The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

IFRS 3 Business Combinations

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number

- Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

- 1. Executive summary – introduction

- 2. Scope and background to the thematic report

- 3. Overview of accounting and disclosure requirements

- 4. Management commentary

- Contents of the Management Report / Strategic Report

- The reasons behind a business combination

- Explaining how and when control was obtained

- Impacts on liquidity and funding

- Alternative performance measures

- Pro-forma information

- Other observations on disclosures within the front end of annual reports

- 5. Fair value

- 6. Consideration

- 7. Other IFRS 3 disclosures

- 8. Statement of cash flows

- 9. Significant judgements and estimates

- 10. Deferred taxation

- Accounting for deferred tax

- Intangible assets and goodwill

- Assessing the recoverability of deferred tax assets of the acquiree

- Re-assessing deferred tax assets of the acquirer

- Initial recognition exemptions

- Other fair value adjustments

- Reassessment of deferred tax subsequent to the business combination

- 11. Other matters

- Recognising non-controlling interests

- Puts over NCIs

- Transactions not included in the business combination

- Business combinations after the end of the reporting period

- Contingent liabilities

- Merger relief

- Multiple business combinations

- Indemnification assets

- Accounting policies

- Different accounting policies used by acquired businesses

- Impairment testing

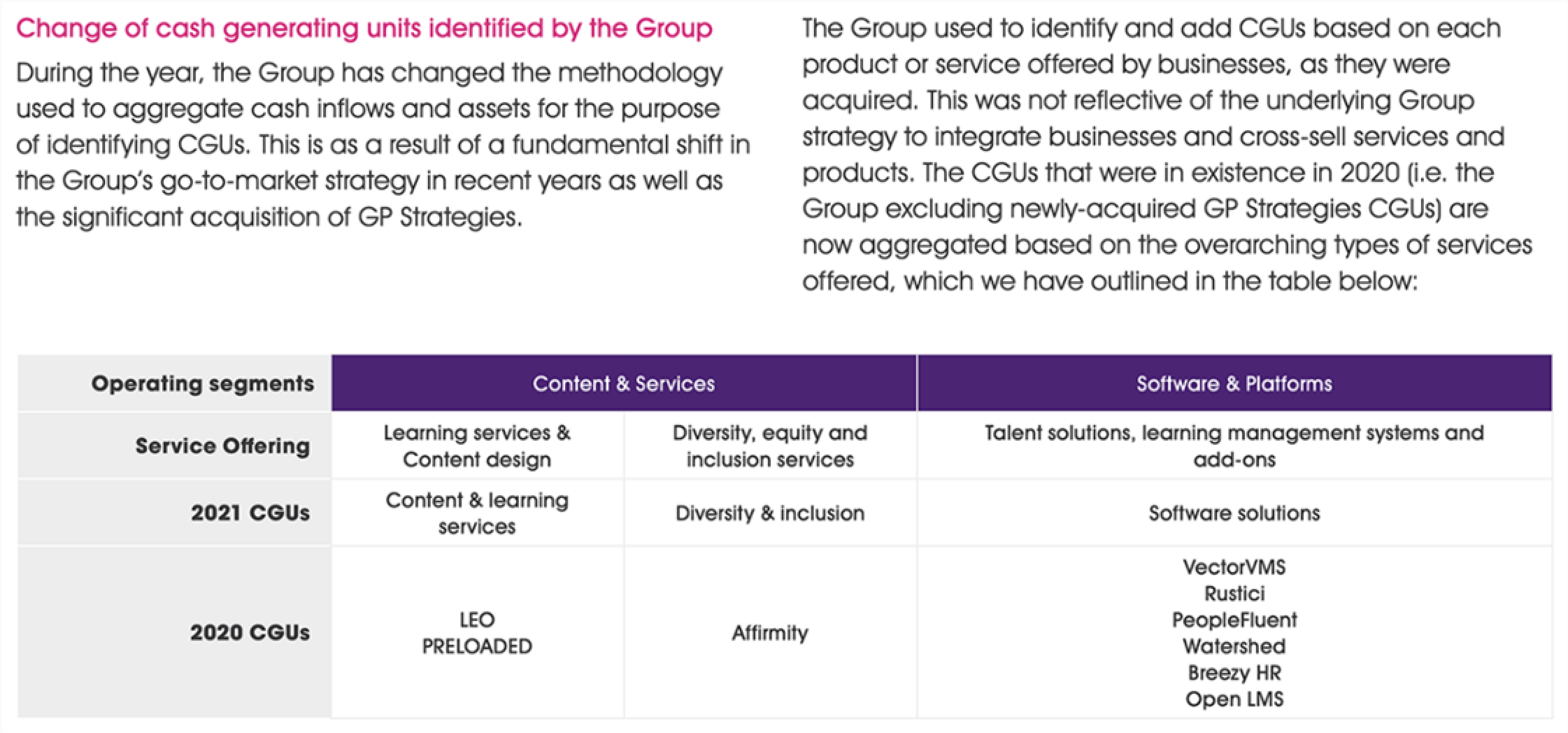

- Changes in segmentation

- Future developments

- 12. Key expectations

- Appendix

- Appendix - Case Study: Telling the story of a business combination

- Appendix - Case Study: Telling the story of a business combination

1. Executive summary – introduction

Business combinations tend to be significant but infrequent transactions that give rise to issues outside the routine work of the accounting function. These transactions can have a significant impact on a company's operations and financial performance and therefore, unsurprisingly, often require thorough discussion within the management commentary of an annual report as well as having a widespread impact on the financial statements themselves.

Our review looked at the annual reports of 20 companies of various sizes across a number of industries that had recently completed a business combination. This thematic draws out the features of better reporting and disclosures, whilst also highlighting areas for improvement.

The areas of better practice and opportunities for improvement are identified in the report as follows:

- Represents good quality application that we encourage other companies to consider when preparing their annual reports.

- Represents opportunities for improvement by companies to move them towards good practice.

- ▲ Represents an omission of required disclosure or other issue. We want companies to avoid such issues in their annual reports.

This report includes extracts from the annual reports and accounts of companies included in our sample, and highlights some of the better practice examples we saw. The examples will not be relevant for all companies or all circumstances, but each demonstrates a characteristic of useful disclosure. Inclusion of a company's disclosure should not be seen as an evaluation of that company's reporting as a whole.

1. Executive summary – key observations

Summary of key observations

Overall we were generally pleased with the quality of reporting of business combinations. However, there remains room for improvement. Our main findings were as follows:

- The best reports gave clear and consistent explanations of the reasons for, and the impact of, the combination throughout the annual report, with careful thought given as to how to convey the information in an understandable and concise way.

- The requirements to determine whether share-based payments form part of the consideration or are accounted for as a post combination expense are complex, and companies could improve their explanations of how such payments have been treated.

- When alternative performance measures (‘APM') were used to explain the impact of the combination, the best examples followed recommendations from our recent APM thematic.

- Disclosures related to contingent consideration could be enhanced. Explanations of the arrangements were often boilerplate, and it was hard to understand the potential variability in the amounts.

- The better disclosures provided an explanation of the valuation techniques applied to value acquired assets and liabilities, the key assumptions used and disclosed this by significant class of asset and liability. They explained how fair value adjustments would unwind over time.

- Some companies incorrectly reported cash flows for acquisition costs as investing cash flows. These should be classified as operating cash flows within the consolidated accounts.

- Some companies used a three-column approach to present fair value adjustments to the previous carrying values which can in some instances be helpful in highlighting material adjustments.

- Accounting for business combinations often requires significant judgements and estimates to be made. When companies disclosed that there was significant estimation uncertainty, sensitivity disclosures could be improved.

- Explanation of factors giving rise to goodwill were sometimes not provided or were boilerplate and of little benefit to readers.

- Companies need to be careful to apply the relevant provisions of IAS 12, 'Income Taxes'. Combinations can give rise to additional deferred tax balances, for example when revaluing assets to fair value or reassessing the recoverability of assets.

We have included a case study, in the appendix, of a company where we felt the disclosures provided the reader with a comprehensive and consistent overview of the business combinations in the period.

2. Scope and background to the thematic report

Why are we reviewing business combination accounting?

Business combinations can have a fundamental impact on the acquirer's strategies, resources and operations. For most companies, such transactions are infrequent, and each is unique. They often involve accounting issues that are outside the regular day to day work of an accounting function as well as using forward looking information and related assumptions, which may introduce significant estimation uncertainty. These include the valuation of intangible assets, the valuation of contingent consideration and its subsequent remeasurement, deferred tax matters, accounting for pre-existing relationships and the revision of share-based payment arrangements. Given the complexity of some of these matters and the reduced familiarity with the related accounting requirements due to their 'one off' nature, there is an increased risk of error in recording and disclosing these transactions.

Issues related to business combination accounting have frequently featured in the FRC's 'top ten' findings. The global economy continues to face a number of challenges, including continuing impacts from the Covid-19 pandemic, supply disruptions, the Russia Ukraine war, increasing prices and interest rates, and the energy crisis, all of which contribute to a significant increase in the risk of recession.

The current economic environment means that companies in some sectors may be more vulnerable to takeovers and we may see more acquisition activity. The risks and opportunities posed by climate change may also be a driver of future business combinations.

We have not previously undertaken a thematic review of business combinations, and this review has allowed us to identify better practices and highlight common pitfalls.

A business combination has the potential to have a significant and wide ranging impact on a company's annual report and accounts. Not only do companies have to consider the IFRS 3, 'Business Combinations', requirements, but there are also disclosure requirements in the Companies Act 2006 (the ‘Act') and the Disclosure Guidance and Transparency Rules ('DTR') that could apply. This report is not intended to cover all aspects of the reporting requirements and should not be relied upon as a guide to the detailed requirements, but highlights examples that we thought were particularly informative and helpful to users as well as areas where we believe reporting could be improved.

The companies reviewed

For this thematic, we performed a desktop review of 20 companies looking at how they had reported the outcomes of business combinations in their annual report and accounts. We also considered the findings of our routine desktop reviews performed over the last few years.

Our selection was based upon the annual reports of companies for year-ends falling between December 2021 and March 2022 which included a business combination. We chose companies from a variety of sectors. Of these 20 companies1, 15 were listed on the main market, with 4 being constituents of the FTSE 100 and 8 being constituents of the FTSE 250; there were 3 companies listed on AIM and 2 large private companies.

