The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Guidance on the Strategic Report (June 2022)

The FRC's purpose is to serve the public interest by setting high standards of corporate governance, reporting and audit and by holding to account those responsible for delivering them. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number

- Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

- Summary

- Section 1 Objectives and how to use this Guidance

- Section 2 Scope

- Section 3 The annual report

- Table 1 Document

- Section 4 The strategic report: purpose

- Section 5 The strategic report: materiality

- Section 6 The strategic report: communication principles

- Section 7 The strategic report: content elements

- Section 7A The strategic report: content elements for entities that are not PIEs or are PIEs with 500 or fewer employees

- Signature of the statutory reports and the statement of directors' responsibilities

- Section 7B

- Section 7C

- Section 8

- The strategic report: content elements for the section 172 reporting

- Scope

- Summary of legal requirements

- The purpose of the section 172(1) statement

- Materiality

- Content of the section 172(1) statement

- Issues, factors and stakeholders

- Decision making

- Capital allocation and dividend policy

- Culture

- Website publication of section 172(1) statement

- Section 9

- Appendix I: Glossary

- Appendix II

- Appendix III

- Appendix IV(a)

- Appendix IV(b)

- Basis for Conclusions

- Scope

- The annual report

- The purpose of the annual report

- Placement of information

- The strategic report: purpose

- The strategic report: materiality

- The strategic report: communication principles

- The strategic report: content elements

- Objectives, strategy and business model

- Principal risks and uncertainties

- Environmental, employee, social, community, human rights, anti-corruption and anti-bribery matters

- Employee gender diversity

- Section 172 reporting

- Strategic report with supplementary material

Summary

(i)The Financial Reporting Council's (FRC's) purpose is to serve the public interest by setting high standards of corporate governance, reporting and audit and by holding to account those responsible for delivering them. The FRC believes that encouraging entities1 to prepare a high quality strategic report – which provides shareholders with a holistic and meaningful picture of an entity's business model, strategy, development, performance, position and future prospects – is a key part of achieving this purpose.

(ii)The FRC believes the strategic report should be clear and concise and result in fair, balanced and understandable reporting. The Guidance on the Strategic Report (the Guidance) is therefore intended to encourage preparers to consider how the strategic report fits within the annual report as a whole with a view to improving the overall quality of corporate reporting.

(iii)This Guidance relates to the Companies Act 2006 requirement to prepare a strategic report, which was brought in through the following regulations:

- The Companies Act 2006 (Strategic Report and Directors' Report) Regulations 2013 (SI 2013/1970);

- The Companies, Partnerships and Groups (Accounts and Non-Financial Reporting) Regulations 2016 (SI 2016/1245);

- The Companies (Miscellaneous Reporting) Regulations 2018 (SI 2018/860);

- The Statutory Auditors Regulations 2017 (SI 2017/1164); and

- The Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022 (SI 2022/31).

(iv)It is also relevant to limited liability partnerships (LLPs) that are required to prepare a strategic report in accordance with the Limited Liability Partnerships (Accounts and Audit) (Application of Companies Act 2006) Regulations 2008 (SI 2008/1911), which were amended by The Limited Liability Partnerships (Climate-related Financial Disclosure) Regulations 2022 (SI 2022/46).

Aims of the Guidance

(v)The FRC has developed guidance that aims to be:

- principles-based;

- mindful of recent developments in narrative reporting best practice; and

- aligned with the requirements in the UK Corporate Governance Code.

Overview

(vi)The Guidance serves as a best practice statement and, as such, has persuasive rather than mandatory force. One of its objectives is to set out high-level principles that enable entities to 'tell their story'.

(vii)The Guidance is for directors (or members in the case of an LLP) and is intended to serve as best practice for all entities preparing strategic reports.

The annual report

(viii)The Guidance encourages entities to provide information in annual reports that is relevant to shareholders. With that in mind, the Guidance is framed in the context of the annual report as a whole. In practice, an annual report comprises a number of components. The information contained in each of these components has different objectives that should guide preparers to where disclosures could be located. The aim is to promote cohesiveness and enable related information to be linked together.

(ix)In meeting the needs of shareholders, the information in the annual report may also be of interest to other stakeholders. The annual report should not, however, be seen as a replacement for other forms of reporting addressed to other stakeholders.

(x)Placement is a key theme in the Guidance with a view to providing entities with the building blocks to be innovative in the location of information whilst working within the regulatory framework. The aims are to ensure that important information is prominent and improve the accessibility of information. The Guidance recommends that information that is not relevant for shareholders should be provided outside the annual report where this is permitted by law or regulation.

The strategic report

(xi)The purpose of the strategic report is to provide information for shareholders and help them to assess how the directors have performed their duty under section 172, to promote the success of the company2 and, in doing so, had regard to the matters set out in that section. This includes considering the interests of other stakeholders which will have an impact on the long-term success of the entity.

(xii)The strategic report should reflect the board's view of the company and provide context for the related financial statements.

(xiii)The Guidance recommends that information that is material to shareholders should be included in the strategic report. Immaterial information should be excluded as it can obscure the key messages and impair understandability.

(xiv)The communication principles suggest that strategic reports should have the following characteristics – be fair, balanced and understandable; be concise; have forward-looking orientation; include entity specific information; and link related information in different parts of the annual report. There are also principles which recommend that the structure, presentation and content of the strategic report be reviewed to ensure that information remains relevant to the current period. The communication principles are intended to emphasise that the strategic report is a medium of communication between a company's board and its shareholders.

(xv)The content elements for the strategic report set out in the Guidance are derived from the Companies Act 2006, and include a description of the entity's strategy, objectives and business model. In addition, the strategic report must include an explanation of the main trends and factors affecting the entity; a description of its principal risks and uncertainties; and an analysis of the development and performance of the business; including key performance indicators. Entities must disclose information about the environment, employees, social, community, human rights, and anti-corruption and anti-bribery matters when material. There is also a requirement for certain entities to include climate-related financial disclosures and disclosures on gender diversity.

This edition of the Guidance

(xvi)This edition of the Guidance issued in June 2022 updates the edition of the Guidance issued in June 2018 for the following:

- the changes introduced by The Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022 (SI 2022/31) and The Limited Liability Partnerships (Climate-related Financial Disclosure) Regulations 2022 (SI 2022/46) which require certain entities to make climate-related financial disclosures;

- amendments to The Limited Liability Partnerships (Accounts and Audit) (Application of Companies Act 2006) Regulations 2008 (SI 2008/1911) introduced by The Statutory Auditors Regulations 2017 (SI 2017/1164), which requires a traded LLP or banking LLP to prepare a strategic report;

- amendments to The Large and Medium-Sized Companies and Groups (Accounts and Reports) Regulations 2008 (SI 2008/410) and The Limited Liability Partnerships (Accounts and Audit) (Application of Companies Act 2006) Regulations 2008 (SI 2008/1911), which implement the government's policy on Streamlined Energy and Carbon Reporting (SECR). The SECR amendments were made to the appendices that relate to the directors' report disclosure requirements;

- amendments to the definition of a public interest entity (PIE) to align it with the existing legislation; and

- some minor typographical or presentational corrections.

(xvii)The effective date of the requirements that this Guidance relates to vary. The Guidance is intended to serve as best practice when entities are applying the relevant legal requirements.

Section 1 Objectives and how to use this Guidance

1.1The objectives of the Guidance on the Strategic Report (the Guidance) are to:

- ensure that relevant information that meets the needs of shareholders is presented in the strategic report;

- encourage entities to experiment and be innovative in the drafting of their annual reports, presenting narrative information in a way that enables them to best 'tell their story' while remaining within the regulatory framework; and

- promote greater cohesiveness in the annual report through improved linkage between information within the strategic report and in the rest of the annual report.

