The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Audit Quality Inspections Annual Report 2012/13

The Financial Reporting Council is responsible for promoting high quality corporate governance and reporting to foster investment. We set the UK Corporate Governance and Stewardship Codes as well as UK standards for accounting, auditing and actuarial work. We represent UK interests in international standard-setting. We also monitor and take action to promote the quality of corporate reporting and auditing. We operate independent disciplinary arrangements for accountants and actuaries; and oversee the regulatory activities of the accountancy and actuarial professional bodies.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2013 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 5th Floor, Aldwych House, 71-91 Aldwych, London WC2B 4HN.

- 1. Introduction

- 2. Key messages

- 3. Five year analyses

- 4. Summary of activities

- 4.1 Introduction

- 4.2 Coverage of inspections

- 4.3 Analysis of audits reviewed

- 4.4 Public sector inspections

- 4.5 Crown Dependency inspections

- 4.6 Third country auditor inspections

- 4.7 Oversight of inspections by the professional bodies

- 4.8 International liaison

- 4.9 Input to standard-setting process and policy matters

- 4.10 Liaison with Corporate Reporting Review

- 4.11 Collaboration with the Financial Services Authority

- 4.12 Basis of funding

- 5. Enhancements to inspection activities

- Appendix A – Inspection process and basis of reporting

- Appendix B – Scope of inspections 2012/13

1. Introduction

This report provides an overview of the audit quality inspection activities of the Financial Reporting Council's ("FRC") Audit Quality Review ("AQR") for the year ended 31 March 2013.

It includes an overall assessment of audit quality together with a number of key messages for audit firms and audit committees. Some of these messages are similar to those we have highlighted previously. Further details of our inspection findings in 2012/13 are set out separately in individual firm reports.

We have made a number of changes to the report this year to give greater prominence to the key messages. These changes include a new section which reports our audit quality findings over the last five years.

A number of important changes to enhance the effectiveness of our future inspections are also summarised in a separate section. These changes, many of which were developed as part of the FRC reform process, will ensure our inspections are more proportionate and independent of the profession and that there is greater interaction with audit committees.

2. Key messages

2.1 Introduction

The more significant findings arising from our 2012/13 inspections, including an overall assessment of audit quality, form the basis of the key messages relevant to audit firms and audit committees set out in this section.

2.2 Assessment of audit quality in 2012/13

Overall assessment

- Our 2012/13 inspection results show an improvement in the overall standard of audit work subject to our inspections.

- This improvement is not uniformly spread across all the firms and types of entities.

- Firms need to maintain and in some cases enhance their focus on professional scepticism and the effectiveness of their independence and ethical policies and procedures.

Over the years we have seen continuous improvement in overall audit quality as indicated by the results of our inspection of individual audits. This improvement was more pronounced in the sample of audits inspected in 2012/13. The improvement is, however, not uniformly spread across all the firms and types of audited entities subject to our inspections, and there has been an increase in the proportion of audits of entities outside the FTSE 350 assessed in the current year as requiring significant improvements.

While these inspection results are encouraging, further improvement is still required in a number of key areas. Many of these areas are recurring in nature including the exercise of sufficient professional scepticism and the approach to independence and ethics. Several new issues of significance have also emerged from our 2012/13 inspections. Section 2.3 discusses each of these key areas.

The UK audit inspection regime is one of the most transparent in the world and we believe that this contributes to a continuous and sustained improvement in overall audit quality.

As the focus of our reporting is on those aspects where improvement is required, our reports may create the impression that there may be more problems with the quality of auditing in the UK than elsewhere. However, our discussions with overseas regulators confirm that this is incorrect and that the issues identified in the UK, and in particular those discussed in this report, are also raised internationally.

Our approach to the assessment of individual audits

For public reporting we grade the quality of the audit work we examine on individual audits on three levels which are as follows:

- good with limited improvements required (grades 1 and 2A combined);

- acceptable overall with improvements required (grade 2B); and

- significant improvements required (grade 3).

An audit is assessed as requiring significant improvements if we have:

- significant concerns in relation to the sufficiency or quality of audit evidence; or

- significant concerns in relation to the appropriateness of audit judgments in one or more key audit areas; or

- if the implications of concerns relating to other areas were considered to be individually or collectively significant.

A risk model covering listed and AIM companies is used in the selection of audits to be reviewed each year. As a consequence, our reviews of individual audit engagements include a significant number of complex entities where the audit is generally more challenging and therefore may not be representative of the market as a whole. Our reviews place emphasis on the appropriateness of key audit judgments made in reaching the audit opinion based on the sufficiency and appropriateness of the audit evidence obtained. Our initial assessment of the quality of an individual audit engagement is based primarily on the evidence on the audit files provided to us. However, our inspection conclusions take account, as appropriate, of any explanations provided to us by audit teams to supplement the evidence on the audit files.

Each review of an individual audit is subject to rigorous quality control procedures. These procedures include a peer review process at staff level and a final review by independent non-executives who approve the issue of all reports. These processes are designed to ensure both a high quality of reporting and that a consistent approach is adopted across all inspections.

An audit makes a vital contribution to the confidence that may be placed on financial statements. It is important to emphasise, however, that our reviews focus on how a particular audit was performed and are not designed to assess whether the information being audited was correctly reported. A poor overall assessment of the audit therefore does not necessarily imply that the financial statements were materially inaccurate or incomplete, or that an inappropriate audit opinion was issued.

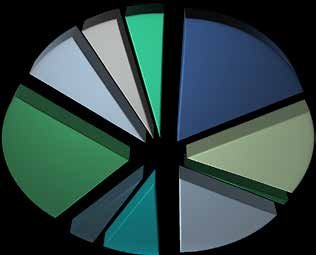

Assessment of individual audits

The following table¹ provides a summary of our assessment of individual audits inspected (excluding public sector and follow-up reviews) over the last three inspection cycles (85 audits in 2012/13, 84 audits in 2011/12 and 81 in 2010/11). Further information on our assessment of audits over the last five years is set out in section 3.

Number of AQR audit review grades

Number of AQR audit review grades

Key findings from the 2012/13 inspection of individual audits as shown in the above table are:

- A significant increase in audits assessed as good with limited improvements required (59% compared with 46% in 2011/12).

- An offsetting reduction in audits assessed as acceptable overall with improvements required (26% compared with 44% in 2011/12).

- An increase in the number of audits assessed as requiring significant improvements (15% compared with 10% in 2011/12). This increase is attributable to the audit of entities outside the FTSE 350. Section 3.4 provides a further analysis of audits requiring significant improvements.

