The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Financial Reporting Council: 3 Year Plan 2023-26

- 1. Introduction

- 2. Transitioning from the FRC to ARGA

- 3. Our approach to regulation

- 4. Our operational impact

- 5. Meeting our existing and future obligations

- 6. Risks and challenges

- 7. Key outputs and success measures

- 8. Statutory funding plans

- 9. UK Endorsement Board

- Annex 1 – Detailed expenditure and funding 2023/24

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2023

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Introduction

The FRC sets out below its second 3-Year Plan. In this plan, we expect an increase of £6.5m in our overall costs for 2023-24.

In our 2022-25 Plan, we anticipated legislation to create the Audit, Reporting and Governance Authority (ARGA) in 2023. We were disappointed by further delay and the need to push back our planning by one year, to 2024. Our 2023-26 Plan reflects this change and the delay to some activities and associated increase in capacity, cost and headcount we previously expected to occur in 2023.

We have, therefore, re-prioritised our work, focusing on the changes we can make using our existing powers and remit. Our Position Paper, published in July, provided stakeholders with clarity on the work we intend to prioritise ahead of legislation. Already, in 2022, we have taken action to deliver further on the aspirations of the reform programme, whilst maintaining or enhancing our existing regulatory functions to ensure that they are delivering the best possible outcomes. For example, we recently issued a consultation on a draft Minimum Standard for Audit Committees. When published in 2023, FTSE 350 audit committees will be able to adopt the standard on a voluntary basis before it becomes mandatory and we start to supervise it when ARGA is created. This will be a positive step forward in promoting the importance of audit committee focus on the appointment and oversight of auditors. 2023 will also see the first revisions to the UK Corporate Governance Code since 2018.

In our Supervision division, 2022 has seen us take on responsibility for Public Interest Entity (PIE) auditor registration. Owning this process means the FRC can act decisively when it identifies systemic issues in an audit firm, allowing us to impose conditions, suspensions and, in the most serious cases, remove registration. This is just the first of several planned changes to our supervision approach and powers which are incorporated in this latest 3-Year Plan. The work of our Enforcement division continues to deliver proportionate sanctions in a timely manner, with Constructive Engagement (CE) an increasingly useful approach to many of the cases we investigate. We expect that the current volatile economic climate creates heightened risk of an increase in the number of enforcement cases we see towards the latter stages of our 2023-26 Plan.

As an organisation, hybrid working has proved effective and will be maintained. In our previous plan we noted the intention to open a second office location outside London, however no plan is yet agreed with government. Our latest plan does anticipate at least one office move, when the lease for our current premises expires in 2025.

We acknowledge that many stakeholders would value a detailed 3-year budget. We remain committed to transparency and accountability, as evidenced by our recent publications on how we interpret the public interest in our work and refreshed Regulators' Code disclosures. The Board will continue to keep the format and content of the 3-Year Plan under review.

Sir Jan du Plessis Chair

March 2023

Sir Jonathan Thompson Chief Executive Officer

2. Transitioning from the FRC to ARGA

The purpose of the FRC is to serve the public interest by setting high standards of corporate governance, reporting and audit and by holding to account those responsible for delivering them.

Our 2022-25 Plan was based on the planning assumption that ARGA would be created via legislation, with a start date of April 2023. After the publication of that plan, it became clear that the ARGA Bill would not receive Parliamentary time in the third session. In the continued absence of a firm legislative timetable, we therefore pushed our planning assumption back by one year to April 2024. Since the publication of the draft of our 2023-26 Plan, changes to the Parliamentary timetable began to cast some doubt over this date also. After considering the alternatives, we have opted to retain the 2024 assumption for the purposes of this Plan, whilst acknowledging the continued uncertainty around timing of legislation. When the timetable becomes clearer, we will communicate any changes in our planning assumptions to our stakeholders. The 2023-24 budget would not have been significantly altered had we changed the 2024 planning assumption.

2024

Our revised planning assumption for legislation

The Government's response to feedback on its consultation Restoring Trust in Audit and Corporate Governance was published in May 2022 and was followed by our own Position Paper in July 2022. The aim of the position paper was to set out the actions the FRC can take in the period between now and the passing of legislation, to give our stakeholders clarity on what to expect over the next 12-18 months and greater certainty regarding the pace of delivery of the elements of our transformation that are reliant upon primary or secondary legislation. We will shortly publish an updated workplan and timeline to support stakeholders’ understanding of our activities and resource allocation in these areas.

Our transformation programme continues to work alongside colleagues across government to support the development of policy which will eventually become draft legislation. Some of the projects which form part of the programme are well enough developed to form part of 'business as usual' in 2023, such as PIE auditor registration and audit committee oversight. Others remain in the design stage, requiring, as a minimum, the clarity of draft legislation to proceed further.

Building trust brings better outcomes for all stakeholders

Overall, we expect our headcount to increase in 2023/24 from the current budgeted number of 486 at March 2023, to 533 at March 2024. This is slightly lower than we had anticipated in our last plan and reflects the delay to ARGA and our recruitment priorities. It also recognises the need to keep levy increases proportionate during a challenging economic period. We expect most of the increase in operational capacity previously planned for 2024 and 2025 to shift back by one year in line with the delay to ARGA. This will mean achieving an anticipated stable state and headcount of around 600 people, one year later than originally planned, in 2026/27. The allocation of our planned headcount increase for 2023/24 is described in more detail at section 5, below.

