The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC/YouGov: Audit Committee Chairs’ views on, and approach to, audit quality (2020)

- Background

- The research

- Executive Summary

- Defining a good quality audit

- Commonalities in good audits and bad audits

- Differences between a good service and a good audit

- Planning and executing an audit

- Selecting an auditor

- Important factors when selecting an auditor

- Changes in the audit sector

- The Audit Committee Chairs' view on independent reviews

- What outcome did the ACCs hope to see from the reviews?

- The extent to which the reviews will improve audit quality

- The ideal world of audit according to ACCs

- ACCs' views on specific recommendations for reform and recent changes in the sector

- Operational separation of Big Four firms' audit and non-audit practices

- Mandatory joint audits

- Mandatory tendering and rotation

- Familiarity with Audit Quality Indicators (AQIs)

- The role of the FRC

- Appendix 1

- Appendix 2

Background

The Financial Reporting Council sets the UK Corporate Governance and UK Stewardship Codes; sets UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the competent authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality. The FRC works in the public interest. Our work is aimed at investors and others who rely on company reports, audit and high-quality risk management.

The role of audit and audit committees

A high-quality audit gives assurance to investors and other stakeholders that the financial statements of an entity are an accurate representation and can form a reliable basis for decision-making.

Audit committees serve the interests of investors and other stakeholders through their independent oversight of the annual corporate reporting process, including the audit of the company's financial statements, and have an important role in ensuring quality. Within this, the audit committee is responsible for appointing the external auditor, signing-off auditor remuneration and any non-audit service work commissioned. A further function of the audit committee is to provide challenge during audits to ensure audit quality and independence of the appointed auditor. The audit committee reports on the work done by the external auditor, and the conclusions drawn, in the annual report.

Since May 2015, there have been significant changes in the governance and auditing framework which continues to emphasise the fundamental role of audit committees. In 2016, legislation was introduced requiring all Public Interest Entities (PIEs) to conduct a tender for their external auditor at least every 10 years and rotate their external auditor after no more than 20 years. The legislation includes specific responsibilities for PIE audit committees with respect to tender processes.

Further changes may be introduced in future in response to the Competition and Markets Authority (CMA) study of the statutory audit services market (April 2019). The CMA recommended increased regulatory scrutiny of audit committees to help improve audit quality. Further changes to the role of audit committees may also result from recommendations made in the other two independent reviews into the audit sector: Sir John Kingman's Independent Review of the FRC (December 2018); and Sir Donald Brydon's review into the quality and effectiveness of audit (December 2019). Given the key role audit committees can play in facilitating a high-quality audit, the FRC has regularly engaged with Audit Committee Chairs (ACCs) to inform its work. In recent years, the FRC has set out its survey findings with respect to ACCs in its annual Developments in Audit reports, e.g. Developments in Audit 2018, and Developments in Audit

- The FRC also published findings from its Audit Committee Chairs' (ACCs) survey in 2015.

The current audit landscape including recent independent reviews

In the last few years, the collapse of high-profile companies, such as BHS and Carillion, has given rise to wider public and political concerns about the quality of audits, resulting in three independent reviews into the sector over 2018-19. Each independent review has focused on a different area

- the role of the regulator, the market for statutory audit services, and the audit process and product – and made various recommendations. The government is now considering these recommendations some of which may require legislative changes - and has indicated its intention to set out proposals for audit reforms in due course.

Sir John Kingman's Independent Review of the FRC (December 2018)1

Sir John Kingman's review focused on the role of the regulator. The review recommended that the FRC be replaced with a new independent statutory regulator, accountable to Parliament, with a new mandate, new clarity of mission, new leadership and new powers. The new regulator would be called the Audit, Reporting and Governance Authority (ARGA).

Competition and Markets Authority (CMA)'s statutory audit services market study (April 2019)2

The CMA's review focused on the audit market, identifying problems with competition, choice and resilience that were adversely affecting audit quality. The review made various recommendations to address these problems including mandatory joint audit, an operational split between the Big Four audit firms' audit and non-audit businesses, and greater regulatory scrutiny of audit committees.

Sir Donald Brydon's independent review into quality and effectiveness of audit (December 2019)3

Sir Donald Brydon's review focused on how the audit process and product could be developed to serve the needs of users and the wider public interest more effectively. The review made various recommendations and suggestions, including in relation to the role of audit committees. These included recommending that audit committees invite shareholders to suggest areas for the audit plan, Audit Committee Chairs (ACCs) negotiate the audit fee, and audit committees publish a three-year rolling Audit and Assurance Policy as well as minutes of their meetings.

The current audit landscape, including the three independent reviews, are important background to this research and have informed its content.

The research

Following previous large-scale annual surveys with Audit Committee Chairs (ACCs), the FRC commissioned YouGov to deliver 50 qualitative depth interviews with ACCs of Public Interest Entities (PIEs)5 to explore ACCs' views on, and approach to, audit quality. The FRC was seeking a more detailed understanding of ACCs' views to help inform its work to support Audit Committees in their role of driving high quality audits.

Aims

The overarching objective of the research was to provide the FRC with a rich understanding of ACCs' views on, and approach to, audit quality. This included exploration of the following areas:

- ACCs' views on the key drivers of audit quality

- What does a good/bad audit look like to an ACC?

- Selection of auditors / tender process

- Audit planning

- Considerations of quality during the audit and post-audit

- How ACCs use the results of AQR inspections to drive improvements in audit quality

- How ACCs satisfy themselves as to the independence and suitability of their auditor

- Developments in the audit sector and role of audit committees in future

The FRC intends to use the findings from this research to inform its ongoing work, including that on further reforms to the audit sector.

Sampling and recruitment

This report is based on primary research conducted by YouGov, made up of 54 telephone 'depth interviews' with ACCs. A number of the ACCs interviewed were the chair of more than one Audit Committee so in total 73 companies were covered by the sample.

In collaboration with the FRC, and following desk-based research, YouGov compiled a database of ACCs to contact. ACCs were contacted in waves to ensure a broad mix of respondents in terms of business sectors and company size, including FTSE 100, FTSE 250 and smaller listed entities.

| Type | Number interviewed | % of total sample |

|---|---|---|

| FTSE100 | 16 | 22% |

| FTSE250 | 29 | 40% |

| Listed elsewhere or on the Middle Market | 19 | 26% |

| Unlisted PIES | 9 | 12% |

We also sought out those entities that had recently conducted an audit tender, as well as those with experience of being audited by non-Big Four firms.

Within the sample, 47 ACCs had trained as accountants, with 43 of these also having worked at one of the Big Four firms as part of their early career. A minority of the sample had not worked at a Big Four firm, and a few of the ACCs interviewed had actuarial rather than accounting experience. Appendix 1 sets out more details of the sample of ACCs.

YouGov reached out to ACCs using a co-branded email, sending a warm-up email introducing the research, followed by a formal invitation to participate, and finally two reminder emails. Where email addresses were not publicly available, ACCs were approached by telephone as necessary. In the final stages of the research, a few potential participants were also sourced via the FRC who obtained consent for their contact details to be disclosed to YouGov. A small number of ACCS were also approached via LinkedIn where details were available.

In line with MRS guidelines, all participants were given the option to direct a donation to a charity of their choice in recognition of their time. Verbatim quotations have been used throughout this report to illustrate key themes and findings; however, these are not attributed to individual participants.

