fees & Subscriptions | 13.21 | 14.42 | 15.60 | 16.10 | 15.97 |

| Education & Exam Fees | 11.11 | 11.31 | 11.65 | 12.26 | 12.25 |

| Regulation & Discipline | 0.01 | 0.02 | 0.03 | 0.03 | 0.05 |

| Commercial Activities | 0.33 | 0.33 | 0.53 | 0.44 | 0.56 |

| Other (Including Investment Income) | 1.06 | 1.03 | 1.16 | 1.13 | 1.30 |

| Total Income | 25.72 | 27.11 | 28.97 | 29.96 | 30.13 |

| Number of Staff | 218 | 235 | 249 | 256 | 261 |

Section Three – Resource Information on the Accountancy Bodies

Section Three – Resource Income of the Seven Accountancy Bodies

Figures 16 and 17 show the income and average income per member/student of the accountancy bodies on a worldwide basis from 2014 to 20187 & 8.

Since 2014 ACCA and ICAEW have experienced a continuous increase in their income, recording the highest income of the seven accountancy bodies at £209m and £125m respectively in 2018.

CIMA and CIPFA have seen a decrease in their income between 2014 and 2018, down 2.7% and 8% respectively.

Average Income Per Body from Members and Students

The average income per member and student is calculated by dividing the income of each accountancy body, excluding “Commercial Activities” and “Other” (Figure 18), by its total worldwide population of members and students.

CAI and ICAS have the highest average income per member and student in 2018.

The fluctuation in CAI's income since 2015 is as a result of the exchange rates applied (€1.287 in 2014, €1.362 in 2015, €1.175 in 2016, €1.127 in 2017 and €1.115 in 2018).

Breakdown of Income

Figure 18 provides an analysis of the streams of income by the accountancy bodies for 2018.

Fees and subscriptions taken together with education and exam fees from members and students are the main sources of income for each of the bodies other than CIPFA.

Fees and subscriptions make up almost all of AIA's income (88%). CIPFA's income mainly comes from Commercial Activities9 (73%).

Staffing of the Accountancy Bodies

Figure 19 shows the number of staff (full time equivalent) employed worldwide by the seven accountancy bodies from 2014 to 2018.

| Staffing of the Seven Chartered Accountancy Bodies | ACCA | CIMA | CIPFA | ICAEW | CAI | ICAS | AIA | TOTAL |

|---|---|---|---|---|---|---|---|---|

| 2014 | 1,137 | 454 | 256 | 667 | 140 | 138 | 26 | 2,818 |

| 2015 | 1,199 | 459 | 274 | 693 | 147 | 142 | 26 | 2,940 |

| 2016 | 1,272 | 458 | 275 | 724 | 149 | 143 | 26 | 3,047 |

| 2017 | 1,358 | 198 | 259 | 706 | 149 | 154 | 25 | 2,849 |

| 2018 | 1,362 | 190 | 216 | 741 | 150 | 161 | 23 | 2,843 |

| % growth (17-18) | 0.3 | -4.0 | -16.6 | 5.0 | 0.7 | 4.5 | -8.0 | -6.5 |

| % growth (14-18) | 19.8 | -58.1 | -15.6 | 11.1 | 7.1 | 16.7 | -11.5 | 5.6 |

| % compound annual growth (14-18) | 4.6 | -19.6 | -4.2 | 2.7 | 1.7 | 3.9 | -3.0 | 1.4 |

In 2017 CIMA amalgamated with the American Institute of Certified Public Accountants (AICPA), to create a new Association. UK and US staff of CIMA are now employed by the Association rather than CIMA which is reflected in its % reduction between 2014 and 2018.

Diversity Information on Workforce under the Public Sector Equality Duty (PSED)

In the 2017/18 publication we reported on the following indicators: age, gender, ethnicity, disability, religion/ belief and sexual orientation. This year, we amended our questionnaire in line with the PSED and asked all bodies whether they collect diversity information on the protected characteristics listed in the Equality Act

- Figure 20 shows the number of bodies that collect this diversity information on their workforce.

All eight bodies now collect age, disability and sex data of their workforce. In the 2018 publication only four of the eight bodies collected this data.

Seven of the eight bodies capture information on both Marriage and Race characteristics of their workforce, with an average completion rate of nearly 70%.

In 2018, all the bodies confirmed that they have a Diversity policy and/or statement in place. The policies cover a range of issues, such as equality, inclusion and social mobility for both their workforces and external stakeholders. The policies also extend to deal with bullying and harassment in the workplace.

All the policies are aimed at improving awareness of diversity and ensuring that no employee or applicant for employment will be treated less favourably than another because they have a protected characteristic.

There is no requirement for employees to disclose their diversity status to their employer. Diversity indicators in the workforce are collected on a voluntary basis.

Section Four – Oversight of Audit Regulation

Recognised Supervisory Bodies (RSBs)

Under the Statutory Audit and Third Country Auditor Regulations (SATCAR) 201610 the FRC is the designated Competent Authority for statutory audit in the UK. SATCAR 2016 sets out the responsibilities of the Competent Authority and permits the FRC to delegate some of the tasks required to fulfil its responsibilities. The FRC retains the task of monitoring the quality of audits for PIEs and undertaking enforcement actions against members of the RSBs where there are public interest considerations. These are the "Retained tasks"11.

