The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Our Approach to Regulation: The FRC and the Regulators’ Code

Introduction

The FRC regulates the work of accountants, auditors and actuaries; setting, supervising and enforcing against professional standards. We are also the home of the UK's Corporate Governance and Stewardship Codes. As a responsible regulator, until 2021 we applied the Regulators' Code voluntarily. The Regulators' Code sets out a clear and principles-based framework for how regulators should engage with those they regulate. From 2021, the FRC was added to a list of regulators whose functions are specified by order under section 24(2) of the Legislative and Regulatory Reform Act 2006 and who must have regard to the code. It is now, therefore, even more important that the FRC, when carrying out its regulatory work, explains how it complies with the Regulators' Code and follows the principles of good regulation.

This document covers:

- an explanation of our regulatory role and approach

- how we are funded

- how we comply with the Regulators Code, and

- the impact of our planned transition to ARGA.

At the FRC we believe our strategy, objectives and regulatory approach embody the principles set out in the Regulators' Code. The FRC's activities have an important impact in improving outcomes for all our stakeholders, through greater transparency, high- quality corporate reporting, increased trust in UK markets and lower cost of capital for companies.

The FRC acknowledges that with our regulatory powers and the expectations we set on firms and preparers comes a responsibility, not only to be fair and proportionate, but also to be transparent and provide clear and effective guidance to those we regulate, to support them to improve and meet our expectations over time. Over the next few years, as we transition to the Audit Reporting and Governance Authority (ARGA), our stakeholders can expect to see regular reporting on how we have applied the principles of the Regulators' Code and our assessment of the effectiveness of our regulatory activities. The contents of this document will form the basis of our future reporting in this area.

Purpose and objectives

The FRC's purpose is to serve the public interest by setting high standards of corporate governance, reporting and audit, and by holding to account those responsible for delivering them. This was updated in 2020 and is expected to be reflected in future legislation to create the new regulator, ARGA. As expressed in our Annual Report and Accounts 2023/24, the FRC's objectives are as follows:

- Set high standards in corporate governance and stewardship, corporate reporting, auditing and actuarial work, and assess the effectiveness of the application of those standards, enforcing them proportionately where it is in the public interest.

- Promote improvements and innovation in the areas for which we are responsible, exploring good practice with a wide range of stakeholders.

- Influence international standards and share best practice through membership of a range of global and regional bodies, and incorporate appropriate standards into the UK regulatory framework.

- Create a more resilient audit market through greater competition and choice.

- Develop our organisation as a respected, independent, and high-performing regulator; trusted to deliver best-in-class public interest.

We deliver against these objectives using our 'four faces' regulatory approach:

Our functions and powers

Our functions derive from several sources. A full list of our functions and the basis on which our powers are exercised can be found in FRC Roles and Responsibilities: Schedule of Functions and Powers on our website.

Our functions can broadly be broken down into the following:

- UK statutory audit – we set the UK's audit standards, which are based on those set at an international level. We monitor and supervise the application of those standards, register firms and individuals who wish to audit Public Interest Entities (PIEs) (the largest and most systemically important companies in the UK), and we take action to hold firms and individuals to account where they fall short of our expectations. We also operate a regime to recognise the status of various professional bodies as supervisory and/or qualifying bodies, and we provide oversight of their activities as delegated supervisors of audit, and as providers of audit education and professional qualifications.

- Third Country Audit – auditors in countries outside the UK who wish to audit entities listed on a regulated market in the UK are subject to a registration, monitoring and enforcement process administered by us.

- Local audit – currently, the FRC is responsible for monitoring the quality of local audit and for providing statutory guidance on Key Audit Partners. Following an independent review into local audit, the government intends for ARGA to take on the role of Systems Leader, which (subject to legislation) will broaden our functions and responsibilities in this area. The FRC will take on this role in shadow form until ARGA is created.

- Auditors General – we are currently the independent supervisor of Auditors General (auditors assigned by Parliament to audit public sector accounts) in respect of the audits they carry out under the Companies Act 2006, and their disciplinary arrangements.