Discussion guide design

A semi-structured discussion guide was developed iteratively in partnership with the FRC, covering the audit process from planning through to execution and evaluation, as well as the audit tender process. The discussion guide also touched on the recent independent reviews of audit and changes to the sector. Discussions focussed on the experiences of ACCs and were exploratory in nature.

Following sign-off of the discussion guide, a pilot interview was carried out to check the discussion length, flow and language used. Small adjustments were made to topic ordering as a result, and the finalised guide was then put into practice with the remaining interviews. Following an interim presentation of key findings after c.25 interviews, a small number of additional questions were added, seeking further clarity on key points of interest (see Appendix 2 for full discussion guide).

Analysis and reporting

Interviews were transcribed and compiled into an analysis grid. Initial analysis was then undertaken by the research team for this project, with a more granular secondary analysis subsequently carried out by YouGov's two project leads.

Note on the nature of qualitative research

It is important to note that the discussions with ACCs were qualitative in nature. The aim of the research was to explore, in detail, ACCs' views on, and approach to, audit quality, identifying the common themes as well as the specific nuances. While the number of interviews completed is large in the context of qualitative research, and a saturation point of common views was reached, the findings cannot be taken as statistically significant (i.e. the findings cannot be extrapolated to all ACCs). However, the research provides a richer understanding of a diverse sample of ACCs' views on audit quality, which can help inform the future work of the FRC.

Executive Summary

The key theme that emerges from this research is that ACCs have different views on, and approaches to, audit quality.

During the interviews, ACCs offered a range of understandings of what was expected from them in relation to audit quality and while many commented on how they or their committees assessed quality throughout the entire audit, this was not always the case. Often the ACCs expressed a desire to improve their understanding of what makes a good audit, and particularly called for clarity on the scope of audit to aid them in this. Such findings suggest that while some Audit Committees may be very focused on the quality of an audit, there could be inconsistencies in how they go about promoting audit quality. This lends weight to proposals for reforms in the audit sector, including the introduction of standards for Audit Committees.

These broad themes emerged from how the ACCs defined a good quality audit, described their approach during the planning and execution of an audit and in selecting auditors, and how they viewed changes in the sector. Some of the key findings on these areas are summarised below.

Defining a good quality audit

While most ACCs reported measuring the quality of an audit by its assurance of the financial statements, they also frequently defined a good audit with reference to the auditors. For many ACCs, the lead audit partner was synonymous with quality. The ACCs reported a good audit partner would have an understanding of the business and its sector, the ability to identify key risk areas and a sensible approach to handling them, along with a focus on timeliness in terms of raising issues and completing work, and good communication skills. Some ACCs mentioned challenge and scepticism as key to ensuring a high-quality audit, although these were not named as key attributes for a good auditor by all.

It was not always clear that ACCs distinguished between a good quality service and a good quality audit. In some cases, a high-quality service appeared to be a proxy for a high-quality audit and for a majority, good service was seen as a necessary facet of quality.

Planning and executing an audit

Some ACCs reported difficulties in assessing quality throughout an audit and it appeared that many ACCs sought to balance this by focusing their efforts on ensuring a rigorous audit tender process and using a number of proxy measures.

In terms of challenging the auditors, many ACCs reported that this mostly happened during the planning phase of the audit. Challenge was less apparent in relation to auditors' judgements and findings. At the planning stage, challenge often focused on the scope of the audit but did not always seem to concern audit materiality or the level at which misstatements were reported to the Audit Committee.

Few ACCs mentioned regularly challenging company management as well as the auditors and, while some acknowledged that there may be tension to an extent between auditors and company management, there was a sense that a good auditor would manage this without audit committee involvement. In terms of receiving external support to help drive challenge, a majority of ACCs suggested shareholders were not engaged in their audits. There was a feeling that shareholders were uninterested, or that audit was not readily accessible to them.

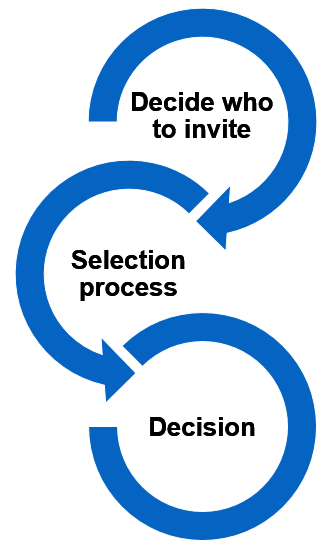

Selecting an auditor

On average, the ACCs started thinking about the audit tender process 12 to 18 months ahead of it starting and invited around four to five audit firms to bid. While around seven-in-ten of ACCs said they had invited non-Big Four firms to participate in tenders, many reported ruling out a non-Big Four firm at the outset because they felt these firms lacked the relevant expertise or capacity. Some mentioned non-Big Four firms choosing not to bid and suggested they could do little in response. Likewise, there were a handful who mentioned that Big Four firms might not bid if they already had more lucrative contracts in place for non-audit work.

Most ACCs cited the lead partner as the key criterion when selecting an audit firm. Another important criterion was the wider audit team. Some ACCs talked about the importance of seeing 'chemistry' within the audit team and between the audit team and company management. No ACC mentioned price as a primary determinant when selecting an auditor.

In reaching a decision on which audit firms to propose to their Boards, most ACCs said the choice of auditor was often between two Big Four firms.

Changes in the audit sector

The ACCs wanted to see a range of outcomes from the recent reviews into the audit sector. Some supported a redefinition of audit and transforming the FRC into ARGA. Many wanted greater transparency of the issues when audits go wrong; to learn lessons from high profile audit failures and from this develop a better sense of what a good audit looks like. The ACCs mentioned both benefits and possible issues in relation to potential interventions in the audit market such as the FRC's proposal for managed shared audit and operational separation.

Similarly, the ACCs offered mixed views on recent changes in the sector, such as the introduction of mandatory tendering and rotation of auditors. On developments with the audit firms' transparency reports, including greater reporting of audit quality indicators (AQIs), many ACCs said they did not consider AQIs in detail and thought they could be made more useful. A majority of ACCs suggested audit firms' transparency reports were fairly 'boilerplate'. Many of the ACCs reported that the FRC's Audit Quality Review (AQR) reports were more informative in supporting their work on audit quality although these, and AQR ratings, might not be a major consideration when selecting an auditor.

Many ACCs said they would welcome further information and support from the FRC to help in their work on audit quality.

Defining a good quality audit

At the outset of the interviews ACCs were asked to define a good quality audit. Improving the quality of audit requires an understanding of what makes a good quality audit in the first place. What might initially seem like a broad question tended to elicit similar responses from most ACCs.

At the very least, the majority of ACCs said that a good quality audit is one that meets regulatory standards, following due process. Above all it seemed the ACCs measured the quality of an audit in terms of the assurance of the financial statements it provided.

I want to make sure that this external assurance does exactly that, which gives us assurance that the numbers that we're putting together, the means by which we do it, are correct, so that's question number one.

Unlisted Entity ACC, Banks

What you're, first and foremost, looking for is comfort from the auditors that what you're getting is right.

