The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Climate Thematic – Investors

Introduction

Throughout 2020, the FRC has been undertaking a thematic review of climate-related considerations by boards, companies, auditors, investors and professional associations. This report forms part of that review and addresses the question 'what do investors want to see?'. It also includes the FRC's review of early reporting against the UK Stewardship Code 2020.

Other aspects of the FRC's findings can be found at the following links:

- The consolidated findings across corporate reporting and audit can be found here.

- The detailed findings on governance can be found here.

- The detailed findings on corporate reporting can be found here.

- The detailed findings on audit can be found here.

- The detailed findings on professional oversight can be found here.

Lab examples

This report highlights examples of reporting practice that were identified as better practice, with reference to what investors want to see from reporting, as highlighted in interviews during this thematic, and with reference to the Lab's report last year.

The FRC's corporate reporting report, carried out as part of this thematic review, identifies examples of better practice reporting within the sample of reports reviewed, within the UK regulatory framework and within the annual report and accounts. Some of the disclosures highlighted in this report are from reporting that is outside of a company's annual report and accounts, and some go beyond the current requirements of the UK regulatory framework.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. Nor does it provide any assurances of the viability or going concern of that company and should therefore not be relied upon as such. Investors have contributed to this project at a conceptual level. The examples used illustrate the principles and should not be taken as confirmation of acceptance of the company's reporting more generally.

We asked: What do investors want to see?

Why is this important?

As climate change has the potential to impact societies and companies around the world, investors will need to respond to its far-reaching impacts. Institutional investors are also facing changes to their own regulatory and reporting environment, as the expectations of how they will invest for a sustainable future also grow.

Investors play an important role in signalling, through investment decision-making, engagement activities and other means, their views on corporate activities. They assess and respond to corporate reporting through investment decisions and are calling for more information about the climate-related challenges companies face. Information on climate-related issues must also flow through the investment chain not only to allow investors to make decisions, but also to report to their clients and beneficiaries where relevant.

What did we do?

Over the course of 2020 the Lab held discussions with over 20 investors and investor groups to gather views on what they wanted to see from the integration of climate-related issues into corporate reporting and audit. Investors were asked whether the views shared in the Lab's 2019 report on this topic - Climate-related corporate reporting – Where to next? held true or had developed further. They were also asked to identify examples of reporting under the Task Force on Climate-related Financial Disclosures Framework that they felt constituted better practice.

We also considered investors' adherence to the expectations of the UK Stewardship Code (Stewardship Code). While we will be accepting the first round of applications to the new Stewardship Code in 2021, we conducted a review of 21 responsible investment, active ownership and stewardship reports and looked at how well prospective signatories are addressing the higher standards we have set.

What did we find?

Investors support the Task Force on Climate-related Financial Disclosures framework, but also expect to see disclosures regarding the financial implications of climate change. Investors are themselves facing a changing regulatory environment.

Diagram showing interrelation of climate reporting components:

A central "Investors" block is surrounded by four gears: * "Corporate reporting" * "Governance" * "Audit" * "Professional Oversight"

All gears point towards a central "Company approach and disclosure" block.

Background

The challenges of climate change

The Paris Agreement aims to strengthen the response to climate change by: "Holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels, recognising that this would significantly reduce the risks and impacts of climate change", amongst other aims.

A serious reallocation of resources would be required to meet these goals, and therefore companies can be exposed to a wide range of risks and opportunities. Below is a high-level overview of some of the physical and transitional risks and opportunities companies will face. Climate change considerations are obviously relevant for entities across many industries and will therefore be relevant for their reporting and the auditing of their financial statements.

Figure 1: Possible physical risks, transitional risks and opportunities companies may face, as identified by the Task Force on Climate-related Financial Disclosures.

Three main categories with sub-categories are shown:

Physical risks * Long-term changes to weather and climate at a regional and international level * Risks of acute events such as floods, droughts and storms

Transition risks * Impact of changing policy and regulation * Reputational damage * Changing consumer preferences and concerns * Changes in technology to respond to climate concerns

Opportunities * Resource efficiency * Energy source * Products and services * Markets * Resilience

The Green Finance Strategy

On 2 July 2019 the UK Government presented its Green Finance Strategy. The strategy aims to align private sector financial flows with clean, environmentally sustainable and resilient growth and strengthen the competitiveness of the UK financial services sector. It covers three areas: greening finance; financing green and capturing the opportunity.

The Green Finance Strategy includes the expectation that listed companies and large asset owners should disclose in line with the Taskforce on Climate-related Financial Disclosures (TCFD recommendations by 2022. A cross-Whitehall and cross-regulator Taskforce was established to consider how this ambition might be implemented, and an interim report from that Taskforce has just been published. The FRC's position on non-financial reporting can be found here.

The UK Stewardship Code

The Stewardship Code took effect on 1 January 2020. It sets high expectations for how investors, and those who support them, invest and manage money on behalf of UK savers and pensioners, and how this leads to sustainable benefits for the economy, environment and society. The Stewardship Code states that "Signatories systematically integrate stewardship and investment, including material environmental, social and governance issues, and climate change, to fulfil their responsibilities". Climate change is also mentioned with reference to the systemic risks it poses.

The Financial Reporting Lab report

While 'climate change' is not specifically mentioned as a required topic for reporting, there are a number of ways in which climate-related issues may still need to be disclosed in both narrative reporting and within the financial statements.

The Financial Reporting Lab's 2019 report on climate-related disclosure outlined investors' views on the integration of climate-related considerations into company activity and reporting. This report found that investors were very interested in climate-related reporting, and the investors we spoke to were supportive of the TCFD framework of 11 recommended disclosures across four core areas as a framework for companies to think through, and report on, their climate-related activities. An increasing number of companies are providing reporting on climate-related issues, and many use the TCFD framework.

The Task Force on Climate-related Financial Disclosures

The TCFD, established in December 2015 by the Financial Stability Board, was tasked with reviewing how the financial sector could take account of climate-related issues.

In 2017, the TCFD published a report which set out four core elements of recommended climate-related financial disclosures that apply to organisations across sectors and jurisdictions.

- Governance: The organisation's governance around climate-related risks and opportunities.

- Strategy: The actual and potential impacts of climate-related risks and opportunities on the organisation's businesses, strategy, and financial planning.

- Risk Management: The processes used by the organisation to identify, assess, and manage climate-related risks.

- Metrics and Targets: The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

The four core areas, and 11 recommended disclosures, are shown in Figure 2 below.

| Governance | Strategy | Risk Management | Metrics and Targets |

|---|---|---|---|

| Disclose the organization's governance around climate-related risks and opportunities. | Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning where such information is material. | Disclose how the organization identifies, assesses, and manages climate-related risks. | Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. |

| Recommended Disclosures | Recommended Disclosures | Recommended Disclosures | Recommended Disclosures |

| a) Describe the board's oversight of climate-related risks and opportunities. | a) Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term. | a) Describe the organization's processes for identifying and assessing climate-related risks. | a) Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process. |

| b) Describe management's role in assessing and managing climate-related risks and opportunities. | b) Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning. | b) Describe the organization's processes for managing climate-related risks. | b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks. |

| c) Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. | c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management. | c) Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets. |

Figure 2: TCFD recommended disclosures.