The FRC delegates statutory tasks for the regulation of auditors of non-public interest entities to the RSBs, through delegation agreements. The FRC oversees the fulfilment of the “Delegated Tasks", which include provisions for: - Registration: The application of the FRC's criteria for determining whether persons are eligible for appointment as statutory auditors, the registration of such persons, keeping the register12 and making it available for inspection; - Continuing Professional Development: Procedures for maintaining the competence of statutory auditors; - Audit Monitoring: Monitoring of statutory auditors and the quality of audit work; and - Enforcement: Except for categories retained by the FRC, investigations and imposing and enforcing sanctions in relation to breaches of relevant requirements by statutory auditors.

The FRC also exercises delegated statutory functions under Part 42 of the Companies Act 2006 for the recognition, supervision and de-recognition of RSBs. The FRC reports annually to the Secretary of State (SoS) on the discharge of these functions13.

Number of Firms Registered with the RSBs

Figure 21 shows the number of registered audit firms for each RSB split by the number of principals14 at each firm, for each of the three years15 to 31 December 2018.

| Number of Principals per Firm | ACCA | ICAEW | CAI | ICAS | TOTAL |

|---|---|---|---|---|---|

| 1 | 1,064 | 1,058 | 388 | 48 | 2,558 |

| 2-6 | 549 | 1,513 | 367 | 105 | 2,534 |

| 7-10 | 10 | 135 | 13 | 11 | 169 |

| 11-50 | 4 | 90 | 12 | 6 | 112 |

| 50+ | 0 | 16 | 3 | 2 | 21 |

| Total as at 31.12.18 | 1,627 | 2,812 | 783 | 172 | 5,394 |

| Total as at 31.12.17 | 1,719 | 2,948 | 810 | 183 | 5,660 |

| Total as at 31.12.16 | 1,856 | 3,121 | 844 | 189 | 6,010 |

The number of audit firms registered to carry out statutory audit work in the UK and ROI continues to fall. The number of registered audit firms fell by 5.1% in 2015/16 (6,010), 5.8% in 2016/17 (5,660) and 4.7% in 2017/18 (5,394).

There has been a decline in 2018 compared to 2017 at each of the RSBs in both the number of registered audit firms that are sole practitioners (2,558 from 2,733 respectively) and firms with 2 - 6 Principals (2,534 from 2,618 respectively).