Why does this matter? And how will our stakeholders, particularly those who will be responsible for funding ARGA, know whether ARGA is having a positive impact on these outcomes? At section 7 we discuss the FRC's current Key Performance Indicators (KPIs), and the work we are doing to baseline additional outcome measures as we get ready to take on new responsibilities as ARGA.

3. Our approach to regulation

Four Faces – a balanced yet assertive approach

The four faces are the framework through which we seek to realise our strategic objectives, which we first articulated alongside our refreshed purpose statement in 2020.

Our 2022-25 Plan

introduced the four faces regulatory approach

The four faces approach helps us to stay aligned with our core purpose by ensuring we consider the extent to which our regulatory priorities are appropriately balanced. The System partner and Facilitator faces are linked to improvement priorities, supporting those we regulate to understand and meet our expectations. Our Supervisor and Enforcer faces are a necessary part of assessing the effectiveness of the application of standards and holding to account, where it is in the public interest, those who fail to meet our expectations. In turn, our supervision and enforcement activities provide insight regarding how well the corporate reporting and governance ecosystem is functioning and how we might adapt our improvement regulation over time.

The combination of the four faces and our five strategic objectives (shown on next page) supports us in ensuring that we comply with both the spirit and the letter of the Regulators' Code, the accompanying principles of good regulation, and our regulatory remit as set by Government. More information on how we comply with the Regulators' Code can be found on our website here.

Five Strategic Objectives

- Set high standards in corporate governance and stewardship, corporate reporting, auditing, and actuarial work and assess the effectiveness of the application of those standards, enforcing them proportionately where it is in the public interest.

- Promote improvements and innovation in the areas for which we are responsible, exploring good practice with a wide range of stakeholders.

- Influence international standards and share best practice through membership of a range of global and regional bodies and incorporate appropriate standards into the UK regulatory framework.

- Create a more resilient audit market through greater competition and choice

- Transform the organisation into a new robust, independent, and high-performing regulator, acting in the public interest.

4. Our operational impact

Each of the FRC’s four divisions sets divisional objectives aligned to our five strategic objectives and our Purpose.

Our 2022-25 Plan described the new responsibilities each division expected to take on over the coming three years, and those areas in which they would increase focus or develop further. Whilst there will be no further responsibilities in addition to those we reported on last year, the delay to ARGA creates an opportunity to bring forward some activities or spend more time on developing others. The tables below set out how each division intends to organise its work, and the associated deliverables across the 3-year period of this plan.

Divisions organised around our approach to regulation

Regulatory Standards

- What we said new responsibilities and activities 2022-25: Local audit policy, competition policy, actuarial monitoring regime, new audit and corporate reporting guidance, audit sandbox and UK Endorsement Board (UKEB) due process oversight.

- New or updated in 2023-26 Plan: Deliverables as set out in the FRC Position Paper.

- Continued or increased focus: non-financial reporting standards, Environmental, Social and Governance (ESG) and climate reporting, actuarial support for Audit Quality Review (AQR) and Enforcement, UK Corporate Governance Code and Wates Principles, Stewardship Code, Lab deliverables aligned to priority policy areas.

Supervision

- What we said new responsibilities and activities 2022-25: PIE auditor registration, International Standard on Quality Management (ISQM1) implementation, mutual recognition of overseas qualifications creating greater mobility and capacity in the global audit market, monitoring of mandatory climate risk disclosures from 2022, statutory oversight of accountants and actuaries and implementation of market opening measures, reporting on operational separation implementation, supervision of Audit Firm Governance Code, firm level Audit Quality Indicators (AQI).

- New or updated in 2023-26 Plan: Shadow System Leader for local audit; audit committee supervision of new minimum standards, FRC Scalebox.

- Continued or increased focus: Supervision thematic reviews including regular publications on inspection/supervision and professional oversight activity, PIE auditor registration, ISQM1 implementation, mutual recognition of overseas qualifications following EU Exit, monitoring of mandatory climate risk disclosures from 2022.

Enforcement

- What we said new responsibilities and activities 2022-25: Embedding of, and training in, new Enforcement policies to reflect significant Audit Enforcement Procedure (AEP) revisions; design and delivery of changes to support effective implementation of the Enforcement aspects of regulatory reform.

- New or updated in 2023-26 Plan: No change from 2022/23

- Continued or increased focus: Supervision liaison to support CE activities and increasingly sophisticated Non-Financial Sanctions (NFS), monitoring of increasing number of NFS already imposed; recruitment for transformation and anticipated increase in investigations due to the increased risk to audit and corporate reporting quality arising from geopolitical and economic turmoil; ongoing focus on Members in Business; input from experienced auditing/accounting professionals at earlier stages; operational resourcing to accommodate increase in size of division, and supporting additional FRC-wide processes; stakeholder engagement with regulated persons and their legal representatives, particularly in the context of transformation.

Corporate Services

- What we said new responsibilities and activities 2022-25: A statutory funding model, delivering on information management and medium-term IT strategy, enhanced internal and external reporting, set up of a second office location.

