The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

IFRS 9 'Financial Instruments' Interim Disclosures in the First Year of Application

- Executive Summary

- Overview of the thematic

- Transition

- Non-banking entities

- Banks

- Classification and measurement

- Impairment: Policies and methodologies

- Impairment: Policies and methodologies (continued)

- Impairment: Staging and credit risk profile

- Impairment: Staging and credit risk profile (continued)

- Impairment: Alternative economic scenarios

- Judgements and estimation uncertainty

- Judgements and estimation uncertainty (continued)

- Next steps

Executive Summary

Introduction

This report summarises the key findings of our thematic review of disclosures in 2018 interim accounts relating to the implementation of IFRS 9 'Financial Instruments', which:

- Became effective on 1 January 2018;

- Replaces IAS 39 'Financial instruments: Recognition and Measurement' and expands the disclosure requirements of IFRS 7 'Financial instruments: Disclosures';

- Introduces an expected credit loss model that leads to earlier recognition of losses on loans and other receivables; and

- Aligns hedging requirements more closely to risk management practices than IAS 39.

Banking is the sector most significantly affected by IFRS 9, principally owing to the introduction of the expected credit loss model. Outside the banking sector, IFRS 9 has generally not had a material effect. Consequently, this thematic review focuses on the quality of interim disclosures in banking entities although other sectors are also considered. It aims to provide useful guidance for companies when considering the completeness of their upcoming, and more extensive, year-end disclosures.

Key findings

We noted some good examples of disclosure, some of which are highlighted in this report. These excerpts of published interim accounts are intended to illustrate helpful ways of communicating the effect of adopting IFRS 9 to users.

Our review also identified a number of areas where disclosure could be improved, and some areas where no disclosure had been provided at all.

Although we accept that interim disclosure requirements are less extensive than those for full-year accounts, we felt that some companies, in particular, some smaller banks, did not sufficiently explain the impact of adopting IFRS 9. We hope companies will provide more comprehensive disclosure in their upcoming annual reports and accounts.

Separate topics are addressed throughout this report, but our key findings were that the following disclosures could be improved:

- Transitional disclosures analysing the principal differences between IAS 39 and IFRS 9;

- Qualitative and quantitative disclosures made by the smaller banks regarding determination of significant increases in credit risk, including linkage to internal credit ratings;

- Disclosure of estimation uncertainty, in particular quantification of sensitivities of expected credit losses to changes in assumptions; and

- Discussion of the business model in assessing the classification of financial assets.

We encourage preparers to carefully consider the extent of disclosures included within their upcoming annual reports. Companies should aim to ensure not only that mandatory disclosure requirements have been met, but that sufficient explanation of concepts, elaboration of judgements made and conclusions reached have also been provided, where material.

We recognise that it may not be possible to implement all of our recommendations in 2018 annual reports. As disclosures develop, we will continue to review best practice.

We hope preparers find this review useful and we encourage engagement with external auditors to plan for the upcoming annual reporting period.

Overview of the thematic

Scope of our review

Our review consisted of a limited scope desktop review of the interim financial statements of a sample of companies. Our focus was on the adequacy of disclosures regarding the effect of the transition to IFRS 9 in the first year of adoption. We have only considered IFRS 9 transition documents published by the major banks to the extent necessary to support the interim disclosures.

The application of the expected credit loss ('ECL') model by banks, and especially the larger banks, requires the use of complicated models to determine the level of loan loss provisions. Our review did not consider the reasonableness of the assumptions used in those models nor did we assess the appropriateness of the methodologies applied.

Interim disclosure requirements

IAS 34 'Interim Reporting' does not specify how much detail entities must provide when explaining changes in accounting policy in interim accounts. The extent of disclosures is therefore largely left to management's judgement.

Where the adoption of IFRS 9 has had a significant impact for a company, we expect management to consider the requirements of IAS 8 'Accounting Policies, Changes in Accounting Estimates and Errors' in order adequately to explain the adjustments made to financial statement line items for the comparative period(s). In addition, companies should consider the additional transitional disclosure requirements in IFRS 7 'Financial Instruments: Disclosures' which are intended to explain the impact of the adoption of IFRS 9.

We also expect management to ensure that the disclosures are of a sufficient level of granularity as to allow users to understand fully the extent to which IFRS 9 has had an impact on the business. Consequently, we expect the disclosures for banks to be considerably more detailed than those for the non-banking sector.

Our sample

We reviewed the interim financial statements of a sample of 15 entities. This sample was skewed to banking entities, including one building society1. We also included one life insurance company that had adopted the deferral method to assess the adequacy of its disclosures regarding this decision.

Industries sampled

A pie chart illustrating the distribution of sampled industries: - Banks (including building societies): 60% - Oil & Gas: 13% - Insurance: 13% - Travel & Leisure: 7% - Mining: 7%

We intend to review the full-year accounts of companies in our sample whose interim disclosures were weaker, to ensure improvements have been made at the year-end.

Transition

Comparatives

As permitted by IFRS 9, none of the entities restated comparatives, although a number of banks voluntarily presented their credit risk disclosures at 1 January 2018 on an IFRS 9 basis to enable greater comparability.

Classification and measurement

Most of the entities reviewed provided a reconciliation of the key balance sheet line items to highlight the key changes in classification between IAS 39 and IFRS 9. The qualitative analysis of the differences in classification could be improved. Most entities chose to set out the revised accounting policy under IFRS 9 without explanation of the key changes in the classification of assets and liabilities.