"There are definitely reporting leaders, but this is not a static situation and they need to keep moving and they need to keep evolving. There is no one who has worked this out 100%. Given what's available, there are leaders for where we are today" – Investor

Investors – headline finding:

Investors support the Task Force on Climate-related Financial Disclosures framework, but also expect to see disclosures regarding the financial implications of climate change. Investors are themselves facing a changing regulatory environment.

Investor reporting

KEY FINDING: Investors are also facing a changing regulatory environment, heightening the need to report on their role in relation to climate change.

Investors are not only interested in companies' approaches to climate change from an investment perspective; they are also facing calls for more disclosure on their own approach to climate-related issues. Investor reporting is developing to incorporate the principles of the Stewardship Code. The wider regulatory framework, and the need for investors to report to their own clients, also drives the need for companies to respond to climate-related challenges, and to report how they are doing so.

Stewardship Code Review of Early Reporting

Although the FRC's first applications to the Stewardship Code are being accepted from 2021, the FRC conducted a review of early reporting to support prospective signatories in meeting the new reporting challenge. This involved analysing 21 responsible investment, active ownership and stewardship reports to assess how well prospective signatories are addressing the standards of the new Stewardship Code.

Climate-related considerations are a feature for many key stewardship activities, including integration of stewardship and investment, engagement and voting. However, from the reports we reviewed, the level of detail and specificity of how climate-related issues were discussed on these activities varied widely.

Integration of stewardship and investment

The Stewardship Code specifically lists climate change as an issue for asset owners and asset managers to consider when systematically integrating stewardship and investment. The reports we reviewed highlighted a range of different approaches to this challenge.

Some explained that their process was fully integrated, with fund or portfolio managers responsible for incorporating climate-related considerations into their investment process, often supported by a dedicated environmental, social and governance (ESG) or responsible investment team providing more in-depth analysis on industries and issues. Others described approaches where companies would be excluded from responsible investment-focussed funds if they did not demonstrate transition to a low carbon economy. Others explained that investment managers have full discretion over considering ESG and climate-related risks for the companies they invest in, with no firm-wide policy on considering these issues.

Many reports noted that the organisation was still increasing its capacity to consider climate-related issues and integrate these with the investment process, for example by increasing the use of scenario analysis. Reporting on integrating climate change considerations and investment was largely focused on listed-equity investments, but some reports also discussed climate change considerations for other asset classes, such as real estate and fixed income. Overall, reporting could better explain how climate-related issues are integrated into the investment process systematically, not only in specialist funds, but in all assets under management.

Engagement

Climate was a prominent theme in engagements across most of the reports reviewed. Engagement with companies on climate change issues often had the objective of enhancing disclosures, encouraging them to share more information on their planning and preparation for the transition to a low carbon economy, including their overall strategy and governance. Better reporting included overall information on an organisation's engagement strategy regarding climate change, with case studies to show how this policy is put into practice. Engagements on climate change issues are often very long term, and better reporting also detailed next steps and timelines for engagements, with escalation if necessary.

Voting

The Stewardship Code asks signatories to exercise their rights and responsibilities, and voting on annual general meeting resolutions for listed equity assets was the most common example of how these rights are exercised. Climate-related issues featured in most of the voting disclosures reviewed. This was often in the form of shareholder resolutions, either where the asset manager had put forward a shareholder resolution or voted on a climate-related resolution raised by the company themselves. Climate-related shareholder proposals often asked for a commitment to reduce carbon emissions or for a company to adopt a strategy for their business to align with the goals of the Paris Agreement, adopt a 'net zero' or science-based target. Some resolutions highlighted in case studies also asked for the remuneration structure of the company to include a climate-related component to support the climate strategy.

Collaboration and collaborative initiatives

Most of the reports reviewed included climate change as a market-wide and systemic risk. It is also an issue on which asset owners and asset managers frequently collaborate and join initiatives to address. Better reporting made clear the organisation's role and contribution to collaborative initiatives, included what the initiative sets out to achieve, and how it does so. The Stewardship Code asks for organisations to outline not only their activities, but also the outcomes of their stewardship over the past year. We acknowledge that climate-related initiatives are active over a long timescale, and thus the objectives of these initiatives are unlikely to be met over the reporting year, but there is significant scope for investors to reflect on the effectiveness of their actions and contribution to these initiatives even before they have reached resolution.

Data providers

The Stewardship Code asks signatories to explain the extent to which service providers were used and how signatories ensure service providers meet their needs to support effective stewardship. While many of the reports reviewed mentioned the ESG and climate-related data providers they use, there was little discussion in the reports reviewed about how they view the reliability and variability of this third party data, and their actions to monitor their providers to ensure the quality and accuracy of the data provided. In addition, few of the reports reviewed gave information on how this third party data interacts with the proprietary ESG data and ratings systems they employ.

Frameworks

The vast majority of the reports reviewed noted that they were supporters of TCFD. Many of the organisations explained that they use the TCFD core areas as a lens to consider climate-related issues for the companies they invest in. A number of reports reviewed, particularly those by larger asset managers, indicated that they are already, or intend to, produce their own TCFD reporting, though these disclosures are largely still at a preliminary stage.

"On strategy and governance there has been quite a lot of good reporting, but it's difficult to do forward-looking analysis unless you have some sense of where the company is really going and what it is aiming for" - Investor

Investor approaches to consideration of climate change

More investors are responding to the challenges of climate change. There are a range of approaches to integrating climate-related considerations developing at different investors. The CFA Institute's Climate change analysis in the investment process aims to “improve knowledge and understanding about how climate risk can be applied to financial analysis and portfolio management... [and] informs practitioners how best to incorporate these analyses into their investment processes, based on case studies of firms that are currently integrating climate-related analysis into their investment models”.

This report provides a range of case studies, including:

- Assessing the viability of a company's decarbonisation plan.

- Using climate considerations to build positive impacts into fixed-income portfolios.

- The APG approach to climate risk and opportunities.

- Investing wisely and responsibly in timberland assets a climate conscious study.

- Carbon as an emerging asset class.

- Physical risks of climate change: assessing geography of exposure in US residential mortgage-backed securities.

- India equity: supply chain opportunities in a global low-carbon transition.

- Meaningful climate data, intentional investments.

- Carbon budgeting in quantitative managed portfolios.

- Climate change: a new driving force for engagement.

"The way we're thinking about TCFD is that it's a baseline level. It's about the governance pillar, how the board thinks about and understands climate issues, what's management role in assessing and managing, how it's influencing strategy and what risk management insights and changes have been made and what metrics and targets used. That's the baseline – any company with climate risk, the vast majority, needs to be disclosing that stuff" – Investor

Investor views

As the demand for climate-related disclosure by investors and wider stakeholders increases, many companies are developing their approaches to addressing, and reporting on, climate-related challenges.

This year, the Lab spoke to investors to understand their views on the integration of climate-related considerations into corporate reporting and audit. As we found in the Lab's 2019 project, investors are very supportive of the TCFD as a framework for company consideration, and disclosure, of climate-related issues.