- Crown Dependency audit – under the terms of a memorandum of understanding with relevant regulatory authorities, we monitor audits of entities incorporated in Jersey, Guernsey or the Isle of Man whose securities are traded on a regulated market in the UK or European Economic Area (Crown Dependency inspections). The FRC also determines sanctions on entities where failures have been found during Crown Dependency inspections.

- Accounting - the FRC is responsible for contractual monitoring and enforcement arrangements with the accountancy profession, issuing UK GAAP accounting standards and upholding good practice. As supervisor, the FRC also provides oversight of regulation by the professional accountancy bodies and monitors compliance with accounting requirements. To uphold good practice, we provide independent investigation and discipline schemes for matters relating to accountancy firms and members of professional bodies.

- Corporate reporting - our work on corporate reporting covers a wide range of activities including regular reviews to ensure that the provision of financial reporting complies with Companies Act and requirements and accounting standards, issuing guidance on all aspects of corporate reporting, and influencing and collaborating with other regulators and standard setters.

- Actuarial – we provide independent oversight and set technical actuarial standards in line with the terms of a memorandum of understanding between the FRC and the actuarial profession. The FRC also provides independent investigation and disciplinary schemes for matters relating to members of the actuarial profession.

- Corporate governance and stewardship – we promote high standards of behaviour by boards and investors by setting the framework for corporate governance and investor stewardship. This involves maintaining the UK Stewardship Code and the UK Corporate Governance Code, and all associated guidance, monitoring and reporting on compliance and good practice.

Some of our functions are supported by statutory obligations on third parties, such as other regulators, to meet our requirements and/or participate in arrangements provided by the FRC. Although some of our functions have no statutory backing at present, they derive their authority from widespread support through voluntary arrangements with our stakeholders, and a united belief in these functions serving the public interest. It is this public interest which has led the government to conclude that these functions should be placed on a consistent, statutory basis when we become ARGA.

Our role in both setting codes and standards, and monitoring their implementation, gives us an informed view of the effectiveness of our codes and standards, including their impact on the quality of financial reporting and audit.

Our remit and the public interest

The various groups of society which constitute the public include investors, creditors, savers, insurance policy holders, pension scheme members, employees, consumers, suppliers, clients of professional accountancy and actuarial advice, and taxpayers. Those groups all benefit from a well-functioning and stable economy in which their individual and collective interests are respected. A well-regulated system of corporate governance and reporting contributes to such a well-functioning and stable economy.

In all our work, our primary responsibility is to pursue the public interest in high standards of auditing, reporting, actuarial work and governance. Much of the scope of ARGA's work is expected to be determined by the new PIE definition. Although its remit may continue to include non-PIEs in some areas of work, our risk-based operational focus will be weighted towards PIEs, in recognition of their systemic importance as the largest entities in the UK. However, as recognised by the government response to the White Paper on Restoring Trust in Audit and Corporate Governance, there will be circumstances where, exceptionally, ARGA is expected to take regulatory action in areas of public interest that are not within this regulatory focus.

Transparency and proportionality are essential principles of good regulation, as stated in the Code, and as such we wish to demonstrate that we are applying the often loosely defined concept of public interest to our decision-making in a fair and consistent manner. We have published details of our approach to assessing the public interest against a non-exhaustive list of principles that we will consider in carrying out our regulatory, supervisory and enforcement work, where that work is not clearly defined as being within the regulatory perimeter but where it may still be in the public interest for us to act ('the public interest test'). These principles reflect characteristics which, when present, may indicate increased risk to the public interest and justify investigation, intervention, or some other action within our remit. It provides a high-level framework against which we can assess our activities and, where appropriate, we will consult on and publish more detailed information on how the principles apply to other specific ‘in-remit' functions and decision-making processes.

Our regulatory approach

1. Supporting those we regulate to comply and grow

The Regulators' Code encourages regulators to take a proportionate approach to regulation, seeking to avoid unnecessary regulatory burdens, and designing their policies and procedures with this in mind. Regulators must ensure that those they employ in regulatory roles have the necessary knowledge and skills to support those they regulate, and that they understand the principles of good regulation and how the regulator delivers its activities in accordance with them.

What is our approach?