1.2This Guidance is structured as follows:

Boxed text in bold type describes the main principles or, in Sections 7, 7A, 7B, 7C and 8, content elements that form the basis of this Guidance. References to legislative or other regulatory requirements are given in the footnotes to this Guidance.

1.3The bold text is followed by further supporting guidance explaining how the main principles and content elements might be applied. The supporting guidance is then supplemented by highlighted text as follows:

Summary of legal requirements

Where the law or regulation underpinning the Guidance requires explanation or highlighting, this information is included in a 'summary of legal requirements'. This information is intended to summarise important aspects of the legal requirements; it is not intended to be a comprehensive analysis of the law.

Example

Where a specific paragraph warrants further application guidance, practical examples are included. These examples are intended to be illustrative only and may not be appropriate for all entities.

Linkage example

One of the main objectives of this Guidance is to encourage the preparation of more cohesive annual reports. The 'linkage examples' illustrate ways in which interdependencies or relationships between strategic report content elements and disclosures placed elsewhere in the annual report might be highlighted or presented. The linkage examples are not intended to be a comprehensive list of all possible linkages in the strategic report, nor are they intended to be a template for the presentation of information.

1.4This Guidance uses the following terms to distinguish between mandatory disclosure requirements and best practice guidance:

- 'Must' is used to refer to mandatory legislative or other regulatory requirements for entities within their scope. Such requirements might be mandatory only when resulting disclosures would be material;

- 'Should' is used throughout this document to refer to guidance and recommended ways of achieving the requirements in legislation; and

- 'Could' is generally used when preparers may wish to consider alternative forms of presentation of information, or when providing examples of disclosures which may be applicable.

1.5Terms defined in the Glossary (Appendix I) are in bold type the first time they appear in each section.

1.6Clarifications of the Act's requirements in respect of the strategic report are provided in a letter from the Department for Business, Innovation and Skills (BIS) (now the Department for Business, Energy & Industrial Strategy (BEIS)) that can be found on the FRC's website at https://www.frc.org.uk/guidance-on-the-strategic-report.

Section 2 Scope

2.1This Guidance is non-mandatory and encourages best practice for all entities3 preparing a strategic report.

2.2The Act sets out different levels of reporting depending on the type of entity.

Summary of legal requirements

Section 414A of the Act requires all companies that are not small4 or micro-entities5 to prepare a strategic report.

For a financial year in which the company is a parent company, and the directors of the company prepare group accounts, the strategic report must be a group strategic report relating to the entities included in the consolidation6.

A detailed analysis of the legal requirements in respect of the strategic report, including information on the application of the statutory requirements to different types of entity, is set out in Appendix II and Appendix IV(a).

Additionally, section 415 of the Act requires all companies that are not micro-entities7 to prepare a directors' report which contains other information specified by the Act and its associated regulations. The extent of disclosure in a directors' report also varies depending on the type of company. An analysis of the legal requirements in respect of the directors' report is set out in Appendix III and Appendix IV(b) (energy and carbon report requirements for LLPs).

Both the strategic report and the directors' report are integral parts of the annual report.

Section 4(1)(a) of The Partnerships (Accounts) Regulations 2008 (SI 2008/569) requires qualifying partnerships to prepare a strategic report. The Limited Liability Partnerships (Accounts and Audit) (Application of Companies Act 2006) Regulations 2008 (SI 2008/1911) also require a traded limited liability partnership (LLP) or banking LLP to prepare a strategic report.8

2.3As noted above, the extent of disclosure that is required for an entity will vary according to the type of entity. As a general principle, this Guidance encourages disclosure of material financial and non-financial information that is necessary for an understanding of the development, performance, position or future prospects of the entity9 in the strategic report, irrespective of whether there is an explicit statutory disclosure requirement.

Example

Section 414C(6) of the Act has the effect of providing an exemption for medium-sized companies from the requirement to disclose non-financial key performance indicators (KPIs). However, where disclosure of non-financial KPIs is the most appropriate method of providing the information necessary for an understanding of the development, performance, position or future prospects of the entity's business, this Guidance recommends their use, even if the company is medium-sized.

2.4This Guidance covers a range of entities that are required to prepare a strategic report and therefore should be applied proportionately. The narrative reporting requirements for quoted and public interest entities (PIEs) with more than 500 employees are more extensive than those for unquoted companies. The content elements in this Guidance identify the legal requirements that apply to different types of entities and have been structured to aid proportionality.

Content elements of the strategic report

2.5Sections 414C Contents of the strategic report, 414CB Contents of non-financial and sustainability information statement and 414CZA Section 172(1) statement of the Act set out the content requirements for the strategic report. Section 414C sets out the overall framework and main principles for the content of the strategic report. The scope of application of sections 414CB and 414CZA are different. The content elements of this Guidance are structured into four sections to ease navigation.

- Section 7A sets out content elements (other than climate-related financial disclosures – see Section 7C) for entities that are not PIEs, and PIEs with 500 or fewer employees (i.e. subject to the requirements in section 414C of the Act).

- Section 7B sets out content elements for entities that are PIEs with more than 500 employees (i.e. subject to some of the requirements in section 414C and within the scope of section 414CB of the Act).

- Section 7C sets out the climate-related financial disclosures in the non-financial and sustainability information statement that apply to PIEs with more than 500 employees and certain entities that are not PIEs.

- Section 8 sets out the content elements for large companies that are required to provide a section 172(1) statement (i.e. within the scope of section 414CZA of the Act).

2.6An entity should either use section 7A or 7B as well as section 7C, when applicable; plus section 8 if it is a large company.

Summary of legal requirements

Entities within the scope of the disclosure requirements introduced by The Companies, Partnerships and Groups (Accounts and Non-financial Reporting) Regulations 2016 (SI 2016/1970) and The Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022 (SI 2022/31)

Section 414CA requires a traded, banking or insurance company (a public interest entity or 'PIE') with more than 500 employees or a parent company in a group headed by that company with more than 500 employees to include a non-financial and sustainability information statement as part of its strategic report.

The requirement to provide a non-financial and sustainability information statement also applies to an AIM company with more than 500 employees; and either a company with a turnover of more than £500 million (high turnover company) or an LLP with a turnover of more than £500 million, which has more than 500 employees. However, these entities are only required to disclose the climate-related financial disclosures set out in section 414CB(2A) or (4B).

If an entity's strategic report is a group strategic report, the non-financial and sustainability information statement must be a group non-financial and sustainability information statement relating to the entities included in the consolidation.10

For a financial year in which the entity is a subsidiary company, and the directors of its parent company prepare a group strategic report, including a group non-financial and sustainability information statement, there is no requirement for the subsidiary to provide a non-financial and sustainability information statement as part of its strategic report.11

Section 414CB sets out the content of the non-financial and sustainability information statement which effectively requires entities within its scope to include additional non-financial information. As many of the disclosures in section 414CB are similar to those required in section 414C for quoted companies, section 414CB(7) of the Act provides exemptions from overlapping disclosure requirements.

Entities within the scope of the disclosure requirements introduced by The Companies (Miscellaneous Reporting) Regulations 2018

Section 414CZA requires all large companies to include a section 172(1) statement as part of their strategic report.

Part 4 of Schedule 7 of The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (SI 2008/410) expands on certain aspects of the section 172(1) statement. These include detailed disclosure requirements relating to engagement with employees which apply to companies with more than 250 UK employees (or a parent company with more than 250 UK employees in a group headed by that company); and the need to foster the company's business relationships with suppliers, customers and others which apply to certain large companies. The requirements are included in Appendices III and IV(b).