FTSE 100 ACC, Insurance

Speaking to ACCs, we came to understand that the concept of assurance, upon which good quality audits depend, is very much provided by the people conducting the audit. There was a clear understanding that major factors of audit quality were the professional judgements and experience of the auditor, and management of the junior audit team on the ground; thus, a high calibre lead partner was key.

I think a lot of it is down to the lead audit partner and his senior management team on the audit. Particularly the lead audit partner being a robust individual who's going to tell you how it is and is not going to sugar-coat it. But also who understands the business, its challenges and is able to provide input and insight that is tailored to that business. In other words, adapts where he is able to, to work with the business.

FTSE 250 ACC, Health Care

Scepticism is quite relevant. What you want is the auditors to make sure that judgements are appropriate and sensible and obviously the basic hygiene of compliance with the accounting standards and company act is a given, but the real value add is how do the auditors probe and challenge and satisfy themselves on key judgements?

MM ACC, Banks

Indeed, for many ACCs, the lead partner was pivotal and could make or break an audit. A good lead partner was often summarised as having:

- An understanding of the business being audited;

- An understanding of the sector in which the business operates and its context;

- The ability to identify the key risk areas and suggest a sensible approach to handling them;

- Timeliness in terms of raising issues and finishing the audit on time;

- The ability, and necessary degree of integrity;

- An ability to communicate clearly throughout the audit.

For many ACCs, the difference between a passable and an excellent audit was an audit partner who could add value to their outputs, bringing their own understanding of the sector's context into the audit, rather than merely 'ticking boxes'.

The other thing that I think is helpful is the experience of the auditor of other similar institutions in terms of what they do, and they don't do in terms of sharing information. Clearly there are commercially sensitive things

- what you can't have is a direct interface - but nonetheless one of the benefits of getting a large firm to audit you is that they have experience elsewhere and they can bring that experience to bear.

MM ACC, Banks

When probed on what makes a good audit partner, knowledge was deemed key. On the whole, ACCs expected the lead partner to understand their business, its problems, and bring that knowledge to the audit. They expected the people conducting the audit to be technically competent as a minimum. Softer skills were also highly valued, be it a willingness to engage or appropriately challenge the company where needed. A majority of ACCs recognised however that behind every star audit partner must lie a highly capable audit team, and so this was also often seen as a key determinant of what makes a good quality audit.

I'd want to make sure that the people who were doing the audit were very, very talented and had great training and work well as a team. I'd want to make sure that the audit team is using the right level of technology and digital initiatives to help them be sceptical and challenging because I think that's the core requirement of all...[is]...to be sceptical and sometimes suspicious actually of what they see, to question that. I'd want to know that the firm broadly stood behind the individual audit teams in terms of audit quality support, so by way of internal reviews And I'd want to make sure that the individuals on the audit team, the senior members of the audit team, are paid properly based on audit quality as well.

FTSE 250 ACC, Financial Services

From the auditor side of things, I think the quality of the individuals in the team is very important. Frankly there is a difference between the Big Four and the other firms...but generally it's about the quality of the team...So, those individuals need to be smart and they need to understand the business, and when it comes to audit judgement issues then the partner needs to be pragmatic and smart, and then you get the best answers.

YouGov plc, 50 Featherstone Street London EC1Y 8RT. Registration no. 3607311. Copyright 2020 YouGov plc. All rights reserved.

The other thing that I think is helpful is the experience of the auditor of other similar institutions in terms of what they do, and they don't do in terms of sharing information. Clearly there are commercially sensitive things - what you can't have is a direct interface - but nonetheless one of the benefits of getting a large firm to audit you is that they have experience elsewhere and they can bring that experience to bear.

MM ACC, Banks

When probed on what makes a good audit partner, knowledge was deemed key. On the whole, ACCs expected the lead partner to understand their business, its problems, and bring that knowledge to the audit. They expected the people conducting the audit to be technically competent as a minimum. Softer skills were also highly valued, be it a willingness to engage or appropriately challenge the company where needed. A majority of ACCs recognised however that behind every star audit partner must lie a highly capable audit team, and so this was also often seen as a key determinant of what makes a good quality audit.

I'd want to make sure that the people who were doing the audit were very, very talented and had great training and work well as a team. I'd want to make sure that the audit team is using the right level of technology and digital initiatives to help them be sceptical and challenging because I think that's the core requirement of all...[is]...to be sceptical and sometimes suspicious actually of what they see, to question that. I'd want to know that the firm broadly stood behind the individual audit teams in terms of audit quality support, so by way of internal reviews ... And I'd want to make sure that the individuals on the audit team, the senior members of the audit team, are paid properly based on audit quality as well.

FTSE 250 ACC, Financial Services

From the auditor side of things, I think the quality of the individuals in the team is very important. Frankly there is a difference between the Big Four and the other firms...but generally it's about the quality of the team...So, those individuals need to be smart and they need to understand the business, and when it comes to audit judgement issues then the partner needs to be pragmatic and smart, and then you get the best answers.

FTSE 250 ACC, Automobiles and Parts

Indeed, when the audit team has been found lacking, a small number of ACCs told us that they would demand an entirely new audit team.

I will kick people off if they weren't good enough on the team, if they weren't interested in the business, if they just didn't interact well, we would change them. That was usually a mutual agreement, we couldn't insist obviously... We've changed partners before; they just weren't good enough.

FTSE 250 ACC, Automobiles and Parts

For a majority of the ACCs we spoke to, having the right people doing the audit was absolutely crucial to a good quality audit. It is the auditors themselves who provided comfort, and ultimately assurance, to the ACCs that they were receiving a good quality audit.

The ACCs often had a particular vision of the skills of a good auditor. While these might vary slightly due to the ACC's business and its area or sector of operations, the research identified a clear list of hard and soft skills that almost all ACCs looked for in the audit partner and their team. In most cases, a technical competency was assumed and, in addition to this, the partner and his/her team were expected to:

- Be communicative - ACCs wanted to know what was going on and preferred to be informed of problems sooner rather than later;

- Demonstrate that they understood the context of the business they were auditing;

- Identify risks, particularly to demonstrate that they were on the same wavelength as the audit committee by identifying the same risks; and

- Challenge management and ask questions, which showed inquisitive mind-sets.

Some, but not all, ACCs mentioned that challenge and scepticism were key in terms of delivering a high-quality audit.

I think [a good quality audit is] when, at the end of it, you feel that you've actually been audited, and I don't mean that this is something whereby there are no issues, and everybody just agrees with everything that's going on. I think what makes it worthwhile is where there are some important issues for discussion, and where the auditors are raising issues and challenging on things which the organisation might not have thought about.

- FTSE 250 ACC, Financial Services

Commonalities in good audits and bad audits

We canvassed the ACCs for their audit experiences, the good and the bad, to see if there were any common themes.

