The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Annual Review of Corporate Reporting 2018/2019

- 1. Executive Summary

- 2. Introduction

- 3. Annual Review of Corporate Reporting

- 4. IFRS Reporting

- Judgements and estimates

- Consolidation judgements

- Statement of cash flows

- FRC focus points

- Insights from the Lab

- Areas for improvement

- Reverse factoring

- Income taxes

- Provisions and contingencies

- Fair value measurement

- Thematic reviews

- Initial application of IFRS 15

- The expected effect of the new IFRS for lease accounting

- 5. Narrative Reporting

- 6. UK GAAP

- 7. Future Developments

- Appendix A: FRC Year-End Advice Letter to Audit Committee Chairs and Finance Directors

- Appendix B: FRC Monitoring Activities

- Contact Information

- Footnotes

The FRC does not accept any liability to any party for loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2019 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Executive Summary

Despite continued effort from companies to meet our and investors' expectations from corporate reporting, we continue to see scope for improvement. This is particularly true in respect of forward looking information, the potential impact of known and emerging risks and opportunities on future business strategy and the carrying value of assets and the recognition of liabilities. Failure to discuss such risks and opportunities, including those with a longer time horizon, can lead to the conclusion that management is not aware of their potential impact, is not managing them effectively or is being opaque. High quality reporting improves trust in businesses and how they are being run.

The 2019 Edelman Trust barometer reports that the trust deficit in core institutions in the UK between the informed and general public has never been greater. Investors and other stakeholders continue to drive the agenda for corporates as uncertainty on the political stage and what the future holds for the UK and business continues. The report indicates that the public now look to business - rather than government - to provide the changes needed to meet their heightened expectations. The FRC's Citizen's Jury concluded that wider society take annual reports at face value and as a trusted source of information, highlighting the need for Boards to ensure that reports and accounts taken as a whole, are fair, balanced and understandable.

The changes the FRC made last year both to the UK Corporate Governance Code and the Guidance on the Strategic Report and the revisions to the Stewardship Code this year, provide a benchmark against which corporates can measure their own progress towards clear and transparent reporting on their environmental, social and governance responsibilities as well as the broader impacts of their activities.

This Annual Review focusses on corporate reporting. This year, we undertook an assessment of both early adoption of the new UK Corporate Governance Code and reporting on the 2016 Code. We will publish our findings and our expectations for reporting in 2020 later this year.

Our review of corporate reporting is based primarily on our monitoring work opened in the year to 31 March 2019, predominantly relating to reports and accounts with 31 December 2017 year ends, and recent thematic reviews. It is also informed by a wider outreach on the quality of corporate reporting, the development of standards and the work of our Financial Reporting Lab ('the Lab').

Outcome of our reviews

We are pleased to report that companies generally have continued to respond well to our enquiries, even when they go beyond strictly what is required by reporting standards. Our exchanges of correspondence usually lead to a better understanding by the FRC of the underlying matters that we have queried; we then recommend that the additional or clearer information provided to us is summarised in the company's next report to provide investors and other stakeholders with that same level of understanding. These suggestions are usually adopted.

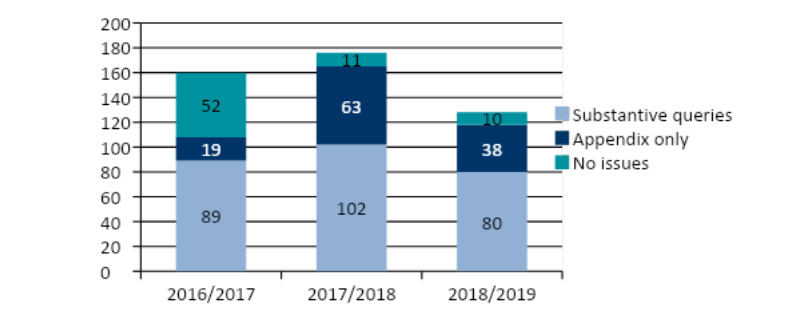

We wrote letters with substantive queries to be resolved in 80 of the 207 reviews undertaken (2017/18: 101 of 220). Our reviews often result in undertakings from the company to improve the clarity of their disclosures in subsequent years. For more urgent matters we expect immediate action by the company. We did not publish any press notices in the year but did ask twelve companies to specifically reference our intervention in their subsequent annual reports. Such cases represent the more serious matters of non-compliance that we identified; for example, matters around consolidation and impairment.

We always follow up to ensure that our expectations regarding any specific undertakings for improvements provided by companies are appropriately met in subsequent reports. This year, we re-opened two cases where we considered the relevant companies had failed to adequately address the undertaking provided. Companies should be under no illusion - we take compliance with undertakings provided to us very seriously.

Corporate Reporting: Areas for improvement

At first sight, it is unsatisfactory that our most frequent enquiries in the year cover the same topics as 2017/18 and 2016/17. However, the nature of the enquiries made in respect of these matters has changed; overall, we have seen some improvement in the quality of the disclosures made in these areas.

Our challenges around judgements and estimates still the most frequent area of questioning were more nuanced this year. Most companies are now adequately distinguishing between judgements and estimates; our probing sought a better articulation of the disclosures and how they can best inform investors. The focus of our enquiries often lay in the provision of sensitivity analysis around the range of possible outcomes. This disclosure is key to investors' understanding of the extent to which assets and liabilities may change in the twelve months ahead.

We continued to see errors within cash flow statements and related disclosures, many of which inflated cash generated from operating activities at the expense of investing or financing activities. As these errors can be identified from a desk top review of the accounts, it remains a concern that companies' own quality control procedures and those of their auditors are failing to spot such matters. There are few hard rules in IFRS, which are essentially principles based. Where there are specific rules, we, and investors, expect them to be complied with.

The Lab's recent report 'Disclosures on the Sources and Uses of Cash'1 identified that investors look to other disclosures, sometimes outside of the annual report, to inform their understanding of how cash is generated and how it has been spent, which is a critical underpinning of their investment process.

The Lab's report highlights investors' need for more comprehensive analysis of how cash is, and more importantly, will be generated and used, including more disaggregation of cash based metrics, clearer links to strategy, and better disclosure of the company's priorities for the use of cash, such as capital expenditure and dividends. For companies experiencing specific and significant working capital issues the need for clearer disclosures on working capital finance arrangements such as reverse factoring and any restrictions on the use of cash is needed.

This need does not, however, detract from the value of the cash flow statement as the audited primary statement on which such disclosures hang and on which investors need to be able to rely.

Our thematic reviews included consideration of the first-time mandatory application of two new accounting standards (IFRS 9 'Financial Instruments' and IFRS 15 'Revenue from Contracts with Customers'). Generally, companies had responded well to the challenge of these new standards; many appeared to have taken note of the guidance and expectations set out in our thematic reviews of the transitional disclosures of the new standards last year. Nevertheless, we identified plenty of scope for improvement in the clarity of disclosures around both loan loss provisions, particularly in respect of smaller banks, and the comprehensiveness of the accounting policies for revenue recognition. Our monitoring work will continue to chart the progress of application of these standards as they are embedded by the financial reporting community.

This year we wrote to a number of companies about their disclosure of contingent liabilities or provisions due either to missing or unclear disclosures, or instances where the information disclosed in the provisions note appeared inconsistent with information provided elsewhere. We questioned companies where inadequate explanations were given of the origin of the provisions, including how management determined when a present obligation had arisen.

> The FRC, investors and other stakeholders expect greater transparency in reports of the risks to which companies are exposed and the actions they are taking to mitigate their impact.

