The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Developments in Audit – February 2017 update

The Financial Reporting Council (FRC) is the UK's independent regulator responsible for promoting high quality corporate governance and reporting to foster investment. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2017

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Overview

In July 2016, shortly after becoming the UK's single competent authority for audit, we published a report assessing confidence in UK audit ("Developments in Audit 2015/16"). The FRC has a strategic objective to promote justifiable confidence in audit in the UK. Recognising that audit quality is not yet consistently and sufficiently high, we aim to promote continuous improvement, taking tough action when necessary and focussing on areas of higher risk to the public interest.

TRENDS

This report provides a summary of developments since July 2016 against our plan for 2016/17 to focus on:

- making a success of our competent authority status, in liaison with the RSBs, to promote audit quality;

- working with auditors, audit committees and investors to communicate good practice and promote continuous improvement;

- underpinning confidence with sound and effective enforcement;

- continuing to promote audit quality internationally, recognising the international nature of UK markets and investment; and

- keeping pace with, and facilitating where possible, changes in audit and its use of technology in improving the effectiveness and quality of audit.

We have reviewed our first six months as the competent authority for audit and are satisfied that we are meeting legal requirements. We will assess the effectiveness of our actions in our full year report. In this report we provide an update on:

1) Standards and Guidance on Audit - Progress has been made in the implementation of the new Auditing and Ethical Standards introduced in June 2016. We have set up a consultative group, including auditors, audit committee members, investors and the professional bodies for audit. We have been active members in the new European body to facilitate consistent implementation of the new requirements.

The new Ethical Standard emphasises the importance of considering conflicts of interest from the perspective of an objective, reasonable and informed third party. Auditors and audit committees are developing practice for such considerations, particularly for difficult judgements, including seeking input from the audit firm's independent non-executives ("INEs”1), key investors and the FRC. Investors have raised concerns with us that in dealing with conflicts of interest, not all firms are demonstrably serving their interests.

A faster pace of improvement in, and greater consistency of, audit quality requires strong leadership of, and the right culture in, the audit firms. We have issued a revised Audit Firm Governance Code clarifying and emphasising the public interest role of INEs. In 2017/18 we propose to review the effectiveness of governance and the culture of the eight firms adopting the Code.

We have begun work to update Practice Notes for auditors in light of the new standards and other developments. We have issued an updated Practice Note on the audit of insurers and have work in hand on the audit of charities and pension schemes.

We have consulted on Third Country Auditor Register Procedures to strengthen our ability to deal with non-compliance issues.

2) Audit Committees – We continue to focus on working with audit committees given their key role in auditor appointment and assessing ongoing quality. We have undertaken a third audit committee chair survey on audit quality, finding that audit committees remain overwhelmingly positive as to tendering developments and audit quality. Of those entities that had carried out an audit tender, 70% changed auditors and, of those, 18% think there has been a significant change for the better in audit approach and quality.

To promote effective audit tenders, we recently issued updated notes on good audit tender practice.

We will continue to focus on audit committee communication to seek to narrow the gap between our findings, the views of investors and audit committees as to audit quality.

3) Our Monitoring of Audit Quality – Our 2016/17 monitoring cycle is ongoing. An emerging theme is that we continue to see examples of insufficient auditor scepticism in identified areas of significant risk such as the assessment of potential impairments and judgements concerning material accounting treatments.

We have increased our engagement with audit committees on audit quality reviews. We are increasing the number of pre-review discussions and offer all audit committee chairs an opportunity to meet us after the review, irrespective of the nature of our findings. We seek feedback on every review.

We are publishing, for the first time, a list of those entities whose audits we have reviewed. We will issue further lists periodically. As a result of this increased transparency, we expect to see increased reporting by audit committees on our findings and increased investor scrutiny of audit quality.

During our 2016/17 monitoring cycle we have to date issued thematic reviews on:

- root cause analysis undertaken by audit firms, so as to accelerate learning from positive and adverse audit quality outcomes; and

- the use of data analytics to assist in embedding techniques which have the potential to improve audit quality.

Audit firms can accelerate audit quality improvements through root cause analysis and structured support of the introduction of data analytic tools.

4) Our Oversight of the Professional Bodies for Audit - We have reached final delegation agreements with the professional bodies, replacing the temporary agreements entered into in June 2016. We have agreed new working protocols with them and are nearing completion of our oversight inspection activities for 2016/17.