The good

Where audits went well, good communication appeared to be a consistent factor throughout. This communication was characterised as open and forthcoming, with information delivered by the auditor in a timely manner. Ideally such communication would involve the auditor challenging prevailing views within the audited entity. Good audits also went beyond merely 'going through the motions' and 'ticking boxes' - they added value, drawing on industry context and previous experience, as mentioned. This 'added value' was expanded upon by a few respondents to mean the auditor offering a personal view of sorts, a unique opinion that went beyond presenting the facts and figures.

| Respondent | Case studies |

|---|---|

| FTSE 100 ACC, Insurance | The best example we had of [a good audit] was clearly during our demerger when we were splitting off [COMPANY]. You had a company that was splitting off who were clearly looking for the best result possible and we were selling it, so we were wanting a more prudent result. Working through that required huge amounts of recognition of conflicts of interest, judgements and challenge. The auditors, I think, did an excellent job at keeping everybody honest and straight and using different teams. It boiled down to just ongoing regular day-by-day communication...of getting to an answer that was acceptable for everybody. |

| FTSE 250 ACC, Real Estate | We had a new audit team - we were very happy with the process previously, and this is a very, very well organised company - But they [the new auditors] did come up, quite early on in the process, with three or four disclosure points which should have been picked up previously... [it] really sought to demonstrate they had been looking at it, at the company, very thoroughly, in depth...[which showed] their understanding of the sector in question. That actually helped their credibility and helped us as an audit committee have faith in what they were doing. |

| Other listed ACC, Banks | ...they took our data, built their own model, ran some different assumptions through it and gave us a different graph to the one we were using. That was very valuable because we thought we'd got it right, but they gave us a different picture, and in fact events have proved they were right. They did it in a way... it wasn't just them coming in and saying, “We think you should be booking this adjustment,' ...it was actually, ‘This is what we think is more likely to happen than the graph you've got for the following reasons.' That, to me, goes back to what's the alternative view? It was well constructed, well thought out, well presented and actually right. |

Notable in these examples was the constructive nature of the communication between ACCs and the auditors. There was a common sense of purpose for the best possible outcome. This shared sense of purpose with the auditors made ACCs feel they had received a good audit.

The bad

If good communication is fundamental to a good quality audit, then its antithesis – poor communication – was often cited as a common factor in bad audits. Poor communication entailed various things for many ACCs, but instances where there was no challenge, or a lack of depth in the auditor's explanations, were often cited as a failure in communication by many ACCs who had experienced a bad audit.

| Respondent | Case studies |

|---|---|

| FTSE 100 ACC, Insurance | I've seen bad audits and I've also seen, more commonly, bad elements of audits and I think that it tends to be where... the audit partner has not invested sufficient time in really understanding what's happening in the business. He's maybe arrived as a new partner or it could be that the audit team below the partner has changed, and it tends to be where somebody is very new to it and hasn't really got a good understanding of the business... it's when the level of challenge has been, let me say, immature. Ultimately, the audit team that's come along, including the partner on occasion, is too inexperienced and hasn't got that level of backbone and is potentially too accepting of what they've been told about the past of a company and hasn't provided enough challenge during the year, they're just learning the ropes. So, those tend to be the things that result in a bad audit. [The other] thing that really annoys clients is auditors leaving things until too late in the day. Rather than coming along, getting views at an early stage...feeding back into them findings, coming back with any concerns at an early stage. If you just leave things too late, that goes down very badly. |

| FTSE 250 ACC, Travel and Leisure | It doesn't happen very often because if you choose a good team with a good leader, it doesn't happen. But I've seen it once or twice where more junior members of staff have, if you like, floated over ... [or] ... haven't brought out the right amount of detail ... or [not passed on] questions that need to rise up to the audit partner. As a result of which, the audit partner hasn't asked the right questions. [We then had] a situation where we've thought that they understood something, we've made a decision... to do something in a particular way, and this surprised the [lead] auditor...because he didn't understand. He'd got a different message from his team, and it transpired...that that person hadn't done enough work to understand the issues. Or if they had done enough work, they hadn't understood it. And it took us a while to solve that particular issue. We had to almost go back to the beginning and work through the detail again. |

| Unlisted entity ACC, Building Society | I was in an audit once where we were transitioning from a Big Four auditor to another Big Four auditor, and of course we went out and vetted him. The [tender] document talked about planning, making sure the transition went smoothly and all these sorts of things. For all sorts of reasons planning wasn't up to scratch, the deliverables, wasn't [sic] presented to us. There were numerous changes amongst the audit staff on the engagement, including the manager had been changed. These things happen, don't get me wrong, but in those situations, I think the partner's got to step up and be seen to be leading that engagement, and I don't know if that really happened. From our perspective as well, we were on a fairly tight schedule ... In fairness to the guy he did stay on longer than he should have to try and see this through, but it was generally pretty disastrous, and as I said, that was about planning and communication, I would think, more than anything else. |

Tardiness was also mentioned by many of the ACCs, in relation to bad audits. There are two ways in particular that tardiness affected the ACCs' perceptions of quality:

- Last minute delivery – a few ACCs mentioned examples of where the auditor had completed their work late, which had an impact on the wider company timetables.

I had a case [where] a partner signed off at 2.00am because he was [abroad]. [The] CFO had to get up at 7.00am and present his results to the city...just no common sense understanding that you don't leave a client hanging...they think the audit is the most important thing in the world... but [the] most important thing on a results day is your indications of what you believe that the current year is going to bring. So, a lot of work for finance teams around audit time is also getting the budgets and forecasting right...The actual focus on results day is much more about ...what is the future going to hold, and I think auditors sometimes forget that.

FTSE 250 ACC, Basic Materials

- Errors discovered or communicated at the last minute – although no ACCs indicated these had any catastrophic impact on their company.

The bad quality ones are where the auditors are... scrabbling around at the last-minute doing things, which means they probably aren't spending as long; they're trying to race through it. They haven't got to the point early enough, and therefore they'll kind of get there in the end, but because they're doing it very late and it's all a bit fractious, sometimes you worry that they're going to miss a trick. I mean, not enormous errors or big things, but I can just think on occasions where something's come up very late, the auditors have investigated it, for whatever reason it's too late to change the numbers so you end up with an unadjusted difference. But actually, when they go back a year later and look at it again, they just didn't calculate the difference right for example, because it was so last-minute...when things are last-minute, they're prone to going wrong.

FTSE 100 ACC, Financial Services

Tardiness in either of these forms in almost all cases soured the relationship between the ACC and the auditor, with the ACC having felt they received a poor-quality service in these instances.

A further commonality of poor audits, for a small minority of the ACCs, was inexperience of junior staff.

Most of the staff on audits have been relatively junior staff, and in some cases the finance function has felt that they were almost teaching the audit staff how to do the audit.

Unlisted entity ACC, Banks

ACCs who raised this issue did not doubt the intellect of junior staff per se but questioned whether a lack of experience had an impact on some of the tasks they might need to carry out in an audit.

...[the audit firms are] hiring young, bright people out of university, but they don't actually know anything about, or as much as you would maybe like them to, about the industries that they're auditing....Lack of experience and maybe too much unnecessary process...is inflicted on them.

Other Listed ACC, Construction and Materials

This links back to what ACCs look for in the lead partner and their teams, namely a good understanding of their business. On some level while it is accepted that junior members of the audit team will be lacking experience or an in-depth understanding of their business, mistakes do not "...happen very often because if you choose a good team with a good leader, it doesn't happen" (FTSE 250 ACC, Travel and Leisure). Any oversights made by junior staff might then be expected to be picked-up by senior audit staff, but we note that, again in terms of communication, when such oversights were not 'passed up the chain' then issues may occur. Indeed:

... is somebody going to miss a piece of evidence on an area of audit work that's not high risk? Of course, all the time. This is inevitable. But is that going to cause a corporate collapse. Very rarely I would say. If it's a detailed, low risk piece of audit work, that's not going to be a contributing factor to a corporate collapse but getting a critical judgement wrong on the going concern or the viability of the entire entity and not disclosing that there may be a risk to that, that is a massive judgement which the market is obviously interested in and if that is wrong then there's a clear risk to audit quality.