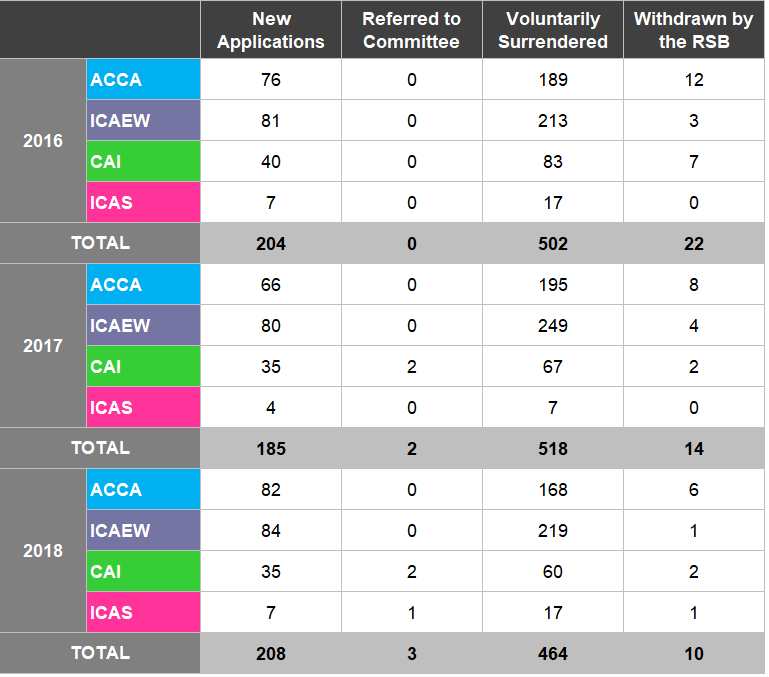

Statutory Audit Firms

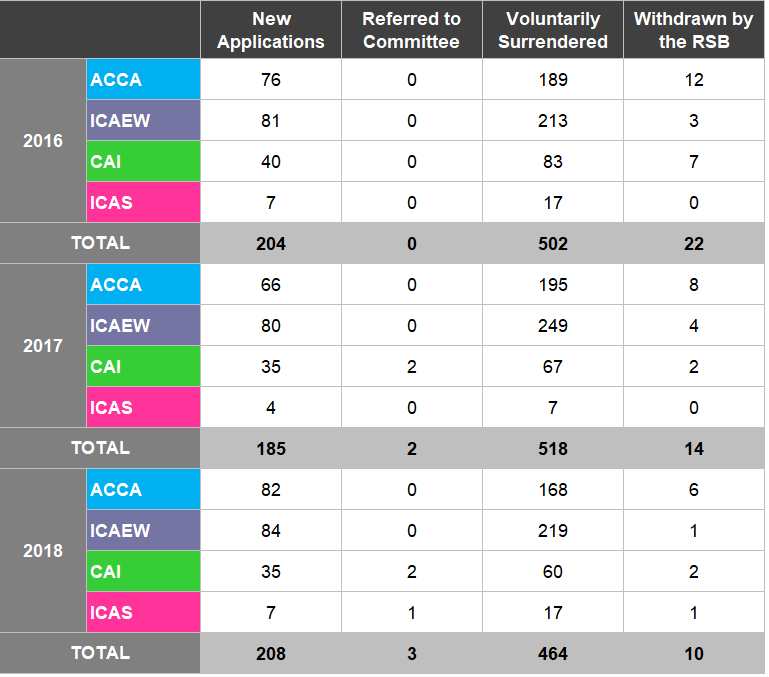

Figure 22 details the number of registrations by firms split by New Applications, Referred to Committee, Voluntarily Surrendered16 or Withdrawn received by the RSBs in 2016, 2017 and 2018. - New Applications: applications submitted to become a registered statutory audit firm; - Referred to a Committee: applications referred to a committee to make a decision; - Voluntarily withdrawn: where a registered statutory audit firm no longer wants to carry out statutory audit work; and - Withdrawn by the RSB: where an RSB's Committee deems a firm unable to carry out statutory audits to the standard required.

| New Applications | Referred to Committee | Voluntarily Surrendered | Withdrawn by the RSB | ||

|---|---|---|---|---|---|

| ACCA | 76 | 0 | 189 | 12 | |

| ICAEW | 81 | 0 | 213 | 3 | |

| 2016 | CAI | 40 | 0 | 83 | 7 |

| ICAS | 7 | 0 | 17 | 0 | |

| TOTAL | 204 | 0 | 502 | 22 | |

| ACCA | 66 | 0 | 195 | 8 | |

| ICAEW | 80 | 0 | 249 | 4 | |

| 2017 | CAI | 35 | 2 | 67 | 2 |

| ICAS | 4 | 0 | 7 | 0 | |

| TOTAL | 185 | 2 | 518 | 14 | |

| ACCA | 82 | 0 | 168 | 6 | |

| ICAEW | 84 | 0 | 219 | 1 | |

| 2018 | CAI | 35 | 2 | 60 | 2 |

| ICAS | 7 | 1 | 17 | 1 | |

| TOTAL | 208 | 3 | 464 | 10 |

Although there was a 20% decrease in New Applications between 2016 and 2017, the RSBs have seen a 12.4% increase from 2017 to

- There was also a 7.5% decline in number of audit firms that have voluntarily surrendered their audit registration between 2016 and 2018.

Footnotes

Figure 22 details the number of registrations by firms split by New Applications, Referred to Committee, Voluntarily Surrendered17 or Withdrawn received by the RSBs in 2016, 2017 and 2018.

- New Applications: applications submitted to become a registered statutory audit firm;

- Referred to a Committee: applications referred to a committee to make a decision;

- Voluntarily withdrawn: where a registered statutory audit firm no longer wants to carry out statutory audit work; and

- Withdrawn by the RSB: where an RSB's Committee deems a firm unable to carry out statutory audits to the standard required.

| New Applications | Referred to Committee | Voluntarily Surrendered | Withdrawn by the RSB | ||

|---|---|---|---|---|---|

| 2016 | ACCA | 76 | 0 | 189 | 12 |

| ICAEW | 81 | 0 | 213 | 3 | |

| CAI | 40 | 0 | 83 | 7 | |

| ICAS | 7 | 0 | 17 | 0 | |

| TOTAL | 204 | 0 | 502 | 22 | |

| 2017 | ACCA | 66 | 0 | 195 | 8 |

| ICAEW | 80 | 0 | 249 | 4 | |

| CAI | 35 | 2 | 67 | 2 | |

| ICAS | 4 | 0 | 7 | 0 | |

| TOTAL | 185 | 2 | 518 | 14 | |

| 2018 | ACCA | 82 | 0 | 168 | 6 |

| ICAEW | 84 | 0 | 219 | 1 | |

| CAI | 35 | 2 | 60 | 2 | |

| ICAS | 7 | 1 | 17 | 1 | |

| TOTAL | 208 | 3 | 464 | 10 |

Figure 22: Firm Registrations 2016 to 2018 Although there was a 20% decrease in New Applications between 2016 and 2017, the RSBs have seen a 12.4% increase from 2017 to

- There was also a 7.5% decline in number of audit firms that have voluntarily surrendered their audit registration between 2016 and 2018.

Monitoring of Registered Audit Firms by the FRC's Audit Quality Review Team

The FRC's Audit Quality Review team (AQR) monitors the quality of the audits of retained audits and the policies and procedures which underpin audit quality at UK audit firms that perform the audits of these entities. The remainder of audit monitoring is conducted by the RSBs.

Figure 23 below details the number of reviews of audits conducted by the AQR during the years ended 31 March 2017 to 31 March 201918, 19 & 20. More information on work performed by the AQR team can be found in the FRC's Developments in Audit Report at www.frc.org.uk.

| Inspection Category | Audit Reviews 2016/17 | Audit Reviews 2017/18 | Audit Reviews 2018/19 |

