The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC PricewaterhouseCoopers LLP Public Report

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

These reports, published in July 2022, provide an overview of the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms 1, and how the firms have responded to our findings.

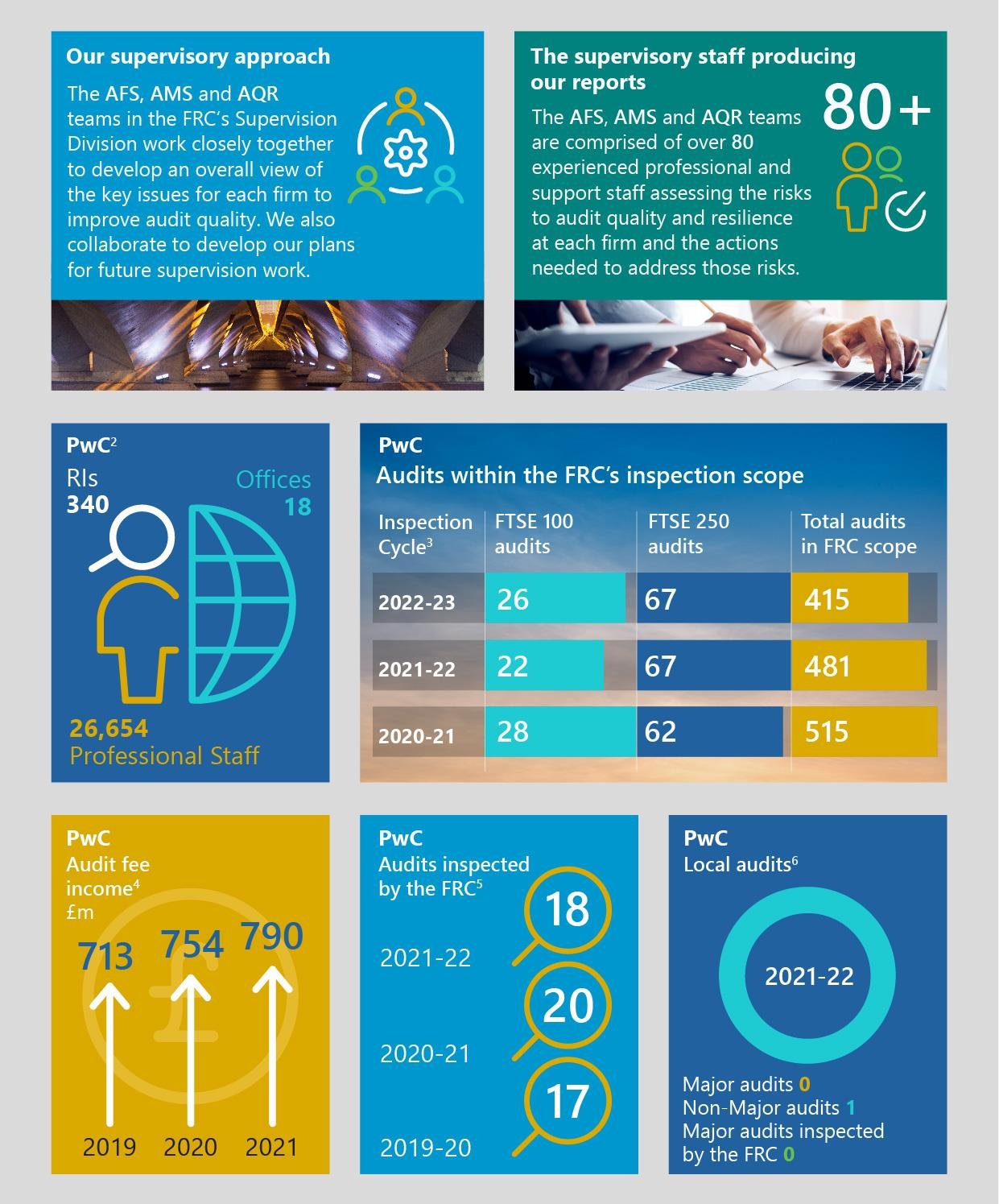

[^2] Source - the ICAEW's 2022 QAD report on the firm. [^3] Source - the FRC's analysis of the firm's PIE audits as at 31 December 2021. [^4] Source - the FRC's 2020, 2021 and 2022 editions of Key Facts and Trends in the Accountancy Profession. [^5] Excludes the inspection of local audits. [^6] The FRC's inspections of Major Local Audits are published in a separate annual report to be issued later in 2022. The October 2021 report can be found here.

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- 2. Review of individual audits

- 3. Review of the firm's quality control procedures

- Monitoring review by the Quality Assurance Department of ICAEW

- Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

- Engagement Performance – EQCR, consultations and audit documentation

- Methodology

- Monitoring – Internal quality monitoring

- Approach to reviewing the firm's quality control procedures

- Firm-wide key findings and good practice in prior inspections

- 4. Forward-looking supervision

- Appendix

- Footnotes

This report sets out the FRC's findings on key matters relevant to audit quality at PricewaterhouseCoopers LLP (PwC or the firm). As part of our 2021/22 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firm's quality control systems.

The FRC focuses on the audit of public interest entities (PIEs 2). Our risk-based selection of audits for inspection focuses, for example, on entities: in a high-risk sector; experiencing financial difficulties; or having material account balances with high estimation uncertainty. We also inspect a small number of non-PIE audits on a risk-based basis.

Entity management and those charged with governance can make an important contribution to a robust audit. A well-governed company, transparent reporting and effective internal controls all help underpin a high-quality audit. While there is some shared responsibility throughout the ecosystem for the quality of audits, we expect firms to achieve high-quality audits, regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

Higher-risk audits are inherently more challenging, requiring audit teams to assess and conclude on complex and judgemental issues (for example, future cash flows underpinning impairment and going concern assessments). Professional scepticism and rigorous challenge of management are especially important in such audits. Our increasing focus on higher risk audits means that our findings may not be representative of audit quality across a firm's entire audit portfolio or on a year-by-year basis. Our forward-looking supervision work provides a holistic picture of the firm's approach to audit quality and the development of its audit quality initiatives.