FTSE 250 ACC, Financial Services

Differences between a good service and a good audit

To a small extent, there was divergence of opinion amongst the ACCs on whether a good audit service can be disentangled from a good quality audit.

On the one hand, many ACCs felt that you could not have one without the other.

No, the two go hand-in-hand, because a good audit actually identifies issues and appropriately raises them and points out and understands the difference between being best in class and being acceptable and is able to explain to you the difference in approach. A lot of the accounts are now about disclosures and [auditors] can actually articulate what's to be benefitted from one approach versus another. So, they're actually bringing knowledge and experience to the conversation. You can have a lovely, warm fuzzy relationship with somebody, it doesn't give you any confidence about the audit. We're looking for somebody that knows their job and knows what they're doing, and understands where the issues are going to lie, and is able to communicate that.

Other listed ACC, Financial Services

However, on the other hand, some ACCs identified separate aspects of an audit that related to service.

There are some empirical bits which are around the way and speed with which the audit's delivered, so do they [auditors] do it to plan? There's the quality of the original plan as well, and also the quality of the presentation and how they present things, both initially, in the plan and the strategy for the audit, but also as they progress. I've had to pull up audit partners in the past because they've not provided either timely information or in fact any useful information at audit committees, and for instance, once sent a report which virtually said that everything was in progress, didn't tell me whether it was progressing well or not, but everything was in progress, which wasn't much use.

Unlisted entity ACC, Banks

A good service means that the process works properly and you aren't surprised by them [the auditor] coming up [with something at short notice], there's nothing more irritating to an executive or a non-exec than [them] coming up with a really deeply interesting technical point right at the death throes of the audit. Now sometimes it can happen, from a practical point of view, but there's nothing more irritating. That's a service point of view, that's where the audit is delivered, i.e. hit the difficult technical things early rather than late. Having been there I do understand that sometimes big judgements really only get made in the death throes, but let's have a conversation about what the issues are that we might be thinking about early doors rather than waiting until that point. So, the service delivery to me is that the process works properly, I do get slightly irritated when the judgements that we're talking about get lost in the Big Four's process points, about what they have to do.

Unlisted entity ACC, Banks

Some ACCs also wondered whether it was possible to have a good quality audit without receiving a good service.

I suppose there could be [a possibility]. You could have good service but not very good quality [audit] but I think that's probably unlikely because if you were getting a good service, like calls returned on time and all of that sort of thing, I don't think you'd have that and not be having a good [quality audit]. I think sometimes a less than good service leads to questions about how the audit is that you're having done and... you definitely don't want to feel like you're the Friday afternoon job... the job they squeeze in. Because obviously that would raise concerns... I'd be questioning, what's the quality but if you're getting a good service, I would see that as an indication of quality.

Other listed ACC, Media

For some ACCs considering the potential difference between receiving a good service from an audit firm and receiving a good audit, the relationship with the auditor was key.

...I don't think you can have a good service without it being a good experience overall in terms of relationships, and I think it's all wrapped up. That relationship thing that you just mentioned is really important. It must be a healthy relationship, but not too cosy. I think for an audit chair, it's very important to make sure that it doesn't become too cosy between the audit team and the management team in the business. If that gets too cosy, then you're not going to get a good audit. The audit needs to be challenging management, but as I say, in the right areas.

FTSE 250 ACC, Travel and Leisure

The sort of problems that are not raised in any one reporting cycle will probably come up next time, so it is possible to be a smooth relationship manager who can iron over the issues that should be discussed, but you can't keep doing it. So, the relationship can override, in the first instance, quality of audit...So, the chances of there being problems with quality that can be overridden by an apparently high level of service and good communication about certain things at the highest level, it could happen, but I think to sustain it happening, over multiple reporting periods and cycles, it would be quite difficult, and there would be an abdication of duty for the audit chair or audit committee members to allow that to happen, because it would mean they probably haven't been asking questions, or didn't have an intuitive understanding of the business, about where questions could or should be asked.

FTSE 100 ACC, Basic Resources

Often ACCs saw themselves as performing a distinct role in the relationship that might include arbitrating between the auditors and company management.

Clearly, if the auditors don't like something, then my job is to make sure that we change it so that they do. Equally, it should never get to that point because I have a regular dialogue with the lead partner on the key areas of their business. He's very good at telling me areas that might become a problem so that we can head them off before they do.

FTSE 100 ACC, Insurance

Ultimately, a good service seemed to be closely linked to a high-quality audit for many of the ACCs.

...to my mind, if you look at the service and quality, you cannot provide a good service without having quality at the forefront, and that's a mind-set.

FTSE 250 ACC, Financial Services

Planning and executing an audit

Evidence used in assessing audit quality

Some ACCs felt audit quality could be difficult to assess. While many said they scheduled check-ins with the audit partner, it was not practicable to maintain continuous oversight of the audit activities day to day, so a base level of integrity and ability on the part of the auditors was assumed. Building on this, ACCs spoke of common indicators throughout the audit cycle, which they used to monitor the quality of audit.

The audit committee does not see the working files of the auditors...Because the audit committee role is to make sure that the plan for the audit is correct. Not correct, but it is going to meet expectations and requirements. That means that they [auditors] have understood the risks associated with the company, and how they're going to address those risks in the audit plan. Then, so long as the audit plan can be carried out as agreed with the audit committee, then the audit committee does not need to intervene.

- FTSE 250 ACC, Travel and Leisure

The audit is not a once a year event that happens for a few weeks and then everybody goes away and goes back to sleep again. Their [auditors] reports to audit committees are comprehensive in detail, and a really important part is understanding the key risks and the areas that are audit-focussed, but at the same time how the translation of those key risks and areas of audit focus are translating to the work on the ground. That will carry on as a continuum, and indeed may evolve through the year, and then it's really important that you look at the effectiveness of the audit because you need to be able to say something about that in the audit committee report.

- FTSE 100 ACC, Financial Services

In commenting on how they assessed audit quality, many ACCs indicated that they sought to ensure good quality well before the audit commenced through a rigorous and diligent tender process. The ACCs' approach to tendering and the criteria they used is covered in a later section in this report.

When transitioning between audit teams, many ACCs expected that this would be as smooth as possible, with the outgoing audit team transferring knowledge of the business, and previous learning, to the new team. This held true when it came to the transition between audit firms; some ACCs commented that since the introduction of mandatory rotation, there was a need for cooperation and transparency between firms. However, some ACCs also acknowledged that in the early stages of an audit there would be a certain level of support and 'teaching' required to ensure that the new audit team had an effective grasp of the business and the context in which it operated.

I think you would spend a lot longer with the audit team/ with a new auditor just going through [things]. Actually, to a certain extent, we're partly helping them, but also again assessing if they've really got everything. What you don't want with a new auditor is they've just completely missed something because management have decided not to tell them about it, and they didn't ask the question.

- FTSE 100 ACC, Financial Services

Some ACCs said poor communication during auditor transitions could compromise the quality of audit, if the audit teams did not have sufficient understanding of the business.

