The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

COVID-19 Resources, action, the future - a look forward

- Introduction

- Investor needs have remained consistent

- How to read this report

- Resources

- Actions (and stakeholder impacts)

- The future

- Looking back

- Recent developments

- Recent developments

- Looking forward

- Europcar Mobility Group: CONNECT > PROFOUNDLY RESHAPING THE GROUP WITH A VISION FOR 2021-2023

- Financial Stabilization Package - Key Points (Lufthansa Group)

- Tesco plc First Quarter Trading Statement additional information pack slide 6

- SThree plc Interim report 2020 page 5

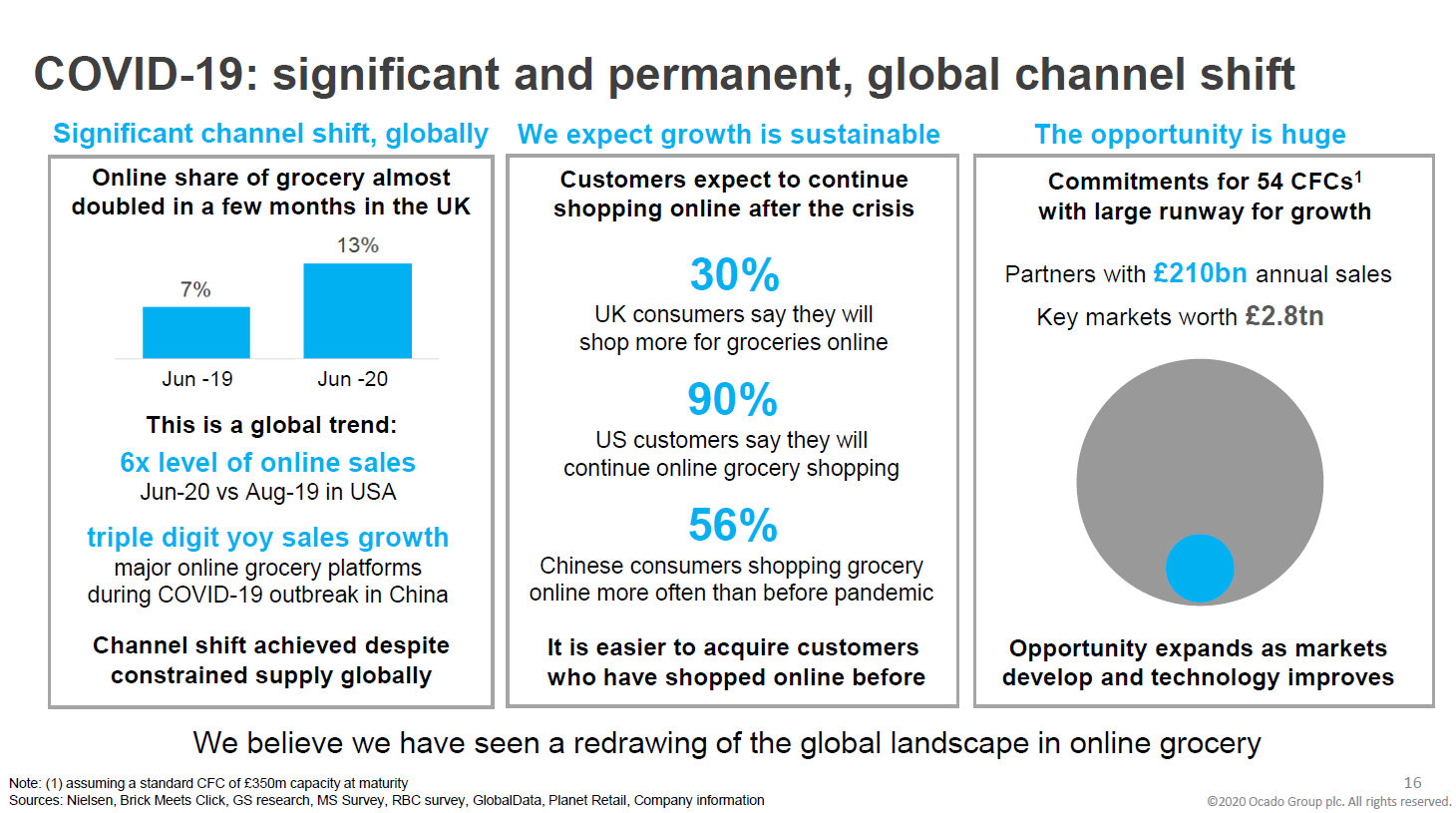

- Ocado Group plc First Half 2020 results presentation slide 16

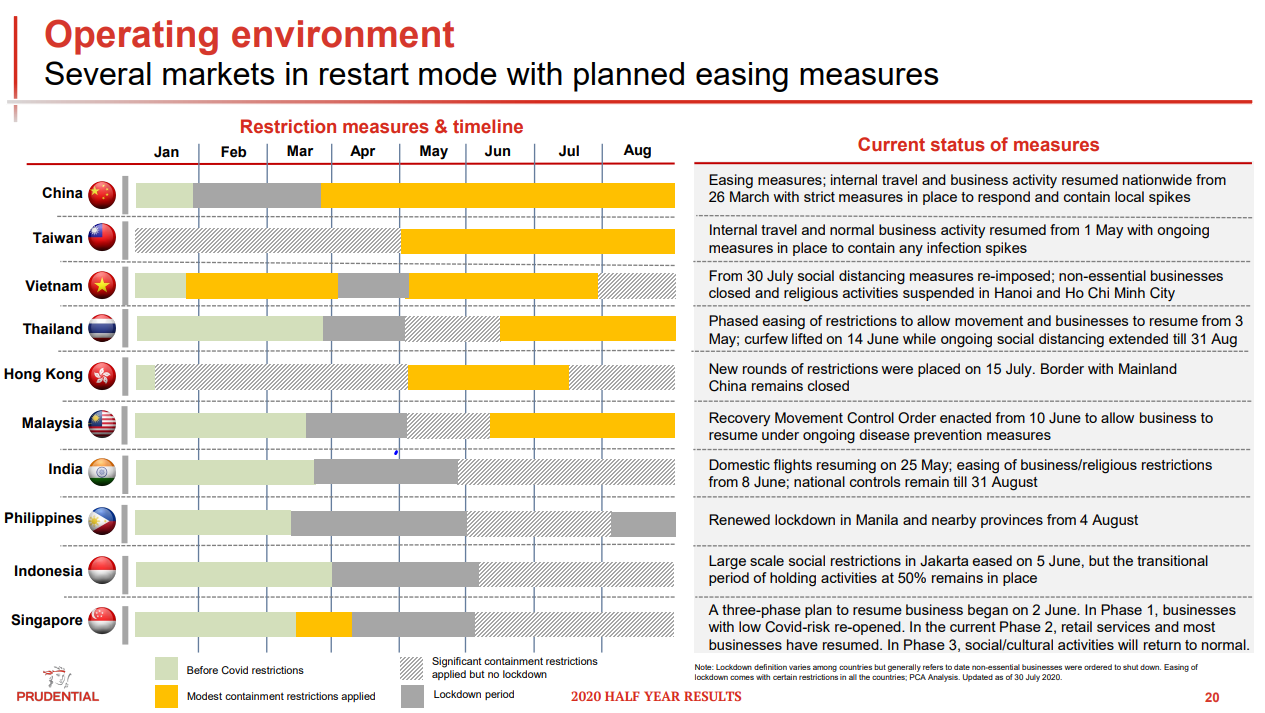

- Prudential plc 2020 Half year results presentation slide 20

- The Lab has published reports covering a wide range of reporting topics.

Introduction

In response to the COVID-19 pandemic, and based on discussions with investors, the Lab issued an infographic in March 2020 and two reports (and related summaries): Going concern, risk and viability and Resources, action the future in June 2020 relating to reporting in times of uncertainty.

The June reports reflected the practice at the time, which was limited. Practice has evolved and, therefore this report aims to provide examples that reflect more recent reporting practice. Further examples of good practice and guidance can be found in the FRC Corporate Reporting Review's Covid-19 Thematic Review.

Company reporting is continuing to develop to meet the challenges of the extended COVID-19 pandemic and the uncertainties that it brings. Against this backdrop, investors' needs are evolving with the aim of understanding how companies are meeting the challenges of the pandemic.

This report looks back at key elements highlighted in the Lab's previous work, considers current practice and takes a look forward at how reporting is developing.

The report focuses on the areas and themes addressed previously in the COVID-19 - Resources, action, the future report. Where relevant it includes examples of current disclosure practices and provides some ideas of how we expect disclosure to evolve. In addition, an update to the report focused on Going concern, risk and viability can be found on the FRC website.

Using QR codes

For those reading the report in a printed form, the QR codes provide a direct way to view linked publications using a mobile phone. To use the QR codes, point your camera at the QR code (special QR reader apps may be required for older phones). The phone should then take you automatically to the publication.

Investor needs have remained consistent

Three themes:

- Resources

- Actions

- The future

Five questions:

- How much cash does the company have?

- What cash and liquidity could the company obtain?

- What can the company do to manage expenditure?

- What actions can support viability?

- How is the company protecting its key assets and value drivers?

Our original report and infographic demonstrated that COVID-19 created a change in investor needs and time horizons; this led to a need for information around three key themes. The FRC's continued outreach shows that these themes remain the key areas of focus for investors, they still have questions that they want answered – but the answers and the disclosures they now need must reflect the company, its specific circumstances and the actions it already has taken.