The report also considers other, wider measures of audit quality. The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales ICAEW inspects a sample of the firm's non-PIE audits. The firm also conducts internal quality reviews. A summary of the firm's internal quality review results is included at Appendix 1.

1. Overview

Overall assessment

In our 2020/21 public report, we concluded that PwC had made improvements to audit quality through its transformation programme, which we would continue to monitor as it moved from transformation to business as usual.

The firm has continued to complete its transformation programme and to take actions to address findings arising from all external and internal reviews. We are pleased that the firm has demonstrated continuous improvement to audit quality and culture through the introduction of new initiatives in these areas. The firm maintained its focus on audit quality on individual audits, including those that were impacted by Covid-19, with a continuing improvement in the FRC inspection results. None of the audits we inspected were found to require significant improvements and 83% required no more than limited improvements, compared with 80% in the previous year and 78% on average over the past five years.

The area that contributed most to the audits assessed as requiring improvements was the audit of revenue. There continues to be recurrent findings related to the audit of impairment and journals, which were key findings last year, although some improvement in those areas were identified. At the same time, we identified a range of good practice in these and other areas.

The firm has compared good practices in some audits to findings in the same areas in other audits as an addition to its root cause processes and this meant an increased focus on the root causes of both recurring findings and inconsistent audit quality. A continued focus on reducing inconsistency is needed to further improve audit quality.

83%

of audits inspected were found to require no more than limited improvements.

No audits inspected in the current cycle required significant improvements.

The results from other measures of audit quality, covering a broader population of audits, also showed an improvement. The results from the Quality Assurance Department of the ICAEW (QAD) set out on pages 19 and 20, which is weighted toward higher risk and complex audits of non-PIE entities (within ICAEW scope), assessed all the audits it inspected as good or generally acceptable (90% in the prior period). Over a similar period, the firm's internal quality monitoring process (covering both PIE and non-PIE audits) assessed 83% of audits as meeting its highest quality standard, consistent with the prior period (see page 33). Where findings are identified by the firm, they have commonly been consistent with the FRC findings noted above.

The firm has continued to invest in resources in line with, and additional to, those outlined in its Programme to Enhance Audit Quality (PEAQ) and has developed a new Audit Quality Plan for 2023 (AQP or plan) when PEAQ moves into business as usual. This new plan is grounded in the audit strategy and includes plans to invest further in technology to transform the audit. We will consider and assess this and other areas of additional focus and significant change going forward.

Our inspection results only provide a single point in time view on audit quality. The firm must continue to critically evaluate all its audit quality results, particularly any inconsistencies impacting the overall assessment of quality, across different populations of audits. This is particularly key, in implementing the firm's new Audit Quality Plan and related initiatives, and its intentions for continual improvement and responsible growth.

In response to this year's findings, we will take the following action:

- Reduce the number of audits inspected at PwC in proportion to the number of audits in scope, compared with other Tier 1 firms.

- Continue to assess the implementation of the new audit quality plan, as well as its monitoring and reporting.

- Require all actions to be included in a Single Quality Plan (SQP), subject to formal reporting and regular review by the FRC.

Firms must include all actions within a Single Quality Plan, subject to formal reporting and regular review by the FRC.

Inspection results: arising from our review of individual audits

We reviewed 18 individual audits this year and assessed 15 (83%) as requiring no more than limited improvements. Of the nine FTSE 350 audits we reviewed this year, we assessed eight (89%) as achieving this standard.

Our assessment of the quality of audits reviewed: PricewaterhouseCoopers LLP

Bar chart showing the quality of audits reviewed by PricewaterhouseCoopers LLP over five inspection cycles.

The chart displays three categories: "Good or limited improvements required" (blue), "Improvements required" (light blue), and "Significant improvements required" (dark blue), as percentages of total audits inspected each year.

- 2017/18: 23% Good or limited, 5% Improvements, 0% Significant

- 2018/19: 20% Good or limited, 4% Improvements, 2% Significant

- 2019/20: 11% Good or limited, 5% Improvements, 1% Significant

- 2020/21: 16% Good or limited, 4% Improvements, 0% Significant

- 2021/22: 15% Good or limited, 3% Improvements, 0% Significant

FTSE 350: PricewaterhouseCoopers LLP

Bar chart showing the quality of FTSE 350 audits reviewed by PricewaterhouseCoopers LLP over five inspection cycles.

The chart displays three categories: "Good or limited improvements required" (blue), "Improvements required" (light blue), and "Significant improvements required" (dark blue), as percentages of total FTSE 350 audits inspected each year.

- 2017/18: 16% Good or limited, 3% Improvements, 0% Significant

- 2018/19: 11% Good or limited, 4% Improvements, 2% Significant

- 2019/20: 8% Good or limited, 3% Improvements, 1% Significant

- 2020/21: 9% Good or limited, 1% Improvements, 0% Significant

- 2021/22: 8% Good or limited, 0% Improvements, 0% Significant

The audits inspected in the 2021/22 cycle included above had year ends ranging from August 2020 to March 2021.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings related to the audit of revenue, impairment, and journals.

We identified a range of good practice related to risk assessment, execution of the audit and completion and reporting.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews, auditor consultations and audit documentation; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements.

Our key findings on individual audits included the audit of revenue, impairment, and journals.

Our key findings related to the firm's actions to implement the revised Ethical Standard and internal quality monitoring arrangements. We also identified good practice in the areas of consultations, methodology and internal quality monitoring.

Further details are set out in section 3.

Forward-looking supervision

The firm's new audit quality plan has been developed to take over from PEAQ and allow for the monitoring and reporting of all quality initiatives, those moving from PEAQ to business as usual and those outside of PEAQ. The plan is mapped to the pillars of the audit strategy and these are then underpinned by the firm's culture and audit behaviours. The planned monitoring and reporting are complex and it may be difficult to understand the progress and effectiveness of the plan as a whole. The plan has only just been released and therefore we will continue to assess its implementation, as well as the monitoring and reporting during 2022/23.

With respect to quality control procedures, our key findings related to implementing the revised Ethical Standard and internal quality monitoring.

The firm has made refinements to its Root Cause Analysis (RCA) approach to give more focus to positive quality outcomes and develop more examples of what good looks like.

