The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Tier 2 and Tier 3 Audit Firms - Audit Quality Inspection and Supervision 2021/22

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking, proportionate supervisory approach and hold firms to account for making the changes needed to safeguard and improve audit quality.

In this report we set out the key messages from our supervision and inspection work at Tier 2 and Tier 3 firms. We explained in Our Approach to Audit Supervision, published in March 2021, how we allocate firms into one of three tiers (Tier 1, Tier 2 and Tier 3), based on the number of audits of Public Interest Entities¹ (PIEs) that a firm conducts and other risk factors, and how we vary the intensity of our inspection and supervision work at each tier proportionately to the risk to the public interest. Tier 2 and Tier 3 firms together currently audit a minority of entities within the FRC's scope with a significant majority being audited by the seven Tier 1 firms².

This is the first report on Tier 2 and Tier 3 firms collectively that we have issued since we became the UK Competent Authority for Statutory Audit in 2016. In previous years we have summarised our findings at these firms in the annual Developments in Audit publication. We are publishing this new report because of the increased focus on promoting audit quality, resilience and competition throughout the audit market. We intend to publish a report on our work at Tier 2 and Tier 3 firms annually. In this first report we present a summary of our findings over the period 2016/17 to 2021/22, since we became the UK Competent Authority.

Further details of our inspection approach at Tier 2 and Tier 3 firms are included in Appendix 1. A list of firms in Tier 2 and Tier 3 in 2021/22 is included in Appendix 2 and a list of firms inspected in each of the years 2016/17 to 2021/22 is included in Appendix 3.

Except for identifying the firms that were in Tier 2 and Tier 3 for 2021/22 and the firms inspected in each year, the information in this report is aggregated and anonymised. This is in view of the statutory confidentiality requirements which apply to individual inspection reports. Many Tier 2 and Tier 3 firms have only a small number of audits falling with the FRC's inspection scope, in some cases only one. To publish firm-specific inspection data would risk identifying how we have assessed the audits of specific entities. To provide further information on audit quality, we also include details of inspection findings identified by Tier 2 and Tier 3 firms' Recognised Supervisory

Bodies (RSBs). We do not include reference to firms' own internal quality monitoring findings as there is a lack of comparability across Tier 2 and Tier 3 firms.

Stakeholders should not draw conclusions from this report about audit quality at individual Tier 2 and Tier 3 firms. We conduct inspection work at these firms on a cycle, usually every three or six years, depending on the nature and number of audits that the firm conducts. We currently aim to inspect around six firms per year, and a small number of audits at each individual firm. The sample of audits we select is risk based and not necessarily representative of the quality of the firm's audit practice as a whole. All firm's that audit PIEs are required to produce an annual Transparency Report which includes details of external inspection findings as well as the firm's own internal quality monitoring. Stakeholders may consult a firm's Transparency Report for insights into its individual quality results.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance.

- Inspect the quality of audits performed.

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits.

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

The FRC is committed to transparent reporting of our work and to sharing good practice so as to promote continuous improvement in audit quality. In November 2021 we published What Makes a Good Audit which set out key elements and good practices in individual audits and firms' systems of quality control. In July 2022 we published a suite of reports setting out the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms along with a cross-firm overview report. Earlier in the year, we published anonymised details of our inspection findings and good practices from our inspection activity at Tier 1 firms in the year ended 31 March 2021 (2020/21).

In March 2021 the Department for Business Energy & Industrial Strategy (BEIS) began a public consultation entitled Restoring Trust in Audit and Corporate Governance. The Government's response to the consultation, published in May 2022, proposes the creation of the Audit, Reporting and Governance Authority (ARGA) with broader supervisory powers over auditors, audit committees and directors. The FRC has already begun strengthening the supervision of audit firms and has set out in a Position Paper issued in July 2022 how we will support the Government's reforms as we transition into ARGA.

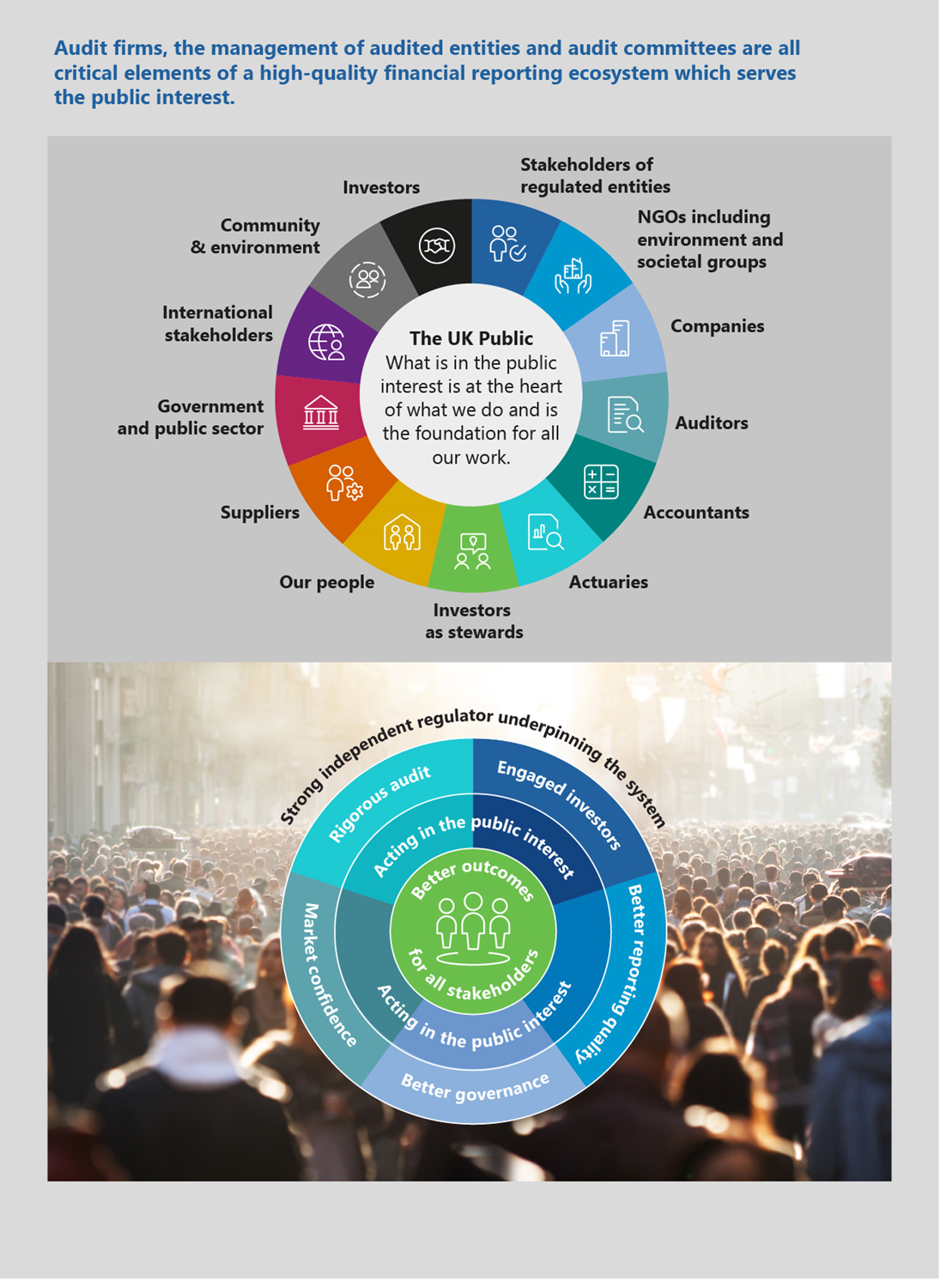

Audit firms, the management of audited entities and audit committees are all critical elements of a high-quality financial reporting ecosystem which serves the public interest.

