The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Cutting Clutter: Combating clutter in annual reports

Financial Reporting Council

The Financial Reporting Council (FRC) is the UK's independent regulator responsible for promoting high quality corporate governance and reporting to foster investment.

For further information visit www.frc.org.uk The FRC published *Louder than Words: Principles and actions for making corporate reports less complex and more relevant

- in June 2009. One of the actions we wanted to progress related to 'cutting clutter'. This publication seeks to be a catalyst to help all of us to change our behaviours and how we approach removing unnecessary text and data from annual reports.

- Foreword

- Investigating clutter

- Barriers to cutting clutter

- Understanding the role of behaviours

- Behavioural influences

- Behavioural aid: Influencing behaviours

- Other barriers to tackling clutter

- Call for action one: Continue to encourage debate on materiality

- Call for action two: Tackle explanatory information

- Call for action three: Engage with other stakeholders regarding their information requests

- Addressing common areas containing clutter

- Further opportunities

- Other information

- Behavioural influences

- Addressing common areas containing clutter

- Disclosure aid 1: Governance

- Disclosure aid 2: Accounting policies

- Disclosure aid 3: Share-based payments

- Further opportunities

- Other information

- Project methodology

- Cutting Clutter Advisory Panel

- Sources and further reading

Foreword

Cutting clutter

Clutter in annual reports generates debate. All agree that a problem exists: most say that someone else is the cause and that they need to change first. As regulators our actions, and the way others respond to them, also contribute to the clutter we often see in annual reports and accounts.

Clutter undermines the usefulness of annual reports and accounts by obscuring important information and inhibiting a clear understanding of the business and the issues that it faces. We are committed to being a catalyst for change – to move from debate to action, and to being an active participant in the change process to ensure that our actions are proportionate and targeted so reducing clutter, not adding to it, wherever possible.

Cutting clutter cannot be achieved just by taking a red pen to a late printer's proof. Making a significant and permanent change has to be addressed at the planning stage for the next annual report through a clear idea of the desired outcome and how change will be achieved. A good time to start this process is at the debriefing meetings reflecting on the current year's annual reports, which for many companies will be taking place over the next few months.

The Government, the FRC and many others have called for improvements to companies' narrative reports. The debate continues on exactly how such reports should be restructured. But whatever is decided our aim must be to make the text clear and clutter free. This publication contains a number of aids for reducing clutter which we hope will be used to start making change a reality. The FRC intends to follow through on this initiative in a number of ways, for example by working with the Government on its review of narrative reporting. In addition, as proposed in its recent *Effective Company Stewardship

- consultation, the FRC would like to create a ‘financial reporting lab' where constituents can get involved by developing and testing ideas (without liability) to enable greater innovation.1

We welcome comments on this paper. We plan to hold a meeting with interested parties in the autumn to share experiences and to identify best practice as it develops.

Cutting clutter will not happen overnight. But the benefit in the longer term will be significant – reducing the time, energy and cost of preparing unnecessary disclosures and increasing clarity for investors.

Clutter undermines the usefulness of annual reports and accounts by obscuring important messages...

Bill Knight Chairman, Financial Reporting Review Panel

Roger Marshall Chairman, Accounting Standards Board

Investigating clutter

What do we mean by clutter?

The annual report's primary purpose is to provide “investors with information that is useful for making their resource allocation decisions and assessing management's stewardship."2 It can also help stakeholders assess the company's governance and whether, in the words of the FRC's UK Corporate Governance Code, it enables the board and management to deliver on the long-term success of the company.3

Clutter makes it more difficult for users to assess a company's progress by obscuring relevant information. Due to the time and effort involved in preparing such disclosures, clutter is also a big issue for preparers. The FRC's publication *Louder than Words

- identified clutter in annual reports as a problem because key messages are getting lost. Respondents agreed. Louder than Words noted that “generally, if regulations require a disclosure, it goes in the report – regardless of the materiality or importance to the business."4

We have used the term ‘clutter' throughout this paper as comprising two problem areas:

- immaterial disclosures that inhibit the ability to identify and understand relevant information; and

- explanatory information that remains unchanged from year to year.

Immaterial disclosures are remarkably common, for example detailed notes supporting line items that are small – often the case for share-based payments. However, reports also contain explanatory narrative information that is either wholly or largely unchanged from year to year. It is the changes that can often be illuminating but, without comparing the precise text, it is often difficult to identify them.

What we have done so far?

Understanding behaviours

Those interviewed when researching *Louder than Words

- gave a number of reasons for ‘kitchen sink' reporting - most of which were the result of behavioural barriers. Importantly, respondents noted that it was not just the behaviour of preparers that can lead to clutter, but regulators and standard setters also bear a degree of responsibility, including parts of the FRC. In addition, those providing guidance to preparers, such as auditors and institutes, contribute to the problem.

Understanding the behavioural influences leading to clutter is key.

Understanding the behavioural influences leading to clutter is key. All of those involved in the annual report process are influenced by others' behaviours; the combined effect is often a barrier to cutting clutter. For example, the lack of agreement over what materiality means from a disclosure perspective results in each reviewer erring on the side of caution.

Practical examples

Despite these constraints, some change can be achieved without changing standards or guidance. With input from the Advisory Panel (see page 48) and a small number of preparers we developed illustrations of what disclosures could look like without the clutter.

Three areas commonly found to contain clutter have been considered. They come from different parts of an annual report – both the narrative usually contained in the front of the annual report, as well as examples within the notes to the financial statements. The illustrations are not templates. The focus is not on the detailed wording provided in each disclosure – some of the text is in Latin – but on providing some pointers to things to think about in order to improve the disclosures and cut the clutter, in part by moving explanatory information onto a website.

We are aware that currently, where required by law or IFRS, explanatory information would still have to be provided and included in an appendix within the annual report, rather than separately on a website. While this isn't ideal, as it requires preparers to continue to produce the information year on year within the annual report, it lessens the clutter effect for users.

...some change can be achieved without changing standards or guidance.

Making change happen

We are well aware that achieving change will not be easy. However, we believe there are some steps that can be taken to start to combat a number of the barriers and to give confidence that removing clutter is achievable even in the short term. This paper includes three steps:

- We have set out three calls for action which we believe are essential to start combating a number of barriers to cutting clutter and provide better reporting.

- We have developed a behavioural aid that preparers can use at suitable times during the annual report process to help overcome some of the barriers.

- We have developed three disclosure aids to demonstrate what some key areas of the annual report could look like without the clutter.

These are explained in more detail in the following sections.

We are well aware that achieving change will not be easy.

What happens next?

We are particularly interested in your views on the challenges and ideas presented in this paper. Please send these to: [email protected] by 30 September

- Responses will be published on our website unless confidentiality is requested.

What we intend to do:

- We will continue to work with preparers, standard setters and regulators to push for change in response to the issues we have identified.

