The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Thematic review of climate-related metrics and targets 2023

- Executive Summary

- Background to this review

- Has companies' climate-related metrics and targets reporting improved since last year?

- Are companies adequately disclosing their plans for transition to a lower carbon economy, including interim milestones and progress?

- Are companies using consistent and comparable metrics?

- Are companies explaining how targets have affected the financial statements?

- Sector-specific observations

- FRC expectations and regulatory approach for TCFD reporting and climate in the financial statements

- Greenwashing

- How to use this thematic review

- 1. Introduction

- 2. Cross-sector findings

- 4. Energy

- 5. Banks

- Sector overview

- Key findings

- Clear and concise disclosures

- Climate-related targets

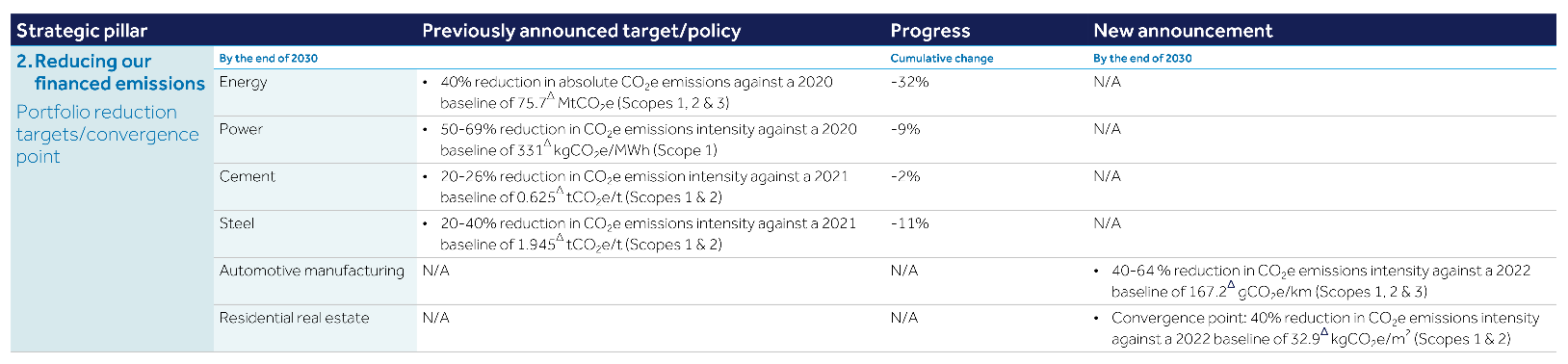

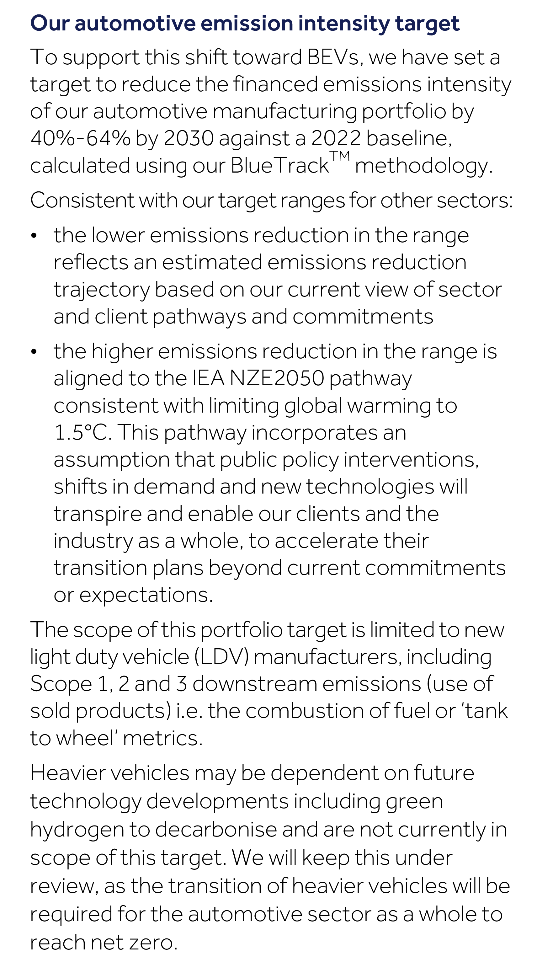

- Targets for financed emissions

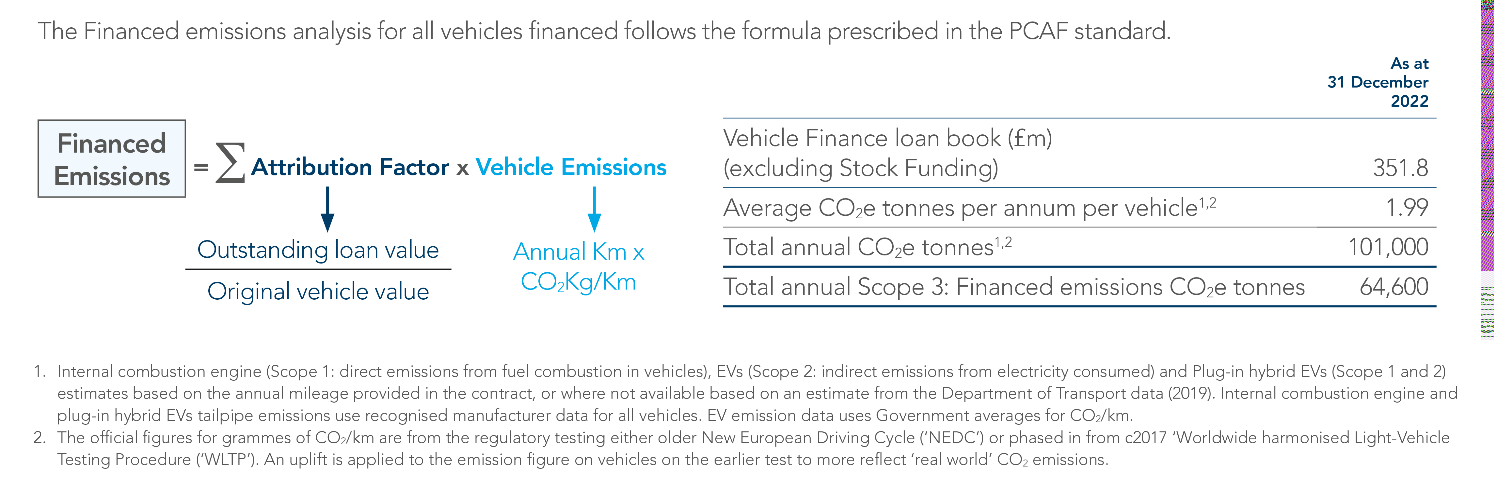

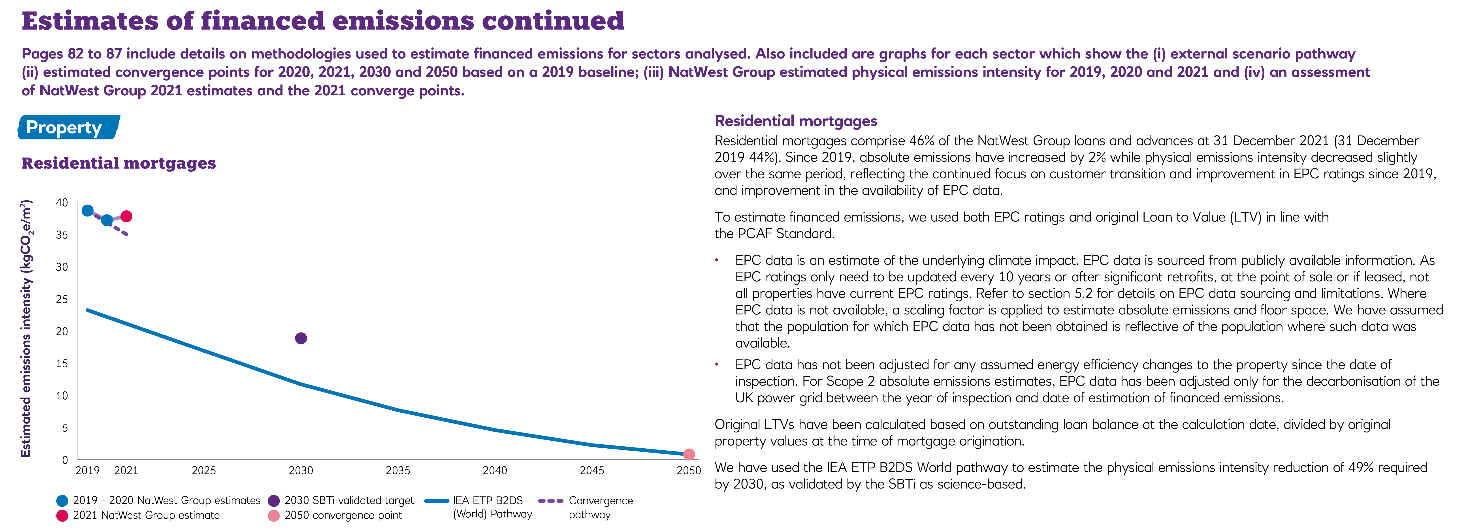

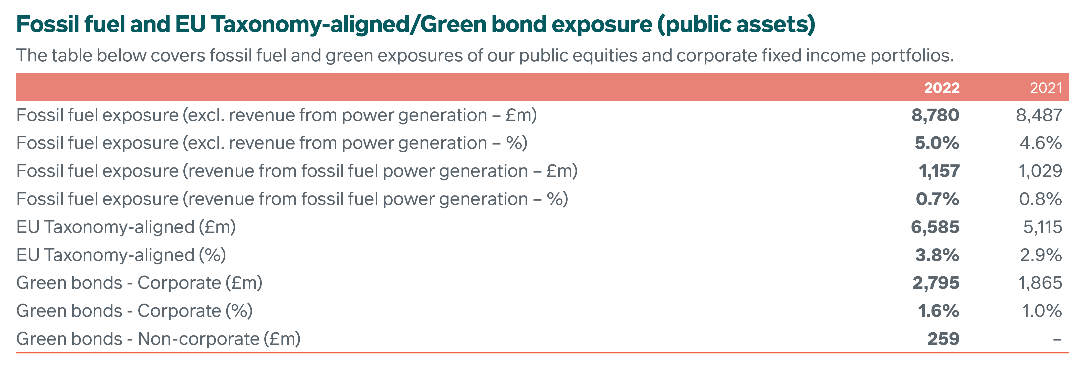

- Estimates of financed emissions continued

- Estimates of financed emissions continued

- Financed emissions – sources and reliability of data

- Current data limitations result in the use of judgements and assumptions in the estimation of financed emissions.