How to read this report

This report is structured to provide a reminder of the views and practice that existed in June 2020 along with updates to reflect more recent disclosure practices. In addition, we provide some suggestions about how disclosure could evolve further to provide more information to investors. These suggestions are based on our observations of recent reporting practices in the context of the input received from investors prior to the release of the original reports.

The different sections of this report have been broken into four areas:

- key messages from the Lab's earlier reports; (Looking back)

- an update on recent developments in corporate reporting; (Recent developments)

- some thoughts regarding how corporate reporting can develop; and (Looking forward)

- practical examples from reports and presentations released by companies since June.

This report follows the themes identified in June, namely: resources, actions and the future.

However, we have broadened the section on actions to include ‘stakeholder impacts', as a number of actions significantly affect stakeholders and good disclosures should indicate such impacts.

Resources

Looking back

In the original report, the two key questions that investors were seeking to have answered were:

- what cash and liquid resources does the company have now?

- what cash and liquid resources could the company get access to in the short term?

Next plc in their Trading Statement on 29 April 2020 provided a useful example, which we highlighted in our June 2020 report, about the measures taken to generate and secure cash resources at that time.

Recent developments

Companies continue to provide information regarding their cash balance and liquidity. They describe what actions they have taken to secure cash or access to cash (debt facilities) over the period reported on and in the short term (i.e. access to revolving credit facilities) (refer to Saga and National Express).

Looking forward

As the crisis extends, cash might again become an issue for companies even if they took actions earlier. Further cash may be needed to fund current operations or for new opportunities. Therefore, understanding the evolving cash position, the uses of the cash accessed and the company's plans for that cash become even more important.

Given that the government schemes have a repayment timeline, clarity on this repayment and other information is useful.

In the FRC Corporate Reporting Review's Covid-19 Thematic Review, the required disclosures regarding a company's liquidity, covenants and headroom, as well as those in relation to the availability and use of the Covid Corporate Financing Facility and other government schemes, are discussed.

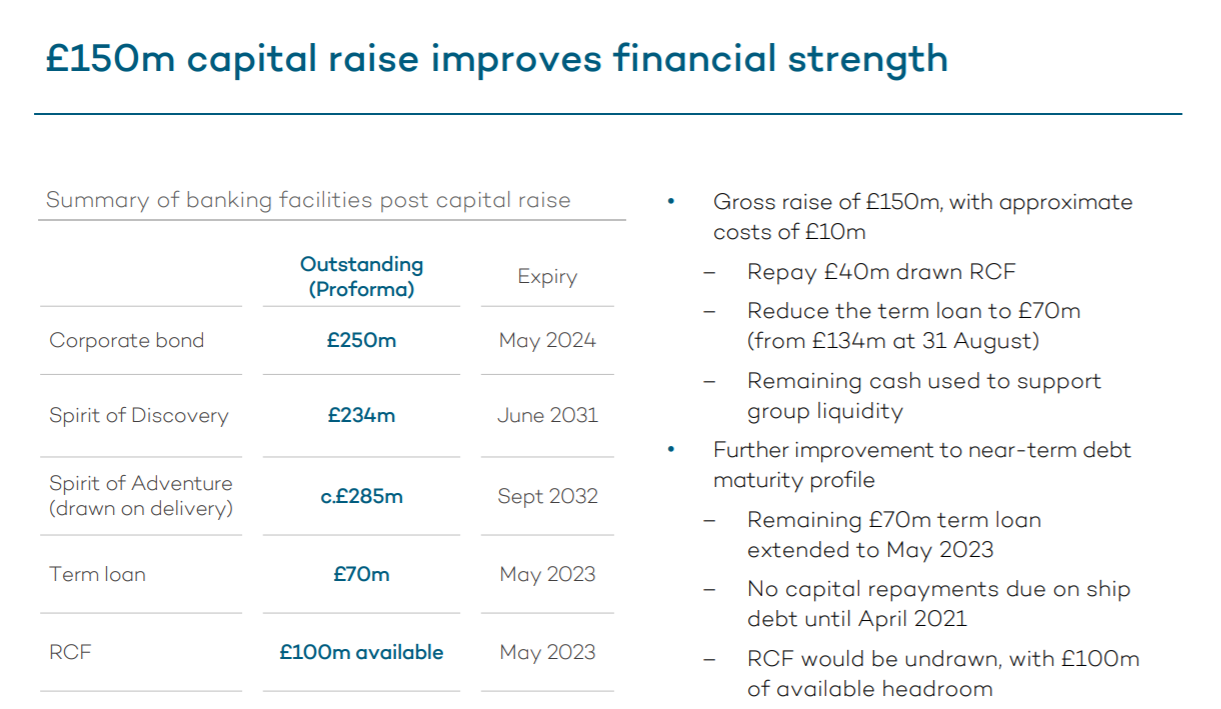

£150m capital raise improves financial strength

| Outstanding (Proforma) | Expiry |

|---|---|

| Corporate bond | £250m |

| Spirit of Discovery | £234m |

| Spirit of Adventure (drawn on delivery) | c.£285m |

| Term loan | £70m |

| RCF | £100m available |

- Gross raise of £150m, with approximate costs of £10m

- Repay £40m drawn RCF

- Reduce the term loan to £70m (from £134m at 31 August)

- Remaining cash used to support group liquidity

- Further improvement to near-term debt maturity profile

- Remaining £70m term loan extended to May 2023

- No capital repayments due on ship debt until April 2021

- RCF would be undrawn, with £100m of available headroom

Saga plc Interim results presentation 2020 slide 19

What is useful?

Saga provides a clear explanation of how the amount raised will be used. In addition, expiry dates are provided for amounts available.

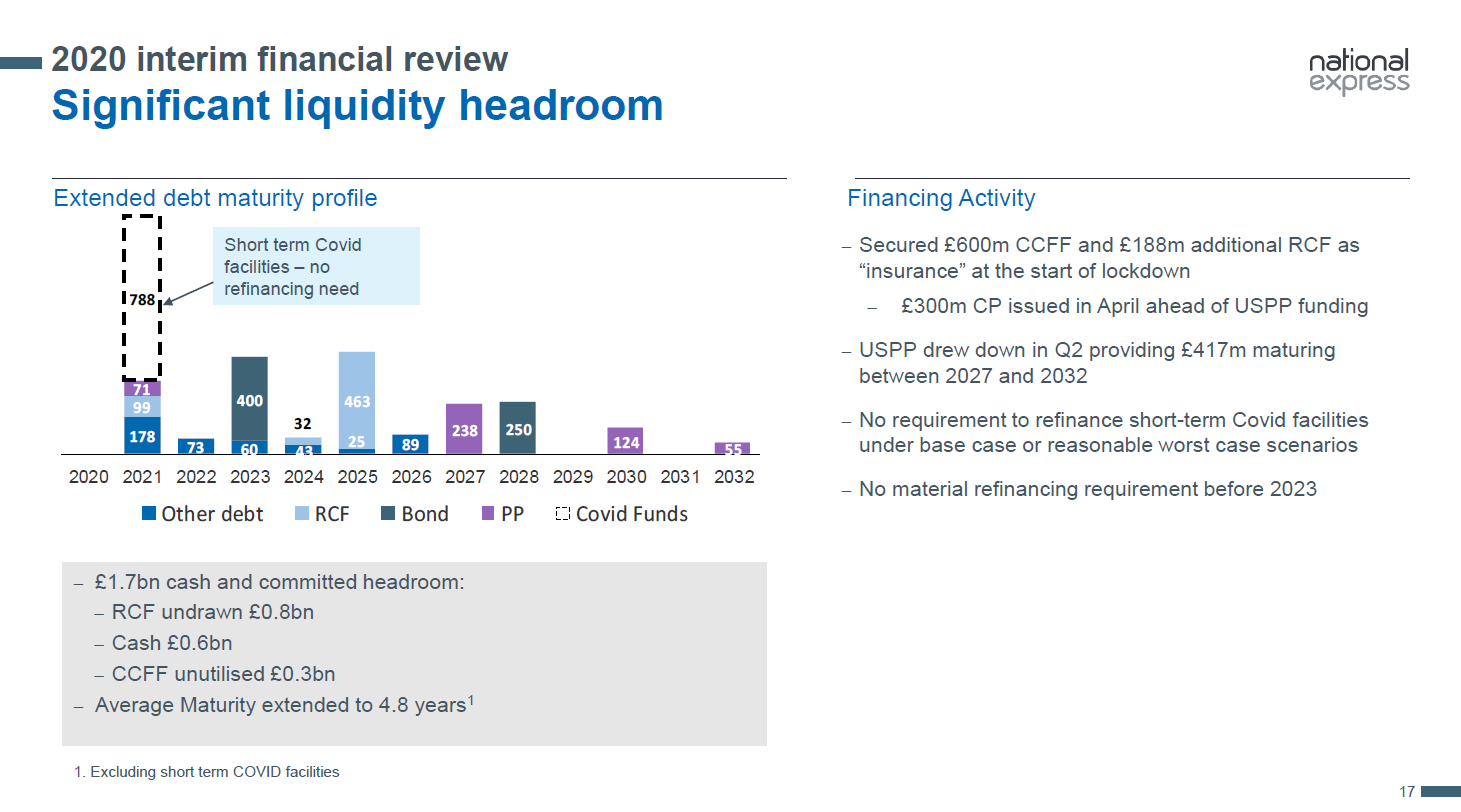

2020 interim financial review Significant liquidity headroom

Extended debt maturity profile Stacked bar chart showing extended debt maturity profile by year from 2020 to 2032, broken down by debt type including RCF, Bond, PP, and Covid Funds.

