The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Response to IAASB’s ED 540 Consultation – Accounting Estimates and Disclosures

Matt Waldron Technical Director International Auditing and Assurance Standards Board 529 Fifth Avenue New York 10017 USA

20 July 2017

Dear Mr Waldron

Exposure Draft – Proposed International Standard on Auditing 540 (Revised): Auditing Accounting Estimates and Related Disclosures

The Financial Reporting Council (FRC) welcomes the opportunity to comment on the exposure draft of the proposed revision of International Standard on Auditing (ISA) 540. To help inform our response we have conducted outreach meetings with UK stakeholders, including investors, preparers, other UK regulatory authorities, valuation professionals, auditors and professional bodies.

There is a clear need to update ISA 540 to support better quality audits of increasingly complex accounting estimates addressing concerns, that more attention should be given to the audit of disclosures and that auditors should more consistently exercise professional scepticism. These issues are regularly identified in the audit inspections that we carry out as the UK's Competent Authority for Audit.

We are supportive of the aims of the IAASB as reflected in the exposure draft and there are many proposals that we want to be retained when the revised standard is finalised. We are particularly supportive of:

- Having regard to developments in financial reporting, but not attempting to address within the standard specific accounting requirements at a detailed level. We comment more on this in our response to question 1.

- The inclusion of requirements and application material that should have the effect of enhancing professionally sceptical behaviour. Professional scepticism is absolutely fundamental in delivering a rigorous and high quality audit and we discuss this further in our response to question 2.

- Introducing the requirement to have regard specifically to the qualitative inherent risk factors, and in particular those of 'complexity' and 'judgement' in addition to estimation uncertainty, when performing risk assessment procedures and designing responses to those assessed risks. We believe this is essential to facilitating an appropriate audit response to more complex accounting estimates, rather than just focussing on estimation uncertainty. However, we believe the inter-relationship between the factors and how they affect the susceptibility to misstatement could be better explained - see our response to Q4 (b) and Attachment 2.

- Using the term 'reasonable' for both the estimate and disclosures, subject to ensuring its meaning, and that of "appropriate", is clear as set out in paragraphs A2 and A3, which we recommend are incorporated in the definitions. We comment further on this in our response to Q4(c), including recommending that paragraph A123, which currently supports A2, is elevated to a requirement.

- The new requirement in paragraph 26 to remind auditors of their responsibilities to communicate certain matters to those charged with governance. An important aspect of paragraph 16(a) of ISA 260 is that, when applicable, the auditor communicates why the auditor considers a significant accounting practice, which is acceptable under the applicable accounting framework, is not the most appropriate to the particular circumstances of the entity. However, we believe that the auditor should be specifically required to consider in performing its work, whether management has used the most, rather than an, appropriate approach. This would support the auditor's communication responsibilities and serve the public interest by requiring actions that would be more likely to drive appropriately sceptical behaviour. We comment further on this in our response to Q2.

- Having work effort requirements expressed in an objective/outcome based manner to address different types of accounting estimate and proportionality, whilst driving more consistent and granular work to obtain sufficient appropriate audit evidence.

- Not requiring particular types of procedures on the basis of whether risks are significant risks. Procedures that are appropriate for 'significant risks' would also be appropriate for many risks that are not determined to be 'significant risks'. This would reflect the expectations of those investors we have spoken to in our outreach.

- The improvements to what constitutes an appropriate 'auditor's range' and the approach to misstatements, although, as explained below in our response to question 5, we have some concerns as to the clarity of the proposed changes.

- That the standard should be applicable to all estimates, with scalability to ensure that 'simpler' less risky estimates can be addressed in a proportionate manner. We believe this is more appropriate than developing two separate standards, particularly as there will be many audits with a combination of estimates with different levels of risk.

- That the criterion of 'low inherent risk' is appropriate as a dividing line for scalability. As we comment in our response to question 3, there is a concern among some stakeholders that under this proposed approach, some auditors may assess estimates as having low inherent risk when in fact they do not. Nonetheless, we believe this criterion should be capable of more consistent interpretation than other possible criteria.

- The emphasis on determining whether specialised skills or knowledge are required and the extension from the current requirement to include this in relation to the identification and assessment of the risks of material misstatement.

We believe that the proposals could be further enhanced in a number of important respects, including in particular:

- As a matter of practicality, the ISA needs to be generic and cannot, nor should it attempt to, address in detail all the various emerging accounting requirements. Nevertheless, we do believe there is a need for separate detailed guidance to help apply the standard to different types of more complex or judgmental estimate and the IAASB should set out how this will be addressed when it issues the final standard. We comment further on this in our response to Q1.

- We agree with the approach being taken by the IAASB in ED 540 to emphasise the importance of professional scepticism. However, we are concerned about the absence of clear drivers to challenge management and believe there is room for use of the words "question" and "challenge" in the context of the requirements and application material that address how the auditor approaches its work. We comment further on this in our response to Q2.

- We support the focus on the factors of complexity and judgment as well as estimation uncertainty. However, in our outreach we have encountered confusion as to how these factors inter-relate. We believe the differences and inter-relationships between the factors could be further explained, so that they do not give rise to such confusion or conflation in implementation. We comment further on this, and give a suggested explanation, in our response to Q4 (b) and Attachment 2.

- Further guidance on internal controls that may be relevant in the audit of estimates could helpfully be provided. We comment further on this in our response to Q4(c).

