The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Lab Report: Net Zero Disclosures

This report

This report has been prepared by the Financial Reporting Council Lab (the Lab).

Our report, and related example bank, highlights examples of current practice that were identified by the Lab team and investors. Not all of the examples are relevant for all companies, and all circumstances, but each provides an example of a company that demonstrates an approach to useful disclosures. Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's annual report as a whole. Investors have contributed to this project at a conceptual level. The examples used are selected to illustrate the principles that investors have highlighted and, in many cases, have been tested with investors.

If you have any feedback, or would like to get in touch with the Lab, please email us at: [email protected].

Introduction and quick read

As part of global efforts to combat climate change, companies are increasingly making commitments to reduce greenhouse gas (GHG) emissions. Targets to reach net zero or carbon neutrality are a subset of these. Investors and other stakeholders want to understand these commitments, and companies' abilities to deliver against targets.

However, as noted in the FRC's Environmental, Social and Governance (ESG) statement of intent, reporting is too often aspirational and high level. It frequently fails to provide users with sufficient information. Investors also continue to call for better information in financial statements, including connecting net zero targets to relevant disclosures. This was one of the five areas for improvement highlighted in the FRC's Corporate Reporting Review's (CRR) thematic review on the Task Force on Climate-Related Financial Disclosures (TCFD) discussed on page 4.

To understand net zero disclosures further, the Lab spoke with investors, companies and other stakeholders (see page 28 for participants and methodology).

In particular, we sought to understand:

- how investors use disclosures on net zero or other GHG reduction commitments;

- investor perspectives on current reporting, including good practice and areas for improvement; and

- reporting challenges and successes for companies with these types of commitments.

Investors' use of net zero disclosures

During the project, we heard from investors who use disclosures on net zero for a range of reasons:

- understanding corporate alignment with own investment values

- comparing companies and their strategies and plans

- assessing the credibility of plans and performance against commitments

- understanding and comparing the GHG footprint of portfolios

- understanding governance and assessing management incentives

- making decisions, such as whether to invest, divest, or provide financing

How to use this report

Each section of the report explores investor needs, highlights issues, interesting practice and practical questions for preparers to consider. It is supported by a separate detailed example bank to help companies.

Investor expectations and regulatory context

This report explores investor expectations and highlights information that would provide better and more useful disclosures on GHG emission reduction commitments. This information is likely to cover many of the current regulatory requirements for net zero reporting.

This is a rapidly evolving reporting environment, both in the UK and internationally. We note that many elements highlighted in this report may already form part of some companies' reporting requirements, for example, those who must report under TCFD or Streamlined Energy and Carbon Reporting (SECR) requirements.

Further international regulatory requirements may apply in the future and Appendix 2 sets out a summary of the current regulatory context. Companies will need to consider their wider reporting requirements as they prepare disclosures.

Materiality

Companies will need to determine whether elements highlighted in this report are material for them. We understand that assessing what is material for non-financial reporting disclosures is a challenging area for many. The Lab will shortly be launching a project exploring materiality issues. If you'd like to contribute to this work, you can email us: [email protected].

The FRC has encouraged companies to disclose the basis on which they have assessed materiality of climate-related disclosures. This helps users to understand whether materiality considerations have driven omissions of recommended disclosures, or whether disclosures have been omitted for other reasons, such as the non-availability of information.

TCFD reporting: CRR thematic review

In July 2022, the FRC CRR team published a TCFD thematic report which sets out expectations for companies, as well as five areas for improvement which are consistent with the investor expectations highlighted in this report. These areas are:

- Granularity and specificity: explain the potential impact on different businesses, sectors and geographies, as well as the link with financial planning.

- Balance: balance the discussion on risk and opportunities and consider the linkage to technological dependencies.

- Interlinkage with other narrative disclosures: integrate TCFD into other elements of narrative reporting, for example, potentially discussing the implications of climate-related scenario analysis in the strategic report.

- Materiality: explain how materiality has been applied to TCFD disclosures and provide clarity on how the TCFD all-sector guidance and supplemental guidance has been considered.

- Connectivity between TCFD and financial statements disclosure: consider the connectivity between narrative reporting aspects, such as risks and uncertainties, scenario analysis, emission reduction commitments and opportunities, with the judgements, estimates and disclosures in the financial statements.

Elements to consider when preparing net zero disclosures

During our discussions with investors and companies, we identified three elements that investors want to understand from disclosures:

- Commitments: the level of ambition, scope, nature and timing of the commitment, and what is included and excluded.

- Impacts: how the commitment impacts strategy and business model, including information on transition plans, assumptions, uncertainties, and risks and opportunities.

- Performance: how performance is being measured in the short, medium, and long term. How high-quality data and accountability will be ensured, and actions management is taking in response to changes.

These elements are part of an iterative reporting process, where company and investor understanding is developing and evolving.

As companies develop definitions and estimate impacts, this improves their understanding of what is important for them to measure. In turn, as they improve processes and data, it helps them refine the scope of their commitments, and potentially increase the ambition of their aims.

The report highlights investor needs at each stage and identifies questions and disclosures to consider based on whether these were:

- Foundational – providing a basic understanding of the commitment, including high-level targets, timelines and impacts; or

- Advanced – providing updates on progress, refinements of goals, and more detailed information on impact and accountability.

Companies may find it helpful to begin preparing more advanced elements despite being at an earlier stage in their process.

The information we highlight throughout this report may not be relevant to all cases and companies should consider what is material to them when drafting disclosures. We would also note these foundational elements are not intended to represent minimum compliance with existing disclosure frameworks, and advanced elements may be needed to do so.

Commitments

Foundational:

Clearly define the commitment for users:

- the types of GHGs included

- the scopes of emissions included

- the type of reductions committed to (absolute and/or intensity)

- what the boundaries of the commitment are and if these differ from the financial statements

- the timelines for the commitment

- any plans to use offsets, including the extent and nature of the offsets

- Provide information on any exclusions or limitations to the commitment

Advanced:

- Consider whether the commitment will be updated, for example, a new approach or a more ambitious target

Impacts

Foundational:

- Set out the strategy to achieving net zero, including how it may impact on the business model and start to consider transition planning

- Frame the risks and opportunities of the commitment to the business in a balanced way

- Provide estimates of potential future costs, where relevant on capital expenditure (capex), research and development (R&D), and other green operating expenditure

- Explain uncertainties and assumptions to reaching the commitment, in a manner consistent with financial statements and that links to issues such as resilience and viability

Advanced:

- Provide updated views on impact and financing requirements

- Develop and disclose transition plans

- Consider what quantitative estimates or additional scenario analysis may be helpful for users

Performance

Foundational:

- Set out the frameworks and methodologies used for setting targets and measuring progress

- Detail the targets that have been set, including for the short, medium, and long term

- Set out progress to date, and if this is or is not in line with expectations

- Provide an understanding of the expected trajectory for the future

- Explain how management measures performance, including relevant metrics

- Provide details on governance and monitoring, including any links to remuneration

Advanced:

- Provide information on leading performance indicators

- Consider whether any external assurance would be appropriate, and where obtained, whether to disclose this

Company processes

Effective processes and governance underpin commitments, plans and ultimately, lead to better and more useful disclosures. Robust processes, systems and controls will enable companies to better understand their progress, iterate and achieve their net-zero commitments over the longer term.

We spoke with companies about their processes, challenges and successes to date. Four stages emerged from these conversations which align to the three-stage iterative approach to providing net zero disclosures for investors:

- Define the commitment;

- Assess the impact;

- Measure progress; and

- Refine the approach

Tips from preparers

- "Start as soon as you can – it takes a while to familiarise yourself with the science, terminology and how it applies to your specific business"

- "Build relationships across the business. While finance is great for introducing processes, controls and pulling all the strands together, we need the input and expertise from the wider business to succeed"

- "The tone from the top matters. It should be clear to employees that this is a key priority of the board, and individual goals should link to it"

- "Running training sessions for the whole business was really helpful for employees to understand not just the commitment, but to put it into real terms for their roles"

Define

- What will we reduce and over what time period? What can we reduce within our own operations, and what, if any, offsets will be used?

- What interim targets do we need to set?

- How will we communicate these goals internally? How will our corporate culture support achieving these goals?

Assess

- How will the business model and strategy need to change?

- What resources do we need? What gaps do we have?

- What new policies do we need to put in place, for example, on business travel or new supplier relationships?