Narrative reporting

Environmental, social and governance considerations, as they relate to companies, are increasingly significant factors underpinning investment processes and investor behaviour. Recent regulatory changes in narrative reporting requirements reflect this development and present companies with the opportunity of extending their reporting on such matters.

We continued to challenge companies about the completeness of the principal risks and uncertainties disclosed in their strategic reports, particularly where matters disclosed elsewhere in the annual report, or externally, indicated a significant risk that was not identified in the strategic report.

We wrote to some companies whose business models would appear to give rise to significant climate risk, but which was not disclosed in the annual report. We expect disclosure of significant physical or transitional risks.

The Government's 'Green Finance Strategy'2 set out the expectation that all listed companies should report under the Task Force on Climate-Related Financial Disclosures' ('TCFD') reporting framework by 2022. TCFD helps align companies' thinking and discussions on how climate change impacts their business and what they should then report and are widely supported by investors and other stakeholders. The Lab recently published a report providing companies with a list of questions to ask themselves when considering the adequacy of their disclosures in this area3.

We frequently identified strategic reports which did not appear to provide a fair, balanced and comprehensive analysis of the development and performance of the business during the year. Examples included business reviews that failed to discuss the performance of acquisitions, the progress of transformation programmes or significant changes or concentrations of credit risk.

Our focus over the last few years on the use of Alternative Performance Measures ('APMs') has yielded improved reporting. However, we still see too many cases of absent or unclear definitions of APMs and their reconciliation to the closest equivalent IFRS line item. Strictly, the relevant reporting requirements only apply to companies listed on the main market. In our view, however, they represent best practice reporting in an area which is highly significant to investors. We recommend the ESMA Guidelines4 to all preparers who use alternative measures to supplement their IFRS reporting and expect compliance.

Satisfying the recent requirement for a Non-Financial Information Statement in the strategic report continues to provide challenges for many companies who need to provide the content in a manner that is clear and accessible. More focus is required on the reporting of the impact of the company's business on the environment, as well as the risks environmental matters may pose to the company.

> Continued errors in cash flow reporting are unsatisfactory; investors are looking for reliable and thorough analysis of how cash is generated and spent.

> Environmental reporting, with particular focus on climate change, is an increasingly important area of focus for investors and other stakeholders.

Independent review of the FRC

The Independent Review of the FRC led by Sir John Kingman found that our monitoring of corporate reports was valued. It was suggested that this value could be enhanced were we to have additional powers aimed at expediting our reviews, to cover aspects of the annual report and accounts not currently within the scope of existing powers and the ability to provide greater transparency of our findings. The review also recommended increasing the number of reviews undertaken. We are working closely with the Department for Business, Energy and Industrial Strategy to deliver the necessary powers. Introducing additional statutory powers takes time and it is unlikely that this will be achieved in the short term. In the meantime, and subject to the availability of resources, we are looking to see how we can bring forward some of the recommendations that can be implemented without primary legislation.

> We are working with BEIS to extend our monitoring function and with enhanced powers consistent with recommendations of the Independent Review of the FRC.

Changes to UK GAAP

Amendments made to UK Financial Reporting Standards in the 2017 Triennial review are effective for accounting periods beginning on or after 1 January 2019. Some companies will have adopted these changes early as they generally led to simplifications or improved the cost-effectiveness of reporting. The changes included simplifications in the measurement of investment property rented to another group company and a reduction in the extent to which intangible assets must be recognised in a business combination.

We have also consulted on proposed amendments to FRS 102 'The Financial Reporting Standard applicable in the UK and the Republic of Ireland', relating to the reform of LIBOR. Our proposals are based on the IASB's proposals to amend IFRS 9 'Financial Instruments' for the same issue. It is proposed that the amendments will apply from 1 January 2020, with early application permitted. This will only be relevant to entities with contracts linked to an interest rate benchmark, such as LIBOR, that have chosen to apply hedge accounting. We advise UK GAAP and IFRS reporters who are parties to contracts referencing LIBOR, or any other rate subject to the reforms, to start planning now for the transition to new rates. This should include early consideration of the need to re-negotiate relevant contracts and agreements.

Future of Corporate Reporting

The Independent Review of the FRC encourages the FRC to promote brevity and comprehensibility within the annual report. This recommendation links to the FRC's major project, launched in October 2018, to consider the Future of Corporate Reporting. The aim of the project is to develop thought leadership proposals and recommendations for changes in regulation and practice governing corporate reporting. It seeks to reconcile the increasing demands on the form and content of the annual report and its intended audience. We expect to publish our thoughts in 2020.

> The FRC embarked on a major project to stimulate improvements in relevant regulatory requirements and to deliver clear and concise corporate reporting.

Impact of technology

Regulatory change and wider use of technology in reporting and financial analysis is continuing to improve the information flow from companies to investors. The European Single Electronic Format, which will apply in the UK if the UK is subject to European law on 1 January 2020, will require impacted companies to report in digital, machine-readable format, for periods beginning on or after 1 January 2020. We encourage companies to start considering how this will change their reporting. The Lab will continue to provide practical guidance on its implementation.

More widely, technology is increasingly being used by investors to gain greater insight into the value of companies, often using the exponentially increasing data available that is derived from sources outside of the company, including social media. Companies need to keep pace in order to maintain control of their own narrative.

2. Introduction

Structure of the Report

This year, given the significant changes to the UK Corporate Governance Code and our work assessing the extent of early adoption, we have decoupled our assessments of corporate reporting and corporate governance to ensure appropriate visibility of both.

This report is structured around our overall assessment of corporate reporting and the two key elements of annual reports and accounts, the financial statements and the strategic report, which fall within the remit of our reviews. Our review of corporate governance reporting will be published later this year.

This section provides an overview of our monitoring activities, with further details provided in the appendices. Section 3 addresses the key findings from our monitoring work, with section 4 focussed on financial statements produced under IFRS, while section 5 summarises our main findings with respect to narrative reporting. Section 6 provides information on reporting by those companies using UK GAAP and section 7 provides our views on future developments.

> This report sets out our expectations of next season's reporting, informed by our monitoring activity and our drive for continuous improvement.

Purpose of the Report

This report sets out our findings in respect of the quality of corporate reporting in the UK, primarily based on our monitoring work on cases opened in the year to 31 March 2019 and thematic reviews conducted more recently. The FRC does not have powers to support effective monitoring of corporate governance matters, which include remuneration reports, and does not conduct its own reviews in this area. Nor does it, at present, review individual corporate governance statements, although some monitoring of these is carried out to assess overall trends.

The report informs the financial reporting community of our findings for the year, highlights where we see room for improvement and sets out our expectations for the next season of reporting. This year, in view of recent changes to the content of the strategic report, we have a particular focus on the additional matters Boards will have to consider when preparing that report.

Key audiences for this report are preparers and auditors of corporate reports, and investors.

> Our monitoring activity includes full scope reviews and others which focus on specific areas of reporting where we see particular room for improvement to meet expectations.

The FRC's monitoring programme

The Corporate Reporting Review team of the FRC ('CRR') is responsible for reviewing the annual and interim reports of quoted and large private UK companies in accordance with the Conduct Committee's Operating Procedures. Although strictly charged with assessing compliance with legal requirements and relevant accounting standards, CRR focuses on the quality of reporting, often suggesting ways in which a company could improve its communication with investors. This is consistent with its philosophy of continuous improvement.

At present, CRR reviews cover the strategic report, directors' report and financial statements, although there are proposals to extend this responsibility, and ability to correct any defect, to the entire annual report, including the corporate governance and remuneration reports (see 'Recent developments - the Kingman Review').