- There is a very significant amount of application material in comparison to the number of requirements. We are concerned that some of the application material identifies actions that would be expected of the auditor in particular circumstances, but their presentation as actions the auditor 'may' take risks them not always being performed when appropriate and could lead to inappropriate or inconsistent practice. We strongly recommend that the IAASB review all the application material and consider whether designating potential actions by the auditor as "may" is appropriate. Where they represent actions that should be expected when applicable circumstances exist that should be made clearer, eliminating the "may" and/or moving the points to requirements. We comment further on this, with examples, in our response to Q4(c).

- We support the IAASB addressing a concern that currently auditors may develop an auditor's range that is inappropriately wide. However, we are concerned that some auditors may not actually see the requirement in paragraph 20 and the related application material as a significant change from the extant standard and, in consequence, may not change what they do in practice and thereby fail to comply with the intent of the new requirements. We comment further on this, and how it might be addressed, in our response to Q5.

We note that the IAASB has invited auditors to participate in field testing of the proposals. We commend this as practical experience can provide helpful insights. We highlight that there may be limitations in the effectiveness of such testing. For example, some of the new accounting requirements that the proposed revisions to ISA 540 are intended to help address have yet to come into effect. As a result auditable examples may not exist. Such field tests will be performed by auditors in isolation from other stakeholders'. Accordingly, any difficulties identified in the feedback from auditors should be explored very carefully and any changes made in response should have regard to the public interest by following appropriate due process and having regard to other stakeholders' views.

Yours sincerely,

Melanie McLaren Executive Director, Audit and Actuarial Regulation DDI: 020 7492 2406 Email: [email protected]

Appendix

Responses to IAASB's Specific Consultation Questions

1) Has ED-540 been appropriately updated to deal with evolving financial reporting frameworks as they relate to accounting estimates?

The proposed new "objective based" approach to developing responses to risks of material misstatement is suited to addressing a wide range of types of estimate. It has the potential to drive more appropriate responses to risks of material misstatement when complexity, judgment and uncertainty are particular factors giving rise to the underlying susceptibility of estimates to misstatement.

However, as inherent risk increases, particularly as a result of complexity of accounting requirements and methods to address them, auditors will need sufficient knowledge and expertise to design and perform appropriate specific procedures. The emphasis on the need for the auditor carefully to consider the need for specialised skills and knowledge, both in the risk assessment and performance phases of the audit, is important and welcomed.

The application material has been enhanced from extant 540 but, understandably given the wide range of types of accounting estimates that the standard will apply to, provides relatively little specific guidance to help design procedures to address particular circumstances. For example, although a number of references to 'expected credit loss' have been included in the application material, we note that they generally just provide examples of estimates that may have high complexity, judgment and uncertainty and where controls around models may be particularly relevant.

As a matter of practicality, the ISA needs to be generic and cannot, nor should it attempt to, address all the various emerging accounting requirements. Nevertheless, as explained below, we do believe there is a need for separate guidance to help apply the standard to different types of complex estimate. The IAASB should set out how these needs will be met when it issues the final standard.

Attachment 1, dealing with the broad nature and types of estimate, is important both in explaining the underlying concepts relating to accounting estimates referred to in the ED and in providing a reasonable degree of future proofing. However, more specific guidance to assist application of the revised standard is needed. We note that the IAASB's work plan for 2017-2018 (issued in February 2017) identifies that the 'Accounting Estimates project' includes developing IAPNs or other publications as appropriate. We support the development of such guidance, although a lack of authoritative status may be an issue for some sector regulators. Specialised areas that could be covered include estimates of expected credit losses under International Financial Reporting Standard (IFRS) 9, which the IAASB specifically identifies as one of the drivers for revising ISA 540, but also new accounting standards covering leases (IFRS 16), revenue recognition (IFRS 15) and insurance contracts (IFRS 17). We are aware of the limitations of the IAASB's resources - we note that the development of an IAPN on "Special Audit Considerations Relevant to Financial Institutions", included in the IAASB's work plan, is behind schedule - and we encourage the IAASB to explore means to overcome this.

2) Do the requirements and application material of ED-540 appropriately reinforce the application of professional skepticism when auditing accounting estimates?

Professional scepticism is fundamental in delivering a rigorous and high quality audit. We discussed this extensively in our response in 2016 to the IAASB's Invitation to Comment Enhancing Audit Quality in the Public Interest – A focus on Professional Skepticism, Quality Control and Group Audits.

We agree with the approach being taken by the IAASB in ED 540 - to emphasise the importance of professional scepticism in the Introduction to standard, and then establish requirements and application material that are intended to drive sceptical behaviour, rather than to scatter the words "professional scepticism" more liberally throughout the standard.

An important aspect of applying professional scepticism, particularly in relation to estimates, is evaluating management's methods and judgments, considering whether there is evidence that other methods and/or judgments may be appropriate and challenging management accordingly. Management's methods and judgments may be appropriate, but are they the most appropriate - if not, why not, and what are the implications? We are concerned with the absence of clear requirements for the auditor to challenge management and believe there is room for use of the words "question" and "challenge" in the context of the requirements and application material that address how the auditor approaches its work.

For example, many of the requirements in paragraphs 18 and 19 are in the form of obtaining evidence that what management has done is appropriate in the context of the applicable financial reporting framework (AFRF). This could suggest an approach that looks to obtain evidence that supports management, rather than actively determining whether there is evidence to the contrary.