- Green finance targets

- Other industry recommendations

- TCFD Supplemental Guidance for the Financial Sector

- Explaining changes to data

- Financial statements impact

- 6. Asset managers

- Sector overview

- Key findings

- Location and presentation of disclosures

- Net zero targets

- Transition plans

- Net zero actions

- Other targets

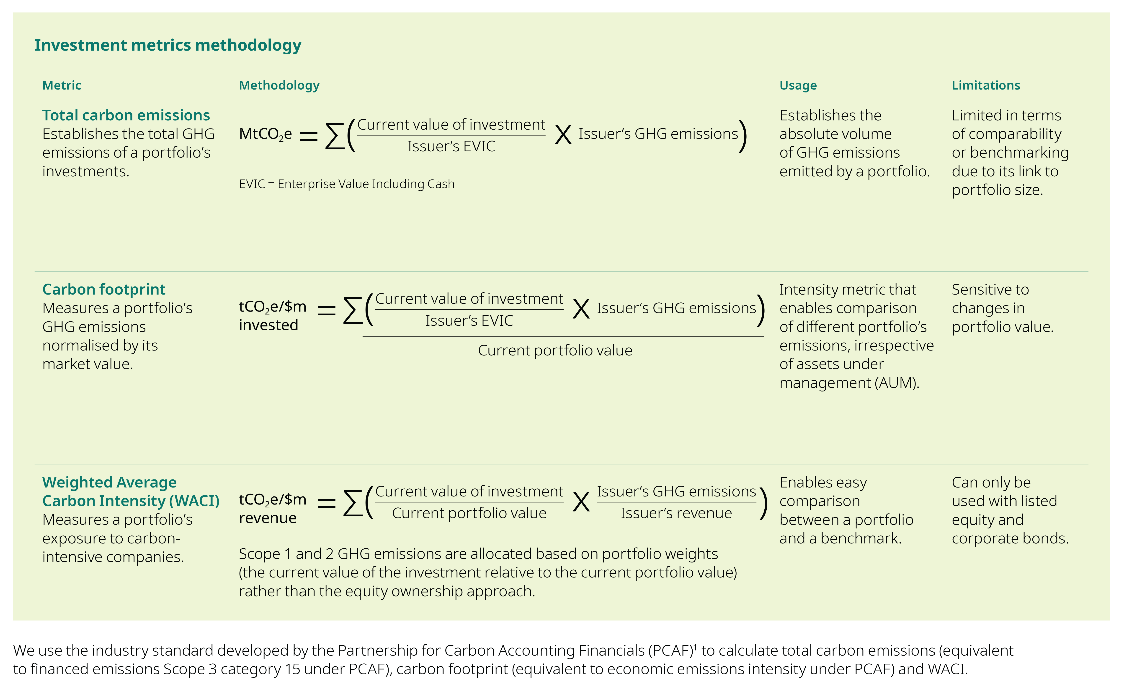

- Choice of metrics

- Scope 3 GHG emissions

- Financed emissions

- Temperature alignment metrics

- Explanation of metrics used

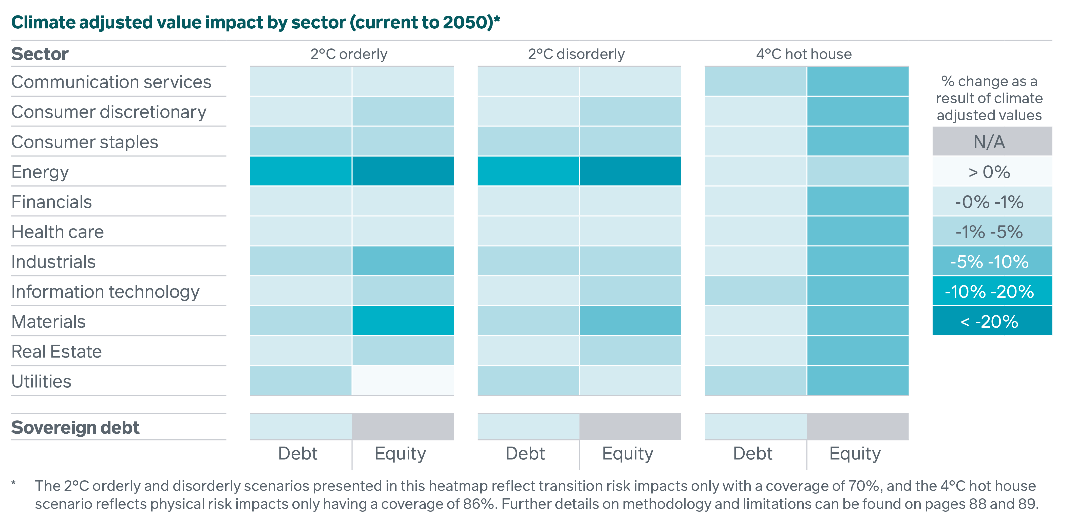

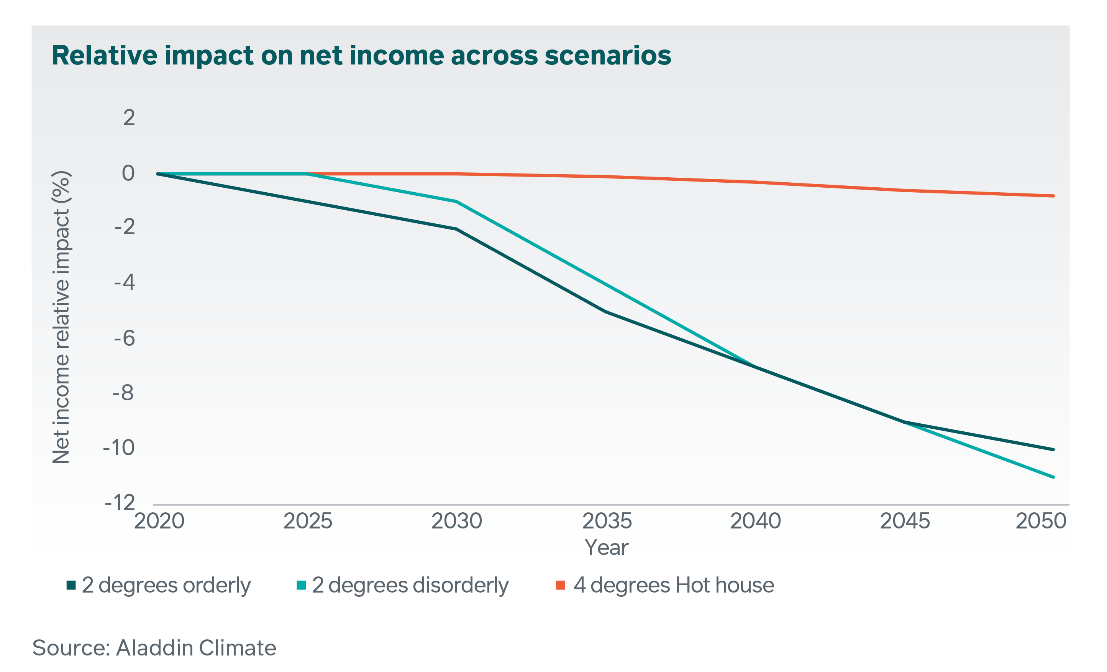

- Data limitations of scenario analysis

- Financial impact of climate risk

- Appendices

- Appendix 1. Regulatory landscape

- Appendix 2. Summary of FRC expectations

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2023 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number

- Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Executive Summary

Background to this review

Our 2022 thematic review, carried out in collaboration with the Financial Conduct Authority (FCA), covered the first year of mandatory Task Force on Climate-Related Financial Disclosures (TCFD) reporting by premium listed companies. It highlighted that, whilst UK premium listed companies had made a significant effort, there was room for improvement in their TCFD disclosures, especially in relation to metrics and targets and the disclosure of the effect of climate change on their financial statements.

Climate-related metrics and targets, including 'net zero' plans, are seen as increasingly important by investors and other stakeholders, who expect comparable, clear information explaining company targets, the metrics to track climate risks and the plan for transitioning to a lower carbon economy.

The availability and quality of climate-related data is still evolving, and all companies are on a journey, both in assessing climate impacts on their business, and in determining how best to effectively communicate their plans to adapt and transition to a lower carbon economy. We expect this journey to continue apace as companies increase their ability to report against the TCFD framework, commence reporting under the UK Climate-Related Financial Disclosures requirements, and prepare for the FCA and UK government's plans regarding the recently published IFRS Sustainability Disclosure Standards, also known as ISSB standards, issued by the International Sustainability Standards Board (ISSB), IFRS S1 and IFRS S2. Companies with significant EU operations will also need to consider the requirements of the EU Corporate Sustainability Reporting Directive.

This review considers the TCFD metrics and targets disclosures of twenty UK premium and standard listed companies operating in four sectors covered by TCFD sector-specific supplemental guidance included in the TCFD Implementing the Recommendations of the Task Force on Climate-Related Financial Disclosures document (the 'TCFD Annex'). Four of the companies reported against the TCFD recommendations for the first time, with the others providing a second year of mandated TCFD reporting.

We considered four overarching questions: * Has companies' climate-related metrics and targets reporting improved since last year? * Are companies adequately disclosing their plans for transition to a lower carbon economy, including interim milestones and progress? * Are companies using consistent and comparable metrics? * Are companies explaining how their targets have affected the financial statements?

We set out cross-sector and sector-specific observations and our expectations of companies' future reporting. Better practice disclosures are provided throughout this report to act as a reference point to help companies continue to develop their climate-related disclosures.

Has companies' climate-related metrics and targets reporting improved since last year?

Companies' reporting of climate-related metrics and targets has improved incrementally, with overall greater consideration of cross-sector and sector-specific metrics. However, there was a broad range of maturity in the companies we reviewed across four sectors. Due to the large volume of information to be presented, many companies are struggling to present a clear message to investors about which metrics and targets are materially important for managing climate-related risks and opportunities and their transition plans. It was not always easy to locate the most relevant disclosures from additional information presented, or to understand how companies had decided which information to present within the annual report and which to include elsewhere. We remind companies of the '4Cs' of effective corporate communication1: company specific; clear, concise and understandable; clutter free and relevant; and comparable.

Following the expectations we set last year, we were pleased to see increased transparency in companies' statements of the extent of consistency with the TCFD framework, including clearer statements about data that is not yet available. For example, more companies have now assessed which Scope 3 categories are relevant to them, and explained how and when they expect to be able to measure Scope 3 emissions and include them in net zero targets. This gives investors better insight into what they can expect to see reported in the future, and the level of ambition of the company's transition plan.

The main areas where we see room for further improvement overall are: * the definition and reporting of company-specific metrics and targets, beyond headline 'net zero' statements; * better linkage between companies' climate-related metrics and targets and the risks and opportunities to which they relate; * the explanation of year-on-year movements in metrics and performance against targets; * transparency about internal carbon prices, where used by companies to incentivise emission reduction; and * better linkage between climate-related targets reported in TCFD disclosures and ESG targets disclosed in the Directors' Remuneration Report.

Are companies adequately disclosing their plans for transition to a lower carbon economy, including interim milestones and progress?

Most companies have set net zero or other climate-related targets, but the metrics used to track progress were sometimes unclear and explanations of performance were not always provided.

Similarly, most have set interim emissions targets, but it was not always clear whether these targets cover all business activities or how the company plans to meet them.

Better practice examples included in this report outline expected steps to meet their targets, highlighting areas of judgement and uncertainties such as reliance on technological advances, or the commercialisation of early-stage technology.

Few companies currently publish and refer to separate transition plans, although many mention aspects of a transition plan; for example, forward-looking emissions projections. We encourage companies to review the Transition Plan Taskforce (TPT) guidance and consider how best to articulate their targets and plans for transition, pending further developments from the TPT, government, and the FCA2.

Are companies using consistent and comparable metrics?

Our sector-based approach assessed the extent of comparability between companies in the same sector. Whilst we did identify some commonality, methodological differences due to company-specific adjustments made direct comparisons challenging.

We encourage the use of TCFD cross-sector and industry-specific metrics to aid comparability. Some companies helpfully provided details of the methodology applied when calculating non-standard metrics to help interested parties make inter-company comparisons.

Are companies explaining how targets have affected the financial statements?

It was often difficult to determine the extent to which the impact of targets on the financial statements had been considered, due to lack of company-specific disclosures. Most companies provided some explanation of how they considered climate in the financial statements, but fewer included disclosures explaining how the impact of announced climate-related targets and transition plans had been considered. Better practice examples cited the assumptions made in respect of useful economic lives and the potential impact on key asset balances.

When there is a reasonable expectation that companies' climate-related targets and transition plans could impact the financial statements, we expect companies to explain the assessments undertaken and any impacts on the financial statements.

Sector-specific observations

Materials and Buildings (see section 3)

All companies disclosed net zero targets, primarily covering Scope 1 and 2 emissions. Companies have made progress in assessing Scope 3 emissions, but only one company reported this data whilst the other companies disclosed plans to report in the future.

Most companies reported a range of metrics, and increased consideration of industry-specific metrics was evident compared to last year. However, the linkage with risks and opportunities and granularity of information could be improved.

Many of the explanations of the consideration of net zero targets and transition plans in the financial statements seemed boilerplate.

Energy (see section 4)

Most companies disclosed net zero targets. All companies reported some Scope 3 emissions, but it was not always clear what these related to and whether they were included in the net zero targets.

Most companies reported some relevant sector-specific and cross-sector metrics, but could improve the linkage with risks and opportunities. One of the smaller companies in the sample was still in the process of determining appropriate metrics and targets to report.

The larger companies in the sample provided helpful explanations of the assessment of climate on the financial statements.

Banks (see section 5)

All banks disclosed 2050 net zero targets, with interim targets for their own emissions. Financed emissions were the largest contributor to overall emissions and were reported by larger banks for some activities, but data was a significant challenge. Comparability was difficult due to company-specific methodologies.

Banks presented data across several reports; some were better at explaining the purpose of the information, their climate strategy and summarising the key information in the annual report.

No bank quantified a financial effect of climate change on the financial statements, and four banks explicitly stated that they did not consider the quantitative impact to be material at this time.

Asset Managers (see section 6)

Most asset managers disclosed 2050 net zero targets, with the majority having some interim emissions targets in place.

The largest contributor to overall emissions was financed emissions; all asset managers presented some financed emissions from their investment portfolios, or intended to do so in the future. Most also reported a temperature alignment metric, but comparability was difficult due to the lack of a common methodology.

Only one company provided data regarding the potential impact of climate change on the group's assets and income.

FRC expectations and regulatory approach for TCFD reporting and climate in the financial statements

TCFD reporting

Our initial supervisory approach for mandatory TCFD reporting, developed in collaboration with the FCA, was focused on raising awareness of the new rules and guidance and improving the quality of disclosure in this fast-evolving area. In the first year of TCFD reporting by premium listed companies, we wrote to 75 companies in respect of their TCFD disclosures3. We highlighted specific areas where companies could improve their disclosures, and signposted relevant sections of our 2022 TCFD and climate change thematic report for consideration when producing future annual reports and accounts. In a small number of cases, we sought specific undertakings from companies to improve the clarity of their statement of consistency with the TCFD framework.

In the second year of listed companies' reporting against the TCFD framework, we are more likely to enter into substantive correspondence with companies who do not meet the expectations set in both our 2022 and 2023 thematic reports, especially when climate change is significant for the company, and it does not provide the TCFD recommended disclosures that are 'particularly expected' by the Listing Rules. We will continue to work closely with the FCA in this respect. We will also develop our regulatory approach in respect of the new Companies Act TCFD requirements (see page 18).

Climate in the financial statements

As set out on page 7 of this report, we see considerable variation in the quality of companies' disclosures of how climate change targets have been taken into account in the preparation of their financial statements disclosures. We also continue to see mixed practice in our routine correspondence with companies in respect of connectivity between climate-related information included in narrative reporting and financial statements disclosures. We have written to 16 companies during 2022-23, either to seek more information about how climate change has been considered in their financial statements, or to highlight areas where we believe that disclosures could be improved. We will continue with this regulatory approach.