The more detailed findings from the Lab's interviews are included in the specific reports on governance, corporate reporting, audit and professional oversight. These reports show that investors' views continue to evolve, however, at a high level, investors reiterated that they would like to see more reporting on climate-related issues and noted that the questions they seek to understand mirror those they were asking last year.

Investors reiterated that they continue to seek a better understanding of:

- how boards consider and assess climate-related issues;

- how the business model may be affected by climate-related issues, whether it remains sustainable, and how the company may respond to the challenge posed by climate change, including what changes the company might need to make to strategy;

- the risks and opportunities presented by climate change including the prioritisation, likelihood and impact, what scenarios might affect the company's sustainability and viability, and how the company is responding; and

- how climate-related issues, and their impact, are measured, including metrics, data and financially-relevant information.

Investors noted that more companies have started disclosing under TCFD. Whether this is in response to investor pressure, or governmental and regulatory pressures, this development was welcomed. Investors noted, however, that reporting, whilst continuing to evolve, needs to develop further better to meet their needs. Current reporting is often non-specific, lacks substance and is considered insufficiently linked to the company's plans, business model and strategy.

This report provides examples of reporting under the TCFD identified as better practice by investors, but investor expectations, the reporting framework, and companies' own reporting continue to develop rapidly.

In addition, our engagement with users has shown an increasing level of interest in the financial implications of climate-related issues. Over the course of this thematic, the Lab encountered a greater call for integration of climate-related issues into financial statements.

Investors reiterate the need for consistency between the front half and back half of reports, and, mirroring the FRC's own findings, noted that financial statement disclosures lag behind those in the narrative reporting. They are particularly looking for disclosure of the accounting assumptions made where these may be affected by climate change.

Alongside an expectation of better reporting in the financial statements, investors also highlighted the important role auditors play in challenging and testing management. Investors expect auditors to consider risks facing the company as a result of climate change, and expect appropriate challenge of management, particularly where climate-related risks have an impact on the entity's accounting estimates.

In order to help companies respond to the growing calls for information, and to provide disclosure under the TCFD's 11 recommended disclosures, the Lab's 2019 report posed a series of suggested questions. Investors noted that these remain highly relevant and useful as companies consider how best to meet the disclosure expectations of the TCFD framework. The questions, which cover governance and management, business model and strategy, risk management and metrics and targets are included over the next two pages.

TCFD reporting is not currently mandatory, although an FCA consultation on introducing a 'comply or explain' requirement for premium-listed companies recently closed. The UK's TCFD Taskforce, set up under the Green Finance Strategy, is investigating possible routes to mandatory reporting against the TCFD, but in the meantime there are already reporting requirements which companies must follow in both their narrative and financial statements disclosures. This includes addressing climate change in both of these areas where material. The FRC's review of corporate reporting, carried out as part of this thematic, sets out the FRC's expectations.

The FRC also encourages public interest entities to report against the TCFD and the Sustainability Accounting Standards Board metrics relevant for their sector. The FRC's statement on non-financial reporting can be found here.

Governance and management questions

- What arrangements does the board have in place for assessing and considering climate-related issues? What is the board's view of the climate change challenge, and what assumptions is it making?

- Who has responsibility for climate-related issues? How are the board and/or committees involved and how often are climate-related issues considered?

- What insight does the information give the company and how is it being integrated into strategic planning?

- What information helps the board understand the company's risk profile?

- What information and metrics do the board monitor in relation to climate-related issues? How does the board, establish, monitor and oversee, including modifying, climate-related goals and targets?

- Is the board preparing for different outcomes where there is uncertainty?

- How does the board get comfort over the metrics being used to monitor and manage the relevant issues?

- What arrangements does the Executive Committee, or other divisional levels, have in place for assessing and considering climate-related issues, and who has responsibility for them?

- Does the board consider the climate-related reporting to be fair, balanced and understandable?

- What competence and expertise does the board feel it needs, or needs access to, in order to consider and address the challenges climate-related issues pose?

- Has the board reviewed its public policy approach to climate-related issues for consistency?

- Is the organisation planning to report against the TCFD? If so, what can be shared about the progress made and what are the plans for disclosure?

"On Paris-agreement goals, I want not only an assessment of where the risks are, I want to know what the company is doing. How is it adjusting its business model and strategy to thrive in a changed world where we have transitioned to low carbon, or there is some degree of increased climate risk?" - Investor

Business model and strategy questions

- What does the company look like in the future and how will it continue to generate value? What strategy does the company have for responding to the challenges?

- How was the decision about the materiality of climate-related issues made?

- What opportunities and risks concerning climate-related issues are most relevant to the company's business model and strategy? Which, if any, of these are financially material? What process has been followed in order to assess the impact of climate-related issues?

- Where do the biggest risks and opportunities sit?

- Has the company considered the impact of low-carbon transition as well as physical risk?

- What are the relevant short, medium and long-term horizons? How do these different horizons affect key divisions, markets, products and/or revenue/profit drivers?

- How resilient is the business model to climate change? How does the company respond to a 1.5 degree, 2 degree or more world?

- What strategy has been put in place to reach that aim, and what operational or capital expenditures are needed to address any necessary business model changes? How are long-term projects structured to ensure flexibility, including options for deemphasising and emphasising if circumstances should dictate?

- What are the possible effects on the company's revenues, expenditures, assets, liabilities, products, customers, suppliers etc of different climate scenarios?

- How does the information gathered factor into strategic planning? What triggers would require a change of direction?

- Are there opportunities better to explain exposure to particular product lines or 'green' revenues?

- How are the risks and opportunities reflected in the financial statements, for example the effect of assumptions used in impairment testing, depreciation rates, decommissioning, restoration and other similar liabilities and financial risk disclosures?

Risk management questions

- What oversight does the board have of climate-related opportunities and risks?

- What systems and processes are in place for identifying, assessing and managing climate-related risks? To what extent can current processes be developed to assist?

- How will transitional and physical risks affect the company?

- How is a consideration of climate-related issues integrated into the risk management process and connected to other related risks?

- Over what horizons have the risks been considered and risk assessments carried out?

- How are the risks from climate change being monitored, including decisions around mitigation, transfer, acceptance and control?

- How is the assessment of the company's viability over the longer-term taking into account climate-related issues?

- Is the company's business and business model viable? What signals or leading indicators might encourage a reconsideration of this assessment and the related strategy, or an understanding of whether the risk mitigation activities are being achieved?

- If the company is undertaking scenario analysis, how did the company decide on which scenarios to use and what assumptions have been made? How do these relate to the outcomes advocated in the Paris Agreement?

- Are the scenarios sufficiently diverse and challenging?

- How did the company translate scenarios to operational/financial models?

- How is the scenario analysis used in strategic planning?

"There is more profile, more reporting, still further to go" - Investor

Metrics and targets questions

- What information is most relevant to monitoring and managing the impacts of climate-related issues? How were these identified and how do they link to the strategy and business model?

- Has a strategy been defined, with related metrics to measure progress, setting the company on a course to 'net zero' carbon by 2050, and for interim stages in between now and then? What metrics are monitored in relation to mitigation and adaptation? If metrics are not related, what metrics are being used, and what timelines has it set?