Paragraph 23 requires the auditor, in performing an overall evaluation, to consider all relevant audit evidence obtained whether corroborative or contradictory. We believe, however, that earlier requirements should clearly drive actions that are more likely to ensure the auditor identifies potential alternative sources of evidence that may be contradictory. For example the hanging paragraph at the end of paragraph 15 could be amended to:

> "The auditor's further audit procedures shall be responsive to the reasons for the assessment given to the risk of material misstatement in accordance with paragraph 13, recognizing that the higher the assessed risk of material misstatement, the more persuasive the audit evidence needs to be. The auditor shall seek to obtain all relevant audit evidence, whether it corroborates or contradicts management's assertions."

Paragraph 26 reminds auditors of their responsibilities to communicate certain matters to those charged with governance. An important aspect of paragraph 16(a) of ISA 260, as referred to in paragraph A155 of ED 540, is that, when applicable, the auditor communicates why the auditor considers a significant accounting practice (which includes management's judgments in making accounting estimates), which is acceptable under the applicable accounting framework, is not the most appropriate to the particular circumstances of the entity. However, we think that consistent with ISA 260, there should be a requirement for the auditor to consider, in performing its work, whether management has used the most, rather than an, appropriate approach. For example, under 10(e) when obtaining an understanding of how management makes accounting estimates; 18(a)(i) when obtaining evidence about management's judgments regarding the selection and use of the method; and the overall evaluation required by paragraph 22. This would support the auditor's communication responsibilities and serve the public interest by requiring actions that would be more likely to drive appropriately sceptical behaviour.

For example paragraph 22(c) could be amended as follows:

> "[whether] Management's decisions relating to the recognition, measurement, presentation and disclosure of these accounting estimates in the financial statements are: > (i) in accordance with the applicable financial reporting framework > (ii) where alternative decisions would be acceptable under the applicable financial reporting framework, whether management's decisions are the most appropriate in the circumstances of the entity."

Similar amendments could be included in paragraphs 10 and 18.

Focus on Risk Assessment and Responses

3) Is ED-540 sufficiently scalable with respect to auditing accounting estimates, including when there is low inherent risk?

We agree that the standard should be applicable to all estimates and that the criterion of 'low inherent risk' is appropriate as a gauge for scalability. We believe that the standard is sufficiently clear and capable of proportionate application to estimates that have risks of material misstatement for which inherent risk is low. The proposed requirements are broadly the same in nature as those in the extant ISA 540 and we are not aware of significant issues in applying them to 'simpler' estimates. However, there is a concern amongst some stakeholders that under this proposed approach, some auditors may see a dividing line and assess estimates as having low inherent risk when in fact they do not. The examples in paragraphs A72 and A73 of where inherent risk may be low or not should help, but this is likely to be a matter that audit regulators will wish to monitor when the standard is implemented.

For estimates that have risks of material misstatement for which inherent risk is not low, we believe that expressing the more detailed requirements on an objectives/outcomes basis should assist their proportionate application to the wide variety of accounting estimates, having regard to the spectrum of risk and that some estimates should be more straightforward to audit than others.

4) When inherent risk is not low (see paragraphs 13, 15 and 17-20):

a) Will these requirements support more effective identification and assessment of, and responses to, risks of material misstatement (including significant risks) relating to accounting estimates, together with the relevant requirements in ISA 315 (Revised) and ISA 330?

In principle, we believe that they should. While we understand why it was not possible, it is unfortunate that the project to revise ISA 315 could not have taken place at the same time. This would have enabled the developing thinking in relation to the spectrum of risk and risk factors, and how significant risk fits within that, to have been aligned. As it is, we believe that some conforming amendments to the revised ISA 540 may be required as part of the ISA 315 revision.

b) Do you support the requirement in ED-540 (Revised) for the auditor to take into account the extent to which the accounting estimate is subject to, or affected by, one or more relevant factors, including complexity, the need for the use of judgment by management and the potential for management bias, and estimation uncertainty?

Yes. We believe it has the potential to deliver significant improvements in the identification and the design and implementation of appropriate responses by auditors to risks of material misstatement relating to accounting estimates.