Section 3 The annual report

The purpose of the annual report

3.1Although this Guidance is primarily focused on the application of the strategic report requirements, it also addresses the role of the strategic report in the context of the annual report as a whole. This recognises that the strategic report does not exist in isolation.

3.2The purpose of the annual report is to provide shareholders with relevant information that is useful for making resource allocation decisions and assessing the directors' stewardship.

3.3The annual report should provide the information necessary for shareholders to assess the entity's:

- development, performance and position;

- future prospects;

- strategy for achieving its objectives;

- business model;

- governance; and

- directors' remuneration.

3.4In meeting the needs of shareholders, the information in the annual report may also be of interest to other investors (such as debt investors and potential investors) and creditors. Other stakeholders such as customers, employees and members of society more widely may also wish to use information contained within it. The annual report should address issues relevant to these other users where, because of the influence of those issues on the development, performance, position or future prospects of the entity's business, they are also material to shareholders. The annual report should not, however, be seen as a replacement for other forms of reporting addressed to other stakeholders.

3.5The annual report as a whole should be fair, balanced and understandable and should provide the information necessary for shareholders to assess the entity's position and performance, business model and strategy.12

3.6The board of a company that is required to report on how it has applied the 2018 UK Corporate Governance Code (the Code), or to explain when it has not, is required to include a statement in the annual report confirming that the board considers the annual report and accounts to be fair, balanced and understandable.

3.1Although this Guidance is primarily focused on the application of the strategic report requirements, it also addresses the role of the strategic report in the context of the annual report as a whole. This recognises that the strategic report does not exist in isolation.

The purpose of the annual report is to provide shareholders with relevant information that is useful for making resource allocation decisions and assessing the directors' stewardship.

3.3The annual report should provide the information necessary for shareholders to assess the entity's:

- development, performance and position;

- future prospects;

- strategy for achieving its objectives;

- business model;

- governance; and

- directors' remuneration.

3.4In meeting the needs of shareholders, the information in the annual report may also be of interest to other investors (such as debt investors and potential investors) and creditors. Other stakeholders such as customers, employees and members of society more widely may also wish to use information contained within it. The annual report should address issues relevant to these other users where, because of the influence of those issues on the development, performance, position or future prospects of the entity's business, they are also material to shareholders. The annual report should not, however, be seen as a replacement for other forms of reporting addressed to other stakeholders.

The annual report as a whole should be fair, balanced and understandable and should provide the information necessary for shareholders to assess the entity's position and performance, business model and strategy.

3.6The board of a company that is required to report on how it has applied the 2018 UK Corporate Governance Code (the Code), or to explain when it has not, is required to include a statement in the annual report confirming that the board considers the annual report and accounts to be fair, balanced and understandable.

Auditor's responsibilities

3.7The auditor's report is required to state13 whether, based on the work undertaken in the course of the audit, the information in the strategic report, directors' report and corporate governance statement:

- is consistent with the financial statements;

- has been prepared in accordance with applicable legal requirements; and

- contains any material misstatements.

3.8In respect of the financial statements, the auditor's report is required to contain a clear expression of opinion on the financial statements taken as a whole. To form an opinion on the financial statements the auditor concludes as to whether:

- sufficient appropriate audit evidence has been obtained;

- uncorrected misstatements are material, individually or in aggregate;

- the financial statements, including the disclosures, give a true and fair view; and

- the financial statements are prepared, in all material respects, in accordance with the requirements of the applicable financial reporting framework, including the requirements of applicable law.

Placement of information

3.9Table 1 provides an overview of the annual report. It identifies the principal components of an annual report, sets out their different but linked objectives and the main sources of disclosure requirements. The table is intended to help preparers make judgements regarding where information would be best located. Considering these different objectives when drafting each component of the annual report will help ensure that only relevant and focused information is included in them.

3.10Law or regulation defines the components of the annual report, but does not dictate a structure. Similarly, Table 1 is not intended to impose a specific structure or order for the annual report or restrict the directors to including only the components it specifically identifies. Other sections that are not required by law or regulation (e.g. a chair's statement or a chief financial officer's report) may be included in the annual report as a subsection of a mandatory component, or in a separate non-mandatory section, if that is considered the best way of ensuring that the document is both relevant and understandable.

3.11Table 1 is not intended to stifle innovation or experimentation. This Guidance encourages entities to consider and challenge the structure of their annual reports using the flexibility available within the framework.

Table 1 Document

| Document purpose | Component | Component objectives |

|---|---|---|

| • The purpose of the annual report is to provide shareholders with relevant information that is useful for making resource allocation decisions and assessing the directors' stewardship. | Strategic report14 | • To provide information for shareholders and help them to assess how directors have performed their duty under section 172 (duty to promote the success of the company) • To provide context for the related financial statements. • To provide insight into the entity's business model and its main objectives and strategy. • To describe the principal risks the entity faces and how they might affect its future prospects. • To provide relevant non-financial and sustainability information. • To provide an analysis of the entity's past performance. • To provide signposting to show the location of complementary information. |

| Main sources of annual report disclosure requirements for an unquoted UK company17 | • The Act s414C | • The Act s414CB • The Act s414CZA |

| Corporate governance report15 | • To provide information necessary to explain how the composition and organisation of the entity's governance structures supports the achievement of the entity's objectives. | |

| • n/a | ||

| Directors' remuneration report16 | • To set out all elements of the entity's directors' remuneration policy and key factors that were taken into account in setting the policy. • To report on how the directors' remuneration policy has been implemented. • To set out amounts awarded to directors and provide details on the link between the entity's performance and directors' remuneration. |

|

| • n/a | ||

| Financial statements | • To present the entity's financial position, performance and, when required, cash flows in accordance with Generally Accepted Accounting Practice. | |

| • Accounting standards • The Act • SI 2008/41018 |

||

| Directors' report | • To provide other statutory/ regulatory information about the entity. | |

| • SI 2008/410 Schedule 719 • DTR 7.2 |

||

| Main sources of annual report disclosure requirements for a UK company with a premium listing on the London Stock Exchange | • The Act s414C | • The Code, Provision 1 • DTR 4.120 • The Act s414CB • The Act s414CZA |

| • LR 9.8.6(5)-(6)21 | • SI 2008/410 Schedule 8 • The Code Section 5 |

|

| • Accounting standards | • SI 2008/410 Schedule 7 • The Act • DTR 4.1 • DTR 7.2 • SI 2008/410 |

|

| LR 9.8 requires the inclusion of certain specific disclosures in the 'annual report and accounts'. |

3.12The placement of information within the annual report or elsewhere should facilitate the effective communication of that information.

3.13The annual report is a medium of communication between the board and shareholders. Its structure should facilitate that communication while also complying with the Act and other regulatory requirements. In general, information should be placed in the annual report when it is material to shareholders. Information that is provided to meet the needs of other users should be placed elsewhere (e.g. online or in another report), where law or regulation permits. The strategic report could signpost to other related disclosures outside the annual report that are provided for a different purpose or audience.

Placement of information in a component of the annual report

3.14The Act envisages each component of the annual report to be a separately identifiable part of the annual report. Therefore, the strategic report, corporate governance report, directors' remuneration report, financial statements and directors' report should generally include only the content that is necessary to meet the objectives of those components.

3.15It follows from paragraph 3.14 that information that is required to meet the requirements of the strategic report should generally be placed in the strategic report.

Cross-referencing within the annual report

3.16In some instances, it may be helpful to group together similar or related disclosure requirements arising from different legal or regulatory requirements that apply to different components of the annual report. This will reduce duplication and enable linkages to be highlighted and explained clearly in one place.