- New or updated in 2023-26 Plan: No change from 2022/23

- Continued or increased focus: Business Continuity Planning (BCP) and testing, risk, controls and assurance activities, impact assessment, data analytics and legal services support, Learning and Development (L&D) focus on leadership capabilities, 2025 office move.

i) 2023/24 priorities and deliverables

In translating our regulatory focus into actions and deliverables, we will continue to prioritise those areas where we i) have a statutory obligation to conduct an activity or produce reports, ii) anticipate an increased volume of work, and/or iii) have identified a need for investment in new capacity:

Regulatory Standards

15%

increase in resource for Regulatory Standards to meet Position Paper commitments

The Regulatory Standards division is responsible for our UK and international policy influencing agenda. It sets UK audit, assurance, ethical, Financial Reporting Standards (FRS) accounting, and technical actuarial standards and promotes innovation in reporting across all those topics as well as in the rapidly developing areas of climate and ESG reporting. The division is also home to the Stewardship Code and the UK Corporate Governance Code. The FRC's competition policy work also takes place in this division, supporting the design and delivery of new competition measures planned for ARGA. The FRC's Lab has recently won £796,000 of project funding from the Regulators Pioneer Fund which will be used to support the development of a regulatory toolkit for structured data. Priorities and deliverables for the division during the period of this 3-Year Plan encompass all five of the FRC's strategic objectives.

- Development and maintenance of standards and codes, including completion of the periodic review of FRS 102, adoption of a revised International Standard on Auditing (ISA) (UK) 500 Audit Evidence, post-implementation reviews of UK auditing standards, in particular ISA (UK) 540 Accounting Estimates and Related Disclosures, review of the UK Corporate Governance Code, and post-implementation review and revision of technical actuarial standards (TAS)

- International influencing of auditing, assurance and ethical standards, and significant contribution to non-financial reporting developments in the UK and internationally (especially sustainability reporting)

- Policy support for ARGA's local audit systems leader role

- Activities focused on improvements and innovation to support high quality reporting and audit including Lab publications and use of the new 'Audit Sandbox'

- Promoting the use of technology throughout our policy areas, through digital reporting and the implications for data and data governance, and commencing the Company and Organisational Data Explorer (CODEX) project

Supervision

18%

increase in Supervision resource, delivering assertive supervision

The Supervision division delivers the FRC's monitoring and oversight obligations in respect of audit, accounting, corporate reporting, and actuarial work. Priorities and deliverables for the division during the period of this 3-Year Plan primarily address our strategic objectives in assessing the effectiveness of the application of standards, promoting improvements and innovation in corporate reporting and audit, and promoting a more resilient audit market. Over the period of this plan, the division will take on several significant new responsibilities, including Local Audit systems leadership for England, statutory accountancy oversight, and supervising the new audit committee minimum standards. The divisional priorities for this period recognise the important transformational element of these new responsibilities.

- Deliver a full programme of high-quality AQR inspections, CRR reviews and the FRC's statutory professional oversight functions and publish associated reporting, including thematic reviews

- Increase activities focused on improvements and innovation to support improved audit quality and resilience in the market, including implementation of the FRC Scalebox

- Approval and registration of audit firms and responsible individuals who undertake PIE audit work

- Assess the effectiveness of the firms' implementation of new auditing and quality management standards

- Develop a supervisory approach for audit committees

- Develop the supervisory oversight strategy for the professional bodies

- Develop the local audit system leader role and team in shadow form ahead of ARGA implementation

- Reporting on implementation of operational separation

- Develop market monitoring function

- Deliver projects on developing AQR and Improving the Quality of Auditor Education and Training

Enforcement

Deferred headcount increase to reflect current case load and longer-term anticipated increase in cases

Delivering a timely and proportionate enforcement regime is an essential part of our regulatory approach. The work of Enforcement not only ensures that those responsible for poor quality audit and reporting and the underlying poor behaviours are held to account, but also supports root cause analysis which can be fed into quality improvement plans or used to inform subsequent policy and supervisory work. The division has made good progress in improving timeliness and utilising constructive engagement where appropriate. The priorities and deliverables focus primarily on our first strategic objective, whilst recognising that the division will contribute strongly to transformational change with new statutory powers and the anticipated ARGA directors enforcement regime in particular.

- Fair, robust, and timely case closures, or conclusion through focus of investigations, prioritisation, training, and recruitment

- Upskilling and training to respond to changes in AEP from January 2022 and to intended changes to procedural published guidance

- Collaboration with the Department for Business and Trade (DBT) on planned legislative change to reach the best achievable outcomes as they pertain to enforcement and the FRC's stated purpose and objectives

- Upskilling to enable full implementation of future powers arising from proposed regulatory reform in 2024 onwards

- Publication of the Annual Enforcement Review, delivering transparency and driving improved behaviours through messaging case outcomes

Corporate Services

7%

increase in Corporate Services resource, realising efficiencies whilst supporting improved regulatory capacity

As the only non-regulatory division, Corporate Services priorities and deliverables are focused on supporting the effectiveness of all our activities as part of our transformation objective. Running an effective organisation starts with creating a statutory funding base, which we expect will be realised during the period of this 3-Year Plan.

- Develop a statutory funding model for ARGA

- Develop and implement an integrated information management strategy, including a medium-term IT strategy and enhanced cybersecurity risk management

- Data analytics and reporting, economic advice and impact assessment – supporting enhanced market monitoring, the implementation of the FRC position paper, and transition to ARGA

- Appropriate workforce planning, aligned with our business planning cycle and designed to incentivise, reward, and retain key skills and accommodate any re-location plans

- Strengthen our support infrastructure, including in finance and procurement systems, internal controls, and IT

- Enhancing the level of assurance activity, against internal policies and controls

- Legal support for all FRC activities and legal and operational support for the UKEB

- Embedding our contingency planning processes and testing regime.