|---|---|---|---|

| Deloitte LLP | 23 | 25 | 25 |

| EY LLP | 17 | 18 | 18 |

| KPMG LLP/KPMG Audit Plc | 23 | 24 | 29 |

| PricewaterhouseCoopers LLP | 27 | 28 | 26 |

| Big Four firms | 90 | 95 | 98 |

| BDO LLP | 8 | 8 | 8 |

| BGS Valentine | 1 | 0 | 8 |

| Grant Thornton UK LLP | 8 | 8 | 8 |

| Mazars LLP | 4 | 5 | 4 |

| Moore Stephens LLP | 1 | 5 | 3 |

| RSM UK Audit LLP | 3 | 0 | 2 |

| UHY Hacker Young | - | 2 | 0 |

| Beever and Struthers | - | - | 2 |

| Crowe U.K. LLP | - | - | 2 |

| Haysmacintyre | - | - | 1 |

| Scott-Moncrieff | - | - | 3 |

| PKF Littlejohn | - | - | 0 |

| 111 | 125 | 129 | |

| Crown Dependency (CD) audit firms | 5 | 5 | 5 |

| 116 | 125 | 134 | |

| Third Country Auditors | 6 | 3 | 5 |

| Private sector audits | 122 | 128 | 139 |

| National Audit Office (NAO) | 6 | 7 | 7 |

| Local Audit | 12 | 10 | 14 |

| Public Sector audits | 18 | 17 | 21 |

| Total audits inspected | 140 | 145 | 160 |

Figure 23: AQR Monitoring 2016/17 to 2018/19

Monitoring of Registered Audit Firms by RSBs

Figure 24 shows the number of monitoring visits conducted by the RSBs during the years ending 31 December 2016 to 31 December 201821 and the number of monitoring visits conducted as a percentage of the total number of registered audit firms at each RSB. There is a statutory requirement that the RSBs should monitor the activities undertaken by each registered audit firm at least once every six years22.

| ACCA | ICAEW | CAI | ICAS | TOTAL | ||

|---|---|---|---|---|---|---|

| 2016 | No | 362 | 584 | 142 | 40 | 1,128 |

| % | 19.5 | 18.7 | 16.8 | 21.2 | 18.8 | |

| 2017 | No | 291 | 598 | 84 | 44 | 1,017 |

| % | 16.9 | 20.3 | 10.4 | 24.0 | 15.3 | |

| 2018 | No | 404 | 567 | 100 | 47 | 1,118 |

| % | 24.8 | 20.2 | 12.8 | 27.3 | 20.7 |

Figure 24: RSB Monitoring and Percentage of the Total Registered Firms 2016 to 2018

Reasons for Monitoring Visits to Registered Audit Firms by RSBs

Figure 25 shows the reasons for the monitoring visits to registered audit firms by the RSBs during the years ended 31 December 2016 to 31 December 201823 & 24.

| ACCA | ICAEW | CAI | ICAS | TOTAL | ||

|---|---|---|---|---|---|---|

| Requested by the registration/licensing committee | 2016 | 7 | 7 | 0 | 0 | 14 |

| 2017 | 7 | 3 | 6 | 0 | 16 | |

| 2018 | 15 | 2 | 21 | 2 | 40 | |

| Specifically selected due to heightened risk | 2016 | 102 | 41 | 2 | 9 | 154 |

| 2017 | 96 | 253 | 0 | 23 | 372 | |

| 2018 | 108 | 215 | 9 | 31 | 363 | |

| Cyclical Visits | 2016 | 253 | 502 | 140 | 29 | 924 |

| 2017 | 188 | 342 | 78 | 21 | 629 | |

| 2018 | 281 | 350 | 70 | 13 | 714 | |

| Firms with Public Interest Entities visited without AQR involvement | 2016 | 0 | 30 | 0 | 1 | 31 |

| 2017 | N/A | N/A | N/A | N/A | N/A | |

| 2018 | N/A | N/A | N/A | N/A | N/A | |

| Firms with Public Interest Entities visited with AQR involvement | 2016 | 0 | 4 | 0 | 1 | 5 |

| 2017 | 0 | 0 | 0 | 0 | 0 | |

| 2018 | 0 | 0 | 0 | 1 | 1 |

Figure 25: Monitoring Visit Reason 2016 to 2018

Since 17 June 2016, audit firms which audited PIEs are now subject to review by the FRC's AQR team. Prior to this date, different arrangements applied where the RSBs were responsible for the monitoring of some of these firms. The RSBs have no involvement in the monitoring of PIE audits, although they may rely on AQR's whole firm procedures when monitoring non-PIE audits at those audit firms.