3.17Where information satisfying a disclosure requirement that applies to the strategic report is presented outside of that component, cross-referencing must be used in order for the disclosure requirement to be met. Cross-references should be clear and specific. Cross-referencing may also be applied to other components of the annual report.

3.18The use of cross-referencing should be limited to when a piece of information would tell the company's story more effectively if it were located in another component of the annual report.

Example

Some accounting standards require the disclosure of large amounts of explanatory detail which may remain unchanged year to year. This information, while material to an understanding of particular items in the financial statements, may be of a nature or volume that would interrupt the flow of information in the components of the annual report (e.g. background information on share-based payment arrangements). The directors might consider locating these disclosures in a separate (audited) 'other financial information' section of the financial statements and linking the disclosures by cross-referencing.

Summary of legal requirements

Section 463 of the Act provides that directors are liable to compensate the company if the company suffers any loss as the result of any untrue or misleading statement in (or any omission from) the strategic report, the directors' remuneration report or the directors' report. The extent of the liability is limited: directors are only liable to the company. Further, directors are only liable to the company if they knew that the statements were untrue or misleading or if they knew that the omission was a dishonest concealment of a material fact. This protection is sometimes known as 'safe harbour'.

Accordingly, provided directors do not issue a deliberately or recklessly untrue or misleading statement or dishonestly conceal a material fact by way of an omission, they will not be liable to compensate the company for any loss incurred by it in reliance on the report. This 'safe harbour' protection applies to the strategic report, the directors' report and the directors' remuneration report.

In order to benefit from this protection, it is generally accepted that directors should ensure that information required in one of the three specified reports is included in those reports, either directly or via a specific cross-reference.

The exact scope and extent of the protection (including whether it extends to information included in a report on a voluntary basis) has not been tested in court and hence the legal position in relation to the inclusion of such information remains uncertain.

Further information on the application of the 'safe harbour' provisions is provided in a letter from BIS (now BEIS) which can be found on the FRC website at https://www.frc.org.uk/guidance-on-the-strategic-report.

Placement of complementary information

3.19Complementary information that is not required to be included in the annual report (i.e. it is voluntary and not necessary for meeting the objectives of that component), but which the directors wish to place in the public domain, should generally be published separately (e.g. on the company website). The directors may, however, sometimes consider it appropriate to include some of this complementary information in the annual report. In such cases, that information could be included either in a separate, non-statutory component of the annual report or in the directors' report.

Signposting

3.20The strategic report should be considered as the top layer of information for shareholders. Some users may require a greater level of detail. In this case, the strategic report can be used to signpost to other complementary information.

3.21Signposting enables shareholders to 'drill down', to detailed complementary information that is related to a matter addressed in a particular component but that is not necessary to effectively communicate the information that is required by law or regulation in respect of that component. This more detailed complementary information should be placed elsewhere in the annual report, or published separately. Signposts to such information should make clear that it does not form part of the component from which it is signposted.

Example

An entity in the extractive industry may include its total proven and probable reserves within the strategic report as one of its non-financial key performance indicators (KPIs). The provision of the disaggregation of these totals is an example of complementary information that is not required to meet the objectives of a strategic report. Some entities may include this complementary information as part of their annual report within a separate, non-statutory component of the annual report.

3.22Paragraphs 3.14 and 3.15 notwithstanding, the components of an annual report should not be drafted independently. It is only through an integrated approach to drafting the annual report that all relevant relationships and interdependencies between items of information disclosed in it will be properly identified and appropriately highlighted through linkages and signposting.

Assurance

3.23The source of disclosure requirements, and their location in the annual report or otherwise, will usually affect the level of assurance to which information is subjected (e.g. audit, review or no formal assurance). It is important that, as a minimum, it is clear which information has been subject to audit and which has not. This is particularly the case where the application of the Guidance set out in this section has resulted in the splitting of disclosure requirements derived from a single legislative or regulatory source or the combination of requirements derived from different sources.

Structure of information within a component

3.24Effective communication of the matters required to be addressed in a component will not usually be achieved through the use of a 'checklist style' approach to drafting. This can result in the structure of the component being driven by the order in which disclosure requirements arise and the presentation of more granular detail in such a way that other important information is obscured.

3.25Each component of the annual report should be structured in a way that allows for a clear narrative flow and cohesiveness in the information that it contains. The ultimate aim of this is to ensure that the component, and the annual report more broadly, is relevant and understandable.

Section 4 The strategic report: purpose

The strategic report should provide shareholders of the company with information that will enable them to assess how the directors have performed their duty to promote the success of the company for the benefit of shareholders as a whole, while having regard to the matters set out in section 172.22

4.2Directors should apply judgement in determining the level of information that is disclosed, which may require the inclusion of information additional to that specifically listed in the Act.

4.3The strategic report has five main content-related objectives:

- to provide insight into the entity's business model and its main strategy and objectives;

- to describe the principal risks the entity faces and how they might affect future prospects;

- to provide relevant non-financial and sustainability information;

- to provide an analysis of the entity's past performance; and

- to provide information to enable shareholders to assess how directors have had regard to stakeholders and other matters when performing their duty under section 172.

4.4The strategic report should provide essential context to the financial statements to support an understanding of developments in the year and the future financial performance and position of the entity.

4.5The strategic report should provide additional explanations of amounts recognised in the financial statements and explain the conditions and events that shaped the information contained in the financial statements. The strategic report should also include information relating to sources of value that have not been recognised in the financial statements and how those sources of value are managed, sustained and developed, for example a highly trained or experienced workforce, natural capital, intellectual property or intangible assets, as these are relevant to an understanding of the entity's development, performance, position or future prospects.

4.6The success of an entity is dependent on its ability to generate and preserve value over the longer term. Entities do not exist in isolation; they need to build and maintain relationships with a range of stakeholders in order to generate and preserve value.

4.7There should be consistency between the strategic report and the information presented in the financial statements.

4.8The strategic report should reflect the collective view of the board.

4.9The strategic report should also provide signposting to show the location of complementary information.

Summary of legal requirements

The purpose of the strategic report is to inform members23 of the company and help them assess how the directors have performed their duty under section 172 of the Act.

The duty of a director, as set out in section 172 of the Act, is to 'act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to:

- the likely consequences of any decision in the long term;

- the interests of the company's employees;

- the need to foster the company's business relationships with suppliers, customers and others;

- the impact of the company's operations on the community and the environment;

- the desirability of the company maintaining a reputation for high standards of business conduct; and

- the need to act fairly as between members of the company.'

The disclosure requirements set out in section 414C of the Act, on which the content elements in Section 7, 7A, 7B and 7C of this Guidance are based, are intended to ensure that the strategic report achieves its statutory purpose. These are supplemented by section 414CZA of the Act which requires directors to explain how they have had regard to the matters set out in section 172(1)(a) to (f) (see Section 8 of this Guidance).

Section 5 The strategic report: materiality

Information is material if its omission or misrepresentation could reasonably be expected to influence the economic decisions shareholders take on the basis of the annual report as a whole. Only information that is material in the context of the strategic report should be included within it.

Conversely, the inclusion of immaterial information can obscure key messages and impair the understandability of information provided in the strategic report. Immaterial information should be excluded from the strategic report.

5.2The strategic report and the annual report more broadly should contain information that is material to shareholders, including information that enables shareholders to assess the directors' stewardship. A company's shareholder base may comprise groups with different needs and interests (e.g. retail investors vs. institutional investors) and the needs of all significant shareholder groups, including those who take a long-term view on investment, should be considered when determining whether a matter is material. When determining whether information is material, an entity should consider whether the fact or circumstance would affect the ability of the entity to generate or preserve value over the long term.

