The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Audit Quality Inspection Report May 2014: KPMG LLP and KPMG Audit Plc

Financial Reporting Council

The FRC is responsible for promoting high quality corporate governance and reporting to foster investment. We set the UK Corporate Governance and Stewardship Codes as well as UK standards for accounting, auditing and actuarial work. We represent UK interests in international standard-setting. We also monitor and take action to promote the quality of corporate reporting and auditing. We operate independent disciplinary arrangements for accountants and actuaries; and oversee the regulatory activities of the accountancy and actuarial professional bodies.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from an action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2014 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 5th Floor, Aldwych House, 71-91 Aldwych, London WC2B 4HN.

1. Background information and key messages

1.1 Introduction

This report sets out the principal findings arising from the inspection of KPMG LLP and KPMG Audit Plc (together referred to in this report as “KPMG” or “the firm") carried out by the Audit Quality Review team of the Financial Reporting Council (“the FRC”), in respect of the year to 31 March 2014 (“the 2013/14 inspection"). We inspect KPMG annually. Our inspection was conducted in the period from February 2013 to January 2014 (referred to as “the time of our inspection"). The objectives of our work are set out in Appendix A.

Our inspection comprised reviews of individual audit engagements and a review of the firm's policies and procedures supporting audit quality.

We reviewed 17 audit engagements undertaken by the firm, of which one was a further review of an audit reviewed in our last inspection. These related to FTSE 100, FTSE 250, other listed and other major public interest entities, with financial year ends between June 2012 and March 2013. Our reviews were selected on a risk basis, utilising a risk model; each review covered only selected aspects of the relevant audit. The further review included an assessment of the extent to which our previous findings on that audit had been addressed.

Our responsibility is to monitor and assess the quality of the audit work performed by the UK firm. Accordingly, our reviews of group audits covered the planning and control of the audit by the group engagement team, including their evaluation of the adequacy of the work performed by component auditors, and selected aspects of other work performed by the UK firm at group and/or component level. Our reviews did not cover audit work relating to components undertaken by other firms within or outside KPMG's international network.

Our review of the firm's policies and procedures supporting audit quality covered the following areas:

- Tone at the top and internal communications

- Transparency report

- Independence and ethics

- Performance evaluation and other human resource matters

- Audit methodology, training and guidance

- Client risk assessment and acceptance/continuance

- Consultation and review

- Audit quality monitoring

- Other firm-wide matters

We exercise judgment in determining which findings to include in our public report on each inspection, taking into account their relative significance in relation to audit quality, both in the context of the individual inspection and in relation to any areas of particular focus in our overall inspection programme for the relevant year. Where appropriate, we have commented on themes arising or issues of a similar nature identified across more than one audit.

Further information on the scope of our work and the basis on which we report is set out in Appendix A.

1.2 Background information on the firm

All findings requiring action set out in this report, together with the firm's proposed action plan to address them, have been discussed with the firm. Appropriate action may have already been taken by the date of this report. The adequacy of the actions taken and planned will be reviewed during our next inspection.

The firm was invited to provide a response to this report for publication. The firm's response is set out in Appendix B.

We acknowledge the co-operation and assistance received from the partners and staff of KPMG in the conduct of our 2013/14 inspection.

The UK firm of KPMG is owned by KPMG Europe LLP (“ELLP”) which is a limited liability partnership created through a merger of the UK and German member firms of KPMG International in October 2007. It has since been enlarged to include a number of other KPMG member firms. The majority of the partners of KPMG are members of ELLP. The management of ELLP and its operating subsidiaries lies primarily with the Board of ELLP. In September 2013, ELLP approved changes to the governance and management structure to better align with the Europe, Middle East and Africa regional structure. This resulted in a more streamlined governance structure for ELLP which was effective from 1 October 2013.

The UK Board and Executive Management Team have responsibility for the UK firm's general and operational management. The KPMG office in Northern Ireland is part of the Irish member firm, which is not part of ELLP, and does not have any audits within our scope.

The UK firm has 23 offices and is organised into three lines of service, being audit, advisory and taxation. All statutory audit work is performed within audit, which is divided into industry and geographical business units for operational purposes.