Gradings of Monitoring Visits to Registered Audit Firms by RSBs

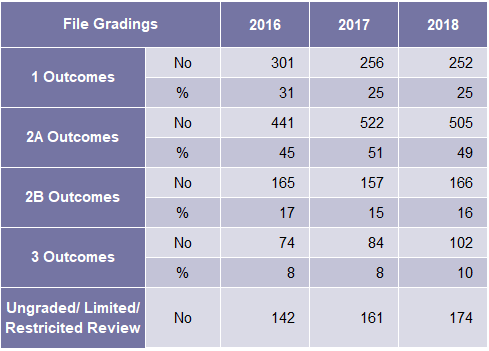

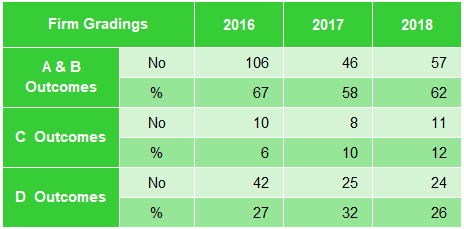

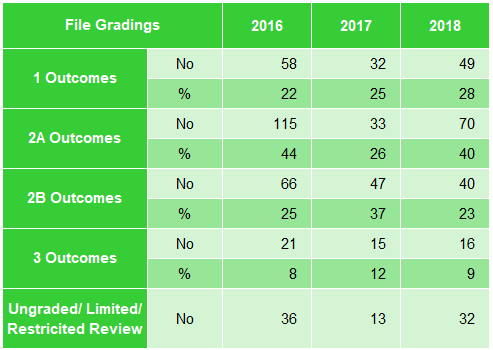

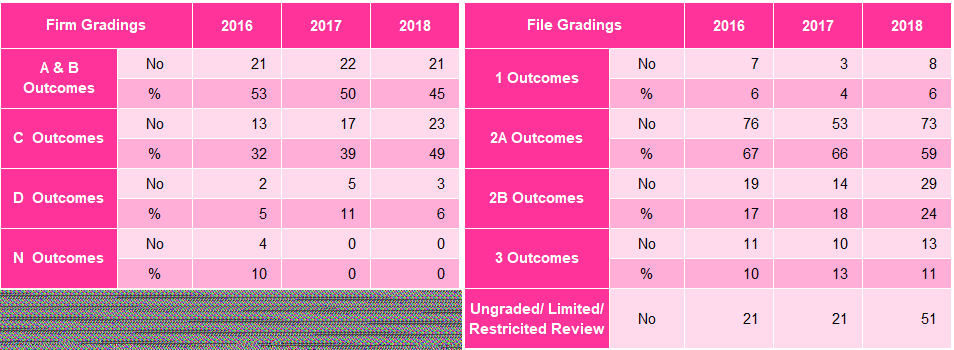

Figures 26 to 29 show the grades for the audit monitoring visits to the firms and full audit file reviews conducted by ACCA, ICAEW, CAI and ICAS during the years ended 31 December 2016 to 2018.

The RSBs continue to have different systems for grading the quality of firms and full audit files reviewed.

- File grading: ICAEW, CAI and ICAS use the same definitions for grading full audit files. ACCA's definitions are set out below. The percentage of audit files provided in the tables for each of the RSBs is calculated on the basis of the number of files actually graded.

- Firm grading: This grade is given following a review by an RSB's inspection unit. The grades and definitions used are set out below.

- Other types of file review: Ungraded, limited and/or restricted are classifications for reviews conducted but not graded. An ungraded review is when a firm has no audit clients in a particular year. A limited and/or restricted review is a brief review of a specific risk or aspects noted from a previous visit.

File Grading

ICAEW, CAI and ICAS:

1 (Satisfactory): No concerns regarding the sufficiency and quality of audit evidence or the appropriateness of significant audit judgments in the areas reviewed; only limited weakness in documentation of audit work; and any concerns in other areas are limited in nature (both individually and collectively). Note: files with non-compliance with audit regulations cannot be graded '1' although there may be ‘minor' matters.

2A (Generally Acceptable): Only limited concerns regarding the sufficiency or quality of audit evidence or the appropriateness of significant audit judgments in the areas reviewed; and/or weaknesses in documentation of audit work are restricted to a small number of areas; and/or some concerns, assessed as less than significant (individually and collectively), in other areas.

2B (Improvement Required): Some concerns, assessed as less than significant, regarding the sufficiency or quality of audit evidence or the appropriateness of significant audit judgments in the areas reviewed; and/ or more widespread weaknesses in documentation of audit work; and significant concerns in other areas (individually or collectively).

3 (Significant Improvements Required): Significant concerns regarding the sufficiency or quality of audit evidence or the appropriateness of significant audit judgments in the areas reviewed (not limited to the documentation of the underlying thought processes) and/ or very significant concerns in other areas (individually or collectively).

ACCA:

ACCA uses the following initial grade assessment in determining the overall outcome on audit work.

A Outcomes: The audit work appears appropriate in scope and extent with no significant deficiencies, forming a reasonable basis for the audit opinion.

B Outcomes: Minor deficiencies were noted in the audit work, but these do not result in a significant risk of any material misstatements remaining undetected and the audit opinion is adequately supported by the work recorded.

C Outcomes: There is serious non-compliance with applicable standards and/or deficiencies in the audit evidence recorded such that there is a significant risk that any material misstatements would remain undetected.

Summary of monitoring results by Body

Each year a mixture of firms are selected for review. This selection is comprised of firms randomly selected to meet the six-year monitoring cycle and those deemed at high risk of poorer audit quality. Since the firm selection changes each year, monitoring results are not directly comparable year on year.

Further, the sample of firms monitored each year will often include a disproportionate number of weaker firms selected due to the targeted selection of firms deemed to be high risk. This needs to be taken into account when interpreting the percentage of D outcomes at each body. (D outcomes are defined below).

Outcomes reported in the below tables include a number of visits to audit registered firms that have no audit clients. These reviews are done on a desktop basis.

Association of Chartered Certified Accountants (ACCA)

| Firm Gradings | 2016 | 2017 | 2018 | File Gradings | 2016 | 2017 | 2018 | ||

|---|---|---|---|---|---|---|---|---|---|

| A & B Outcomes | No | 273 | 205 | 289 | A Outcomes | No | 43 | 28 | 32 |

| % | 76 | 71 | 71 | % | 7 | 4 | 5 | ||

| C+ Outcomes | No | 38 | 38 | 60 | B Outcomes | No | 395 | 482 | 436 |

| % | 10 | 13 | 15 | % | 69 | 72 | 72 | ||

| C Outcomes | No | 4 | 7 | 11 | C Outcomes | No | 136 | 160 | 141 |

| % | 1 | 2 | 3 | % | 24 | 24 | 23 | ||

| D Outcomes | No | 47 | 41 | 44 | Ungraded/ Limited/ Restricted Review | No | 0 | 0 | 0 |

| % | 13 | 14 | 11 |

Figure 26: ACCA Gradings 2016 to 2018

Firm Grading (ACCA)

A Outcomes: The firm complies with auditing standards, ACCA's Global Practising Regulations (GPRs) and the Code of Ethics and Conduct (CEC) and the Ethical Standards for Auditors (ESA) issued by the Financial Reporting Council.

