The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Ernst & Young LLP Audit Quality Inspection and Supervision Report 2023

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2023 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for UK statutory audit, responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair evidence-based approach, whether firms are enhancing audit quality and are resilient. We adopt a forward-looking supervisory model and hold firms to account for changes needed to improve audit quality.

Auditors' opinions on financial statements play a vital role upholding trust and integrity in business. The FRC's objective is to achieve consistent high quality audits so that users have confidence in financial statements. To support this, we:

- Set ethical, auditing and assurance standards and guidance, as well as influence the development of global standards.

- Inspect the quality of audits performed by, and the systems of quality management of, firms that audit Public Interest Entities (PIEs6) and register auditors who carry out PIE audit work.

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification and the monitoring of non-PIE audits.

- Bring enforcement action against auditors for breaches of relevant requirements.

Since our July 2022 report we have delivered on a reform programme ahead of the Government response to restoring trust in audit and corporate governance, including:

- Taking responsibility for PIE auditor registration allowing us to impose conditions, suspensions and, in the most serious cases, remove registration of PIE auditors.

- Agreeing a memorandum of understanding with the Department for Levelling Up, Housing and Communities (DLUHC) setting out our responsibilities as shadow system leader for local audit.

- Updating Our Approach to Audit Supervision, outlining the work of our supervision teams.

- Publishing a Minimum Standard for Audit Committees and the External Audit and consulting on revisions to the UK Corporate Governance Code.

Our 2023/24 transformation programme will demonstrate our continued commitment to the public interest and restoring trust in the audit profession.

The seven Tier 1 firm7 reports provide an overview of key messages from our supervision and inspection work during the year ended 31 March 2023 (2022/23) and the firms' responses to our findings.

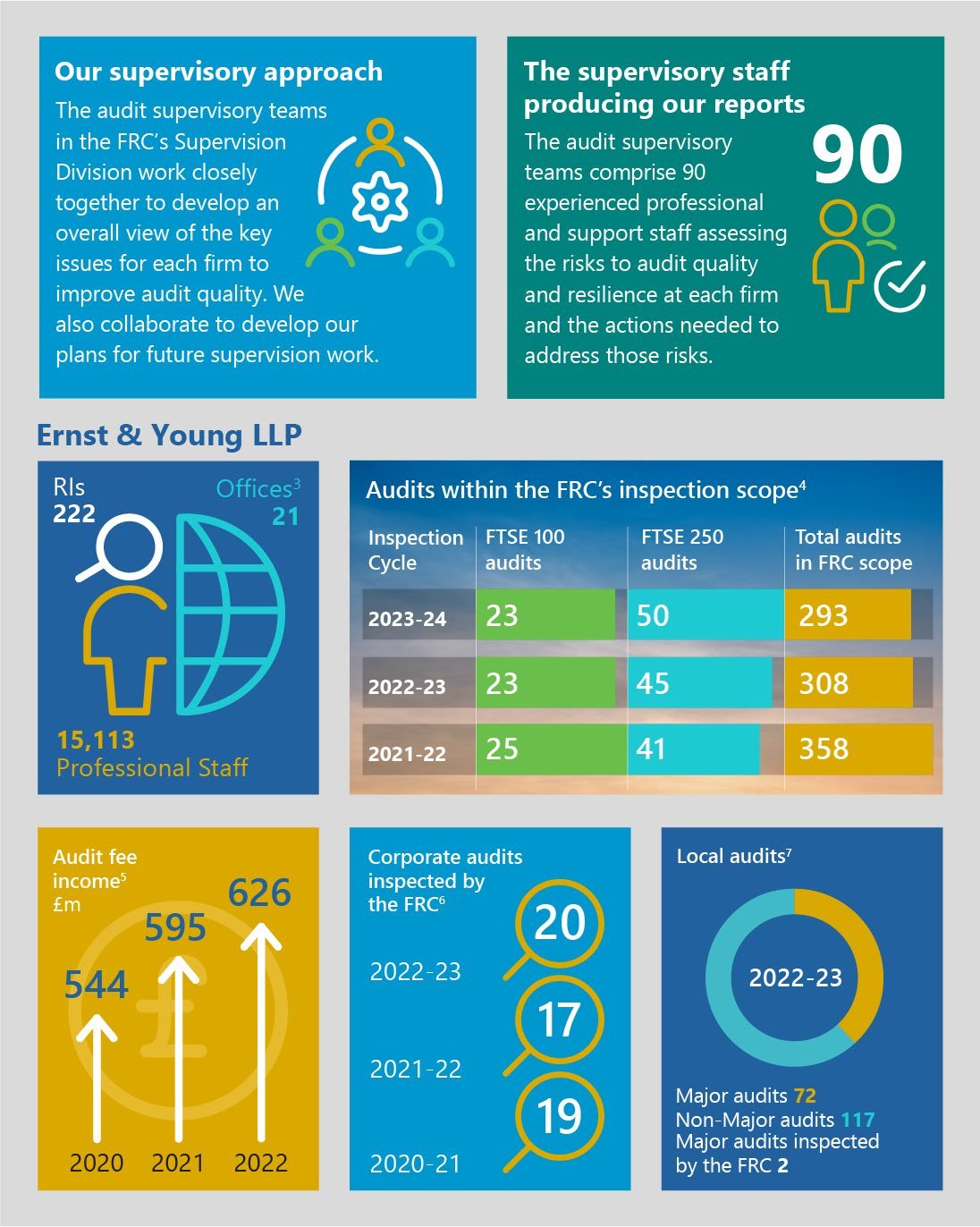

Infographic: FRC's Audit Supervisory Approach & EY LLP Data

Our supervisory approach

The audit supervisory teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our plans for future supervision work.

The supervisory staff producing our reports

The audit supervisory teams comprise 90 experienced professional and support staff assessing the risks to audit quality and resilience at each firm and the actions needed to address those risks.

Ernst & Young LLP

RIs: 222 Offices1: 21 Professional Staff: 15,113

Audits within the FRC's inspection scope2

| Inspection Cycle | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope |

|---|---|---|---|

| 2023-24 | 23 | 50 | 293 |

| 2022-23 | 23 | 45 | 308 |

| 2021-22 | 25 | 41 | 358 |

Audit fee income3 £m: 544 (2020), 595 (2021), 626 (2022)

Corporate audits inspected by the FRC4 2022-23: 20 2021-22: 17 2020-21: 19

Local audits5 2022-23: Major audits: 72 Non-Major audits: 117 Major audits inspected by the FRC: 2

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- 2. Review of individual audits

- Improve the assessment of the recoverability of deferred tax assets and the valuation of certain other assets

- Further enhance the testing of revenue and margins, including the testing of journals

- Enhance the evaluation and challenge of aspects of going concern assessments, in particular the related disclosures

- Monitoring review by the Quality Assurance Department of ICAEW

- 3. Review of firm-wide procedures

- Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019

- Partner and staff matters – recruitment, management of partner and senior staff engagement portfolios, appraisals, remuneration and promotion

- Acceptance, continuance, and resignation procedures

- Audit methodology (settlements and clearing processes for banks and building societies)

- Firm-wide key findings and good practice in prior inspections

- Implementation of ISQM (UK) 1

- 4. Forward-looking supervision

- The Four Faces

- The firm's Single Quality Plan, other quality improvement plans and audit quality initiatives

- Root cause analysis process

- PIE auditor registration

- Other activities focused on holding firms to account

- Culture and conduct

- Initiatives to ensure compliance with the FRC's Revised Ethical Standard

- Operational separation of audit practices

- Appendix

This report sets out the FRC's findings on key matters relevant to audit quality at Ernst & Young LLP (EY or the firm). As part of our 2022/23 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firm's quality control systems.

