The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Grant Thornton UK LLP Public Report

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

These reports, published in July 2022, provide an overview of the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms1, and how the firms have responded to our findings.

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- 2. Review of individual audits

- 3. Review of the firm's quality control procedures

- 4. Forward-looking supervision

- Appendix

- 2. Review of individual audits

- 3. Review of the firm's quality control procedures

- Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

- Engagement Performance – EQCR, consultations and audit documentation

- Methodology

- Monitoring – Internal quality monitoring

- Approach to reviewing the firm's quality control procedures

- Firm-wide key findings and good practice in prior inspections

- 4. Forward-looking supervision

- Appendix

1. Overview

2. Review of individual audits

3. Review of the firm's quality control procedures

4. Forward-looking supervision

Appendix

Firm's internal quality monitoring

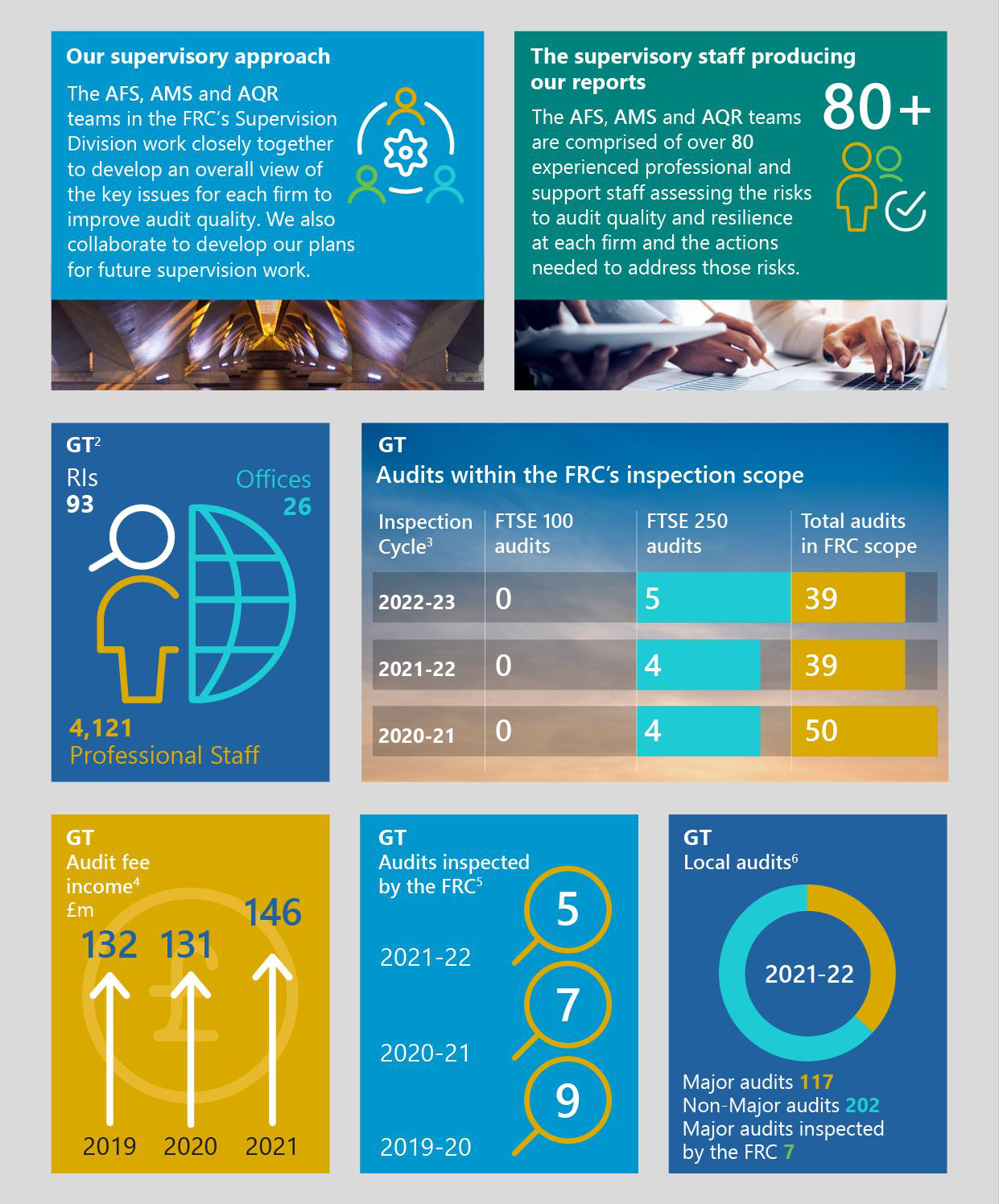

This report sets out the FRC's findings on key matters relevant to audit quality at Grant Thornton UK LLP (GT or the firm). As part of our 2021/22 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firm's quality control systems.