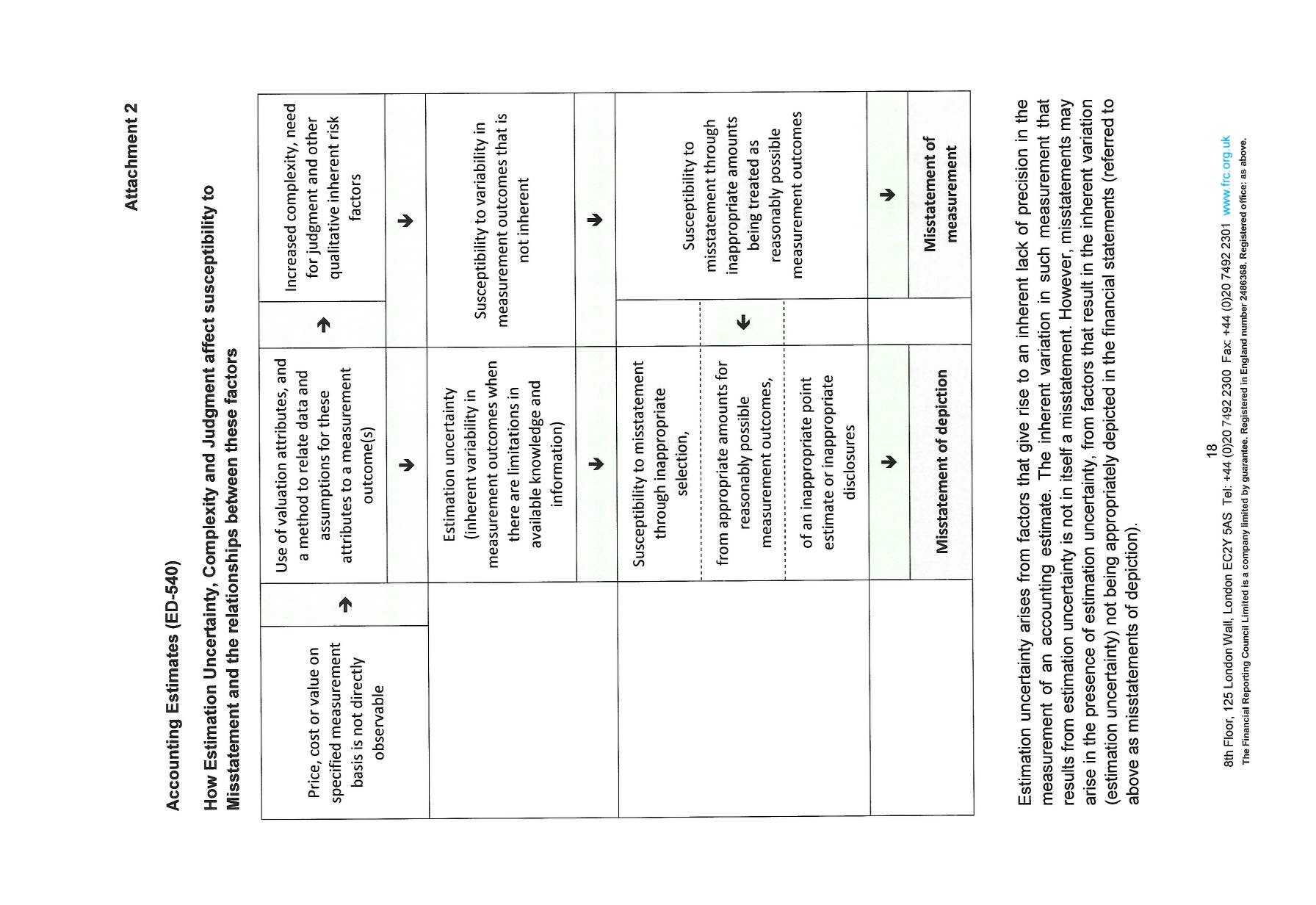

However, we believe the differences and inter-relationships between the factors could be further explained, so that they do not give rise to confusion or conflation in implementation. In discussing this with Stakeholders in the UK, we have found the Table and the explanation that follows it in Attachment 2 to be helpful.

c) Is there sufficient guidance in relation to the proposed objectives-based requirements in paragraphs 17 to 19 of ED-540? If not, what additional guidance should be included?

Balance between requirements and application material

As stated above we support having the work effort requirements expressed in an objective/outcome based manner as this facilitates the flexibility needed to address different types of accounting estimate and proportionality, whilst driving more consistent and granular work effort to obtain sufficient appropriate audit evidence. However, there is a fairly high amount of guidance given in relation to paragraphs 17 to 19 (indeed the ED in general includes a high amount of guidance in relation to the number to requirements) and we believe that it would be appropriate to elevate some of that guidance to the requirements. For example:

- A101 - When management uses a complex method, the expectation ought to be that the auditor will consider whether there were other available valuation concepts, techniques or factors, types of assumption or sources of data that, in the circumstances, might have been more appropriate, or more generally accepted, in the context of the applicable financial reporting framework.

- A105 third bullet - When the accounting estimate is based on complex legal or contractual terms, it is to be expected that the auditor would inspect the underlying contract.

- A123 - We believe that, when applicable, these matters "will" be relevant in obtaining sufficient appropriate audit evidence. See also our further discussion of this in the Attachment to this letter.

- A126 We believe that when, based on the audit evidence obtained, in the auditor's judgment, management has not appropriately understood and addressed the estimation uncertainty, before the auditor moves to develop an auditor's point estimate or range, it should discuss the circumstances with management and obtain an understanding of why management has not appropriately understood and addressed estimation uncertainty. If appropriate, the auditor should ask management to consider alternative assumptions or to provide additional disclosure relating to the estimation uncertainty.

We strongly recommend that the IAASB review all the application material and consider whether designating potential actions by the auditor as "may" is appropriate. Where they represent actions that should be expected when applicable circumstances exist that should be made clearer, eliminating the "may" and/or moving the points to requirements.

We also believe that, given the importance of understanding the meaning of "reasonable" and "appropriate", paragraphs A2 and A3 should be reworked and included as definitions of those terms.

Testing internal control

Much of the application material on internal control relates to obtaining an understanding of internal control. With regard to intended reliance on internal control, the application material in paragraph A98, which supports paragraph 16, focusses on where substantive procedures alone may not provide sufficient appropriate audit evidence at the assertion level and gives examples of such circumstances. We suggest that further guidance could be given to help the auditor when it intends to rely on internal controls that may be relevant in the audit of estimates. In particular, given the different nature of the potential misstatements that can arise from different factors, there would be merit in considering additional guidance about the types of control that may be relevant in the context of each type of misstatement, addressed in relation to each factor.