5.3Materiality is entity specific based on the nature or magnitude (or both) of the actual or potential effect of the matter to which the information relates in the context of an entity's annual report. It requires directors to apply judgement based on their assessment of the relative importance of the matter to the entity's development, performance, position or future prospects.

5.4Materiality in the context of the strategic report will depend on the nature of the matter and magnitude of its effect, judged in the particular circumstances of the case. However, due to the nature of the information contained in the strategic report, and the purpose it serves:

- qualitative factors will often have a greater influence on the determination of materiality in the context of the strategic report, particularly in relation to non-financial information; and

- the materiality of an item in the financial statements may be based on its magnitude relative to other items included in the financial statements in the year under review but may also be based on the potential effect over the longer term. The potential magnitude of future effects of a matter on the entity's development, performance, position or future prospects should also be considered when determining the materiality of a matter in the context of the strategic report.

5.5When making an assessment of materiality for the strategic report, the board should consider the significance of the matter relative to the entity's business model and strategy. For example, when considering if information on the impact of an entity's activities on the environment is material, the directors should consider the implications for the company's long-term value generation arising from stakeholder, legal or regulatory responses.

5.6The assessment of materiality for the strategic report should be reviewed annually to ensure that the information included in the report continues to be material over time in light of changes in facts and circumstances affecting the entity.

Materiality and the Companies Act

5.7Certain strategic report requirements in the Act include a filter to ensure that neither too little nor too much information is included and serve as a guide to the level of detail that should be provided. The filters that apply are:

- 'principal' for risks and uncertainties;

- 'to the extent necessary for an understanding of' when referring to trends and factors and non-financial information; and

- 'key' for key performance indicators (KPIs).

5.8As materiality is a commonly understood term in financial statements, this Guidance uses the term material in conjunction with principal, key or necessary for an understanding of, to help guide entities in making the judgement about what level of disclosure is needed.

5.9The terms 'key' (e.g. as used in the term 'key performance indicators' (KPIs)) and 'principal' (e.g. as used in the term 'principal risks and uncertainties') refer to facts or circumstances that are (or should be) considered material to an understanding of the development, performance, position or future prospects of the business. These will generally be the performance measures or risks considered by the board.

5.10The number of items disclosed as a result of the requirements to disclose principal risks or KPIs will generally be relatively small; they should not, for example, result in a comprehensive list of all performance measures used within the business or of all risks and uncertainties that may affect the entity.

5.11When considering the application of materiality to non-financial information, entities should, as a first step, consider whether the particular matter is material to the business and then, if it is, determine the appropriate level of information to disclose in relation to that matter. The disclosure requirements for non-financial information in the Act should not be applied as a checklist.

5.12The strategic report should focus on those matters that are material to an understanding of the development, performance, position or future prospects of the business. In the annual report of a parent company, for example, the strategic report should be a consolidated report and should include only those matters that are material in the context of the consolidated group.

5.13The concept of materiality cannot, however, be applied to disclosures that are required by company law or its associated regulations unless explicitly allowed (for example, through the use of the terms ‘to the extent necessary for an understanding of’ or 'principal').

Example

A quoted company must provide the following disclosures in its strategic report irrespective of the directors' view of their materiality or strategic importance: * A description of its strategy and business model (See paragraphs 7.11 and 7.14); and * A breakdown by gender of the number people it employs (see paragraph 7.77).

Directors' report

5.14Unlike the strategic report, most of the requirements for the directors' report are required irrespective of the directors' view of materiality.

Example

A quoted company must, to the extent it is practical to obtain the information, provide the greenhouse gas emission disclosures in its directors' report even if the directors do not consider the information to be material to shareholders. In addition, where it is not practicable to obtain the information, a justification of that fact must be included.24

Disclosure of confidential information

5.15There may be occasions when the directors consider the disclosure of detailed information about impending developments or matters in the course of negotiation would be seriously prejudicial to the interests of the entity. The Act provides an exemption from disclosure of such information; however, the directors should still consider whether there is summarised information that is not seriously prejudicial which should be disclosed.

Summary of legal requirements

Sections 414C(14) and 414CB(9) of the Act clarify that for the purpose of sections 414C and 414CB the disclosure of information about impending developments or matters in the course of negotiation is not necessary if the disclosure would, in the opinion of the directors, be seriously prejudicial to the interests of the company. This is the case even if that information is considered material.

Section 6 The strategic report: communication principles

6.1The following principles provide guidance on how the strategic report should be prepared. They are also relevant in the drafting of the annual report as a whole.

6.2Entities should consider the most effective methods of communicating material information, as well as its placement within the annual report.

The strategic report should be fair,25 balanced26 and understandable.27

6.4The strategic report should address the positive and negative aspects of the entity's development, performance, position and future prospects openly and without bias. The board should seek to ensure that shareholders are not misled as a result of the presentation of, or emphasis given to, information in the strategic report, or by the omission of material information from it.

6.5The strategic report should be written in plain language. The excessive use of jargon should be avoided. Where the use of industry-specific terms is necessary for clear communication, they should be clearly defined and used consistently.

6.6The method of presentation can significantly affect the understandability of information in the strategic report. The most appropriate method of presentation will depend on the nature of the information but may include tabular, graphical or pictorial methods as well as narrative text. A combination of these methods may also sometimes be appropriate.

6.7The board should take into consideration the strategic report when ensuring that the annual report, when taken as a whole, is also fair, balanced and understandable.

The strategic report should be clear and concise yet comprehensive.28

6.9Comprehensiveness reflects the breadth of information that should be included in the strategic report rather than the depth of information. The strategic report does not need to cover all possible matters in detail to be considered comprehensive. It should include the information that is necessary for an understanding of the entity's development, performance, position or future prospects of the entity.

6.10Conciseness is achieved through the efficient communication of all material information.

Where appropriate, information in the strategic report should have a forward-looking orientation.

6.12Information on how a fact or circumstance might affect the entity should be included in the strategic report when it is material to an assessment of the development, performance, position or future prospects of the entity. The provision of this information does not require disclosure of a forecast of future results.

6.13The strategic report should not concentrate solely on a single timeframe. Where relevant to an understanding of the development, performance, position or future prospects of the entity, the strategic report should give due regard to the short-, medium- or long-term implications of the fact or circumstance being described.

6.14Entities should communicate relevant information that enables shareholders to assess the matters that may have an impact on the long-term success of the business.

The strategic report should provide information that is entity specific.

6.16Information on how a particular fact or circumstance might affect, or has affected, the development, performance, position or future prospects of the entity and how it is responding to that fact or circumstance provides insightful information that can be used in the assessment of the entity's future prospects. The inclusion of generic or 'boilerplate' information on its own is of limited use to shareholders.

The strategic report should highlight and explain linkages between pieces of information presented within the strategic report and in the annual report more broadly.

6.18Linkages are relationships or interdependencies between, or the causes and effects of, facts and circumstances disclosed in the annual report.

6.19The Act sets out a list of discrete disclosure requirements which could be met in a series of independent sections in a strategic report. It is often the case, however, that there are relationships and interdependencies between the required pieces of information that, if highlighted and explained, will provide a greater insight into the entity's business.

Linkage example

Separate sections setting out the principal risks and uncertainties and key performance indicators may be individually informative. However, highlighting and explaining linkages between these two elements of the strategic report might provide a deeper insight into how risks might impact on the KPIs in future.