Financing Activity

- Secured £600m CCFF and £188m additional RCF as "insurance" at the start of lockdown

- £300m CP issued in April ahead of USPP funding

- USPP drew down in Q2 providing £417m maturing between 2027 and 2032

- No requirement to refinance short-term Covid facilities under base case or reasonable worst case scenarios

-

No material refinancing requirement before 2023

-

£1.7bn cash and committed headroom:

- RCF undrawn £0.8bn

- Cash £0.6bn

- CCFF unutilised £0.3bn

- Average Maturity extended to 4.8 years1

1Excluding short term COVID facilities

National Express plc Interim presentation 2020 slide 17

What is useful?

National Express clearly discloses the financing available, its maturity profile and what government schemes have been utilised.

A link to the base and worst case scenarios is also provided.

Actions (and stakeholder impacts)

Looking back

The two critical questions investors were trying to answer were:

- what is being done to reduce expenditure and cash outflow?

- what other actions can be taken to support viability?

Useful disclosures could be provided on short-term management actions to sustain, extend, and support the company's ability to remain viable. Some examples identified in our June 2020 reports specifically related to:

- suppliers, including information on supply chain and payments (Balfour Beatty, supply chain newsletter for the w/c 27 April 2020);

- government support and other concessions (Hawaiian Holdings, Form 8-K 22 April 2020); and

- dividends (Royal Dutch Shell, Dividend announcement 30 April 2020).

Recent developments

Companies have continued to disclose the actions they have taken in response to the pandemic's impact on their business.

However, the focus of some companies' discussions in this area is starting to shift from the actions taken when the economy was 'stopped', to the actions they are taking to ‘restart' their operations as the government restrictions in different jurisdictions change.

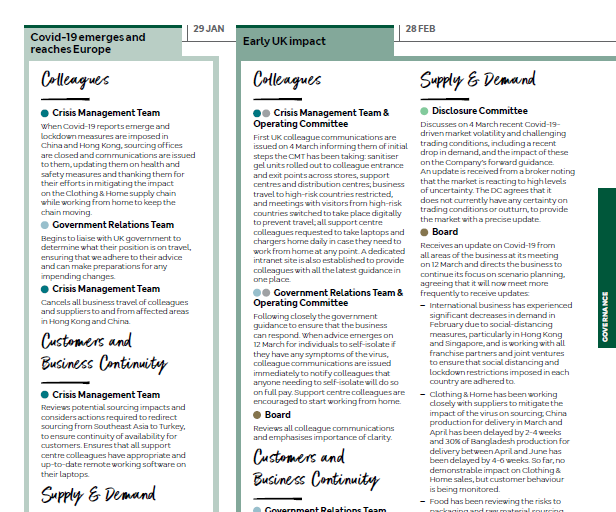

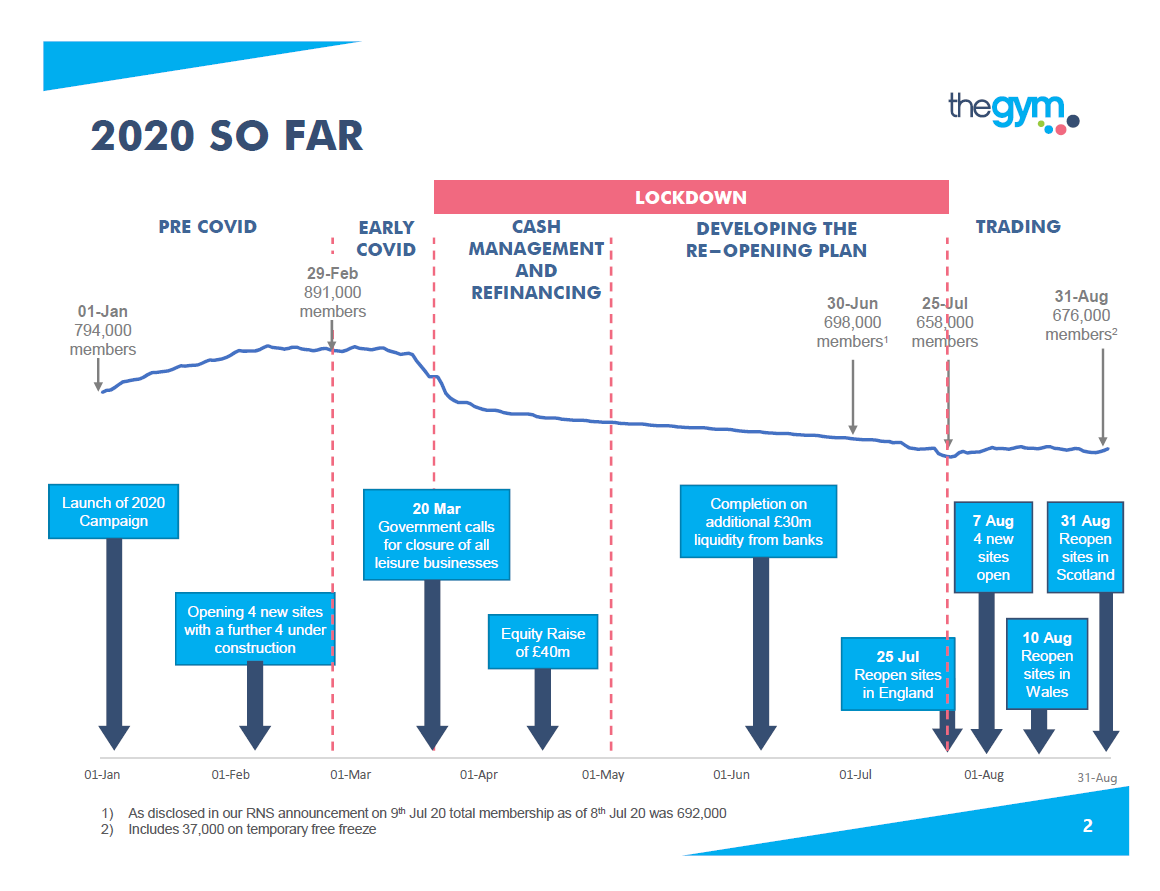

The format of this disclosure varies. Some companies utilise a tabular format, which can effectively summarise, in a single place, the effects and actions relating to all identified stakeholders. Others provide a timeline of events, the related actions taken at the respective dates and how stakeholders were impacted (refer to Marks and Spencer and The Gym Group) - this approach often identifies the 'knock-on' effects of events and actions.

Recent developments

The actions and impacts can be summarised in a single page with references to more detail in other areas of the report or there can be COVID-19 specific information added to all areas of the annual report.

Companies are providing updates regarding their assessment of the pandemic's effect on specific areas of their business. This can be done by discussing:

- sector-specific and geographical information;