For the year ended 30 September 2013, the firm's turnover was £1,782 million, of which £481 million related to audit work and directly related services. There was a total of 583 partners, of whom 140 were authorised to sign audit reports, and 90 employees who were authorised to sign audit reports1.

We estimate that the firm was auditor to 469 UK entities within the scope of independent inspection as at 31 December 2012. Of these entities, our records show that 181 had securities listed on the main market of the London Stock Exchange, including 23 FTSE 100 companies and 52 FTSE 250 companies.

The UK firm audits entities incorporated in Jersey, Guernsey or the Isle of Man whose securities are traded on a regulated market in the European Economic Area. These are inspected by us under separate arrangements agreed with the relevant regulatory bodies in those jurisdictions. The results of these reviews are included in this report. Our records show that, at the time of our inspection, the firm had 14 such audits. KPMG Channel Islands Limited is a separate firm. The results of any reviews undertaken of its audits are, therefore, not included in this report.

1.3 Overview

We focus in this report on matters where we believe improvements are required to safeguard and enhance audit quality. We set out our key messages to the firm in this regard in section 1.4. While this report is not intended to provide a balanced scorecard, we highlight certain matters which we believe contribute to audit quality, including the actions taken by the firm to address findings arising from our prior year inspection.

The firm places considerable emphasis on its overall systems of quality control and, in most areas, has appropriate policies and procedures in place for its size and the nature of its client base. Nevertheless, we have identified certain areas where improvements are required to those policies and procedures. These are set out in this report.

Our file review findings, as set out in section 2, largely relate to the application of the firm's procedures by audit personnel, whose work and judgments ultimately determine the quality of individual audits. The firm took a number of steps in response to our prior year findings to achieve improvements in audit quality. However, a number of findings continue to recur as set out in this report.

In general, the findings arising were diverse in nature and did not fall into common themes. However, we were concerned about the rate of progress in addressing our prior year findings relating to the use of other auditors in undertaking letterbox company audits2. In addition, following the completion of an external review of the firm's ethical policies and procedures, it is important that the firm takes prompt action in response to the recommendations arising from that review. We comment further on these areas in Section 2.

1.4 Key messages

The firm should pay particular attention to the following areas in order to enhance audit quality and safeguard auditor independence:

- Develop and implement a detailed and appropriate action plan in response to the recommendations of the external report commissioned by the firm into its ethical policies, procedures, guidance and training.

- Take further action to ensure that all partners in the firm are fully aware of, and comply with, the requirements under Ethical Standards and the firm's policies and procedures relating to the holding of financial interests in audited entities.

- Take appropriate and timely action to ensure that the firm's guidance requires audits of letterbox companies to be undertaken in accordance with the requirements of Auditing Standards.

- Take further steps to reinforce the firm's approach to the audit of specific and collective impairment provisions in financial services entity audits, in particular the need for audit teams to demonstrate appropriate challenge of management and exercise of professional scepticism in this area.

- Review and enhance the firm's guidance on materiality in the light of the findings in this report and the thematic review report issued by the FRC in December 2013.

- Ensure the results of the firm's annual assessment of compliance and quality for each audit partner and manager (the “Quality and Risk Metrics") are consistently and appropriately reflected in performance evaluation discussions and remuneration decisions.

2. Principal findings

The comments below are based on our reviews of individual audits and the firm's policies and procedures supporting audit quality.

2.1 Reviews of individual audits

We reviewed and assessed the quality of selected aspects of 17 audits (2012/13: 13 audits), of which one was a further review of an audit reviewed in our last inspection which included an assessment of how findings previously raised had been addressed (2012/13: two follow-up reviews were undertaken).