Greenwashing

Greenwashing continues to be an area of concern to investors, regulators and other stakeholders. Scrutiny of 'green claims' is likely to intensify as regulatory bodies such as the FCA, the Advertising Standards Agency, and the Competition and Markets Authority consider appropriate actions to identify and address greenwashing.

We are committed to enforcing transparent disclosures of companies' plans to address climate-related risks and opportunities4. In support of this, through our reviews of company reporting, we have identified some areas that companies should consider, or avoid, when reporting on metrics and targets:

- Consider the overall clarity and balance of reporting, for example between climate-related risks and opportunities and ensuring that key messages are not obscured by the volume of reporting.

- Avoid placing undue focus on immaterial areas of their business which are considered more 'green' at the expense of more material business activities that may be more carbon intensive.

- Consider whether terminology used could imply a greater level of environmental benefit than has actually been achieved. For example, saying that carbon has been ‘removed' rather than 'reduced', or that something is 'sustainable' or carbon 'positive' without explaining what that means and how it is measured.

- Avoid using misleading presentation or making inappropriate metric comparisons to imply a greater level of performance than actually achieved.

- Ensure the scope and boundaries of any metrics or targets are clear, highlighting where significant areas of the business or activities are excluded, particularly if these are the higher emitting parts of the business.

- Explain the methodology, purpose and scope of any 'avoided emissions', 'Scope 4 emissions', or similar metrics, ensuring that comparisons are on an appropriate basis and the relationship to the company's emissions is explained.

- Explain significant areas of uncertainty that could impact the ability to meet targets, for example explaining where future plans are dependent on technological advances that have not yet been developed.

Companies may find it helpful to consider the principles of effective disclosure in our What Makes a Good Annual Report and Accounts publication, which are reflected in the above considerations, when preparing their disclosures.

We will challenge companies where we consider reporting of climate-related metrics or targets to be unclear or potentially misleading.

Under the FCA's PMB 36, we will refer matters to the FCA which are identified as containing potentially false or misleading information, including the omission of material facts, likely to cause investor harm or which may breach other relevant FCA rules for environmental, social and governance (ESG) matters.

How to use this thematic review

Each section contains our observations on the disclosures of the companies in our sample, in the following format:

- Represents good practice

- Represents an opportunity for improvement or enhancement

- Represents an omission of required disclosure or other issue

We have provided several examples of better practice in our report, highlighted in grey boxes, and encourage companies to use these as reference points when preparing their own disclosures. The examples have been identified through both this thematic review and as part of our routine supervisory activities.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The examples included in this report illustrate better practice in a particular area, and should not be taken as an indication of the accuracy of the underlying information, which has not been verified by our review, the validity of the targets reported, or the quality of the company's reporting more generally.

Dark green boxes contain other information relevant to our thematic report.

Our expectations of companies are included in dark blue boxes in each section, and also summarised in Appendix 2 to this report.

Where we use specific terminology for the first time we have provided definitions.

We have not provided definitions for Scope 1, 2 and 3 GHG emissions; we expect most users to be familiar with these terms as they are referred to within the TCFD metrics and targets recommended disclosures and are established areas of reporting.

1. Introduction

Why did we carry out this review?

In our 2022 thematic review of TCFD reporting and the disclosure of climate in the financial statements by a sample of premium listed companies we set out our expectations and identified broad themes for companies to consider in order to improve the quality of climate-related disclosures.

As explained in the FCA's PMB 36, both we and the FCA monitor companies' climate-related disclosures as part of our regular supervisory activities, and regularly correspond with companies in relation to TCFD disclosures and the impact of climate in the financial statements in order to improve the quality of reporting.

Our correspondence in the first year of TCFD reporting was intended to improve the quality of corporate reporting in this fast-evolving area. This meant that the majority of the FRC's correspondence with companies in respect of TCFD disclosures was in the form of points for the company to consider when preparing its next annual report and accounts and suggestions to consider the expectations set out in our 2022 TCFD thematic report. Under this approach, we wrote to 75 companies about TCFD and climate-related disclosures.

In our correspondence we identified more areas of improvement in relation to the TCFD Metrics and Targets recommended disclosures than for any of the other three recommended disclosures (see chart). The points raised covered areas such as missing disclosures, unclear targets and metrics, a lack of explanations for significant movements in performance and unclear disclosure of progress against targets.

TCFD - related points raised in CRR correspondence with companies 2022-23

Pie chart showing the distribution of TCFD-related points raised: * Metrics and targets: 30% * Strategy: 29% * Compliance statement: 25% * Risk Management: 13% * Governance: 3%

Points raised in relation to the statement of consistency required by the Listing Rules

The reporting of companies' net zero targets, climate-related metrics and the impacts on the financial statements continues to be an area of focus for investors and other stakeholders. For example, the Carbon Tracker report Still Flying Blind published in October 2022 highlighted that there was still a lack of disclosure of the impact of companies' net zero targets on their financial statements.

The UK government has indicated that it will consult on the introduction of requirements for the UK's largest companies to disclose their transition plans, including related metrics and targets, if they have them5. In addition, the Transition Plan Taskforce is preparing sector-based disclosure recommendations to respond to investor concerns about the lack of comparability between companies in the same sector.

What did this review cover?

Given the importance of climate-related metrics and targets, net zero transition plans, and the associated impact on companies' financial statements, we focused our thematic review on assessing the extent of improvement in companies' reporting since our previous thematic review, and on identifying better practice and areas for further improvement in four key sectors.

Our thematic review sets out our expectations of companies reporting their consistency with TCFD as required by the Listing Rules, many of which are relevant to non-listed companies that are due to report climate-related financial disclosures under the Companies Act requirements. Our expectations are summarised in Appendix 2.

We considered the extent to which the companies reported against the TCFD metrics and targets recommended disclosures and relevant supplemental guidance.

We also reviewed the same companies' financial statements to identify the extent to which the impact of any disclosed climate-related targets or transition plans on the financial statements had been considered and whether any impacts appeared to be adequately reflected. Our review of the financial statements was focused specifically on the impact of climate-related targets, and did not consider broader potential climate impacts which were covered in our last thematic review.

ESG Statement of Intent

Climate, along with wider ESG matters, continues to be an area of focus for the FRC. In 2021 we published our Statement of Intent which identified six areas of challenges in ESG reporting and outlined the actions we were planning to take across our regulatory activities. In January this year we published an update in our ESG Statement of Intent: What's Next. The report sets out areas where there are ongoing challenges with ESG reporting, actions to address them, and our planned activities. It summarises the initiatives undertaken by the FRC in the last 18 months to assist and support our wide range of stakeholders and to drive best practice as well as signposting future publications.

The publications highlighted in the updated statement of intent are all available on our ESG website.

Corporate Governance Code Consultation

In May 2023 we launched a public consultation on our proposed revision to the Code. This limited revision aims to enhance the Code's effectiveness in promoting good corporate governance and increasing transparency across several areas. This includes reporting and evidencing the effectiveness of the risk management and internal controls framework and making revisions to reflect the responsibilities of the board and audit committee for sustainability and ESG reporting, and associated assurance in accordance with a company's audit and assurance policy.

Sample selection and sector-based approach

We reviewed twenty companies across four sectors in order to consider the extent of comparability within sectors, as well as to identify wider themes and areas of better practice applicable to all companies. Findings applicable to all companies are presented in a cross-sector section (section 2), with sector-specific findings presented in the relevant sector section. We include better practice examples throughout the report and encourage companies to review these, even if they do not operate in the same sector as the example disclosure.

Overall, our sample was 25% FTSE 100, 35% FTSE 250 and 40% other listed companies. The companies were predominantly premium listed companies reporting against TCFD for the second year of mandatory reporting, but the review also includes two standard listed companies and two premium listed companies reporting for the first time.

Market composition

Pie chart showing market composition: * FTSE 100: 25% * FTSE 250: 35% * FTSE Small Cap: 30% * Other listed: 10%

Maturity of reporting

Pie chart showing maturity of reporting: * 2nd year of mandatory TCFD: 80% * 1st year of mandatory TCFD: 20%

We selected a mix of financial and non-financial sectors in order to consider companies across the economy which will have different exposures to, and impacts on, climate change, and for which the TCFD has issued sector-specific supplemental guidance.

Materials and Buildings TCFD supplemental guidance

The Materials and Buildings TCFD supplemental guidance covers companies operating in several sectors, including chemicals, metals and mining and construction materials. These companies are typically capital intensive with long life assets. The products can be energy intensive with hard to abate emissions but many will be required for the transition to a lower carbon economy. Our sample included companies involved in the manufacture and supply of materials including metals, ceramics and concrete. See section 3.

Energy

Energy is fundamental to all economies and energy companies typically have significant exposure to both physical risk, such as the impact of extreme weather on power generation or transmission infrastructure, and transition risk, such as new policy requirements. The TCFD supplemental guidance for the Energy sector covers oil and gas, coal and electrical utilities companies. Our sample considered companies across the electricity value chain, from power generation, through transmission to end-usage. See section 4.

Banks

Banks are exposed to significant climate-related risks and opportunities through their lending and other financial services, for example, through the potential impact of physical climate risk on a debt portfolio and through their key role in financing the energy transition. The climate-related risk related to their own operations is much less significant. See section 5.

Asset managers

Asset managers invest assets on behalf of their clients according to instructions, and need to be able to articulate how climate-related risks and opportunities are managed within their portfolios. Listed asset managers also need to explain their climate-related risks and opportunities to shareholders. Like the banks, they are significant users of their investees' emissions reporting. See section 6.

2. Cross-sector findings

Footnotes

Structure of findings

Our review identified several findings that were applicable across all the sectors in our review; these are outlined in this section of the report.

To minimise duplication, and aid navigation, where there is either additional detail or better practice examples provided in a sector-specific section we have highlighted this using the relevant sector icon.

Materials and Buildings

Energy

Banks

Asset Managers

We recommend users consider the examples and expectations in the cross-sector detail and then refer to the additional detail and examples in the sector-specific sections where relevant.

Materiality

As climate-related reporting is still maturing, companies can find it challenging to ensure that climate-related disclosures provide an appropriate level of detail for their own business circumstances.

The TCFD guidance states that Scope 1 and 2 GHG emissions should be reported, irrespective of materiality. All other metrics are subject to materiality assessments.

Companies need to ensure that the relevant requirements of the Companies Act are met, such as the Streamlined Energy and Carbon Reporting (SECR) requirements, but should consider the appropriate level of detail to be included in the annual report.

Our Guidance on the Strategic Report states 'Information is material if its omission or misrepresentation could reasonably be expected to influence the economic decisions shareholders take on the basis of the annual report as a whole. Only information that is material in the context of the strategic report should be included within it. Conversely, the inclusion of immaterial information can obscure key messages and impair the understandability of information provided in the strategic report. Immaterial information should be excluded from the strategic report.'

The Listing Rules (LR 9.8.6D G, LR14.3.30 G) require companies to consider whether their disclosures provide sufficient detail to enable users to assess the company's exposure and approach to addressing climate-related issues. Companies should carry out an assessment to ascertain the appropriate level of detail to be included in their climate-related financial disclosures, taking into account factors such as:

- The level of its exposure to climate-related risks and opportunities; and

- The scope and objectives of its climate-related strategy, noting that these factors may relate to the nature, size and complexity of the company's business.

In our 2022 TCFD thematic review we discussed materiality and encouraged companies to disclose the basis on which they assessed the materiality of climate-related disclosures.

The most useful disclosures clearly stated the company's climate-related metrics and targets, explained which metrics are used to measure and manage climate-related risks and opportunities, and explained which are used to assess progress against targets.

FRC Lab report on Materiality

As reporting becomes more complex, materiality can be a powerful tool to provide better, rather than more, information for investors. But determining what is or is not material is highly subjective and can present challenges for companies, especially on sustainability and ESG topics.

The Lab is currently undertaking a project to identify tips and best practice to help companies make effective materiality judgements. The project outputs are expected to be published in autumn 2023.

Location of disclosures

All companies in our sample presented their metrics and targets within the strategic report. Several also provided disclosures across other reports designed to meet the needs of stakeholders, but there were opportunities to make reporting clearer and more concise.

Some companies used infographics to communicate complex information and provided links to other reporting.

Most companies presented metrics both in tables and in text. However, in some cases the presentation used made it difficult to understand the relative importance of the metrics, or indeed whether some of the metrics were relevant at all.

A few companies reported climate-related information elsewhere in the strategic report but did not refer to these in their TCFD disclosures.

We encourage companies to consider the principles outlined in our What Makes a Good Annual Report and Accounts publication when preparing their disclosures.

Materiality

Corporate reporting principles - Accurate - Connected and consistent - Complete - On-time - Unbiased - Navigable - Transparent

4Cs of effective communication - Company specific - Clear, concise and understandable - Clutter free and relevant - Comparable

Good ARAs take ACCOUNT of corporate reporting principles and the 4Cs of effective communication

We expect companies to consider how to ensure reporting is clear and concise, using the '4Cs' of effective communication when determining the location and format of disclosures, to ensure key messages are not obscured, and use specific cross references to relevant information reported elsewhere.

UK Climate-Related Financial Disclosure (CFD) Requirements

The UK government introduced mandatory CFD requirements for certain AIM-listed and private companies and LLPs for accounting periods beginning on or after 6 April 2022.