Our supervisory approach

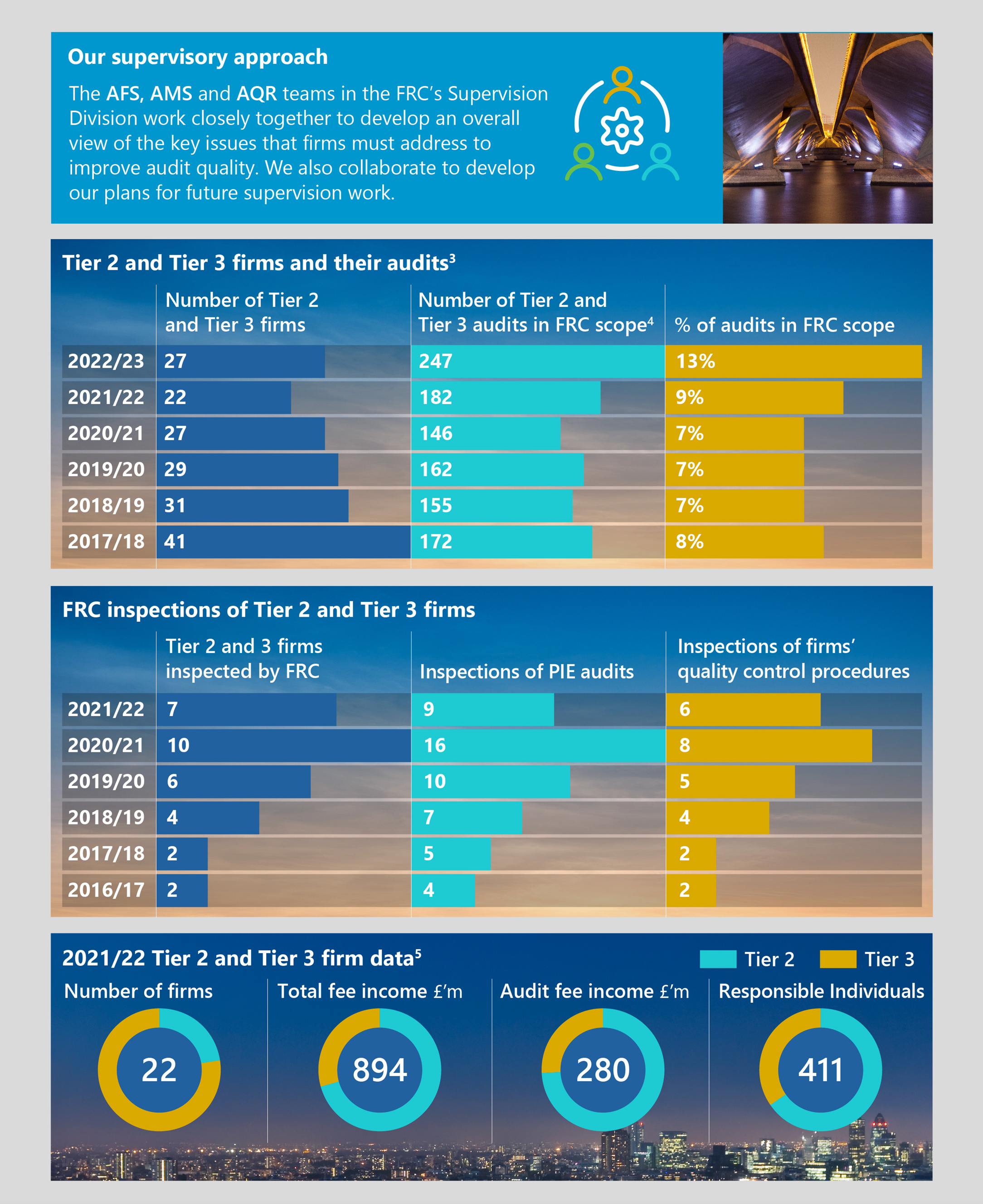

The AFS, AMS and AQR teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues that firms must address to improve audit quality. We also collaborate to develop our plans for future supervision work.

Data held by the FRC as at 31 December in the previous year 3 FRC-scope audits comprise PIEs, Lloyd's Syndicates and UK incorporated AIM-listed entities with a market capitalisation in excess of €200m 4 The FRC's 2022 edition of Key Facts and Trends in the Accountancy Profession supplemented by firms' Transparency Reports and other sources where available 5

- Introduction

- What is high audit quality?

- 1. Overview

- The Tier 2 and Tier 3 audit landscape

- Our findings

- How firms must respond

- How the FRC is responding

- Inspection results: arising from our review of individual audits

- Common inspection findings

- Inspection results: arising from our review of firms' quality control procedures

- Forward-looking supervision

- Monitoring reviews by the RSBs

- Summary of review findings

- 2. Review of individual audits

- 3. Review of firms' quality control procedures

- 4. Forward-looking supervision

- Appendix 1

- Appendix 2

- Appendix 3

What is high audit quality?

The FRC defines high-quality audits as those that:

- provide investors and other stakeholders with a high-level of assurance that financial statements give a true and fair view;

- comply both with the spirit and the letter of auditing regulations and standards;

- are driven by a robust risk assessment, informed by a thorough understanding of the entity and its environment;

- are supported by rigorous due process and audit evidence, avoid conflicts of interest, have strong audit quality processes, and involve the robust exercise of judgement and professional scepticism;

- challenge management effectively and obtain sufficient audit evidence for the conclusions reached; and

- report unambiguously the auditor's conclusion on the financial statements.

1. Overview

The Tier 2 and Tier 3 audit landscape

In 2021/22 there were 22 firms in Tier 2 and Tier 3 which together audited 9% of the entities falling within the FRC's scope. Only four of these entities were within the FTSE 350.

The share of FRC-scope audits conducted by Tier 2 and Tier 3 firms is increasing (9% in 2021/22 to 13% in 2022/23)

While individually and collectively, the impact of Tier 2 and Tier 3 firms on the public interest is relatively low, it is increasing. Our data indicates that Tier 2 and Tier 3 firms' share of FRC-scope audits has risen to 13% for 2022/23. We have seen examples of Tier 1 firms de-risking their audit portfolios, with the work transferring to Tier 2 and Tier 3 firms. The FRC believes that higher-risk entities must be audited by audit firms with the appropriate resources and robust quality control procedures to deliver a high-quality audit.

Our findings

Over the period from 2016/17 to 2021/22, we inspected 51 audits at Tier 2 and Tier 3 firms and assessed 36% of these as requiring no more than limited improvements. This compares to 73% for Tier 1 firms over a comparable period.

