The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Cash flow statements and liquidity (IAS 7, IFRS 7)

Key to symbols

- ✅ Represents good practice

- ⚠️ Represents an omission of required disclosure or other issue

- 💡 Represents an opportunity for enhancing disclosures

Examples of better disclosure...

Including some identified from our routine monitoring of corporate reports (marked *).

1. Executive summary

Introduction

Recent Annual Reviews1 have identified cash flow statements as an area requiring significant improvement in view of the frequency of errors identified in our corporate reporting reviews. The objective of this thematic review is to explore in more detail issues identified in our routine work as well as to consider some of the themes from the FRC Lab's project: Disclosures on the sources and uses of cash2. This includes providing further guidance to avoid some of the more common errors that have been identified from routine reviews.

Our review of liquidity risk disclosures included consideration of companies' assessments of going concern and longer-term viability because the management of cash flows and liquidity risk is an integral feature of these assessments, both of which contain disclosures relevant to liquidity risk.

When this thematic review was announced in December 2019, we explained that we would also consider companies' disclosure of liquidity risk. Since then, a number of topics that this thematic was designed to cover were included in the Covid-19 thematic review. However, we believe there is value in exploring some of the liquidity risk points in more detail and provide further examples of better disclosure. Our sample included companies reporting both before and after the UK lockdown from March.

We selected companies from a range of sectors and industries, including several which are perceived to face greater risks concerning cash flow, liquidity and viability. This included general retailers, retail property, and tourism and leisure. We initially selected a sample of 20 annual reports and accounts; however, the sample was extended to 30 companies as we saw the value of considering a greater number of accounts published since April.

Key findings

Cash flow statement

The majority of companies complied with the requirements of IAS 7 in the presentation of the cash flow statement. However, in line with our findings from routine reviews, we challenged companies where requirements did not appear to be met, due to:

- Material inconsistencies between items in the cash flow statement and the notes

- Missing or incorrectly classified cash flows

- Inconsistencies between financing cash flows and the reconciliation of changes in liabilities arising from financing activities in the notes

We also identified several areas for improvement in the disclosure of accounting policies for the treatment of significant and large one-off transactions in the cash flow statement. Consistent with our findings from routine reviews, we note most companies could improve their disclosures of accounting policies and judgements in relation to the cash flow statement.

Liquidity

Several companies published their accounts before the UK lockdown in March and many of these accounts contained only boiler plate disclosures in respect of liquidity risk and related issues. There was, however, a marked improvement in going concern, viability and liquidity disclosures following the initial economic impact of Covid-19, most notably in smaller listed companies. The findings on liquidity risk disclosures in this thematic are consistent with the findings of our thematic review on the financial reporting effects of Covid-19 published in July 2020.

The majority of companies in our sample that published their accounts from April onwards disclosed key liquidity information such as availability of cash, undrawn borrowing facilities and compliance with covenants. We did, however, identify that some companies could improve their disclosures of covenant testing, and assumptions and judgements around going concern and viability.

2. Scope and sample

Background and scope of our review

Our review consisted of a limited scope desktop review of the annual reports and accounts of 30 entities.

As part of our routine monitoring activity, we often ask companies for additional information regarding the nature or classification of transactions presented in the cash flow statement.

In the light of the downturn in the worsening economic outlook, particularly as a result of the impact of Covid-19, liquidity disclosures are under increasing scrutiny from investors.

Therefore, we considered the comprehensiveness and quality of cash flow and liquidity disclosures throughout the annual report and accounts, including compliance with the requirements of IAS 7 'Statement of Cash Flows' and IFRS 7 'Financial Instruments: Disclosures'.

We also considered the following areas that are linked to cash and liquidity:

- Strategic report, including the use of cash and liquidity based alternative performance measures ('APMs')

- Viability statement

- Going concern assessment.

In line with our philosophy of promoting continuous improvement in reporting, we have identified both examples of better practice and areas for improvement. The examples are taken from reviews performed for the purpose of this thematic, as well as our routine reviews.

Our sample

We initially planned to review the full-year accounts of a sample of 20 entities, including 12 companies with December year ends, most of which reported before the UK lockdown in March. As a result of the impact of Covid-19, we extended the sample to 30 to allow the inclusion of more companies reporting from April onwards.

Our sample covers a cross section of industries, with a focus on industries which are potentially facing particular liquidity stress such as travel and leisure, and high street retailers.

Our sample did not include financial services companies such as banks and insurers, which are subject to regulatory capital, liquidity and solvency regimes.

INDUSTRIES SAMPLED

Pie chart showing the distribution of sampled industries: - Travel & Leisure: 20% - Industrial Goods & Services: 13% - Retail: 13% - Personal & Household Goods: 10% - Food & Beverage: 7% - Construction & Materials: 6% - Media: 7% - Real Estate: 7% - Technology: 7% - Other: 10%

3. Key findings

Cash flow statement

Findings of previous routine reviews

The cash flow statement has featured in the top ten most frequently raised topics in our corporate reporting reviews in recent years, as highlighted in successive editions of our Annual Reviews of Corporate Reporting. It ranked as the seventh area of challenge in our reviews last year1.

Our reviews continue to highlight significant concerns regarding the preparation of some companies' cash flow statements. In 2019/20, five companies (2018/19: 4, 2017/18: 7) restated their cash flow statements as a result of our enquiries. We are concerned that most of these errors were basic in nature and were evident from our desktop review of the accounts. We believe that the errors could have been avoided by robust pre-issuance review by companies, built into their financial statement close process. We have, therefore, provided further information about the nature of the questions we have raised on the cash flow statement in the last three years to help companies avoid regulatory challenge.

The most frequent questions related to investing activities, the definition of cash and cash equivalents, the reconciliation of profit to net cash flows from operating activities, the acquisition or disposal of subsidiaries, and incorrect classification of cash flows.

We also wrote to companies on a number of areas where we considered disclosures had been omitted or could be improved. The most common areas related to the disclosures of changes in liabilities arising from financing activities (IAS 7.44A). Other common issues related to the acquisition and disposal of subsidiaries, and cash flows from investing activities.

IAS 7 DETAILED QUESTIONS BY TOPIC

Pie chart showing the distribution of detailed questions by topic: - Investing activities - Other - Bank borrowings included in cash and cash equivalents - Direct / indirect method - IAS 7.44A disclosures - Non-cash transactions - Reconciliation to operating profit - Definition of cash & cash equivalents - Acquisition / disposal of subsidiaries

IAS 7 DISCLOSURE IMPROVEMENTS BY TOPIC

Pie chart showing the distribution of disclosure improvements by topic: - Disclosure of changes in liabilities arising from financing activities - Acquisition / disposal of subsidiaries - Investing activities - Additional liquidity disclosures - Definition of cash & cash equivalents - Interest presentation - Other

Summary of historical cash flow statement errors where corrective action was required

A list of cash flow statement errors requiring restatement following a corporate reporting review is included in the appendix at the end of this report. We encourage companies to consider these matters as they provide an indication of the types of issues companies should look for, and correct, when performing their pre-issuance reviews.

A summary of the impact of these cash flow statement errors requiring restatement is presented in the graphs showing, as a percentage of the number of cases, whether the impact of the correction led to an increase, decrease or no change for each cash flow statement category.

This analysis shows that there is not necessarily a clear trend to the cash flow statement errors, with errors leading to increases and decreases in cash flows included in all three categories. We found examples of restatements distorting each possible pairing of categories (for example reclassifications between operating and investing, operating and financing, and investing and financing), and several which were included in all three categories. Some restatements resulted in no net change in cash flows, while others impacted the net cash flows for the period.

Our analysis does, however, show that errors to operating and investing cash flows (75% of cases requiring restatement) appear to be more frequent than errors in financing cash flows (44% of cases requiring restatement). Further information on the nature of these errors is provided in the appendix.

Impact on operating cash flows (% of cases)

Pie chart showing 31% Increase, 44% Decrease, 25% None.