5) Audit Enforcement - Justifiable confidence in audit is underpinned by sound and effective enforcement. We have concluded four audit related cases since July resulting in sanctions of £6,525,600. We have begun our first investigation under the new Audit Enforcement procedure, into the audit of Sports Direct International, and are making enquiries into the audits of Rolls-Royce and British Telecom.

During the remainder of 2016/17 and into 2017/18 we intend to continue our work to promote justifiable confidence in audit, focusing in particular on enhancing the speed and effectiveness of our audit enforcement and on the targeted improvement in audit quality of FTSE 350 audits as assessed by our monitoring activities. Our proposed priorities also include playing an active role with other regulators in helping address the challenges and opportunities of Brexit and remaining influential internationally.

Actions for audit committees, investors and audit firms

| Audit firms | Audit committees | Investors |

|---|---|---|

| Focus on good practice governance as set out in the new Audit Firm Governance Code. | Focus on perceived conflicts and challenge auditors on significant judgement affecting matters of independence, seeking investor input where necessary. | Engage with audit committees on matters of auditor appointment and independence. |

| Stay abreast of developments in the application of the new standards and how to address the third party test in assessing independence. | Report meaningfully on how audit quality has been assessed, including reflecting on FRC findings and actions taken to address them2. | Gain insight into the quality of specific audits through the FRC published list of reviews and the audit committee reports on them. |

| Enhance the audit of impairment and other key areas identified by the FRC. | Seek evidence from auditors of the quality of their impairment testing and their challenge of management. | |

| Assess the FRC thematic reports to identify areas for continuous improvement in audit quality. | Read our updated notes on tendering and consider what changes may be made to ensure an effective tender process. |

Standards and Guidance on Audit

Implementation of new standards

The implementation of the new EU requirements for statutory audit from June 2016 has brought with it questions regarding interpretation. We have established a consultative group which brings together representatives from audit firms, audit committee members, investors and the professional bodies to help develop a common understanding of the implications of these new requirements.

The advisory group met five times in 2016. A record of the group discussion is made publicly available on the FRC's website3.

Much of the discussion in the UK to date has focused on the challenges presented by the changes and additions to the UK Ethical Standard, particularly with regard to firms maintaining independence and avoiding conflicts of interest in carrying out their audit work.

Some of the issues raised at the meetings also require a consistent approach to interpretation across the single market. The Committee of European Audit Oversight Bodies (CEAOB), a European organisation of which the FRC is a member, has been established under the EU Regulation with the objective of facilitating the exchange of information, expertise and best practices for the implementation of the Regulation and the Directive. The CEAOB is currently in the process of setting up a mechanism to assess and respond to requests on interpretation of the new requirements.

The FRC engages with audit committee chairs, investors and auditors in addressing significant matters of judgement, guiding stakeholders rather than intervening in their decision making process. The new ethical standard is built on the principle of viewing independence through the eyes of an objective reasonable and informed third party. Stakeholders are establishing ways of seeking such a perspective, engaging with INEs and key investors. Investors have raised concerns with the FRC that not all firms are demonstrably serving their interests.

We have set up a new consultative group to bring stakeholders together to discuss implications of the new UK standards

Investors have concerns that in dealing with conflicts of interest, not all firms are demonstrably serving their interests

Audit Firm Governance Code

A faster pace of improvement in, and greater consistency of, audit quality requires strong leadership of, and the right culture in, the audit firms. Since the publication of the Developments in Audit Report, we have issued a revised Audit Firm Governance Code, which became effective for financial years beginning on or after 1 September 2016. The Code, which operates on a comply or explain basis, applies to firms auditing 20 or more listed companies, but may be adopted on a voluntary basis by other firms. Currently we are aware of eight UK firms which apply it.

We have issued a revised Audit Firm Governance Code, seeking to enhance the role of INEs and increase the focus of those firms applying the Code on audit quality

In 2017/18 we propose to review the effectiveness of governance and the culture of the eight firms adopting the Code

The revised Code has been amended to:

- sharpen the Code's purpose to ensure that audit quality is at its core;

- introduce a minimum number of INEs for firms and a provision that at least one should have experience in audit or another relevant sector; and

- maximise transparency in reporting by the firms and their INEs.