- We will work with the Government on its proposals to simplify narrative reporting to make it clearer and more focused.

- We plan to hold a meeting with interested parties in the autumn so that we can share views, discuss progress and showcase developing good practice. Please contact us at [email protected] to confirm your interest.

- If there is support for the 'financial reporting lab' proposal set out in the FRC's Effective Company Stewardship consultation, we will ensure that cutting clutter is a key agenda item for that group.

- We will keep constituents informed of our progress at: www.frc.org.uk/about/cuttingclutter.cfm. Now it's over to you. All those involved in the annual report process can start to cut clutter now by building on the ideas and aids within this publication. We have provided some ideas of further opportunities to cut clutter on pages 41 to

- We look forward to seeing examples of disclosures without the clutter.

All those involved in the annual report process can start to cut clutter now...

Recommendations

1. Calls for action to reduce barriers

While there are some steps preparers can take now, some of the barriers to reducing clutter will take a more concerted effort. Accordingly, we make three calls for action we believe are necessary to remove some of the existing barriers:

- Encourage continuing debate around what materiality means from a disclosure perspective.

- Investigate how to tackle long-standing explanatory material in printed annual reports.

- Engage with other stakeholders around their information requests.

2. Addressing behaviours

Our investigation into clutter has convinced us that one of the main causes is behavioural. As a first step to combat this, we have developed a short behavioural aid to be used by teams involved in the preparation and review of annual reports. A point of clarification – this is not a checklist to be completed by an individual in isolation – it is an aid to the teams to change some of the behaviours that currently serve as barriers to cutting clutter.

3. Disclosure aids to enable preparers to tackle clutter now

During our investigations, individuals mentioned a number of common areas of clutter in annual reports.

We believe that preparers can tackle a number of these common areas now. To illustrate what we have in mind, and also to encourage preparers, we have developed a few disclosure aids.

These cover:

- Governance

- Accounting polices

- Share-based payments.

Barriers to cutting clutter

Understanding the role of behaviours

Louder than Words documented a number of reasons for including every disclosure in the annual report, regardless of the materiality or importance of the item to the long-term success of the business or to decisions that might be made by investors. These ranged from "simply repeating disclosures made in prior years" to "fear of challenge from regulators".5

Most of the reasons given have at their core behavioural influences. An example of a behavioural influence is the way in which some preparers and audit staff use illustrative accounts. Such aids are prepared with the objective of covering every eventuality, assuming everything is material. They are not themselves a barrier to cutting clutter, but the unchallenging way they may be applied can be. The result – disclosures are reproduced without first addressing the relevance of each item to the individual company.

Behavioural influences

A significant part of our investigation into clutter has focused on the behavioural issues that lead to it. We commissioned a report from the Behavioural Insights Team (Cabinet Office) which is being published alongside this paper. Our analysis focused on the underlying causes of what we have called ‘kitchen sink’ reporting, where disclosures become a comprehensive repository of all possible information, rather than being tailored to the circumstances of the company and the needs of its users.

The FRC believes that there are six main behavioural influences, or a combination of them, that contribute to clutter:

- Fear – of challenge by others, particularly regulators, audit committees and auditors. The perception that “it is safer to include everything”.

- Habit – often reflected in using last year’s annual report as the primary guide for this year’s report, including areas of reporting that have long ceased to be relevant.

- Diffusion of responsibility – a sense that ‘someone else’ is responsible for addressing the clutter. This often applies across the whole process.

- The copy-out culture – in some areas of annual reports, particularly accounting policies, the tendency to ‘copy out’ verbatim from standards, or from a checklist (eg, the example of illustrative financial statements).

- Limited scope for innovation – a perception that reporting is about rules and compliance and not about communicating relevant information.

- Perception of low value to users – an implicit assumption that users do not value the content of some disclosures, and therefore little effort is put into refining or simplifying them.

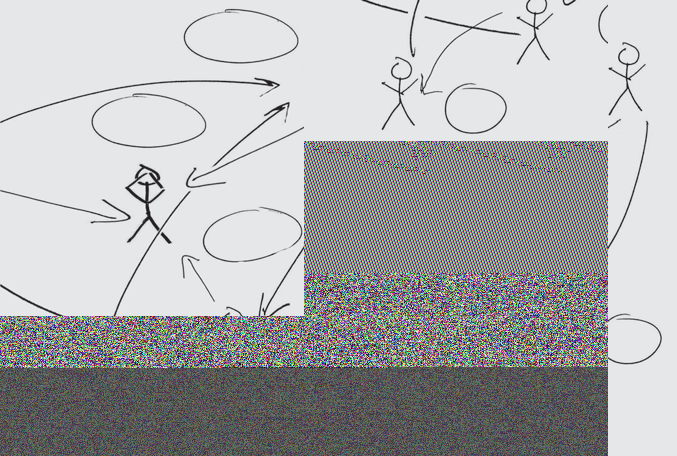

This diagram is a simplification of these behaviours, but it illustrates how they interact. A fear of challenge means that preparers are reluctant to omit or amend disclosures. This means that the existing disclosures, which often arose from habit, continue to be reproduced. This is exacerbated by the copy-out culture in some disclosures. The result is a report that is not fit for purpose in terms of communicating with users. Unless there are clear signals about the scope for innovation, the disclosures continue to deteriorate. The cycle continues unless there is a clear ‘owner’ who takes responsibility for taking action. This leads to a further diffusion of responsibility.

When combined with the current framework, these behavioural influences lead to excessive disclosure. It is important to note that these behavioural influences are not just an issue for preparers, but for others in the reporting supply chain, including the FRC.6 Indeed, the FRC has published its own action plan to address the clutter it may inadvertently contribute through its own actions and publications.7

For example, the FRC is often perceived as an organisation that will challenge omission rather than excessive inclusion of information. This leads to preparers being overly cautious in preparing their reports and disclosure aids often being seen as a ‘floor’ rather than as a starting point. There may also be a misunderstanding of what is material from a user perspective, ie, what affects users’ economic decisions. It should be noted that in the UK, the concept of materiality relates to users’ economic decision-making and not merely to meeting compliance requirements, so the FRC is keen to promote a debate on materiality as part of this project.

Behavioural aid: Influencing behaviours

As identified earlier, clutter is largely a behavioural issue. To help preparers overcome some of the behavioural barriers we have developed a short behavioural aid. The aid describes the underlying behavioural causes of clutter and encourages preparers to think differently when developing their annual reports.

The aid is presented as a framework, and is not designed to be used as a mechanical checklist. Each company faces different challenges in cutting clutter and each individual within the reporting process will be able to influence different areas. By encouraging behavioural change and providing a logical framework to think about clutter, we expect the aid to be an important catalyst to change. We have tested the aid with a small number of companies and expect to refine it further during the consultation period. The aid is focused on how preparers and others involved in the annual report process can take action. It can be found on pages 18 and 19.