Industries sampled (number of reports)

A - Electronic and Electrical Equipment (1) B - Financial services and banks (3) C - Food & Beverages (2) D - Gas, Water and Multi-utilities (2) E - Home Construction (1) F - Industrial goods and services (3) G - Industrial Transportation (2) H - Non-life insurance (1) I - Pharmaceuticals and Biotechnology (2) J - Real Estate Investment Trusts (1) K - Software and Computer Services (2)

Selection by equity market

- FTSE 100 (10%)

- FTSE 250 (20%)

- Other main market (15%)

- AIM (15%)

- Private (40%)

Our review did not include reverse acquisitions. An example of such a transaction is when a private company obtains a market listing by acquiring a listed shell company, which generally does not involve the combination of two businesses.

Our review also excluded business combinations under common control as these are scoped out of IFRS 3. A business combination between entities under common control usually involves transactions between subsidiaries in a group and will not normally impact the accounting within the consolidated group accounts. It is the consolidated group accounts which were the focus of this review.

3. Overview of accounting and disclosure requirements

IFRS 3 requirements

IFRS 3 aims to improve the relevance, reliability and comparability of information provided for a business combination. To do this it establishes principles and requirements for:

- the recognition and measurement of identifiable assets acquired and liabilities assumed, and the resulting goodwill or gain on bargain purchase; and

- the information to be disclosed to enable users to evaluate the nature and financial effects of the business combination2.

Through the course of this report, we will focus on different areas of the IFRS 3 requirements.

Narrative reporting

The Act and the DTR both require a company to provide a narrative review of the company's business. The DTR applies to listed companies on the main market, whilst the Act applies to all UK incorporated companies; however, the requirements of each largely overlap.

A summary of requirements are listed opposite. It is important to note that the information provided should be commensurate with the size of the acquisition, and that judgement is required in determining the appropriate level of detail to provide to users.

Disclosure Guidance and Transparency Rules

The FCA's DTR requires that an annual report contains a management report. The report must include a fair review of the company's business which should be a balanced and comprehensive analysis of:

- the development and performance of the business during the year; and

- the position of the business at the end of that year, consistent with the size and complexity of the business.

It should also include references to, and additional explanations of, amounts included in the financial statements, where appropriate3.

The requirements of section 414C of the Act relating to the Strategic Report largely mirror the above DTR requirements. There is an additional requirement for quoted companies to explain the main trends and factors likely to affect the future development, performance and position of the company's business.

Whilst this report summarises some of the main requirements of accounting standards, the DTR and other authoritative literature, readers should not rely on the summaries provided and are advised to consult the original text of the respective requirements and guidance.

4. Management commentary

Contents of the Management Report / Strategic Report

Management must provide a fair, balanced and comprehensive review of the development and performance of a company's business during the financial year and its position at year end. As each business combination is unique, judgement will need to be exercised in determining what needs to be disclosed to meet this requirement.

All of the companies in our sample made reference to the business combination in either the Strategic Report, or in the case of non-UK companies, the management report.

The quoted companies also referred to the impact of the business combination in the analysis of the main trends and factors that were likely to affect the company's future development, performance and position.

The reasons behind a business combination

The best examples we saw explained the specific reasons for the business combination and how it aligned to the company's strategic objectives.

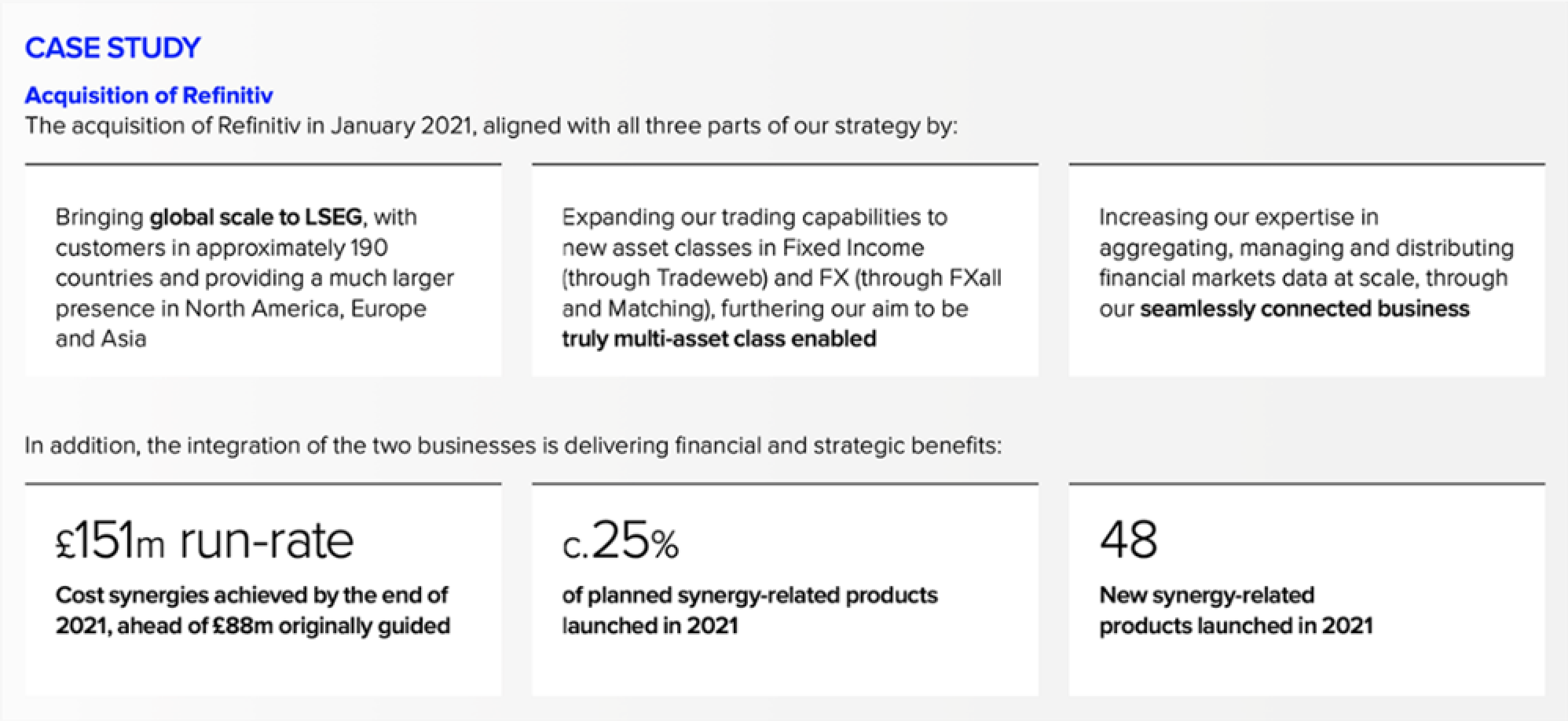

Explains how the business combination contributes to the execution of the business strategy in a simple graphic.

The company went on to elaborate, in the Strategic Report, the reasons behind the business combination, and what it meant for the future development of the group.

London Stock Exchange Group plc, Annual Report 2021, p13

London Stock Exchange Group plc, Annual Report 2021, p13

Provides an overview of the financial and operational benefits expected to be achieved from the business combination.

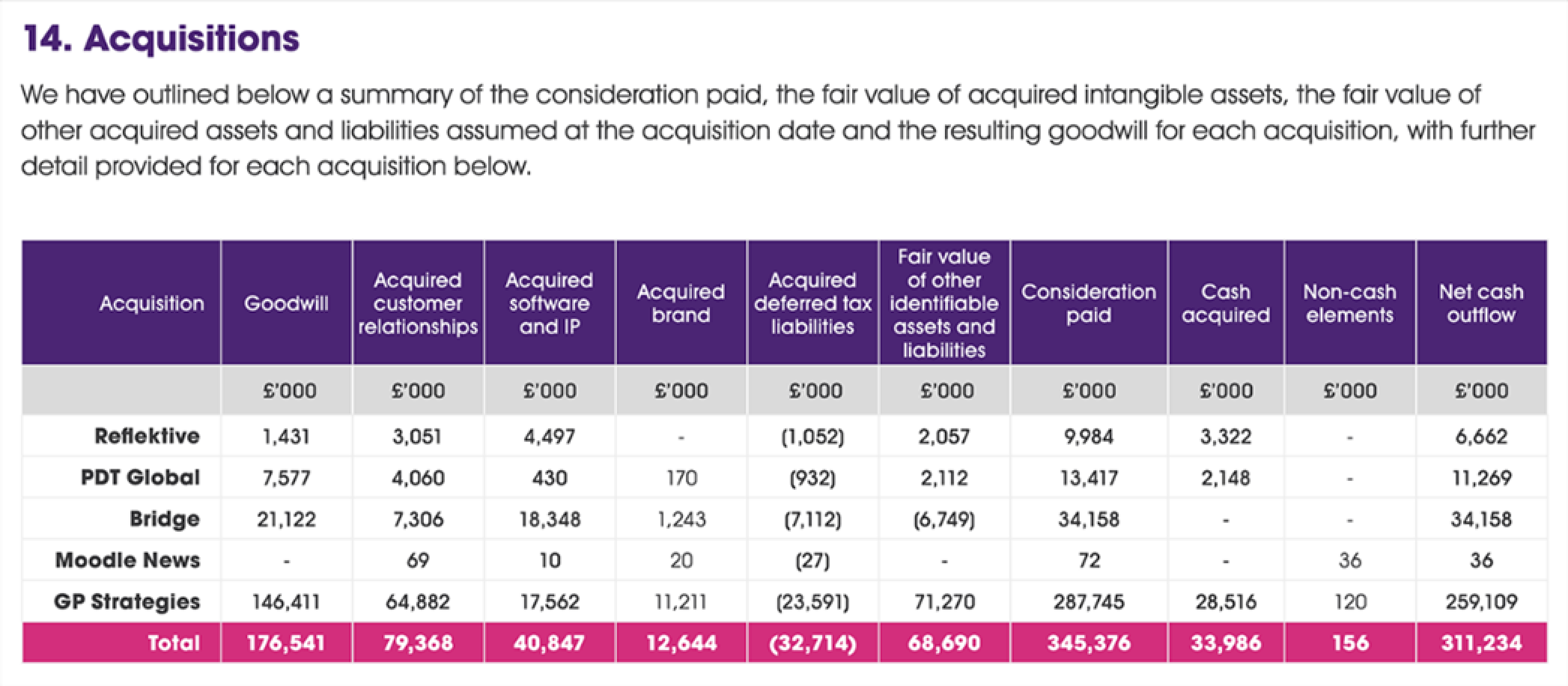

During 2021, we have added significant momentum to this progress with the completion of the transformational acquisition of US-listed GP Strategies in October 2021 for a consideration of $392 million. The strategically compelling combination of LTG and GP Strategies has created a leading global workforce transformation business focused on learning and talent development. We now have global reach; enhanced and complementary service offerings; and deep, long-standing customer relationships. In the first quarter of 2021, we also acquired Bridge and Reflektive, two strategically important Software as a Service (SaaS) learning and talent platforms, and PDT Global, a specialist diversity and inclusion consultancy, resulting in a combined cash outflow of £52.1 million in the year. We also made the small acquisition of Moodle News in August 2021.