To be honest, usually, what I've found, if the feedback's poor [from management], it's because they've [auditor] completely changed the audit team, and there's been no continuity, and therefore, the new team have taken a while to understand the business.

- FTSE 250 ACC, Basic Materials

That being said, many ACCs were clear that there were benefits to switching audit teams (and audit firms when required), with a 'fresh pair of eyes' adding value to the audit and possibly meaning that new issues were identified.

It is really, really important that the incoming audit partner is present even before he takes over next year, to ensure that the plans and the judgements and so on are well-founded without compromising his independence when he actually takes over. So, you absolutely want a smooth transition, but you want the smooth transition with the benefit of a fresh pair of eyes.

- FTSE 100 ACC, Financial Services

The concept of a 'fresh pair of eyes' was often mentioned in our conversations with ACCs in the context of auditor transitions and mandatory rotations.

I think it's important to rotate the audit partner because I think a fresh pair of eyes is incredibly important and a new way of thinking. So, I'm very supportive of the big firm's approach of rotating of partners. In terms of rotating audit firms, there is pros and cons, you're absolutely right because having the history and all of the working papers from the prior year is really helpful because they can build on their experience but there does sometimes come a point where actually, that fresh pair of eyes and that new way of looking does become interesting and I think a lot of that will depend on where you are on the evolution of your business

- FTSE 250 ACC, Travel and Leisure

While many ACCs welcomed the 'fresh pair of eyes', the sense of a new auditor bringing value by 'kicking the tyres' did not resonate as strongly. A few ACCs spoke at length about transitions that had not gone well.

"It's the second year of [Big Four A] doing the audit at [company]. I think they had some challenges in the transition from [Big Four B] and there were quite a few issues around errors that [Big Four B] had failed to pick up and so I think a lot of their first year was occupied with trying to sort out issues. I think by the second year having understood the business a lot better...understood a lot more in depth about the risks... they came up with a very good and balanced review and various issues... which management didn't necessarily agree with, but what I liked about it was that they still brought them forward to the Audit Committee and in fact, our view is that we agreed with the auditors rather than the management and we adjusted accordingly."

FTSE 250 ACC, Consumer Products and Services

The overall sense was that transitioning between auditors was a delicate process, and ACCs wanted the new auditor bringing insights and value without too much disruption.

".. yes, you do want, and [it] is really valuable, to have fresh eyes. On the other hand, you don't want someone coming in and effectively rewriting history. So, it's almost that the fresh pair of eyes, it's a very delicate balance.”

FTSE 100 ACC, Financial Services

"On the one hand... as chair of the audit committee, you're keen to ensure that the audit goes smoothly. That there aren't too many issues and that the accounts can be produced in a timely manner. At the same time...you have an independent, scrutinising role, and so with that perspective, one is looking for new auditors to turn things over a bit and bring a fresh perspective...what's been quite striking for me, in terms of the number of [auditor] transitions I've had, is that incoming auditors will often raise new topics that haven't been raised before, because they've looked at them in a fresh way, or they've carried out a different kind of approach... So... for example, ...we had [Big Four A] take over from [Big Four B], and I would characterise [Big Four B] as having great strengths in the area of ... commercial understanding and commercialism. So,...they would present their report in a language and a framework that, actually, was very business orientated... Whereas [Big Four A] ... have great strengths in the technical field. They have tended, in my experience, to focus much more on technical accuracy and compliance with standards and other norms. The transition from one to the other [auditor]... produced a whole raft of information to the audit committee about things like the quality of the control environment, the extent to which substantive auditing techniques had to be used...It gave us some tools to start thinking about how we could actually improve our control environment..."

Other listed ACC, Financial Services

While many ACCs said new auditor insights could bring positive change, they appeared wary of potential problems that wholesale change might cause to the audit itself in terms of preventing or delaying it happening.

Following on from a comprehensive tender process, the majority of ACCs identified the audit plan as key in ensuring a quality audit. Within this, risk assessment was a crucial focus. For many ACCs, identification of appropriate areas of risk, and adequate resources allocated to these, indicated a good quality audit plan and indicated a comprehensive understanding of the business and sector context. Conversely, if an audit plan did not identify the areas of risk as expected, some ACCs would be concerned that the audit itself might become a 'tick-box' exercise. For global businesses, there was the additional question of whether the auditor was aware of, and intended to cover, potential risks or issues in different locations.

I think one of the markers of good quality audit is a clear, understandable and supportable plan...setting out key areas of risk. It's something that I participate in, both formally, through the audit committee, and in informal conversation with the audit partners. It's their document but we collaborate. I think the evidence of that being a good document is that it's very clear, not overcrowded with stuff. So, the priorities really are the priorities, and not just a listing of everything you can think of. That there is an indication of how the audit will be modified to take account of those key risk areas, so that they get the right level of focus and allow us all to come to a conclusion about them.

- Other listed ACC, Financial Services

Once the audit had commenced, a majority of ACCs indicated that they assessed audit quality through different direct and indirect feedback methods. Audit committee meetings with the auditors were a key touch point, and some ACCs also reported scheduling formal engagements with auditors prior to, during, and at the end of the audit. However, open communication outside of these times was also seen as a vital and overarching component of a quality audit. This seemed especially important for matters of materiality; timely communication of these was a key indicator of quality and was one reason why sector knowledge was so highly valued.

We'd have audit committee meetings at the planning stage, there's a committee meeting during the audit, there's a committee meeting at the end. At each one, I would expect, a week ahead of the meeting, for a properly constructed document to be coming forward from the auditors. So, a planning document setting out the staff, the timetable, the fees, the risks, the approach to risk, how they're going to audit. During the audit, any issues identified, where they are, are they on time etc. At the end, a proper audit memorandum, saying what they've found, saying any issues, saying management recommendations etc. If any one of those is missing, there's a problem.

- Unlisted entity ACC, Insurance

I personally have a private session with them [the auditor] before every audit committee [meeting] where they talk through what they're finding, what they're thinking about.

- MM ACC, Banks

For the majority of ACCs we spoke to, feedback from company management was also important for assessing audit quality.

I would expect them [auditors] to be very transparent, certainly with me. The audit partner has my mobile phone number and is welcome to call me if they have any concerns. So, we keep that dialogue open. But, without sitting and monitoring how they're doing their work, it's actually really difficult to know whether what they're planning is actually being executed. So, we almost have to rely on the executive team and the feedback that the executives have over the audit.

because it's not covered in your report?' - FTSE 100 ACC, Basic Resources

We also challenge them on judgements. So, when they conclude their work, they come up and say we think it should be this number, and we think it should be this number, and there's a difference between the two, so why do you think that? Have we got the same assumptions? Have we made the same interpretation? Why are we making different interpretations? Now, most of the time, that's fine, because we are not that far apart. - FTSE 250 AC, Travel and Leisure

At the performance and evaluation stage, some ACCs said materiality was a key factor when it came to challenging auditors' judgements and findings. There was an expectation that issues raised should be material to the business, and the implications of these for the business should be understood. Again, this relied on the expertise and judgement of the auditor. Some of the issues raised would be uncontentious. However, where there was contention, ACCs said there needed to be sufficient time for discussion.