How can the behavioural aid be used?

We anticipate that the aid could be used in a number of ways:

- Audit committees can use it to help focus their discussions with management and their auditors on areas of clutter. This could include asking: ‘Are we giving enough prominence to those areas of the report where we have changed policies or assumptions?’ or ‘How can we ensure that the report includes a discussion of what is material for our company, rather than just what is material for companies in general?’.

- Management can use the aid to help design a process for improving the effectiveness of their annual report and to ensure that the individuals and departments within their organisation consider their contribution to clutter. This could include: ‘How can we review the extent to which our disclosures add value and reduce clutter?’ or ‘What is our process for challenging disclosures that have remained largely unchanged for a number of years?’.

- Auditors can use the aid to help them in their discussions with management and audit committees on areas of clutter. This could include asking: ‘Is this disclosure decision an appropriate application of materiality to this company?’ or ‘What process has the company been through to ensure that its annual report is clear and clutter-free?’.

- Analysts and other users can use the aid to help frame their questions to companies on their annual reports.

The behavioural aid is based on five key areas which are explored through a series of questions:

| Area to consider | Questions to ask |

|---|---|

| 1. Challenge existing disclosures | Does this disclosure add value? What would we lose if we removed it? Does it enable users to make economic decisions? |

| 2. Review processes and behaviours | Does our process encourage cutting clutter? Do we consider what other stakeholders will focus on? Are our internal incentives aligned to cutting clutter? |

| 3. Look to the future | What does the user want for the future? How can we communicate this? |

| 4. External signals | What signals are we getting from regulators? Do we fully understand the requirements of accounting standards? |

| 5. Take responsibility and lead | Who is taking responsibility for the overall communication effectiveness of the report? How can we be a catalyst for change within our peer group? |

Other barriers to tackling clutter

In addition to the behavioural influences, our research identified other barriers to tackling clutter. Many of these issues are interconnected with the behavioural influences. The main ones are:

- Materiality – this concept is not consistently applied. Many preparers believe that if a disclosure is in an accounting standard or a legal requirement, it must be included regardless of its importance to the understanding of the business. Also, the concept of ‘primary users’ is not consistently understood.

- The legal and regulatory framework – this is complex and can be seen as an impediment to cutting clutter. The UK regulatory framework has evolved in an incremental way over many years. There are often unintended consequences, such as the requirement for more disclosures and more explanations, particularly for areas that are not material.

- Company law – many of the current requirements are set out in the Companies Act 2006. Some of these requirements are seen as adding to clutter.

- Accounting standards – for example, the detailed disclosure requirements in IFRS, particularly for financial instruments.

- The audit report – the current form of the audit report is seen by some as being a barrier to cutting clutter as it leads to a ‘check box’ mentality.

-

Lack of understanding of users’ needs – some preparers perceive that users want ‘all information’ rather than a summary of the most important information. The FRC has recently issued a Statement of Principles that clarifies who the primary users of financial statements are.

-

Audit committees – some audit committees do not challenge management enough on the extent of their disclosures. In some cases, the audit committee may be seen as a contributor to clutter by requesting additional information.

- Auditors – some auditors take a highly conservative approach to disclosure by ensuring that all possible disclosures are included. Some believe that to reduce litigation risk it is safer to ensure that everything is included. Also, auditors do not have to report on disclosures that are not part of the financial statements; it is often felt that this leads to less rigour being applied to the narrative parts of the report. The auditor’s liability position is also not clear as to whether it extends to the full annual report.

- Analysts – some analysts are perceived to be interested in the smallest detail, rather than a focus on what is material. This creates an incentive for preparers to include everything.

These barriers are largely outside the control of preparers acting in isolation. To make progress we need a concerted effort across the reporting supply chain, including regulators, standard setters and users. We believe that there are a number of actions that can be taken now by preparers, but also some longer term actions that need to be led by others. These are outlined as three calls for action.

Why is clutter a problem? The FRC’s report *Louder than Words

-

identified three main problems associated with clutter:8

-

It undermines decision-making by distracting users from the most important information.

- It reduces accountability because it is difficult for users to identify what the key messages are.

- It increases costs for preparers because they have to provide more information.

The diagram below illustrates how a number of the behavioural influences and other barriers interact to create clutter in annual reports. It also shows the actions needed to cut clutter.

Diagram illustrating behavioural influences and other barriers creating clutter in annual reports and actions needed to cut clutter.

(This is a conceptual diagram and not provided as an image in the image report. It is described as illustrating how various factors interact.)

The diagram illustrates how the three calls for action and the three disclosure aids (as outlined on pages 12 and 13) can help preparers to cut clutter now. These are discussed in more detail in the following sections of this paper.

Call for action one: Continue to encourage debate on materiality

Clutter is exacerbated by the perception of materiality by preparers and others. Materiality is often perceived as relating to accounting standards or legal requirements rather than to the economic decision-making of the primary users of the financial statements.

In the UK, the concept of materiality is set out in the FRC’s Statement of Principles for Financial Reporting, paragraph 2.10:

Information is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements. Materiality depends on the size of the item or error judged in the particular circumstances of its omission or misstatement. Thus, materiality provides a threshold or cut-off point rather than being a primary qualitative characteristic which information must have if it is to be useful.

This definition is also set out in IFRS (IAS 1 Presentation of Financial Statements) and is consistent with the definition in the IASB/FASB *Conceptual Framework

- (exposure draft). The FRC’s Statement of Principles also states that quantitative materiality is not enough to define materiality. Qualitative factors also need to be considered.

In practice, there can be a tension between what is legally required and what is considered material from a user perspective. The FRC considers that, where possible, legal requirements should be aligned to user needs rather than just being a set of ‘compliance’ requirements. The FRC has committed to considering these issues as part of its wider work plan.

What action can preparers take now?

Preparers can apply the concept of materiality to their disclosures more rigorously now. They could consider:

- Challenging existing disclosures. Are they relevant to users’ economic decisions? Are they important to the entity being reported on?

-

Considering what makes the information ‘material’ to the company. What are the specific circumstances of the company that make the information material? Is this information simply boilerplate?

-

Applying a materiality lens to all disclosures. This is particularly applicable to the accounting policy disclosures. Many companies include accounting policies that are not applicable to them, or disclose all possible accounting policies when only a few are material.

- Engaging with users more on materiality. What do users really need? What is useful for their economic decisions?

What action can others take now?

Others in the reporting supply chain also have an important role in influencing the application of materiality. They could consider:

- FRC, regulators and standard setters – clarifying their position on materiality. The FRC has set out its views on materiality in its Statement of Principles and will continue to promote its application consistently. The FRC will also continue to challenge companies in cases of excessive disclosure.