CFD is based on TCFD, and the UK government considers that companies complying with all TCFD recommended disclosures are 'normally likely to meet the requirements' of CFD. However, there are some differences so companies need to consider the detailed requirements when preparing disclosures. In addition, there are differences between the Companies Act and Listing Rules requirements:

- The Listing Rules require companies to provide a statement of consistency in the annual report but has flexibility in where TCFD disclosures are provided. Under CFD the mandated disclosures must be included within the Non-Financial and Sustainability Information Statement in the Strategic Report.

- Under the Listing Rules, if a TCFD recommended disclosure is not provided then companies must state that, and outline any actions being taken to enable future disclosure. CFD is mandatory but allows a company to omit certain disclosures where the directors 'reasonably believe' that they are not relevant and a 'clear and reasoned explanation' is provided.

Statement of the extent of consistency with TCFD

Listing Rules 9.8.6R and 14.3.27R require companies to include in their annual financial report a statement setting out whether the company has included disclosures consistent with the TCFD Recommendations and Recommended Disclosures.

When disclosures are provided, but outside the annual report, companies must explain why, and identify precisely, where they are reported. Where recommended disclosures have not been provided, the Listing Rules require companies to explain why not, and to outline any steps it is taking, or planning to take, to facilitate disclosure within a specified timeframe.

In our review, ten of the twenty companies reviewed stated full compliance with the TCFD metrics and targets recommended disclosures and nine stated partial compliance. The main reason provided for partial compliance was in relation to data integrity and availability, primarily in respect of Scope 3 GHG emissions.

Our sample included companies reporting against the TCFD framework for the first time; as expected, the level of consistency with TCFD was lower than for other companies in the sample. In most cases the disclosures outlined the actions they were taking to enhance their consistency with the TCFD framework.

Better practice examples set out clearly the process undertaken to determine what information to include.

It was unclear in some cases whether the company had considered the impact of any areas of non-disclosure, including relevant supplemental guidance, in their assessment of consistency with TCFD.

Some companies did not provide all the information required by the Listing Rules, for example, the actions being taken and the expected timeline to be able to provide the disclosures.

Company stated level of compliance

Not stated 5%

Partially compliant 45%

Fully compliant 50%

We expect companies to provide a clear statement of the extent of consistency with TCFD in the annual report, including all information required by the Listing Rules.

Data challenges

Companies in all sectors noted challenges in data collection, especially difficulties in relation to the identification, collection and reporting of Scope 3 GHG emissions (see page 28). There can also be challenges when data is collected from sources outside of the finance team which may be subject to different internal controls or which had not been collected previously for external reporting purposes.

We encourage companies to be transparent in their disclosures and explain the actions they are taking to develop the extent and reliability of the data collected for climate-related reporting, including that outside of their direct control.

We also encourage companies to be transparent about data limitations, including explanations of estimations and areas where it is not feasible to collect data.

Some companies provided clear explanations of their reporting boundaries and data limitations, with information on intended actions to improve data completeness and quality where relevant.

Some companies provided methodologies which included definitions and data assumptions. Some also included thresholds for when they would restate metrics reported in the prior period due to changes in estimates or identified errors.

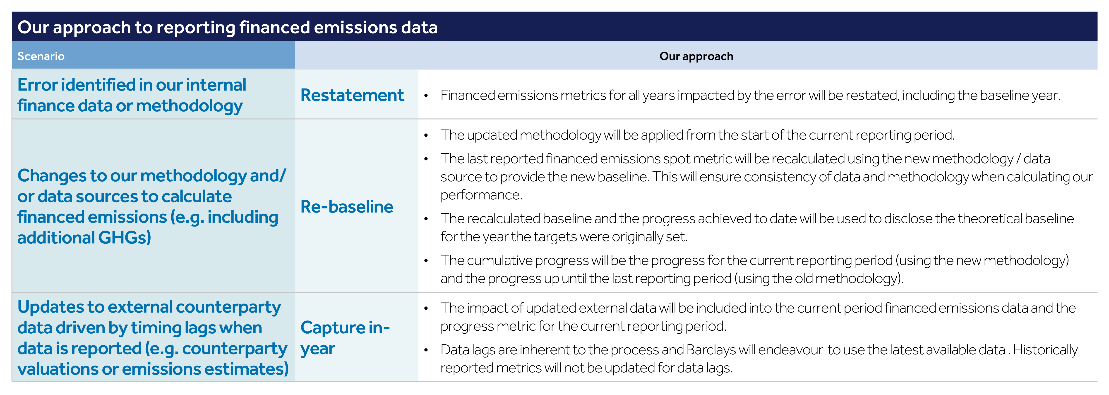

We encourage companies to explain when there have been changes to previously reported metrics, for example as a result of updated definitions or the correction of an identified error.

We expect companies to provide clear explanations of metrics and targets reported, including where relevant, areas of data limitations, methodologies, reporting boundaries and any changes to data.

FRC Lab reports on ESG data

The first phase of the Lab project focused on the production of ESG data from a company's perspective. The report set out the three key elements of ESG data production: motivation, method and meaning and outlined some suggested positive actions to address challenges in ESG data production and how Boards can optimise how ESG data is collected and used.

The second phase of the project was published in July 2023; this examined how investors access and collect ESG data and how they use it. The findings of the report highlighted the need for companies to understand who the audiences for their information are and target accordingly. For investors, who primarily rely on third party data providers to source data in an aggregated manner and then use company reporting for context, the report suggests to:

- Focus on ESG issues relevant to the company within the annual report.

- Use datasheets to provide additional detail.

- Ensure the data is backed up by an interconnected narrative, which is also consistent with the financial statements.

The report also provides recommendations on the clarity of location and presentation of information.

Targets and plans for transition

Transition plans

There is no current requirement to publish a separate transition plan; however, the TCFD recommended disclosures include forward-looking information and the Listing Rules include the supplemental guidance on Metrics, Targets and Transition plans in the list of relevant documents. This supplemental guidance outlines some characteristics of effective disclosures of transition plans and provides elements to consider across each of the four TCFD pillars. In our sample, half of the companies provided at least some of the elements suggested across each of the four TCFD pillars.

Companies have started to report interim targets, but in many cases the overall plan and any detailed steps to meet interim and longer term targets are still unclear, making it hard for users to assess the potential impacts on business strategy and the financial statements.

Some companies have provided transition plans to explain how they are planning to meet targets and transition to a lower carbon economy.

We encourage companies to consider the Transition Plan Taskforce guidance when preparing disclosures explaining their targets and transition plans.

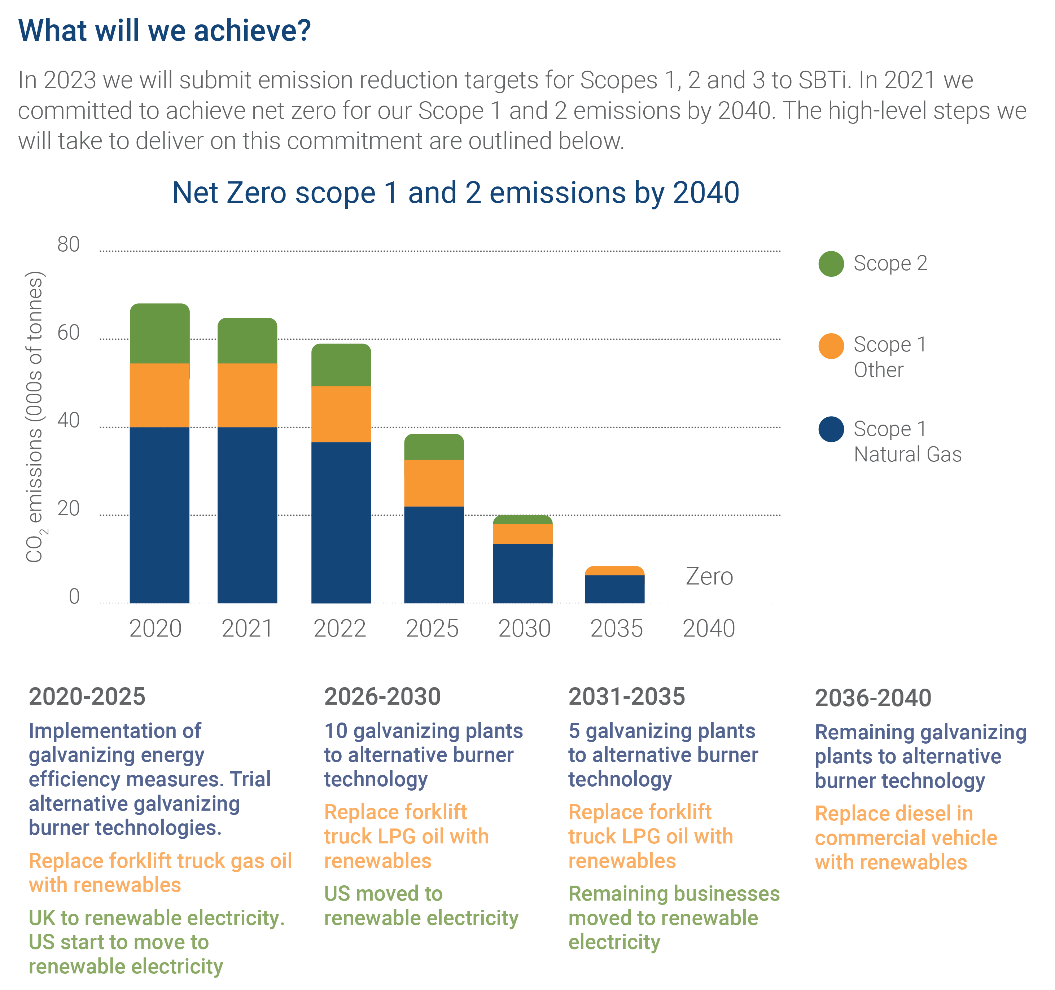

Specifies which scope of emissions the net zero target relates to and the high-level steps planned to reach the target, with further detail on uncertainties provided elsewhere in the annual report

What will we achieve? In 2023 we will submit emission reduction targets for Scopes 1, 2 and 3 to SBTi. In 2021 we committed to achieve net zero for our Scope 1 and 2 emissions by

- The high-level steps we will take to deliver on this commitment are outlined below.

Hill & Smith PLC, Annual Report and Accounts, 31 December 2022, p38

We expect companies to consider the TCFD guidance, including relevant supplemental guidance, when reporting on targets and the plans to meet them.

We have clear targets including a reduction in our carbon emissions of 32% (from a 2019 baseline) by the end of the decade. In the longer term we are committed to reaching net zero and having identified the measures required to meet our medium-term targets, we have also developed an implementation roadmap to ensure that we deliver on our commitments – The Forterra Carbon Management Plan...

...It is important to appreciate that at this stage, our decarbonisation plans beyond 2030 are not yet clearly defined and that not every initiative we pursue will ultimately be successful.

Forterra plc, Annual Report and Accounts, 31 December 2022, p8

Distinguishes between the 2050 net zero commitment and the emission reduction plans to 2030, highlighting that longer term decarbonisation plans have not yet been clearly defined

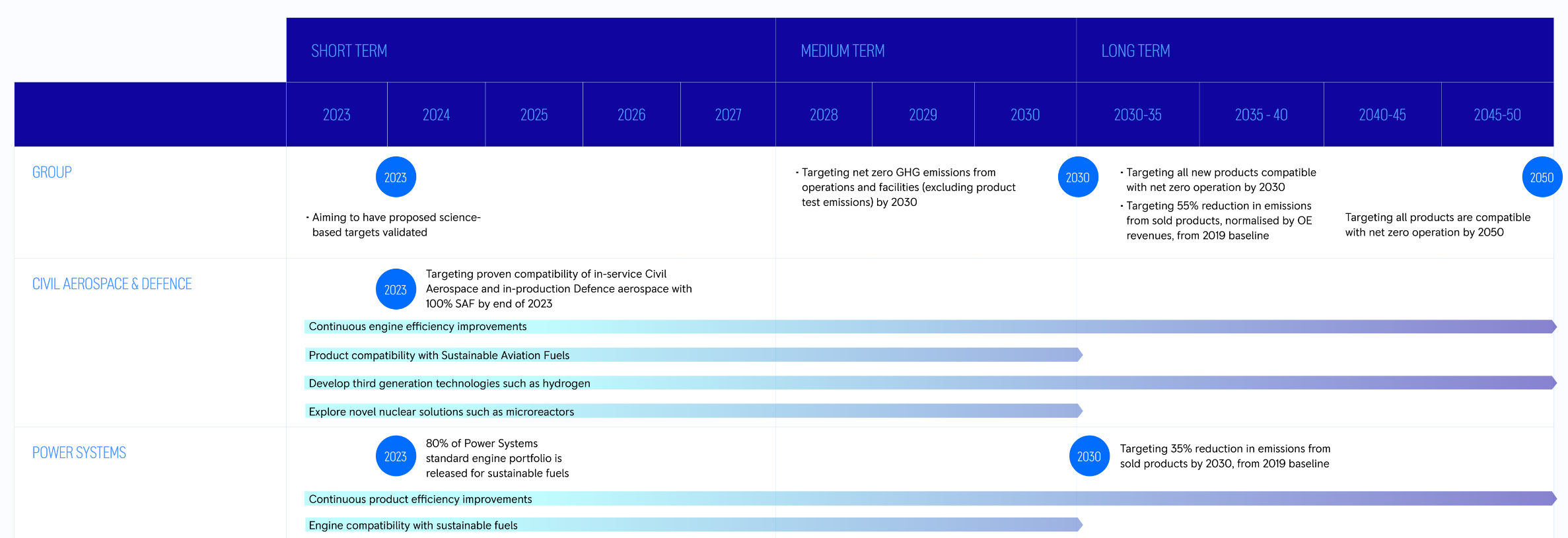

Includes interim and longer term targets with planned actions by business area. The disclosure states that it is a preliminary, high level outline and that more work is needed to further define the plan, but it provides users with a clear summary of the current maturity of the transition plan

Rolls-Royce Holdings plc, Climate Review, 31 December 2022, p63 (Note that this extract has been cropped and does not provide all business areas presented)

Climate-related targets

Companies reported various targets, covering both GHG and other climate-related impacts. All but two of the companies in the sample had GHG emission reduction targets in place; however, the clarity of the target was variable. For example, in one case the interim targets covered Scope 1 and 2 emissions, but the longer term targets included Scope 3 emissions, without providing an explanation of the actions to meet the Scope 3 target. In another example it was unclear whether all businesses were included in the target.