36% of audits inspected between 2016/17 and 2021/22 were assessed as requiring no more than limited improvements which is unacceptable

This is clearly unacceptable. We have seen progress at some firms that we have inspected more than once during the period which have taken effective action to address our findings. It is imperative that all firms act upon our specific inspection findings and take heed of the wider findings and good practice that we publish regularly in order to improve audit quality.

We acknowledge that some firms need more support and we set out below some of the actions we are planning to take to provide this. Where we see significant or continuing risks at firms, the FRC now has the ability to impose conditions on or seek undertakings from firms through the PIE Auditor Registration process. This will enhance our ability to drive improvements in audit quality and we will monitor closely any firms with conditions or undertakings. We will also consider, on a case by case basis, whether it is in the public interest to publish details of these conditions or undertakings.

We also acknowledge that inspection findings on firms' non-PIE audits by their RSBs are significantly better than the FRC's inspection findings. The RSBs assessed an average, over a comparable period, of 75% of audits inspected as requiring no more than limited improvements, more than double the 36% assessed by the FRC in this category, albeit still a lower percentage than the FRC would like to see. The difference between the FRC's and RSBs' findings will reflect a number of factors, including: differences in the underlying nature and complexity of the non-PIE audits being inspected by the RSBs compared to the PIE audits inspected by the FRC; and, the more extensive scope of inspections conducted by the FRC.

While many of our audit inspection findings, and those at the RSBs, are in similar areas to those we have reported at Tier 1 firms, such as the inadequate application of professional scepticism and judgement, we have more findings at Tier 2 and Tier 3 firms in relation to the nature and extent of audit evidence, and in particular independent evidence, gathered across various audit areas

Our inspection data also suggests that firms which have small PIE audit portfolios, sometimes only one PIE audit, do not perform as well as firms with larger PIE audit portfolios. At such firms we tend to find an absence of formal procedures, rather than more isolated procedural gaps that we tend to find at firms with larger PIE audit portfolios.

How firms must respond

Firms must invest appropriately in adequate systems of quality management to underpin the execution of high-quality audits, across their PIE and non-PIE audit portfolios. Particular areas to address, based on our findings, are in relation to:

- Risk assessment and acceptance and continuance procedures, to ensure that firms only accept or continue engagements where they have the capacity and capability to conduct a high-quality audit, including ensuring that the audit fee is commensurate with the level of resource required. This is of particular importance given the de-risking examples we are seeing.

- Systems to prevent and detect breaches of ethical requirements, particularly in relation to PIE audits where standards are more stringent.

- Technical resources, to ensure that audit methodologies adequately comply with all of the requirements in the ISAs, including those specific to PIEs, and are appropriately tailored to the entity being audited. As well as addressing current findings, firms intending to grow or take on more complex audits must take a forward-looking approach and build their capability to use more sophisticated audit techniques such as controls based testing and data analytics where appropriate.

- People resources, to ensure that firms have sufficient, appropriately trained and experienced auditors for their audit portfolio who are incentivised to conduct high-quality audits. Firms must also invest in sufficient central resources to provide a robust monitoring and remediation environment, as well as technical support for audit teams to consult on complex accounting, auditing and other issues. Where such services are outsourced, firms must thoroughly assess the quality of their service providers and the risks they may pose to the firm's quality objectives. It remains the firm's responsibility to ensure that its system of quality management is appropriate.

Firms' leaders must demonstrate their commitment to audit quality and invest in appropriate systems of quality management

How the FRC is responding

Above all, firms' leadership must demonstrate in their strategic planning a commitment to audit quality and take steps to set and embed a culture which supports and encourages both internal challenge and the application of scepticism and challenge of management by audit teams. Our inspection findings often are linked to weaknesses in an audited entity's internal controls or the quality of information provided to auditors. Achieving a high-quality audit in these circumstances requires audit teams to challenge management and respond appropriately if weaknesses are not addressed.

The International Standard of Quality Management (UK) 1 (ISQM 1), which comes into force from 15 December 2022, provides an excellent opportunity for firms to re-evaluate and introduce more effective systems of quality management.

Introducing PIE Auditor Registration in December 2022 improves the FRC's ability to hold firms to account and take an assertive supervisory approach

The FRC wants to see a strong pipeline of audit firms capable of conducting high-quality audits at a wider range of entities of increasing complexity in order to improve market resilience, competition and choice.

We are responding to challenges in the audit market by taking an increasingly assertive supervisory approach, augmented by our new PIE Auditor Registration powers which improve our ability to hold firms that audit PIEs to account.

We are also increasing our support to Tier 2 and Tier 3 firms, as well as firms planning to enter the PIE audit market, through:

- Increasing our supervisory resources dedicated to Tier 2 and Tier 3 firms.

- Sharing more about 'what good looks like' and the FRC's expectations through: increasing our face-to-face engagement with firms; holding more events such as roundtables and briefings; and, developing new publications, in particular a guide to what makes a good audit firm operating at or planning to enter the smaller end of the PIE audit market, which we plan to publish in early 2023.

- The intention to create an 'Audit Firm Scalebox' to provide bespoke input, outside of the formal inspection process, to Tier 2 and Tier 3 firms and firms considering entering the PIE audit market, so as to improve their ability to meet the standards we expect of them as they enter the market and grow.

- Creating an 'Audit Sandbox' to explore audit policy and innovative ways to drive improvements in audit quality, including through technology.

- Conducting research to better understand the challenges faced by smaller firms in entering the PIE audit market and performing high-quality audits.

Further details of our new initiatives will be published in due course.

The FRC is increasing support to firms as they grow by sharing more about what good looks like, creating an 'Audit Firm Scalebox' and other initiatives

Inspection results: arising from our review of individual audits

We inspected 51 individual audits conducted by 20 Tier 2 and Tier 3 firms over the period 2016/17 to 2021/22.

Only 18 audits (36%) were assessed as requiring no more than limited improvements. While this percentage is only an indicator given the different firms and audits inspected each year, it is interesting to note that the equivalent percentage of audits requiring no more than limited improvements for firms with more than five audits falling within the FRC's scope is 41%. This indicates that firms with larger PIE audit portfolios average, achieve, on average, better inspection results.

33% of the 51 individual audits were assessed as requiring improvements and, concerningly, 31% were assessed as requiring significant improvements. 11 firms have had at least one audit assessed as requiring significant improvements, and three of these firms have had more than one. We have inspected five of these 11 firms more than once. At three firms, audit inspection results have improved in our subsequent visit.

All inspections – Tier 2 and Tier firms 2016/17 to 2021/22

This stacked bar chart shows the number of audits by assessment category ("Significant improvements required", "Improvements required", "Good or limited improvements required") for each year from 2016/17 to 2021/22, and an aggregate total.

- 2016/17: Good or limited: 1. Total: 1.

- 2017/18: Good or limited: 3, Improvements: 3, Significant: 1. Total: 7.

- 2018/19: Good or limited: 2, Improvements: 2, Significant: 3. Total: 7.

- 2019/20: Good or limited: 4, Improvements: 4, Significant: 4. Total: 12.