- What signals or specific climate scenarios are monitored?

- Has the company considered whether issues regarding water, energy, land use and waste management may be material, and if so, how these should be measured?

- What do the metrics being monitored and managed indicate about the future direction of the company? How is this information used? How are they being integrated into day-to-day business management and reporting?

- What is the scope and boundary of the information presented? Is this the same across all information presented?

- To what level of oversight or assurance have the metrics been subjected?

- What external data, or external expertise, has the company relied upon?

- Are the metrics disclosed calculated consistently? Is trend data provided?

- Which methodology has been used for constructing the metrics? Is this comparable to other companies in the sector?

- Have estimates been used in compiling measures or targets? Can you describe the calculation of these?

- What are the company's Scope 1, Scope 2 and, where relevant, Scope 3 greenhouse gas emissions? Is the GHG Protocol and/or another industry-specific methodology used for this calculation?

- Is an internal carbon price used? If so, what is it and for which purposes is it used?

- What is the company trying to achieve in relation to climate resilience and what targets has it set? Have the targets been achieved, and what comes next?

- How are metrics being integrated into the remuneration policies? Is this the most effective linkage possible?

Examples of reporting against the TCFD framework

QBE Insurance Group Limited

What is useful?

QBE outlines its governance approach, noting over which areas specific entities have responsibility, and how each committee's involvement works at both the Board, executive and operational levels.

It also outlines its climate change action plan across the four core areas of the TCFD. It highlights what has been achieved and which areas are still being addressed.

QBE's Climate Change Action Plan

In 2018 we released our Climate Change Action Plan. During 2019, our focus was on progressing our understanding of climate-related risks and opportunities and considering our strategic response.

| DESCRIPTION | ACTION | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| Governance | |||||

| Disclose the organisation's governance around climate-related risks and opportunities | Board: | ||||

| * Strengthen Group Board and Committee oversight of climate-related issues | ✓ | ||||

| * Strengthen divisional governance of climate-related issues | ✓ | ||||

| Management: | |||||

| * Establish senior cross-functional, cross-divisional Climate Change Working Group to support the Board and management in identifying and managing climate-related risks and opportunities | ✓ | ||||

| * Sign TCFD Statement of Support with commitment to begin disclosures in February 2019 | ✓ | ||||

| Strategy | |||||

| Disclose the actual and potential impacts of climate-related risks and opportunities on the organisation's businesses, strategy and financial planning where such information is material | * Complete high level impact assessment of physical, transition and liability risks and opportunities across the business over the short, medium and long-term | ✓ | |||

| * Review investment strategy to ensure it appropriately reflects consideration of climate-related risks and opportunities | ✓ | ||||

| * Complete further detailed analysis of climate-related risks and opportunities in priority underwriting portfolios. ↑ Refer pages 34 to 37 | ✓ | ||||

| * Review underwriting strategy in line with detailed analysis of climate-related risks and opportunities. ↑ Refer pages 34 to 37 | ✓ | ||||

| * Participate in the UNEP FI insurance industry TCFD pilot group on scenario analysis. ↑ Refer page 37 | ✓ | ||||

| * Integrate additional climate-related scenario analysis into strategic planning across the business | ○○○○○○ | ||||

| Risk Management | |||||

| Disclose how the organisation identifies, assesses and manages climate-related risks | * Establish ESG Risk team to coordinate ongoing integration of climate-related risks and opportunities across the business | ✓ | |||

| * Review Enterprise Risk Management Strategy and Framework to ensure they appropriately reflect climate change considerations | ✓ | ||||

| * Review risk classes, risk appetites and risk management standards and processes to ensure that climate change risks are properly reflected | ✓ | ||||

| * Integrate multi-year scenario analysis into risk management strategy | ○○○○○○ | ||||

| Metrics & Targets | |||||

| Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material | * Disclose scope 1, 2 and 3 operational greenhouse gas emissions | ✓ | |||

| * Evaluate metrics and targets for assessing climate-related risks and opportunities that are in line with strategy and risk management processes | ✓ | ||||

| * Disclose metrics and performance against targets for assessing climate-related risks and opportunities | ○○○○○○ |

KEY: ○ Commencement date ● Continued in progress ○ Target completion date ✓ Action completed

| Group Board |

|---|

| Risk & Capital Audit Investment Operations & Technology |

| Climate-related risk management |

| Group Executive Committee |

|---|

| Accountable for implementing climate change strategy Receiving and reviewing progress reports |

| Group CRO Group CFO Group CUO Group Executive, Corporate Affairs and Sustainability |

| Accountable for embedding climate-related risk into the Group's risk management framework |

| Executive Non-Financial Risk Committee |

|---|

| Accountable for overseeing the integration of ESG risk into business processes |

| Head of ESG Risk Group Chief Investment Officer Group Head of Sustainability |

| Integrating climate-related risks and opportunities into business processes |

| Delivering and reporting on the Climate Change Action Plan |

| ESG Risk Committee |

|---|

| Reviewing ESG business policies and strategies, including climate-related policy positions, and providing recommendations to the Executive Non-Financial Risk Committee for approval |

| Climate Change Steering Committee |

|---|

| Overseeing the identification and management of climate-related risks and opportunities, reporting and working group activities. |

QBE Insurance Group Limited

What is useful?

QBE identifies the time horizons it considers to be short, medium and long term. Risks in specific business lines are outlined, and these are linked to the business plan. There is also a link to remuneration and an indication of what was learnt from the considerations, and how strategy changes as a result.

Transition risks and opportunities

Through our insurance and investment activities, we are exposed to the risks and opportunities arising from the transition towards a low carbon economy. Some sectors will require a bigger transition than others. We seek to collaborate with government, industry and our customers to support an orderly transition.

Analysis: transition risks and opportunities in emissions intensive industries

What did we do?

In 2019, we undertook scenario analysis to identify the risks and opportunities associated with the transition to a low carbon economy. We focused on three industries which will require significant changes if the world is to meet the goals of the Paris Agreement - energy, transport and heavy industry.

We developed two qualitative scenarios consistent with meeting the objective of the Paris Agreement. The first scenario is early and coordinated transition driven by political ambition, regulatory and policy support. The second scenario presented a delayed and uncoordinated transition, with ambitious action around 2025-30. We then held deep dive workshops to identify the risks and opportunities associated with each of the three industries.

What did we find?

We identified a range of opportunities and risks across underwriting and investment, both at a high level and at an industry specific level. Opportunities include development of new insurance products, and investment opportunities in renewable energy and low emissions transport. Risks include changes to insurance premiums in declining sectors, stranded assets and regulatory and reputation risks.

How are we responding?

In 2019, we developed a Group Energy Policy (see page 38 for more detail) to respond to the risks in the energy sector, including targeting zero direct investment in, and phasing out insurance for, the thermal coal industry. We have continued to grow our investment exposure to low carbon projects through Premiums4Good (see page 38 for more detail).

What are our next steps?

We will continue to develop and embed our response to the risks and opportunities identified into our strategy and risk management processes.