The work of CRR consists initially of desktop reviews of published information. If there is a question as to whether there is, or may be, a breach of the relevant reporting requirements, CRR will write to the company to obtain sufficient information to determine whether there is in fact a breach or opportunity for improvement. We recognise that others with more detailed understanding of a company's business - auditors and Audit Committees - may also have recommendations for future improvement, consideration of which we also encourage.

The Companies Act 2006 provides the FRC with a statutory power to require companies, their officers and their auditors to provide any information and explanation required to carry out this function. This power has only been used very rarely as the vast majority of company Boards engage with CRR on a voluntary basis with a view to improving their corporate reporting. It is our experience that most companies with whom we engage want to do the 'right thing'. We did not invoke our statutory power at all last year.

In most cases, CRR review all areas of the annual report that are within scope for the selected companies. However, we also carry out thematic reviews on areas of particular stakeholder interest, looking at just a single aspect of a selected sample of annual reports.

Further details of this year's thematic reviews are given below.

We may also review certain aspects of a company's annual report when a narrowly-focussed complaint has been received. In the year to 31 March 2019 a higher number of complaints was received than historically, at 28 (2017/18:11). Of these, 18 resulted in an approach being made to the company that was the subject of the complaint. The trend of increasing complaints looks set to continue, with 17 complaints received from April to September 2019. We will report on these next year. We continue to welcome well informed complaints to supplement our risk-based selection of reports and accounts for review. Further information on how we address complaints and referrals is available on our website5.

The majority of cases are resolved by the company volunteering or agreeing to make improvements to the disclosures made in their next annual report. In some cases, more substantial changes are required, in which case CRR may ask the company to refer to our interaction in their financial statements. In the most significant cases, a press notice may be required (see further discussion of CRR publicity below). The most complex cases may be assisted by the formation of a Review Group (see Appendix B for further details.)

If a company does not agree to the changes requested by CRR (or the Review Group, as appropriate), or suggest alternatives that satisfy the point at issue, the Conduct Committee has the power to seek a court order to require the necessary corrections. The FRC has never used this power to date.

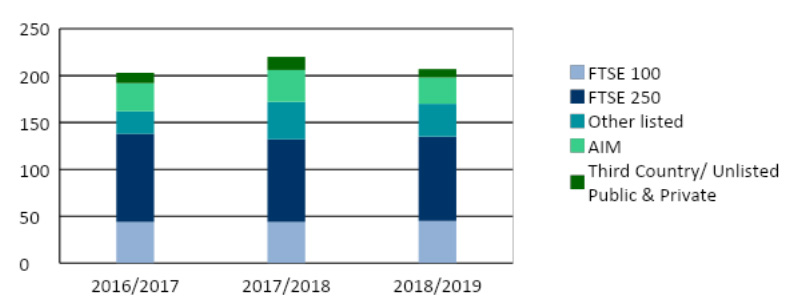

This year, we reviewed aspects of 207 sets of reports and accounts. Of these, 92 were full scope reviews, chosen from the full range of entities in scope. The general findings of our routine full scope reviews provide us with evidence of those areas of reporting where, generally, there is room for improvement. These findings prompt our consideration of topic areas for the following year's thematic reviews which we test through outreach to determine their relevance to investors and other users of corporate reports.

This year we reviewed aspects of a further 72 company reports as part of three substantive thematic reviews. The remaining company reports were selected for lighter touch thematic reviews.

In April 2019 we launched a survey in which we ask management and Audit Committees for their perspectives on our process and outcomes following completion of a review of their report and accounts. This is in line with the principles set out in the Regulators' Code and will contribute to the development of our future policies and procedures, as one aspect of our wider engagement with stakeholders. The responses give us further insight into a range of matters; not just the relevance of the questions we ask or the proportionality of outcomes but, for example, the impact of our publications and guidance on preparer behaviour, and how best to plan our work to align with companies' reporting cycles.

The survey is still in its early stages. We will report on the findings when more data is available.

Thematic Reviews

Following thematic reviews of the effect of two new accounting standards (IFRSs 9 and 15) on companies' interim accounts in 2018, this year we reviewed the effect of adopting these standards in a selection of full year accounts. Our third thematic review covered the quality of disclosures relating to the impairment of non-financial assets in the reports of companies for whom circumstances and events indicated that impairment may be a significant matter. This review was prompted by the results of our previous monitoring and the additional risk posed by the general economic uncertainty which has characterised the year under review.

We also followed up on our prior year review of the new accounting standard for leases and continued our monitoring of Brexit related disclosures.

The full list of topics selected for thematic review in 2019 was therefore as follows:

- The effect of the new International Financial Reporting Standards (IFRSs) on revenue and financial instruments in companies' 2018 full year accounts;

- Impairment of non-financial assets;

- The effect of the new IFRS on leases in companies' 2019 interim accounts; and

- The effects of the decision to leave the EU on companies' disclosures.

Summary findings of each of these are outlined below. The detailed findings of (1)67 and (2)8 are available on the FRC's website. Our report on IFRS 16 'Leases' will be published next month.

> In the year to 31 March 2019, the FRC reviewed aspects of 207 sets of reports and accounts and wrote to 80 companies with substantive questions.

Recent developments - The Kingman Review

Sir John Kingman was appointed in the spring of 2018 to conduct an independent review of the FRC, which published its findings in December. The review recommended that the FRC should be replaced by a new regulator, the Audit, Reporting and Governance Authority ('ARGA'). The review found that the work of CRR is respected and has real value but that its contribution could – and should – be extended by 'doing more' in a number of areas where transparency, scope and powers are common themes. The Review recommended that:

- the volume of CRR activity should be expanded on a risk basis;

- ARGA should be given the power to direct changes to accounts rather than having to go to court;

- CRR findings are reported publicly by the regulator in a set timeframe;

- CRR's work should be limited to Public Interest Entities, except to the extent unavoidable under EU law (although a separate point recommends amending the definition of a Public Interest Entity, possibly to include large AIM and large private companies);

- the new regulator should introduce a pre-clearance procedure in advance of the publication of accounts;

- the corporate reporting review process should be extended to cover the entire annual report, including corporate governance reporting, on the basis of risk; and

- ARGA should consider extending its regulation to a wider range of investor information.

The FRC is in the process of working with the Department for Business, Energy, and Industrial Strategy to determine how best to respond to the recommendations.

In the meantime, the FRC continues its work to promote transparency and integrity in business. It contributes to a robust framework for corporate reporting in the UK by:

- monitoring companies' compliance with the Companies Act and applicable accounting standards;

- influencing the development of IFRS;

- setting UK accounting standards; and

- supporting clear and concise reporting and the development of good reporting practice throughout the full range of its activities.

3. Annual Review of Corporate Reporting

Quality of Corporate Reporting

Table A on page 10 summarises the most frequently raised issues in 2019, which are similar to previous years. This is not so surprising as IFRS has been relatively stable in recent years and the areas that feature at the top of the table tend to be the most relevant and complex. In particular, we continued to ask questions about the adequacy of key accounting judgement disclosures, aspects of the strategic report and alternative performance measures.

However, these headline figures mask the fact that, generally, reporting has improved in these areas. More companies appear to be getting more of the basics right; the specific focus of our questions has tended to be more targeted.

It is frustrating, however, that we raised more questions in relation to cash flow reporting than in previous years. In the majority of cases, the resulting errors were easily identifiable from a desktop review of the financial statements, and should therefore have been identified and corrected prior to publication. Although we identified errors in the cash flow reporting of a significantly higher proportion of the smaller companies reviewed, overall almost half of the cash flow related adjustments we identified related to companies in the FTSE 350.

We repeat the concern expressed last year about the apparent failure by some to instigate and maintain a robust control environment which ensures that errors of this nature are caught and corrected prior to publication.