6.20Similarly, there are many examples where separate sources of requirements that apply to different components of the annual report result in the disclosure of related information. While each component of the annual report is independently useful, more valuable insight can be provided if the strategic report highlights and explains linkages between the information disclosed in them.

Linkage example

Providing independent information on an entity's KPIs in the strategic report and the drivers of directors' remuneration in the directors' remuneration report components will be informative. However, highlighting and explaining linkages or differences between these two components of the annual report might provide a deeper insight into the entity's executive incentivisation policies.

6.21The most appropriate method of dealing with these linked requirements will depend on factors such as the nature of the information and any regulatory requirements specific to the disclosures being made. The methods are closely linked to the guidance on the placement of information in the annual report set out in Section 3 and may involve the use of cross-referencing or signposting or combining related disclosures. Where cross-referencing or signposting is used, care should be taken that the nature of the relationship or interdependency is adequately explained, rather than just highlighting its existence.

6.22It is probable that the information related to some disclosure requirements will be relevant to several different parts of the annual report. Where this is the case, directors will need to consider how the linkages between these discrete disclosure requirements can be highlighted and explained in the most efficient and understandable way.

6.23The duplication of information should generally be avoided as it usually leads to unnecessary volumes of disclosure detracting from the understandability and usefulness of the annual report as a whole. This can be achieved by using signposting or cross-referencing. In some cases, it may be necessary to repeat certain pieces of information, although this should be limited to circumstances when this would tell the company's story more effectively.

Example

The directors might consider some information on trends and factors to be relevant to an understanding of an entity's strategy, principal risks and current year performance. The directors might choose to highlight relevant linkages either through: * combining relevant information on trends and factors with the strategy, principal risks and current year performance disclosures; * highlighting linkages between relevant information on trends and factors and different parts of the strategic report dealing with strategy, principal risks and current year performance; or * a combination of some or all of the above.

6.24It would be impracticable to highlight and explain all relationships and interdependencies that exist within the annual report while also ensuring the strategic report is both concise and understandable. In consequence, priority should be given to the relationships and interdependencies that are most relevant to the assessment of development, performance, position and future prospects of the business.

The structure, presentation and content of the strategic report should be reviewed annually to ensure that it continues to meet its purpose and only contains information that is relevant.

6.26Consistent structure, presentation and content will facilitate comparison from year-to-year but the benefits of continuity should not override innovation where this will improve the relevance and understandability of the information presented.

6.27Content that has been brought forward from previous years should be reviewed to ensure that it has continuing relevance. Any information that is no longer necessary in meeting the objectives of the strategic report should be removed.

Section 7 The strategic report: content elements

7.1The Act requires all companies and qualifying partnerships that are not small; all traded LLPs; and all banking LLPs to prepare a strategic report. The content requirements for the report are set out in sections 414C Contents of the strategic report, 414CB Contents of non-financial and sustainability information statement and 414CZA Section 172(1) statement of the Act. The requirements vary depending on the size and type of entity.

7.2Section 414CA applies to public interest entities (PIEs), AIM companies and high turnover companies with more than 500 employees, and sets out the requirement to prepare a non-financial and sustainability information statement. PIEs are entities that are traded, banking or insurance companies. PIEs with more than 500 employees (or, in the case of a parent company, more than 500 employees in the group headed by that company) are required to comply with all the requirements of section 414CB but are exempt from certain parts of section 414C. Section 414CB sets out additional non-financial and sustainability reporting requirements for entities within its scope.

7.3Section 414CB(A1) sets out climate-related financial disclosures for PIEs with more than 500 employees; AIM companies with more than 500 employees; and UK registered companies with a turnover of more than £500m (high turnover companies) which have more than 500 employees. These disclosures are also applicable to LLPs with more than 500 employees and more than £500 million turnover.

7.4Section 414CZA of the Act requires all large companies to report on how directors have had regard to the matters set out in section 172(1)(a) to (f) when performing their duty to promote the success of the company.

Organisation of this guidance

7.5Section 7A contains the legal requirements in section 414C for entities that are not PIEs; and for PIEs with 500 or fewer employees. Certain entities that are not PIEs are also required to make the climate-related financial disclosures set out in Section 7C.

7.6Sections 7B and 7C of this Guidance contain the legal requirements for entities that are PIEs with more than 500 employees and are therefore within the scope of section 414CB of the Act. These entities are also required to comply with the disclosures in Section 7C of this Guidance and some of the disclosure requirements in section 414C of the Act.

7.7Section 7C sets out the climate-related financial disclosures in the non-financial and sustainability information statement that must be disclosed by:

- PIEs with more than 500 employees;

- UK registered companies with securities admitted to the Alternative Investment Market (AIM) with more than 500 employees;

- UK registered companies which are not included in the categories above, which have more than 500 employees and a turnover of more than £500 million; and

- Limited liability partnerships (LLPs) which have more than 500 employees and a turnover of more than £500 million.

7.8In Sections 7A and 7B, some of the disclosure requirements are only applicable to quoted companies. Those requirements which are only applicable to quoted companies are indicated by a 'Q'. Nonetheless, all companies that are required to produce a strategic report are encouraged to apply the relevant sections as best practice.

7.9Section 8 contains the legal requirements for large companies which are required to include a section 172(1) statement in their strategic report.

Section 7A The strategic report: content elements for entities that are not PIEs or are PIEs with 500 or fewer employees

Scope of this Section

7A.1This section of the Guidance applies to:

- medium-sized and large private companies; and

- AIM and quoted companies, traded and banking LLPs that are not PIEs and PIEs that have 500 or fewer employees.

7A.1AThe section sets out the legal requirements that apply to quoted and unquoted companies that are not PIEs or are PIEs with 500 or fewer employees. Some of these entities will also be required to make mandatory climate-related financial disclosures as set out in Section 7C. Legal requirements applicable only to quoted companies are identified by 'Q'. Footnotes identify the source and applicability of each part of the legislation.