Paragraph 95 of IAPN 1000 provides a list of factors the auditor may consider in reaching a decision on the nature, timing and extent of testing of controls. Suitably adapted, these could provide a starting point for guidance to include in ISA 540.

Particularly important to accounting estimates and controls that it might be appropriate to rely on is the precision of those controls. Where complexity is a relevant risk factor, controls that the auditor may be able to rely on may have high precision, especially if, for example, the complexity relates to application of a systematic method or the integrity of significant data. In many such circumstances, the use of IT by the audited entity and related controls will be relevant.

Where judgment or estimation uncertainty are relevant risk factors, controls may have varying levels of precision and, generally, be less precise than controls for complexity. These controls will typically be performed at a higher, less granular level for judgments, recognising that there may be no definitive 'right' or 'wrong' answer and expectations are less predictable. Auditors will need to assess the level of precision when determining the extent to which it is appropriate to plan to rely on such controls to address the identified risks. Auditors will need to exercise their own judgment in evaluating the results of testing such controls and the need for additional sources of evidence from other tests of controls or substantive tests.

Independent monitoring of controls, such as by an internal audit function, may be a useful source of audit evidence. Another important consideration is how management responds to identified deficiencies in internal control.

Complexity, judgment and estimation uncertainty are not mutually exclusive and inter-relationships, where they exist, also need to be taken into account when designing and performing tests of controls.

When developing guidance on the design and performance of internal controls, it will be helpful to link this to the earlier guidance on understanding internal controls, which should be amended as necessary so that all the guidance aligns.

5) Does the requirement in paragraph 20 (and related application material in paragraphs A128-A134) appropriately establish how the auditor's range should be developed? Will this approach be more effective than the approach of "narrowing the range", as in extant ISA 540, in evaluating whether management's point estimate is reasonable or misstated?

We understand that the IAASB is seeking to address a concern that currently auditors may develop an auditor's range that is inappropriately wide. Based on our outreach, we are concerned that some auditors may not see the requirement in paragraph 20 and the related application material as a significant change and, in consequence, may not change what they do in practice thereby failing to comply with the intent of the new requirements. As the result, the IAASB should ensure that this is clearly set out in the Explanatory Memorandum that is issued when the Standard is finalised. We illustrate this below with a side by side comparison why some auditors may incorrectly perceive that there is no change in substance:

| ED 540 | Extant 540 | FRC Comment |

|---|---|---|

| 20(a) requires that the auditor only includes in the range amounts that "are supported by the audit evidence" | 13(d)(ii) requires the auditor to narrow the range "based on audit evidence available" | While less explicitly clear, extant 540 does in effect require amounts in the range to be supported by audit evidence |

| 20(b) requires that the auditor only includes in the range amounts that "the auditor has evaluated to be reasonable in the context of the measurement objectives and other requirements of the applicable financial reporting framework." | 13(d)(ii) requires the auditor to narrow the range "until all of the outcomes are considered reasonable" | In both cases the amounts have to be "reasonable". The ED sets out what that means whereas extant ISA 540 does not. Some auditors may consider that they already take this into account and that to be reasonable an amount would necessarily have to be acceptable under the applicable financial reporting framework. |

However, the other key change is that the ED no longer includes the extant guidance that "ordinarily, a range that has been narrowed [from all possible measurement outcomes] to be equal to or less than performance materiality is adequate for the purposes of evaluating the reasonableness of management's point estimate." This is an important change that we support and helps address concerns that the points at the ends of the range may not be reasonable because they do not appropriately meet the measurement objectives. This is why the revised approach, which requires all amounts to be "reasonable" as now described in A2 and A3, is importantly different from extant ISA 540. For the purpose of measuring any misstatement, it is important that the range is as narrow as it can be based on the audit evidence, not taken to be 'reasonable' so long as it is no wider than performance materiality. We believe it is important that this point is reflected in the application material in the revised standard as it would help highlight the change from the extant position.

It is also important that what is meant by "supported by the audit evidence" is sufficiently clear. In particular, it should be clear that it includes all evidence that is reasonably available to the auditor, whether or not obtained or taken into account by management.

6) Will the requirement in paragraph 23 and related application material (see paragraphs A2-A3 and A142-A146) result in more consistent determination of a misstatement, including when the auditor uses an auditor's range to evaluate management's point estimate?

We believe they will help, but see also our comments above in response to questions 2 and 5.

Conforming and Consequential Amendments

7) With respect to the proposed conforming and consequential amendments to ISA 500 regarding external information sources, will the revision to the requirement in paragraph 7 and the related new additional application material result in more appropriate and consistent evaluations of the relevance and reliability of information from external information sources?

The proposed change to the requirement in paragraph 7 of ISA 500 is one of limited clarification rather than substance. However, extant ISA 500 has little application material to assist the auditor in considering the relevance and reliability of information obtained from an external information source. Indeed, the prominence of the first bullet point in paragraph A31 that "the reliability of audit evidence is increased when it is obtained from independent sources outside the entity" may lead auditors not to give sufficient attention to evaluating the reliability of such information.