The firm developed actions in relation to all last year's findings and the majority have been taken. The firm takes a similar approach to constructive engagement cases, taking positive and prompt action to strengthen policies, procedures, and training.

Although we recognise there are timing delays between our review cycle and seeing the impact of the actions taken, the firm needs to utilise its RCA to understand the findings which are driving the poorer graded audits, especially those that are recurring, in order to prevent further recurrence.

Further details are set out in section 4.

Firm's overall response and actions

Introduction

Our purpose is to build trust in society and solve important problems, and the delivery of consistently high quality audits by our audit practice is a fundamental part of achieving this. We have made significant investment in our audit practice in the last three years, through our Programme to Enhance Audit Quality (PEAQ) and are committed to our critical public interest role.

The positive progress indicated by the overall outcome of the 2021/22 AQR inspection is pleasing, and we are proud of our people and their contribution to achieving this result, particularly given the challenging circumstances in which many of the audits were undertaken. Whilst none of our audits required significant improvement, we recognise that aspects of three of our audits did not meet the expected quality standard, and that there were findings in recurring areas identified in the inspection process. We have reflected on the engagement specific findings and are taking responsive action as appropriate. Our Continuous Improvement Team is focused on understanding and addressing the factors leading to recurring findings through further root cause analysis and action effectiveness assessments.

We also welcome the increased focus on identifying good practice. Where these are reported on certain inspections in the same areas as individual findings on other inspections, it demonstrates to our teams that high quality audit is achievable. We are now focused on the importance of consistency of execution across all our audits.

We are proud of the benefits that PEAQ has delivered, and in particular the work undertaken on the culture of the audit practice. We are pleased that the FRC has recognised the progress made, and the positive impact of the programme. Our FY23 Audit Strategy and new Audit Quality Plan (AQP) continue to ensure our primary focus is on delivering consistently high quality audits.

We value the insight provided by the FRC inspection and supervision teams as part of the review of our audits, processes and controls to support audit quality, and in their review of our strategic plans and other audit quality initiatives and activities. We have agreed to enhance existing guidance and/or activities for all key findings, and where benchmarking has indicated enhancements could be made. We also welcome the observations made in the report on forward-looking activities, and in particular the recognition of the investment the firm has made in respect of our continuous improvement programmes and firm culture.

Root Cause Analysis and action planning

Our Continuous Improvement Team (CIT) uses a well-established methodology to undertake Root Cause Analysis (RCA) using data collated from multiple sources, including external inspection findings. We have further strengthened the CIT during the year to continue to undertake RCA on an ongoing basis, enabling themes to be promptly identified and actions undertaken. Findings are regularly shared with and considered by key stakeholders.

As the inspection results continue to provide a positive indication that audit quality is improving, alongside analysing the three lower rated inspections, the CIT has focused on the factors leading to higher rated engagements and examples of good practice identified by the AQR team. This approach provides more balanced insight when determining the root causes and responsive actions. The CIT also focused on the drivers of findings in recurring areas, including considering whether these relate to technical or behavioural factors, and those leading to lower quality inspection outcomes.

The key factor identified by the CIT which underpinned the examples of good practice identified by the AQR team was the extent of challenge by the audit team. Whilst it can be difficult to capture the extent of challenge of management assumptions, judgements or evidence, this Audit Behaviour (see 'Our focus on culture' below) has resonated strongly with our teams. A common factor identified within the lower rated engagements was an over-dependence on a key audit team member.

The work of the CIT identified four factors which, either individually or in combination, contributed to the findings across the quality spectrum. These were:

- The audit team's demonstration of professional scepticism in relation to the matter: Creating safe space for challenge, capturing inherent knowledge, re-evaluation of prior year approaches and documenting the journey to the auditor conclusion led to a clearer demonstration of consideration and auditor challenge. Conversely, an over-reliance on prior year information or audit approach, instances where extended and extensive challenge is required or an insufficient response from the audit team to a change in risk, can lead to lower quality demonstration of scepticism;

- The quality of the engagement team audit project plan including overall timelines, milestones and tracking: Engagements with realistic and detailed project plans, timely deliverables and evidence from management, and a prioritisation of review activities lead to well managed audits. Where poorer quality was identified, there were examples of unrealistic timelines, timelines which did not include any flexibility for issues occurring during the course of the audit, or when review was not prioritised;

- The quality and timeliness of audited entity deliverables: Where poor quality or late audit deliverables were received by the audit team, timelines became more challenging leading to examples of lower quality evidence. Where our deliverables management tool, Connect, was fully utilised, or where the teams actively and robustly challenged poor quality deliverables, these contributed to more consistent audit quality; and

- The sufficiency of review performed over the audit procedures and/or supporting documentation: Review procedures which are planned, prioritised and performed on a continuous basis ensures that comprehensive review is performed. Where this is not the case, examples of insufficiently granular or timely review have contributed to poorer quality evidence being documented on the audit file.

In developing further actions in response to these themes, the CIT has considered the timing and effectiveness of existing actions as well as actions undertaken in the last 12 months, before identifying whether further action is needed. This is of particular importance where findings are in recurring areas of the audit.

Continued Investment in audit quality

Our overall response to these factors is through our AQP which includes a continued focus on audit culture and behaviours, including psychological safety to promote a strong learning environment, and our ongoing culture programme responds to a number of these findings. Our culture initiative 'leading from the middle' aims to empower our managers through further shared responsibility.

The AQP also includes a number of workstreams in relation to the quality pillar, including our quality review initiatives and methodology activities. In addition, we have continued our focus on the performance of effective review, through deskside support, and in mandatory training programmes.

Further evolution of our technology and transformation tools are also included in the AQP. This pillar includes our BtAC programme to support engagement teams to improve project management through project milestones and managing the timeliness of audit deliverables through our Connect project management tool.

We have also identified specific actions in response to the ISQC 1 inspection cycles which concluded during the 2021/22 inspection cycle and have agreed a number of other actions which respond to the output from benchmarking or process improvement matters noted.

Whilst the PEAQ formally concluded in June 2022, the initiatives, processes, and activities implemented through PEAQ are now embedded into our business as usual processes and will continue to have a positive impact.