> Our questioning of judgements and estimates, still the most frequently raised issue, was more nuanced this year. More companies appeared to be getting the basics right.

Review Outcomes

We reviewed aspects of 207 annual and interim reports and accounts as part of our 2018/19 monitoring activities. We wrote to 80 companies with substantive questions about their reporting, asking for additional information or further explanation. This was usually to help us better understand an accounting policy or the manner in which it had been applied to a particular transaction and where there may be a matter of recognition, measurement or valuation to correct where non-compliance was found. Of those companies receiving a request for additional information or explanation, the most common topics are detailed below.

With the exception of the adjustments needed to correct errors in cash flow statements, very few CRR enquiries led to corrections to the primary statements. Details of these cases can be found in the section on 'References' below. Companies may be reassured that the financial statements themselves are generally fairly presented, although investors acknowledge that these do not provide full transparency and the related disclosures do require improvement.

Most cases are closed when companies offer undertakings to make certain corrections or improvements in their next set of accounts. We always follow up such undertakings to ensure that the necessary improvements have been made. We will re-open the case and write to the company if our expectations have not been met. Two cases were re-opened this way in the last year (2018: three); all of the companies were held to their original commitment.

Where we do not have any substantive questions to ask of a company, we may write to draw their attention to a number of more minor matters which we encourage the Board to consider when preparing their next report and accounts. These letters may identify unnecessary duplication of information and suggestions for how they might improve their report by keeping their disclosures clear and concise.

More detail about our monitoring activities during 2018/19 can be found in Appendix B.

> The detail of companies' voluntary reporting of their interaction with the FRC was variable.

Publication of CRR Interaction

The primary medium for reporting our activities is companies' own Audit Committee reports. The FRC's Guidance on Audit Committees9 expects companies to explain the nature and extent of interaction (if any) with the FRC in their subsequent report and accounts, including details of the questions raised and any corrections or improvements made to the company's reporting as a result of our enquiry. Although not subject to the UK Corporate Governance Code, we extend this expectation to all corporates with whom we have engaged and sought some improvement. We ask all companies to reference the inherent limitations of our review in their disclosure. As in previous years, the quality and comprehensiveness of voluntary reporting has been mixed.

Press notices

At the conclusion of our most significant cases, we may issue a press notice in order to bring the matter to the attention of a wider audience. This is usually restricted to those cases where there is a significant material change such as to a primary statement, or the content of the strategic report. No press notices were issued this year (2017/18: one; 2016/17: one).

> We required 12 companies to specifically refer to our interaction in the year which included a mix of basic errors and more complex accounting issues.

References

This year eleven companies (2017/18: fifteen; 2016/17: three) were required to refer to the corrective action taken following CRR review. The twelve required references this year are outlined below.

> All of our approaches led to some element of change in the companies' future reporting.

Cash flow statements

We asked a lot of questions about cash flow statements and related disclosures during the year. Four companies have so far been required to refer to the correction of errors in the cash flow statement:

- McCarthy & Stone plc had classified promissory notes as debt, but had shown movements in the balance as operating, rather than financing, cash flows;

- Marlowe plc restated its cash flow statement to present post acquisition and restructuring cost cash flows within operating activities rather than investing activities;

- Galliford Try had reported advances to joint ventures as operating cash flows rather than investing activities on the grounds that it viewed joint ventures as an extension to its core activities but corrected the presentation when challenged;

- and Carey Group plc had presented assets purchased under finance leases as a cash flow.

Consolidation

In its 2018 report and accounts, Kier Group plc disclosed that it was in discussion with CRR about a number of matters in its 2017 report; principally its accounting treatment of specific joint ventures and the effect of certain pre-emption rights, the effect of which could enable the company to take control of the company in a deadlock situation. The company did not consider the rights to be substantive and had accounted for the investments as joint ventures. The company has acknowledged that this is an area of significant accounting judgement and, in agreement with its partners, is amending the agreements to remove the rights in question.

Following our intervention, Inspired Energy plc reconsidered its accounting policy in respect of an acquisition using a locked box mechanism. Management concluded that, while there were significant indicators of control, including the benefit of cash generated by the acquired entity from the locked box date, the share purchase agreement did not contain sufficient substantive rights to conclude that the ability to control the acquired entity had passed at that date. The financial statements were therefore restated to show control passing at the date of legal completion, some four months later.

Impairment of investments in subsidiaries

Laura Ashley Holdings plc identified, following our correspondence, that it should have performed its 2018 impairment test of its parent company investment in subsidiaries using assumptions that were more consistent with past results. As a result, it has now impaired the investment.

Balance sheet presentation

Cerillion plc restated its balance sheet to correct the proportion of accrued income that had been presented as non-current.

Another company had incorrectly included deferred tax balances within current assets and liabilities (not yet published).

Financial instruments

Countryside Properties plc corrected the discount rate applied to liabilities for deferred land and overage payments, after concluding that this should not have been changed subsequent to initial recognition.

Reserves and other comprehensive income

First Derivatives plc corrected its reserves and other comprehensive income to reflect discretionary dividends paid to non-controlling interests. These had previously been included in the net exchange movement in foreign subsidiaries within other comprehensive income, and therefore reflected in the currency translation reserve. They were reclassified as a deduction from retained earnings.

Correction of error

Laura Ashley Holdings plc identified a material prior period error arising from a discrepancy in its fixed asset register. The correction was included in other comprehensive income for the year in which the error was discovered, but should have been corrected by retrospective restatement.

This section provides further details of the issues that were most commonly raised with companies relating to IFRS financial statements as identified in table A. It includes the more significant findings from our routine reviews, together with an outline of the findings from our recent thematic reviews.

A more detailed summary of our observations, with illustrative examples, Technical Findings 2018/19, is available on the FRC website.

Key findings

Table A ranks the areas in which we put substantive questions to companies in order of their frequency.

| Topic | Ranking | ||

|---|---|---|---|

| 2018/19 | 2017/18 | 2016/17 | |

| Judgements & Estimates | 1 | 1 | 1 |

| Strategic Report | 2 | 3 | 2 |

| Alternative Performance Measures (APMs) | 3 | 2 | 5 |

| Impairment of Assets | 4 | 6= | 7 |

| Statement of Cash Flows | 5 | 9 | 10 |

| Income Taxes | 6 | 4 | - |

| Provisions and Contingencies | 7 | 10 | - |

| Financial Instruments: Recognition and Measurement | 8= | - | - |

| Fair Value Measurement | 8= | - | - |

| Revenue | 10 | 5 | 6 |

Our key findings with respect to financial statements produced under IFRS are outlined in chapter 4, while significant matters raised through our monitoring of narrative reports are discussed in chapter 5. Chapter 6 provides a summary of our reviews of financial statements prepared in accordance with UK GAAP.

4. IFRS Reporting

Judgements and estimates

Judgements and estimates remains the area in relation to which the most questions were raised with companies in 2018-19. It is encouraging that our routine reviews this year identified:

- fewer companies that failed to clearly distinguish judgements from estimates;

- fewer instances of boilerplate or unclear wording; and

- fewer cases where matters were not disclosed as key judgements or areas of significant estimation uncertainty in the financial statements despite indicators to the contrary elsewhere in the annual report.

This may indicate that the key messages from our thematic reports, and further supported by the Lab, are having an effect.

In common with last year, however, the most frequent area of challenge was lack of, or inadequate, sensitivity analysis or information about the range of possible outcomes for areas of estimation uncertainty. Although IAS 1 'Presentation of Financial Statements' does not explicitly require sensitivity analysis, it does require disclosures to be given to help users understand the judgements made about the future and other sources of estimation uncertainty. In our view, it would be difficult for users to understand the significance of management estimates without information regarding their sensitivity to changes in assumptions or range of outcomes.