Accordingly, we support the inclusion of the proposed new application material in ED 540, noting that it draws from that in IAPN 1000. It should help drive more appropriate and consistent evaluations of the relevance and reliability of information from external information sources. This is particularly helpful as many auditors may not be aware of the guidance in IAPN 1000 as the IAASB has determined that IAPN's do not provide authoritative guidance.

Attachment 1

Exposure Draft - Proposed International Standard on Auditing 540 (Revised): Auditing Accounting Estimates and Related Disclosures

Further comments and recommendations on specific matters

Professional scepticism

Paragraph 5 of the ED includes a reminder of the importance of professional scepticism, with a particular focus on the risk of management bias. The two application material paragraphs in the ED that refer to professional scepticism are also linked to management bias. We agree that possible management bias is a particularly important consideration, but it is also important to be aware that professional scepticism is about more than just being alert to management bias and this should be recognised in the final revised standard. Paragraphs A18 to A20 of ISA 200 give a fuller indication of why professional scepticism is important and it would be helpful to reflect at least some of this in ISA 540. For example, paragraph 5 could be amended along the following lines:

> "[As explained in ISA 200] professional skepticism is necessary to the critical assessment of audit evidence, including consideration of the sufficiency and appropriateness of that evidence and being alert to, and questioning, audit evidence that contradicts other evidence obtained. The application of professional-skepticism-by-the auditor This is particularly important to the auditor's work relating to accounting estimates due to their subjective, potentially complex and uncertain nature. These factors can heighten the risks of material misstatement, including as a result of management bias. Professional skepticism also is important because there is a particular risk of management-bias affecting accounting estimates due to their subjective, potentially complex-and uncertain nature."

Please see also our response to question 2 in the main letter.

Inconsistency with ISA 700

The Explanatory Memorandum notes a degree of inconsistency with ISA 700 that will result from the change to 'reasonable' from 'adequate' for disclosures and suggests that this can be addressed during the post-implementation review of the auditor reporting standards. We believe such inconsistency is unhelpful and confusing and it is not appropriate to wait, potentially several years, to address it through revision of ISA 700, which may follow the post-implementation review of that standard. We recommend that the inconsistency is addressed as part of the finalisation of the revision of ISA 540 by making conforming amendments to ISA 700 at that time.

In particular, it is important to amend paragraph 13(e) of ISA 700 to the effect that the auditor is required to evaluate whether disclosures are 'reasonable' rather than 'adequate'. As noted in the Explanatory Memorandum, continuing to use 'adequate' may inappropriately suggest that disclosures are less important than the accounting estimates themselves.

Risk assessment procedures

Paragraph 10(c) requires the auditor to obtain an understanding of "the nature of the accounting estimates and related disclosures that the auditor expects to be included in the entity's financial statements." Related application material in paragraph A17 refers to how this may assist in understanding the three specific qualitative inherent risk factors given most prominence in the ED, but within the requirements those factors are not referred to until paragraph 13.

We recommend that a requirement is added to paragraph 10 to obtain a sufficient understanding of the extent to which making the estimates would be subject to, or affected by, the inherent risk factors, including the three given most prominence. This would help set up paragraph 13 which, in effect, requires taking such an understanding into account when identifying and assessing the risk of material misstatement. One way to achieve this would be to move points (a) to (c) of paragraph 13 to be sub-points of paragraph 10(c), and shorten the references to the factors in paragraph 13.

Review of outcome of previous accounting estimates

Paragraph 11 of the ED requires the auditor to review the outcome of accounting estimates included in the previous period financial statements or, where applicable, their subsequent re-estimation to assist in identifying and assessing the risk of material misstatements in the current period. The related application material in paragraph A62 identifies that a retrospective review may also be performed for accounting estimates made over several periods or a shorter period (such as half-yearly).

We believe that, as recognised by the application material, reviewing the outcome of previous accounting estimates other than those just in the previous accounting period can help provide a better understanding of management's effectiveness in making accounting estimates. This is particularly relevant for estimates that involve judgments and projections extending more than one year (e.g. the outcome of management's credit loss projections over a cycle). Accordingly, we recommend that the requirement should be amended along the following lines:

> "The auditor shall review the outcome of previous accounting estimates included-in-the previous-period financial statements, or, where applicable, their subsequent re-estimation, when it will assist in identifying and assessing the risk of material misstatement in the current period. The auditor shall take into account the characteristics of the accounting estimates in determining the nature and extent of that review. The review is not intended to call into question judgments about previous period accounting estimates that were appropriate based on the information available at the time they were made."

In relation to some accounting estimates, paragraph A65 of the ED clarifies that the estimate itself will not have an outcome. We recommend that this guidance is extended to explain that while this may be the case for the overall estimate, some of the valuation attributes used in making the estimate may nonetheless have an outcome that can be reviewed. For example a Level 3 fair value could be based on a Level 3 input such as a projected cash flow derived from an asset or liability, and that cash flow may have an output that can be back-tested in subsequent periods.

Specialised skills or knowledge

Paragraph 12 requires the auditor to "determine whether specialised skills or knowledge are required, in order to perform the risk assessment procedures, or to identify and assess the risks of material misstatement." Saying "or to" identify and assess the risks of material misstatement may imply that risk assessment procedures are separate from identification and assessment of risk, whereas they are related as defined in ISA 315 (paragraph 4(d)). We recommend that the requirement is amended to say:

> "... in order to perform the risk assessment procedures relating to accounting estimates, or to identify and assess the risks of material misstatement based on those procedures."