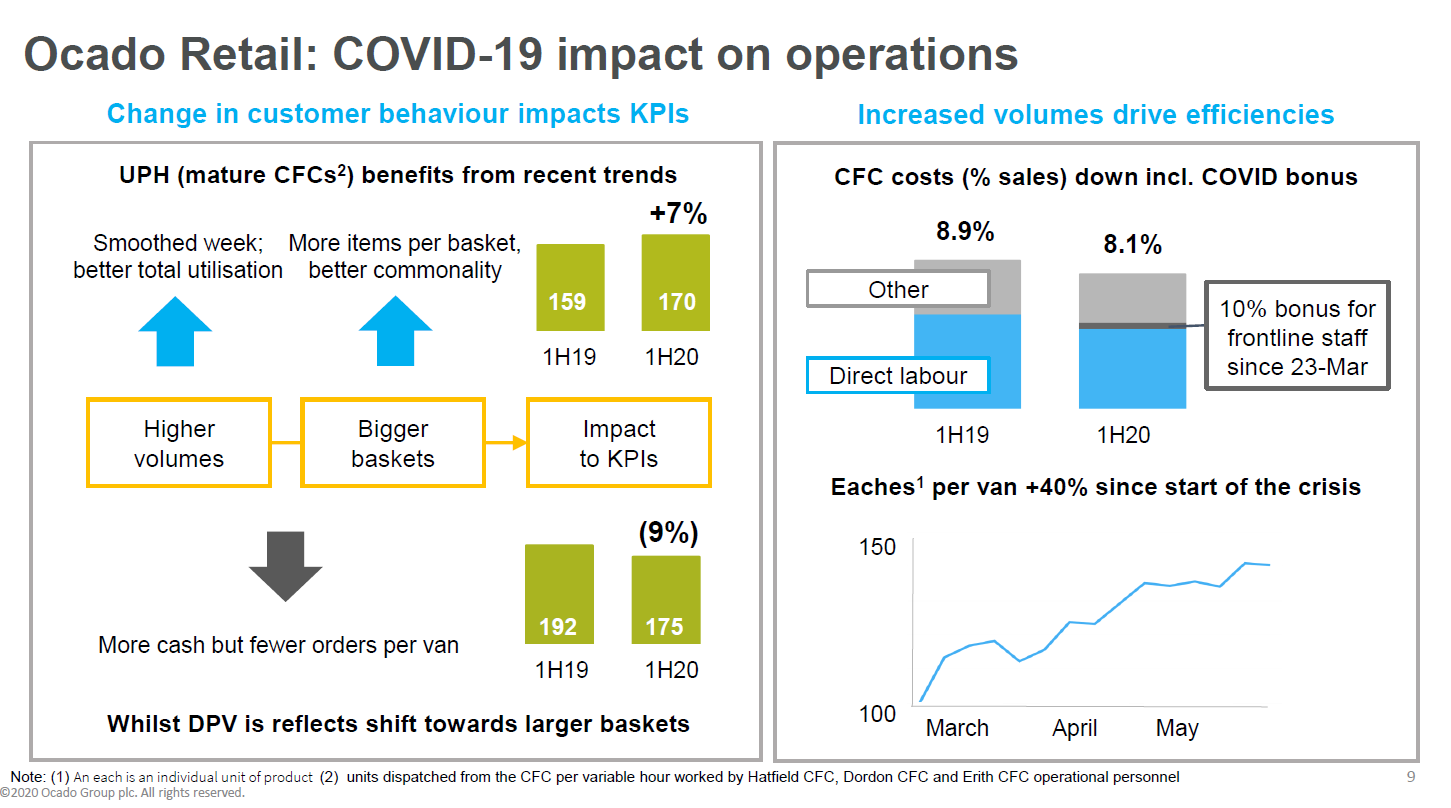

- customer behavioural information (refer to Ocado); and

- regulatory and political influence on operations.

Looking forward

Providing clear disclosure of the actions taken by management at different stages in the recovery process is very useful. Some companies have achieved this through use of timelines to indicate actions taken pre and post the lockdown period.

Such information should also be provided as further lockdown measures are put in place by governments or as recovery continues.

Stakeholder and S172 communications

In 2020, large and/or public companies under the Companies Act 2006 are required to prepare a Section 172 statement for the first time. As reflected in the Lab's latest publication, investors are particularly interested in a company's strategic decisions regarding stakeholders, as this assists them in developing a full picture of the company.

If you would be interested in finding out more about the Lab's current project on stakeholder and Section 172 reporting (and possibly taking part) you can find details on the Lab's section of the FRC's website.

Marks and Spencer Group plc Annual report 2020 page 51

Covid-19 emerges and reaches Europe

Colleagues

- Crisis Management Team When Covid-19 reports emerge and lockdown measures are imposed in China and Hong Kong, sourcing offices are closed and communications are issued to them, updating them on health and safety measures and thanking them for their efforts in mitigating the impact on the Clothing & Home supply chain while working from home to keep the chain moving.

- Government Relations Team Begins to liaise with UK government to determine what their position is on travel, ensuring that we adhere to their advice and can make preparations for any impending changes.

- Crisis Management Team Cancels all business travel of colleagues and suppliers to and from affected areas in Hong Kong and China.

Customers and Business Continuity

- Crisis Management Team Reviews potential sourcing impacts and considers actions required to redirect sourcing from Southeast Asia to Turkey, to ensure continuity of availability for customers. Ensures that all support centre colleagues have appropriate and up-to-date remote working software on their laptops.

Supply & Demand

Early UK impact

Colleagues

- Crisis Management Team & Operating Committee First UK colleague communications are issued on 4 March informing them of initial steps the CMT has been taking: sanitiser gel units rolled out to colleague entrance and exit points across stores, support centres and distribution centres, business travel to high-risk countries restricted, and meetings with visitors from high-risk countries switched to take place digitally to prevent travel; all support centre colleagues requested to take laptops and chargers home daily in case they need to work from home at any point. A dedicated intranet site is also established to provide colleagues with all the latest guidance in one place.

- Government Relations Team & Operating Committee Following closely the government guidance to ensure that the business can respond. When advice emerges on 12 March for individuals to self-isolate if they have any symptoms of the virus, colleague communications are issued immediately to notify colleagues that anyone needing to self-isolate will do so on full pay. Support centre colleagues are encouraged to start working from home.

- Board Reviews all colleague communications and emphasises importance of clarity.

Customers and Business Continuity

Government Relations Team

Supply & Demand

- Disclosure Committee Discusses on 4 March recent Covid-19-driven market volatility and challenging trading conditions, including a recent drop in demand, and the impact of these on the Company's forward guidance. An update is received from a broker noting that the market is reacting to high levels of uncertainty. The DC agrees that it does not currently have any certainty on trading conditions or outturn, to provide the market with a precise update.

- Board

Receives an update on Covid-19 from all areas of the business at its meeting on 12 March and directs the business to continue its focus on scenario planning, agreeing that it will now meet more frequently to receive updates:

- International business has experienced significant decreases in demand in February due to social-distancing measures, particularly in Hong Kong and Singapore, and is working with all franchise partners and joint ventures to ensure that social distancing and lockdown restrictions imposed in each country are adhered to.

- Clothing & Home has been working closely with suppliers to mitigate the impact of the virus on sourcing, China production for delivery in March and April has been delayed by 2-4 weeks and 30% of Bangladesh production for delivery between April and June has been delayed by 4-6 weeks. So far, no demonstrable impact on Clothing & Home sales, but customer behaviour is being monitored.

- Food has been reviewing the risks to working with and ensuring secure supply.

GOVERNANCE

What is useful?

Marks and Spencer incorporates company actions, expectations of the future (at the time) and 'normal' non-COVID-19 trends into this disclosure.

2020 SO FAR (The Gym Group)

Timeline chart "2020 SO FAR" showing member numbers alongside key events and phases of the COVID-19 lockdown and reopening for a gym business.

PRE COVID 01-Jan: 794,000 members 29-Feb: 891,000 members * Launch of 2020 Campaign * Opening 4 new sites with a further 4 under construction

LOCKDOWN

EARLY COVID * 20 Mar: Government calls for closure of all leisure businesses * Equity Raise of £40m

CASH MANAGEMENT AND REFINANCING * Completion on additional £30m liquidity from banks

DEVELOPING THE RE-OPENING PLAN 30-Jun: 698,000 members[^2] 25-Jul: 658,000 members[^3]

TRADING 31-Aug: 676,000 members[^4] * 7 Aug: 4 new sites open (Scotland) * 25 Jul: Reopen sites in England * 10 Aug: Reopen sites in Wales * 31-Aug: Member numbers continue.

The Gym Group plc Half year 2020 results presentation slide 2

What is useful?

The Gym Group highlights the actions, using a timeline, that it has taken in response to COVID-19 in the context of the external environment and including the lockdown period. The actions taken during lockdown are divided between those to ensure liquidity while the industry was 'closed' as well as those that relate to its relaunch post-lockdown. The impact on business (in terms of membership) is indicated, too.

2As disclosed in our RNS announcement on 9th Jul 20 total membership as of 8th Jul 20 was 692,000 3Includes 37,000 on temporary free freeze 4Includes 37,000 on temporary free freeze

COVID-19 and performance

The impacts of COVID-19 on many companies is significant. It is therefore important to explain the impacts to users in a clear way using appropriate performance measures and to provide context and comparatives where relevant.

Companies should try to link the actions they have taken in response to the pandemic and associated challenges, the external influences and drivers of their business and their plans and strategies for the future to their performance measures.

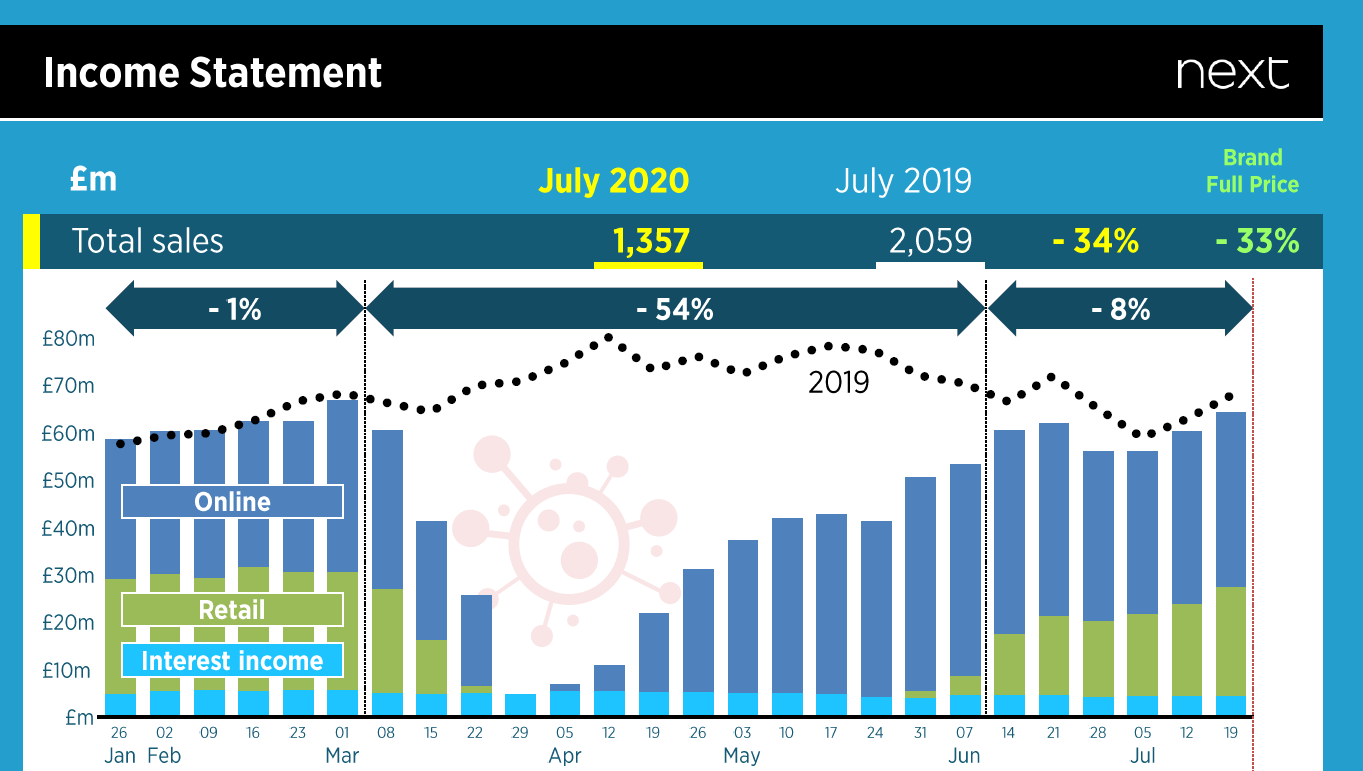

There are several ways to illustrate how companies' profits, key performance indicators and revenue drivers have been impacted, many of which are illustrated in the identified examples that follow (refer to Next).