We consult on our policies and procedures to ensure that they are both effective and proportionate. We pursue delivery of our regulatory objectives through a mix of statutory arrangements and, where such an approach is likely to be effective, through non-statutory means. For example, we publish comply or explain codes and use guidance to support the consistent interpretation and application of all our codes and standards. This lighter touch approach has been shown to be effective in avoiding additional mandatory regulation.

We aim to use innovative approaches to avoid regulatory burden. For example, our audit sandbox will provide an opportunity for the users of our audit standards to solve shared issues of practical interpretation in a safe regulatory space. Within our Supervision division, our approach is to tier regulated firms, with smaller firms and areas of lower risk receiving lower regulatory scrutiny. We are also working on proposals to introduce a new scalebox initiative to support smaller audit firms to grow and take on more challenging audits, by providing an environment in which they can experience what enhanced regulation would look like for their firm, ahead of making any scale-up decisions. Our overall approach is proportionate, risk-based and focuses primarily on the very largest entities and audit firms.

Our enforcement procedures have proportionality built in, through an escalating pathway of enforcement options, which include constructive engagement. Full tribunal proceedings are only used where deemed necessary to achieve an appropriate regulatory outcome, or where requested by the parties being investigated. Credit is given for early and continued cooperation with us.

Our funding needs are set at a proportionate level to meet the costs of delivering our regulatory activities. We consult each year on setting our budget, so that each funding group understands the components of and can comment on their funding obligation for the forthcoming financial year. The FRC also ensures that we assume accountability and responsibility that our financial resources are being consistently managed under the principles set out in Managing Public Money.

We believe that high standards of auditing, reporting and governance support the efficient working of the capital markets and help attract investment; they benefit market participants as well as investors and the wider public who rely on their work. We publish annual assessments of those issues we have identified through our work and provide specific updates on aspects of auditing, reporting and governance where we believe that these will be helpful to market participants.

2. Providing simple and straightforward ways to engage with us

The Code expects stakeholder engagement to encompass not only appropriate mechanisms for regulated parties, citizens, and others to offer views and feedback, but also clear information regarding regulatory expectations, non-compliance and impartial appeals mechanisms and complaints procedures.

What is our approach?

Our dedicated Stakeholder Engagement and Corporate Affairs team is responsible for supporting all FRC teams with their stakeholder engagement activities. They support all publications, consultations and formal and informal outreach activities in line with our strategic objectives. These activities include consulting publicly each year on our funding and regulatory priorities in our 3-Year Plan, and commissioning surveys of stakeholders' views, including the views of the general public. We undertake outreach across the breadth of our stakeholders and offer several regular feedback fora, such as our Stakeholder Insight Group. These bring together views from business, investors, other regulators, the professions and third-sector bodies.

We engage extensively and openly with business and professional bodies that have an interest in our work. Our audit supervision approach includes regular contact between individual supervisors and firms. Our relationship with professional bodies we regulate involves informal consultation and engagement, as well as formal consultation where applicable.

Our approach to our monitoring and enforcement work is rigorous; reflecting the public interest in high standards of auditing, reporting and governance, and the potential harm to the public interest which failure to meet those standards can cause. We have procedures in place to ensure that we operate in line with the requirements of the law and the principles of natural justice. In many respects, our regulatory activities do not give rise to simple compliant/non-compliant decisions. For example, we take decisions in exceptional circumstances on requests for exemptions to the independence requirements of the Ethical Standard, and our Audit Quality Reviews consider audit quality in the round, including in respect of the application of principles-based standards, which can be subject to a high degree of professional judgement. In all our regulatory work, we seek to be proportionate and consistent.

The procedures for our monitoring and enforcement activities are designed to be both effective and fair, and include appropriate separation of powers. Our enforcement procedures make provision for decisions to be referred to an independent tribunal for determination and also for appeal. Where we are responsible for making regulatory decisions outside our enforcement procedures, such as in respect of PIE Auditor Registration, we may put in place appropriate internal review and/or an appeals mechanism.

The FRC employs a number of feedback mechanisms, including (but not limited to) our complaints procedure, public consultations, survey evidence and citizens juries. When it is appropriate, we publish consultation feedback, together with feedback statements to clearly explain how we have responded to the feedback.