The FRC focuses on the audit of public interest entities (PIEs7). Our risk-based selection of audits for inspection focuses, for example, on entities: in a high-risk sector; experiencing financial difficulties; or having material account balances with high estimation uncertainty. We also inspect a small number of non-PIE audits on a risk-based basis.

Entity management and those charged with governance can make an important contribution to a robust audit. A well-governed company, transparent reporting and effective internal controls all help underpin a high-quality audit. While there is some shared responsibility throughout the ecosystem for the quality of audits, we expect firms to achieve high-quality audits, regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

Higher-risk audits are inherently more challenging, requiring audit teams to assess and conclude on complex and judgemental issues (for example, future cash flows underpinning impairment and going concern assessments). Professional scepticism and rigorous challenge of management are especially important in such audits. Our increasing focus on higher risk audits means that our findings may not be representative of audit quality across a firm's entire audit portfolio or on a year-by-year basis. Our forward-looking supervision work provides a holistic picture of the firm's approach to audit quality and the development of its audit quality initiatives.

The report also considers other, wider measures of audit quality. The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales (ICAEW) did not inspect a sample of the firm's non-PIE audits this year in accordance with its planned rotational inspection programme of the firm and therefore there are no results included in this report. The firm does, however, conduct annual internal quality reviews. A summary of the firm's internal quality review results is included at Appendix 1.

Overall assessment

The firm has continued to respond positively to and made good progress on actions to address our previous findings in relation to its audit execution and firm-wide procedures. This year, it is pleasing that 100% of the audits inspected were assessed as good or limited improvements required. This is the second year that there has been an improvement in the number of audits requiring no more than limited improvements compared to the number of such audits identified in both our 2019/20 and 2018/19 public reports. Given the small sample size (which has reduced to five, to reflect the fall in the number of audits within the scope of the FRC) as well as the firm's approach of de-risking its audit portfolio, this may not be a trend across its whole portfolio. Nevertheless, the firm's progress is very encouraging.

As set out in the Appendix, the results from the firm's internal quality monitoring process (covering both PIE and non-PIE audits), also showed an improvement. Over a similar period, the firm's internal quality monitoring process assessed 86% of audits as meeting its highest quality standard. The Quality Assurance Department of the ICAEW (QAD), which is weighted towards higher risk and complex audits of non-PIE audits (within ICAEW scope), did not undertake any inspections in the current year, although we note that their most recent inspection year (2020/21) also showed an improvement.

It is important that the firm keeps up momentum on quality issues and that it also finds ways in which it can further extend its more effective audit quality initiatives used for audits within the scope of the FRC (including processes such as regular audit leadership discussions, oversight and challenge and second line of defence support) into the wider audit practice. There must also be continued focus on further improvement in the challenge and corroboration of key judgements and estimates in conjunction with firm-wide findings.

In response to this year's findings, we will take the following actions:

- Assess the extent to which initiatives have been extended beyond FRC scope entities.

- Continue to focus on the adequacy of audit teams' assessments of key judgements and estimates.

- Require all actions to be included in a Single Quality Plan (SQP), subject to formal reporting and regular review by the FRC.

Summary of Audit Inspection Results

100% of audits inspected were found to require no more than limited improvements.

No audits inspected in the current cycle required significant improvements.

Firms must include all actions within a Single Quality Plan, subject to formal reporting and regular review by the FRC.

Inspection results: arising from our review of individual audits

We reviewed five individual audits this year and assessed all five (100%) as requiring no more than limited improvements.

Our assessment of the quality of audits reviewed: Grant Thornton UK LLP

A bar chart showing the number of audits requiring "Good or limited improvements", "Improvements required", or "Significant improvements required" for financial years 2017/18 to 2021/22.

- 2017/18: 6 Good or limited improvements required, 2 Improvements required, 0 Significant improvements required.

- 2018/19: 4 Good or limited improvements required, 2 Improvements required, 0 Significant improvements required.

- 2019/20: 5 Good or limited improvements required, 2 Improvements required, 0 Significant improvements required.

- 2020/21: 6 Good or limited improvements required, 1 Improvement required, 0 Significant improvements required.

- 2021/22: 5 Good or limited improvements required, 0 Improvements required, 0 Significant improvements required.

The audits inspected in the 2021/22 cycle included above had year ends ranging from July 2020 to June 2021.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings related to improving the challenge and corroboration of key judgements and estimates.

Inspection results: arising from our review of the firm's quality control procedures

We identified a range of good practice related to risk assessment, execution of the audit and completion and reporting.

Further details are set out in section 2.

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews, auditor consultations and audit documentation; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements.

Our key findings related to the firm's actions to implement the revised Ethical Standard, EQCR, methodology and internal quality monitoring reviews. We also identified good practice points on internal quality monitoring.

Further details are set out in section 3.