In considering these findings it is important to note that our responsibility is to monitor and assess the quality of audit work performed by UK and Crown Dependency² audit firms. Accordingly, our reviews of group audits covered the planning and control of the audit by the group engagement team, including their evaluation of the adequacy of the work performed by component auditors, and selected aspects of other work performed by the UK or Crown Dependency firm at a group and/or component level. In the case of many FTSE 350 and other large listed companies a significant amount of the underlying audit work is performed by other auditors and is therefore outside the scope of our review.

For smaller listed company audits the proportion of audit work performed by the UK or Crown Dependency audit firm is often considerably higher and therefore our assessment of the quality of the audit is based on a broader range of work.

As can be seen from the above table the vast majority of audits assessed as requiring significant improvement relate to entities outside the FTSE 350.

2.3 Key messages to audit firms and audit committees

To continue to improve overall audit quality, we expect audit firms to pay particular attention to the key messages set out below. A number of these are similar in certain respects to those we have highlighted previously and therefore require further action by firms, while others relate to issues emerging from our 2012/13 inspections. Many of these messages are also of relevance to audit committees.

Audit committees play an essential role in ensuring the quality of financial reporting. In particular, their work in discussing with auditors the audit plan, as well as the audit findings, contributes greatly to the quality of that audit. To assist audit committees, we highlight below those matters which we believe will enhance their oversight of the audit process and contribute to an overall improvement in audit quality. In some instances these matters are the same as those of relevance to audit firms, while in other cases the emphasis differs.

The key messages we highlight in this report relate to:

- Focus on audit quality

- Professional scepticism

- Financial services

- Group audit considerations

- Auditor independence and ethical issues

- Audit quality monitoring

Each key message contains a high level summary followed by a more detailed explanation. Separate messages are provided to audit firms and audit committees where the message differs.

Focus on audit quality

- Audit efficiency is becoming progressively more important to firms as audited entities seek to reduce fees.

- Firms should have appropriate controls and procedures to ensure that audit efficiencies are not achieved at the expense of audit quality.

- Audit committees, where significant fee reductions have been proposed or agreed, should carefully consider whether the overall level of work to be performed is likely to be sufficient to identify material misstatements and ensure that audit quality is not compromised.

Fee pressures are a commercial reality that cannot be ignored and firms face significant and increasing pressures in the current economic environment as evidenced by substantial reductions in audit fees as a consequence of audit tenders, particularly in respect of large listed entities.

Firms respond to these pressures for example, by seeking efficiencies and by reducing overall audit hours. This may be through the application of higher materiality levels which reduces the sample sizes tested and by reducing the extent of testing in areas of low audit risk. For example:

- we have found samples that do not cover the entire period or the total population, with insufficient justification provided;

- we have seen an increase in the level of judgmental sampling, where the sample sizes deemed necessary are judged to be lower than those determined using statistical sampling; these are not always sufficiently responsive to areas considered to represent significant audit risks; and

- in the context of group audits we have seen instances where the materiality applicable to business components has been increased, and thus the number of business components subject to full audit procedures reduced.

Findings such as these call into question the sufficiency of work performed. To enable us to gauge the significance of these findings, we are undertaking a thematic inspection of audit materiality, which will consider differences in policies and practices across audit firms.

Firms continue to pursue "off-shoring" of certain audit procedures in order to reduce costs. While the extent of off-shoring is generally less than 5% of core audit hours, it is increasing, sometimes significantly. Appropriate policies and procedures to maintain audit quality are essential to manage the risks arising from off-shoring. Our principal concern is whether off-shore staff are sufficiently integrated into the audit team, and possess sufficient knowledge to be able to identify matters that are significant in the context of the particular audit.

We remain concerned that the consequences of efforts to improve audit efficiency may have an adverse effect on audit quality. Firms should have appropriate controls to ensure this is not the case, particularly, in light of the expected increase in tendering activity and the consequential reduction in audit tenure.

Audit committees also have an important role to play in this area. Where fee reductions have been offered, audit committees should scrutinise the proposed scope of the audit, including the determination of materiality, the attention to be given to each business component and to the significant audit risks identified. Where, following a reduction in audit fees, there are significant changes in these areas, audit committees should carefully consider whether the overall level of work to be performed is likely to be sufficient to identify material misstatements and to ensure that audit quality is not compromised.

Professional scepticism

- Initiatives to reinforce the importance of exercising sufficient professional scepticism appear to be working although progress is not uniform.

- Firms should ensure that further improvements and greater consistency are achieved.

- Audit committees have an important role both in supporting and encouraging a sceptical approach in the audit of areas of key judgment, and in ensuring the auditors have access to all relevant information.

In previous years we reported that firms have undertaken a number of good initiatives to reinforce professional scepticism. Our inspection findings in 2012/13 suggest that these initiatives are now resulting in changes in behaviour and that the application of professional scepticism is becoming more embedded within the audit. While some firms have more work to do in this area than others, overall there appears to be an improvement with fewer relevant adverse findings this year. Nevertheless, we continue to raise a number of concerns, notably in respect of the auditor's review of the assumptions used for impairment testing of goodwill and other intangibles.

It is important that firms continue to emphasise the need to exercise appropriate professional scepticism in relation to key audit judgments. Similarly audit committees have an important role to play in supporting and encouraging a sceptical approach. In particular, audit committees should be prepared to discuss the work performed and the concerns of audit teams about management's key judgments. Equally audit committees should encourage audit teams to demonstrate the extent of their challenge in relation to key judgments, even where the final audit judgment supports management's views. This might include information about the alternative approaches that were considered and why the approach adopted was considered appropriate in the circumstances.

Audit committees should also establish whether management have provided all relevant information to audit teams to assist in their assessment of the appropriateness of key judgments.

We will continue to monitor closely the application of professional scepticism to assess the extent to which it is embedded within the audit process.

Financial services

- Further improvements are required in the audits of financial services sector entities.

- Firms should strengthen their testing, particularly in respect of loan loss provisioning and general IT controls.

- Audit committees should challenge auditors to demonstrate the steps they have taken to achieve these improvements.

The financial services sector is an important focus of our inspection activity and an area where we have worked collaboratively with the Financial Services Authority ("FSA")³. The nature of our relationship with the FSA is discussed in more detail in section 4.11.

In 2012/13 our inspection of financial services entities included eight banks, six building societies, and one insurance company.