Impact on investing cash flows (% of cases)

Pie chart showing 31% Increase, 44% Decrease, 25% None.

Impact on financing cash flows (% of cases)

Pie chart showing 25% Increase, 19% Decrease, 56% None.

Findings from this thematic

Our findings for this thematic were generally consistent with our annual routine reviews. Most companies presented a cash flow statement that complied with the requirements of IAS 7. However, we found some cases of potential non-compliance and have written to three companies, out of our sample of 30, with substantive questions relating to their cash flow statement.

Many of our questions result from straightforward consistency checks between amounts presented in the cash flow statement and other primary statements and notes.

Definition of cash3 and cash equivalents

Paragraph 6 of IAS 7 states that “cash comprises cash on hand and demand deposits". It also describes cash equivalents as short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

Paragraph 45 of IAS 7 requires a reconciliation of the amounts shown as cash and cash equivalents in the statement of cash flows with the equivalent items reported in the statement of financial position.

Judgement may have to be exercised in determining what comprises cash and cash equivalents. While IAS 7 provides only limited guidance on the meaning of 'cash', it is generally well understood. Judgement may exist as to what comprises cash equivalents based on the terms of particular instruments and the company's practices. The standard states that investments will normally qualify as cash equivalents only if the maturity, at acquisition, is less than three months.

Bank overdrafts, in certain circumstances, may be included as part of cash equivalents in the cash flow statement (see section below on the Composition of cash and cash equivalents). Where this is the case, we expect disclosure of the basis for including overdrafts within cash equivalents and a reconciliation between cash and cash equivalents as presented in the cash flow statement and the corresponding items in the statement of financial position.

We expect companies to provide a sufficiently detailed accounting policy to explain what is included within cash and cash equivalents.

Composition of cash and cash equivalents

IAS 7 requires cash equivalents to be held for the purpose of meeting short-term cash commitments and be subject to an insignificant risk of changes in value, with a short maturity of three months or less from the date of acquisition. Bank overdrafts which are repayable on demand may be included as a component of cash and cash equivalents.

IAS 7 also requires disclosures of any restrictions on the use of cash and cash equivalents by the group.

The types of borrowings which can be included as a component of cash and cash equivalents, for the purpose of the cash flow statement, were considered by the IFRS Interpretations Committee ("the Committee”) in March 20184. The fact pattern considered short-term loans and credit facilities that have a short contractual notice period (for example, 14 days). The agenda decision includes the observation that 'if the balance of a banking arrangement does not often fluctuate from being negative to positive, then this indicates that the arrangement does not form an integral part of the entity's cash management and, instead, represents a form of financing.'

Examples of better disclosure included:

- An accounting policy detailing what constitutes cash and cash equivalents;

- Analysis of the components of cash and cash equivalents, for example, cash at bank, short term deposits, money market funds;

- Description of the terms of deposits, such as maturity, break clauses and interest rates;

- Whether overdrafts are included within cash and cash equivalents and, if so, the terms of such arrangements; and

- Disclosure of the amount of restricted cash and the nature of the restrictions.

Composition of cash and cash equivalents (cont.)

⚠️ We identified one company where an invoice discounting facility was treated as part of cash and cash equivalents in the cash flow statement, despite appearing not to fluctuate between an asset and liability position.

Examples of better disclosure...

"Cash and cash equivalents Included within cash and cash equivalents are amounts held by the Group's travel and insurance businesses which are subject to contractual or regulatory restrictions. These amounts held are not readily available to be used for other purposes within the Group and total £98.2m (2019: £108.6m).

Cash at bank earns interest at floating rates based on daily bank deposit rates. Short term deposits are made for varying periods of between one day and three months, depending on the immediate cash requirements of the Group, and earn interest at the respective short term deposit rates.

The bank overdraft is subject to a guarantee in favour of the Group's bankers and is limited to the amount drawn. The bank overdraft is repayable on demand."

Saga plc, Annual Report and Accounts 2020, p174

Treatment of interest and dividends

IAS 7 allows an accounting policy choice for the presentation of interest and dividends. Interest paid and interest and dividends received may be classified as operating cash flows because they enter into the determination of profit or loss. Alternatively, interest paid and interest and dividends received may be classified as financing cash flows and investing cash flows respectively, because they are costs of obtaining financial resources or represent returns on investments.

We expect companies to select an appropriate accounting policy for the presentation of interest, including interest relating to leases, and dividends and to apply this consistently.

⚠️ We identified several companies through our routine reviews which did not apply a consistent, IAS 7 compliant, accounting policy for the presentation of interest and dividends.

Cash flows from operating activities

All companies in our sample used the indirect method, where profit and loss is adjusted for the effects of non-cash items, showing a reconciliation from profit before tax to net cash from operating activities, either on the face of the cash flow statement or in the notes, as required by paragraph 20 of IAS 7.

Our previous thematic, “Reporting by Smaller Listed and AIM Quoted Companies" contained an example reconciliation between the cash flows from movements in working capital and amounts presented in the statement of financial position. We believe disclosures of this nature are helpful where the cash flow impact of working capital movements is not apparent from the changes in the statement of financial position, for example, due to business combinations in the year.

Examples of better disclosures included:

- A reconciliation to explain the cash flow impact of working capital movements, where this was not apparent from the statement of financial position;

- A logical ordering of the items presented, for example, grouping similar items together such as working capital movements and non-cash items; and

- References to relevant notes.

The issues we identified in respect of operating cash flows included:

- ⚠️ Changes in cash flows from working capital which were inconsistent with movements in the statement of financial position; and

- ⚠️ Material unexplained variances in impairment and depreciation charges between the cash flow statement reconciliation and the notes to the accounts.

Cash flows from investing activities

Paragraph 16 of IAS 7 requires that only expenditure that results in a recognised asset in the statement of financial position is eligible for classification as investing activities.

We expect companies to exclude cash flows that do not result in a recognised asset within investing activities, such as acquisition expenses in a business combination or settlement of provisions.

For many companies in our sample, the cash flows from investing activities agreed to the amounts presented in the notes. Where there are material differences, we believe it would be helpful to provide an explanation.

Examples of better disclosures included:

- References to notes which agreed to the amounts presented in the cash flow statement; and

- A reconciliation between the cash flows in the cash flow statement and notes where the reason for the difference was not apparent.

The issues identified included:

- ⚠️ Material unexplained differences in additions to property, plant and equipment between the cash flow statement and the property, plant and equipment notes; and

- ⚠️ Settlements of provisions and other liabilities being presented as investing cash flows.

Examples of better disclosure...

Cash flows from investing activities

NEXT PLC, Annual Report and Accounts 2019*, p136

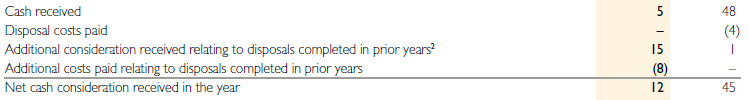

Acquisition and disposal of subsidiaries

Paragraph 39 of IAS 7 states that the aggregate cash flows arising from obtaining or losing control of subsidiaries or other businesses should be presented separately and classified as investing activities.

Where the impact of acquiring or disposing of a subsidiary or business is material, we expect the notes to provide a breakdown of the impact on the cash flow statement.

We expect companies to carefully consider the nature of cash flows occurring at the point of acquisition, such as settlement of the acquiree's debt and working capital movements. In addition, key accounting judgements should be disclosed; for example, determining if amounts paid relate to consideration or are a separate transaction.

Examples of better disclosures included:

- References to notes which agreed to the amounts presented in the cash flow statement; and

- A breakdown of the cash flows resulting from the acquisition or disposal of subsidiaries and other businesses.

Examples of better disclosure...

Disposals and closures

G4S PLC, Annual Report and Accounts 2019, p194

Deferred or contingent consideration

IAS 7 does not contain detailed guidance on the classification of deferred and contingent consideration and cash flows may be presented under different activities in the cash flow statement. For example:

- movements in contingent consideration may be presented as operating cash flows, with the initial estimate being shown as investing;

- both deferred and contingent consideration could have an implicit financing element, depending on the nature of the transaction; or

- contingent consideration that was deemed to be post-acquisition remuneration, should be presented as an operating cash flow.