Good approaches include providing:

- comparatives;

- information at different ‘stages' of the pandemic;

- percentage changes and trends;

- actions taken, that could influence performance, during the period; and

- clearly labelled and relevant graphs.

A previous Lab report on performance metrics set out five principles for their disclosure. Performance metrics should be: aligned to strategy; transparent; in context; reliable and consistent. Companies should take this into account when describing effects on their performance metrics and not produce misleading or inconsistent measures.

On 20 May, the FRC updated its COVID-19 related guidance for companies to outline its expectations regarding the reporting of exceptional or similar items and Alternative Performance Measures. This note provides the following:

APMs should also be presented consistently year-on-year. However, there may be circumstances where the Covid-19 crisis has, for example, resulted in a company making changes to its operations or business model. These may result in changes to the APMs used to run and monitor the business. In these circumstances, readers should be informed of any such changes and provided with an explanation of why they provide reliable and more relevant information.

APMs which attempt to provide a measure of ‘normalised' or 'pro-forma' results, excluding the estimated effect of the Covid-19 crisis, are likely to be highly subjective and, therefore, potentially unreliable. In addition to the subjectivity arising around which costs to exclude, in most cases Covid-19 is likely to have resulted in reductions in revenues. Any adjustment for lost revenues would be hypothetical and could not be reflected reliably in an APM. We do not expect companies to provide these measures; for example, by including them in a ‘third-column' income statement presentation.

KEY Q3 FINANCIALS

| Three months ended | 30 June 2020 | 30 June 2019 | Change Fav./(adv.) |

|---|---|---|---|

| Number of flights | 709 | 165,656 | (99.6%) |

| Number of aircraft in operation | 10 | 315 | (96.8%) |

| Passengers (thousand) [^5] | 117 | 26,382 | (99.6%) |

| Seats flown (thousand) | 132 | 28,772 | (99.5%) |

| Load factor (%) [^6] | 88.9% | 91.7% | (2.8ppt) |

| Total group revenue (£ million) | 7 | 1,761 | (99.6%) |

| Total group headline cost (£ million) | (332.1) | (1,587.2) | 79.1% |

| Group headline loss before tax (£ million) | (324.5) | 174.2 |

What is useful?

EasyJet provides key items that impact the company along with comparatives and percentage changes.

easyJet plc Trading Statement Q3 2020 page 4

5easyJet passenger load factor 6easyJet passenger load factor

Ocado Retail: COVID-19 impact on operations

Infographic on Ocado Retail's COVID-19 operational impact, showing changes in customer behavior, UPH, CFC costs, and "Eaches per van" through various charts.

Change in customer behaviour impacts KPIs

UPH (mature CFCs[^7]) benefits from recent trends +7% Smoothed week; better total utilisation More items per basket, better commonality * 1H19: 159 * 1H20: 170

Higher volumes Bigger baskets Impact to KPIs

(9%) More cash but fewer orders per van * 1H19: 192 * 1H20: 175

Whilst DPV is reflects shift towards larger baskets

Increased volumes drive efficiencies

CFC costs (% sales) down incl. COVID bonus 8.9% 8.1% * Other * Direct labour 10% bonus for frontline staff since 23-Mar

Eaches[^8] per van +40% since start of the crisis (Chart showing 'Eaches per van' increasing from March to May 2020, from 100 to 150)

Ocado Group plc First Half 2020 results presentation slide 9

What is useful?

Ocado indicates how a change in customer behaviour has impacted its KPIs.

7An each is an individual unit of product 8units dispatched from the CFC per variable hour worked by Hatfield CFC, Dordon CFC and Erith CFC operational personnel

Next plc Income Statement

Income Statement

Next weekly income statement, breaking down total sales into online, retail, and interest income for July 2020 vs 2019.

-

£m Total sales

- July 2020: 1,357

- July 2019: 2,059

- Change: -34%

- Brand Full Price: -33%

-

Graph showing weekly sales from Jan to Jul for 2019 and 2020, with 2020 showing a sharp decline during April-May lockdown and recovery. Sales broken into Online, Retail, Interest income.

- Total Sales % change: -1% (Jan-Feb), -54% (Mar-Apr), -8% (May-Jun)

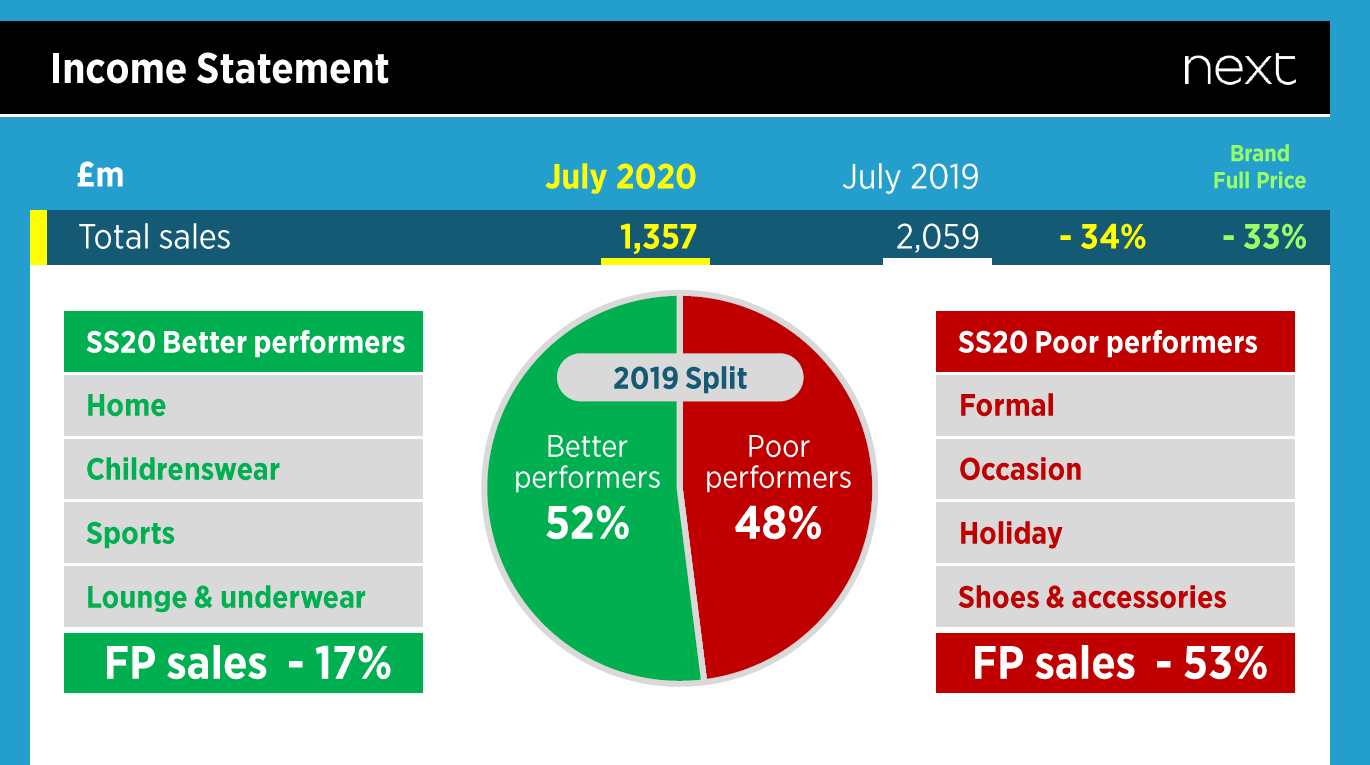

Income Statement

Income statement and pie chart showing 2019 sales split between better (52%) and poor (48%) performers, with details on categories and full price sales.

- £m Total sales

- July 2020: 1,357

- July 2019: 2,059

- Change: -34%

- Brand Full Price: -33%

SS20 Better performers * Home * Childrenswear * Sports * Lounge & underwear * FP sales - 17%

2019 Split * Better performers: 52% * Poor performers: 48%

SS20 Poor performers * Formal * Occasion * Holiday * Shoes & accessories * FP sales - 53%

Next plc Half year 2020 results presentation slides 6 and 8

What is useful?