Two smaller building society audits were assessed as requiring significant improvements. This compares with one smaller building society in 2011/12. In respect of a follow-up review of a non-listed bank we were disappointed to find that certain issues identified previously had not been adequately addressed and that a number of additional issues were also identified.

As in previous years our inspections included the audits of a number of major financial institutions, where issues of significance were identified. These are discussed below.

The audit of loan loss provisions in a number of banks and building societies continues to be an area of concern and it is disappointing that we have not seen any significant improvement. The issues included insufficient challenge to the key assumptions and inputs used to determine both specific and collective provisions, together with inadequate corroboration of management's explanations and insufficient verification of supporting calculations. In one instance we noted that insufficient consideration was given to the appropriateness of the credit risk characteristics used to determine the collective provision. Insufficient evidence demonstrating the completeness of information in respect of forbearance arrangements and the implications for both provisioning and disclosures was also of concern in a number of audits.

The testing of the effectiveness of internal controls is a fundamental element of the overall audit approach for most financial institutions, as sufficient audit evidence can rarely be obtained on a timely basis from substantive testing alone. Deficiencies of significance were identified in the testing of general IT controls on a number of audits including insufficient testing of the effectiveness of such controls, insufficient consideration of the implications of ineffective controls or other deficiencies and undue reliance on information derived from untested systems. In one instance deficiencies in the testing of general IT controls resulted in insufficient testing being performed in respect of automated application controls⁴.

The above issues indicate that further improvements are required in auditing in the financial services sector. Firms should strengthen their testing, particularly in respect of loan loss provisioning and general IT controls. Audit committees should challenge their auditors to demonstrate the steps they have taken to achieve this.

Group audit considerations

- Further improvement is required in respect of the conduct of group audits.

- The audit of "letterbox companies", where virtually all of the work is performed by component auditors, without appropriate control, supervision and review, is an emerging issue.

- Firms should ensure they are sufficiently involved in all stages of the work of component auditors to meet the relevant requirements of Auditing Standards.

- Audit committees should require firms to explain the extent of their involvement in the work of component auditors.

We continued to identify a range of issues in respect of the quality of group audit work. These principally related to the sufficiency of the group audit team's involvement in component auditors' risk assessments or the extent of their review of component auditors' work. We also noted instances where the group audit team did not undertake audit procedures on the group consolidation as required but instead delegated this to the component auditors. Insufficient justification of component materiality, which should be lower than the materiality for the group financial statements as a whole, was also an issue on a number of audits.

A new issue emerging from this year's inspections related to the audit of companies or groups that have little more than a registered office or correspondence address in their country of registration, with general, financial and corporate management and all economic activity being based elsewhere; such companies are often referred to as "letterbox companies". In such situations the group auditor is usually based in the country of legal registration of the company, rather than where management is based, and the majority of the audit work is often performed by component auditors.

This is in contrast to large multi-national groups which have the majority of their operations overseas, but which have a fully functioning and sizable head office in their country of registration which exercises management, and financial, control over the group as whole.

When auditing "letterbox companies" firms should recognise the enhanced risks inherent in such arrangements and ensure they have sufficient involvement in the audit work of component auditors so as to enable the engagement partner to lead and control the audit as a whole.

We identified a number of instances in respect of the audit of "letterbox companies" where reliance was placed primarily on sign-offs from component auditors, with the group or company auditor insufficiently involved in the control, supervision and review of the audit work.

The above matters indicate that further improvement is required in respect of the conduct of group audit work to ensure this fully meets the requirements of Auditing Standards. Audit committees can assist the process of improvement when reviewing the annual audit planning report, by ensuring that this includes sufficient detail on the extent of the group audit team's involvement in the risk assessment and determination of procedures to be performed by component auditors. Audit committees should also challenge their auditors to explain the extent of their involvement in the work performed by component auditors.

Auditor independence and ethical issues

- The nature and extent of independence and ethical issues continues to be of concern.

- Firms should review the adequacy of their independence and ethical procedures and the training they provide to staff at all levels.

- Audit committees should seek additional independence information where appropriate, and challenge firms to demonstrate their independence, both in form and in substance.

The effective identification and assessment of threats, the application of appropriate safeguards and the proper reporting of these to audit committees are critical to maintaining auditor independence. It is disappointing therefore that our inspections do not show any substantive improvement in this area and, in particular, that we continue to see firms adopting a "boiler plate" approach to their independence reporting.

In addition, a number of specific issues relating to compliance with the requirements of the Ethical Standards were identified across all firms. These included references to targets for the cross-selling of non-audit services to audited entities in partner appraisal documentation; failure to consult the Ethics Partner on the appropriateness of contingent fee arrangements for certain tax services; key partners involved in the audit from other network firms not being identified as such or monitored for potential rotation; and instances where shareholdings in audited entities were not disposed of on a timely basis.

One of these latter instances related to a former executive of an audited entity who on re-joining the firm as a partner had a significant shareholding in that entity. Ethical Standards do not permit partners of the firm to hold any direct financial interest in an audited entity. The individual did not dispose of the shareholding upon joining the firm and it was some months before this was done. We were informed that senior personnel with responsibility for the firm's ethical compliance arrangements were not aware of this issue until it was drawn to their attention as a result of our inspection. We were advised that the firm has subsequently penalised the relevant partner and established that no financial benefit was obtained from the delay in disposal.

Of particular note this year are two issues identified at one firm relating to partners who may have been in the chain of command. The first issue concerned the individual referred to above who was subsequently promoted to a senior management role. The seniority of this role could indicate that the individual was in the chain of command of the firm. Ethical Standards do not permit the appointment of such an individual to a role in which he or she is able to influence the conduct and outcome of the audit within two years of their departure from the relevant audited entity.

The other issue concerns the same firm's consideration of whether a former partner who joined an audited entity as a director was, prior to his retirement, in the chain of command for audit. If the former partner was in the chain of command, Ethical Standards require the firm to resign as auditor.

We have drawn the matters above to the attention of the Conduct Committee, the part of the FRC responsible for professional discipline. We are also undertaking a review of recent director appointments across an extensive sample of FTSE 350 and other listed companies to identify any further instances where there may have been a breach of the Ethical Standards.

Firms should review the adequacy of their independence and ethical procedures and the training they provide to staff at all levels to achieve an improvement in the overall standard of compliance with the requirements of the Ethical Standards. They should also increase the level of focus on this area in their own internal quality reviews.

Audit committees are entitled to expect a good standard of independence reporting from their auditors and should seek additional information where it is not initially provided. Audit committees should also be prepared to challenge firms to demonstrate their independence, both in form and in substance, and to understand the specific safeguards the auditors have in place to protect their independence and the particular consideration given to the threats identified. All of these should help to ensure that auditors take these matters more seriously.