Our FY23 AQP was designed following active engagement with the Audit Firm Supervisor and sets out the activities we are now focused on to continue to enhance audit quality. The FY23 AQP is grounded in the audit strategy, the development of which is overseen by the AOB. Members of the Audit Executive are sponsoring each workstream within the AQP. The AQP embraces the requirements of ISQM 1, the FRC publication 'what makes a good audit', and our Annual Supervisory Letter. The FY23 AQP will ensure our continued focus and investment in audit quality by the firm, including further embedding our culture within the audit practice.

We are well-progressed with the implementation of the new quality control standard (ISQM 1), with the PwC Network having developed and evolved a framework for quality management that focuses on the design of the firm's system of quality management over the past five years. We therefore expect to be compliant with the standard by the implementation date of 15 December 2022.

Our focus on culture

Over the last three years, PEAQ has driven an evolution in our audit culture. At the start of the programme we commissioned an independent paper from Professor Karthik Ramana, which alongside the work of our firm's cultural experts helped develop our Audit Behaviours to support high quality audit. The Audit Behaviours of Team First, Challenge and be Open to Challenge and Take Pride, set clear expectations for our auditors, and have been embedded into everything we do, including our audit training, delivery and how we evaluate performance.

We conduct an annual Audit culture and behaviours survey to assess how well the behaviours are embedded. In addition, our Audit Culture team is observing audit teams' behaviours, holding focus group discussions, and undertaking analysis of feedback and other data to assess the current Audit culture. We use these measures to inform our activities to ensure our culture drives high quality.

Culture is a fundamental element of our FY23 AQP, with a key focus on an enhanced culture of psychological safety where our teams can safely learn from mistakes to support continuous improvement. We believe that this will help further empower our auditors.

Audit market challenges

We support the development of a corporate reporting and audit ecosystem that better meets the expectations of stakeholders and broader society. We welcome recent progress on a package of legislative reforms to improve standards for audit, reporting and corporate governance and the Government's response to the "Restoring trust in audit and corporate governance" consultation acknowledges that all parts of the corporate governance ecosystem have a part to play in reform and outlines a suite of measures covering the whole market. We welcome the FRC leadership focus on the key changes required from each market participant to drive improvements in audit quality and are encouraged by the recognition of the important role management and company directors play.

The impact of recent unprecedented global events has demonstrated the adaptability of our people to respond to challenges effectively. The global pandemic required an immediate change in our approach to audits, and to respond to the increased uncertainty inherent within audit risks. It also had a direct impact on our people, audited entity finance teams and the financial information subject to audit. Our multidisciplinary structure enabled audit teams to continue to access experts and specialists without disruption. In response, we have been able to change the way we work, embracing hybrid working models, with tangible benefits for auditors and the entities subject to audit. Whilst proud of how quickly we adapted to remote working, we also recognise the importance of face to face interactions with the organisations we audit and each other to support high quality audits.

Conclusion

While we are encouraged by our continued progress, we are not complacent, and recognise the further investment needed to deliver consistently high quality audits, address recurring findings and implement our AQP. We will continue our focus on Audit Behaviours and psychological safety, to ensure that we embed a culture that best supports our teams to deliver high quality audits.

We are proud of our people and the progress we have made during PEAQ. We remain committed to playing our part in building trust in UK business and to delivering consistently high quality audits.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements if they are considered key due to the extent of occurrence across the audits we inspected.

Improve the consistency of the testing of revenue

Revenue is a key driver of operating results and a key performance indicator on which investors and other users of the financial statements focus. Audit teams are expected to ensure that they design an approach which is responsive to the identified risks and undertake adequate audit procedures to address the risks.

Key findings

We reviewed the audit of revenue on the majority of audits inspected and had findings on four of them, including two assessed as requiring improvements. We also identified good practice in this area, indicating an element of inconsistency across the audits we reviewed.

- On one of the audits requiring improvements, Covid-19 had a significant impact on the entity's business, which led to a high level of credit vouchers being issued. There was inadequate audit evidence that all subsequent transactions using vouchers originated from cash or were otherwise accounted for appropriately, or that the data analytics performed responded sufficiently to the circumstances.

- On the other audit assessed as requiring improvements, the sample testing of revenue transactions only covered half of the year. The audit team should have ensured the testing covered revenue throughout the year.

- On another audit, the audit team did not adequately evidence aspects of its testing of customer contractual terms, assessment of the performance obligations and the reliability of certain supporting information.

- On a further audit, the audit team did not adequately evidence whether the complete population of revenue had been subject to testing through sampling. In addition, there were no procedures performed on the completeness of the data within the system generated report used for cut-off testing.

We reviewed the audit of revenue on the majority of audits inspected and had findings on four of them.

Continue to improve aspects of the audit of impairment

The audit of management's impairment assessment often involves significant judgement. Changes to key assumptions could result in a material impairment. Auditors are expected to obtain sufficient and appropriate evidence when evaluating the reasonableness of these assessments made by management.

Last year we stated that the firm should improve the evaluation of management's impairment assessments. The firm has since implemented a number of actions in this area and we have seen improvements, with several examples of good practice. However, there was still some inconsistency in the audits we reviewed.

Key findings

Given the potential impact on the financial statements, a large proportion of audits reviewed this year included the auditors' assessment of impairment, particularly where this had been identified as an area of significant risk. We identified the following findings on four audits, one of which was assessed as requiring improvements:

- On the audit requiring improvement, the audit team did not challenge management on the inclusion of cost of debt on a pre-tax basis within the discount rate calculation, nor why the discount rate was disclosed as pre-tax in the financial statements, when it had been applied to post-tax cash flows.

- On the same audit, and two further audits, there were findings related to the extent of audit evidence for growth rates used in management's cash flow forecasts. On one of these audits, the audit team did not adequately evidence its consideration of the impact of the sensitivity of the goodwill impairment to changes in management's forecast scenarios. On the other audit, there was insufficient evidence of the audit team's challenge of management's short-term growth rates, given significantly lower growth recorded in recent actual results. On the third audit, the audit team did not perform a sufficiently granular assessment of the cash flow forecasts for those CGUs that were identified as partially impaired in the year.

- On another audit, there was insufficient evidence of evaluation and challenge over aspects of asset impairment, including allocation of intangible and other assets across locations, and in relation to the identification of cash generating units.

