The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Reporting on stakeholders, decisions and Section 172

- Quick read

- Introduction

- Section 1 - Information on stakeholders

- The investor view

- The company view

- What investors want to see reported

- Fresnillo plc Annual Report 2020 pg 80

- Relationship with stakeholders

- Fresnillo plc Annual Report 2020 pg 28-31

- National Grid plc Annual Report 2019/20 pg 45-47

- Risks and opportunities

- Uncomfortable Truths and Difficult Decisions

- Post Pandemic Retention?

- OUTLOOK FOR THE YEAR AHEAD

- Next PLC Annual Report January 2021 pg 11, 13, 16

- Diageo plc Annual Report June 2020 pg 14-16, 24-25

- Performance and metrics

- Some stakeholder metrics that investors told us they want:

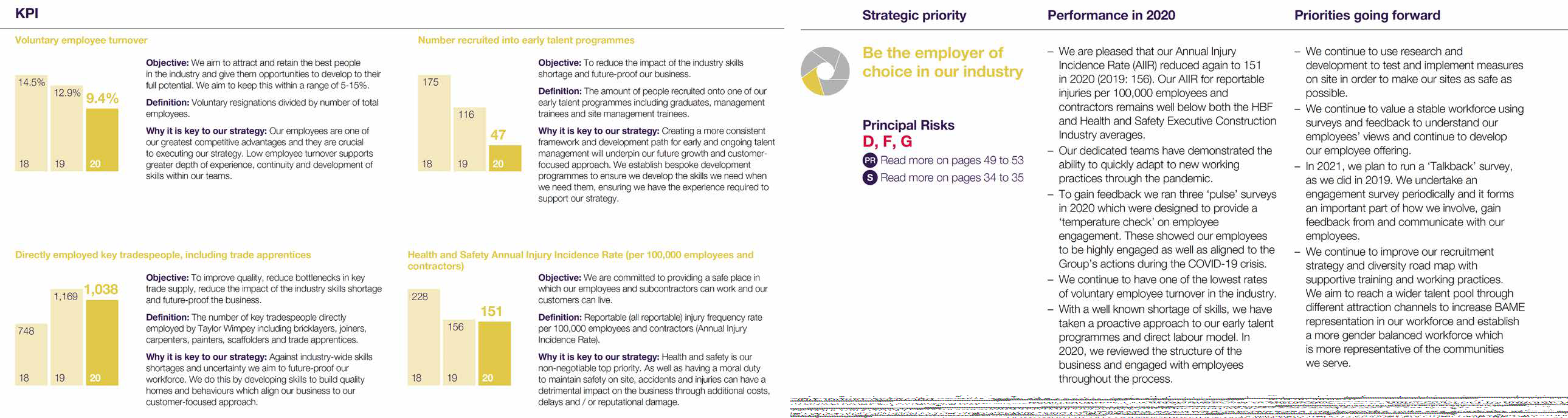

- Taylor Wimpey plc Annual Report 2020 pg 23-24

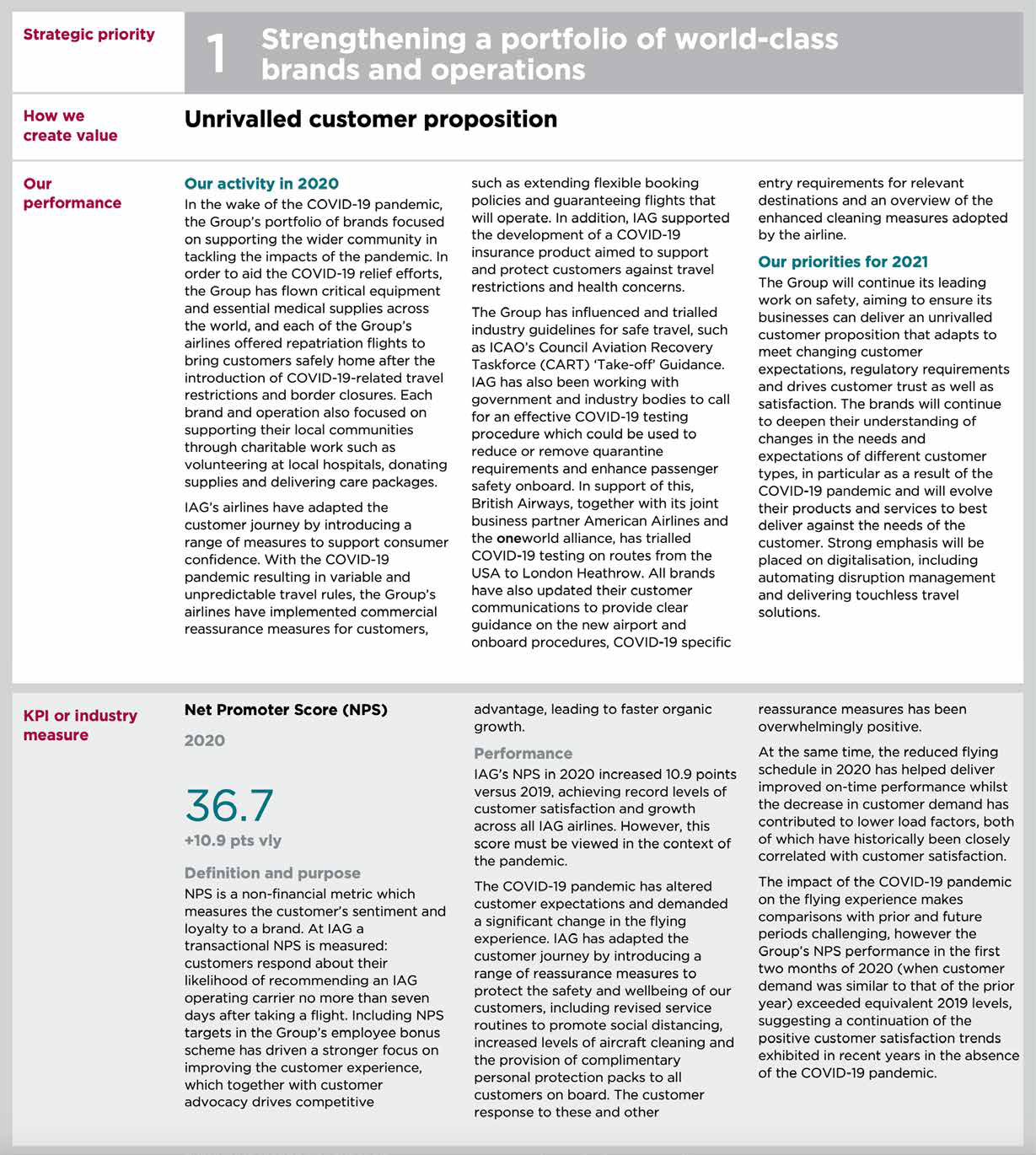

- International Airlines Group (IAG) Annual Report 2020 pg 18

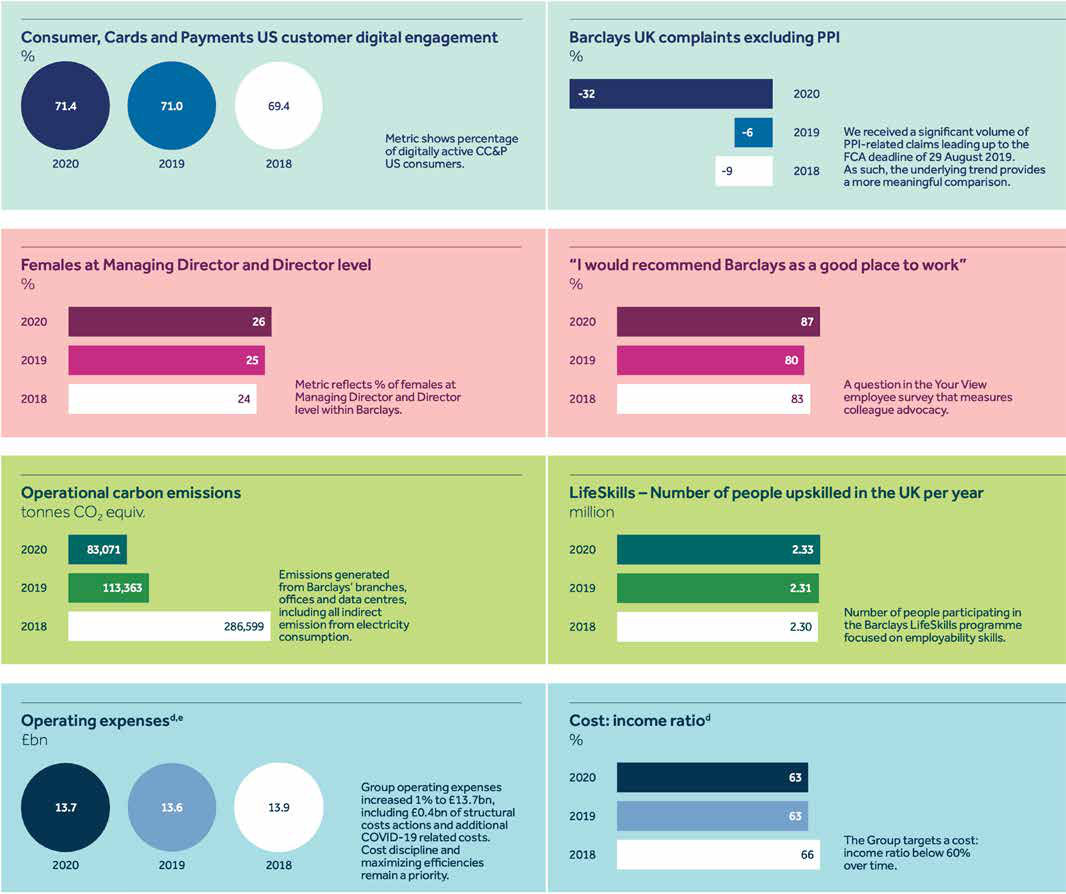

- Barclays PLC Annual Report 2020 pg 22-23

- Safestore Holdings plc Annual Report 2020 pg 44-45

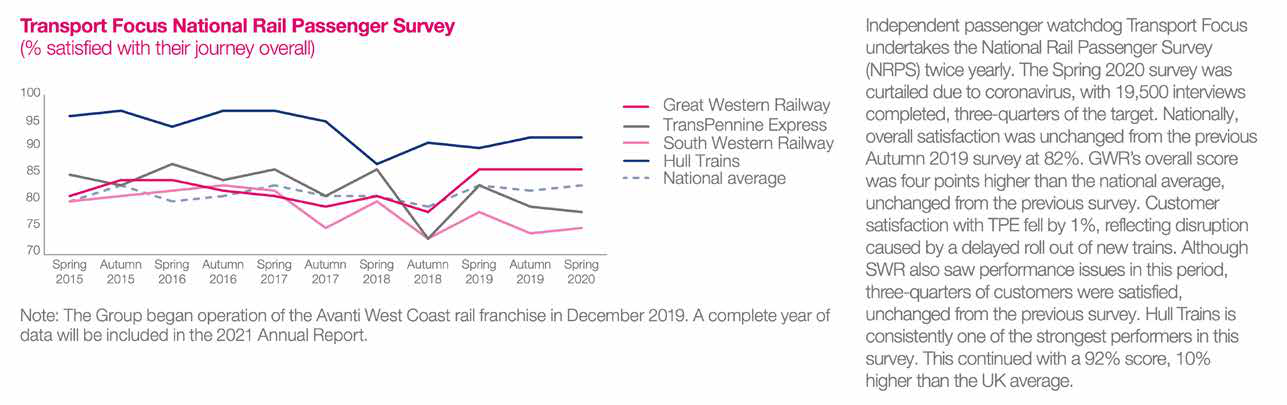

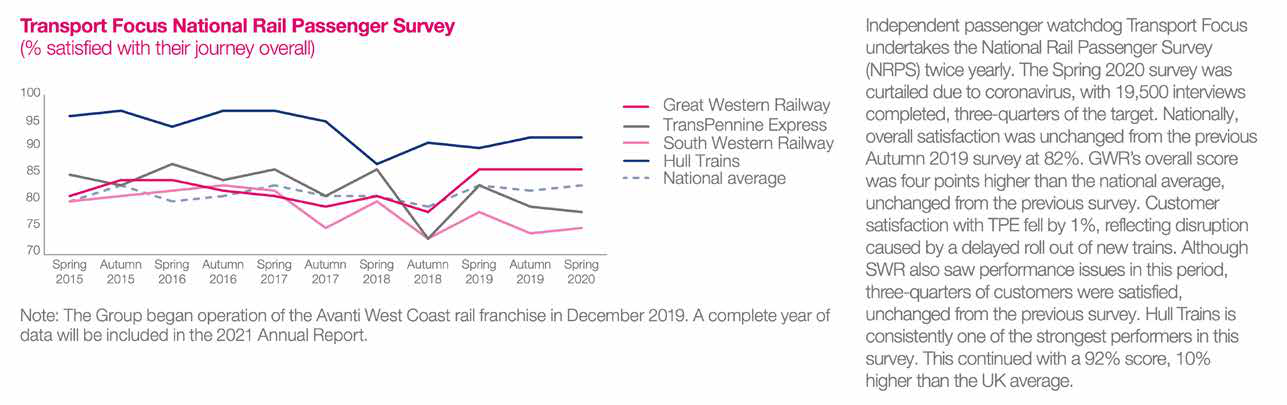

- First Group plc Annual Report 2020 pg 56, 57

- Our customers

- 5 Maintain responsible partnerships with our customers and communities

- Spotlight on suppliers

- Suppliers

- International Airlines Group (IAG) Annual Report 2020 pg 16

- OUR SUPPLIERS

- Next PLC Annual Report January 2021 pg 81

- Spirax-Sarco Engineering plc Annual Report 2020 pg 75

- Associated British Foods plc (ABF) Annual Report y/e 12 Sept 2020 pg 18

- Primark decision to cease placing new orders with suppliers following worldwide closure of all stores and subsequent reinstatement of orders.

- Assessing the risks

- Risk profile by region

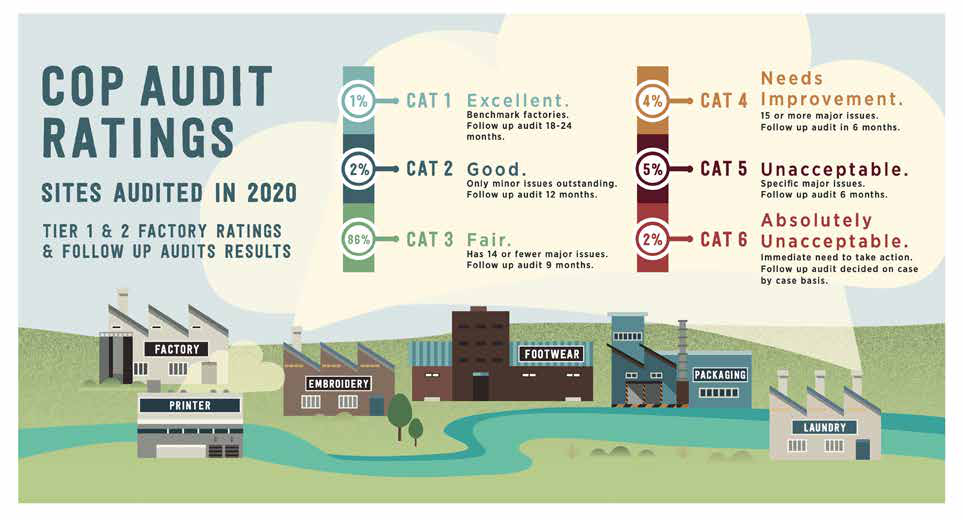

- Pentland Brands Modern Slavery Report 2019 pg 21

- Culture and stakeholders

- Overarching considerations for information on stakeholders

- Section 2: Information on decisions

- The investor view

- The company view

- A challenge for subsidiaries?

- Tips for approaching disclosures on decisions and decision-making

- The work of the Board

- BAE Systems plc Annual Report 2020 pg 30-33

- SSE plc Annual Report y/e 31 March 2020 pg 16-23

- Fresnillo plc Annual Report 2020 pg 132-134

- Fresnillo plc Annual Report 2020 pg 132-134

- Taylor Wimpey plc Annual Report 2020 pg 72-75

- Section 3

- Section 172 statements

- Section 4

- Appendices

- Appendix 3: Process and participants

- Explore more work of the Lab

Quick read

There are increasing calls for better information on how companies are having regard for their stakeholders and how key decisions take their perspectives into account. New regulatory requirements, including the introduction of the Section 172 statement and changes to the UK Corporate Governance Code and the Guidance on the Strategic Report in particular, have driven companies to increase reporting on their stakeholders. Discussions with investors on reporting on stakeholders and Section 172 statements highlighted that they are ultimately interested in understanding how a company is progressing towards fulfilling its purpose and achieving long-term success. Information on stakeholders and information on decisions can help with that understanding. With consideration of stakeholders and consequences of decisions being part of the Section 172 duty, the Section 172 statement is then a helpful bridge between the two types of information.

Such reporting may be of interest to a range of stakeholders, but this Lab report sets out what investors are looking for in reporting on these areas and how companies can improve their reporting to better meet their needs. In light of what we have heard from investors, this report has been divided into three sections to address the overarching need for information on how a company is progressing towards its purpose and long-term success:

- In the first section, we highlight that investors view information on a company's key stakeholders as critical to understanding the company and its prospects. We outline how investors want to see information on stakeholders' relevance to the business model and strategy, the strength of stakeholder relationships, risks and opportunities, and performance and metrics.

- In the second section, we highlight that investors want to know what the strategic decisions were during the period, how such decisions were made, including how stakeholders were considered in reaching them, the difficulties encountered, and the outcomes of these decisions.

- The final section addresses better practice Section 172 statements, highlighting that the statements are not just about stakeholder engagement, but should reflect all aspects of the Section 172 duty to allow a better understanding of how a company is progressing in its pursuit of its purpose and long-term success.

Each section includes examples which reflect possible helpful ways of addressing some of the aspects highlighted by investors.

Information that investors need in order to understand how a company is progressing towards its purpose and long-term success includes:

A Venn diagram showing "Information on stakeholders" and "Information on decisions" overlapping, with the intersection labeled "Section 172 statement". This illustrates that Section 172 statements act as a bridge between information on stakeholders and information on decisions.

Information on stakeholders

Many investors believe they currently do not get sufficient information on stakeholders from companies themselves and, when information is provided, investors are concerned about “social washing" and too much generic information, without sufficient discussion of what really matters to the company and of any negative issues.

Investors we spoke to wanted companies to set out clearly:

- what could affect the company's relationships with its stakeholders and how these relationships could affect the company's pursuit of success – this includes information on:

- market factors and trends or regulatory changes that have affected or could affect the company's key stakeholders;

- the risks that could affect key stakeholders and the company's relationship with them, as well as the risks that the stakeholder relationships give rise to;

- the mitigating actions taken to address these risks; and

- the opportunities arising from key stakeholders which the company is considering strategically.

- who are the stakeholders relevant to a company's success and how they influence the operation of the business model and delivery of strategy – this includes information on:

- who the key stakeholders are, i.e. identify the stakeholders the business model depends on, including those who become more relevant over a longer time horizon;

- why these key stakeholders are important, including how the business model and strategy depend on them, how they have been considered strategically, and what value is created through the stakeholder relationship; and

- what is important to the company's key stakeholders, including the value the company creates for them and what encourages the stakeholder group to maintain a relationship with the company or discourages them from it.

- how the company builds and maintains strong relationships with its stakeholders and understands their interests, needs and concerns to enable it to pursue long-term success - this includes information on:

- the actions the company is taking to build and maintain strong relationships with its key stakeholders, including how it engages and the feedback mechanisms it uses;

- the board's role in engagement, as well as the information the board receives about stakeholders and engagement; and

- the feedback received and the outcomes of engagement, including the actions the company took in response and how it affected decisions.

- what is measured, monitored and managed in relation to stakeholders, to understand the strength of a company's relationships with its stakeholders and how they are contributing to the company's success – this includes:

- metrics used by management and the board to monitor and assess stakeholder relationships;

- prior-years' comparatives, targets and industry benchmarks to allow trend analysis; and

- explanations of what affected the performance, whether a trend is likely to continue, and related actions to address performance issues.

Information on decisions

To understand how a company is progressing in meeting its purpose and its pursuit of success, investors want information on the decisions taken by management and the board since decisions link directly to the company's strategy and will have implications for the company's future. Investors told the Lab they expect decisions, and disclosures on those decisions, to:

- be connected to the company's purpose;

- be aligned with the business model and strategy;

- take into consideration risks and opportunities; and

- consider how different stakeholders will be impacted.

Investors we spoke to wanted companies to set out clearly:

- the significant decisions taken during the year and how they link to the company's purpose and strategic priorities, and for each significant decision:

- how the board or management reached the decision, including information used to back it up and any long-term considerations;

- how stakeholders were considered in reaching the decision, including consideration of feedback and engagement activities, and the impacts of the decision on different stakeholders;

- the difficulties or challenges in making the decision, including how different stakeholder needs or concerns are balanced, and any short-term negative consequences which are offset by long-term benefits; and

- the expected and/or actual outcomes of the decision, including how they are reflected in current performance and metrics, and the long-term implications on the company.

It is also helpful for investors to understand the process undertaken by the board for reaching principal decisions and its oversight when decisions are delegated to management. This helps them assess the board's role in challenging and overseeing that decisions are conducive to the success of the company.

Section 172 statements

The Section 172 statement requirement has led many companies to reconsider how they engage with their stakeholders and has prompted them to specifically discuss significant decisions during the year. With the requirement having come into effect for annual reports published in 2020, investors expect to see companies report more significant and difficult decisions than usual, in light of the COVID-19 pandemic. Investors expect companies not to shy away from discussing thorny issues and to discuss how impacts and consequences on different stakeholders were considered. So far, investors have seen too many statements that just focus on stakeholder engagement and that are process-oriented without a consideration of outcomes. Instead, the statement should tackle what the company is doing to be successful for the long term and highlight the board's role in this. Section 172 statements should address a company's route to long-term success and reflect all of the (a-f) aspects of Section 172, with a particular focus on decisions.

The Lab's tips on Section 172 statements, published in October 2020, provide a basis for what companies need to consider including in the statement and how to present it. In our discussions, investors emphasised that more useful Section 172 statements:

- do not only focus on stakeholder engagement, but consider the other aspects of Section 172;

- discuss principal decisions (linking to the long-term success of the company) and how stakeholders and other factors were considered in making those decisions;

- bridge information on stakeholders and decisions by considering them in a two-way approach, and incorporate both in the statement even if by cross-referencing;

- can be a standalone source of information which is still concise if cross-referencing is used well; and

- fit into a connected narrative linking to business model, strategy and how business is done (through consideration of governance and culture), demonstrating how the company is progressing in its pursuit of its purpose and long-term success.

Conclusion

This project has highlighted that investors are interested in how a company is progressing in fulfilling its purpose and achieving long-term success. Understanding how the company has considered its stakeholders and other Section 172 aspects strategically, including the company's impact on the stakeholders it relies on, as well as understanding what and how decisions were taken in the interest of the company's success, will help investors assess this progress. Currently, investors do not typically obtain sufficient insight from companies' reporting on these areas, which is often considered generic.

Investors also emphasised the importance of a connected narrative throughout, whether the company is reporting on stakeholders, its decisions or its Section 172 duty. Such information is seen in the context of the whole annual report and investors' knowledge of the company from other sources. Therefore, investors will be looking for consistency of message and alignment with the company's purpose and discussion of business model and strategy. Companies need to also remember not just to focus on the positives, and to discuss more the outcomes of both engagement with stakeholders and of decisions, for both stakeholders and the company.

Finally, although this report reflects on reporting under UK requirements, these are matters of global interest which provide companies with the opportunity to improve practice across different jurisdictions. In addition, this information, while targeted at investors, may also be of interest to stakeholders themselves.

Examples used in the report

| Information on stakeholders | |

| Relevance to business model and strategy | Barratt Developments plc, SSE plc, Handelsbanken, Fresnillo plc |

| Relationship with stakeholders | Fresnillo plc, National Grid plc |

| Risks and opportunities | Next PLC, Diageo plc |

| Performance and metrics | Taylor Wimpey plc, International Airlines Group (IAG), Barclays plc, Safestore plc, First Group plc |

| Spotlight on suppliers | International Airlines Group (IAG), Next PLC, Spirax-Sarco Engineering plc, Associated British Foods plc (ABF), Pentland Brands |

| Information on decisions | |

| Significant decisions | BAE Systems plc, SSE plc |

| Consideration of stakeholders | Fresnillo plc, Taylor Wimpey plc |

| Difficulties in making decisions | Taylor Wimpey plc, BAE Systems plc |

| Decision outcomes | Fresnillo plc |

| Section 172 statements | |

| Statements addressing (a)-(f) aspects | BT Group plc, Derwent London plc |

| Specific aspects of S172 duty: act fairly as between members | Man Group plc |

| Specific aspects of S172 duty: communities | Fresnillo plc |

Introduction

The requirement for a Section 172 statement introduced by The Companies (Miscellaneous Reporting) Regulations 2018, the UK Corporate Governance Code, the Guidance on the Strategic Report and other recent regulations have driven UK companies to increase reporting on their stakeholders (see Appendix 2 for more detail). In parallel, recent events, including the COVID-19 pandemic, and an increasing interest by investors and civil society alike, have also meant that treatment of stakeholders has been brought into sharper focus.

Calls for "stakeholder capitalism" are not just driven by stakeholder groups or their representatives, but also by investors who recognise that considering stakeholders is in the interest of the company and its shareholders in the long term. Asset managers and asset owners that sign up to the UK Stewardship Code and/or the UN Principles for Responsible Investment (PRI) need to integrate environmental, social and governance (ESG) issues into their investment process and, therefore, need to understand how the companies they invest in consider stakeholders.

"Companies that seek to build long-term value for their stakeholders will help deliver long-term returns to shareholders" Larry Fink, Blackrock CEO, 2021 letter to CEOs

Given these requirements and developments, and in response to companies' demand for guidance on reporting that best addressed investors' needs, the Lab launched this project addressing Section 172 statements and reporting on stakeholders more broadly, i.e. beyond the statements. As part of this project, the Lab spoke to companies of differing sizes across a variety of industries to understand their approach to reporting on their stakeholders and the Section 172 duty. We also spoke to both institutional and retail investors to understand how they currently obtain information on stakeholders and what is missing or could be improved. In the course of our discussions, investors highlighted how they are seeking to understand how a company is progressing towards fulfilling its purpose and achieving long-term success. Besides information on how stakeholders are being considered strategically, they are interested in how the Section 172 duty of promoting the success of the company is being met, particularly the aspect concerning decisions and their consequences for the long term. The discussions further highlighted that the Section 172 statement should be a helpful bridge between information on stakeholders and on decisions.

Recent and upcoming developments

Numerous sustainability and ESG reporting frameworks and initiatives address stakeholders to a greater or lesser extent. As noted in a BEIS report on frameworks for standards for non-financial reporting, these include:

- Task Force on Climate-related Financial Disclosures (TCFD) recommendations, on which research by CDSB on how the four pillars could be applied to reporting on social factors, including stakeholders, is ongoing.

- Sustainability Accounting Standards Board (SASB) standards by industry, which include stakeholder metrics where relevant.

The FRC has already encouraged public interest entities to report under TCFD and SASB.

In 2020, the IFRS Foundation announced the proposed establishment of the International Sustainability Standards Board. Although the initial focus will be on climate reporting, it is expected that any new board will later address broader sustainability reporting with an investor focus. In the meantime, the International Accounting Standards Board has published an Exposure Draft on Management Commentary, which includes guidance on addressing stakeholders through its discussion of resources and relationships.

In October 2020, the FRC published a discussion paper on the Future of Corporate Reporting, where it considered the need to report to a wider set of stakeholders. Responses are being analysed and proposed next steps will be published later this year.

To reflect these discussions, the Lab's report is structured around these two distinct but interrelated strands of information and Section 172 statements.

Information that investors need in order to understand how a company is progressing towards its purpose and long-term success includes:

A Venn diagram showing "Information on stakeholders" and "Information on decisions" overlapping, with the intersection labeled "Section 172 statement". This illustrates that Section 172 statements act as a bridge between information on stakeholders and information on decisions.

Section 1 - Information on stakeholders

Investors want to understand:

- who are the stakeholders relevant to the company's success, and how they influence the operation of the business model and delivery of strategy

- how the company builds and maintains strong relationships with its stakeholders and understands their interests, needs and concerns to enable it to pursue long-term success

- what could affect the company's relationships with its stakeholders, and how these relationships could affect the company's pursuit of success

- what is measured, monitored and managed in relation to stakeholders to understand the strength of the company's relationships with its stakeholders and how they are contributing to the company's success

The investor view

To understand how a company is progressing in meeting its purpose and its pursuit of success, investors need information on stakeholders. While much of this information is currently used for stewardship purposes, an understanding of a company's stakeholders is critical to an understanding of that company's business model and strategy, and the likelihood of its success. The COVID-19 pandemic has only further highlighted the importance of stakeholders and companies' dependency on them and the need to improve reporting in this area.

"It's one thing to report, but it's another thing to actually do. Some companies have poor relationships with stakeholders but this is usually not reflected in reporting. It has to be authentic reporting.” Investor

Investors are looking for an honest dialogue and assessment of where the company stands with its stakeholders. A concern shared by many investors is that there is too much generic information, without sufficient discussion of what really matters to the company and its stakeholders and of any negative issues.

"Stakeholder sections tend to be very descriptive and paint a picture which is acceptable but not enlightening. These sections seem to be more of a policing health check – you won't read anything that's bad.” Investor

A few investors commented how the information they seek in order to understand how a company is pursuing success is aligned with the four pillars in the TCFD recommendations that were also found to be a useful structure for workforce reporting as set out in the in the Lab's report on Workforce reporting. Those four elements (governance, strategy, risk management and metrics and targets) were raised by a range of investors, alongside the importance of a connected narrative across stakeholder issues.

Investors told us that when considering the business and its stakeholders, they are trying to understand and assess the following:

- Relevance to business model and strategy – who are the stakeholders relevant to a company's success and how they influence the operation of the business model and delivery of strategy.

- Relationship with stakeholders – how the company builds and maintains strong relationships with its stakeholders and understands their interests, needs and concerns to enable it to pursue long-term success.

- Risks and opportunities – what could affect the company's relationships with its stakeholders and how these relationships could affect the company's pursuit of success.

- Performance and metrics – what is measured, monitored and managed in relation to stakeholders to understand the strength of a company's relationships with its stakeholders and how they are contributing to the company's success.

In addition, investors are interested in the governance and oversight that the board and management exercise across all the above elements. Reporting on the processes undertaken in considering and engaging with stakeholders can indicate to investors whether the company has the capability to detect particular issues through its monitoring and engagement, and the level of importance the company attributes to stakeholder matters.

However, while investors are interested in the "how", what they are truly interested in and would like to see more of in the annual report is the why and the outcomes of processes, implementation of policies and engagement.

Investors told us they use a number of different sources for information on stakeholders. These include the company's annual report, website and sustainability report, as well as data aggregators and providers. For some investors, the annual report is the first indication that a company's board is engaged on stakeholder issues and they will use the information within the annual report, or lack thereof, as an engagement tool to drill for more information.

The company view

However, access to management and direct engagement, as well as some information from data providers, is often not easily available to retail shareholders, which is why publicly available information from the company itself, particularly within the annual report, is considered so important.

Yet, some investors believe they currently do not get sufficient information on stakeholders from companies themselves and so they look at external sources such as customer review sites, as well as using Al-driven data scraping tools. Such information is helpful for investors to corroborate what companies are reporting. This is especially relevant due to concerns of "social washing" or that reporting on stakeholders ends up being more of a public relations or marketing exercise.

Although many companies say that consideration of stakeholders has been part of "business as usual" for many years, the recent wave of new regulations has led companies to reassess, formalise and articulate how they think about and engage with stakeholders. Companies highlighted that in the past some stakeholders were viewed through a corporate social responsibility lens but they are now being assessed more strategically. Some companies have undertaken stakeholder mapping exercises to identify their stakeholders and the issues that matter to them. Companies have updated their board papers and minutes templates to remind both those preparing and those reading the papers to consider stakeholders. Some companies also told us they are seeing a better feedback loop as engagement feedback is now more visible to the board.

"Having to report on stakeholders is leading to improved practice and better engagement" Company

Responsibility for reporting on stakeholders varies by company. Due to the nature of the requirements and the board duty, company secretarial teams are often managing the process but are collaborating with investor relations, sustainability, talent, remuneration and procurement teams to compile the information.

Companies noted the following challenges in reporting on stakeholders, including:

- identifying what is most important to report;

- balancing the need to provide useful information with not disclosing commercially sensitive information; and

- distinguishing between what the board and management does.

"There is a new level of transparency – we had to get the necessary buy-in on what needs to be communicated" Company

Tips for approaching stakeholder-related considerations and disclosures

- Assess stakeholders strategically. Whilst some companies felt that they were already doing this, the new regulations forced them to reassess.

- Really consider which stakeholders are most pertinent to the company. Disclosure on other stakeholders may be relevant and useful, but investors want to understand which stakeholders are considered to be most important by the board and management.

- Consider whether board paper templates and discussions need updating. However, this should not be the only way to evidence the company's consideration of stakeholders. While the Section 172 duty, which includes consideration of stakeholders, is the directors' duty, investors expect that stakeholders will be considered throughout the company, and not just by the board. Therefore, consider whether other processes and templates need to be updated too.

- There is not one right 'owner' of stakeholder relationships and reporting for every company. Integration and coordination is key.

- Consider highlighting key information through use of graphics and tables to help time-poor investors.

What investors want to see reported

In this section, we explore further what investors want to see included in information on stakeholders and identify some examples from current reporting practice which address particular aspects.

Relevance to business model and strategy

"Without employees you cannot run the company but without customers you cannot sustain the company.” Investor

"There is no harm in not talking about a stakeholder group if it is genuinely not applicable – companies should set out how they thought about the impacts and explain why they are not key (if they would generally be expected to be)." Investor

Who are the company's key stakeholders?

Investors want to know who the company has identified as its key stakeholders, that is those stakeholders on which the company's business model depends. Although there is a general expectation that the workforce and customers are likely to always be key and reported on, investors expect the key stakeholders to vary by company and want companies to reach their own conclusions in identifying the ones that are most important. Some investors told us that they are interested in management's process for identifying stakeholders and how they decide why particular stakeholders are more important than others. One example of this is reporting on how the company conducted its stakeholder mapping exercise and a review in the current year (Rentokil Initial plc

-

page 24 of its 2020 annual report). Investors also expect companies to consider the following when identifying their key stakeholders:

-

There are many possible stakeholders, not just those listed in Section 172. These could include future generations, lenders, governments and regulators. Some consider nature also to be a stakeholder.

- There are stakeholders that are relevant for the long term and those who become important if there is a problem – these need to be monitored regularly, and as a result, prioritisation of stakeholders may vary over time.

- Key stakeholders will be ones the company impacts, but also ones the company may want to avoid impacting.

- Companies also need to consider the connectivity between stakeholders, for example, employees are future pension holders and communities hold potential customers or future employees.

Investors also need information to assess who makes up each stakeholder group. Although information about the identity of stakeholders may not be possible due to commercial sensitivity or practical reasons, information about the number of individuals or organisations within a stakeholder group and where the stakeholder is located would be helpful. Such information can be valuable in enabling investors to assess associated risks and how the stakeholders could influence the company's success.

Companies should also consider whether information about key stakeholders applies across a whole group or whether there are significant differences in regions, business units or segments. Investors want sufficient granularity and disaggregation so that underlying issues cannot be masked.

"Stakeholder relationships are often a key source of value that help to ensure that an entity's success is sustainable over the longer term. It is important that boards identify [the company's] key stakeholders and the importance of those stakeholders to the long-term success of the company." paragraph 8.16, Guidance on the Strategic Report

Why are these stakeholders important?

Investors want to know how the key stakeholders fit in with the operation of the business model and the delivery of strategy, and ultimately, purpose and the company's long-term success. They want to understand how stakeholders have been considered strategically and what the related strategic long-term priorities are. Information on the implications of loss, damage or reduction of a stakeholder relationship, such as loss of skills or intellectual capital, reputational damage or fines should also be provided. In this way, investors can be reassured that such issues are being considered by management but can also assess the implications on the company's success.

What is important to the company's key stakeholders?

"There will be instances where it really matters to focus on certain stakeholders – you also need to realise that they impact each other besides also considering them individually.” Investor

"Companies need to consider the circular impact of stakeholders and cannot just focus on one particular stakeholder group, as an emphasis on just customers for example, giving priority to speed of low-cost delivery could be detrimental to employees and suppliers if the counter effect is not considered." Investor

By recognising and providing information on what is important to their key stakeholders, investors can assess how value creation for stakeholders affects value and success for the company. The value created is not necessarily quantifiable. What is important to stakeholders should ultimately link back to why they are important for the company. If these matters affect the continuity of the relationship, they then have an effect on the company's business model and strategy. A possible way of reporting this is by depicting the company's materiality assessment.

The examples on pages 13-16 reflect possible ways of addressing some of these aspects, and below we set out some questions for companies to consider when reporting who the key stakeholders are and their relevance to business model and strategy.

| Who are the company's key stakeholders? | Why are these stakeholders important? | What is important to the company's key stakeholders? |

|---|---|---|

| * On which stakeholder groups does the business model depend? | * How does the business model depend on these stakeholders? | * What value does the company create for its key stakeholders? |

| * Are there different relevant stakeholders for different business units, segments or locations? | * What role do these stakeholders play in enabling the company to achieve its strategy? | * What encourages or discourages the stakeholder group in maintaining its relationship with the company? |

| * Are there stakeholders who become more relevant over a longer time horizon? | * How does the continuity and strength of the relationship affect the company's ability to deliver on its strategy? | |

| * Who makes up each stakeholder group and where are they located? | * How are these stakeholders considered strategically? | |

| * How does the company identify its key stakeholders and is this appropriate? | * What value is created for the company through the stakeholder relationship? | |

| * How often are key stakeholders reviewed, including consideration of whether new stakeholders have emerged or will become key? | * Which stakeholders could detract value from the company? |

Barratt Developments plc

Annual Report 2020 pg 64

What is useful? For each of its strategic priorities and principles, Barratt Developments outlines the objectives and (qualitative) value created for the relevant stakeholders over the short, medium and long term and the progress so far.

Being a trusted partner

Our principles

Housebuilding is a long term business and the development of sustained partnerships with landowners, local authorities, suppliers and sub-contractors is critical to our success.

Strategic priority

We build meaningful, long term relationships that make us the developer of choice for our partners. We are innovating in our supply chain to drive efficiency and meet our customer needs.

Our objectives

- Short term

- Continue the deployment of our strategic supplier capability assessment, a process designed to work with our suppliers in highlighting and addressing potential supply performance risks to ensure deliverability and reliability.

- Highlight and address potential supply performance risks, including through our strategic supplier capability assessment.

- Medium term

- Work with our suppliers on ways we can manage and reduce embodied carbon in our supply chain.

- Adapt our business and supply chain requirements to meet the Future Homes Standard.

- Long term

- Work with our offsite partners on more advanced forms of MMC.

- Investigate, develop and grow industrialised offsite solutions to meet housing demand through our AIMCH project.

Value created for stakeholders

- Short term

- Ongoing engagement with suppliers, particularly as the impact of COVID-19 evolves, is important to help them identify risks and plan accordingly to ensure they can meet our demand.

- Medium term

- We engage with local authorities and other key Government agencies to understand their priorities and needs and ensure we build quality homes in the right locations.

- We are developing offsite solutions to reduce embodied carbon and make our operations efficient and effective.

- Long term

- Suppliers and sub-contractors are critical to our business success, carrying out the majority of construction on our sites and providing the materials and services we require. It is essential for us to build good, long-lasting relationships that make us the developer of choice to partner with.

Progress

- Working with our partners to build homes We are committed to delivering high quality, sustainable, energy efficient places to live that satisfy the needs of customers and communities. Key to this is ensuring we provide quality housing in the right locations. It is vital that we have good relationships with landowners and other partners to ensure we are their developer of choice. We have a comprehensive Group Partnerships Policy to ensure proper engagement with our key land partners and stakeholders.

-

Working with our suppliers and sub-contractors We recognise our suppliers and sub-contractors are critical to the delivery of our strategic objectives and we invest in our relationships with them. We continuously communicate with our suppliers, holding regular performance and business reviews focusing on our ongoing relationship and health and safety. This engagement has become vitally important during the COVID-19 pandemic. We are committed to providing a safe place in which our employees and sub-contractors can work. We engaged with our suppliers throughout the lockdown and remobilisation periods of our site operations to ensure we had clear visibility of each other's plans. This exchange of business planning information, such as our build programmes and their manufacturing plans, enabling a smooth transition between our respective operational phases.

The procurement for the majority of our construction materials, site equipment and business consumables is centralised. This arrangement enables us to manage supply, cost, sustainability specifications and supplier relationships effectively. We believe it is important to engage openly with our suppliers regarding the challenges they are facing and to help them identify and address opportunities and mitigate risk. Through the COVID-19 pandemic we have been able to leverage our investment in supplier relationships to ensure we have appropriate supply of scarce resources such as PPE and other consumable material requirements directly related to new COVID-19 operating protocols. We have also been able to ensure that whilst our supply chain returns from hibernation and material supply in some areas is constrained, they support our build requirements as required.

Annual Report 2020 pg 38-48

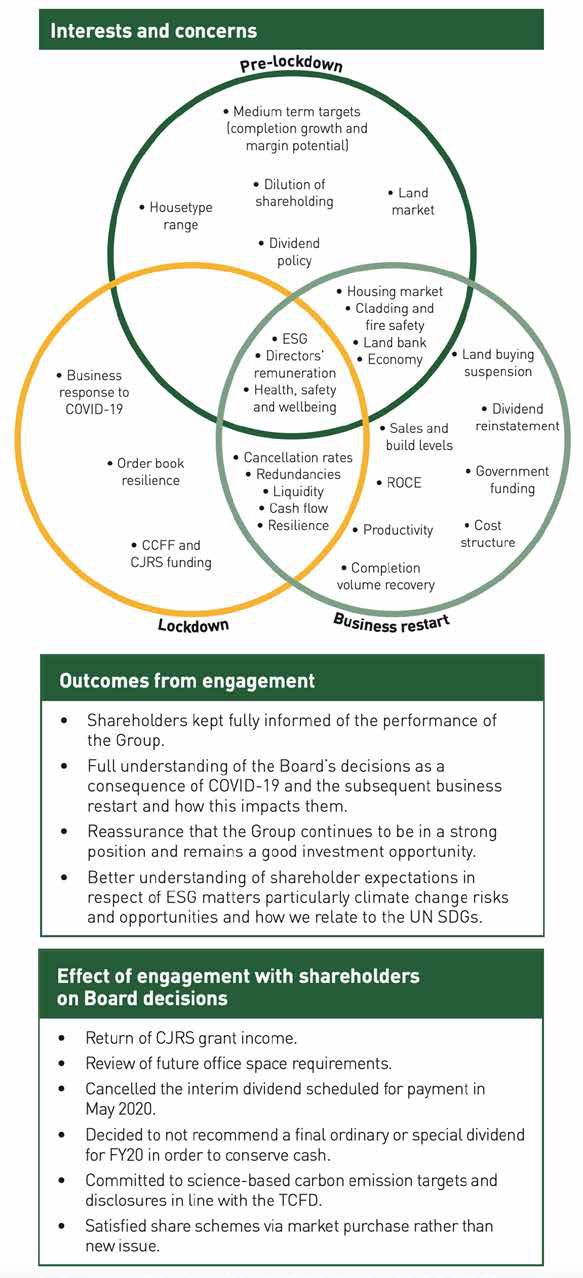

What is useful? As part of its S172 statement, Barratt Developments' stakeholder engagement section includes Venn diagrams for each stakeholder group's interests and concerns, highlighting how these have changed from before and during the pandemic, and what they expect them to be after lockdown. For each stakeholder group they also include the outcomes of engagement and the effect on board decisions.

Interests and concerns

Pre-lockdown

- Medium term targets (completion growth and margin potential)

- Dilution of shareholding

- Housetype range

- Land market

- Housing market

- Cladding and fire safety

- Economy

- Land bank

- Directors' remuneration

- Land buying suspension

- Dividend policy

- Dividend reinstatement

- ESG

- Government funding

- Business response to COVID-19

- ROCE

- Order book resilience

- Cancellation rates

- Cost structure

- Redundancies

- Liquidity

- Cash flow

- Productivity

- Resilience

- Completion volume recovery

- CCFF and CJRS funding

Lockdown

Business restart

Outcomes from engagement

- Shareholders kept fully informed of the performance of the Group.

- Full understanding of the Board's decisions as a consequence of COVID-19 and the subsequent business restart and how this impacts them.

- Reassurance that the Group continues to be in a strong position and remains a good investment opportunity.

- Better understanding of shareholder expectations in respect of ESG matters particularly climate change risks and opportunities and how we relate to the UN SDGs.

Effect of engagement with shareholders on Board decisions

- Return of CJRS grant income.

- Review of future office space requirements.

- Cancelled the interim dividend scheduled for payment in May 2020.

- Decided to not recommend a final ordinary or special dividend for FY20 in order to conserve cash.

- Committed to science-based carbon emission targets and disclosures in line with the TCFD.

- Satisfied share schemes via market purchase rather than new issue.

SSE plc

Annual Report y/e 31 March 2020 pg 12

What is useful? SSE's introduction to the stakeholder engagement section includes a diagram highlighting the inputs and outputs (i.e. a two-way consideration) of the relationships for its key stakeholders, addressing the benefits that the company and stakeholders obtain respectively.

SSE's stakeholder relationships

SSE aims to have a two-way constructive relationship with the following six key stakeholder groups. By considering their perspectives, insights and opinions, SSE seeks to ensure outcomes of operational, investment or business decisions are more robust and sustainable.

Handelsbanken

Annual and Sustainability Report 2020 pg 42

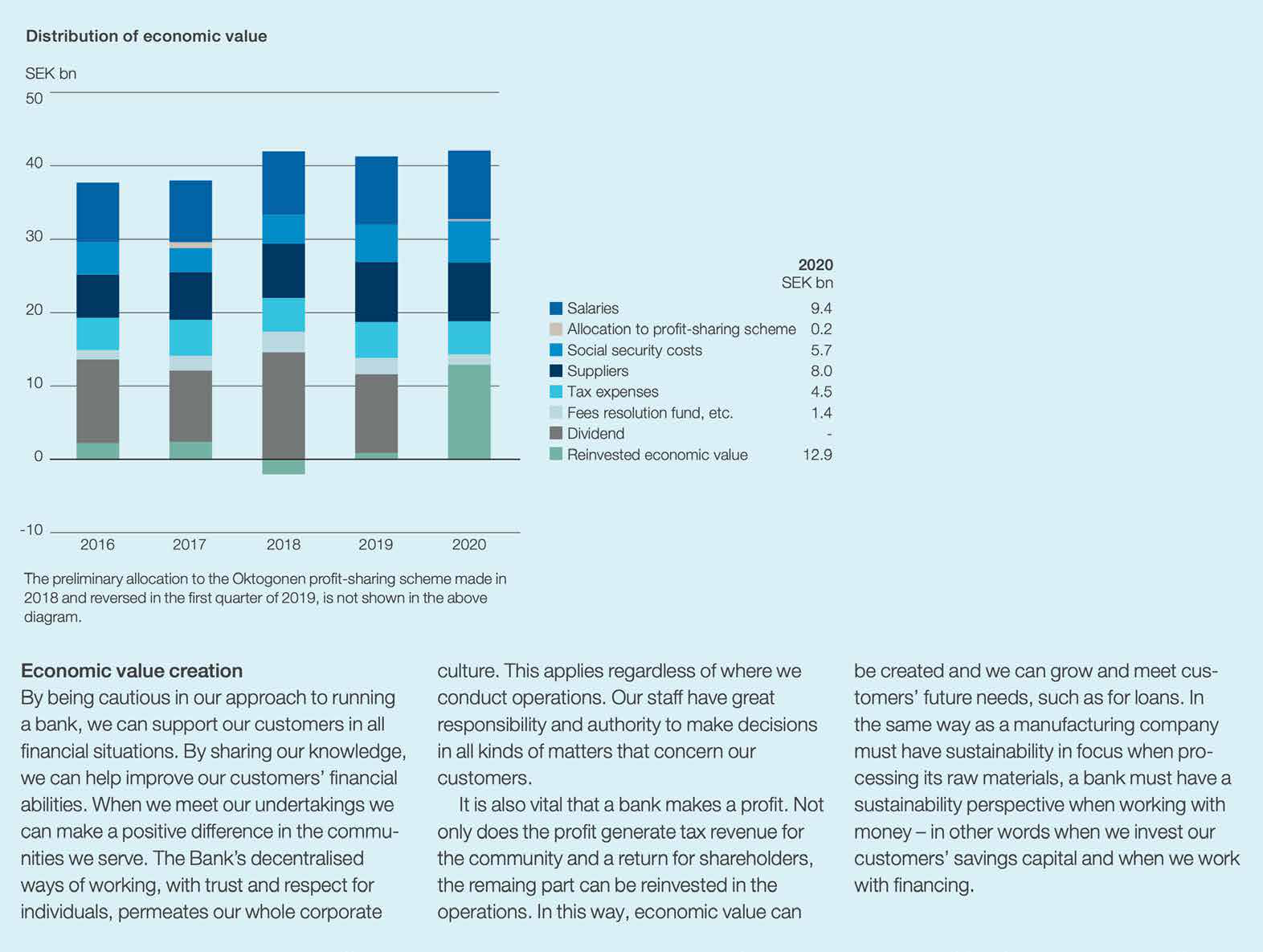

What is useful? Handelsbanken discloses distribution of economic value creation amongst different stakeholders across five years, allowing for comparison with prior years, and clearly highlights where no distributions (e.g. dividends) were made during the year.

| 2020 SEK bn | |

|---|---|

| Salaries | 9.4 |

| Allocation to profit-sharing scheme | 0.2 |

| Social security costs | 5.7 |

| Suppliers | 8.0 |

| Tax expenses | 4.5 |

| Fees resolution fund, etc. | 1.4 |

| Dividend | |

| Reinvested economic value | 12.9 |

The preliminary allocation to the Oktogonen profit-sharing scheme made in 2018 and reversed in the first quarter of 2019, is not shown in the above diagram.

Economic value creation

By being cautious in our approach to running a bank, we can support our customers in all financial situations. By sharing our knowledge, we can help improve our customers' financial abilities. When we meet our undertakings we can make a positive difference in the communities we serve. The Bank's decentralised ways of working, with trust and respect for individuals, permeates our whole corporate culture. This applies regardless of where we conduct operations. Our staff have great responsibility and authority to make decisions in all kinds of matters that concern our customers. It is also vital that a bank makes a profit. Not only does the profit generate tax revenue for the community and a return for shareholders, the remaing part can be reinvested in the operations. In this way, economic value can be created and we can grow and meet customers' future needs, such as for loans. In the same way as a manufacturing company must have sustainability in focus when processing its raw materials, a bank must have a sustainability perspective when working with money

- in other words when we invest our customers' savings capital and when we work with financing.

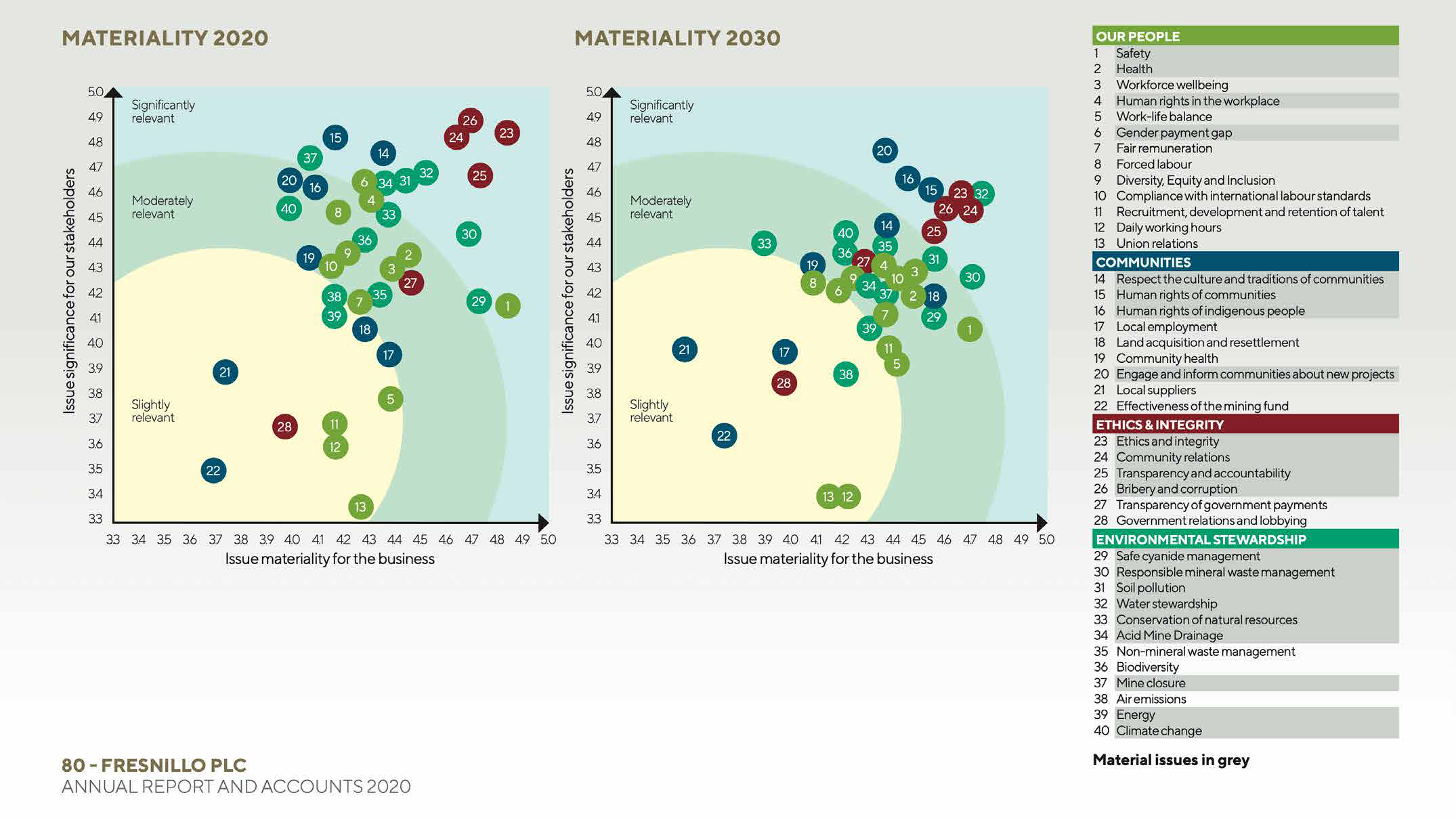

Our People 1. Safety 2. Health 3. Workforce wellbeing 4. Human rights in the workplace 5. Work-life balance 6. Gender payment gap 7. Fair remuneration 8. Forced labour 9. Diversity, Equity and Inclusion 10. Compliance with international labour standards 11. Recruitment, development and retention of talent 12. Daily working hours 13. Union relations

Communities 14. Respect the culture and traditions of communities 15. Human rights of communities 16. Human rights of indigenous people 17. Local employment 18. Land acquisition and resettlement 19. Community health 20. Engage and inform communities about new projects 21. Local suppliers 22. Effectiveness of the mining fund

Ethics & Integrity 23. Ethics and integrity 24. Community relations 25. Transparency and accountability 26. Bribery and corruption 27. Transparency of government payments 28. Government relations and lobbying

Environmental Stewardship 29. Safe cyanide management 30. Responsible mineral waste management 31. Soil pollution 32. Water stewardship 33. Conservation of natural resources 34. Acid Mine Drainage 35. Non-mineral waste management 36. Biodiversity 37. Mine closure 38. Air emissions 39. Energy 40. Climate change

Material issues in grey

Fresnillo plc Annual Report 2020 pg 80

What is useful? As part of its materiality assessment, Fresnillo identifies issues by stakeholder group or topic and the degree of relevance to the company. Fresnillo provides a materiality map not only for the current year but also for 10 years ahead, showing how issues change in importance.

Relationship with stakeholders

What actions is the company taking to build and maintain strong relationships with its key stakeholders?

Investors want information on the actions that a company is taking to build and maintain strong relationships with its key stakeholders. This is not only about engaging with stakeholders, but also about monitoring the relationship and how management and the board use information to understand the stakeholders' interests, needs and concerns.

When it comes to reporting on engagement, investors note that companies tend to discuss the engagement mechanisms in detail, particularly for employees. However, many companies do not sufficiently discuss the outcomes of the engagement, including the feedback received, how the company responded to it, and what implications it has on strategy and decisions. As highlighted in the FRC's 2020 Annual Review of Corporate Governance Reporting, there needs to be a two-way process of engagement which ensures that stakeholders' views are being heard (and reflected in reporting), as some engagement seems to be more about just informing stakeholders. See Fresnillo for a discussion of actions and outcomes as a result of engagement.

“Companies are good at saying what engagement they've done but not what they've learnt from it.” Investor

“There is a lack of strategic interpretation of engagement surveys.” Investor

Investors also highlighted that discussion of feedback or outcomes often did not sufficiently address negative feedback or problems. Investors expect honest disclosure on disappointing feedback which then includes the actions that the company is taking to address such issues.

"Negative news needs to be presented with how the company is planning to address it if it is reasonably significant – it is important to reassure stakeholders that it's a problem under control and that there are plans in place.” Investor

Investors recognise that the majority of engagement is undertaken by management, but they do expect the board to engage where relevant (including through designated non-executive directors and committees). They also expect the board to have oversight of the engagement and receive insights, which together are considered in decision-making and in assessing whether any actions are needed to improve stakeholder relationships. Disclosure which distinguishes between engagement at a company/management level and the board's role, including assigned director responsibilities, board oversight and direct engagement, is helpful (e.g. by Fresnillo). National Grid also distinguishes between board and company level, and breaks down the latter at regional level where relevant.

Especially in light of the COVID-19 pandemic, investors are also interested in actions that a company is taking to support its stakeholders to ensure a continuing relationship and sustain the pursuit of the company's success. Evidence of supporting stakeholders in difficult circumstances, and doing the right thing by them, indicates that the company is more likely to in turn have supportive stakeholders enabling it to create value and be resilient and successful.

To help investors understand how the company builds and maintains strong relationships with its stakeholders and understands their interests, needs and concerns to enable it to pursue long-term success, companies should ask themselves:

- What actions is the company taking to build and maintain strong relationships with its key stakeholders?

- How does the company engage with its key stakeholders?

- Does engagement differ across business units, segments or locations?

- What is the board's role in this engagement?

- Where the board does not engage directly, what information does the board receive about the stakeholders and the engagement with them?

- What feedback mechanisms are used?

- What was the feedback received from stakeholders?

- What are the outcomes of this engagement?

- How did the company respond to feedback received?

- What actions has the company taken to address the feedback or in response to other information about the stakeholder group?

- Has the company made any changes to its strategy in response to stakeholder feedback?

- How do management and the board get comfort that appropriate and sufficient engagement is taking place and that the company is acting on feedback received?

- How do management and the board get comfort that appropriate policies around stakeholder relationships are in place and that these have been reliably followed?

- Has the company taken any actions to support stakeholders in view of difficult circumstances or other factors?

Fresnillo plc Annual Report 2020 pg 28-31

What is useful? In its section "Relationships with key stakeholders", Fresnillo distinguishes between what management does and what the Executive Committee and Board do in terms of engagement. In addition, they include governance activities and, where relevant, highlight the designated non-executive director and their activities. The section also discusses actions taken during the year and what's planned based on the engagement undertaken.

Communities

Metrics * Social and environmental incidents. * Local employment and procurement. * Social investment.

How we engage our communities What management does: * Raise awareness on the measures to prevent Covid-19. * Engage with formal and informal leaders, local and regional authorities to understand and discuss their concerns and aspirations. * Preventive measures were implemented to safely conduct interviews and to limit the number of participants in meetings. * Operate grievance mechanisms to address community concerns and questions. * Conduct social studies every two years to identify and evaluate issues that matter to our communities. The next round of studies may be conducted in the second half of 2021 or postponed, depending on the Covid-19 risk. * Support our social investment portfolio with emphasis on education, health and sports, capacity building and water access. During Covid-19, some programmes were postponed and others adapted to be conducted online, while a number of new initiatives were launched.

How the Board complements the engagement efforts: * Visits from Board members to communities to gain further insights into the Company's social projects. Visits were postponed in 2020 to mitigate the Covid-19 risks. * Visits/appointments of the Chairman, the Deputy Chairman and other members of the Board with key Government officials, both at the federal and local level.

28-FRESNILLO PLC ANNUAL REPORT AND ACCOUNTS 2020

Governance activities of the Board and Board Committees * Gain insights into the corporate citizenship expectations of society during Covid-19. * Monitor community engagement and social investment portfolio in order to collaborate with communities to address the impacts of Covid-19.

Actions and Decisions (A - Actions undertaken, D - Decisions) * A - Engaged our communities on preventive measures to contain Covid-19, notably the use of masks. * A - Supported the most vulnerable members of the community, including supplying food so they could stay at home during lockdowns. * A - Shared rapid testing of Covid-19 with the communities. * A - Adapted our education and entrepreneurship programmes to be delivered online. To address the digital gap in remote communities, we launched a pilot project to test technologies and content for educational internet services. * A - Partnered with INNOVEC and the Smithsonian Science Education Center to create Covid-19 training, based on science, for children and their parents. * D - To increase donations of personal protection equipment and ventilators to the regional hospitals that serve our communities.

Outcomes * No conflicts with communities affecting our ability to operate. * Community engagement and programmes were adapted to the new dynamic of Covid-19. * Social investment (KPI). * Local employment (KPI).

For more information → See pages 105-109

29-FRESNILLO PLC ANNUAL REPORT AND ACCOUNTS 2020

National Grid plc Annual Report 2019/20 pg 45-47

What is useful? National Grid's S172 statement distinguishes between company and board-level engagement and, where relevant, it also distinguishes engagement at a divisional level (UK and US).

Stakeholder group

Our regulators

How we engage and communicate

Company engagement UK - regular interactions with Ofgem and the Health and Safety Executive. The Company also organises stakeholder fora and consultations with stakeholders, including members of the public, our suppliers and customers around specific projects and proposed business plan submissions for RIIO-2.

We work with other networks and organisations outside of the energy industry to identify good practice.

US - regular interface with both federal and state regulators and customers on an ongoing basis, as well as the pre-filing stakeholder engagement programme in the build-up to and during any rate case process. Specific engagement was undertaken regarding the decarbonisation pathways and the Niagara Mohawk Power Corporation advanced metering infrastructure.

Board-level engagement The Board met with the Chair, CEO and incoming CEO of Ofgem in November

- The topics of conversation included our net zero ambition, with a focus on practical solutions to move the agenda forward. The discussions also covered RIIO-2.

The outcomes of engagement activities are reported to the appropriate forum and ultimately to the Executive Committee and Board. In the US, any rate case engagement is reported up to the Executive Committee and the ordering of Executive Committee and Board as appropriate. The Board met with the Governor of Massachusetts and a member of the Governor's office in March

- Recognising the severity of the adverse reaction of various stakeholders to the gas moratorium that was enforced by the Company in downstate New York, the Board commissioned two external reviews to understand how the US business had made the original decision. Long-term solutions are being implemented.

How stakeholder interests have influenced decision-making and the execution of our strategy

In the UK, discussions with our regulators have contributed to the productive outcome of key business issues such as: * the 9 August 2019 power outage: the Company had regular engagement with Ofgem and the UK government, and the Board regularly discussed the outcome of investigations and reports focused on this, including the response to Ofgem on the findings from the investigation. In January 2020, the Board welcomed Ofgem's report on this incident which confirmed that our actions did not cause the outage. * the future of our ESO business, which will be reviewed by Ofgem following legal separation last year. * RIIO-2 business plans: for the development of the RIIO-2 business plans, we have followed Ofgem's enhanced stakeholder engagement process, which is based on greater engagement with our industry and end consumers to prioritise their needs in our RIIO-2 business plans. Three independent groups were established to provide challenge throughout this process - two independently Chaired User Groups, (one for the ESO and one for the transmission businesses) and an Ofgem Challenge Group. Regular discussions were held at the Executive Committee and the Board on progress with stakeholder engagement, the development of the RIIO-2 business plans and on interactions with the challenge groups. On invitation, the Chairs of the Chaired Independent User Groups met with the Board in 2019. Following a period of engagement with Ofgem, we submitted our final business plans for RIIO-2 in December

- Thereafter, engagement has continued with Ofgem evidencing various aspects of the Company's RIIO-2 business plans such as the formal question and answer process to explore our RIIO-2 business plan submission ahead of its draft and final determinations later in 2020.

In the US we refined the Company's regulatory strategy and business planning for rate cases and other US regulatory priorities. The Company's rate case pre-filing stakeholder engagement programme has become a major contributor to the Company's successful rate case outcomes. The external reviews conducted on the gas moratorium have highlighted lessons and recommendations which are already being implemented. In the short term, all affected customers have been contacted and plans are in place to make sure that they are connected to a gas supply in the near future. Medium

- to long-term solutions that are in the best interests of our customers and regulators continue to be progressed. The Board is closely monitoring the output of these developments.

Views of other stakeholder groups considered Customers, Investors, Communities and governments, Suppliers, Our colleagues.

Risks and opportunities

What could affect key stakeholders and how do they affect the company?

Investors want information about what could affect a company's relationships with its stakeholders and how these relationships could affect the company's pursuit of success. Investors will be aware of trends and factors that could affect a company's stakeholders and will be forming an opinion on related risks and opportunities. However, they want to understand the board and management's own assessment. They want information on: * how management makes its risk assessment and monitors risks, which is in part addressed by how management understands who its stakeholders are and what their concerns are; * factors that are affecting or could materially affect stakeholders, such as market trends, economic factors, technological change, social movements and new legislation and the resulting risks or opportunities; * what are the risks and opportunities associated with stakeholders and how the company is responding to them.

The COVID-19 pandemic highlighted that certain risks affecting stakeholders, particularly customers and suppliers, were not sufficiently considered and disclosed. Investors hope that this increased awareness will lead to better practice and reporting, including an honest depiction of the uncertainties and consequences for the business model. Some investors are concerned that disclosures can still be too positive, even when discussing implications of new government-imposed restrictions and changes in people's attitudes which could drastically affect the way stakeholders interact with a company and how a company operates.

"It's a shame it took a pandemic to bring certain stakeholders and risks into focus." Investor

This information could be included either in the risk section or in the stakeholder section in the annual report – what is important is that there is good linkage between the different sections where these issues are relevant, including discussion of business model and strategy. We set out some helpful examples of reporting on trends and opportunities on pages 22-23. Disclosures of risks and opportunities will be addressed in the Lab's upcoming project report on reporting of risks and uncertainties, which will be published later in the year.

To help investors understand what could affect the company's relationships with its stakeholders and how these relationships could affect the company's pursuit of success, companies should ask themselves:

- What could affect key stakeholders and how do they affect the company?

- How does the company, including the board, monitor what could affect its key stakeholders over different time horizons?

- What market factors and trends or regulatory changes have affected or could affect the company's key stakeholders?

- What are the risks that could affect the stakeholders and the company's relationship with them?

- What risks do the stakeholder relationships give rise to?

- What mitigating actions are being taken to address these risks?

- What are the opportunities that the key stakeholders give rise to that the company is considering strategically?

Uncomfortable Truths and Difficult Decisions

In many ways the last ten years has been about adapting to the simple truth that, initially, we did not want to believe: Retail stores were, and will remain, at a fundamental and irreversible disadvantage to online competition. This is not being driven by price or even home delivery, but by the scale of the choice websites can offer relative to any physical store. The annual decline in Retail like-for-like sales has become the new normal, and looks set to remain that way for many years.

The moment we reconciled ourselves to that fact was, in some ways, a new beginning. Managing the transition was harder than fighting it, but much more productive. It allowed us to follow the new money rather than defend the old.

Following the money can be uncomfortable, because new ideas often pose a threat to existing businesses. The decision to compete with ourselves through selling third-party brands and, more recently, the opening up of our sourcing skills to other brands through licensing were not entirely uncontroversial. We have learned to embrace these and other opportunities nonetheless.

Our view is simple: there is nowhere to hide on the internet, and we are better to collaborate with other brands to our mutual benefit, than cling on to past advantages in the vain hope our customers will not find the competition. And of course, the broader our product offer, the more relevant our website becomes to an increasing number of customers.

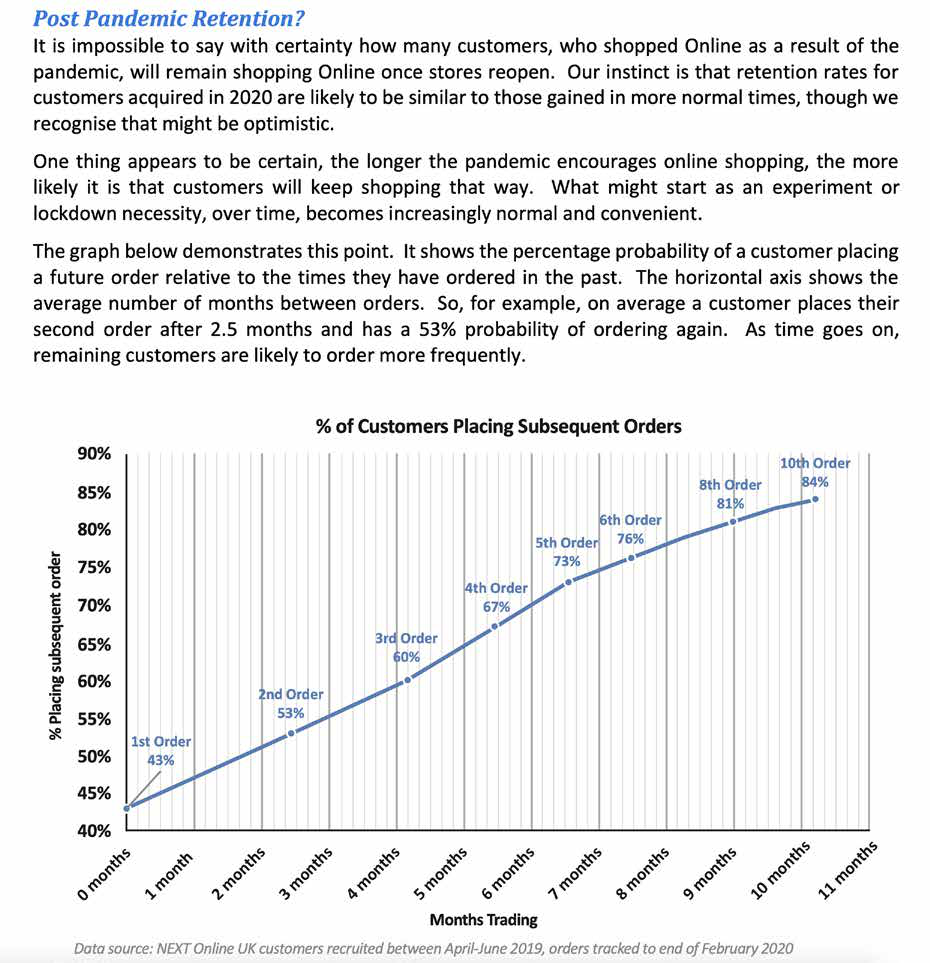

Post Pandemic Retention?

It is impossible to say with certainty how many customers, who shopped Online as a result of the pandemic, will remain shopping Online once stores reopen. Our instinct is that retention rates for customers acquired in 2020 are likely to be similar to those gained in more normal times, though we recognise that might be optimistic.

One thing appears to be certain, the longer the pandemic encourages online shopping, the more likely it is that customers will keep shopping that way. What might start as an experiment or lockdown necessity, over time, becomes increasingly normal and convenient.

The graph below demonstrates this point. It shows the percentage probability of a customer placing a future order relative to the times they have ordered in the past. The horizontal axis shows the average number of months between orders. So, for example, on average a customer places their second order after 2.5 months and has a 53% probability of ordering again. As time goes on, remaining customers are likely to order more frequently.

OUTLOOK FOR THE YEAR AHEAD

Uncertainty on Many Levels It is hard to think of a year where the outlook has been so uncertain. The health of the consumer economy, the future course of the pandemic and the prospects for Retail stores remain unknown. It also remains to be seen how many of the product preferences and shopping trends induced by the pandemic will persist once life returns to normal. The following paragraphs set out our thinking on the main uncertainties facing the business and our guidance for the year ahead.

Assumptions About the Consumer Economy and Future Lockdowns Our best guess is that the consumer economy, at least in the short term, will be healthier than many presume. It seems likely that a combination of pent-up demand along with a healthy overall increase in personal savings will serve to keep the consumer economy moving forward.

Whether or not there will be further lockdowns this year is impossible to predict. We have (perhaps optimistically) assumed that the rollout of COVID vaccines will result in stores remaining open for the year, once the current lockdown has passed. If this assumption is not correct, it is unlikely we will meet our central guidance for sales and profit.

Structural Change and the Future of Retail Stores There remains a big question mark over the level of sales our stores will achieve when they reopen. The pandemic has served to accelerate a pre-existing social trend – the move to more online shopping. History has been given a shove and, having moved forward, seems unlikely to reverse.

That said, the steady reduction in Retail occupancy costs, the continued relevance of our stores to online shopping through collections and returns and (perhaps) the closure of competing shops, mean that the battle to keep our stores relevant in an online world is far from over.

So our base case for the year ahead is that store sales will decline, on a like-for-like basis, by -20%. At this level (after reversing out the effects of the current lockdown) our store network would remain marginally profitable (see page 49).

Next PLC Annual Report January 2021 pg 11, 13, 16

What is useful? Next discusses the difficulties and uncertainties affecting the company because of the pandemic and changing customer behaviours affecting retail, particularly its store strategy. Next also provides an analysis of online customer ordering patterns and insight into sales opportunities.

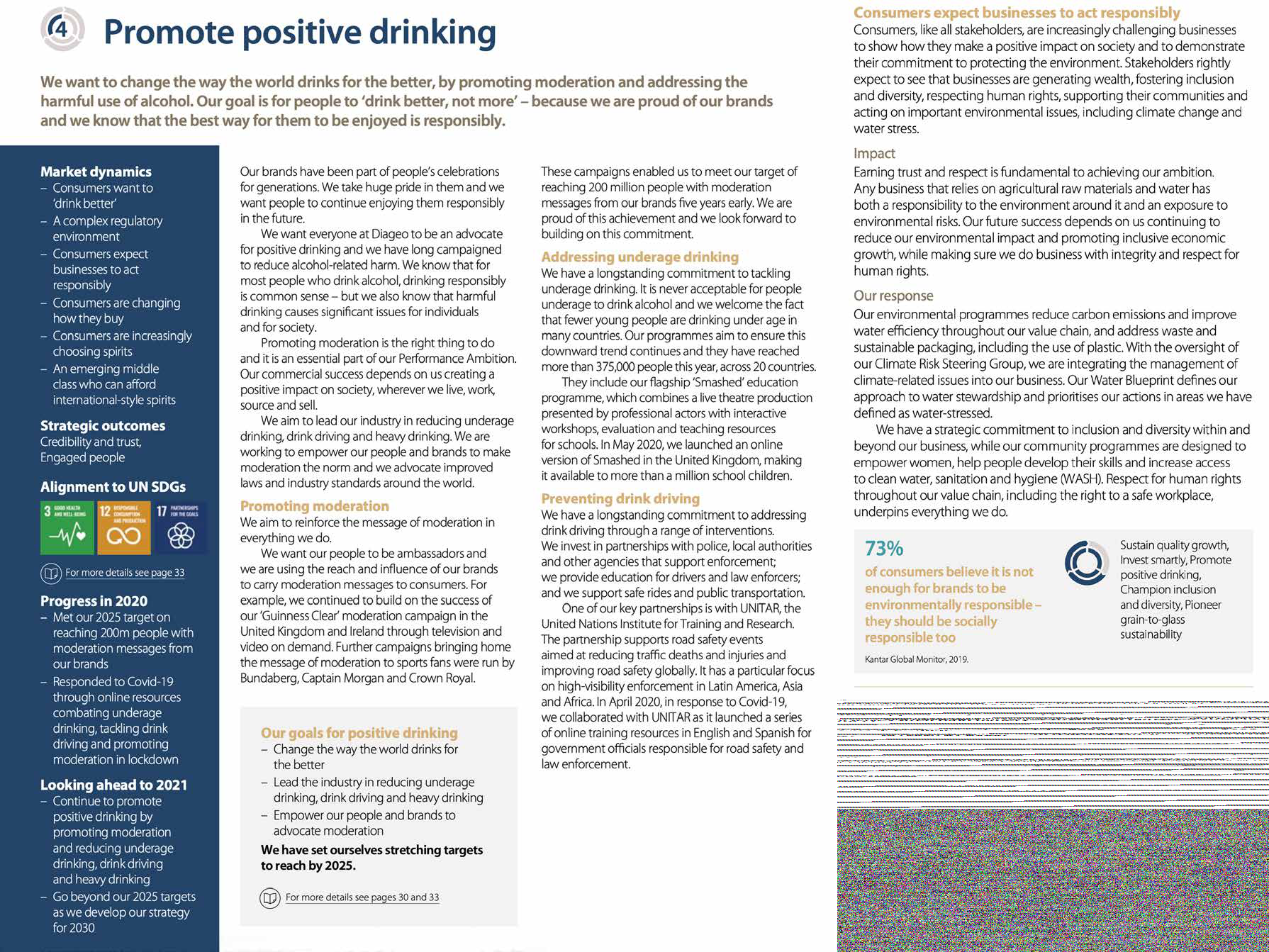

Diageo plc Annual Report June 2020 pg 14-16, 24-25

What is useful? Diageo includes a detailed discussion of market trends and consumer behaviours (including interest in the company's treatment of other stakeholders), which addresses how each trend affects the company and what the related response is. The trends are also linked to relevant strategic priorities. In discussing the strategic priority, which is linked directly to market dynamics and consumer behaviour, Diageo provides further detail on its response and future goals.

4 Promote positive drinking

We want to change the way the world drinks for the better, by promoting moderation and addressing the harmful use of alcohol. Our goal is for people to 'drink better, not more' - because we are proud of our brands and we know that the best way for them to be enjoyed is responsibly.

Market dynamics * Consumers want to 'drink better' * A complex regulatory environment * Consumers expect businesses to act responsibly * Consumers are changing how they buy * Consumers are increasingly choosing spirits * An emerging middle class who can afford international-style spirits

Strategic outcomes Credibility and trust, Engaged people

Alignment to UN SDGs

Section of a report page displaying alignment to UN Sustainable Development Goals 3, 12, and 17, and a visual summary of 73% consumer belief in social responsibility, listing five key principles.

For more details see page 33

Progress in 2020 * Met our 2025 target on reaching 200m people with moderation messages from our brands * Responded to Covid-19 through online resources combating underage drinking, tackling drink driving and promoting moderation in lockdown

Looking ahead to 2021 * Continue to promote positive drinking by promoting moderation and reducing underage drinking, drink driving and heavy drinking * Go beyond our 2025 targets as we develop our strategy for 2030

Our brands have been part of people's celebrations for generations. We take huge pride in them and we want people to continue enjoying them responsibly in the future. We want everyone at Diageo to be an advocate for positive drinking and we have long campaigned to reduce alcohol-related harm. We know that for most people who drink alcohol, drinking responsibly is common sense

- but we also know that harmful drinking causes significant issues for individuals and for society. Promoting moderation is the right thing to do and it is an essential part of our Performance Ambition. Our commercial success depends on us creating a positive impact on society, wherever we live, work, source and sell. We aim to lead our industry in reducing underage drinking, drink driving and heavy drinking. We are working to empower our people and brands to make moderation the norm and we advocate improved laws and industry standards around the world.

Promoting moderation We aim to reinforce the message of moderation in everything we do. We want our people to be ambassadors and we are using the reach and influence of our brands to carry moderation messages to consumers. For example, we continued to build on the success of our 'Guinness Clear' moderation campaign in the United Kingdom and Ireland through television and video on demand. Further campaigns bringing home the message of moderation to sports fans were run by Bundaberg, Captain Morgan and Crown Royal.

Our goals for positive drinking * Change the way the world drinks for the better * Lead the industry in reducing underage drinking, drink driving and heavy drinking * Empower our people and brands to advocate moderation

We have set ourselves stretching targets to reach by 2025.

(D) For more details see pages 30 and 33

These campaigns enabled us to meet our target of reaching 200 million people with moderation messages from our brands five years early. We are proud of this achievement and we look forward to building on this commitment.

Addressing underage drinking We have a longstanding commitment to tackling underage drinking. It is never acceptable for people underage to drink alcohol and we welcome the fact that fewer young people are drinking under age in many countries. Our programmes aim to ensure this downward trend continues and they have reached more than 375,000 people this year, across 20 countries. They include our flagship 'Smashed' education programme, which combines a live theatre production presented by professional actors with interactive workshops, evaluation and teaching resources for schools. In May 2020, we launched an online version of Smashed in the United Kingdom, making it available to more than a million school children.

Preventing drink driving We have a longstanding commitment to addressing drink driving through a range of interventions. We invest in partnerships with police, local authorities and other agencies that support enforcement; we provide education for drivers and law enforcers; and we support safe rides and public transportation. One of our key partnerships is with UNITAR, the United Nations Institute for Training and Research. The partnership supports road safety events aimed at reducing traffic deaths and injuries and improving road safety globally. It has a particular focus on high-visibility enforcement in Latin America, Asia and Africa. In April 2020, in response to Covid-19, we collaborated with UNITAR as it launched a series of online training resources in English and Spanish for government officials responsible for road safety and law enforcement.

Consumers expect businesses to act responsibly Consumers, like all stakeholders, are increasingly challenging businesses to show how they make a positive impact on society and to demonstrate their commitment to protecting the environment. Stakeholders rightly expect to see that businesses are generating wealth, fostering inclusion and diversity, respecting human rights, supporting their communities and acting on important environmental issues, including climate change and water stress.

Impact Earning trust and respect is fundamental to achieving our ambition. Any business that relies on agricultural raw materials and water has both a responsibility to the environment around it and an exposure to environmental risks. Our future success depends on us continuing to reduce our environmental impact and promoting inclusive economic growth, while making sure we do business with integrity and respect for human rights.

Our response Our environmental programmes reduce carbon emissions and improve water efficiency throughout our value chain, and address waste and sustainable packaging, including the use of plastic. With the oversight of our Climate Risk Steering Group, we are integrating the management of climate-related issues into our business. Our Water Blueprint defines our approach to water stewardship and prioritises our actions in areas we have defined as water-stressed. We have a strategic commitment to inclusion and diversity within and beyond our business, while our community programmes are designed to empower women, help people develop their skills and increase access to clean water, sanitation and hygiene (WASH). Respect for human rights throughout our value chain, including the right to a safe workplace, underpins everything we do.

73% of consumers believe it is not enough for brands to be environmentally responsible – they should be socially responsible too

Kantar Global Monitor, 2019.

Sustain quality growth, Invest smartly, Promote positive drinking, Champion inclusion and diversity, Pioneer grain-to-glass sustainability

Performance and metrics

As part of this project, investors reiterated their desire for information about performance and progress against strategic objectives and targets. In respect of stakeholders, this will primarily be non-financial information but could also relate to financial metrics, such as spending on employees or revenue from customers. Performance information is useful where it helps investors assess the strength or otherwise of a relationship with a stakeholder and see how that affects the pursuit of strategy, and ultimately the company's success. Investors also want to understand the metrics that management and the board are using to monitor, understand and manage their stakeholder relationships and assess where improvements are necessary.

The principles for reporting metrics identified in the Lab's report Performance metrics – principles and practice are still relevant and apply to metrics in relation to stakeholders too:

Aligned to strategy: Investors want to know how metrics tie into the strategy, reflecting what is being monitored by the board and management for their assessment on the delivery of strategy, but they also want the metrics which give insight into the capability of meeting and delivering the strategy. These should ultimately be the same, which is why it is useful for companies to explain why the key performance indicators (KPIs) and metrics chosen are important to the company (e.g. Taylor Wimpey). An alternative presentation is a dashboard view such as Barclays table of KPIs by key stakeholder group, which in turn are linked to strategy and the business model. Linking to remuneration is another way of highlighting the importance of KPIs but as noted in the FRC's May 2021 research on remuneration reporting, although many companies used non-financial KPIs such as diversity or health and safety KPIs in executive pay formulas, they often did not explain why these were chosen or how they were formulated. More granular metrics can indicate the current success of strategy and plans, e.g. customer and employee satisfaction scores, and/or provide insight into the future "health" of the drivers of value and any related risks, e.g. diversity, training and turnover metrics. We noted reporting that included detailed breakdowns of employee departures, including dismissals, by country, and average remuneration by categories of seniority, age and gender. While these disclosures can be helpful as data builds up over subsequent periods, companies should provide their interpretation of the results and discuss any actions to address related performance issues or stakeholder matters reflected by the metrics.