Audit quality monitoring

- Internal audit quality monitoring processes often show more positive results than our inspection findings.

- Firms should reconsider the robustness of their monitoring processes and the extent to which they contribute to an improvement in overall audit quality.

- Audit committees may wish to ask firms whether their audit has been reviewed by the firm's internal monitoring processes and, if so, what the main lessons learnt were; how the findings compare with our inspection findings; and what actions firms have taken to address the issues identified.

Firms are required to establish processes to monitor the quality of their audit work. Our inspections regularly identify issues relating to these processes, such as the timeliness of the completion and the extent of coverage. More fundamental, however, is the divergence in the findings of these monitoring processes from our inspection findings. While direct comparisons can be difficult as firms use differing assessment bases and grading structures, it is evident that the overall findings from these processes are more positive than ours. This divergence in findings may call into question the robustness of these processes, or the general standards or expectations that the firms set themselves.

Audit committees may find it useful to ask firms whether their audit has been reviewed by the firm's internal monitoring processes, and if so what the main lessons were; how these finding compare with our inspection findings; and what actions firms have taken to address the issues identified.

3. Five year analyses

3.1 Introduction

This section provides further analyses of our inspections undertaken in the last five years. During this period we inspected 408 audits (excluding public sector and follow-up reviews), including the audits of 67 FTSE 100 companies, 97 FTSE 250 companies and 98 other full listed companies.

We grade the quality of the audit work we examine on individual audits on four levels as follows:

- good (grade 1);

- acceptable with limited improvements required (grade 2A);

- acceptable overall with improvements required (grade 2B); and

- significant improvements required (grade 3).

As noted in section 2.2 grades 1 and 2A have been combined for public reporting purposes. In this section these grades have been separated to facilitate further analysis.

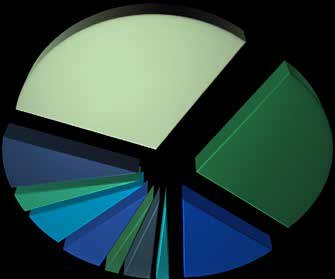

3.2 Five year aggregate assessment

The following graph provides the disposition of grades of all audits inspected (excluding public sector and follow-up reviews), in aggregate, over the last five years with comparative results for FTSE 350 and banks and building societies respectively. A brief commentary is set out below.

AQR audit review grades – 5 year aggregation

- The disposition of grades of FTSE 350 audits inspected in the last five years is better than that for all audits inspected as indicated by:

- A higher proportion of audits assessed as a grade 1 or grade 2A.

- A lower percentage of audits assessed as a grade 3.

- The disposition of grades for banks and building societies inspected in the last five years is not as good as that for all audits inspected as indicated by:

- Few bank and building society audits have been assessed as a grade 1.

- A higher proportion of audits have been assessed as a grade 3. None of these are major UK banks and building societies.

3.3 Five year average assessment

The following graph depicts the average grade for all audits (excluding public sector and follow-up reviews) inspected in each of the last five years, with comparatives for the FTSE 350 and banks and building societies respectively. A brief commentary is set out below.

AQR average audit review grades

- The average grade of all audits inspected shows a gradual improvement in the last five years.

- In respect of the FTSE 350 the rate of improvement is more marked and the average grade is higher than that for all audits inspected in the last five years.

- For banks and building societies the average grade in the last three years is lower than that for all audits inspected. A number of factors are likely to contribute to this pattern including:

- The inclusion within the scope of inspections for the first time in 2010/11 of the audits of non-listed banks, typically subsidiaries of overseas banks.

- The inclusion within the scope of inspections for the first time in 2011/12 of the audits of all building societies. Previously only the largest building societies were included.

- The audits of such financial institutions frequently involve highly judgmental and complex areas.

- The smaller number of audits inspected (39 in the last five years) means the grades are likely to vary significantly between years.

3.4. Audits requiring significant improvements

The following graph provides an analysis of audits (excluding public sector and follow-up reviews) assessed each year as requiring significant improvements (grade 3) by type of entity. A brief commentary on this analysis is set out below.

AQR audit reviews requiring significant improvements

- The number of grade 3 audits fluctuates from year to year with a range of 10% to 17% of the audits inspected.

- The decline in numbers in 2010/11 and 2011/12 did not continue in 2012/13 partly as a result of issues relating to the audit of "letterbox companies".

- The number of FTSE 350 grade 3 audits is relatively low and has decreased over the years.

4. Summary of activities

4.1 Introduction

This section provides a summary of our inspection and other activities undertaken in 2012/13.

4.2 Coverage of inspections

Firms which audit more than ten entities within our scope are subject to full scope inspections. These inspections cover a sample of listed and other major public interest entities that fall within scope and the firms' policies and procedures supporting audit quality⁵.

There are currently nine firms where we perform full scope inspections ("the major firms") being Deloitte LLP, Ernst & Young LLP, KPMG LLP & KPMG Audit Plc, PricewaterhouseCoopers LLP (“Big Four” firms), and Baker Tilly UK Audit LLP, BDO LLP, Crowe Clark Whitehill LLP, Grant Thornton UK LLP and Mazars LLP.

In 2012/13, we completed full scope inspections of the Big Four firms, BDO LLP and Grant Thornton UK LLP. Individual public reports summarise the findings from these inspections.

In addition we undertook inspections at 11 firms that audit ten or fewer entities within our scope. These inspections were limited to a review of a sample of individual audits. From 2013/14 such inspections will be undertaken in full by the monitoring units of the professional accountancy bodies responsible for registering these firms to conduct audit work in the UK⁶. This work will be overseen by us.

We currently inspect the Big Four firms annually. These firms audit approximately 80% of the entities within our scope, including over 85% of UK incorporated FTSE 350 companies. Our inspections at the other major firms are undertaken less frequently. For BDO LLP and Grant Thornton UK LLP this is every two years. The remaining major firms are now inspected on a three yearly cycle.

In 2012/13 we continued to undertake public sector and Crown Dependency inspections which are discussed in sections 4.4 and 4.5 respectively.

We review the focus of our inspections annually to ensure that account is taken of risks arising from the current economic climate and other relevant developments. In 2012/13 we continued to give particular consideration to the exercise of appropriate professional scepticism in areas of key judgment. We also continued to place emphasis on the quality of auditing in the financial services sector, in particular banks and building societies.