As audit chair, generally if there are any material issues, I'd know about them. If they're material you deal with them in advance... most things aren't contentious, have you got the cash in the bank? That's easy. But when it's things like revenue recognition, have you made a sale or not, that's actually around the year end, that becomes quite contentious. Those are where the judgements come in. - FTSE 250 ACC, Automobiles and Parts

Once it gets to the reporting stage, it's making sure that they [the auditors] understand the implications of the audit findings, relevant to the internal controls but also to the financial statements themselves. - FTSE 100 ACC, Insurance

Sometimes the auditor can, if you like, have an accounting paper and you'll sit down have a meeting, the auditor will have various challenges and you maybe go away, you refine the accounting paper. If you have a flat-out disagreement, then you will make sure that the auditor goes away and gives you a very full basis for their technical opinion because ultimately these will typically end up in being differences of technical opinion. Then, frankly, you're into, we may disagree, and you may think we're not doing this the best way possible but are we doing it in an acceptable way?' - FTSE 100 ACC, Financial Services

A large minority of ACCs indicated that the evidence used when challenging auditors' judgements in performance and evaluation relied heavily on the expertise of the ACC; both in terms of the particular business but also in terms of having oversight of issues in the sector. In conjunction with this ACCs expected that, in cases of disagreement, the auditor would be able to articulate their judgement process clearly and present a relevant body of evidence; however, some ACCs also mentioned calling on internal audit to provide a benchmark for identifying and evidencing issues, or drawing on other external resources, such as independent reviews.

Obviously, there's your experience of the industry, there's the executive within the organisation, but the benefit or disadvantage of sitting on numerous boards is you're facing the same issues in different places, so you can bring some of that. Also, there's the technical updates, one keeps oneself up to date, you attend the presentations by most of the Big Four actually on topical areas to see where the industry is coming from. Unlisted entity AC, Banks

Internal audit will do different things to external audit, so it's not often you will have a direct contrast between the two. I mean, we will try and work out, well, if the external auditors have found an issue, why did the internal audit not identify it? And likewise, if internal audit has raised something they're concerned about, how is that picked up by the external auditors and did they respond appropriately to it? I think that's where those kinds of challenges tend to sit as much as everything else. Unlisted entity ACC, Banks

Obviously, the auditors bringing in consultants when appropriate, it's a good way to also double-check some of the more major judgement areas we might have. FTSE 250 ACC, Basic Materials

We even had another Big Four firm give an opinion, which actually supported our own view on this. Of course, at the end of the day, I have to respect their [the auditors'] right to come to an independent view on things, even if I disagree with it. Other listed ACC, Financial Services

I do see that [challenge] occasionally, we had one last year, but it was immaterial. On that particular one, management felt very strongly the auditors were wrong, the auditors obviously thought they were right. The audit committee, I have to say, were unable to tell, but it was below materiality, so we were able to agree to live with it, but we commissioned a third opinion. MM ACC, Banks

Some ACCs suggested challenge often came down to interpretation of industry standards. Again, given that there is a level of judgement involved, many ACCs felt the track record and sector understanding of the audit partner could be important.

Where there's particularly questionable accounting standards or where the accounting standard isn't crystal clear in those situations then certainly, we would have a debate around it. In those instances I would be really interested in the auditor's view and how they've arrived at that judgement and see what background they've used for that and I would balance that off with the judgement from the company, and then based on that would have a view of what is the right thing to do. - FTSE 250 ACC, Travel and Leisure

This is where I take issue with the slightly slavish mentality that says: 'this is what some academic says about the interpretation of this standard, and that's what we're following'. We slightly lose sight of the wood for the trees - does this actually help the people who are going to use these accounts to understand what's going on? Other listed ACC, Financial Services

A minority of ACCs mentioned their role when there were disputes between company management and the auditors.

We may possibly have to take a position where we either agree with management or we agree with the auditors. So, then we upset the other side. But that's the audit committee's responsibility or it's to form the decision to recommend to the Board a certain approach or a certain outcome. - FTSE 250 ACC, Health Care

We have to make a decision at the end of the day, if they can't agree. I mean this hasn't happened, normally both sides are sophisticated enough that they know that they've got to have got something sorted out before they get to us. But if that didn't happen, then we'd have to do that. Other Listed ACC, Construction and Materials

I think there are going to be a number of different sources of conflict. The easiest one to resolve is a people issue. In a big audit, PwC or KPMG might have 100 individuals working on the audit facing off to 100 people in the business, and in virtually every audit at some point, one of those pairs of individuals just can't get on because square pegs in round holes. That's easy to fix because that's just a personality issue and that happens all the time in business. So, that's your easy one to fix. Seldom does that get as far as the chairman of the audit committee, because normally people can see it for what it is and deal with it. Other Listed ACC, Financial Services

Frequency of communication with the auditor

Across the interviews it was clear that the majority of ACCs utilised both formal and informal feedback channels when engaging with their auditors. Audit Committee meetings were the key means of communication. However, engagement with auditors outside of these meetings varied, with some ACCs scheduling additional meetings to get an early view on the work of the audit team. Nevertheless, ACCs expected communication to be ongoing to some extent across the audit cycle, with timely and clear communication of issues seen as a key indicator of audit quality.

I don't think you can just say, 'Okay, let's look at the plan, let's look at the results of some interim audits and let's look at the final.' That's only three interactions, businesses are making decisions day in, day out, and you at least need to talk to them [the auditors] every eight weeks I would say in some shape or form. It may be a fifteen-minute conversation, it may be an hour conversation, but if you're really trying to make sure that they do a quality audit, and make sure you as an audit committee chair know what's going on, then you need to have some form of regular communication with them. - FTSE 250 ACC, Health Care

I would expect them [the auditors] to be attending at least four, and it's sometimes more, meetings a year. I always have a private session with the auditors unless they say they've got nothing to talk about. I would also expect to be talking to them at least somewhere between four and ten times during the course of the year, depending on the complexity of the company and the issues it's facing, which are ad-hoc, general conversations. Other Listed ACC, Financial Services

Outside of set reporting times, the large majority of ACCs encouraged an 'as and when' approach to communication and told us that a good audit partner would not hesitate to arrange calls to discuss matters as they arose.

Well, they [the audit partner] would normally come to two or three audit committee meetings a year. I would speak to them or see them before each audit committee, and I might have one other general chat during the course of the year just to see how things are going. I think it's quite a lot to do with the mutual trust really. I want them to feel that the relationship is close enough that if they're worried about something...to feel able to pick the phone up and say, 'Look, can we have a cup of coffee and just have an off-the-record conversation about something?' - FTSE 250 ACC, Real Estate

For many ACCs, as the audit evolved, it seems that more frequent contact was needed if serious issues were uncovered and needed to be resolved.

It depends what you are dealing with ... clearly with Covid-19, if you are in a bank among many things it's going to do is increase the provision for loan losses, and provision for loan losses is the single most sensitive accounting and audit judgement. So, the engagement with the auditor is, I won't use the word continuous, but you may have a conversation once a week as it evolves. So, that could be, if you've got a big issue going on, it can be very frequent. - FTSE 100 ACC, Financial Services

A majority of ACCs mentioned that issues needed to be raised by auditors in a timely manner in order for them to be appropriately dealt with. Delays in auditors reporting issues could have a significant impact in terms of signing off company accounts. Surprises late in the day were not appreciated or conducive to quality and a good service.