Time horizons

Taking into account average policy duration allowing for renewals, as well as the average term of its investments, QBE defines short, medium, and long-term risk time horizons as follows:

Short-term: 0 to 3 years

Medium-term: 3 to 8 years

Long-term: 8+ years

Climate change and remuneration

A component of our Group Executive Committee's (GEC) short-term incentive (STI) outcome is determined with reference to the achievement against strategic priorities. 75% of our Group Chief Risk Officer's STI outcome, and 35% of the outcome for all other members of the GEC, is determined in this manner.

QBE's 2019 strategic priorities include managing risk (including implementation of our Climate Change Action Plan) and operating sustainably (including the effective management of climate-related risks and opportunities).

Specific roles within QBE that are responsible for integrating the identification and management of climate-related risks into business processes and developing, managing and implementing the strategy to address the environmental impacts of our operations include QBE's Head of ESG Risk and QBE's Head of Environment respectively. The performance objectives for these roles, and their achievement of those objectives, is a key reference when determining incentive outcomes.

Strategy

In 2019, we have continued to progress our Climate Change Action Plan, with a focus on identifying risks and opportunities and developing our strategic responses across both underwriting and investment management.

Underwriting

This year we focused on identifying climate-related risks and opportunities across some of our key underwriting portfolios. This work has been driven by our physical, transition and liability working groups.

Physical risks

Climate change will increase the frequency and severity of acute weather-related events such as floods, bushfires, tropical cyclones, hail, storms and coastal inundation, as well as lead to chronic changes such as sea level rise, increased heat waves and droughts over time. During 2019, we saw severe drought and extensive bushfires across Australia and wildfires in North America, as well as severe flooding in the UK. As an international provider of insurance such as property, crop, marine and aviation, QBE is exposed to these risks.

QBE assesses the impact of weather-related events using catastrophe models. Our catastrophe modelling team uses sophisticated computer simulations of natural catastrophes to estimate their financial impact. By allowing for scientific predictions of the impact of climate change under different climate scenarios, we also use those computer models to quantify the financial impact of climate change on weather-related events. One key component of a catastrophe model is the hazard module that generates weather events such as cyclones, flood and hail which are the foundation for simulating damages to the properties we insure and estimating claims under the insurance policies protecting our clients' assets.

QBE has long recognised that climate change has a direct impact on the unpredictability and extremity of weather conditions around the world. In 2014, our Annual Report included a spotlight on catastrophe modelling. Since then, QBE has continued to invest in and greatly increase our natural catastrophe modelling capabilities as well as embed the insights into our strategic planning and operational management.

AXA SA

What is useful?

AXA's disclosure demonstrates the warming potential of its equities and corporate bonds versus the markets across different sectors. The disclosure acknowledges the warming potential, and that it does not meet the 2 degree Celsius trajectory.

"Portfolio alignment”: a macroeconomic conclusion

According to the evolving methodologies explored in this report, AXA's corporate investments (equities and debt) display a warming potential which is slightly below benchmark, and decreasing, while our benchmark is rising slightly. Our Sovereign debt investments, which are more concentrated, display a more pronounced gap with the benchmark thanks to our strong exposure to the EU. A weighted average of these two figures - which involves combining different methodologies and some double-counting of carbon emissions - produces a combined Warming potential for AXA's corporate and sovereign holdings of 2.81°C, which is significantly lower than the broad market reference of 3.62°C, as well as projections derived from the current NDC pledges (3.2°C) and BAU scenarios (i.e. should the NDCs not be implemented) in excess of 4°C.

The main objective of the warming potential metric, which still requires getting certainty that tested methodologies are robust enough, is to provide a "science-based" reference point showing the extent to which today's markets reflect a course that is not on track to reach the goals set under the Paris Agreement.

Prudence must be exerted when analyzing these figures, as the underlying methodologies are still evolving (see work on this matter in following section "Net-Zero Asset Owner Alliance"). Yet, according to these metrics, given AXA's current asset allocation and issuer selection, our investments support a rise in global temperature of almost 3°C, well above the Paris Agreement's objectives.

Five years after the inception of the Paris Agreement, and a few months ahead of COP26, this work confirms that the world's economies are not yet "Paris-aligned" and implementing the 2015 NDCs would not even be sufficient to achieve this target. Even the Covid crisis, which has pushed the world's economy to an unprecedented halt, confined half of the world's population, and will lead to a record decrease in carbon emissions in 2020, is insufficient to achieve the goals of the Paris Agreement. A fundamental reorganization is required to decorrelate wealth creation and welfare from carbon emissions, which is also why a "green recovery", as outlined in this report's opening statements, is absolutely essential. Failing this will derail any remaining chance of achieving the Paris Agreement, let alone the next ramped-up "Glasgow Agreement".

In this context, while investors can reorient some capital flows, for example via divestments and sector reallocations, they remain largely dependent on a broader investment universe which evidences how economies are "trapped" into carbon intensive pathways. In a nutshell, the concept of "investment portfolio alignment" requires a far broader multi-stakeholder effort that investors alone cannot achieve. This is the purpose of the new "Net-Zero Asset Owner Alliance".

Reference scenarios/BAU: 4.0°C AXA benchmark 2019: 3.6°C Unconditional NDCs 2030: 3.2°C AXA Aggregate portfolio 2019: 2.8°C Paris Agreement minimum goal: 2.0°C Paris Agreement ideal goal / 1.5°C Net-Zero Asset Owner Alliance target

AXA's Warming Potential: 2019 corporate results

Based on the methodology described above, AXA updated its analysis of the "warming potential" (WP) of its investments, both for Corporate securities (debt and equities, using Carbon Delta) and sovereign debt issuers (using Beyond Ratings). A brief analysis provides the following insights.

Corporates: a wide sector diversity

AXA's equity warming potential slightly decreased from 3.26°C to 3.21°C between 2018 and 2019, our corporate debt WP decreased from 2.93°C to 2.79°C and our aggregate corporate equity & debt WP decreased from 2.96°C to 2.83°C - while a broad benchmark on the same universe increased from 3.05°C to 3.07°C. This shows that AXA's corporate investments warming potential has decreased while the economy into which we invest has increased slightly. These results are encouraging, although it would be unwise to draw short-term conclusions from small variations on evolving metrics that bear most relevance in a long-term horizon. This also shows that these figures are still significantly above 2°C, which confirms that with today's public policies and business environment, and according to the "warming potential" approach tested here, AXA's operating investment universe is not aligned with the 2°C trajectory agreed during COP21.

A sector-level analysis comparing AXA's warming potential vs benchmark provides further insights.

Chart showing AXA's Corporate Investments' Warming Potential Sector Breakdown for Equities.

A bar chart titled 'Equities Warming Potential' shows 'AXA's Investments Temperature in °C' and 'MSCI ACWI's Temperature in °C' for various sectors: Energy, Basic Materials, Utilities, Industrial, Consumer Cyclical, Consumer Non-cyclical, Financial, Technology, Communications, and Others. AXA's investments generally show lower or comparable temperatures to the MSCI ACWI benchmark across sectors.

Chart showing AXA's Corporate Investments' Warming Potential Sector Breakdown for Corporate Bonds.