Areas of particular focus were revenue recognition, fair value measurements and disclosures, the impairment of goodwill and other intangible assets, the recoverability of deferred tax assets, going concern and related party relationships and transactions. We also continued to place emphasis on group audit considerations and the quality of reporting to audit committees.

4.3 Analysis of audits reviewed

In the year to 31 March 2013 we completed the review of 111 audits, including reviews performed under contractual arrangements with the Audit Commission and the National Audit Office. The audits reviewed in 2012/13 related to financial years ending between March 2011 and April 2012, with a significant proportion being 31 December 2011 year ends. An analysis of the audits reviewed by type of firm, together with comparatives, is set out in the following table.

| Firm type | File reviews 2012/13 | File reviews 2011/12 |

|---|---|---|

| Major firms | ||

| Big Four firms-UK entities | 52 | 52 |

| Big Four firms-Crown Dependency entities | 9 | 7 |

| Other major firms-UK entities | 16 | 21 |

| Other major firms–Crown Dependency entities | 1 | 3 |

| Crown Dependency audit firms | 8 | - |

| Firms auditing ten or fewer entities within scope | 11 | 11 |

| Total excluding public sector⁷ | 97 | 94 |

| Public sector | ||

| National Audit Office | 6 | 6 |

| Audit Commission | 4 | 4 |

| Audit Commission – Appointed Firms | 4 | 4 |

| Public sector total⁸ | 14 | 14 |

| Overall total | 111 | 108 |

An analysis of the audits reviewed in 2012/13 by sector and by type of organisation is set out below:

Audit files reviewed by sector 2012-13

Audit files reviewed by type of organisation 2012-13

Since we commenced inspection activities in 2004, we have reviewed in excess of 800 audits including the audits of 145 FTSE 100 companies and 192 FTSE 250 companies. The composition of these indices change quarterly and a number of companies have been inspected more than once.

We have developed a risk model covering listed companies, including AIM, which we use to inform the selection of audits to be reviewed each year. The majority of audits selected for review were drawn from those identified as higher risk within this risk model.

4.4 Public sector inspections

We carry out inspections of audits undertaken by or on behalf of the Audit Commission and the National Audit Office. They are undertaken in the first quarter of each calendar year, the period in which we undertake less inspection fieldwork at the major firms. Public sector inspections, therefore, contribute to the overall efficiency and cost-effectiveness of our inspection activities and add to our overall view of audit quality in the UK. Each of these inspections is discussed below.

Audit Commission

Since 2008, at the request of the Audit Commission we have undertaken inspections of the Audit Commission's in-house Audit Practice and those firms undertaking audits on behalf of the Audit Commission ("Appointed Firms"). These inspections are outside our statutory scope and the findings are not subject to public reporting.

Our inspection of the Audit Practice comprised a sample of audits and the policies and procedures supporting audit quality. We undertook our first inspection in 2007/8 and following the transfer in 2012 of all audits undertaken by the Audit Practice to the Appointed Firms we performed our last inspection of the Audit Practice in 2012/13.

In respect of the Appointed Firms, our inspection of Appointed Firms was undertaken in 2008/9 and will continue in its current form for at least another two years pending changes to the regulatory regime for local government and health sector audits. These changes which are set out in the draft Local Audit Bill will result in the abolition of the Audit Commission and the establishment of new oversight arrangements, similar in many respect to those for statutory audits as set out in the Companies Act 2006. Following this legislative change it is envisaged that we will continue to inspect on an annual basis a sample of the largest local government and health sector audits.

National Audit Office (NAO)

Since 2010 we have inspected the National Audit Office for the purposes of the FRC's oversight role of the NAO's statutory audit work. As the Independent Supervisor, the FRC is required under Section 1229 of the Companies Act 2006 to monitor the performance of the NAO's statutory audit work. This inspection, which is undertaken annually, comprises the review of a small sample of statutory audits together with a review of the NAO's policies and procedures relevant to this audit work. The statutory audits reviewed are not "major audits" as defined and therefore are outside our statutory scope of inspection. The FRC as Independent Supervisor is required to report on the results of this inspection annually to the Secretary of State.

In addition, by agreement with the NAO, we review a sample of its government department and public body audits.

Other than reporting to the Secretary of State, the findings from these inspections are not subject to public reporting.

4.5 Crown Dependency inspections

Firms undertaking the audits of companies incorporated in the Crown Dependencies (Jersey, Guernsey and the Isle of Man), with securities that are traded on a regulated market in the European Economic Area (EEA)⁹, are required to be subject to independent inspection. The arrangements that have been put in place ensure that the Crown Dependencies have auditor oversight arrangements that are equivalent to those in place in EEA member countries under the EU's Statutory Audit Directive.

In conjunction with the monitoring unit of the ICAEW which registers firms to conduct audit work, we have entered into arrangements with the Crown Dependency Regulatory Authorities to undertake these inspections on their behalf. We are responsible for inspecting all major UK audit firms registered to undertake the audits of relevant Crown Dependency companies, together with non-UK audit firms with more than ten relevant audits (currently KPMG Channel Islands Limited and PricewaterhouseCoopers CI LLP).

In 2012/13 our Crown Dependency inspections included major UK audit firms, and KPMG Channel Islands Limited. PricewaterhouseCoopers CI LLP will be inspected in 2013/14 together with major UK audit firms. The cost of these inspections is met by the individual firms concerned.

One benefit of these inspection arrangements is that the audits of companies incorporated in a Crown Dependency which are listed in the UK are now subject to our inspection. This includes a number of major FTSE 350 companies, including nine FTSE 100 companies. The findings from our inspection of the audits of Crown Dependency companies are incorporated within the findings in section 2.

4.6 Third country auditor inspections

The third country auditor inspection regime will commence in 2013/14. Third country auditors (TCAs) are non-EU auditors of non-EU incorporated companies that have issued securities on UK regulated markets, principally on the LSE main market. The regulation of TCAs under the EU Statutory Audit Directive is one of the responsibilities delegated by the Government to the FRC.

There are some 115 TCAs registered with the FRC from 44 countries with roughly 230 relevant issuers. Most of these TCAs are members of one of the Big Four international 'networks' of accountancy firms.

There are significantly more third country issuers on UK markets than for any other EU Member States and they and their auditors come from a wide spread of countries around the world.

A number of TCA countries have inspection regimes that have been assessed by the European Commission ("EC") to be equivalent to those in the EU while others are in the process of establishing such regimes and have been granted transitional status by the EC.