Other cross-divisional teams

Several teams sit outside the divisional structure and are the responsibility of the CEO. This includes Strategy & Change, Governance, and Stakeholder Engagement and Corporate Affairs (SECA), all of whom provide cross-divisional support to the organisation. SECA's 2023/24 priority will be supporting the FRC's objectives and activities through increased stakeholder engagement with impact and influence, including website improvements, connected and systematic development of publications, webinars, and podcasts, all focused on collective impact.

5. Meeting our existing and future obligations

The FRC has increased in size significantly since the Kingman report was published in 2018. This transformation has been in response to Sir John Kingman's, the Competition and Markets Authority's and Sir Donald Brydon's recommendations and in anticipation of becoming ARGA. Two years ago, in our 2021-22 plan, we set out information on the operating model and expected headcount which ARGA would require. Last year we acknowledged that the pace of change could slow and lengthen due to delays in legislation. Nevertheless, we chose in 2022 to focus on bringing forward change which was within the FRC's current remit and which we knew would be supported by those we regulate and the wider markets, so as to smooth our trajectory over the medium-term. We still believe that the likely required total headcount once ARGA is established will be in the region of 600 people. With that in mind and considering that the FRC is unlikely to become ARGA any earlier than April 2024, we have budgeted for a modest overall headcount increase in 2023-24.

A realistic and achievable increase in size to maintain our trajectory towards ARGA

Overall, the combined budgeted cost of the FRC and the UKEB will increase by 10.9% to £66.3m (2022/23: £59.8m). The number of people we employ will increase by 9.7% to 533 by March 2024 (budgeted March 2023 headcount: 486). This small increase takes into account the slower than planned actual recruitment during 2022 due to challenging market conditions. In the Enforcement division in particular this leads to our budgeted 2024 headcount being lower than it was for 2023. Headcount changes by division are shown below (budget to budget) and reflect the priorities and deliverables outlined in section 4, above, and in the case of enforcement the reduction in the case portfolio through improved timeliness of case resolutions.

| Division | March-23 Budget | March-24 Budget |

|---|---|---|

| Regulatory Standards | 78 | 90 |

| Supervision | 182 | 215 |

| Enforcement | 86 | 80 |

| Corporate Services | 111 | 119 |

| Total FRC | 457 | 504 |

| UK Endorsement Board | 29 | 29 |

| Total | 486 | 533 |

FRC headcount increase

9.7%

increase in headcount (Mar 23 – Mar 24)

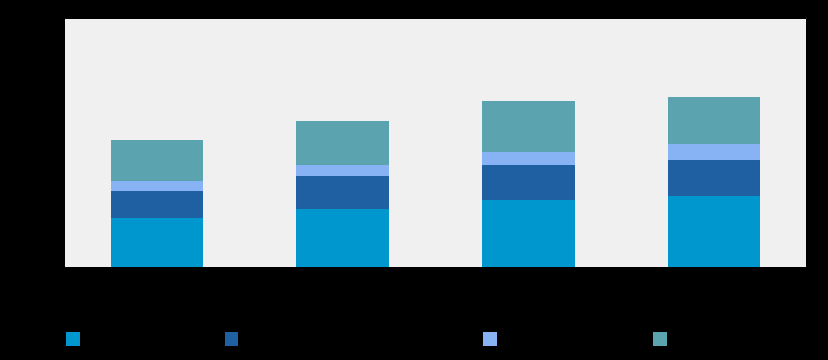

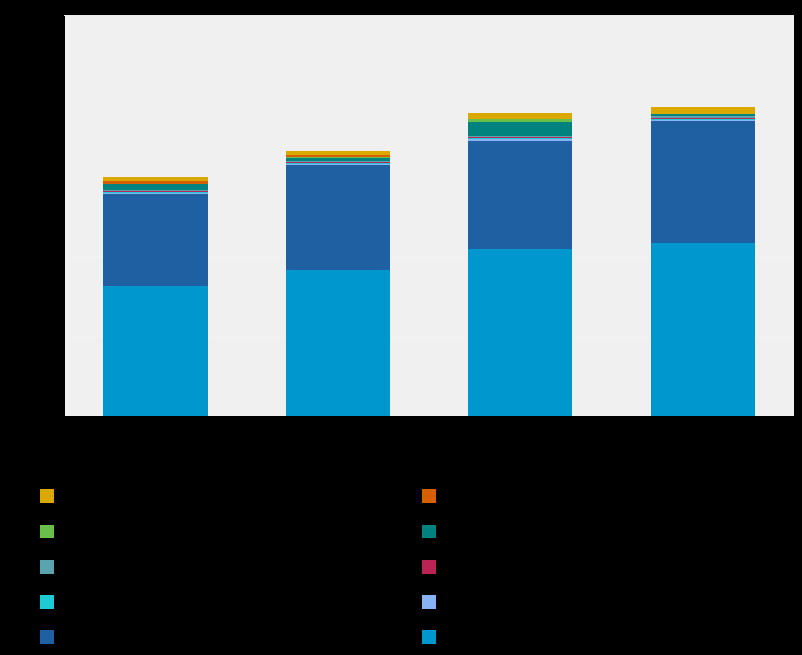

The trajectory of expenditure associated with years two and three of the plan is shown in the figures below:

FRC Expenditure

10.9%

Increase in budget (incl. UKEB) (Mar 23 – Mar 24)

Expenditure by division (excluding case costs & UKEB)

i) Our People

The largest portion of the FRC's expenditure is on staff costs. Providing an efficient yet effective supporting infrastructure for our people is essential. During the course of this 3-Year Plan we expect many of the current external factors to persist, such as a hard recruitment market and cost pressures on suppliers. Our people have been and, we believe, will continue to adapt well to the changing environment. Our established hybrid working approach provides flexibility for teams to achieve their own and the organisation's goals, but we do not underestimate the additional challenges facing us during the period of this plan. Continuing to deliver good regulatory outcomes, whilst adopting new or improved Finance, IT, HR and information management processes and incorporating an office move in 2025 when our current lease expires will require careful planning, excellent leadership and staff engagement, and expert delivery.