Forward-looking supervision

In response to observations made in our 2020/21 public report, the firm has extended its Audit Quality Plan (AQP, or the plan) to 2025. The firm has identified three priority focus areas (which are audit culture, technology and audit quality indicators) for the next year, and these have been clearly communicated. There is continual reassessment of the effectiveness of the AQP and its underlying initiatives. However, the firm must continue to focus on extending its key audit quality initiatives beyond FRC scope entities, to the wider audit practice.

The firm's Root Cause Analysis (RCA) process is well established and there have been continued refinements in the year, including further extending the scope of reviews. The RCA team continue to be proactive in sharing their findings with other audit quality teams, the Audit Quality Board, senior leadership and the wider audit practice. However, we continued to find examples where further improvements to the depth and quality of the interrogation of the root cause analysis are needed.

The firm's audit leadership takes a proactive and constructive approach. We have seen positive examples of this in respect of responding to challenge and acting on feedback. This includes non-financial sanctions, where there is an active mindset of using sanctions to improve audit quality.

Further details are set out in section 4.

Summary of Key Findings

Our key finding on individual audits was improving the challenge and corroboration of key judgements and estimates.

With respect to quality control procedures, our key findings related to implementing the revised Ethical Standard, EQCR, methodology and internal quality monitoring.

Firm's overall response and actions

When we set out our Audit Investment Plan in 2019, we did so to address each of the ingredients of a high-quality audit – our plan comprised a large number of workstreams across the following areas: clients, people, culture within audit, technology, processes and controls and monitoring.

We are pleased that this year's FRC reviews (along with our own internal quality reviews) demonstrate that we have made significant progress in evidencing high quality audit work. Our reviews this year spanned a broad range of audits, from FTSE250 to small AIM entities and private entities and not all of the files reviewed had the additional processes and reviews that our most complex audits benefit from. Notwithstanding this, we continue to extend our approach to quality to all of our non-PIE engagements as we believe audit quality throughout our entire audit base is paramount.

We believe this represents a positive trend across quality in our entire audit base, whilst recognising that, as a people profession reliant on professional judgement, there will always be instances where isolated issues may drive quality points on individual files. We have built in additional training and support (both technical training and softer skills training) for our teams to assist them in further developing their professional scepticism, challenge of management and speaking up as part of them being high quality auditors. In addition, we continue to strengthen our second line of defence activities and are continuing our ongoing improvements to the depth and quality of the interrogation and interpretation of our root cause analysis activities.

We are encouraged that the findings made by the FRC are findings aligned to reviews which were identified as either "good or limited improvements required" rather than those where either “improvements" or "significant improvements” were required. We have captured all the actions and learnings from the findings identified and will reinforce these through training and other means to the entire audit practice.

We have a thorough and comprehensive Root Cause Analysis programme and each of the findings (both from external and internal file reviews) has been explored and has been factored into our activities and action plans where appropriate. To further improve the depth of interrogation of the analysis of findings, we will further refine the RCA process to consider any further AQIs which may provide additional information for the analysis, as well as deeper questioning in interviews to ensure further potential causal factors are considered. This, together with the weighting we now apply to causal factors in our root cause analysis activities will continue to strengthen our learnings and consequent actions arising both from any findings and also good practice.

We are also pleased to see good practice points across each of the planning, execution and completion phases and, as an action, will continue to ensure the practice are aware of these so that we can ensure such actions are taken on all of our audits to promote high quality.

Our culture workstream within our Audit Investment Plan remains of high priority for us. Audit is a people centric activity, and any people centric activity brings the risk of human error. Our approach to culture across audit within Grant Thornton is specifically designed to ensure each of our team members has a range of processes available to them to "speak up" if they are uncomfortable with any aspects of their audit role so that other, more experienced individuals, can support them through their tasks to achieve a high quality audit. In addition to this, we have commenced a bespoke training programme around holding “difficult conversations” with our teams to equip them both with the knowledge of what sort of matters they should speak up about, how to challenge clients effectively and robustly, how to manage difficult conversations and also how and what channels to use to speak up and gain more support in challenging clients. We consider this to be one of the key mitigating actions we can take in this respect and, in addition to our “difficult conversations” training, we have provided training for our associates around communication skills and our actions also include creating speak up champions in each location, providing further additional training to our more junior colleagues on holding difficult conversations and to our senior colleagues on how to ensure they create an environment where everyone feels able to speak up when something doesn't feel right.

In addition to the above we have continued to update our mandatory workpapers factoring in learnings from prior year external and internal reviews to enable audit teams to better identify and better evidence their areas of challenge. We have also focused our flagship annual audit training on professional scepticism, challenge of management, communication and speaking up as well as the technical content of that three day annual training programme.