- Auditors and audit committees – challenging management on the application of materiality to disclosures. They should be aware that the concept of materiality extends beyond quantitative considerations.

- Users – clearly stating what information they need and what is material.

Call for action two: Tackle explanatory information

Many annual reports contain large quantities of explanatory information. Much of this information is boilerplate (eg, general background information about a standard). It is often repeated year on year, with little or no change. It adds to clutter and reduces the clarity of the report. This problem is exacerbated when the explanatory information is not material.

What action can preparers take now?

Preparers should consider whether the explanatory information:

- is material to the entity. Is it necessary for users to understand the entity being reported on?

- is boilerplate. Does it add value to the report? Can it be removed without affecting the users’ economic decisions?

- is repeated year on year without change. Is there a better way to communicate this information (eg, by putting it on a website or by referencing a publication)?

It is important to note that if explanatory information is required by a standard or by law, it would still have to be included (eg, in an appendix or in a separate statement). However, preparers could still usefully consider whether the information needs to be repeated in the body of the report. The key is to reduce clutter by separating the truly relevant information from boilerplate.

What action can others take now?

Others in the reporting supply chain also have an important role in influencing the application of materiality. They could consider:

- FRC, regulators and standard setters – consider how to move away from a ‘one size fits all’ approach to explanatory information requirements in standards and legislation. This will require a long-term approach and careful consideration of how the legal and regulatory framework operates.

- Auditors and audit committees – challenging management on the inclusion of large quantities of boilerplate explanatory information.

- Users – clearly stating what explanatory information they need to enable them to make economic decisions.

Example

The example below (from a company’s annual report) illustrates some of the issues with explanatory information. It is difficult to ascertain what is truly material to the entity, and what is merely boilerplate (eg, the definition of Fair Value and how it is determined).

Example showing issues with explanatory information from a company’s annual report.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

Call for action three: Engage with other stakeholders regarding their information requests

Companies often receive information requests from a wide range of stakeholders, including regulators, investors, proxy advisers, credit rating agencies and research organisations. Many of these information requests may lead to additional information being included in the annual report, often inadvertently contributing to clutter.

What action can preparers take now?

Preparers should be clearer about:

- what information is material to the company. If information is not material, preparers should consider whether it needs to be included in the annual report. There may be other ways to communicate the information (eg, by putting it on a website or by referencing a separate publication).

- what information they are legally or contractually obliged to provide, and what they are providing on a voluntary basis. If information is being provided on a voluntary basis, preparers should consider whether it needs to be included in the annual report.

It is important to distinguish between information that is important for economic decision-making and information that is important for compliance or other purposes.

What action can others take now?

Others in the reporting supply chain also have an important role in influencing the application of materiality. They could consider:

- FRC, regulators and standard setters – engaging with other stakeholders regarding their information requests. The FRC will continue to engage with other stakeholders to promote a proportionate approach to information requests.

- Users and other stakeholders – being clearer about what information they need for their economic decisions. This will help preparers to focus on the information that is most relevant.

Addressing common areas containing clutter

How to use the disclosure aids

In our report, we outlined three disclosure aids that demonstrate what some key areas of the annual report could look like without clutter. These aids are not templates, but are designed to illustrate the principles of cutting clutter. They are focused on three common areas that contain clutter:

- Governance disclosures

- Accounting policies

- Share-based payments

The aids demonstrate how the principles of materiality can be applied in practice, and how explanatory information can be managed. The aids are focused on the following questions:

- What is the purpose of the disclosure?

- Is the information material to the company?

- Is the information boilerplate?

- How can the information be presented more effectively?

We expect to refine these aids during the consultation period.

The aids are designed to be used in conjunction with the behavioural aid (pages 18 and 19). For each area, we have identified some key questions that preparers should ask themselves when developing their disclosures.

| Disclosure area | Key questions for preparers |

|---|---|

| Governance | Does the disclosure explain how the principles of the UK Corporate Governance Code have been applied, and not just whether they have been applied? Is the information tailored to the company’s circumstances, or is it boilerplate? |

| Accounting policies | Does the disclosure explain the accounting policies that are material to the company, and not just copy out boilerplate from the accounting standards? Does it explain why the accounting policy is appropriate for the company? |

| Share-based payments | Does the disclosure provide users with enough information to understand the impact of share-based payment transactions on the company’s financial position and performance, without providing excessive detail on every single scheme? |

Disclosure aid 1: Governance

Governance disclosures often contain a significant amount of boilerplate information. The FRC’s *UK Corporate Governance Code

- applies a ‘comply or explain’ approach, but companies often adopt a ‘comply and explain everything’ approach. Many disclosures repeat verbatim from the Code, rather than explaining how the principles have been applied to the company’s specific circumstances.

What action can preparers take now?

Preparers should focus on:

- Explaining how the principles have been applied, not just whether they have been applied. This means providing tailored information about the company’s governance arrangements, rather than copying out text from the Code.

- Tailoring the information to the company’s circumstances. What is unique about the company’s governance that users need to understand?

- Removing boilerplate information. Is the information adding value, or is it merely repeating what is already publicly available?

Example: Audit committee report

Audit committee reports often contain extensive boilerplate information. The FRC is currently undertaking a review of audit committee reporting, and will publish its findings in due course. The example below (from a company’s audit committee report) illustrates some of the issues.

Example of an audit committee report showing issues with boilerplate information.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

The example below shows a potential approach to an audit committee report that focuses on explaining how the principles have been applied, rather than just whether they have been applied.

Example of a concise audit committee report, focusing on applied principles.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

Disclosure aid 2: Accounting policies

Accounting policies are often seen as an area where preparers are reluctant to cut clutter. This is because many preparers feel that they are required to disclose all possible accounting policies, even if they are not material to the company. This leads to long lists of accounting policies that are not relevant to the entity, or that are merely boilerplate.

What action can preparers take now?

Preparers should focus on:

- Disclosing only those accounting policies that are material to the company. This means applying the concept of materiality to accounting policies, rather than just copying out boilerplate from accounting standards.

- Explaining why the accounting policy is appropriate for the company. How does the accounting policy reflect the specific circumstances of the company?

- Removing boilerplate information. Is the information adding value, or is it merely repeating what is already publicly available?

Example: Revenue recognition policy

Revenue recognition policies often contain extensive boilerplate information. The example below (from a company’s annual report) illustrates some of the issues.

Example of a revenue recognition policy showing issues with boilerplate information.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

The example below shows a potential approach to a revenue recognition policy that focuses on explaining why the accounting policy is appropriate for the company.

Example of a concise revenue recognition policy, focusing on company-specific appropriateness.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

Disclosure aid 3: Share-based payments

Share-based payment disclosures can often contain a significant amount of detail, particularly for companies with multiple share schemes. This can lead to clutter, as users may struggle to identify the most important information.

