The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Streamlined Energy and Carbon Reporting (SECR)

1. Executive summary

Introduction

In November 2020, the FRC published the Climate Thematic Review 2020 (the 'Climate Thematic'), which looked at climate-related considerations by boards, companies, auditors, professional bodies and investors. We set out our views on current market practice, our expectations, and a commitment to play our part in raising the bar on the quality of reporting on climate change. In our review of companies' annual reports and accounts we made a number of observations on emissions reporting, noting the significance to users of metrics, targets and broader strategic commitments such as ambitions to reach 'net zero' emissions or to align strategies with the goals of the Paris Agreement.

The Streamlined Energy and Carbon Reporting ('SECR') rules set out certain required statutory disclosures about emissions and energy use. From 1 April 2019 the rules expanded the existing emissions disclosure requirements for quoted companies, and required emissions reporting for the first time for large unquoted companies and limited liability partnerships ('LLPs').

This follow-up review is part of the FRC's ongoing programme of work on climate change. It considers how a sample of preparers have complied with the new SECR requirements, highlights where we saw examples of emerging good practice, and sets out our expectations for reporting in future periods.

Represents good quality application that we would want other preparers to provide in their annual reports and accounts.

Represents opportunities for improvement by preparers to move them towards good practice.

▲ Represents an omission of required disclosure or other issue. We expect preparers to avoid such issues in their annual reports and accounts.

Summary of key observations

The entities in our sample largely complied with the minimum statutory disclosure requirements

- All entities in our sample disclosed their emissions and the majority disclosed their energy use. However, we identified a number of entity-specific disclosure errors or omissions (page 8)1.

More needs to be done to make these disclosures understandable and relevant for users. We identified a number of challenges in this first year of reporting

- Reports did not always provide sufficient information about the methodologies used to calculate the emissions and energy use information. In particular, it was not always clear which entities were included in groups' SECR disclosures (pages 14-16).

- More thought is needed about how to integrate these disclosures with narrative reporting on climate change, where relevant, and make them easier for users to navigate. Three reports disclosed an emission-reduction target, but not the corresponding metric (page 12). Emissions metrics and trends may represent an important aspect of the entity's broader strategic narrative, particularly where risks have been disclosed or targets have been set (page 19).

- It was sometimes unclear whether the ratios selected were the most appropriate for the entities' operations. It was also often not possible to recalculate emissions ratios by reference to other disclosures in the report, for example, emissions per £m revenue (page 17).

- The extent of third party assurance obtained over the SECR information was not adequately explained in most cases (page 10). We had previously identified this issue in our Climate Thematic.

- Disclosures about energy efficiency measures did not always clearly describe the 'principal measures' taken by the entity in the current year (page 18).

We were pleased to see some examples of emerging good practice

- Several reports disclosed additional information encouraged by the Government Guidelines on SECR (page 6). These included disclosure of Scope 3 emissions, information about the use of renewable energy and reporting of both location-based and market-based emissions (page 10).

- Many of the reports disclosed emissions reduction targets or an intention to set targets. Better practice examples explained 'net zero' or other emission-reduction commitments and strategies, and included more specific details on pathways and interim targets (pages 12,13).

- We were also encouraged to see progress in entities' broader disclosures on climate-related matters, in the context of a developing regulatory environment. All quoted entities, and several others, either reported disclosures in a format consistent with the recommendations of the Taskforce on Climate-related Financial Disclosures ('TCFD'), or stated an intention to adopt the framework in future. We encouraged the use of TCFD in our Climate Thematic (page 19).

Our expectations for future reporting periods

- We have set out our key disclosure expectations on (page 20) and encourage preparers to consider the findings of this thematic carefully when preparing future annual reports and accounts.

2. Scope and sample

Our review consisted of a limited scope desktop review of the annual reports and accounts of entities reporting under the SECR requirements, in the first period in which these disclosures were mandatory.

Our sample comprised 27 entities across a cross-section of industries, with a bias towards those expected to generate significant emissions. These included:

- ten FTSE 350 companies2 under the scope of the rules for quoted companies; and

- ten AIM quoted companies3, five large private companies and two LLPs under the scope of the rules for large unquoted companies and large limited liability partnerships.

As our sample focusses on larger groups and particular industries, the findings of this report may not be representative of reporting practice in the wider population covered by the new requirements, which is expected to include thousands of entities4.

Our report includes extracts from the limited number of reports and accounts included in our sample. The examples will not be relevant for all companies or all circumstances, but each demonstrates a characteristic of useful disclosure. Inclusion of a company's disclosure should not be seen as an endorsement of that company's SECR disclosures as a whole.

Industries sampled (number of reports)

- 3 Basic Materials

- 3 Energy

- 2 Professional Services

- 1 Real Estate

- 1 Utilities

- 5 Construction and Materials

- 1 Manufacturing

- 2 Retail

- 3 Technology, Telecommunications and Media

- 5 Industrial Support Services

- 1 Health Care

3. Overview of requirements

The Companies (Directors' Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018 implement the government's policy on Streamlined Energy and Carbon Reporting.

These make amendments to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 and the Limited Liability Partnerships (Accounts and Audit) (Application of Companies Act 2006) Regulations 2008 ('the Regulations').

The new requirements, which are effective for reporting periods beginning on or after 1 April 2019, expand on existing emissions disclosure requirements for quoted companies, and introduce new, slightly different, requirements for large unquoted companies and LLPs.

The disclosure requirements are summarised on the following page.

The government has published additional guidance in the document Environmental reporting guidelines: including Streamlined Energy and Carbon Reporting and greenhouse gas reporting ('the Guidelines'). The Guidelines encourage additional best practice disclosures, which go beyond the minimum requirements in the legislation. We have made several observations on these matters throughout this report.