3. Our risk-based approach

Effective assessment of risk, underpinned by a suitable risk management framework, is a core principle of the Code. Regulators are expected to take an evidence-led approach, targeting their regulatory activities in line with what they identify to be the priority risks. In doing so, they should consider all available and relevant data on compliance.

What is our approach?

We target our supervision and monitoring programmes based on an assessment of those sectors and issues we consider pose the greatest risk to the public interest. We do this by considering a variety of data points, including market intelligence, information from other regulators and evidence from our own supervision, monitoring and enforcement activities. As mentioned above, we publish annual summaries of our assessments of issues we have identified through our regulatory work.

Our Risk team supports all FRC colleagues in their risk analysis activities, through training and support in applying the FRC's risk management framework. We publish and report on performance against our principal risks each year in our Annual Report and Accounts. We set out details of our risk management framework in our annual report, including our assessment of principal risks. We then consult stakeholders annually on our priorities, including priority sectors and issues for our monitoring programmes, to help identify risks to our regulatory objectives.

We publish performance indicators in our annual 3-Year Plan against which the effectiveness of our outputs and regulatory outcomes can be measured. Selecting appropriate outcomes measures is a maturing process which we are continually reviewing and improving. Our project management framework encourages the definition of clear success measures during project planning stages, so we can more accurately assess benefits.

We recognise that the majority of market participants seek to comply with the codes and standards we set; and we consult and communicate with them accordingly. Our supervision approach seeks a cooperative relationship with those we regulate and adapts to appropriately reflect the risk profile of each firm. Our enforcement approach also encourages and provides credit for cooperation over and above that required.

4. How we share information

The Code expects regulators to follow the principle of 'collect once, use many times' when requesting information from those they regulate, and that (law permitting) this principle should extend to the sharing of information with other regulators to ensure an efficient regulatory landscape with minimal overlap.

What is our approach?

We only collect information when it is deemed necessary to pursue our regulatory activities, and we share that information within the FRC subject to our established data privacy procedures, which can be found on the privacy page of our website. Our Chief Information Technology Officer is responsible for the design and implementation of our information management strategy, which will ensure that we continue to collect, store and share information legally, efficiently and effectively. We maintain data securely and in accordance with GDPR principles.

We have agreements in place with other regulators that provide for information sharing where statutory information gateways do not already exist or do not make adequate provision. As the FRC transitions towards becoming ARGA, we will take the opportunity to review all information sharing mechanisms to ensure that they are appropriate. We have well-established relationships with other regulators and meet regularly to discuss the interaction between our regulatory remits and activities, to determine how we can be most effective in achieving our desired regulatory outcomes.

5. Providing clear information, guidance and advice

The Regulators' Code requires regulators to provide advice and guidance that is focused on helping those they regulate to understand and meet their responsibilities. Any such guidance should be clear, accessible and concise. The regulator should ensure that feedback mechanisms exist to determine whether guidance is meeting stakeholder needs. As with information sharing, effort should be made to assist those who are regulated by more than one regulator. Where advice is given, those who receive it should have confidence in the advice and be able to seek it without fear of triggering enforcement action.

What is our approach?

Guidance can have many benefits. It can serve to aid interpretation of regulatory requirements, support transparency, spread good practice and provide information on our regulatory expectations. We distinguish between guidance that complements regulatory requirements and guidance that identifies best practice. For example, we publish comprehensive application guidance to accompany audit and accounting standards, and we also publish guidance to sit alongside the UK Corporate Governance Code, as well as more general guidance on topics of interest to our stakeholders based on our research and monitoring activities. We strive to ensure that any guidance we publish is targeted and useful, and its publication meets one or more of our stated strategic objectives.

We aim to act in a timely manner, having proper regard to the legitimate interests of all affected parties and the wider UK regulatory framework. When publishing guidance, we use formats appropriate to the content and the target audience. All our current publications are available on our website in an accessible format and, where appropriate, information on alternative methods to access guidance is provided. We support publication of guidance with a range of learning and feedback opportunities, such as podcasts, webinars and roundtables. We consult market participants on the usefulness of the guidance we produce.