What action can preparers take now?

Preparers should focus on:

- Providing users with enough information to understand the impact of share-based payment transactions on the company’s financial position and performance. This means providing a high-level overview of the schemes, rather than excessive detail on every single scheme.

- Summarising information where appropriate. Can information about similar schemes be aggregated?

- Removing boilerplate information. Is the information adding value, or is it merely repeating what is already publicly available?

Example: Share-based payment disclosure

Share-based payment disclosures often contain extensive boilerplate information. The example below (from a company’s annual report) illustrates some of the issues.

Example of a share-based payment disclosure showing issues with boilerplate information.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

The example below shows a potential approach to a share-based payment disclosure that focuses on providing a high-level overview of the schemes.

Example of a concise share-based payment disclosure, focusing on high-level overview.

(This is described as an "example" and not provided as an image in the image report. It likely contains textual data or a specific layout example.)

Further opportunities

Cutting clutter will require a concerted effort across the reporting supply chain. In addition to the actions outlined in the three calls for action and the three disclosure aids, we believe there are a number of further opportunities to cut clutter. These include:

- Reviewing the legal and regulatory framework. This is a complex area, and a long-term review will be needed to ensure that the framework is fit for purpose and does not inadvertently contribute to clutter.

- Developing guidance on materiality. This could help to ensure that the concept of materiality is applied consistently across the reporting supply chain.

- Promoting innovation in reporting. This could include encouraging companies to experiment with new reporting formats and technologies.

- Engaging with users more effectively. This could involve conducting more research into users’ needs, and developing more effective ways to communicate with users.

Other information

Glossary

Clutter Excessive or irrelevant information in annual reports that obscures important messages and hinders effective communication.

Materiality Information is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements.

Boilerplate Standardised text or information that is repeated without significant change across multiple reports, often lacking specific relevance to the entity being reported on.

Narrative reporting The non-financial sections of an annual report, including the strategic report, directors' report, and governance statement, which provide context and explanation for the financial statements.

Footnotes

Project methodology

Approach Our project involved a combination of literature review, stakeholder interviews, and analysis of existing annual reports. We engaged with preparers, auditors, investors, and regulators to gather diverse perspectives on the causes and impacts of clutter.

Behavioural Insights Team collaboration We commissioned a report from the Behavioural Insights Team (Cabinet Office) to gain deeper understanding of the psychological factors contributing to 'kitchen sink' reporting. Their findings informed our analysis of behavioural influences.

Disclosure aid development Based on our research, we developed three prototype disclosure aids for governance, accounting policies, and share-based payments. These aids were tested with a small number of companies to evaluate their practicality and effectiveness in reducing clutter.

Cutting Clutter Advisory Panel

Members A panel of experts, including representatives from companies, auditing firms, investor groups, and academia, provided guidance and feedback throughout the project. Their diverse experience was invaluable in shaping our recommendations.

Sources and further reading

FRC Publications - Louder than Words: Principles and actions for making corporate reports less complex and more relevant (June 2009) - UK Corporate Governance Code - Statement of Principles for Financial Reporting - Effective Company Stewardship (consultation document)

External Publications - Reports from the Behavioural Insights Team (Cabinet Office) on behavioural issues in financial reporting. - IASB and FASB Conceptual Framework (exposure draft) - IAS 1 Presentation of Financial Statements

But it isn't just preparers' behaviour that is creating barriers to cutting clutter. Those involved in setting standards, regulating, auditing and advising preparers about their preparation of annual reports are also contributing. Examples include the ICAEW's guidance on materiality, which currently focuses on what to include rather than what could be taken out, as well as the big firms' manuals, where again the words can tend to result in a checklist for inclusion. Some of these actions are summarised on pages 16 and 17.

A despairing preparer

Standard setters, regulators, auditors, internal teams, specialist users and others, all play a role in influencing each other and preparers.

It was there last year!

These well-meaning actions weigh down on the preparers; the overall result – a despairing preparer, as illustrated opposite.

However, it is possible to change the dynamic. To demonstrate how one group (preparers) can start to change behaviours in an effort to cut clutter, we have prepared a behavioural aid, which can be used at suitable times during the annual report process, see pages 18 and 19.

For more detail on how we assessed behavioural influences, see Project methodology, page 46.

... it isn't just preparers' behaviour that is creating barriers to cutting clutter.

Behavioural influences

Understanding why we act the way we do, and specifically in the context of this report, why preparers include clutter in annual reports, requires an appreciation of the behaviours of all those involved.

| Influence of authoritative sources | Influence of authoritative sources |

|---|---|

| IASB – global accounting standards | UK implementation |

| - Some disclosure requirements appear to be derived from an anti-abuse viewpoint. | Persuasive |

| - Verifiability can lead to disclosures detailed enough to enable users to (re)perform calculations. | - Guidance, for example, ICAEW materiality guidance, focuses on inclusion rather than exclusion. |

| - Manuals of Accounting produced by 'Big Four'. | |

| - Illustrative accounts and GAAP checklists produced by accounting firms address all disclosure eventualities. | |

| Regulators need to be seen as effective | Regulatory |

| - Reviews by FRRP and AIU may give an appearance of seeking ‘tick-box’ compliance with disclosure requirements. | |

| Want to minimise risk of adverse comment |

| Auditors | Influenced by what everyone else is doing |

| - The prospect of internal firm review and/or external review by the AIU can induce auditors to take a 'tick-box' compliance approach to avoid challenge and adverse publicity. | Existence of illustrative accounts |

| Preparers (Including finance teams, investor relations, in-house lawyers and Audit Committee.) | Build on previous years' disclosure |

| - Opinions provided by internal teams (for example, in-house lawyers) and external auditors tend to focus on what to put in, not what to take out, in order to ensure that the financial statements comply with every disclosure. | Driven to comply fully with all disclosure requirements regardless of materiality |

| - Prospect of external review by FRRP can further reinforce a 'tick-box' approach as far as disclosure is concerned, to avoid challenge and adverse publicity. | Fear – err on side of caution |

Behavioural aid: Influencing behaviours

To help preparers cut clutter we have developed two short aids to be used by the annual report team at key points in the annual report process.

1 Significant changes to disclosures will not be achieved without planning. At the start of the annual report process the following issues should be discussed by the annual report project team, ideally steered by the project sponsor.

Planning phase/Kick-off

- [ ] Who is the project sponsor?

- [ ] What are the overall objectives for the annual report?

- [ ] What is the overall tone of the annual report?

- [ ] What are the learning points from the prior year and areas of focus for this year?

- [ ] What is the agreed approach to materiality and clearly trivial in financial statement disclosures?

- [ ] Who will be the single author empowered to take a high-level view of the annual report and edit it based both on the significance of individual disclosures to the report as a whole, and consistency with the overall objectives?