- How will we embed the commitment into decision making, for example including GHG impact in business cases?

- How much will it cost? How will we fund any changes?

Measure

- What internal targets and measures do we need to have in place?

- Do we have the systems, controls and processes in place to measure and monitor progress?

- Do we have access to sufficient data, including from third parties?

- What internal review processes do we need?

- How do measures link to individual objectives?

Refine

- What lessons have we learned to date? Are there areas we could improve on?

- Do we need to redefine any of our commitments, for example, accelerate progress on specific areas?

- Do we need any external review?

- How will we share lessons with the wider workforce?

Commitments

Investors value transparent net zero disclosures that clearly articulate the scope of the commitment. They use disclosures to understand how ambitious a commitment is and compare it to those of similar companies. Investors may also use disclosures to assess whether it aligns with their own values or objectives. They raised concerns about:

- high-level commitments with limited detail;

- ambitious headline commitments that are heavily caveated in smaller print; and

- incorrect or inconsistent use of terminology.

At a foundational level, investors want to understand:

- the types of GHG emissions in scope, and any scopes excluded;

- whether the commitment relates to absolute and/or intensity-based reductions;

- the boundaries of the commitment, including any regions or operations excluded;

- the timelines management expects to meet the commitment in; and

- whether the company intends to rely on offsets, and if so, the nature and extent of reliance.

As a company progresses, investors expect more advanced disclosures updating on any changes to the commitment. We will explore aspects of each of these in more detail.

Challenge area: enablers of the low carbon economy

Transitioning to a low carbon economy will not be as simple as all companies reducing GHG emissions at the same pace. Some high-emitting industries may be necessary to enable others to meet net zero targets, for example, mineral mining of materials such as cobalt for their use in batteries. This means that some companies may not be able to set significant GHG reduction commitments themselves despite being crucial to reaching global net zero goals.

While this report primarily focuses on those who can set net zero or GHG reduction targets, the role of enablers should not be forgotten. Investors noted that, where companies are not able to set commitments, it is helpful to include disclosures which provide information on the company's role and contribution to a low carbon future. Many investors noted a desire to align investments with their values; disclosures that allow users to readily understand this broader contribution provides them with richer information for making investment decisions.

"Only looking at scopes 1 and 2 emissions may give the wrong answer. The question to ask is 'if we have more of this company, will it be a net benefit to the world?' Do we need more of it to provide the solutions to the problems?” Investor

Types of emission – CO₂ vs other GHGs

Investors noted current disclosures are often unclear on the specific types of GHGs included in commitments. Often companies talk about decarbonisation or a low carbon transition, however carbon dioxide is only one of the seven greenhouse gases covered by the Kyoto Protocol. Addressing these other GHGs is crucial as all types contribute to climate change.

This ties into the terminology confusion noted by many, as carbon neutral, for example, is sometimes used to describe commitments for only CO₂, while other times it is taken to mean carbon and carbon-equivalents (which would include all GHGs, converted to CO₂ impact).

Investors indicated when discussing net zero or GHG reduction, that it is important to be clear on the specific gases included in targets.

“When some companies talk about net zero, they might only be talking about CO₂ rather than all GHGs – which can be very confusing. It needs to be very clear in the disclosures." Investor

Net zero vs. carbon neutral

One thing frequently noted by investors was confusion on terms, such as 'net zero' or 'carbon neutral' used to describe commitments to reduce GHG emissions.

The United Nations Framework Convention on Climate Change has developed a detailed lexicon to understand the various terms used, but at a high level, the differences are typically explained as:

Net zero: when a company first reduces all its GHG emissions as much as possible, and only then offsets the remaining residual emissions with removals.

Carbon neutral: when a company's CO₂ emissions are fully balanced by a combination of CO₂ reductions and/or offset by removals without necessarily reducing any of its GHG emissions.

Other terms, such as 'science-based' or 'Paris-aligned' are also regularly used. When labelling their commitment, it is important for companies to use language that clearly and consistently describes their approach, and not confuse users by using inappropriate terminology.

Investor use: portfolio footprint

GHG emissions data is used by investors to calculate and compare the relative footprints of companies and subsequently their portfolios. The majority of investors' carbon footprints will typically be their Scope 3 emissions, i.e., the emissions associated with their investments. Where emissions data is not available, portfolio managers may use data sets including estimates and other analytic metrics from external data providers. The FRC Lab will be looking at ESG data distribution and data providers further in a future phase of work. If you would like to take part in this work, you can email us: [email protected] or sign-up to communications from the FRC.

Types of emission – scopes of emission

The GHG Protocol's Corporate Standard sets out three scopes of emissions:

- Direct emissions (Scope 1) – those occurring from sources owned or controlled by the company;

- Electricity indirect emissions (Scope 2) – those emissions from purchased electricity (including heating, cooling and steam) consumed by the company; and

- Other indirect emissions (Scope 3) – all other indirect emissions that occur in a company's value chain.

These emission types are widely accepted internationally. The SECR requirements use broadly similar terminology and scopes.

Many investors noted they look for net zero commitments to include Scope 3 emissions when relevant to the company. Where this not the case, at a minimum, they expected clarity as to which scopes of emission were included and excluded. Where timelines and targets differed by scope, it was also important to make this clear.

"We expect net zero should include Scope 3, however, that is not always the case. In this case, we wouldn't consider that a proper net zero target." Investor

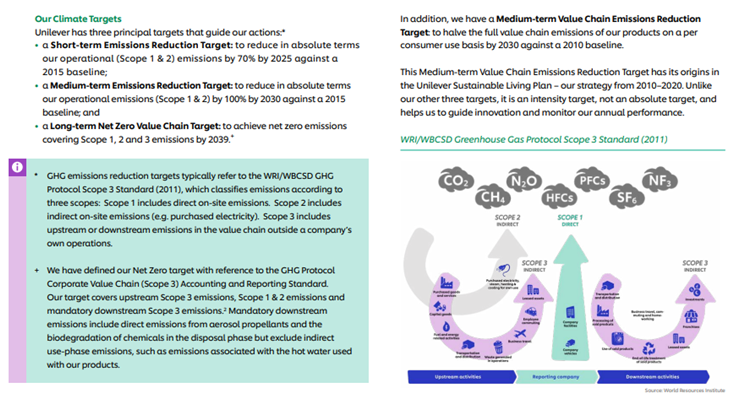

Example: providing clarity on what is meant by ‘net zero’

Why it's useful: Unilever defines 'net zero' and sets out what targets are included, including information on the scopes, timelines and baselines.

Source: Unilever plc Climate Action Transition Plan 2021

Absolute vs intensity

Some companies report their emission commitments in absolute terms, while other companies focus on reductions to the intensity of emissions (i.e., emissions compared to a financial or business metric, such as revenue or square metres of floorspace).

Investors noted they value both types of targets. Absolute targets allow them to understand the total reductions, while intensity measures allow them to compare companies with each other.

"You have to be flexible, it's not all black and white. Absolute reductions while preferred, won't work for all industries." Investor

Investor use: temperature scores

During our discussions with asset managers, many noted using absolute GHG emission data to calculate internal temperature scores, or implied temperature rise measures to assess the impact of a portfolio in degrees Celsius. This metric allows them, for example, to evaluate and compare how funds align to global average temperature goals.

Challenge area: Scope 3 emissions

The GHG Protocol includes 15 categories of Scope 3 emissions, covering all indirect emissions (excluding Scope 2) that occur in the value chain of a company. For some industries, like the oil and gas industry, these emissions represent the majority of a company's GHG footprint.

Obtaining complete and robust data from external suppliers in a timely manner makes calculating and estimating Scope 3 emissions particularly challenging. During interviews for the Lab's recent ESG data production report, Scope 3 was consistently highlighted by companies as a key area of concern. Many companies either do not include Scope 3 emissions in their disclosures, or where included, include figures largely based on estimates.

Investors were themselves acutely aware of these challenges, as investments represent one of the Scope 3 categories. Accordingly, many look for:

- Where no Scope 3 figures are provided, an explanation as to why these are not included; or

- Where Scope 3 figures are estimated, an explanation as to the extent to which Scope 3 figures are estimates.

Investors also emphasised the importance of improving measures of Scope 1 and 2, as ultimately those emissions become Scope 3 emissions for others in the value chain.

Commitment boundaries

When a company states that it has a commitment to reach net zero emissions, investors felt it was reasonable to assume that applies to the whole of its operations and group structure. Where this is not the case, it is helpful if companies clearly articulate which parts of their operations, for example, specific regions or ventures, are excluded from the commitment.