Two entities used the adoption of IFRS 9 as an opportunity to review the overall presentation of assets and liabilities. As a result, changes were made to the presentation of certain items which were considered to be more relevant for users of the accounts. Where this was the case, we found that they provided clear explanation of the changes made.

Own credit risk

Only the large banks in our sample have designated financial liabilities at FVTPL and thus present changes in own credit risk in OCI. All early adopted these requirements in their 2017 annual report and accounts.

Impairment

The only entities materially affected by the new requirements were banks. We found that there was no evidence that banks were taking advantage of some of the transitional exemptions permitted under IFRS 9.

Two banks provided a helpful analysis of the differences in the key terms in IFRS 9 and IAS 39. Most others provided a reconciliation of the impairment provisions under IAS 39 to the ECL provision under IFRS 9.

Most banks did not provide detail of key assumptions made on transition, in particular, to assess the probability of default ('PD') at origination and significant increase in credit risk for loans originating prior to 2018.

None of the banks disclosed that they were unable to determine significant increase in credit risk because it would require undue cost or effort.

Hedging

None of the banks reviewed have adopted the hedging requirements under IFRS 9, all opting to continue to apply IAS 39. With the exception of the life assurer, the non-banking entities reviewed did adopt IFRS 9 hedging but few provided details of the new requirements compared to those under IAS 39.

Examples of good disclosure...

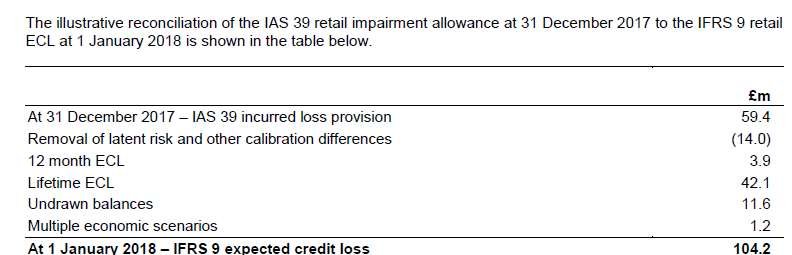

Virgin Money provided a helpful reconciliation of impairment provisions under IAS 39 to the expected loss provisions under IFRS 9.

The illustrative reconciliation of the IAS 39 retail impairment allowance at 31 December 2017 to the IFRS 9 retail ECL at 1 January 2018 is shown in the table below.

- Virgin Money Holdings (UK) plc, p19

Points to remember on transition

- IFRS 7 has a number of additional transitional disclosures which are required on adoption of IFRS 9.

- We expect the impact on deferred tax as a result of the transition to IFRS 9 to be considered and disclosed where material.

- Companies will need to update hedging documentation and assess the effectiveness of existing hedges on application of the new hedging requirements.

- An adjustment within opening equity is required for the time value of options where only the intrinsic value of the option was designated as a hedging instrument under IAS 39.

- Companies should explain any key assumptions adopted on implementation of IFRS 9. We expect companies to explain and, where possible, quantify the material differences between IAS 39 and IFRS 9.

For example, the requirement to determine ECL on undrawn commitments could be a material change for banks with a large retail portfolio. We therefore expect the impact to be quantified.

Examples of good disclosure...

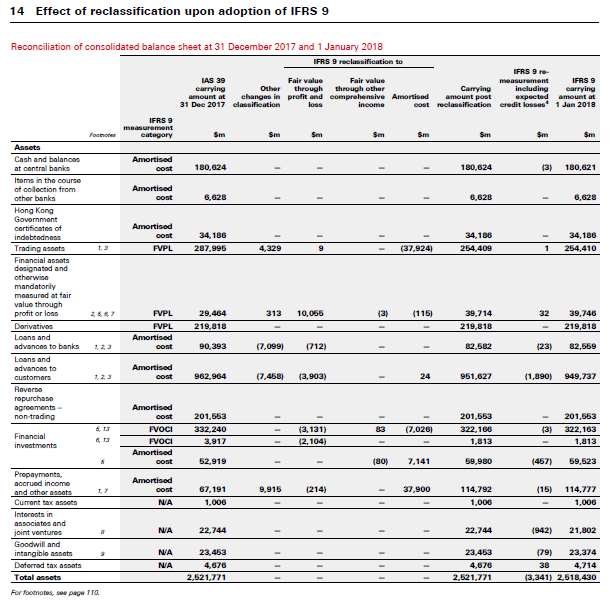

We found HSBC's manner of setting out the quantitative effect on the balance sheet of transition to IFRS 9 helpful. It was clear and provided the reader with a good understanding of how the new standard specifically affected the company.

14Effect of reclassification upon adoption of IFRS 9

- HSBC Holdings plc, p107

Non-banking entities

IFRS 9 did not have a material effect on the results of non-banking entities

Using the 2017 auditor's assessment of materiality as a guide, we observed that IFRS 9 did not materially affect the results of the non-banking entities we reviewed. Notwithstanding this, we were pleased to see that non-banking entities provided some useful disclosures explaining the effect of adopting IFRS 9.

We identified one example of a contract that failed the solely payments of principal and interest (SPPI) test and was classified in its entirety as FVTPL. This was clearly explained by the company. Whilst trade receivables and basic loans will usually meet the SPPI test, commodity purchase contracts that have repricing mechanisms or receivables linked to the value of an asset, such as housebuilders' shared equity schemes, will usually fail the test.