Under the regulatory arrangements, our inspection of TCAs excludes those auditors based in countries with either equivalent or transitional status. This reduces the population of TCAs subject to inspection to 37.

In 2013/14 we envisage reviewing approximately five audits undertaken by TCAs although this will be dependent on successfully navigating the legal and practical challenges to undertaking our inspections in a wide range of jurisdictions around the world.

4.7 Oversight of inspections by the professional bodies

We undertook certain oversight activities in relation to inspections by the monitoring units of the professional accountancy bodies in respect of firms auditing fewer than ten entities within our scope. This comprised approval of the inspection methodology used to assess the policies and procedures supporting audit quality at such firms and the assignment of inspectors to undertake this work. We also review the inspection reports produced by those monitoring each of these firms. This oversight provides an opportunity for collaborative working with the respective monitoring units and contributes to the overall quality of their inspection activities.

As explained in section 5.2 in addition to delegating the inspection of firm policies and procedures, we propose to delegate to the monitoring units of the professional accountancy bodies the inspection of individual audits undertaken by the firms auditing less than ten entities within our scope. From 2013/14 our oversight arrangements will be expanded to include the results of these inspections.

4.8 International liaison

As part of the FRC's on-going commitment to liaise with other independent audit regulators, we meet regularly with other audit regulators. We also participate in the International Forum of Independent Audit Regulators (“IFIAR”) plenary meetings, working groups and inspection workshops and the European Audit Inspection Group, comprising independent audit regulators from within Europe.

It is noteworthy that there continues to be considerable commonality between our inspection findings and those of audit regulators in other major jurisdictions.

The emergence of Europe-wide firms such as KPMG Europe LLP and Ernst & Young Europe LLP has required us to work closely with other regulators. To respond to these developments, we play a leading role in colleges of regulators, established to facilitate the sharing of information and efficient inspection processes across these European firms.

In accordance with the Statement of Protocol agreed in 2011 with the US Public Company Accounting Oversight Board ("PCAOB"), our inspections at BDO LLP, Grant Thornton UK LLP and KPMG LLP/KPMG Audit Plc in 2012/13 were undertaken jointly with the PCAOB. Further inspections with the PCAOB are planned in 2013/14.

4.9 Input to standard-setting process and policy matters

As an important consequence of our work, we gain an overall understanding of how firms are interpreting and applying the requirements of Auditing, Ethical and Quality Control Standards. In this respect we continue to provide regular feedback to the FRC's Codes and Standards Division on issues arising from our inspections in relation to the application of standards in practice and how they might be improved.

We worked closely with colleagues from Codes and Standards on the FRC's response, in December 2012, to the International Auditing and Assurance Standards Board's request for feedback from auditor oversight bodies and others on the implementation of the Clarified International Standards on Auditing.

We also sought input from our colleagues in Codes and Standards in planning our inspection activities for 2013/14. In particular, in scoping our thematic reviews, as discussed in section 5.4, we gave particular consideration to the likely value of the output from a standard-setting and policy-making perspective, consistent with the FRC's focus on evidence-based decision making.

We also have regular discussions with our international counterparts on standards and policy matters and have participated in various initiatives to engage directly with international standard-setting bodies and others with an interest in this area, such as investor groups.

4.10 Liaison with Corporate Reporting Review

We work closely with the FRC's Corporate Reporting Review team ("CRR”), which supports the Financial Reporting Review Panel, with whom we share findings of mutual interest. The FRC reform process has strengthened this working relationship with the removal of the legal barriers to the exchange of certain information and consequential changes to CRR's operating procedures. We have also adopted common priority sectors which are the focus of our respective inspection activities. In 2012/13 we also undertook a number of co-ordinated inspections with CRR and it is envisaged that there will be greater coordination of our respective review activities going forward.

4.11 Collaboration with the Financial Services Authority

A Memorandum of Understanding ("MoU") was entered into in 2011 with the FSA. Its purpose was to assist each body in the proper performance of its respective functions. While the MoU provides that we meet at least four times a year, in practice our meetings have been more frequent.

During 2012/13 we met the FSA regularly to discuss areas of mutual interest. These discussions were wide ranging and covered issues relating to banks, building societies, insurance and investment management companies. The FSA shared with us intelligence from its supervisory enquiries which might have a bearing on the external audit, as well as the output from its bi-lateral and tri-lateral meetings with auditors and management. These discussions informed both the selection of audits for review and the specific areas of the audit work to focus on. In turn, we provided the FSA with specific feedback on the issues arising from the audits of banks, building societies, insurers and investment management companies that we reviewed in 2012/13. We also provided them with a copy of our report on each of these reviews. For those audits that we assessed as requiring significant improvement, the FSA discussed our findings with both the auditors and the company.

In addition to bilateral meetings with the FSA, we also participated in meetings organised by the FSA with firms of auditors to discuss matters of mutual concern such as year-end reporting issues.

In our view these arrangements have worked well and have been of mutual benefit to each organisation. We anticipate that this will continue with both the Prudential Regulation Authority and the Financial Conduct Authority. MoUs with both organisations are now in place.

4.12 Basis of funding

We form part of the FRC's Conduct Division and have a staff of approximately 21 full-time equivalents engaged in audit inspections. The direct costs of the inspection activities falling within our normal scope are funded by the relevant professional accountancy bodies. Inspection activities outside our normal scope, such as those relating to public sector bodies, the auditors of Crown Dependency entities, and TCAs are subject to separate funding arrangements designed to recover in full the costs of these inspections.

5. Enhancements to inspection activities

5.1 Introduction

This section provides a summary of key enhancements we expect to make in 2013/14 to improve the effectiveness of our inspections.

Our inspections are intended to be both rigorous and challenging to firms. Nonetheless, just as we expect to see improvements in the quality of audit work undertaken by firms, we regularly review the approach to our inspections to assess how we can enhance their effectiveness. The recent FRC reform process provided an additional catalyst for a number of important changes to the scope and nature of our inspection activities and processes as set out below.

5.2 More proportionate inspections

In 2013/14 we will give greater emphasis to the largest public interest entities, thereby ensuring that our inspections are seen as more proportionate to the potential impact of issues arising in respect of these entities. The changes set out below are designed to achieve this.

Inspection scope

The definition of a "major audit" determines those entities and firms that are subject to our inspections. The definition is reviewed periodically to ensure that it captures those audits in which there is considered to be the greatest public interest.

The most recent review of the definition has resulted in a significant change for 2013/14 in respect of AIM companies to ensure that only the most significant AIM companies are subject to our inspections. To achieve this, the threshold has been increased from a market capitalisation in excess of £50 million to in excess of £100 million. As a result of this change the number of AIM companies classified as major audits falls from approximately 150 to around 80¹⁰.