Part of this issue may arise due to differences between the consolidation accounting boundary of a group compared with the GHG emission boundary. The GHG Protocol allows for a choice between two distinct approaches: the equity share and the control approach. For companies with complex structures, for example in the oil and gas industry, where ownership and operational control are not always aligned, this can have a significant impact on what is included and excluded.

"Lots of oil and gas companies don't operate fields but will have economic interests in them. You don't know what basis they're measuring on and they do not use consistent methods. This creates comparability issues.” Investor

Investors noted that where the boundary of the commitment and/or emissions data provided differs from the consolidation boundary, they would value information on the basis used and what is not included in the boundary.

The International Sustainability Standards Board's (ISSB) exposure draft for IFRS S2 Climate-Related Disclosures has set out proposals on how this may need to be disclosed in the future.

Challenge area: regional differences in Scope 2 emissions

Many companies flagged challenges in reducing GHG emissions when renewable energy options are not readily available where they operate. Greening Scope 2 emissions was noted as relatively easy in western Europe, but more challenging in Asia-Pacific and developing markets.

Investors were broadly aware of these issues and emphasised that where these challenges exist, it is helpful to include disclosures that break out the regional emissions and provide context on the likely impact to reaching net zero targets. Many investors noted they alter their approach to engagement depending on the countries operated in and assume longer timelines for reaching commitments in these jurisdictions.

Baseline years and target dates

To understand how far a company needs to reduce GHG emissions, investors look to understand the baseline year from which GHG emissions are measured, and the ultimate target dates, including any interim targets. Where these differ based on the scope of emissions and/or the type of reduction (e.g., absolute vs intensity), this will also be relevant to investors. Some investors noted a preference for baselines to be as 'recent as possible' to when the commitment was made to allow them to understand how significant cuts would be compared to recent operations.

Challenge area: COVID-19 and baseline measures

COVID-19 closures resulted in reduced GHG emissions for many companies during 2020 and 2021. Given that emissions during those periods were likely to be unrepresentative of normal business operations, many companies have been opting to use 2019 as a baseline for their commitments.

Use of offsetting

Reaching net zero means focusing on prioritising the reduction of GHG emissions. For those emissions that cannot be abated, companies may need to rely on offsetting. However, investors noted that they regularly find it difficult to understand how companies use or plan to use offsets. Investors expect to be able to understand the nature of the offsets used, as well as the degree of reliance. They value disclosures which provide information on the type of offsets (avoided vs removals), the amount and types of GHGs offset, and information on the nature of the projects (e.g., afforestation or carbon capture and storage (CCS)).

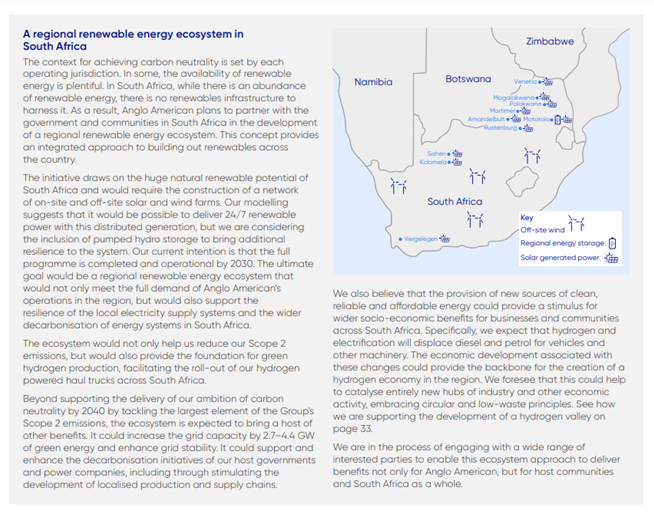

Example: understanding regional Scope 2 issues and plans

Why it's useful: the disclosure discusses the local operating jurisdiction and its renewable energy availability, as well as management's plans to develop capability.

Source: Anglo-American plc Climate Change Report 2021

Example: providing clarity on offsets

Why it's useful: Microsoft provides information on the nature of offsets used and a specific note quantifying the carbon offsets purchased overtime.

| FY17 | FY18 | FY19 | FY20 | FY21 | |

|---|---|---|---|---|---|

| GHG Emissions within Carbon Neutral Boundary | 573,871 | 652,282 | 781,345 | 612,927 | 292,106 |

| Offsets Applied to Reporting Year | 573,871 | 652,282 | 781,345 | 612,927 | 292,106 |

| Net GHG Emissions within Carbon Neutral Boundary | |||||

| Total Removal Offsets Contracted11 | 1,391,187 |

9 Represents the values prior to historic recalculations due to acquisitions and methodology changes. 10 This data supports Microsoft's ongoing target to be carbon neutral every year from fiscal year 2013 onward. The boundary for this carbon neutral commitment includes global Scope 1, Scope 2 Market-based, and Scope 3 business air travel. As progress is made towards the carbon negative commitment, which includes purchasing removal offsets, the commitment to carbon neutrality will also be maintained. 11 Values reported represent offsets contracted. Contracted removal values only include removal credits that have been evaluated as compliant with Microsoft's quality removal criteria. This number might change based on contract fulfillment.

Source: Microsoft Corporation Environmental Sustainability Report 2021

"Offsets can have questionable impact. We need more information to understand them.” Investor

Advanced: discussing changes to commitments

Companies are frequently setting net zero commitments for 2050. Many investors noted sympathy for companies in planning this far out and an awareness that the approach may need to change in the future. As a company progresses on its net zero journey, it may, for example, decide it needs to change approach or timelines. Where this is the case, investors value transparency and honesty on the changes, their scope, and how progress will be measured going forward.

"It's ok to say you didn't have the right approach and change." Investor

Questions to ask when preparing disclosures:

Foundational:

- How are we defining our commitment (e.g., net zero, carbon neutral, Paris-aligned, etc.)? Is this appropriate terminology based on the GHG emissions included and the approach to reductions and offsets?

- Have we clearly articulated which GHG emissions are in-scope of our commitment? Could a user readily understand where commitments differ based on the GHG emission or scope of emissions?

- Have we set out how we are measuring the reductions (absolute and/or intensity)?

- How do we describe the boundary of our commitment? If applicable, would a user be able to understand how this differs from the boundary of the financial statements?

- Are our baselines and commitment timelines clear? Where they differ by scopes of emissions, could a user easily understand this?

- If relying on offsets, have we provided users with an understanding of how much we will need to use and the nature of the offsets?

Advanced:

- Where updating a commitment, have we clearly explained why the commitment is changing and what the changes are?

Impacts

Once a company has set and defined a net zero or GHG reduction commitment, investors seek to understand management's views on how it may impact the company's strategy and business model. This allows them to scrutinise the approach and assess whether they believe plans are robust and credible for the future.

Initially, if management's plans are not yet well developed, they may only be capable of providing high-level qualitative disclosures on impact.

At a foundational level, investors want to understand:

- The company's strategy to achieving net zero, including impact to business model;

- Risks and opportunities of the commitment;

- Potential future costs; and

- Uncertainties and assumptions to meeting goals.

However, for those where a commitment will have material impact on the business, investors expect management to begin to prepare more advanced disclosures providing more detailed analysis, including where relevant, quantitative information and transition plans, in a timely manner.

Strategy to achieving net zero commitments

For some companies, reaching net zero GHG emissions may require material changes to operations and/or business strategy. Goods and services may need to be materially changed and new supply chains secured with a lower GHG footprint.

For example, companies may look for more local sourcing of materials to reduce transport costs or put in place procurement policies requiring suppliers to have their own commitments in place. For some high-emission goods and services, it may not be possible to reduce emissions – this could potentially result in management discontinuing some operations. Management may also aim to grow low carbon segments of the business in the future.

Investors are looking for disclosures that provide details on what management plans to do and the extent to which it changes (or does not change) business as usual. They value disclosures that set out the planned pathway, including what the key enablers are that will allow them to reach net zero.

"Some companies are great at setting targets and publishing a shiny website, but then don't have any published plans on how to get there.” Investor

"We need to talk about what may be impossible to cut – or that we might need to live without those products.” Investor

Investors want to understand how management is considering the existing business and how commitments may impact the business model. It helps them to evaluate the prospects of the business across timeframes and make decisions, for example, as to whether they believe the investment should be held for the short or longer term, and whether or not to increase or decrease holdings. Business models are not homogeneous across sectors – being able to understand a company's business model compared to peers allows investors to compare them more readily.