A bar chart titled 'Corporate Bonds Warming Potential' shows 'AXA's Investments Temperature in °C' and 'BofAML Global Aggregate-Corporate's Temperature in °C' for various sectors: Energy, Basic Materials, Utilities, Diversified Industrial, Consumer Cyclical, Consumer Non-cyclical, Financial, Technology, Communications, and Others. AXA's investments generally show lower or comparable temperatures to the BofAML Global Aggregate-Corporate benchmark across sectors.

Source: Carbon Delta / AXA IM.

Derwent London plc

What is useful?

Derwent lists resilience to climate change as a risk. The disclosure highlights the movement during the year and provides details of executive responsibility. It also links key performance indicators to science-based targets; short, medium and long-term and specifies those horizons.

Strategy

Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long-term.

We consider short, medium and long-term time horizons to be 0-5, 5-15 and 15+ years respectively, recognising that climate-related issues are often linked to the medium to long-term, and our properties have a service life of many decades.

Short-term - we have seen a greater shift in terms of legislation e.g. the introduction in the UK of the Minimum Energy Efficiency Standards (MEES) for commercial and domestic property, which sets a legal minimum in terms of the Energy Performance Certificate (EPC) rating for buildings and outlawing new lettings on spaces with an EPC rating of lower than an E. Likewise, occupier demand continues to drive the requirement for ever more efficient and sustainable buildings, which are cost effective to occupy and promote high levels of health and wellbeing.

Medium-term - issues are a direct consequence of what we see in the short term i.e. we must continually invest in and develop our new and existing properties to ever higher standards and levels of efficiency to ensure we continue to attract occupiers.

Long-term - we will have to continue to invest in our existing portfolio and our development pipeline to ensure they are climate resilient such that our central London buildings remain occupiable.

The processes used to determine the risks which are material to our business are set out in the risk management section below.

The Group suffers either a financial loss or adverse consequences due to processes being inadequate or not operating correctly, human factors or other external events.

| Risk | Our key controls |

|---|---|

| #### 7. OUR RESILIENCE TO CLIMATE CHANGE | * The Board and Executive Committee receive regular updates and presentations on environmental and sustainability performance and management matters. |

| The Group fails to respond appropriately, and sufficiently, to climate change risks or adapt to benefit from the potential opportunities. This could lead to damage to our reputation, loss of income and/or property values, and loss of our licence to operate. | * The Sustainability Committee monitors our performance and management controls. |

| Movement during 2019: Increased | * Employment of a qualified team led by an experienced Head of Sustainability. |

| Although climate change risks remain unchanged for the Group, the impacts of climate change can already be seen and will become more severe and widespread as global temperatures rise. In response, we have accelerated our ambition to become 'net zero carbon' to 2030 (see page 80). | * The Group benchmarks its ESG (environmental, social and governance) reporting against various industry benchmarks. |

| Executive responsibility: Paul Williams | * The Group has set long-term, science-based carbon targets and actively monitors portfolio performance against these. |

| * Production of an Annual Responsibility Report, the key data points and performance of which are externally assured. | |

| Potential impact | What we did in 2019 |

| Strategic objectives | * Agreed a revised target that the Group would be net zero carbon by 2030 and approved our strategy to achieve this target (see page 80). |

| 1.3.4. | * Established the Responsible Business Committee to strengthen the Board's oversight of ESG matters (report on pages 136 to 139). |

| Business model | * Agreed with our principal bankers a revolving credit facility, with a £300m 'green' tranche, which provides a lower rate of interest to finance our green initiatives (see page 72). |

| Could potentially impact on all aspects of our business model | * Project approval forms updated to ensure any capital expenditure will not adversely affect our carbon target performance or the EPC rating of the property. |

| KPIs | * The Group continued to set sustainability targets that were monitored during the year. |

| * Total return | * Reviewed and updated our sustainability policy and strategy. |

| * BREEAM rating | * Implementation of a new carbon measurement tool to help the Group track its performance against the new science-based targets. |

| * Science-based target performance | |

| * Total shareholder return | |

| A significant diversion of time could affect a wider range of KPIs |

Owens Corning Inc

What is useful?

Owens Corning defines its risk horizons and also provides detail on some of the specific issues and products considered in the context of climate change risk, namely roof shingles and associated weather-related supply issues.

It also outlines some of the possible financial impacts of climate change, including those related to specific products. The disclosure references links to capital expenditure and highlights where operations are not yet impacted.

Impacts of risks and opportunities on our financial planning are as follows:

-

Revenues: Impacted. Owens Corning has incorporated the identified risks and opportunities into our financial planning process. Our new product developments are factored into our forecasting, as previous climate-related products such as EcoTouch® were when they were being developed.

A growing number of Owens Corning products, including some of our high-density insulation products and shingles, are made with 100% wind-powered electricity and are part of a reduced embodied-carbon portfolio. We currently have eleven products that have received third-party wind electricity certification. See our Product Innovation & Stewardship chapter for more information. * Operating costs: Impacted. Owens Corning incorporates the impact of the identified risks into our operating costs for financial planning models based on a number of factors including the likelihood, timeframe, and magnitude of the financial impact of the risk or opportunity. * Capital expenditures/capital allocation: Impacted for some suppliers, facilities, or product lines. Capital expenditures and allocations are frequently impacted by identified risks and opportunities. Examples include the capital expenditures needed to make cool roof shingles, driven by our recognition of the opportunity that Owens Corning has due to climate change. See the Expanding Our Product Handprint section for more discussion about our portfolio of sustainable products. * Access to capital: Not yet impacted. Owens Corning's access to capital in our financial planning process may be impacted by the risks and opportunities we have identified. Our financial modeling incorporates the impact of risks and opportunities based on the timeframe, likelihood, and magnitude of impact. Our finance organization during planning will look at different scenarios based on the likelihood of potential risks or opportunities occurring.

Climate Change Risks

Climate change risks and opportunities are fundamentally driven by three factors: regulations, physical climate factors, and other climate-related variations. We monitor physical and transition risks (such as new technologies or changing regulations) that may impact our operations or planning. In addition, we are committed to managing market and reputational risk from climate change impacts. This influences our greenhouse gas emissions reduction goals and approach, as both our products and processes can help us combat climate change. We define risk horizons as short-term (1-3 years), medium-term (3-6 years), and long-term (over 6 years).

We assess and disclose these risks in our CDP report. Some of the ways that identified risks and opportunities have impacted our business include the following:

-

Products and services. In recent years, Owens Corning has made dramatic improvements to its product lines in all businesses, to strengthen our sustainable portfolio and address the identified potential risk for increased regulation on energy efficiency and emissions standards. This includes Cool Roof Collection™ shingles and our Sustaina® glass fiber fabric.

Using a highly reflective granule technology that reflects the sun's rays, "cool roof" shingles help reduce energy use by keeping roofs cooler and reducing air conditioning energy levels. Some of our cool roof solutions meet ENERGY STAR® requirements for solar reflectance. In 2019, we introduced eight new shingle colors with a minimum solar reflectance index of 20. The new colors provide options for darker colors and higher solar reflectance with the potential for cooling cost savings.

Our Sustaina® nonwoven glass fiber fabric uses a bio-based binder system with high tensile strength performance and does not contain formaldehyde.