Learning Technologies Group plc, Annual Report 2021, p1

Some companies may be rethinking their operations given the risks and opportunities posed by climate change and this may be a driver of future business combinations.

We have solidified our commitment to lower carbon proteins by taking full ownership of vegetarian and vegan protein producer, Dalco Foods.

Hilton Food Group plc, Annual Report and Financial Statements 2021, p48

Explains the sustainability considerations for the business combination.

There were a number of business combinations in the year. They explain the rationale behind the largest, and summarise the others.

Explaining how and when control was obtained

The majority of the business combinations in our sample were effected by the acquirer paying cash either from existing liquid resources, through raising funds via an equity issue or from drawdowns of loans. Some involved the exchange of shares in the acquirer for shares in the acquiree with others using a combination of both. Control4 usually passed at the time of the transfer of the consideration.

- Some business combinations may be subject to regulatory or other approvals. Where judgement is required to determine when control is obtained, we expect the acquirer to disclose the factors considered in making this assessment, and to clarify the date from which the acquiree is consolidated.

On 2 June 2021, the Company acquired 100% of the issued share capital and voting rights of Bristol Water Holdings UK Limited ... The acquisition of the Bristol Water Group was reviewed by the Competition and Markets Authority and given full clearance on 7 March

- The Bristol Water Group is consolidated in Pennon's accounts with effect from the completion of acquisition at midnight on 2 June 2021.

By working collaboratively with both the Competitions and Markets Authority (CMA) and Ofwat, we were able to conclude the merger review in Phase 1, avoiding a potential lengthy Phase 2 referral. This was a great outcome for Pennon, for customers and for the greater good of the sector.

Pennon Group plc, Annual Report and Accounts 2022, pp247 & 11

Regulatory approval was not obtained until 7 March 2022, however, the acquiree was consolidated from the date of control which was 2 June 2021.

When such a transaction is subject to review and clearance from a regulator, judgement may be required to determine at which point control transfers.

Impacts on liquidity and funding

Where the business combination resulted in the acquirer assuming the debt of the acquiree, we often saw that this debt was subsequently refinanced or repaid post acquisition.

- Where there have been significant cash flow movements and changes to the liquidity profile and risk, we would expect companies to explain these changes and the impacts they have had on the financial statements5. For further discussion on how such cash flows should be classified, please see section 8.

Details changes to the group's existing borrowing facilities made at the time of the business combination.

Explains the post combination actions taken in relation to the debt assumed on acquisition.

Provides an overall summary of the impact of the combination and refinancing.

Effective at the time of the Refinitiv acquisition in January 2021, the Group increased its committed revolving credit facilities to £2.5 billion (2020: £1.2 billion). This was achieved by increasing its £600 million facility maturing in December 2024 to £1,425 million and replacing the £600 million facility due in November 2022 with a £1,075 million facility maturing in December

- During the period, the first of two one-year extension options on the £1,075 million facility were taken up, extending the facility's maturity out to December 2026.

On completion of the Refinitiv acquisition the Group refinanced Refinitiv's debt by borrowing $9.936 billion and €3.629 billion under the bridge facility, term loans and multi-currency revolving credit facilities. The bridge facility and multi-currency revolving credit facilities were repaid on the issuance of nine senior unsecured bonds under a newly established Global Medium Term Note Programme and using proceeds from the sale of the Borsa Italiana Group. The bridge facility was cancelled upon repayment. Partial repayments have been made to the US Dollar and Euro term loans using cash generated by the Group's operations.

With £2.5 billion of fully available funding headroom and strong cash generation, the Group continues to be well positioned to fund further growth opportunities and meet its stated deleveraging targets.

London Stock Exchange Group plc, Annual Report 2021, p47

Alternative performance measures

All of the companies in our sample already used APMs to help explain the performance of the group6. However, as a result of the business combinations, nine of our sample changed the definition of their APMs to adjust for amounts related to the business combination. Three of these companies also introduced new APMs.

Where changes are made to APMs, the ESMA guidelines on APMs state that companies should: i.) explain the changes; ii.) explain the reasons why these changes result in reliable and more relevant information on the financial performance; and iii.) provide restated comparative figures7.

- A Whilst all of the companies which had changed the definition explained the changes, two of them did not explicitly provide reasons for why the changes resulted in more reliable and relevant information.

16 companies adjusted for the effects of the business combination when reporting their adjusted measures. Some of the common adjustments we saw were to exclude the amortisation of acquisition related intangibles and transaction costs from the measure of adjusted profit.

Pro-forma information

As well as presenting APMs, 11 companies also presented pro-forma information for the business combination as if the acquired business had always been part of the group. The use of such information can help users understand the operations of the acquired entity, but such information also has its limitations as the results were generated under a previous ownership and may not be comparable to future results.

- The better examples we saw explained the reasons for presenting pro-forma information and provided reconciliations of the pro-forma amounts to the results presented on an IFRS basis.

Due to the significance of the Coca-Cola Amatil (CCL) acquisition during the year, revenue, comparable operating profit and ROIC have been presented on a pro forma basis to provide investors with relevant information about the combined Group.

Refer to Business and Financial Review on pages 50-63 for a reconciliation of our IFRS reported results to the pro forma financial information and non-GAAP performance measures.

Coca-Cola Europacific Partners plc, 2021 Integrated Report and Form 20-F, p2

Highlights what and why pro-forma information has been presented.

Clearly signposts where reconciliations from the results on an IFRS basis to the pro-forma information (and APMs) can be found.

Other observations on disclosures within the front end of annual reports

Principal risks and uncertainties

Some companies updated their principal risks and uncertainties following the business combination. This was particularly prevalent in companies where software and technology had been identified as a principal risk, as the business combination required the integration of the different systems.

Audit committee reporting

The UK Corporate Governance Code states that the annual report should describe the significant issues that the audit committee considered relating to the financial statements, and how these issues were addressed.

Of the 18 companies that applied the UK Corporate Governance Code, 16 disclosed that the accounting for the business combination was a significant issue that the audit committee had considered in the period.

Remuneration targets

In seven companies, we saw the remuneration committee make changes to the targets included in incentive schemes as a result of the business combination. The reason given for the changes was to ensure that the targets were not disproportionally affected by the business combination.

Environmental and social reporting

We saw a mixed approach as to how companies integrated the newly acquired businesses into their environmental and social reporting. Where companies had access to the data they integrated the acquiree into their existing reporting.

However, where the data was not available, for example if the acquiree was in a jurisdiction that had differing reporting requirements, the acquirer typically explained its approach to ensure that the acquiree would be integrated into the reporting in the future.

Section 172 report

All large companies must include a statement explaining how directors have considered stakeholder needs when performing their duty under section 172 of the Act8. As part of achieving this, it could include information on how directors have considered those needs when making significant decisions which impact the company's strategy.

Of the 18 companies that had to make such a statement, 11 identified the decision to undertake the business combination as a significant decision of the board in their section 172 statement.

For further information on section 172 reporting please see the FRC Lab's review on the Reporting on stakeholders, decisions and Section 172.

5. Fair value

Fair value adjustments

IFRS 3 requires the acquirer to measure the identifiable assets acquired and liabilities assumed at their acquisition date fair values9. There are some specific exceptions to the general recognition and measurement criteria which we discuss in more detail on page 19.

Most companies made clear that they had recorded assets and liabilities acquired at their acquisition date fair values.

Better examples provided narrative explanations with further detail of specific fair value adjustments.

Characteristics of better disclosure included:

- Quantification of fair values of specific significant assets and/or liabilities

- Explanation of the valuation techniques applied

- Details of key assumptions used in the valuation

- Disclosure of whether qualified or third-party experts were used in determining the valuation e.g. RICS registered valuers

The fair value of inventory, which includes raw materials, work in progress and finished goods related to the launched products was estimated at $6,769m, an uplift of $5,635m on the carrying value prior to the acquisition. The fair value adjustment relates only to work in progress and finished goods and was calculated as the estimated selling price less costs to complete and sell the inventory, associated margins on these activities and holding costs. The fair value adjustment is expected to amortise over approximately the first 18 months post-acquisition, in line with revenues.

AstraZeneca PLC, Annual Report and Form 20-F Information 2021, p179

Explains the gross fair value of the asset and the uplift recognised.

Details the method used to calculate the fair value.

In some instances, companies explained the expected period of amortisation of fair value adjustments which provided useful information of the future impact on the income statement and profit based key performance indicators.

Outlines the expected amortisation period of the fair value adjustment.

IFRS 3 requires the acquirer to measure the identifiable assets acquired and liabilities assumed at their acquisition date fair values9. There are some specific exceptions to the general recognition and measurement criteria which we discuss in more detail on page 19.

Most companies made clear that they had recorded assets and liabilities acquired at their acquisition date fair values.

Better examples provided narrative explanations with further detail of specific fair value adjustments.