- 2020/21: Good or limited: 6, Improvements: 6, Significant: 2. Total: 14.

- 2021/22: Good or limited: 2, Improvements: 4, Significant: 3. Total: 9.

- Aggregate: Good or limited: 18, Improvements: 17, Significant: 16. Total: 51.

Changes to the proportion of audits falling within each category in each year reflect a wide range of factors, including the firms inspected, the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus set out annually by the FRC. For these reasons, and given the small numbers of inspections at individual firms and the different firms inspected in each year, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of audit quality across Tier 2 and Tier 3 firms and are not necessarily indicative of any overall change in audit quality.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for relevant firms to take action to achieve the necessary improvements.

Common inspection findings

Our key inspection findings are common across the period with the significant majority of findings relating to the audit of judgements and estimates, going concern, revenue, and inventory.

Common inspection findings

This stacked bar chart shows the number of "Key findings" and "Other findings" across various audit areas: Judgements and estimates, Revenue, Inventory, Going Concern, Financial statements, and Journals.

- Judgements and estimates: Key findings: 15, Other findings: 16. Total: 31.

- Revenue: Key findings: 12, Other findings: 2. Total: 14.

- Inventory: Key findings: 8, Other findings: 5. Total: 13.

- Going Concern: Key findings: 5, Other findings: 14. Total: 19.

- Financial statements: Key findings: 3, Other findings: 18. Total: 21.

- Journals: Key findings: 4, Other findings: 12. Total: 16.

Weakness in the application of professional judgement and scepticism are one of our most common areas of findings but we also have findings in more routine audit areas

Areas requiring judgements and estimates are often the most complex audit areas and may be subject to management bias, thus requiring both technical expertise and the stringent application of professional judgement and scepticism.

While, as at Tier 1 firms, we found that Tier 2 and Tier 3 firms improved their procedures over the audit of going concern in response to the Covid-19 pandemic, the extent of challenge and scepticism applied by Tier 2 and Tier 3 firms remains a key area for improvement.

Other common findings were in areas such as aspects of revenue and inventory, where firms need to improve the extent of audit evidence gathered even in relatively routine audit areas.

Inspection results: arising from our review of firms' quality control procedures

Firms must also address our findings, prevalent across the period covered by this report, on the audit of journal entries, which carry a risk of management over-ride of controls, and financial statement disclosures.

In order to improve their capability to audit more complex entities, firms must also focus on developing their audit approaches in terms of:

- The design of audit testing, including developing a wider range of procedures, rather than relying solely on substantive testing.

- Expanding procedures and guidance relating to the evaluation of an entity's general IT controls.

- Integrating the use of appropriate data analytics.

Further details are set out in section 2.

Firms must focus on developing their audit approaches in order to improve their capability to audit more complex entities

At Tier 2 and Tier 3 firms, we have, to date, reviewed all aspects of their quality control procedures, under International Standard on Quality Control (UK) 1 (ISQC 1), on either a three or six year cycle. We inspected quality control procedures in 2021/22 at six firms and a total of 20 firms over the period 2016/17 to 2021/22, with more than one inspection at six firms.

ISQM 1 replaces ISQC 1 from December 2022 and we will revise our future inspection approach accordingly. As set out in “What Makes a Good Audit?”, the key components of a system of quality management under ISQM 1 are as follows:

Our key findings at Tier 2 and Tier 3 firms follow similar themes across the 2016/17 to 2021/22 period and cover various components of firms' systems of quality control.

A summary of the themes in our key findings, mapped to the ISQM 1 quality management framework, are as follows:

- Relevant ethical requirements: firms not having adequate policies or processes to prevent and detect breaches of ethical requirements, in particular long association with non-PIE entities and the provision of non-audit services.

- Acceptance and continuance: lack of an objective and systematic process to identify risk factors associated with accepting an engagement, and failing to appropriately reflect risks in audit planning.

- Resources – methodology: over-reliance on off-the-shelf methodology, including limitations on sample sizes, without adequately tailoring or augmenting to deal with specific audit risks or ISA requirements for PIE audits.

- Resources – people: absence of any link between audit quality and reward and the need to improve the extent and depth of training.

- Monitoring and remediation: inadequate depth or rigour in firms' internal quality monitoring (IQM) procedures and lack of processes to follow up and remediate findings.

Further details are set out in Section 3.

We have common inspection findings in various aspects of firms' systems of quality control

Forward-looking supervision

We commenced more in-depth supervision of Tier 2 and Tier 3 firms in 2021/22, in a proportionate manner, focusing on the key quality risks based primarily on our inspection findings. We are doing more to follow up on inspection findings to ensure that they are promptly and effectively addressed, as well as responding to emerging risks, for example where we have concerns that a Tier 2 or Tier 3 firm has accepted an audit that may be beyond its capacity or capability.

We are also doing more to share what good looks like amongst Tier 2 and Tier 3 firms and to provide bespoke feedback on individual areas, particularly to Tier 2 firms. In 2021/22 the areas we focused on included ISQM 1 implementation, governance arrangements, transparency reporting and cyber security.

Further details are set out in section 4.

Monitoring reviews by the RSBs

Tier 2 and Tier 3 firms are subject to independent monitoring by their RSB. The RSB for 19 of the 22 Tier 2 and Tier 3 firms listed at Appendix 2, is the Institute of Chartered Accountants in England and Wales (ICAEW), with the remaining firms monitored by the Institute of Chartered Accountants of Scotland (ICAS) or Chartered Accountants Ireland (CAI). The RSBs undertake their reviews under delegation from the FRC as the Competent Authority. They review audits outside the FRC's population of PIE and other retained audits, and accordingly their work covers private companies, smaller AIM listed companies, charities and pension schemes. The RSBs do not undertake work on Tier 2 and Tier 3 firms' quality control systems. This is performed by the FRC.

ICAEW CAS:: CHARTERED ACCOUNTANTS IRELAND

RSB monitoring reviews are designed to form an overall view of the quality of the audit. The RSBs assess these audits as 'good' or 'satisfactory', 'generally acceptable', 'improvements required' or 'significant improvements required'. Files are selected to cover a broad cross-section of entities audited by a firm and the selection is focused towards higher-risk and potentially complex audits within the scope of the RSBs' review.

The frequency of an RSB review at a Tier 2 or Tier 3 firm will depend on the size and nature of the firm's audit practice, and other risk factors which include previous compliance history, but is typically between two and six years.

Summary of review findings

The RSBs' review findings for Tier 2 and Tier 3 firms in the five years ended 31 March 2022 are set out below.

75% of non-PIE audits inspected by the RSBs in the five years to 2021/22 were assessed as requiring no more than limited improvements

RSB review outcomes

This stacked bar chart shows the number of RSB review outcomes for Tier 2 and Tier 3 firms from 2017/18 to 2021/22, and an aggregate. Outcomes are categorized as "Good/satisfactory or generally acceptable", "Improvements required", and "Significant improvements required".

- 2017/18: Good/satisfactory: 27, Improvements: 4, Significant: 1. Total: 32.

- 2018/19: Good/satisfactory: 55, Improvements: 6, Significant: 0. Total: 61.