As such, where amounts are material, we expect companies to disclose the accounting policy they have applied.

Examples of better disclosures included:

- An explanation of the accounting policy applied for the cash flow statement presentation of deferred or contingent consideration; and

- A breakdown of the amounts shown within each section of the cash flow statement.

Examples of better disclosure...

"Acquisition-related arrangements

The cash payments are reflected in the cash flow statement partly in operating cash flows and partly within investing activities. The tax relief on these payments is reflected in the Group's Adjusting items as part of the tax charge. The part of each payment relating to the original estimate of the fair value of the contingent consideration on the acquisition of the Shionogi-ViiV Healthcare joint venture in 2012 of £659 million is reported within investing activities in the cash flow statement and the part of each payment relating to the increase in the liability since the acquisition is reported within operating cash flows."

GSK PLC, Annual Report 2019, p52

Cash flows from financing activities

Paragraph 17 of IAS 7 provides examples of cash flows from financing activities including: proceeds from issuing shares; cash payments to owners to redeem shares; and proceeds and repayment of loans and cash payments in relation to the outstanding liability relating to a lease.

Paragraph 44A of IAS 7 requires disclosures that enable users to evaluate changes in liabilities arising from financing activities, including both changes arising from cash flows and non-cash changes.

While the standard is not prescriptive, the most common way of meeting the requirements of paragraph 44A is to present a reconciliation.

The area where we identified most potential issues was in the disclosure of changes in liabilities arising from financing activities; for example, some incorrectly included derivative assets which were not hedging risks relating to borrowings, and so should not have been presented as part of liabilities from financing activities. In addition, while companies can include cash and cash equivalents to present a 'net debt' reconciliation, care should be taken to ensure the requirements of IAS 7 are met, for example, by providing a subtotal of liabilities arising from financing activities.

In several cases, we found inconsistencies between amounts presented in the cash flow statement and the disclosure of changes in liabilities arising from financing activities.

The topics on which we wrote to companies in our sample included:

- ⚠️ Settlement of liabilities shown as a cash flow in the disclosure of changes in liabilities arising from financing activities, but which was not included in the cash flow statement;

- ⚠️ Settlement of financing liabilities in the cash flow statement appeared inconsistent with movements in the statement of financial position and notes; and

- ⚠️ Non-cash amounts, such as assets purchased under finance leases and non-cash finance charges, incorrectly presented as cash flows.

Disclosure of accounting policies and significant judgements

Paragraph 117 of IAS 1 requires disclosure of significant accounting policies.

Paragraph 122 of IAS 1 requires disclosure of judgements, apart from those involving estimations that management has made in the process of applying the entity's accounting policies and that have the most significant effect on the amounts recognised in the financial statements.

We have recently reported evidence of some improvement in the reporting of significant judgements5. However, we continue to be surprised by the lack of disclosure of cash flow related judgements, even where it is clear that such judgements have been made.

💡 Given IAS 7 does not contain detailed guidance on many types of transactions, we believe judgement will often be required, given the range, complexity and size of transactions companies undertake.

Most companies in our sample did not provide accounting policies for the cash flow statement.

However, we were pleased to find some better examples of accounting policies in relation to the cash flow statement. Examples of better disclosures of accounting policies in relation to the cash flow statement and which include:

- a description of where contingent consideration is presented within the cash flow statement;

- an explanation of where cash flows from supplier financing arrangements are presented within the cash flow statement; and

- an explanation of where cash flows from leases are presented.

Examples of better disclosure...

"Cash and cash equivalents Lease payments are presented as follows in the Group statement of cash flows:

- short-term lease payments, payments for leases of low-value assets and variable lease payments that are not included in the measurement of the lease liabilities are presented within cash flows from operating activities;

- payments for the interest element of recognised lease liabilities are included in 'interest paid' within cash flows from operating activities; and

- payments for the principal element of recognised lease liabilities are presented within cash flows from financing activities.”

Intercontinental Hotels Group plc, Annual Report and Form 20-F 2019, p141

We will continue to challenge companies where we believe significant judgements have been made in the presentation of the cash flow statement but are not disclosed. In some cases, the treatment in the cash flow statement may be the result of another accounting judgement, for example, whether a sale and leaseback transaction contains a financing element, or the application of hedge accounting. In these cases, we expect companies to explain the impact on the cash flow statement and link the cash flow presentation to the underlying accounting judgement.

Other selected topics

Our routine reviews have highlighted additional areas of cashflow reporting to which companies should pay close attention.

Foreign currency cash flows

IAS 7 requires that cash flows denominated in a foreign currency are reported in a manner consistent with IAS 21. The effect of exchange rate changes on cash and cash equivalents is presented in order to reconcile the movements in cash and cash equivalents during the year.

We know from routine revies that the treatment of foreign currency cash flows can be complex and prone to errors, although we did not find any such errors in our sample.

We expect companies to consider the presentation of foreign currency cash flows in their pre-issuance review of the financial statements. Where our enquiries have led to errors being identified elsewhere in their cash flow statement, corresponding errors, or balancing figures, have often also been identified within foreign currency.

Hedge accounting

The guidance in IAS 7 and IFRS 9 states that cash flows arising from a hedging instrument are classified as operating, investing or financing activities, on the basis of the classification of the cash flows arising from the hedged item.

The disclosures in paragraph 44A of IAS 7 on changes in liabilities arising from financing activities, also apply to financial assets which hedge liabilities arising from financing activities.

Discontinued operations

Paragraph 33(c) of IFRS 5 requires disclosure of the net cash flows attributable to the operating, investing and financing activities of discontinued operations. These disclosures may be presented either in the notes or in the financial statements.

Companies have flexibility in how cash flows from discontinued operations are presented and we see a range of acceptable approaches from our routine reviews, including:

- presenting cash flows from discontinued operations by category in the notes to the financial statements;

- presenting cash flows from discontinued operations by category on the face of the cash flow statement; and

- presenting cash flows from discontinued operations as a separate column within the cash flow statement.

Disclosure of material non-cash transactions

Paragraph 43 of IAS 7 requires that investing and financing transactions that do not require the use of cash or cash equivalents shall be excluded from a statement of cash flows. The standard also requires that such transactions shall be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these investing and financing activities

The standard gives examples of non-cash transactions which include acquiring assets through leases, acquisitions of an entity by an equity issuance and conversion of debt to equity.

Examples of better disclosure...

Non-cash investing and financing transactions

| 2020 £'000 | 2019 £'000 | |

|---|---|---|

| Acquisition of property, plant and equipment by means of a lease | 3,500 | 4,000 |

| Acquisition of subsidiary by issue of ordinary shares | 26,000 | - |

| Settlement of borrowings by issue of ordinary shares | 18,000 | - |

Illustrative example created for the purpose of this thematic

Strategic report

Operating and financial review

The Companies Act 2006, s414C6 and s414CB6 require the strategic report to explain the company's business model (which means how the company generates and preserves value), the company's year end position, and how it has developed and performed during the year. The business review should, therefore, include both information on historical performance and forward looking information explaining the company's strategy and business model.

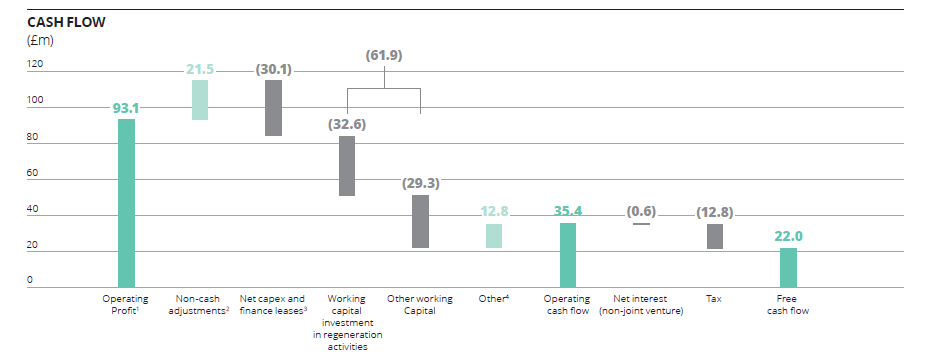

All companies in our sample provided a summary of IFRS cash flows, adjusted cash flows and liquidity in the strategic report. However, the quality of disclosures varied. Better examples presented concise information in clearly labelled sections. Most companies presented an analysis of both IFRS cash flows and alternative performance measures (APMs).