Better practice examples provided clear explanations of the meaning of terms such as carbon neutral or net zero and the scope of any targets.

Companies also reported other relevant climate-related metrics, for example, in relation to water usage, the number of customers with SBTi-aligned targets, or the proportion of sustainable products.

<img "3.="" "4.="" "assurance="" "clarity="" "climate-related="" "directors'="" "disaggregated="" "financial="" "impact="" "intensity="" "key="" "linkage="" "metrics="" "net="" "other="" "provider"="" "scope="" "sector="" "standard"="" "voluntary="" "we="" #section-2-cross-sector-findings-continued-page-32="" #section-2-cross-sector-findings-continued-page-33="" #section-2-cross-sector-findings-continued-page-34="" #section-2-cross-sector-findings-continued-page-35="" #section-3-materials-and-buildings-continued-page-38="" #section-3-materials-and-buildings-continued-page-39="" #section-3-materials-and-buildings-continued-page-40="" #section-3-materials-and-buildings-continued-page-41="" #section-3-materials-and-buildings-continued-page-42="" #section-3-materials-and-buildings-continued-page-43="" #section-4-energy="" #section-x-y="" 'explanation="" 'page="" 'table="" (continued)="" (continued).="" (section="" (this="" ="" also="" another="" different="" is="" looks="" 1="" 1,="" 1.5°c="" 10.="" 11.="" 12.="" 13.="" 14.="" 15.="" 16.="" 17.="" 18.="" 19.="" 2="" 2,="" 2.="" 2.0°c="" 20.="" 2019="" 2025="" 2030="" 21.="" 22.="" 23.="" 24.="" 25.="" 26.="" 27.="" 28.="" 29.="" 3="" 3.="" 30="" 30.="" 31="" 31,="" 31.="" 31:="" 32,="" 32.="" 33,="" 33.="" 34,="" 34.="" 35,="" 35.="" 35:="" 36.="" 37="" 37.="" 38,="" 38.="" 38:="" 39,="" 39.="" 4.="" 40,="" 40.="" 41,="" 41.="" 42,="" 42.="" 43,="" 43.="" 44.="" 45.="" 46.="" 47.="" 48.="" 49.="" 50.="" 51.="" 52.="" 53.="" 54.="" 55.="" 56.="" 57.="" 58.="" 59.="" 60.="" 61.="" 62.="" 63.="" 64.="" 65.="" 66.="" 67.="" 68.="" 69.="" 70.="" 71.="" 72.="" 73.="" 74.="" 75.="" 76.="" 77.="" 78.="" 79.="" 80.="" 81.="" 82.="" 9.="" <img="" ##=""###="" ####="" ```markdown=""https:="" {:="" a="" actual="" add="" again="" against="" all="" also="" an="" analysis"="" and="" annual="" append="" are="" as="" asset="" assumptions.="" assumptions.'="" assurance="" bar.="" baseline.'="" be="" benefits,="" blank="" block="" blue="" body="" both.="" box="" box.="" boxes="" boxes.="" buildings="" buildings".="" bullet="" but="" by="" callout="" capital="" carbon="" careful="" carefully.="" category"="" change="" chart-description"="" charts.="" check="" chunk="" clarity="" climate="" climate-related="" co2="" companies="" complete="" complete.="" contain="" contains="" content="" continue="" corresponding="" cost="" costs="" costs...'.="" create="" cross-sector="" current="" custom="" data="" data,="" deployment="" description="" development"="" development.="" directors'="" div.="" divider.="" does="" element,="" emissions="" emissions"="" emissions,="" emissions.'="" emissions.="" ended="" ended.="" energy="" energy"="" ensuring="" entry="" esg="" estimates="" except="" expect="" figures,="" financed="" financial="" findings="" findings".="" findings).="" footnote.="" for="" from="" ghg="" given="" green="" gross="" group="" h2,="" handle="" has="" have,="" heading="" headings,="" headings.="" https:="" i="" i'll="" id="" id.="" identify="" ids="" image="" image,="" image:="" images="" impact="" impact"="" impact,="" impact.="" impairment,="" in="" including="" increases="" intensity="" internal="" inventories,="" is="" it="" it.="" its="" key="" known="" large="" let's="" liabilities,="" like="" like*="" lives,="" loan="" main="" major="" markdown="1" matches="" matching="" materials="" means="" media.frc.org.uk="" methodology="" metrics="" metrics"="" metrics.="" narrative="" navigation="" need="" net="" new="" next="" normally.="" not="" number="" numbered="" numbers.'="" of="" oh,="" on="" operating="" opportunities"="" opportunities.="" or="" other="" overview="" overview"="" own="" page="" page_30_img_0_jktrdef.original.png="" page_31_img_1_u9crng0.original.png').="" page_31_img_1_u9crng0.original.png="" page_35_img_0_dgr2swv.original.png="" page_38_img_0_nsoiglo.original.png.="" parent="" pdf="" physical="" planning="" point="" points="" points.="" portfolio="" present.="" previous="" price"="" price.="" pricing="" pricing's="" product="" progress,="" provided="" quality="" ratios"="" ratios.="" re-checking="" red="" reduction="" refer="" reference.="" references="" related="" reliance="" remuneration"="" remuneration.="" repeat="" repeating="" report="" report.="" report:="" reporting"="" reporting.="" research="" restated="" retirement="" right="" right.="" risk="" risks"="" risks`.="" says="" scenarios,="" scope="" screenshot="" section="" section,="" section.="" seems="" should="" showing="" side="" skip.="" so="" source="" src="data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAABgAAAAYCAYAAADgdz34AAAABmLR0QA/wD/AP+gvaeTAAAAl0lEQVRIx2P4////jwARoB1kK4D4Pxz//1+I8v87B6Qy0IEML/tNIfK/c+

Sector overview

The TCFD annex contains guidance for companies operating in the energy sector, including those operating in the Oil and Gas, Coal and Electric Utilities industries. The energy sector is critical for most economic activity, and other industries whose transition plans depend upon increased electrification of their activities will rely on the decarbonisation of the electric utilities sector. The sector must balance enabling overall decarbonisation in support of countries' climate ambitions with the need to provide a reliable supply of energy.

Electric utility companies typically have long planning horizons. They are often exposed to physical risks, for example, severe weather events impacting power generation and transmission assets. They are also often exposed to transition risks, for example, through changing government policies, which can vary significantly across different jurisdictions.

We reviewed the disclosures of five companies across the electricity value chain, including companies involved in the generation and transmission of energy and the provision of energy end-use infrastructure. Our sample was split between companies reporting against TCFD for the first time and companies for whom it was the second year of mandatory reporting.

Key findings

- Three companies disclosed net zero targets, but it was not always clear whether these included Scope 3 emissions. Two of the smaller companies explained they were not yet in a position to set net zero targets.

- Four companies reported a range of metrics, with some disclosures implying consideration of the sector-specific energy guidance. The remaining company explained that it will develop a metric and target framework as it matures and grows.

- All companies reported some Scope 3 emissions. However, the reporting boundaries were not always clearly explained, and it was sometimes unclear which categories had been reported.

- Most companies could improve the linkage between their climate-related risks and reported metrics, including cross-referencing to relevant metrics included outside the TCFD reporting.

- There were some better practice examples of the consideration of climate change in the financial statements; however, we also identified examples of apparent inconsistencies.

4. Energy

Clarity and understandability of reporting

All companies in our sample included their TCFD disclosures within their strategic reports.

> Better practice clearly presented the metrics and targets in tables or with graphics summarising performance, with additional detail in narrative disclosures.

> One company reported metrics alongside identified risks and opportunities, but it was not always clear how these related to one another. Additional information that helped to explain this was presented within large blocks of text in a separate location.

> We identified instances where seemingly relevant metrics were reported elsewhere in the annual report, including the Directors' Remuneration Report and key performance indicators, but were not referred to within the TCFD disclosures.

> Some companies provided more detailed data on their websites. However, for one company we noted unexplained differences between the base year emissions underpinning its net zero target in the annual report and on its website.

> We expect companies to: > > Ensure that any linkage between risks and opportunities and metrics used to measure, monitor or manage them is clear. > > Consider the connectivity across disclosures to ensure coherent messaging. > > Ensure that where metrics are reported in more than one place, any inconsistencies are explained.

> We consider the disclosures to be partially consistent with the recommendations for cross-industry metrics and targets (recommended disclosures “Metrics and targets a) and c)”). We believe our cross-industry metrics currently lack the level of specificity required to meet the threshold for full consistency. Over the coming year, we intend to evaluate appropriate targets and evolve our business methods, and our approach to metric reporting. This should enable us to increase the level of specificity we are able to provide on these disclosure requirements. Our objective is to confirm that the 2023 Annual Report and Accounts is consistent with the current TCFD recommendations.

Drax Group plc, Annual report and accounts, 31 December 2022, p52

Clear consideration of the impact of not reporting cross-industry climate-related metrics on the statement of consistency

Net zero targets

The companies within our sample were at varying levels of maturity in setting net zero targets and determining their transition plans. Two smaller companies explained they were not yet in a position to set net zero targets.

> Two companies disclosed clear net zero targets, which covered Scope 1, 2 and 3 emissions.

> One company set a carbon reduction goal, but it was not clear whether this included the Scope 3 emissions that had been disclosed, or whether the target related to only Scope 1 and 2.

> Some companies specified that their targets are SBTi-aligned. However, they did not always explain where they were in the SBTi target process.

Other climate-related targets

Companies disclosed targets in a number of other areas, including: * transition of fleet to electric vehicles; * installation of electric vehicle charging points; * production of biomass pellets; and * reduction in the use of SF6 (used in electricity transmission and distribution).

<div class=" start="" statements="" statements"="" status,="" structured="" subsequent="" such="" table="" table,="" table.="" tag="" target="" targets"="" targets,="" targets.="" text="" text,="" text.="" that="" the="" these="" this="" to="" to:"="" topics="" transcribe="" truncated.="" uk"="" under="" understandability="" uniqueness="" updates,="" url:="" use="" useful="" uses="" using="" vendor="" visible="" visual="" visual,="" voluntary="" wait,="" which="" will="" with="" within="" years,="" zero="" {:="" }="" }`.=""/>

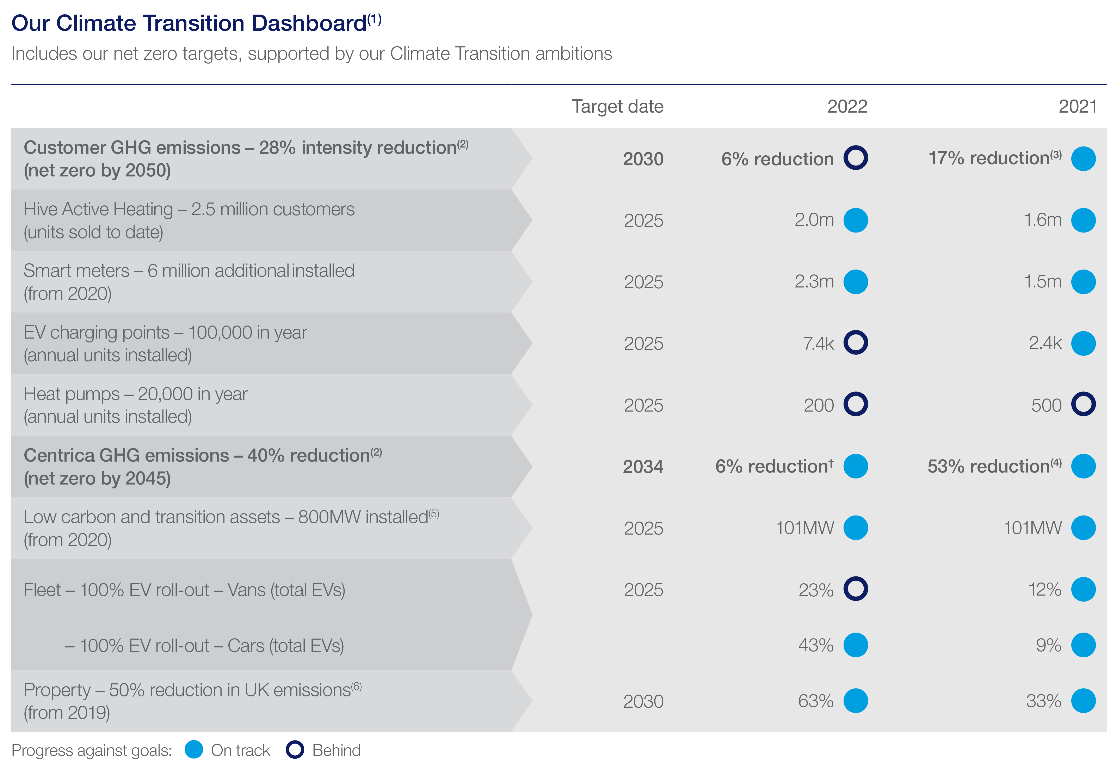

Discloses interim targets6 for the longer-term commitments.