We have continued to invest in both our client and technical teams over the last 12 months and will continue to do so and will continue to survey our audit practice, both as part of firmwide and audit specific surveys so that we can continue to grow our client base without putting undue pressure on our teams. Since Q1 2021, we have grown our audit team by over 12% (headcount) and continue to attract high quality people to our firm which then enables us to both perform higher quality work, give our teams a better work/life balance (which in itself is good for quality as well as wellbeing) but also allows us capacity to grow in a managed, risk focused way to continue to bring even more high quality companies into our client base and work.

with them successfully for many years. Our last survey indicated an increase of 11% in the response to the question “I have sufficient time and resources to deliver high quality” demonstrating we are making progress in this key area, although there is still more to achieve here through our action plans.

Our overall audit wide action plan is fully tailored to address each of our firm wide findings and individual file findings and is carefully monitored by our Audit Quality Board, which includes two Independent Audit Non-Executives (one of which is the Chair). That board monitors and provides governance around all key quality actions we undertake, both proactive and reactive.

We continue to extend the support provided to all our audit teams which includes mandating certain workpapers for all audits and investing in additional people in our central technical teams to ensure more resource is available to work with and assist the entirety of audit including increased levels of in-flight support.

As a firm, we have worked extremely hard and with unrelenting focus on audit quality since 2019. The pride that our auditors take from our strong file reviews (both FRC, ICAEW and internal file reviews) is a feeling that we, collectively, are keen to sustain. As such, we remain fully committed to audit quality, our Audit Investment Plan, root cause analysis, our audit wide action plan and further developing the culture we have within our audit practice. We will continue to invest in our teams to ensure consistent, sustained high quality audits are maintained in parallel with our successful ongoing growth of our complex client base.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements if they are considered key due to the extent of occurrence across the audits we inspected.

Further improve the challenge and corroboration of evidence over key judgements and estimates

Financial statements often include balances subject to estimation and judgement, including evaluation of impairment and provisions for future obligations and expected losses, which involve estimation uncertainty and rely on management judgement. Audit teams are expected to adequately assess these judgements and perform appropriate challenge procedures.

Last year we reported that audit teams should obtain sufficient and appropriate audit evidence in relation to the significant judgements and estimates made and challenge management on their appropriateness.

Key findings

We reviewed the audit of impairment of tangible and intangible non-current assets and other significant judgements and estimates on all five audits inspected in this cycle. We continue to see improvements compared with prior years but did identify findings on the sufficiency of audit evidence and challenge over the appropriateness of impairments recognised:

- On two audits, there was insufficient evidence of the appropriate assessment and challenge of sales assumptions used in assessing the impairment of specific cash generating units.

- On another audit, the audit team did not evidence sufficient scepticism in its assessment of the forecast cash flows used in determining the recoverable value.

In the audit of other judgements and estimates, we identified the following issues:

- On another audit, the audit team did not appropriately challenge and evaluate the assumption supporting the net retirement obligation. The audit team did not follow up its actuarial expert's finding on mortality assumptions, a key driver in the calculation of the pension liability. It did not quantify and evaluate the potential overstatement of the pension

We continue to see improvements in the audit of impairment and other significant estimates and judgements, but did identify findings on the sufficiency of audit evidence and challenge of impairments recognised.

obligation identified in the expert's report, given the mortality assumption was highly sensitive to change. * On another audit, the audit team's assessment of the Expected Credit Loss (ECL) provision was insufficient. The audit team did not appropriately challenge management over the completeness of the ECL provision due to errors in the team's underlying calculations nor did it assess plausible sensitivity scenarios.

Review of individual audits: Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach which responds to those risks.

- Audit planning: On one audit, the planning report to the Audit Committee included a prominent and clear statement that management should expect audit challenge in areas that were complex, significant or highly judgemental.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Long-term contracts: On one audit, robust challenge of management's accounting for project costs and loss provisioning identified a material error and a significant deficiency in controls.

- Derivatives: On another audit, the audit team engaged a financial instrument accounting expert from the firm's central team to assist in the assessment of hedge effectiveness. The expert's report provided a comprehensive oversight of the relevant aspects of the assessment, how these had been challenged and how any observations were assessed and resolved.

- Impairment: On a further audit, the audit team carried out a detailed and extensive search for potential impairment indicators, including consideration of the results of other audit testing, and demonstrated an appropriate level of professional scepticism. This was in response to

Good practice examples included the robust challenge of management's accounting for long-term contracts, evaluation of impairment and journals testing.

management's assertion that, except at two sites identified by management, there were no impaired properties. * Journals: On the same audit, the audit team made detailed enquiries of client staff, including junior members of the finance team and business systems personnel, to identify potentially inappropriate journals and fraud risks.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Audit report: On one audit, the audit team delayed issuing the auditor's report until covenant waivers were obtained from the key lenders.