HM Government

Environmental Reporting Guidelines: Including streamlined energy and carbon reporting guidance

March 2019 (Updated Introduction and Chapters 1 and 2)

The required disclosures are summarised in the table below, with further detail in the relevant sections of this report. New requirements introduced by SECR are highlighted in grey.

| Quoted companies (information should be reported in the directors' report, or the strategic report where it is of strategic importance – see page 11) | Large unquoted companies (directors'/strategic report) and LLPs ('energy and carbon report')6 |

|---|---|

| Emissions (Global)5 from: | Emissions (UK and offshore area only) from: |

| * activities for which the company is responsible, including (a) the combustion of fuel; and (b) the operation of any facility ('Scope 1'7 emissions). | * activities for which that entity is responsible involving: (a) the combustion of gas; or (b) the consumption of fuel for the purposes of transport. |

| * the purchase of electricity, heat, steam or cooling by the company for its own use ('Scope 2'7 emissions). | * the purchase of electricity by the entity for its own use, including for the purposes of transport. |

| (Disclosure of Scope 37 emissions is voluntary but encouraged.) | (Disclosure of other Scope 3 emissions, to the extent not captured by the requirements above, is voluntary but encouraged.) |

| Energy consumption in kWh (Global) – an aggregate figure, corresponding to the above | Energy consumption in kWh (UK only) – an aggregate figure, corresponding to the above |

| Proportion of emissions and energy consumed in the United Kingdom and offshore area | n/a |

| Principal measures taken to increase energy efficiency (if any measures have been taken) | Principal measures taken to increase energy efficiency (if any measures have been taken) |

| Comparatives (except for the first year) | Comparatives (except for the first year) |

| Exemptions: | Exemptions: |

| * Disclosures are only required to the extent practical (but preparers must state what is not included and why). | * Disclosures are only required to the extent practical (but preparers must state what is not included and why). |

| * Disclosures are not required if: (a) the company consumed 40,000 kWh of energy or less and the report states this; or (b) disclosure would be seriously prejudicial and the report states this. | * Disclosures are not required if: (a) the entity consumed 40,000 kWh of energy or less and the report states this; or (b) disclosure would be seriously prejudicial and the report states this. |

| * Groups may exclude subsidiary information which those entities would not be required to disclose in their relevant reports. | * Subsidiaries are not required to report information which is included in a group report. (Detailed size threshold requirements are set out in the Regulations.) |

| Methodologies used to calculate the emissions and energy consumption information disclosed. | Methodologies used to calculate the emissions and energy consumption information disclosed. |

| At least one ratio expressing emissions in relation to a quantifiable factor associated with the company's activities, for example, emissions per £m revenue. | At least one ratio expressing emissions in relation to a quantifiable factor associated with the company's activities, for example, emissions per £m revenue. |

4. Emissions and energy use

Entities are required to disclose the following information:

| Quoted companies (Global emissions and energy use) | Unquoted companies and LLPs (UK emissions and energy use) |

|---|---|

| * the annual quantity of emissions8 (in tonnes of carbon dioxide equivalent) resulting from: | |

| - activities for which that company is responsible, including: (a) the combustion of fuel; and (b) the operation of any facility ('Scope 1 emissions') | - activities for which that entity is responsible involving: (a) the combustion of gas; or (b) the consumption of fuel for the purposes of transport |

| - the purchase of electricity, heat, steam of cooling by the company for its own use ('Scope 2 emissions') | - the purchase of electricity by the entity for its own use, including for the purposes of transport |

| * an aggregate figure (in kWh) of the annual quantity of energy consumed resulting from these activities and purchases | |

| * the proportion of these figures which relate to emissions and energy consumed in the UK and offshore area |

All 27 entities in our sample disclosed their emissions as required by the Regulations. The majority provided the required energy use disclosures.

We saw potential for improvement in disclosure of which entities are included within groups' SECR disclosures. A lack of clarity over which emissions are included may significantly limit the usefulness and comparability of these disclosures. This is discussed further in Methodology on page 15.

In addition, we noted the following issues:

- Two entities did not provide the required energy use disclosures.

- Two entities disclosed a single total, rather than separate subtotals, for Scope 1 and 2 emissions.

- Two quoted companies did not report the proportion of emissions or energy use in the United Kingdom and offshore area.

- Two entities reported emissions of carbon dioxide ('CO2'), rather than the carbon dioxide equivalent ('CO2e') of all six greenhouse gases that fall into the scope of the requirements.