Our primary responsibility is to the discharge of our regulatory responsibilities, acting in the public interest. However, we frame our codes and standards to help market participants apply them in practice. Our Financial Reporting Lab enables open dialogue between investors, companies and their advisers on reporting issues. More recently, we have created a new audit sandbox initiative, which is designed to support quality, innovation and competition by creating a safe regulatory space in which auditors can work to apply auditing, assurance, and ethical and independence standards for better regulatory outcomes. Our regulatory procedures incorporate appeals mechanisms, where relevant, so that those we regulate can have confidence that our decisions can be challenged if they are felt to be inappropriate.

We work closely with other regulators, including the FCA, PRA and The Pensions Regulator, and share information with them, where appropriate, and subject to applicable law. Our annual reviews of enforcement, audit supervision and corporate reporting describe our joint working with other regulators in these areas.

6. Our approach to transparency

Regulators should ensure that their approach to their regulatory activities is transparent. This involves publishing clear services standards, setting out certain information on key matters in an easily accessible format on a single page on their website, ensuring that their employees act in accordance with the published service standards, and reporting regularly on their performance.

What is our approach?

Our regulatory remit is broad, encompassing the entire UK audit market, various aspects of the accountancy and audit professions, corporate reporting, governance and stewardship. Each profession, and the users of the information they produce, will have different needs and expectations from our services. Our operating procedures aim to make clear how we conduct each of our regulatory activities, and what those we regulate should expect from us. Some examples of this include audit firms agreeing with us audit quality improvement plans with dates for actions and progress updates, third country and PIE auditor registration processes which set clear timeframes for each stage of decision-making, and corporate reporting review procedures that explain how we engage with individual entities so that matters we identify can be addressed in a timely manner before their next set of accounts is due. A number of our regulatory processes involve an annual selection of entities for review, and we publish details of those sectors on which we intend to focus for the coming year, in advance. While many of the matters we address are frequently complex and technical, and cannot therefore be resolved within a set timetable, we seek to act expeditiously and fairly in seeking information and responding to enquiries.

We publish all the information required by the Regulators' Code, in an accessible format, on a single page on our website. This includes signposting to all relevant publications which support the delivery of our regulatory activities in accordance with the Code provisions.

We act proportionately when exercising our powers, including carrying out inspections, pursuing investigations or reporting. Colleagues are also expected at all times to act in accordance with our agreed Values and Behaviours.

Where our procedures provide for it, we take account of the cooperation of and/or corrective actions taken by any party or parties involved in any enforcement proceedings.

Our assurance plan incorporates work to review compliance with our operating procedures and policies, including, where relevant, any applicable service standards. Where recommendations for improvement are made, we define the actions necessary and track them to completion. We follow an annual internal audit plan and work to the government's functional standards where appropriate.

Our Annual Report summarises the feedback we have sought and received on our regulatory activities and data relating to our performance on dealing with complaints. Our Annual Enforcement Review publishes data on our performance in opening, progressing and closing enforcement cases and enforcement outcomes. This includes how our appeals procedures operate.

Our governance

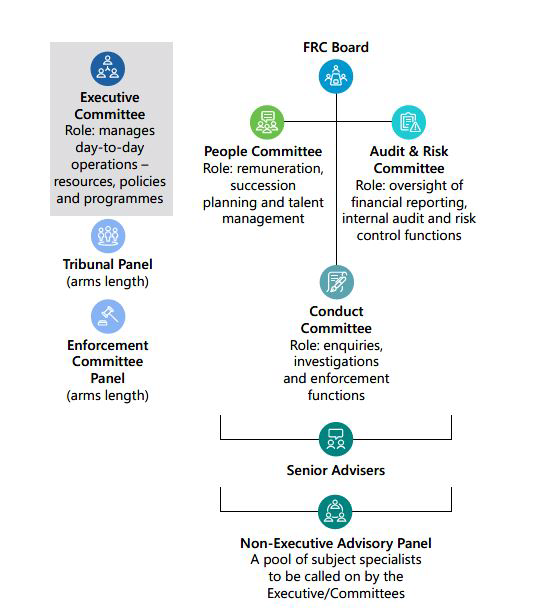

Our Governance structure is designed to support effective executive decision-making and non-executive oversight. The FRC is headed by the Board, which is comprised of non-executive and executive directors. It is responsible for the long-term success of the FRC. The Board's role is to provide strategic leadership within a framework of prudent and effective controls enabling risk to be properly assessed and managed. The Board sets the FRC's strategy, and its values and culture.