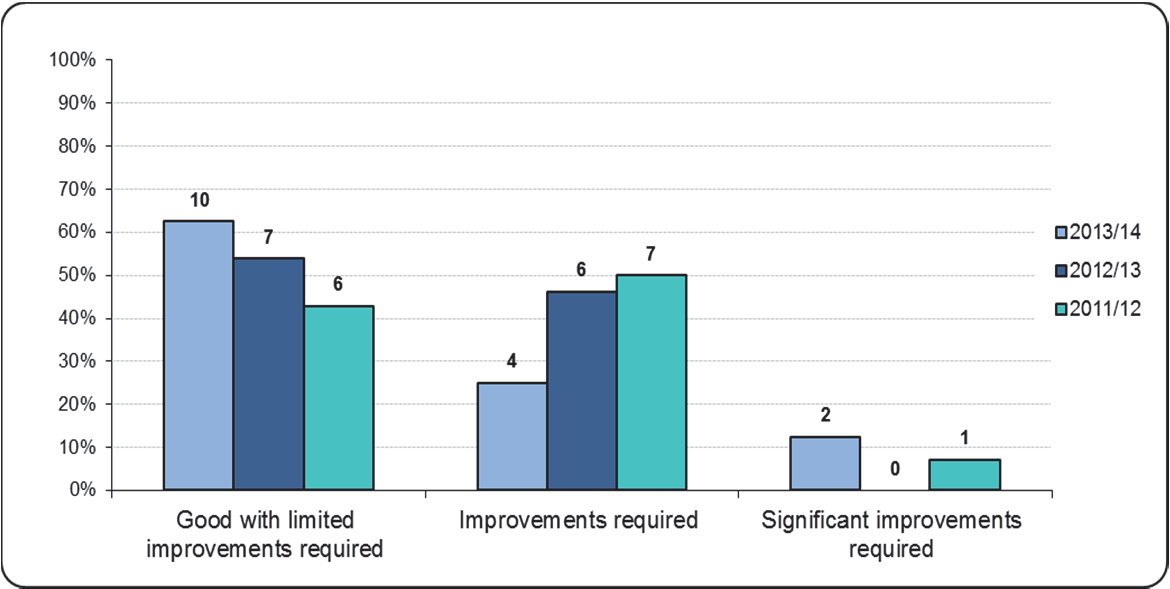

10 of the audits we reviewed (2012/13: seven) were performed to a good standard with limited improvements required and four audits (2012/13: six) required improvements. Two audits (2012/13: none) required significant improvements in relation to the audit of intangible assets and revenue. Further details are set out later in this section. An assessment of the quality of one audit was not finalised3.

An audit is assessed as requiring significant improvements if we had significant concerns in relation to the sufficiency or quality of audit evidence or the appropriateness of significant audit judgments in the areas reviewed, or the implications of other matters are considered to be individually or collectively significant. This assessment does not necessarily imply that an inappropriate audit opinion was issued.

Findings in relation to audit evidence and judgments

The bar chart below shows the percentage of the audits we reviewed in 2013/14 falling within each grade, with comparatives for 2012/13 and 2011/12. The number of audits within each grade is shown at the top of each bar.