- 2019/20: Good/satisfactory: 43, Improvements: 7, Significant: 4. Total: 54.

- 2020/21: Good/satisfactory: 31, Improvements: 9, Significant: 4. Total: 44.

- 2021/22: Good/satisfactory: 41, Improvements: 14, Significant: 2. Total: 57.

- Aggregate: Good/satisfactory: 197, Improvements: 50, Significant: 17. Total: 264.

Given the change in composition of firms inspected in a particular year, and the relatively small sample size compared to the number of audits conducted as a whole, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of performance or any overall change in audit quality.

In total, 264 audits were reviewed by the RSBs at 23 firms in the five years ended 31 March 2022. Overall, 75% of audit files reviewed were assessed as good/satisfactory or generally acceptable, 19% required improvements and 6% required significant improvements.

The most common weakness identified across the firms related to the valuation of assets, particularly goodwill, development costs and other intangibles. Issues generally arise from lack of professional scepticism and challenge of management's estimates and assumptions. In one case a material error was identified where certain development costs had been capitalised rather than expensed as required.

Valuation findings also occurred in relation to property and investments, including investments held by pension funds. Frequently, in these cases, there was insufficient assessment of the experts and service organisations relied upon for these valuations.

Other thematic weaknesses were:

- Revenue – in particular the inherent estimates and judgements for long term contracts, but also issues with controls over revenue and substantive audit procedures.

- Group audits – insufficient audit work undertaken on significant components of the group, or lack of oversight and review of the work of component auditors.

In other cases, issues related to the adequacy of audit evidence across different areas of the audit, arising from weaknesses in audit risk assessment, inadequate sample sizes or more simply a lack of substantive audit evidence for relevant audit assertions.

2. Review of individual audits

In this section, we set out the themes in our key and other findings identified in our inspections of 51 audits at Tier 2 and Tier 3 firms between 2016/17 and 2021/22.

The themes we identified are common across the period and reflect areas where key findings have driven our assessment of an audit as requiring improvements or significant improvements.

Estimates and judgements

We had findings in this area in over 60% of the audits we inspected, more than half of which were assessed as requiring improvements or significant improvements. Many of our key findings centre on a lack of professional scepticism on the part of the auditor, which is essential given that estimates and judgements are subject to significant management input and potential management bias.

Our most common findings are in relation to the audit of estimates and judgements including impairment

Examples of specific areas where we had findings include the audit of: impairment of intangible and tangible assets; defined benefit pension scheme liabilities; capitalisation of development costs; provisions for liabilities; investment property valuations and Expected Credit Loss (ECL) provisions under IFRS 9.

Key findings

The following are examples of our key findings:

- Insufficient challenge of the assumptions used by management to support, for example: the carrying value of intangible and tangible assets, including forecast growth rates, and discount rates; defined pension scheme liabilities, including mortality rates, discount rates and inflation; and, the capitalisation of development costs.

- Inadequate sensitivity analysis, for example on management's impairment or ECL models.

- Insufficient challenge of management's experts, for example in terms of the assumptions, including yields, used within property valuation models.

Revenue

We review the audit of revenue in most audits we inspect given the significance to the financial performance being reported by the entity. We had findings in this area in over 27% of the audits we inspected, the majority of which were key findings.

Key findings

The following are examples of our key findings:

- Audit procedures resulted in insufficient independent evidence being gathered, for example by not corroborating information from an entity's finance system to supporting independent evidence such as customer orders, signed delivery notes, or cash receipts.

- Insufficient procedures to evaluate the appropriateness of revenue recognised on long term contracts.

- Limitation of sample sizes used in substantive testing without adequate explanation.

- Reliance on substantive analytical procedures without having confirmed the accuracy or completeness of the underlying data or having formed independent expectations.

Going concern

The audit of going concern includes the examination of forecasts and projections that are often based upon management's judgement and estimates, necessitating scepticism and challenge of management. The Covid-19 pandemic impacted significantly on this area for audits conducted during 2020/21 and 2021/22 and we found that Tier 2 and Tier 3 firms generally took steps to strengthen their procedures.

Firms took steps to strengthen their going concern procedures during the Covid-19 pandemic

We had findings in this area in over 37% of the audits we inspected. Our findings were more prevalent in audits of less established entities or those showing signs of financial distress. Our findings were also linked to audits where the quality of information produced by management was poor. In some cases, management had not produced a formal going concern paper or had only compared the entity's net asset value to its market capitalisation.

Key findings

The following are examples of our key findings in this area:

- Reliance placed on future events, such as a refinancing or disposal of illiquid investments, or on support from group companies or shareholders, without adequate assessment of the feasibility of the events or means of support available.

- Reliance on liquidity ratios without adequate review of detailed liquidity movements across a period.

- Insufficient procedures over the viability statement, including the assessment of the appropriateness of the period used by management.

Inventory

We had findings in this area, the majority of which were key findings, in 20% of the audits we inspected. As with revenue, issues with the audit of inventory are often a key driver of audits being found to require either improvements or significant improvements.

Key findings

The following are examples of our key findings in this area:

- Insufficient procedures performed over provisions for obsolescence, including the appropriateness of the characteristics (such as the type or age of an item) used by management to determine the obsolescence provision.

- Insufficient rationale for decisions to limit the sample of inventory counts attended.

- Insufficient procedures performed to support the appropriateness of overheads capitalised into inventory at the year end.

Other findings resulting in lower audit quality assessments

Two audit areas, financial statement disclosures and journal entries, have given rise to a significant number of other findings which have contributed to lower audit quality assessments.

A checklist approach will not be sufficient for the audit of significant or complex financial statement notes

Financial statement disclosures: In over 41% of the audits we inspected, we found that insufficient audit procedures had been performed on financial statement disclosures or the group consolidation. While most firms use disclosure checklists, a more comprehensive approach is required for complex or highly disclosure significant notes, such as preparing a working paper which explains how the disclosure has been checked to underlying supporting information.

Findings

The following are examples of our findings in this area:

- Procedures to check the accuracy and appropriateness of the financial statement disclosure notes were not evidenced.

- Material errors in disclosure notes were not identified.

- Accounting errors in the consolidation were not identified or the consolidation workings did not reconcile to the final financial statements.

Journal entries

We had findings in this area in over 31% of audits we inspected, most relating to the inadequate design of audit testing (including how data analytic techniques are employed) resulting in testing that did not address adequately the risk of management override of controls.

Findings

The following are examples of our findings in this area:

- Audit procedures did not sufficiently assess and validate the completeness of journal entry system reports obtained from management.

- Inadequate understanding of the risk characteristics of journal entries in determining the basis for sample selection and reviewing anomalies or exceptions.

- Failure to evidence an appropriate fraud risk assessment that supported how higher risk journal entries were selected for review.

- Insufficient evidence retained or documented to support the results of journal testing performed.

Good practice

In the following table we set out a summary of our observations considered to be examples of good practice in the context of Tier 2 and Tier 3 firms' audit work:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach responding to those risks. Better performing audit teams:

- Consulted a wider range of sources relevant to understanding audit risks at entities, particularly in complex sectors.

- Adopted more detailed procedures in first year audits to better understand audit risks.