Identifying and assessing the risks of material misstatement

Paragraph 13 requires the auditor to "... take into account the extent to which the accounting estimate is subject to, or affected by, one or more, relevant factors, including [complexity, judgment and estimation uncertainty]". However, there is no explicit requirement to evaluate the degree to which the estimate is subject to, or affected by, the other qualitative inherent risk factors identified in paragraph A78, which may result in them not receiving sufficient appropriate attention.

We recommend that paragraph 13 is amended to explicitly require the auditor to take into account the other inherent risk factors of 'change' and 'susceptibility of material misstatement due to fraud'.

Procedures responsive to 'change' are already included with those for 'judgment' (e.g. in 18(a)(ii)) so, on this basis, the risk factor of change could be included by rewording 13(b). For example;

> The need for the use of judgment by management, including to respond to circumstances giving rise to a need for changes in the method, assumptions or data used, and the potential for management bias, including with respect to methods, assumptions, and data;"

This would also address what could be perceived to be a weakening in the ED compared with extant ISA 540, which includes a more explicit requirement for the auditor to determine whether changes, if any, in accounting estimates or in the method for making them from the prior period are appropriate in the circumstances.

Where 'susceptibility of material misstatement due to fraud' is identified as a relevant factor, the auditor should be directed to ISA 240.

Evaluating the reasonableness of disclosures

Paragraph A123 sets out "Matters that may be relevant in obtaining sufficient appropriate audit evidence about the reasonableness of management's point estimate and related disclosures include, when applicable:" We believe that, when applicable, these matters "will" be relevant in obtaining sufficient appropriate audit evidence. Accordingly, as stated in the main letter, we recommend that paragraph A123 should either be incorporated in the requirements or, at the least, amended to remove the "may" by for example changing it to:

> ".... Matters that may be relevant to obtaining sufficient appropriate audit evidence about the reasonableness of management's point estimate and related disclosures include, when applicable:"

This would be an approach similar to that used in ISQC 1 to avoid overly detailed requirements.

Further, paragraph A123 is cross referred to paragraph A2 which describes what is meant by "reasonable", including that all relevant requirements of the applicable financial reporting framework (AFRF) have been applied "appropriately". If paragraph A123 remains as application material, it would be helpful to move it up to follow paragraph A2.

We also recommend that more emphasis is given to the importance of the presentation of disclosures in the financial statements and the need for them to be understandable by the users. This could be included in paragraph A136.

Responses to assessed risks of material misstatement

Paragraph 15 sets out requirements to design and perform further audit procedures to respond to assessed risks of material misstatements. It identifies specific procedures that may be appropriate when inherent risk is low or, if it is not, directs the auditor to the requirements in paragraphs 17-20. There is a hanging paragraph at the end of 15 that requires that these further audit procedures shall be responsive to the reasons for assessment of the risk of material misstatement.

Paragraph 16 requires that "If the auditor intends to rely on controls relating to accounting estimates, or if substantive procedures alone cannot provide sufficient appropriate audit evidence at the assertion level, the auditor shall design and perform tests of controls to obtain sufficient appropriate audit evidence as to their operating effectiveness." Since tests of controls are "further audit procedures", which are therefore designed and performed in accordance with paragraph 15, the requirement in the hanging paragraph in 15 also applies in relation to any such tests of controls. However, this is not stated explicitly.

We believe this presentation is ambiguous and we recommend that it is clarified that the hanging paragraph applies also in relation to tests of controls. This could be achieved by amending the hanging paragraph as follows

> "The auditor's further audit procedures, including any tests of controls (see paragraph 16), shall be responsive to ...."

Estimation uncertainty

Paragraph 19 establishes requirements for procedures when the reasons for assessing inherent risk as not being low include estimation uncertainty. Given that estimation uncertainty is (by definition) always present, we believe that if there is an assessment that the risk of material misstatement is not low, then the risk attributable to estimation uncertainty would always be expected to be a contributing factor to that. Accordingly, we believe that paragraph 19 should always apply whenever inherent risk is not low.

Auditor's range

Paragraph 19(b) requires that "When, based on the audit evidence obtained, in the auditor's judgment, management has not appropriately understood and addressed the estimation uncertainty, the auditor shall, to the extent possible, develop an auditor's point estimate or range ...". As stated in the main letter, we recommend that before doing that the auditor should discuss with management why management has not appropriately understood and addressed estimation uncertainty and, if appropriate, ask management to consider alternative assumptions or to provide additional disclosure relating to the estimation uncertainty. This, in part, would elevate paragraph A126 to a requirement.

The wording of paragraph 19(b) could support a false impression that the auditor only develops a point estimate or range when management has not appropriately understood and addressed the estimation uncertainty. Developing a point estimate or range may in fact be one of the ways the auditor seeks to obtain audit evidence for the purpose of paragraph 19(a). To address this we suggest adding the words "if the auditor has not already done so" after "the auditor shall".

Paragraph 20 establishes requirements that should apply whenever the auditor concludes that it is appropriate to develop an auditor's range. However, this is not stated explicitly. Given the placing of this requirement after paragraph 19(b), it is possible that the assumption may be made that it only applies when the auditor concludes in accordance with paragraph 19(b) that it is appropriate to develop an auditor's range.

We recommend that it is clarified that the requirement in paragraph 20 applies whenever the auditor concludes that it is appropriate to develop an auditor's range, which would include under paragraph 15(a)(iii).