Transition dashboard clearly sets out targets and progress towards achieving targets.

Centrica plc, Annual report and Accounts, 31 December 2022, p53

> We expect companies to clearly explain whether net zero targets or commitments include Scope 3 emissions.

> One company disclosed a target but did not disclose the corresponding metric for the current period. This made it difficult to understand the extent of progress needed in order to reach the target.

Climate-related metrics

Choice of metrics

Most companies disclosed at least one metric beyond the GHG emissions, energy use and intensity ratio required by SECR, with two companies disclosing most of the cross-industry climate-related metrics. One company explained that it will develop a metric and target framework as it matures and grows.

The sector-specific guidance notes that energy companies should consider providing additional industry-specific metrics7 and refers to the SASB 'Climate Risk Technical Bulletin', April 12, 2021. One company in our sample stated that it had reported SASB metrics.

> We saw some examples of company-specific metrics including: > > * % of emissions from hydrocarbon production, transport and storage; and > * an electricity transmission company reported SF6 gas discharges.

We have considered the metrics reported in more detail throughout the subsequent sections within this report – specifically in relation to physical risks, transition risks, Scope 3 emissions and intensity ratios.

> We expect companies to report material cross-sector climate-related metrics and keep industry-standard metrics and peer reporting under review.

Metrics relating to physical risks

The energy sector guidance states that companies should consider providing disclosures related to the financial implications of potential physical impacts, such as severe storms and flood mitigations.

Three of the five companies sampled outlined the different physical risks to which they were exposed. Two of these indicated the amount and extent of assets or business activities vulnerable to physical risks8, which includes acute weather events: * One company determined the risk of extreme weather, flooding and sea levels rising to be significant, and quantified the potential impact on profit in a given year. * One company quantified the impact of rising mean temperatures on the gross margin in the short, medium and long-term.

> One company included brief details of its risk assessment of physical risks but did not disclose the output of this.

The energy sector guidance notes that many companies are dependent on the availability of water, and that all energy companies should consider disclosing their reliance on water in areas of high water stress. We did not identify any disclosure of this. However, two companies did disclose their water use and one specified how much water was abstracted and returned for hydrogeneration, and abstracted for pumped storage.

Metrics relating to transition risks

Our sample mostly focused on utility companies. The TCFD sector-specific guidance notes that electric utility companies often face significant transition risk from the potentially disruptive impact of the policy, technology, and portfolio changes likely to occur over the next two to three decades as part of a shift to a low-carbon energy system.

Three companies in our sample disclosed their transition risks, which in each case included policy, technology and market risks. Two of these companies clearly disclosed metrics associated to the transition risks, as well as indicating the amount and extent of assets or business activities vulnerable to transition risks9.

> One company quantified the impact of its transition risks and opportunities on its gross margin in the short, medium and long-term, under two different climate scenarios.

> One company gave high level descriptions of the metrics, which made it difficult to understand what the metrics were measuring.

> One company disclosed metrics which seemed to be relevant to its transition risks elsewhere in its strategic report, but did not refer to these in its TCFD reporting.

> One company disclosed only physical risks in relation to climate change and did not explain whether it considers transition risks to be relevant.

The sector-specific guidance notes that energy companies should focus their disclosures on potential impacts of: * changes in compliance and operating costs, risks or opportunities, (e.g. for older, less-efficient facilities); * exposure to regulatory changes or changing consumer and investor expectations (e.g. expansion of renewable power); and * changes in investment strategies (e.g. increased investment in carbon-capture technology).

> We identified disclosures suggesting that some companies had considered these disclosures from the sector-specific guidance. Examples of metrics disclosed include the following: > > * current fuel mix; > * pumped storage and hydro capacity; > * MW of low carbon and transition assets installed; and > * number of EV charging points installed.

The energy sector guidance notes that the regulatory and competitive landscape surrounding electric utilities differs significantly between jurisdictions, which can make assessment of climate-related risks very challenging. The companies who did not disclose either their transition risks or associated metrics all predominantly operate in the UK, suggesting this was not the primary reason for not disclosing metrics. The lack of disclosure seemed to be due to the maturity of the reporting, with the companies all reporting TCFD disclosures for the first year, due to either being standard listed, or premium listed but having made limited disclosures last year.

Scope 3 GHG emissions

All companies reported some Scope 3 emissions. Scope 3 emissions are often significant for energy companies; however, the nature of these will vary depending on the company's business model.

> Scope 3 reporting categories were not always disclosed and it was sometimes unclear whether the categories not reported were immaterial, or if there was not yet readily available data to determine the extent of these emissions.

> One company disclosed Scope 3 emissions, but did not provide any details of what these related to.

> Better practice disclosures presented data in tables and provided explanations of the emission scopes and categories included. This was particularly helpful for understanding the extent of Scope 3 emissions, which can be wide-ranging and include upstream and downstream emissions.

> We expect companies to report Scope 3 GHG emissions where appropriate and to clearly explain the different categories of Scope 3 emissions disclosed.

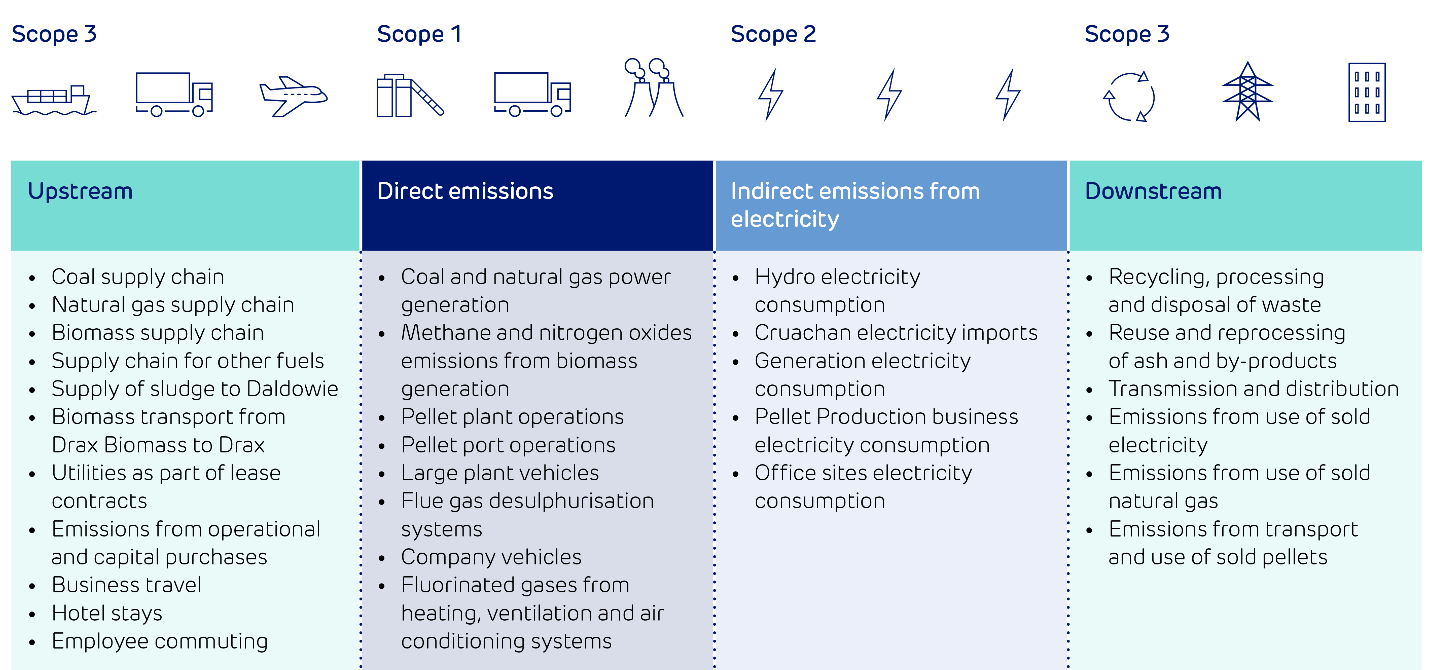

Diagram categorizing greenhouse gas emissions into Upstream, Direct, Indirect, and Downstream, with examples for Scope 1, 2, and 3 emissions.

- Scope 3 Upstream

- Coal supply chain

- Natural gas supply chain

- Biomass supply chain

- Supply chain for other fuels

- Supply of sludge to Daldowie

- Biomass transport from Drax Biomass to Drax

- Utilities as part of lease contracts

- Emissions from operational and capital purchases

- Business travel

- Hotel stays

- Employee commuting

- Scope 1 Direct emissions

- Coal and natural gas power generation

- Methane and nitrogen oxides emissions from biomass generation

- Pellet plant operations

- Pellet port operations

- Large plant vehicles

- Flue gas desulphurisation systems

- Company vehicles

- Fluorinated gases from heating, ventilation and air conditioning systems

- Scope 2 Indirect emissions from electricity

- Hydro electricity consumption

- Cruachan electricity imports

- Generation electricity consumption

- Pellet Production business electricity consumption

- Office sites electricity consumption

- Scope 3 Downstream

- Recycling, processing and disposal of waste

- Reuse and reprocessing of ash and by-products

- Transmission and distribution

- Emissions from use of sold electricity

- Emissions from use of sold natural gas

- Emissions from transport and use of sold pellets

Drax Group plc, Annual report and accounts, 31 December 2022, p61

Explanation of current level of assessment of Scope 3 and planned actions

> In monitoring our supply chain sustainability risk, our Scope 3 emissions data highlighted the top suppliers by emissions, enabling us to engage with the top two during 2022 on their sustainability goals and metrics. We will extend this out to the remainder of our top ten suppliers during 2023.

Pod Point Group Holdings plc, Annual report and accounts, 31 December 2022, p52

Summary of the business activities and classification as Scope 1, 2 or 3

Intensity ratio

The TCFD sector-specific guidance refers to the WBCSD, “TCFD Electric Utilities Preparer Forum,” July 16, 2019. The forum notes that it can be useful for utility companies to disclose both intensity and absolute metrics, due to emissions often being volatile due to weather variability10.

All companies disclosed an intensity ratio metric11. We saw a range of emission factors, including tonnes of CO2 equivalent per: * currency unit of sales revenue; * kWh of electricity generated or energy transferred; * units of production shipped; and * km of area covered by electricity licence.

The range of emission factors disclosed is reflective of how companies within the energy sector often have diverse operations, both within the company and compared with other companies. This can make comparisons between companies difficult.

Most companies within our sample disclosed targets on an absolute basis; however, one company's targets included reducing Scope 3 downstream emissions in relation to £m of sales revenue.

> We expect companies to consider the relevant metrics for their sector and business and provide clear explanations of the choice of metric where they are not standard for the industry.

Financial statements impacts

As noted previously, two companies in our sample were at an early stage of defining their transition plans and had not yet set net zero targets.

> We saw examples of additional disclosure to explain the linkage between the metrics and targets, and the financial statements. For example: > > * one company explained why the assumptions used in impairment testing were not consistent with net zero scenarios, and disclosed additional sensitivity analysis to show the impact on the carrying value of using net zero-aligned assumptions; and > * another company explained how the emerging technology necessary to meet its net zero targets would impact the useful economic lives of existing assets, disclosing an associated key source of estimation uncertainty.

> We identified an instance where the financial statements did not seem to consider the announced targets, and it was unclear whether this was appropriate due to a lack of detail regarding the target.

> We expect companies to explain how they considered their announced targets when preparing their financial statements, when there is a reasonable expectation that the targets could have a material impact.