We will continue to monitor the implementation and operation of the revised Code including through regular liaison with the firms' INES.

We have work in hand to update other Practice Notes in the light of new standards, including for the audit of charities and occupational pension schemes. The Public Audit Forum recently issued a revised Practice Note4 to support the audit of public sector bodies.

Practice Notes for auditors

Under the ARD most insurance undertakings have been designated as public interest entities, the audit of which is subject to direct oversight and regulation by the FRC.

We have published a revised Practice Note, bringing together guidance for practitioners auditing insurance entities in the UK. The Practice Note supports the delivery of a high quality audit of the statutory financial statements and insurers' regulatory reports under Solvency II.

We have issued a revised Practice Note on the audit of insurers, most of which are now public interest entities

Third Country Auditors (TCA) consultation

The FRC is responsible for oversight of the TCAs, including registration and removal of TCAs from the Register of Third Country Auditors (the Register).

To date, we have dealt with any non-compliance issues, which could require a TCA registration to be withdrawn, by engaging with the TCA to resolve the issue. Although this is not always successful, where we have issues we publicise them on our website. We have recently developed and consulted on Third Country Auditor Register Procedures5 to apply a consistent, efficient and transparent process for de-registration of TCAs between renewals. Our consultation with stakeholders to obtain their views on these procedures has just ended and we are in the process of reviewing the responses received.

We have recently consulted on revised Third Country Auditor Register Procedures, to enable deregistration, and will be finalising them in the first quarter of 2017

Audit Committees

Quality of audit remains high, according to audit committee chairs in annual FRC survey

Audit committee chairs survey

Feedback from the FRC's third audit committee chairs survey on audit quality, which was sent to all FTSE 350 audit committee chairs as well as a selection from other listed companies, was overwhelmingly positive. With 192 responses, the return rate for the survey was broadly in line with 2015.

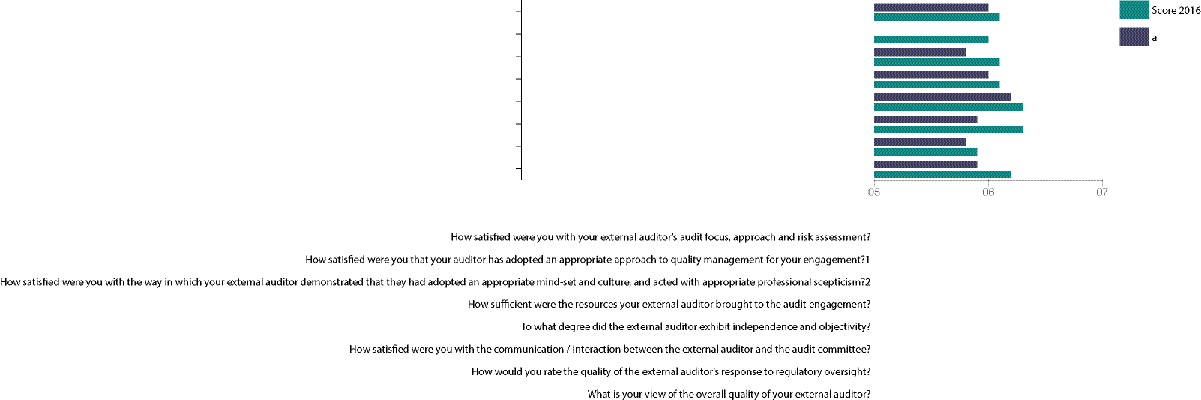

Comparison of mean scores per question (on a scale where 1 was the lowest and 7 the highest)

Score 2015 Score 2016

- How satisfied were you with your external auditor's audit focus, approach and risk assessment? 6.0 / 6.1 Change +1.6%

- How satisfied were you that your auditor has adopted an appropriate approach to quality management for your engagement?6 6.0

- How satisfied were you with the way in which your external auditor demonstrated that they had adopted an appropriate mind-set and culture, and acted with appropriate professional scepticism?7 5.8 / 6.1 Change +5.2%

- How sufficient were the resources your external auditor brought to the audit engagement? 6.0 / 6.1 Change +1.6%

- To what degree did the external auditor exhibit independence and objectivity? 6.2 / 6.3 Change +1.6%

- How satisfied were you with the communication / interaction between the external auditor and the audit committee? 5.9 / 6.3 Change +6.8%

- How would you rate the quality of the external auditor's response to regulatory oversight? 5.8 / 5.9 Change +1.7%

- What is your view of the overall quality of your external auditor? 5.9 / 6.2 Change +5.1%

Across most of the eight questions asked, auditors scored between 6 or 7. All of the firms subject to the survey scored a mean score of over 6. While some differences in ratings and response levels between firms were observed, there were no clear conclusions to be drawn by firm.