- [ ] What plans are in place to 'cut clutter'?

- [ ] What plans are there to communicate more effectively, for example, highlighting key information and changes for users?

2 Time pressure can mean that some of the initial 'good intentions' are lost along the way. Before the annual report is approved the project sponsor, along with others, should assess whether the objective of cutting clutter and improving communications is still on track.

Review phase/Time out

- [ ] Is the annual report still meeting the overall objectives?

- [ ] Do new disclosures, added since the planning phase, enhance clarity/understandability?

- [ ] Do new disclosures partially duplicate/replace other disclosures that can now be eliminated/refined?

- [ ] Does the emphasis placed on various elements of the annual report accurately reflect the significance/risk to the business as a whole?

- [ ] What are the learning points for next year and areas to focus on for cutting clutter?

Other barriers to tackling clutter

There are a number of other barriers as well. The most important are discussed below.

The lack of clarity around materiality

IAS 1 states that “An entity need not provide a specific disclosure required by an IFRS if the information is not material.”6 Yet it is exactly these immaterial disclosures that we observe and define as clutter. Is this message not understood or not getting through, or does it need to be refined to change the default of including everything?

It is apparent that the lack of clarity around what materiality means from a disclosure perspective continues to be a significant barrier...

One of the key reasons for including all disclosures given by interviewees was a “lack of confidence in making the judgement between disclosures that are material and those that are not.”7 It is apparent that the lack of clarity around what materiality means from a disclosure perspective continues to be a significant barrier in both preparing and auditing financial statements.

We are convinced that users suffer from the provision of immaterial disclosures, as these can obscure relevant information. In our own conceptual framework (published in 1999), materiality was seen as a “threshold quality” that sat above the qualitative characteristics.8

Extract from ASB December 1999 Statement:

3.29Materiality is therefore a threshold quality that is demanded of all information given in the financial statements. Furthermore, when immaterial information is given in the financial statements the resulting clutter can impair the understandability of the other information provided. In such circumstances, the immaterial information will need to be excluded.

We are convinced that users suffer from the provision of immaterial disclosures, as these can obscure relevant information.

Understanding what materiality means is made harder by the use of different terms in law, standards and other guidance to describe the threshold above which information should be disclosed. For example, companies are required to report the “PRINCIPAL risks and uncertainties”, not simply list all their risks and uncertainties, but many provide extensive lists. Is this because the threshold has been misunderstood?

This 'threshold problem' could be reduced by agreeing a small number of thresholds and how they relate to each other. For example, at what point would you judge it necessary to make a disclosure for each of the following descriptors drawn from IFRS and company law? Or do most of them mean the same thing?

Different descriptors triggering disclosure:

- Critical

- Essential

- Fundamental

- Important

- Key

- Main

- Major

- Primary

- Principal

- Significant

The IASB is currently developing an updated conceptual framework for financial reporting. In the first phase of the project, completed in September 2010, materiality is not considered a ‘qualitative characteristic’ of useful financial information.[^9] The rationale for this is provided in the background to the framework, which states that “... immaterial information does not affect a user's decision.”[^10]

... a clear message that clutter should be eliminated could well be a catalyst for change.

We encourage the IASB to refine its thinking as it finalises its revised conceptual framework – a clear message that clutter should be eliminated could well be a catalyst for change. To contribute to the debate we have been working with EFRAG as they seek to develop a framework for disclosures and are expecting to contribute to similar work being considered by the IASB.

Another possible contributor to clutter is the way in which auditing standards are interpreted and applied. For example, auditing standards require auditors to communicate uncorrected misstatements to those charged with governance unless they are "clearly trivial.”[^11] There is an interaction here with accounting standards permitting non-disclosure where an item is not material (see above), but the thresholds are different. However, to reduce the risk of items being reported, preparers can, again, err on the side of caution and include immaterial disclosures in annual reports and accounts. We welcome the actions of the IAASB which is now seeking to better understand these issues and has included the issue of materiality for disclosures and evaluation of disclosure misstatements in its January 2011 discussion paper *The evolving nature of financial reporting: Disclosure and its audit implications

- (open for comment until 1 June 2011).

Call for action one:

Continue to encourage debate about what materiality means from a disclosure perspective.

Action

The ASB and other FRC bodies will continue to encourage and participate in the debate the FRC started about materiality for disclosures.

Immaterial disclosures can obscure relevant information. Users have limited time to process information and immaterial disclosures make it difficult for users to filter the information so that they can focus on what is relevant.

A number of projects have been started, partly as a result of the FRC's Call for action in Louder than Words, and we support that debate continuing. Specifically, we would encourage the IASB to clarify what materiality means from a disclosure perspective.

These initiatives will take time to develop. To start to make change happen now, despite the difficulty in making assessments of materiality, there are ways preparers can work with their auditors to agree significant reductions in disclosures, and with little or no risk of regulatory challenge.

One topic often cited as giving rise to a disproportionate number of pages of disclosure is share-based payments.[^12] Feedback suggests that preparers simply provide all the prescribed disclosures about every single share scheme whatever the scheme's size and impact.

To act as a catalyst for change we have produced a disclosure aid aimed at encouraging preparers to:

- disaggregate the cost of share-based payment schemes;

- make full disclosure only about those schemes that are material; and

- provide only brief details of immaterial schemes.

Our thinking is illustrated on pages 38 and 39 (Disclosure aid 3).

Explanatory information

Annual reports contain a number of types of information. These can be classified into three categories. Information that is:

- entirely new each year;

- refreshed to reflect changing circumstances; and

- unchanged or where the changes are trivial.

It is the third category of information – referred to here as 'explanatory information' – which we believe offers a significant opportunity to reduce clutter.

To meet the practical consequences of current legal requirements the annual report and accounts is produced as a single volume that contains all such information. As a result every document contains every disclosure even when it is identical to that made in prior years. It is the third category of information – referred to here as 'explanatory information' – which we believe offers a significant opportunity to reduce clutter.

For example, accounting policies can be made more relevant and easier to evaluate. The summary of 'significant' accounting policies required by IAS 1 often remains unchanged from year to year, with individual policies even copied from IFRSs or illustrative accounts and can easily run to eight or more pages. Refinements to these policies may be informative, yet unless they represent a change in policy, would not trigger additional disclosures.

Such standing data could be presented separately within the annual report and with regulatory change it could be possible for such standing data to be included on a website. This would be similar to the current approach adopted for interim financial statements and to the typical content of company preliminary announcements.

Such standing data could be presented separately...

Preliminary announcements

In preliminary announcements (prelims), accounting policies are not usually provided, unless there has been a material change in a policy. Instead there is a simple statement making it clear that the financial statements are prepared under EU-adopted IFRS. Importantly, this statement is accompanied by a further statement as to where the full accounting policies can be found. So the full information is available, but just not in the prelims each year.[^13]

We believe that there are significant potential benefits for many users of annual reports from separating standing data from information about what has changed during the period under review.