Our focus for much of this plan will be on enhancing our leadership capabilities

During the period of this plan, we will continue the learning and development work we started in 2021, which has delivered co-ordinated onboarding, training linked to personal and professional development needs and better L&D outcomes for colleagues. Our focus for much of this plan period will be on enhancing our leadership capabilities across the two most senior levels of the organisation to meet the growing demands of the organisation and on meeting our demanding diversity and inclusion aspirations both in terms of recruitment and internal promotion prospects.

6. Risks and challenges

We report on our principal risks and the operation of our risk management framework during the preceding year in our Annual Report and Accounts.

In setting our annual budget and determining our priorities across the 3-year period of this Plan, we have considered our current risks, their trend, and the likelihood of our existing mitigating actions failing to be sufficient to address those risks over the medium-term. We have identified as a Principal risk the impact of delay or ineffective regulatory reform due to political and other pressures, and we have seen already the effects of what we hope will be only temporary delay to ARGA legislation. Our Plan recognises the need to be flexible and seeks to create options for alternative routes to similar outcomes so that not only are we ready to become ARGA when legislation is passed, but that those we regulate, and our wider group of stakeholders, have time to adapt to regulatory change.

Our Plan recognises the need to be flexible

The risks to our operational effectiveness, in particular the ability to recruit and retain adequate numbers of professionally qualified staff, are likely to persist for much of the period of this Plan. In response, like many other public sector organisations, we are focused on the whole of our employee offering and those areas where we have flexibility to improve the attractiveness of working at the FRC.

The majority of our principal risks have time horizons which are short (1 year or less) or medium (1-5 years) term in nature. The two risks which have longer-term horizons relate to the overall effectiveness of our regulatory model and the risk of the quality of audit and corporate reporting degrading despite our efforts. The priorities and deliverables described in section 4 above are designed to address the time horizons over which we think those risks may materialise; and actively contribute to mitigation and maintaining each risk within our agreed appetite and tolerance.

7. Key outputs and success measures

The KPIs below are those which we have chosen to publish from 2021 onwards. These represent quantitative metrics against which we assess our operational performance. They are supported by more detailed management information and additional internal metrics. The table below shows our full year target for each KPI, the previous full year's performance, and our half year1 performance for the current financial year. Full year performance for the 2022-23 financial year will be published in our annual report and accounts in July 2023.

| Category | Measure | Target | 2021/22 (FY) | 2022/23 (HY) |

|---|---|---|---|---|

| Supervision and Monitoring | Number of Audit Quality Review (AQR) reports completed | 154 | 152 | 84 |

| Number of Corporate Reporting Review (CRR) reports completed | 240-260 | 252 | 201 | |

| Complaints against professional bodies for auditors, accountants and actuaries investigated and responded to within 6 weeks | 75% | 79% | 87% | |

| Constructive engagement cases concluded within 12 months | 100% | 100% | 100% | |

| Enforcement | Enforcement case investigations concluded, settled, or closed within two-year target*2 | 100% | 40% | 44%3 |

| Financial and operational performance | Operating costs against budget (excluding UKEB) | £50.3m | £39.8m | £23.8m |

| Recruitment against budget (excluding UKEB) | 457 | 374 | 400 | |

| FRC complaints responded to within service level agreement timeframe | 100% | 100% | 100% | |

| Research projects undertaken | 14 | 12 | 4 |

We intend to include an additional supervision and monitoring KPI in respect of PIE auditor registration. This will reflect our performance against set processing timescales for registration applications. This KPI is not included as the transition period has not yet concluded, therefore no data has been collected.

In November 2021 we published What makes a good audit in which we defined the attributes of a high-quality audit and set out our views on what conducting a good audit should look like, which was well received by stakeholders. In 2022 we followed it up with What makes a good environment for auditor scepticism and challenge which set out the characteristics of an audit practice that can support auditors in exercising the behaviours that are crucial for audit quality. We will also soon publish What makes a good Annual Report and Accounts which identifies the features that we associate with a high-quality report and accounts, beyond compliance with basic reporting requirements. We intend to follow this with further publications which explain our view on other topics relevant to the production of high-quality, decision-useful corporate reports. We have also defined what we believe to be the primary characteristics of a well-functioning audit market with greater choice and resilience. These publications aim to set out our expectations, providing context for the work we are doing to baseline the current state of the regulatory space in which we are operating. This will allow us in due course to publish more informative, outcomes-based measures showing how our work has impacted on quality in each of the areas we regulate. Identifying appropriate measures, which may often be qualitative in nature, or proxies in the absence of clearly correlated quantitative measures, forms part of the deliverables described in section 4, above.

8. Statutory funding plans

Our aim for ARGA's statutory funding is to create a fairer, more transparent model in which costs are allocated proportionately across those parties who benefit from each of our regulatory activities. The delay to legislation permitted us the opportunity to consult first on the high-level principles for ARGA's funding. The consultation ran from July to October 2022.