Many chairs highlighted the quality of the audit partner as being crucial to their assessment of the overall quality of the audit. Several discussed the importance of auditor independence to both the company and the audit firm and provided examples of the way in which their auditor had sought to demonstrate independence through robust challenge of management.

The most improved metric was satisfaction with the communication and interaction between the audit committee and the auditor.

The communication between the auditor and the audit committee was excellent... as a result we were able to exercise our judgement and take necessary action steps in a very well informed way.

We also asked audit committee chairs to comment on criteria they use to assess audit quality outside of the headings in the questionnaire (a number of which draw on the guidance in the FRC's Audit Quality Practice Aid8). These additional criteria included:

- surveys of management and finance staff on their views of the performance of the auditors;

- the extent to which the auditor can demonstrate knowledge of the business and the key risks facing it;

- perceived calibre of the individuals on the audit team;

- continuity within the audit team; and

- the extent to which the auditor can add value, for example by pointing the company's management towards instances of best practice in corporate reporting.

The FRC is working to understand the differences between audit committee chairs' views on quality, the views of investors and the findings of our inspections.

As set out in the following section, we increasingly engage with audit committee chairs to develop a mutually agreed view of quality and we are encouraging increased transparency of what we have reviewed so that audit committees are better able to explain how they have assessed audit quality.

Audit committee chairs reported that good quality responses were received from firms in audit tenders and that a real choice was available to the audit committee at the time of the final selection decision.

We have issued updated notes on good practice for audit tenders.

In the light of the increase in tendering activity, this year the survey also asked whether their company had been involved in a tender process during the previous twelve months. 49 companies (26% of the sample) indicated that the company had conducted an audit tender. Of these, nearly 70% changed their auditor as a result.

| Question | Score |

|---|---|

| For those entities which had tendered for the provision of audit services in year: | |

| If the company has tendered its audit in the last twelve months, was the tender process easier or more difficult than expected?9 | 4.9 |

| If the auditor has changed as a result of a tender process, have you noticed any significant differences in audit approach or audit quality?10 | 6.1 |

| For those entities which had not changed auditor as a result of the tender: | |

| If you have not changed auditor during the year, have you noticed any area where audit quality has increased or decreased in the course of the last twelve months? | 6.2 |

Amongst those who changed auditor, 18% think there has been a significant change for the better in audit approach and quality.

We have used this evidence, together with roundtable feedback from audit committee chairs who have undertaken a tender in recent years, investors and audit firms in updating our notes on good practice for audit tenders. This document11, published on 7 February 2017, reflects the good practice that has been emerging as the audit market starts to see tendering as 'business as usual'.

Our Monitoring of Audit Quality

Insufficient auditor scepticism and challenge of management in areas such as impairment testing is an emerging theme in the current inspection cycle

Audit committees are a key audience for our audit quality review findings. We continue to look for opportunities to develop the nature and extent of our engagement with audit committees to improve the overall effectiveness of our inspections

Emerging themes from 2016-17 engagement reviews

The FRC's Audit Quality Review (AQR) team's 2016-17 cycle of reviews of the UK auditors of UK Public Interest Entities is not yet complete. We will publish reports on the findings of our work at each of the largest six audit firms later in 2017 along with a summary in the July 2017 Developments in Audit report, covering progress towards the target that, by 2019, no more than 10% of FTSE 350 audits will require more than limited improvements.

An emerging theme to date is that we continue to see examples of insufficient auditor scepticism in areas of significant risk such as in the assessment of potential impairment of goodwill and other intangibles.

Liaison with audit committees on engagement reviews

For a number of years, we have provided the confidential reports on each of the audits our AQR team reviews directly to the relevant audit committee chair or, where there is no audit committee, to those charged with governance of the audited entity. These reports are provided at the same time as they are provided to the audit firm.