We have seen improvements in the evaluation of management's impairment assessments, however, there was still some inconsistency in the audits we reviewed.

We identified findings relating to the extent of audit evidence for growth rates used in management's cash flow forecasts on three audits.

Further improve aspects of journal testing in response to the risk of management override

Auditors are expected to perform appropriate testing of journals as one of the key audit procedures in response to the risk of management override.

Last year we raised a key finding relating to improving the audit procedures for the residual journal population in response to the risk of management override. This year, we reviewed the testing of journal entries on the majority of audits inspected.

Key findings

We have seen some progress against the specific findings reported previously, however, we continue to raise findings relating to the firm's testing of journal entries on five audits, as follows:

- On three audits, there was insufficient justification as to the level of untested journals that met certain high risk fraud criteria.

- On another two audits, insufficient audit procedures were performed over the information produced by the entity to ensure that the data elements within the journal listings were accurate.

We have seen some progress against the specific findings reported previously in relation to journals testing, however, we identified findings on five audits.

Review of individual audits: Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach which responds to those risks.

- Group audit planning: On a group audit, the risk assessment and planning procedures were of a high standard and included the use of comprehensive, focused group instructions and timely global planning workshops with all component auditors.

- Fraud risk assessment and Covid-19: On another audit, a thorough fraud risk assessment was performed, including an assessment of the impact of Covid-19, resulting in a series of unpredictable audit procedures being designed by the audit team.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Robust impairment assessments: We identified examples of good practice in the assessment of goodwill or intangible asset impairment on five audits, with the audit teams applying a good level of professional scepticism. This was demonstrated through corroboration of the forecast growth rates and identification of impairment indicators to external evidence, as well as good use of look back procedures. There was also a granular assessment of growth rates and strong challenge over management's impairment models, resulting in changes to those models.

- Effective testing of revenue: We identified three examples of good practice for revenue. These comprised thorough testing of the completeness of revenue by selecting published activities during the year and tracing them to the revenue recorded, detailed understanding and assessment of complex agreements with third parties and testing of underlying data and controls to establish whether the results were in line with expectation.

- Quality of controls testing: On one audit, where the audit team identified management's contract review meetings as a key control, year-end meetings were attended by the audit team to support the assessment of the operating effectiveness of the controls. On another audit, the audit team's understanding and testing of manual and automated controls for the fair value and trade settlement processes enhanced the design and application of the audit execution.

- Effective group oversight: We continue to see effective group oversight of component auditors through the use of tracking documents to monitor and record their work, which was observed on two audits and was used to raise matters with management and the Audit Committee.

- Testing of asset valuations: On two audits, good practice was observed in relation to the audit of asset valuations. On one of these, the firm's experts developed independent models to assess the integrity of management's models when valuing illiquid investments. On the other audit, the risk of potential impairment of a financial asset was mitigated through the extensive sensitivity analysis performed over each assumption in the valuation.

Good practice examples included robust impairment assessments, effective testing of revenue, effective group oversight and testing of asset valuations.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Deferring audit sign-off: On one audit, the audit team deferred issuing the auditor's report until satisfied that sufficient and appropriate audit procedures had been completed and appropriate quality control procedures completed.

- Reporting: On another audit, the Audit Committee report contained a succinct graphical representation of the audit team's assessment of management's key judgements. There was also a clear articulation in the auditor's report of materiality, including revisions made since the prior year and the rationale for use of certain benchmarks.

3. Review of the firm's quality control procedures

Monitoring review by the Quality Assurance Department of ICAEW

The firm is subject to independent monitoring by the ICAEW, which undertakes its reviews under delegation from the FRC as the Competent Authority. The ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. The ICAEW does not undertake work on the firm's firm-wide controls as it places reliance on the work performed by the FRC.

The ICAEW reviews are designed to form an overall view of the quality of the audit. The ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher-risk and potentially complex audits within the scope of the ICAEW review.

The ICAEW has completed its 2021 monitoring review and the report summarising the audit file review findings and any follow up action proposed by the firm will be considered by the ICAEW's Audit Registration Committee in July 2022.

Summary

100% of the ICAEW reviews were assessed as either good or generally acceptable.

Overall, the audit work the ICAEW reviewed was of a good standard, with all ten standard engagements either good or generally acceptable. These results compare favourably to the 2020 visit when nine of the ten files were either good or generally acceptable and one file needed improvement.

Results

Results of the ICAEW's reviews for the last three years are set out below.

Bar chart showing the results of ICAEW reviews over three years.

The chart displays three categories: "Significant improvements required" (dark blue), "Improvement required" (light blue), and "Good / generally acceptable" (blue), as percentages of total reviews each year.

- 2019: 7% Good/Generally Acceptable, 2% Improvement Required, 1% Significant Improvements Required.

- 2020: 9% Good/Generally Acceptable, (no value for Improvement Required), 1% Significant Improvements Required.

- 2021: 10% Good/Generally Acceptable, (no value for Improvement Required), (no value for Significant Improvements Required).

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Good practice

The ICAEW identified good practice across the files we reviewed. Broad themes were:

- Comprehensive documentation of audit work, including consideration of an independence matter, understanding of a complex conglomerate group and interaction with component auditors.

- Demonstrable professional scepticism in engagement team discussions and challenge of assumptions in impairment models.

- High quality reporting to management and those charged with governance.

We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021. We also set out our approach to reviewing the firm's quality control procedures and a summary of our prior year findings (in the two previous years) at the end of this section.

Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors (the “Revised Standard”). The revisions predominantly became effective for audits commencing on or after 15 March 2020. The focus of the revisions was to enhance the reality and perception of auditor independence, necessities both for auditors to form objective judgements about the entity being audited and for stakeholders to have confidence in the outcome of the audit. Certain prohibitions, on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important “Objective Reasonable and Informed Third Party test”, against which auditors must apply judgements about matters of ethics and independence.

In the current year, we evaluated the firm's actions to implement the Revised Standard. We reviewed changes to policies and procedures and the support provided to audit teams to aid the transition (for example, communications, guidance and training events). We also conducted a benchmarking exercise to compare the implementation approaches across the firms and to share good practice.