3. Review of the firm's quality control procedures

In this section, we set out the key findings and good practice we identified in our review of the following four areas of the firm's quality control procedures, which we have inspected this year. This table shows how these areas in International Standard on Quality Control (UK) 1 (ISQC 1) map to International Standard on Quality Management (UK) 1 (ISQM 1), which will come into effect at the end of 2022, and the FRC "What Makes a Good Audit?" publication.

| ISQC 1 area | ISQM 1 area | What Makes a Good Audit |

|---|---|---|

| • Relevant ethical requirements - Implementation of the FRC's Revised Ethical Standard (2019) | • Relevant ethical requirements | • Execution of the agreed audit plan |

| • Engagement performance - EQCR, consultations and audit documentation | • Engagement performance | • Execution – Consultation and oversight |

| • Audit methodology | • Resources – Intellectual Resources including methodology | • Resources – Methodology |

| • Monitoring - Internal quality monitoring | • Monitoring and remediation | • Monitoring and remediation |

We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021. We also set out our approach to reviewing the firm's quality control procedures and a summary of our findings in the two previous years at the end of this section.

Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors (the “Revised Standard”). The revisions predominantly became effective for audits commencing on or after 15 March 2020. The focus

of the revisions was to enhance the reality and perception of auditor independence, necessities both for auditors to form objective judgements about the entity being audited and for stakeholders to have confidence in the outcome of the audit. Certain prohibitions, on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important “Objective Reasonable and Informed Third Party test", against which auditors must apply judgements about matters of ethics and independence.

In the current year, we evaluated the firm's actions to implement the Revised Standard. We reviewed changes to policies and procedures and the support provided to audit teams to aid the transition (for example, communications, guidance and training events). We also conducted a benchmarking exercise to compare the implementation approaches across the firms and to share good practice.

Key findings

We identified the following key findings where the firm needs to:

- Improve the firm's guidance on how to more consistently consider the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence, and in particular, that of non-practitioners, such as informed investors, shareholders or other stakeholders.

- Enhance the existing controls in place to ensure a network firm cannot commence a non-audit service before approval is provided by the UK audit partner.

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard.

Our inspection work next year will assess whether audit teams have adhered to the firm's updated policies and procedures.

Engagement Performance – EQCR, consultations and audit documentation

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team. The reviews are completed on public interest and other heightened risk audits before the audit report is signed. Our inspection evaluated the firm's policies and procedures in relation to the appointment of EQCR reviewers. Key factors

considered included the individuals' audit experience and level of seniority, availability and capacity, internal and external quality results and industry knowledge. We also considered how the challenges raised by the EQCR were made and resolved, as well the training provided to reviewers.

Consultation with the firm's central functions, on difficult or contentious matters, enable auditors to be guided by the collective experience and technical expertise of the firm. We reviewed the firm's policies and procedures in relation to auditors consulting with the firm's central quality teams, including areas where mandatory consultations are required.

Audit documentation comprises the evidence obtained and conclusions drawn during an audit. Archiving ensures that the documentation is maintained should it be needed in the future. We reviewed the firm's arrangements relating to the assembly and timely archiving of final audit files, and the monitoring and approval of changes made to audit files after the signing of the audit report.

Key findings

We identified the following key findings where the firm needs to:

- Strengthen and formalise its EQCR policies and procedures. We identified a number of improvement points in relation to the firm's appointment of EQCRs based on their experience, quality results, available time and other factors.

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team.

Methodology

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control, to help audit teams perform audits consistently and comply with auditing standards. In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities.

Key findings

We identified no key findings given the firm does not audit banks and similar entities. Should the firm start to perform audits in this sector it needs to:

- Issue guidance in relation to auditing the fair value of financial instruments. The firm does not have any financial services specific work programmes, templates and related guidance in relation to auditing the fair value of financial instruments.

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control.

Monitoring – Internal quality monitoring

It is a requirement for firms to monitor their own quality control procedures to evaluate whether they are adequate and operating effectively. This allows action to be taken should deficiencies be identified.

We evaluated key aspects of the firm's annual process to inspect the quality of completed audits. This included the criteria for selecting audit partners and completed audits for review, the composition and allocation of quality review teams, the scoping of areas to review, the evidencing of the review, the identification of findings and the overall assessment. We planned to compare the scope and outcome of a sample of audits reviewed by the FRC's AQR team with the firm's internal quality monitoring team. We were not able to perform this due to the small number of audits selected in the AQR inspection program.

Key findings

We identified the following key findings where the firm needs to:

- Improve the timeliness of monitoring the quality of completed audits so that findings and insights can be communicated to the audit practice in time for the planning and performance of next year's audits. The firm aims to complete its inspection program by 31 December when the planning and performance of the majority of next year's audits has already commenced. The firm should assess the timing of its inspection program and ensure that findings are identified and communicated on a timely basis to be able to impact the planning and performance of next year's audits.