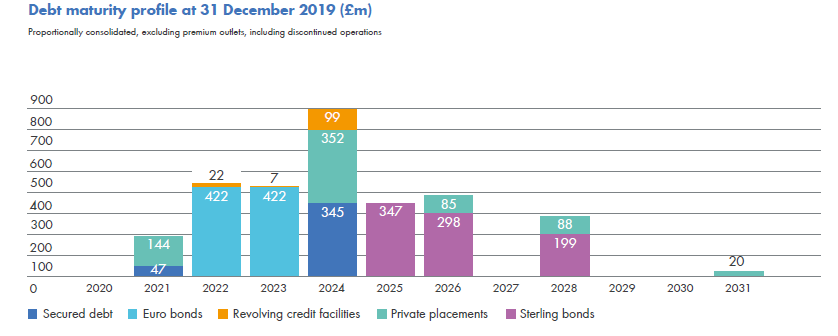

Most companies made good use of tables to present summaries of key information and reconciliations in a clear and easy to read manner. In addition, several companies used graphs to visually explain movements in net debt or debt maturity profiles.

As a result of the impact of Covid-19, many of the companies in our sample provided additional information about their liquidity position, including available liquidity, and provided an update at the time the report was published. We also noticed an increase in disclosures about events which happened after the balance sheet date, such as subsequent funding or financing transactions.

💡 Terms such as 'available liquidity' should be explained to allow users to understand how it relates to amounts presented in the financial statements, even if the meaning is readily apparent.

💡 Disclosures should clearly distinguish between discussions of the company's liquidity position at the balance sheet date and the date the financial statements were signed.

Examples of better disclosures included:

- Summary cash flow statement information, including year end cash and net debt positions, supported by explanation of the cash flows by operating, investing and financing activities;

- Explanation of movements in cash, net debt or debt maturity profiles;

- Description of available liquidity resources, including composition of cash and cash equivalents and undrawn borrowing facilities;

- Details of debt and borrowing facilities including financial covenants;

- Disclosure of other relevant obligations such as off balance sheet arrangements, supply chain financing, pension commitments and contingent liabilities; and

- Narrative explanation of cash and liquidity based APMs such as free cash flow, cash conversion, net debt and leverage.

Examples of better disclosure...

"Off-balance sheet arrangements At 31 December 2019, the Group had no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on the Group's financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Contingent liabilities Contingent liabilities include guarantees over the debt of equity investments of $55m and outstanding letters of credit of $33m..."

Intercontinental Hotels Group plc, Annual Report and Form 20-F 2019, p75

The company discloses other obligations such as off-balance sheet arrangements and contingent liabilities.

Operating and financial review

Examples of better disclosure...

CASH FLOW (£m)

Morgan Sindall Group PLC, Annual Report 2019, p22

Figures provided for movements and key subtotals.

Examples of better disclosure...

Debt maturity profile at 31 December 2019 (£m)

Proportionally consolidated, excluding premium outlets, including discontinued operations

Hammerson plc, Annual Report and Accounts 2020, p57

Colour coding provides further insight into debt mix and sources of funding.

Use of APMs and KPIs

Alternative performance measures (APMs) have been a focus of our work in recent years and were the subject of a previous thematic review published in 2017. While the principles around reporting APMs set out in that review remain relevant, we issued additional guidance in May 20207 in response to the challenges of the pandemic.

Alternative performance measures

As part of our review, we considered compliance with the ESMA guidelines8 with particular emphasis on the clarity of labels and definitions and clear reconciliations to measures presented in the financial statements. We considered what constituted a cash flow or liquidity based APM, and compared APMs with similar titles and definitions.

APMs were used throughout strategic reports and we observed different approaches to locating information required to comply with the ESMA guidelines such as definitions and reconciliations. The majority of companies provided an appendix with the definitions of all APMs.

All companies in our sample provided between two and eight cash flow or liquidity based APMs. While all companies presented some measure of net debt or net cash, some companies used it predominantly as an input into another APM such as 'net debt to EBITDA9' ratio.

After net debt, the most common APMs were 'net debt to EBITDA' (leverage) ratio, 'free cash flow' and 'cash conversion ratio'. Other APMs used included measures of adjusted operating cash flow and measures relating to capital expenditure and working capital.

Key performance indicators ('KPIs')

By comparison, most companies had only one or two cash flow or liquidity KPIs, although 23% of the sample had no such KPIs. We found this surprising given the importance of cash and liquidity to companies' performance. The most common KPIs were net debt and free cash flow followed by cash conversion ratio and net debt to EBITDA ratio.

No. of APMs / KPIs per company

Bar chart showing number of companies against number of measures (0 to 8) for APMs and KPIs.

Most common APMs & KPIs

Stacked bar chart showing number of companies against various APMs/KPIs (Net debt, Net debt/EBITDA, Free cash flow, Cash conversion ratio, Adjusted operating cash flow, Net capex, Gross capex).

Use of APMs and KPIs

We expect companies to present APM disclosures that:

- have clear and accurate labelling;

- have an explanation of their relevance and use;

- are reconciled to the closest IFRS measure; and

- are not given more prominence than the equivalent IFRS measures.

In line with the findings of our routine reviews, we found that most companies complied with the ESMA guidelines and met the expectations set out in our previous thematic.

Examples of better disclosures included:

- explanation of why variants of certain measures were used, for example, where one measure of leverage is used by management and another measure is used for covenant testing;

- providing a comprehensive section on APM disclosures detailing definitions, explanations and reconciliations where multiple APMs are used; and

- disclosure of the closest equivalent statutory measure for each APM presented.

We did, however, identify a few instances where there was room for improvement:

- ⚠️ In two cases, companies presented multiple versions of net debt (for example, 'net debt' and 'adjusted net debt') without explaining why multiple measures were necessary. In addition, the definitions and labels did not clearly distinguish between the separate measures of net debt, with the consequence that it was not clear as to which measure the commentary was referring; and

- ⚠️ One company presented an APM (comprising adjusted operating cash flows) with a label that could be confused with an IFRS measure.

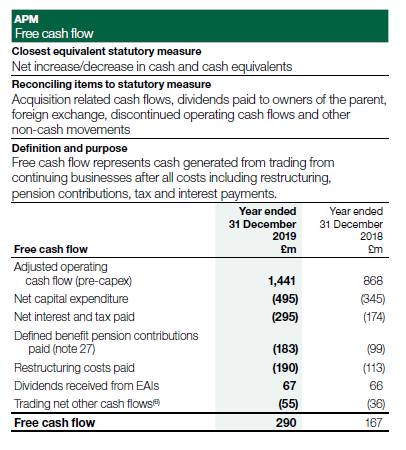

Examples of better disclosure...

APM Free cash flow

Closest equivalent statutory measure Net increase/decrease in cash and cash equivalents

Reconciling items to statutory measure Acquisition related cash flows, dividends paid to owners of the parent, foreign exchange, discontinued operating cash flows and other non-cash movements

Definition and purpose Free cash flow represents cash generated from trading from continuing businesses after all costs including restructuring, pension contributions, tax and interest payments.

Melrose Industries PLC, Annual Report 2019, p194

Closest statutory measure is explicitly stated.

Reconciling items are listed.

A definition is provided.

Tabular format of the APM information allows various items to be easily located.