Inspection frequency

Inspections are undertaken annually at the Big Four firms, while other major firms have to date been inspected on a two yearly cycle. As the number and nature of entities within the scope of our inspections varies significantly across these other major firms, we reconsidered the need to inspect each of them every two years. We concluded that our inspections of Baker Tilly UK Audit LLP, Crowe Clark Whitehill LLP, and Mazars LLP should now be undertaken every three years. BDO LLP and Grant Thornton UK LLP, however, will continue to be inspected every two years. In the period between full scope inspections we will continue to undertake short follow-up visits to such firms to assess progress in addressing issues identified previously.

This change to our inspection frequency ensures that our inspection activities are focused on those firms where the number of entities falling within the scope of our inspections is greatest.

Delegation of inspection activities

There are approximately fifty firms with ten or fewer audits within our scope. In many cases these firms have only one or two such audits and these include a number of very small listed companies. The Companies Act permits the inspection of these firms to be delegated to the monitoring units of the relevant RSB. To date this delegation has only been applied to the review of the policies and procedures supporting audit quality and we have not delegated the inspection of individual audits. Accordingly, we have typically inspected annually 10-12 audits undertaken by these firms.

From 2013/14 the inspection of these firms will be delegated in full to the monitoring unit of the relevant RSB. This additional delegation will be subject to enhanced supervision by us and will be supplemented from time-to-time with a cyclical review which focuses primarily on the audits of smaller listed companies undertaken by all categories of firm including those subject to full scope inspections.

As a result of this change we will be able to devote more resources to the inspection of the largest audits.

These proposals are subject to the outcome of the European Commission's consideration of the extent to which audit regulators should be able to delegate inspection activities to professional bodies. If that consideration results in limitations to our ability to delegate such inspections to the professional bodies, as was initially proposed, we may not be able to proceed with these proposals and so focus our resources on the inspections of audits of more significant entities.

5.3 Enhanced interaction with audit committees

Audit committees are key users of our inspection findings. The confidential reports on each of the audits we inspect, together with our public inspection reports on audit firms are important vehicles for communicating our inspection findings to audit committees. In addition last year's annual report included a section with specific messages for audit committees and we have again provided such messages in this report (within section 2.3).

In 2013/14 we intend to pilot a change to our procedures by which we will hold a discussion with the audit committee chair at the commencement of our inspection of individual audits. Such discussions, which will cover only a sample of the audits we plan to inspect, will assist us in planning aspects of the inspection. We will review this pilot at the end of the year to determine whether it is continued and extended in 2014/15.

In addition a copy of our report on each audit we have inspected will now be sent directly to the audit committee or, where there is no audit committee, to the directors of the audited entity at the same time as it is provided to the audit firms. Previously firms were requested to provide these to the directors of the audited entity.

These changes respond to feedback we have received from audit committees, and we welcome further comments and observations on how we might further engage with them to improve the overall effectiveness of our inspections.

5.4 Thematic inspections

The focus of our inspection activity has to date been centred on the review of the audit work and policies and procedures of individual audit firms. This will continue to be the case. A number of international audit regulators also undertake inspections on a thematic basis and we note that there is a growing trend toward such inspections as they provide an opportunity to review particular areas of significance in greater depth across relevant firms.

In 2013/14 we will expand our inspection activities to include two thematic inspections. These two inspections will relate to aspects of the audit of fraud risks and compliance with laws and regulation, and to audit materiality.

5.5 Greater independence

Following the FRC reform process, amendments to the Companies Act 2006 have been made that give the FRC the power to determine sanctions to be applied in respect of issues arising from our inspections. Prior to this, we could only make recommendations to the RSBs as to the sanctions that should be imposed where we had identified poor quality audit work. These additional powers give the FRC greater independence from the accountancy profession in determining appropriate sanctions.

The Auditor Regulatory Sanctions Procedure has been approved by the FRC Board. It is envisaged that this Procedure will become effective during 2013/14 once changes have been made to the RSB's Audit Regulations.

Appendix A – Inspection process and basis of reporting

Inspection process

The overall objective of our work is to monitor and promote improvements in the quality of auditing. As part of our work, we monitor firms' compliance with the regulatory framework for auditing, including the Auditing Standards, Ethical Standards and Quality Control Standards for auditors issued by the FRC and other requirements under the Audit Regulations issued by the relevant professional bodies. The Standards referred to in this report are those effective at the time of our inspections or, in relation to the reviews of individual audits, those effective at the time the relevant audit was undertaken.

Our inspections of the major firms comprise a review of the firms' policies and procedures supporting audit quality and a review of the quality of selected audits of listed and other major public interest entities that fall within the scope of independent inspection, as determined each year. The scope of our inspections for 2012/13 is set out in appendix B.

Our inspections of firms auditing ten or fewer entities within our scope are limited to a review of the quality of selected audits of listed and other major public interest entities that fall within our scope of inspection.

The professional accountancy bodies in the UK register firms to conduct audit work. Their monitoring units are responsible for monitoring the quality of audit engagements falling outside the scope of our independent inspection but within the scope of audit regulation in the UK. Their work, which is overseen by the FRC, covers audits of UK incorporated companies and certain other entities which do not have any securities listed on the main market of the London Stock Exchange and whose financial condition is not otherwise considered to be of major public interest. They also review the policies and procedures supporting audit quality of those firms auditing ten or fewer entities within our scope. With effect from 2013/14 the inspection of these firms will be undertaken solely by the monitoring units of the professional accountancy bodies. The reports of those inspections will be reviewed by us.

Our review of the policies and procedures supporting audit quality of major firms covers the following areas:

- Tone at the top and internal communications

- Transparency reports

- Independence and ethics

- Performance evaluation and other human resource matters

- Audit methodology, training and guidance

- Client risk assessment and acceptance/continuance

- Consultation and review

- Audit quality monitoring

- Other firm-wide matters

Our reviews of individual audit engagements and policies and procedures supporting audit quality of major firms cover, but are not restricted to, compliance with the requirements of relevant standards and other aspects of the regulatory framework. Reviews of individual audit engagements place emphasis on the appropriateness of key audit judgments made in reaching the audit opinion together with the sufficiency and appropriateness of the audit evidence obtained. We also assess the extent to which each firm has addressed the findings arising from our previous inspection.