The Lab previously published a report exploring key elements of business models important to investors. In the context of net zero commitments and business models, it may be helpful to consider:

- How does the GHG reduction commitment impact the value chain? What, if anything, needs to change?

- What divisions and key markets may be impacted? Will any parts need to be potentially wound down? Will any be expanded?

- How does it impact competitive advantage?

- What are the likely financial impacts of the commitment?

Investors are also interested in how net zero commitments impact wider sustainability objectives, such as any 'just transition' goals or biodiversity issues. They want to understand how these interlink, and if they require management to consider any potential trade-offs.

As management begins to understand the impact on the business model and strategy, it may need to consider and develop a transition plan that sets out the targets and actions supporting it to not only reach its GHG emission reduction goals, but also operate in a low-carbon economy.

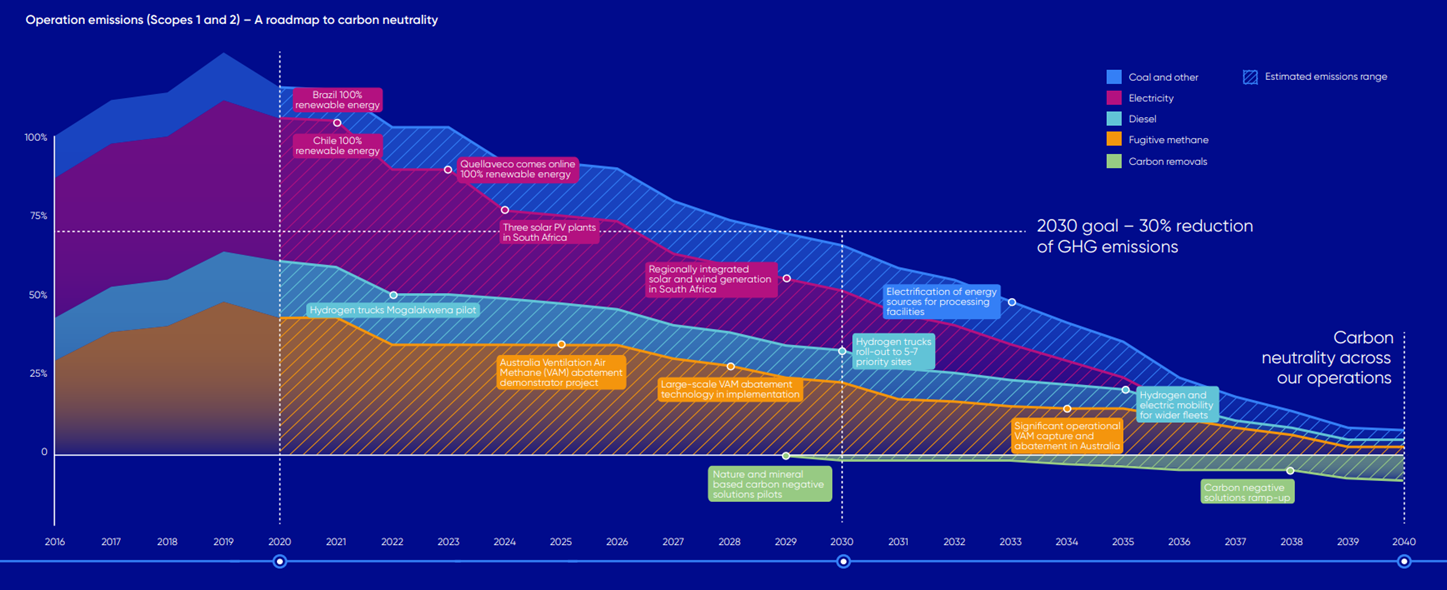

Example: understanding the strategy and pathway to reaching carbon neutrality

Why it's useful: the disclosure sets out the pathway to reaching net zero split by key elements of the business model

Source: Anglo-American plc Climate Change Report 2021

"Companies that are doing well are explaining what's their pathway and how they're using assets. Honesty – that is what we need to see more of." Investor

"We're looking for evidence they've done their homework before they think about metrics. Have they done a deep dive investigation of the breadth of the business?” Investor

"I'm interested in understanding what management see as enabling the change – is it business change? R&D? Public policy? What would help them accelerate action?” Investor

Those who report under the TCFD, will be expected to reflect the implementation guidance issued in 2021 explaining how disclosures on transition plans may form part of climate-related financial disclosures.

At COP26, the UK government announced that large companies and certain financial sector firms will be required to publish transition plans from 2023. The Transition Plan Taskforce (TPT) is currently working on developing guidance for climate transition plans.

Resource: transition plan guidance

TCFD issued guidance on transition plans in October 2021. It covers characteristics of effective transition plans, transition plan elements and disclosures.

Task Force on Climate-related Financial Disclosures and Transition Plans

Committing to reducing GHG emissions could give rise to both risks and opportunities for a company. Investors are interested in a balanced view of how management understands the environment it operates in – including not only the entity and industry specific factors, but also the political and macro- and microeconomic environment.

Some risks mentioned by investors in our conversations included (but were not limited to) aspects such as exposure to high emission industries, potential supply constraints, for example from critical minerals, and reputational risks of greenwashing.

Equally of importance to investors was understanding what opportunities could arise from a company committing to net zero. For example, they seek information on whether it could lead to advantages such as more attractive or competitive low carbon products and services or benefits such as reduced exposure to energy costs through reduced consumption.

"Wherever possible, we're looking to allocate funds towards where there are green opportunities." Investor

"We see it as an opportunity for our business. We're part of the low carbon solution so are considering the opportunities out there for green financing" Preparer

Risks and opportunities

Future area: avoided emissions

While Scopes 1, 2, and 3 are regularly reported on by companies, reporting on avoided emissions (frequently referred to as Scope 4) is less common. The term 'avoided emissions' is typically used to imply positive impacts of reduced emissions due to using a low carbon product.

There have been challenges raised about the reliability of avoided emissions reporting, and it should be noted that avoided emissions are not part of the GHG Protocol's Corporate Standard nor included in frameworks such as TCFD or the ISSB's proposals. It is also not commonly considered appropriate to offset avoided emissions against other scopes of emissions.

However, for some companies, measuring avoided emissions presents an opportunity to highlight the advantages of their low carbon products. We spoke to the team at one such company that includes avoided emissions disclosures. They noted avoided emissions are an innovation unique to their products, and that they engage with customers on the comparative advantage of their products for downstream Scope 3 targets.

Where companies are considering including avoided emissions disclosures, the GHG Protocol has a paper to aid in estimating and reporting impact.

Potential future costs

Where meeting net zero commitments is likely to require significant costs, investors value disclosures that allow them to understand this further. Key aspects include not only management's estimates on costs, but also the nature of the expenditure and timeframes, and consistency with the wider strategy.

Potential future cost estimations could include:

- Capex: how much of future capex will be on low carbon assets and technology, for example, low emission vehicles or new low carbon plant and equipment? How does this compare to overall planned capex? How much capex is planned for carbon intensive assets and projects?

- R&D: where a company's strategy is based on developing low carbon technologies and/or solutions (for example, for internal use and/or as new products/services that contribute to the low carbon economy) – how much of future R&D expenditure will be dedicated to low carbon R&D?

- Other green opex: how much other opex is for 'green' solutions? How will the profile of expenditure change over time?

Where companies need to raise financing or are dependent on the renegotiation of existing finance to meet their commitments, investors expect that this is acknowledged and disclosed. For some companies, availability of green financing may provide a benefit of lower financing costs.