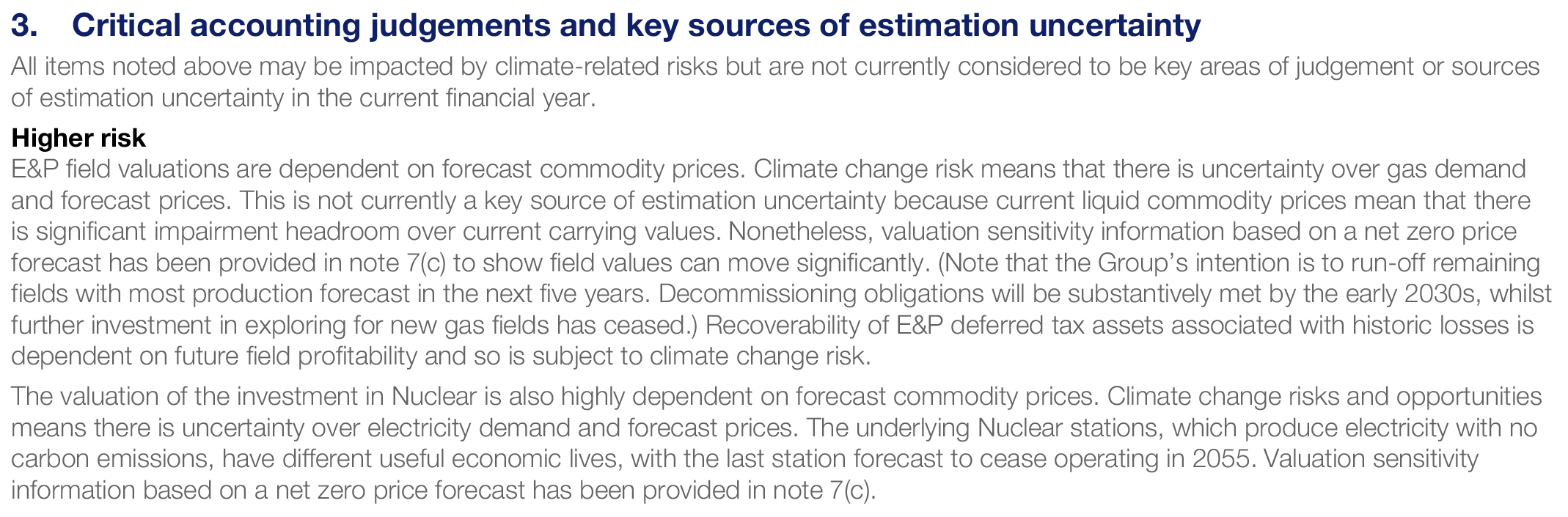

3. Critical accounting judgements and key sources of estimation uncertainty

Accordingly, the Group is mindful of these dynamics when it considers which areas of the balance sheet are exposed to key estimation uncertainty from climate-related issues. The Group considers which assets are most exposed to impairment from climate risks and similarly whether there are any liabilities that are either currently unrecognised or might increase as a result of those risks.

The Group's assets/liabilities have been segmented into three tranches, grading each balance's exposure to climate risks/opportunities:

- Higher risk - As the consumption of gas and power is intrinsically linked to carbon emissions, their pricing is consequently exposed to climate and legislative risk. Accordingly, where assets or contract values have a key dependency on commodity price assumptions, those assets (or contracts) are deemed higher risk.

- Medium risk - Gross margin energy transition considerations and their potential impact on forward-looking balances (e.g. Supply and Services and Energy Trading goodwill) and decommissioning balances in E&P.

- Lower risk - No significant risk identified on the basis that positions are short-term in nature or are specifically linked to the energy transition or are immaterial.

The key non-current asset (and decommissioning provision) balance sheet items have been presented in more granular detail below, together with the groupings into the above risks and with rationale set out below the table:

| As at 31 December 2022 related to (£m): | Goodwill | Intangibles | Investment in associates | Property, plant & equipment | Deferred tax assets | Decommissioning provision |

|---|---|---|---|---|---|---|

| Gas Assets (E&P and Storage) | ||||||

| E&P fields (Spirit) | 1,124 | (256) | (1,175) | |||

| E&P tax losses (Spirit) | 214 | |||||

| Gas storage facility (Rough) | 71 | 131 | (324) | |||

| Power Generation | ||||||

| Nuclear investment | — | 1,560 | (15) | |||

| Gas-fired power stations/engines | 95 | |||||

| Combined heat and power (CHP)/fuel cell | 45 | |||||

| Solar | 14 | |||||

| Higher | ||||||

| Medium | ||||||

| Lower |

Centrica plc, Annual report and Accounts, 31 December 2022, p135 (Note that this extract has been cropped and does not include all assets)

Classifies the balance sheet assets according to level of climate risk, and then explains why those classified as higher risk have not been considered to be key judgements or sources of estimation uncertainty

All items noted above may be impacted by climate-related risks but are not currently considered to be key areas of judgement or sources of estimation uncertainty in the current financial year.

Higher risk

Centrica plc, Annual report and Accounts, 31 December 2022, p136

5. Banks

Sector overview

One of the challenges that the Financial Stability Board sought to address with TCFD was the need to provide financial markets with accurate and timely disclosures to support informed, efficient capital-allocation decisions in the transition to a net zero economy. As providers of capital, banks are key consumers of TCFD data. However, they also report on the climate-related impact of their own operations, including their investing and lending decisions.

Banks have a systemically important role in the economy and society as a whole and therefore have a diverse range of stakeholders. They are custodians of wealth which they use to provide finance to others. Their actions in seeking to reduce their carbon footprint have the potential to have wide ranging impacts.

Each bank is unique. The size and complexity of their operations varies, and their disclosures relating to climate reflect this. To see the progress banks are making in disclosing meaningful metrics and targets, we reviewed the reporting of five banks, including two from the FTSE 100 and one from the FTSE 250.

Key findings

- All five banks disclosed targets to reach net zero by 2050, including financed emissions. They also set interim targets for their own direct emissions.

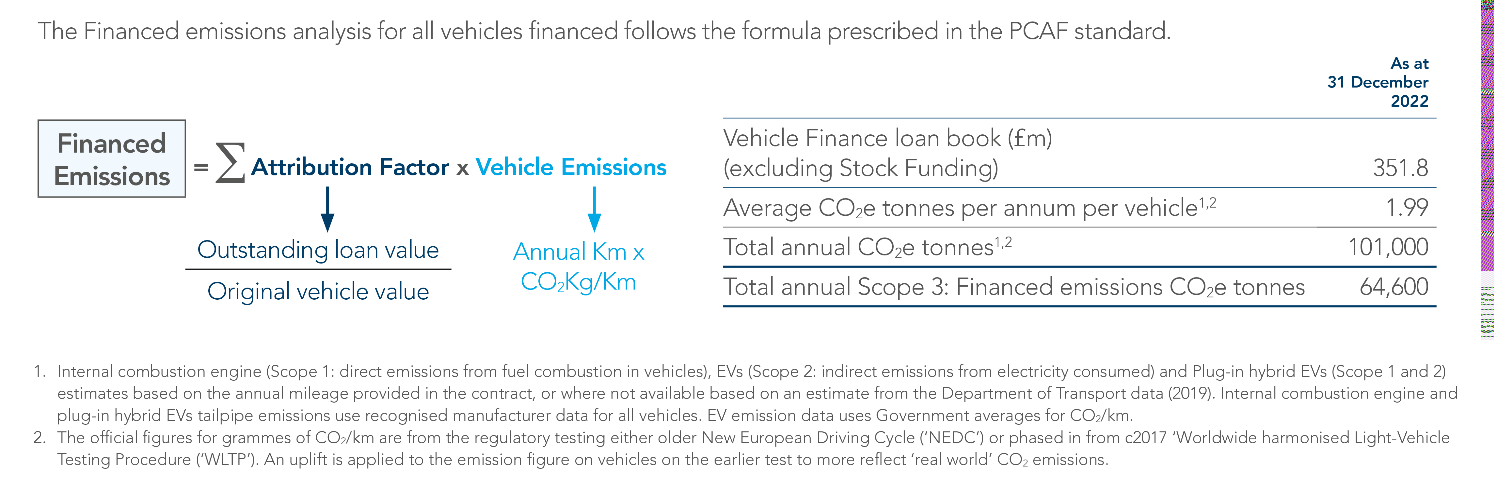

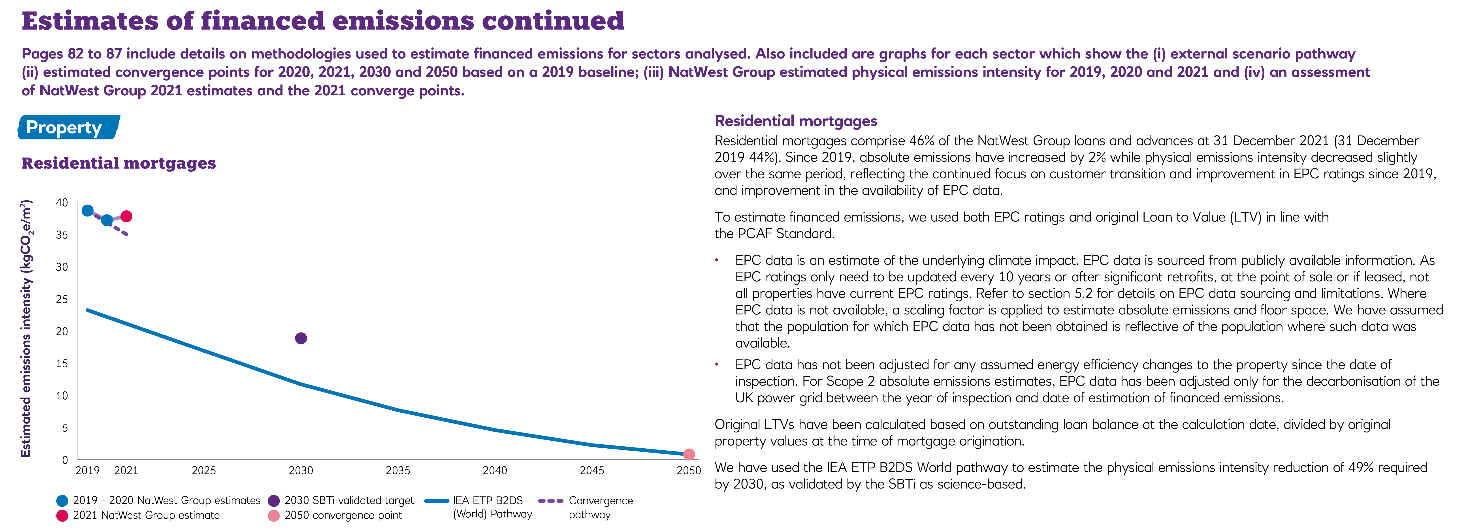

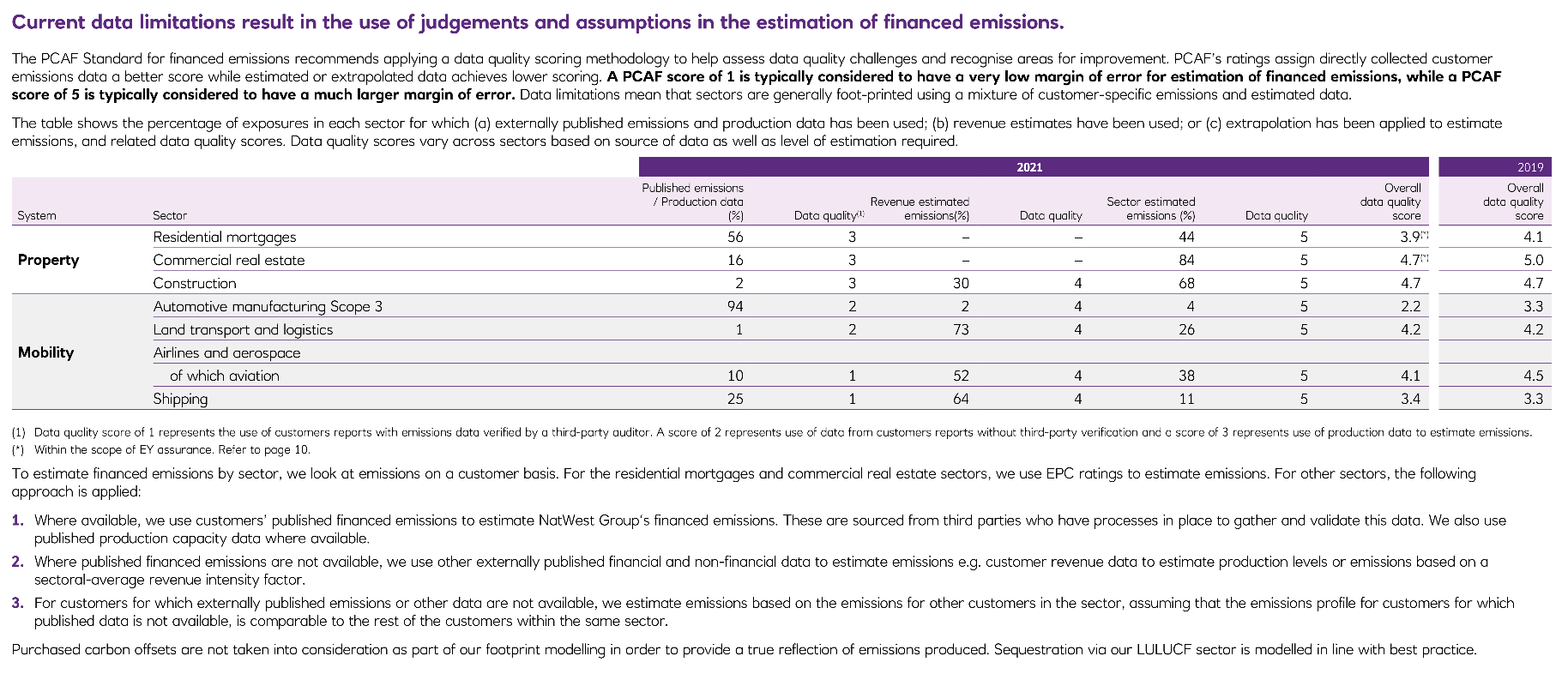

- Three banks reported financed emissions for the most heavy-emitting of their lending activities and continue to develop emissions disclosure for their remaining significant loan portfolios. The other two are developing their capabilities to be able to report in the coming years. The financed emissions calculations were based on the Partnership for Carbon Accounting Financials (PCAF) industry standard.