Next's disclosures effectively convey a few key messages. The graph presented clearly indicates the current year total sales broken down by ‘type' of revenue and when it was earned. It highlights the effect of lockdown and provides comparatives. The percentage change from the previous period is also provided. All of this information is presented in a single, easy to follow slide. In later slides, similar information is provided on a per-division basis. The company also shows how sales of items have changed given the lockdown response to the pandemic.

The future

Looking back

Investors wanted to know how the company was protecting its key assets and value drivers.

Investors seek disclosures on how decisions made in response to the pandemic will affect the future of the company, and on management's views on the future of the business itself, including what different scenarios might mean for the company. These could include:

- the company's purpose and whether it needs to change;

- how the company takes account of and supports its stakeholders and its drivers of value;

- base case, upside and downside scenarios and assumptions; and

- longer-term trends and impacts, including how the business model may need to adapt, and changes to the company's aims and prospects.

Recent developments

Companies continue to communicate the higher than normal level of uncertainty as a result of the pandemic.

Disclosure around the future is generally incorporated into going concern and viability disclosures, which is where the majority of scenario-based disclosure is also presented.

Recent developments

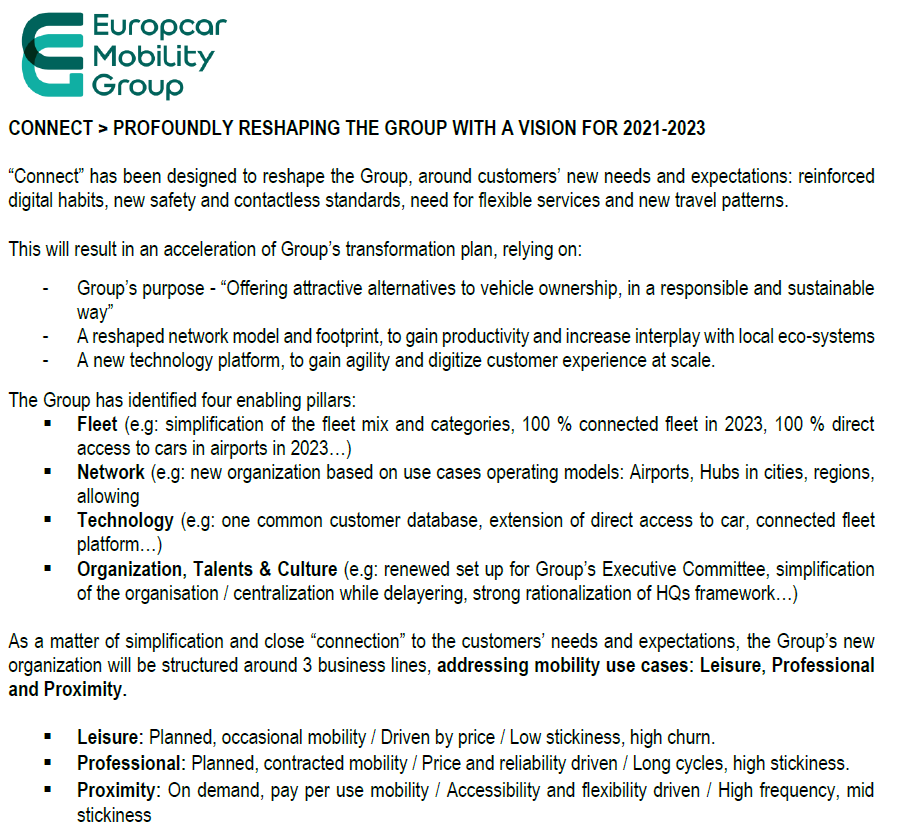

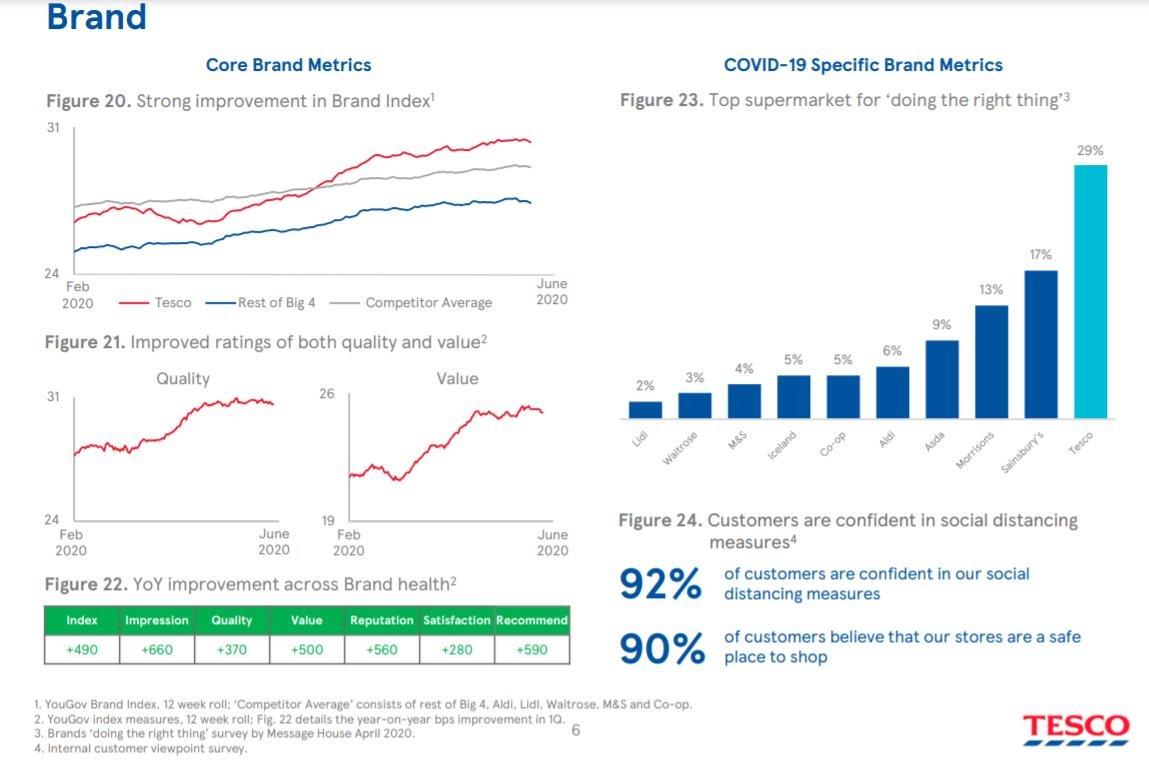

In order to 'protect their future', companies have announced a number of actions. These include corporate restructurings and streamlining of the business (refer to Europcar Mobility Group and Lufthansa). Some entities have announced acceleration of their previously announced transformation programmes. Some of the actions taken may have led to unexpected, positive consequences, such as a positive impact on a brand (refer to Tesco).

These reassessments of companies' operations may be as a result of:

- external business limitations, for instance, political restrictions in different countries which may impact trading in those countries or supply chains (refer to SThree, Ocado and Prudential);

- reimagining their purpose and business model; and

- the need to control costs (this is often achieved through redundancies).

There is some disclosure of recovery scenarios. However, since the Lab's reports were released in June 2020, the expectation of the shape of recovery in the economy has changed with a variety of possible shapes of recovery. This should lead to updated scenarios being provided in reports issued over time.

Looking forward

There is some information that, if provided by a company, would assist investors to formulate their view of the company's prospects.

Such information could include:

- an explanation of management's view of the company's future and prospects in the context of actions taken by them and the challenges they face;

- more granular information by geographical location in which the company operates to illustrate the nature of differing external pressures per location; and

- details regarding opportunities that may exist for the company.

Europcar Mobility Group: CONNECT > PROFOUNDLY RESHAPING THE GROUP WITH A VISION FOR 2021-2023

"Connect" has been designed to reshape the Group, around customers' new needs and expectations: reinforced digital habits, new safety and contactless standards, need for flexible services and new travel patterns.

This will result in an acceleration of Group's transformation plan, relying on:

- Group's purpose - "Offering attractive alternatives to vehicle ownership, in a responsible and sustainable way"

- A reshaped network model and footprint, to gain productivity and increase interplay with local eco-systems

- A new technology platform, to gain agility and digitize customer experience at scale.

The Group has identified four enabling pillars:

- Fleet (e.g: simplification of the fleet mix and categories, 100% connected fleet in 2023, 100% direct access to cars in airports in 2023...)

- Network (e.g: new organization based on use cases operating models: Airports, Hubs in cities, regions, allowing...)

- Technology (e.g: one common customer database, extension of direct access to car, connected fleet platform...)

- Organization, Talents & Culture (e.g: renewed set up for Group's Executive Committee, simplification of the organisation / centralization while delayering, strong rationalization of HQs fram...)

As a matter of simplification and close "connection" to the customers' needs and expectations organization will be structured around 3 business lines, addressing mobility use cases: Leisure and Proximity.

- Leisure: Planned, occasional mobility / Driven by price / Low stickiness, high churn.

- Professional: Planned, contracted mobility / Price and reliability driven / Long cycles.

- Proximity: On demand, pay per use mobility / Accessibility and flexibility driven / High stickiness.

Europcar Mobility Group First Half results 2020 press release page 7

What is useful?

Europcar outlines its accelerated transformation given the changes in the external environment and customer needs. The decision is consistent with the company's purpose and illustrates consideration of a major stakeholder's (customers) needs.