Products like these, that can help our customers save energy and avoid emissions, accounted for 64% of our revenue in 2019. * Supply chain or value chain. We believe transportation of materials and engagement with a supplier is more efficient when the supplier is nearby. This enhances sustainability across the supply chain and minimizes the impact of storms and natural disasters.

One important area where supply chain-related risks have impacted our business is regional shingle production. Historically, when shingles of a particular color were made at different plants, they were different and therefore could not be mixed on a roof. We have worked with our suppliers to create shingles regionally, so we can produce consistent colors across many of our roofing plants.

This improves our ability to meet demand if a disaster disrupts production at one plant.

Regional shingles have had a significant impact on our roofing business, as we can now mix product from different plants, greatly expanding our distribution flexibility, even in non-storm-related situations.

ING Groep NV

What is useful?

ING outlines whether the areas it lends to are meeting the trajectory required to steer its lending portfolio in line with the goals of the Paris Agreement, and where ING's record sits in relation to that. It also discloses targets and outlines what does and does not get funded given INGs' view of the future.

The Climate Alignment Dashboard

Portfolio view - Outstandings as of year-end

For data sources please refer to Table 5 'Data source by type and sector' in the Technical Annex.

Set of nine line charts showing climate alignment performance across various sectors.

Each chart visualizes a 'Decarbonisation Pathway' or 'Financing Trend Reduction Pathway' against ING's portfolio, target, and relevant scenarios (e.g., SDS Scenario, B2DS Scenario). The charts display metrics such as kg CO₂e/MWh, Outstandings (M€), kg CO₂/m², tCO₂/tonne cement, kg CO₂/km, and alignment delta over time (from approximately 2018 to 2050).

Specific charts include: * Power Generation (Global and OECD Decarbonisation Pathways) * Upstream Oil & Gas (Absolute Financing Trend Reduction Pathway) * Commercial Real Estate (NL Decarbonisation Pathway) * Residential Real Estate (European Union Decarbonisation Pathway) * Cement (Global Decarbonisation Pathway) * Steel (Global Decarbonisation Pathway) * Automotive (Global Pathway to Zero Tailpipe Emissions) * Aviation (Global Decarbonisation Pathway) * Shipping (Alignment Delta)

A key at the bottom indicates status: 'On track: Under or equal to pathway or scenario', 'Above pathway by up to 5%', 'Not on track: Above pathway by more than 5%', and 'Unavailable'.

2. What we do finance

We've financed billions of euros in energy projects, from wind farms, solar energy, and geothermal power production; to energy efficiency in buildings and production lines; to electric vehicles and bio-based plastics; to (waste) water treatment and supply and circular economy solutions. We do this through green loans, green bonds, and other innovative products and financing constructions.

One such innovation is our sustainability improvement loan, which offers corporate clients a lower interest rate for improved sustainability performance. This has been very well-received since we introduced it in 2017, and we've supported more than 65 of these types of deals as at 30 September 2019. These loans cover more than just climate, but it's an important motivator for companies looking to improve their climate performance.

We also do a lot to financing a circular economy – one where people and companies 'reduce, reuse and recycle' instead of ‘take, make and waste'. It's about making the transition from ownership to access.

2. What we don't finance

We apply strict social, ethical and environmental criteria in our financing and investment policies and practices.

Every client and transaction is assessed, monitored and evaluated against the requirements of our Environmental and Social Risk (ESR) framework to ensure compliance and limit negative impact on the environment and communities. This way, climate and environmental impact are taken into account every time we make financing or investment decisions.

We also say 'no' to certain companies and sectors, like with our aim to reduce our exposure to coal power generation to close to zero by 2025. ING was the first bank to commit to exiting coal.

How we steer

We have identified two main ways that ING can influence the CO2 intensity of our sector portfolios: 1) by supporting and engaging with existing clients to shift investments more towards low-carbon technologies, and 2) by shifting our own capital allocation choices more towards low-carbon technologies and away from high-carbon. One example is to reduce our financing of sectors that require a decline in production over time to meet the Paris goals, such as coal and upstream oil and gas, while financing more renewables.

Regarding the latter, ING increased our renewable power generation financing by €1.19 billion in 2019 while reducing our direct exposure to coal-fired power plants by 22%. This year, we also announced our commitment to reduce our financing to upstream oil and gas by 19% by 2040, in line with the Sustainable Development Scenario production trend. In commercial real estate, we also saw an increase to a total of 65% of A-C label buildings in our commercial real estate portfolio, in line with our ambitious 2019 goal. In shipping's first year of reporting, ING's portfolio has been outperforming the required annual efficiency ratio by 8.1%.

National Grid plc

What is useful?

National Grid outlines why climate change has moved from an emerging to a principal risk. The disclosure outlines transition and physical risk separately, with descriptions within those categories and the National Grid response. The extracts also state that there are financial statement implications and references where these are disclosed in the financial statements.

What metrics are used to assess these risks and opportunities?

We have continued to advance our environmental sustainability strategy, focusing on three key areas: climate change, responsible use of natural resources and caring for the natural environment. We have metrics and targets that allow us to measure our impact on the environment, demonstrate our commitment and monitor our performance. As previously discussed, the cornerstone of our suite of metrics is our commitment to reducing our impact by achieving net zero for our Scope 1 and 2 emissions by 2050, with interim targets of an 80% reduction by 2030 and a 90% reduction by 2040. Numerous underlying metrics support this goal and our broader sustainability ambition, including reducing the carbon footprint of our operating facilities, enhancing the natural value of our properties, recycling and/or reusing our recovered assets and reducing our office waste. These are discussed in more detail on pages 50 and 51.

We have also included enhanced disclosures in the financial statements prepared under IFRS to explain how we have considered the financial impacts of climate change, in particular evaluating the impact of new net zero commitments in our territories, and the effect this has had on judgements and estimates such as the useful economic life of our assets. See notes 1 and 13 to the financial statements for details. This remains a recurring area of focus for the Audit Committee.

Future intent

We continually review our metrics and targets, as needed, to ensure that the data we are measuring is meaningful, aligns with our strategy, and is providing the information the business and our stakeholders need to effectively monitor our performance and demonstrate our progress. In 2020/21, we will be laying out our pathway to achieve our net zero by 2050 emission reductions and setting targets to align our ambitions and provide better visibility to our progress.

We are also evaluating development of a meaningful Scope 3 target that enables us to align to Science Based Targets Initiative (SBTI) criteria, specifically focusing on our customers.

Case study on climate change moving from an emerging risk to a principal risk

Our risk registers typically include risks likely to manifest within the short to medium, rather than longer term. In the case of climate change, weather-related event risks previously featured, as did transition risks associated with the decarbonisation of heat and electricity and these were included as a threat in several of our existing principal risks (e.g. energy interruption, disruptive forces).

Over the last 12 to 18 months, facilitated workshops were held with each of the core businesses to ensure completeness of risk capture specifically relating to climate change and our net zero commitment, considering both physical and transitional risks.