Characteristics of better disclosure included:

- Quantification of fair values of specific significant assets and/or liabilities

- Explanation of the valuation techniques applied

- Details of key assumptions used in the valuation

- Disclosure of whether qualified or third-party experts were used in determining the valuation e.g. RICS registered valuers

The fair value of inventory, which includes raw materials, work in progress and finished goods related to the launched products was estimated at $6,769m, an uplift of $5,635m on the carrying value prior to the acquisition. The fair value adjustment relates only to work in progress and finished goods and was calculated as the estimated selling price less costs to complete and sell the inventory, associated margins on these activities and holding costs. The fair value adjustment is expected to amortise over approximately the first 18 months post-acquisition, in line with revenues.

AstraZeneca PLC, Annual Report and Form 20-F Information 2021, p179

Explains the gross fair value of the asset and the uplift recognised. Details the method used to calculate the fair value. Outlines the expected amortisation period of the fair value adjustment.

In some instances, companies explained the expected period of amortisation of fair value adjustments which provided useful information of the future impact on the income statement and profit based key performance indicators.

Fair value of intangible assets acquired

One of the major areas where fair value adjustments were recorded related to the recognition, separately from goodwill, of identifiable intangible assets acquired.

We have previously challenged companies in our routine reviews where it was unclear why few or no intangibles, other than goodwill, had been recognised in accounting for the business combination. We were pleased to see that 90% of the companies we looked at recognised separately identifiable intangible assets as part of the business combination.

Where intangible assets were recognised, most companies explained and quantified the main sub-categories of intangibles such as brand names or customer contracts/relationships. Some companies provided this detail within the business combinations disclosures while others cross referred to the intangible asset note.

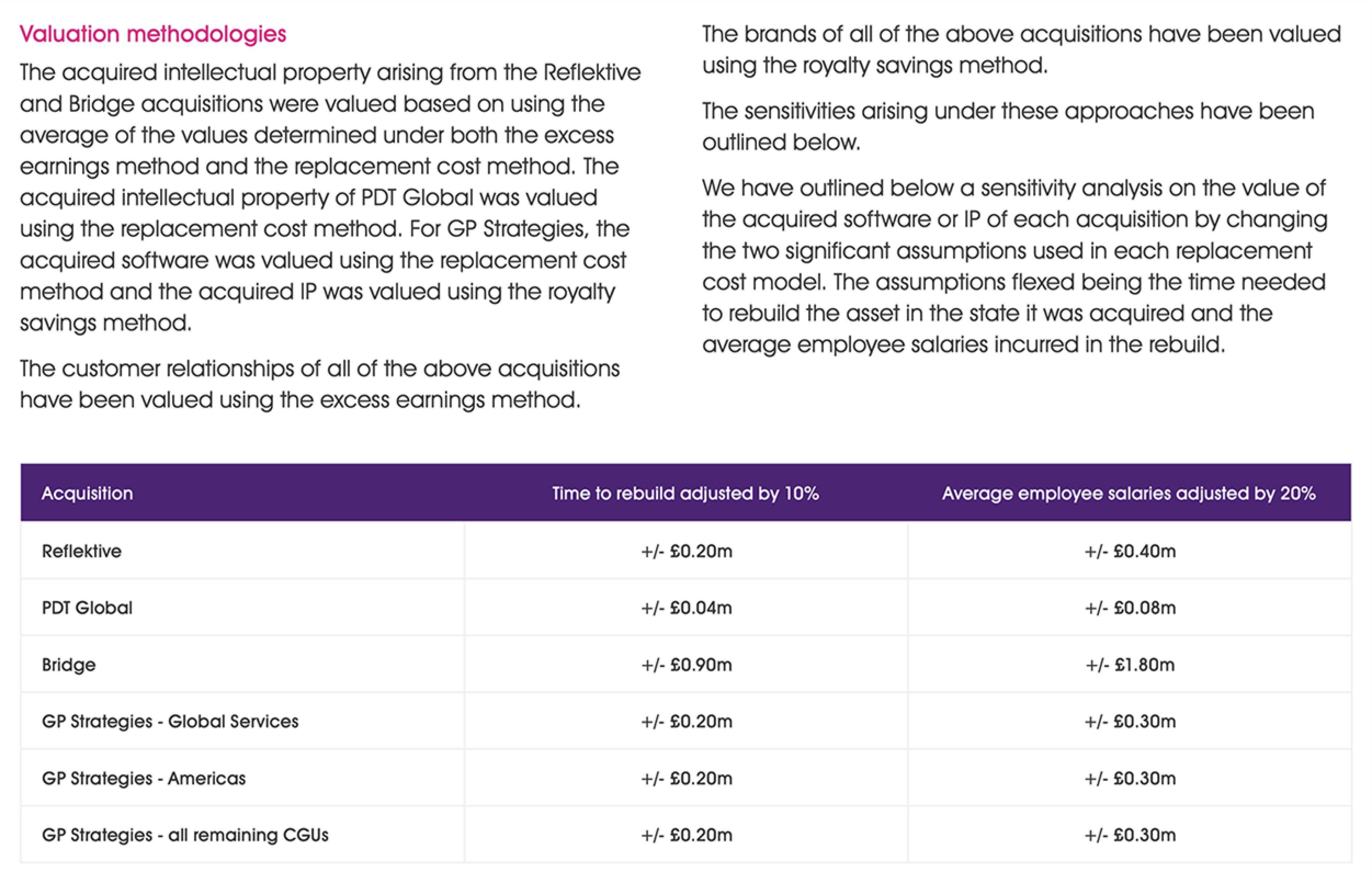

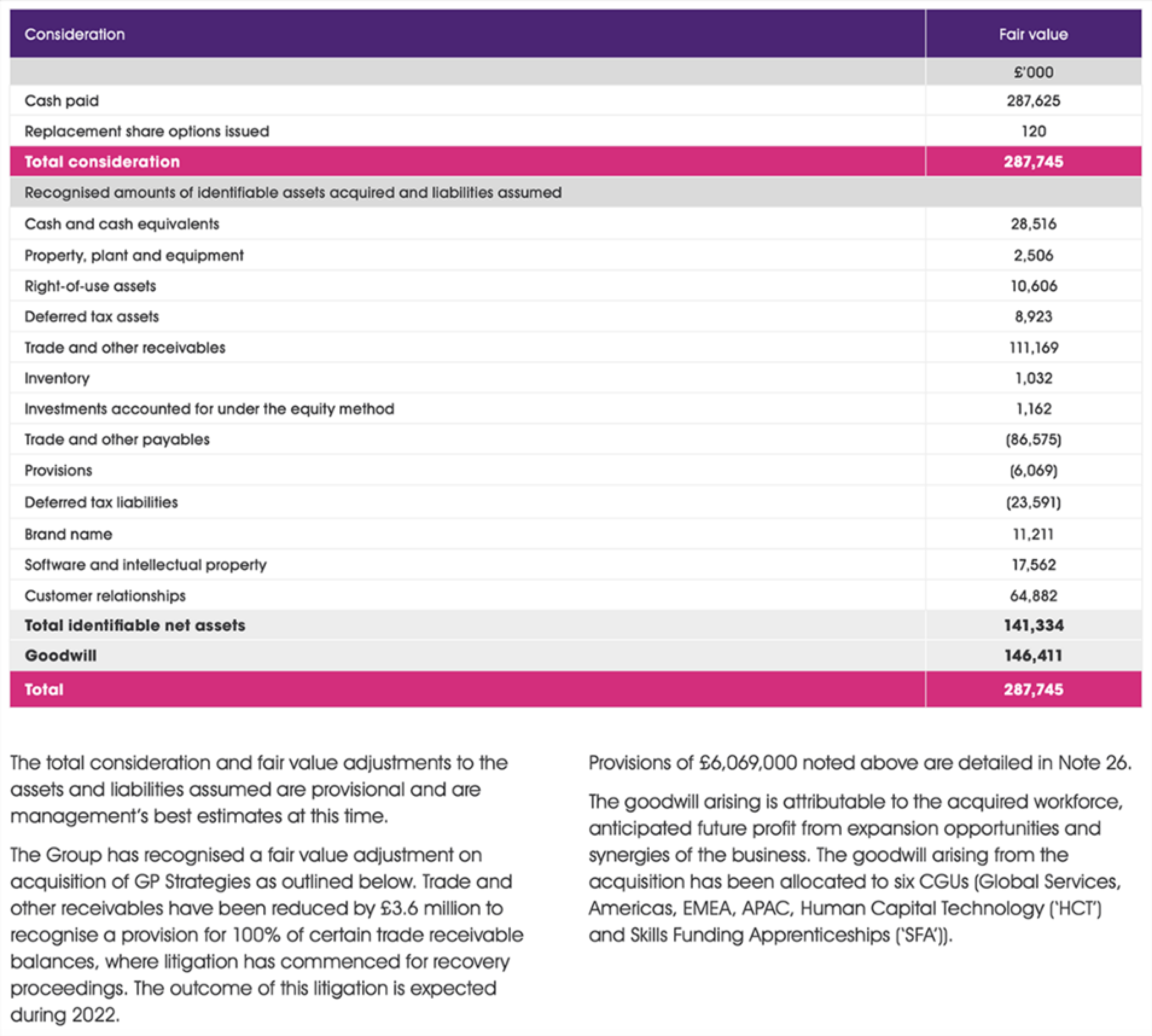

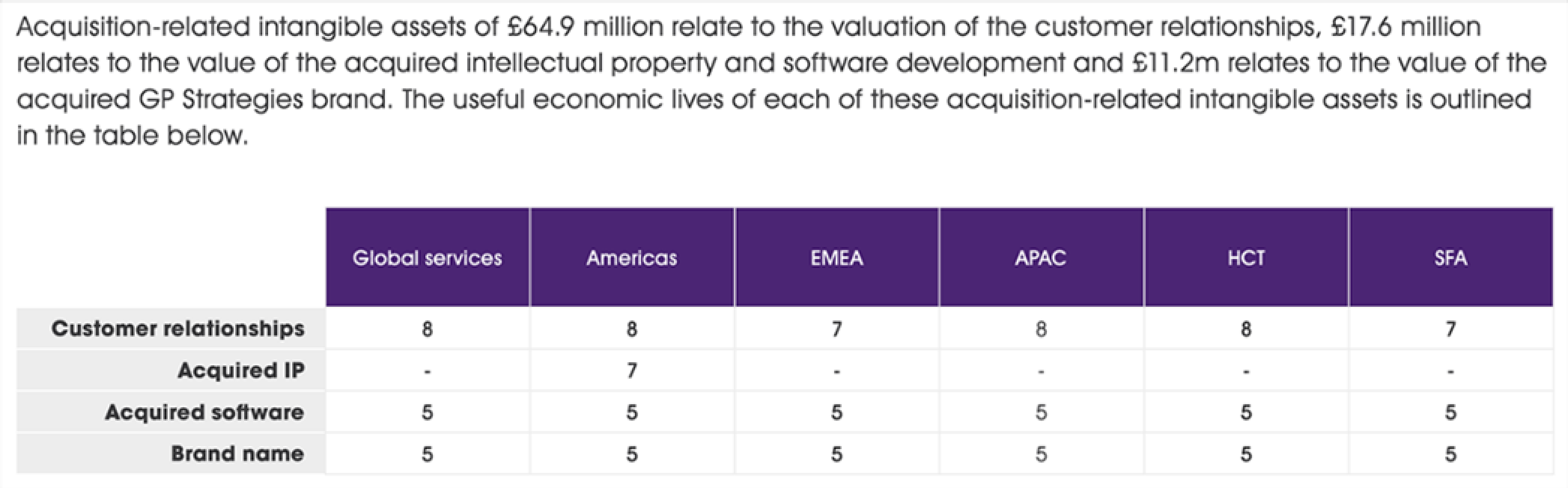

In addition to quantifying the assets better examples also explained the valuation techniques applied to each individually material category of acquired intangible assets recognised as part of the business combination. In addition to quantifying the assets better examples also provided details of the key assumptions used in the valuation.