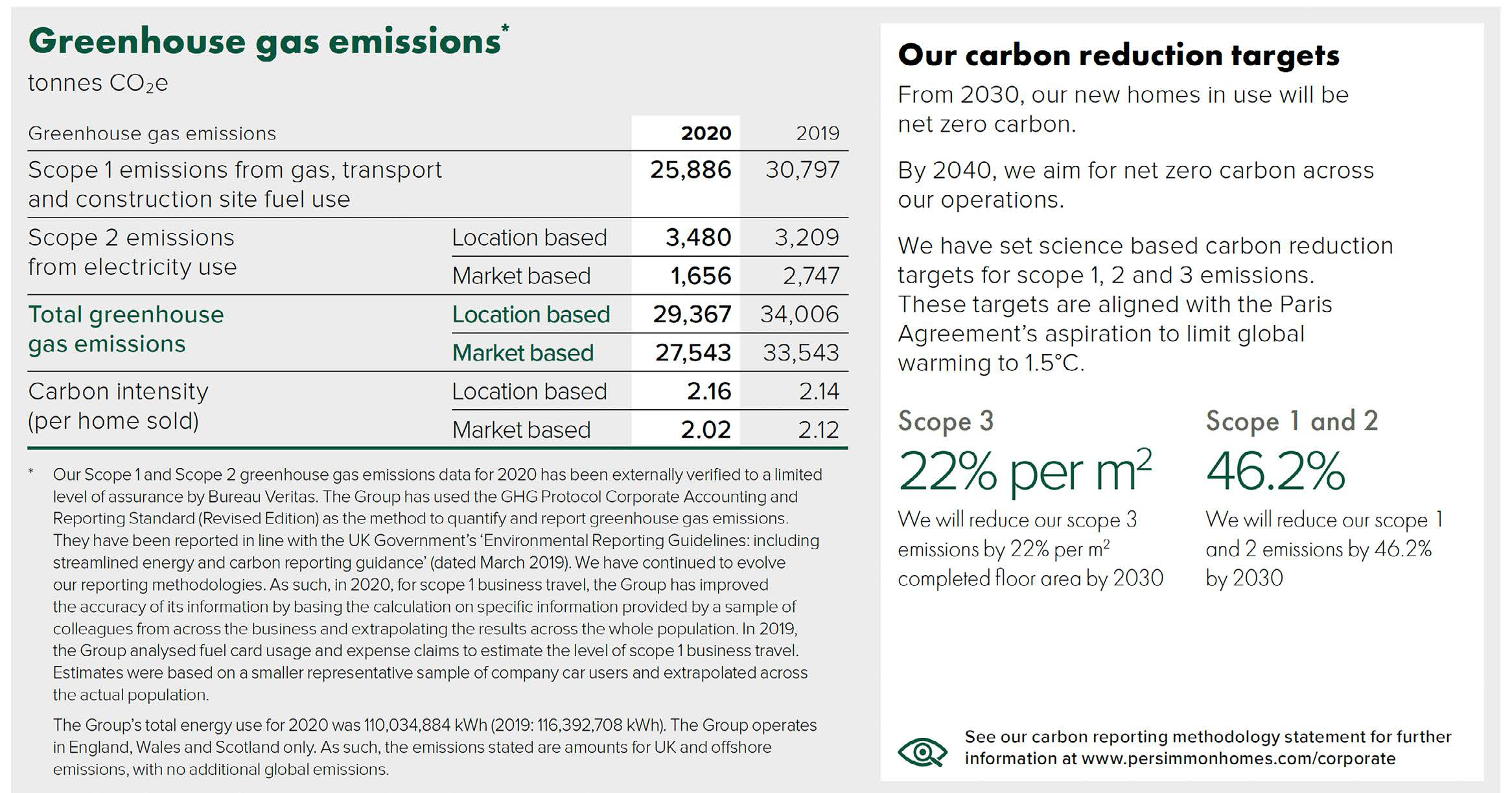

Our Scope 1 and Scope 2 greenhouse gas emissions data for 2020 has been externally verified to a limited level of assurance by Bureau Veritas. The Group has used the GHG Protocol Corporate Accounting and Reporting Standard (Revised Edition) as the method to quantify and report greenhouse gas emissions. They have been reported in line with the UK Government's 'Environmental Reporting Guidelines: including streamlined energy and carbon reporting guidance' (dated March 2019). We have continued to evolve our reporting methodologies. As such, in 2020, for scope 1 business travel, the Group has improved the accuracy of its information by basing the calculation on specific information provided by a sample of colleagues from across the business and extrapolating the results across the whole population. In 2019, the Group analysed fuel card usage and expense claims to estimate the level of scope 1 business travel. Estimates were based on a smaller representative sample of company car users and extrapolated across the actual population.

The Group's total energy use for 2020 was 110,034,884 kWh (2019: 116,392,708 kWh). The Group operates in England, Wales and Scotland only. As such, the emissions stated are amounts for UK and offshore emissions, with no additional global emissions.

Persimmon Plc, Annual Report 2020, p68

Our carbon reduction targets

From 2030, our new homes in use will be net zero carbon.

By 2040, we aim for net zero carbon across our operations.

We have set science based carbon reduction targets for scope 1, 2 and 3 emissions. These targets are aligned with the Paris Agreement's aspiration to limit global warming to 1.5°C.

Scope 3 22% per m² We will reduce our scope 3 emissions by 22% per m² completed floor area by 2030

Scope 1 and 2 46.2% We will reduce our scope 1 and 2 emissions by 46.2% by 2030

See our carbon reporting methodology statement for further information at www.persimmonhomes.com/corporate

Several entities linked their SECR disclosures to emissions reduction strategies, for instance by disclosing long-term and interim targets, progress towards those targets and which emissions are included in 'net zero' commitments.

Emissions were often labelled 'Scope 1', '2' or '3'. These terms are defined in the GHG Protocol Corporate Standard ('GHG Protocol'), and may be commonly understood by many users, although they are not directly referenced in the legislation. Better disclosures explained to users which emissions were included under each heading.

Clear, concise presentation of emissions and energy use figures

Details of assurance obtained (see page 10)

Disclosure of both location-based and market-based emissions (see page 10)

Target for reduction of scope 1 and 2 emissions presented alongside the corresponding metrics (see page 12)

Assurance

There is no requirement in the legislation to obtain assurance over the information reported. However, the Guidelines state that voluntary independent assurance on the accuracy, completeness and consistency of energy use, GHG emissions data and energy efficiency action is encouraged as beneficial to both internal decision-making and for external stakeholders.

Ten entities in our sample disclosed that they had obtained some form of third-party assurance over the disclosures.

Only seven of these ten reports adequately explained the level of assurance obtained. Two reports stated that the disclosures had been 'audited' or 'verified', without providing sufficient context. As noted in our Climate Thematic, where external assurance has been obtained, disclosures should explain the level of assurance given and what it covered, to avoid giving the impression of a higher level of assurance than has actually been obtained.

Location-based and market-based methods

The GHG Protocol also describes different methods of calculating emissions. A location-based method of calculating emissions reflects the average emissions intensity of grids on which energy consumption occurs. A market-based method reflects emissions from electricity that companies have purposefully chosen (or their lack of choice). Market-based emissions may be significantly lower, or nil, if the entity has entered into contractual arrangements for renewable energy, such as the purchase of Renewable Energy Guarantees of Origin ('REGOs').

Neither basis is specified in the SECR requirements; however, the Guidelines indicate that organisations are encouraged to use location-based reporting, with 'dual reporting' of market-based emissions also encouraged.