Auditor's range - multiples of materiality

Paragraph A134 refers to circumstances where the auditor's range for an accounting estimate may be multiples of materiality for the financial statements as a whole. This should really only arise where the inherent uncertainty is itself multiples of materiality and it would be more helpful to consider this initially from that perspective. We agree with the guidance in A134 that, in these circumstances, evaluation of the reasonableness of disclosures is important. However, we believe further guidance would be helpful. The nature of the uncertainty and the requirements of the applicable financial reporting framework will be relevant to considering the disclosures and also implications for the auditor's report. For example, the guidance in paragraph A90 about where estimation uncertainty is so high that a reasonable accounting estimate cannot be made is relevant. There can also be business sectors, such as insurance, where very high estimation uncertainty is the norm and there are specific requirements in the applicable financial reporting frameworks in relation to that. The cross reference to paragraphs A133, A144 and A145 are not particularly helpful.

Overall evaluation

Paragraph 23 establishes a requirement for an evaluation whether the accounting estimates and related disclosures are reasonable in the context of the applicable financial reporting framework, or are misstated. In making this evaluation, the auditor is required to consider all relevant audit evidence obtained whether corroborative or contradictory.

There are some ambiguities in this requirement. The auditor detects misstatements "at the assertion level" (i.e., at the level of an assertion about a class of transactions, an account balance or a disclosure) through performing substantive tests. This requirement should, therefore, logically be read as applying to each accounting estimate (or at least classes of them tested together). However, the requirement (as in extant ISA-540) refers to "estimates", unlike the requirement in paragraph 22 (which refers to "each accounting estimate"). It also does not say that it applies only to those estimates referred to in paragraph 15(b) and therefore paragraph 22. By inference, it therefore also includes estimates referred to in paragraph 15(a), although that is not clear. Similar ambiguities exist for paragraph 21, which requires obtaining sufficient appropriate audit evidence about whether the disclosures related to accounting estimates are reasonable.

We recommend these ambiguities are resolved and the wording clarified.

Communication with those charged with governance

Paragraph 26 cross refers to communication requirements in ISAs 260 and 265. However, the related application material in paragraph A155 is worded in a manner that suggests this is optional. We recommend that paragraph A155 is amended, by deleting "may" in the second sentence, to be clear these are requirements and not optional.

A new requirement in paragraph 26 is for the auditor to "consider the matters, if any, to communicate related to the extent to which the accounting estimates and their related disclosures are affected by, or subject to, complexity, the need for the use of judgment by management, estimation uncertainty, or other relevant factors." We believe a requirement to "consider" is weak and may give rise to inconsistency in communication by different auditors. We recommend that this be strengthened, for example along the lines of:

> "When relevant to the understanding of those charged with governance, the auditor shall explain the matters, if any, related to the extent to which ...."

Effective date

We believe it would be considered unreasonable for revised ISA 540 to be mandated to be applicable to all periods for which IFRS 9 is required to be implemented. However, given that IFRS 9 was one of the key drivers for the revision, we recommend that early adoption of the revised standard is permitted and that it is not finalised in a way that would preclude that (i.e. it would not necessitate substantive 'minuses' from the extant standard).

Attachment 2

Accounting Estimates (ED-540)

How Estimation Uncertainty, Complexity and Judgment affect susceptibility to Misstatement and the relationships between these factors

Estimation uncertainty arises from factors that give rise to an inherent lack of precision in the measurement of an accounting estimate. The inherent variation in such measurement that results from estimation uncertainty is not in itself a misstatement. However, misstatements may arise in the presence of estimation uncertainty, from factors that result in the inherent variation (estimation uncertainty) not being appropriately depicted in the financial statements (referred to above as misstatements of depiction).

Other factors, such as complexity and the need for judgment in making accounting estimates, may give rise to additional variation in the measurement of an accounting estimate that is not inherent and therefore does not represent estimation uncertainty. Such variation in the measurement of an accounting estimate would, if reflected in management's point estimate or related disclosures, be a misstatement (referred to above as misstatements of measurement).

When different qualitative inherent risk factors are present, they increase the susceptibility to different types of misstatements of depiction or measurement. For example, when there is complexity in making an accounting estimate, misstatements may occur because inadequate skills and knowledge are applied in making the accounting estimate. When there is a need for management judgment in making an accounting estimate, such judgment may result in misstatements because of inherent or motivated management bias.

Identifying the factors that are present therefore enables the auditor to identify the types of misstatement that may be present and to better identify and assess the related risks of material misstatement. It also enables the auditor to design more tailored responses to those risks.

Whilst each of these three factors may give rise to different types of misstatements, they are also inter-related because they all have the same root cause, the need to develop an estimate using information, about relevant valuation attributes, which, though it is the best available information, may nonetheless be incomplete or subjective.

Complexity and the need for management judgment are therefore inherent to the process of making an accounting estimate, though they may affect different accounting estimates to a greater or lesser degree. However, when there is high estimation uncertainty, not only is there a greater likelihood that the estimation uncertainty will be inappropriately depicted in management's point estimate and related disclosures, but there is also more likely to be greater complexity, and a greater need for management judgment, in making the estimate.

Financial Reporting Council

8th Floor, 125 London Wall, London EC2Y 5AS Tel: +44 (0)20 7492 2300 Fax: +44 (0)20 7492 2301 www.frc.org.uk The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered office: as above.