- Adapted planning approaches to take account of risk factors such as the Covid-19 pandemic.

- Planned for a greater senior level involvement in key audit areas.

- Considered whether they had the appropriate expertise to challenge underlying assumptions and, if not, engaged additional support.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit. Better performing audit teams:

- Validated source data upon which estimations were based.

- Tested management's models using IT applications.

- Engaged with and challenged management's expert.

- Considered plausible alternatives to management's assumptions.

- Prepared audit working papers which documented in sufficient detail how they had challenged management.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely. Better performing audit teams:

- Prepared a detailed memorandum drawing together the key facts and considerations in support of the auditor's conclusions.

- Presented graduated findings to Audit Committees, for example whether estimates were considered to be optimistic, balanced or pessimistic.

3. Review of firms' quality control procedures

Between 2016/17 and 2021/22 we inspected the quality control procedures at 20 firms (four of which were no longer within the FRC's scope by 2021/22), some of which we have inspected on two occasions.

In this section, we set out our approach to the review of Tier 2 and Tier 3 firms' quality control procedures and the principal themes in our findings and good practice observations, with a focus on more recent inspections.

Approach to reviewing the firm's quality control procedures

Our inspection programme covers each area set out in ISQC 1: leadership, compliance with ethical requirements, acceptance and continuance procedures, human resource, engagement performance and monitoring. As well as reviewing a firm's procedures, we also test samples of the application of individual policies (usually as part of the review of individual audits). For 2021/22, we performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021.

Methodology

Findings in relation to firms' methodology, including engagement documentation, were the most frequent of all our findings on firms' quality control procedures. At the time of our inspections, only a small number of firms had developed their own audit methodology (or used methodology developed by their international network and adapted for use in the UK). The majority of firms used off-the-shelf audit software and audit methodology solutions although many of them had made bespoke enhancements which are essential in order to capture adquately all of the ISA requirements relating to PIE audits and to appropriately tailor the audit approach to the entity and the audit risks, especially at more complex entities.

Our most common findings were in relation to weaknesses in a firm's audit methodology

Key findings

Our key findings in this area included:

- Checklist-type working papers being used which do not adequately allow auditors to evidence the work they have performed in order to support the conclusion reached, particularly where greater levels of scepticism and challenge are required.

- Methodology not being updated on a timely basis for revisions to the ISAs.

- Inappropriate use of fixed, capped or limited sample sizes without demonstrating how the sample adequately addresses audit risks across the population of items, particularly in significant risk areas.

- A lack of guidance on how to assess the design and implementation or operating effectiveness of an entity's general IT controls, and how to respond to exceptions or deficiencies identified in any testing performed.

- Instances of audits not being archived within the permitted time frame and audit working papers in significant risk areas being amended after the date of the audit report.

Good practice

Good practice was identified in firms which:

- Adapted audit software to be able to tailor audit procedures relevant to the entity.

- Introduced additional audit working papers covering the additional PIE audit requirements in the ISAs, or sector specific areas, which were not incorporated into their off-the-shelf audit methodology, including guidance on sampling.

Compliance with ethical requirements

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors, focused on enhancing the reality and perception of auditor independence. Certain prohibitions on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important 'Objective Reasonable and Informed Third Party' test, against which auditors must apply judgements about matters of ethics and independence.

Many firms needed to strengthen their policies and procedures in relation to compliance with ethical requirements which are more stringent for PIEs

Key findings

Our key findings in this area included:

- Inadequate policies and procedures in relation to non-audit services, including not seeking approval from the Responsible Individual (RI) for the audit, resulting in breaches of requirements in relation to, for example, the provision of prohibited services and failure to hold appropriate consultations.

- Where internal consultations were held, a lack of evidence as to consideration of whether an objective, reasonable and informed third party would consider there to be an independence threat.

- Inadequate policies, monitoring and safeguards in relation to long association, particularly on non-PIE audits.

- Inadequate monitoring of overdue audit fees, which may pose an an independence threat.

Good practice

Good practice was identified at firms which had:

- Developed bespoke ethics and independence guidance documents (rather than merely referring to the Ethical Standard).

- Introduced mandatory technical consultations in relation to non-audit services or where a non-PIE RI's tenure exceeded 10 years.

Acceptance and continuance

ISQC 1 requires firms to establish policies and procedures for the acceptance and continuance of relationships and engagements. This is to ensure that firms only enter into or continue engagements where they have the necessary competence and capability, can comply with relevant ethical requirements and have considered the integrity of the entity.

Firms must rigorously consider their capacity and capability to conduct 'higher risk' audits

As we have noted in section 1, we have seen a trend for certain Tier 1 firms to resign from certain audits considered higher risk. It is essential that Tier 2 and Tier 3 firms rigourously consider risks if they are invited to tender for audits where the outgoing auditor has raised questions about governance of the entity, the ability to obtain reliable audit evidence or to obtain a fee commensurate with the level of audit work considered to be required.

Key findings

Key findings in this area included:

- Inadequate process for considering of the risks associated with an entity and whether the firm or its staff had appropriate experience to undertake audits.

- Inadequate processes to identify where an entity was a PIE, therefore giving risk to risks of breaches of ethical requirements and deficiencies in the entity's financial statements not being identified.

Good practice

Good practice was identified in firms which:

- Convened special internal panels to consider appointments to higher-risk or higher-profile entities.

Human resources

Recruitment, performance management and reward processes are key to creating and maintaining a culture and environment that supports the delivery of high-quality audits. Portfolio management processes and training programmes are also essential in ensuring that audits are being led and staffed by auditors with appropriate skills and experience.

Many firms need to improve how they link reward and recognition to audit quality

Key findings

Key findings in this area included:

- Inadequate appraisal processes which do not link audit quality to reward, promotion or recognition, particularly in relation to Rls and decisions to promote people to RI roles.

- A small pool of RIs able to act as Engagement Quality Control Reviewers (EQCR), and EQCRs failing to apply adequate challenge to the audit team.

- Insufficient mandatory technical training, as well as the absence of attendance monitoring and the assessment of the effectiveness of the training, and a lack of softer skills training.

Good practice

Good practice was identified in firms which:

- Develop sector specialisms and build an appropriate team of suitably experienced Rls and staff.

- Develop an accreditation system for individuals working on PIE or other specialist audits.

Internal Quality Monitoring

A robust IQM process is essential to identifying and then remediating audit quality deficiencies. The majority of firms inspected had, at the time, a wholly outsourced IQM process. Four firms had a wholly internal IQM process and three had a hybrid process.

Firms must ensure that their IQM process is sufficiently rigorous, including where this is outsourced to a third-party service provider

Key findings

Key findings in this area included:

- An unsatisfactory grading system, for example, one which does not adequately distinguish between findings of different severity or which potentially impact on the integrity of an audit as a whole. We found that some firms had no grading system at all.

- Use of a checklist type approach which does not facilitate understanding of the issues arising or their remediation.

- The EQCR's role not being considered in the review.

- Insufficient communication or follow-up of IQM findings.

- In three audits we assessed as requiring more than limited improvements, the firm's IQM process (conducted by an external service provider) had assessed the audits as requiring only limited improvements, raising concerns about the depth and rigour of the IQM process.