The FRC focuses on the audit of PIEs. Our risk-based selection of audits for inspection focuses, for example, on entities: in a high-risk sector; experiencing financial difficulties; or having material account balances with high estimation uncertainty. We also inspect a small number of non-PIE audits on a risk-based selection.

Entity management and those charged with governance can make an important contribution to a robust audit. A well-governed company, transparent reporting and effective internal controls all help underpin a high quality audit. While there is some shared responsibility throughout the ecosystem for the quality of audits, we expect firms to achieve high quality audits regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

Higher risk audits are inherently more challenging, requiring audit teams to assess and conclude on complex and judgemental issues (for example, future cash flows underpinning impairment and going concern assessments). Professional scepticism and rigorous challenge of management are especially important in such audits. Our increasing focus on higher risk audits means that our findings may not be representative of audit quality across a firm's entire audit portfolio or on a year-by-year basis. Our forward-looking supervision work provides a holistic picture of the firm's approach to audit quality and the development of its audit quality initiatives.

This report also considers other, wider measures of audit quality. The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales (ICAEW) inspects a sample of the firm's non-PIE audits. The firm also conducts internal quality reviews. A summary of the firm's internal quality review results is included in the Appendix.

1. Overview

Overall assessment

In the 2021/22 public report, we concluded that the firm must critically evaluate its audit quality results, given that only 65% of the audits we inspected were found to require no more than limited improvements.

This year, there has been an improvement in these results, with 80% of audits inspected were found to require no more than limited improvements, and this was the case for 89% of FTSE 350 audits inspected. None of the audits we inspected were found to require significant improvements. We are pleased that the firm has maintained its focus on, and continued investment in, audit quality.

The areas of the audit that contributed most to audits requiring improvement were the audit of deferred tax and loans receivable assets balances and the testing of revenue and margin recognition. There continues to be recurring findings related to the audit of revenue, which was also a key finding last year, although some improvement was identified. At the same time, we identified a range of good practice in these and other areas.

The results from other measures of audit quality, covering a broader population and a larger sample of audits, were positive. No audits inspected in the current cycle required significant improvements. The results from the Quality Assurance Department of the ICAEW (QAD) set out on pages 21 and 22, which is weighted toward higher risk and complex non-PIE audits (within ICAEW scope), assessed 100% of the audits it inspected as good or generally acceptable. QAD identified several good practices, including examples of thorough and insightful documentation that demonstrated the audit team's good understanding of the business, risk-focused approach to planning, and depth of going concern review. Over a similar period, the firm's internal quality monitoring process (covering both PIE and non-PIE audits) assessed 87% of audits as meeting its highest quality standard (see page 40).

This year's inspection results are an improvement on the previous year and the firm must ensure that momentum is maintained in driving change that will allow high audit quality to be delivered more consistently. This will require ongoing strategic focus, particularly in priority areas such as reducing and rebalancing work intensity for auditors.

In response to this year's findings, we will take the following action:

- Reduce the number of audits inspected at EY in proportion to the number of audits in scope, compared with other Tier 1 firms.

- Require all actions to be included in a Single Quality Plan (SQP), and use that plan to monitor their completion and evidence of their effectiveness. All firms are required to include actions within a Single Quality Plan, subject to formal reporting and regular review by the FRC.

- Pay particular attention to actions designed to promote greater consistency in audit quality, which may require ongoing strategic focus.

Inspection results: arising from our review of individual audits

We reviewed 20 individual audits this year and assessed 16 (80%) as requiring no more than limited improvements. Of the nine FTSE 350 audits we reviewed this year, we assessed eight (89%) as achieving this standard.

Our assessment of the quality of audits reviewed: Ernst & Young LLP

Bar chart showing the quality of audits reviewed for Ernst & Young LLP from 2018/19 to 2022/23.

| Year | Good or limited improvements required | Improvements required | Significant improvements required | Total audits reviewed |

|---|---|---|---|---|

| 2018/19 | 14 | 3 | 1 | 18 |

| 2019/20 | 10 | 3 | 1 | 14 |

| 2020/21 | 15 | 4 | 0 | 19 |

| 2021/22 | 11 | 6 | 0 | 17 |

| 2022/23 | 16 | 4 | 0 | 20 |

FTSE 350: Ernst & Young LLP

Bar chart showing the quality of FTSE 350 audits reviewed for Ernst & Young LLP from 2018/19 to 2022/23.

| Year | Good or limited improvements required | Improvements required | Significant improvements required | Total FTSE 350 audits reviewed |

|---|---|---|---|---|

| 2018/19 | 8 | 1 | 0 | 9 |

| 2019/20 | 7 | 1 | 1 | 9 |

| 2020/21 | 9 | 3 | 0 | 12 |

| 2021/22 | 7 | 2 | 0 | 9 |

| 2022/23 | 8 | 1 | 0 | 9 |

The audits inspected in the 2022/23 cycle included above had year ends ranging from July 2021 to March 2022.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for inspection and the individual inspection scope. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings on individual audits included the audit of deferred tax and certain other assets, revenue and margin recognition, and going concern disclosures.

Our key findings related to the audit of deferred tax and certain other assets, revenue and margin recognition and going concern disclosures.

We identified a range of good practice related to risk assessment, execution of the audit, and completion and reporting.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: compliance with the FRC's Revised Ethical Standard; partner and staff matters; acceptance, continuance, and resignation procedures; and audit methodology relating to settlement and clearing processes.

Our key findings related to compliance with the FRC's Revised Ethical Standard and, within partner and staff matters, improving aspects of the objective setting process for individuals below partner level. We also identified good practice in the majority of areas inspected.

Further details are set out in section 3.

Forward-looking supervision

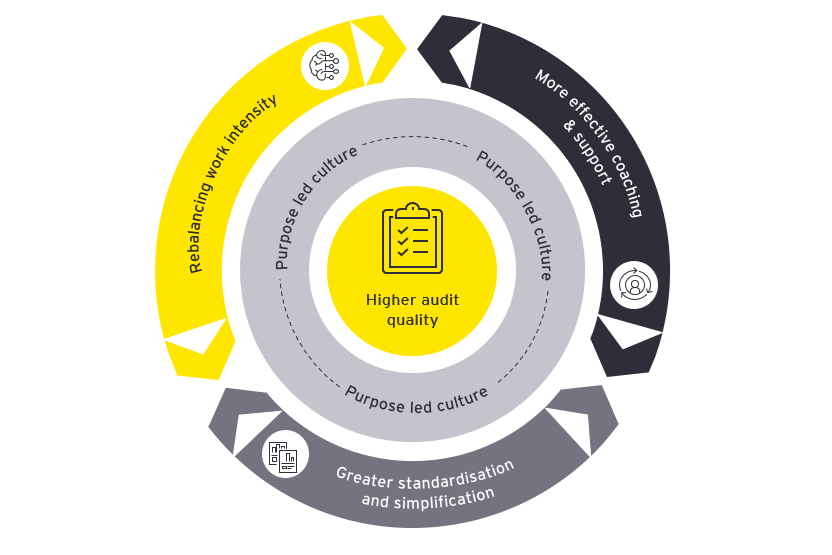

In response to our audit inspection results identified in our 2021/22 public report and the firm's root cause analysis (RCA), the firm refreshed its Audit Quality Strategy and identified three key priority areas where steps should be taken to enable teams to more consistently deliver high-quality audits. The three areas were greater standardisation and simplification, more effective coaching and reducing work intensity. The related initiatives are encouraging and there remains work for the firm to do to deliver the full benefits they may bring. Audits that have seen the impact of the initiatives already completed will be assessed for the first time in our 2023/24 inspection cycle.