B Outcomes: The firm is eligible for audit registration; it complies with the GPRs, CEC and the ESA and 50% or more of its audit files inspected, including all significant audits, comply substantially with relevant auditing standards.

C+ Outcomes: The firm is eligible for audit registration and it complies with the GPRs, CEC and ESA but its quality controls over audit work are not effective and either the majority of the firm's audit files, or the significant audit files, inspected do not comply with relevant auditing standards.

C Outcomes: The firm is eligible for audit registration but it does not comply with the GPRs, CEC and ESA and/or its audit work does not comply with relevant auditing standards.

D Outcomes: When a firm's work is considered very poor or if a firm has a second or subsequent unsatisfactory visit and there are no mitigating factors the visit is graded 'D', which indicates that regulatory action is required and will usually result in a referral to a Regulatory Assessor or the Admissions and Licensing Committee (ALC). Regulatory action in this context includes ACCA referring the findings of a monitoring visit to the Assessment Department to consider whether disciplinary action is appropriate. 'D' outcomes do not always result from an inadequate standard of audit work but could be for failure to meet the eligibility requirements for holding a firm's auditing certificate; they may also indicate a referral to the Assessment Department for other regulation breaches such as non-compliance with client money rules or with the terms of a regulatory order.

Institute of Chartered Accountants in England & Wales (ICAEW)

| Firm Gradings | 2016 | 2017 | 2018 | File Gradings | 2016 | 2017 | 2018 | ||

|---|---|---|---|---|---|---|---|---|---|

| A & B Outcomes | No | 365 | 363 | 333 | 1 Outcomes | No | 301 | 256 | 252 |

| % | 62 | 59 | 56 | % | 31 | 25 | 25 | ||

| C Outcomes | No | 107 | 93 | 116 | 2A Outcomes | No | 441 | 522 | 505 |

| % | 18 | 16 | 20 | % | 45 | 51 | 49 | ||

| D Outcomes | No | 37 | 61 | 59 | 2B Outcomes | No | 165 | 157 | 166 |

| % | 6 | 10 | 10 | % | 17 | 15 | 16 | ||

| N Outcomes | No | 83 | 94 | 85 | 3 Outcomes | No | 74 | 84 | 102 |

| % | 14 | 16 | 14 | % | 8 | 8 | 10 | ||

| Ungraded/ Limited/ Restricted Review | No | 142 | 161 | 174 |

Figure 27: ICAEW Gradings 2016 to 2018

Firm Grading (ICAEW)

A Outcomes: Where there are no instances of non-compliance with the Audit Regulations and no matters requiring follow-up action.

B Outcomes: Where there are some instances of non-compliance with the Audit Regulations. ICAEW's Quality Assurance Department (QAD) are confident that the firm has the commitment and ability to correct the issue(s) and the firm's responses address the matters raised without the need for follow-up action.

C Outcomes: Where there are instances of non-compliance and follow-up action is required: * Submit information – Additional details or evidence of the firm's actions previously agreed is required to demonstrate its commitment and ability to correct the issue. * Accept withdrawal – non-compliance that would require a follow-up action if the firm had not proposed to withdraw from the audit registration (No need for a report to Audit Registration Committee (ARC)) * Release from conditions and/or restrictions Some or no instances of non-compliance and confidence that previous conditions and restrictions can be lifted.

D Outcomes: Where instances of non-compliance are likely to be serious or extensive and require a detailed report to ARC which can include three potential outcomes: * Impose conditions and/or restrictions - non-compliance is likely to be serious or extensive and/or the firm's responses may be inadequate and/or raise doubts about the firm's ability/willingness to make the improvements. * Withdrawal – reserved for the most serious situations when the firms audit registration should be withdrawn. * Committee consideration – to provide information to the committee when no conditions or restrictions have been proposed but the committee are required to consider the results of the visit.

N Outcomes Is used for visits where no statutory audit work has been reviewed. For example, a firm continues with audit registration but has no audit clients and no audit work has been reviewed; or a firm's withdrawal application is under consideration by QAD. This rating is also applied to 'Year 2' visits to large firms where no audit files are reviewed.

Chartered Accountants Ireland (CAI)

| Firm Gradings | 2016 | 2017 | 2018 | File Gradings | 2016 | 2017 | 2018 | ||

|---|---|---|---|---|---|---|---|---|---|

| A & B Outcomes | No | 106 | 46 | 57 | 1 Outcomes | No | 58 | 32 | 49 |

| % | 67 | 58 | 62 | % | 22 | 25 | 28 | ||

| C Outcomes | No | 10 | 8 | 11 | 2A Outcomes | No | 115 | 33 | 70 |

| % | 6 | 10 | 12 | % | 44 | 26 | 40 | ||

| D Outcomes | No | 42 | 25 | 24 | 2B Outcomes | No | 66 | 47 | 40 |

| % | 27 | 32 | 26 | % | 25 | 37 | 23 | ||

| 3 Outcomes | No | 21 | 15 | 16 | |||||

| % | 8 | 12 | 9 | ||||||

| Ungraded/ Limited/ Restricted Review | No | 36 | 13 | 32 |

Figure 28: CAI Gradings 2016 to 2018

Firm Grading (CAI)

A Outcomes: Where no instances of breaches have been recorded.