All directors must act in what they consider to be the best interests of the FRC as a public interest regulator, consistent with their statutory directors' duties.

The Schedule of Matters Reserved to the Board contained in our Governance Handbook outlines matters that are suitable for delegation to a committee or the executive. This also indicates matters which are reserved for the Board and are not suitable for delegation to a committee.

The FRC Board is supported by two governance committees, the People Committee, and the Audit and Risk Committee. The People Committee is responsible for providing the FRC Executive with challenge, constructive dialogue and strategic direction on issues relating to the recruitment, remuneration, talent management and welfare of FRC staff, and takes high-level decisions on such issues as necessary. The Audit and Risk Committee is responsible for supporting and advising the Accounting Officer (the Chief Executive) and the Board by providing oversight of the FRC's financial reporting process; audit process; the system of internal controls, including business continuity; and information technology. They also oversee the identification and management of significant risks and the FRC's compliance with laws and regulations.

The Board and governance committees are also supported by the Conduct Committee. This committee is supported by non-voting Senior Advisors, who attend committee meetings, and members of the Advisory Panel, who are there to provide input on technical matters on a project-to-project basis.1

Our funding

The FRC's funding comes from a number of sources. Our main funding groups are the following:

- The audit and accountancy professional bodies, who fund the costs of Audit Quality Review (AQR), Audit Market Supervision (AMS), Audit Firm Supervision (AFS), audit and accountancy enforcement activities, and audit and accountancy standards-setting and professional oversight.

- Listed companies and other specified groups of accounts preparers, who pay a non-statutory ' preparers levy'. This funds the FRC's work on corporate governance and reporting, including setting codes and standards, influencing international standards and the corporate reporting review. (The specified groups are AIM companies, large private companies and public sector organisations.)

- Insurance companies and pension schemes, who each contribute 45% of the annual cost of actuarial regulation. The Actuarial Profession contributes the other 10%.

Every year, the FRC consults stakeholders on its Plan and Budget. The annual funding requirement is set to recover the cost of regulatory activities and overheads. The FRC allocates the funding requirement to its funding groups in line with its regulatory priorities and the size of each group.

The following table summarises the funding sources for our 2023/24 funding plan and budget. These are raised on a statutory basis (as UK Competent Authority for audit) and through either contractual or voluntary routes:

| Ref. | FRC funding sources | Status |

|---|---|---|

| Audit professional bodies | ||

| (I) | RSB contribution to AQR funding | Statutory; actual costs recovered |

| (III) | CCAB contribution to audit standards/ oversight | Statutory |

| (V) | Contribution to enforcement case costs | Statutory; actual costs recovered |

| (VI) | Contribution to AMS | Statutory; actual costs recovered |

| (VI) | Contribution to AFS | Statutory; actual costs recovered |

| Total statutory – audit regulation | Statutory | |

| (III) | CCAB contribution to accountancy oversight | Voluntary contribution |

| (IV) | CIMA contribution | Voluntary contribution |

| Preparers Levy | ||

| (VII) | Accounts preparers (listed) | Voluntary levies |

| (VII) | Accounts preparers (non-listed) | Voluntary levies |

| Actuarial funding groups | ||

| (VIII) | Insurance companies | Voluntary levy; collected by FCA |

| (IX) | Pension schemes | Voluntary levies; collected by agent (Adetiq) |

| (X) | IFoA | Voluntary contribution |

| Total voluntary | ||

| (II) | NAO, Crown Dependencies and health authorities audits contribution to AQR funding | Contractual |

| (XII) | Publications, FRC Taxonomies and TCA registration fees | Contractual |

Accountancy and audit

The accountancy profession is funded by the contributions of the Consultative Committee of Accountancy Bodies (CCAB), whose members are ICAEW, ICAS, ACCA and CAI. CIMA, who are not a member of the CCAB, also contribute to the FRC's funding requirement under the terms of a separate arrangement.