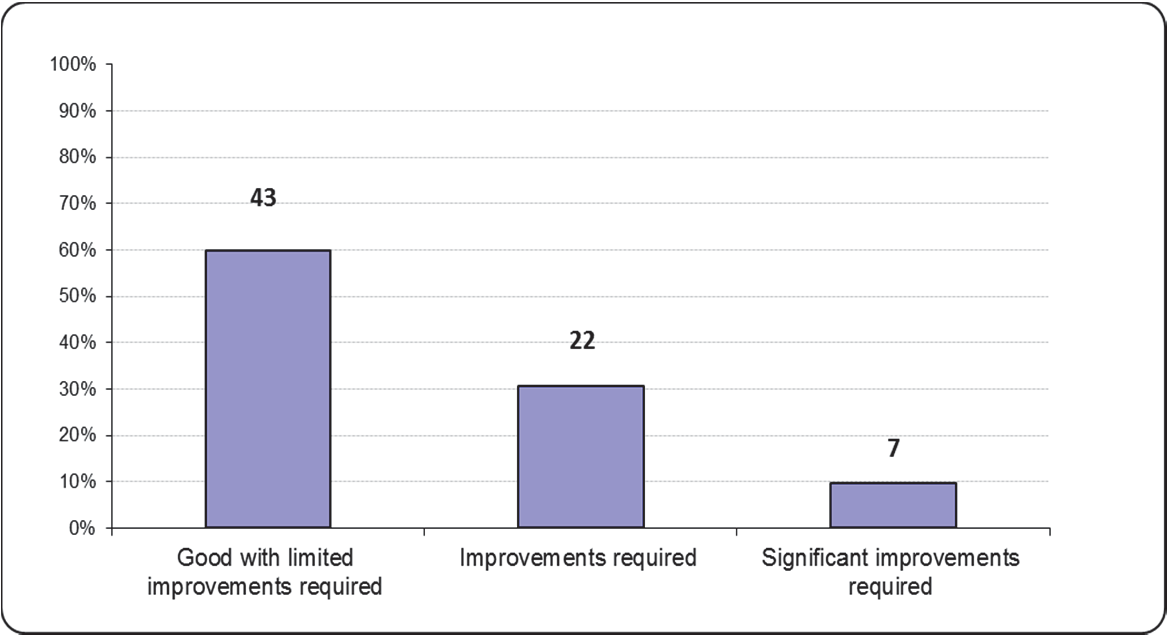

Changes to the proportion of audits reviewed falling within each grade from year to year reflect a wide range of factors, which may include the size, complexity and risk of the individual audits selected for review and the scope of the individual reviews. For this reason, and given the sample sizes involved, changes in gradings from one year to the next are not necessarily indicative of any overall change in audit quality at the firm. In the bar chart below, we have therefore provided summary information over a longer period and, consequently, based on a larger number of audits. This shows the proportion of audits reviewed falling within each grade in the five years up to and including 2013/14. The number of audits within each grade is shown at the top of each bar.

Our reviews focused on the audit evidence and related judgments for material areas of the financial statements and areas of significant risk. We draw attention below to findings which the firm should ensure are addressed appropriately in future audits.

The significance of these findings in the context of an individual audit reviewed, and therefore the implications for our grading of that audit, will vary. However, whatever the implications for the specific audits reviewed, we nevertheless include the relevant findings in this report if we consider them important in the broader context of improving audit quality at the firm.

Audit of loan loss provisions

We reviewed the audit of loan loss provisions for five financial services entities.

In all five audits we identified issues relating to the extent of audit evidence to support the level of specific provisions and, in four cases, collective provisions. In particular, we continue to find cases where further audit evidence should have been obtained or there was a lack of appropriate challenge of management by the audit team.

On two of the audits, insufficient audit evidence was obtained that all forbearance arrangements in place had been identified for disclosure and provisioning purposes.

General IT controls

We reviewed the testing of the operational effectiveness of IT controls on 12 audits and found weaknesses on six of them.

In two cases, the audit procedures performed relied upon system generated reports which had not been adequately tested for completeness or accuracy. In two further audits, insufficient procedures were performed on IT systems hosted by outsourced service providers. In the remaining two audits, it was unclear how the audit team had responded to deficiencies identified by their testing.

Inventories

The audit of inventory was reviewed on six audits and we identified weaknesses in three of them.

On two of those audits, there was insufficient evidence to support the rationale for the locations selected for stocktake attendance; and insufficient procedures performed regarding changes in inventory in the period between the dates of stocktakes attended and the year end. On the third audit, there was insufficient challenge of the stock provisioning method.

Audit of goodwill and other intangible assets

We reviewed the firm's audit of goodwill and other intangible assets on nine audits and found weaknesses in six of those audits.

We concluded that two audits required significant improvements in this area. In both cases, there were errors in the disclosures made in the financial statements which had not been identified by the audit team. In these cases and one further audit, there was a lack of challenge by the audit team of key assumptions used. In two further audits, there was insufficient evaluation of the value in use calculation for certain assets. In another audit, we found insufficient evidence of the audit team's assessment of a valuation model.

Group audit considerations

We assessed the quality of the firm's audit work in this area on eleven of the audits we reviewed.

In seven audits, there was insufficient evidence of appropriate involvement by the group audit team, in particular the group audit engagement partner, in certain audit work performed at component level.

Audit of revenue

We assessed the quality of the firm's audit work in relation to the audit of revenue on thirteen of the audits we reviewed and identified weaknesses on eight audits.