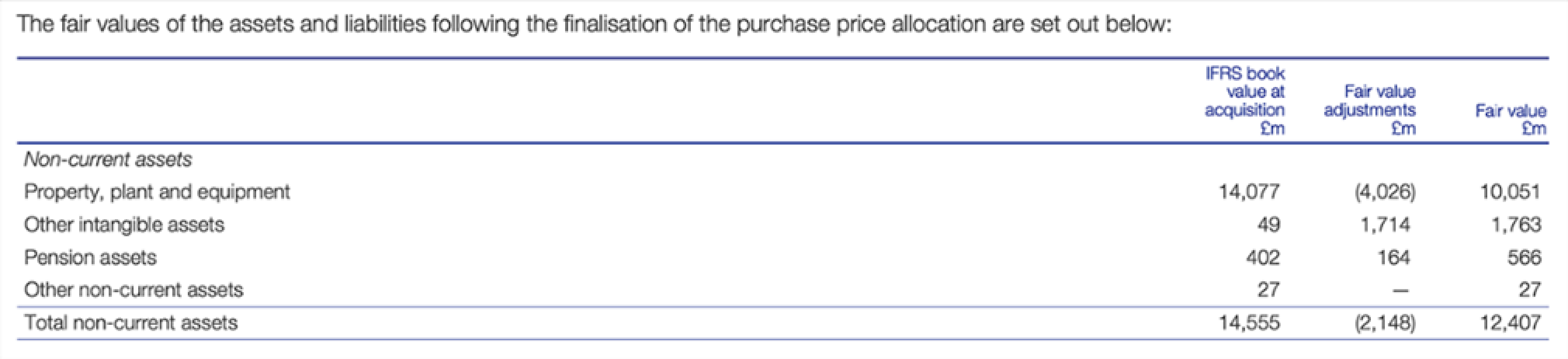

Three-column presentation

Some companies in our sample used a three-column presentation to disclose the assets and liabilities acquired, though this is not required by IFRS 3.

These showed:

- the previous book value from the acquiree accounts;

- fair value adjustments; and

- the total fair value recognised.

This information was particularly helpful where there were material fair value adjustments, to allow users to understand the specific line items with significant adjustments. Some companies supplemented tabular disclosure with narrative explanations.

The fair values of the assets and liabilities following the finalisation of the purchase price allocation are set out below:

National Grid plc, Annual Report and Accounts 2021/22, p233

Shows clearly the previous IFRS book values applied by the acquiree and fair value adjustments recognised.

Measurement period

The measurement period is the period after the acquisition date during which the acquirer may adjust the provisional amounts recognised for a business combination10.

The measurement period ends as soon as the acquirer receives the information it was seeking about facts and circumstances that existed as of the acquisition date or learns that more information is not obtainable. However, the measurement period shall not exceed one year from the acquisition date11.

Ten of the companies we reviewed disclosed that the accounting for the business combination was incomplete at the period end.

Only half of these companies explained the areas where the accounting remained incomplete and the reasons why this was the case as required by paragraph B67(a) of IFRS 3.

The better examples also explained the impact that subsequent adjustments may have including the potential adjustment to goodwill.

One company had an outstanding arbitration that would not be resolved within one year of the acquisition date. The company explained this and quantified the estimate it had made of the expected resolution noting that any further adjustment for the outcome would be recognised in the income statement.

In several instances, companies had reported provisional amounts in the prior period or interim financial statements.

The better examples reconciled the previously reported values to the finalised amounts to allow users to understand the changes made. Some companies also helpfully provided a qualitative explanation for the items adjusted.

Where there were material measurement period adjustments to acquisitions made in the prior period, the provisional amounts that were initially recognised at the acquisition date were retrospectively adjusted in accordance with the requirements of the standard12.

At 29 January 2021, the purchase price allocation (PPA) was prepared on a provisional basis in accordance with IFRS 3. During the measurement period, the Group finalised:

- the valuation of the intangible assets recognised on acquisition

- the valuation of certain right-of-use property assets

- the measurement of deferred tax liabilities assumed on acquisition

Adjustments were made to the provisional PPA, which was disclosed in the Group's condensed consolidated financial statements for the six months ended 30 June 2021, resulting in:

- decrease in the fair value of customer contracts and relationships (intangible assets) of US$100 million (£73 million)

- decrease in right-of-use property assets of US$109 million (£80 million)

- decrease in net assets of US$14 million (£10 million)

- decrease in the net deferred tax liabilities of US$188 million (£138 million)

- decrease in the non-controlling interest of US$87 million (£63 million)

- resulting decrease in goodwill of US$52 million (£38 million)

London Stock Exchange Group plc, Annual Report 2021, p141

Explains which assets and liabilities were adjusted during the measurement period. Quantifies the adjustments to specific balances compared to the provisional amounts included in the interim financial statements, including the impact on goodwill.

Exceptions to the recognition/measurement principles

There are several areas where IFRS 3 requires exceptions to the general fair value measurement principle. Two of the most common examples seen in our sample related to leases and employee benefit liabilities/assets arising from defined benefit pension schemes.

Employee benefits

Companies are required to follow the measurement criteria in IAS 19, 'Employee Benefits', to value employee benefit liabilities/assets13. The basis of measurement under IAS 19 is often significantly different to fair value with, for example, defined benefit obligations measured using an actuarial valuation method, the projected unit credit method, and any surplus potentially subject to an asset ceiling.

Six companies acquired businesses that had existing defined benefit pension schemes.

The better examples explained clearly how the liabilities and assets acquired had been valued and the terms of the specific schemes linking into the disclosure requirements in IAS 19.

Where companies acquire material employee benefit liabilities/assets we expect disclosures to explain the nature of the acquired schemes and detail how they have been valued.

The value of obligations and plan assets acquired with Bristol Water were measured in accordance with IAS 19 at the date of acquisition. The Group believes that it has an unconditional right to a refund of surplus and that the gross pension surplus can be recognised. This benefit is only available as a refund as no additional defined pension benefits are being earned. Under UK tax legislation a tax deduction of 35% is applied to a refund from a UK pension scheme, before it is passed to the employer. This tax deduction has been applied to restrict the value of the surplus recognised for this scheme.

Pennon Group plc, Annual Report and Accounts 2022, p232

Details the basis upon which a plan asset has been recognised.

Leases

Where the acquired business is a lessee, IFRS 3 requires the acquirer to measure the lease liability as the present value of the remaining lease payments as if the acquired lease was a new lease at the acquisition date. The right-of-use ('ROU') asset is measured at the same amount, adjusted to reflect terms which are either favourable or unfavourable compared to market terms14.

There were 17 companies which had acquired businesses with leased assets. Few companies explained how leases were valued within their business combination disclosures or accounting policies. Where there was a difference between the value of the ROU asset and lease liability generally there was little, or no, detail disclosed to explain the reasons for this.

Two companies in our sample had material unexplained differences between the ROU assets and lease liabilities.

From our routine casework we have identified an instance of a company adjusting the ROU asset to reflect company specific circumstances rather than differences between the lease terms and market terms. The company agreed to restate the comparative amounts in the following year's annual report and accounts.

6. Consideration

Overview

The acquirer shall disclose the following for each business combination that occurs during the reporting period:

- the acquisition-date fair value of the total consideration transferred and the acquisition-date fair value of each major class of consideration, such as:

- cash;

- other tangible or intangible assets, including a business or subsidiary of the acquirer;

- liabilities incurred, for example, a liability for contingent consideration; and

- equity interests of the acquirer, including the number of instruments or interests issued or issuable and the method of measuring the fair value of those instruments or interests15.

All of the companies we reviewed disclosed the fair value of the major classes of consideration transferred. Better examples also explained how the fair value of each major class was determined.

Equity interests

Six of the companies issued equity instruments as part of the consideration for the business combination. All these companies disclosed the number and total fair value of the instruments issued.

One company did not disclose the method of measuring the fair value of equity instruments.

Where companies were listed entities, they explained that the fair value was based on the market price of shares using either the closing price the day before the acquisition date or the opening share price on the acquisition date.

Better examples also disclosed the impact of share price movements between the date the acquisition terms were announced and the date the acquisition completed. This assists users in understanding the amounts disclosed compared to previous amounts included in regulatory announcements.

The consideration transferred consisted of 62.8 million ordinary shares issued and share-based payment replacement awards issued. The fair value of the ordinary shares issued was based on the Just Eat Takeaway.com N.V. 14 June 2021 closing share price of €73.89 per share. Between the date of the announcement (10 June 2020) and the acquisition date, our share price decreased from €98.60 to €73.89, resulting in a lower consideration transferred at acquisition date.

Just Eat Takeaway.com N.V., Annual Report 2021, p203

Discloses the number of shares issued and the method of determining the fair value of the shares. Explains the movement in the share price between the date the terms of the acquisition were announced and the acquisition date, as well as the impact this had on total consideration.