The focus on efficiency in a number of areas also indicates the focus on cost-control in the future.

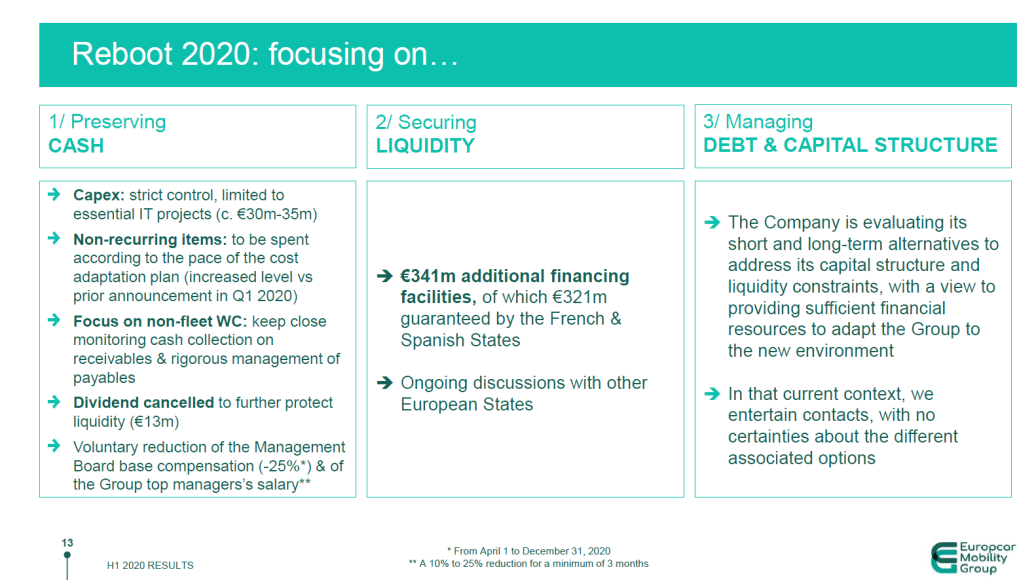

Reboot 2020: focusing on...

Reboot 2020: focusing on...

1/ Preserving CASH * → Capex: strict control, limited to essential IT projects (c. €30m-35m) * → Non-recurring items: to be spent according to the pace of the cost adaptation plan (increased level vs prior announcement in Q1 2020) * → Focus on non-fleet WC: keep close monitoring cash collection on receivables & rigorous management of payables * → Dividend cancelled to further protect liquidity (€13m) * → Voluntary reduction of the Management Board base compensation (-25%) & of the Group top managers's salary*

2/ Securing LIQUIDITY * → €341m additional financing facilities, of which €321m guaranteed by the French & Spanish States * → Ongoing discussions with other European States

3/ Managing DEBT & CAPITAL STRUCTURE * → The Company is evaluating its short and long-term alternatives to address its capital structure and liquidity constraints, with a view to providing sufficient financial resources to adapt the Group to the new environment * → In that current context, we entertain contacts, with no certainties about the different associated options

Europcar Mobility Group First Half results presentation 2020 slide 13

What is useful?

Europcar discusses the short-term steps it has taken to establish a platform for its ‘Reboot 2020' programme. This programme lays the foundation for the reshaping of the group in the medium term under the 'Connect' Programme.

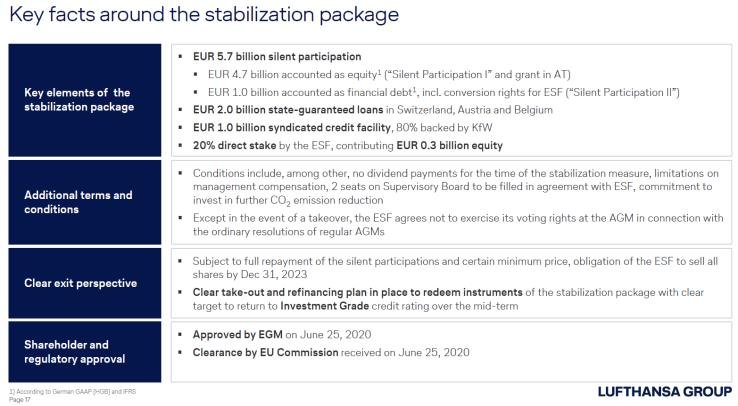

Financial Stabilization Package - Key Points (Lufthansa Group)

- Stabilization package agreed with the German Economic Stabilization Fund (ESF) ensures going concern and viability of the Lufthansa Group

- Result of intense negotiations with the ESF and EU Commission

- Secures the necessary strategic and operational flexibility of Lufthansa Group in the current challenging environment

- Preserves integrity of Lufthansa Group as an integrated airline group

- Balanced approach protecting all stakeholder groups (shareholders, creditors, customers, business partners, employees, German tax payers)

Lufthansa Group Investor Meeting Presentation September 2020 slides 16, 17, 21, 25, 26 and 51

What is useful?

Lufthansa has clearly laid out its plan and the related actions that need to be taken in order to protect the future of the company. It has imagined the ‘new normal' and how the company will adapt to it. It illustrates an approach that considers how current and future resources have been secured to ensure going concern and viability and the actions taken based on the needs of various stakeholder groups. This group of disclosures tells a story of how the company has reacted to and been proactive in response to the external challenges.

Key facts around the stabilization package

| Key elements of the stabilization package | EUR 5.7 billion silent participation - EUR 4.7 billion accounted as equity2 ("Silent Participation I" and grant in AT) - EUR 1.0 billion accounted as financial debt3, incl. conversion rights for ESF ("Silent Participation II") EUR 2.0 billion state-guaranteed loans in Switzerland, Austria and Belgium EUR 1.0 billion syndicated credit facility, 80% backed by KfW 20% direct stake by the ESF, contributing EUR 0.3 billion equity |

| Additional terms and conditions | - Conditions include, among other, no dividend payments for the time of the stabilization measure, limitations on management compensation, 2 seats on Supervisory Board to be filled in agreement with ESF, commitment to invest in further CO2 emission reduction - Except in the event of a takeover, the ESF agrees not to exercise its voting rights at the AGM in connection with the ordinary resolutions of regular AGMs |

| Clear exit perspective | - Subject to full repayment of the silent participations and certain minimum price, obligation of the ESF to sell all shares by Dec 31, 2023 - Clear take-out and refinancing plan in place to redeem instruments of the stabilization package with clear target to return to Investment Grade credit rating over the mid-term |

| Shareholder and regulatory approval | - Approved by EGM on June 25, 2020 - Clearance by EU Commission received on June 25, 2020 |

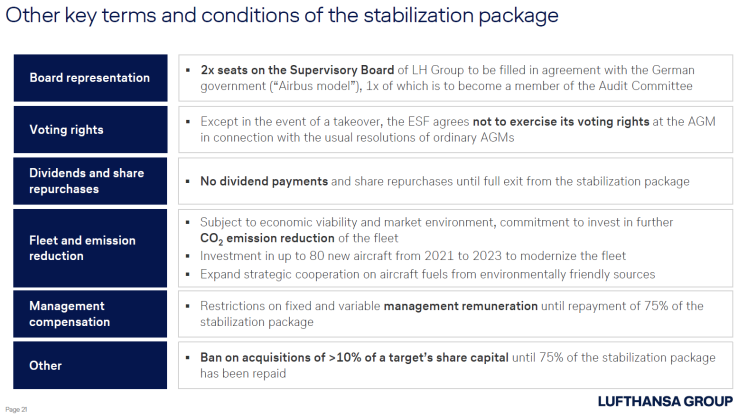

Other key terms and conditions of the stabilization package

| Board representation | 2x seats on the Supervisory Board of LH Group to be filled in agreement with the German government ("Airbus model"), 1x of which is to become a member of the Audit Committee |

| Voting rights | Except in the event of a takeover, the ESF agrees not to exercise its voting rights at the AGM in connection with the usual resolutions of ordinary AGMs |

| Dividends and share repurchases | No dividend payments and share repurchases until full exit from the stabilization package |

| Fleet and emission reduction | Subject to economic viability and market environment, commitment to invest in further CO2 emission reduction of the fleet - Investment in up to 80 new aircraft from 2021 to 2023 to modernize the fleet - Expand strategic cooperation on aircraft fuels from environmentally friendly sources |

| Management compensation | Restrictions on fixed and variable management remuneration until repayment of 75% of the stabilization package |

| Other | Ban on acquisitions of >10% of a target's share capital until 75% of the stabilization package has been repaid |

Core elements of the restructuring program ReNew

Organizational chart illustrating the Lufthansa Group's ReNew restructuring program, outlining business unit and corporate initiatives.

ReStructure Business unit restructuring

Business Units: Lufthansa, Eurowings, Lufthansa Cargo, Miles & More, LSG group. Corporate:

ReFocus Portfolio optimization, partnering opportunities

ReOrg Corporate and functional restructuring

RePay Capital market initiatives and refinancing of credit facilities

Ambitious targets for the New Normal

Diagram showing ambitious 2023 targets for the company.