B Outcomes: Where breaches were noted, and the firm are deemed to have the ability (competence and resources) to address the issue(s) within the stated timescales.

There will generally be no matters to follow up on firms graded A and/or B.

C Outcomes: Where breaches have been noted and the firm has undertaken actions to address the issues raised. In such instances, the firm is required to provide a written undertaking to cover the volunteered actions. Quality Assurance Committee (QAC) will not impose conditions or restrictions; however, there is a need for further confirmation/follow up.

D Outcomes: Where breaches or issues have been identified, which require consideration by the Head of Quality Assurance and by the QAC. There are four classes of D reports: D1, D2, D3 reports are determined by the seriousness of the regulatory action, while D4 reports provides information to QAC.

Institute of Chartered Accountants of Scotland (ICAS)

| Firm Gradings | 2016 | 2017 | 2018 | File Gradings | 2016 | 2017 | 2018 | ||

|---|---|---|---|---|---|---|---|---|---|

| A & B Outcomes | No | 21 | 22 | 21 | 1 Outcomes | No | 7 | 3 | 8 |

| % | 53 | 50 | 45 | % | 6 | 4 | 6 | ||

| C Outcomes | No | 13 | 17 | 23 | 2A Outcomes | No | 76 | 53 | 73 |

| % | 32 | 39 | 49 | % | 67 | 66 | 59 | ||

| D Outcomes | No | 2 | 5 | 3 | 2B Outcomes | No | 19 | 14 | 29 |

| % | 5 | 11 | 6 | % | 17 | 18 | 24 | ||

| N Outcomes | No | 4 | 0 | 0 | 3 Outcomes | No | 11 | 10 | 13 |

| % | 10 | 0 | 0 | % | 10 | 13 | 11 | ||

| Ungraded/ Limited/ Restricted Review | No | 21 | 21 | 51 |

Figure 29: ICAS Gradings 2016 to 2018

Firm Grading (ICAS)

Since June 2016, ICAS amended its firm grading approach for all regulatory functions including audit. The following amendments have been made from previous years:

| Pre June 2016 | Post June 2016 |

|---|---|

| A | A |

| B | B |

| C2 | C+ |

| C1 | C- |

| D3/D2/D1 | D |

Under the delegation agreement 'A' and 'B' graded monitoring reports are cleared by ICAS staff with C+ reports being dealt with by a Nominated Committee Member (“NCM”) outside of main Authorisation Committee with the C- and D reports going to the Authorisation Committee (a quorum of at least 1 Public Interest Member and 2 Chartered Accountants).

A Outcomes: Where no issues have been identified and no follow-up action is needed.

B Outcomes: Where some regulatory issues were identified; however, these issues have been addressed adequately by the firm's closing meeting responses and no further action is required.

C Outcomes: Where there are regulatory issues and there is a need for the firm to submit evidence of action taken in a restricted area. The 'C' grading is now split into a 'C-' or 'C+' grading with 'C-' being more serious, where one or more of the issues identified are considered to be pervasive; whereas 'C+' is where findings are specific to particular individuals or files and do not indicate systemic problems.

D Outcomes: Where the standard of compliance is such that the Authorisation Committee (AC) needs to consider appropriate follow-up action, such as imposition of conditions and restrictions or withdrawal of registration.

Complaints about Auditors

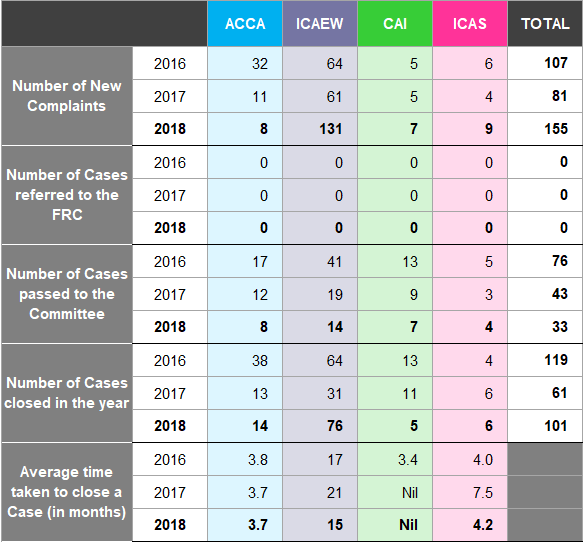

Figure 30 shows the number of audit related complaints received by the RSBs from 2016 to 201825 to show (i) number of new complaints, (ii) number of cases passed to the FRC Enforcement Division (iii) number of cases referred to the committee26, (iv) number of cases closed in the year and (v) average time taken to close a case27.

| ACCA | ICAEW | CAI | ICAS | TOTAL | |

|---|---|---|---|---|---|

| Number of New Complaints | 2016 | 32 | 64 | 5 | 6 |

| 2017 | 11 | 61 | 5 | 4 | |

| 2018 | 8 | 131 | 7 | 9 | |

| Number of Cases referred to the FRC | 2016 | 0 | 0 | 0 | 0 |

| 2017 | 0 | 0 | 0 | 0 | |

| 2018 | 0 | 0 | 0 | 0 | |

| Number of Cases passed to the Committee | 2016 | 17 | 41 | 13 | 5 |

| 2017 | 12 | 19 | 9 | 3 | |

| 2018 | 8 | 14 | 7 | 4 | |

| Number of Cases closed in the year | 2016 | 38 | 64 | 13 | 4 |

| 2017 | 13 | 31 | 11 | 6 | |

| 2018 | 14 | 76 | 5 | 6 | |

| Average time taken to close a Case (in months) | 2016 | 3.8 | 17 | 3.4 | 4.0 |

| 2017 | 3.7 | 21 | Nil | 7.5 | |

| 2018 | 3.7 | 15 | Nil | 4.2 |

Figure 30: Complaints 2016 to 2018

The definition of the average time taken to close a case differs across the accountancy bodies. Some record their data having regard to cases that are opened and closed within a particular year, while other bodies take the total length for a case to be concluded.

