The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Review of financial reporting effects of Covid-19

- Key to symbols

- 1. Executive summary

- 2. Scope and sample

- 3. Key findings

- Dividends and capital management

- Strategic Report

- Business review

- Impact of Covid-19 on historical performance and year end position

- Examples of better disclosure

- Impact of Covid-19 on strategy and business model

- Examples of better disclosure

- Examples of better disclosure

- Principal risks and uncertainties

- Examples of better disclosure

- Information on Employee, Supplier and Customer relationships

- Information in respect of Employee relationships

- Examples of better disclosure

- Examples of better disclosure

- Examples of better disclosure

- Information on supplier relationships

- Examples of better disclosure

- Information on customer relationships

- Examples of better disclosure

- Examples of better disclosure

- Information on customer relationships

- Information on other relationships

- Alternative performance measures

- Presentation of primary statements

- Expected credit loss provisioning

- Significant judgements and estimates

- Fair value measurements

- Impairment of non-financial assets

- Other impairment issues

- Defined benefit pension schemes

- Provisions and onerous contracts

- Adjusting and non-adjusting post balance sheet events

- Other areas for companies to consider

- Revenue from contracts with customers

- Employee benefits other than defined benefit pension schemes

- Government Grants

- Deferred tax

- Exploration for and evaluation of mineral resources

- Capitalisation of interest

- Leases

- Assets (or disposal groups) classified as held for sale

- Biological assets and agricultural product fair value

- Contingent consideration

- Financial service companies

- Next steps

Key to symbols

- Represents good practice

- Represents an omission of required disclosure or other issue

- Represents an opportunity for enhancing disclosures

- i Represents notes relevant for interim reporting

- Examples of better disclosure

1. Executive summary

Introduction

The Coronavirus (Covid-19) pandemic represents a challenge, unprecedented in modern times, for businesses both in the UK and overseas. Although its effects are uneven across the economy, many sectors have been severely affected and none have been left untouched. In the face of this challenge, users of accounts want to understand not only how the historical financial performance has been impacted, but also what it means for a company's future prospects.

This thematic review builds on the guidance contained in the FRC / FCA / PRA joint statement, published on 26 March 20201, and complements the two reports published by the Financial Reporting Lab on 15 June: ‘Covid-19: Going concern, risk and viability’2 and ‘Covid-19: Resources, action, the future’3. A central theme of the joint statement and the Lab's reports is the importance of providing high quality forward-looking information in the current environment and that theme, combined with current disclosure and measurement issues arising as a result of Covid-19, features heavily in this thematic.

This report summarises the key findings of our review of the financial reporting effects of Covid-19 for a sample of interim and annual reports and accounts with a March period end.

We hope that this report provides useful guidance for companies preparing their annual and interim accounts by identifying areas where disclosures affected by Covid-19 can be improved, as well as providing examples demonstrating the level of detail provided by better disclosures.

Our report includes extracts from the limited number of reports and accounts included in our sample. The examples will not be relevant for all companies or all circumstances, but each demonstrates a characteristic of useful disclosure. Inclusion of a company's disclosure should not be seen as an evaluation of that company's reporting as a whole; nor does it provide any assurance or confirmation of the viability or going concern of that company, and should not be relied upon as such.

Key findings

We found that most of the companies we reviewed provided sufficient information to enable users to understand the impact that Covid-19 has had on the company's performance, position and prospects.

However, there was room for improvement by many companies. Notable areas in which improvement is needed include:

1 Going concern disclosures in both interim and annual financial statements should clearly explain the key assumptions and judgements taken in determining whether a company is able to operate as a going concern. In particular, any significant judgements taken in determining whether or not there is a material uncertainty in respect of going concern must be clearly documented.

2 Assumptions used in determining whether the company is a going concern should be compatible with assumptions used in other areas of the financial statements.

3 We expect sensitivity analysis or details of a range of possible outcomes to be provided for areas subject to significant estimation uncertainty. The number of disclosures in this area is likely to increase as a result of Covid-19.

4 We discourage the arbitrary splitting of items such as impairment charges between Covid-19 and non Covid-19 financial statement captions as such allocations are likely to be highly subjective and therefore unreliable. We also expect companies to apply consistently existing accounting policies for exceptional and other similar items to Covid-19 related income and expenditure.

5 Although IAS 34 ‘Interim Financial Reporting' has only limited disclosure requirements, interim financial statements would benefit from more detailed disclosures explaining the way in which Covid-19 has impacted a company's reported performance and future prospects.

Some of our observations concern disclosures which are not explicitly required by either accounting standards or the relevant law. Additional information in these areas would have been helpful to the user.

In the current environment, we would also encourage companies to consider the need for disclosures not explicitly prescribed by IFRS to enable users of accounts to understand the impact of events and conditions on a company's position and financial performance, as required by paragraph 31 of IAS 1 'Presentation of Financial Statements'.

Overall, the best disclosures were those that were specific to the company and which provided additional information that clearly explained how Covid-19 had impacted the company's reported position and performance and how it may affect future prospects.

We encourage preparers to consider carefully the findings of this review when preparing their forthcoming interim and annual reports. Companies should aim to ensure that not only mandatory disclosure requirements have been met but that sufficient explanations have been included within the financial statements to enable a user to understand how Covid-19 has affected both the amounts presented and the company's future prospects.

We recognise that the situation posed by Covid-19 is evolving rapidly and that disclosures will develop as more interim and annual reports covering longer Covid-19 impacted periods are published. As a consequence, some of the examples and guidance in this report may be superseded more quickly than guidance provided in our previous thematic reviews.

We hope that preparers find this review useful and we encourage preparers to engage with their external auditors when preparing their forthcoming annual and interim accounts.

2. Scope and sample

Background and scope of our review

Covid-19 will have an impact on all companies. However, the extent of the impact of Covid-19 will be more significant for companies in certain sectors such as retail, hospitality, and travel that have been more significantly affected by social distancing rules and potential longer term changes in consumer behaviour. Our review consisted of a limited scope desktop review of a selection of 17 interim and annual financial statements with a period end date of March

- As a result, all sets of interim and annual financial statements that were reviewed had a post – UK lockdown period end date.

In reviewing interim financial statements, we considered the requirements of IAS 34 and whether the information provided in the interim accounts offered sufficient information to enable a user to understand the impact of Covid-19. We have separately identified interim specific financial statement disclosure improvement areas within our report.

The areas we focused on were:

- Going concern

- Viability statements (annual accounts only)

- Cash, liquidity and covenant compliance

- Dividends and capital management

- Strategic report (annual accounts only for all sections other than principal risks and uncertainties for which interim accounts were also reviewed)

- Alternative performance measures

- Presentation of primary statements

- Expected credit loss provisioning

- Significant judgements and estimates

- Fair value measurements

- Impairment of non-financial assets and other impairment issues

- Defined benefit pension schemes

- Provisions and onerous contracts

Our sample

We planned to review the interim and annual financial statements with a period end date of March 2020 for 17 companies.

We aimed to include a cross section of all industries within our sample.

Industries sampled

Bar chart showing interim and annual accounts reviewed by industry.

Retail: 1 interim, 0 annual Equity investment instruments: 0 interim, 1 annual Airlines: 1 interim, 0 annual Real estate holding and development: 1 interim, 1 annual Telecommunications: 0 interim, 1 annual Construction: 1 interim, 1 annual Restaurants and bars: 1 interim, 0 annual Consumer goods: 1 interim, 1 annual

Due to the planned timing of publication of this thematic review, no banks or insurers were included in our sample. These companies largely have 31 December year ends and, therefore, their interim reports will be published after this report is published.

3. Key findings

Going concern and viability statements

Going concern

IAS 1 paragraphs 25 and 26 require the directors to make an assessment of the company's ability to continue to operate as a going concern for at least 12 months from the balance sheet date. As part of this assessment, the directors must consider whether there are any material uncertainties that may cast significant doubt on the ability of the company to continue to operate as a going concern. Where these uncertainties exist, they must be disclosed.