"If you're still investing in exploration or development of carbon intensive projects, that's questionable. If you don't allocate capex to low carbon technologies, it raises the question that you're not getting ready for transition." Investor

"Disclose your capex and R&D – this lets us understand how your commitment is being planned into the business strategy. Things like, what's your turnover strategy for assets, especially long lifespan assets.” Investor

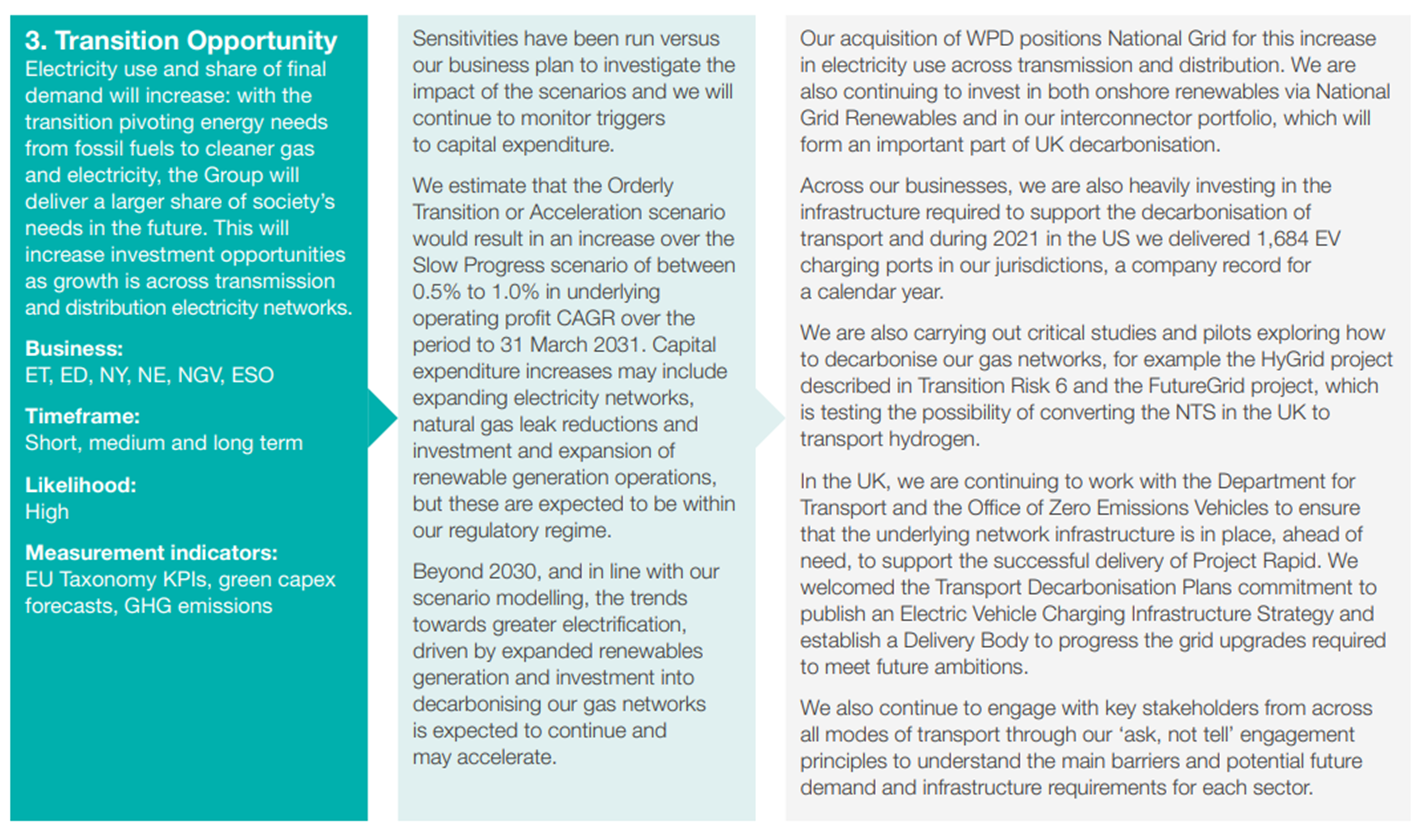

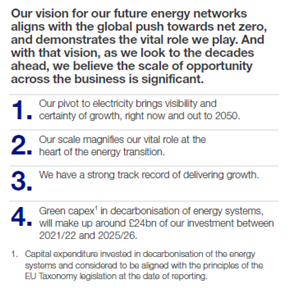

Example: capex investment targets for net zero

Why it's useful: National Grid quantifies the amounts the company intends to invest in 'green capex'. This is further tied into the opportunities, timeframes and KPIs.

Source: National Grid plc Annual Report 2022

Uncertainties and assumptions

Commitments to net zero frequently span long time periods, often out to 2050. Planning anything over long time frames is inherently challenging and plans to reaching net zero emissions are likely to be complex.

To help them understand and assess plans, investors value information on the uncertainties and assumptions that impact a company's ability to reach net zero emissions, as well as factors that may cause companies to change plans. Current reporting, investors noted, was not always clear or transparent on these areas. The FRC and AMBS's 2021 research report Climate Scenario Analysis: Current Practice and Disclosure Trends provides some best practice tips on scenarios.

"Scenarios help organisations understand the potential consequences of a range of climate related risks and opportunities and, in turn, help to identify the specific and relevant factors that can impact financial results." Investor

TCFD and scenario analysis

Under the TCFD framework, companies should describe the resilience of an organisation's strategy over a range of scenarios. The FRC CRR's TCFD thematic review notes that companies should provide sufficient detail of any scenarios for users to understand the analysis undertaken, including where relevant, explanations of how the scenarios discussed, including assumptions and sensitivities, correspond to the discussions in the financial statements.

"We want to understand the assumptions – they should be clear and transparent – we know they won't be exactly perfect, but they should seem reasonable." Investor

While not all uncertainties or assumptions will impact or be material for every company, some common areas of uncertainty that will likely be of interest to investors include (but are not limited to):

- dependencies on future public policies, especially with energy and infrastructure policy;

- reliance on developing future technologies, for example for CCS;

- access to and dependencies on critical supply chains, such as minerals

- management's assumptions on carbon pricing;

- potential impacts of inflation;

- future changes in consumer behaviours, for example from a cost-of-living crisis;

- energy supply, including forecast demand levels, access to green sources and stability; and

- impact on timelines of key projects and investments, as well as the phasing out of any assets and/or business operations.

These assumptions should be consistent with financial estimates and judgements, for example, estimates on the useful economic lives of long-life assets. Linking together uncertainties with disclosures on strategy, planning, risks and opportunities, resilience and viability, and assumptions on future cost requirements will provide richer information that aids decision making.

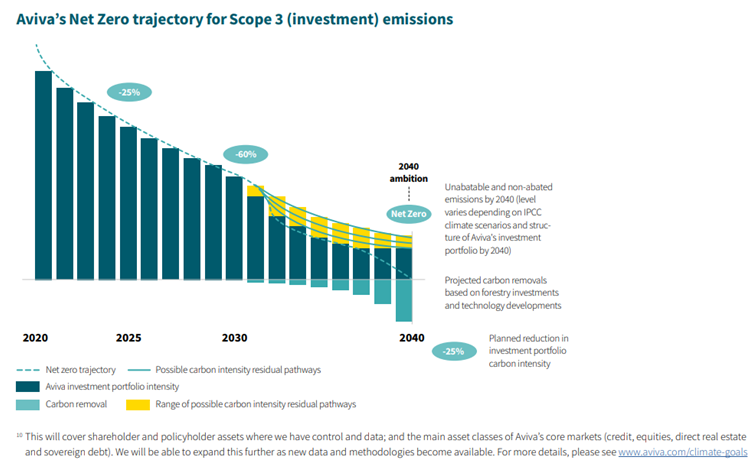

Example: understanding the trajectory for meeting Scope 3 commitments

Why it's useful: Aviva illustrates an estimated range of potential outcomes to reach longer-term targets.

Source: Aviva plc 2021 Climate Transition Plan

Emerging issue: energy security and net zero commitments

The Russian invasion of Ukraine has caused significant impacts on energy supplies worldwide. To ensure energy security, some countries have had to take short term decisions, for example, to repower coal power plants, that may impact plans to reach net zero.

When we spoke to a number of companies about this issue, they noted while it might impact the short-term trajectory, potentially through higher than planned Scope 2 emissions, it was in many cases causing them to make investments in renewables, like solar panels, that would potentially speed up their medium-term progress. These events highlight the importance of companies regularly reviewing and updating plans where appropriate.

"We're missing assumptions – for example, clarity on key technologies they'll invest in, the projects they're undertaking for reductions, what the financial, operational and people commitment will be." Investor

Questions to ask when preparing disclosures:

Foundational:

- Have we clearly articulated our strategy for reaching our net zero or GHG emission reduction commitment? How have we described potentially material impacts that our commitment could have on our business model and strategy?

- Where relevant, have we discussed aspects such as changes to the business structure, value chain, goods and services, or other material elements of the business to meet our commitment?