Key findings

We identified the following key findings where the firm needs to:

- Improve the firm's guidance on how to more consistently consider the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence, and in particular, that of non-practitioners, such as informed investors, shareholders or other stakeholders.

- Enhance the existing controls in place to reduce the risk of a network firm commencing a non-audit service for a component of a UK group before approval is provided by the UK group audit partner.

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard.

Our inspection work next year will assess whether audit teams have adhered to the firm's updated policies and procedures.

Engagement Performance – EQCR, consultations and audit documentation

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team. The reviews are completed on public interest and other heightened risk audits before the audit report is signed. Our inspection evaluated the firm's policies and procedures in relation to the appointment of EQCR reviewers. Key factors considered included the individuals' audit experience and level of seniority, availability and capacity, internal and external quality results and industry knowledge. We also considered how the challenges raised by the EQCR were made and resolved, as well the training provided to reviewers.

Consultation with the firm's central functions, on difficult or contentious matters, enable auditors to be guided by the collective experience and technical expertise of the firm. We reviewed the firm's policies and procedures in relation to auditors consulting with the firm's central quality teams, including areas where mandatory consultations are required.

Audit documentation comprises the evidence obtained and conclusions drawn during an audit. Archiving ensures that the documentation is maintained should it be needed in the future. We reviewed the firm's arrangements relating to the assembly and timely archiving of final audit files, and the monitoring and approval of changes made to audit files after the signing of the audit report.

Key findings

We identified no key findings.

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team.

Good practice

We identified the following areas of good practice:

- The firm's audit software requires each audit working paper to be re-reviewed when it has been modified, including in the period after the audit report date.

- The firm specifically assesses whether mandatory consultations have taken place for all engagements selected for review in the internal quality monitoring process.

Methodology

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control, to help audit teams perform audits consistently and comply with auditing standards. In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities.

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control.

Key findings

We identified no key findings.

Good practice

We identified the following areas of good practice:

- The firm's risk assessment guidance provides good examples of how to gain a detailed understanding of financial instrument products and how this understanding can then be used to determine appropriate audit procedures to perform.

- The firm's illustrative guidance on control and substantive testing is of a high quality and guides teams on the most appropriate extent of procedures to be performed.

- Certain key aspects of the firm's model risk management specialist guidance are comprehensive and of a high quality. In particular, the guidance provides direction and technical information to assist in the audit of complex portfolios based on a robust risk assessment.

We had no key findings to report in respect of engagement performance and audit methodology.

Monitoring – Internal quality monitoring

It is a requirement for firms to monitor their own quality control procedures to evaluate whether they are adequate and operating effectively. This allows action to be taken should deficiencies be identified.

We evaluated key aspects of the firm's annual process to inspect the quality of completed audits. This included the criteria for selecting audit partners and completed audits for review, the composition and allocation of quality review teams, the scoping of areas to review, the evidencing of the review, the identification of findings and the overall assessment. We also compared the scope and outcome of a sample of audits reviewed by the FRC's AQR team with that undertaken by the firm's internal quality monitoring team.

Key findings

We identified the following key findings where the firm needs to:

- Ensure that the professional judgements made by the review team are recorded to support the depth of their review and the conclusions reached in key areas where no findings have been raised. This is particularly important for high-risk and complex areas where conclusions on the adequacy of the audit evidence obtained are inherently judgemental.

Good practice

We identified the following areas of good practice:

- There is a requirement for an audit partner who receives an adverse result to be re-selected for review in the following year.

- The firm requires all grading decisions, including where no findings have been raised, to go through a moderation panel.

Approach to reviewing the firm's quality control procedures

We review firm-wide procedures based on those areas set out in ISQC 1, in some areas on an annual basis and others on a three-year rotational basis. The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2021/22 | Prior year 2020/21 | Two years ago 2019/20 |

|---|---|---|---|

| - Audit quality focus and tone of the firm's senior management | - Implementation of the FRC's Revised Ethical Standard (2019) | - Audit methodology (recent changes to auditing and accounting standards) | - Partner and staff matters, including performance appraisals and reward decisions |

| - Root cause analysis (RCA) process | - EQCR, consultations and audit documentation | - Training for auditors | - Acceptance and continuance (A&C) procedures for audits |

| - Audit quality initiatives, including plans to improve audit quality | - Audit methodology (fair value of financial instruments with a focus on banks) | ||

| - Complaints and allegations processes | - Internal quality monitoring |

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas we reviewed on a rotational basis:.

- For Partner & staff matters (2019/20) improvements were needed in relation to how audit quality metrics were considered in staff appraisals and to the manager and senior manager promotion process.

- On Acceptance and continuance procedures (2019/20) we identified that improvements were required on the firm's A&C form to more fully explain the conclusions drawn and on the timing of approval and completion of all independence checks.

We provided an update on the firm's actions in our 2020/21 report.

Good practice

Good practice was identified in all three areas:

- On Audit methodology and training we identified a strong monitoring process of completion of mandatory training with clear consequences for individuals that did not attend, good frequency and quality of ongoing communications to partners and staff on methodology updates and detailed guidance to audit teams on controls that are common at banking entities.

- On Partner & staff matters, the partner appraisal forms we reviewed incorporated clear consideration of audit quality including detailed commentary on the results of internal and external quality inspections in the year.

- On Acceptance and continuance procedures, where the firm concludes that it should not accept or continue work on specific entities (for example, in respect of concerns relating to reputation risk, integrity of management or legal matters), the entity is added to a "black box" list with the relevant reason. This list is maintained centrally and is available to the PwC network.

4. Forward-looking supervision

We supervise by holding firms to account through assessment, challenge, setting actions and monitoring progress. For instance, we do this through assessing and challenging: the effectiveness of the firms' RCA processes; the development of firms' audit quality plans; the firms' progress against action plans; the effectiveness of firms' responses to prior year findings; and the spirit and effectiveness of the firms' response to non-financial sanctions. We are currently introducing a single quality plan (SQP) to be maintained by each Tier 1 firm as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve quality. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Supervision.