- In our consultation, we proposed: to align ARGA's statutory levies with the Financial Conduct Authority (FCA)'s long-standing approach by setting an annual budget and funding requirement for each main activity and requiring defined funding groups to pay for each activity; and

- to establish the funding groups based on five main categories: PIE audit firms and the audit professional bodies; listed and large private companies; FCA-authorised institutional investors and asset managers; accountancy professional bodies; and the actuarial funding groups – insurers, pension schemes and the actuarial professional body.

Responses were broadly supportive of the high-level principles but raised several policy and technical issues which will require consideration. We have published a feedback statement, summarising the responses we received and the actions we intend to take. A further, detailed consultation on ARGA's Funding Rulebook will take place once draft legislation has been published. In the meantime, we will continue to engage regularly with our key funding stakeholders to ensure that future funding changes are well understood ahead of coming into force.

9. UK Endorsement Board

The UK Endorsement Board (UKEB) was set up by the government in 2021 as an independent body, to adopt International Financial Reporting Standards (IFRS) for use in the UK, and to lead the UK's participation in and contribution to the development of a single set of international accounting standards. The UKEB is accountable to the Secretary of State for its technical decision-making and subject to FRC oversight in respect of its governance and due process. Further information can be found on the UKEB website.

The UKEB has set its budget at a level designed to ensure that it has adequate resource to enable It to fulfil its statutory objectives, which are approved by the Secretary of State, and deliver on its regulatory strategy. The UKEB's 2023/24 Regulatory Strategy is available to view on its website. In setting its budget, the UKEB consults with the FRC and follows the FRC's budgeting processes.

The UKEB considers that its existing budgeted headcount of 29 staff is sufficient to undertake its responsibilities, and therefore no additional headcount is required in 2023/24. The full cost of the UKEB's funding is collected on their behalf through the FRC's funding arrangements. IFRS adoption and influencing, on behalf of the UK, is not an FRC function and therefore UKEB costs are shown separately in Annex 1, below.

Annex 1 – Detailed expenditure and funding 2023/24

Expenditure

To undertake the activity proposed in this plan during the 2023/34 financial year we have set a budget of £66.3m (Table 1) (2022/23: £59.8m). This is based on our planning assumption that the transition to ARGA will take place in 2024. The budget will enable us to deliver the regulatory functions as set out above, build additional capacity in anticipation of ARGA, further develop our professional oversight role, and collect funding for the work of the UKEB as agreed with DBT. A delay to the ARGA start date would not have had a significant impact on the 2023/24 budget but could result in small changes to years 2 and 2 of this Plan, assuming a smoothing of the overall plan.

| Table 1: Regulatory activities | 2022/23 Forecast £m | 2022/23 Budget £m | 2023/24 Budget £m | Change £m |

|---|---|---|---|---|

| Supervision | ||||

| Audit Quality Review | 10.0 | 10.5 | 10.7 | 0.2 |

| Corporate Reporting Review | 6.8 | 7.4 | 7.2 | (0.2) |

| Audit Firm Supervision | 2.6 | 2.8 | 3.8 | 1.0 |

| Audit Market Supervision | 2.7 | 2.9 | 3.4 | 0.5 |

| Local Audit | 0.3 | 0.0 | 1.1 | 1.1 |

| Professional Oversight | ||||

| Professional Oversight | 5.0 | 5.0 | 6.5 | 1.5 |

| Third Country Auditors | 0.8 | 0.8 | 0.8 | 0.0 |

| Enforcement Core Costs | 6.2 | 6.7 | 6.2 | (0.5) |

| Regulatory Standards | ||||

| Corporate Governance and Stewardship | 2.3 | 2.5 | 2.8 | 0.3 |

| Accounting and Reporting Standards | 2.2 | 2.6 | 3.0 | 0.4 |

| Audit & Assurance Standards | 3.3 | 3.7 | 4.0 | 0.3 |

| Financial Reporting Lab | 2.1 | 2.3 | 2.8 | 0.5 |

| FRC Taxonomies | 0.4 | 0.3 | 0.3 | 0.0 |

| Actuarial | ||||

| Standards | 2.6 | 2.6 | 3.4 | 0.8 |

| Professional oversight | 0.2 | 0.2 | 0.2 | 0.0 |

| Total Core Costs | 47.5 | 50.3 | 56.2 | 5.9 |

| Enforcement Case Costs | (0.3) | 5.0 | 5.0 | 0.0 |

| Actuarial Investigation costs | 0.0 | 0.0 | 0.0 | 0.0 |

| Total FRC Costs | 47.2 | 55.3 | 61.2 | 5.9 |

| UK Endorsement Board | 3.7 | 4.5 | 5.1 | 0.6 |

| Total | 50.9 | 59.8 | 66.3 | 6.5 |

The key areas in which we will increase expenditure in 2023/24 are in Supervision and Regulatory Standards due to: i) delivery of the Scalebox initiative and the supervision of professional bodies project, ii) setting up an audit market monitoring team, iii) supervising the new, mandatory ISQM (International Standard of Quality Management) standard, iv) implementing a voluntary supervision regime for the Minimum Standard for Audit Committees, v) creating a new local audit team as FRC assumes the shadow system leader role for local authority financial reporting and local audit in England, vi) revision of Technical Actuarial Standards, vii) developing competition policy activities, and vii) establishing the new Audit Sandbox.