This type of information is generally provided where specifically required by another accounting standard, for example impairment reviews or pension assets and liabilities. Far fewer of the accounts we reviewed, however, disclosed sensitivity or range of outcome information for other areas of significant estimation uncertainty such as uncertain tax positions, onerous contracts or asset valuations where, for example, IFRS 13 'Fair Value Measurement' requires sensitivity analysis if fair value is used.

Another common area of enquiry related to estimation uncertainties which did not appear to give rise to a significant risk of material adjustment to the related balances within the next year. While information about uncertainties expected to crystallise, or assumptions expected to change, in a period beyond 12 months may often be useful to users of the accounts, these disclosures should be clearly distinguished from those required by IAS 1.

We encourage companies to be mindful that the judgements and estimates disclosed are those with the greatest potential effect on the financial statements. Where there is a significant risk of material adjustment to related balances within the next year, companies should ensure that all necessary disclosures are provided to enable investors to fully understand the financial implications of the judgements and estimates made by management.

> Candid reporting of sensitivity analysis underlying judgements that include estimation uncertainty enhances investors' ability to understand their significance and impact on companies' results.

Consolidation judgements

More recent standards produced by the IASB tend to place more emphasis on control than on economic risk and reward when compared to predecessor standards. This can be seen in IFRS 10 'Consolidated Financial Statements', IFRS 16 and IFRS 15.

Although not one of our top issues by the number of times raised, the most complex cases in this and recent years have related to consolidation judgements and specifically, the question of control over another entity. Questions considered during the year included:

- the control of trusts;

- the determination of joint control in a situation where one party holds a majority of voting rights;

- de facto control, in a situation where a company and its associate have several directors in common; and

- the point at which control passed with a "locked box" arrangement.

Companies need to have a full understanding of the rights and obligations - both contractual and constructive - arising from their arrangements, in order to assess the criteria for control of another entity and determine correctly whether or not it should be consolidated. This may be particularly relevant in situations such as a joint arrangement where the rights arise from contractual, rather than voting, rights.

IFRS 10 sets out a three-part definition of control, providing detailed guidance on the assessment of evidence for each part: power over an investee, returns from the investee and the ability to use that power to influence those returns. In particular, the standard distinguishes between substantive rights to exercise decision-making powers over another entity and other rights, which may be only protective and/or limit the powers of other parties.

Companies should be able to differentiate substantive from protective and other rights relating to their power to direct the relevant activities of another entity. While IFRS 10 requires that all facts and circumstances be taken into account, it is important to give each element in the assessment appropriate weight, applying the detailed guidance given in the standard.

The very nature of the judgement that needs to be made - whether or not to consolidate - means that it often has a material effect. Where that is the case, we expect to see the disclosure required by paragraph 122 of IAS 1.

> Cases involving judgements around consolidation were among the most complex.

Statement of cash flows

As last year, we raised a significant number of questions to companies about their cash flow statements. Most of the errors that we found were apparent from a desktop review of the financial statements. Almost half of the companies approached with cash flow related questions were in the FTSE 350.

Most of the errors identified related to cash flows being misclassified between operating, investing and financing activities. The following table illustrates where IAS 7 'Statement of Cash Flows' requires some commonly misclassified items to be categorised in the cash flow statement:

| Cash Flow Type | Incorrectly Presented as... | Examples |

|---|---|---|

| Operating Cash Flows | Investing | Fees received from associates and joint ventures. Restructuring and post-acquisition integration costs. Purchase and sale of rental fleet assets*. |

| Investing Cash Flows | Operating | Disposal of investments in joint ventures. Non-trading advances to joint ventures. |

| Financing Cash Flows | Operating | Repayment of loans from joint ventures. |

* While purchases and sales of fixed assets would generally give rise to investing cash flows, IAS 7 'Statement of Cash Flows' is clear that cash flows from the purchase or sale of assets held for rental to others are operating cash flows.

A case study illustrating this issue can be found below. Other challenges to companies included the following:

- additions and disposals of assets held under finance leases presented as cash flows;

- dividends from associates and joint ventures not presented separately;

- unclear captions providing insufficient explanation of cash flows presented;

- instances where the basis for inclusion or exclusion of amounts such as overdrafts and current asset investments within cash and cash equivalents was not clear; and

- difficulty in reconciling movements in working capital balances to the amounts shown in the reconciliation of cash flows from operating activities.

> Robust pre-issuance reviews are needed to avoid misclassification errors in the cash flow statement.

Case Study - Cash Flow Statement

Background

A company had acquired a subsidiary three years earlier. The accounts explained that part of the consideration had been deferred for two years and was contingent on the performance of the acquired business. It was payable to a major shareholder of the acquiree who had been retained as an employee of the combined group.

IFRS 3 'Business Combinations' contains specific criteria for assessing whether payments to employees or selling shareholders are consideration for a business or, for example, employee compensation10. Arrangements in which the contingent payments are automatically forfeited if employment terminates are accounted for as remuneration for post-combination services. The company had correctly identified this requirement of IFRS 3 and accounted for the payments in the income statement as employee compensation, with a liability for the amount payable. The liability was settled in cash in the current year.

Company's initial view

The company had presented the cash paid to the former shareholder as an outflow arising from the company's investing activities. It believed that this was the most appropriate classification of the cash flow as it related to the company's acquisition of a subsidiary.

FRC's view

IAS 7 is clear that cash flows from investing activities should represent the acquisition and disposal of long-term assets and other investments not included in cash equivalents11. Only expenditures resulting in assets recognised on the balance sheet are eligible for classification as investing activities.

Payments to and on behalf of employees are required to be classified as cash flows from operating activities12. As the contingent payments were expensed, rather than recognised as an asset, they should have been classified the same way as the rest of the company's employee compensation; that is, as outflows from operating activities.

Company's amended view

The company accepted the FRC's view and agreed to present any such contingent payments as operating cash outflows in future. It expanded its accounting policy for contingent payments arising from business combinations to explain the basis for recognising the payments in the cash flow statement.

The company did not restate the comparative amounts in the cash flow statement in its next report and accounts as it had assessed the error as not material.

FRC focus points

Companies often make and disclose judgements when applying accounting standards to complex transactions. However, the FRC sees few examples of accounting policies or judgements relating to the presentation of the cash flows arising from such transactions. This may indicate that cash flow presentation is seen by preparers as less important than other primary statements.

As noted in the Lab's recent report, investors look for clear and relevant information about the sources and uses of cash, to assess company stewardship and inform their expectations of future results. The FRC expects companies making complex accounting judgements to consider whether there are also judgements to be made and disclosed on cash flow presentation. Such disclosures would help investors assess the comparability of different companies' information on cash flow presentation.

Although judgement may be required in certain circumstances, investors expect companies to comply with the detailed requirements of IAS 7. Where a genuine material judgement has been made on presentation, we expect that judgement to be disclosed and explained.

The findings of the Lab regarding the reporting of the sources and uses of cash are set out below.

Insights from the Lab

Reporting on the sources and uses of cash

Gaining an understanding of the generation, availability, and use of cash is a fundamental objective for users of annual reports. For investors it is a critical underpinning of their investment process, both in their assessment of management's stewardship administration of a company's assets, and in supporting their analysis of future expectations.