With respect to quality control procedures, our key findings related to compliance with the FRC's Revised Ethical Standard and partner and staff matters.

The firm has maintained a strong focus on embedding a culture that supports high audit quality and this continues to be a core element of the Audit Quality Strategy, underpinning each of the key priority areas.

As well as continuing the strategic focus on enabling teams to more consistently deliver high-quality audits, it is important that the firm remains responsive to emerging themes from quality inspections and other monitoring. Related to this the firm has sought to refine parts of its RCA approach to accelerate the process and share learning with the practice more quickly. Last year, we required EY and all Tier 1 firms to develop an SQP that included the actions needed to improve audit quality and resilience. The firm has developed this plan which allows for prioritisation and monitoring of actions. The design of the SQP also provides an escalation route, if needed, for emerging themes to become priority areas with oversight from the Audit Board.

Further details are set out in section 4.

Firm's overall response and actions

A. Executive Summary

At EY we are committed to consistently delivering high-quality audits that serve the public interest. This core ambition is guided by our global purpose Building a better working world. For us, this means protecting the public interest and taking personal pride in audit.

The improvement in our FRC inspection results from the prior year, combined with the achievement of 100% good or generally acceptable ICAEW reviews, shows progress.

While none of our engagements were assessed as requiring significant improvement for the third year in succession, we are disappointed that certain aspects of four audits fell short of the high standards that we and our regulators expect. The good practice examples identified indicate that the steps we have taken are having a positive impact, so our future focus continues to be achieving this consistently.

Our positive internal Audit Quality Review results are broadly consistent with the improved results seen last year, albeit there was a small adverse shift between engagements graded 1 (with no or minor findings) and those graded 2 (with more than minor but not material findings).

We discuss our response to the key findings identified as part of the inspections and firmwide review in section B.

During the period the audits covered by this report were undertaken, businesses were grappling with the continued impact of COVID-19, the onset of the War in the Ukraine and the associated increased sanctions regime, supply chain disruption, and inflationary pressures culminating in a cost-of-living crisis. We are proud of the way that our audit teams have responded to the complexities arising from these challenging circumstances.

We welcome the independent perspective provided by our regulators, enabling us to benchmark our own initiatives against those of the wider profession. The FRC's forward-looking supervisory approach, assessment of our Audit Quality Strategy and our Single Quality Plan have all helped improve our audit quality. Our drive for continuous improvement is supported by our extensive root cause analysis process (see Section C), which has been expanded and accelerated over the past year.

Although we have not identified any systemic issues leading to findings, we have taken the opportunity to share learning from the ongoing reviews across the practice in regular messaging throughout the inspection cycle.

Our FY24 update to our multi-year Audit Quality Strategy, which is described in section D, will be finalised and launched to the audit practice in the Autumn of 2023. We believe the building blocks of our strategy remain appropriate and effective, including our continued focus on culture which is a central element of our strategy.

B. Review of individual audits and the firm's quality control procedures

We are encouraged that 80% of the engagements inspected by the FRC and 100% of the engagements inspected by ICAEW's QAD were assessed as either good or requiring limited improvements. Equally encouraging were examples of good practice identified by both the FRC and ICAEW across these reviews. These improved results are more consistent with these other measures of audit quality at EY.

In each of the past five years, 75% or more of our FTSE 350 audit reviews have been rated as good or requiring no more than limited improvements. This year, 89% of our FTSE 350 audits achieved this rating, and we are committed to achieving this high standard consistently across all of our engagements. We are therefore disappointed that four of the 20 selected engagements required more than limited improvements.

The majority of the key areas identified as requiring improvements in audit quality overlap with examples of good practice. This demonstrates that whilst there is more to do to ensure consistency of execution, there are no systemic issues leading to quality failings. During the year, we have proactively issued additional guidance to teams to support them in areas that could be more challenging, using the feedback and dialogue with the inspection teams on ongoing reviews to support this process. This has enabled us to implement timely, responsive, firmwide actions, in advance of review findings being concluded.

The good practice points identified in areas previously included as key findings such as in relation to testing of impairment and cash and cash equivalents demonstrate the positive quality impact that our timely interventions have had.

We have undertaken root cause analysis on all of the engagements that were inspected by the FRC, and a proportion of those reviewed by ICAEW, and implemented additional actions as a result of this where necessary.

Good practice was identified by the FRC in the majority of areas inspected as part of their consideration of our firmwide procedures. This includes our automated validation checks, supporting accuracy and completeness in personal independence declarations. The FRC has also recognised the clear links that we have established between quality and remuneration, and the safeguards that we put in place to maintain quality on higher risk and prospective engagements.

Following the FRC's review of our policies and procedures in relation to Ethics and Independence, we have required our audit partners and teams to formally document independence conclusions when approving each non-audit service including the threat of self-interest. We also require engagement teams to re-assess their analysis of previously approved non-audit fees, comparing estimated fees to actual fees on a frequency determined by the level of non-audit fees.

The Partner and staff matters review did not identify any weaknesses with the partner appraisal process. The review was undertaken on data informing the 20/21 appraisal cycle, and therefore a number of responsive actions have already been taken and are embedded, addressing the matters expressed. We have also critically assessed whether there is more that we can do to further improve our processes and support our people's development and their delivery of high quality audits. In response to this, we required non-audit partners with significant roles in the performance of external audits to include audit quality objectives as part of their annual goal setting. We have also issued guidance to teams to ensure clearer documentation of any objectives that are set in response to adverse findings.

These actions have been subject to review and approval by our Audit Quality Executive and governance and oversight from our Audit Non-Executives. Ongoing actions are integrated into our Single Quality Plan.

C. Root cause analysis (RCA)

RCA is an important component of our system of quality management, and a key tool which supports continuous improvement. It enables us to identify contributing factors leading to both positive and negative quality outcomes, including inspection results amongst a number of other quality indicators. Understanding the 'why' supports our development of appropriate actions where needed, and our assessment of the effectiveness of responsive actions planned or already taken, including those reflected in our Audit Quality Strategy. We have increased the extent of reviews performed to 124 reviews in the 2022/23 cycle (from 107 reviews in the 2021/22 cycle and 84 in the 2020/21 cycle). These cover both positive and negative quality outcomes on internal and external inspections as well as other matters.

As part of this process, we reflect on whether the root causes identified are specific to the circumstances of the engagement, or indicative of a wider systemic issue, and design responsive actions accordingly. We have not identified any systemic issues.

This year we have maintained and increased our focus on comparing and contrasting the positive traits and factors associated with positive quality outcomes to those identified as leading to negative quality outcomes. This helps us to better understand why there is inconsistency in execution and overlap between areas of good practice and findings, such as going concern and the audit of revenue. It also enables us to reinforce instances of good practice, and the behaviours and actions that led to them. As part of this, we have noted that the dissemination of good practice examples and implementation of standardised work programmes is having a positive impact.