The ICAEW, ICAS, ACCA and CAI are Recognised Supervisory Bodies (RSB). The ICAEW raise funding by invoicing the audit and accounting professional bodies for the relevant amounts. The FRC provide a figure for the following year's budget to the ICAEW following early budget meetings. At the end of the financial year, the FRC can calculate an estimate of the surplus funding received for audit and accounting activities, and the following year's budgeted funding requirement is reduced by that surplus and spread over 12 months.

Preparers levy

The FRC is funded partly through a preparer's levy on the following organisations that are subject to, or have regard to, FRC regulatory requirements in preparing their accounts:

- Companies listed on the London Stock Exchange, and UK AIM and Aquis Exchange group companies with an equity share listing.

- Large private entities with a turnover of £500m or more. Subsidiaries of UK listed companies with a turnover of £500m or more are invoiced on the same invoice as their parent company.

- Standard Global Depository Receipt companies.

- Government departments and other public sector organisations that publish accounts.

Once the overall funding requirement is identified during the plan and budget consultation process, we calculate the percentage increase/decrease in the preparer's levy rate we should apply to secure the requirement. This can depend on several factors, such as the population that we will be invoicing, the most recent collection rate from each funding group, and the percentage increase/decrease in the tariff data. In addition to the FRC funding requirement, we also collect the UK contribution to the funding of the International Accounting Standards Board as part of the preparer's levy.

Insurance levy

The insurance levy is charged to insurance companies. The levy is invoiced by the FCA, the FRC sets a levy equivalent to a percentage of the fees charged by the FCA and PRA for their categories. The insurance levy is imposed on insurance companies under two FCA-defined categories or 'fee blocks':

- AF03 - Insurers – General

- AF04 - Insurers – Life.

Pension levy

The FRC pension levy applies to all Defined Benefit and Defined Contribution schemes with 5,000 members or more, at a pension levy rate based on the number of members. During the preparation of the draft 3-Year Plan, the target funding requirement from pension schemes is calculated and we consult on the pension levy rate for the following year. The levy rate to be applied to individual schemes is also based on the latest available data on scheme membership provided by The Pensions Regulator.

Actuarial funding

The annual budget for all actuarial regulatory activities (including enforcement cases) is met through contributions from the actuarial profession (IFoA), insurance companies and pension schemes with more than 5,000 members. There is no government contribution. All three funding groups contribute to the cost of public interest disciplinary cases involving actuaries. Due to the unpredictability of disciplinary cases, a fund is maintained through contributions from the annual budget, which can be used to manage the impact of a big case.

During the preparation of the draft budget in November/December, the target funding requirement from the IFoA is calculated and we consult on the amount.

Third country auditors

A third country auditor seeking registration in the UK must pay a fee to the FRC upon application and an annual fee thereafter for renewal of its registration in accordance with the Third Country Auditors (Fees) instrument. This fee is based upon our anticipated costs to administer the regime.

Funding ARGA

The March 2021 White Paper, Restoring trust in audit and corporate reporting, set out initial proposals for the way ARGA should be funded. In response to the consultation, the government confirmed its intention to give ARGA statutory powers to raise a levy. This means ARGA would be given powers to make rules requiring that market participants pay a levy to meet the regulator's costs of carrying out its regulatory functions.

ARGA's annual funding requirements will be based on the budget that is set for its regulatory responsibilities; we define these as 'activity blocks'. Each activity block will be allocated to prescribed groups of market participants ('funding groups'), which are responsible for funding each activity block. Overheads and corporate costs will be allocated proportionately.

The funding model we propose is designed to fund ARGA's purpose and operations in pursuit of its regulatory objectives and with regard to its regulatory principles. We consulted in Autumn 2022 on the high-level principles and design of ARGA's funding. A feedback statement and further detailed consultation on ARGA's Rulebook will follow in due course.

Financial Reporting Council

8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in. or X @FRCnews

-

For more information on the Regulatory Committees, please refer to the Governance page on the FRC website here. ↩