Principal risks and uncertainties (PRUs)

Liquidity or funding risk was identified as a principal risk and uncertainty for 23% of the companies in our sample. These risks included management of working capital and the availability of cash or borrowing facilities. A further 13% of companies disclosed other treasury risks indirectly related to liquidity and cash flow, such as potential cash requirements from pension commitments or exposure to currency or other financial risks.

Unsurprisingly, many companies that published their annual report and accounts from April onwards, identified Covid-19 as either a principal risk or as a significant emerging risk which developed after the balance sheet date. Where Covid-19 was identified as a principal risk, the impact on cash flows and liquidity was included as part of this risk.

The remaining 34% of companies did not identify any risks relating to cash flows or liquidity. However, this does include companies which published their annual reports and accounts before March, when the impact of Covid-19 was not generally considered to be a major risk.

💡 We expect all companies to reassess their disclosure of principal risks and uncertainties in future reporting periods to ensure that liquidity risks are appropriately considered.

Examples of better disclosures included:

- Entity-specific risks and changes to those risks both during the year and anticipated to arise in the future;

- A description of mitigating factors and actions taken; and

- Links to strategy, business model and KPIs.

Examples of better disclosure...(excerpts)

"Risk Poor treasury planning or external factors, including failures in the banking market, leads to the Group having insufficient liquidity. The Group's financial position is unable to support the delivery of our strategy Deterioration in our financial position due to property valuation declines could result in a breach of borrowing covenants

Mitigating factors/actions Proactive treasury planning to ensure adequate liquidity levels are maintained Board approves and monitors key financing guidelines and metrics Annual Business Plan includes a financing plan and associated stress tests Capital provided by a diverse range of counterparties All major investment approvals supported by a financing plan No debt maturities due until mid-2021 Low level of capital commitments of £104 million at 2019 year end Significant headroom on Group debt covenants. Further details of covenants are given on page 57 of the Financial review

Change during 2019 and outlook At 31 December 2019, our balance sheet and key financing metrics remained robust. Taking into account the 2020 UK retail parks disposals, on a pro forma basis, we have significant liquidity of £1.6 billion, loan to value of 35% and gearing of 55%. Our average debt maturity has reduced to 4.7 years (2018: 5.4 years) and the next debt maturity is not until mid-2021. Total debt maturity over the next 24 months is £634 million, significantly less than our current liquidity.

Interest rates in the UK and EU are forecast to remain low over the medium term and the Group has significant headroom and financial flexibility to cope with further valuation reductions.

Nonetheless, given the current and forecast challenges in the retail and investment property markets, debt reduction through disposals and tight control over expenditure remains the key priority for the Group in 2020."

Hammerson plc, Annual Report and Accounts 2020, p62

Details of risk provided

Mitigating actions listed and linked to other parts of the report.

Future changes and external market factors considered

Going concern

Paragraphs 25 and 26 of IAS 1 require the directors to make an assessment of the company's ability to continue to operate as a going concern for at least 12 months from the balance sheet date. As part of this assessment, the directors must consider whether there are any material uncertainties that may cast significant doubt on the ability of the company to continue to operate as a going concern. Where these uncertainties exist, they must be disclosed.

Determining whether or not a material uncertainty exists is considerably more difficult given the uncertain economic climate as a result of Covid-19. Management may have exercised significant judgement in reaching the conclusion that no material uncertainties exist, in which case, disclosure of that significant judgement is required in accordance with paragraph 122 of IAS 1.

The Financial Reporting Lab report: 'Covid-19 - Going concern, risk and viability[^10]' provides useful guidance on the information that could be included within going concern disclosures, and the factors that boards may need to consider in making their going concern assessment. The Covid-19 Thematic Review[^10] also provides further guidance and examples of better disclosures.

Most of the companies in our sample that published accounts before March provided boiler plate going concern disclosures. There was, however, a marked improvement in disclosure made by those companies that published accounts later in the year. Of these companies, most included helpful, company-specific going concern disclosures within their financial statements. However, the level of detail presented varied with some companies providing high level going concern disclosures, which would have been improved by further detail of the underlying assumptions supporting the assessment.

Our findings were consistent with the findings of the Covid-19 Thematic which observed that the most helpful going concern disclosures had the following characteristics:

- Clear explanation of any material uncertainties that may cast doubt on the company's going concern status;

- Explanation of the different going concern scenarios that had been considered, such as the impact of Covid-19;

- Indication of which inputs were subjected to stress tests and explanation of how these stress tests affected the going concern conclusions; and

- Explanation of whether the company would need to make structural changes in order to continue to operate as a going concern.

In addition, we also found helpful examples which:

- Explained the company's exposure to vulnerable sectors, countries and key suppliers;

- Described the assumptions which were considered before the impact of Covid-19 were known;

- Provided outputs of reverse stress tests and commented on the likelihood of such scenarios; and

- Described the governance process taken by the board to challenge the assessment made.

Examples of better disclosure... (excerpts)

The assessment of going concern relies heavily on the ability to forecast future cashflows over the going concern assessment period which covered through to 30 September 2021. Although GBG has a robust budgeting and forecasting process, the current economic uncertainty caused by the Covid-19 pandemic means that additional sensitivities and analysis have been applied to test the going concern assumption under a range of downside and stress test scenarios. The following steps have been undertaken to allow the Directors to conclude on the appropriateness of the going concern assumption:

- Understand what could cause GBG not to be a going concern

- Consider the current customer and sector position, liquidity status and availability of additional funding if required

- Board review and challenge the base case forecast produced by management including comparison against external data sources available and potential downside scenarios

- Perform reverse stress tests to assess under what circumstances going concern would become a risk – and assess the likelihood of whether they could occur

- Examine what mitigating actions would be taken in the event of these stress test scenarios

- Conclude upon the going concern assumption

a) Understand what could cause GBG not to be a going concern

The potential scenarios which could lead to GBG not being a going concern are considered to be:

- Not having sufficient cash to meet our liabilities as they fall due and therefore not being able to provide services to our customers, pay our employees or meet financing obligations.

- A non-remedied breach of the financial covenants within the Group Revolving Credit Facility (RCF) agreement (detailed in note 22). Under the terms of the agreement this would lead to the outstanding balance becoming due for immediate repayment. These covenants are:

- Leverage – consolidated net borrowings (outstanding loans less current cash balance) as a multiple of adjusted consolidated EBITDA for the last 12 months, assessed quarterly in arrears, must not exceed 3.00:1.00

- Interest cover – adjusted consolidated EBITDA as a multiple of consolidated net finance charges, for the last 12 months, assessed quarterly in arrears, must not fall below 4.00:1.00

GB Group Plc, Annual Report and Accounts 2020, pp86-88

Explanation of the steps taken by the company and provides a clear structure to the disclosures.

Disclosure sets out what could cause the company to not be a going concern.

Specific details of covenant levels are provided.

Examples of better disclosure... (cont)

- Consider the current customer and sector position, liquidity status and availability of additional funding if required GBG does not have a high customer concentration risk with no individual customer generating more than 2% of Group revenue. The Group's customers operate in a range of different sectors which reduces the risk of a downturn in any particular sector. The financial services sector accounts for the largest percentage of customers, particularly within the Fraud and Identity segments, and there has not been a downturn in demand for these services since the pandemic began. There are also macro dynamics supporting the increased use of GBG products and services, both in general and within the context of the Covid-19 pandemic, such as: - continued compliance requirements globally - the ongoing existence of fraud globally, with Covid-19 giving fraudsters new opportunities, leading to increased cyber security risks and therefore demand for GBG anti-fraud solutions - continued digitisation and rise of online versus physical transactions in both consumer and business to business settings; - speed and quality of customer onboarding being a key differentiator, which is enhanced through the use of GBG's software GBG is not reliant upon any one supplier to provide critical services either to support the services we provide to our customers or to our internal infrastructure..."

GB Group Plc, Annual Report and Accounts 2020, pp86-88

Details of sector exposure, geographical and customer concentrations given.

Examples of better disclosure...(excerpts)

d) Perform reverse stress tests to assess under what circumstances going concern would become a risk – and assess the likelihood of whether they could occur

The base case forecast model was then further adjusted to establish at what point a covenant breach would occur without further mitigating actions. A covenant breach would occur before the available cash resources of the Group are fully exhausted and therefore the focus of the reverse stress test was on covenant compliance. In making this assessment it was assumed that management had reduced operating expenses by 20% which is the level that is considered possible without causing significant disruption to business operations. These savings would primarily be linked to people costs, net of any related redundancy costs.

With a 20% operating expenses saving introduced in Q3 of FY21 it would take a revenue decline of 42% for a covenant breach to occur (33% without any operating expenses savings). This breach would be as at 30 June 2021 although even at this point it would only take a net debt improvement of £400,000 or EBITDA increase of £130,000 to remedy this breach. With the assumption of revenue being flat during the year to 31 March 2022 the breach would be remedied by 30 September 2021.

Based on the current trading performance and through reference to external market data a decline of anywhere near 42% is considered by the Directors to be highly unlikely. If this became even a remote possibility then deeper cost cutting measures would be implemented well in advance of a covenant breach as well as consideration of a range of other mitigation actions detailed in the next section.

e) Look at what mitigating actions could be taken in the event of these reverse stress test scenarios

In the very unlikely event of the reverse stress test case scenario above a breach of covenants would occur on 30 June 2021 unless further mitigation steps were taken. Detailed below are the principal steps that would be taken (prior to the breach taking place) to avoid such a breach occurring:

- Make deeper cuts to overheads, primarily within the sales function if the market opportunities had declined to this extent. It would only take a reduction of 0.1% of overheads (based on the 31 March 2020 level) to increase EBITDA to remedy a covenant breach of £130,000.

- Request a delay to UK Corporation Tax, Employment Tax or Sales Tax payments under the HMRC ‘Time to Pay' scheme. This would be in addition to the deferral of VAT payments announced by the UK Government on 20 March 2020. This announcement has meant that VAT which would have been due by the Group between 20 March 2020 and 30 June 2020 is not due until 31 March 2021. In the year to 31 March 2020 Corporation Tax payments averaged £900,000 per quarter, Employment Tax payments (including employee taxes) were approximately £1.2 million per month and Sales Tax payments were £2.5 million per quarter.

- Draw down on the £30 million Accordion facility within the Group's banking agreement. This facility is subject to credit approval from the syndicate banks.

- Request a covenant waiver or covenant reset from our bank syndicate. Even under this stress test scenario the forecast is that the Group would only be in breach for one quarter (quarter ending 30 June 2021) before returning to covenant compliance the following quarter. The business would still be EBITDA positive at this point and the directors have a reasonable expectation of achieving a temporary covenant waiver from the banks if needed.

- Raise cash through an equity placing. Under its Articles of Association GBG has the right to raise cash through an equity placing up to 10% of its market valuation at the date of the placing. Even factoring in a discount being applied to the share price, on the basis that the level of extra cash needed to remedy a breach at 30 June 2021 would be £400,000, the Directors are confident that funding well in excess of this level could be raised.

- Disposal of part of the business."

GB Group Plc, Annual Report and Accounts 2020, pp86-88

Detailed discussion of reverse stress testing including identification of the point at which covenants will be breached.

Details are provided of what further action could be taken.

Examples of better disclosure...

“Our severe and plausible downside scenarios contemplate lower regional bus commercial revenue and vehicle mileage over the forecast period, in addition to more cautious assumptions around levels of government support measures. The range of downside scenarios considered cover:

- commercial revenue at between 50% and 80% of pre-COVID levels by 1 May 2021;

- commercial revenue at between 75% and 85% of pre-COVID levels in the year ending 30 April 2022;

- concessionary revenue at between 70% and 85% of pre-COVID levels by 1 May 2021;

- concessionary revenue at between 75% and 90% of pre-COVID levels in the year ending 30 April 2022;

- vehicle mileage at between 80% and 90% of pre-COVID levels by 1 May 2021 and in the year ending 30 April 2022;

- additional COVID-related government measures ending between July 2020 and October 2020.

Mitigating actions

As explained in section 1.6.10 of this Annual Report, we have secured waivers of the net debt to EBITDA and EBITDA to interest covenant tests in our £325m of committed bank facilities entered into in March 2020. The waivers cover the years ending 31 October 2020 and 1 May 2021. As things stand, the next testing of those covenants will be in respect of the year ending 30 October 2021. In the meantime, the Group has agreed with the banks to maintain a minimum level of available liquidity. The minimum liquidity thresholds are £400m as at 31 October 2020 and £150m (plus the amount of any commercial paper outstanding under the COVID-19 Corporate Financing Facility) as at 1 May 2021. To the extent any severe downside scenarios materialised, we consider that the Group would have sufficient controllable, mitigating actions to avoid a breach of the liquidity thresholds.

The key mitigation available would be to further reduce the Group's cost base, in particular reducing vehicle mileage to better match customer demand, which would result in variable cost savings and the reduction of capital expenditure."

Stagecoach Group plc, Annual Report and Financial Statements 2020, p48

Description of key assumptions underpinning the downside scenarios.

Disclosure clearly explains details of mitigating actions which have and could be taken in the event of a stress scenario.

Viability statements

Unlike going concern, the viability statement is designed to provide information to stakeholders about the longer term economic and financial viability of the company. Consequently, the viability statement requires a longer term assessment of a company's ability to meet its liabilities as they fall due, although there is an element of overlap.

The Financial Reporting Lab report: 'Covid-19 - Going concern, risk and viability' provides useful guidance on the information that could be included within the viability statement and the factors that boards may need to consider in determining whether the group is viable over the longer term. The Covid-19 Thematic Review also provides further guidance and examples of better disclosures.

As a result of the economic uncertainty caused by Covid-19, high quality viability disclosures are critical to enable users of accounts to understand how a company intends to deal with the challenges posed by the pandemic.

💡 Given the current uncertain environment, it is even more important that the viability statement sets out clearly the company's specific circumstances, and the degree of uncertainty about the future. In particular, the board should draw attention to any qualifications or assumptions made in determining the company's viability.

We continue to observe that the better viability disclosures included:

- Identification of areas which were particularly subject to uncertainty and how that uncertainty may be mitigated;

- Explanation of the viability scenarios that had been prepared, including a description of key assumptions within each scenario and how they impacted the viability conclusion;

- Indication of which inputs had been subject to stress testing and reverse stress testing and explanation of how this impacted the viability assessment;

- Explanation of the impact of post balance sheet events such as the arrangement of new lending facilities, extension of existing facilities and renegotiation or waiver of bank covenants; and

- Linkage to relevant information included in other areas of the annual report.

Many of the companies in our sample failed to present clear details of the assumptions that underpinned their viability assessment. In addition, while some companies referred to the use of stress testing in assessing viability, very few companies provided details of stress testing or reverse stress testing performed.

In particular we identified that:

- ⚠️ One company in our sample planned to raise further funds after the reporting date, but it was not clear how this had been treated for the purpose of the scenarios considered.

Clear linkage provided to other areas of the annual report including accounting judgement and estimates.

Examples of better disclosure...

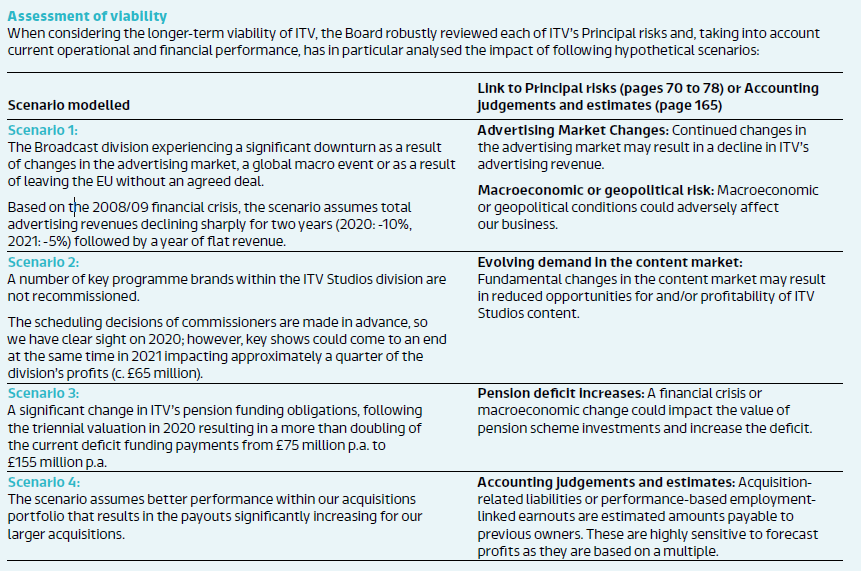

Assessment of viability When considering the longer-term viability of ITV, the Board robustly reviewed each of ITV's Principal risks and, taking into account current operational and financial performance, has in particular analysed the impact of following hypothetical scenarios:

ITV Plc, Annual Report 2019, p79

Details of scenarios modelled including specific assumptions for revenue in response to external factors.

Link made to the triennial valuation of defined benefit pension scheme.

IFRS 7 liquidity risk disclosures

Qualitative disclosures

IFRS 7 requires quantitative and qualitative disclosures of the exposure to liquidity risk and how it arises, as well as disclosure of the company's objectives, policies and processes for managing the risk, and the methods used to measure it. IFRS 7 permits these disclosures to be incorporated by reference from the financial statements and presented elsewhere in the report and accounts.

Many companies in our sample provided relatively brief qualitative disclosures of liquidity risk in the financial risk management notes, with more detailed information provided elsewhere (such as details of liquidity risk presented in the going concern disclosures, viability statement and governance and liquidity policies included in the strategic report).

💡 The Group needs to ensure that it has sufficient liquid funds available to support its working capital and capital expenditure requirements. All subsidiaries submit weekly and bi-monthly cash forecasts to the treasury function to enable them to monitor the Group's requirements.

Examples of better disclosure...

"Liquidity risk

Group policy ensures sufficient liquidity is maintained to meet all foreseeable medium-term cash requirements and provide headroom against unforeseen obligations.

Cash and cash equivalents are held in short-term deposits, repurchase agreements, and cash funds which allow daily withdrawals of cash. Most of the Group's funds are held in the UK or US, although $16m (2018: $2m) is held in countries where repatriation is restricted (see note 19).

Medium and long-term borrowing requirements are met through committed bank facilities and bonds as detailed in note 22. Short-term borrowing requirements may be met from drawings under uncommitted overdrafts and facilities."

Intercontinental Hotels Group plc, Annual Report and Form 20-F 2019, p184

Key information on cash is provided with references to other notes for further information.

Borrowings are analysed as short, medium and long term.

Examples of better disclosure...

"(d) Liquidity Risk

The Group needs to ensure that it has sufficient liquid funds available to support its working capital and capital expenditure requirements. All subsidiaries submit weekly and bi-monthly cash forecasts to the treasury function to enable them to monitor the Group's requirements.

The Group has sufficient credit facilities to meet both its long- and short-term requirements. The Group's credit facilities are provided by a variety of funding sources and total $164.2m (2018 – $164.9m) at the year-end. The facilities comprise $160.0m of secured committed facilities (2018 – $159.5m) and $4.2m secured uncommitted facilities (2018 – $5.4m).

The Group's $160m Revolving Credit Facility (“RCF”) is due to mature in December 2022, with an option to extend for a further one year to December 2023. The main features of the RCF are as follows:

- The base margin on amounts drawn under the facility is 1.00%.

- Market standard financial covenants of the facility, as discussed below.

- A $75.0m accordion feature, providing Hunting with additional flexibility to increase the size of the bank facility to $235.0m, subject to approval of its bank lending group."

Hunting PLC, Annual Report and Accounts 2019, p149

The company provides entity specific information on how cash is forecast.

Details are provided for committed facilities as well as options available.

Better disclosures contained:

- entity-specific policies on managing liquidity risk;

- details of liquid resources and uncommitted facilities;

- references to liquidity information contained in other notes; and

- information about any changes to liquidity risk management.

Maturity analysis

IFRS 7 requires a maturity analysis of all financial liabilities to be provided (including leases and issued financial guarantees). The maturity analysis should include undiscounted, contractual cash flows, including principal and interest payments. The time bands disclosed need to be consistent with the information provided internally to key management personnel.

Liquidity risk disclosures will continue to be a key area of interest for investors given the uncertainty in the current economic environment. While all companies in our sample provided a maturity analysis, the quality varied.

💡 While the appropriate level of disaggregation of time bands may differ between companies, we expect companies to consider whether a greater degree of disaggregation than reported previously is required in the current circumstances.

💡 Companies should consider if it is clearer to present liquidity information together in one location rather than in separate maturity tables.

Examples of better disclosures in our sample included:

- clear explanation of what the maturity analysis represented;

- information presented in a way which could be easily compared to items in the statement of financial position (for example, showing the carrying value next to the total of undiscounted contractual cash flows);

- all relevant liabilities, including lease liabilities, presented together for easy analysis; and

- sufficient granularity in the time bands chosen.

Examples of better disclosure...

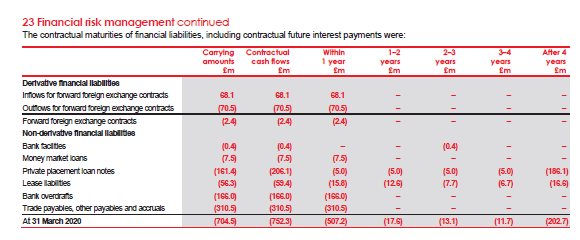

"Undiscounted financial liabilities

The Group is required to disclose the expected timings of cash outflows for each of its financial liabilities (including derivatives). The amounts disclosed in the table are the contractual undiscounted cash flows (including interest), so will not always reconcile with the amounts disclosed on the Statement of Financial Position.”

ITV PLC, Annual Report and Accounts 2019, p211

The narrative provides a clear and concise explanation of what the disclosure represents, is explicit that undiscounted cash flows include interest and explains that this may differ from the amounts presented in the statement of financial position.

Areas identified as warranting improvement included:

- ⚠️ some companies in our sample failed to clearly distinguish the maturity analysis presented on an undiscounted basis from that presented on a discounted basis, for example, by having the same titles for both;

- ⚠️ several companies excluded contractual interest cash flows from the contractual undiscounted cash flows; and

- ⚠️ several companies presented the maturity disclosures in separate notes, which made it hard to understand the aggregate position.

Maturity analysis

Examples of better disclosure...

23 Financial risk management continued

The contractual maturities of financial liabilities, including contractual future interest payments were:

Electrocomponents plc, Annual Report and Accounts 2020, p143

The presentation of information in one-year time bands provides detailed information about a significant proportion of the company's exposure to cash outflows in the shorter term.

Totals are provided comparing the contractual cash flow to the carrying amount.

All financial liabilities, including derivatives and leases are shown together.

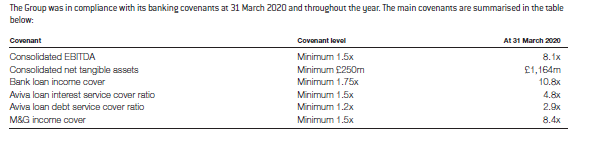

Compliance with banking covenants

In our Covid-19 Thematic Review we stated that, in the current environment, we expect companies to disclose details of their banking covenants, even when they have complied with the terms of the arrangements and there is significant headroom. Any judgements made in assessing compliance with covenants should also be explained.

We were pleased to see that the majority of companies that published the annual report and accounts after March provided information regarding their compliance with the terms of covenants and waivers agreed with their debt providers.

Where a company had multiple covenants, or covenant levels changing over time we found tabular disclosures to be helpful.

Examples of better disclosure...

The Group was in compliance with its banking covenants at 31 March 2020 and throughout the year. The main covenants are summarised in the table below:

Big Yellow Plc, Annual report 2019/20, p143

The disclosure lists the covenants, the covenant levels and the position at year end.

Examples of better disclosure...

"The Group has entered into a revised agreement with its banking partners. This will enable it to utilise not only the full Revolving Credit Facility of £200m but also to utilise secured funding from the Bank of England Covid Corporate Financing Facility ('CCFF'), up to a combined net debt limit of £275m at its peak. As part of this agreement, the Group's existing covenant requirements will lapse and be replaced by three new covenant tests relating to total net debt; cash burn; and last twelve months EBITDA. These tests will be applied monthly until June 2021, after which it is envisaged that the business will have a phased return back to existing six-monthly covenant tests of EBITDA to net debt and EBITDA to interest cover.

Until the business returns to existing covenant tests – which is currently envisaged as commencing July 2021 – Adjusted Leverage is less than 2.0x (i.e. pre-IFRS 16) and it has no outstanding commercial papers issued under the CCFF, there will be a prohibition of any payment to shareholders by way of dividend or share buy-back, with the same tests applying to acquisitions. Furthermore, the Group must use best efforts to raise equity if leverage is above 3.0x before the later of January 2021 or 3 months before the redemption of the final commercial paper issuance.”

Card Factory Plc, Annual Report and Accounts 2020, p28

The company explained how new financing facilities resulted in changes to covenants, how often the revised covenants will be tested, and when the business will return to the existing covenants.

The disclosure links the covenants to restrictions on shareholder distributions and acquisitions.

Compliance with banking covenants

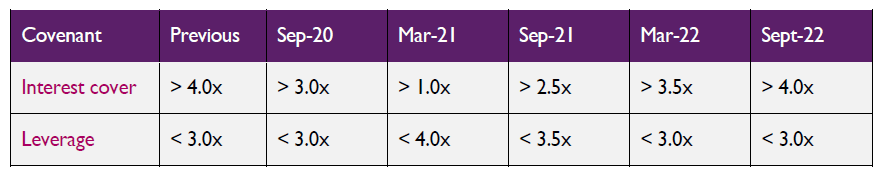

In our Covid-19 Thematic Review we identified that better disclosures explained:

- how calculated covenant ratios compare with the requirements of lending arrangements;

- the available headroom;

- whether the adoption of IFRS 16 had any impact on covenants;

- any waivers agreed with debt providers; and

- any changes post year-end as a result of further measures taken (for example, equity raise).

This review also identified that the better disclosures explained:

- the impact on covenants of new borrowing facilities and government support;

- how often covenants are tested;

- how covenant levels will change over time; and

- any restrictions on the company such as over shareholder distributions or acquisitions.

Examples of better disclosure...

"Mitie's two key covenant ratios are calculated on a pre-IFRS 16 basis. These are the leverage (ratio of consolidated total net borrowings to consolidated EBITDA to be no more than three times) and interest cover covenant (ratio of consolidated EBITDA to net finance costs to be no less than four times).”

MITIE Plc, Annual report and accounts 2020*, p43

The disclosure clearly shows how covenant levels change over time.

Seasonality

Paragraph 35 of IFRS 7 states that if the quantitative data disclosed as at the end of the reporting period are unrepresentative of an entity's exposure to risk during the period, an entity shall provide further information that is representative.

In addition to disclosure of the exposure to liquidity risk at the reporting date, several companies in our sample provided additional disclosures of the exposure during the year. Examples of better disclosures included:

- disclosure of the maximum drawdown of revolving credit facilities during the year;

- explanation of the impact of seasonality on liquidity and working capital in comparison to seasonality in the business operations; and

- use of metrics which considered average exposures in the report period (such as average daily net cash) in addition to the position at the reporting date.

Examples of better disclosure...

"Although there is an element of seasonality in the Group's operations, the overall impact of seasonality on working capital and liquidity is not considered significant."

Stagecoach Group plc, Annual Report and Financial Statements 2020, p152

The company explicitly stated that the impact on liquidity was not significant.

Examples of better disclosure...

“At various periods during the year, the Group drew down on the £630 million Revolving Credit Facility ('RCF') to meet short-term funding requirements. At 31 December 2019, the Group had drawings of £nil million under the RCF (2018: £50 million), leaving £630 million available to draw down at year end. The maximum draw down of the RCF during the year was £400 million (2018: £400 million).”

ITV PLC, Annual Report and Accounts 2019, p226

The disclosure states the maximum drawing during the year in addition to explaining its use in meeting short term funding requirements.

Examples of better disclosure...

"Average daily net cash during 2019 was £108.9m (2018: £98.8m). Average daily net cash is defined as the average of the 365 end-of-day balances of the net cash (as defined above) over the course of a reporting period. Management use this as a key metric in monitoring the performance of the business."

Morgan Sindall Group plc, Annual Report 2019, p130

The company provided a measure of average daily net cash as used by management.

Working capital and supplier financing arrangements

Companies are reminded that supply chain financing arrangements, including reverse factoring transactions, are currently an area of focus for the FRC.

We note that the IASB's Interpretations Committee recently considered the principles and requirements in IFRS Standards relating to reverse factoring. While a final decision has yet to be reached, the Committee noted that companies should not gross up the cash flow statement, unless the arrangement involves cash inflow and outflow for the entity when an invoice is settled by the financing transaction.

Companies also need to determine whether to derecognise the supplier payable and recognise a liability to the finance provider, and what additional disclosures about exposures to risk from financial instruments, significant judgements and material effects are required.

Where companies are using material supplier financing arrangements, we expect disclosure of:

- the amount of the facility and usage;

- the accounting policy applied, including the basis on which the company recognised the liability to suppliers;

- whether the liability is included within the determination of key performance indicators such as net debt;

- the cash flows generated by such arrangements; and

- the impact on liquidity risk which could arise from losing access to the facility, for example, acceleration of payments to suppliers leading to demands on cash and working capital.

Findings from our thematic

Three companies in our sample disclosed material supplier financing arrangements. In addition, a further four companies disclosed immaterial arrangements, or stated explicitly that no supplier financing arrangements were used.

Examples of better disclosures included:

- a description of the supplier financing arrangements used including the purpose of the arrangement;

- how amounts relating to the arrangement are presented in the balance sheet and cash flow statement;

- details of interest or fees payable;

- the impact on the timing of the company's cash flows; and

- how liquidity risk is managed in relation to the risk of losing access to the facility.

Examples of better disclosure...

"The Group finances the purchase of New vehicles for sale and a portion of Used vehicle inventories using vehicle funding facilities provided by various lenders including the captive finance companies associated with brand partners. Such arrangements generally are uncommitted facilities, have a maturity of 90 days or less and the Group is normally required to repay amounts outstanding on the earlier of the sale of the vehicles that have been funded under the facilities or the stated maturity date. Related cash flows are reported within cash flows from operating activities within the consolidated statement of cash flows.

Vehicle funding facilities are subject to LIBOR-based (or similar) interest rates. The interest incurred under these arrangements is included within finance costs and classified as stock holding interest (see note 7). At 31 December 2019, amounts outstanding under vehicle funding facilities and on which interest was payable were subject to a weighted average interest rate of 1.5% (2018 – 2.5%).”

Inchcape plc, Annual Report and Accounts 2019, p156

The disclosure explains that the cash flows are presented as operating flows in the statement of cash flows.

The company provides information about the arrangement, including details of the interest rates payable.

Examples of better disclosure...

"Working capital

The Group has a small number of uncommitted working capital programmes, which predominantly relate to the programmes inherited as part of the GKN acquisition. These programmes provide favourable financing terms on eligible customer receipts and competitive financing terms to suppliers on eligible supplier payments.

GKN businesses which participate in these customer related finance programmes have the ability to choose whether to receive payment earlier than the normal due date, for specific customers on a non-recourse basis. As at 31 December 2019, the drawings on these facilities were £200 million (31 December 2018: £206 million).