We also engage with the audit committee chair at the beginning of our review. This helps us plan certain aspects of the review and provides an opportunity for audit committees to draw matters to our attention. To date we have adopted a sampling approach, holding such discussions on typically 20-25% of the audits reviewed each year. From 2017/18 we are increasing the number of discussions we hold with audit committee chairs, with the aim of a discussion being held in respect of the majority of the audits we review.

We now invite audit committee chairs to discuss our findings with us following the receipt of our report on the inspection of their respective audit, irrespective of the nature of our findings.

We have also begun to seek specific feedback on our review from audit committees on each audit we inspect. Three months after we issue our report, audit committee chairs are being asked to complete a short online survey. The survey provides an opportunity to comment on the usefulness of our findings and the nature of the engagement between the audit committee and its auditor in respect of the findings. The feedback obtained from this survey will assist us in improving the effectiveness of our reviews and how we communicate our findings.

As highlighted in FRC thematic reviews, audit firms can accelerate audit quality improvements through root cause analysis and structured support of the introduction of data analytic tools

We are publishing the first list of entities reviewed in 2016/17 at the same time as this report. We expect to publish further details of audits reviewed by AQR on a quarterly basis on our website.12

Publishing information on reviews of audit engagements

We have decided to publish the names of all audited entities whose audits we have reviewed. Publication will be done periodically, after the publication of the entity's next annual report and accounts following inspection. This increased transparency will enable investors and others to refer to the discussion in the audit committee report of our inspection findings, including the actions taken by both the auditor and audit committee to address issues where appropriate.

Thematic reviews 2016/17

In addition to reviews of individual audits and of firm-wide arrangements, we also conduct 'thematic reviews', aimed at promoting continuous improvement in audit quality. These reviews look across audit firms at particular aspects of audit quality arrangements, to provide insights and identify areas of good practice. In 2016/17 we are conducting three thematic reviews: root cause analysis into the findings arising from external and internal quality monitoring; data analytical tools used in the audit, and processes for achieving consistent audit quality. These reviews each cover the six largest audit firms.

Root Cause Analysis

Our report13 was published in September 2016. Whilst there is no requirement in auditing standards for firms to perform Root Cause Analysis (RCA), in practice they are devoting more resources in this area to understand why audits have fallen below the standard expected, according to the results of internal or external reviews. We identified that the firms are improving their RCA process and some are more advanced than others. We recommended that firms: improve planning and training on the process; consider using individuals and RCA techniques from outside the audit practice; and adopt more consistent processes for investigating causes for internal and external inspections. We plan to perform a follow up thematic review within the next three years to report on the progress of firms on their RCA.

Firms' use of data analytics in the audit

We have observed that audit firms are increasingly describing in tender documents how they plan to make greater use of data analytics in the audit process to improve audit quality and bring more insights to management. The firms are each making significant investment in data analytic tools. In January 2017 we published a thematic review14 on the stage that audit firms have reached in developing their tools in this area and how frequently they are being used by audit teams in practice. We will also use the information gathered through this work to inform the development of UK and international auditing standards.

Firm's processes for achieving consistent audit quality

This review is considering the processes audit firms have in place to support the audit team in delivering a quality audit. These include technical reviews of financial statements, internal reviews of audit work, use of specialists on audits and the firm's responsibilities for these quality processes. We intend to publish our findings in the first quarter of 2017.

Our Oversight of the Professional Bodies for Audit

As the Competent Authority for the UK, the FRC has ultimate responsibility for the performance and oversight of the audit regulation tasks required by law. Our new responsibilities include oversight of the competent authority functions which we delegated to the Recognised Supervisory Bodies (RSBs) under temporary Delegation Agreements in June 2016. These are: audit monitoring; approval and registration of statutory auditors; continuing professional development and investigations; and complaints and discipline. In respect of audit monitoring and enforcement, the FRC has retained responsibility for PIES, large entities on markets that are not EU regulated and Lloyd's syndicates. The final Delegation Agreements were agreed in September 2016.

Our role in respect of the Recognised Qualifying Bodies (RQBs) continues to be one of oversight and our approach has not changed from previous years. The implementation of ARD has required us to reassess our approach to monitoring activity for the RSBs. We aim to balance the more directive approach that may be required in specific circumstances with sustaining and improving our relationship with the RSBs and RQBs as we work towards the common goal of improving audit quality.