- Ensure that the professional judgements made by the reviewer are recorded to support the depth of their review and the conclusions reached in key areas that have been reviewed where no findings have been raised. This is particularly important for high risk and complex areas where conclusions on the adequacy of the audit evidence obtained are inherently judgemental. The firm must also ensure that key queries or discussions with audit teams are recorded.

The firm does not audit banks or similar entities. Should the firm start to perform audits in this sector it must issue guidance in relation to auditing the fair value of financial instruments.

Good practice

We identified the following areas of good practice:

- The firm performs targeted thematic reviews on selected topics which have a wide scope and coverage. The reviews are designed to respond to themes arising from internal and external reviews, and to monitor areas

where the firm is trying to implement changes, share good practice and drive continuous improvement.

- The firm ensures that audit partners are reviewed every year either as a full internal quality monitoring review, a limited scope review or an external review.

Approach to reviewing the firm's quality control procedures

We review firm-wide procedures based on those areas set out in ISQC 1, in some areas on an annual basis and others on a three-year rotational basis. The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2021/22 | Prior year 2020/21 | Two years ago 2019/20 |

|---|---|---|---|

| • Audit quality focus and tone of the firm's senior management | • Implementation of the FRC's Revised Ethical Standard (2019) | • Audit methodology (recent changes to auditing and accounting standards) | • Partner and staff matters, including performance appraisals and reward decisions |

| • Root cause analysis (RCA) process | • EQCR, consultations and audit documentation | • Training for auditors | • Acceptance and continuance (A&C) procedures for audits |

| • Audit quality initiatives, including plans to improve audit quality | • Audit methodology (fair value of financial instruments with a focus on banks) | ||

| • Complaints and allegations processes | • Internal quality monitoring |

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas we reviewed on a rotational basis:.

- On Audit methodology and training (2020/21) the firm needed to ensure that practitioners complete their mandatory training on a timely basis, introduce audit specific training for IT and tax specialists and issue guidance in relation to auditing lease accounting and financial instruments accounting under IFRS 16 and IFRS 9.

- On Partner & staff Matters (2019/20) we raised an issue in relation to the processes followed to respond to adverse quality results when setting quality objectives and to the lack of formalisation for considering audit quality matters as part of the partner remuneration process. Also, for senior staff there was no formal process to consider results of internal and external inspections to objective setting and remuneration decisions.

- On Acceptance and continuance procedures (2019/20) the firm needed to establish a centralised monitoring and review of key documents within the process. We provided an update on the firm's actions in our 2020/21 report.

Good practice

- We identified good practice in our review of Acceptance and continuance procedures (2019/20) in relation to the firm increasing the prominence and visibility of the consideration by engagement teams of the impact that accepting or continuing a relationship with a specific entity has in terms of reputation, values and brands

4. Forward-looking supervision

We supervise by holding firms to account through assessment, challenge, setting actions and monitoring progress. For instance, we do this through assessing and challenging: the effectiveness of the firms' RCA processes; the development of the firms' audit quality plans; the firms' progress against action plans; the effectiveness of firms' responses to prior year findings; and the spirit and effectiveness of the firms' response to non-financial sanctions. We are currently introducing a single quality plan (SQP) to be maintained by each Tier 1 firm as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve quality. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Supervision.

In our role as an Improvement Regulator, we also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22 we held two roundtables, attended by the seven largest firms, sharing good practices and success stories on RCA. We have been undertaking benchmarking and thematic-based work on areas including Tone at the Top, ISQM 1, Overseas Delivery Centres, and on Culture and Challenge of Management.

We have also carried out pre-implementation work on the firms' preparedness for ISQM 1. Further details are set out in Tier 1 Overview Report.

In the remainder of this section, we set out our observations from the work we have conducted this year, and updates from previously reported findings, as follows:

- Audit quality initiatives

- RCA

- Other activities focused on holding the firms to account

- Operational separation

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

Audit quality initiatives

Background

Firms are expected to develop audit quality plans (AQPs) that drive measurable improvements in audit quality and include initiatives which respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality.

The firm's AQP has recently been extended to 2025 and includes longer term and forward-looking audit quality initiatives. The firm's Audit Quality Board has responsibility for the oversight of the plan and continues to receive regular progress reports.

When we reviewed the plan last year, we assessed it as relatively mature, and we identified good practices in relation to the oversight and governance of the AQP, the breadth of the plan and the extent of central monitoring and challenge. However, we found that the firm needed to extend the plan (which at that time, covered the period to Spring 2022), strengthen the procedures around monitoring the effectiveness of the plan and continuing to strengthen the culture of challenge in the audit process.

Observations

We assessed the following:

- Oversight and governance of the AQP: The Audit Quality Board is provided with the latest version of the plan and other relevant material. The meetings are well facilitated and we have observed instances of challenge from the Audit Quality Board and the Audit Non Executive (ANE).