As was the case last year, there is a spread of root causes from this year's inspection cycle, with no structural or common cause. This is perhaps symptomatic of the reduction in findings this year, and is also reflective of the disparate nature of the findings. The root causes can be broadly grouped into the following themes:

-

Varying impact of familiarity bias and experience with the engagement

In certain instances, accumulated knowledge of the sector or engagement, or over-reliance on prior year work, resulted in key judgements not being adequately considered (for example, placing too much emphasis on prior year considerations where the circumstances had changed).

Therefore, the audit files did not always convey the full extent of the work performed, or the rationale for audit judgements taken.

In response to this, our FY24 Audit Quality Strategy builds on our existing focus on Standardisation, so that each team consistently applies the appropriate level of challenge, guided by standard work programmes, to combat the negative effects of familiarity bias. This is emphasised by our Audit Culture, which is one that expects and values professional scepticism at all times and constructive challenge.

-

Inconsistency in the quality of coaching received

Where strong coaching is embedded throughout the audit, it results in a clarity of thinking that improves the quality of the audit. Conversely, poor quality outcomes can arise where expectations are not adequately established with teams. This can be reflected in the procedures performed, the extent and nature of evidence retained, or where senior team involvement is reduced or delayed.

To address this we are building on the initiatives launched during FY23 including expanding access to coaching through our newly launched Quality Enablement Network, development of a new app for queries and consultations, and availability of on-demand coaching videos – our Task Specific Tutorials.

-

Misalignment between task allocation and relevant team experience

In some instances, there were gaps in knowledge within the team that were not identified or understood. This led to a misalignment in task allocation, resulting in insufficient or incomplete audit procedures that required re-work. In other examples, it reduced the level of scepticism and challenge applied to complex accounting judgements.

We are responding to this through the Rebalancing Work Intensity pillar of our audit quality strategy, which includes an assessment of the level and nature of resources assigned to our engagements.

These root causes were often combined with a lack of clarity in the work performed or judgements made, as set out on the audit files, and failure to explain assumed knowledge.

The primary factors identified from our RCA as leading to positive quality outcomes is consistent with last year:

- High degree of manager and partner involvement

- Appropriate and sufficient resources

- Strong team culture

The observations from our RCA have been included as inputs into our refreshed FY24 Audit Quality Strategy.

D. Audit Quality Strategy

Our multi-year Audit Quality Strategy went through a major redesign in 2020. Following this, it has remained adaptable and responsive to emerging issues, with annual refreshes based on data points including feedback from the FRC and lessons learned from both positive and negative outcomes in inspections, as well as feedback from our people. This cycle's inspection results indicate that our Audit Quality Strategy includes the right building blocks. We continue to strive to do even better, increasing consistency in our delivery of high-quality audits.

Our FY23 Audit Quality Strategy focussed on three priority areas:

- Greater standardisation and simplification.

- More effective coaching and support.

- Reducing work intensity.

The year ends of the audits inspected ranged from July 2021 to March 2022. Although we know that the full impact of our strategy updates will not be evident immediately, we have seen through our RCA that approaching complex areas in a standardised way has led to improved quality, with no findings in areas where teams have adopted our standardised work programmes. We see building on this as a key element to driving increased consistency. For FY24, our refreshed strategy will maintain its focus on these priority areas, with culture continuing to be its central tenet:

i. Greater standardisation and simplification

In FY23 we built on our good practice examples and standardised work programmes, showing teams what 'good' looks like and driving consistency in areas such as Revenue and Group oversight. We will expand this further, helping teams to execute our methodology and rebalance their audit effort through:

- Release of additional topic specific methodologies.

- Creation of further standard work programmes and workpapers.

- Disseminating more examples of good practice.

- Expansion of Centres of Excellence.

ii. More effective coaching and support

In FY23 we expanded access to coaching support through:

- Increasing capacity within our coaching and quality teams, including through launching a quality enablement network of senior managers with representation in each office.

- Making existing resources more easily accessible through development of our Conduct Portal – a one-stop-shop to facilitate navigation through EY guidance.

- Developing a new app which provides a single conduit for all queries and consultations.

- Expanding on-demand content, including our library of task specific tutorial videos.

In FY24 we plan to maintain each of these activities and include an additional focus on training. We will also take steps to improve on the job coaching, including delivering coaching workshops over the summer.

Rebalancing work intensity

Since the launch of our FY23 strategy we have made progress towards our aim of rebalancing and reducing workloads:

- We have developed a new index to track the work intensity of our people. This index means that our progress is now quantifiable.

- We have started a conversation with teams across the business to understand what reducing work intensity means, and what the barriers to a sustainable workload might be.

- We have performed a deep-dive across our highest risk engagements, realigning resource to ensure appropriate team experience and additional support.

- We launched our 'Lifehack' series, sharing top tips for managing workloads.

In FY24 we plan to continue and expand each of these initiatives and increase our focus on project management. We recognise that our teams are diverse and have differing needs and challenges when it comes to this area, so we will empower them to make meaningful change locally.

E. Our Audit Culture

Our Audit Culture is fundamental to driving high quality outcomes consistently, underpinning each of the three priority areas set out within our audit quality strategy. We will continue to enhance our audit culture to continually focus all of our auditors on our combined responsibility of performing quality audits for all our stakeholders.

In 2021 we introduced the EY Audit Culture Framework, which articulates our desired audit culture, identifying those elements which we consider to be important to foster the behaviours that drive the delivery of high-quality audits.

Each year we measure our progress in an Audit Quality Culture survey, with the most recent survey assessing the cultural health of the firm as 86% – an increase of 8% from the previous year.

Communication of our desired culture starts from the moment a new team member is introduced to our firm, as it is embedded within our onboarding material. Our audit leadership emphasises the importance of this through our audit quality roadshows where our audit leadership team and Audit Non-Executives tour the country to share key messages around the culture of audit quality and to hear first-hand from our people.

In FY23 we celebrated our inaugural Audit Trust Awards in which we asked everyone to nominate outstanding individuals or teams across eight categories which are reflective of what it means to be an audit professional at EY, including:

- Coaching quality.

- Having the courage to challenge.

- Demonstrating a sceptical mindset

In FY24 we will continue each of these initiatives. We have also recently launched 'Better Me', which is dedicated time regularly set aside for all of our auditors across every grade, to focus on training and personal development.

F. Looking ahead

Audit quality is our priority. We commend the resilience, commitment and hard work of our teams over what has been a challenging few years. We will continue to work to deliver rewarding careers and exceptional experiences for our people. We will hold ourselves to the highest standards, whilst expecting the same of the companies that we audit.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements but are considered a key finding in this report due to the extent of occurrence across the audits we inspected.

Improve the assessment of the recoverability of deferred tax assets and the valuation of certain other assets

Deferred tax assets are recognised to the extent it is probable that they can be recovered within a reasonable time frame; this can be a highly judgemental area. The valuation of other assets can also be subjective and judgemental. Auditors should therefore demonstrate an appropriate level of consideration and challenge to assess the judgements made and conclude on their appropriateness.

Key findings

We reviewed the audit of the recoverability of deferred tax assets or the valuation of other assets on a number of audits and raised findings on four of them, including two assessed as requiring improvements.