Recognised Supervisory Bodies

Monitoring visits to the RSBs have been undertaken and covered:

- an overall assessment of compliance with the conditions of delegation set out in the Delegation Agreement. The assessment covered the delegated tasks relating to registration of auditors, audit monitoring, enforcement (complaints and discipline) and continuing professional development; and

- a 'deep dive' on the RSBs performance of one of these tasks – selected on a risk based/rotational basis. For 2016/17 our in-depth work at each of the RSBs related to complaints and discipline.

We are currently finalising our reports on these visits and will provide further details in our full year report.

Recognised Qualifying Bodies

In 2016/17 our RQB visits, which are not yet complete, focus on the review of the processes and procedures relating to examinations, including assessing the RQBs' expertise and examination setting / moderation processes (including syllabus and exam paper coverage of the Prescribed Subjects, as set out in The Statutory Auditors (Examinations) Instrument 2008) and marking processes. The controls in this area are key to ensuring adequate standards are maintained across the profession. We last reviewed this area in 2011 and there have been significant developments since our last review, including the introduction of computer-based assessments and insurance and banking exam papers.

Audit Enforcement

We seek to underpin justifiable confidence in audit with sound and effective enforcement. Since July 2016 four cases have concluded resulting in severe reprimands and fines of £6,525,600:

Justifiable confidence in audit is underpinned by sound and effective enforcement. We have made further progress on concluding cases and are carrying out the first investigation under the new Audit Enforcement Procedure

| Company | Audit firm /Audit partner | Investigation Announced | Outcome | Date concluded | Sanction | Costs |

|---|---|---|---|---|---|---|

| Cattles plc | PwC | 23-Jul-09 | Misconduct admitted Sanction agreed | 22-Aug-16 | Severe reprimand Fine £2,300,000 | £750,000 |

| Cattles plc | Simon Bradburn | 23-Jul-09 | Misconduct admitted Sanction agreed | 22-Aug-16 | Severe reprimand Fine £75,600 | N/A |

| Aero Inventory plc | Deloitte | 03-Mar-11 | Misconduct by Tribunal Sanction by Tribunal | 10-Nov-16 | Severe reprimand Fine £4,000,000 | £2,275,000 |

| Aero Inventory plc | John Clennett | 03-Mar-11 | Misconduct by Tribunal Sanction by Tribunal | 10-Nov-16 | Severe reprimand Fine £150,000 | N/A |

In relation to the audit of Cattles plc15, PwC admitted that its conduct fell significantly short of the standards reasonably to be expected in issuing unqualified audit opinions in circumstances where PwC:

- had insufficient audit evidence as to the adequacy of the loan loss provision; and

- had failed to identify the fact that the impairment policy was not adequately disclosed and that the disclosures in those financial statements were not in compliance with IFRS 7.

In relation to the audit of Aero Inventory plc, Deloitte did not admit misconduct and a tribunal therefore heard evidence over five weeks on three allegations brought by the FRC's Executive Counsel:

- the appropriateness of the accounting and disclosure in Aero's 2006 financial statements of the Garuda Transaction;

- the costs of sales and stock valuations in the 2006, 2007 and 2008 audits; and

- stock existence in the 2007 and 2008 audits.

The tribunal found all three allegations proved and fined Deloitte £4million plus costs. The fine is the highest recorded by the FRC for misconduct by a member firm.

A public tribunal hearing took place in November and December 2016 to consider the FRC Executive Counsel's formal complaint alleging misconduct by PwC in its audit of Connaught PLC. The outcome of that hearing is expected in the near future.

In November the Conduct Committee decided to open the first investigation under the new Audit Enforcement Procedure16 in connection with the audit of Sports Direct International plc. The investigation was opened following reports of an arrangement between Sports Direct and Barlin Delivery Limited which was not disclosed as a related party in the company's financial statements.17

The Case Examination and Enquiries team is currently enquiring into two further audits relating to:

- Rolls-Royce plc – following the announcement of the outcome of an SFO investigation; and

- BT Group plc - following a statement about accounting issues in its Italian business.

Who we are and what we do: AUDIT QUALITY REVIEW

In each Developments in Audit report we will look at one area of the FRCs work in a little more detail. In this report we look at the day to day activities in the UK of our Audit Quality Review team.

What is AQR? The team within the FRC that, amongst other things, assesses the quality of whole firm procedures and audit work undertaken by UK auditors of Public Interest Entities (PIEs). There are around 50 PIE audit firms. AQR also inspects Third Country Auditors and carries out other activities by contract.