Good practice

Good practice was identified in firms which:

- Ensure that Rls are subject to IQM at least every two years (with some firms adopting an annual approach).

- Use audit quality indicators to select files for review.

- Conduct Root Cause Analysis (RCA) on key IQM findings.

4. Forward-looking supervision

Our forward-looking supervisory activity at Tier 2 and Tier 3 firms commenced in 2021. We focus on holding firms to account through the assessment of key quality drivers, setting actions to drive improvements, monitoring progress and providing challenge to the firm's leadership.

At Tier 2 firms, we focus on assessing and challenging a firm's: audit quality improvement plan; progress in addressing the action plans arising from external inspections and internal quality monitoring activities; and, RCA processes. At Tier 3 firms we primarily focus on how a firm is addressing action plans arising from external and internal monitoring. We constantly flex our approach to respond to quality issues as they emerge either at specific firms or across the market. A fuller explanation of our forward-looking supervision approach is set out in our Approach to Audit Supervision.

In 2022, for the first time we issued all Tier 2 and Tier 3 firms with an Annual Supervisor Letter (ASL) setting out specific priority issues for improvement, derived from our work in 2021/22, for the firm to address during 2022/23. The ASL also included improvement or quality issues applicable to all firms. During 2021/22 we also reviewed Tier 2 firms': progress towards implementation of ISQM 1; compliance with the Audit Firm Governance Code (at those firms where it applies); and, cyber security arrangements. We reviewed all of the 2021 Transparency Reports published by Tier 2 and Tier 3 firms.

As well as providing bespoke feedback to firms from our work, we seek to promote continuous improvement in standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22, we shared good practice on the audit of fraud risks and, as in previous years, held a comprehensive briefing event on key issues for Tier 2 and Tier 3 firms. Subsequently we have held a roundtable event for Tier 2 firms on ISQM 1 implementation and shared common findings and good practice in Transparency Reporting.

In this section, we set out our observations from the work we have conducted in 2021/22 as follows:

- Priority areas in the 2021/22 ASLs.

- ISQM 1 preparedness.

- Transparency Report review.

Priority areas in the 2021/22 ASLs

Background

We issued Tier 2 and Tier 3 firms with their first ASL shortly after the end of the 2021/22 year. In the ASL we set out any specific priority areas, identified through our supervision and inspection activity, for the firm to address urgently and issues of general application. We asked firms to respond with actions to address the priority areas, alongside a clear timeline and allocation of responsibility to a senior individual in the firm.

Priority areas

Key themes in firm-specific priority areas were:

- Methodology improvements, including in relation to estimates, revenue, oversight of component auditors and ensuring that off-the shelf methodology is appropriately augmented to cater for PIE audits and other more complex issues.

- Improving procedures to monitor compliance with the requirements of the Ethical Standard, including in relation to non-audit services.

- Embedding audit quality metrics into partner and staff reward and recognition procedures.

- Improving monitoring and remediation procedures such as IQM and RCA.

During 2022/23 we will follow up the actions that firms are taking on their specific priority areas. At Tier 2 firms we will hold meetings with the firm's leadership and any independent non-executives to hold them to account for delivering the necessary improvements.

The need to improve methodology, ethical procedures, people processes, IQM and RCA procedures and featured heavily in our bespoke feedback to firms

Priority areas for all firms included ensuring that:

- They are adequately prepared for registration with the FRC as PIE audit firms.

- The firm is on track to implement ISQM 1 in December 2022. Further observations on this topic are set out later in this section.

- The firm's leadership demonstrates an appropriate focus on audit culture and supports audit teams in the challenge of management.

- Where the firm conducts or is planning to take on financial services audits, they have appropriate expertise and methodology to address the complexities of IFRS 9 and other sector specific issues. This is in response to the systemic importance of financial services entities, particularly banks, and an increase in the instances of Tier 2 and Tier 3 firms taking on such audits.

ISQM 1 preparedness

Background

ISQM 1 is the new international standard on quality management that sets out the firm's responsibility to design, implement and operate a system of quality management for audits of financial statements, or other assurance or related services. ISQM 1 replaces the extant standard of quality control (ISQC 1) with an effective date of 15 December 2022. By the effective date, firms must have established their quality objectives, identified and assessed the risks to meeting those objectives, and designed and implemented their responses to address such risks. During the second half of 2021/22 we performed a limited scope pre-implementation review to understand the preparedness of Tier 2 firms to meet the effective date and to identify particular challenges being faced. We also held a roundtable event to explore further particular areas of ISQM 1 in order to facilitate the sharing of good practice between firms.

All Tier 2 firms had a plan in place to implement ISQM 1 by the deadline but some firms were further along with their plan than others

Observations

Our principal observations from the review we conducted in 2021/22 were as follows (it should be noted that firms actions will have progressed significantly since then, as the ISQM 1 deadline approaches):

- All Tier 2 firms had a plan in place to implement ISQM 1 by 15 December 2022. Some firms were significantly further along with their plan than others and, at the date of our work, not all firms had fully identified risks or designed and implemented their responses.

- There was a mixture of firms developing their own entirely bespoke solution to ISQM 1, either themselves or in conjunction with their international network, and firms using an 'off-the-shelf' software solution within which to develop the firm's own system.

- Common challenges related to: identifying audit quality risks, and the number of risks that were appropriate; identifying and assessing service providers; and, the extent to which ISQM 1 should be applied to non-audit departments which conduct some assurance services.

During 2022/23 the FRC will continue to focus on ISQM 1 implementation at Tier 2 and Tier 3 firms. The FRC is also developing its approach to the review of firms' quality control procedures under ISQM 1 which will become relevant for 2023/24 onwards.

Transparency Report review

Background

The FRC reviews the Transparency Reports of Tier 1 firms annually and reports our findings privately to the firms. This year, for the first time since the FRC's Thematic Review on Transparency Reporting published in September 2019, we conducted a review and benchmarking exercise over Tier 2 and Tier 3 firms' 2021 Transparency Reports.

Observations

We identified a range of findings and good practices in Tier 2 and Tier 3 firms Transparency Reports, the most common being as follows:

Most firms' 2021 Transparency Reports were of an appropriate length and tone, but there were often gaps in certain disclosures

Key findings

Key findings included:

- Inadequate disclosures of the results of internal or external quality inspections.

- Incomplete disclosures of independence procedures and rotation or cooling off periods for senior staff.

- Lack of transparency on the basis of remuneration of members of a firm's management body.

- Most reports did not adequately address the firm's culture and its impact on audit quality, but there were some reports which covered this well.

Good practice

Good practice was identified at firms whose reports:

- Were concise in length and written in an appropriate tone that was not overly positive.

- Contained detailed descriptions or disclosures relating to the firms' IQM arrangements, technical training provided and service providers used.

We found that some firms had not published their 2021 Transparency Report within the four month period allowed, or the report was not readily available on the firm's website. A small number of firms had failed to prepare a 2021 Transparency Report. Where this occurs, the FRC will consider an appropriate response, potentially including an undertaking on the firm's PIE Auditor Registration.