As mentioned previously, with the exception of the life assurer, all non-banking entities reviewed had adopted IFRS 9's hedging requirements, explaining that existing hedges under IAS 39 continued to qualify for hedge accounting under IFRS 9. Under IFRS 9, the time value of options has to be recognised as a cost of hedging in OCI and accumulated in a separate component of equity. Where only the intrinsic value of the option was previously designated as a hedging instrument, an adjustment within opening equity will be required on transition. The entities in our sample that used options to hedge had made this adjustment.

Insurance companies

We observed that the impact of IFRS 9 on general insurers was not material as most assets are managed on a fair value basis.

Most life assurers have applied the temporary exemption in IFRS 4 'Insurance Contracts' and have opted to defer implementation of IFRS 9 until 1 January 2021. The life assurance company reviewed provided adequate explanation as to how it met the criteria for deferral.

The main issues identified in our review of non-banking entities were:

- Although we would expect non-banking entities generally to have a hold-to-collect business model, in many cases this was not clarified.

- In one case, IAS 39 terminology ('available for sale') continued to be used for the interim balance sheet.

- Only two entities clarified that they had adopted the simplified approach, recognising full lifetime credit losses on initial recognition. We acknowledge that there may not be a material difference between the three-bucket approach and the simplified approach when trade receivables have short credit terms but it would be helpful if this could be clarified.

- One company in our sample had very significant equity and debt security investments but the explanation of the IFRS 9 classification (FVOCI) could have been improved.

Points to consider for non-banking entities

- Many of the transition disclosure requirements will not be required.

- However, we expect companies to explain why the impact is not material, particularly given that many non-banking companies recognise material financial instruments in their accounts

- Take care not to overlook categories of financial instruments or assume too readily that IFRS 9 has no effect. For example IFRS 9's impairment provisions have been extended to include IFRS 15 contract assets and apply to loans to joint ventures and, for parent companies, loans to subsidiaries.

- Remember where a host contract containing an embedded derivative is a financial asset, the embedded derivative feature will usually result in the entire asset being measured at fair value. Embedded derivatives should, however, continue to be separated where (i) the derivative is not closely related to the host contract and the host contract is a financial liability; or (ii) where the host contract is not a financial asset.

- Under IFRS 9 it is necessary to reconsider the accounting for previous modifications of debt that did not result in derecognition, e.g. a refinancing that did not result in the loan being derecognised. Whilst the previous practice was to adjust the interest rate going forward for the modified terms and costs incurred, under IFRS 9 a gain or loss must be recognised to preserve the original effective interest rate.

- Remember that IFRS 7's disclosure requirements have been expanded by IFRS 9. This should be factored into preparations for the 2018 report and accounts.

Banks

Classification and measurement

One of the key interim disclosure requirements in the first year of applying a new accounting standard is to provide adequate explanation of the nature and effect of any changes in accounting policies.

Most of the banks reviewed provided detailed reconciliations of the impact on the balance sheet of the change in measurement categories following implementation of IFRS 9.

Nearly all provided a description of the classification categories under IFRS 9 and the application of the business model and SPPI tests. However, we found that the quality of this disclosure varied greatly, with a marked difference between the larger and smaller banks.

For example, gains and losses on equity securities designated at FVOCI are recognised in equity and cannot be recycled

Examples of good disclosure...

> "Non-trading equity instruments acquired for strategic purposes rather than capital gain may be irrevocably designated at initial recognition as held at FVOCI on an instrument by instrument basis. Dividends received are recognised in profit or loss. Gains and losses arising from changes in the fair value of these instruments, including foreign exchange gains and losses, are recognised directly in equity and are never reclassified to profit or loss even on derecognition." > > - Standard Chartered plc, p102

The main issues identified in this area were:

- Use of boilerplate language which was generic and was often directly quoted from the standard

- Where assets and liabilities were designated at FVTPL or, in the case of equity securities, at FVOCI, there was little explanation of the reasons for such designations; most banks quoted the designation criteria directly from the standard

- Whilst most banks discussed the implications of loan modifications in assessing significant increase in credit risk and staging, only three discussed the accounting implications of modifications which do not result in derecognition

- Not all banks disclosed the treatment of gains and losses in profit or loss or other comprehensive income

- Whilst we have no concerns regarding the classifications adopted, we found that descriptions of the business model were often generic and did not address, for example, assets held for liquidity purposes.

For example, factors which are likely to prevent a financial asset meeting the SPPI test, assessment of the business model criteria and determination of the period over which cash flows are assessed.

Examples of good disclosure...

> "Financial assets that are held to collect contractual cash flows where those cash flows represent solely payments of principal and interest are measured at amortised cost. A basic lending arrangement results in contractual cash flows that are solely payments of principal and interest on the principal amount outstanding. Where the contractual cash flows introduce exposure to risks or volatility unrelated to a basic lending arrangement such as changes in equity prices or commodity prices, the payments do not comprise solely principal and interest. Financial assets measured at amortised cost are predominantly loans and advances to customers and banks together with certain debt securities. Loans and advances are initially recognised when cash is advanced to the borrower at fair value inclusive of transaction costs. Interest income is accounted for using the effective interest method" > > - Lloyds Banking Group plc, p59

Points to consider when explaining classification and measurement

- Avoid the use of boilerplate language or quoting directly from the standard.