What is a Public Interest Entity (PIE)? Any entity with listed debt or equity on an EEA regulated market (e.g. London Stock Exchange); a credit institution (e.g. bank) or an insurance undertaking. (In addition, the FRC also includes within the AQR's scope the audit of AIM listed entities and Lloyds Syndicates).

How is a UK PIE audit selected for review? Audits are selected on a combined risk and rotational basis, with FTSE 350 companies reviewed on average every 5 years.

Is the entire audit reviewed? Certain areas are reviewed, with selection influenced by the nature of the business as well as the key audit matters articulated in the audit report and the risks listed in the audit committee report.

Which areas of an audit are typically reviewed? Impairment testing of goodwill and other intangibles, asset valuations and revenue recognition are all areas identified as key audit matters and so are more frequently chosen.

What areas are in scope? For a UK based group with significant operations overseas, AQR's remit can be quite limited. It excludes audit work performed by auditors overseas on components of the group. AQR covers the UK audit firm's work in its role as group auditor. It does include work performed in the UK on UK components.

How does AQR measure audit quality? AQR classifies audits into four categories, ranging from 'good' to 'significant improvements required'.

Are the results of these reviews made public? The findings of individual audit reviews are shared with the audit firm and the audit committee, which is expected to include details of any significant findings in the following year's annual report. AQR publishes a list of those entities it has reviewed and annual reports on firms with a significant number of PIE audits as well as annual summary statistics on all its reviews.

Financial Reporting Council 8TH FLOOR 125 LONDON WALL LONDON EC2Y 5AS

+44 (0)20 7492 2300

www.frc.org.uk

Footnotes

-

https://www.frc.org.uk/Our-Work/Publications/FRC-Board/Audit-Firm-Governance-Code-Revised-2016.pdf ↩

-

https://www.frc.org.uk/Our-Work/Publications/Audit-and-Assurance-Team/Audit-Quality-Practice-Aid-for-Audit-Committee-(1).pdf.pdf) ↩

-

https://www.frc.org.uk/Our-Work/Audit/Audit-and-assurance/Standards-and-guidance/Standards-and-guidance-for-auditors/Staff-Guidance-Notes.aspx ↩

-

http://www.public-audit-forum.org.uk/wp-content/uploads/2016/12/Statement_of_recommended_practice_PN10.pdf ↩

-

https://www.frc.org.uk/Our-Work/Publications/Professional-Oversight/Public-Consultation-%E2%80%8BThird-Country-Auditor-de-reg-File.pdf ↩

-

This question replaced the 2015 question - How satisfied were you with your auditor's assessment of materiality. No comparison of scores is made. ↩

-

This question replaced the 2015 question - How satisfied were you with the level of professional scepticism demonstrated by the external auditor. ↩

-

https://www.frc.org.uk/Our-Work/Publications/Audit-and-Assurance-Team/Audit-Quality-Practice-Aid-for-Audit-Committee-(1).pdf.pdf) ↩

-

The score reflects the fact that respondents reported the experience as being easier than expected. ↩

-

The score reflects a net perceived improvement in quality. ↩

-

https://www.frc.org.uk/Our-Work/Publications/Audit-Quality-Review/Audit-Tenders-notes-on-best-practice.pdf ↩

-

https://www.frc.org.uk/Our-Work/Audit-and-Actuarial-Regulation/Audit-Quality-Review/AQR-Audit-Reviews.aspx ↩

-

https://www.frc.org.uk/Our-Work/Publications/Audit-Quality-Review/Audit-Quality-Thematic-Review-Root-Cause-Analysis.pdf ↩

-

https://www.frc.org.uk/Our-Work/Publications/Audit-Quality-Review/Audit-Quality-Thematic-Review-The-Use-of-Data-Ana.pdf ↩

-

https://frc.org.uk/Our-Work/Publications/Enforcement/Settlement-Agreement-PricewaterhouseCoopers-LLP-a.pdf ↩

-

https://www.frc.org.uk/Our-Work/Publications/Professional-Discipline/Audit-Enforcement-Procedures.pdf ↩

-

https://www.frc.org.uk/News-and-Events/FRC-Press/Press/2016/November/Investigations-into-the-preparation,-approval-and.aspx ↩