Share-based payments

Share based payments are one of the exceptions to the general measurement principle in IFRS 3. Instead of being measured at fair value these are measured in accordance with IFRS 2, 'Share-based Payment'.

If the acquirer replaces existing awards of the acquiree then all, or a portion, of the cost of these may, depending upon the circumstances and the terms of the arrangement, be required to be treated as either consideration for the business combination or as remuneration cost. Appendix B16 of IFRS 3 provides detailed information in respect of these requirements and it can be a complex area of application.

Four of the companies in our sample acquired businesses with existing share-based payment arrangements and the replacement of these formed part of the consideration. This suggested that the companies were obliged to replace the awards.

It is helpful when companies explain where share-based payment schemes are replaced, and the resulting accounting applied.

Better examples clearly explained the split between the portion of share-based payment awards included within the consideration for the business combination and the portion included as post combination remuneration. They also quantified the value of the two portions.

Contingent consideration

Contingent consideration ... an obligation of the acquirer to transfer additional assets or equity interests to the former owners of an acquiree as part of the exchange for control of the acquiree if specified future events occur or conditions are met17.

The acquirer shall disclose the following for each business combination that occurs during the reporting period:

For contingent consideration arrangements and indemnification assets:

- the amount recognised as of the acquisition date;

- a description of the arrangement and the basis for determining the amount of the payment; and

- an estimate of the range of outcomes (undiscounted) or, if a range cannot be estimated, that fact and the reasons why a range cannot be estimated. If the maximum amount of the payment is unlimited, the acquirer shall disclose that fact18.

We have previously questioned the accounting for contingent consideration with several companies through our routine reviews.

In particular, we have challenged where there are indications that the contingent payments are linked to continuing employment of personnel and, therefore, should be excluded from the consideration for the business combination.

Six of the companies in our sample disclosed contingent consideration arrangements. All of the companies quantified the amount of contingent consideration recognised at the acquisition date. While most also provided disclosures to meet the requirements of the standard, the quality of these varied with several being boilerplate in nature.

One company explained that future payments were contingent on the performance of the acquired business with no further detail disclosed.

Better examples provided specific details of the target measures on which the contingency was based, without quantifying the targets themselves, and the time period over which they would be assessed. They also made clear whether the contingent consideration was linked to ongoing employment.

Companies should also consider whether contingent consideration represents a major source of estimation uncertainty requiring disclosure under paragraph 125 of IAS 1, 'Presentation of Financial Statements'. One company in our sample concluded it did and provided the relevant disclosures.

Some companies also disclosed details of the discount rates applied to long term contingent consideration where this was considered to be a key assumption in the valuation.

Except for measurement period adjustments (see page 17) and contingent consideration classified as equity, which is not remeasured, post acquisition contingent consideration is recognised at fair value with movements recognised through the income statement19. IFRS 3 has the additional ongoing disclosure requirements:

For each reporting period after the acquisition date until the entity collects, sells or otherwise loses the right to a contingent consideration asset, or until the entity settles a contingent consideration liability or the liability is cancelled or expires:

- any changes in the recognised amounts, including any differences arising upon settlement;

- any changes in the range of outcomes (undiscounted) and the reasons for those changes; and

- the valuation techniques and key model inputs used to measure contingent consideration20.

The level of detail provided by companies in these disclosures was mixed. Better examples split out details for individually material balances and disclosed the line items within the income statement where movements were recognised.

We observed some companies using the terms 'deferred consideration' and 'contingent consideration' interchangeably, for the same amounts, within the annual report and accounts.

Given the different risks attached to consideration that is contingent on future events and conditions, compared to that which is simply deferred, we expect companies to be accurate and consistent in their use of terminology when describing amounts as contingent or deferred (or both).

IFRS 13, 'Fair Value Measurement', includes additional disclosure requirements for assets and liabilities that are measured at fair value on a recurring or non-recurring basis21, including contingent consideration after initial recognition.

All of the companies in our sample that disclosed contingent consideration arrangements classified their measurements as level 3 in the fair value hierarchy. The key additional disclosures for level 3 valuations include quantitative information about the significant unobservable inputs used in the fair value measurement and a narrative description of the sensitivity of the fair value to changes in these unobservable inputs.

Deferred contingent consideration, with an initial fair value of US$53m (£39m) is payable, based on Liquidnet's Equities revenues over a three year earn-out period to

- The initial fair value reflects the discounted value of estimated payments, measured at the time of the acquisition, and reflects management's estimate of future performance at that time. Remeasurement of deferred contingent consideration reflecting changes after the acquisition date will be recorded in profit or loss. Management's projected estimate was based on Liquidnet's 2019 and 2020 Equity revenues. The fair value is based on unobservable inputs and the projected outcome is classified as a level 3 fair value estimate under the IFRS fair value hierarchy. The maximum payment in respect of deferred contingent consideration is capped at US$125m (£92m at year end rates).

TP ICAP Group plc, Annual Report & Accounts 2021, p213

Other disclosures distinguished between ‘deferred contingent consideration' and 'deferred non-contingent consideration'. Provides details of the target measures on which the contingency is based and the time period over which it will be assessed. Explains how management have calculated their estimate and the inputs this was based upon. Confirms the classification within the fair value hierarchy. Quantifies the potential maximum payment.

Business combinations achieved in stages

Where an acquirer obtains control of an acquiree in which it already held an equity interest immediately before the acquisition date, then this is a business combination achieved in stages which is sometimes also referred to as a step acquisition.

In a business combination achieved in stages, the acquirer shall remeasure its previously held equity interest in the acquiree at its acquisition date fair value and recognise the resulting gain or loss, if any, in profit or loss or other comprehensive income, as appropriate22.

The acquirer shall disclose the following for each business combination that occurs during the reporting period:

In a business combination achieved in stages:

- the acquisition date fair value of the equity interest in the acquiree held by the acquirer immediately before the acquisition date; and

- the amount of any gain or loss recognised as a result of remeasuring to fair value the equity interest in the acquiree held by the acquirer before the business combination ... and the line item in the statement of comprehensive income in which that gain or loss is recognised23.

Two companies in our sample had an existing equity interest in the acquirees over which they obtained control. Both fair valued the existing equity interest as part of calculating the consideration for the business combination in line with IFRS 3.

One company included the gain recognised in profit and loss as an 'exceptional item', explaining why it considered that it was appropriate to exclude the amount from its APMs and clearly disclosing where the gain was presented within the income statement.

One company did not disclose the line item in the statement of comprehensive income in which the gain or loss was recognised.

7. Other IFRS 3 disclosures

Bargain purchases

Where the fair value of assets acquired exceeds the consideration a gain on bargain purchase is recognised in the statement of comprehensive income.

Entities are required to disclose the amount of any gain, the line item in the statement of comprehensive income in which it is recognised and a description of the reasons that resulted in the gain arising24.

IAS 1 explains that entities should present separately items of a dissimilar nature or function and should include additional line items in the income statement when this is necessary to explain the elements of financial performance25.

Two companies in our sample had a gain on bargain purchase.

Where a gain on bargain purchase is significant, we would generally expect this to be shown separately on the face of the income statement, due to the requirements within IAS 1 referred to above.

Companies should disclose specific reasons for the gain on bargain purchase arising.

Qualitative description of the factors forming goodwill

If goodwill is recognised in a business combination companies are required to explain the factors that make it up26.

The quality of this disclosure varied in the annual reports that we reviewed.

Several companies provided generic or boilerplate disclosure.

Better examples provided detailed descriptions, specific to the business acquired, allowing users to understand the factors that support the material balances recognised for goodwill. For example, this included clear linkage to the strategic reasons for the business combination.

Goodwill amounting to $8,287m was recognised on acquisition and is underpinned by a number of elements, which individually could not be quantified. Most significant amongst these is the premium attributable to a pre-existing, well positioned business in the innovation intensive, high growth rare diseases market with a highly skilled workforce and established reputation. Other important elements include the potential unidentified products that future research and development may yield and the core technological capabilities and knowledge base of the company.

AstraZeneca PLC, Annual Report and Form 20-F Information 2021, p179

Clearly explains the different elements making up goodwill

Acquisition-related costs

The disclosure of separately recognised transactions required by B64(I) shall include the amount of acquisition-related costs and, separately, the amount of those costs recognised as an expense and the line item or items in the statement of comprehensive income in which those expenses are recognised. The amount of any issue costs not recognised as an expense and how they were recognised shall also be disclosed27.

Most companies provided good disclosure of the acquisition-related costs, correctly excluding them from the acquisition accounting and explaining where they were presented in either the statement of comprehensive income or, where appropriate, in equity.

Three companies did not provide any disclosures of acquisition-related costs.

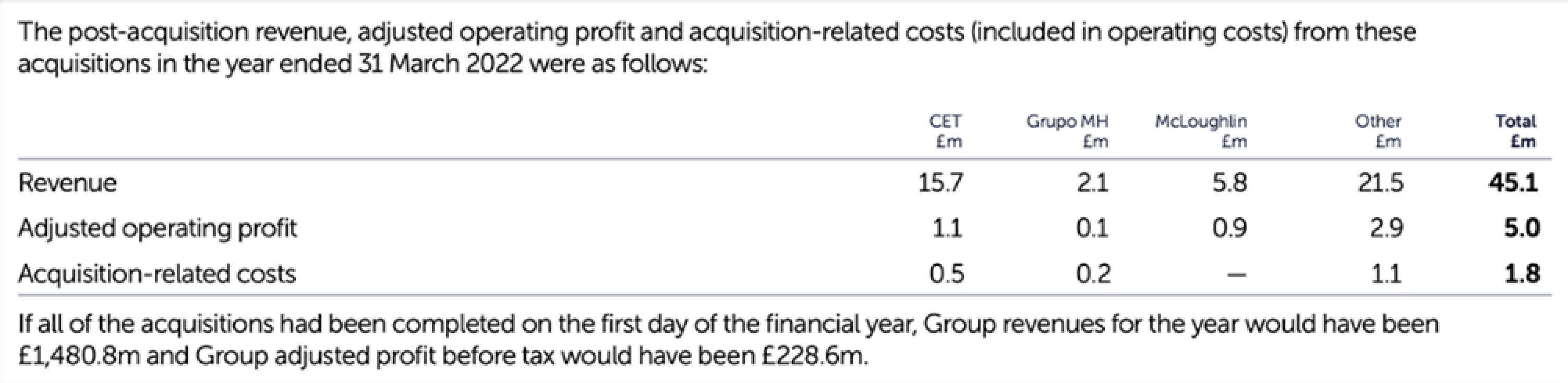

Where companies have made multiple acquisitions within the period separate disclosure is required for each material acquisition; immaterial acquisitions may be aggregated. We observed examples of good disclosure clearly splitting the acquisition-related costs incurred between each business combination in the period. An example of this is shown on page 47.