- Deferred tax asset recoverability: On one audit, there was insufficient challenge and evidence to support the recoverability of the deferred tax asset against future profits; this particularly related to discretionary action over certain costs. The audit team also did not sufficiently challenge management to make specific disclosures of the nature of the evidence supporting the recognition of the deferred tax asset.

- Loan receivable valuation: On another audit, there was insufficient audit evidence obtained to support the valuation of a loan receivable. In particular, the audit team did not sufficiently challenge the interest rate used in the cash flows which supported the value of the loan.

- Investment valuations: On one audit, the audit team did not obtain an independent confirmation of the units held by the custodian to support the value of certain investments.

- Freehold property valuations: The audit team did not adequately justify its sampling approach for the testing of property valuations and did not obtain sufficient, appropriate audit evidence over the key inputs used by management's valuation expert.

The FRC reviewed the audit of the recoverability of deferred tax assets or the valuation of other assets on a number of audits and raised findings on four of them.

Further enhance the testing of revenue and margins, including the testing of journals

Revenue and margins are key drivers of operating results and key performance indicators on which investors and other users of the financial statements focus. Auditors should ensure that they design an approach which is responsive to the identified risks and undertake adequate audit procedures to address them. The testing of journals is one of the key audit procedures to respond to the risk of fraud. Auditors should obtain sufficient appropriate audit evidence for revenue, including any related journals.

Last year we stated that the firm should improve the effectiveness of the testing of revenue. The firm has since implemented a number of actions in this area and we have seen examples of good practice, however, we are still raising findings in this area.

Key findings

The firm has implemented a number of actions for the audit of revenue since last year. However, we are still raising findings in this area.

We reviewed the audit of revenue on nearly all of the audits inspected and raised findings on four of them, including two assessed as requiring improvements.

- Revenue journals testing: On one of these audits, the audit team did not adequately execute its planned procedures for the testing of revenue related journals; as a consequence, it did not demonstrate that it had adequately addressed the risk of fraud in revenue recognition. On another audit, the audit team did not evidence how it had performed adequate procedures over the information produced by the entity used to select revenue journals.

- Margin recognition: The audit team did not perform adequate audit procedures for the estimated margins on contracts, in particular in relation to the substantive analytical procedures, as the expectations set were not based on independent data or corroborated to supporting evidence. The thresholds used to identify any outliers in the analytical procedures were not sufficiently precise and there was insufficient challenge and corroboration of the outliers identified.

- Revenue cut-off testing: The audit team did not sufficiently evidence why the procedures performed over revenue cut-off were appropriate. There was also insufficient challenge of the reasons for certain cut-off errors identified.

Enhance the evaluation and challenge of aspects of going concern assessments, in particular the related disclosures

Management's going concern assessments include the estimation of future cash flows and can be subjective. Uncertainties relating to going concern require disclosures in the financial statements. Auditors should evaluate going concern assessments, the accuracy and adequacy of any related disclosures and whether the assessment takes account of all relevant information of which they are aware from the audit.

Key findings

We reviewed the audit of going concern on audits inspected where it was identified as a significant risk. We raised findings on two audits, including one assessed as requiring improvements.

The FRC reviewed the audit of going concern on audits inspected where it was identified as a significant risk. We raised findings on two audits.

- Going concern disclosures: There was insufficient evaluation of aspects of management's going concern assessment and insufficient challenge of certain related disclosures. In particular, the audit team did not sufficiently challenge and evaluate the accuracy and adequacy of the disclosures related to stress test scenarios and the related mitigating actions disclosed, including consideration of post year-end information up to the date of the auditor's report.

- Going concern model: The audit team did not evidence which specific procedures had been performed to verify the integrity of the numbers, related assumptions and calculations in management's going concern models and there were insufficient procedures to corroborate and challenge certain assumptions.

Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach responding to those risks.

- A detailed summary was prepared confirming any untested amounts for each component that were immaterial.

- Benchmarking of risk assessment procedures: To assess the completeness of risks identified, the audit team performed a benchmarking exercise against other similar companies to identify similarities and differences in the areas of significant risks and judgements.

- Effective consideration of inspection findings: As part of the planning phase, the audit team performed a detailed exercise to assess recent inspection findings on other audits in their audit planning considerations.

- Detailed revenue planning procedures: A clear link was demonstrated from each revenue stream to the respective planned audit procedures.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

Good practice examples included robust testing of cash, challenge of inventory valuations, effective sensitivity analysis for impairment, comprehensive revenue testing and good use of specialists on going concern.

- Robust testing of cash and cash equivalents: On one audit, the audit team performed detailed procedures to assess the quality of the responses received and the authenticity of the third-party confirmations. On another audit, the audit team performed additional procedures when nil balance bank accounts were identified in the bank confirmation response, to understand whether there had been any transactions within this account during the year and what the account was used for.

- Challenge of inventory valuations: On one audit, the audit team demonstrated good challenge of management in the audit of goods in transit, having considered a benchmarking of the company's accounting policy against industry practice. On another audit, the audit team analysed social media coverage after key events to obtain supplementary evidence as to whether related inventory was likely to be sold.

- Effective sensitivity analysis for impairment of goodwill: The audit team used the risks identified during the evaluation of management's impairment assessment to perform targeted sensitivity analysis.

- Comprehensive revenue testing: The audit team used its comprehensive understanding of the revenue process to enhance its data analytics testing.

- Use of data analytics on core payment process: The audit team designed and executed a focused four-way match data analytics approach for testing the core payment process. This included, for the key payment schemes identified, the audit team reconciling payment instructions generated by the third-party provider to the customer's ledger, general ledger and bank statements.

- Comprehensive IT testing: The IT specialists undertook a comprehensive review of the configuration of IT system codes used in the underlying applications. This included retaining and annotating the screenshots of IT code and explaining it in a way the audit team could easily understand.

- Use of specialists on going concern: The audit team performed extensive procedures over management's going concern assessment. This included engaging different specialists, assessing the financial ability of external investors to provide additional funding in an extreme scenario and a benchmarking exercise against the entity's peers.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Timely Engagement Quality Control Review: There was good evidence of the Engagement Quality Control Reviewer's timely involvement and clear articulation of the specific challenges raised and their resolution.

Monitoring review by the Quality Assurance Department of ICAEW

The firm is subject to independent monitoring by ICAEW. ICAEW undertakes its reviews under delegation from the FRC as the Competent Authority. ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. ICAEW does not undertake work on the firm's firm-wide controls as it places reliance on the work performed by the FRC, except for review of continuing professional development (CPD) records for a sample of the firm's staff involved in audit work within ICAEW remit.

ICAEW reviews are designed to form an overall view of the quality of the audit. ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher risk and potentially complex audits within the scope of ICAEW review.

ICAEW has completed its 2022 monitoring review and the report summarising the audit file review findings and any follow up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2023.

Summary

Overall, audit work continues to be acceptable. Of the ten files reviewed, all were either good or generally acceptable. This is consistent with the results of the previous visit.

Results

Results of ICAEW's reviews for the last three years are set out below. 100% of the ICAEW reviews were assessed as either good or generally acceptable.

