The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Preparers Levy 2022-23 Public Sector

PREPARERS LEVY 2022/23 - FACT SHEET

PUBLIC SECTOR ORGANISATIONS

The Financial Reporting Council (FRC)'s role

The purpose of the FRC is to serve the public interest by setting high standards of corporate governance, reporting and audit and by holding to account those responsible for delivering them. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; promotes the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC develops and maintains UK accounting standards (UK GAAP). It monitors and influences the International Accounting Standards Board (IASB) in setting International Financial Reporting Standards (IFRS). A range of public sector organisations, including central government bodies, prepare their accounts in line with EU-adopted IFRS, which the FRC influences on behalf of the UK, working closely with Government and other stakeholders. Some adaptations are made to these standards for application by public sector organisations under the advice of the Financial Reporting Advisory Board (FRAB). The FRC provides input into the process of review and adaptation through its representation on the FRAB.

The FRC seeks to improve the quality of annual reports by developing and maintaining Guidance on the Strategic Report. It develops and maintains Taxonomies for EU adopted IFRS, UK GAAP standards and the Charities SORP.

The national audit authorities in the UK have chosen to adopt the ethical, auditing and quality control standards issued by the FRC for audits as the basis of their approach to the audit of financial statements in the public sector. This includes the requirements established in the Codes of Audit Practice for local government and local NHS bodies.

The FRC takes public sector considerations into account when developing standards and guidance. The FRC's Audit and Assurance Council includes a public sector representative and has a Public Sector Advisory Group that considers and gives advice on issues pertinent to public sector audit. The FRC issues a Practice Note that gives specific guidance on the application of the auditing standards in the public.

Under the Local Audit and Accountability Act 2014 the FRC is responsible for oversight of the regulation of auditors of local authorities and health service bodies, including directly inspecting the quality of audits of the most significant bodies. In common with all other inspection activities the direct costs are recovered separately; the levy funds the associated overheads and corporate costs.

The FRC is going through a period of significant and sustained change. Our Strategy 2022 - 25, published in March 2022, sets out the programme of work we will deliver in 2022/23 and the resources we will need. It is available on our website at www.frc.org.uk.

As a public body the FRC aims to meet the highest standards of governance and accountability, operating within the framework agreed with Government and independent from those we regulate.

Preparers Levy

By agreement with the Department or Business, Energy and Industrial Strategy and HM Treasury, the Financial Reporting Council is funded partly through a voluntary 'preparers' levy' on organisations that are subject to, or have regard to, FRC regulatory requirements in preparing their accounts, including Government Departments, local authorities and other public sector organisations.

The FRC's responsibilities are funded through these non-statutory arrangements on the basis of an understanding with the groups who pay the levy. Should this voluntary approach prove unsustainable, the FRC would formally request that the Secretary of State make regulations for the FRC to levy its funding on a statutory basis under Section 17 Companies (Audit, Investigations and Community Enterprise) Act 2004.

Calculation of the Preparers Levy

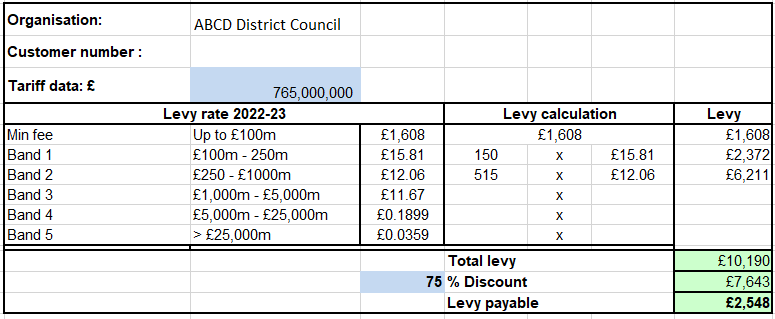

The 2022-23 levy is made up of a minimum levy of £1,608 and further amounts requested from organisations above a certain threshold, with the rate per £m declining in five levy size bands. Public sector organisations receive a 75% discount on the levy, which is calculated on their latest published expenditure / turnover. An example of the calculation is as follows:

Purchase orders (POs)

A number of organisations paying the levy provide us with a Purchase Order (PO) number, which makes it easier for them to facilitate the payment process. In general, the PO number has been provided by the individual or team responsible for preparing the organisation's annual report and accounts.

Contact Us

If you have a query, please contact the Levy Collection Team at Adetiq on [email protected] or 01273 764 511.

If you have a policy related question on the levy, please email on [email protected]

Financial Reporting Council

September 2022

8th Floor, 125 London Wall, London EC2Y 5AS Tel: +44 (0)20 7492 2300 Fax: +44 (0)20 7492 2399 www.frc.org.uk The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered office: as above.