- The banks that disclosed financed emissions had to make estimates and assumptions in their calculations. Banks need to be clear about the limitations of the reliability of any data.

- The banks' TCFD disclosures were among the lengthiest of the companies reviewed, and were often supplemented by information outside the annual report. Without careful consideration of how this information is presented, there is a risk that decision-useful information is obscured. There are opportunities to improve the clarity and conciseness of the banks' TCFD reporting.

- No bank quantified a financial effect of climate change on the financial statements, and four banks explicitly stated that they did not consider the quantitative impact to be material at this time.

Clear and concise disclosures

TCFD reporting for the larger banks extended to over 100 pages.

Banks need to consider how best to present information in a clear and concise manner, whilst ensuring that all the statutory information required to be in a strategic report is given in that report (either directly in the report or clearly cross-referenced to other parts of the annual report and accounts).

It was clear that the banks had given thought to aiding stakeholders in navigating their way through the voluminous information, but there was often repetition of the same data in different sections of the annual report.

> Presenting extensive information without explanation of which audience it is intended for can make it harder to identify the key messages.

> As reporting becomes more developed and embedded, companies need to think carefully about how to present the required information in a clear, concise and understandable manner.

> Companies should ensure that additional information does not obscure material TCFD disclosures. The reporting of risks and opportunities arising from climate change should be clearly identified from more general business opportunities.

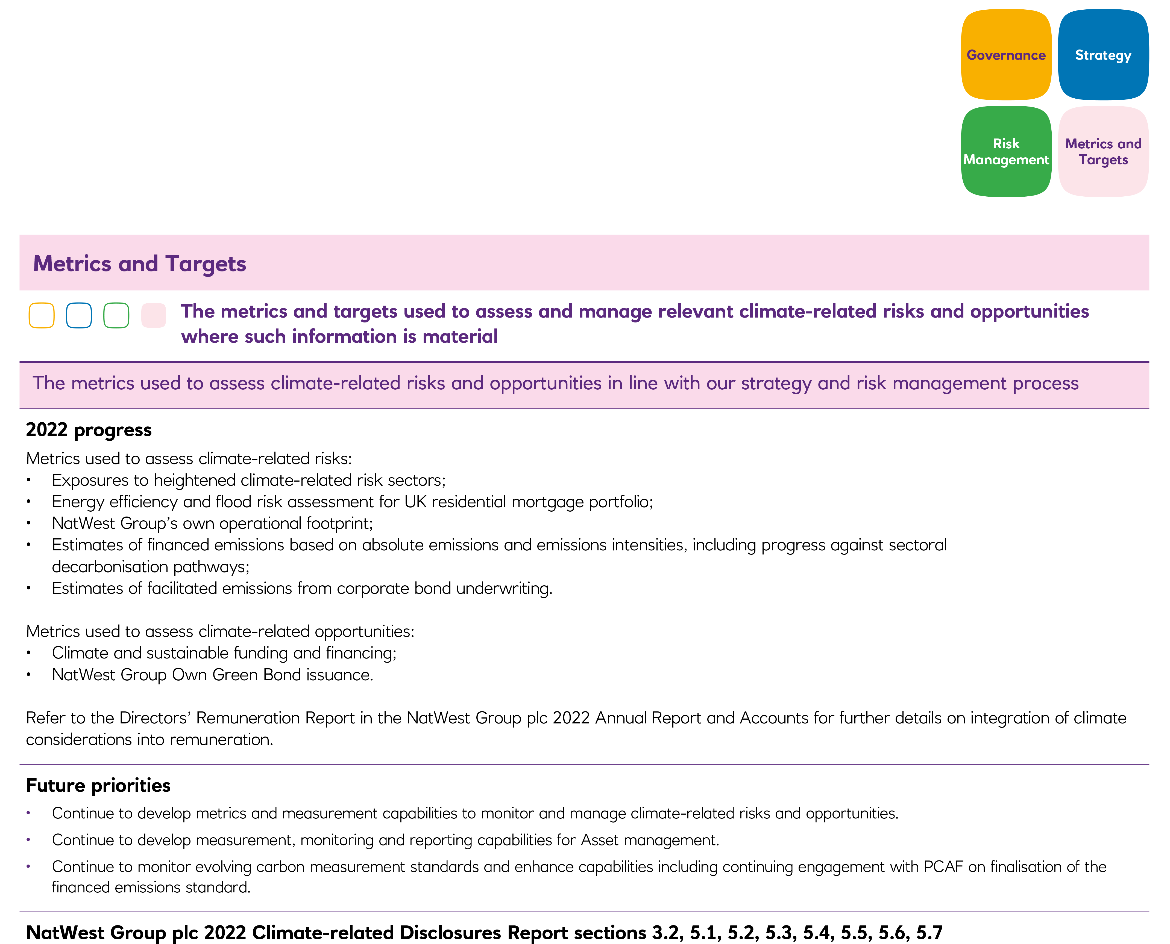

Conceptual framework showing Governance, Strategy, Risk Management, and Metrics and Targets, with text detailing 2022 progress and future priorities for climate risks.

Sets out the TCFD recommended disclosure. Uses colour coded labels to help navigate.

Metrics and Targets

The metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. The metrics used to assess climate-related risks and opportunities in line with our strategy and risk management process.

2022 progress Metrics used to assess climate-related risks: * Exposures to heightened climate-related risk sectors; * Energy efficiency and flood risk assessment for UK residential mortgage portfolio; * NatWest Group's own operational footprint; * Estimates of financed emissions based on absolute emissions and emissions intensities, including progress against sectoral decarbonisation pathways; * Estimates of facilitated emissions from corporate bond underwriting.

Metrics used to assess climate-related opportunities: * Climate and sustainable funding and financing; * NatWest Group Own Green Bond issuance.

Refer to the Directors' Remuneration Report in the NatWest Group plc 2022 Annual Report and Accounts for further details on integration of climate considerations into remuneration.

Future priorities * Continue to develop metrics and measurement capabilities to monitor and manage climate-related risks and opportunities. * Continue to develop measurement, monitoring and reporting capabilities for Asset management. * Continue to monitor evolving carbon measurement standards and enhance capabilities including continuing engagement with PCAF on finalisation of the financed emissions standard.

NatWest Group plc 2022 Climate-related Disclosures Report sections 3.2, 5.1, 5.2, 5.3, 5.4, 5.5, 5.6, 5.7 NatWest Group plc, Annual Report and Accounts, 31 December 2022, p61

Provides an overview of progress Details work still to be done Signposts where further information can be found

Infographics can be a good way of communicating complex information in an easily understandable way.

> Companies should consider how best to present the key messages in a clear and understandable way.

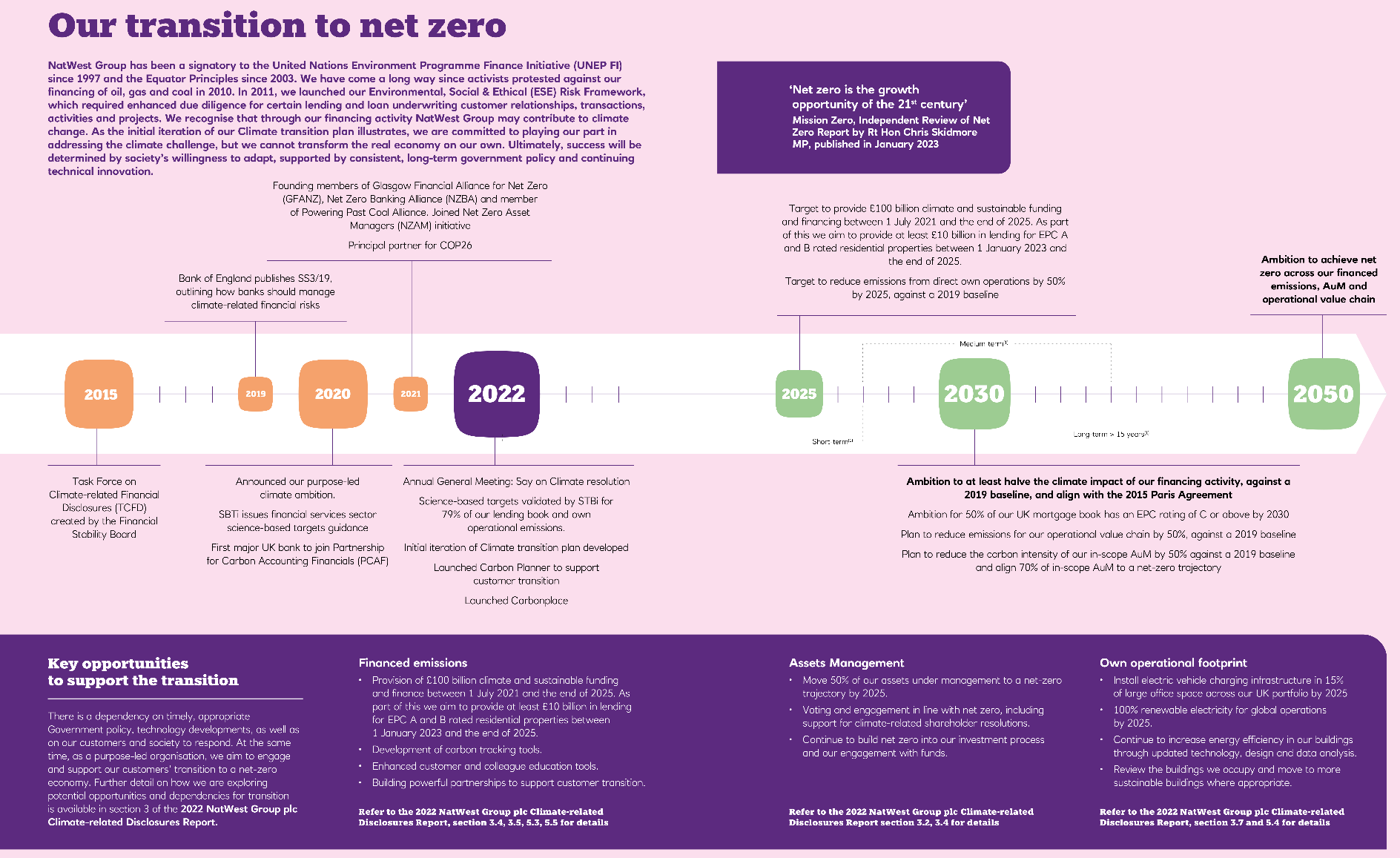

Infographic: Our transition to net zero NatWest Group has been a signatory to the United Nations Environment Programme Finance Initiative (UNEP FI) since 1997 and the Equator Principles since

- We have come a long way since activists protested against our financing of oil, gas and coal in 2010. In 2011, we launched our Environmental, Social & Ethical (ESE) Risk Framework, which required enhanced due diligence for certain lending and loan underwriting customer relationships, transactions, activities and projects. We recognise that through our financing activity NatWest Group may contribute to climate change. As the initial iteration of our Climate transition plan illustrates, we are committed to playing our part in addressing the climate challenge, but we cannot transform the real economy on our own. Ultimately, success will be determined by society's willingness to adapt, supported by consistent, long-term government policy and continuing technical innovation.

Founding members of Glasgow Financial Alliance for Net Zero (GFANZ), Net Zero Banking Alliance (NZBA) and member of Powering Past Coal Alliance. Joined Net Zero Asset Managers (NZAM) initiative. Principal partner for COP26.

Bank of England publishes SS3/19, outlining how banks should manage climate-related financial risks.

'Net zero is the growth opportunity of the 21st century' Mission Zero, Independent Review of Net Zero Report by Rt Hon Chris Skidmore MP, published in January 2023.

Timeline:

- 2015

- Task Force on Climate-related Financial Disclosures (TCFD) created by the Financial Stability Board

- 2019

- Announced our purpose-led climate ambition.

- SBTi issues financial services sector science-based targets guidance.

- First major UK bank to join Partnership for Carbon Accounting Financials (PCAF).

- 2020

- Annual General Meeting: Say on Climate resolution.

- Science-based targets validated by SBTi for 79% of our lending book and own operational emissions.

- 2021

- Initial iteration of Climate transition plan developed.

- Launched Carbon Planner to support customer transition.

- Launched Carbonplace.

- 2022

- Target to provide £100 billion climate and sustainable funding and financing between 1 July 2021 and the end of 2025. As part of this we aim to provide at least £10 billion in lending for EPC A and B rated residential properties between 1 January 2023 and the end of 2025.

- Target to reduce emissions from direct own operations by 50% by 2025, against a 2019 baseline.

- 2025

- Ambition to at least halve the climate impact of our financing activity, against a 2019 baseline, and align with the 2015 Paris Agreement.

- Ambition for 50% of our UK mortgage book has an EPC rating of C or above by 2030.

- Plan to reduce emissions for our operational value chain by 50%, against a 2019 baseline.

- Plan to reduce the carbon intensity of our in-scope AuM by 50% against a 2019 baseline and align 70% of in-scope AuM to a net-zero trajectory.

- 2030

- Ambition to achieve net zero across our financed emissions, AuM and operational value chain.

- 2050