Overall, the increase in expenditure can be broken down into the full year impact of prior year phased headcount increase, a small increase in non-staff costs relating to corporate services and external legal and professional fees, and the budgeted total increase in headcount of 47 people for 2023/24. Existing, ongoing expenditure (including staff costs) has been adjusted for inflation. The FRC is subject to public sector pay policy in determining our overall pay strategy. We do not publish a specific assumption on the impact of inflation, but will as far as possible take account of salaries elsewhere in the regulatory sector and in the areas from which we recruit.

The budget for case costs set at the beginning of each year is an estimate. Actual costs, comprising in year case costs less costs recovered, depend on the nature and timing of the individual cases that are in progress and cost awards received at the conclusion of a case.

| Table 2: Expenditure type | 2022/23 Forecast £m | 2022/23 Budget £m | 2023/24 Budget £m | Change £m |

|---|---|---|---|---|

| Staff costs | 39.1 | 41.1 | 45.9 | 4.8 |

| Restructuring costs | 0.7 | 0.7 | 1.0 | 0.3 |

| NED and Committee Member Fees | 0.9 | 1.1 | 1.0 | (0.1) |

| Facility costs | 2.6 | 2.6 | 2.7 | 0.1 |

| IT & Website | 2.1 | 3.0 | 3.6 | 0.6 |

| Travel | 0.4 | 0.6 | 0.6 | 0.0 |

| Conferences | 0.2 | 0.4 | 0.4 | 0.0 |

| Recruitment | 0.8 | 0.8 | 0.7 | (0.1) |

| Training | 0.5 | 0.4 | 0.6 | 0.2 |

| Legal / professional / audit | 1.3 | 1.5 | 1.9 | 0.4 |

| Research | 0.5 | 0.6 | 0.6 | 0.0 |

| All others (see note) | 1.7 | 1.7 | 2.0 | 0.3 |

| FRC Taxonomies | 0.4 | 0.3 | 0.3 | 0.0 |

| Total | 51.2 | 54.8 | 61.3 | 6.5 |

| Actuarial Investigation Costs | 0.0 | 0.0 | 0.0 | 0.0 |

| Audit and Accountancy Case Costs | (0.3) | 5.0 | 5.0 | 0.0 |

| Total | 50.9 | 59.8 | 66.3 | 6.5 |

| Table 3: Expenditure by Division | 2022/23 Forecast £m | 2022/23 Budget £m | 2023/24 Budget £m | Change £m |

|---|---|---|---|---|

| Supervision | 19.1 | 20.0 | 23.6 | 3.6 |

| Regulatory Standards | 8.4 | 9.1 | 11.0 | 1.9 |

| Enforcement | 3.8 | 4.1 | 3.9 | -0.2 |

| Corporate Services* | 17.2 | 18.1 | 18.7 | 0.6 |

| Sub Total | 48.5 | 51.3 | 57.2 | 5.9 |

| Case Costs | (0.3) | 5.0 | 5.0 | 0.0 |

| Total FRC | 48.2 | 56.3 | 62.2 | 5.9 |

| UK Endorsement Board | 2.7 | 3.5 | 4.1 | 0.6 |

| Total | 50.9 | 59.8 | 66.3 | 6.5 |

* Corporate costs are distributed proportionally against the regulatory activities in Table 1 above

Funding

We have set a funding requirement of £66.3m (2022/23: £59.8m). This represents an increase of £6.5m on last year's funding requirement. To keep a steady and reasonable increase to the preparers levy, we will use £0.8m from our reserves towards funding our budget. The use of any reserves is subject to approval by DBT. We will consider how the remaining reserves may be best utilised in future as we transition to ARGA. The full cost of the UKEB for 2023/24 will again be collected on the UKEB's behalf by the FRC through the preparers levy. The funding requirement for local audit systems leader functions will be met via grant-in-aid from the Department for Levelling Up, Housing, and Communities (DLUHC).

We set our annual funding requirement and levies based on the budget we set each year following consultation with stakeholders. To enable stakeholders to assess our expenditure against the funding we have raised, we are comparing our expenditure each year against the budget set at the beginning of the year rather than forecast outcome.

We have allocated the funding requirement using our existing funding model as follows:

| Table 4: Funding sources | 2022/23 Forecast £m | 2022/23 Budget £m | 2023/24 Budget £m | Change £m |