For large acquisitions, the period of time to secure all relevant approvals before final completion can be significant with acquisition-related costs incurred over multiple periods. We saw several good examples where companies provided clear disclosure to explain the costs incurred and the period in which they were recognised.

Total acquisition-related costs of £110 million were recognised within Other operating income and costs, within exceptional items and remeasurements in the consolidated income statement, of which £15 million was recognised in the year ended 31 March 2021 and £95 million in the year ended 31 March 2022.

National Grid plc, Annual Report and Accounts 2021/22, p234

Shows split of acquisition-related costs between the current and prior period

Revenue and profit/loss disclosures

The acquirer shall disclose the following for each business combination that occurs during the reporting period:

- the amounts of revenue and profit or loss of the acquiree since the acquisition date included in the consolidated statement of comprehensive income for the reporting period; and

- the revenue and profit or loss of the combined entity for the current reporting period as though the acquisition date for all business combinations that occurred during the year had been as of the beginning of the annual reporting period.

- If disclosure of any of the information required by this subparagraph is impracticable, the acquirer shall disclose that fact and explain why the disclosure is impracticable28.

Most companies in our sample provided the disclosures of revenue and profit or loss for both the acquiree since the acquisition date and of the whole combined entity as if all acquisitions took place as of the beginning of the period.

For the latter requirement, we observed that some companies disclosed the combined amounts for the whole expanded group, as explicitly required, while others met this requirement by quantifying what the increase would have been if all acquisitions took place as of the beginning of the period.

Disclosure is required for each material acquisition; non-material acquisitions may be aggregated. We observed examples of good disclosure clearly splitting the revenue and profit or loss incurred between each business combination in the period. An example of this is shown on page 47.

One company did not disclose any of the revenue and profit or loss amounts required by IFRS 3 and did not provide any explanation as to why it was impracticable to comply with these disclosure requirements.

We noted that two of the companies in our sample disclosed a non-IFRS profit/loss measure in these disclosures without providing an equivalent IFRS measure. Although the profit measure to be disclosed is not specified in IFRS 3, we would expect an IFRS measure to be included even if additional non-IFRS measures are also presented.

One company did not present amounts as if all acquisitions took place as of the beginning of the period. Instead, they provided detailed disclosure setting out the specific reasons why this was impracticable given the nature of the acquisition.

Receivables

IFRS 3 has specific disclosure requirements for receivables which are acquired as part of a business combination.

For acquired receivables:

- the fair value of the receivables;

- the gross contractual amounts receivable; and

- the best estimate at the acquisition date of the contractual cash flows not expected to be collected.

The disclosures shall be provided by major class of receivable, such as loans, direct finance leases and any other class of receivables29.

The level of detail disclosed by companies in our sample varied. The only major class disclosed for most companies was trade receivables.

Only half of the companies provided a clear disclosure of the gross contractual amounts receivable and their best estimate of cash flows not expected to be collected.

Where the fair value of receivables is equal to contractual amounts companies should make this clear in the disclosure.

The fair value of trade and other receivables acquired as part of the business combination amounted to £22.3 million with a gross contractual amount of £38.9 million. At the acquisition date the Group's best estimate of the contractual cash flows expected not to be collected amounted to £16.6 million.

Pennon Group plc, Annual Report and Accounts 2022, p247

Clearly discloses the fair value of receivables, gross contractual amounts and the best estimate of contractual cash flows not expected to be collected.

Receivables

IFRS 3 has specific disclosure requirements for receivables which are acquired as part of a business combination.

Where the fair value of receivables is equal to contractual amounts companies should make this clear in the disclosure.

For acquired receivables:

- the fair value of the receivables;

- the gross contractual amounts receivable; and

- the best estimate at the acquisition date of the contractual cash flows not expected to be collected.

The disclosures shall be provided by major class of receivable, such as loans, direct finance leases and any other class of receivables29.

The level of detail disclosed by companies in our sample varied. The only major class disclosed for most companies was trade receivables.

Only half of the companies provided a clear disclosure of the gross contractual amounts receivable and their best estimate of cash flows not expected to be collected.

The fair value of trade and other receivables acquired as part of the business combination amounted to £22.3 million with a gross contractual amount of £38.9 million. At the acquisition date the Group's best estimate of the contractual cash flows expected not to be collected amounted to £16.6 million.

Pennon Group plc, Annual Report and Accounts 2022, p247

Clearly discloses the fair value of receivables, gross contractual amounts and the best estimate of contractual cash flows not expected to be collected.

8. Statement of cash flows

Payments to acquire control

All of the companies in our sample presented cash flows arising from obtaining control of businesses as a separate cash flow within investing activities in the cash flow statement, net of cash acquired, as required by IAS 730.

We observed some good examples of companies with multiple business combinations presenting the net cash flow for each material acquisition separately in the statement of cash flows.

Several companies had consideration which was mostly, or wholly, non-cash in nature, such as the issue of equity interests. Better examples provided clear disclosure to explain the reasons for the cash inflow, resulting from cash acquired in the acquiree company.

In some instances, the value of cash and cash equivalents acquired as part of the business combination was so significant that companies disclosed this amount, and the total cash consideration paid, gross on the face of the cashflow statement to provide context for users.

| £m | |

|---|---|

| Cash acquired on acquisition of subsidiaries (Refinitiv) | 925 |

| Acquisition of subsidiaries, net of cash acquired (NFI) | (151) |

| Acquisition of subsidiaries, net of cash acquired (Quorate) | (12) |

London Stock Exchange Group plc, Annual Report 2021, p131

Presents the cash flows for individually material business combinations separately in the statement of cash flows.

Shows clearly the cash inflow for cash acquired on one transaction (Refinitiv) where the consideration was non-cash.

Other cash flows

Some cash flows associated with the business combination are excluded from the net investing cash flow from obtaining control of businesses.

Cash flows for acquisition-related costs should be recognised within operating cash flows within consolidated accounts as these do not give rise to an asset. IFRS 3 requires them to be expensed in the statement of comprehensive income.

Three companies in our sample included acquisition-related costs within investing cash flows.

Where contingent payments are linked to continuing employment, and therefore excluded from the consideration for the business combination, the associated expense will be recognised within the statement of comprehensive income. Consequently, the cash flows for these payments should also be recognised within operating cash flows. We have challenged companies in routine reviews where this has not been the case.

Borrowings of the acquiree

Eight of the companies in our sample repaid the debt of the business they acquired either at the point of acquisition or within the period following the business combination. As the settlement of these liabilities is not an amount paid to the previous owners of the acquiree it is excluded from the consideration transferred in the acquisition accounting.

For all of the companies in our sample the liability for the debt was appropriately included within the assets and liabilities acquired with the repayment excluded from the consideration.

Given its nature we would generally expect this cash flow to be presented as financing in the statement of cash flows, although there may be certain scenarios where investing is appropriate.

Better examples presented the repayment of borrowings as a separate line within financing activities in the statement of cash flows and disclosed additional details of the repayment within the notes to the financial statements to explain that this was not part of the consideration paid for the business.

In addition to the cash purchase consideration paid of £16.0m above, the Group immediately settled £14.0m of Cygnia’s borrowings comprising an interest-bearing loan and amounts due to a debt factoring company of £11.8m and £2.2m respectively...

Wincanton plc, Annual report and accounts 2022, p133

Explains the amounts of borrowings repaid and distinguishes these from the purchase consideration.

9. Significant judgements and estimates

Sources of estimation uncertainty

An entity shall disclose information about the assumptions it makes about the future, and other major sources of estimation uncertainty at the end of the reporting period, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year. In respect of those assets and liabilities, the notes shall include details of:

- their nature, and

- their carrying amount as at the end of the reporting period31.

12 of the companies in our sample disclosed at least one major source of estimation uncertainty (significant estimate) which was related to business combinations completed in the period. The most common uncertainties disclosed were the valuation of assets and liabilities acquired in business combinations and the fair value of intangible assets acquired.

The items disclosed involved estimation uncertainty. However, it was often not made clear the basis on which they were considered to be significant estimates. These are those estimates where there is a significant risk of a material adjustment to assets and liabilities within the next financial year. As set out on page 17, the measurement period in which the acquirer may adjust the provisional amounts recognised lasts for no more than one year from the acquisition date. It was not clear if it was the measurement period which gave rise to a significant risk of a material adjustment in the next financial year or if they were disclosed for another reason. This is consistent with the findings in our thematic review on judgements and estimates published in July 2022.

All of the companies disclosing significant estimates provided at least high-level details of the nature of the estimates and the carrying amount of the assets and liabilities to which they related.

IAS 1 provides further examples of the types of disclosure which an entity should make to helps users of financial statements understand the judgements that management makes about the future and about other sources of estimation uncertainty. These examples are:

- the nature of the assumption or other estimation uncertainty;

- the sensitivity of carrying amounts to the methods, assumptions and estimates underlying their calculation, including the reasons for the sensitivity;

- the expected resolution of an uncertainty and the range of reasonably possible outcomes within the next financial year in respect of the carrying amounts of the assets and liabilities affected; and

- an explanation of changes made to past assumptions concerning those assets and liabilities, if the uncertainty remains unresolved32.

The quality of these disclosures for significant estimates varied. Most companies provided some details of the nature of the assumptions applied. However, only five of the companies in our sample provided either sensitivities or a range of reasonably possible outcomes.

Characteristics of better disclosure included:

- Details of the specific key assumptions used by management

- Quantitative information of the sensitivities or range of reasonably possible outcomes

When presenting details of other estimates it is important to clearly distinguish them from significant judgements and estimates that are required to be disclosed under IAS 1. Better examples included these under a separate heading with a specific explanation.