- Continual evolution of the AQP: The AQP was refreshed in January 2022. As part of that process, the firm reset its priorities and clearly communicated its current key priority areas and associated initiatives to the audit practice. The AQP and supporting documents are regularly presented to the Audit Quality Board along with monthly progress reports. The plans are clear and comprehensive; however, the monthly progress reports would be improved by including information on longer-term initiatives.

- Continual reassessment of the effectiveness of the AQP and the underlying initiatives: The overall effectiveness of the AQP is measured against both quantitative and qualitative measures and is regularly reassessed. The assessment considers overall progress, the completion of initiatives and future priorities.

- Central monitoring and challenge: The plan and associated processes are established and understood throughout the firm. Senior members of the

Audit quality plans should include forward-looking measures which contribute directly or indirectly to audit quality.

audit practice discuss all PIE audited entities on a weekly basis and, where appropriate, ensure that there is additional support, challenge and intervention.

- Extension of key initiatives to the wider audit practice: The firm must continue to further extend some its key audit quality initiatives that are currently focused on FRC scope audits, to the wider audit practice (e.g. second line of defence support).

- Continue to strengthen the culture of challenge in the audit process: The firm has continued to focus on this area and has recently engaged an external specialist to undertake two audit culture surveys. The results of these are currently being assessed and include a detailed analysis by staff grade and office. While there continues to be an Audit Culture working group, this has recently lost some of the more senior audit members. The firm must continue to ensure that there is adequate senior audit involvement in this group.

We will continue to assess the AQP and encourage all firms to develop or continue to develop their audit quality plans including the focus on continuous improvement and measuring the effectiveness of initiatives.

Root Cause Analysis

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

ISQM 1, when implemented, introduces a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we assessed that the firm's overall approach to RCA was well developed and identified good practice in relation to a dedicated RCA, the oversight of and communication from the RCA team and (year round) continual RCA activities. However, we found that the firm needed to expand the scope of reviews and increase the depth and quality of the interrogation of the root cause analysis. The firm has not made any significant changes to its RCA approach during the year but has continued to make refinements.

RCA is an important part of a continuous improvement cycle.

ISQM 1 requires firms to use RCA as part of their quality remediation process.

The firm must continue to further extend some its key audit quality initiatives to the wider audit practice.

Observations

We assessed the following:

- The RCA team: The core RCA team is supported by a flexible team that draws on senior members of the audit practice. Where specific specialist expertise is needed, the firm continues to engage external consultants.

- Behavioural factors: The firm recognises that behavioural factors form a significant part of overall causal factors. In order to further develop the firm's understanding of this, a senior member of the RCA team splits his time to also work as part of the Audit Culture team.

- Oversight and communication within the firm: The RCA team are proactive at sharing findings with key audit support teams such as internal quality monitoring. This is undertaken on a real time basis so that underlying themes can be verified and the firm can respond more promptly to these. RCA findings continue to be regularly reported to the Audit Quality Board, the senior audit leadership team and shared with the audit practice.

- Scope of reviews: The scope and coverage of reviews has been expanded to capture firm-wide findings and good practices and to include other types of inspections (for example, audits with prior period adjustments).

- Causal factors: The firm has recently changed its approach so that causal factors are now weighted. This allows the firm to consider secondary causal factors and to incorporate an increased breadth of analysis into its reviews.

- Depth and quality of the interrogation of the root cause analysis: GT apply a consistent and well understood approach. However, we have seen examples where the analysis would benefit from further challenge and interrogation before concluding on the root cause. The firm must ensure that the RCA assessment has a greater depth of analysis.

We will continue to assess the firm's RCA process. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result.

GT's approach to the interrogation of the root cause analysis is consistent and well understood, but would benefit from further challenge.

Other activities focused on holding firms to account

Background

As part of our forward-looking supervisory approach we hold firms to account for making the changes needed. This firm was not subject to increased supervisory activities during the year.

Observations

We assessed the following:

- Responsiveness and proactivity: The firm takes a proactive approach to responding to internal and external challenge and acting on feedback. For example, we have seen evidence that quality learning points from 'near-misses', investigations and publicly available themes and findings relating to the firm's peers have been considered and the findings shared.

- Tone at the top and audit leadership: The firm's audit leadership take a proactive and constructive approach. Communications are clear, with consistent messages provided around the importance of audit quality, highlighting the risks to quality and its focus on continuous improvement. As noted above, the firm considers and, where appropriate, communicates wider learnings including sharing with the audit practice its assessment of FRC communications relating to audit quality.

- Action plans and non-financial sanctions: GT has made good progress in remediating the majority of its action plan items and has formalised its oversight of these using a dedicated actions monitoring group. In addition, we note that the teams responsible for monitoring non-financial sanctions relating to audit quality have approached these in a constructive and effective manner with a clear goal of improving audit quality.