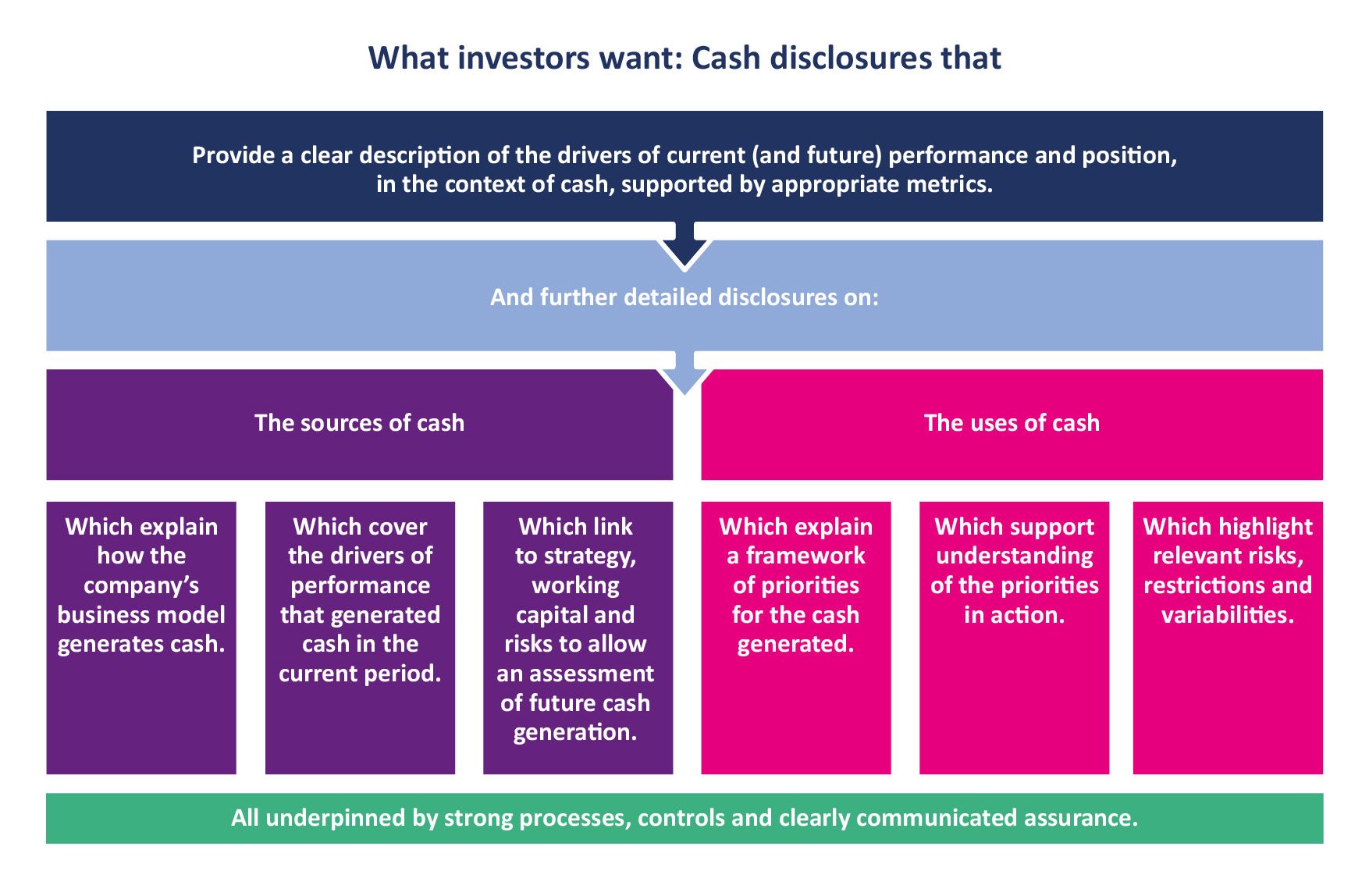

What investors want: Cash disclosures that

Provide a clear description of the drivers of current (and future) performance and position, in the context of cash, supported by appropriate metrics.

And further detailed disclosures on:

| The sources of cash | The uses of cash |

|---|---|

| Which explain how the company's business model generates cash. | Which explain a framework of priorities for the cash generated. |

| Which cover the drivers of performance that generated cash in the current period. | Which support understanding of the priorities in action. |

| Which link to strategy, working capital and risks to allow an assessment of future cash generation. | Which highlight relevant risks, restrictions and variabilities. |

All underpinned by strong processes, controls and clearly communicated assurance.

The Lab's recent project, "Disclosures on Sources and Uses of Cash", sought to understand what information (other than cash flow) investors look for about how cash is and, more importantly, will be generated and used. It identified that investors wanted company disclosures to cover some key areas:

While investor needs were clear, many considered that they were not necessarily being met by current disclosures.

Areas for improvement

Investors identified two levels of improvement, reflecting companies' circumstances. For companies where the availability of cash was not a significant issue, investors considered that additional information would be useful. They considered that there was a need for:

- a more joined-up, holistic disclosure of the company's cash generation across the annual report, and consistent discussion between various investor-focused communications;

- better disclosure supporting the cash-based key performance indicators (KPIs), to explain the link to strategy and provide detail of performance in the period;

- specific focus in the business model disclosure on cash generation;

- more detailed disaggregation in cash relevant metrics (e.g. generation, capital expenditure, working capital), especially where fundamentally different operations exist within the same group;

- narrative explanation that provides clearer context for movements and balances; and

- disclosure of a company's priorities for use of cash that had been generated (or might be generated), including capital expenditure and dividends.

For companies experiencing specific and significant issues (current or developing) which are related to, or impact cash, investors consider disclosure could be improved.

Examples include:

- a need for more transparent disclosure of the existence of substantial working capital finance arrangements, such as reverse factoring; and

- a need for more disclosure around the presence of hard or soft restrictions, risks and possible variability, which might impact cash and its use.

The full report provides a number of market examples which present characteristics that were identified as useful by investors.

Reverse factoring

We continue to have concerns about the adequacy of disclosures provided to explain supplier financing arrangements, also known as reverse factoring. While we have noted an increase in both the number and quality of disclosures provided by companies this year, we believe that there are still many companies that are not providing relevant information.

The Lab's report contains an appendix on reverse factoring. Investors want to know which companies are using reverse factoring, why, and the extent of their dependency. The report also found examples of companies explicitly disclosing that they did not use reverse factoring. This is a particularly helpful disclosure by companies operating in sectors where such arrangements are more common.

In addition, we expect companies to disclose:

- the accounting policy applied;

- whether the liability to suppliers is derecognised;

- whether the liability is included within KPIs such as net debt;

- the cash flows generated by such arrangements; and

- the existence of any concentrations of liquidity risk which could arise from losing access to the facility.

> Clear disclosure of supplier financing arrangements remains an area of concern. We will challenge those who operate in sectors where these are common and where no reference to such arrangements are made.

Income taxes

Income tax is another area where we continued to raise relatively more questions of companies, despite it having been the subject of a recent thematic review. In prior years we identified a large number of matters such as provisions, share based payments or acquisitions that were disclosed elsewhere in the annual report and that we would expect to have had a tax effect, but about which no disclosures were made in the tax note or related accounting policy. Encouragingly, we identified such fewer cases this year. We also identified fewer instances where it was unclear whether tax effects had been correctly allocated between profit or loss and equity.

We did, however, challenge companies whose descriptions of adjusting items in the tax reconciliation were insufficiently precise to enable readers to understand their nature. We continued to identify material amounts within tax disclosures described as "other", such as "other non-deductible expenses", "other timing differences" or "other temporary differences". We will always seek a more specific description of items where the related balance is material.

We also identified several instances where a company recognised a deferred tax asset in respect of unutilised losses, and where the company had suffered a loss in either the current or preceding period. In these circumstances, IAS 12 'Income Taxes' requires disclosure of the nature of the evidence supporting the recognition of the asset, but this disclosure had not always been provided.