In view of the current requirement that the entire annual report and accounts must be provided in a printed document, we have sought to develop some practical thinking about how it might be possible to separate such standing data and include it in an appendix or otherwise distinguish it within the annual report. To illustrate the potential benefits of separating recurring explanatory information we have developed an illustration of what might be the most relevant and easily read information on accounting policies. This is set out on pages 36 and 37 (Disclosure aid 2).

Call for action two:

Investigate the possibility and potential benefits of separating explanatory information within or outside the printed annual report.

Action

Companies and standard setters should investigate separating explanatory material within or outside the printed annual report.

Annual reports contain a significant amount of information that is repeated year after year. Some of this information is boilerplate, providing little or no added value and should simply be removed. In relation to the rest, any change in the information such as amendments to policies or processes is likely to be more highly valued than their existence. We encourage a reconsideration of how to display the most relevant information in a way that separates it from background clutter, such as continuing policies and processes. We believe that alternatives to the current requirement to repeat explanatory information in every printed annual report year after year should be investigated. We also encourage companies to experiment with how such data is presented within the confines of the current requirements.

Non-accounting information

The discussion and analysis so far has concentrated on the financial statements. Further opportunities exist to develop strategies for reducing clutter in other parts of the annual report. To illustrate some of the potential to achieve change we have looked in particular at governance and Corporate Social Responsibility (CSR) reporting.

Governance

Only 18 of the 52 provisions of the UK Corporate Governance Code (the Code) require disclosure to demonstrate compliance.[^14] For the other 34 provisions, companies are only required to report when they do not comply, and explain why. Despite the 'comply or explain' philosophy at the heart of the Code, practice seems to be to explain everything.

Many companies tell us that they are responding to others' demands.

Many companies tell us that they are responding to others' demands. They feel under pressure to report against each provision of the Code because of proxy voting services and other analysts who compile checklist based score sheets to assess governance compliance. Our research has shown that often these additional disclosures take the form of simply repeating the wording of the relevant Code provisions each year. One effect is that they can detract attention from those parts of the governance section that are of most importance to investors, as well as adding to its length. In particular, it makes it much harder for readers to identify the more relevant company-specific information about governance issues and practice.

To help act as a catalyst for change, we have developed some ideas about how a report on governance might be developed to highlight the relevant company-specific information and separate it from generic information about compliance with the Code. The illustrative example is set out on pages 34 and 35 (Disclosure aid 1).

Corporate Social Responsibility (CSR) reporting

Our earlier research into narrative reporting conducted in 2009 resulted in the publication Rising to the challenge. We concluded that “CSR sections of annual reports contain significant immaterial clutter that is not necessarily essential for making resource allocation decisions.”[^15] We also concluded that one of the potential reasons for this is social pressure making it difficult for a company to disregard specific CSR areas, regardless of the importance of each area to its particular business.

Extract from Rising to the challenge

Companies are feeling their way in developing their CSR reporting and there is significant social pressure in this area. But some have fallen into the trap of delivering unnecessary clutter such as: “football coaching” for an insurance company and “donating chocolate gifts to the community at Easter” for a service company – these are worthwhile activities but in our view are not material to understanding a company's performance and position.

Nine companies had a CSR section longer than their financial review. Only 20% of the sample provided a convincing explanation of why CSR is important to their business.

In *Rising to the challenge

- we noted that there was an “evolving plethora” of sustainability reporting requirements in the pipeline, and since then we have seen a number of consultations taking place on CSR, narrative and integrated reporting. These are likely to lead to further reporting requirements. In our latest response to the European Commission on Disclosure of Non-Financial Information by Companies we support the objectives of a framework of integrated reporting (for example, by showing the broader and longer-term consequences of decision-making).[^16] However, we guard against: increasing the length and complexity of the annual report; and the risk of the report being 'captured' by particular interest groups at the expense of the needs of the long-term investor.

We encourage all regulators to consider how they ensure that any change to reporting requirements does not increase clutter, and that there is a clear understanding of what is necessary to be reported rather than just nice to have.

Call for action three: Engage with other stakeholders regarding their information requests

As set out in Louder than Words, there is a need to refocus annual reports on their primary purpose: providing investors with the information that is useful for making their resource allocation decisions and assessing stewardship. However, there continues to be a number of other stakeholders requesting that further information is added to an already lengthy annual report.

Action

The ASB will continue to engage with other stakeholders and regulators to ensure that their legitimate information needs can be met without adding clutter to annual reports.

Addressing common areas containing clutter

During our work it became apparent that there are many areas within an annual report that commonly contain clutter and some progress could be made in the short term. We also wanted to illustrate what various aspects of an annual report would look like if we could achieve more significant change. Our target was to deliver on the first principle of effective communication that we set out in Louder than Words, namely that reports should be focused – they should highlight important information and avoid distracting readers with immaterial clutter.9

We have developed three disclosure aids, covering different parts of an annual report, which we have discussed with a small number of people involved in annual reporting. In addition to attempting to cut clutter, we have also borne in mind the other three principles of effective communication, namely that reports should be: open and honest; clear and understandable; and interesting and engaging.10

How to use the disclosure aids

Our aids are not templates and cannot be applied without careful thought on a case-by-case basis. Each one contains a screen capture of a spread from an imaginary annual report. However, the spreads themselves are deliberately not complete. What we have presented is an illustration of what is possible, and surrounded them with some hints and tips for implementation.

Each of the three aids addresses one of the areas commonly containing clutter in an annual report today, from the narrative provided up front, to detailed notes relating to a specific amount contained within the financial statements. In addition to selecting different areas of the annual report, we wanted to illustrate how the two different types of clutter could be addressed, namely immaterial disclosures and explanatory information.

Each of the three aids addresses one of the areas commonly containing clutter in an annual report today...

We are sensitive to the difficulty of judging what is material. In the share-based payment example we have assumed that one of the four schemes passed that threshold but the others do not. In the debate that follows the publication of this report we hope that greater understanding can be developed about what is material. This should provide preparers and auditors with greater confidence that their reasonable decisions should not be challenged by regulators.

In addition, we are acutely aware that currently explanatory information cannot be provided on a website. In developing our disclosure aids, we have assumed that progress is made in this area. Unfortunately we are not there yet. Accordingly, in the current environment we suggest moving explanatory information into an appendix within an annual report. While this isn't ideal, as it requires preparers to continue to produce the information year after year within the annual report, it lessens the clutter effect for users, as the two page summary envisaged effectively does the work for the reader. The full information currently required would still be available, although deeper within the annual report.

In the debate that follows the publication of this report we hope that greater understanding can be developed about what is material.