A number of reports included voluntary disclosure of additional information. The most common, all of which are encouraged in the Guidelines, were as follows:

- Scope 3 emissions (11 reports)

- Use of renewable energy (eight reports)

- Market-based emissions (five reports)

The disclosures are required to be provided in the directors' report and must always meet the requirements in the applicable Regulations, except where exemptions apply (page 7). Matters that are considered to be of strategic importance to the entity, that would otherwise be included in the directors' report, may be disclosed in the strategic report, provided that the directors' report contains an appropriate cross-reference. This may be appropriate for SECR disclosures where closely related climate change disclosures have been provided in the strategic report. The threshold 'to the extent necessary for an understanding of the development, position and performance of the company's business', which is applicable for certain strategic report disclosures, does not apply to these disclosures.

We saw significant variation in the level of detail provided in the disclosures we reviewed. Additional detail may be necessary or helpful to users, particularly where emissions and energy use metrics are linked to key aspects of the entity's strategy, such as 'net zero' commitments. However, we do not encourage disclosure of additional information where it is not useful and may obscure relevant information.

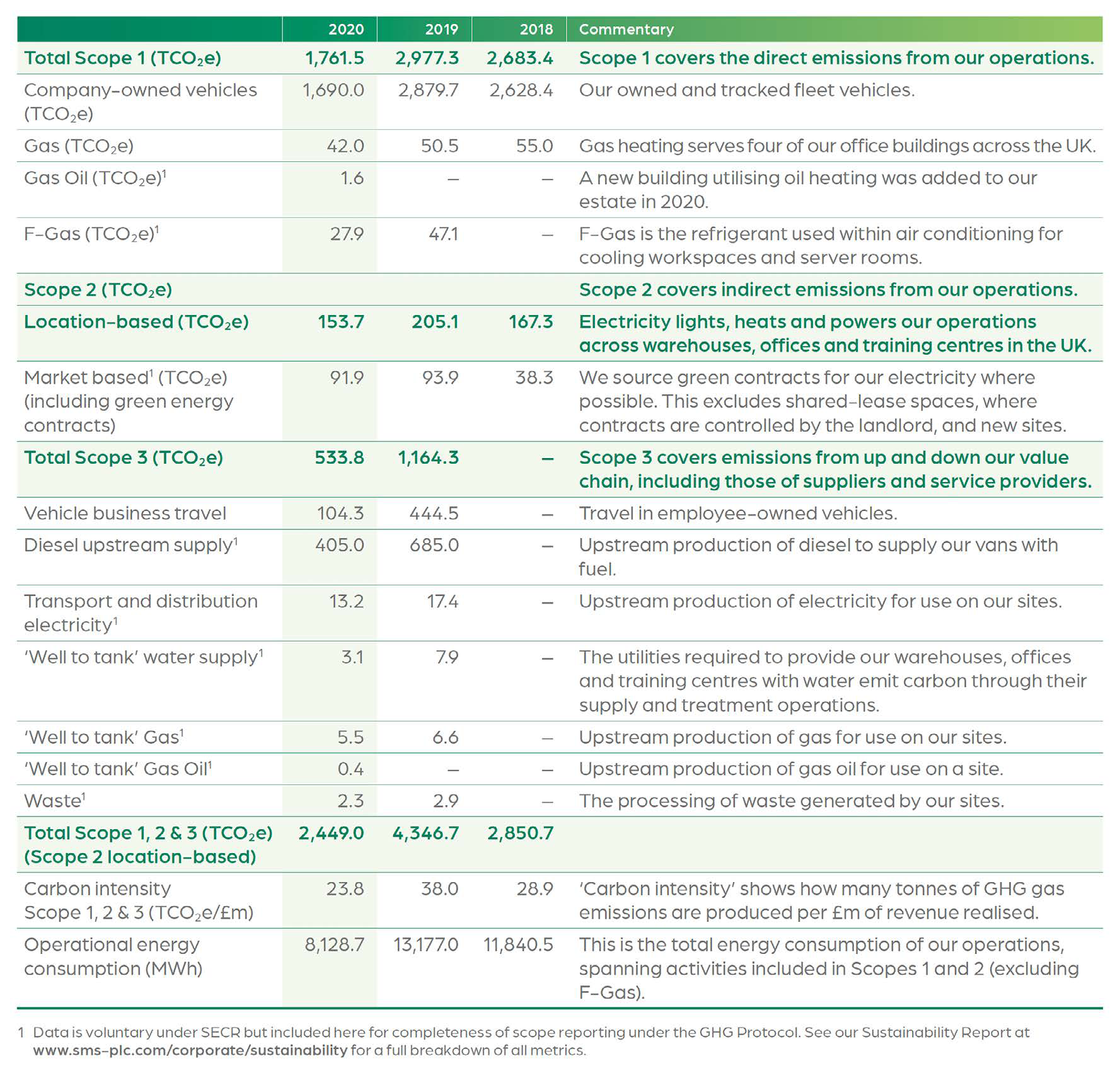

More detailed example, with a number of voluntary disclosures including:

- Scope 3 emissions

- Sub-categories of emissions

- Disclosure of both location-based and market-based emissions

Smart Metering Systems plc, Annual report and accounts 2020, p47

Clear explanations which help users understand the nature of emissions

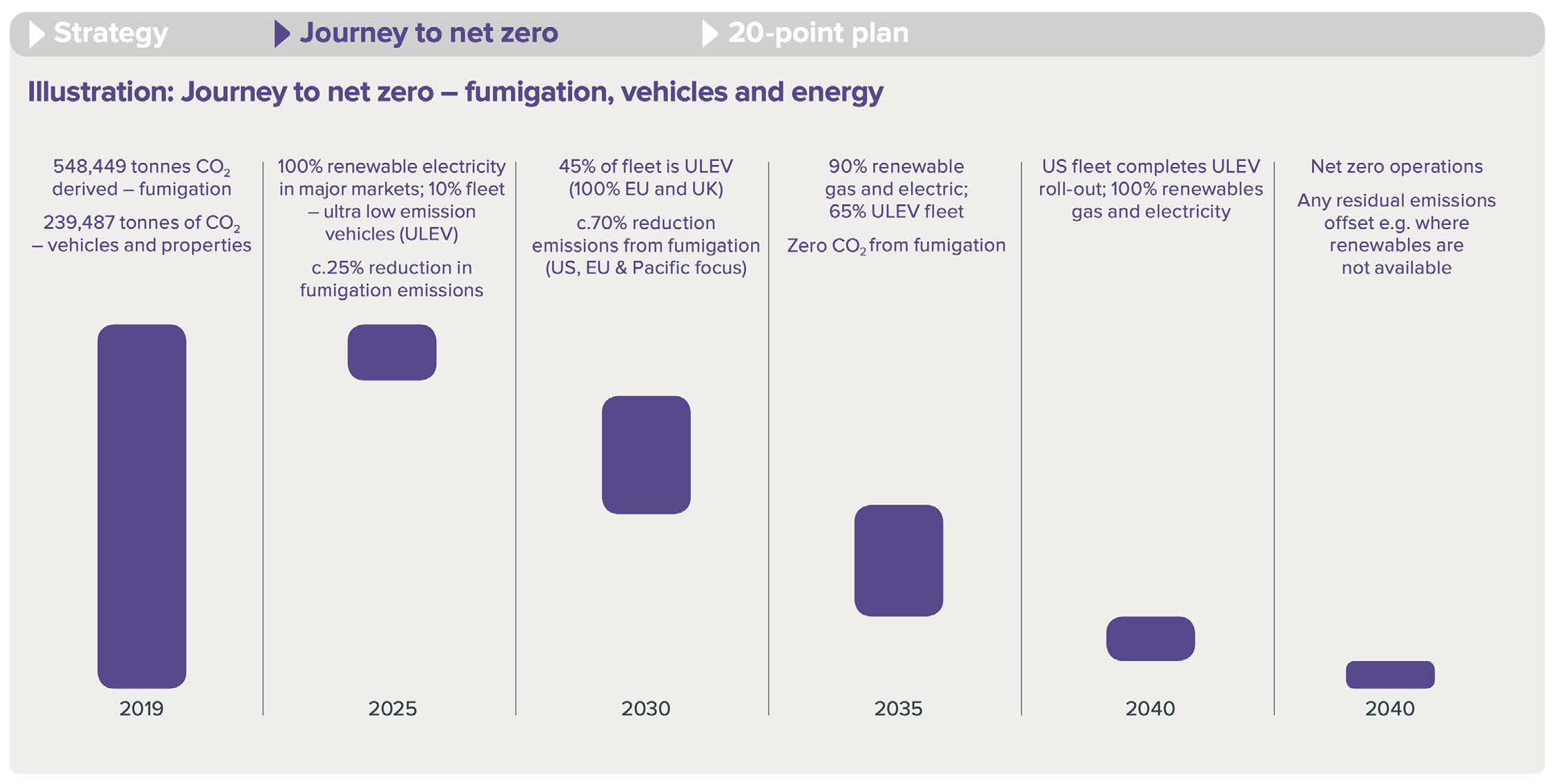

Rentokil Initial plc, Annual Report 2020, p53

During our Climate Thematic work, investors told us that metrics and targets were an area of concern, with many reporting that targets were non-specific and lacked substance, particularly relating to interim milestones.

In our review of emissions disclosures, we noted some better practice examples which provided more specific detail, including timescales, of the pathway towards these longer term targets.

12 of the reports we reviewed included emissions targets of some form. These included targets for reductions in absolute emissions or intensity metrics. A further five disclosed an intention to set targets in the future. Better practice reporting included disclosure of any targets alongside the corresponding metric for the reporting period.

However, three of the 12 reports which disclosed an emissions-reduction target did not disclose the corresponding metric.

The company has illustrated the timescales and specific emissions reduction initiatives that contribute to its net zero strategy