In our role as an Improvement Regulator, we also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22 we held two roundtables, attended by the seven largest firms, sharing good practices and success stories on RCA. We have been undertaking benchmarking and thematic-based work on areas including Tone at the Top, ISQM 1, Overseas Delivery Centres, and on Culture and Challenge of Management.

We have also carried out pre-implementation work on the firms' preparedness for ISQM 1. Further details are set out in our Tier 1 Overview Report.

In the remainder of this section, we set out our observations from the work we have conducted this year, and updates from previously reported findings, as follows:

- Audit quality initiatives

- RCA

- Other activities focused on holding the firms to account

- Operational separation

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

Audit quality initiatives

Background

Firms are expected to develop audit quality plans (AQPs) that drive measurable improvements in audit quality and include initiatives which respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality.

Last year we reported that we had reviewed key aspects of the firm's plan (PEAQ) which was as intended, a three-year transformational / change plan. The plan had four workstreams of which culture was central to the success of the plan.

Audit quality plans should include forward-looking measures which contribute directly or indirectly to audit quality.

When we reviewed the plan last year, we assessed it as mature with all the initiatives moving to business as usual during 2022. We identified good practices in relation to the governance of PEAQ by the Audit Oversight Body and the Benefits Realisation Framework that was being used to assess the impact of the actions taken. The impact assessment uses evidence from various sources including management information, audit quality indicators, RCA, and stakeholder feedback. However, we found that the firm needed to develop an AQP for the future to operationalise the strategy and to ensure that monitoring and reporting of key initiatives would continue with sufficient prominence.

Observations

We assessed the following:

- PEAQ: The firm has continued to monitor and report on the progress of its three-year transformational plan. The reporting is clear, concise, and useful. The graphics used show progress to completion against plan and also the impact of any benefit analysis performed.

- The new AQP: In April 2022, the firm introduced the quality plan to replace PEAQ as it becomes part of business as usual. The AQP is grounded in the audit strategy. The strategy has five pillars including quality; passionate people; and technology and transformation. The core activities or audit quality initiatives are mapped to each of the five pillars and then this is all underpinned by the firm's culture and audit behaviours of Team first, Challenge and be open to challenge and Take pride. The plan has also been mapped to quality standards (ISQC 1 and ISQM 1) and the FRC's What Makes a Good Audit.

The AQP is grounded in the audit strategy and sets out areas of additional focus and significant changes for FY23.

The plan sets out areas of additional focus and significant changes for FY23 which we will consider and assess going forward.

The monitoring and reporting of the new plan has been considered and the good governance that PEAQ had will continue. We note, however, that the planned monitoring and reporting is complex with different reports covering different initiatives being presented to different committees / Boards at different times. It may be difficult to understand the progress and effectiveness of the plan as a whole.

- Continuous improvement: PwC continues to demonstrate its focus on continuing to improve audit quality. Making Quality Easier (MQE) and Breaking the Audit Cycle (BtAC) are new key initiatives which demonstrate the firm's commitment to continuous improvement in relation to audit quality. One aim of the MQE programme is to simplify the execution of audit methodology through clarification of existing guidance and methodology. BtAC helps ensure that work is carried out earlier in the audit process to allow sufficient time for the audit work, its review and challenge of management.

- Culture: In the new AQP, culture underpins all the pillars of the strategy and is also a separate core activity. The new plan demonstrates the level of integration that culture has in the audit strategy. The firm's work on culture continues to improve with new initiatives and further development of the measurement of culture, where the firm now combines various inputs into their assessment.

We will continue to assess the AQP and encourage all firms to develop or continue to develop their audit quality plans including the focus on continuous improvement and measuring the effectiveness of initiatives.

Root Cause Analysis

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

ISQM 1, when implemented, introduces a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

Root cause analysis is an important part of a continuous improvement cycle.

ISQM 1 requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we assessed that the firm's overall approach to RCA was well developed and identified a number of good practices in relation to the dedicated continuous improvement team, along with what this means in terms of training and a further role in monitoring the effectiveness of actions taken. Additionally, there were good practices such as the use of a taxonomy, continual RCA activities, analysis of Audit Quality Indicators (AQIs) and embedding culture in the RCA activities and material. However, we found that the firm needed to carry out further analysis and action effectiveness assessments for recurring findings and inconsistencies. The firm has not made any significant changes to its RCA approach during the year but has done more on recurring findings and has continued to make refinements, which particularly focussed on positive quality outcomes. We are pleased to see this continuous improvement to a well-developed approach.

Observations

We assessed the following:

- Focus on positive quality outcomes: Additional focus has been placed by the Continuous Improvement Team on the characteristics of a good audit by carrying out root cause analysis on good or limited improvements / generally satisfactory audits. The characteristics and root causes are also being compared to poor graded audits with similar risks, to analyse what has worked better for one team compared with another. The results of this comparison suggest that team attributes such as a strong team dynamic and shared responsibility lead to better quality outcomes.

- Monitoring effectiveness of actions: The firm uses both quantitative and qualitative analysis to assess the effectiveness of actions. This includes monitoring trends through management information and AQIs, culture and other staff surveys, focus groups and feedback from the hot review team or chief auditor network.

- Recurring findings and inconsistent audit quality: The Continuous Improvement Team has analysed further the reasons for recurring findings and identified a number of potential factors for the recurrence which include a narrowing of the finding or time being needed to embed an action, particularly where behavioural change was required.

PwC has demonstrated continuous improvement and its approach to RCA is well-developed.

In addition, comparing key findings in some audits to good practices in the same areas on other audits has led to more understanding of the inconsistency and specific, more targeted actions. A continued focus on inconsistency is needed to further improve audit quality.

We will continue to assess the firm's RCA process. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result.

Other activities focused on holding firms to account

Background

As part of our forward-looking supervisory approach we hold firms to account for making the changes needed. This firm was not subject to increased supervisory activities during the year.

Observations

We assessed the following:

- Detailed action plans arising from inspection findings: PwC has made sound progress in remedying the majority of last year's findings (both key and other for the FRC and those arising from internal quality monitoring and the ICAEW's monitoring) by taking all planned actions. However, given the recurring FRC inspection findings in relation to impairment and journals, there is still more that must be done.