- What potential risks could arise from our net zero commitment, for example, supply chain dependencies or reputational damage if commitments are not met?

- What opportunities arise from our commitment, for example lower energy costs or new products and services?

- How much do we estimate these changes will cost? Over what time period? Will we need significant opex, capex or R&D?

- What are the key uncertainties to our ability to meet our commitment? Have we considered external factors, for example, dependencies on public policy or supply chain, or macroeconomic factors and geopolitical events?

- What internal uncertainties exist, such as dependencies on key projects being delivered, R&D outcomes or the timing of phasing out assets?

Advanced:

- Have we undertaken scenario analysis to road test different strategic approaches? How have we fed the results back into our plans? What detail have we included about the results of scenario analysis in our disclosures, including where possible, quantifying outcomes that factor into financial planning?

- Can we provide more information on financial impacts, including information on projects and phasing of expenditure necessary to meet commitments?

- Do we need to raise any financing to cover costs? Have we explained our plans for raising cash?

- Where relevant, have we revised our strategy and plans since previous reporting periods? Have we provided information on the rationale for changes?

Performance

After defining the commitment and setting out the strategy, companies will need to measure, monitor and disclose their progress against their strategy over the short, medium, and long term. This allows investors to understand whether a company is currently achieving what it has committed to, as well as assess their prospects for meeting their longer-term commitment.

Frameworks used

Investors prefer information that is consistent and comparable; using consistent frameworks can help to meet this need. There are frameworks available covering elements such as measurement, disclosure and commitments.

The investors that we spoke to said they prefer companies to use established frameworks, such as the GHG Protocol to measure their GHG emissions. Many also noted a preference for companies to set net zero targets aligned to the Science Based Targets initiative (SBTi) frameworks. These targets align with the latest climate science deemed necessary to meet the goals of the Paris Agreement. Many investors expressed favourable views of TCFD and the ISSB proposals.

"We don't want people to reinvent the wheel – there are well established methodologies for net zero – we want people to use them." Investor

At a foundational level, investors want to understand:

- Frameworks used;

- How progress is measured; and

- Quality and accountability processes

The Lab's previous report on ESG data production noted that many companies currently face challenges in producing relevant and high-quality non-financial data. The ability to produce advanced disclosures with more detailed measures will depend on the maturity of a company's data collection and production processes, the underlying data systems and associated internal controls. However, investors expect companies to improve their processes in a timely manner where commitments have been made.

Challenge area: SBTi validation

Many companies we spoke with already have or are working towards getting their targets validated by SBTi. However, with high international demand for SBTi validation, many companies mentioned long timeframes for validation. As a result, some were describing their targets as 'science-based' where they had followed the methodology to develop them but had not yet had their targets validated. Disclosures should be clear where targets have not yet been validated and not mislead users.

“I want to know if it's achieving what it says it's achieving, so I can sleep easily and know I'm not investing in companies wrecking the environment” Investor

Measuring progress

Setting targets

While the ultimate commitment (e.g., to reach net zero emissions) may be set for a date in the future, such as 2040 or 2050, investors expect credible net zero commitments to be backed by interim targets set in the short and medium term.

"Interim targets are very important. Net zero targets are all well – but it's a long timeframe. We would want companies to set short- and medium-term targets to have milestones and to manage their long-term goal better.” Investor

These interim measures and targets should be consistent with the defined commitment and set out in sufficient detail for investors to understand what is included and excluded. Where possible, investors value disclosures that provide a view on the trajectory of the progress, so that they can assess whether the company is ahead of, at, or behind original plans.

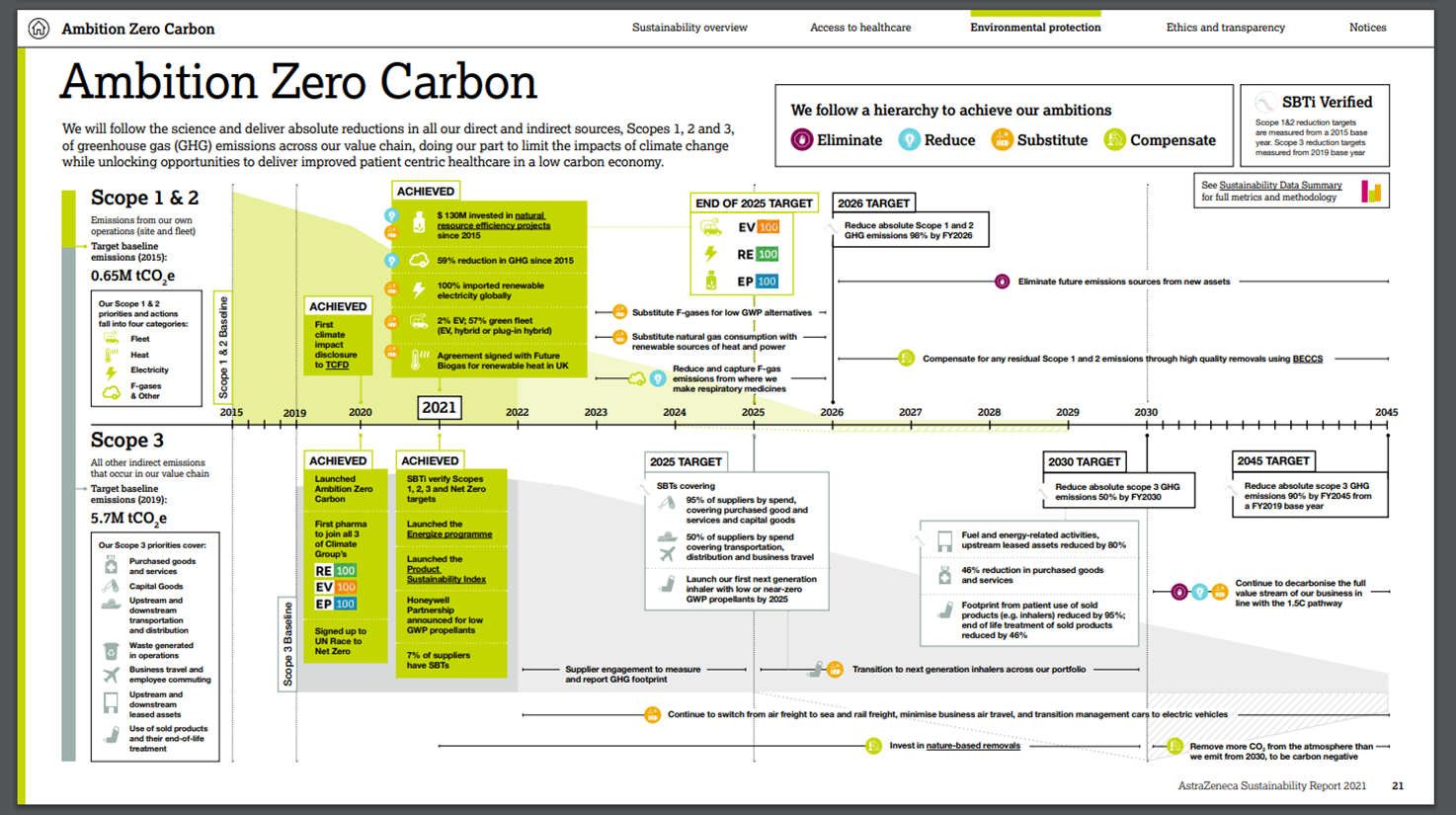

Example: current performance and future targets to reach net zero

Why it's useful: AstraZeneca sets out performance to date for each commitment and maps out remaining targets and future actions.

Source: AstraZeneca plc Sustainability Report 2021

Current progress

Investors value disclosures that clearly articulate current performance against targets and the overall commitment. They want to understand what steps have been taken in the past year and how that compares with what management had planned to achieve.

If performance has been impacted by an event, investors value information setting out why a target has not been hit or why progress has been slower than anticipated.

"It shouldn't just be a pretty brochure. It has to be hard data." Investor

"It's sometimes hard to square the numbers and how they link together with the business model.” Investor

Challenge area: non-linear progress

A number of companies we spoke to noted how progress against targets is unlikely to be seen in smooth, linear decreases of GHG emissions. Significant reductions may appear in 'lumps' or show rapid improvements, for example, as high-emission assets are decommissioned, or as new green technology, such as solar panel investments, is turned on. Preparers may find it helpful to provide information on the pace of progress so that investors can more readily assess performance.