We concluded that two audits required significant improvements in this area. In both cases, and in one further audit, insufficient testing was performed in respect of certain material revenue balances or to assess whether revenue had been recorded in the correct period.

In three audits, where reliance had been placed on the results of substantive analytical procedures performed, the explanations obtained for variances identified from the expectation set were either too general in nature or were not adequately corroborated. In two further audits, insufficient audit testing was performed for certain revenue balances or to assess controls relating to the revenue cycle.

Materiality

On seven audits, we raised concerns in respect of the materiality levels set. On four audits, there was insufficient justification for the overall materiality levels set. On three further audits, we identified deficiencies in the setting of materiality for work at component level. In two of these cases, component materiality was set at the same level as overall materiality for the group financial statements, contrary to Auditing Standards which require a lower level to be set. The firm should review and enhance its guidance on materiality in the light of our findings.

Journals

We reviewed the testing of journals on 15 audits.

In six audits, there was insufficient evidence supporting the journals selected and tested by the audit team. Other weaknesses in this area included the design and implementation of controls around the journal entry process not being adequately reviewed (three audits) and insufficient audit procedures being performed when concerns were identified relating to the review and approval of journals (three audits).

Other findings

Findings in relation to independence and ethics

On three audits there was insufficient evidence that the audit team had given appropriate consideration to independence threats, and related safeguards, arising from the provision of non-audit services. On a further audit, there was insufficient evidence of approval by the firm's Ethics Partner of certain non-audit services which included a contingent fee arrangement.

On two audits a senior partner with a client relationship role accompanied the audit engagement partner to certain meetings with the Audit Committee. The firm considers this to be acceptable if the Audit Committee has been informed of the separate roles and responsibilities of the two partners. However, attendance by a client relationship partner while audit issues are being discussed with the Committee may give the impression that such a partner is in a position to influence the conduct or outcome of the audit.

Engagement quality control reviews

There was insufficient evidence of appropriate involvement by the engagement quality control reviewer (“EQCR”) on six audits, including reviewing certain audit work performed for significant risk areas and following up how the audit team had addressed matters which the EQCR had raised.

Reporting to Audit Committees

We considered the sufficiency, quality and timeliness of the firm's reporting to the Audit Committee on all the audits we reviewed. The communication of significant risks identified to Audit Committees and component auditors required improvement on eight of these audits. In addition, the risk of management override of controls and/or the risk of fraud in revenue recognition, presumed to be areas of significant risk under Auditing Standards, were not adequately addressed in communications with the Audit Committee on nine of the audits we reviewed.

Review of financial statements

The firm's processes for review of the financial statements did not identify certain disclosure deficiencies on three audits reviewed, including the disclosure errors related to intangible assets on two audits noted above. On one of these audits and one further audit, there was also insufficient evidence of review of the financial statements by the audit engagement partner. In another audit, there was insufficient evidence of consideration of the appropriateness of certain disclosures in the financial statements of the audited entity.

2.2 Review of the firm's policies and procedures

The firm's policies and procedures have been developed either globally or at an ELLP level and the UK firm puts significant resources into the global and its own central support functions, such as risk management, audit and accounting technical, independence compliance and HR.

While emphasising the importance of audit quality, the strategy of the audit practice also continues to focus on revenue growth and improving audit efficiency.

Improvements made during the year

The firm has taken a number of actions to address our prior year findings and enhanced its procedures in a number of areas.

The firm's internal monitoring programme comprises a review of engagements, the Quality Performance Review (“QPR”), and a self-assessment of compliance with global quality control procedures, the Risk Compliance Programme (“RCP”). A Global Compliance Review (“GCR”) is undertaken at least every three years to review the firm's policies and procedures, including the RCP self-assessment.

In response to the GCR review of RCP, the firm have revised their approach and the volume of testing undertaken. RCP testing is now carried out on a continuous basis, sample sizes have been significantly increased and a greater number of staff performs the testing. We consider this a positive enhancement to the firm's quality control procedures.

Enhancements were also made to the annual QPR programme in 2013. These included increased involvement of the EQCR in the QPR. Another notable enhancement was in the level of detail in the firm's root-cause analysis into the findings, including consideration of the reasons why training had not resolved the issue and the development of a detailed action plan by the firm.