Bar chart showing the results of ICAEW reviews from 2020 to 2022.

| Year | Good / generally acceptable | Improvement required | Significant improvement required |

|---|---|---|---|

| 2020 | 9 | 1 | 0 |

| 2021 | 10 | 0 | 0 |

| 2022 | 10 | 0 | 0 |

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Good practice

ICAEW identified good practice in several files. Broad themes were:

- Detailed records of the group audit team's interaction with the component auditors at key stages of the audit.

- Examples of thorough and insightful documentation that demonstrated the audit team's good understanding of the business, risk-focused approach to planning, and depth of going concern review.

3. Review of firm-wide procedures

We reviewed firm-wide procedures, based on those areas set out in ISQC (UK) 1, on an annual basis in certain areas, and on a three-year rotational basis in others.

In this section, we set out the key findings and good practice we identified in our review of the four areas of the firm's quality control procedures, which we reviewed this year under our three-year rotational testing. We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2022.

Matters arising from our review of the quality control procedures assessed on an annual basis are included, where applicable, in section 4.

The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2022/23 | Prior year 2021/22 | Two years ago 2020/21 |

|---|---|---|---|

| * Audit quality focus and tone of the firm's senior management | * Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019 | * Implementation of the FRC's Revised Ethical Standard 2019 | * Audit methodology (recent changes to auditing and accounting standards) |

| * RCA process | * Partner and staff matters, including recruitment, appraisals, remuneration, and promotion | * Engagement Quality Control Reviewers (EQCRs), consultations and audit documentation | * Training for auditors |

| * Audit quality initiatives, including plans to improve audit quality | * Acceptance, continuance and resignation procedures | * Audit methodology (fair value of financial instruments with a focus on banks) | |

| * Complaints and allegations processes | * Audit methodology (settlements and clearing processes for banks and building societies) | * Internal quality monitoring |

We also set out a summary of our prior year findings (in the two previous years) later in this section.

Going forward firm-wide monitoring will be performed under ISQM (UK) 1, which came into effect on 15 December 2022 (see further detail on our approach later in this section).

Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019

In the current year, we evaluated the firm's compliance with the FRC's Revised Ethical Standard 2019. The work considered the breadth of the Ethical Standard, focusing on the areas where there were more significant changes to the requirements in the 2019 revisions. This testing involved checking for:

- Prohibited non-audit services.

- Timely approvals of non-audit services.

- Identification and assessment of threats and safeguards for non-audit services.

- Compliance with fee ratios for non-audit services.

- Robust evidencing of consultations.

- Timely rotation of individuals off audit teams.

- Financial independence of individuals.

Firms must have policies, procedures, and internal monitoring to drive compliance with the FRC's Revised Ethical Standard 2019 and identify and address deficiencies and breaches.

We also held biannual meetings with the Ethics Partners to inform our understanding of their current challenges and priorities.

Key findings

We identified the following key finding where the firm needs to:

- Ensure robust assessment of independence threats and safeguards are performed before approving non-audit services. Such assessments need to reflect all the relevant threats, their significance and how the safeguards appropriately mitigate the threat(s). For self-interest threats, this should include identifying the expected value of the non-audit service fee and, where relevant, identifying and assessing the aggregate value of non-audit service fees received.

Good practice

We identified the following areas of good practice where the firm:

- Has in-built validation checks in the personal independence declaration system to flag unusual answers and request the individual to confirm the completeness of their declaration in respect of these matters.

- Requires individuals, in their personal independence declarations, to record all financial interests by ISIN, enabling automated checks against restricted investments.

Partner and staff matters – recruitment, management of partner and senior staff engagement portfolios, appraisals, remuneration and promotion

Recognition and reward of partners and staff, particularly those involved in the delivery of external audits, is a key element of a firm's overall system of quality control and is integral to support and appropriately incentivise audit quality. Robust recruitment processes are also essential in creating a culture and environment that supports audit quality. We reviewed the firm's policies and procedures in these areas and tested their application for a sample of partners and staff for the firm's 2021 appraisal year processes.

Recognition and reward of partners and staff, particularly those involved in the delivery of external audits, is a key element of a firm's overall system of quality control.

Appropriate allocation and management of partner and senior staff portfolios enables a firm to ensure its audits are being led and staffed by auditors with appropriate skills, experience and time. We reviewed the firm's policies and procedures around the accreditation of auditors (Responsible Individuals or RIs), to sign audit reports, the allocation of RIs to audits, and the review of responsibilities and workloads for audit staff and partners. We tested the application of these policies for a sample of RI accreditations.

Key findings

We identified the following key findings where the firm needs to:

- Ensure that individuals below partner level set personal objectives to respond to adverse quality findings. LEAD, the firm's performance management system, did not, for the 2021 cycle, require or prompt staff to set individual objectives, with staff only required to confirm acceptance of the firm's expectations for their role and behaviour. Staff may be involved in development plans, to address adverse quality findings, following root cause analysis undertaken. This was a recurring area of concern from our review of this area in 2019/20. Following our review, we understand that the firm has implemented an additional process requiring managers and above, as part of the objective setting process, to agree actions to address adverse quality findings, which are followed up through the appraisal process.

- Strengthen the evidencing of the appraisal process. Across the staff appraisals reviewed, for the appraisal process finalised in September 2021, we identified several instances where: staff had not evidenced any self-assessment; it was unclear how their quality ratings reflected adverse feedback on quality or file review results; no appraiser comments were evidenced to support the quality or performance rating awarded; or where the appraiser comments evidenced did not refer to quality metrics or feedback. This is a recurring area of concern from our last review of this area. Following our review, the firm has issued guidance to staff and appraisers on how the appraisal process should be evidenced and implemented monitoring to embed this.

Good practice

We identified the following areas of good practice where the firm:

- Has strong mechanisms to reward positive staff quality, including an annual bonus scheme, where staff with the two highest quality ratings are specifically considered for a bonus, ad hoc bonus schemes to reward demonstrations of the firm's values during the year, and publicised awards for exceptional examples of staff living the firm's values.

- Undertakes internal reviews of audit files for director promotion candidates to assess their audit quality and technical skills.

- Has a rigorous manager promotion assessment process, with a clear process to address all development areas identified.

Acceptance, continuance, and resignation procedures

A firm is required to establish policies and procedures for the acceptance and continuance of audits to ensure that it only undertakes audits: that it is competent to and has the resources to perform; where it can comply with the ethical requirements; and where it has considered the integrity of management, those charged with governance and, where relevant, the owners of the entity. This assessment needs to be made prior to the acceptance or continuance decision for each engagement.

Firms must have comprehensive policies and procedures in respect of acceptance and continuance.

We have reviewed these policies and procedures, including the firm's wider risk assessment of entities and audits as part of acceptance and continuance decisions. In addition, we have considered the firm's policies relating to withdrawal or dismissal from audits and the required communication on ceasing to hold office.

We also reviewed the application of these policies, and quality of evidence retained, for a sample of audits accepted, continued and ceased in the year.

Key findings

We had no key findings to report.

Good practice

We identified the following areas of good practice:

- The firm has a robust acceptance and continuance software system, which integrates the automated workflows from the independence, anti-money laundering and risk assessment procedures to ensure that a decision cannot be made until these are complete. The risk assessment process is also automated, using risk trigger questions on higher risk business activities, reputational factors, financial stability and audit complexity, to drive further risk assessment questions and to support the overall risk rating conclusion.

- For prospective audits identified as higher risk during the tender approval process, where requested by the bid review panel, the central risk team is consulted to determine which safeguards, such as the planned use of specialists and other quality control safeguards, may be required.

