The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC’s Response to ISSB’s Request for Information on Agenda Priorities

Emmanuel Faber International Sustainability Standards Board Opernplatz 14 60313 Frankfurt am Main Germany

22 June 2023

Dear Emmanuel

RE: ISSB Request for Information on Agenda Priorities

The Financial Reporting Council (FRC) welcomes the opportunity to provide comments on the ISSB's recently published Request for Information (RFI) on Agenda Priorities. The FRC strongly supports the development of high-quality global standards for sustainability-related reporting and looks forward to the imminent publication of IFRS S1 and IFRS S2. We commend and congratulate the ISSB for working at pace to deliver these first two standards.

This letter highlights some overarching comments for consideration in relation to the strategic direction of the ISSB and is followed by Appendix A which includes our detailed responses to the specific questions posed by the ISSB. In particular, our response to this RFI focuses on matters relating to the proposed integration in reporting project. The FRC does not intend to comment on the three proposed topical standards at this time and therefore has not responded to all questions.

The FRC has extensive experience in standard setting, including in issuing accounting, auditing, assurance and actuarial standards, in addition to setting the UK's Corporate Governance Code and Stewardship Code. We are responsible for the Guidance on the Strategic Report which provides an overarching guidance about the framework in the UK for the reporting of narrative information, including sustainability-related information. Our views in this letter build upon our experience in standard setting and developing guidance for narrative reporting requirements.

Integration of reporting

In response to the 2021 consultation on targeted amendments to the IFRS Foundation Constitution to accommodate the ISSB, the FRC identified a need for clear formal and informal mechanisms for joint projects between the IASB and ISSB. Such joint projects will encourage corporate reporting that tells a complete and joined-up narrative. Our position on this matter remains unchanged, and therefore the FRC recommends that the IASB and ISSB continue to consider joint projects that would lead to coherent and comprehensive reporting of both financial and non-financial information. The FRC strongly recommends that the integration in reporting project is undertaken as a joint project with the IASB. As this proposed project could lead to a corporate reporting framework that integrates both financial and non-financial (including sustainability-related information) into one or more documents, it is imperative that the IASB is involved as part of a formal joint project, and that this takes account of its experience with Management Commentary.

However, it is important to note that narrative reporting, which is sometimes referred to as the front end of annual reports, contains information beyond sustainability-related information. Whilst it is important for the IASB and ISSB to consider the connectivity and integration of sustainability-related information and information in the financial statements, further work needs to be completed on how the front-end narrative reporting is connected to both sustainability-related information and financial statements. The proposed project on integration in reporting should therefore consider the spectrum of information a company could disclose within the annual reporting package.

The UK already has extensive experience in the integration of reporting. Many UK companies - including both companies that report using IFRS Accounting Standards and those that do not - are required to prepare a strategic report in accordance with the Companies Act 2006, which includes requirements relating to sustainability-related reporting. The FRC believes that encouraging companies to prepare a high-quality strategic report is key to providing users of general-purpose financial reports with a holistic and meaningful picture of the company's business model, strategy, development, performance, position and future prospects. The FRC considered both the Management Commentary Practice Statement and the Integrated Reporting Framework when developing the Strategic Report Guidance, which sets out high-level principles for reporting and serves as a best practice statement, and there is broad consistency between them. We therefore see benefit in utilising both documents for the project on integration in reporting.

The FRC strongly recommends that the integration in reporting project is advanced as part of the ongoing project on Management Commentary. We also believe that the principles and content requirements in the Integrated Reporting Framework should be incorporated, where appropriate, into the Management Commentary Practice Statement. We provide detailed comments on this matter in our response to Question 7.

Conceptual Framework

The FRC strongly recommends that the ISSB considers a joint project with the IASB to review and update, the IFRS Conceptual Framework for Financial Reporting to ensure it is applicable to sustainability-related financial reporting and embeds the concept of 'integrated thinking'. We provide detailed comments on this matter in our response to Question 1.

The Basis for Conclusions for the IFRS S1 Exposure Draft stated that the IFRS Foundation does not have a separate conceptual framework that applies directly to sustainability-related disclosure. Additionally, paragraph C2 of the IFRS S1 Exposure Draft stated that sustainability-related financial information is part of general-purpose financial reporting and therefore subject to the same qualitative characteristics that are described in the IFRS Conceptual Framework. Therefore, it is unclear whether the IFRS Conceptual Framework is applicable to sustainability-related disclosures.

The importance of a conceptual framework was also noted by IOSCO in its report on sustainability-related issuer disclosure 1. In this report, IOSCO called for a clear link between sustainability-related reporting and financial reporting underpinned by an integrated conceptual framework. As noted by IOSCO, this integrated conceptual framework will enable more coherence and internal consistency between sustainability-related financial disclosures and financial statements.

The ISSB would also benefit from a conceptual framework before developing further standards. Whilst a conceptual framework will support the application of the standards, it will also support the ISSB in setting standards. To ensure consistent principles are applied in its standard setting activities, the ISSB should prioritise the development, or clear communication, of its conceptual framework. At the very least, the ISSB should effectively communicate the relationship between the existing IFRS Conceptual Framework and the IFRS Sustainability Disclosure Standards. This work should be part of wider communication of the architecture of the IFRS Sustainability Disclosure Standards.

Architecture of the IFRS Sustainability Disclosure Standards

In our letter to the ISSB about the prototypes published in 2021 by the Technical Readiness Working Group (TRWG), the FRC commented on the need for clear communication of the architecture of the standards. One of the deliverables of the TRWG's Programme of Work was entitled 'Architecture of Standards'. We note that since the completion of the work of the TRWG, there has been no further public discussion about the architecture of the standards. The FRC continues to be of the view that the ISSB should provide the architecture of the standards to inform stakeholders, as a matter of priority. It is more challenging to comment on the ISSB's future work plan when it is unclear how the ISSB's proposed agenda items fit together with IFRS S1 and IFRS S2 to form a coherent set of disclosure requirements.

The FRC has some fundamental questions about the ISSB's existing, planned and proposed work plan and how it is all intended to fit together within the architecture of the standards, including: - if the ISSB were to pursue research and standard-setting activities on biodiversity, human capital or human rights, how would these standards be expected to be applied in relation to the requirements in IFRS S1 and IFRS S2, including any targeted enhancements to IFRS S2? - will all future standards follow the structure of the TCFD (governance, strategy, risk management, metrics and targets), and how will this work with the proposed work on integration in reporting? - how will companies be expected to apply all of the standards and application guidance together, including the industry-based requirements?

Without clear communication of how the ISSB envisions the architecture of the standards, there is a risk that any future project that is not consistent with this architecture will create more confusion and lead to disjointed disclosure. We provide further comments on this matter in our response to Question 8.

Continued implementation support for the application of IFRS S1 and IFRS S2

The success of the IFRS Sustainability Disclosure Standards relies upon the widespread adoption of the requirements. The FRC commends the ISSB for publishing the first two standards at pace and welcomed the announcement at COP27 about the capacity building and implementation support. In particular, IFRS S1 should provide a comprehensive foundational standard which future standards can build upon and supplement. Therefore, the FRC welcomes the ISSB's plans to support the implementation of the IFRS Sustainability Disclosure Standards, including helping stakeholders obtain a common understanding of the standards, and enable the delivery of the comprehensive global baseline of sustainability-related disclosures. We note the recent discussions with the Sustainability Standards Advisory Forum, which recognised that this would consume the majority of the resources available to the ISSB, which would for the medium term at least, limit the amount of standard setting and other activity. This needs to be better and more clearly articulated by the ISSB.

The ISSB should continue to work with other standard setters, including jurisdictional standard setters, to promote the IFRS Sustainability Disclosure Standards as the global baseline and to ensure the interoperability of the requirements. The ISSB should carefully consider how it will work with jurisdictions to avoid developing diverging disclosure requirements that add to an already complex reporting landscape both for companies and the users of annual reports and accounts. Where companies need to comply with multiple divergent jurisdictional requirements, this will drive ever more complex and costly reporting. The challenge for these companies will be to communicate a clear narrative in their disclosures that is compliant with all the requirements in addition to being consistent, comparable and understandable.

Concluding remarks

The FRC understands that responses to this RFI will inform the ISSB's two-year agenda which already includes existing and planned projects beyond those that are subject to this RFI. The ISSB should consider clarifying the status of the existing, planned and proposed projects by using steps similar to the IASB's standard-setting process to describe whether the projects are research, standard-setting or maintenance projects.

The FRC recognises that the ISSB is likely to continue to work at pace. However, the ISSB must consider the effective use of its time to ensure the success of both its current and future sustainability-related standards. This means that the ISSB must endeavour to build a strong framework for future work which includes: - significant ongoing support for the global implementation of IFRS S1 and IFRS S2; - the development of a conceptual framework; - clarity over the expected architecture of the standards; and, - a joint project with the IASB on the integration in reporting as part of the Management Commentary project.

We welcome the opportunity to continue to work with the Board in developing its agenda. If it would be helpful to discuss any of our comments in more detail, please contact Sarah-Jayne Dominic ([email protected]).

Mark Babington Executive Director, Regulatory Standards Direct telephone line: 020 7492 2323 Email: [email protected]

Appendix A

Question 1—Strategic direction and balance of the ISSB's activities

** (c) Should any other activities be included within the scope of the ISSB's work? If so, please describe these activities and explain why they are necessary. **

The FRC strongly recommends that the ISSB pursues a joint project with the IASB to review, and potentially update, the IFRS Conceptual Framework.

It is unclear whether IFRS S1 is intended to be a conceptual framework or if the IFRS Conceptual Framework is applicable to sustainability-related disclosure. The Basis for Conclusions for the IFRS S1 Exposure Draft stated that the IFRS Foundation does not have a separate conceptual framework that applies directly to sustainability-related disclosure (paragraph BC60). Additionally, Appendix C of the IFRS S1 Exposure Draft outlined the qualitative characteristics of useful sustainability-related financial information, using concepts derived from the IFRS Conceptual Framework. As stated in paragraph C2 of the IFRS S1 Exposure Draft, sustainability-related financial information is part of general-purpose financial reporting and therefore is subject to the same qualitative characteristics that are described in the IFRS Conceptual Framework. The content in Appendix C of the IFRS S1 Exposure Draft then goes on to explain how those concepts relate to sustainability-related financial information.

It is therefore implied that the IFRS Conceptual Framework is applicable to sustainability-related disclosure. However, it is important to note that there are significant differences between narrative reporting, which includes sustainability-related reporting, and financial reporting. For example, narrative reporting is often prepared using different processes and internal controls as used for financial reporting, especially given that it has a longer-term and forward-looking focus, and therefore has greater uncertainty. As such, the FRC recommends that the ISSB commences a joint project with the IASB to review the IFRS Conceptual Framework, and if necessary, to make changes to reflect sustainability-related reporting matters. The ISSB has already initiated this work in Appendix C of IFRS S1 Exposure Draft which can be used as a starting point for a larger project to update the IFRS Conceptual Framework.

This approach would be consistent with comments made by IOSCO during the formation of the ISSB. At that time, IOSCO published its report on sustainability-related issuer disclosure which outlined its support and vision for the ISSB. In this report, IOSCO called for a clear link between sustainability-related reporting and financial reporting underpinned by an integrated conceptual framework. On page 35 of this paper, IOSCO noted that "[o]ne of the important benefits of a solution under the IFRS Foundation is to bring financial and sustainability reporting closer together. An integrated conceptual framework to connect financial and sustainability reporting would help address many of the issues identified in our factfinding exercise. It could support investor demand for more coherence and internal consistency between sustainability-related financial disclosures and companies' financial statements. In addition, a structured and systematic reporting standard integrated with financial reporting will make it easier for auditors to challenge issuers on the links between sustainability disclosures and their financial accounts." 1

As part of this proposed joint project, the FRC also recommends that the ISSB and IASB consider the concept of 'integrated thinking' which underpins the Integrated Reporting Framework. We provide further comment on the Integrated Reporting Framework in our response to Question 7. However, the FRC strongly recommends that the ISSB considers working with the IASB on updating the IFRS Conceptual Framework to embed 'integrated thinking' as a core concept that will inform and underpin much of the ISSB's future work.

If a joint project with the IASB is not possible, then the ISSB should effectively communicate the relationship between the IFRS Conceptual Framework and the IFRS Sustainability Disclosure Standards, including whether the ISSB considers IFRS S1 as a conceptual framework for sustainability-related disclosure.

Question 2—Criteria for assessing sustainability reporting matters that could be added to the ISSB's work plan

** (a) Do you think the ISSB has identified the appropriate criteria? **

The FRC agrees with the seven criteria for assessing sustainability-related reporting matters that could be added to the ISSB's work plan. These criteria are mostly appropriate and should enable the ISSB to focus the work plan on the most critical projects. The FRC also agrees and thinks that it is appropriate that the criteria used by the ISSB is consistent with the criteria used by the IASB.

The FRC also agrees with the statement made in paragraph 25 of the RFI that the application of this criteria will require judgement, and the relative importance of each criterion will vary depending on the circumstances surrounding the potential project. This approach will provide a sufficient level of flexibility for the ISSB to consider potential projects.

However, it is unclear how criteria 2, which looks at any deficiencies in disclosure, will be assessed. Will the ISSB only use stakeholder feedback, or will there be a comprehensive review of sustainability reporting to uncover the different reasons why there might be deficiency in reporting? Sustainability-related reporting is less mature and the reasons why there are deficiencies in reporting may go beyond the lack of standardisation.

** (b) Should the ISSB consider any other criteria? If so what criteria and why? **

When applying the criteria, the ISSB may also consider the diversity in practice which is not necessarily the same as deficiencies in disclosure. For example, if companies are consistently reporting on topics using other frameworks, then the ISSB may consider whether it would be more appropriate and necessary to focus efforts on topics where there is more diversity in practice, and therefore more inconsistency in disclosure.

When identifying matters, and before applying the criteria, the ISSB should consider existing reporting requirements. For many years, the market has criticised the "alphabet soup” of sustainability reporting initiatives that have resulted in a plethora of voluntary and mandatory reporting requirements. The IFRS Foundation has sought to consolidate some of these requirements through the acquisition of CDSB, IIRC and SASB. However, the reporting landscape is vast, with thousands of mandatory and voluntary sustainability-related disclosure requirements 2. The ISSB should work with other standard setters—including GRI and EFRAG—to continue to seek consolidation of existing requirements, when appropriate, in order to streamline the reporting landscape. The ISSB should avoid adding more requirements to this reporting landscape when such requirements would add to the complexity and burden for companies. Therefore, when identifying potential projects the ISSB could consider the existing reporting requirements, including the maturity of these requirements, and whether to build upon these requirements rather than creating new requirements.

Question 3—New research and standard-setting projects that could be added to the ISSB's work plan

** (a) Taking into account the ISSB's limited capacity for new projects in its new two-year work plan, should the ISSB prioritise a single project in a concentrated effort to make significant progress on that, or should the ISSB work on more than one project and make more incremental progress on each of them? **

- If a single project, which one should be prioritised? You may select from the four proposed projects in Appendix A or suggest another project.

- If more than one project, which projects should be prioritised and what is the relative level of priority from highest to lowest priority? You may select from the four proposed projects in Appendix A or suggest another project (or projects).

The FRC does not intend to comment on whether the ISSB should prioritise a single or multiple projects in its two-year work plan. However, the ISSB should consider whether a post-implementation review of IFRS S1 and IFRS S2 would be included in this work plan. As jurisdictions begin planning and enacting their process for adoption of the IFRS S1 and IFRS S2 standards, stakeholders would benefit from understanding when the ISSB intends to conduct this review and hear about its findings. It is likely that this two-year plan will not include a post-implementation review, but it would be helpful to have a clear understanding of when the ISSB plans to add it to its work plan.

Additionally, the ISSB would benefit from clearer communication about whether the two-year work plan will result in new standards. It is the FRC's understanding that the proposed projects in this RFI represent research projects, and it is unlikely that any new IFRS Sustainability Disclosure Standards will be developed as part of the two-year work plan.

Question 7—New research and standard-setting projects that could be added to the ISSB's work plan: Integration in reporting

** (a) The integration in reporting project could be intensive on the ISSB's resources. While this means it could hinder the pace at which the topical development standards are developed, it could also help realise the full value of the IFRS Foundation's suite of materials. How would you prioritise advancing the integration in reporting project in relation to the three sustainability-related topics (proposed projects on biodiversity, ecosystems and ecosystem services; human capital; and human rights) as part of the ISSB's new two-year work plan? **

The FRC believes that the integration in reporting project is equally as important as the other proposed topics as it will influence the way in which new topic standards will be reported.

** (b) In light of the coordination efforts required, if you think the integration in reporting project should be considered a priority, do you think that it should be advanced as a formal joint project with the IASB, or pursued as an ISSB project (which could still draw on input from the IASB as needed without being a formal joint project)? **

- If you prefer a formal joint project, please explain how you think this should be conducted and why.

- If you prefer an ISSB project, please explain how you think this should be conducted and why.

The FRC strongly recommends that the integration in reporting project is undertaken as a joint project with the IASB. As this proposed project could lead to a corporate reporting framework that integrates both financial and sustainability-related information into one or more documents, it is imperative that the IASB is involved as part of a formal joint project.

If the intention of this proposed project on the integration in reporting is to build on the concept of 'connectivity' between financial and sustainability-related information, and to develop a more cohesive and efficient approach to corporate reporting to improve the quality of information, then a joint project is essential. The ISSB has sought to distinguish the concepts of 'integration' and 'connectivity' which is helpful as it separates the process of connecting related information from the more complex concept of integration. The FRC agrees that 'connectivity' is already being addressed through the existing requirements in both Exposure Drafts for IFRS S1 and IFRS S2, in addition to the current IASB project on climate change in the financial statements. However, the proposed project on 'integration of reporting' must address both concepts as they cannot be completely disentangled. 'Connectivity of information' is a guiding principle of the Integrated Reporting Framework which states that integrated reporting "should show a holistic picture of the combination, interrelatedness and dependencies between the factors that affect the organisation's ability to create value over time.” 'Connectivity' is therefore crucial to integration of reporting and should include connections not only between sustainability-related information and information in the financial statement, but it should also address connectivity across narrative reporting. Therefore, it would be highly beneficial for the ISSB to work with the IASB to enhance the Management Commentary Practice Statement to enable the integration of information to address connectivity between sustainability-related information, financial information and broader narrative reporting.

The ISSB also notes in this RFI that a joint project could result in complexities due to the fact that the IFRS Sustainability Disclosure Standards are purposefully designed to be GAAP-agnostic. For example, a company that does not apply the IFRS Accounting Standards may apply the IFRS Sustainability Disclosure Standards. Conversely, a company that does apply the IFRS Accounting Standards may not apply the IFRS Sustainability Disclosure Standards. This concern should not hinder the ISSB from pursuing a joint project on the integration of reporting. The FRC recognises that the Management Commentary Practice Statement is not only helpful for companies that report using IFRS accounting standards, but for all companies that prepare annual accounts. In the FRC response to the ED Management Commentary Practice Statement, we noted that "...the [Management Commentary] Practice Statement will provide high quality guidance for management commentary reporting that does not rely on the use of IFRS concepts of recognition, measurement, presentation or disclosure. As such it can be decoupled from the basis of preparation used for the financial statements." The FRC reiterates its belief that companies should be able to use the Management Commentary Practice Statement to prepare narrative reporting even if these companies do not prepare financial statements in accordance with IFRS. Therefore, the ISSB should not allow this concern to hinder it from pursuing a joint project with the IASB.

** (c) In pursuing the project on integration in reporting, do you think the ISSB should build on and incorporate concepts from: **

- the IASB's Exposure Draft Management Commentary? If you agree, please describe any particular concepts that you think the ISSB should incorporate in its work. If you disagree, please explain why.

- the Integrated Reporting Framework? If you agree, please describe any particular concepts that you think the ISSB should incorporate in its work. If you disagree, please explain why.

- other sources? If you agree, please describe the source(s) and any particular concepts that you think the ISSB should incorporate in its work.

The FRC strongly recommends that the integration in reporting project is pursued as part of the ongoing project on Management Commentary, which should be advanced as a joint IASB-ISSB project. We believe that the requirements in the Management Commentary Practice Statement have an important role to play in bringing together financial and non-financial information and can provide the overarching framework for narrative reporting within which key sustainability-related matters should be reported.

The UK already has extensive experience in the integration of reporting. Many UK companies – including both companies that report using IFRS accounting standards and those that do not – are required to prepare a strategic report in accordance with the Companies Act 2006, which includes requirements relating to sustainability-related and climate-related reporting. The FRC believes that encouraging companies to prepare a high quality strategic report is key to providing users of general purpose financial reports with a holistic and meaningful picture of the companies' business model, strategy, development, performance, position and future prospects. The FRC considered both the Management Commentary Practice Statement and the Integrated Reporting Framework when developing the Strategic Report Guidance, which sets out high-level principles for reporting and serves as a best practice statement, and there is broad consistency between them. Therefore, the FRC strongly believes that there is value in utilising both documents in this project.

In October 2020, the FRC published a thought leadership paper on the Future of Corporate Reporting which attempted to provide an alternative view of corporate reporting to making the system more effective and engaging for all those with an interest in a company. In this paper, the FRC proposed a network of interconnected reports to unbundle existing reporting. This network of reports would be centred around a stakeholder-neutral Business Report (similar to the Strategic Report) that is then supplemented by additional reports that address separate and specific reporting needs. The FRC consulted on this paper and received several views that both supported and challenged this alternative and conceptual view of corporate reporting. In particular, a number of respondents were critical of the proposed network of reports and noted that, as a concept, it contradicted the principles of integrated reporting. Additionally, respondents had concerns that multiple reports within this network could result in duplication when there would be a need for information to be repeated to enable each standalone report to make sense. The ISSB may benefit from considering the feedback the FRC received, which can be accessed on the FRC website 3, when conducting research about integration in reporting.

In the April 2023 IFRS Advisory Council meeting, the IASB and ISSB staff presented a comparison between the Management Commentary and Integrated Reporting principles and content requirements 4. This document helpfully demonstrates the areas of alignment and outlines where there are differences. The mapping diagram on page 34 compares the content requirements of both Management Commentary Practice Statement and Integrated Reporting Framework. It is clear from this mapping that there is already significant alignment between the two documents which proves that any project on integration in reporting should incorporate concepts and requirements from both documents.

Two areas where there are key differences between the documents are in the content requirements for 'Governance' and 'Basis of Preparation' which are included in the Integrated Reporting Framework but not the Management Commentary Practice Statement. The FRC strongly believe that careful consideration is given as to whether this project, and any future project, includes requirements about governance-related matters. Although we agree that governance is an important aspect of both financial and sustainability-related reporting, we encourage the IFRS Foundation to consider whether governance reporting is within the scope of its remit. Many countries, including in the UK, have their own Corporate Governance Codes and Standards, and there is already significant international alignment though the G20/OECD Principles of Corporate Governance and the ICGN Global Governance Principles. Therefore, the ISSB should carefully consider whether additional requirements on governance-related matters is appropriate or necessary, and whether it would be sufficient for any project to reference and reflect existing jurisdictional requirements on corporate governance rather than create new requirements. It is important to understand how governance-related matters fit within the overall architecture of the standards, but the FRC would not recommend any new reporting requirements are developed that would duplicate existing jurisdictional requirements.

As noted above, the FRC strongly recommends that the integration in reporting project is pursued as part of the ongoing project on Management Commentary. As such, we believe that the principles and content requirements in the Integrated Reporting Framework should be incorporated, where appropriate, into the Management Commentary Practice Statement. Additionally, the FRC recommends that the concepts on which integrated reporting was developed should be considered in the context of a conceptual framework. Underpinning the Integrated Reporting Framework is the concept of 'integrated thinking' which is fundamental for the objective of connectivity and integration. As such, the FRC recommends that the ISSB, in collaboration with the IASB, considers how the concept of integrated thinking is embedded into the IFRS Conceptual Framework. For example, the IFRS Conceptual Framework may benefit from additional content about how corporate disclosure—including both financial and sustainability-related information—reflects a company's decision-making that may affect the creation, preservation or erosion of value over the short, medium and long term. See our response to Question 1 for further suggestions for an integrated conceptual framework.

** (d) Do you have any other suggestions for the ISSB if it pursues the project? **

When considering the proposed project on the integration in reporting, the ISSB should also consider the content structure of any output. Currently, the Management Commentary Practice Statement and Integrated Reporting Framework are structured in a similar way and have similar content requirements which will enable consistent application. This structure is different to the TCFD-style structure that has been used by the ISSB for IFRS S1 and IFRS S2. In considering the integration of reporting, the ISSB will need to address the inconsistencies in the structure of the component frameworks. In some areas, the content requirements already contained in the Exposure Drafts of IFRS S1 and IFRS S2 are aligned to the requirements in the Management Commentary Practice Statement and Integrated Reporting Framework. However, to support the integration of reporting that will lead to cohesive and efficient corporate reporting, the ISSB will need to address the areas that are not currently aligned, including the content structure.

Question 8—Other comments

** (a) Do you have any other comments on the ISSB's activities and work plan? **

The FRC welcomes plans for targeted enhancements of IFRS S2. Climate change is a unique and complex challenge which is also intrinsically linked to other sustainability-related matters, including those the ISSB is planning to focus on (i.e., those related to nature and the 'just transition' to a lower-carbon economy). Connectivity of sustainability-related risks and opportunities is already a requirement within IFRS S1, and therefore the FRC welcomes further guidance on how climate-related risks and opportunities are connected to other sustainability-related topics. However, the FRC recommends that the ISSB clarifies what these targeted enhancements are likely to be (i.e., application guidance, implementation guidance or updates to the standard itself), and how these enhancements relate to future standard-setting activities. The ISSB should consider clarifying the status of the existing, planned and proposed projects by using steps similar to the IASB's standard-setting process to describe whether the projects are research, standard-setting or maintenance projects. By providing a clear structure to the work plan, the ISSB will be able to effectively communicate the status of these projects to its stakeholders.

The ISSB should carefully consider how the targeted enhancements to IFRS S2 are linked to future research and standard-setting projects, including those that are subject to this RFI and the enhancements of the SASB Standards. For example, the ISSB should carefully consider how any additional content about biodiversity as part of the targeted enhancement of IFRS S2 will interact with any potential standard-setting project on biodiversity. Additionally, any industry-based aspects of climate-adjacent risks and opportunities should also be aligned with updates to the SASB Standards. The RFI already acknowledges potential synergies with the research on targeted enhancements to IFRS S2 for climate-adjacent risks and opportunities with the proposed topical research and standard-setting projects. However, the market would greatly benefit from explicit and consistent communication about the overall architecture of the existing, planned and proposed work plan, including how the various topical requirements within the various work streams should be applied together.

These concerns about the coherence of the existing, planned and proposed work plan could be resolved if the ISSB effectively communicated the architecture of the standards. This should include information about how IFRS S1 and IFRS S2 are intended to be applied together, including the industry-based materials, in addition to information about how the IFRS Sustainability Disclosure Standards should be applied in accordance with the IFRS Conceptual Framework.

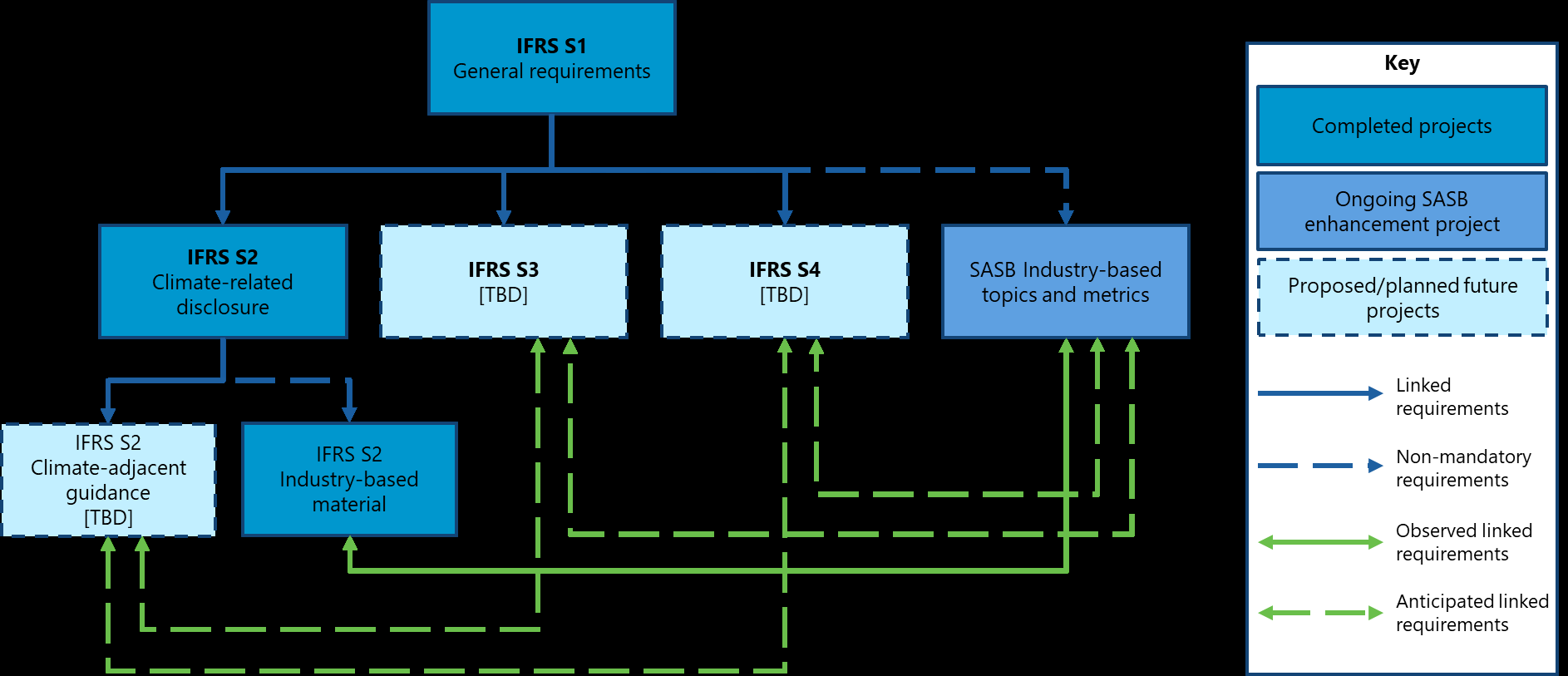

Using existing communications from the ISSB and this RFI, the diagram below demonstrates the observed architecture of the existing, planned and proposed standard-setting work plan. This diagram illustrates some of the complexities that are observed within the current work plan, which will only become more complex and convoluted as the ISSB expands the suite of sustainability-related standards and guidance.

In reviewing UK responses to the Exposure Drafts of IFRS S1 and IFRS S2, the FRC has observed concerns from respondents about the duplication of information and confusion about how IFRS S1 and IFRS S2 should be applied together. Some respondents noted that where there are requirements that are duplicative between IFRS S1 and IFRS S2, this could result in unnecessary reporting that is fragmented and confusing. Taking heed of these concerns, the ISSB should avoid unnecessary duplication of information and clarify how any planned or proposed project interacts with other projects, including current projects that have already been started by the ISSB.

Without clear communication of how the ISSB envisions the architecture of the standards, including how they should be applied together, there is a risk that any future project that is not consistent with this architecture will create more confusion and lead to disjointed disclosure. Additionally, national standard setters and preparers would greatly benefit from improved communication about the objective and intended outcome of the ISSB's work, which will enable sufficient investment into developing the capabilities needed to implement the standards. For example, a company may spend significant resources on developing the processes to apply IFRS S1 and address all sustainability-related matters only to have to spend further resource to amend these processes once further IFRS Sustainability Disclosure Standards are published. With a better understanding of what the ISSB envisages, national standard setters and companies can ensure appropriate planning and resource allocation.

Therefore, the FRC strongly recommends that the ISSB provides clarity on how it envisions the architecture of the standards and guidance. This could form part of a conceptual framework which we provided comments on in our response to Question 1.

Footnotes

Legal and Contact Information

8th Floor, 125 London Wall, London EC2Y 5AS | T: +44 (0)20 7492 2300 | [email protected] | www.frc.org.uk

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered office: as above. Please see our privacy page at https://www.frc.org.uk/about-the-frc/procedures-and-policies/privacy-the-frc if you would like to know more about how the FRC processes personal data or if you would like to stop receiving FRC news, events, outreach or research related communications.

-

The IOSCO Report on Sustainability-related Issuer Disclosures is available at https://www.iosco.org/library/pubdocs/pdf/IOSCOPD678.pdf ↩↩

-

The Carrots & Sticks database which catalogues global sustainability reporting instruments includes over 1000 mandatory reporting requirements and 1300 voluntary reporting requirements as of May 2023 and is available at https://www.carrotsandsticks.net/reporting-instruments/? ↩

-

Information about the FRC Future of Corporate Reporting Project is available at https://www.frc.org.uk/getattachment/dd02e72e-fac2-4c4d-a80a-988be58e54e4/Feedback-Statement-A-Matter-of-Principles-The-Future-of-Corporate-Reporting-2021.pdf ↩

-

The Staff Paper AP8: Connectivity in financial reporting is available at https://www.ifrs.org/content/dam/ifrs/meetings/2023/april/ac/ap08-management-commentary-and-integrated-reporting.pdf ↩