Content elements

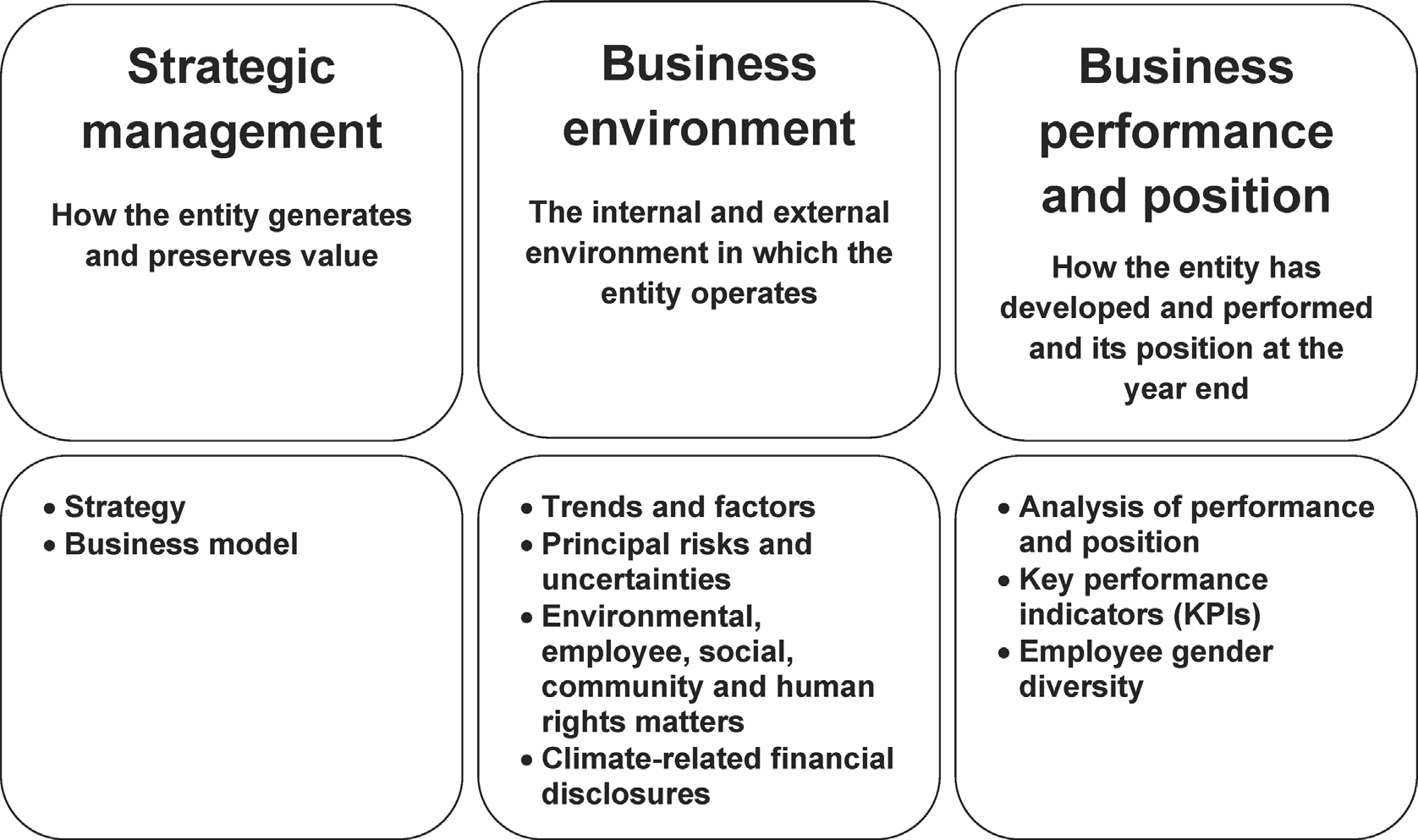

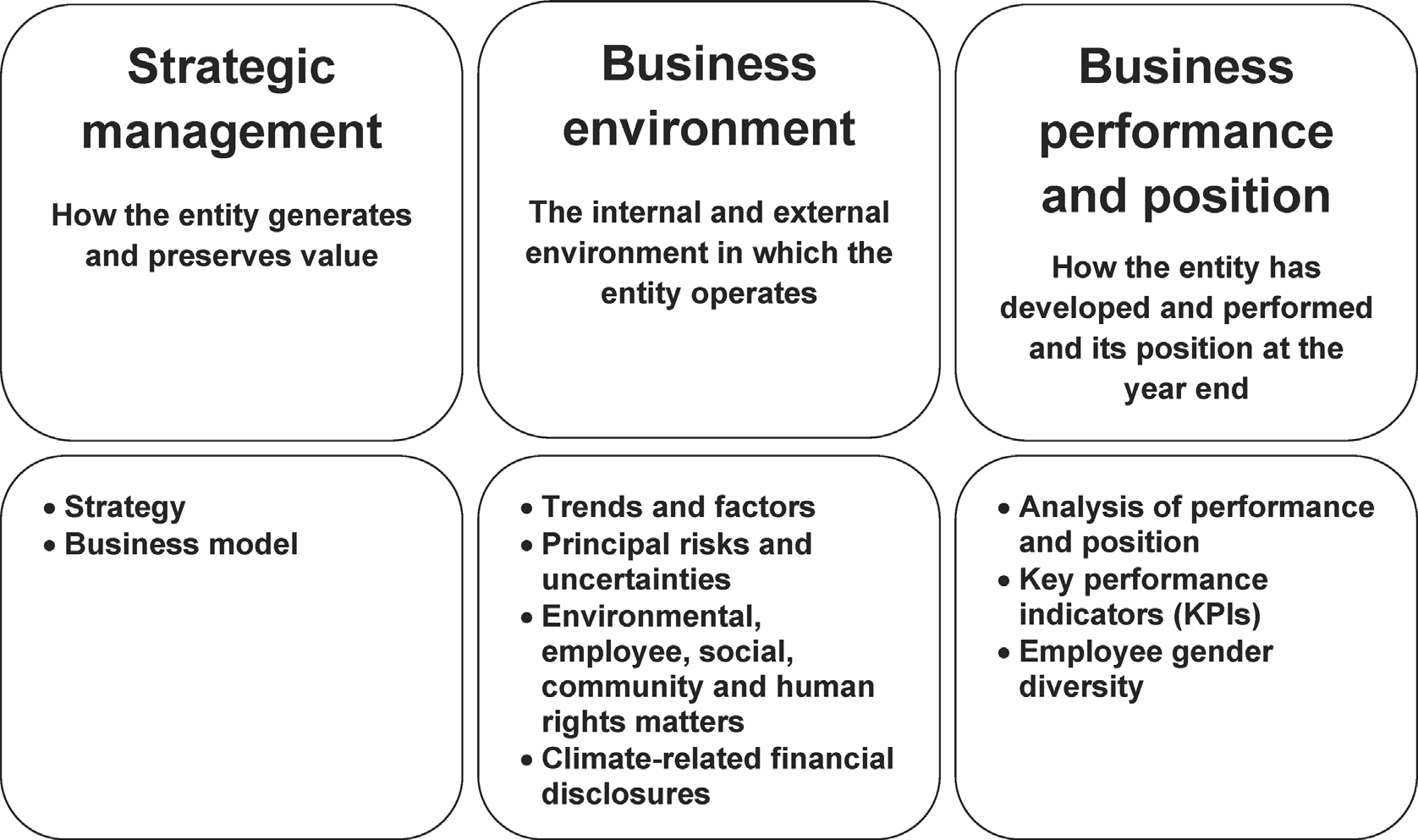

7A.2The content elements of the strategic report set out in the Act can be analysed into three broad categories: strategic management, business environment and business performance and position:

7A.3In addition to the specific disclosure requirements set out in the Act, entities should ensure that the strategic report meets its overall purpose: to provide information to shareholders and help them to assess how the directors have performed their duty under section 172. Section 414CZA of the Act requires large companies to report on how the directors have considered the matters set out in section 172(1) (a section 172(1) statement). Guidance on the application of this requirement is set out in Section 8.

7A.4Traded LLPs and banking LLPs that are not PIEs with more than 500 employees, are subject to a reduced set of strategic report content disclosure requirements which includes a fair review of the LLP's business; and a description of the principal risks and uncertainties facing the LLP.

7A.5The various content elements to be included in the strategic report should not be addressed in isolation; there are numerous relationships and interdependencies between those elements and other disclosures in the annual report which, as noted in paragraph 6.17, should be highlighted and explained in the strategic report. In particular, relevant non-financial and sustainability information should be considered as integral to the strategic report and should be linked, where appropriate, to other content elements. The relevance and strength of the relationships and interdependencies between the content elements will vary according to the facts and circumstances of the entity.

7A.6Where there has been a material change in the facts or circumstances relating to any of the content elements set out below, that fact should be highlighted and explained.

Strategic management

7A.7An entity's purpose, strategy, objectives, and business model are inter-related concepts. Different businesses may use different terms for these concepts and/or may approach them in a different order. The disclosure of an entity's purpose, strategy, objectives and business model should together explain what an entity does and how and why it does it. A description of an entity's values, desired behaviours and culture will help to explain and put its purpose in context.

7A.8An entity's purpose is why it exists. It could encompass generating benefits for members through its economic success whilst having regard to the matters identified in section 172 and, in the broader social context, contributing to inclusive and sustainable growth. The entity's strategy should be informed by what it wants to achieve in the future.