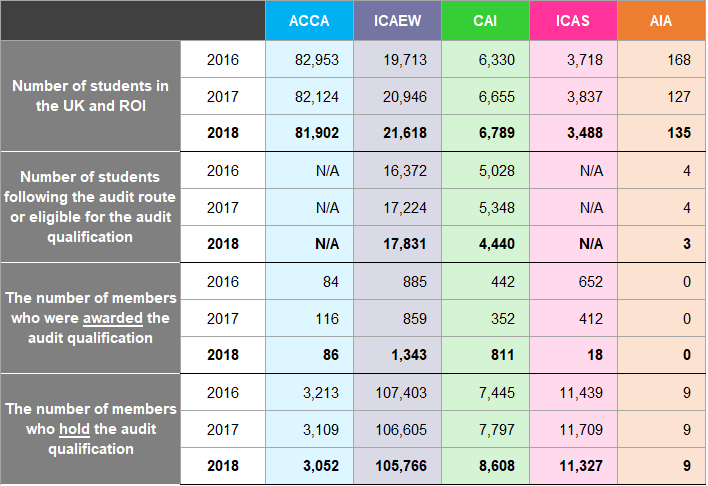

Recognised Qualifying Bodies (RQBs)

The FRC also exercises delegated statutory functions under Part 42 of the Companies Act 2006 for the recognition, supervision and de-recognition of those accountancy bodies responsible for offering the audit qualification (RQBs) in line with the requirements of Schedule 11 of the Act. There are five bodies28 in the UK recognised to offer the audit qualification. RQBs must have rules and arrangements in place to register students and track their progress, administer examinations and ensure that appropriate training is given to students in an approved environment. The FRC reports annually to the SoS on the discharge of these functions13. Figure 31 shows the number of students registered with each RQB as at 31 December 2016 to

- It also shows the number of members who were awarded the audit qualification29 and the number of students following the audit route or eligible for the audit qualification30.

| ACCA | ICAEW | CAI | ICAS | AIA | ||

|---|---|---|---|---|---|---|

| Number of students in the UK and ROI | 2016 | 82,953 | 19,713 | 6,330 | 3,718 | 168 |

| 2017 | 82,124 | 20,946 | 6,655 | 3,837 | 127 | |

| 2018 | 81,902 | 21,618 | 6,789 | 3,488 | 135 | |

| Number of students following the audit route or eligible for the audit qualification | 2016 | N/A | 16,372 | 5,028 | N/A | 4 |

| 2017 | N/A | 17,224 | 5,348 | N/A | 4 | |

| 2018 | N/A | 17,831 | 4,440 | N/A | 3 | |

| The number of members who were awarded the audit qualification | 2016 | 84 | 885 | 442 | 652 | 0 |

| 2017 | 116 | 859 | 352 | 412 | 0 | |

| 2018 | 86 | 1,343 | 811 | 1829 | 0 | |

| The number of members who hold the audit qualification | 2016 | 3,213 | 107,403 | 7,445 | 11,439 | 9 |

| 2017 | 3,109 | 106,605 | 7,797 | 11,709 | 9 | |

| 2018 | 3,052 | 105,766 | 8,608 | 11,327 | 9 |

Figure 31: RQB Students and Members 2016 to 2018

Many members do not apply for the audit qualification until they wish to be able to sign audit reports. Although there has been an increase in the number withdrawing their audit registration due to their clients falling below the audit exemption threshold; the number of students awarded the audit qualification in 2018 has increased.

The audit qualifications of some members may be counted twice; firstly, by the body awarding the qualification and then again if they become a member of another body while retaining their initial qualification.

Approved Training Offices

Figure 32 shows the total number of approved training offices31 in the UK and ROI over the period 2016 to

- The pie chart represents the 2018 data in percentages by each body.

| ACCA | ICAEW | CAI | ICAS | AIA | |

|---|---|---|---|---|---|

| 2016 | 3,829 | 3,841 | 727 | 172 | 10 |

| Number of approved Training Offices in the UK & ROI | 2017 | 3,641 | 4,052 | 718 | 195 |

| 2018 | 3,576 | 4,372 | 718 | 394 |

Figure 32: UK and ROI Training Offices 2016 to 2018 and Proportion of Total Training Offices per Body 2018

Section Five – Audit Firms

This section covers Audit Firms with PIE2 clients. The FRC as Competent Authority has ultimate responsibility for the performance and oversight of the audit regulation tasks mandated by EU Regulation 537/2014 and EU Directive 2006/43/EC as amended and as implemented by SATCAR 2016. The FRC cannot by law delegate the Regulatory Tasks of audit monitoring and enforcement pertaining to PIEs.