If things are being challenged at the audit committee you've got a problem. - FTSE 250 ACC, Automobiles and Parts

What I like is to have an audit committee [meeting] shortly before year end where all the issues are out on the table and we have the conversations and the challenge then, because that means people have still got time to change their minds or do more work or back down. It's not very helpful the day before a set of accounts are signed, to challenge the auditors. It's too late, you are where you are. FTSE 100 ACC, Financial Services

Raising issues in a timely fashion is extremely important because there is so much preparation to be done before you put out press releases and things like that these days. FTSE 250 ACC, Industrial Goods and Services

Many ACCs reported having telephone calls with auditors as well as face to face meetings; the face to face element was seen as being beneficial for clear communication and establishing a good professional relationship with the audit team. However, many noted that given the restrictions on face to face meetings in light of Covid-19, much of their contact was now online. Whether this was of detriment to overall audit quality was not clear; some ACCs were keen to see face to face meetings reinstated, while a few saw technology enhancing communications in future.

Many times [I have contact with the auditor]. By phone, by Zoom call these days. I don't do face to face these days and I kind of think that's an issue because I don't think you can get nearly the same depth of conversation over Zoom or the telephone as you can get face to face...I personally was having these conversations face to face all the time, you know very regularly. What I'm saying is doing it in this environment I think if anything increases audit risk. - FTSE 250 ACC, Financial Services

Emails, phone calls and, now, it's Zoom or Teams. I suspect that will endure, to a degree. There will still be a personal interaction, in terms of face to face meetings but, yes, there will probably be some video meetings, I would imagine. It depends. If there's nothing to report, there's nothing to report so there's no point having a conversation about nothing. There is more interaction certainly at the moment. I do think that as a generality that the auditors should spend more time having informal discussions with the senior people around the audit activity. I don't think you need to just rely on them informally at meetings of which we have a few. FTSE 100 ACC, Chemicals

I think in the future we may find that more audits are done remotely than have been done in the past because there's probably been a good learning curve from the audit firms as to how you can do things efficiently remotely. FSTE 250 ACC, Consumer Products and Services

Reporting in audit

When it came to auditors' reporting, some ACCs said they would challenge where needed – often this came down to a question of technical correctness versus the implications for the business of the issues as presented. In order to challenge on the auditor's reporting, many ACCs said that they reviewed draft auditors' reports, and that this should be done in a timely manner so as to allow for proper interrogation.

We would often look at the drafting of particular parts of the [audit] of financial statements, particularly if there's been a big judgement, perhaps in relation to goodwill, or another intangible, and what does that actually say? I would expect, if it's a significant matter, for the committee to look at that particular drafting. We might say we think words may be changed, or someone may say, 'I think you ought to put that in', or 'You ought to describe that.' I would expect to read the whole of the back end of the financial statements, and I will tell the committee I have done that. FTSE 250 ACC, Industrial Goods and Services

I said, 'What you have written here is technically correct but you're giving an impression that is not wholly reasonable.' They [auditors] really need to understand who is reading the documents and the impact of what they say, as opposed to it just being technically correct. Unlisted entity ACC, Banks

For many ACCs, auditors' reports were often long and cumbersome, making it difficult to get to the heart of key issues. Some ACCs mentioned that this was a result of heavy regulation and auditors having to 'tick boxes'.

They're pretty uninteresting reports generally. I don't think they involve very much more than, you know, a bland report to be honest. FTSE 250 ACC, Consumer Products and Services

The audit report is a strange document, the external reporting. It's been extended in a very regulated way, and I'm still not sure what value it has. I think the value is far more on the internal reporting, to be honest. We get very good reporting from the auditors. What you want to know is, where were we last year, and where are we this year, and have we broadly kept at the same place within those ranges year on year? If you move, then you're distorting the results for the year potentially. So, it's that kind of reporting that we find very useful, but I'm not sure that would be appropriate for external reporting. Unlisted entity ACC, Bank

All you've ended up with in the long-form reports is just a series of words ... I think it's now got to the stage that it's so long that people don't read it. So, I think again it's just adding words that don't necessarily add value, and I think that's one of the problems of requiring more and more documentation and more and more words, you lose the wood for the trees. FTSE 100, Insurance

As with auditors' reports, some ACCs said that audit committees' reports involved a level of 'boilerplate' reporting, and there was judgement required to ensure that they were useful. Many ACCs did mention focusing on quality in their reporting, setting out how audit quality was addressed through planning and challenge; for example, outlining any feedback channels used with local teams to understand the quality of the audit on the ground. However, there was a sense that audit committees' work on quality could sometimes be difficult to convey.

I think they regard a lot of it [audit committee report] as boilerplate. All you're looking to do is to make sure that what you refer to in the audit committee report is the same as what they [auditors] refer to in their audit report. There is so much in annual reports these days, it's so difficult to get too tightly involved in the detail of it. - FTSE 250 ACC, Industrial Goods and Services

We take audit quality very, very seriously indeed and it's our number one priority. So, we don't sugar coat that in any way, that's the most important thing to us in terms of external audit and we make that very clear. - FTSE 250 ACC, Financial Services

There is a significant amount of reporting in there [audit committee report] on the activities of the Audit Committee and how we've challenged the auditors, how we've challenged management, but also how we've assessed quality throughout the year. - FTSE 250 ACC, Health Care

I find this really difficult... they are expecting you in your audit committee report to be specific on areas where the auditors challenged management or disagreed with management... and to be honest...trying to put that into a formal report is actually quite tricky...if I did go to the nth degree and even give a very specific example of an area which was very contentious and we've had a lot of debate, you'd have to spend a lot of time describing that whole issue and why we resolved it the way we did. You've got to take care that the report is fair, balanced and understandable and not lead people off into little cul-de-sacs, where we thought this was an issue but actually when we got to the end, we realised it was okay. FTSE 250 ACC, Chemicals

Other assessments of audit quality

A majority of ACCs were clear that shareholders were typically not engaged in audits. While many ACCs wanted more shareholder engagement there was a feeling that shareholders were uninterested, and that audits were not particularly accessible for those outside of the profession. ACCs told us that shareholders tended to be more concerned with matters of remuneration or were more likely to engage, and provide feedback, if they were distrusting of the audit firm appointed – for example if the firm's reputation had been questioned through its involvement in high profile audit failures.

I'd love to [speak to shareholders], but nobody wants to speak to me. It's interesting, I'm trying to make our audit committee report a bit more personal and [about] what we actually do... [But] we don't tend to get any reaction, other than...people seemed to get upset that we had [firm X] as our auditors. That's the only time that people have got excited, because they've seen [firm X's] name in the headlines for something...implying that they're not a quality firm or doing a quality job. - FTSE 100 ACC, Insurance

Everybody talks about shareholders being very interested in audits and things, but the reality is, shareholders are not really interested in the audit. They see the audit as hygiene. The fact that shareholders don't engage with audit committee chairs is quite frankly, a mistake. Because if systemically, they're looking at the risk associated with their investment, is their company going to go bust? With every company facing severe economic difficulties, this is a very legitimate question right now, why are they not asking the question? And part of the reason they don't is they don't understand it [the audit]. - FTSE 250 ACC, Travel and Leisure

Resourcing a high-quality audit