Presentation and measurements

As a company progresses towards meeting its goals, investors want meaningful data to measure performance. This goes beyond just top-level data; investors want data that connects to the business model and allows them to understand relevant aspects, such as how different business lines and regions of the business are progressing. Investors noted that this is of particular interest to them when a company has operations in regions with limited access to green electrical grids.

It's helpful for corporates to break out their emissions by region, sector and product line. It's ok to say in X country we don't have the data to meaningfully disclose it yet – we will at least then know where the data gap is.” Investor

In addition to emissions data, it is helpful for disclosures to include other types of performance metrics considered by management, particularly those that can provide leading indicators for future reductions to emissions.

Some examples that we found include:

- External suppliers signed up to net zero commitments;

- Percentage of assets that are green assets, such as solar panels, electric vehicle fleets or new refrigeration units;

- Energy efficiency of buildings; and

- Energy purchase agreements for green energy.

Depending on the maturity of a company's data collection and production processes, these examples may represent advanced disclosures.

Example: emissions split by regions

Why it's useful: Microsoft provides a detailed appendix breaking down GHG emissions in a number of ways, including splitting out GHG emission by region.

| FY17 | FY18 | FY19 | FY20 | FY21 | |

|---|---|---|---|---|---|

| Scope 1 | |||||

| Asia | 9,699 | 6,483 | 7,330 | 8,650 | 9,664 |

| Europe, Middle East, Africa | 44,873 | 41,276 | 57,957 | 61,719 | 69,251 |

| Latin America | 6,260 | 6,173 | 3,919 | 3,871 | 4,403 |

| North America | 46,620 | 45,076 | 48,750 | 43,860 | 40,386 |

| Subtotal | 107,452 | 99,008 | 117,956 | 118,100 | 123,704 |

| Scope 2 (Location-Based) | |||||

| Asia | 439,035 | 528,277 | 691,772 | 804,567 | 942,892 |

| Europe, Middle East, Africa | 399,194 | 519,058 | 681,743 | 860,858 | 866,689 |

| Latin America | 20,968 | 23,450 | 25,403 | 15,707 | 16,204 |

| North America | 1,838,357 | 1,875,258 | 2,158,600 | 2,421,313 | 2,919,412 |

| Subtotal | 2,697,554 | 2,946,043 | 3,557,518 | 4,102,445 | 4,745,197 |

| Scope 2 (Market-Based) | |||||

| Asia | 121,930 | 174,533 | 266,725 | 219,416 | 157,841 |

| Europe, Middle East, Africa | 14,460 | 7,301 | 7,463 | 7,376 | 5,353 |

| Latin America | 2,053 | 751 | 632 | 594 | 433 |

| North America | 623 | 744 | 600 | 808 | 308 |

| Subtotal | 139,066 | 183,329 | 275,420 | 228,194 | 163,935 |

Source: Microsoft Corporation Environmental Sustainability Report 2021

Quality and accountability

Reviews and quality

Investors want to be able to trust and rely on disclosures on net zero commitments. To this end, investors value disclosures that enable them to understand what controls and governance procedures are in place.

Given issues and challenges with ESG data production, investor views varied on the use of external assurance. However, investors emphasised the need for high quality data which was subject to assurance either internally or externally, by those with specialist knowledge.

"We don't have a view on whether it should be done by an auditor, just that it is done by someone with the expertise to do the work." Investor

Where information is subject to assurance, investors noted it was helpful to have clarity about the type of assurance (e.g. limited or reasonable), as well as the scope of the assurance. For example, some companies include symbols next to assured metrics or assurance statements within their disclosures. This allows investors to easily assess which information has and has not been subject to assurance.

Internal skills and embedding of processes

A number of investors stressed the importance of building skills internally and developing governance processes and controls. Many companies we spoke to were already proactively working to improve their climate and ESG reporting generally.

Many mentioned projects to upskill staff on their net zero commitments and wider ESG goals. Tips for developing skills and embedding net zero commitments included:

- Putting the drivers for the commitment in the context of the employees' day-to-day work – for example, how extreme weather could impact delivery of projects.

- Highlighting opportunities – for example, the development of new, low-carbon products that will be more attractive to customers.

- Providing training sessions to upskill employees.

- Creating forums so that employees can engage on net zero and wider ESG issues.

Case study: embedding carbon into decision making

One of the participating companies we spoke to requires project managers to proactively monitor emissions for key projects using an industry standard carbon calculator.

This allows them to easily quantify and assess the carbon impact of materials and techniques and offer lower-carbon solutions to clients. It also allows them to compare the impact of potential projects for their GHG impact on a standardised basis. To ensure consistent application, they ran a series of training sessions on the tool for over 100 of their staff.

Remuneration policies

Many investors that we spoke with felt that tying net zero targets to director remuneration could be helpful. This was frequently caveated, that any link should be clear and measurable, and aim to avoid any unintended consequences. Where relevant, it may also be appropriate to have employee bonuses tied to hitting specific net zero linked targets, for example, one company we spoke with had set carbon budgets and reduction targets for travel for individual operating units.

"We think it's quite important to have net zero tied to remuneration. We ask companies to include specific emission reductions, rather than vague targets on sustainability." Investor

"Please invest in human capital and develop teams to report on net zero and sustainability issues properly.” Investor

Responding to events and changes

Reaching net zero will take most companies decades to achieve. Investors understand that management's strategy and plans will need to be refined and updated over time to reflect, for example, new technological developments or changes in government policies. Energy prices are already impacting how companies and countries think about reaching net zero. Investors want to understand these drivers and management's response.

"What's the right pathway will change over time – it's critical to remain dynamic and not rigid. Decisions and actions will need to shift to reflect changes to the environment and technology.” Investor

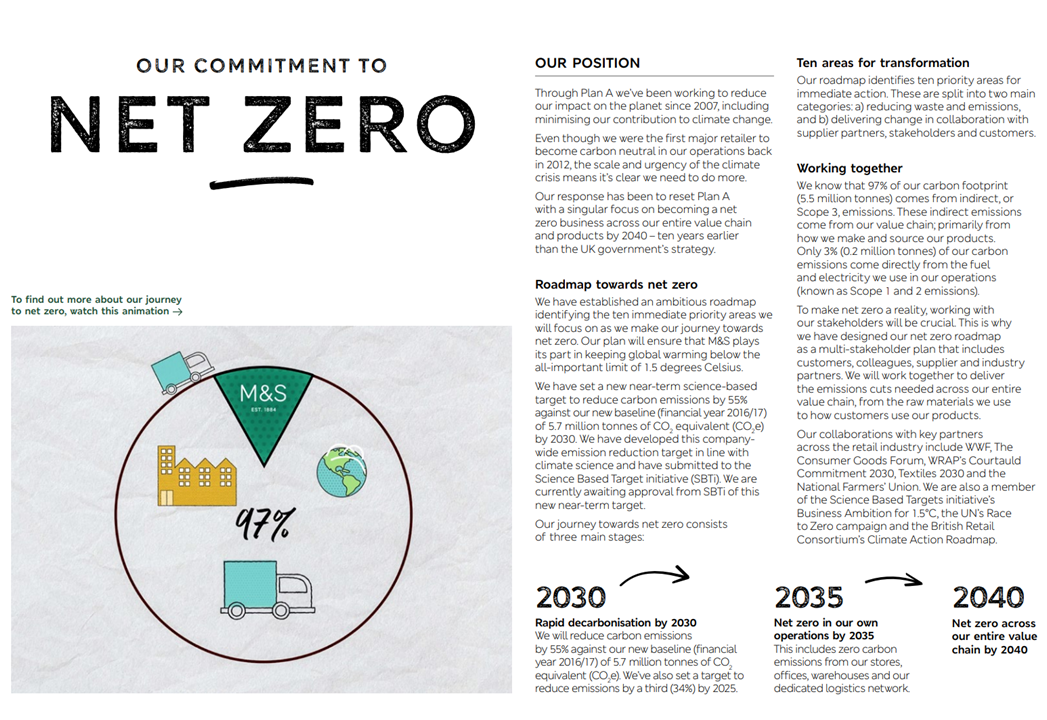

Example: changing from a carbon neutral commitment to a net zero commitment

Why it's useful: the disclosure sets out how the company's strategy has changed and includes information on stages, timelines, and offsetting.

Source: Marks and Spencer plc Sustainability Report 2022

Questions to ask when preparing disclosures:

Foundational:

- What frameworks are we following for reporting? Are they aligned with our stakeholders' information needs?