Audit methodology (settlements and clearing processes for banks and building societies)

In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to the audit of the cash and payments process cycle for the audit of banks, building societies, other credit institutions and payment services providers. Our evaluation focused on assessing the firm's guidance and templates provided in relation to:

- Understanding the relevant financial statement line items and their linkage to internal and external applications.

- Performing appropriate risk assessment procedures.

- IT specific guidance including the assessment of matching and other configuration rules and system generated report logic.

- Testing bank reconciliations (both controls and substantive testing).

- Guidance over external confirmations.

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control.

Key findings

We had no key findings to report.

Good practice

We identified no specific examples of good practice in our review.

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas we reviewed on a rotational basis:

We identified good practice in ethical compliance, partner and staff matters and acceptance and continuance procedures.

- Implementation of the FRC's Revised Ethical Standard (2021/22): The firm needed to improve its guidance on how to consider the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence. The firm also needed to ensure cumulative fees for non-audit services were monitored on a timely basis.

- Internal quality monitoring (2021/22): The firm needed to strengthen the reviews of completed audits to consistently identify key areas that require improvement, and also ensure that the reviewer's professional judgements were recorded to support the depth of their review and the conclusions reached in key areas where no findings have been raised.

Good practice

Good practice was identified in four areas:

- On consultations, the firm had a robust process for monitoring consultations raised by audit teams to identify themes.

- On audit methodology for fair value of financial instruments, the firm had developed good guidance on auditing complex valuation adjustments and expected IFRS 13 disclosures.

- On internal quality monitoring, the firm required follow-up reviews for all audits rated as having more than minor findings or material findings to review the remediating actions.

- On audit methodology and training we noted the amount of mandatory training provided to managers, the good illustrative audit procedures for the allowance for expected credit losses and the disclosure guidance on performing banking audits.

Implementation of ISQM (UK) 1

In the 2022/23 inspection cycle, prior to the implementation of ISQM (UK) 1, we have held discussions with the firm to understand its plans and progress for implementation, focusing on how the firm has:

- Ensured adequate oversight of and accountability for its system of quality management.

- Identified quality objectives, risks and responses and assessed the significance of its quality risks and the design and implementation of its responses.

- Identified the service providers and network resources that it relies upon in its system of quality management and how it will assess the reliability of these on an ongoing basis.

- Planned to undertake monitoring activities over its system of quality management on an ongoing basis.

Since the implementation of ISQM (UK) 1 we have begun our statutory monitoring under this standard.

In the 2022/23 inspection cycle, prior to the implementation of ISQM (UK) 1, (2023/24), we are focusing on the firm's identification of objectives, risk assessment processes and the completeness of the risks identified. In addition, we are reviewing certain components of the system of quality management, including governance and leadership, acceptance and continuance, network resources and service providers. In these areas we are looking at the design and implementation of responses. We will also review the firm's plans for ongoing monitoring and remediation of the system of quality management and the annual evaluation process.

On an ongoing basis, our inspection will be undertaken on a risk focused and cyclical basis, supported by targeted thematic work where we will perform in-depth reviews of particular aspects of the firm's systems of quality management. Our thematic reviews in the 2023/24 inspection cycle will also cover the following areas:

- Audit sampling methodology, within the engagement performance and intellectual resources components.

- Hot reviews, within the engagement performance component.

- Identification and assessment of network resources and service providers, within the resources component.

- Root cause analysis, within the monitoring and remediation component.

We will also annually review elements of the ethics component as this continues to be a priority area for the FRC, where our work will again focus on ensuring firms adhere to the FRC's Revised Ethical Standard through: compliance testing; review of breaches reported; and regular interaction with the firm's ethics functions.

Other annual areas of review will include elements of monitoring and remediation, including root cause analysis and audit quality plans, and leadership and governance, including tone at the top.

4. Forward-looking supervision

This section of the report focuses on our forward-looking supervisory approach – identifying and prioritising what firms must do to improve audit quality and enhance resilience. We balance an assertive approach, holding audit firms accountable, with acting as an improvement regulator, identifying and sharing good audit practice to drive further improvements across the sector.

We employ, to differing extents, all four faces of supervision in our work. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Firm Supervision 2023.

The Four Faces

This diagram illustrates the four roles of the FRC's supervisory approach:

- System Partner: Educating, collaborating, and supporting continuous improvement

- Supervisor: Supervision and monitoring of requirements, culture and behaviours

- Facilitator: Encouraging good practice through structured engagement

- Enforcer: Investigating conduct and applying proportionate sanctions and directions

We hold the firms to account through assessment, challenge, setting actions and monitoring progress. We do this through: assessing and challenging the effectiveness of the firm's RCA processes; evaluating the developments of firms' audit quality plans (AQPs); reviewing firms' action plans – now including their Single Quality Plan (SQP) – and monitoring the effectiveness of firms' responses to our prior year findings; assessing the spirit and effectiveness of the firm's response to non-financial sanctions; and through PIE auditor registration.

We also seek to promote a continuous improvement of standards and quality across firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2022/23 we held a roundtable, attended by the Tier 1 firms, sharing good practices and success stories on in-flight or hot reviews (internal reviews that take place during the audit, prior to the audit report being signed). We also carried out thematic work including on tone at the top and aspects of IFRS 9.

Our observations from the work we have conducted this year, and updates from previously reported findings, are set out under the following areas:

- The firm's SQP, other quality improvement plans and audit quality initiatives.

- Root cause analysis.

- PIE auditor registration.

- Other activities focused on holding the firms to account.

- Culture and conduct.

- Initiatives to ensure compliance with the FRC's Revised Ethical Standard.

- Operational separation.

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

The firm's Single Quality Plan, other quality improvement plans and audit quality initiatives

Background

The SQP was introduced, as we required, by the Tier 1 firms during the year and is maintained by each firm as a mechanism to further facilitate our holding firms to account. Each firm should develop an SQP that drives measurable improvements in audit quality and resilience. The firm should also have an overarching plan and strategy for audit (audit quality plan or AQP). The AQP should include initiatives that respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality. Where a firm has poorer results, these audit plans should either be transformational in themselves or be supplemented with a plan that prioritises those initiatives that will quickly bring about the transformation needed to improve audit quality. These overarching plans should then be used in the development of the firm's SQP in terms of purpose and prioritisation of individual actions or in the development of core pillars or similar. The SQP allows the firm and us to monitor whether changes are being prioritised and made in a timely and effective way. Where they are not achieving the objectives, we will hold the firm to account against their plan and consider whether further actions are necessary.

Single Quality Plans should enable firms to identify the areas which contribute directly or indirectly to audit quality and to prioritise their actions.

Last year we reported that we had reviewed key aspects of the firm's audit quality plan which was continually evolving to reset priorities, refocus existing initiatives and add new initiatives such as preparing for ISQM (UK) 1 and adding audit response to climate change to the plan. We saw this evolution continue with the firm identifying new key priority areas under the theme of enabling their auditors to concentrate their efforts in the right places to drive more consistent high-quality. The priorities were informed by the outcomes from last year's RCA and direct feedback from audit team members via focus groups.

Observations

We assessed the following:

The Audit Quality Strategy and the Single Quality Plan have been well integrated. Over time effectiveness measures must be used by the firm for individual actions and the SQP as a whole, so that both immediate and long-term effectiveness are considered.