|---|---|---|---|---|

| Audit and Accountancy funding groups | ||||

| RSB contribution to AQR | 9.0 | 9.7 | 10.4 | 0.7 |

| RSB contribution to AMS | 2.6 | 2.9 | 3.4 | 0.5 |

| RSB contribution to AFS | 2.5 | 2.8 | 3.8 | 1.0 |

| NAO & Crown Dependencies | 0.8 | 0.7 | 0.6 | (0.1) |

| CCAB contribution | 10.8 | 11.5 | 13.1 | 1.6 |

| CIMA | 0.7 | 0.8 | 0.9 | 0.1 |

| Contribution to Enforcement case costs | (0.3) | 5.0 | 5.0 | - |

| Subtotal | 26.1 | 33.4 | 37.2 | 3.8 |

| Companies (Accounts Preparers) | ||||

| For the FRC | 17.0 | 15.8 | 17.7 | 1.9 |

| Towards UKEB | 3.7 | 4.5 | 5.1 | 0.6 |

| Contribution from reserves | - | 1.6 | 0.8 | (0.8) |

| Government contribution | 0.2 | 0.2 | ||

| Sub-total | 20.7 | 21.9 | 23.8 | 1.9 |

| Actuarial funding groups | ||||

| Insurance companies | 1.3 | 1.2 | 1.7 | 0.5 |

| Pension schemes | 1.4 | 1.2 | 1.7 | 0.5 |

| IFOA | 0.2 | 0.3 | 0.2 | (0.1) |

| Sub-total | 2.9 | 2.7 | 3.6 | 0.9 |

| Publications, XBRL and TCA registration fees | 0.9 | 0.8 | 0.6 | (0.2) |

| DLUHC | 0.3 | 1.0 | 1.1 | 0.1 |

| Total | 50.9 | 59.8 | 66.3 | 6.5 |

Three-Year Funding

The audit and accountancy profession's contributions are paid by the Consultative Committee of Accountancy Bodies (CCAB), whose members are ACCA, CAI, CIPFA, ICAEW, and ICAS, and by CIMA, which contributes to the FRC's funding requirement under the terms of a separate agreement with the FRC. The contributions from the professional bodies reflect the cost of the FRC's professional oversight activities, audit quality reviews, our work on audit firm supervision and audit market resilience, and the other audit and assurance activities, including standard-setting.

More detail on ARGA funding proposals is contained at section 8, above. In our recent funding consultation, we proposed that ARGA, once established, should levy audit firms directly for audit quality review and audit firm and audit market supervision, while invoicing the professional bodies for standard-setting and professional oversight. The FRC will consult further with stakeholders on the appropriate methodology and the impact of the proposed changes, in particular the proportion of funding to be provided by the firms and the professional bodies.

To fund our work on corporate reporting, corporate governance, and investor stewardship the FRC raises a preparers levy. We fund our work on actuarial regulation through levies on pension schemes and insurers. These levies are collected on a non-statutory basis. The actuarial profession also contributes to the cost of actuarial regulation. Should this system of voluntary payments prove unsustainable the Secretary of State is able to make regulations to put the FRC's levies on a statutory basis. The Companies (Audit, Investigations and Community Enterprise) Act 2004 includes a provision to enable this.

We will increase the amount we request through the preparers levy by 12%, which will require an increase of 14% in the rates we apply, which are calculated based on the market capitalisation of listed entities as at September 2022. As in previous years we will continue to raise £0.9m for the IFRS Foundation alongside our levies.

| Organisation size per £m of market cap* | 2023/24 Preparers levy rate |

|---|---|

| Minimum fee for all companies | Up to 100m |

| £1,836 | |

| Additional fees based on the following levy bands | |

| 1 | 100m - 250m |

| £18.02 | |

| 2 | 250m - 1,000m |

| £13.75 | |

| 3 | 1,000m - 5,000m |

| £13.30 | |

| 4 | 5,000m - 25,000m |

| £0.216 | |

| 5 | \> 25,000m |

| £0.041 |

The following table gives an indication of the amounts that will be charged to different types of entities:

| Organisation | 2023/24 levy |

|---|---|

| UK AIM company with £100m market cap | £918 |

| Private company with £750m turnover | £5,707 |

| Premium listed company: £10bn market cap | £69134 |

Pension levy for 2023/24

The FRC pension levy applies to all Defined Benefit and Defined Contribution schemes with 5,000 members or more. We will raise £1.7m from the pension levy in 2023/24 and we will confirm the levy rate to be applied after receiving data on scheme membership provided by the Pensions Regulator.

Insurance levy for 2023/24

The insurance levy is allocated to insurance companies as a proportion of the FCA and PRA regulatory fees and requested on the same invoice as the FCA/PRA fees. We will raise £1.7m from the insurance levy in 2023/24 and we will apply the levy rate necessary to secure this as a proportion of the FCA/PRA fees.

Audit regulation: Equivalence and adequacy assessments

Audit regulation involves the principles of 'equivalence' (where another country's audit regime is deemed to apply a comparable standard of oversight) and 'adequacy' (where another competent authority is deemed adequate for the purposes of sharing information). Equivalence and adequacy decisions were previously made by the European Commission on behalf of all its member states. Following EU exit, the UK makes its own 'equivalence' and 'adequacy' decisions in relation to third country audit (TCA) regimes. DBT have asked the FRC to make recommendations on the 'equivalence' and 'adequacy' of selected countries. The FRC undertakes assessments to make those recommendations. To raise the necessary funds from market participants in 2023/24, we estimate that the FRC's costs for this work will total £200,000. We are not changing the level of fees for each registered TCA firm for 2023/24. The fees are shown in the table below.

| Annual fee payable by a registered third country auditor 2023/24 | |

|---|---|

| Number of audit clients | Type of registration as a third country auditor |

| Equivalent registration (Form A) | |

| 0–9 | £1,221 |

| 10+ | £2,925 |

| Full registration (Form B) | |

| £2,357 | |

| £5,765 |

Further information about our current funding is available on our website.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

-

HY performance is not indicative of FY outturn, due to the back-end loaded nature of many of our measures. ↩

-

The Enforcement KPI is a period of two years between commencement of an investigation and service of either the Proposed Formal Complaint (PFC) or Investigation Report (IR) (or closure or settlement if sooner). Please see the FRC's Annual Enforcement Review for further details on our enforcement activities and findings during 2021/22. In the AER, we noted that in the coming year we would review our target KPI to identify a metric which provides more meaningful insight into our performance while maintaining our emphasis on securing improvements to the timeliness of our investigations and enforcement action. ↩

-

Percentage of Enforcement case investigations where the KPI falls due in FY22/23 and KPI has been met in H1. Some KPIs do not fall due until H2. ↩