- Where assets or liabilities have been designated to a measurement category, companies should explain how they have met the criteria for designation.

- Remember to address the key elements of IFRS 9 classification requirements in disclosing the accounting policies, including modifications, reclassification, recognition and derecognition.

Impairment: Policies and methodologies

On the whole, the disclosures were generally good regarding the policies and methodologies adopted in determination of ECLs.

Most of the banks defined the key terms underlying the ECL models and explained the basis on which probability of default, loss given default and exposure at default were determined for both retail and wholesale portfolios. In addition, the banks clearly explained how the expected life of assets was determined, in particular for credit cards and other revolving credit facilities.

The main issues identified in this area were:

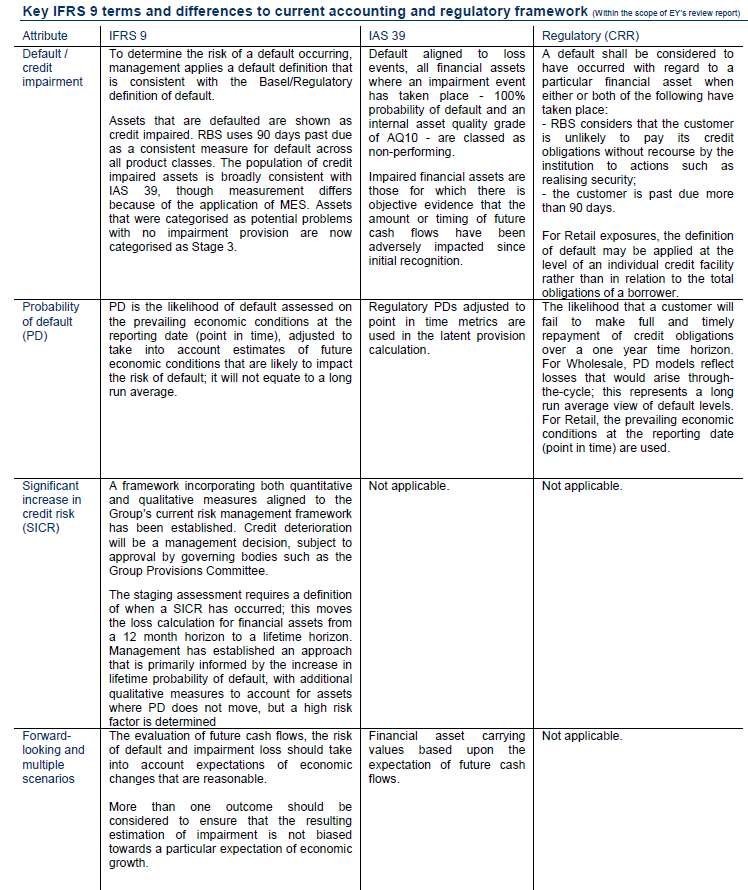

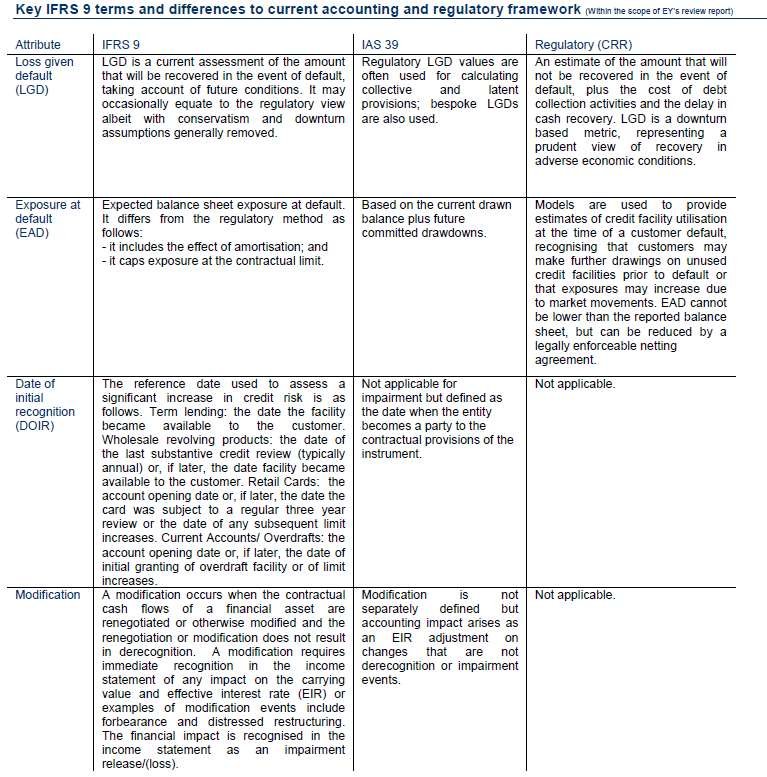

- A number of banks disclosed that they used regulatory models as a starting point for the development of the IFRS 9 models. However, few banks provided a comparison of the key terms and differences between the models used to determine ECLs under IFRS 9 compared to the regulatory models.

Examples of good disclosure...