SEGRO plc, Annual Report and Accounts 2020, p86

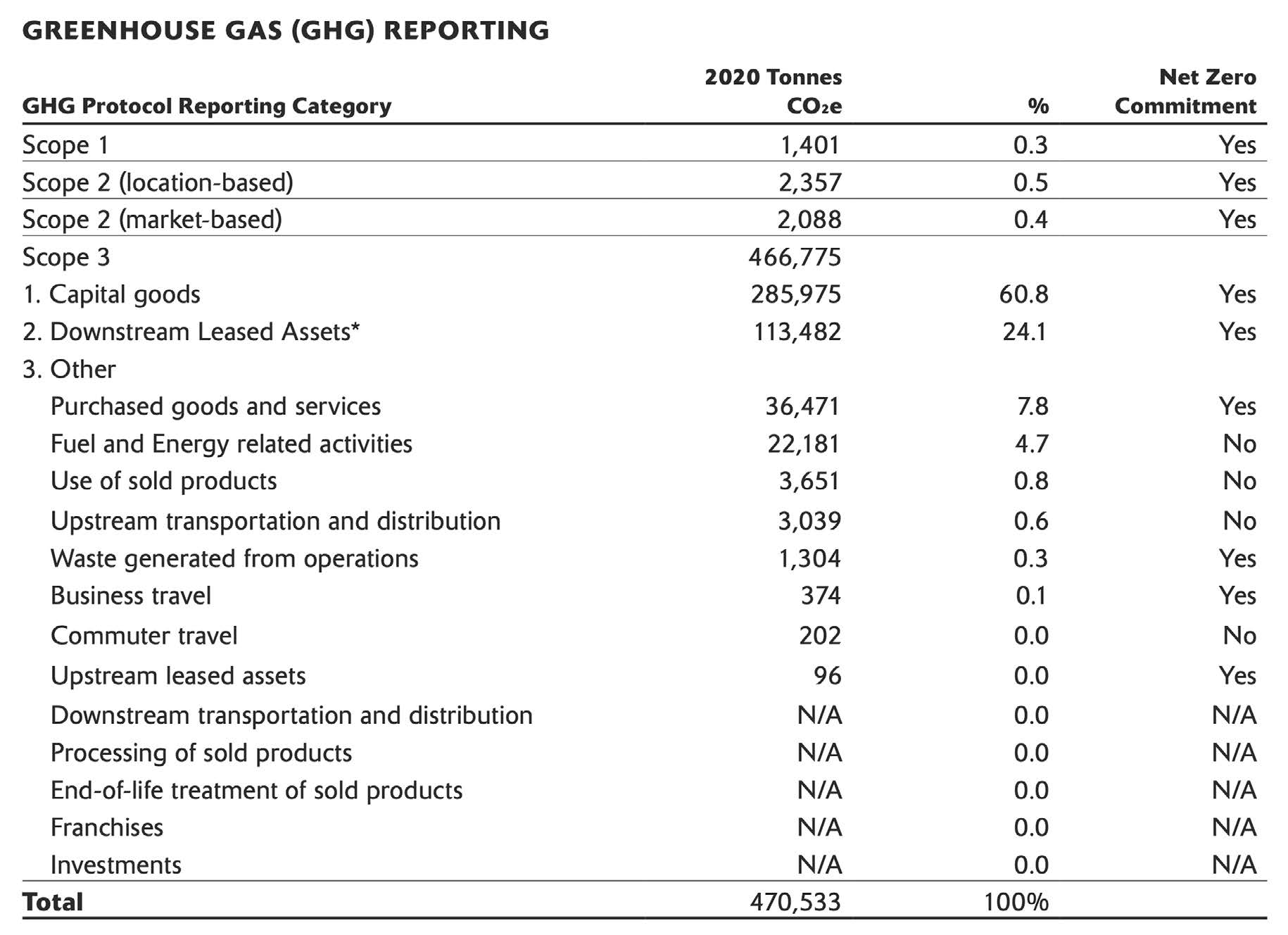

In our Climate Thematic we stated that we expect companies to provide clear explanations which help users to understand and compare major commitments such as 'net zero emissions' targets or 'Paris-aligned' strategies, including which activities and emissions are included in the scope of these commitments.

In our current review, 11 entities disclosed a strategic aim in relation to emissions reductions, typically reaching 'net zero' emissions within a fixed timeframe.

Better practice disclosures showed the relationship between statutory SECR emissions disclosures and those strategic commitments.

In addition to core SECR disclosures, the company has presented a table setting out which categories of emissions are included within its Net Zero Commitment. All Scope 3 categories are addressed, including those marked ‘N/A', which the company has determined are not relevant to its operations.

5. Methodology

Entities are required to state the methodologies used to calculate the annual emissions and annual energy consumption information.

In our Climate Thematic we stated that 'we expect companies to describe the methodologies used to calculate emissions metrics and the extent of any due diligence or assurance over these. There is significant scope for judgements in determining boundaries and which emissions are included, so companies should explain these decisions clearly. This information is expected to be more material where these metrics underpin a major policy or strategy.'

Reporting standards

The Regulations do not specify any particular methodology, although the Guidelines refer to a number of widely used standards including the GHG Protocol Corporate Standard, ISO 14064, the Climate Disclosures Standards Board (CDSB) and The Global Reporting Initiative (GRI) Sustainability Reporting Guidelines. Other methods may also be appropriate. 14 entities in our sample disclosed the application of one or more reporting standards, with 13 referencing the GHG Protocol.

These reporting standards allow for certain policy choices, including in respect of which subsidiaries and other investments are included within a group's reporting boundary (see page 15). Reported emissions may not, therefore, align with the entities included in the consolidated financial statements. Similarly, the categories of emissions that are reported may vary. For instance, where preparers voluntarily disclose Scope 3 emissions, they may choose to report only those emissions that are most relevant to their operations. Standards also include a concept of measurement materiality, allowing preparers to exclude certain categories of emissions where these are less significant.

25 out of 27 entities in the sample reviewed provided some description of the methodology used, although in several cases the disclosure was very limited. The extent of disclosure required will vary depending on the complexity of the entity and approach. Several unquoted entities provided brief, but sufficient, explanations of how they had obtained UK energy consumption data and applied specified conversion factors to derive the associated emissions. For more complex groups, in addition to a statement of the standard applied, further information may be needed to adequately explain the methodology to users (see pages 16 and 20).

One report did not include any disclosure of methodology and another only provided a cross-reference to the entity's website, which was not sufficient to meet the requirement. We expect preparers to provide an adequate summary of methodology within their annual reports, although it may be helpful to direct users to more detailed information provided in a different report.

21 entities clearly identified which categories of emissions were included in their disclosures. These disclosures ranged from brief narrative explaining the nature of emissions, to more detailed descriptions such as the examples on pages 11 and 13.

One company prepared its disclosures using EU Emissions Trading System ('EU ETS') data, but it was not clear that gases other than CO2, or emissions from all activities required to be reported under SECR, had been included. The Guidelines state that data reported under other domestic or international regulatory reporting processes may be helpful; however, preparers should consider whether additional data is needed to satisfy SECR reporting requirements.

None of the entities in our sample disclosed that they had taken advantage of the 'seriously prejudicial' or low energy use disclosure exemptions. The only explicit statement that it was not practical to obtain data was in respect of one category of a company's voluntary Scope 3 disclosures.

Reporting boundary

There are several policy choices and other matters which may result in different reporting boundaries.

- Groups may determine their reporting boundary using several methods, including operational control, financial control or equity share approaches. Determining the entities and activities captured under these methods may be complex and subject to further judgements.

- Exemptions in the SECR Regulations permit the exclusion of subsidiaries which would not be required to report the information in their relevant individual reports.

- Unquoted companies and LLPs are permitted, but not required, to exclude emissions outside the UK and offshore area.

- We noted some complexity with interpretation of the quoted company legislation and, in particular, whether group disclosures should include overseas subsidiaries as well as UK entities. However, the Guidelines clearly set out the following expectations:

- The disclosures are expected to cover operations in the UK and abroad, consistent with those included in the consolidated financial statements.