- AQP: The key priority areas in the refreshed Audit Quality Strategy are greater standardisation and simplification, more effective coaching and support, and reducing work intensity. Alongside these key priority areas are a number of other workstreams to better enable audit teams to deliver consistently high-quality. The Audit Quality Strategy and SQP have been well integrated, with the SQP containing detailed actions that are to be taken to achieve the strategy.

- Greater standardisation and simplification: The firm has completed a number of actions including the creation of additional topic specific methodologies and standard work programmes, accompanied by short coaching videos on how to use the new materials and particular areas of audit risk to look out for. Progress in this area has been generally good, however, the development of centres of excellence to assist auditors in specific areas has been mixed, with some centres delayed.

- More effective coaching and support: A key action taken in this area has been the establishment of a quality enablement network of senior managers to provide additional quality support at an individual office level. The firm has also invested in increasing the size of its quality control team and will continue to do so.

- Rebalancing and reducing work intensity: This can be a challenging area across the audit profession, and we are pleased the firm has identified it as a key priority area. The firm's proposed actions in this area are broad and will require ongoing strategic focus to complete and embed effectively. There is also a clear connection with other key priority areas such as more effective coaching and simplification, which have the potential to reduce work intensity.

- Principles of SQPs: EY's SQP encompasses all the principles outlined by the FRC as we worked with firms to develop these plans. These principles include prioritisation, having a forward-looking focus, an ability to measure the effectiveness of the individual actions and the overall SQP, and regular reporting.

- Measuring the effectiveness of individual actions and the overall SQP: The firm has designed performance measures for actions contained in the SQP. As the SQP continues to operate, the firm will increasingly use these measures to determine whether completed actions have been effective and whether, in some cases, additional actions are needed. This is a key feature of the SQP and over time effectiveness measures must be used by the firm for individual actions and the SQP as a whole, so that both immediate and long-term effectiveness are considered.

- SQP – Monitoring and reporting: The SQP is regularly reported to management and the Audit Board, and includes RAG ratings on action progress. The reporting is clear, however, at present this is a manual process and the firm must develop a tool that assists both the monitoring and reporting of actions.

We will use the SQP alongside the AQP to monitor the progress of actions and how the firm measures their effectiveness. We will continue to assess the actions and / or initiatives the firm adds to the SQP to facilitate continuous improvement.

Root cause analysis process

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

Root cause analysis is an important part of a continuous improvement cycle.

ISQM (UK) 1, introduced a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process in previous years, we assessed that the firm's overall approach to RCA was well developed and identified good practice in relation to the extent of challenge from audit leadership, the breadth of information used in the RCA analysis, and analysis of good practices. We did not identify any key findings but given the poorer inspection results last year, we requested the firm to reconsider the depth and breadth of its RCA analysis and whether the actions taken had been effective. The firm completed this process as part of the annual Audit Quality Strategy refresh where its strategic quality priorities were updated. This year the firm has not made any significant changes to its RCA approach but has continued to make refinements.

Observations

We assessed the following:

- Actions tracking: The RCA process has been enhanced to more formally track actions that have been identified for audit team members to take with evidence retained to support their completion. Firm-wide actions are tracked via the Single Quality Plan, which includes success measures and mechanisms to escalate overdue actions.

- Accelerated RCA process: The firm started its RCA process for external inspections earlier this year to meet deadlines set by the global network and to allow the firm to share learnings with the audit practice more quickly.

- Focus groups: Although not formally part of the RCA process, the firm holds regular focus groups with front line auditors to identify audit quality challenges / themes. These are considered alongside the overall messages coming from the RCA process when the Audit Quality Strategy is refreshed each year. Although less formal, the advantage of the focus groups over RCA on inspection findings is that they provide a real time perspective on audit quality.

We will continue to assess the firm's RCA process as a crucial part of the feedback loop within ISQM (UK) 1 as well as part of our holding the firm to account. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result through the SQP.

PIE auditor registration

Background

The FRC is now responsible for the registration of all firms which carry out statutory audit work on public interest entities (PIEs). This registration is in addition to the ongoing requirement for firms and Responsible Individuals (RIs)8 to register with their Recognised Supervisory Body (RSB). The FRC's PIE auditor registration remit covers all firms and relevant Rls which audit one or more PIEs which includes: UK incorporated entities listed on the London Stock Exchange (or another UK-regulated market); a UK registered bank, building society or other credit institution (but not credit unions or friendly societies); or are a UK insurance entity which is required to comply with the Solvency II regulations.

The FRC is now responsible for the registration of all firms which carry out statutory audit work on public interest entities (PIEs).

All firms and RIs carrying out statutory audit work on PIEs were required to register with the FRC by 5 December 2022 under a set of transitional provisions. Thereafter, any firm that plans to take on a PIE audit, or remain auditor to an entity that is to become a PIE (for example, if it obtains a listing on the London Stock Exchange), together with relevant RIs, must register with the FRC before undertaking any PIE audit work.

Where appropriate, firms and / or Rls can be held to account through conditions, undertakings and suspension or involuntary removal of registration, adding to our activities focused on holding firms to account. Measures used through the PIE auditor registration process are not always published.

Observations

On 5 December 2022 EY's transitional application for registration as a PIE auditor was approved and as at 31 March 2023 102 Rls at the firm had been approved. The following diagram shows the number of PIE and non-PIE RIs as a percentage of the total RIs at EY.

Ernst & Young LLP

Pie chart showing the breakdown of PIE and non-PIE Responsible Individuals (RIs) at Ernst & Young LLP.

- PIE and non PIE: 63%

- Non PIE: 37%

Other activities focused on holding firms to account

Background

Our forward-looking supervisory approach includes a number of other activities designed to hold firms to account. We have carried out certain procedures during the year to consider tone at the top, the contents of the firm's Transparency Report and the firm's responsiveness to feedback, and where relevant, to constructive engagement and non-financial sanctions. This firm was not subject to increased supervisory activities during the year.

The firm has taken prompt action to strengthen policies, procedures and training aimed at preventing future recurrence of findings.

Observations

We assessed the following:

- Constructive engagement: Where we have undertaken constructive engagement during the period, the firm has taken prompt action to strengthen policies, procedures and training aimed at preventing future recurrence of findings. The majority of actions were completed in the latter half of 2022 and early 2023, so it is too soon to determine whether they will have a lasting impact. The firm must continue to monitor these areas until it can determine whether the actions have been successful.

- Non-financial sanctions: In respect of non-financial sanctions, there have been no new sanctions imposed and agreed in this inspection cycle. The firm has made good progress against the one sanction that is running from previous years.

- Tone at the top: The firm remains clear and consistent in its communications around the importance of audit quality. It responds well to feedback from the regulator and has a strong focus on continuous improvement. During the year, Senior Quality Leaders held a series of roadshows across all offices to engage with staff and hear their perspectives on audit quality first hand.

- Internal quality monitoring: Last year we identified that the firm needed to take action to strengthen its internal quality monitoring of completed audits. The firm acted quickly and made several enhancements to its process for the 2022 cycle of reviews.

Culture and conduct

Background

The firm's culture has a significant impact on audit quality and the speed at which audit quality is improved. Firms that have more advanced cultural programmes, where desired audit specific behaviours are promoted through their wider policies and procedures (in particular training and coaching, performance management and reward and recognition), typically have better or improving audit quality.