Consideration was given to whether the individual or combined risks arising from increased variability in temperature, and/or greater wear and tear on assets under more extreme weather conditions such as flooding and higher temperatures, should feature more prominently. This was especially pertinent in the light of updates in climate science, observations of the changing weather such as increased intensity and frequency of storms on the US east coast, and wildfire ferocity in locations such as South America, California and Australia. We also understand the growing urgency to find a solution to decarbonise heat and the future of gas in a way that is fair, affordable and not overly disruptive to consumers.

As a result, a recommendation to develop a bespoke climate change risk was considered by the Executive Committee and Board, and discussed with US, UK and NGV executives and subject matter experts. The addition of a bespoke climate change principal risk was finalised in autumn 2019.

| Risk/opportunity type | Description | Our response |

| Transition |

|---|

| Markets |

| Markets |

| Markets |

| Security and reliability |

| Security and reliability |

| Physical risks |

| Extreme weather |

| Changing weather conditions |

| Changing weather conditions |

| Description | Our response |

Landsec plc

What is useful?

Landsec's disclosure outlines some of the specific inputs into its four-degree scenario, outlines the operational challenges that will be faced and outlines some of the changes that Landsec will need to make to respond, thereby displaying a consistency of message across reporting formats.

Four-degrees scenario

This scenario is aligned with the IPCC's RCP 8.5, where climate change will increase by up to four degrees by 2100. In the lead-up to 2030, limited actions are taken to mitigate climate change, current levels of investment in low-carbon technology continue, and emissions continue to rise along their current trajectory. In the period between 2030 and 2100, the physical effects of climate change begin to intensify rapidly, and government, business and society will need to adapt to the effects.

Beyond 2030, widespread disruption to markets could begin to occur, and investment in climate change-resilient technologies and infrastructure is likely to be required for organisations with physical assets. The policy, regulatory and legal response, although limited in the short term, could begin to force organisations in control of physical assets to adapt to climate change. In this scenario, businesses with high levels of carbon emissions could experience a backlash in consumer, customer and investor sentiment.

Physical and adaptation risks

What could happen in this scenario by 2070?

- 5.4°C hotter in summer

- 50% increase in heatwaves

- 35% more rain in winter

- 9% increase in electricity use

- 32% decrease in gas use

In this scenario it is likely we will experience an increase in flash flooding, river floods, coastal flooding and storm surges. These weather events are applicable to a small proportion of assets in our portfolio, noted in the Metrics and targets section of this report. Increases in year-round temperature are predicted, with summer temperatures 5.4°C higher and winter temperatures 4.2°C higher than the current climate. Higher levels of precipitation are predicted in winter at up to +35%, and lower levels of summer precipitation are predicted at down to -47%.

These physical effects could have several effects on our business due to changes in markets, policy, regulation and technology. Accordingly, we do not consider the consequences of these physical risks to be 'transition' risks, as under the four-degrees scenario there will be very little transitional activity. We consider these risks and associated impacts to be costs of adapting to the new climate and weather patterns.

In this scenario, the physical risks to our portfolio could pose several market challenges, including potential lower asset values, higher operational costs, higher costs of insurance premiums, and reduced attractiveness to our customers and consumers. Specifically, asset values could fall where they are proven to have poor resilience to windstorm and flooding. Where we own assets in cities, particularly London, we could experience reduced demand for our properties affected by extreme heat and air pollution.

Due to the extreme temperature and weather patterns associated with this scenario, it is likely that poorly designed, operated and maintained assets will experience more frequent building system and envelope failures. This is likely to lead to higher operational costs, but also reputational risks, where customers begin to rely more on property companies to maintain safe and comfortable spaces for their staff and consumers. More extreme weather could also lead to increasing numbers of building failures and natural catastrophes, leading to rising insurance premiums.

In this scenario our business could also be affected by higher raw material costs due to increasing fossil fuel and water costs, disruption to logistics and higher cost of production from taxes and levies. Similarly, we would experience higher construction costs arising from climate change-resilient facades and building services with increased capacity.

In the long term under this scenario, a widespread decrease in combustion engine vehicle use could lead to assets without good public transport links becoming less attractive to consumers. Consumers and our direct customers could develop greater awareness and expectations of property businesses, pressurising them to act on climate-related issues, and creating greater favour for destinations which are sustainable.

Owing to the nature of this scenario, there are only limited opportunities as the impacts are predominantly negative for most business types. We could experience higher levels of customer and investor demand for resilient assets which can withstand the increasing frequency of windstorm and flooding. In addition, falling asset values and business failures could lead to opportunity for more resilient businesses to gain increasing market share.

How we'll need to respond

In this scenario, our analysis demonstrates that changes to our strategy and financial planning will be required. This will include divestment of assets which are less resilient to extreme heat and rainfall, or investment into infrastructure to limit the impact of flooding and coastal surge. We believe our strategy for investing in high-quality assets in primary locations will continue to be resilient in this scenario. However, to maintain an effective strategy we will need to increase our prioritisation of climate change factors in investment, development and divestment decisions.

This scenario could also result in changes to our customers' and supply chain partners' businesses, as well as consumer preferences. To continue to be resilient in this scenario, we will need to constantly reassess the risks posed by climate change to ensure we are not exposed to risk of default from business failures or supply chain disruption. Increased due diligence in supply chain selection will be required, particularly considering the sourcing of construction materials which may be processed or manufactured in countries where the effects of climate change are more extreme.

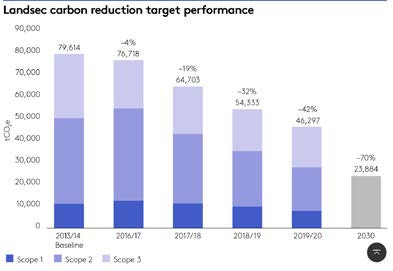

Landsec plc

What is useful?

Landsec's disclosure outlines that an internal shadow price of carbon is used within its planning and decision making. This is referred to both on online resources and within the annual report, thereby displaying a consistency of message across reporting formats.

3. Use an internal shadow price of carbon

To support us in assessing climate-related risks and opportunities as we transition to net zero carbon, we're using an internal shadow price of carbon. This internal metric gives an investment's carbon risks and opportunities a monetary value, so that we have a standard metric to assist investment decision making.

We've set our internal carbon price at £80/tonne CO2. This was calculated by estimating how much we're spending on carbon reduction projects currently and how much more would be needed long-term to achieve our goals. This balances out expensive retrofit projects with cost-effective early design choices in our development pipeline. £80/tonne CO2 is in line with the recommendation from the Commission on Carbon Pricing for a carbon price level consistent with the Paris agreement and aligned with guidance from the United Nations Global Compact on carbon pricing. Importantly, it's also in line with the Department for Business, Energy and Industrial Strategy's (BEIS) forecast of carbon prices through to 2030.

In our investment decisions, this shadow carbon price helps our business quantify the medium-term transition risk associated with the UK shifting to a low-carbon economy. It helps us capture the financial risk of continued carbon emissions in the likely future event of a carbon tax being imposed on our industry, as is currently the case with heavy industries such as steel and cement. It's also here to support the business case for transitioning to low-carbon solutions in our own operations. Our Sustainability Team work with our Investment, Development and Asset Management colleagues across the business to align our capital allocation strategies to our net zero carbon pledge and factor transition risk into our decision-making process.