IFRS 9 methodology

Approach for determining expected credit losses Credit loss terminology

| Component | Definition |

|---|---|

| Probability of default (PD) | The probability at a point in time that a counterparty will default, calibrated over up to 12 months from the reporting date (stage 1) or over the lifetime of the product (stage 2) and incorporating the impact of forward-looking economic assumptions that have an effect on credit risk, such as interest rates, unemployment rates and GDP forecasts. The PD is estimated at a point in time that means it will fluctuate in line with the economic cycle. The term structure of the PD is based on statistical models, calibrated using historical data and adjusted to incorporate forward-looking economic assumptions. |

| Loss given default (LGD) | The loss that is expected to arise on default, incorporating the impact of forward-looking economic assumptions where relevant, which represents the difference between the contractual cash flows due and those that the bank expects to receive. The Group estimates LGD based on the history of recovery rates and considers the recovery of any collateral that is integral to the financial asset, taking into account forward-looking economic assumptions where relevant. |

| Exposure at default (EAD) | The expected balance sheet exposure at the time of default, taking into account the expected change in exposure over the lifetime of the exposure. This incorporates the impact of drawdowns of committed facilities, repayments of principal and interest, amortisation and prepayments, together with the impact of forward-looking economic assumptions where relevant. |

To determine the expected credit loss, these components are multiplied together (PD for the reference period (up to 12 months or lifetime) x LGD at the beginning of the period x EAD at the beginning of the period) and discounted to the balance sheet date using the effective interest rate as the discount rate.

Although the IFRS 9 models leverage the existing Basel advanced IRB risk components, several significant adjustments are required to ensure the resulting outcome is in line with the IFRS 9 requirements.

- Standard Chartered plc, p53

Examples of good disclosure...

> "The maximum period considered when measuring ECL (be it 12-month or lifetime ECL) is the maximum contractual period over which HSBC is exposed to credit risk. For wholesale overdrafts, credit risk management actions are taken no less frequently than on an annual basis and therefore this period is to the expected date of the next substantive credit review. The date of the substantive credit review also represents the initial recognition of the new facility. However, where the financial instrument includes both a drawn and undrawn commitment and the contractual ability to demand repayment and cancel the undrawn commitment does not serve to limit HSBC's exposure to credit risk to the contractual notice period, the contractual period does not determine the maximum period considered. Instead, ECL is measured over the period HSBC remains exposed to credit risk that is not mitigated by credit risk management actions." > > - HSBC Holdings plc, p86

Points to consider when explaining policies and methodologies

- Avoid the use of boilerplate language or quoting directly from the standard.

- IFRS 7 requires disclosure of inputs, assumptions and estimation techniques used to determine ECLs. Users may find it helpful to understand how the ECL models differ from those used for regulatory purposes, particularly where regulatory models are used as a basis for ECL.

- The policy should be sufficiently granular to enable users to understand the differences in the approach to model ECLs for significant product or business lines.

Impairment: Policies and methodologies (continued)

Examples of good disclosure...

The Royal Bank of Scotland provided a good analysis of the key terms of IFRS 9 compared to those under IAS 39 and the regulatory framework.

- Royal Bank of Scotland plc, App 2 p4-5

Impairment: Staging and credit risk profile

In addition, most of the larger banks mapped the distribution of assets by stage to their internal credit quality classifications used for risk management purposes.

Nearly all of the banks reviewed discussed the impact of cure periods, including explanation as to how long a balance must remain in stage 3 once it is no longer in default.

Some smaller banks provided insufficient disclosure of the credit risk profile and analysis of staging for key portfolios

The most significant disclosure for banks is the determination of credit risk for key portfolios. On the whole, the qualitative disclosure was good. All of the banks explained the difference between the stages and the measurement of the ECL at each stage. In addition, the banks defined how assets fell into each of the stages, specifically how significant increases in credit risk and default were assessed. Only one of the banks disclosed that it used the practical expedient for assets deemed to be of low credit risk.

We found it disappointing that two of the smaller banks did not provide an analysis of the credit risk profile of major portfolios, for example gross and net exposures by stage. The larger banks provided an analysis of balances for major portfolios which showed a split of gross exposures and ECLs between the three stages and the impact of backstops on stage 2.

The main issues identified in this area were:

- Although not strictly a requirement for interim reports, only two banks provided an analysis of the movement in gross exposures and associated ECLs during the period, including movement between stages

- We expected most banks with significant retail banking portfolios to assess significant increase in credit risk on a collective basis or through the use of cohorts. However, it was not always clear if this was the case. We expect the banks to disclose how assets are grouped and how the assessment of significant increase in credit risk is performed.

- Only one bank clarified that it used a 12 month PD as a proxy for lifetime PD in assessing whether there had been a significant increase in credit risk for retail portfolios.

Examples of good disclosure...

> "IFRS 9 contains a rebuttable presumption that default occurs no later than when a payment is 90 days past due. The Group uses this 90 day backstop for all its products except for UK mortgages. For UK mortgages, the Group has assumed a backstop of 180 days past due as mortgage exposures more than 90 days past due, but less than 180 days, typically show high cure rates and this aligns to the Group's risk management practices." > > - Lloyds Banking Group plc, p61

Examples of good disclosure...

> "ECLs are calculated by multiplying three main components, being the PD, LGD and the EAD, discounted at the original EIR. The regulatory Basel Committee of Banking Supervisors (BCBS) ECL calculations are leveraged for IFRS 9 modelling but adjusted for key differences which include: > > - ECL is measured at the individual financial instrument level, however a collective approach where financial instruments with similar risk characteristics are grouped together, with apportionment to individual financial instruments, is used where effects can only be seen at a collective level, for example for forward-looking information." > > - Barclays plc, p59

Points to consider when explaining staging and credit risk profile

- Disclosure should explain the qualitative and quantitative criteria used to assess if a financial asset is in stage 2 or 3, including the use of backstops and the impact of any cure or probation criteria.

- Banks should clarify the basis on which assets are assessed. Where on a collective basis, the apportionment of the effect to individual assets should be clear.

- Banks should disclose where a 12 month PD is used as a proxy for lifetime PD to assess whether a significant increase in credit risk has occurred for material portfolios.

- If non-performing loans are disclosed in the annual accounts, we expect these amounts to be reconciled to the stage 3 credit impaired balances.

Impairment: Staging and credit risk profile (continued)

Examples of good disclosure...

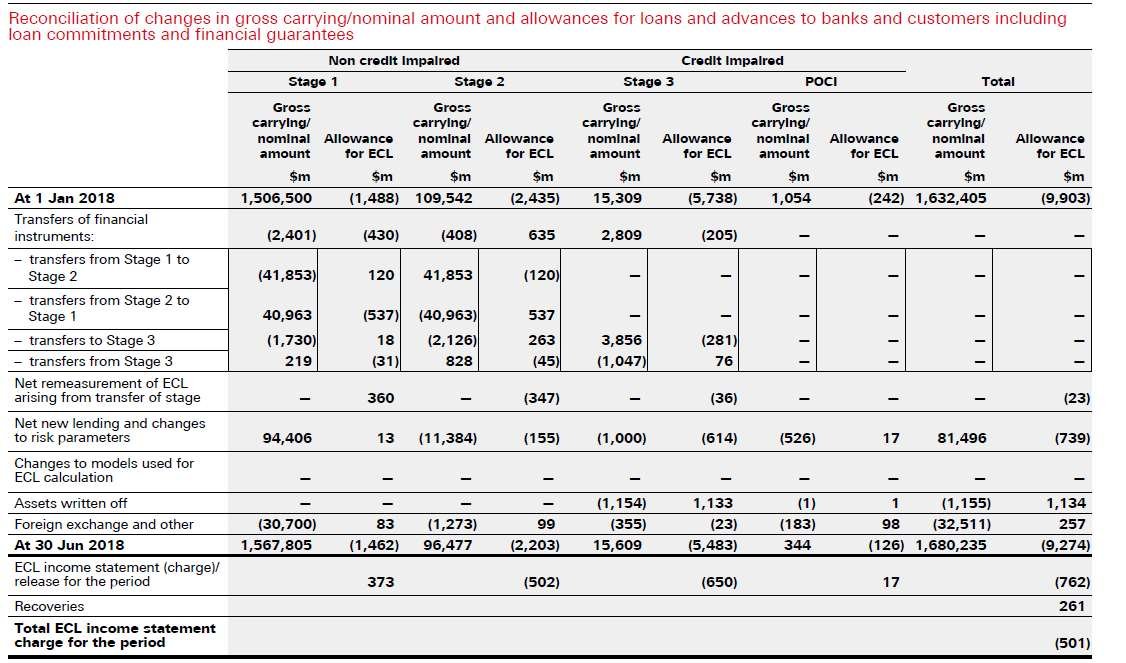

HSBC analysed the movements in gross exposures and ECLs for the period:

- HSBC Holdings plc, p52

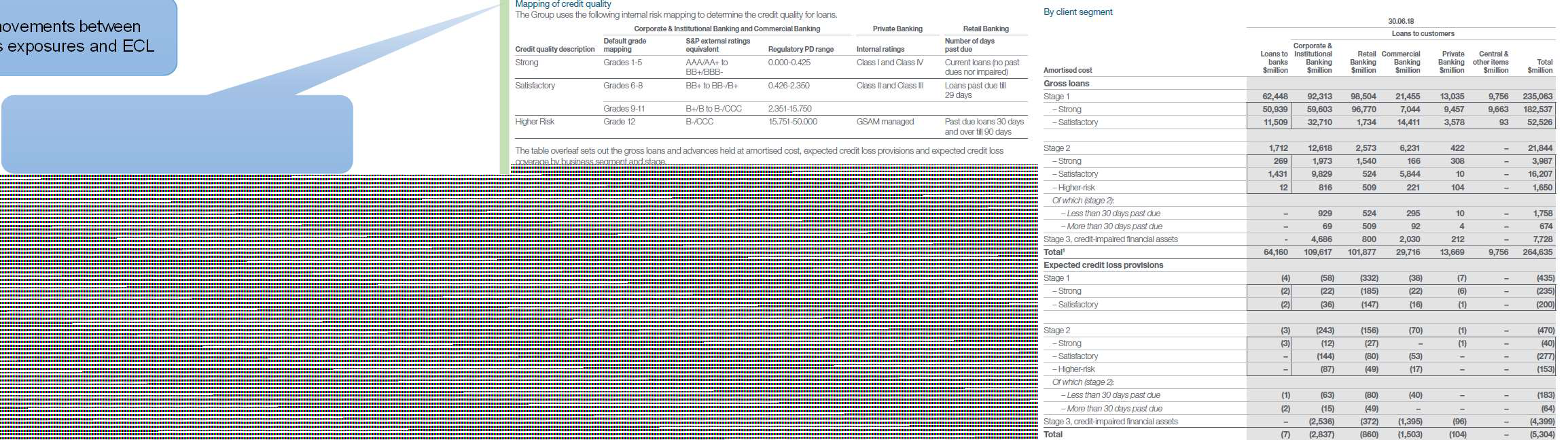

Examples of good disclosure...

Standard Chartered mapped its internal credit ratings to the IFRS 9 stages:

By client segment

| Amortised cost | Corporate & Institutional Banking $million | Retail Banking $million | Commercial Banking $million | Private Banking $million | Central & other items $million | Total $million |

|---|---|---|---|---|---|---|

| Gross loans | ||||||

| Stage 1 | ||||||

| Strong | 62,448 | 92,313 | 98,504 | 21,455 | 13,035 | 9,756 |

| - Satisfactory | 50,939 | 59,603 | 96,770 | 7,044 | 9,457 | 9,663 |

| Stage 2 | 11,509 | 32,710 | 1,734 | 14,411 | 3,578 | 93 |

| Strong | 1,712 | 12,618 | 2,573 | 6,231 | 422 | - |

| - Satisfactory | 269 | 1,973 | 1,540 | 166 | 308 | - |

| - Higher-risk | 1,431 | 9,829 | 524 | 5,844 | 10 | - |

| Of which (stage 2): | 12 | 816 | 509 | 221 | 104 | - |

| - Less than 30 days past due | - | 929 | 524 | 295 | 10 | - |

| - More than 30 days past due | - | 69 | 509 | 92 | 4 | - |

| Stage 3, credit-impaired financial assets | - | 4,686 | 800 | 2,030 | 212 | - |

| Total^1 | 64,160 | 109,617 | 101,877 | 29,716 | 13,669 | 9,756 |

| Expected credit loss provisions | ||||||

| Stage 1 | ||||||

| - Strong | (4) | (58) | (332) | (38) | (7) | - |

| - Satisfactory | (2) | (22) | (185) | (22) | (6) | - |

| Stage 2 | (2) | (36) | (147) | (16) | (1) | - |

| - Strong | (3) | (243) | (156) | (70) | (1) | - |

| - Satisfactory | (3) | (12) | (27) | (1) | - | - |

| - Higher-risk | - | (144) | (80) | (53) | - | - |

| Of which (stage 2): | - | (87) | (49) | (17) | - | - |

| - Less than 30 days past due | (1) | (63) | (80) | (40) | - | - |

| - More than 30 days past due | (2) | (15) | (49) | - | - | - |

| Stage 3, credit-impaired financial assets | (2,536) | (372) | (1,395) | (96) | - | - |

| Total | (7) | (2,837) | (860) | (1,503) | (104) | - |

- Standard Chartered plc, p33-34

Impairment: Alternative economic scenarios

Disclosures of the use of multiple economic scenarios were generally good

ECLs do not respond to changes in the macroeconomy on a linear basis. IFRS 9 requires that expected credit losses are measured in a way that reflects an unbiased probability-weighted amount that is determined by evaluating a range of possible outcomes. Banks simulate multiple economic scenarios in order to account for the potential non-linearity.

With the exception of two entities, the banks reviewed discussed the use of scenario analysis to determine ECL. Key highlights included disclosure of:

- the number of scenarios applied, although not all banks disclosed the weighting applied to each scenario;

- the economic assumptions underlying the base case scenario. A number of the larger banks with an international presence provided the assumptions for key geographical areas; and

- differences in the application of multiple economic scenarios to Retail and Wholesale portfolios.

The main issue identified in this area was:

- Whilst banks referred to the need to make additional adjustments (overlays) to the models only two quantified the adjustments made.

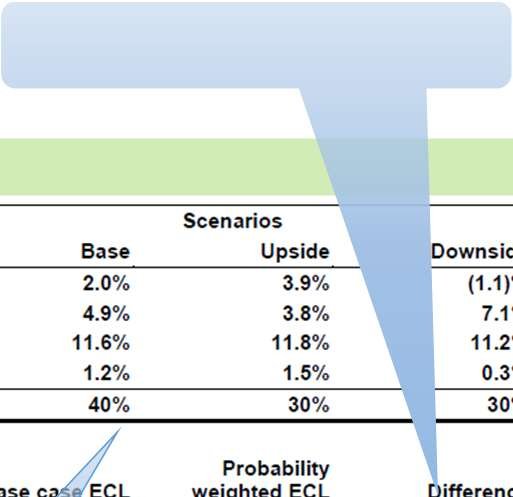

Examples of good disclosure...

Difference between base case and the ECL provision quantified

- Virgin Money Holdings (UK) plc, p63

Key assumptions identified

Probability weighting for each scenario is clearly disclosed

Examples of good disclosure...

> "A management overlay of $245m has been included in the 30 June 2018 ECL, adding to the result from the consensus economic scenarios; $150m of this relates to Wholesale, and $95m to Retail, to address the current economic uncertainty in the UK. This overlay was raised at transition on 1 January 2018 and reflected management's judgement that the consensus economic scenarios did not fully reflect the high degree of uncertainty in estimating the distribution of ECL for UK portfolios..." > > - HSBC Holdings plc, p51

Points to consider when explaining alternative economic scenarios

- We expect banks to explain how alternative economic outcomes are selected from a range of possible outcomes and to provide a description of scenario weightings.

- Key economic variables used to determine the central scenario should be disclosed.

- Where there are material additional adjustments (overlays) which are used to capture factors not specifically embedded in the models used, these should be disclosed.

- The difference between the base case scenario and the ECL provision should be quantified.

Judgements and estimation uncertainty

Whilst not a strict requirement of interim reports, most banks disclosed helpful information about the judgements made in applying IFRS 9. These disclosures assist the reader in understanding how the new standard has been applied to facts and circumstances specific to the company's business model.

IFRS 7 requires disclosure of the key judgements and assumptions used to classify and measure financial instruments. We therefore expect companies' year-end disclosures about significant judgements, which are in addition to the requirements of IAS 1, to be more extensive than the information that was disclosed for the interim period.

Examples of good disclosure...

Main judgments that have financial impact

IFRS 9 introduces additional complexity into the determination of credit impairment provisioning requirements; however, the building blocks that deliver an ECL calculation already existed within the organisation. Existing Basel models have been used as a starting point in the construction of IFRS 9 models, which also incorporate term extension and forward-looking information.

There are five key areas that could materially influence the measurement of credit impairment under IFRS 9 – two of these relate to model build and three to their application:

Model build:

- The determination of economic indicators that have most influence on credit loss for each portfolio and the severity of impact (this leverages existing stress testing mechanisms).

- The build of term structures to extend the determination of the risk of loss beyond 12 months that will influence the impact of lifetime loss for assets in Stage 2.

Model application:

- The assessment of the significant increase in credit risk and the formation of a framework capable of consistent application.

- The determination of asset lifetimes that reflect behavioural characteristics whilst also representing management actions and processes (using historical data and experience).

- The determination of a base case (or central) economic scenario which has the most material impact (of all forward-looking scenarios) on the measurement of loss (RBS uses consensus forecasts to remove management bias).

- Royal Bank of Scotland plc, App2 p6

Disclosure examples

| Category | Examples of Disclosure |

|---|---|

| Accounting judgement | Significant increase in credit risk |

| - Description of the qualitative and quantitative measures used to determine significant increase in credit risk | |

| - Use of the 30 days past due backstop and rationale if rebutted | |

| - Whether 12 month PD has been used as a proxy for lifetime PD | |

| - Whether significant increase in credit risk has been determined on a portfolio basis | |

| Accounting judgement | Definition of default |

| - How the definition of default aligns to the regulatory definition | |

| - Interaction with forbearance and other concessions | |

| - Use of the 90 days past due backstop and rationale if rebutted | |

| Estimation uncertainty | Economic scenarios |

| - Key economic assumptions used to determine the base case scenario | |

| Estimation uncertainty | Asset lifetimes |

| - Approach for revolving credit facilities such as credit cards and overdrafts | |

| - Use and impact of behavioural factors such as refinancing or prepayment |

Judgements and estimation uncertainty (continued)

All banks disclosed key assumptions in the determination of ECLs and noted that, in the future, there will be greater volatility in impairment given the uncertainty inherent in the use of forward looking information. None of the banks provided quantitative information on the sensitivity of ECL balances to changes in key assumptions.

Whilst not strictly a requirement for interim reporting, IAS 1 requires disclosure of assumptions and major sources of estimation uncertainty at the end of the reporting period that have a significant risk of material adjustment to the carrying amounts of assets and liabilities within the next financial year. This has been an area of focus for the FRC and was the subject of a thematic review in 20172.

In January 2018, the PRA sent an open letter to CFOs outlining their expectations for banks to provide quantitative sensitivity information in addition to that required under IAS 1 in order for users to better understand the uncertainty in the staging and provisioning levels, and the impact of changes in credit conditions on ECL measurement.

Historically, this has been an area where the banks' disclosures have required improvement. Given the increased subjectivity involved in determining ECLs, we expect banks to provide both qualitative and quantitative information, which discloses the sensitivity of ECL amounts to assumptions and estimates, and/or a range of reasonably possible outcomes within the next financial year.

Next steps

Impact on our future reviews

We intend to review the full-year accounts of entities in our sample whose interim disclosures were weaker, to ensure improvements have been implemented at the year-end. Our review sample for 2019 will also include a number of companies not considered as part of this thematic. We will engage in correspondence with those entities whose disclosures are considered inadequate.

Key points for companies to consider when preparing year-end disclosures

The year-end disclosure requirements of IFRS 9 are more extensive than those required for interim reporting purposes.

We encourage companies to invest the time during their upcoming year-end reporting cycle to ensure that:

- explanations of the impact of transition are comprehensive, and are linked to other information disclosed in the annual report;

- changes made to accounting policies (including the reasons for these changes and associated judgements) are clearly articulated and convey company-specific information;

- disclosures are sufficiently granular to enable users to understand the impact on the business and key portfolios; and

- there is clear linkage to the business model and risk management strategy which underpin the classification and hedging requirements of IFRS 9.

Quick checks: have you met the annual disclosure requirements about...?

A diagram showing six hexagonal elements connected in a network, each representing a key area of disclosure requirements: - Governance - Business model - Fair, balanced and understandable - Capital management – effect on capital - Estimation uncertainty - Significant judgements

Information about the Financial Reporting Council can be found at: https://www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

The FRC's mission is to promote transparency and integrity in business. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2018

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.