Please see section 4 of our thematic review on judgements and estimates published in July 2022 for further detail on our expectations and additional examples of better practice.

Other estimates

In addition to details provided of significant estimates, some companies in our sample also provided details of other estimates. These were estimates which were not considered to be significant, for example because the measurement period had now finished and consequently material adjustment to the carrying value was not expected in the next financial year. However, they did represent an estimate which had been of particular focus for management and were considered to be relevant to users of the accounts. Although these estimates were not required to be disclosed under IAS 1, we do not discourage such additional disclosure where this provides material, relevant information.

Other areas of focus

Whilst not considered to be critical accounting judgements or key sources of estimation uncertainty, the following are areas of focus for management...

HomeServe plc, Annual Report & Accounts 2022, p154

Clearly distinguishes these from significant judgements and estimates disclosed under paragraphs 122 and 125 of IAS 1.

Significant judgements

An entity shall disclose, along with its significant accounting policies or other notes, the judgements, apart from those involving estimations ... that management has made in the process of applying the entity's accounting policies and that have the most significant effect on the amounts recognised in the financial statements33.

There were six companies in our sample that disclosed significant judgements related to business combinations. The most common judgement disclosed related to whether or not the group of assets acquired and liabilities assumed met the definition of a business in IFRS 3 and therefore should be accounted for as a business combination.

One company disclosed clearly that it had applied the optional concentration test in paragraph B7B of IFRS 3 in concluding that an acquisition was not a business combination as the definition of a business was not met. Consequently it accounted for the transaction as an asset acquisition.

Business - An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities34.

A business consists of inputs and processes applied to those inputs that have the ability to contribute to the creation of outputs35.

Better examples clearly explained the assets and liabilities to which the judgement relates, the rationale for the conclusion reached by management and reasons why this judgement was considered significant.

Intangible assets with indefinite lives acquired through business combination transactions are measured at fair value at the date of acquisition...

TCCC franchise intangible assets The Group’s bottling agreements contain performance requirements and convey the rights to distribute and sell products within specified territories. The Group’s agreements with TCCC in each territory are for terms of 10 years and each contain the right for the Group to request a 10 years renewal. The existing bottling agreements expire no earlier than 1 September

- While these agreements contain no automatic right of renewal beyond that date, the Group believes that its interdependent relationship with TCCC and the substantial cost and disruption to TCCC that would be caused by non-renewal ensure that these agreements will continue to be renewed and, therefore, are essentially perpetual. The Group has never had a bottling agreement with TCCC terminated due to non-performance of the terms of the agreement or due to a decision by TCCC to terminate an agreement at the expiration of a term. After evaluating the contractual provisions of bottling agreements, the Group’s mutually beneficial relationship with TCCC and history of renewals, indefinite lives have been assigned to all of the Group’s TCCC bottling agreements.

Coca-Cola Europacific Partners plc, 2021 Integrated Report and Form 20-F, p141

Sets out the nature of the judgement.

Explains the rationale for the conclusion reached.

Identifies the assets to which it applies.

10. Deferred taxation

Accounting for deferred tax

IFRS 3 requires that deferred taxes in a business combination be recognised and measured in accordance with IAS 12.

An acquirer does not recognise the deferred tax balances recorded in the acquiree’s own financial statements. Instead, a new acquisition-date exercise is performed to determine the deferred tax balances to be recognised in accordance with IAS 12 based on the assets and liabilities recognised as part of the business combination36, using the tax rate in the jurisdiction in which the related profits will arise.

For further discussion of deferred tax in general, please see our deferred tax asset thematic review published in September 2022.

All but one of the companies in our sample recognised deferred tax assets or liabilities as part of the business combination. The one company that did not was a Real Estate Investment Trust (‘REIT’) which is not subject to tax on income distributed to shareholders.

The deferred tax that arises will affect the amount of goodwill or the bargain purchase gain that is recognised as part of the business combination37.

All 19 companies that recognised deferred tax clearly showed how the recognition of these balances impacted the calculation of goodwill.

Intangible assets and goodwill

One common group of assets that companies recognise as a result of a business combination is intangible assets. 18 companies in our sample recognised intangible assets as part of the business combination in their consolidated financial statements.

The tax rules on intangible assets vary from jurisdiction to jurisdiction. Companies will need to understand these rules to determine what the tax base of an intangible asset is and, hence, any temporary difference that may arise.

When an intangible asset is not deductible for tax purposes, for example when the asset is only recognised on consolidation and tax is assessed by reference to separate financial statements, its tax base is likely to be nil, although this should be confirmed. This would result in a temporary difference equal to the carrying value of the asset in the consolidated accounts.

Of the 18 companies that recognised intangible assets as part of the business combination, 14 explicitly disclosed that they had recognised deferred tax liabilities as a result. For the other 4 companies, it was not clear whether deferred tax had been recognised. We will challenge companies where we would expect deferred tax to be recognised in a business combination but no amounts appear to have been recognised.

If the intangible asset is subject to amortisation, the temporary difference will decrease over time and the resulting deferred tax credit will be recognised in the income statement. The recognition of this credit reduces the impact of the amortisation of the intangible asset on profit after tax for the year.

We saw many companies adjusting for the impact of the amortisation of acquisition related intangibles, and as we explain in our thematic on APMs, where companies present post tax APMs we expect them to disclose the tax impact of material APM adjustments.

An entity does not recognise deferred tax liabilities arising from the initial recognition of goodwill itself38.

When goodwill is tax deductible, a temporary difference can arise after the business combination, for example as the tax deductions start to be claimed. The carrying amount of goodwill will remain the same (provided it is not impaired), but the tax base will decrease over time giving rise to a deferred tax liability. We saw an example of this in HomeServe Plc where goodwill from past business combinations was tax deductible. As the deductions started to be claimed, a deferred tax liability was recognised after the business combination for the temporary difference in the carrying amount and tax base of the goodwill.

The goodwill arising on the excess of consideration over the fair value of the assets and liabilities acquired represents the expectation of future growth, synergistic benefits and efficiencies. Where elections are made to treat an acquisition that is in scope of US tax legislation as an asset purchase for tax, goodwill is deemed deductible for tax purposes. Where goodwill arises on consolidation within the Group it is not deductible for tax purposes, but tax deductions on goodwill amortisation may arise at a local level in certain territories, subject to specific local rules. Deferred tax liabilities associated with elected goodwill deductions are disclosed in note 10.

HomeServe Plc, Annual Report & Accounts 2022, P172

Explains why deferred tax on goodwill has arisen after the business combination.

Entities should disclose the amount of goodwill that is expected to be deductible for tax purposes39. Only seven companies gave this disclosure, although for the others the amounts may not be material.

Assessing the recoverability of deferred tax assets of the acquiree

The recoverability of a deferred tax asset related to the acquiree’s assets and liabilities needs to be assessed from the acquirer’s perspective. The acquirer’s assessment may differ from that of the acquiree because of a change in circumstances of the combined entity which will not have been considered by the acquiree. Any deferred tax asset recognised as a result will form part of the assets and liabilities acquired40.

Re-assessing deferred tax assets of the acquirer

Tax losses

An acquirer should reassess the probability of realising a tax benefit relating to historical losses if they expect the business combination to have an impact on the future profitability of the existing business. If additional deferred tax assets are recognised, this recognition is accounted for separately from the acquisition accounting and in accordance with IAS 1241.

Other deferred tax assets

An acquirer will also need to reassess the amount of deferred tax assets recognised when material new deferred tax liabilities arise in relation to the same taxable entity in the same tax jurisdiction. A business combination often results in the recognition of deferred tax liabilities as part of the acquisition accounting.

Initial recognition exemptions

As well as not recognising a deferred tax liability on the initial recognition of goodwill, IAS 12 also provides an exemption from having to recognise a deferred tax liability on the initial recognition of an asset or liability that is acquired outside a business combination which, at the time, affects neither accounting or taxable profit42.

However, when an acquiree has utilised this exemption, the exemption will not apply when viewed from the perspective of an acquirer in a business combination. Therefore, the acquirer will need to determine if a deferred tax liability or asset should be recognised in respect of such assets and liabilities as part of the acquisition accounting.

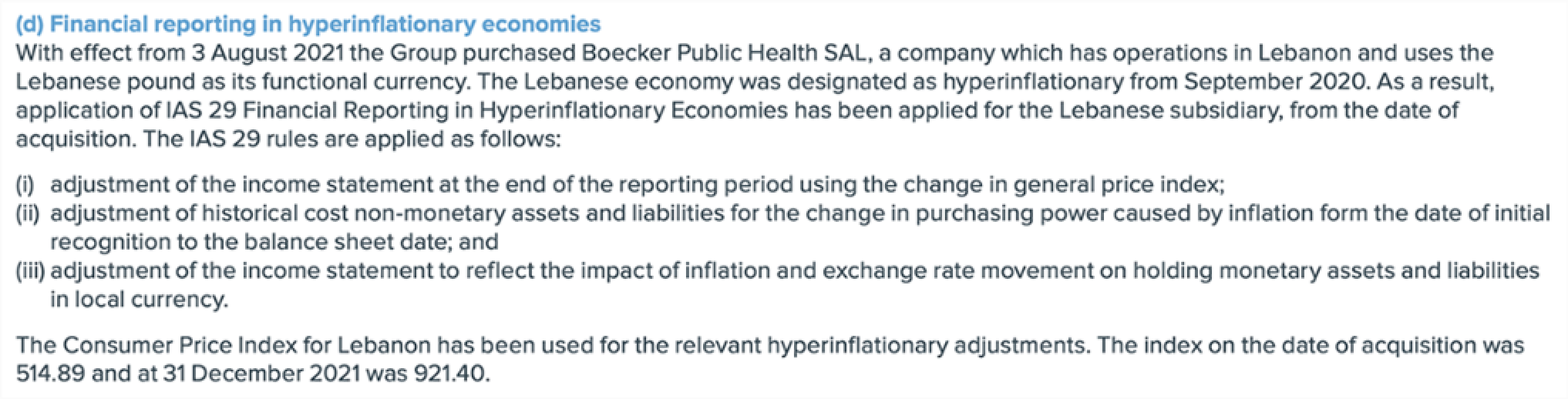

Other fair value adjustments