Determining whether or not a material uncertainty exists will be considerably more difficult given the impact of Covid-19. Furthermore, management may have exercised significant judgement in reaching the conclusion that no material uncertainties exist.

In cases where the board concludes that a material uncertainty does not exist but the conclusion reached required the application of significant judgement, IAS 1 paragraph 122 requires the disclosure of this judgement. (IFRIC July 2014).

- Given the current uncertain environment, we expect company specific going concern disclosures to explain clearly the key assumptions and judgements that the board has made in determining whether or not the company is a going concern and whether or not there are material uncertainties.

- We expect going concern discussion in the strategic report to reflect the going concern information presented in the notes to the accounts.

- We also expect disclosure of the possible scenarios that could lead to failure and details of any mitigating actions available to the board. The disclosures presented should be sufficiently granular to enable a user to understand clearly the way in which the company intends to meet its liabilities as they fall due.

The Financial Reporting Lab report: ‘Covid-19- Going concern, risk and viability' provides useful guidance on the information that could be included within going concern disclosures and the factors that boards may need to consider in making their going concern determination.

All companies within our sample included helpful, company specific going concern disclosures within their financial statements. However, the level of detail presented varied between companies with some companies providing high level going concern disclosures which could have provided more details of the assumptions made in determining whether the company was a going concern.

i To aid user understanding during the uncertain environment, we encourage interim financial statements to provide going concern disclosures which follow the characteristics of good reporting as noted on page 8. Further details of the information that should be included in the interim financial statements can be found in the FRC / FCA / PRA joint statement.

We observed that the most helpful going concern disclosures had the following characteristics:

- Clearly explained whether there were any material uncertainties that may cast doubt on the company's going concern status.

- Clearly stated the period the going concern assessment covered.

- Explained the different going concern scenarios that had been considered. The best disclosures clearly stated the key Covid-19 assumptions within each forecast and how those assumptions affected the going concern conclusion.

- Indicated which inputs had been subject to stress tests and explained how these stress tests affected the going concern conclusions.

- Identified and explained any mitigating actions the board could take to improve liquidity.

- Explained any post balance sheet changes to liquidity, specifically the arrangement of new lending facilities, the extension of existing facilities or the renegotiation or waiving of bank covenants.

- Described the level of drawn and undrawn finance facilities in place.

- Stated what covenants were in place and whether they expected to breach them.

- Explained whether the company would need to make structural changes in order to continue to operate as a going concern.

A number of companies in our sample noted that they had secured access to the Joint Bank of England and HMT's Covid Corporate Financing Facility (CCFF). However, they did not explain how their going concern status was affected by whether or not they had drawn down on the facility by selling eligible commercial paper to the Covid Corporate Financing Facility Limited (CCFFL). As the terms of the CCFF* allow any unused portion of the facility to be withdrawn, we expect companies to clearly distinguish between amounts of commercial paper already sold to CCFFL and any undrawn facility. We also expect companies to take account of all relevant circumstances, including whether the ability of the government and the Bank of England to withdraw the unused facilities contributes to a material uncertainty in respect of going concern that warrants disclosure.

None of the companies sampled presented any significant judgement disclosures in respect of going concern as required by IAS 1 paragraph 122 despite going concern notes, audit reports or audit committee reports implying that some significant judgements had been made. We expect companies to present these disclosures when significant judgement has been applied.

Going concern disclosures could be further improved by including information which explains any reverse stress testing that has been conducted.

- 'Each of the Bank, the Fund and the HM Treasury reserve the right in its sole discretion to deem any security ineligible for any reason, and to deem ineligible securities the Fund has previously purchased and vice versa. Notwithstanding the foregoing, the Bank confirms that, whereas it reserves the right not to roll over at maturity and not to acquire any commercial paper that is (or is deemed to be) ineligible, it does not have the right to and will not unilaterally: 1. Cancel any commercial paper (whether or not it is ineligible or deemed to be so). 2. Require or make any variations to the terms of any issued commercial paper acquired by the Fund. 3. Require any ineligible commercial paper previously acquired by the Fund to be bought back by the issuer' (CCFF Market Notice). ** 'Each of the Bank and the HM treasury reserve the right, in its sole discretion, to deem any issuer ineligible for any reason after taking into account the information available to it.' (CCFF Market Notice)

Disclosure explains that they do not envisage making any structural changes to the business to remain a going concern.

Disclosure explains the scenarios modelled in the light of Covid-19 and what they are most sensitive to.

Disclosures note the mitigating actions that can be taken to preserve liquidity.

Disclosure explains the covenants attached and current position in respect of covenants.

Examples of better disclosure

'As part of the directors' consideration of the appropriateness of adopting the going concern basis in preparing the interim report and financial statements, a range of severe scenarios have been reviewed. The assumptions modelled are based on the estimated potential impact of Covid-19 restrictions and regulations, along with our proposed responses over the course of the next 18 months. These include a range of estimated impacts primarily based on length of time various levels of restrictions are in place and the severity of the consequent impact of those restrictions on our At-Home and Out-of-Home channels For each of our markets we have sensitised the revenue, profit and cash flow impact of reduced trading activity in our Out-of-Home channel and a negative impact of changes in product mix for the At-Home channel. The scenarios are most sensitive to the assumptions made for GB and Ireland where exposure to the Out-of-Home channel is greater. France and Brazil are predominantly At-Home markets and therefore drive less sensitivity. We have not assumed any uplift in the At-Home channel in any market, under any level of restrictions, for the purpose of the scenario modelling. A key judgement applied is the likely time period of restrictions on trading activity in the Out-of-Home channel, movement of people and social distancing. The severe scenarios include an an assumption that such restrictions will remain in place until March 2021 with only a small proportion of Out-of-Home outlets re-opening during this time. Our Covid-19 impact range of £12m-£18m per month is based on assumptions for lockdown impacting the busiest trading period in 2020. As the level of trading restrictions reduce, and as we exit both lockdown and our busiest trading periods, the Covid-19 impact should also reduce. Under each scenario, mitigating actions are all within management control, can be initiated as they relate to discretionary spend, and do not impact the ability to meet demand. These actions include reduced A&P and stopping all non-essential and non-committed capex in the next 12-18 months. We believe that the risk of enforced plant closure is low and have implemented additional health and safety measures in each of our factories to reduce the risk of a major supply disruption. We have assumed no significant structural changes to the business will be needed in any of the scenarios modelled. As at 31 March 2020, the condensed consolidated balance sheet reflects a net asset position of £432.8m and the liquidity of the Group remains strong. We have a recently re-financed £400m bank facility with a maturity date of November 2025 and approximately £625m of private placement notes, at contracted rates, with maturity dates between 2020 and 2035. Since the half year date, we have received approximately £150m from the recent refinancing of private placement notes, increasing undrawn facilities to approximately £300m and the RCF also offers an accordion facility of £200m, with lender consent. In all scenarios modelled our liquidity requirements are within the £400m RCF facility. Further, whilst we are confident of our liquidity position even under our Covid-19 stress test modelling scenario, given the uncertain environment we find ourselves in, and to give increased financial flexibility, we have deferred the decision on the dividend until later in the financial year. Debt covenant limits are set at a ratio of 3.5x (rolling 12-month EBITDA/ Adjusted Net Debt) and 3.0x (rolling 12-month EBITDA/ Net Interest Expenses) in all of our lending agreements. At the half year, the net debt position was £664.5m, our covenant net debt EBITDA ratio was 2.5x and our covenant net interest EBITDA ratio was 15.0x. As part of our EBITDA and cashflow modelling, we tested the possibility of the debt covenants being breached in September 2020, March 2021, and September 2021. March 2021 is the most sensitive test point as the EBITDA modelling assumes a full 12 months of reduced trading due to the impact of restrictions and a working capital peak ahead of summer trading. Under all the scenarios modelled, after taking mitigating actions as needed, our forecasts did not indicate breach on any of those dates. On the basis of these reviews, the directors consider it is appropriate for the going concern basis to be adopted in preparing the interim report and financial statements.'

Britvic Plc, Interim results, p20

Viability statement has been linked to other areas of the financial statements.

Disclosure explains the period over which viability has been assessed and why that period is appropriate.

Further details of the base case scenarios have been disclosed.

Disclosure indicates that there is volatility in the forecasts and explains how that volatility is being mitigated.

Further disclosure of mitigations taken to minimise volatility.

Disclosures explains the key Covid-19 assumptions in the forecast and quantify the assumptions used.

Examples of better disclosure (cont)

Given the Covid-19 scenario is most sensitive to changes in the length of the Covid-19 impacting period and the depth of the impact, and without firm guidance from the government on a possible 'exit strategy', a prudent approach has been taken to stress test this Covid-19 case with further downside sensitivities, which extend the length of the social-distancing measures or increase the depth of the impact on sales and margin as follows:

- Sensitivity 1 – The Covid-19 scenario above, but with a much slower recovery, thereby impacting Clothing & Home and Food sales for longer and including a recession for the duration of the Three-Year Plan period (modelled as a 5% decline vs plan in Clothing & Home and Food sales on an ongoing basis through-out the three years). The incremental impact on Clothing & Home and Food revenues is £251m and £281m respectively for the financial year.

- Sensitivity 2 – as per sensitivity 1, plus a deeper sales decline over the first six-month period, with Clothing & Home on average c.80% down on budget. The incremental impact on Clothing & Home and Food revenue is £424m and £99m respectively, over and above sensitivity 1 for the financial year. Reverse stress testing has also been applied to the model, which represents a further decline in sales compared with sensitivity

- Such a scenario, and the sequence of events which could lead to it, is considered to be remote. The impact of the Covid-19 scenario and sensitivities has been reviewed against the Group's projected cash flow position and financial covenant over the three-year viability period. Should these occur, mitigating actions would be required to ensure that the Group remains liquid and financially viable. These actions were identified as the Covid-19 pandemic emerged as part of the contingency planning that the Group has been undertaking, which considered both feasibility and timeframe to execute. Mitigating actions taken include, but are not limited to, reducing planned capital and marketing spend, freezing pay and recruitment, making technology and operating expenditure cuts, reducing the supply pipeline of Clothing & Home stock by c.£560m, and lengthening payment terms, and ceasing to pay the final dividend payment for 2019/20 and for the current financial year, resulting in a total anticipated cash saving of c.£340m. The Group also expects to benefit from c.£172m of business rates relief in 2020/21 and the government's Coronavirus Job Retention Scheme to help meet the cost of furloughed roles in store, distribution and support centres, which should generate cash savings of c.£50m up to 30 June 2020.

In addition, in order to maximise liquidity for the likely duration of the crisis and the recovery period beyond, the following further steps have also been taken:

- Formal agreement has been reached with the lending syndicate of banks providing the £1.1bn revolving credit facility to remove or substantially relax the covenant conditions for the tests arising in September 2020, March 2021 and September 2021.

- The Group has confirmed its eligibility under the UK government's CCFF and allocated an issuer limit of £300m, providing additional further liquidity headroom.

Stress test assumptions applied have been disclosed and quantified.

Details of the reverse stressing performed have been documented.

Mitigating actions taken to preserve viability have been disclosed.

Details provided of debt waivers sought and the expected use of government support schemes disclosed.

Examples of better disclosure (cont)

The agreement with the banks combined with the other measures taken means that, even under the Covid-19 scenario and the sensitivities, the business would continue to have significant liquidity headroom on its existing facilities and against the revolving credit facility financial covenant. Neither the Covid-19 scenario, nor the sensitivities individually threaten the viability of the Company. In all assessments, there is an option to extend the potential mitigations available, such as further reduction in capital expenditure and reduced returns to shareholders. The Audit Committee reviews the output of the viability assessment in advance of final evaluation by the Board. The directors have also satisfied themselves that they have the evidence necessary to support the statement in terms of the effectiveness of the internal control environment in place to mitigate risk. Having reviewed the current performance, forecasts, debt servicing requirements, total facilities and risks, the Board has a reasonable expectation that the Group has adequate resources to continue in operation, meets its liabilities as they fall due, retain sufficient available cash across all three years of the assessment period and not breach any covenant under the revolving credit facility. The Board therefore has a reasonable expectation that the Group will remain commercially viable over the three-year period of assessment. The Viability Statement can be found on page 96.'

Marks and Spencer Group Plc, Annual Report and Financial statements, 2020 pp42-43

Disclosure clearly explains the viability conclusion.

Cash, liquidity and covenant compliance

Explanation of liquidity risk and sources of finance

IFRS 7 Financial Instruments: Disclosures' requires disclosure of sufficient information about the nature and extent of a company's risks exposure from financial instruments, including liquidity risk. Disclosure of information about sources of liquidity, risk exposure and the steps that companies are taking to manage their liquidity risk is critically important in the current environment.

We expect companies to provide sufficiently detailed quantitative and qualitative disclosures about:

- their access to cash and sources of finance (including reverse factoring arrangements);

- any changes or likely changes to the existing financing arrangements;

- any new arrangements entered into;

- credit gradings and any changes, which impact cost or access to funding (eg if the grading falls below investment grade); and

- any developments subsequent to the reporting date.

Companies included in our sample quantified drawn and undrawn amounts and explained the key terms of the existing and new debt arrangements and financial covenants.

We expect the liquidity disclosures to:

- be consistent with the going concern note and the viability statement; and

- highlight any significant judgements and significant sources of estimation uncertainty.

i In this environment of high uncertainty, we expect companies to provide enhanced liquidity disclosures in their interims as information reported in the last annual report is likely to quickly become out of date.

Examples of better disclosure

'At 31 March 2020 net debt was £4,876 million, including additional £926 million related to the impact of IFRS 16, and net debt to EBITDA was 2.0x (excluding the impact of IFRS 16, net debt to EBITDA would have been 0.3x lower).

We have taken a series of steps to strengthen the Group's liquidity and increase the resilience of our balance sheet:

- In March, the Group qualified for, and drew down, £600 million from the Bank of England's Covid Corporate Financing Facility (CCFF)

- On 24 March Standard & Poor's reaffirmed our long term (A) and short term (A-1) credit ratings and Moody's A3/P-2 long and short term credit ratings remain unchanged

- In April we put in place an additional Revolving Credit Facility (RCF) of £800 million and now have total committed credit facilities of £2,800 million

- We have recently obtained waivers of the leverage covenant test in our US Private Placement agreements for the September 2020 and March 2021 test dates. The interest cover covenant test has also been waived for September 2020 and reset at more than or equal to 3x on a 6 months proforma basis for March 2021

- Today we have announced a non-pre-emptive equity placing of new ordinary shares targeting gross proceeds of approximately £2.0 billion. Including the raise our proforma net debt will be £2.9bn .

Together this package of measures will reduce our leverage and strengthen our financial liquidity. By increasing our resilience these measures allow us to weather the crisis whilst continuing to invest in the business to enhance our competitive advantages and support our long term growth prospects. This will put us in a strong position in the recovery and further consolidate our position as the industry leader in food services.

At this stage, we are targeting a strong investment grade rating and net debt to EBITDA range of 1-1.5x. Beyond this, our priorities for cash are: (i) invest capital expenditure to support organic growth, (ii) bolt-on M&A opportunities that improve our exposure or strengthen our capabilities. At the appropriate time, after we reach our target leverage range, we will resume the dividend and additional returns to shareholders.'

Compass Group Plc, Interim Results, 31 March 2020, p5

The company explained its position at the end of the six month reporting period and the measures it took prior and subsequent to the period end to enhance liquidity. It clarified elsewhere in the report that without the mitigating measures in the severe but plausible downside scenario, the leverage covenant on its debt could have been potentially breached over the next two testing dates.

Government support

We expect companies to provide detailed disclosures about the use of government support schemes, explaining how much funding is available, the likelihood of the scheme being utilised and the time horizon over which the funds are available.

The disclosure states the amount and maturity date of CCFF funding the company accessed after the end of the year.

Examples of better disclosure On 14 May 2020, Burberry Limited issued commercial paper with a face value of £300.0 million and a maturity of 17 March

- The commercial paper was issued under the UK Government sponsored COVID Corporate Finance Facility (CCFF). Proceeds of £298.4 million were received by Burberry Limited on 14 May 2020.

Burberry Group Plc, Annual report 2019/20, p187

Companies should explain whether and how they have incorporated funds available under a government support scheme in their going concern assessment.

The UK Government has also provided support by allowing companies to defer VAT payments and, for some sectors, has provided business rates relief. The use of schemes such as these, either in the UK or overseas, should be discussed.

Examples of better disclosure...

At 31 March 2020, the Group held cash and cash equivalents of £271 million and had a committed, undrawn revolving credit facility of US$800 million. Net debt/EBITDA ratio was 0.9 times (2019 – 0.8 times), with the increase driven by the impact of IFRS 16. On a covenant testing basis, net_debt/EBITDA ratio was 0.6 times, which was significantly lower than the covenant ratio of not greater than 3.5 times, demonstrating significant headroom above this covenant requirement.

Tate & Lyle Plc, Annual Report 2020, p44

The company clearly explained how it performed compared with banking covenants and clarified that adoption of IFRS 16 'Leases' had no impact on covenant test.

Better disclosures explained:

- how calculated covenant ratios compare with the requirements of lending arrangements;

- the available headroom;

- whether the adoption of IFRS 16 had any impact on covenants;

- any waivers agreed with debt providers; and

- any changes post year-end as a result of further measures taken (eg equity raise).

Compliance with banking covenants

- In the current environment, we expect companies to disclose their banking covenants, even when they complied with the requirements and there is significant headroom.

- Any judgements made in calculating covenants should also be explained.

Most of companies in our sample provided information regarding compliance with the covenants and any waivers agreed with their debt providers.

Covenant breaches

- Covenant breaches not rectified at the balance sheet date usually result in debt becoming repayable on the lender's demand. In such cases, we expect the related debt to be classified as current in the financial statements, even where breaches are waived by the lender by the time the financial statements are approved. Further discussion of this can be found in the 'Presentation of Primary Statements' section.

Modification of debt arrangements

In the current environment, companies are more likely to renegotiate or otherwise amend their lending arrangements. The measurement of the resultant gain or loss depends on whether the terms of the modified and the original liability are substantially different:

IFRS 9 'Financial Instruments' paragraph 5.4.3

| Gain or loss measured by comparing the carrying amount of debt immediately before modification with: | Treatment of costs/fees incurred: | |

|---|---|---|

| Substantial modification/ derecognition of the existing debt | fair value of consideration paid | recognised in profit or loss |

| Non-substantial modification | present value of revised cash flows discounted at the original effective interest rate | adjust the carrying amount of debt and amortise over the remaining term |

The previous IAS 39 'Financial Instruments' practice of deferring gains and losses for non-substantial modifications by adjusting the effective interest rate going forward is not permitted under IFRS 9.

Where the terms of debt have been modified, we expect companies to disclose:

- how the modified and original terms of debt instruments are different;

- the accounting policy applied on modification;

- the derecognition or modification gain or loss; and

- any significant accounting judgements made.

Changes in estimated cash flows

Companies may revise their estimated cash flows on their debt instruments (eg regarding exercise of conversion, prepayment, extension options or interest payments). The change in estimates may affect profit and loss either through fair value remeasurement or adjustment to amortised cost, depending on the original accounting for such features. Similar to debt modifications, we expect companies to provide sufficiently detailed disclosures to enable the user to understand the nature of such features, accounting policies and outcomes and any judgements exercised by management.

Where a company revises its estimated contractual cash flows in respect of debt carried at amortised cost, it is required to remeasure the carrying amount of debt by discounting revised contractual cash flows at the original effective interest rate. The remeasurement difference is recognised in profit and loss. (IFRS 9 paragraph B5.4.6)

One company in our sample with significant debt and hedging activities had a credit rating downgrade prior to the year end. Whilst the fact of the downgrade and additional annual interest payable as a result was disclosed, it was not evident that the company considered the accounting impact on:

- remeasurement of debt;

- hedging relationships, and

- profit and loss.

In case of a significant credit rating downgrade, we expect companies to explain the impact both on their existing financial instruments and on future liquidity.

Cash flow hedging

Companies need to consider the impact of Covid-19 on their hedge accounting. In particular, companies should consider:

- whether the forecast transaction remains highly probable to occur ('highly probable' criterion) and discontinue hedge accounting if it is not;

- any ineffectiveness – eg from a mismatch in timing or amount between the hedged item and the hedging instrument or credit risk changes – as this will affect profit and loss even when the transaction is still considered highly probable to occur;

- if credit risk dominates value changes, as this would require hedge accounting to be discontinued (IFRS 9.6.4.1(c)(ii)); and

- whether 'bright line' 80-125% effectiveness requirements are met for hedging relationships still under IAS 39.

One company in our sample disclosed a material loss on the discontinuance of a cash flow hedge immediately after the balance sheet date due to reduced expectation of hedged purchases. However, it was not clear how the 'highly probable' assessment was performed at the year-end. We expect to see a clear detailed explanation of the factors taken into account in performing the 'highly probable' assessment at the reporting period end in such cases.

IFRS 7 contains detailed disclosure requirements in respect of designated hedging relationships. We expect companies to provide the required disclosures and explain their accounting policies and significant judgements made.

Examples of better disclosure

'Determining whether forecast purchases are highly probable

The Group is exposed to foreign currency risk, most significantly to the US dollar as a result of sourcing Clothing & Home products from Asia which are paid predominantly in US dollars. The Group hedges these exposures using forward foreign exchange contracts and hedge accounting is applied when the requirements of IFRS 9 are met, which include that a forecast transaction must be “highly probable". The Group has applied judgement in assessing whether the forecast purchases remain “highly probable”, particularly in light of the decline in expected sales resulting from the Covid-19 pandemic and the related store closures. At the reporting date, a £2.9m gain has been recognised in the income statement as a result of US$76.6m notional forecast purchases no longer expected to occur in relation to the Clothing & Home Autumn and Winter season requirement. In making this assessment, the Group has considered the most recent budgets and plans, including the Covid-19 scenario. The Group's policy is a "layered" hedging strategy where only a small fraction of the forecast purchase requirements are initially hedged, approximately 15 months prior to a season, with incremental hedges layered on over time, as the buying period for that season approaches and therefore as certainty increases over the forecast purchases. As a result of this progressive strategy, reducing the supply pipeline of Clothing & Home inventory, as described in the basis of preparation, does not immediately lead to over-hedging and the disqualification of "highly probable". If the forecast transactions were no longer expected to occur, any accumulated gain or loss on the hedging instruments would be immediately reclassified to profit or loss.'

Marks and Spencer Group Plc, Annual Report & Financial Statements 2020, p124

Disclosure explains significant judgement exercised in their assessment of 'highly probable' criterion.

We expect companies to provide an update of their hedging at interims and, in particular, whether they consider the forecast transactions to meet the 'highly probable' assessment.

Maturity analysis

IFRS 7 requires a maturity analysis of all financial liabilities to be provided (including leases and issued financial guarantees).

- The maturity analysis should include undiscounted, contractual cash flows, including principal and interest payments.

- The time bands disclosed need to be consistent with the information provided internally to key management personnel. Whilst the appropriate level of disaggregation of time bands may differ between companies, we expect companies to consider whether a greater degree of disaggregation than reported previously is required in the current circumstances.

Examples of better disclosure

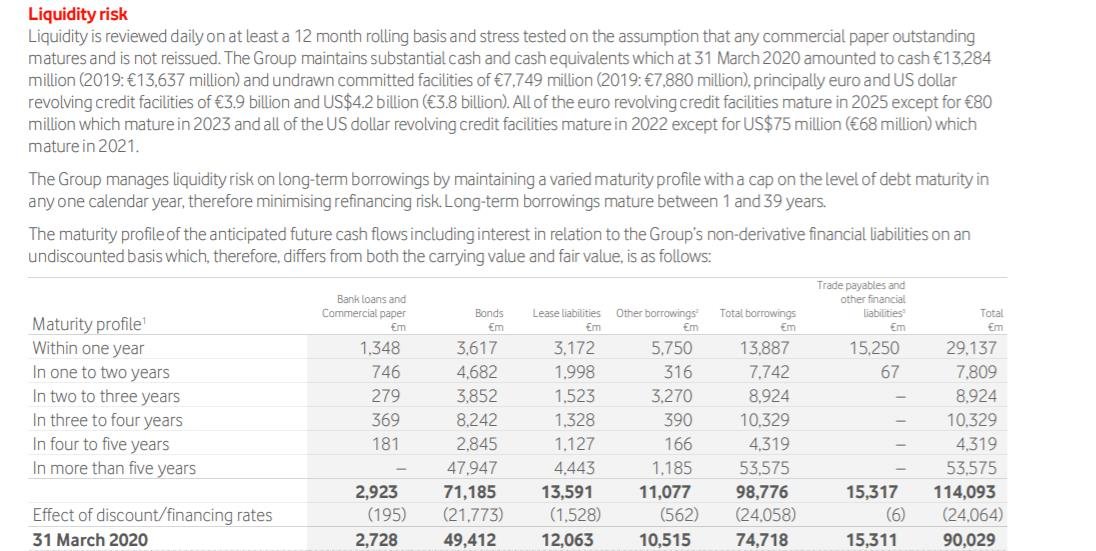

Liquidity risk

Liquidity is reviewed daily on at least a 12 month rolling basis and stress tested on the assumption that any commercial paper outstanding matures and is not reissued. The Group maintains substantial cash and cash equivalents which at 31 March 2020 amounted to cash €13,284 million (2019: €13,637 million) and undrawn committed facilities of €7,749 million (2019: €7,880 million), principally euro and US dollar revolving credit facilities of €3.9 billion and US$4.2 billion (€3.8 billion). All of the euro revolving credit facilities mature in 2025 except for €80 million which mature in 2023 and all of the US dollar revolving credit facilities mature in 2022 except for US$75 million (€68 million) which mature in 2021.

The Group manages liquidity risk on long-term borrowings by maintaining a varied maturity profile with a cap on the level of debt maturity in any one calendar year, therefore minimising refinancing risk. Long-term borrowings mature between 1 and 39 years.

The maturity profile of the anticipated future cash flows including interest in relation to the Group's non-derivative financial liabilities on an undiscounted basis which, therefore, differs from both the carrying value and fair value, is as follows:

Vodafone Group Plc, Annual Report 2020, p198

The disclosure explains how liquidity requirements are reviewed.

Annual maturity analysis for each type of financial liability has been provided.

In addition to providing the annual time bands for the first five years in their disclosure, the company reconciled their undiscounted amounts to the balance sheet, which is helpful.

Maturity analysis focuses on shorter time bands in the first year:

As required the disclosure covers contractual undiscounted cash flows. This includes interest.

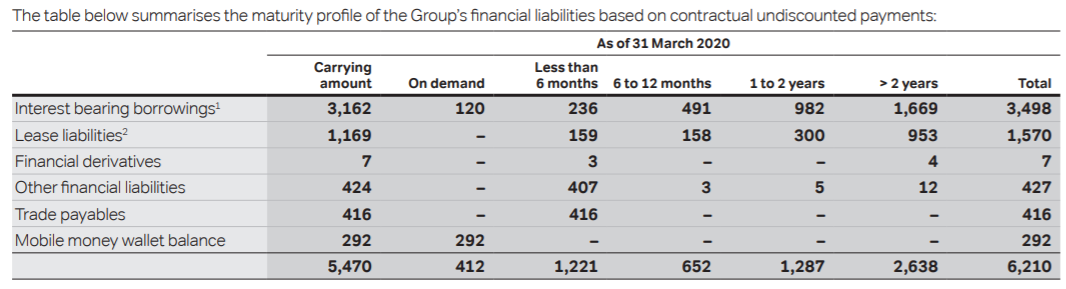

Examples of better disclosure

The table below summarises the maturity profile of the Group's financial liabilities based on contractual undiscounted payments:

Airtel Africa Plc, Annual Report and Accounts 2020, p181

IFRS 7 requires that the maturity analysis should be based on the earliest date on which the company can be required to pay. It is helpful to have a separate time band for the amounts repayable on demand, particularly in the current climate.

The time bands used should be consistent with internal management information.

Dividends and capital management

IAS 1 paragraph 134 requires disclosure of the company's objectives, policies and processes for managing capital, which should include qualitative and quantitative information.

In this environment, we expect companies to explain any changes to their capital management in response to Covid-19, including what the companies manage as capital. This should include an explanation of the dividend policy, in particular:

- where the dividend has been suspended, it is helpful to indicate when the period of suspension is expected to end or the decision revised; and

- where the dividend policy is unchanged, it is helpful to explain how this decision links to the viability assessment.

Examples of better disclosure

'Dividend

To create capacity for BT's value-enhancing investment opportunities, including our strategic intent for an accelerated FTTP build and our extensive transformation and modernisation programme, coupled with the shorter term impact of Covid-19, the Board has decided that it is appropriate to suspend the final dividend for 2019/20 and all dividends for 2020/21. The Board expects to resume dividend payments in 2021/22 at 7.7 pence per share. The Board expects to continue with a progressive dividend policy from this re-based level for future years. The Board continues to expect to declare two dividends per year with the interim dividend being fixed at 30% of the prior year's full year dividend. The Board believes that suspending and re-basing the dividend and then maintaining a progressive dividend policy is the right thing to do for the long-term future of BT and that the headroom generated by this decision is prudent given the Covid-19 pandemic, while the investments will create significant additional value for shareholders.'

BT Group Plc, Annual report 2020, p44

Disclosure explains that dividends have been suspended.

Disclosure explains when the company expects to restore dividend payments.

Disclosure explains the reasons for the dividend suspension.

As announced by the HMT on 19 May 2020, issuers in the CCFF may be required to commit to restraint on their capital distributions and on senior pay. Issuers are required to provide a letter of commitment in relation to this to HMT if:

- an increase in an issuer's CCFF limit, over and above that suggested by the issuer's investment rating, is requested and approved; and/or

-

A CCFF transaction is entered which involved commercial paper maturing on or after 19 May 2021.

-

We would expect the company's dividend policy to explain how this has affected the dividend policy if relevant commercial paper has been sold to the CCFFL and how this might affect the dividend policy if relevant commercial paper were to be purchased by the CCFF in the future.

Examples of better disclosure

'Capital risk

The Board reviews the Group's capital allocation policy annually. The Group's capital allocation framework defines its priorities for uses of cash, underpinned by its principle to maintain a strong balance sheet with solid investment grade credit metrics. The framework has four priorities for the use of cash generated from operations: - re-investment in the business to drive organic growth; - maintaining a progressive dividend policy; • continuing to pursue selective strategic investment; and - to the extent that there is surplus capital to these needs, provide additional returns to shareholders. While the capital allocation policy will remain in place for the long term, as a result of the impact of COVID-19 the Board has reviewed actions to safeguard the business as a temporary modification to the policy.

While funding organic growth remains the Board's first priority, pressure on profit and cash in the short-term requires a reduction in operating and capital expenditure. With a focus on capital retention and sourcing of capital during the current period, the Board has decided to suspend capital returns to shareholders until there is greater visibility on market recovery. The Board has also reviewed the Group's access to funding including sources of debt and equity.'

Burberry Group Plc, Annual Report 2019/20, p249

The disclosure explains how the capital management policy has been amended in the light of Covid-19.

Companies should also ensure sufficient reserves are available when dividends are paid or approved by the shareholders, in addition to making this assessment when they are proposed.

Companies should bear in mind the following key requirements in respect of anticipated distributions:

- Share buy-backs must be supported by distributable reserves;

- CA 2006 s831 net asset test must be met for public companies; and

- Where proposed distributions and share buy-backs cannot be supported by the latest audited accounts, parent company interim accounts must be filed.

Strategic Report

S414C of the Companies Act requires companies to present a strategic report. The strategic report for a quoted company must – among other things – include a fair review of the company's business, a description of the company's business model and its strategy, a description of the principal risks and uncertainties facing the company and information about employees, social and community issues.

Our review of the strategic report was focussed on how companies have considered Covid-19 when preparing the business review, when presenting the principal risk and uncertainty disclosures, and when disclosing how they have fostered relationships with employees, customers, suppliers and others.

Business review

The Companies Act requires the strategic report to explain the way in which the company generates and preserves value, the company's year end position, and how it has developed and performed during the year. The business review should, therefore, include both information on historical performance but also forward looking information explaining the company's strategy and business model. The forward looking information provided in the strategic report is particularly important as it is this information that readers of accounts will focus on to enable them to understand how a company intends to navigate through Covid-19 related challenges.

Impact of Covid-19 on historical performance and year end position

- The impact of Covid-19 on reported results was immaterial for a number of companies sampled, probably due to the UK lockdown starting close to the year end. In these cases, companies focused on explaining the expected effect of Covid-19 on future performance.

- The quality of disclosures describing the impact of Covid-19 on reported performance and position varied for those companies that were materially affected by Covid-19. Most of the companies in our sample explained the operational effect of Covid-19 and how it had affected the results reported in the income statement. Only a small proportion of companies quantified the effect of Covid-19 on their income statement.

- Fewer than a quarter of companies we sampled commented on how Covid-19 had affected their balance sheet position as at the year end with fewer than half of these companies quantifying that impact.

-

None of the companies sampled discussed the effect that Covid- 19 had on their cash flow statement.

-

Helpful narrative disclosures explained how Covid-19 had impacted operations and explained the way in which these changes in operations had affected the company's in year performance and year end financial position.

- The most useful disclosures quantified the impact of Covid-19 using IFRS measures. (We discourage companies from using Covid-19 normalised alternative performance measures and from splitting income and expenses between Covid-19 and non Covid-19 financial statement captions. Please see pages 32-34 for further details).

- We expect the strategic report to comment on the impact of Covid-19 on the cash flow statement as well as the profit and loss account and the statement of financial position.

Examples of better disclosure

'Group revenue decreased 1.9%, largely as a result of lower UK Clothing & Home sales, including an adverse revenue impact of c.£83.5m in March which we largely attribute to Covid-19. Group statutory profit before tax declined 20.2% to £67.2m. This was largely driven by a decline in Clothing & Home operating profit as a result of lower sales. Statutory profit before tax includes an estimated total impact of £264.7m for Covid-19. This comprises a trading impact of £51.9m in March which we largely attribute to the pandemic, in addition to £212.8m of charges in adjusting items which includes the recognition of additional inventory provisions of £157.0m and the impairment of stores and goodwill of £49.2m.'

Marks and Spencer Group Plc, 2020 Annual report, p28

The disclosure explains the impact of Covid-19 on revenue.

The disclosure explains the impact of Covid-19 on profit before tax.

The disclosure states the expected total impact of Covid-19.

The disclosure notes whether the effect seen was as a result of a reduction in trading or write off of balance sheet items.

The disclosure notes the balance sheet impact of Covid-19.

Impact of Covid-19 on strategy and business model

- The impact that Covid-19 is expected to have on a business will be specific to each individual company. Therefore, it is important for businesses to explain clearly how their future strategy and business model may be affected by Covid-19.

All of the companies in our sample indicated that they had reconsidered their strategy in the light of Covid-19. However, the detail included within those disclosures varied significantly across our sample. Some companies clearly explained how Covid-19 had changed their strategy by noting what their new short term focus will be, how they expect that to affect financial performance and position and linking the strategy to principal risks and uncertainties. Other companies simply stated that they had reconsidered their strategy but provided very little further detail to explain the way in which the strategy has been reconsidered.

Examples of better disclosure

'Our strong liquidity position means that we are able to sustain the business throughout this crisis and take advantage of market opportunities as they arise: - Wizz Air's balance sheet is one of the strongest in the industry with €1.5 billion of total cash at the end of March 2020. - Further liquidity has been secured by raising £300 million under the UK Government's COVID Corporate Financing Facility (CCFF) in April 2020. - Immediate cost mitigation measures put in place include the reduction in third-party spending, overhead and discretionary spending as well as non-essential capital expenditure. - We reduced the number of employees by 19 per cent in the short term, in order to adjust the size of the company to the current circumstances. However, longer term it is expected that the workforce will be increased as the industry recovers and Wizz Air resumes its growth trajectory.

We are able to scale up operations quickly thanks to our agile setup: - We can stimulate traffic with low fares due to our ultra-low-cost base. - The majority of our passengers belong to a younger demographic that travels abroad regularly for work and to visit friends and relatives, which are more sustainable sources of traffic than tourism. - We are reviewing our aircraft allocation and will react to the new market reality by taking advantage of opportunities across Europe as other carriers withdraw capacity.'

Wizz Air Holdings Plc, 2020 Annual Report, p12

The disclosure explains the operational changes made in the short term.

The disclosure explains how the company expects to take advantage of future opportunities that may arise in the wake of Covid-19.

We observed the following areas of good practice:

- The strategic report stated clearly what the company's short term strategic focus had become and how that had changed as a result of Covid-19.

- The strategic report clearly explained how the strategy was to be achieved and the post period end operational steps taken to moving that strategy forward.

- The strategy was linked to any principal risks and uncertainties which had been amended or added as a result of Covid-19.

- The strategic report explained how the change in strategy was likely to impact financial performance (or explained why it was inappropriate to provide such guidance).

- The strategic report discussed the way in which longer term strategy could be affected.

- The strategic report explained any opportunities that may present themselves as a result of Covid-19 and how the company may take advantage of presented opportunities.

Examples of better disclosure

'Broadly speaking, in response to this crisis, our planning and actions have focused on preparing the business for five distinct phases, remaining mindful of the need within each phase to ensure readiness for both the next phase and potential reversion to the previous one. We have categorised these five phases as follows: I Pre-lockdown, II Lockdown, III Preparing to emerge, IV Post lockdown, V A new normal...

...III Preparing to emerge

It remains difficult to make precise judgements about how consumers will react as we emerge from lockdown. Over and above managing the business through the pandemic, however, we must endeavour to continue creating value for our shareholders by being well-placed for a recovery in demand. Importantly, all of our stores and nearly all our First Opinion practices have remained open through the crisis, providing some insight into likely future trends. Early indications are that some of the shopping habits that consumers have displayed during lockdown, notably social distancing, channel shift and the preference to purchase goods and services safely and conveniently, may persist post lockdown, thereby impacting the volume of customers we can serve in-store. Preparing for this has meant adapting our working practices and learning new ways to serve our customers across all channels, all the while remaining vigilant across our funding requirements, ongoing measures for cash preservation and prudent allocation of capital.

Retail

Our stores remain open and can respond quickly to changes in footfall. We maintain good availability across all of our product lines, branded and private label, and have extended the number of items we can sell across our full range of consumable and discretionary products. We have introduced further precautionary measures to enhance safe interaction with our customers, including protective masks for all our store colleagues, and implemented training for specific colleagues on the safe delivery of grooming services and contactless sale of pets. Recognising that we may need to maintain some form of social distancing post lockdown, we have successfully piloted a “Call and Deliver-to-Car” service, increased the contactless payment limit from £30 to £45, and made it easier for existing and new customers to sign up to our subscription services online as opposed to in-store. Importantly, the vast majority of our stores are situated on retail parks and, with an average trading space of approximately 6,400 sq ft., are more adaptable to social distancing than smaller, high street formats. Our previous investment in automation, fulfilment and digital capability has given us capacity to process double the pre-COVID-19 level of online orders, both across our UK-wide network of stores, which can be leveraged to meet omni-channel demand, and delivery direct to home. Mindful of the prevailing channel shift to online, which we expect COVID-19 to accelerate, we have been assessing options across our logistics network to ensure that we have a well-invested, fit-for-purpose platform that is capable of managing future growth and driving efficiency benefits.

Vet Group

Across our First Opinion practices, we have implemented training for our vet colleagues to ensure the safe delivery of non-urgent procedures, vaccinations and health checks. Healthcare subscription products, such as flea and worm treatments, can now be delivered direct to home, as well as collected in-practice, and we have accelerated plans to enable remote contact and the performance of remote consults between our Joint Venture Partners and their veterinary customers through an arrangement with “Vet Help Direct".'

Pets at Home Group Plc 2020 Annual Report, extract from pp 16-19

The disclosure states that the group intends to respond to Covid-19 by categorising their business response into five phases.

The disclosure explains the company's priorities during this phase.

The disclosure explains the way in which the company has adapted operationally to meet their priorities.

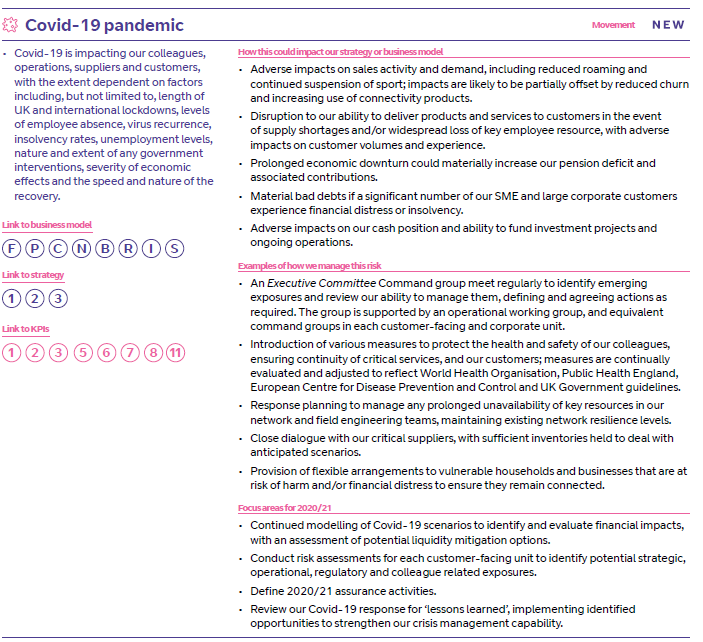

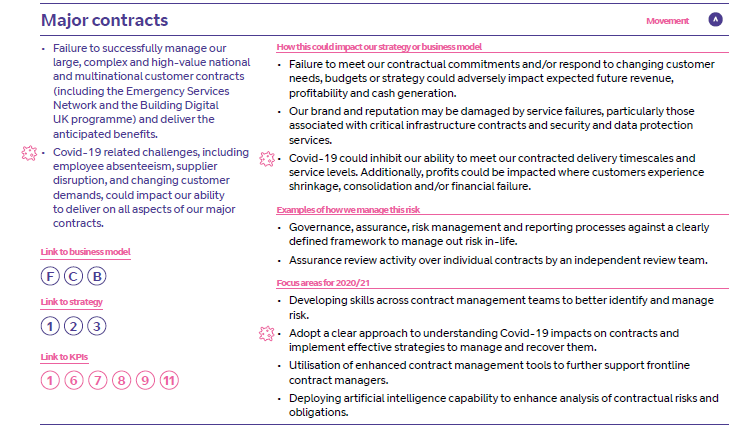

Principal risks and uncertainties

The strategic report requires companies to describe the principal risks and uncertainties facing a company and how these principal risks are mitigated.

-

Given the company specific nature of Covid-19, we expect companies to consider the specific resources, assets and relationships that are most under threat and the steps being taken to protect them when setting out their principal risks and uncertainties. All the companies within our sample disclosed a new, Covid

-

19 based principal risk with most of the companies sampled also updating their pre-existing risks and uncertainties to take account of the specific impact of Covid-19 on those individual risks. We did not identify companies who had completely refocused their principal risks and uncertainties as a result of Covid-19.

Although all companies in the sample identified Covid-19 as a principal risk, the quality of the disclosures presented was varied. Some companies clearly explained the specific risks they faced as a result of Covid-19, outlined the specific mitigations for each of these risks and linked risks identified to their strategy. Weaker disclosures identified Covid-19 as a risk but did not clearly articulate the specific risk faced by the company, the way in which the specific risk was mitigated and failed to link the risk to strategy.

We observed the following areas of good practice:

- Covid-19 risks identified were company specific, rather than generic, and clearly explained how the risk could impact future financial performance.

- Mitigations identified covered all the Covid-19 specific risks disclosed.

- Risks identified were linked to strategy, business model and key performance indicators.

- The future outlook of the risk was discussed.

- The impact of Covid-19 on the risk profile of pre-existing risks was explained.

- Existing risks were amended to take account of the impact of Covid-19 meaning risks remained focused to the company.

The disclosure clearly shows the principal risks and how they are linked to strategy.

Change in risk profile during the year clearly shows the change in risk attributable to Covid-19.

Companies that are required to comply with the DTR rules must include a description of the principal risks and uncertainties for the remaining six months of the financial year in accordance with DTR 4.2.7. Consequently, we would expect interim management reports to explain the relevant risks and uncertainties that may have changed since their previous annual accounts were published.

Disclosure clearly identifies Covid-19 as a new, emerging risk.

Disclosure notes how the company intends to manage risk.

Pre-existing principal risks have been amended for Covid-19 with amendments identified by a virus symbol.

Risk has been linked to strategy, business model and key performance indicators.

Disclosure explains how the risk will be monitored over the next year.

BT Group Plc Annual Report 2020 pp53 and 57

Information on Employee, Supplier and Customer relationships

The protection and retention of staff and the ability of the directors to have fostered business relationships with suppliers, customers and others is likely to be crucial to a company's ability to navigate the challenges arising as a result of Covid-19 and to rebuild when the opportunity arises, particularly since it is these interactions that impact corporate memory.

As a consequence, all stakeholders, including investors, are concerned not only about a company's workforce and how they are being retained and supported but also about how supplier and customer and other relationships have been maintained during the Covid-19 pandemic.

Section 414CZA of the Companies Act requires the strategic report to include a statement which describes how the directors have had regard to the section 172 matters when performing their duty under section

- These matters include how the directors have had regard to employee interests and how the directors have considered the need to foster business relationships with suppliers, customers and others. Consequently we expect the financial statements to include narrative disclosures which explain how relationships with employees, customers, suppliers and others have been maintained during the pandemic.

The most useful employee disclosures explained:

- Whether or not employees had been furloughed, and in cases where employees had been furloughed the number of employees furloughed, the percentage of pay they were receiving and whether or not the company had accessed the government's Coronavirus Job Retention Scheme.

- Whether or not bonuses will be paid and salary reviews conducted as normal.

- How shielding and self isolating employees are remunerated.

- The physical measures (eg PPE) put in place to keep staff, who are unable to work from home, safe.

- The initiatives that had been introduced and offered to employees to help maintain mental health and well being.

- The extent of the workforce that is working from home and the support that had been provided to them to enable them to continue to carry out their work.

Information in respect of Employee relationships

All of the companies in our sample articulated how they had considered the interests of employees when formulating their response to Covid-19.

Most of the companies in the sample explained whether they had placed employees on furlough, with some also explaining how they intended to remunerate employees during the pandemic.

Many of the companies sampled also discussed the changes they had made in order to keep their employees safe. However, the focus of the disclosures presented in this area varied between companies, with some choosing to focus on the physical changes they had made to keep employees safe whilst others focused on how they had tried to maintain employees' mental health and well being during the pandemic.

Examples of better disclosure

'Where possible all our employees are working from home, using enabling technology solutions and working flexibly around their domestic circumstances. For those employees unable to work from home, primarily our factory-based teams, we have implemented both social distancing and elevated health measures, including temperature checking and additional cleaning regimes, to ensure the safety of our people. All employees classified as vulnerable, or with a vulnerable family member, were identified early on and special measures put in place to support and safeguard them. As you would expect we have adopted all government and public health authority guidelines in each of our markets. We have also put additional measures in place to support the health and wellbeing of all our employees in these uncertain times.'

Britvic Plc, 2020 Interim results, p3

Disclosure explains the physical steps the company has taken to ensure the safety of employees unable to work from home.

Examples of better disclosure

'We provide an essential role in keeping the nation's pets happy and healthy, but we have taken significant steps to ensure that this is appropriately balanced with the need to focus on our colleagues' health and wellbeing. You can read the full details of the Group's actions in the CEO statement on page 16, but the pay-related actions taken to date include: - Paying those colleagues undertaking 12 weeks of self-isolation 100% of their average earnings throughout this period. - Furloughing colleagues on a voluntary and non-mandatory basis, and paying them 80% of their normal earnings. We have taken the decision across the Group not to participate in the Government's Job Retention Scheme (JRS) for any of these colleagues. However, we continue to review the position regarding a small proportion of colleagues for whom a prolonged period of shielding may be necessary; predominantly those who are either highly or extremely vulnerable or are carers – and, dependent upon government guidance, may participate in the JRS for these colleagues in future. - Across our Vet Group, our Joint Venture Partners operate independent businesses and are solely responsible for the decisions made in respect of their colleagues. A number of Joint Venture Partners have elected to participate in the JRS. - Paying an additional recognition payment which in total exceeded £1.9m to all those colleagues in our stores whose outstanding commitment meant we could continue to supply the nations' essential pet care needs. - Ensuring all eligible colleagues will still receive their bonuses in respect of FY20 in line with the usual timeline. - Whilst not directly pay related, to further support our colleagues' financial wellbeing through this period, we have added £1m to our colleague hardship fund and relaxed the application criteria to make it possible for colleagues to access these funds should they be experiencing significant financial hardship as a result of the COVID-19 crisis'

Pets at Home Group Plc 2020 Annual Report, pp112-113

The disclosure clearly articulates the remuneration arrangements applying to staff during the pandemic.

Examples of better disclosure

'We quickly mobilised all staff to work from home and cancelled all business travel. No staff were furloughed. - Clear, consistent but personal messages for staff. - Practical support and guidance to aid working from home including early identification and sourcing of equipment, test days to ensure systems worked remotely, cyber security training, ongoing technical support and grants for home equipment. - Mental and physical health prioritised with risk profiling and regular contact to support wellbeing. Social initiatives implemented to combat isolation and boost morale. - Flexibility and staff autonomy promoted and training provided on managing teams remotely with support and guidance from HR. - Succession planning in place. Regular review of workloads.'

Assura Plc, Annual Report and Accounts 2020, p19

The disclosure states that no staff were furloughed.

The disclosure explains how the physical well being of staff has been supported.

The disclosure explains how the mental well being of staff has been supported.

Information on supplier relationships

Fewer than half of the companies in our sample explained how they had supported their suppliers through the pandemic.

When disclosures around changes to supplier relationships were provided, they were often limited and simply explained that suppliers were paid promptly with a small minority of companies noting that they had increased their dialogue with their suppliers as a result of Covid-19.

- We expect supplier payment disclosures to cover the financial and non-financial ways the company has supported the supplier. Disclosures should cover changes to payment terms, any payment arrangements in respect of stock part way through production but not purchased as a result of Covid-19 and should cover any non-financial support offered to the supplier which may include guidance offered or training provided.

Examples of better disclosure

'Our suppliers - We've worked closely with our suppliers and contractors, supporting them to prioritise the health of their teams and to apply best practice guidance for construction and essential building works at this time. - Prompt payment of invoices to aid supplier cash flow. - Support provided to contractors to work safely on site and when visiting premises. Regular contact maintained to identify issues and provide support and aid remobilisation. Remote meetings/inspections. Technology employed to advance schemes'

Assura Plc, Annual Report and Accounts 2020, p19

Disclosure notes the non-financial support offered to suppliers.

Disclosure notes the financial support offered to suppliers.

Information on customer relationships

The majority of companies in our sample explained how they had supported customers in the pandemic.

Disclosures presented were company specific and explained that additional goods and services had been provided to customers for free during the pandemic, or that customers facing financial difficulties as a result of Covid-19 had been offered improved payment terms.

Examples of better disclosure

'We understand that Covid-19 has made day-to-day operations difficult and complex for our customers, and we support the Government's view that no organisation should be left unable to survive as a result. We strongly believe that business has a role to play in delivering assistance. - We have provided support for those customers who are in genuine and immediate financial distress, establishing a support fund to provide up to £80m of rent relief for customers who need our help most to survive. - Around £15m of this fund will support our food & beverage customers, broadly equivalent to three months' rent free. The remaining £65m will be allocated on a case-by-case basis to small and medium sized businesses with a focus on helping those with limited access to other sources of financial assistance. - Non-payment of rent has a serious impact on our business. In order for us to help those customers most in need, we expect those who can afford to pay their rent to do so. Where we are unable to offer assistance from our support fund, we will consider requests to defer rents or a move to monthly rents. - We are responding to the changing environment and investment needs. We're committed to reducing service charge costs, not only in response to the current situation but also through the work started last year on how we run our sites in the most efficient way possible.'

Land Securities Group Plc, Annual Report 2020, p2

Disclosure notes why it is important to provide support.

Disclosure notes the range of financial support offered to customers.

Examples of better disclosure

The safety of our customers is paramount to us. We have executed various social educational digital campaigns explaining best practices during the COVID-19 outbreak, and the importance of being safe. We have also made a number of sites across our businesses accessible free of charge to give students continuous access to quality education. In addition, we have implemented a number of initiatives to support our customers, including zero transaction fees on money transfers, free text messages, extra bonuses on data bundles through Airtel Money subscriptions, and increased availability of home broadband products to support working from home.'

Airtel Africa Plc, Annual Report and Accounts 2020, p9

The disclosure notes the non-financial support offered to customers and the reasons why the support is important.

Disclosure identifies the free services provided to customers and why this is important.

Information on customer relationships

The majority of companies in our sample explained how they had supported customers in the pandemic.

Disclosures presented were company specific and explained that additional goods and services had been provided to customers for free during the pandemic, or that customers facing financial difficulties as a result of Covid-19 had been offered improved payment terms.

Examples of better disclosure

'We understand that Covid-19 has made day-to-day operations difficult and complex for our customers, and we support the Government's view that no organisation should be left unable to survive as a result. We strongly believe that business has a role to play in delivering assistance.

- We have provided support for those customers who are in genuine and immediate financial distress, establishing a support fund to provide up to £80m of rent relief for customers who need our help most to survive.

- Around £15m of this fund will support our food & beverage customers, broadly equivalent to three months' rent free. The remaining £65m will be allocated on a case-by-case basis to small and medium sized businesses with a focus on helping those with limited access to other sources of financial assistance.

- Non-payment of rent has a serious impact on our business. In order for us to help those customers most in need, we expect those who can afford to pay their rent to do so. Where we are unable to offer assistance from our support fund, we will consider requests to defer rents or a move to monthly rents.

- We are responding to the changing environment and investment needs. We're committed to reducing service charge costs, not only in response to the current situation but also through the work started last year on how we run our sites in the most efficient way possible.'

Land Securities Group Plc, Annual Report 2020, p2