7A.9An entity will usually have a number of formal objectives that it intends to achieve in pursuit of its purpose. The entity will also have developed a strategy that describes the means by which it intends to achieve those objectives. Objectives can be financial or non-financial in nature and may be expressed in quantitative or qualitative terms.

7A.10An entity's culture can help to drive its success. The purpose, strategy and values should be aligned with the entity's culture. 29

7A.11The strategic report must include a description of the entity's strategy.30

7A.12A description of the strategy for achieving an entity's objectives provides insight into its development, performance, position and future prospects. The disclosure of the entity's objectives places the strategy in context and allows shareholders to make an assessment of its appropriateness.

Linkage example

Relating the development and performance of the entity during the year to the strategy that was in place at the time will allow shareholders to assess the directors' actions in pursuit of the entity's objectives, how directors have discharged their duty under section 172 and may be relevant in an assessment of the entity's future prospects.

7A.13Where relevant, linkage to and discussion of key performance indicators (KPIs) should be included in any descriptions given in order to allow an assessment of the entity's progress against its objectives and strategy. Similarly, emphasising the relationship between an entity's principal risks and its ability to meet its objectives may provide relevant information.

7A.14The strategic report must include a description of the entity's business model.31

7A.15The description of the entity's business model should explain how it generates and preserves value over the longer term. The business model should be consistent with the entity's purpose.

7A.16A critical part of understanding an entity's business model is understanding its sources of value, being the key resources and relationships that support the generation and preservation of value. In identifying its key sources of value, an entity should consider both its tangible and intangible assets and also identify those resources and relationships that have not been reflected in the financial statements because they do not meet the accounting definitions of assets or the criteria for recognition as assets. This information may provide insight into how the board manages, sustains and develops these unrecognised assets.

Example

An entity may generate a significant portion of its value from its workforce. The strategic report should explain an entity's key sources of value and the actions that it takes in order to manage, sustain and develop these sources of value. Other sources of value may include: corporate reputation and brand strength; customer base; natural resources; research and development; intellectual capital; licences; patents; copyrights and trademarks; outsourcing relationships; and market position.

7A.17An entity will often create value through its activities at several different parts of its business process. The description of the business model should focus on the parts that are most important to an understanding of the generation and, preservation of value. The risks posed by the impact of an entity's activity, however, may be greatest in other parts of the business process and these areas should also be considered.

Example

An entity operating in the pharmaceuticals sector might have a ready market for an innovative drug; the key to the value creation process is in the development and approval of that drug. In this case, the business model description should give due emphasis to the critical drug development and approval processes.

7A.18The description of the business model should include a high-level understanding of how the entity is structured, the markets in which it operates, and how the entity engages with those markets (e.g. what part of the value chain it operates in, its main products, services, customers and its distribution methods). It should also make clear what makes it different from, or the basis on which it competes with, its peers.

7A.19The description of the entity's major products, services and markets and its competitive position within those markets should reflect the way that the business is managed, as should the segment analysis presented in the financial statements. While the level of aggregation and detail may vary, there should be overall consistency between these two information sets.

7A.20The business model should provide context for other information presented in the strategic report and the annual report more broadly.

Linkage example

Identifying relationships between the business model and other content elements could provide linkage with other relevant information in the strategic report. For instance, it could highlight the principal risks that affect, or strategy that relates to, a specific part of the business model.

Linkage example

For instance, where an entity is reliant on technological innovation, this is likely to be reflected in the disclosed KPIs, the review of the business and the principal risks and uncertainties.

Similarly, where the entity is reliant on a highly trained and engaged workforce, or other stakeholders relationships, this should be apparent in different elements of the strategic report which should set out how the entity manages, measures and nurtures those relationships.

Business environment

7A.21To the extent necessary for an understanding of the development, performance Q or position of the entity's business, the strategic report must include the main trends and factors likely to affect the future development, performance or and position of the entity's business.32

7A.22Trends and factors affecting the business may arise as a result of the external environment in which the entity operates or from internal sources. They may have affected the development, performance or position of the entity in the year under review or may give rise to opportunities or risks that may affect the entity's future prospects. In considering the external trends, it is important that entities consider both the trends in the market in which the entity operates and the trends and factors relating to society more generally. For instance, an entity should consider the risks and opportunities arising from factors such as climate change and the environment, and where material, discuss the effect of these trends on the entity's future business model and strategy.

Example

The environment within which an entity operates, particularly that related to consumer sentiment, can change quickly as a result of a specific incident or media interest. A recent incident or media coverage need not be directly related to the entity, and need not have affected the current year performance, to have the potential to give rise to new risks or opportunities that may have a material effect on its future prospects.

7A.23The strategic report should also cover other significant features of its external environment and how those influence the business. This could include trends in the regulatory, macro-economic environment and changes in societal expectations. The strategic report should set out the directors' analysis of the potential effect on the entity's future development, performance, position or future prospects of the trends or factors identified.

7A.24The discussion of internal trends and factors will vary according to the nature of the business, but could, for example, include the development of new products and services or the benefits expected from capital investment.

7A.25Where practicable and relevant, the trend or factor should be quantified and the source of the evidence underpinning it identified.

Example

An entity may wish to state in its strategic report that the market in which it operates has grown substantially in the past five years. In this case, the strategic report should, where practicable, indicate by how much the market has grown and reference the source of the statistic used.

7A.26Given the influence trends and factors might have on many aspects of the entity's development, performance, position or future prospects, the linkage of this type of information to other areas of the strategic report and the annual report more broadly will be particularly important.

Linkage example

The strategic report might highlight the principal risks or opportunities that arise from, or the strategy that has been adopted as a result of, significant trends and factors identified. It might also highlight how certain trends or factors have affected the development, performance or position of the entity through reference to information in the financial statements.

Linkage example

Increasing focus on sustainability may result in an entity making changes to its business model such as to adapt its investment strategy. Information on these trends should be linked to the entity's strategy and business model explaining the potential effects on the development, performance, position or future prospects of the entity.

7A.27The strategic report must include a description of the principal risks and uncertainties facing the entity 33 and should include an explanation of how they are managed or mitigated.34

7A.28The risks and uncertainties included in the strategic report should be limited to those considered by the entity's management to be material to the development, performance, position or future prospects of the entity. They will generally be matters that the board regularly monitors and discusses because of their likelihood, the magnitude of their potential effect on the entity, or a combination of the two.

7A.29The board should consider the full range of business risks, including both those that are financial in nature and those that are non-financial. Principal risks should be disclosed and described irrespective of whether they result from strategic decisions, operations, organisation or behaviour, or from external factors over which the board may have little or no direct control.

7A.30Principal risks should include, but are not necessarily limited to, those risks that could result in events or circumstances that might threaten the entity's business model, future performance, solvency or liquidity, or result in significant value erosion. In determining which risks are the principal risks, entities should consider the potential impact and probability of the related events or circumstances arising and the timescale over which they may occur. For entities that are required to make climate-related financial disclosures, there may be overlap between those requirements and the disclosures required by this section.

Linkage example

Principal risks may result in threats to solvency and liquidity. An entity could consider the period over which principal risks may crystallise and how these have been taken into account when, where relevant, making a viability statement.35 Where a viability statement uses a timeframe shorter than that over which risks may crystallise, the entity could explain the potential impact of these long-term risks on the entity's viability.

7A.31Where the entity is facing long-term systemic risks which may have a material effect on the entity's ability to generate and preserve value in the long term, the strategic report could explain the potential impact on the entity's strategy and business model if those risks crystallise.

Example