Disclosure aid 1: Governance

Have the Chairman report personally in the Governance section.

Discuss key challenges as context for the letter, and the steps taken to operate effectively including:

- Board balance (skills, experience, diversity, etc).

- Succession planning.

- Board evaluation and director development.

- Engagement with shareholders – if any significant governance concerns have been raised by shareholders, indicate how the board has responded.

- Any other significant decisions reached by the board, for example, new remuneration policies or structures.

Visual representation of a Governance Overview section in an annual report.

Governance overview

John Smith Chairman

Dear shareholder

Dolupiet perepel lentus perum exerro beat et mos magnime ndipiet, im culpa con cus, nis reped modio blaboressus nihit venihit velliqui officaerum, sitam dolore, velende prorehendeni aut aut endest

Our activities in 2010

Text heading Ota ne et latust lam quatis apitaquissum nos et ditio bl cte conecto tatium fugia que elessimi, tem quam rerupta et autestotaque sit venimendem sinturibus modignam

Text heading Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestotaque sit venimendem sinturibus modignam

Text heading Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestotaque sit venimendem sinturibus modign

John Smith Chairman

Other committee letters

My colleagues chairing other board committees provide an overview of their activities this year as well. These can be found as follows:

- Audit - page xx

- Nominations - page xx

- Other - page xx

- Remuneration - page xx

Page footer: 64 Annual Report and Accounts

Continue the personal reporting in short letters from the NED Chairman of the board committees. Focus should be on activities, not policies. Provide clear signposting as to where these can be found.

Governance update

Visual representation of a Governance Update section in an annual report.

Compliance statement

Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestotaque sit venimendem sinturibus modignam

Board evaluation

- Process: [Internally or independent assessor]

- Assessor [where used]: XY Jones

- [If there are recommendations that the board is content to make public, add details. Otherwise indicate that recommendations are being implemented.]

Where you can find other information

- Internal control statement - page xx

- Other specific disclosures required to comply with the UK Corporate Governance Code - page xx

- Business model - page xx

Changes to our process

[Describe significant changes to governance processes made during the year.]

Epitaquissum nos et ditio blam, cor auda est, auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et untionecab incto quati temolup taecte um fugia que

Experience of your board

Instead of the usual lengthy CVs for each board member accompanying the board pictures, we have summarised the skills and experience we believe is relevant to their position on our board. See page xx

For our full governance arrangements visit www.asbplc.co.uk/information

Page footer: 65 Annual Report and Accounts

Explicitly state compliance with relevant corporate governance codes, or explain where and why the Group hasn't complied.

Do the work for the reader by drawing out relevant skills and experience of the board.

Consider what information you can provide to demonstrate that the evaluation process was robust and its recommendations are being acted on.

Do the work for the reader by highlighting significant changes to governance processes made during the year.

Rather than repeating the provisions of the Code, separate out longstanding process information. Clearly signpost where the information can be found either on a website or in an appendix.

In order to comply with the Code there are a limited number of specific disclosure requirements, many of which have already been covered (for example, committee reports, board evaluation statement). Clearly signpost where the remaining disclosures such as the internal control statement can be found.

Disclosure aid 2: Accounting policies

Articulate the basis of preparation of the financial statements.

Explicitly state whether or not the adoption of new standards etc has resulted in a material change.

Make it clear whether or not there have been any other changes.

Similarly discuss the impact of accounting developments not yet adopted.

Visual representation of Accounting Policies section in 'Notes continued'.

Notes continued

1. Accounting policies

Basis of accounting

[Describe the basis of preparation, for example, EU adopted IFRS or full IFRS.] quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestatust lam quatis apitaquissumo blam, cor auda est, untionecab incto quati temolup taecte conecto

Accounting developments and changes

Developments – during 2010 [Describe any material change to the financial statements due to the adoption of new accounting developments in the current year.]

Other changes Other than changes arising from new accounting developments, we have not made any changes to our accounting policies during the year.

Developments - not yet adopted [Describe whether or not it is anticipated that issued, but not yet adopted, accounting developments will have a material impact.]

Page footer: 64 Annual Report and Accounts

Choices permitted under IFRS

IFRS provide certain options available within accounting standards. Material choices we have made, and continue to make, include the following:

Financial instruments Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia

Timing of goodwill impairment reviews Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia

Heading Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia

Heading Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia

Do the work for the reader by explicitly noting what choices have been made under IFRSs and why.

Visual representation of 'Notes to the Financial Statements' section, covering critical accounting policies and sensitivities.

Critical accounting policies

Revenue Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum

Hedge accounting Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum

Heading Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum

2. Sensitivities to accounting estimates

In order to illustrate the impact that changes in assumptions could have on our results and financial position, the following sensitivities are presented:

Assets carried at fair value Areda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestatust lam quatis apitaquissum nos et ditio

Pensions and other post-retirement obligations Areda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestatust lam quatis apitaquissum nos et ditio

Impairment Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum

For full accounting policies and developments visit www.asbplc.co.uk/information

Page footer: 65 Annual Report and Accounts

Summarise the critical accounting policies and how they have been tailored to the entity.

Illustrate the possible impact of changes in assumptions to amounts recognised in the financial statements.

Provide a clear link to where a full list of accounting policies and developments can be found, either on a separate website or in an appendix within the annual report.

Disclosure aid 3: Share-based payments

Bring together all the profit and loss charges related to share-based payment into one section of the note, rather than scattering them throughout the note.

Most groups have several share-based payments schemes. Present a disaggregation of the total profit and loss charge so that it is clear which, if any, of the individual schemes is material. In this example, only the Long-Term Incentive Plan is material.

Do the work for the reader by focusing the disclosures on the material plans.

Visual representation of 'Notes continued' section for share-based payments.

Notes continued

6. Share-based payments

Analysis of profit and loss charge:

| 2010 | 2009 | |

|---|---|---|

| £k | £k | |

| Long-Term Incentive Plan | 957 | 924 |

| Executive Share Option Scheme | 189 | 181 |

| Share Incentive Plan | 64 | 200 |

| SAYE Schreme | 269 | 261 |

| Total | 1,479 | 1,566 |

[Describe the number of share-based payment arrangements within the scope of IFRS, under which there were grants in the current or previous year as well as a profit and loss account charge.]

Long-Term Incentive Plan (LTIP)

Ota ne et latust lam quatis apitaquissum nos et ditio bam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestatust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto

Page footer: 64 Annual Report and Accounts

Inputs into the model

Ota ne et latust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte ecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temecte conecto tatium fugia que elessimi, tem quam rerupta et autestoatust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestatust lam quatis apitaquolup taecte conecto tatium fugia que elessimi, tem quam rerupta et autestatust lam quatis apitaquissum nos et ditio blam, cor auda est, untionecab incto quati temolup taecte conecto

The key inputs into the XYZ model were: