The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TCFD disclosures and climate in the financial statements

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from an action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

- Executive Summary

- Background to this thematic review

- (1) Granularity and specificity

- (2) Balance

- (3) Interlinkage with other narrative disclosures

- (4) Materiality

- (5) Connectivity between TCFD and financial statements disclosures

- Summary of key findings – TCFD disclosures

- Summary of key findings – financial statements disclosures (Section 8)

- How to use this thematic report

- Notes on sample selection

- 1. Introduction

- 2. Statement of the extent of consistency with the TCFD framework

- Footnotes

- Listing Rules requirement – statement of the extent of consistency with the TCFD framework

- Listing Rules requirement – location of disclosures

- Location of TCFD disclosures

- Signposting of disclosures outside the annual report

- Reasons for providing TCFD disclosures outside the annual report

- Materiality assessment

- Extent of compliance with TCFD recommendations and recommended disclosures

- TCFD overview

- 2. Statement of the extent of consistency with the TCFD framework

- Listing Rules requirement – statement of the extent of consistency with the TCFD framework

- Listing Rules requirement – location of disclosures

- Location of TCFD disclosures

- Signposting of disclosures outside the annual report

- Reasons for providing TCFD disclosures outside the annual report

- Materiality assessment

- Extent of compliance with TCFD recommendations and recommended disclosures

- TCFD overview

- 3. TCFD – governance

- 4. TCFD – strategy

- 5. TCFD – risk management

- 6. TCFD – metrics and targets

- TCFD recommendation:

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- 6. TCFD – metrics and targets (continued)

- Net zero

- Our path to Net Zero

- Stewardship of net zero

- Other reporting / disclosure frameworks and industry groups

- 7. TCFD – sector-specific and other guidance

- 8. Climate change in the financial statements

- 8. Climate change in the financial statements (continued)

- 8. Climate change in the financial statements (continued)

- Appendices

- Appendix 1 – Scope

- Appendix 2 - Detailed FRC expectations

Executive Summary

Background to this thematic review

Companies' responses to the risks and opportunities posed by climate change and the transition to a low carbon economy are at the forefront of the minds of investors, regulators and other users of corporate reporting. Comprehensive, high-quality and internally consistent climate-related disclosures lead to greater transparency about companies' responses to these challenges which, in turn, helps investors to make more informed investment decisions. In response to these considerations, the Financial Conduct Authority (FCA) introduced specific TCFD climate-related disclosure requirements for listed companies 1, with the first reports issued by premium listed companies in relation to December 2021 year ends.

In accordance with the supervisory strategy agreed with the FCA and set out in Primary Market Bulletin 36, we have carried out a review, supported by the FCA, of both the TCFD disclosures and of climate-related reporting in the financial statements of 25 premium listed companies. This thematic report sets out the results of our review. The FCA have also published a separate report setting out the results of their preliminary review of premium listed companies' TCFD disclosures, which includes an analysis of companies' TCFD disclosures by sector and company size.

A significant step forwards for UK-listed companies' climate change reporting....

The first year of mandatory TCFD disclosures has been challenging for many preparers due to the complexities of data collection, the need to establish robust new processes, sometimes involving information provided by third parties in the company's value chain, and the lack of established good reporting practice. We found that the companies included in our review – which was focussed on larger premium listed companies in sectors that are more exposed to climate change – have generally risen to the challenge, and were broadly able to provide the TCFD disclosures that are 'particularly expected' by the FCA's Listing Rule. 22 of 25 companies also made reference to climate-related risks in their financial statements disclosures, a significant improvement since our 2020 thematic review.

As a result, the December 2021 annual reports and accounts of many of our sample of UK premium listed companies provide a better basis for users of annual reports and accounts to make decisions about risks and opportunities related to climate change, responding to the needs of investors. We have provided examples of better practice disclosures throughout this report, and encourage companies, especially those at an earlier stage in their climate-related reporting journey, to use these as reference points when preparing their own disclosures.

...but companies need to continue to develop their narrative and financial statements disclosures

There is, however, a range of maturity in companies' disclosures, even within our sample which was weighted towards companies who were better prepared for the reporting requirement. Below, we set out five main ways in which companies could significantly improve their TCFD disclosures and financial statements reporting in relation to climate change. We encourage all entities preparing TCFD disclosures under the Listing Rules and/or TCFD-aligned disclosures under the new Companies Act regulations to refer to these broad themes, as well as our more detailed expectations throughout the report, which are also summarised in Appendix 2.

(1) Granularity and specificity

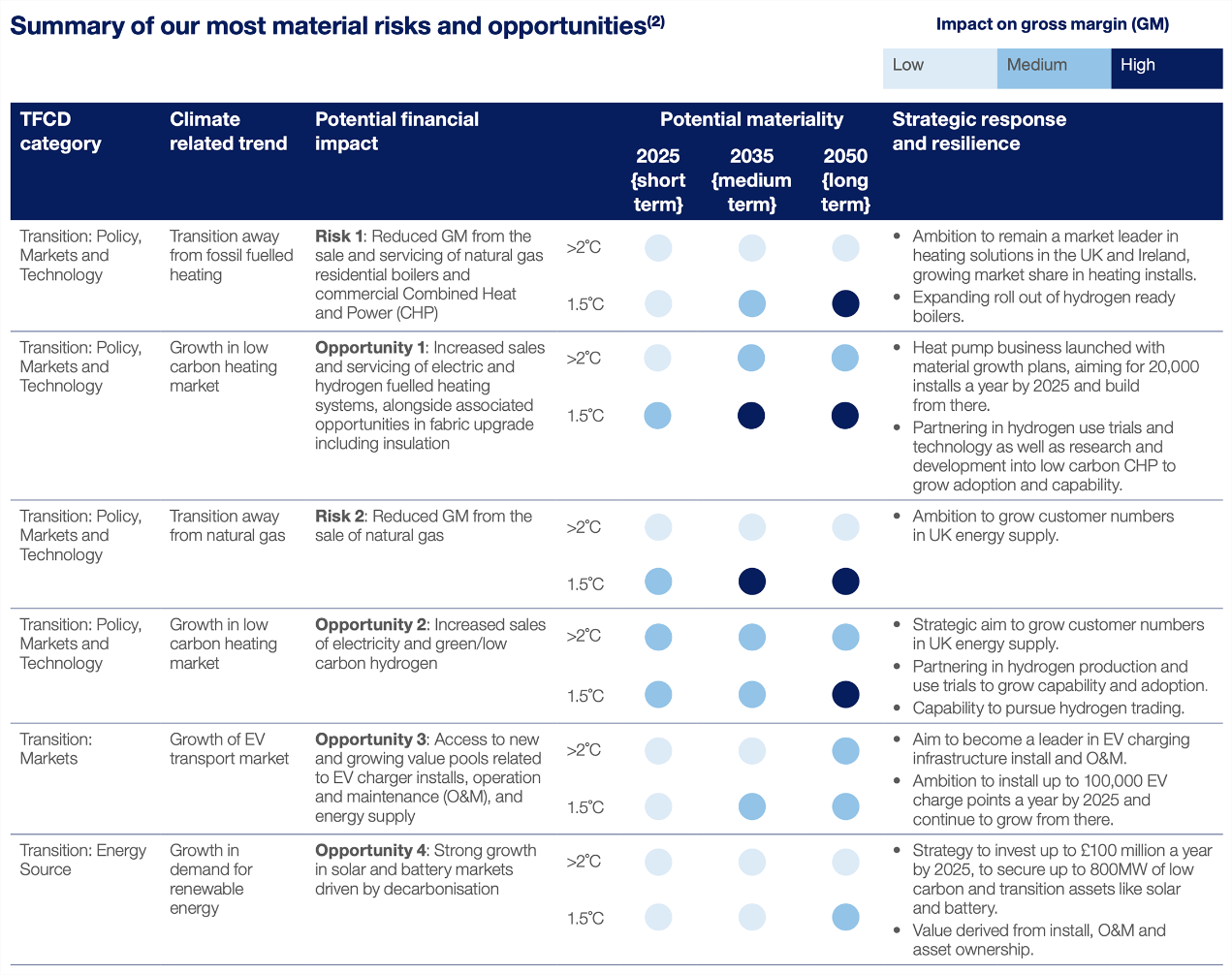

Some companies provided high-level, generic information about climate change which did not appear to adequately explain the potential impact on different businesses, sectors and geographies. We expect the specificity and granularity of companies' climate-related disclosures to improve as their processes to manage climate-related risks and opportunities become more fully embedded into governance and management structures; we also expect the link with financial planning to become clearer and more quantified.

(2) Balance

Some companies discussed opportunities arising from climate change and the transition to a low carbon economy without specifying the expected size of the opportunity relative to existing, more carbon-intensive, businesses, and without identifying dependencies on new technology. We expect companies to ensure that the discussion of climate-related risks and opportunities is balanced, and to consider linking the description of climate-related opportunities to any technological dependencies.

(3) Interlinkage with other narrative disclosures

We saw examples of TCFD disclosures which were not well integrated with other elements of companies' narrative reporting. We expect companies to consider the interlinkages of TCFD disclosures with other narrative disclosures in the annual report. For example, they may need to consider the output of climate-related scenario analysis in discussion elsewhere in the strategic report about the company's business model and strategy, or to explain how climate-related risks have been assessed and prioritised compared to other risks.

(4) Materiality

Most companies in our sample included a clear statement of the extent of compliance with the TCFD framework as required by the new Listing Rule. However, companies did not always explain how they had applied materiality to their TCFD disclosures, and many did not make it clear how they had taken into account the TCFD all-sector guidance and supplemental guidance for financial and non-financial companies. In many cases, when a company did not include some elements from this guidance in their disclosures, it was unclear whether they had considered these elements and decided that they were not relevant or material, or whether these elements had been omitted for other reasons such as a lack of robust data. This is reflected in the charts in Sections 3 to 6 of this report, which show that our assessment of the level of companies' compliance with TCFD was consistently lower than that claimed by the companies.

While we do not encourage a 'checklist' approach to the TCFD guidance, we expect companies to clearly articulate how they have considered materiality in the context of their TCFD disclosures when preparing the TCFD 'statement of compliance'.

We may challenge companies that claim consistency with a recommended disclosure where it is not clear that all relevant and material elements of the recommended TCFD disclosures – including the all-sector guidance and, where appropriate, the supplemental guidance for the financial sector and for non-financial groups – have been addressed.

In addition, we may challenge companies if they do not provide disclosures consistent with the recommendations 'particularly expected' by the FCA, for example, in the areas of risk management and the elements of strategy not concerning scenario analysis, without a credible explanation.

(5) Connectivity between TCFD and financial statements disclosures

Some companies' discussion of the impact of climate on the financial statements was generic in nature and hence not very helpful in understanding the relationship between climate-related risks and amounts in the financial statements. This included a few companies who discussed climate change and transition plans extensively in the strategic report. Investor groups have called for greater connectivity between narrative reporting and climate-related assumptions and estimates in financial statements, including an understanding of the extent to which accounting assumptions and estimates are 'Paris-aligned' (see page 92 for a discussion of 'Paris-aligned' accounting).

We expect companies to consider the connectivity between TCFD disclosures and the financial statements, and to provide explanations where necessary, to address whether:

- the degree of emphasis placed on climate change risks and uncertainties in the narrative reporting, including TCFD disclosures, is consistent with the extent of disclosure about how those uncertainties have been reflected in judgements and estimates applied in the financial statements;

- the relationships between assumptions and sensitivities considered in TCFD scenarios, including any Paris-aligned scenarios, and those applied in the financial statements, require further elaboration;

- emissions reduction commitments and strategies described in the narrative have been appropriately reflected in the financial statements;

- the scale of growth of businesses and extent of progress against climate-related opportunities referred to in the narrative reporting is appropriately reflected in the segmental disclosures; and

- discussion of matters which may have an adverse effect on asset values or useful lives in the narrative reporting is consistent with positions taken in the financial statements.

We may challenge companies who disclose significant climate risks or net zero transition plans in narrative reporting, but who do not appear to adequately explain how this has been taken into account when preparing their financial statements.

Our detailed expectations are set out in dark blue boxes throughout Sections 2 to 8 of this report; for ease of reference, our expectations are also shown against the respective Listing Rule and TCFD requirements in Appendix 2.

Summary of key findings – TCFD disclosures

- Governance (Section 3)

- Describe the organization's governance around climate-related risks and opportunities.

- As expected, all companies provided information about the governance of climate-related matters.

- Fewer companies explained how often the board considers climate-related matters, how management reports back to the board, whether climate-related performance objectives have been set, and the effects of climate on major capital expenditure, acquisitions and disposals.

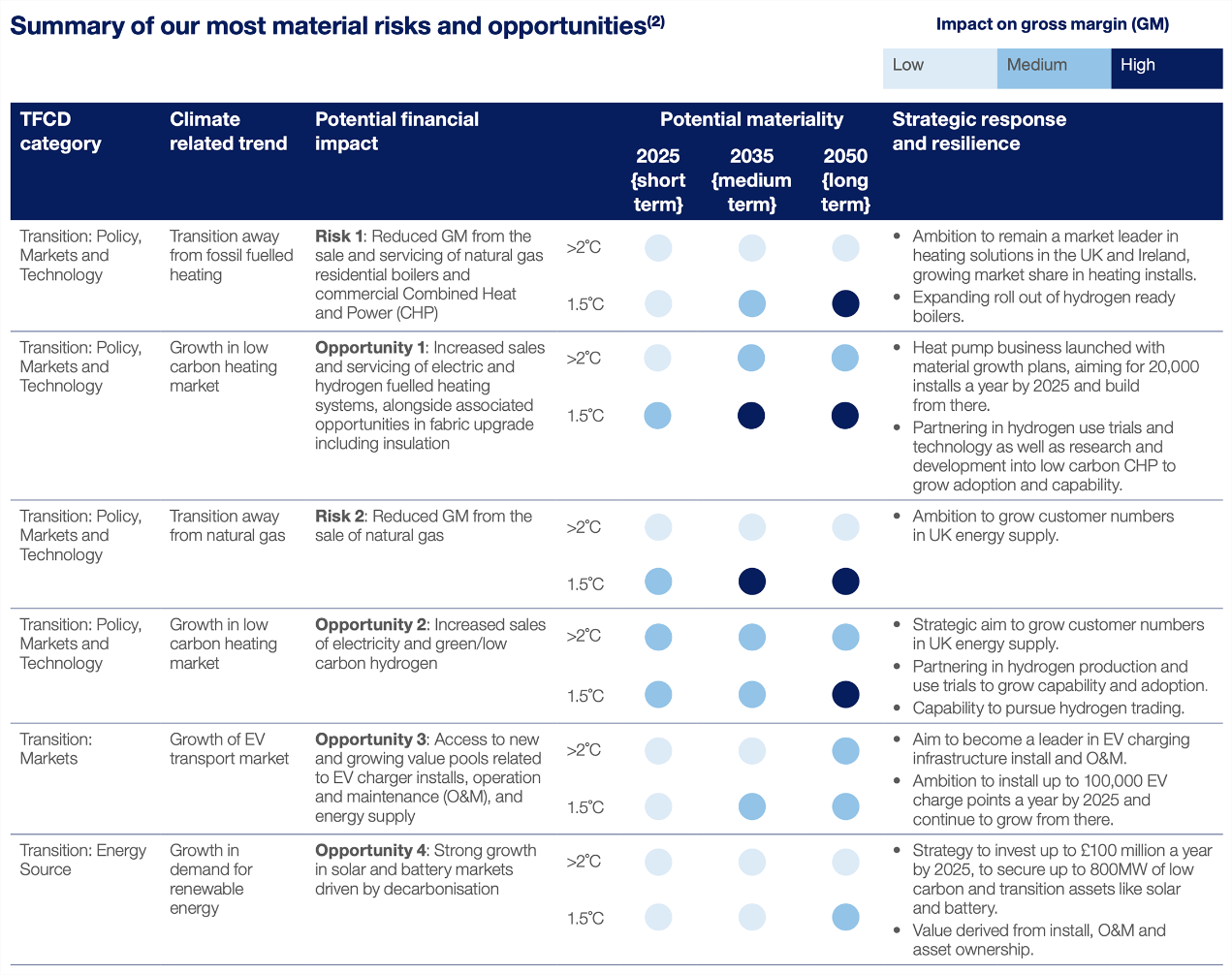

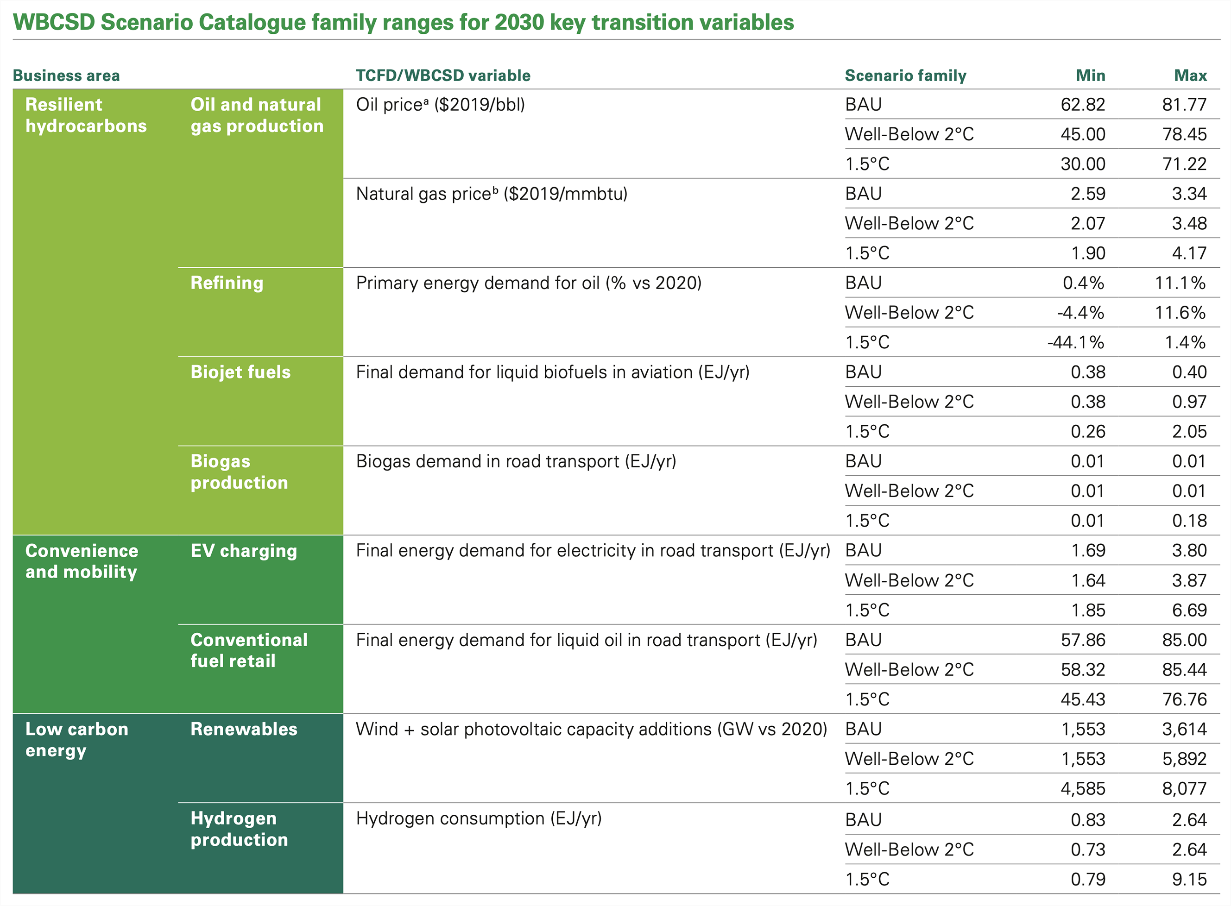

- Strategy (Section 4)

- Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning where such information is material.

- All companies described some climate-related risks and opportunities, but the impact on strategy was not universally well articulated, and granular information linked to businesses or geographies was sometimes missing.

- Some companies' discussion of climate-related risks and opportunities appeared to be unduly focussed on opportunities at the expense of risks.

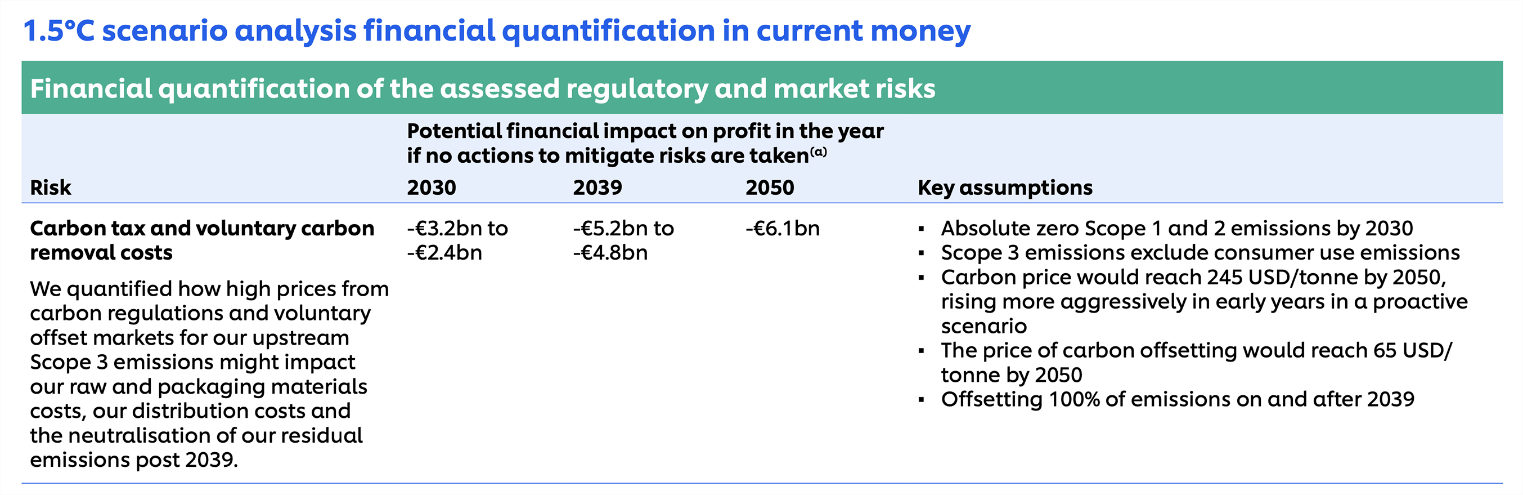

- Most companies undertook a scenario analysis, but the level of detail provided was variable; only a quarter of companies disclosed quantified outcomes.

- It was unclear from most reviews how the scenario analysis had informed financial planning.

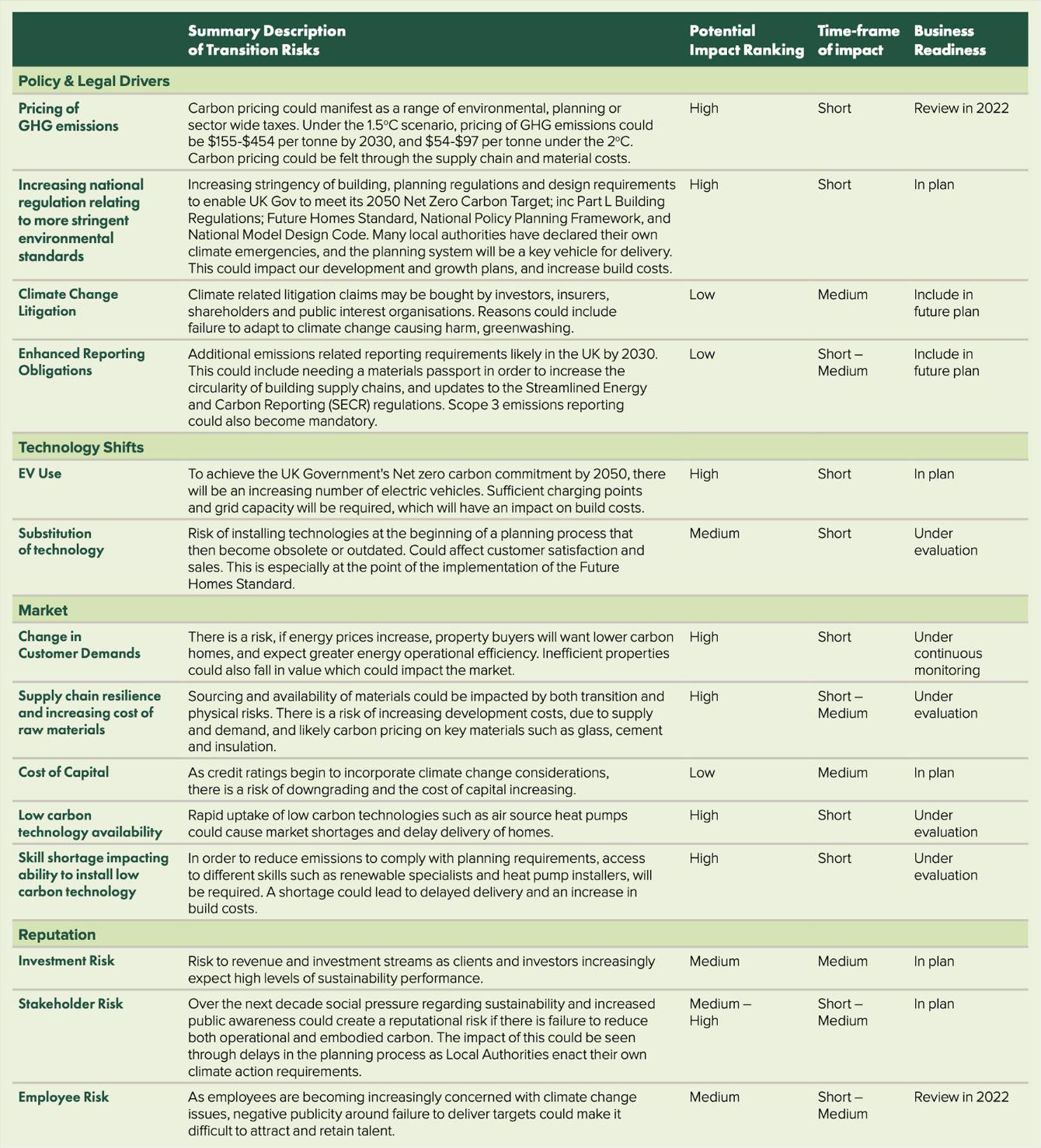

- Risk Management (Section 5)

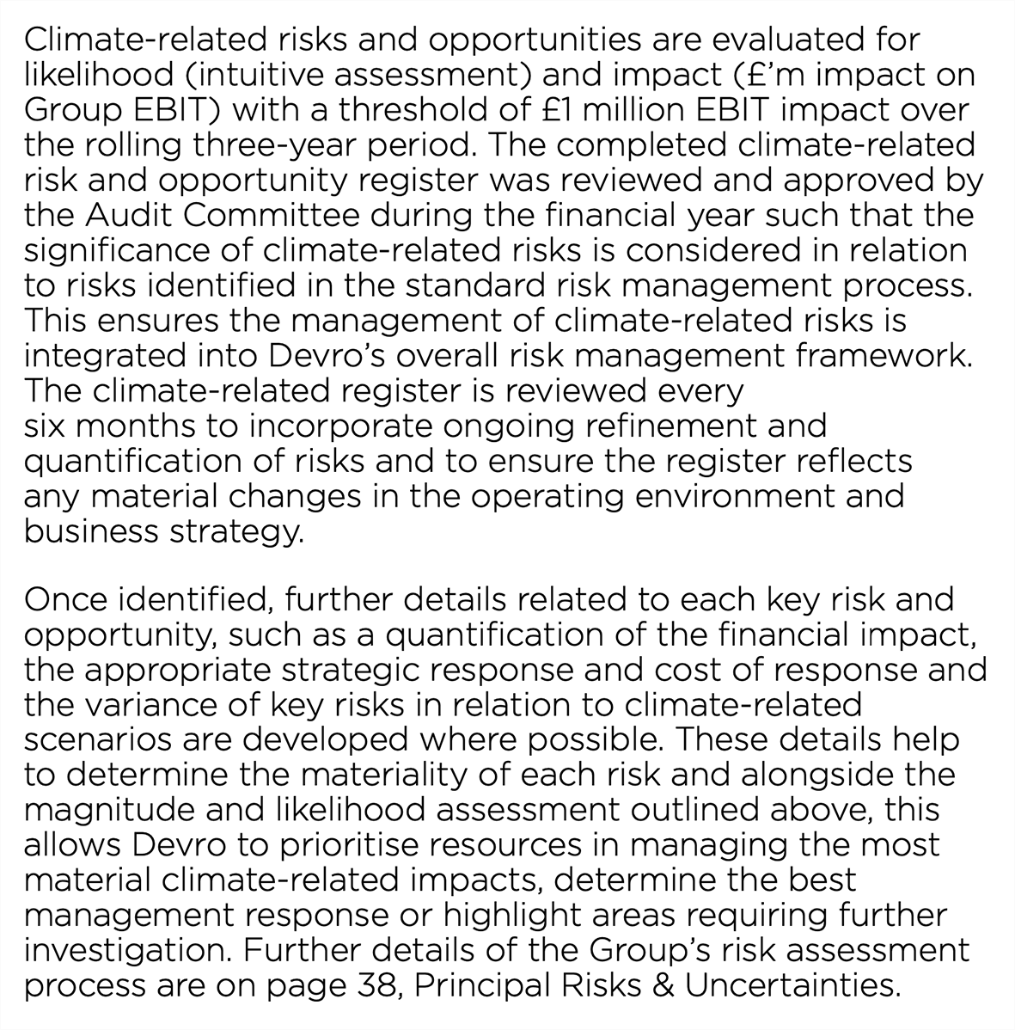

- Disclose how the organization identifies, assesses, and manages climate-related risks.

- Risk management of climate-related matters was integrated into the overall risk management process of most companies, but it was not always clear how climate risks had been prioritised against other risks, and materiality was often not well explained.

- Metrics and Targets (Section 6)

- Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

- Metrics disclosures were focussed on the Scope 1 and 2 emissions which are also required for statutory reporting, with fewer companies reporting Scope 3 emissions or other climate-related risk and opportunity metrics.

- Most companies reported a net zero target, but there was a lack of clarity and consistency in how it was described.

- Historical data and explanations for movements in metrics were not always provided, making it hard to understand how a company is progressing against its targets.

The detailed results of our review of companies' TCFD disclosures and compliance with Listing Rule 9.8.6R(8) / 9.8.7R can be found in Sections 3 to 7.

Summary of key findings – financial statements disclosures (Section 8)

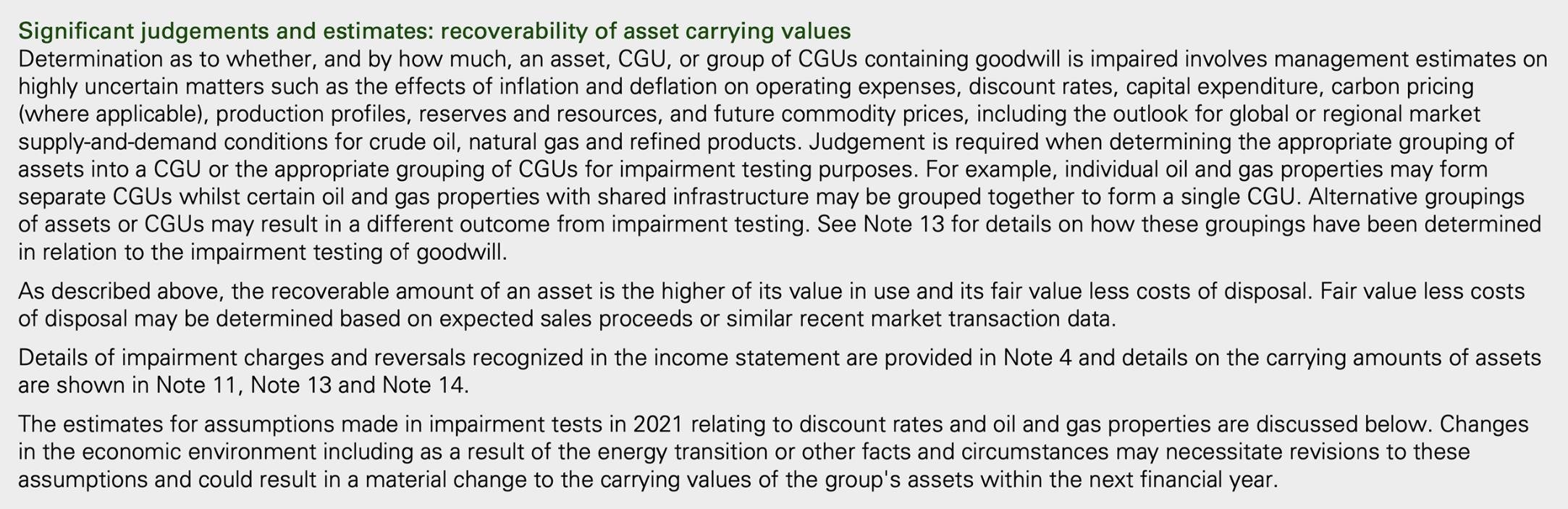

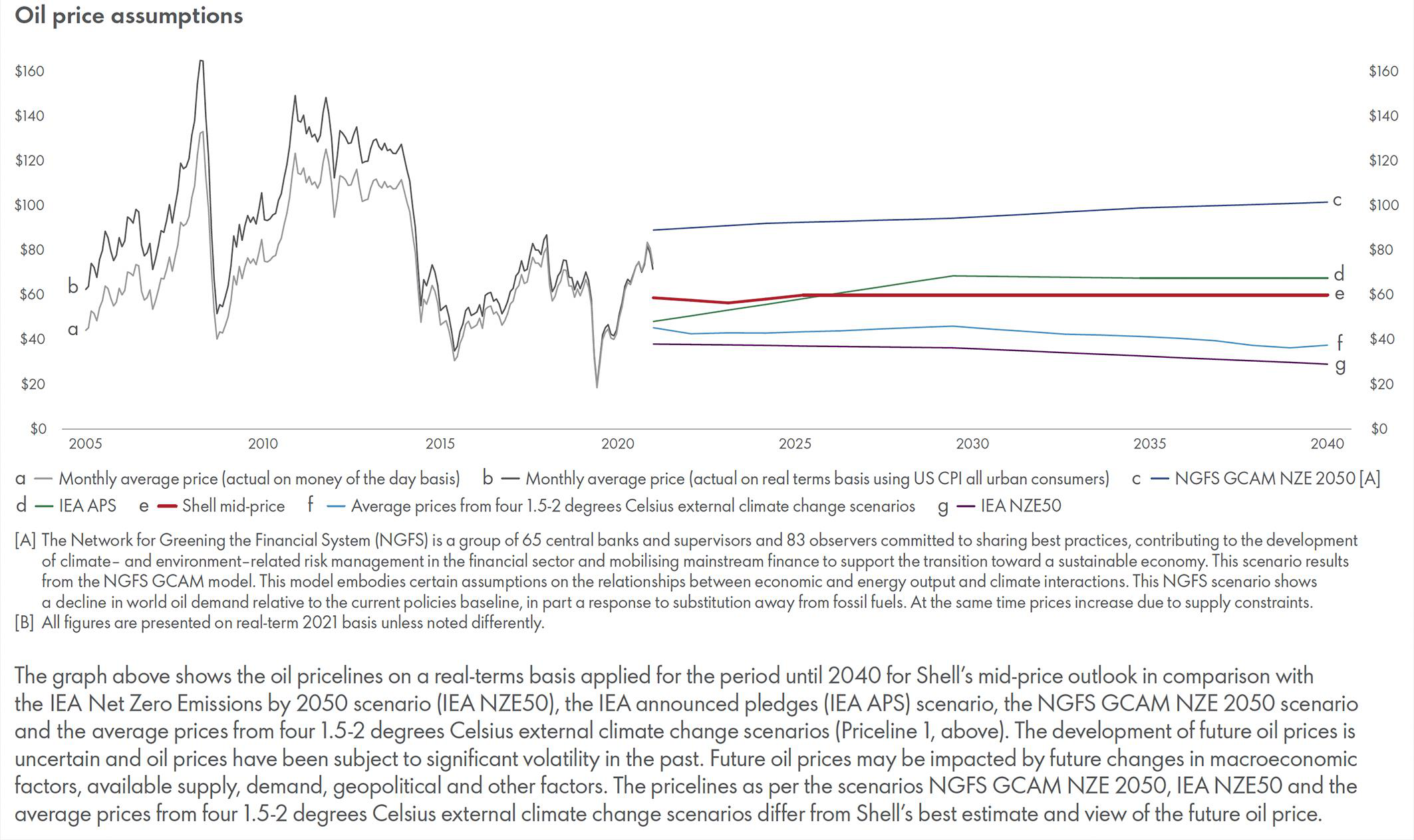

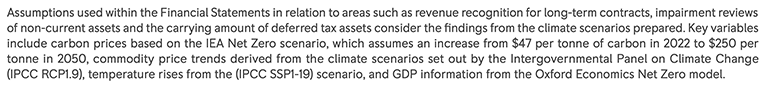

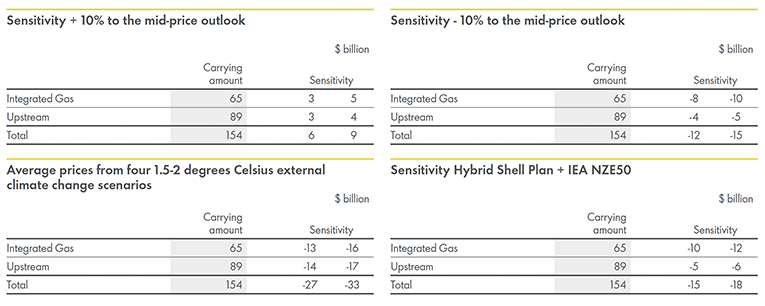

- Judgements and estimates

- A few companies disclosed climate change as a relevant factor for sources of estimation uncertainty with a significant risk of a material adjustment in the next financial year, and for significant judgements.

- In some cases, companies explained why climate was not currently a relevant factor for significant judgements and estimates.

- Some companies presented additional sensitivity disclosures to show the effect of assumptions included in the scenario analysis in TCFD disclosures.

- Impairment reviews

- Several companies clearly addressed climate change in impairment reviews, quantifying significant assumptions such as commodity pricing and carbon pricing, and providing additional climate-related sensitivity analysis.

- Others provided very generic disclosure of how climate had been factored into impairment review calculations and sensitivities.

- A minority of companies did not provide all the disclosures required by IAS 36, which made it difficult to assess how they had considered climate change in their impairment reviews.

- It was not always clear whether climate risk had been factored into cash flow projections or discount rates.

- Useful economic lives of assets

- Several companies clearly explained why the useful economic lives of certain assets were not affected by climate change or the transition to a low carbon economy.

- Other companies, including some that stated their intention to replace or upgrade certain types of asset or production facilities, or that had set specific net zero targets, did not explain how climate change had been taken into account when determining the useful economic lives of related assets.

- Segmental reporting and disaggregated revenue disclosures

- Several companies revised their segmental reporting to reflect changes in the way management information was delivered in response to climate change and transition

- The prominence of other companies' discussion of new low carbon businesses did not appear to be reflected in the segmental disclosures or in disaggregation of revenue disclosures.

- Emerging areas

- A small number of companies recognised emissions right assets or disclosed green finance or sustainability linked finance.

- The extent of explanation of the accounting policies for these items did not always match their prominence in companies' narrative reporting.

The detailed results of our review of companies' financial statements disclosures in respect of climate change can be found in Section 8.

How to use this thematic report

Each section contains relevant requirements in light blue boxes, followed by our observations on the disclosures of the companies in our sample, in the following format:

- Represents good practice

- Represents an opportunity for improvement or enhancement

- ▲ Represents an omission of required disclosure or other issue

We have provided several examples of better practice in our report, highlighted in grey boxes, and encourage companies, especially those at an earlier stage in their climate-related reporting journey, to use these as reference points when preparing their own disclosures.

Dark green boxes contain other information relevant to our thematic report.

Our expectations of companies are included in dark blue boxes in each section, and also summarised in Appendix 2 to this report.

Notes on sample selection

Our sample was weighted towards sectors and industries that are perceived to face greater risks concerning climate change, and towards FTSE 350 companies. It is not, therefore, representative of all listed companies, as the companies in our sample are likely to be further advanced in their TCFD implementation process than the market in general.

This review focussed on the premium listed companies that were required to provide TCFD disclosures for the first time this year. However, our findings will be of interest to other companies for whom climate-related disclosures will be required in future see Section 1 below). Our findings on climate in financial statements are relevant for all companies.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The examples included in this report illustrate better practice in a particular area, and should not be taken as an indication of either the accuracy of the underlying information, which has not been verified by our review, or the quality of the company's reporting more generally.

1. Introduction

Why did we carry out this review?

In 2020, the FRC published a wide-ranging thematic review of climate-related considerations by boards, companies, auditors, investors and professional associations. As part of this review, the Corporate Reporting Review team (CRR) issued a report addressing the question 'How are companies developing their reporting on climate-related challenges?'.

This 2020 thematic report found that:

- an increasing number of companies were providing narrative reporting on climate-related issues. While minimum legal requirements were often being met, users were calling for additional disclosures to inform their decision making;

- some companies had set strategic goals such as 'net zero', but it was unclear from their reporting how progress towards these goals would be achieved, monitored or assured; and

- consideration and disclosure of climate change in financial statements lagged behind narrative reporting; our review identified areas of potential non-compliance with the requirements of International Financial Reporting Standards (IFRS).

Since the publication of that report, a new Listing Rule 2 has come into force requiring commercial companies with a UK premium listing to include a statement in their annual financial report setting out:

- whether they have made disclosures consistent with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in their annual financial report;

- where they have included some, or all, of the disclosures in a document other than the annual financial report, an explanation of why and a reference to where the disclosures can be found; and

- where disclosures have not been made, an explanation of why, and a description of any steps taken or planned to be able to make consistent disclosures in the future – including relevant time frames.

This report seeks to assess the quality of the TCFD disclosures provided by premium listed companies in response to the new Listing Rule. We also consider the extent to which the financial statements reflect the impact of climate change, to determine whether this has improved since our 2020 thematic review.

What did we do?

Our review assessed a sample of 25 premium listed companies' annual reports and accounts to see whether they complied with the requirements of Listing Rule 9.8.6R(8), which requires companies to include a statement in their annual report setting out whether they have included disclosures consistent with the TCFD framework, as summarised below:

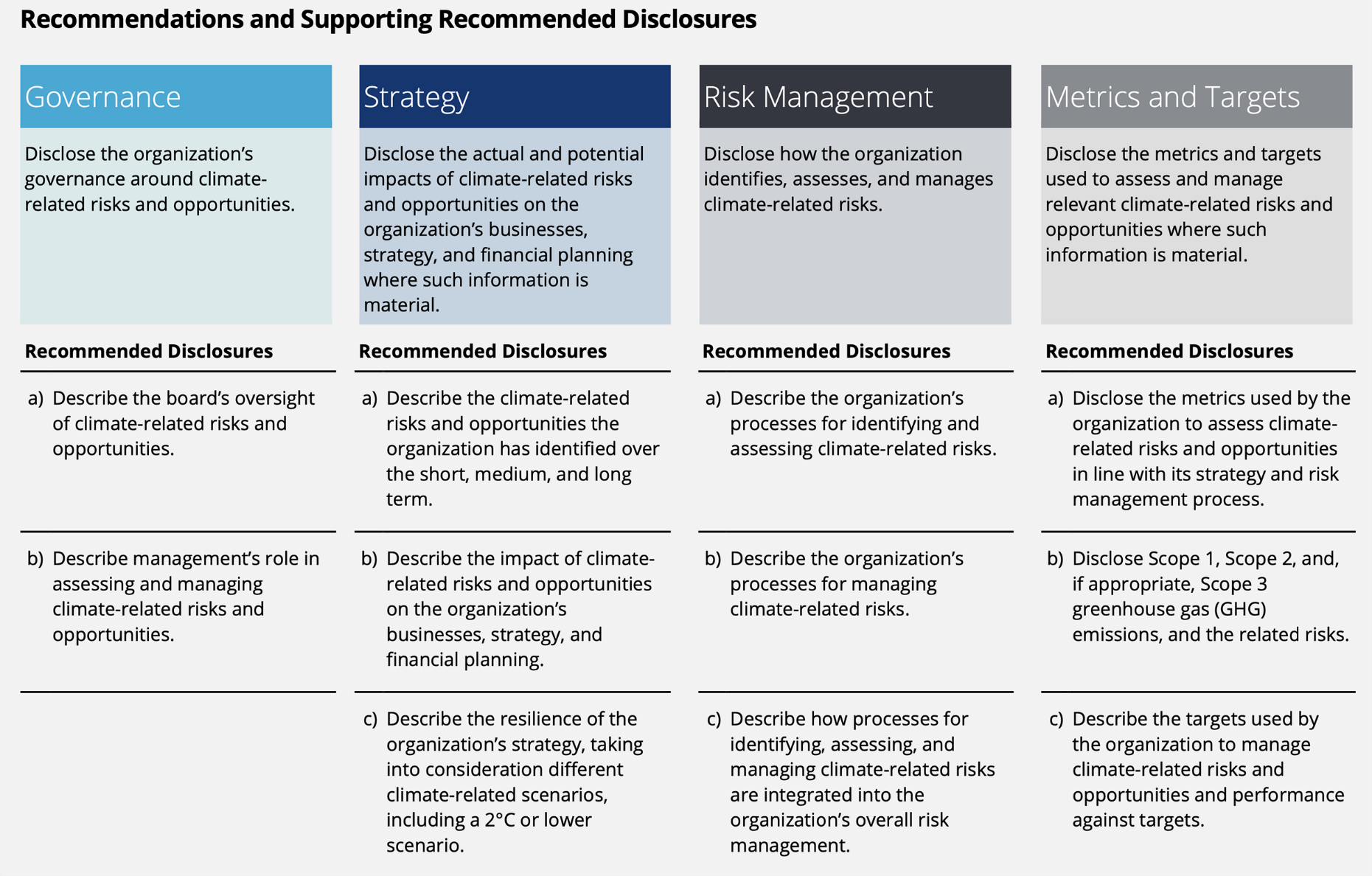

Recommendations and Supporting Recommended Disclosures

| Governance | Strategy | Risk Management | Metrics and Targets |

|---|---|---|---|

| Disclose the organization's governance around climate-related risks and opportunities. | Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning where such information is material. | Disclose how the organization identifies, assesses, and manages climate-related risks. | Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. |

| Recommended Disclosures | Recommended Disclosures | Recommended Disclosures | Recommended Disclosures |

| a) Describe the board's oversight of climate-related risks and opportunities. | a) Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term. | a) Describe the organization's processes for identifying and assessing climate-related risks. | a) Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process. |

| b) Describe management's role in assessing and managing climate-related risks and opportunities. | b) Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning. | b) Describe the organization's processes for managing climate-related risks. | b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks. |

| c) Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. | c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management. | c) Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets. |

Listing Rule 9.8.6BG requires companies to perform a detailed assessment of their disclosures taking into account the TCFD 'Guidance for All Sectors', as well as the supplemental guidance for the financial sector and for non-financial groups in certain industries. In order to assess companies' compliance with the Listing Rules, we considered this guidance where relevant. See Section 7 for further details. The TCFD framework against which companies were required to report for the purposes of the Listing Rules is that set out in the 'Recommendations of the Task Force on Climate-related Financial Disclosures' published in June

- An updated version of the annexe to this report was published in October 2021 (the '2021 guidance', which includes updated guidance for all sectors, as well as some changes to the guidance for specific sectors. Further details of this change can be found in Section 7 below. The Listing Rules require companies to take account of the 2021 guidance with effect from 1 January 2022.

We also assessed the extent to which these companies had considered the risks of climate change in meeting the requirements of IFRS accounting standards.

The FRC's CRR team reviewed 22 UK-registered companies, and a team from the Financial Conduct Authority (FCA) reviewed 3 companies registered overseas with UK listings. The findings of all 25 reviews are incorporated into this report.

Further details of both the sample selected and the areas of reporting reviewed can be found in Appendix 1 to this report.

The FRC's work on ESG and climate-related reporting

In July 2021, the FRC's ESG and Climate Group produced a Statement of Intent on six areas of current challenge in Environmental, Social and Governance (ESG) reporting which outlined the actions the FRC will take within the diverse regulatory framework.

Extract Statement of Intent from the ESG and Climate Group:

"To work towards a more consistent architecture, we will take proportionate action within our remit including developing Codes, standards, guidance and expectations. We will also work with and influence standard setters, regulators, market participants and other stakeholders to build a system that is forward-looking and fit for purpose. We will work to build expectations for collation and ensure the development of appropriate standards and controls, delivering robust internal information which is considered strategically and then reported externally where relevant through high quality disclosure, in a useable and useful format, leading to better stakeholder and investment decision-making, all in the public interest. Some of these actions will be short term and some we will take forward in the longer term. Not all of them can be delivered simultaneously, and we need to use our resources carefully, identifying those areas where we can make the greatest contribution and have the greatest impact.”

Further details of the FRC's other work on ESG and climate-related reporting, including reports from CRR and the Financial Reporting Lab, can be found on our website.

A rapidly changing regulatory environment

Future climate-related reporting requirements will be applicable to a much broader population of companies in the UK, as set out below. These disclosures will also fall to CRR to monitor and enforce; the findings of this review will also help other companies preparing for the extended disclosure regime.

| Standard-listed companies | Regulated businesses | Other companies and LLPs | |

|---|---|---|---|

| What are the new requirements? | The FCA is extending the scope of the climate-related disclosure requirements currently applied to premium listed companies, as set out in Listing Rule 9.8.6R(8) 3 | The FCA has introduced a new Environmental, Social and Governance (ESG) sourcebook containing rules and guidance for disclosures consistent with the TCFD framework 4 | The Department for Business, Energy & Industrial Strategy (BEIS) will require mandatory climate-related financial disclosures in the strategic report in line with the four overarching pillars of the TCFD recommendations (Governance, Strategy, Risk Management, Metrics & Targets) 5. Unlike the current Listing Rules, which allow companies to comply or to explain their non-compliance, these disclosures will be mandatory. |

| Who is affected? | Issuers of standard listed shares and Global Depositary Receipts representing equity shares, in each case excluding listed investment entities and shell companies | * asset managers life insurers (including pure insurers) non-insurer FCA-regulated pension providers, including platform firms and Self-invested Personal Pension (SIPP) operators * FCA-regulated pension providers |

Publicly quoted companies, large private companies and Limited Liability Partnerships (LLPs), specifically: UK companies that have more than 500 employees and have transferable securities admitted to trading on a UK regulated market banking and insurance companies with more than 500 employees UK registered companies with securities admitted to AIM with more than 500 employees Other UK registered companies and LLPs with more than 500 employees and a turnover of more than £500m |

| What is the effective date? | Accounting periods beginning on or after 1 January 2022 | Accounting periods beginning on or after 1 January 2022 | Accounting periods beginning on or after 6 April 2022 |

International reporting developments

In March 2022, the International Sustainability Standards Board (ISSB) published two exposure drafts for public consultation. IFRS S1 covers General Requirements for Disclosure of Sustainability-related Financial Information, while IFRS S2 specifically addresses Climate-related Disclosures. Both exposure drafts are structured around the four pillars of TCFD, and are designed to provide a baseline for individual jurisdictions to build on. The FRC welcomes the publication of the exposure drafts and strongly supports the development of high-quality global standards for sustainability reporting. The FRC's response to the exposure drafts can be found on our website.

The UK government has confirmed it intends to incorporate these standards into the UK corporate reporting framework, and will be consulting on the endorsement and adoption mechanisms in due course.

On 21 June 2022, the Council and European Parliament reached a provisional political agreement on the corporate sustainability reporting directive (CSRD) 6. The CSRD amends the European Non-Financial Reporting Directive (2014). It introduces more detailed reporting requirements on sustainability issues such as environmental rights, social rights, human rights and governance factors. The European Financial Reporting Advisory Group will be responsible for establishing European standards, following technical advice from a number of European agencies. Mandatory application of these proposed standards will be phased in from 2023 to 2026.

In the US, the Securities and Exchange Commission issued a proposed rule titled 'The Enhancement and Standardization of Climate-related Disclosures for Investors' 7, which was also open for public consultation earlier this year. This rule is also proposed to be phased in from 2023, starting with the largest filers.

2. Statement of the extent of consistency with the TCFD framework

Footnotes

Listing Rules requirement – statement of the extent of consistency with the TCFD framework

Paragraph 8(a) of Listing Rule 9.8.6R requires that listed companies must include in their annual financial report a statement setting out whether the listed company has included in that financial report climate-related financial disclosures consistent with the TCFD Recommendations and Recommended Disclosures. (For brevity, we refer to such a statement throughout this report as a 'compliance statement'.)

Of the 25 companies included in our review, 22 provided a clear and unambiguous statement of the extent of consistency with the TCFD framework.

A number of companies used the compliance statement to describe areas of proposed improvement for future years. While this is useful information, in some cases it was not clear whether the company considered that it was currently in compliance with the TCFD Recommendations.

A small number of companies had a clear statement in one location setting out which TCFD disclosures had and had not been provided, but elsewhere in the reporting used terminology referring to "TCFD compliance” without noting the areas where disclosures had not been provided, which could potentially be misleading.

Some companies used vague terminology such as “we support" the TCFD framework; it was not clear from this whether or not they considered their disclosures to be consistent with the TCFD framework as required by the Listing Rules.

We expect companies to:

- Provide a statement of the extent of consistency in the annual report as required by the Listing Rules.

- Ensure that it is clear from the compliance statement whether management considers that they have given sufficient information to be consistent with the TCFD framework in the current year.

- Ensure that any references to the TCFD disclosures elsewhere in the annual report should give consistent messages about the extent of consistency.

"We set out below our climate-related financial disclosures consistent with all of the TCFD recommendations and recommended disclosures. By this we mean the four TCFD recommendations and the 11 recommended disclosures set out in Figure 4 of Section C of the report entitled “Recommendations of the Task Force on Climate-related Financial Disclosures" published in June 2017 by the TCFD.”

Shell plc, Annual Report and Accounts 2021, page 75

Straightforward statement of full compliance

"At the time of publication, the Company has made climate-related financial disclosures consistent with the TCFD recommendations and recommendations disclosures [sic] in this TCFD summary against:

- governance (all recommended disclosures)

- risk management (all recommended disclosures)

- strategy (disclosures (a) and (b))

- metrics and targets (disclosures (a) and (b)).

For strategy disclosures (a) and (b), further work is underway to enhance the identification, impact and reporting for climate-related risks and opportunities, and how these map over the short, medium and long term. This further work will be published in an updated TCFD report which the Company will publish later in the year."

James Fisher and Sons plc, Annual Report 2021, page 52

Clear statement of which recommended disclosures have been provided

Future improvements have been explained without casting doubt on current year compliance

Listing Rules requirement – location of disclosures

Paragraph 8(b)(i) of Listing Rule 9.8.6R requires that, where a listed company has made climate-related financial disclosures consistent with the TCFD Recommendations and Recommended Disclosures, but has included some or all of these disclosures in a document other than the annual financial report, it should disclose:

- the recommendations and/or recommended disclosures for which it has included disclosures in that other document;

- a description of that document and where it can be found; and

- the reasons for including the relevant disclosures in that document and not in the annual financial report.

Paragraph 8(c) requires disclosure of where in its annual financial report or (where appropriate) other document the climate-related financial disclosures can be found.

The majority of the companies in our sample included their TCFD disclosures within the strategic report, as shown below:

Location of TCFD disclosures

This pie chart shows the location of TCFD disclosures:

- 56% - Strategic report

- 28% - Summary in strategic report, further detail elsewhere

- 12% - Elsewhere in annual report

- 4% - Spread between a number of different documents

In a small number of cases, clearer signposting could have been provided to the correct document, for example by ensuring that consistent document titles were used. One company provided additional detail in a separate sustainability report, but did not mention this in the disclosures given in the annual report.

We do not consider vague references such as "these disclosures can be found throughout our Annual Report and Sustainability Report" to be sufficiently precise to meet the Listing Rules requirement.

One company referred to its 2020 CDP report for some of the required information. This was unhelpful as these disclosures related to a different time period. The 2021 update to the TCFD Implementing Guidance clarifies that TCFD disclosures should report information for the same period covered by their mainstream financial filings.

Another company referred to a sustainability report that was to be published later than the annual report. TCFD disclosures should be available at the same time as the annual report.

Signposting of disclosures outside the annual report

Where some or all disclosures were provided outside the annual report, including in integrated reports, sustainability reports and climate change reports, the majority of companies provided an adequate explanation of which disclosures were included in another document and where that document could be found.

As explained in Section 1 above, from 2023 many large companies and LLPs will be required by the Companies Act to provide certain climate-related financial disclosures within their strategic reports. These disclosure requirements are substantially aligned with the TCFD Framework, so companies that are required to comply with both sets of requirements may choose to reduce duplication by also presenting the TCFD-aligned disclosures required by the Listing Rules in their strategic reports.[^8]

We expect companies to:

- Provide granular and specific signposting to where the TCFD disclosures can be found, including specific page references or hyperlinks. Where disclosures are spread between several different locations, it is helpful to provide a single table indicating the location of each element required.

- Ensure that any referenced information presented outside of the annual report covers the same time period and is available no later than the publication of the annual report.

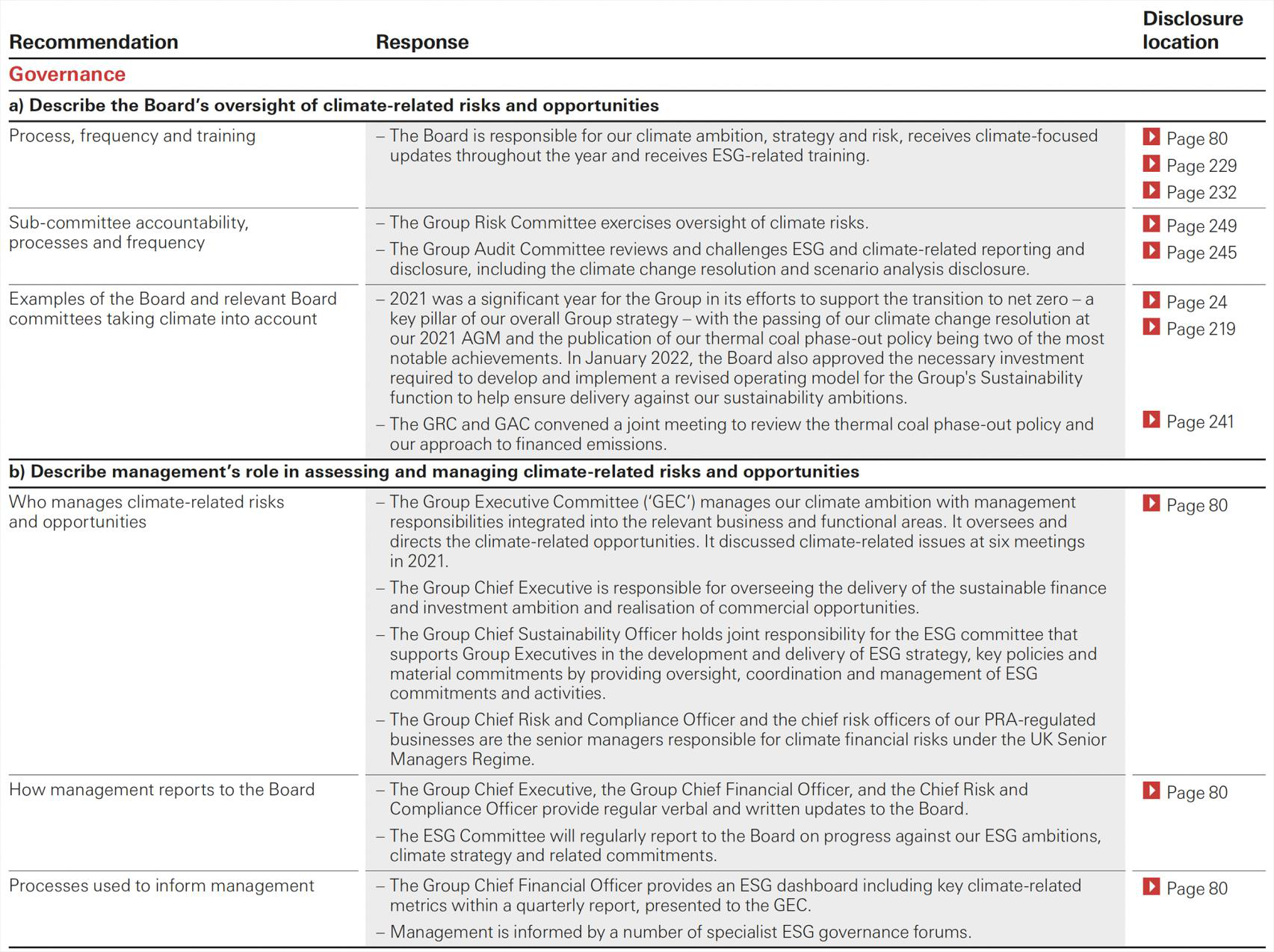

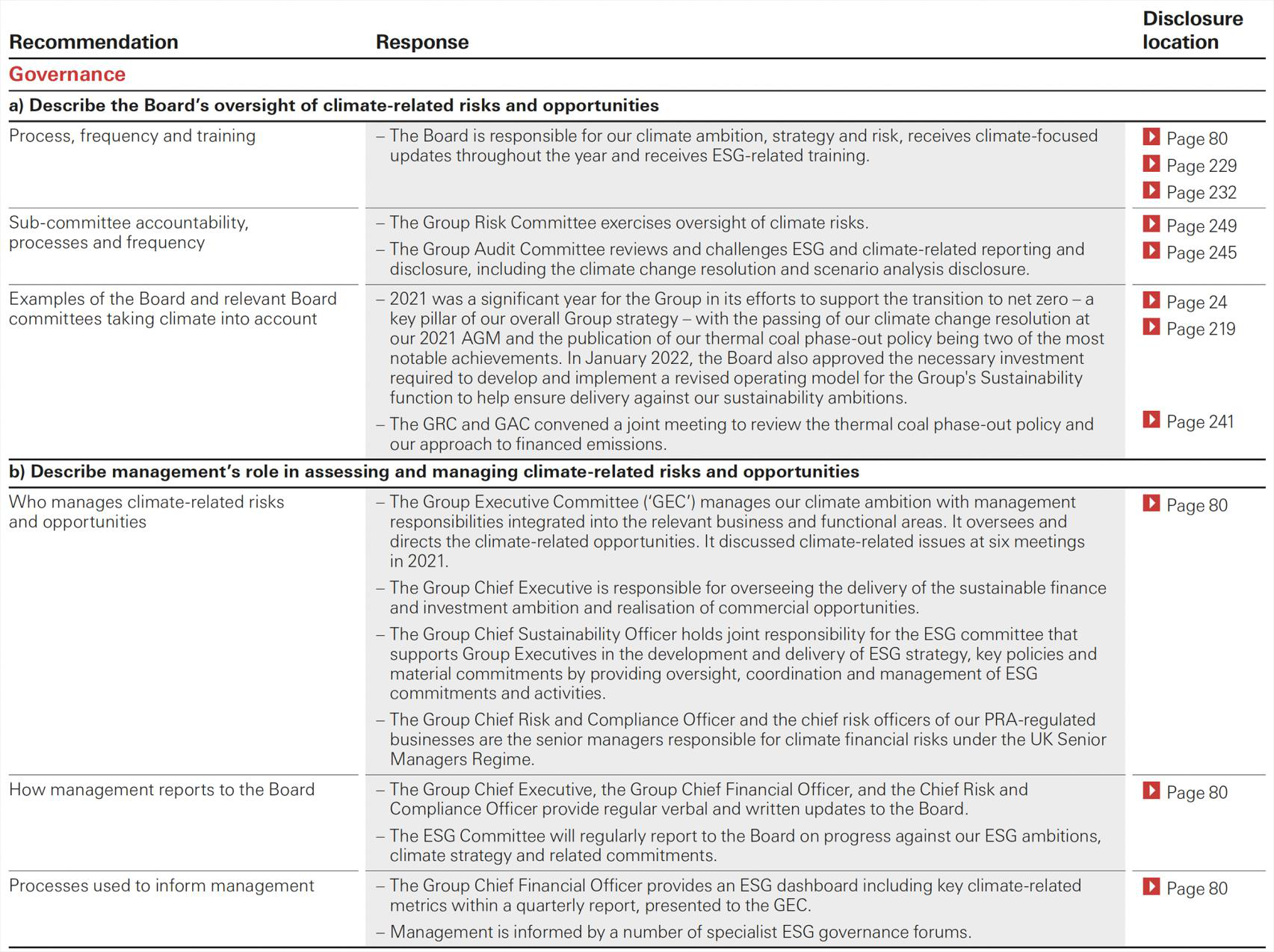

Table clearly setting out where to find each disclosure

HSBC Holdings plc, Annual Report and Accounts 2021, page 63

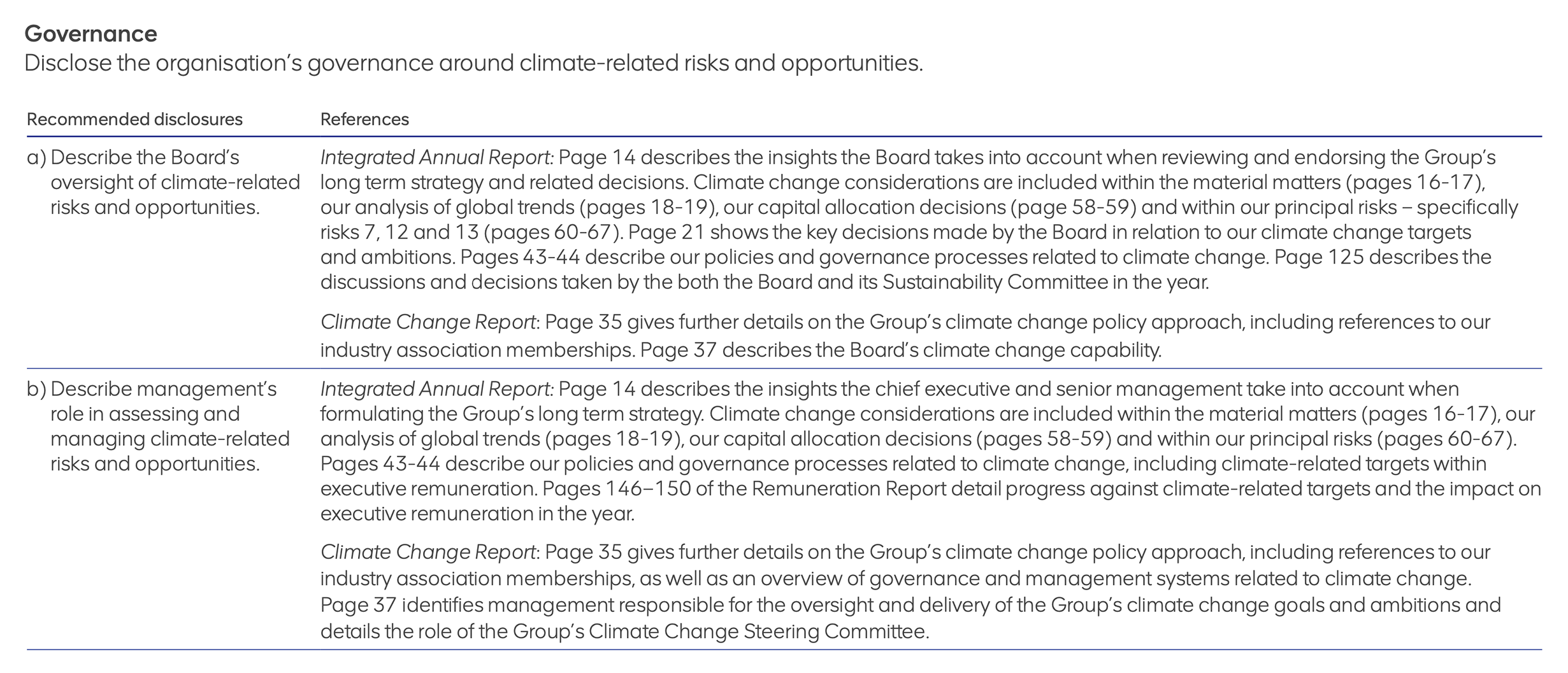

Clearly sets out which disclosures are found in each document

Anglo American plc, Integrated Annual Report 2021, page 102

Reasons for providing TCFD disclosures outside the annual report

Seven companies provided some or all disclosures outside the annual report.

Two companies explained that this was due to the size and scale of the disclosures.

The remaining five companies did not provide an explanation for why the disclosures were provided outside the annual report.

"We are reporting against the Task Force on Climate-related Disclosures (TCFD) framework for the second time this year, building on our prior year reporting. Given its size and scale, our comprehensive 2021 report including all 11 disclosures can be found separately on our website. To aid readers of the accounts we provide a summary of the key disclosures from the report below, together with an overview of our approach to addressing climate change.”

St. James's Place plc, Annual Report and Accounts, page 44

Reason given for disclosing information outside of annual report

We expect companies to:

- Address the Listing Rule requirement to disclose the reasons for including relevant disclosures in a document other than the annual financial report.

Materiality assessment

Materiality and the TCFD

The TCFD recognises that most information included in financial filings is subject to a materiality assessment. However, because climate-related risk is a non-diversifiable risk that affects nearly all industries, many investors believe it requires special attention. For example, in assessing organisations' financial and operating results, many investors want insight into the governance and risk management context in which such results are achieved. The Task Force believes disclosures related to its Governance and Risk Management recommendations directly address this need for context and should be included in annual financial filings irrespective of any materiality assessment.

For disclosures related to the Strategy and Metrics and Targets recommendations, the TCFD believes that organisations should provide such information in annual financial filings when the information is deemed material.

In determining whether information is material, the TCFD believes that organisations should determine materiality for climate-related issues consistent with how they determine the materiality of other information included in their financial filings. In addition, the TCFD cautions organisations against prematurely concluding that climate-related risks and opportunities are not material based on perceptions of the longer-term nature of some climate-related risks.

Listing Rules requirement – materiality assessment

Listing Rule 9.8.6DG requires that, in determining whether climate-related financial disclosures are consistent with the TCFD Recommendations and Recommended Disclosures, a listed company should consider whether those disclosures provide sufficient detail to enable users to assess the listed company's exposure to and approach to addressing climate-related issues.

A listed company should carry out its own assessment to ascertain the appropriate level of detail to be included in its climate-related financial disclosures, taking into account factors such as:

- the level of its exposure to climate-related risks and opportunities; and

- the scope and objectives of its climate-related strategy,

noting that these factors may relate to the nature, size and complexity of the listed company's business.

We encourage companies to disclose the basis on which they have assessed the materiality of climate-related disclosures. This helps readers to understand whether materiality considerations have driven omissions of recommended disclosures, or whether disclosures have been omitted for other reasons such as the non-availability of information. The Listing Rules also explain that companies should undertake a detailed assessment of the TCFD all-sector guidance and supplemental guidance for financial and non-financial entities when preparing their TCFD disclosures (see Section 7). Companies should bear this in mind when considering their approach to materiality.

For 17 of the 25 companies reviewed, it appeared that some assessment of the adequacy of disclosures had been made by the company.

Several companies described their process for determining which climate-related information to include in the report, and how this is kept under review over time.

Process undertaken to determine which information to include

Explanation of how materiality is interpreted

"How we decide what to measure

We listen to our stakeholders in a number of different ways, which we set out in more detail within the ESG review. We use the information they provide us with to identify the issues that are most important to them and consequently also matter to our own business.

Our ESG Committee (previously the ESG Steering Committee) and other relevant governance bodies regularly discuss the new and existing themes and issues that matter to our stakeholders. Our management team then uses this insight, alongside the framework of the ESG Guide (which refers to our obligations under the Environmental, Social and Governance Reporting Guide contained in Appendix 27 to The Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited), and other applicable laws and regulations to choose what we measure and publicly report in this ESG review.

Under the ESG Guide, 'materiality' is considered to be the threshold at which ESG issues become sufficiently important to our investors and other stakeholders that they should be publicly reported. We are also informed by stock exchange listing and disclosure rules globally. We know that what is important to our stakeholders evolves over time and we plan to continue to assess our approach to ensure we remain relevant in what we measure and publicly report."

HSBC Holdings plc, Annual Report and Accounts 2021, page 44

Extent of compliance with TCFD recommendations and recommended disclosures

Listing Rules requirement – disclosures not provided

Paragraph 8(b) of Listing Rule 9.8.6R requires that, where a listed company has not included climate-related financial disclosures consistent with all of the TCFD Recommendations and Recommended Disclosures in either its annual financial report or other document as referred to above, it should disclose:

- the recommendations and/or recommended disclosures for which it has not included such disclosures;

- the reasons for not including such disclosures; and

- any steps it is taking or plans to take in order to be able to make those disclosures in the future, and the timeframe within which it expects to be able to make those disclosures.

19 of the 25 companies in our sample stated that they had provided disclosures fully consistent with all of the TCFD Recommendations and Recommended Disclosures. It should be noted that, as our sample was biased towards the industries expected to be most affected by climate change, the companies in our sample may be further advanced in their TCFD implementation process than the market in general – just over half of the companies in our sample had provided at least some TCFD disclosures in 2020.

Other companies stated that some disclosures were not provided, or were provided only in part. The extent of stated compliance with each of the recommended disclosures was as follows:

Declared provision of recommended disclosures

This horizontal bar chart illustrates the declared provision of recommended TCFD disclosures across Governance, Strategy, Risk Management, and Metrics & Targets, broken down into sub-recommendations (a, b, c). The x-axis represents the 'Number of companies' (0 to 25). Each bar is segmented by compliance level: "Provided in full", "Partially provided", and "Not provided".

- Governance (a): Approximately 19 companies provided in full, 4 partially, 2 not provided.

- Governance (b): Approximately 19 companies provided in full, 4 partially, 2 not provided.

- Strategy (a): Approximately 18 companies provided in full, 4 partially, 3 not provided.

- Strategy (b): Approximately 18 companies provided in full, 4 partially, 3 not provided.

- Strategy (c): Approximately 15 companies provided in full, 5 partially, 5 not provided.

- Risk management (a): Approximately 19 companies provided in full, 4 partially, 2 not provided.

- Risk management (b): Approximately 19 companies provided in full, 4 partially, 2 not provided.

- Risk management (c): Approximately 18 companies provided in full, 4 partially, 3 not provided.

- Metrics & targets (a): Approximately 16 companies provided in full, 6 partially, 3 not provided.

- Metrics & targets (b): Approximately 16 companies provided in full, 6 partially, 3 not provided.

- Metrics & targets (c): Approximately 14 companies provided in full, 6 partially, 5 not provided.

The Listing Rules state that, in particular, the FCA would expect that listed companies should ordinarily be able to make recommended disclosures on governance and risk management and recommended disclosures (a) and (b) on strategy, except where they face transitional challenges in obtaining relevant data or embedding relevant modelling or analytical capabilities. The FCA has a slightly lower level of expectation regarding the recommended TCFD disclosures in respect of metrics and targets (sections (a) (b) and (c)) and strategy section (c) regarding scenario analysis, although it would still ordinarily expect companies to be able to make these disclosures, subject to transitional challenges.

We identified a number of instances where a company's compliance statement indicated a certain recommended disclosure had been provided, but a detailed review indicated that a significant number of the disclosures recommended by the TCFD's 'Guidance for All Sectors', or relevant sector-specific Supplemental Guidance, had not been given. It was unclear whether the companies had considered these disclosures and determined them not to be material, or whether these matters had not been addressed. See Section 7 for further consideration of the guidance that the FCA expects companies to take into account when determining the extent of disclosure necessary.

Several companies used tables and/or symbols to indicate the extent of compliance with each recommended disclosure.

We expect companies to:

- Improve their level of compliance across all the recommended TCFD disclosures, following this initial year of mandatory reporting for premium listed companies.

- We may challenge companies if they do not provide disclosures consistent with the 'particularly expected' recommendations, for example in the areas of risk management and the elements of strategy not concerning scenario analysis, without a credible explanation.

- We may also challenge companies that state consistency with a recommended disclosure where it is not clear that all relevant and material elements of the recommended TCFD disclosures – including the all-sector guidance and, where appropriate, the supplemental guidance for the financial sector and for non-financial groups – have been addressed.

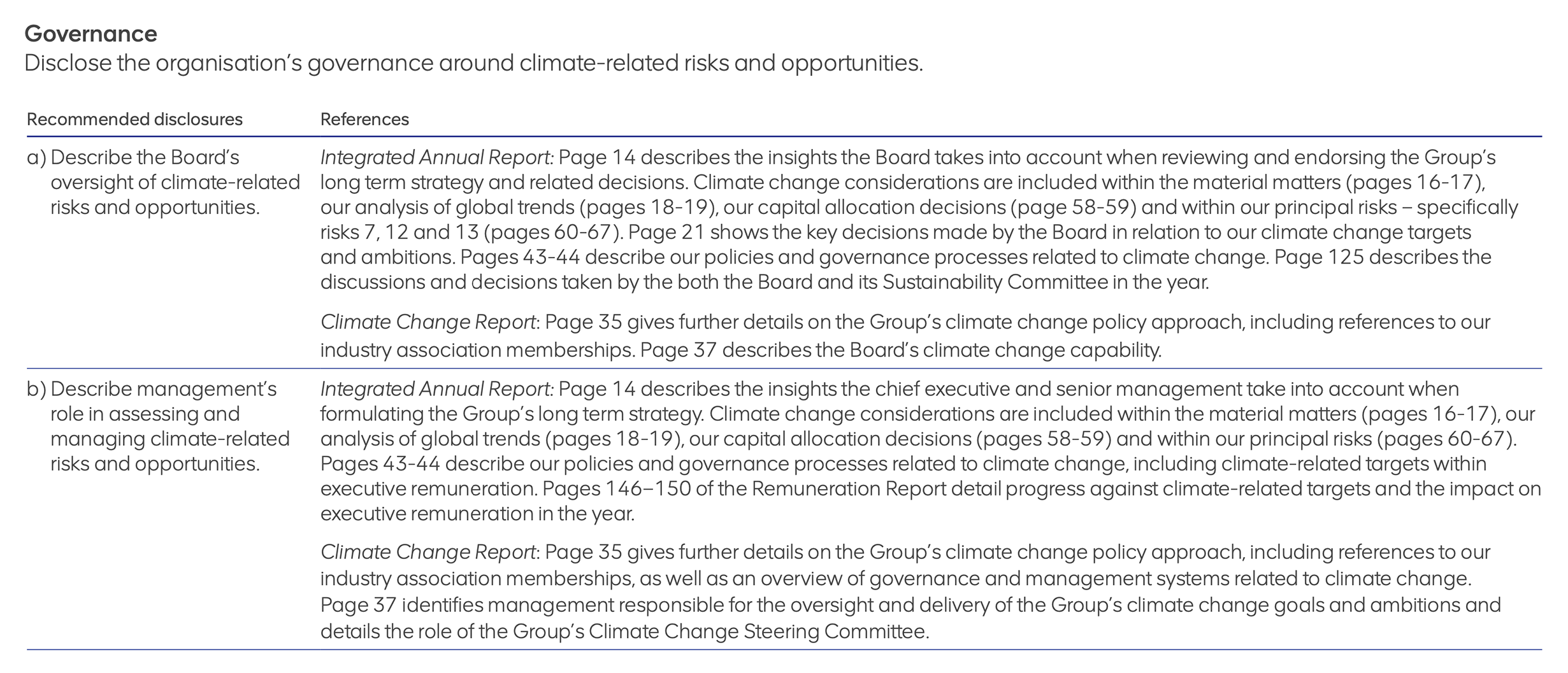

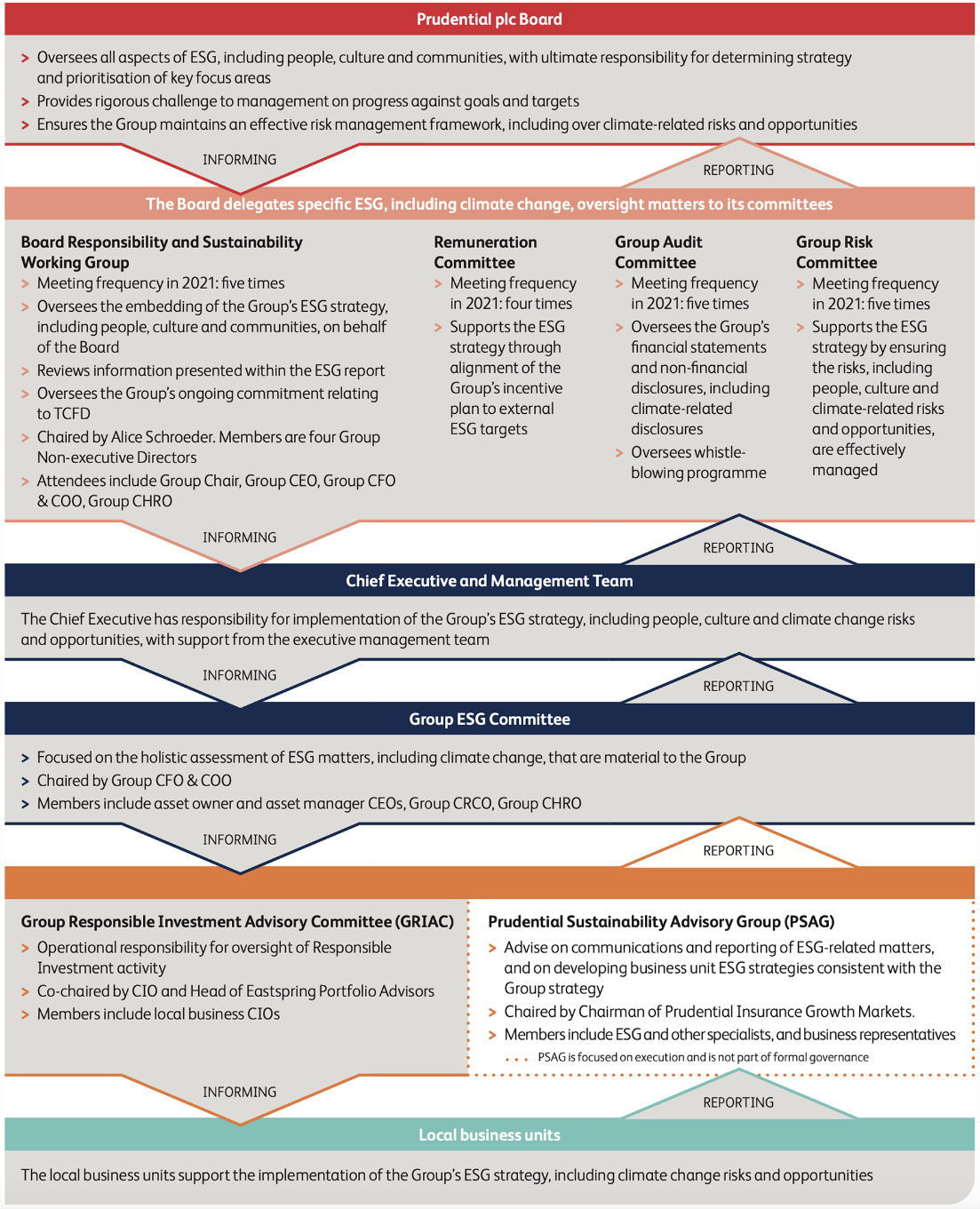

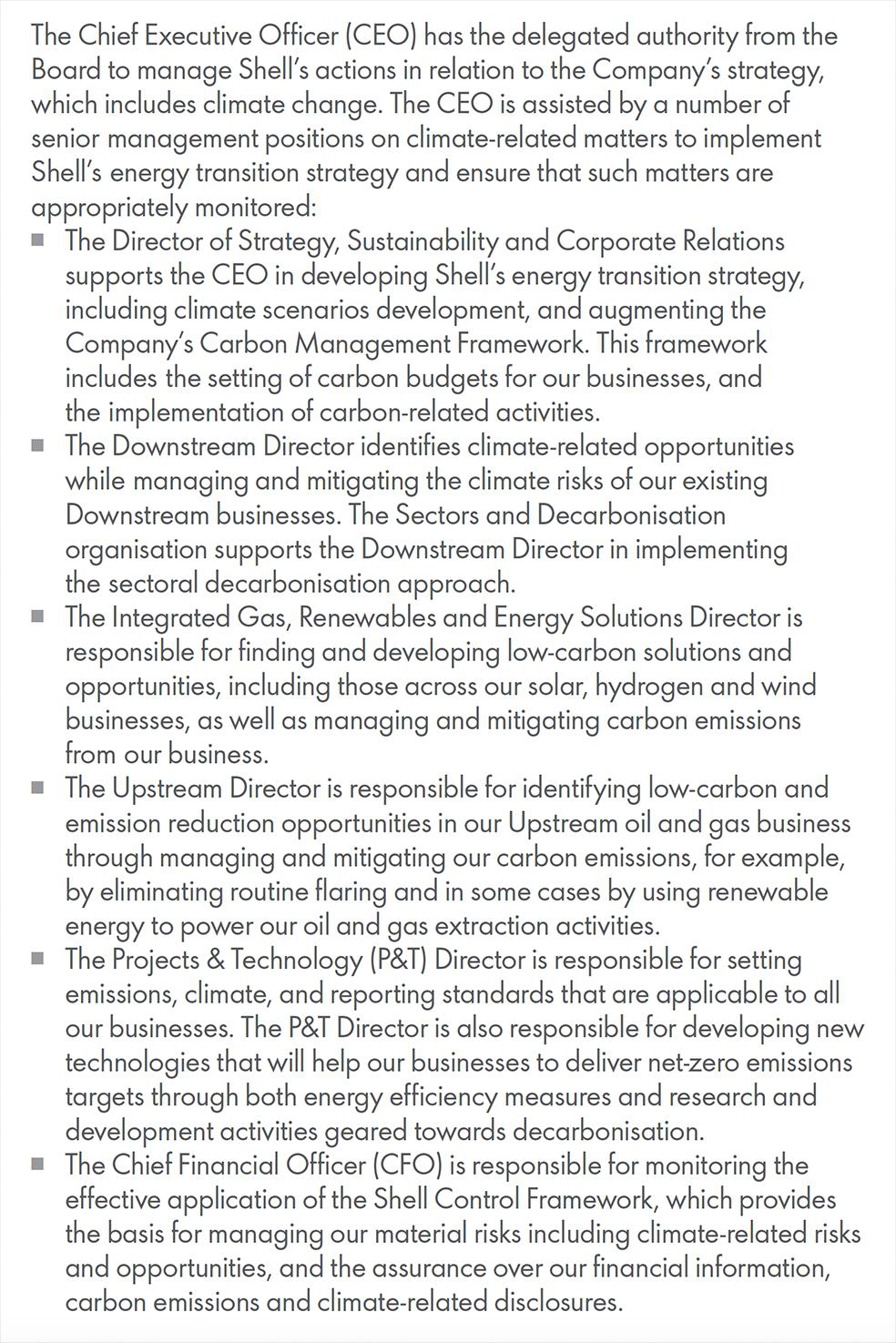

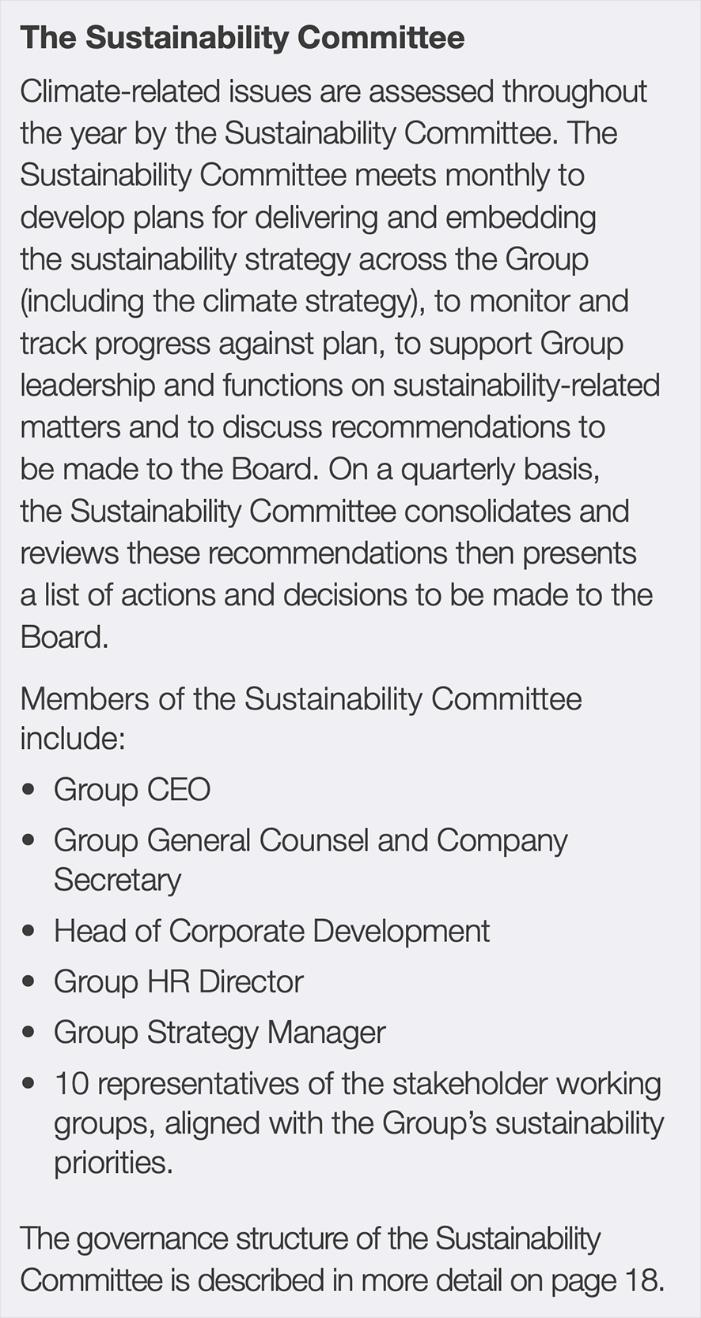

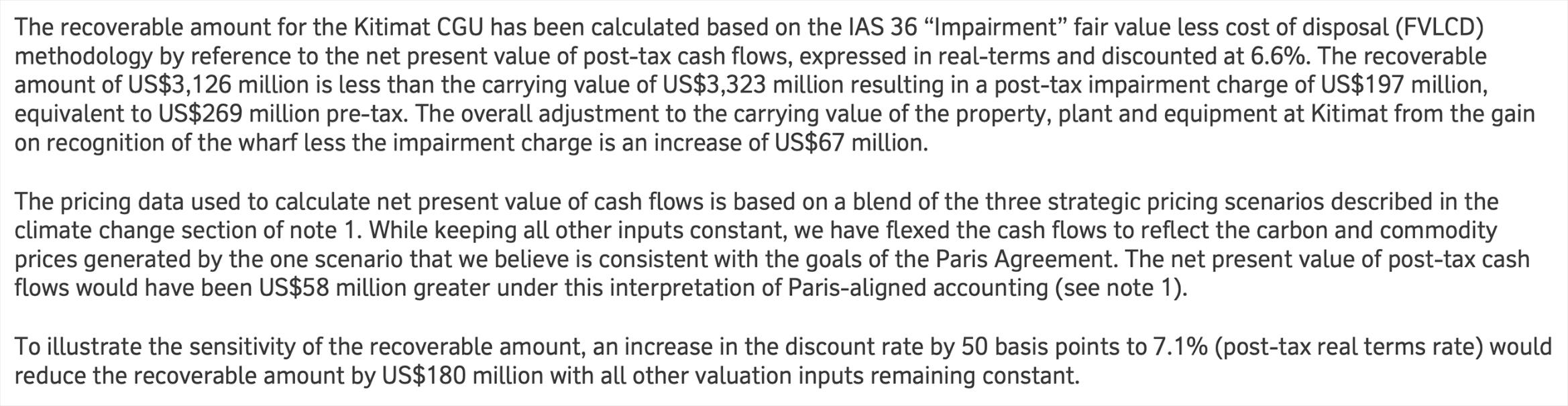

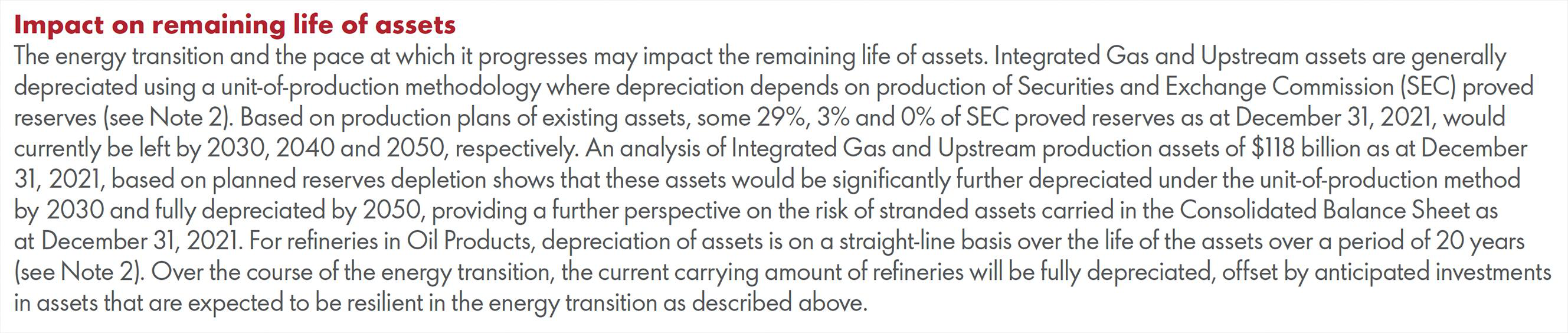

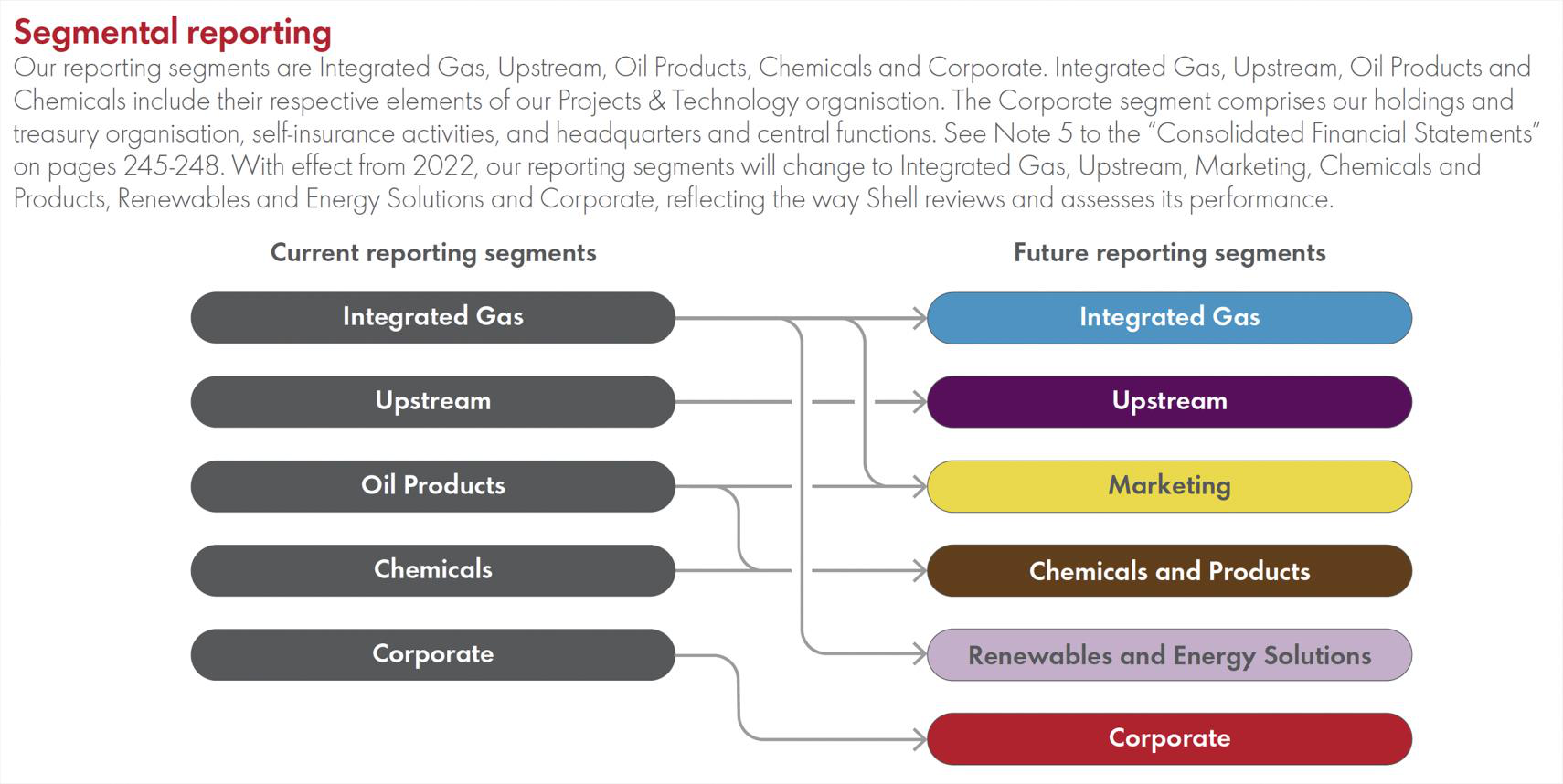

TCFD overview