- AQIs: The firm has developed an AQI dashboard for individual audit engagements. It is used by engagement teams with central oversight and challenge. A consolidated AQI dashboard (amalgamating AQIs across all audit engagements) has recently been developed and is being shared with the Audit Quality Board. These reflect a pre-defined red/amber/green risk assessment for each AQI, the basis of which needs to be kept under review.

We will continue to hold the firms to account through our supervisory activities.

GT has made good progress in remediating the majority of its action plan items

Operational separation of audit practices

Operational Separation aims to ensure that audit practices are focused, above all, on the delivery of high-quality audits in the public interest. Whilst the firm does not need to implement the Operational Separation of its Audit Practice, it has chosen to restructure its governance arrangements, including the formation of an Audit Quality Board and the appointment of two ANEs.

Appendix

Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements. We consider that publication of these results provides a fuller understanding of quality monitoring in addition to our regulatory inspections, but we have not verified the accuracy or appropriateness of these results.

The appendix should be read in conjunction with the firm's Transparency Reports for 2020 and 2021 which provide further detail of the firm's internal quality monitoring approach and results, and the firm's wider system of quality control.

Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring may differ from those of external regulatory inspections and should not be treated as being directly comparable to the results of other firms.

Results of internal quality monitoring

The results of the firm's most recent National Audit Review (NAR), which comprised internal inspections of 44 individual audits with periods ending between December 2019 and March 2021, are set out below along with the results for the previous two years.

Results of internal quality monitoring: 2019-2021

A bar chart showing the percentage breakdown of audit quality ratings ("Good or Good with limited improvements", "Improvements required", "Significant improvements required") for the years 2019, 2020, and 2021 based on the firm's National Audit Review (NAR).

- 2019:

- Good or Good with limited improvements: 61%

- Improvements required: 29%

- Significant improvements required: 10%

- 2020:

- Good or Good with limited improvements: 78%

- Improvements required: 13%

- Significant improvements required: 9%

- 2021:

- Good or Good with limited improvements: 86%

- Improvements required: 5%

- Significant improvements required: 9%

The grading categories used in the graph above are as follows:

Good or Good with limited improvements: A limited number of concerns in a small number of areas. Improvements required: A number of matters in a number of areas but neither individually nor collectively significant. Significant improvements required: Significant concerns in relation to the sufficiency or quality of audit evidence, or the appropriateness of key audit judgements, or the implications of other matters that are considered to be individually or collectively significant.

Firm's approach to internal quality monitoring

The firm's internal inspection program considers the full population of audits performed. The NAR is designed to cover each engagement leader at least once every three years, with engagements biased towards more complex or higher-risk assignments. Each entity in the scope of the FRC's AQR are reviewed internally at least once every 10 years. Audits that fall within the scope of the FRC's AQR are reviewed by the firm's central Audit Quality Monitoring Team (AQMT), with other reviews undertaken by experienced auditors and led by an experienced audit partner under the direction of AQMT or led by the AQMT. The setting of inspection grades is moderated by the AQMT to ensure consistency between reviews and with the approach of external regulators.

The firm undertakes RCA on all significant findings from the NAR. Findings are considered significant where audit procedures performed were not appropriate or where the audit procedure was not compliant with professional standards or the firm's policies. RCA is also completed on a selection of files graded as good or good with limited improvements to identify good practice. Local office leaders develop and implement targeted action plans to address the findings of all individual reviews undertaken and ensure that findings are addressed in the subsequent year's audit. The RCA findings are reviewed to assess where there are repeated incidences or themes of root causes arising and actions are identified to be implemented by the audit practice to address these. The root cause process also considers whether actions are required for isolated, or uncommon findings, with actions being proportionate to the incidence and severity of the findings.

Internal quality monitoring themes arising

The main themes arising from internal quality monitoring were professional scepticism and challenge of management, revenue (principally occurrence) and quality of financial statements. In 2021 there were improvements in the number of significant findings relating to professional scepticism, challenge of management and quality control but an increased number of findings for revenue and quality of financial statements. These main themes are the same as last year except for quality control where the improvements have resulted in this matter not being longer identified as a main theme.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300 www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

-

The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP. We have published a separate report for each of these seven firms along with a Tier 1 Overview Report. ↩

-

Source - the ICAEW's 2022 QAD report on the firm. ↩

-

Source - the FRC's analysis of the firm's PIE audits as at 31 December 2021. ↩

-

Source - the FRC's 2020, 2021 and 2022 editions of Key Facts and Trends in the Accountancy Profession. ↩

-

Excludes the inspection of local audits. ↩

-

The FRC's inspections of Major Local Audits are published in a separate annual report to be issued later in 2022. The October 2021 report can be found here. ↩

-

Public Interest Entity – in the UK, PIEs are defined in the Companies Act 2006 (Section 494A) as: Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a regulated market" where, in the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.); Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England); and Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive. ↩