- There is a strong preference for reporting to be aligned with the boundaries of the financial statements.

- Users should have a clear understanding of the operations for which emissions data has been reported and if, and how, this differs from operations within the consolidated financial statements. This should include a reconciliation of entities which are included and/or excluded.

Most quoted companies appeared to have reported on their global group in line with the above expectations; however, very few provided a clear statement which confirmed this and one quoted company had only provided certain disclosures for UK subsidiaries. Only six groups provided a statement which made clear which entities or activities had been included within the reporting boundary. We did not see any reconciliations to the financial statement boundary of the form suggested in the Guidelines.

In our full sample, 16 entities disclosed details of how the reporting boundary was determined. 11 of these used the operational control boundary, two used the financial control boundary and one entity used the equity share boundary. However, a statement of the standard and boundary principles applied may not be sufficient to help users understand which subsidiaries or other investments fall within the boundary. For example, we were unable to determine whether one group had included the emissions of a significant joint venture.

In accordance with the 2018 Regulations, the energy use and associated greenhouse gas emissions are for those within the UK only that come under the operational control boundary. Therefore, energy use and emissions are aligned with financial reporting for the UK subsidiaries and exclude the non-UK based subsidiaries that would not qualify under the 2018 Regulations in their own right.

GlobalData Plc, Annual Report and Accounts 2020, p36 (Note: the company is AIM-listed and the 'unquoted' rules apply)

Clearly states which entities are included within the scope of the disclosures

Disclosure of overall methodology

We consider that information about the boundary and any other significant reporting policy choices are key components of the methodology disclosures required under SECR. In providing these disclosures, preparers should consider the following matters:

- Without further information, readers may assume SECR reporting to align with the consolidated financial statements and the Guidelines are clear that this is best practice.

- Methodology may change over time where preparers continue to develop their approach to measurement of emissions and energy use.

- Metrics reported using different methodologies may not be comparable between entities. Over time we might expect greater alignment within certain sectors and jurisdictions, but users should be alert to the potential lack of comparability.

We expect these matters, including any significant changes in methodology, to be adequately explained to users.

6. Ratios

The report must state at least one ratio which expresses the entity's annual emissions in relation to a quantifiable factor associated with the entity's activities.

All 27 entities in the sample we reviewed disclosed at least one emissions ratio. Eight reports disclosed two or more ratios.

The legislation does not specify a particular metric, but the Guidelines state that this should be appropriate to the business activity. Organisations are encouraged to apply metrics relevant to their sector and consistently over time. This allows stakeholders to compare performance over time and with similar organisations.

The reports in our sample disclosed metrics using the following quantifiable factors:

- Revenue (18 entities) – e.g. tonnes CO2e per £m revenue.

- Production factors (4 entities) – e.g. tCO2e per tonne of production.

- Other factors - including floor space, average number of employees, units sold and more complex factors, such as normalised revenues or adjusted profit measures.

It was sometimes unclear whether the quantifiable factor chosen provided the most meaningful data in relation to the entity's operations, and explanations for the choice of ratio were generally not provided.

The Guidelines recommend that disclosures explain the choice of ratio and the reason for the movement from the prior year. The following example is provided:

'We have chosen the metric gross global scope 1 and 2 emissions in tonnes of CO2e per tonne of product output as this is a common business metric for our industry sector. Our intensity measurement has fallen this year as we have invested £5 million in more energy efficient process equipment in our operations in the USA. (Guidelines, page 124)'

We were able to recalculate the ratio disclosed in 15 reports in our sample based on the information provided in the annual report and accounts. In two cases we could not recalculate the ratio because the quantifiable factor was not disclosed.

However, in several cases we recalculated a significantly different value for the ratio based on the information disclosed in the SECR disclosures and elsewhere in the financial statements. There may be a number of reasons for this: for example, the disclosed ratio could be based on entity or segment level revenues prior to consolidation adjustments, in which case a user would not be able to reproduce this by reference to the disclosed emissions and consolidated revenues.

If the ratio cannot be recalculated from other information in the annual report and accounts, or is apparently inconsistent with that information, we expect reports to include an explanation or reconciliation.

7. Principal measures

If the entity has taken any measures for the purpose of increasing the company's energy efficiency in the financial year to which the report relates, the report must contain a description of the principal measures taken for that purpose.

Specifies the measures undertaken

24 reports out of our sample of 27 included disclosure of some energy efficiency measures taken in the reporting period.

Where no such measures have been taken, the disclosure is not required but the Guidelines recommend that a statement to this effect should be included. None of the three companies which did not disclose any efficiency measures included this statement.

Some entities included lists of multiple energy efficiency initiatives but it was not always clear how significant these measures were in the context of the group's operations. We understand that, in groups with diverse operations across many territories, a wide range of different energy-saving measures may be undertaken in any period. The requirement is to disclose 'principal' measures, which we expect to be those which collectively have the greatest impact on the energy use of the group. Better practice disclosures quantified the impacts of the different measures.

Several reports discussed long-term, ongoing initiatives but it was not clear which, if any, of these activities had been undertaken in the financial year to which it related. We also note for future periods that the requirement to disclose comparative information includes these 'principal measures' disclosures. Preparers should therefore ensure that the disclosures explain the principal measures undertaken in the current and prior periods. This is particularly relevant where energy use fell significantly in one of these periods. Better practice disclosures distinguished, for example, between reductions in energy use due to energy-savings initiatives, and those which had primarily resulted from reduced activity levels during the pandemic.