The firm has continued to enhance its use of Quality and Risk Metrics (“Metrics”) for partner and manager appraisals and we have seen examples of these Metrics impacting on partner remuneration to emphasise the importance of quality.

Prior year findings not adequately addressed

The following prior year findings and recommendations had not been adequately addressed by the firm:

Independence and ethics

Our prior year report recommended that the firm's senior management undertake a detailed review of the firm's ethical policies, procedures, guidance and training. A number of enhancements were made following an initial internal review in 2013. In addition, the firm commissioned an external review which reported in February 2014.

The report on the findings of the external review concludes that the firm takes ethical matters seriously. However, it makes various recommendations for improvement. It is essential that the firm's leadership carefully assesses the report and develops and implements a detailed and appropriate action plan in response to the recommendations. We will consider the adequacy of the firm's response during our next inspection.

Pre-issuance reviews of financial statements

We recommended in the previous two years that the firm introduce a requirement for its accounting and reporting technical department to review the clearance of any significant matters it raises in a pre-issuance technical review prior to the audit report being signed. The firm continues to take the view that the engagement partner, together with the EQCR, retains responsibility for the audit report and should, therefore, not need to seek such clearance. We recommend that the firm reconsiders this in the light of the increased complexity of financial reporting and established practice of its peers in this area.

Use of other auditors – Letterbox companies

In our prior year report, we stated that the firm's guidance relating to the use of other auditors did not reflect the need for the group engagement team, headed by the UK engagement partner, to comply fully with the requirements of ISA 600; and, in relation to single component audits, did not appropriately reflect the requirements of Auditing Standards regarding the responsibility of the audit engagement partner for the direction, supervision and performance of the audit.

In May 2013 we wrote to all firms regarding concerns arising from our reviews of audits of letterbox companies and the need for them to take action to achieve improvements in their approach to such audits. We subsequently met with KPMG, and other firms, to discuss the points made in our letter.

The firm has informed us that it has worked with KPMG International to prepare revised guidance in response to this issue. Appropriate action should have been taken on a more timely basis, however, to ensure that the firm's guidance requires such audits to be undertaken in accordance with the requirements of Auditing Standards and that audit engagement partners for such entities properly discharge their responsibilities.

Current year findings

We identified certain further areas where improvements to the firm's policies and procedures are required, as set out below.

Independence and ethics - Financial interests in audited entities

The firm requires partners to check a list of prohibited entities prior to acquiring shares to prevent investment in audited entities. All investments are required to be reported to the firm and the system includes secondary checks to ensure inadvertent investment in prohibited entities is identified.

The firm's Ethics Register records, inter alia, details of partners identified as having inappropriately acquired shares in entities audited by the firm. One non-audit partner acquired shares in a number of FTSE100 audited entities. The firm's processes identified this issue a few days later when the partner reported his investment and the shares were then promptly sold. The firm's processes therefore worked as intended but all partners should be fully aware that Ethical Standards prohibit any partner in the firm from holding shares in an audited entity.

Performance evaluation - Quality goals and impact of quality indicators

In 2013 the firm introduced a new performance evaluation tool (“MyPD”). All partner and staff objectives and appraisals are recorded within MyPD. The firm also changed the partner remuneration model and more directly linked remuneration to the outcome of their Quality and Risk Metrics ("Metrics”), which highlight any compliance or quality issues in relation to the firm's policies and procedures.

The firm emphasises the importance of quality as a core objective. The new appraisal form includes strategic goals under four headings. In our view, however, these headings do not give sufficient prominence to quality.

In response to the findings of an internal quality review undertaken in summer 2013, the firm devised a number of specific quality goals applicable to audit partners and senior staff to form part of their 2013/14 objectives. However, a third of the partner appraisals we reviewed and most of the senior staff appraisals reviewed did not include reference to these quality goals.

Three partners had the overall outcome of their Metrics overridden, limiting the extent of any reduction in remuneration. Whilst we acknowledge the importance of considering situations on a case by case basis, and the extent of consultation undertaken in each case, it appeared to us to have been inappropriate for the Metrics to have been overridden in these three cases.