Provisions and contingencies

This year we saw an increase in the number of questions put to companies about their application of IAS 37 'Provisions, Contingent Liabilities and Contingent Assets'. These approaches predominantly related to missing or unclear disclosures of provisions, or instances where the information disclosed in the provisions note appeared inconsistent with information disclosed elsewhere. We questioned companies where inadequate explanations were provided of the source of provisions, including how management determined at what point a present obligation arose.

Other examples of inadequate disclosure included

- releases of provisions netted against increases in provisions;

- movement due to change in discount rate inconsistent with discount rates disclosed; and

- lack of disclosure of the uncertainties about the amount or timing of cash outflows

We also asked companies for additional information where they had not provided the required disclosures regarding the financial effect of contingent liabilities.

> This year we saw an increase in the number of questions we put to companies about their reporting of provisions and contingencies and fair value measurement.

Fair value measurement

We also saw an increase in the number of initial concerns we had about the application of IFRS 13. The most common area of challenge related to the disclosure of the valuation techniques and inputs used for fair value measurements categorised within levels 2 and 3 of the fair value hierarchy, including quantitative information about the significant unobservable inputs used. For fair value measurements categorised within level 3, a description is also required of the sensitivity of the measurement to changes in unobservable inputs. For financial assets and liabilities, the standard requires a quantitative sensitivity analysis. We questioned companies where the relevant disclosures had not been provided.

We also challenged companies that had not provided fair value hierarchy disclosures for all fair values disclosed. A common oversight was to omit this disclosure in respect of fair values disclosed for assets and liabilities not measured at fair value in the statement of financial position. We also challenged companies where the hierarchy levels disclosed appeared to be inconsistent with information given elsewhere, typically fair value measurements disclosed as level 2 in the hierarchy which appeared to involve significant unobservable inputs.

Most of our challenges related to the fair value measurement of financial instruments, including derivatives. A significant minority related to the valuation of investments in subsidiaries or contingent consideration associated with business combinations. Another line of enquiry regarding financial instruments related to inadequate disclosure of the basis on which fair values were calculated, particularly for unusual items such as put options and more complex debt transactions.

Thematic reviews

Impairment of non-financial assets

In times of economic or operational uncertainty, we pay particular attention to the disclosure of management's reviews for impairment of assets. For this reason, and against the background of a weakening high street in the UK, we selected impairment as the subject of a thematic review. Before scoping our work, we met with investors to understand what they find helpful in impairment disclosures and what they would like to see to enhance the information management generally provides.

Two areas of particular investor interest in the current environment are the impact of Brexit on businesses, and the impact of climate change on company activities and prospects. Both matters are discussed in greater detail below. Where these matters are disclosed as principal risks and uncertainties in a company's narrative reports, we expect them to be similarly reflected in any impairment reviews carried out, including any impact on the assumptions used and the range of reasonably possible alternatives considered for the purposes of sensitivity analysis.

We selected 20 listed companies for our review that had either recognised material impairment charges or reversals in their 2018/2019 accounts, or that had a material goodwill balance. We did not notify companies in advance of their inclusion in the sample. We reviewed the quality of disclosures relating to the outcome of testing, under IAS 36, of whether carrying amounts are recoverable, and the recognition of any impairment losses or reversals.

We found numerous instances of good practice across each aspect of disclosure - the events and circumstances triggering an impairment loss or reversal, the description of cash generating units, the key assumptions used to estimate the recoverable amount and of the sensitivity analysis performed - but no company stood out as providing good disclosures in all relevant areas.

Examples of better reporting of the annual impairment testing of goodwill and intangible assets with indefinite useful lives included:

- describing how the entity identified single sites or clusters of sites as Cash Generating Units ('CGUs'), and grouped CGUs for the purposes of testing goodwill for impairment;

- identifying the key assumptions used in the cashflow projections to estimate the recoverable amount of a CGU or group of CGUs, not just the long-term growth rate and discount rate;

- explaining how management determined the key assumptions, linking future expectations to external conditions and/or the company's own strategy;

- quantifying the key assumptions, with comparative figures, for each significant CGU or group of CGUs being tested;

- explaining clearly how the discount rate had been derived, again differentiating different CGUs; and

- clearly stating what changes in key assumptions management thinks are reasonably possible, and the impact of such changes (whether reducing headroom to nil or giving rise to a potentially material adjustment to the carrying value).

We also identified several areas for improvement, aimed at addressing common disclosure issues and making the disclosures more helpful to users. In particular, in line with our findings from our routine reviews, we noted that most companies could improve their disclosures of sensitivity analysis and estimation uncertainty under the different requirements of IAS 36 and IAS 1.

As well as carrying out the thematic review, we also wrote to a number of companies during the year where our routine reviews identified that the carrying value of the parent company's investment in subsidiaries exceeded the market capitalisation of the group. This would generally be considered an indicator of impairment and, where this is the case, we would expect disclosure to address how the matter had been considered in assessing the recoverable amount of the investment.

> Our review of impairment of non-financial assets identified some informative disclosures but identified sensitivity analysis as an area where there is room for improvement.

Initial application of IFRS 9

IFRS 9 became effective from 1 January 2018 and, during the year, the first annual reports prepared under this new standard were published. The main changes introduced by the new standard were:

- a more principles-based approach to the classification and measurement of financial assets, driven by the business model in which the asset is held and its cash flow characteristics;

- impairment requirements based on expected, rather than incurred, credit losses; and

- a reformed approach to hedge accounting that better aligns the accounting treatment with an entity's risk management activities.

We followed up last year's thematic review of disclosures in June 2018 interim accounts with a second thematic review of disclosures in 2018 annual reports. In line with last year's thematic, we skewed our sample towards the banking industry, although this time with a greater focus on smaller banks. Our sample also included non-banking entities from a variety of sectors. The principal findings of the review are set out below.

Non-banking companies

Consistent with our findings in last year's thematic, IFRS 9 did not have a material effect on the results of the non-financial services companies we reviewed. However, all the non-banking companies in our sample provided some explanation of the key changes arising from the adoption of the standard.

The simplified approach, requiring the recognition of lifetime losses, must be used for trade receivables without a significant financing component and may be used for trade receivables with a significant financing component and contract assets. Where a choice exists, we would usually expect non-banking companies to opt for the simplified alternative because it avoids the complications associated with the three-stage approach. While some companies in our sample provided helpful disclosures about how they had implemented the simplified approach, in other cases the disclosures were not particularly informative or failed to provide any details at all.

> Non-banking companies in our sample explained the key changes resulting from adoption of the new standard on financial instruments.

Banking companies

IFRS 9 has different financial asset classification requirements from IAS 39. Generally speaking, these new requirements have not had a major effect on non-banking companies, which principally hold cash and trade receivables to collect. However, we found a few examples of changes in classification. In one case, a company classified an element of trade receivables as fair value through other comprehensive income (FVTOCI) because its policy was to sell some receivables and to hold others to collect. In another case, a debt investment in a money market fund was classified as fair value through profit or loss (FVTPL). In both cases, however, measuring these financial assets at fair value did not have a material effect.

Most non-banking companies elected to classify equity investments as FVTOCI. When this election is taken, there is no requirement to test such equity investments for impairment nor is any amount transferred to profit or loss on disposal of the investment. However, we found one example of a property investment company that did not take this election, and defaulted to a FVTPL measurement basis.

Companies may choose to remain on IAS 39 hedging requirements or adopt the requirements of IFRS 9. Except for one case, all the non-banking companies adopted the new hedging requirements of IFRS 9, which are more flexible than those of IAS 39. Existing IAS 39 hedges should comply with IFRS 9, although the requirements of the standard regarding hedge documentation and effectiveness testing should be applied prospectively. We found one helpful example of a company that clearly explained the key differences between the IAS 39 and IFRS 9 hedging, including how it had updated its hedge documentation to comply with IFRS 9.