We seek to identify areas where improvements are, in our view, needed in order to safeguard audit quality and/or comply with regulatory requirements and to agree action plans with the firms designed to achieve these improvements. Accordingly, our reports place greater emphasis on weaknesses identified requiring action by the firms than areas of strength and are not intended to be a balanced scorecard or rating tool.

Our inspections are not designed to identify all weaknesses which may exist in the design and/or implementation of a firm's policies and procedures supporting audit quality or in relation to the performance of the individual audit engagements selected for review and cannot be relied upon for this purpose.

Basis of reporting

We prepare a public report on each major firm inspected. These reports together with supplementary information are also provided to the Audit Registration Committees of the relevant professional accountancy bodies in the UK with which each major firm¹¹ is registered to conduct audit work.

We also issue private reports to the Audit Registration Committees on the significant findings arising from our review of individual audits undertaken by firms auditing ten or fewer entities within our scope, together with an overall assessment of the quality of the audit.

We exercise judgment in determining those findings that are appropriate to include in our public reports, taking into account their relative significance in relation to audit quality, both in the context of the individual inspection and in relation to areas of particular focus in our overall inspection programme for the relevant year. In relation to reviews of individual audits, we have generally reported our findings by reference to important matters arising on one or more audits. Where appropriate, we have commented on themes arising or issues of a similar nature identified across a number of audits.

While our public reports seek to provide useful information for interested parties, they do not provide a comprehensive basis for assessing the comparative merits of individual firms. The findings reported for each firm in any one year reflect a wide range of factors, including the number, size and complexity of the individual audits selected for review which, in turn, reflects the firm's client base. An issue reported in relation to a particular firm may, therefore, apply equally to other firms without having arisen in the course of our inspection fieldwork at those other firms in the relevant year. Also, only a small sample of audits is selected for review at each firm and the findings may therefore not be representative of the overall quality of each firm's audit work.

When reviewing individual audits, we do not carry out a detailed technical review of the financial statements. Such reviews are the responsibility of CRR. Our focus in relation to financial reporting issues is on the appropriateness of audit judgments exercised and any underlying deficiencies in the firm's audit work and quality control procedures. Accounting and disclosure issues identified are, therefore, raised with firms in an audit context rather than a financial reporting context. However, we challenge audit judgments on financial reporting issues, where appropriate, as an integral part of our work.

If we consider there is sufficient doubt as to whether an accounting treatment adopted and/or disclosures provided comply with the applicable accounting framework, we may draw the matter to the attention of the CRR. CRR will consider such matters in accordance with its operating procedures. Changes to CRR's operating procedures have facilitated a greater exchange of information as noted in section 4.10.

Similarly, if during the course of our inspections we identify a significant concern as to the conduct of an individual or firm, we may draw the matter to the attention of the FRC's Conduct Committee. If the Conduct Committee considers that the matter raises important issues affecting the public interest in the UK, and that there may have been misconduct, the matter will be investigated in accordance with the FRC's Accountancy Scheme: otherwise it may recommend that the matter be investigated by the relevant professional body. The FRC's Professional Discipline team or the professional body concerned will then determine what, if any, action to take in relation to the matter.

We share certain information obtained through our inspections with CRR and Professional Discipline where relevant to their respective responsibilities. Information sharing arrangements with the FSA are discussed in section 4.11.

Appendix B – Scope of inspections 2012/13

Audits of the following UK entities were within scope for the 2012/13 inspections.

The above criteria were applied as at the start of the period to identify those entities within the scope of inspection for 2012/13. Further details relating to the inspection scope, including the criteria applied for the 2013/14 inspections, is available on the FRC's website.

- All UK incorporated companies with listed equity and / or listed debt.

- AIM or Plus-quoted companies incorporated in the UK with a market capitalisation in excess of £50 million.

- Unquoted companies, groups of companies, limited liability partnerships or industrial and provident societies in the UK which have group turnover in excess of £500 million.

- UK incorporated banks not already included in any other category.

- UK building societies.

- Private sector pension schemes with either more than £1,000 million of assets or more than 20,000 members.

- Charities with incoming resources exceeding £100 million.

- Friendly societies with total net assets in excess of £1,000 million.

- UK open-ended investment companies and UK unit trusts managed by a fund manager with more than £1,000 million of UK funds under management.

- Mutual life offices whose "with-profits" fund exceeds £1,000 million.

UK incorporated companies do not include those incorporated in the Crown Dependencies of Jersey, Guernsey or the Isle of Man. Section 4.5 discusses separate inspection arrangements in respect of certain Crown Dependency companies.

Financial Reporting Council 5th Floor, Aldwych House 71-91 Aldwych London WC2B 4HN +44 (0)20 7492 2300 www.frc.org.uk

Footnotes:

-

Similar tables are included in our reports on individual firms. In those reports the tables present the file review gradings arising from the inspection of the firm which in some cases occurs across a two year period. This table however only includes the file review grades for each audit inspected across all firms in an inspection year, including Crown Dependency firms which are not subject to public reporting. A direct comparison of this table with those in the individual reports is therefore not meaningful. ↩

-

Crown Dependency means Jersey, Guernsey or the Isle of Man. ↩

-

The FSA was abolished with effect from 1 April 2013. Its responsibilities have been assumed by the Prudential Regulation Authority ("PRA") and the Financial Conduct Authority ("FCA"). ↩

-

While such matters are of particular importance to the audits of financial institutions, we noted other instances where the relationship between the testing of IT controls and other audit work was not as well considered as it ought to have been. ↩

-

The Companies Act 2006, as amended, requires the independent inspection of auditors undertaking statutory audits of listed companies and other entities in whose financial condition there is considered to be major public interest. ↩

-

The Companies Act 2006, as amended, permits the delegation of inspection activities to the monitoring units of the professional accountancy bodies for those firms conducting ten or fewer audits within our scope. Only the monitoring of firm-wide procedures in relation to these firms was delegated in 2012/13. ↩

-

Includes 12 and 10 follow-up reviews in 2012/13 and 2011/12 respectively. ↩

-

Includes 1 and 3 follow-up reviews in 2012/13 and 2011/12 respectively. ↩

-

EEA comprises the EU, Iceland, Lichtenstein and Norway. ↩

-

Audits outside the scope of our inspections are within the scope of the monitoring activities of the relevant Recognised Supervisory Body ("RSB"). ↩

-

Baker Tilly UK Audit LLP is currently registered with the Institute of Chartered Accountants of Scotland ("ICAS"). All other major firms are currently registered with the Institute of Chartered Accountants in England and Wales ("ICAEW"). ↩