One of the staff appraisals we reviewed related to a manager who had received adverse internal quality review ratings. The individual was awarded a highly effective performance rating, the second highest. There was insufficient evidence that the adverse quality rating had been adequately taken into account in arriving at the performance rating for this individual.

Performance evaluation – Selling non-audit services

In a third of the partner appraisals we reviewed and one staff appraisal, the objectives set appeared to include the individual seeking to provide non-audit services to entities audited by the appraisee. In addition, in three partner appraisals and one staff appraisal, the individual appeared to be seeking credit for their success in selling non-audit services to entities which they audited. This is not permissible under Ethical Standards.

The firm informed us that these references were not taken into account when evaluating performance or making remuneration decisions for these individuals. However, they appear to have believed that this would be taken into account and there was no evidence that the inclusion of this material was challenged. Any such references in appraisals seeking such recognition should have been challenged by those conducting the appraisal.

Methodology – Use of offshore centres

The firm continues to develop its use of offshore centres, primarily through a "department extension" model whereby audit work performed offshore is completed under the direction and review of the UK audit engagement team and included within the UK audit files.

Audit engagement teams have sole responsibility for determining the extent of use of offshore staff. Our inspection identified that work undertaken by offshore staff included work on substantive analytical procedures, reviewing board minutes and reviewing certain third party reports. The firm should ensure that such audit work is undertaken by staff with a sufficiently detailed working knowledge of the audited entity in order to be able to identify significant matters.

Consultation and review

On three audits, significant matters relating to the financial statements were discussed on an informal basis with technical specialists within the firm. The scope and outcome of these consultations was not adequately recorded.

Audit quality monitoring - Business relationships

The firm's internal monitoring identified two instances where audited entities provided the firm with services potentially material to the entity. For one of these entities, the fees paid by the firm were erroneously recorded as representing over 10% of the entity's revenue. In the other case, representing over 5%, no further investigation was undertaken as the audit engagement partner noted that the percentage would decrease going forward due to business developments. These matters, and the implications for the monitoring testing results, were not adequately followed up.

Other matters

Transparency report

We reviewed the firm's transparency report for the year to 30 September 2013, which was published in December 2013, to assess whether the information in the report was consistent with our understanding of the firm's quality control and independence procedures. We did not identify any inconsistencies with our understanding of the firm's quality control and independence procedures.

Andrew Jones Director Audit Quality Review FRC Conduct Division May 2014

Appendix A – Objectives, scope and basis of reporting

Scope and objectives

The overall objective of our work is to monitor and promote improvements in the quality of auditing. As part of our work, we monitor compliance with the regulatory framework for auditing, including the Auditing Standards, Ethical Standards and Quality Control Standards for auditors issued by the FRC and other requirements under the Audit Regulations issued by the relevant professional bodies. The standards referred to in this report are those effective at the time of our inspection or, in relation to our reviews of individual audits, those effective at the time the relevant audit was undertaken.

Our reviews of individual audit engagements and the firm's policies and procedures supporting audit quality cover, but are not restricted to, the firm's compliance with the requirements of relevant standards and other aspects of the regulatory framework. Our reviews place emphasis on the appropriateness of key audit judgments made in reaching the audit opinion together with the sufficiency and appropriateness of the audit evidence obtained. We also assess the extent to which the firm has addressed the findings arising from our previous inspection.

We seek to identify areas where improvements are, in our view, needed in order to safeguard audit quality and/or comply with regulatory requirements and to agree an action plan with the firm designed to achieve these improvements. Accordingly, our reports place greater emphasis on weaknesses identified which require action by the firm than areas of strength and are not intended to be a balanced scorecard or rating tool.

Our inspection was not designed to identify all weaknesses which may exist in the design and/or implementation of the firm's policies and procedures supporting audit quality or in relation to the performance of the individual audit engagements selected for review and cannot be relied upon for this purpose.