We continued to see the use of superseded IAS 39 terminology in a few cases. We encourage companies to check accounting policies and other narrative disclosures carefully to make sure that the terminology is updated.

The calculation of expected credit losses often requires management to exercise significant judgement in determining the assumptions and methodologies used, resulting in estimation uncertainty disclosures under IAS 1. We were pleased to see that all the banks in our sample provided some supporting quantitative disclosures. In many cases, this involved providing sensitivity analysis about how changing the weightings of future economic scenarios would affect the level of expected credit losses.

We also found a few examples of sensitivity analysis for a change in a single assumption. As a rule, multi-variate sensitivity analysis is more appropriate for more complex models owing to the interdependencies between assumptions. However, univariate sensitivity analysis should not be overlooked when the calculation of expected credit losses is dominated by a single assumption, such as house price inflation for portfolios of retail mortgages - which may be more relevant to smaller banks with less complicated models.

Although IFRS 9 may require accounting policy judgements in a number of areas, in almost all cases we would expect judgement to be exercised in the determination of a significant increase in credit risk (SICR). The determination of SICR is particularly important given that this is the trigger for moving from 12-month expected losses to lifetime expected losses. On the whole, the disclosures about how SICR had been determined were good, explaining the qualitative and quantitative factors used and the extent to which the bank had relied on the 30-day backstop.

The level of detail provided about the classification and measurement of financial assets varied across the banks. In some cases, there was limited information provided about how business models had been determined and the effect of the 'solely payment of principal and interest' (SPPI) test. While the business model requirements may, in many cases, be relatively straightforward to apply to the trading and banking books, we encourage banks to avoid boilerplate and provide more entity specific information in this area. Similarly, many of the disclosures we reviewed provided little specific information about how the SPPI test had been applied.

Hedging disclosure requirements were expanded significantly as a result of IFRS 9. All of the banking entities which engaged in hedging activities, with the exception of one, continued to apply IAS 39 for hedge accounting and the disclosures were generally good in this area.

> We were generally satisfied by the standard of IFRS 9 reporting by banks, particularly the larger entities, but were also pleased to see good disclosures by some smaller banks.

Initial application of IFRS 15

IFRS 15 represents a significant change to the method of recognition of revenue. It provides a single, principles based five-step model to be applied to all contracts with customers, as well as requiring companies to provide users of financial statements with more informative, relevant disclosures.

We reviewed the year-end accounts of 25 companies applying IFRS 15 for the first time. We assessed the comprehensiveness and quality of revenue disclosures against IFRS 15 requirements. In particular, we considered those matters which had given cause for concern in our earlier review of a sample of 2018 interim reports, the findings from which were published in November last year.

We skewed our sample to companies in those industries where the implementation of IFRS 15 is known to have had the most significant impact. Six companies were pre-informed of our review. Five of these were identified from our review of interim reports as having specific areas for improvement. The disclosure requirements for annual accounts are significantly more comprehensive than for interim accounts and we were pleased to have seen improved and enhanced revenue disclosures in the year-end accounts by all of these companies.

We found that the companies sampled provided sufficient information to enable users to understand the impact of adopting IFRS 15, including helpful company-specific explanations. However, as this was the first year of application, there was room for improvement by all companies - even those who had provided disclosures that were identified as good within the thematic report. The principal findings of the review are set out below:

- There is still plenty of scope to improve explanations of accounting policies for revenue recognition. Revenue policies should describe the specific nature of performance obligations and when they are satisfied, including whether a company is acting as agent in providing any goods and services. Where arrangements include elements such as variable consideration, financing components, warranties or return rights, the accounting for each should be clear. It should also be clear which policies are relevant for each business activity separately identified in the segmental reporting note and in the strategic report.

- Information provided about significant judgements relating to revenue was variable. Some disclosures appeared to list all judgements rather than focussing on those having a significant effect on the amount and timing of revenue recognition. Descriptions often lacked clarity about the specific judgements made. Where judgements involved estimation uncertainty, quantitative disclosure, such as sensitivities or ranges of potential outcomes, was not always provided.

- We observed more comprehensive disclosures about the balance sheet impact of adopting IFRS 15 in the year end accounts compared to our review of interim accounts. For example, most companies clearly identified the opening and closing balances for receivables, contract assets and contract liabilities. Accounting policies were usually provided for these balances although the quality of explanations in certain areas could be improved, such as the relationship between the timing of satisfying a performance obligation and the timing of payments.

- When provided, accounting policies and judgements relating to the costs of obtaining and fulfilling revenue contracts were helpful and company specific. However, some accounts in the sample made no reference to these costs which, in some instances, was surprising given the companies' activities.

- Many companies disaggregated the transition adjustment by category of impact, explaining the impact by referring to changes in the accounting policies or methods arising from implementing the new standard. However, it was disappointing that some companies sampled (notably telecoms companies) did not provide a quantitative breakdown of the transition adjustment.

- Companies adopting the modified retrospective approach provided adequate detail to explain and address the lack of comparability between the current year revenue prepared under IFRS 15 and prior year revenue prepared under the previous standard. Many companies put in particular effort to ensure that meaningful "like for like" comparisons were clearly made.

> Our pre-informing of a small sample of companies that we would review their year-end IFRS 15 reporting, led to some clear improvement in their disclosures.

The expected effect of the new IFRS for lease accounting

IFRS 16 'Leases', became mandatory for accounting periods beginning on or after 1 January 2019. The main change from the old standard is the removal of the split between operating and finance lease for lessees. Instead, right of use assets and lease liabilities are recognised on balance sheet for most leases.

We carried out a thematic review on the disclosures of the impact of the new standard included within the June 2019 interim reports of a sample of companies. We selected our sample to include industries where the new standard was expected to have had a significant impact and targeted companies with larger disclosed operating lease commitments under IAS 17 'Leases'.

The purpose of the review was to observe initial application of the standard and to identify good examples, and any weaknesses, within interim disclosures, to help us provide relevant and timely guidance for companies to consider when preparing their year-end accounts. The thematic review will also inform our selection of annual reports for review during the next year, having identified those companies with poorer disclosures.

We identified some good examples of transitional disclosures which will be included in the report and to be published shortly. We also noted a number of common weaknesses as follows:

- A number of companies identified key judgements associated with the new standard, for example relating to lease extension options, but without clearly describing the judgement that had been made. We expect companies to describe the specific judgements made and, where they involve estimation uncertainty, to provide the disclosures required by paragraphs 125 to 129 of IAS 1.

- All companies clearly communicated the balance sheet impact of adopting the new standard. However, there was less consistency in clearly communicating the profit and loss impact of the transition.

- Most companies in our sample had adopted the modified retrospective approach to transition, and provided the required reconciliation between operating lease commitments disclosed under IAS 17 and lease liabilities recognised under IFRS 16 at date of initial application. Better examples explained the reconciling items, but some companies failed to provide an explanation for significant reconciling items, including contracts falling outside the scope of IFRS 16, and the impact of significant lease extension options. Where such items would be expected to give rise to significant judgements, we would expect these to be disclosed, but this was not always the case.

- Companies generally provided good disclosure of the practical expedients they had adopted. We encourage companies to ensure that they distinguish clearly between practical expedients on transition and ongoing accounting policy choices, for example for short term leases.

- Only a minority of the companies reviewed included the disclosures required by paragraph 53 of IFRS 16, with very few adopting the tabular presentation recommended for the provision of this information.