- Constructive engagement and non-financial sanctions: Where we have engaged on constructive engagement cases throughout the period, the firm has taken prompt action to strengthen policies, procedures and training aimed at preventing future recurrence of findings. In respect of non-financial sanctions, there has been one case open which required three years of monitoring and reporting. With all actions taken and improvements made, this case has recently been closed as planned with no further actions required.

- Tone at the Top: The firm is clear and consistent in its communications around the importance of audit quality. One of the firm's new culture initiatives focusing on “Leading from the middle” recognises managers as key enablers or blockers to driving and maintaining culture change. The aims of the initiative are development, taking pride and empowerment. We are encouraged by this focus and the potential for these initiatives to align the messages from leadership with the experiences of people throughout the firm.

- Accessibility of the transparency report: The firm is the first among the Tier 1 audit firms to have published a digital transparency report on its webpage, with videos available online and some key reporting sections separately downloadable. This change was made in response to the general feedback received from audit committee members who find transparency reports lengthy and difficult to read. This demonstrates the firm's intention to make transparency reports more accessible for the investor community and for audit committee members to navigate and engage with the report content.

PwC has made sound progress in remedying the majority of last year's findings, however, more must be done with respect to the audit of impairment and journals.

We will continue to hold the firms to account through our ongoing supervisory activities.

Operational separation of audit practices

Operational Separation aims to ensure that audit practices are focused, above all, on the delivery of high-quality audits in the public interest. PwC has operated a separate audit service line since 2019 and has taken a number of steps to implement the principles of Operational Separation including the restructuring of its governance framework, forming an Audit Oversight Body, appointing Audit Non-Executives (ANEs), and its work on promoting a differentiated audit culture.

Operational Separation aims to ensure that audit practices are focused on the delivery of high-quality audits.

PwC has four non-executives in total and they perform the following roles: one is an independent non-executive (INE) at the firm level; one is solely an ANE; and two executives are INEs and ANEs (dual function). The chair of the Public Interest Body is an INE, and the chair of the Audit Oversight Board is dual function.

Appendix

Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements. We consider that publication of these results provides a fuller understanding of quality monitoring in addition to our regulatory inspections, but we have not verified the accuracy or appropriateness of these results.

The appendix should be read in conjunction with the firm's Transparency Report for 2021 and the firm's report to be published in 2022, which provides further detail of the firm's internal quality monitoring approach and results, and the firm's wider system of quality control.

Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring may differ from those of external regulatory inspections and should not be treated as being directly comparable to the results of other firms.

Results of internal quality monitoring

The results of PwC's most recent Engagement Compliance Review (ECR), which comprised internal inspections of 132 individual audits (FY20: 142), with periods ended between 31 December 2019 and 31 March 2021, are set out below along with the results for the previous two years.

Bar chart showing the results of PwC's Engagement Compliance Review (ECR) for 2019, 2020, and 2021.

The chart displays the percentage of audits falling into three categories: "Compliant" (blue), "Compliant with Improvements Required" (light blue), and "Non-Compliant" (dark blue).

- 2019: 84% Compliant, 14% Compliant with Improvements Required, 2% Non-Compliant.

- 2020: 82% Compliant, 13% Compliant with Improvements Required, 5% Non-Compliant.

- 2021: 83% Compliant, 15% Compliant with Improvements Required, 2% Non-Compliant.

An engagement is graded as:

- Compliant (C) - when relevant auditing, assurance, accounting, and professional standards have been complied with in all material respects;

- Compliant with Improvements Required (CwIR) - when the issues identified for improvement (in either substantive or controls work) are mitigated by additional or alternative audit procedures which had been performed in the audit, the departure from accounting standards is not considered to be significant, or where there are audit report (opinion) issues that are more than grammatical/punctuation errors, but which do not mislead the user; or

- Non-Compliant (NC) - when relevant auditing, assurance, accounting and professional standards or documentation requirements were not complied with in respect of a material matter.

Firm's approach to internal quality monitoring

PwC's ECR program considers the full population of audits performed and is designed to cover both PwC's responsible individuals (RIs) and specific categories of audit clients. The ECR program involves a post-signing review of an audit engagement for each RI at least once every three years, and twice in any six-year period for audits identified by PwC as having a high public profile. These are identified by assessing engagements based on specific criteria such as size, listing status, employee numbers, going concern risk and other factors which indicate a higher profile engagement. ECRs are led by experienced partners and are supported by teams of partners, directors and senior managers who are independent of the audit under review. The outcome of each review is evaluated using a standard set of principles set by the PwC Global Network to assess whether relevant auditing, accounting and professional standards have been complied with. A moderation panel, composed of the review team, PwC's UK Quality Review Leader, and a member of PwC's Global Inspections team, forms an overall engagement assessment considering the nature and severity of the individual findings in each review.

PwC's Continuous Improvement team (CIT) undertakes RCA for all inspections with non-Compliant outcomes and a number of Compliant with Improvements Required and Compliant engagements, including engagements identified as 'best in class'. The best-in-class analysis helps identify success factors that inform potential actions. Following RCA, a Quality Improvement Plan is developed to respond to the drivers of systemic issues and specific matters arising from the ECR. Responsive actions may be identified at either the engagement delivery and/or line of service levels. Completion of the ECR and Regulatory Findings action plans are monitored by the Audit Risk and Quality leadership, the Audit Executive and PwC's Audit Oversight Body.

Internal quality monitoring themes arising

The 2021 ECR cycle identified findings in areas consistent with those in the AQR 2021/22 inspection cycle. The ECR also continued to identify a more systemic finding with respect to tailoring errors in audit reports.

The PwC CIT actively monitors recurring findings and assesses the effectiveness of actions taken. Targeted actions were taken, and progress has been made in relation to the 2020 ECR themes, including in respect of audit opinions where new technology was introduced to assist engagement teams. Additional actions were identified following the ECR 2021 cycle, which will be evaluated through the 2022 ECR.

Financial Reporting Council

8th Floor 125 London Wall London EC2Y 5AS

+44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

Footnotes

-

The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP. We have published a separate report for each of these seven firms along with a Tier 1 Overview Report. ↩

-

Public Interest Entity – in the UK, PIEs are defined in the Companies Act 2006 (Section 494A) as: Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a regulated market" where, in the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.); Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England); and Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive. ↩