Targets 2023

- Business unit restructuring plans achieved

- Maximum payback of stabilization package

- 22,000 FTE reduced to adjust to new size

- 15% productivity increase to reach ASK level of 2019 in 2023

- Redimensioned minus 100 A/C in 10 AOCS

- Corporate Headquarter and LH Group portfolio restructured to contribute to airline focus

Tesco plc First Quarter Trading Statement additional information pack slide 6

Brand

Core Brand Metrics

Figure 20. Strong improvement in Brand Index4 (Line chart showing Tesco's brand index trending higher than "Rest of Big 4" and "Competitor Average" from Feb 2020 to June 2020)

Figure 21. Improved ratings of both quality and value5 (Line charts showing Tesco's quality and value ratings trending higher from Feb 2020 to June 2020)

Figure 22. YoY improvement across Brand health6

| Index | Impression | Quality | Value | Reputation | Satisfaction | Recommend |

|---|---|---|---|---|---|---|

| +490 | +660 | +370 | +500 | +560 | +280 | +590 |

COVID-19 Specific Brand Metrics

Figure 23. Top supermarket for 'doing the right thing'7 (Bar chart showing Tesco at 29% for "doing the right thing", highest among other supermarkets)

Figure 24. Customers are confident in social distancing measures8 92% of customers are confident in our social distancing measures 90% of customers believe that our stores are a safe place to shop

What is useful?

Tesco set out how the company's response to the pandemic has had a positive effect for the company – in this instance, on strength of brand.

9YouGov Brand Index, 12 week roll: 'Competitor Average' consists of rest of Big 4. Aldi, Lidl, Waitrose, M&S and Co-op. 10YouGov index measures, 12 week roll; Fig. 22 details the year-on-year bps improvement in 1Q. 11Brands 'doing the right thing' survey by Message House April 2020. 12Internal customer viewpoint survey 13Internal customer viewpoint survey 14Internal customer viewpoint survey 15Internal customer viewpoint survey

SThree plc Interim report 2020 page 5

Our view of the future

Our immediate priorities

Whilst the global fight to contain the virus continues we will be in our ongoing crisis management phase, volatility will persist, and demand will be uncertain as businesses deal with the impact of government responses and adapt to this new environment.

As such, it remains impossible to know exactly what lies ahead while the pandemic continues, and regions deal with their current outbreak level. It should also be noted that as we have seen with the "R" rate in Germany and a number of other regions, recovery is not necessarily a straight line. Notwithstanding the lack of clarity on what the future looks like, the Group will continue to engage with candidates and with clients to deeply understand trends that create products of the future. Alongside this, we will drive operational improvement within our core businesses, focused around people, process and technology, whilst of course, underpinned by disciplined cost management.

It is clear that this crisis will have a lasting impact, and SThree is therefore working to ensure we are best positioned to work in the new world. This includes learning to operate in a blended environment of working, navigating our own recruitment and onboarding, investing in learning and development. A good example of how we are facilitating this is in Germany, where we did not furlough any of our staff. Whilst the office in Germany has been open for some time, the team there are being encouraged to adapt and adjust to working effectively, irrespective of where they are located. Alongside these operational changes, we are improving the way we capitalise on our data, investing in virtual interview and placement solutions and increasing knowledge sharing across our global business. We are confident that we have the right ingredients to steer the Group effectively in the new world of work.

Secular trends

As market trends shifted in response to COVID-19 outbreak, the criticality of STEM skills has been highlighted. In the medium to long term the pandemic has accelerated the demand for STEM skills and digital transformation is a priority for every business and every sector. Alongside this, the seismic shift in working practices has changed the workplace and many businesses are adopting these for the long term, with the notion of flexible working and flexible workforces of the future entering the lexicon of business as a key priority. SThree sits at the centre of these two long term secular trends; STEM talent and Flexible Working, that have now been accelerated as a result of this crisis.

We have been engaging with our customers in critical conversations with them to better understand their needs and priorities, for now and into the future, to help them drive their businesses forward. Many customers are discussing the ability to widen the pool of talent with remote working, and the fact that being present on site will not be required*. Our scale, local knowledge and true expertise in STEM positions us well to help those businesses with whatever their staffing needs may be. In times like this there is even more value in our niche market approach and knowledge base.

Investing in the future to drive our strategy

Our strategy is absolutely the right one; our focus on STEM and flexible working has underpinned our resilience and will continue to do so.

Notwithstanding the current uncertainties, our focus on building for the future has not wavered, and we are investing in the areas that we are confident will drive growth. This includes our own digital enablement, continuing our use of data and insights to drive the business, investing in the right tools and technology, continued learning and development and being judicious about where we focus our headcount. We came into this period selectively investing in the right markets and will continue to do so to position us for the future.

What is useful?

SThree provides a useful analysis that identifies the different geography of its operations. It highlights trends in the market, how the company has responded to these and indicates how the company is being positioned for the future.

Ocado Group plc First Half 2020 results presentation slide 16

COVID-19: significant and permanent, global channel shift

Infographic analyzing COVID-19's impact on online grocery, including market share, consumer behavior statistics, and market opportunity data.

Significant channel shift, globally

Online share of grocery almost doubled in a few months in the UK * Jun-19: 7% * Jun-20: 13%

This is a global trend: * 6x level of online sales (Jun-20 vs Aug-19 in USA) * triple digit yoy sales growth (major online grocery platforms during COVID-19 outbreak in China)

Channel shift achieved despite constrained supply globally

We expect growth is sustainable

Customers expect to continue shopping online after the crisis * 30% UK consumers say they will shop more for groceries online * 90% US customers say they will continue online grocery shopping * 56% Chinese consumers shopping grocery online more often than before pandemic

It is easier to acquire customers who have shopped online before

The opportunity is huge

Commitments for 54 CFCs9 with large runway for growth

Partners with £210bn annual sales

Key markets worth £2.8tn (Diagram: large circle representing 'Key markets worth £2.8tn', with a smaller blue circle within it)

Opportunity expands as markets develop and technology improves

We believe we have seen a redrawing of the global landscape in online grocery

16assuming a standard CFC of £350m capacity at maturity

Ocado Group plc First Half 2020 results presentation slide 16

What is useful?

Ocado provides a clear link between its current supply situation and the shift to online shopping. The company also indicates its planned growth into the online market and highlights the potential future opportunity in the market.

Prudential plc 2020 Half year results presentation slide 20

Operating environment: Several markets in restart mode with planned easing measures

Gantt chart and table showing COVID-19 restriction measures and timelines for several countries, along with the current status of each measure.

Restriction measures & timeline

| Country | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug |

|---|---|---|---|---|---|---|---|---|

| China | ||||||||

| Taiwan | ||||||||

| Vietnam | ||||||||

| Thailand | ||||||||

| Hong Kong | ||||||||

| Malaysia | ||||||||

| India | ||||||||

| Philippines | ||||||||

| Indonesia | ||||||||

| Singapore |

Current status of measures * China: Easing measures; internal travel and business activity resumed nationwide from 26 March with strict measures in place to respond and contain local spikes * Taiwan: Internal travel and normal business activity resumed from 1 May with ongoing measures in place to contain any infection spikes * Vietnam: From 30 July social distancing measures re-imposed; non-essential businesses closed and religious activities suspended in Hanoi and Ho Chi Minh City * Thailand: Phased easing of restrictions to allow movement and businesses to resume from 3 May; curfew lifted on 14 June while ongoing social distancing extended till 31 Aug * Hong Kong: New rounds of restrictions were placed on 15 July. Border with Mainland China remains closed * Malaysia: Recovery Movement Control Order enacted from 10 June to allow business to resume under ongoing disease prevention measures * India: Domestic flights resuming on 25 May; easing of business/religious restrictions from 8 June; national controls remain till 31 August * Philippines: Renewed lockdown in Manila and nearby provinces from 4 August * Indonesia: Large scale social restrictions in Jakarta eased on 5 June, but the transitional period of holding activities at 50% remains in place * Singapore: A three-phase plan to resume business began on 2 June. In Phase 1, businesses with low Covid-risk re-opened. In the current Phase 2, retail services and most businesses have resumed. In Phase 3, social/cultural activities will return to normal.

Legend: * Before Covid restrictions * Modest containment restrictions applied * Significant containment restrictions applied but no lockdown * Lockdown period

17Lockdown definition varies among countries but generally refers to date non-essential businesses were ordered to shut down. Easing of lockdown comes with certain restrictions in all the countries; PCA Analysis. Updated as of 30 July 2020.

What is useful?

Prudential provides insight into its operating environment by describing the approach taken by each jurisdiction in handling the pandemic and the restriction measures over time. This contextualises the performance of the company over the period.

The Lab has published reports covering a wide range of reporting topics.

Reports include:

Blockchain and the future of corporate reporting

How does it measure up? June 2018

Reports and information about the Lab can be found at: https://www.frc.org.uk/Lab

The FRC's mission is to promote transparency and integrity in business. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2020

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Follow us on Twitter @FRCnews or Linked in

Footnotes

-

According to German GAAP (HGB) and IFRS ↩

-

According to German GAAP (HGB) and IFRS ↩

-

According to German GAAP (HGB) and IFRS ↩

-

YouGov Brand Index, 12 week roll: 'Competitor Average' consists of rest of Big 4. Aldi, Lidl, Waitrose, M&S and Co-op. ↩

-

YouGov index measures, 12 week roll; Fig. 22 details the year-on-year bps improvement in 1Q. ↩

-

Brands 'doing the right thing' survey by Message House April 2020. ↩

-

Internal customer viewpoint survey. ↩

-

Internal customer viewpoint survey. ↩

-

(1) assuming a standard CFC of £350m capacity at maturity ↩