Appendix 1

Our inspection approach at Tier 2 and Tier 3 firms

The FRC's inspection focus is on firms that audit PIEs, the PIE audits they conduct and their quality control systems applicable to PIE and non-PIE audits. We will usually inspect Tier 2 firms on a 3 year cycle and Tier 3 firms on a 6 year cycle. However, we may accelerate inspection work to address risks that we identify.

Our selection of individual audits and the areas within those audits for inspection at Tier 2 and Tier 3 firms is risk-based, to the extent possible given the limitations posed by the small number of PIE audits conducted by some Tier 2 and Tier 3 firms, in some cases only one.

Our risk-based selections focus on, for example, entities which: are in a high-risk sector; are experiencing financial difficulties; have material account balances with high estimation uncertainty; or, where the auditor has identified governance or internal control weaknesses. Higher-risk audits are inherently more challenging as they will require audit teams to assess and conclude on complex and often judgemental issues, for example in relation to future cash flows underpinning assessments of impairment and going concern. Rigorous challenge of management and the application of professional scepticism are especially important in such audits.

With some adaptations to take account of the small number of PIE audits conducted by some Tier 2 and Tier 3 firms and the nature of those audits, we also focus on the same sectors and audit areas as we do in our inspections at Tier 1 firms. For 2021/22 these were:

| Sectors | Audit Areas |

|---|---|

| - Travel, Hospitality and Leisure | - Covid-19 Impact (including going concern, impairment of assets, inventory and group audits) |

| - Retail | - Estimates |

| - Property | - Fraud Risk |

| - Financial Services | - Climate Risk |

Our inspection findings cannot therefore be taken as a balanced scorecard of the overall quality of the firm's audit work. Our forward looking supervision work at Tier 2 and Tier 3 firms, while less intensive than at Tier 1 firms, provides us with a greater depth of understanding of a firm's approach to audit quality and the future development of its audit quality improvement initiatives.

How we assess the individual audits we inspect

We assess each completed inspection using four categories: Good; Limited improvements required; Improvements required; and, Significant improvements required. In our public reporting we combine the first two as good or limited improvements required.

Any audit requiring more than limited improvements is a cause for concern.

How we report on the individual audits we inspect

Our inspections of individual audits focus on the quality of the audit work performed in the areas we select for review, the sufficiency and appropriateness of the audit evidence obtained and the appropriateness of the key audit judgements made by the audit engagement partner and their team.

For each inspection we issue a confidential report to the audit engagement partner and the audit committee chair (or other person with equivalent governance responsibilities). This sets out the scope of our review, any key or other findings arising, the actions the firm proposes to take to address our findings and any good practices which we identified in specific areas.

Our inspection reports distinguish between any key findings (resulting in assessment of the audit requiring more than limited improvements) and other findings.

How we report our overall inspection findings

We privately report our inspection findings to Tier 2 and Tier 3 firms, including setting out an action plan for the firm to respond to and set out the actions it will take to remedy the findings from our inspection of:

- The firm's system of quality control (firm-wide procedures).

- Individual audits.

We also report our inspection findings internally and to a firm's RSB for the purposes of decisions on a firm's audit registration.

The FRC is now responsible for the registration of all firms which carry out Statutory Audit Work on PIEs, as defined in the Companies Act 2006, in addition to the ongoing requirement to register with their RSB. Further information on the registration process and requirements may be found here.

Appendix 2

Tier 2 and Tier 3 firms 2021/22

The following table sets out the firms in Tier 2 and Tier 3 for 2021/226:

| Tier 2 (5) | Tier 3 (17) |

|---|---|

| Crowe U.K. LLP | Beever and Struthers |

| Haysmacintyre LLP | Begbies |

| MacIntyre Hudson LLP | Bennett Brooks & Co Limited |

| PKF Littlejohn LLP | Bright Grahame Murray |

| RSM (UK) Audit LLP | BSG Valentine (UK) LLP |

| Carter Backer Winter LLP / CBW Audit Ltd | |

| Deloitte (NI) Ltd | |

| Edwards Accountants (Midlands) Ltd | |

| Edwards Veeder (UK) Limited | |

| Elderton Audit (UK) | |

| Gerald Edleman / Gerald Edelman LLP | |

| Hazlewoods LLP | |

| Jeffreys Henry LLP / Jeffreys Henry Audit Ltd | |

| Johnston Carmichael LLP | |

| Moore Kingston Smith LLP | |

| Shipleys LLP | |

| UHY Hacker Young LLP |

Not all of the above firms have been inspected by the FRC during the period 2016/17 to 2021/22. Details of firms inspected in each year are in Appendix 3.

Appendix 3

Firms inspected by the FRC

The following table sets out the firms inspected by the FRC in each year from 2016/17 to 2021/22:

| Year | Firm |

|---|---|

| 2016/17 | BSG Valentine (UK) LLP |

| RSM (UK) Audit LLP | |

| 2017/18 | PKF Littlejohn LLP |

| UHY Hacker Young LLP | |

| 2018/19 | Beever and Struthers |

| Crowe U.K. LLP | |

| Haysmacintyre LLP | |

| Scott-Moncrieff | |

| 2019/20 | BSG Valentine (UK) LLP |

| Deloitte (NI) Ltd | |

| French Duncan LLP | |

| SBM Associates Limited | |

| RSM (UK) Audit LLP | |

| UHY Hacker Young LLP | |

| 2020/21 | BHP LLP |

| Crowe U.K. LLP | |

| Gerald Edelman | |

| Haysmacintyre LLP | |

| Jeffreys Henry LLP / Jeffreys Henry Audit Ltd | |

| Johnston Carmichael LLP | |

| MacIntyre Hudson LLP | |

| PKF Littlejohn LLP | |

| RSM (UK) Audit LLP | |

| UHY Hacker Young LLP | |

| 2021/22 | Beever and Struthers |

| Begbies | |

| Carter Backer Winter LLP / CBW Audit Ltd | |

| Crowe U.K. LLP | |

| Edwards Accountants (Midlands) Ltd | |

| Hazlewoods LLP | |

| RSM (UK) Audit LLP |

Notes:

- At each firm there was the inspection of at least one audit in the year.

- Where a firm name is in bold type, the FRC also inspected the firm's quality control procedures.

- Firms whose names are in grey were no longer PIE audit firms by 2021/22.

Financial Reporting Council

8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

-

Public Interest Entity – in the UK, PIEs are defined in Section 494A of the Companies Act 2006 and comprise: Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a UK regulated market". In the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.); Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England); Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive. ↩

-

The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP ↩

-

Data held by the FRC as at 31 December in the previous year ↩

-

FRC-scope audits comprise PIEs, Lloyd's Syndicates and UK incorporated AIM-listed entities with a market capitalisation in excess of €200m ↩

-

The FRC's 2022 edition of Key Facts and Trends in the Accountancy Profession supplemented by firms' Transparency Reports and other sources where available ↩

-

At present only commercial UK audit firms are included in Tier 2 and Tier 3. For 2021/22 a further six non-UK audit firms and UK public sector bodies audited a total of 15 UK PIEs. All firms or bodies auditing UK PIEs will be required to register with the FRC during 2022/23. ↩