- Have we clearly defined targets for the short, medium, and long term? Do they clearly tie into how our commitments have been defined? Can investors easily understand our expected path to reach commitments?

- How are we measuring performance? Are metrics easy for investors to understand? Do they allow investors to understand performance against expectations?

- How have we reviewed the data presented? If not subject to assurance, have we clearly articulated the scope of the assurance, including which metrics and measures were in and out of scope?

- Where relevant, have we provided clear disclosures on how commitments link to remuneration?

Advanced:

- How can we improve our performance measures and underlying data processes and controls? Do our performance metrics provide any leading indicators so that users can understand the trajectory of future progress?

- Do we need to update any of our targets to reflect either a faster or slower pace? If so, how have we communicated this with users?

Conclusion and what's next

Our review of net zero and GHG reduction commitment reporting identified that there is a need for more useful disclosures around:

- Commitments: the level of ambition, scope, nature and timing of the commitment, and what is included and excluded.

- Impacts: how the commitment impacts strategy and business model, including information on transition plans, assumptions, uncertainties, and risks and opportunities.

- Performance: how performance is being measured in the short, medium, and long term. How high-quality data and accountability will be ensured, and actions management is taking in response to changes.

This is an emerging area of reporting, and we expect that as companies mature their processes and controls, as well as progress on their journeys to reduce GHG emissions, reporting will likewise be refined and improved to move from providing foundational to advanced disclosures.

We see these areas as inherently interconnected, so that improving one area should help companies improve across the other areas as well. For example, improvements to data gathering could build a better understanding of the GHG footprint and potentially allow for management to bring previously excluded scopes into the commitment. Likewise, enhanced data would allow for a better understanding of impact on the business strategy and model.

While we hope this report and its related example bank provide some useful guidance, we expect that market disclosures will evolve as investor expectations and reporting requirements increase, in particular, in relation to:

- the development of ISSB standards and proposals for the publication of transition plans in the UK; and

- further clarity on local jurisdictional net zero commitments, including any mandatory requirements on companies.

ESG remains a key emerging reporting area for the Lab, and we will be continuing work exploring ESG data in the coming year. If you'd like to be involved, please email us at [email protected].

Appendices

Appendix 1: Methodology and Participants

Participants join projects by responding to a public call or being approached by the Lab. An iterative approach is taken, with additional participants sought during the project, though it is not intended that the participants represent a statistical sample. References made to views of 'companies' and 'investors' refer to the individuals from companies and investment organisations that participated in this project. Views do not necessarily represent those of the participants' companies or organisations.

Views were received from a range of UK and international institutional investors, analysts and retail investors through a series of in-depth interviews. We also heard from a range of companies through one-to-one interviews or roundtables.

Thank you to all of the participants for contributing their time to this project. Some participants have consented to be named.

The Lab also received a great deal of support from a wide range of organisations, advisors and others throughout this project, particularly those organisations that have been working in this area for a number of years. This assistance has been invaluable, and we thank these organisations for giving so generously of their time.

Companies:

- Airtel Africa plc

- Blancco Technology Group plc

- BP plc

- Fresnillo plc

- Howden Joinery Group plc

- J Sainsbury plc

- Keller Group plc

- National Grid plc

- Navigator Terminals Ltd

- Network Rail Ltd

- Prudential plc

- RELX Group plc

- SEGRO plc

- Shell International BV

- Tesco plc

Investors and other users:

- BNP Paribas Exane

- Evenlode Investment Management Ltd

- Hymans Robertson LLP

- Jupiter Fund Management plc

- Legal & General Investment Management Ltd

- P1 Investment Management Ltd

- RBC Global Asset Management (UK) Ltd

- Representatives of the UK Shareholders' Association

- Schroders plc

- Scottish Widows plc

- A number of private investors

Appendix 2: Useful resources – Corporate reporting

In the UK there are no current explicit requirement to report on net zero or GHG reduction commitments. However, there are many reporting requirements that may require certain companies to address related issues.

Existing UK regulatory environment

The Companies Act 2006 (Companies Act)

Strategic report requirements include:

- Section 414C(2)(b) requires a description of the principal risks and uncertainties facing the company. It sits alongside the requirement for a balanced and comprehensive analysis of the development, performance and position of the company in Section 414C(3) and where appropriate analysis of other key performance indicators, including environmental matters in Section 414C(4)(b).

- For quoted companies, Section 414C(7) requires disclosures, to the extent necessary for an understanding of the development, performance or position of the company's business, on environmental matters, including on the impact of the company's business on the environment.

- Section 414CA-CB requires certain types of large and public interest entities to prepare a non-financial and sustainability information statement which includes more extensive disclosures about environmental matters and climate-related financial disclosures which are in line with the four overarching pillars of the TCFD requirements (Governance, Strategy, Risk Management, Metrics and Targets). BEIS has produced non-binding guidance on these requirements.

Guidance on the Strategic Report 2022 (the Guidance)

- The Guidance supports and expands on ways to approach the legislative requirements within the Strategic Report section of the Companies Act. This guidance was updated to reflect the new climate-related disclosure requirements set out in section 414CB.

- Paragraph 7A.22 of the Guidance explains that entities should consider the risk and opportunities arising from factors such as climate change and the environment, and where material, discuss the effect of these trends on the entity's future business model and strategy.

The UK Corporate Governance Code 2018 (the Code)

- The Code was updated in 2018 and applies to accounting periods beginning on or after 1 January 2019. The Code requires companies to describe in the annual report how opportunities and risks to the future success of the business have been considered and addressed, the sustainability of the company's business model and how its governance contributes to the delivery of its strategy.

FCA Listing Rules

- The FCA extended the scope of its climate-related disclosure requirements from premium to standard-listed companies for accounting periods beginning on or after 1 January 2022. These require a statement setting out whether the listed company has included disclosures consistent with TCFD requirements.

FCA ESG sourcebook

- The FCA introduced the ESG sourcebook containing rules and guidance for disclosures consistent with TCFD. This applies to asset managers, life insurers (including pure insurers), non-insurer FCA-regulated pension providers, including platform firms and Self-invested Personal Pension operators, and FCA-regulated pension providers.

SECR requirements

- The SECR rules set out certain required statutory disclosures about emissions and energy use. In April 2019, the rules expanded the existing emissions disclosure requirements for quoted companies and required emissions reporting for the first time for large unquoted companies and limited liability partnerships.

- The Environmental Reporting Guidelines contain details of what is required by SECR, including reporting to total global energy use, energy efficiency action as well as the methodology used to calculate the disclosure requirements. In 2021, the FRC published a thematic on SECR that highlights examples of emerging good practice and sets out expectations for reporting in future periods.

IFRS requirements

- There is no standalone IFRS standard which specifically addresses climate change. However, the requirements of IFRS standards provide a clear framework for incorporating the risks of climate change into companies' financial reporting.

UK and international reporting developments

The regulatory environment for climate-related disclosures is quickly evolving, with a number of new reporting requirements being proposed.

UK TPT

- Following COP26, the TPT was set up to develop a framework and guidance for climate transition plans. They published a Call for Evidence in May 2022 which looked at a range of questions regarding these.

ISSB exposure drafts

- In March 2022, the ISSB published two exposure drafts for public consultation. IFRS S1 covers General Requirements for Disclosure of Sustainability-related Financial Information, while IFRS S2 specifically addresses Climate-related Disclosures.

- The FRC strongly supports the development of high-quality global standards for sustainability reporting and provided comments on the ISSB's first Exposure Drafts. In 2021, the UK government indicated in Greening Finance: A Roadmap to Sustainable Investing that it intends to incorporate the ISSB standards into the UK corporate reporting framework and will be consulting on the endorsement and adoption mechanisms in due course.

EU developments

- In 2022, the Council and European Parliament reached a provisional political agreement on the corporate sustainability reporting directive (CSRD). The CSRD amends the European Non-Financial Reporting Directive (2014) and introduces more detailed reporting requirements, including the European Sustainability Reporting Standards. Mandatory application of these proposed standards will be phased in beginning 2024.

US Securities and Exchange Commission (SEC) proposals

- The SEC issued a proposed rule titled 'The Enhancement and Standardization of Climate-related Disclosures for Investors', which was also open for public consultation earlier this year. This rule is also proposed to be phased in from 2023, starting with the largest filers.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230 www.frc.org.uk Follow us on Twitter@FRCnews or Linked in