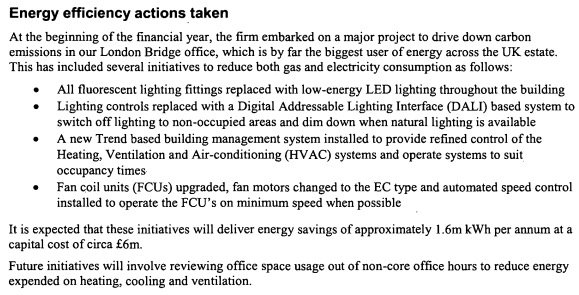

Energy efficiency actions taken

At the beginning of the financial year, the firm embarked on a major project to drive down carbon emissions in our London Bridge office, which is by far the biggest user of energy across the UK estate. This has included several initiatives to reduce both gas and electricity consumption as follows:

- All fluorescent lighting fittings replaced with low-energy LED lighting throughout the building

- Lighting controls replaced with a Digital Addressable Lighting Interface (DALI) based system to switch off lighting to non-occupied areas and dim down when natural lighting is available

- A new Trend based building management system installed to provide refined control of the Heating, Ventilation and Air-conditioning (HVAC) systems and operate systems to suit occupancy times

- Fan coil units (FCUs) upgraded, fan motors changed to the EC type and automated speed control installed to operate the FCU's on minimum speed when possible

It is expected that these initiatives will deliver energy savings of approximately 1.6m kWh per annum at a capital cost of circa £6m.

Future initiatives will involve reviewing office space usage out of non-core office hours to reduce energy expended on heating, cooling and ventilation.

Ernst & Young LLP, Members' Annual Report and Financial Statements 3 July 2020, p5

Quantification of energy savings

8. Integration with broader climate reporting

Ten of the reports we reviewed included disclosures in a format consistent with the recommendations of the Taskforce on Climate-related Financial Disclosures ('TCFD'), with a further seven in our sample stating their intention to adopt this framework in future.

In our Climate Thematic, we encouraged companies to report using the TCFD's 11 recommended disclosures, and against the Sustainability Accounting Standards Board ('SASB') metrics relevant to their sector. TCFD disclosures will be required on a 'comply or explain' basis for premium listed companies for periods commencing 1 January 2021, and the government has expressed its intention to further expand the scope of these disclosures in the future. FTSE listed companies in our sample were further advanced in TCFD adoption. None of the ten AIM listed companies in our sample had yet adopted TCFD and only three had disclosed an intention to adopt.

Some entities provide emissions-related information to satisfy the requirements of SECR, TCFD, or other matters which may be required to be addressed in the strategic report, including discussion of environmental matters in the non-financial information statement. Emissions metrics and trends may represent an important aspect of the entity's broader strategic narrative, particularly where risks has been disclosed or emissions-reduction targets have been set.

Distinct but related reporting requirements can lead to confusing disclosures or inadvertent omissions. One company in our sample provided the core SECR disclosures in a series of sentences, tables and footnotes across four pages, which was difficult to follow.

We encourage preparers to integrate and streamline related material wherever possible. Better practice disclosures made effective use of cross-referencing to avoid duplication and help users navigate the content.

9. Key disclosure expectations for 2021

Whilst we saw many examples of good disclosure, there is scope for improvement. We encourage preparers to consider the findings within this report when preparing their disclosures in future annual reports and accounts.

Our expectations for good Streamlined Energy and Carbon Reporting disclosures

We expect preparers to:

Present all the required information in a form which is clear, understandable, and easy for users to navigate, using cross-references where relevant information is provided across several parts of the annual report. It may be helpful to reference further information in other reports or on a website, but the disclosures within the relevant report must be sufficient to meet the requirements.

Provide an adequate explanation of the methodologies used to calculate emissions and energy use. There is significant scope for judgements in determining boundaries and which emissions are included so entities should explain these decisions clearly. This information is particularly relevant where metrics underpin a major policy or strategy. The following matters should be clearly explained to users:

- Which entities have been included in group disclosures. Readers may assume SECR reporting is aligned with the consolidated financial statements, and government Guidelines10 are clear that this is best practice.

- Any other significant policy choices about which emissions are included.

- Any significant changes in methodology, or any other matters which may affect the comparability of the information disclosed.

Provide an explanation or reconciliation where ratios provided cannot be recalculated from, or are apparently inconsistent with, other disclosures in the annual report and accounts. Consider which emissions ratio is the most appropriate for the entity's operations, and disclose the reason for this choice, if necessary.

Describe the extent of any due diligence or assurance over emissions and energy use metrics. These disclosures should explain the level of assurance given and scope of coverage, and avoid implying a higher level of assurance than has been given, for instance by using terms such as 'audited' or 'verified' inappropriately.

Provide an adequate description of energy efficiency initiatives in the current and comparative period, focussing on those 'principal measures' with the most significant impact.

Consider the matters highlighted in the Guidelines10, which provide further insight into how the requirements may be met, and whether disclosure of additional information, such as scope 3 emissions, would be helpful to investors or other users.

Provide clear explanations which help users to understand and compare major commitments, such as 'net zero emissions' targets or 'Paris-aligned' strategies, including which activities and emissions are included in the scope of these commitments. This may require the disclosure of additional emissions-related information, beyond the minimum required by SECR.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS

+44 (0)20 7492 2300 www.frc.org.uk

Legal Disclaimer and Copyright Notice: The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2021 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

-

As our sample targeted larger groups and particular industries (page 5), the findings of this report may not be representative of reporting practice in the wider population. ↩

-

Listed on the main market of the London Stock Exchange. ↩

-

Listed on the AIM market of the London Stock Exchange. For the purposes of the SECR requirements, these companies fall within the definition of an 'unquoted' company. ↩

-

Estimates included in the Government Response to the SECR consultation https://www.gov.uk/government/consultations/streamlined-energy-and-carbon-reporting ↩

-

See further detail on these requirements in Methodology on page 15. 'Offshore area' is defined in the legislation. ↩

-

Subject to size thresholds set out in the Regulations. ↩

-

The terms 'Scope 1', '2' and '3' are not directly referenced in the legislation (see page 9). ↩↩↩

-

"emissions" means emissions into the atmosphere of a greenhouse gas, as defined in section 92 of the Climate Change Act 2008, which are attributable to human activity. ↩

-

These points reiterate expectations set out in our Climate Thematic in November 2020. ↩