The professional accountancy bodies in the UK register firms to conduct audit work. Their monitoring units are responsible for monitoring the quality of audit engagements falling outside the scope of independent inspection but within the scope of audit regulation in the UK. Their work, which is overseen by the FRC, covers audits of UK incorporated companies and certain other entities which do not have any securities listed on the main market of the London Stock Exchange and whose financial condition is not otherwise considered to be of major public interest. All matters raised in this report are based solely on the work which we carried out for the purposes of our inspection.

Basis of reporting

We exercise judgment in determining those findings which it is appropriate to include in our public report on each inspection, taking into account their relative significance in relation to audit quality, in the context of both the individual inspection and any areas of particular focus in our overall inspection programme for the year. Where appropriate, we have commented on themes arising or issues of a similar nature identified across more than one audit.

While our public reports seek to provide useful information for interested parties, they do not provide a comprehensive basis for assessing the comparative merits of individual firms. The findings reported for each firm in any one year reflect a wide range of factors, including the number, size and complexity of the individual audits selected for review which, in turn, reflects the firm's client base. An issue reported in relation to a particular firm may therefore apply equally to other firms without having arisen in the course of our inspection fieldwork at those other firms in the relevant year. Also, only a small sample of audits are selected for review at each firm and the findings may therefore not be representative of the overall quality of each firm's audit work.

The fieldwork at each firm is completed at different times during the year and rigorous quality control procedures are applied. These procedures include a peer review process at staff level and a final review by independent non-executives who approve the issue of all reports. These processes are designed to ensure both a high quality of reporting and that a consistent approach is adopted across all inspections.

We also issue confidential reports on individual audits reviewed during an inspection. While these reports are addressed to the relevant audit engagement partner or director, they are copied to the chair of the relevant entity's audit committee (or equivalent body).

Purpose of this report

This report has been prepared for general information only. The information in this report does not constitute professional advice and should not be acted upon without obtaining specific professional advice.

To the full extent permitted by law, the FRC and its employees and agents accept no liability and disclaim all responsibility for the consequences of anyone acting or refraining from acting in reliance on the information contained in this report or for any decision based on it.

Appendix B – Firm's response

The firm's response is on the following page

KPMG LLP 15 Canada Square Canary Wharf London E14 5GL United Kingdom

Tel +44 (0) 20 7311 1000 Fax +44 (0) 20 7311 3311 DX 157460 Canary Wharf 5

Financial Reporting Council Aldwych House 71-91 Aldwych London WC2 4HN

Our ref: ib/ds/465

16 May 2014

Dear Sirs

Audit Quality Inspection report 2013/4

We are pleased to respond to this 2013/14 Audit Quality Inspection report.

We are committed to achieving high levels of audit quality and the highest ethical standards, and to continuous improvement in both areas. We take very seriously observations and recommendations made by the FRC and have developed a detailed action plan that responds to these matters together with those identified through other internal and external review processes.

Reflecting our desire for continuous improvement, many of these actions are well progressed having been developed as issues emerged through the inspection process.

We recognise the fundamental importance of quality and ethics in our joint objective of restoring trust in audit and acknowledge the contribution of audit inspection in this process.

We would like to record our thanks to the review team for the way in which they conduct their reviews.

Further information about our approach to delivering quality audits is set out in our Transparency Report available on our website.

Yours faithfully

Tony Cates Head of Audit

KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative, a Swiss entity. Registered in England No OC301540. Registered office: 15 Canada Square, London, E14 5GL

Financial Reporting Council 5th Floor, Aldwych House 71-91 Aldwych London WC2B 4HN

+44 (0)20 7492 2300 www.frc.org.uk

-

As disclosed in the annual return to the ICAEW as at 31 May 2013. ↩

-

Letterbox companies are those groups or companies that have little more than a registered office in their country of registration, with management and activities being based elsewhere. In such situations, the auditor is usually based in the country of legal registration, rather than where management is based. ↩

-

The FRC launched an Accountancy Scheme investigation into the preparation, approval and audit of the financial statements of one of the entities whose audit we were reviewing at the time. As a result, a final report on our review was not prepared and a final assessment of the audit was not completed. While relevant findings arising from this review have been included in this report, the quality assessment relates only to the other 16 audits reviewed. ↩